Good morning!

The GIFT Nifty traded flat at 24,688 as of 6:30 a.m., indicating a muted open for the benchmark Nifty 50.

European futures fell while US index futures were flat during Asian trading hours.

S&P 500 futures flat

Euo Stoxx 50 futures down 0.09%

Markets On Home Turf

On Friday, the benchmark indices saw a volatile session and ended in the red after opening higher. Nifty ended 0.08% lower at 24634.90 while Sensex ended 0.08% lower at 80364.94. Nifty PSU Bank snapped 3-day losing streak, and ended as the top gaining sector for the day. Sectoral indices settled mix.

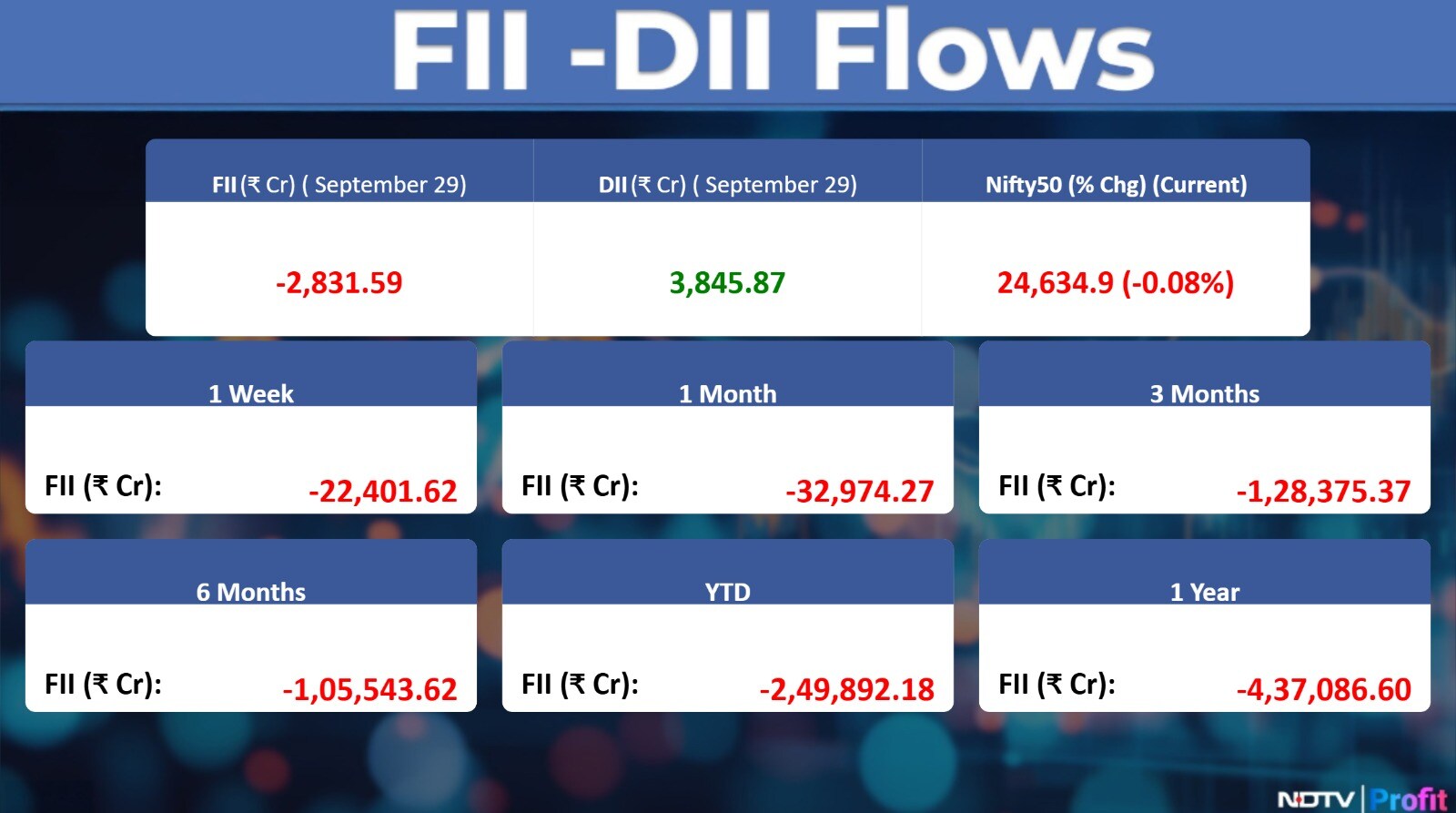

Foreign portfolio investors (FPIs) extended their selling streak into the sixth consecutive session on Monday. The overseas investors sold stocks worth approximately Rs 2,831.59 crore, according to provisional data from the National Stock Exchange (NSE). Domestic institutional investors remained buyers for the 25th session and mopped equities worth Rs 3845.87 crore.

Wall Street Recap

US stocks started the week on a positive note, registering gains even despite concerns around new tariffs, the potential for a government shutdown and looming key economic data.

The S&P 500 Index closed 0.3% higher, led by the consumer discretionary and tech sectors. Energy was the worst-performing of 11 market sectors as crude prices declined in anticipation of another production hike by OPEC+ in November, exacerbating concern about a glut. Robinhood Markets Inc. led gains in the index on expectations for strong event contract volumes.

The tech-heavy Nasdaq 100 gained 0.4%, while the Dow Jones Industrial Average rose 0.2%.

Commodity Check

Oil continued to push lower for a second session as the market weighed a looming glut and the possibility of an end to hostilities in Gaza.

West Texas Intermediate slipped toward $63 a barrel after tumbling 3.5% on Monday, the biggest drop since late June. Brent closed near $68. The OPEC+ alliance meets on Sunday and is likely to agree to raise output in November, though at a modest rate similar to that for October, Bloomberg reported.

Gold hit a new record and the dollar held its losses as concerns mounted over a US government shutdown.

The precious metal climbed above $3,839 an ounce. A gauge of the dollar was little changed after falling for two consecutive days. Equity-index futures for US dipped 0.1% while Asian shares were flat. Treasuries were little changed Tuesday after gaining across the curve in the prior session.

Key Events To Watch

Government will release fiscal deficit for April-August period.

Stocks In News

PN Gadgil : The company launches Litestyle shop-in-shop in Nagpur store for lightweight jewellery exploration.

Zaggle Prepaid: The company approves acquisition of 1.3 lakh shares and investment up to Rs 25 crore in Greenedge Enterprises.

HMT: The company approves to write off Rs 23.9 crore uncertain interest on loans to arm HMT Machine Tools.

Blue Dart: The company to increase average shipment price in range of 9-12% effective Jan. 1.

Saraswati Commercial: The company to acquire 18 lakh shares of Trualt Bioenergy at Rs 496/share, totaling Rs 89 crore.

Oriental Rail: The company secures Rs 4.4 crore order from Indian Railways to manufacture and supply seats and berths.

Redtape: The company re-appoints Arvind Verma and Sunanda as Executive Directors designated as Whole-Time Directors.

Brand Concepts: The company secures exclusive license for Superdry travel gear and handbags in India.

Mahindra & Mahindra: The company will sell its entire stake in arm to TERA for nearly Rs 52 crore via a share purchase pact.

Bharat Seats: The Promoter group has gifted 16.38% of equity shares to the Rohit Relan Family Trust on Sept. 26, 2025, for succession planning, with SEBI granting the Trust exemption from an open offer.

NDR Auto: The promoter group transfers 73.1% stake via gift to Rohit Relan Family Trust

SRM Contractors: The company changes Sanjay Mehta's designation from MD to Non-Executive Director and Puneet Pal Singh's from Whole-Time Director to MD, both effective Oct. 1.

Vijaya Diagnostic Centre: The NCLT reserves order for the scheme of amalgamation of Medinova Diagnostic Services with the company on a going concern basis.

BEML : The company has set Nov. 3 as the record date for its stock split.

Thomas Cook: The company has partnered with the Ministry of Tourism to elevate destination experiences across India, and its arm launches Sterling Rampath Ayodhya as their 11th spiritual location, entering Uttar Pradesh.

Teamless Services:The company's arm TDPL executes an OCD subscription pact with arm TeamLease Digital Singapore for Rs 5 crore.

Globus Spirits: The company unveils the world's first premium vodka, 'TERAI India Craft Vodka'.

Phoenix Mills: The company approves elevation of MD Shishir Shrivastava to Non-Executive Vice-Chairman, effective Oct. 1.

PTC India Financial: The company issued a clarification stating management was surprised by the unexpected resignations of Independent Directors Seema Bahuguna, Naveen Bhushan Gupta, and PV Bharathi, who did not discuss issues with the board prior to submitting.

Bharat Electronics: The company gets additional orders worth Rs 1,092 crore since its last disclosure on Sept. 16.

SEPC: The company gets Rs 32.6 crore order from Avenir International Engineers and Consultants LLC.

RailTel Corp.: The company gets a Rs 37.5 crore order from Visakhapatnam Port Authority for implementation of Smart Video Surveillance.

Bank of India: The bank keeps MCLR and RBLR unchanged across all tenures, effective Oct. 1.

Bank on Maharashtra: The bank cuts 1-Year MCLR by 5 basis points.

Gujarat Fluoro: The company appoints Sunil Kumar Singh Chauhan as Director & Whole-Time Director for one year.

Info Edge: The company to invest Rs 12 crore in arm Zwayam Digital.

IRFC: The company is in pacts to provide a Rs 10,560 crore funding to Maharashtra State Power Generation Company for the Koradi Thermal Expansion Project and has signed a Rs 5,929 crore term loan pact with HPGCL for the 800 MW Yamunanagar Project.

Deepak Builders: The company appoints Parveen Kumari as Chief Financial Officer effective Sept. 29, 2025.

Sundaram Finance Holdings: The company completed the sale of its entire 39% stake in Sundaram Composite Structures Pvt Ltd to Brakes India Pvt Ltd via an off-market transaction

Avenue Supermart: The company opens a new store in New Delhi, bringing the total store count to 431, and allots commercial paper worth Rs 100 crore.

Everest Industries: The company receives a Show Cause Notice from the Odisha GST Department for FY 2021-22 with a proposed tax demand of Rs 56.06 crore, which the company states have no material impact and intends to contest.

BSE: The company appoints Fal Ghancha as Joint Chief Information Security Officer effective Oct. 1.

Religare Enterprises: The company's arm Care Health Insurance allots 1.7 crore shares worth Rs 256 crore.

Stanley Lifestyles:The company entered an exclusive distribution and license pact with Singer to distribute the company's products under the 'Sofas & More' format in Sri Lanka.

Oberoi Realty: The company appoints Tanu Prasad as CEO-Malls.

360 One WAM: The company's arms conclude business transfer pacts with Credit Suisse Securities and UBS.

Purvankara: The company re-appoints Ravi Puravankara as Chairman & Whole-Time Director for five years and appoints Amanda Joy Puravankara as Whole-Time Director.

TGV SRAAC: The company's total solar power generating capacity increased to 55.4 MW after adding 5 MW of new capacity.

Borana Weaves: The company announces the commissioning of an additional 108 looms in Unit 4, taking the total capacity to 346 million meters post complete expansion in October 2025.

Mangalore Chemicals & Fertilizers: The company completed the acquisition of a part of Zuari Agro Chemicals granulated single super phosphate plant and related assets in Mahad, Maharashtra, on a slump sale basis for Rs 72.75 crore, effective Sept. 30, 2025

Zuari Agro Chemicals: The company has completed the transfer of its business to its arm, Mangalore Chemicals & Fertilizers, effective tomorrow.

Tilaknagar Industries: The company approved the allotment of 1.4 Crore shares at Rs 382 per share (worth Rs 549 Crore) to non-promoters, and 4.6 crore convertible warrants at Rs 382 per warrant (worth Rs.1,746 Crore) to promoter and non-promoter categories.

JSW Infra : The company's arm received a show cause notice from Tamil Nadu tax authorities regarding a GST demand of Rs 96.58 crore.

Garware Technical: The company is experiencing strong growth in both topline and profit for fiscla 2024, fiscal 2025, and first quarter of this financial year, driven by a robust performance in its Rockfall, Landfill, and Lining business segments.

Allcargo Gati: The company announced a 10.2% general price increase for its Express Distribution services, effective Jan. 1.

DCX India: The company secured a work order valued at nearly Rs 50 crore.

Camlin Fine: The company approved the allotment of up to 41 Lakh shares at Rs. 247.69 per share, aggregating to Rs 101 crore.

Phoenix Mills: The company reported that for financial year 2025, its Retail Rental Income grew by 18% to Rs 1,951 crore, consumption rose by 21% to Rs.13,750 crore, and Retail Ebitda increased by 20% to Rs.2,010 crore year-on-year.

GNG Electronics: The company's arm has registered a branch named 'Electronics Bazaar BLC' in the Emirates.

Kothari Industrial Corp: The company received 7.8 crore shares of Phoenix Kothari Footwear via a transfer from Rafiq Ahmed through the execution of a Delivery Instruction Slip.

Prime Focus: The board will meet on Oct. 3 to consider and evaluate a future exit option for United Al Saqer Group in DNEG.

CERA Sanitaryware: The company ceased to be a partner in Race Polymer Arts LLP, retiring from the race for a consideration of Rs 16.5 crore.

Tata Steel: The company signed a pact with the Government of the Netherlands and the Province of North-Holland for a health project.

REC: The company's arm RECPDCL executed a share purchase pact with the successful bidder.

Urban Company: The company received a show cause notice from the Mumbai tax body for a GST demand of Rs 51 crore.

BLS E-Services: The company's arm, Zero Mass, and Sub-K Impact Solutions decided not to extend the long stop period to proceed further with the acquisition of CSPs of SBI

IPO Offering

Trualt Bioenergy: The Company engaged in the production of biofuels, with a primary focus on the ethanol sector. The public issue was subscribed to 71.92 times on day 3. The bids were led by Qualified institutional investors (159.22 times), non-institutional investors (98.56 times), retail investors (11 times).

Jinkushal Industries: The Company export trading company supplying construction machinery globally. Operating in over thirty countries. The public issue was subscribed to 65.10 times on day 3. The bids were led by Qualified institutional investors (35.66 times), non-institutional investors (146.39 times), retail investors (47.10 times).

Pace Digitek: The company is a multi-disciplinary solutions provider with a primary focus on the telecom infrastructure industry. The public issue was subscribed to 0.55 on day 2. The bids were led by Qualified institutional investors (0.23 times), non-institutional investors (0.78 times), retail investors (0.62 times).

Glottis: The Company operates in logistics solutions space that offers comprehensive transportation services through ocean, air, and road logistics. The public issue was subscribed to 0.42 times on day 1 . The bids were led by Qualified institutional investors (1.79 times), non-institutional investors (0.16 times), retail investors (0.22 times).

Om Freight Forwarders: The Company is a third-generation logistics company based in Mumbai, India. With over four decades of expertise, it operates across five continents, serving over 700 locations. The public issue was subscribed to 1.39 times on day 1. The bids were led by Qualified institutional investors (1.10times), non-institutional investors (4.03 times), retail investors (0.54 times).

Fabtech Technologies : The company designs and delivers turnkey projects, including cleanroom facilities, modular systems, and customized engineering solutions. The public issue was subscribed to 0.70 times on day 1. The bids were led by Qualified institutional investors (0.77 times), non-institutional investors (0.46 times), retail investors (0.71 times).

Advance Agrolife : The company will offer shares for bidding on Tuesday. The price band is set from Rs 95 to Rs 100 per share. The Rs 192.86 crore IPO is entirely a fresh issue.

Listing Day

Seshaasai Technologies: The company's shares will debut on the stock exchange on Tuesday at an issue price of Rs 423 apiece. The Rs 813 crore IPO was subscribed 68.13 times on its third and final day. The bids were led by institutional investors (189.63 times), retail investors (9.17 times), non-institutional investors (49.89 times).

Anand Rathi Share & Stockbrokers: The company's shares will debut on the stock exchange on Tuesday at an issue price of Rs 414 apiece. The Rs 745 crore IPO was subscribed 20.66 times on its third and final day. The bids were led by institutional investors (43.80 times), retail investors (4.78 times), non-institutional investors (28.60 times).

Jaro Institute of Technology Management & Research: The company's shares will debut on the stock exchange on Tuesday at an issue price of Rs 890 apiece. The Rs 450 crore IPO was subscribed 22.06 times on its third and final day. The bids were led by institutional investors (35.35 times), retail investors (8.71 times), non-institutional investors (35.48 times).

Solarworld Energy Solutions: The company's shares will debut on the stock exchange on Tuesday at an issue price of Rs 351 apiece. The Rs 490 crore IPO was subscribed 65.01 times on its third and final day. The bids were led by institutional investors (70.43 times), retail investors (49.15 times), non-institutional investors (64.73 times).

Bulk & Block Deals

Hero MotoCorp: BNP Paribas Financial Markets bought 19.52 Lakh shares (0.98% stake ) at Rs 5302.91/per share.

Max Healthcare Ins Ltd: BNP Paribas Financial Markets net sold 79.38 Lakh shares (1.07% stake ) at Rs 1111.01/per share.

IndusInd Bank Ltd.: BNP Paribas Financial Markets net bought 1.066 Crore shares (1.37% stake ) at Rs 723.60/per share.

Sammaan Capital Limited: ICICI Prudential Mutual Fund bought 43.47 Lakh shares (0.52% stake ) at Rs 151.95/per share.

Aether Industries Limited: Amansa Holdings Private Limited bought 12.83 Lakh shares (3.87% stake) at Rs 735/share, while Goldman Sachs India EQ Portfolio sold 11.51 Lakh shares (3.47% stake) at Rs 735 /per share.

Bharat Forge Ltd: Motilal Oswal Mutual Fund bought 31.03 Lakh shares (1.16% stake) at Rs. 1217.32/share.

Insider Trade

VIP Industries: Piramal Vibhuti Investments Limited disposed of 77.53 Lakh shares (1.13% stake), Multiples Private Equity Gift Fund IV and Multiples Private Equity Fund IV jointly acquired 60.11 Lakh shares (0.88% stake), and Kiddy Plast Ltd disposed of 10.87 Lakh shares (0.16% stake).

Trading Tweaks

Shares to Exit anchor lock-in: Indogulf Crop science(4%)

List of securities shortlisted in Short - Term ASM Framework Stage – I: Dynamic Services, Indian Emulsifiers

List of securities shortlisted in Long - Term ASM Framework Stage – 1: Foce India, Drone Destination

F&O Cues

Nifty September Futures up by 0.02% to 24,685 at a premium of 51 points.

Nifty September futures open interest down by 36.75%

Nifty Options 30 September Expiry: Maximum Call open interest at 25,000 and Maximum Put open interest at 24000

Securities in Ban Period: SAMMAANCAP, RBL Bank.

Currency/Bond

Rupee consolidated in a narrow range and settled for the day lower by 7 paise at its all-time closing low of 88.79 (provisional) against US dollar on Monday, on persistent foreign capital outflows and rise in risk-off sentiments. The yield on the 10-year bond ended three points higher at 6.55%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.