Good morning!

The GIFT Nifty is trading flat at 25,611 as of 6:45 a.m., indicating a muted open for the benchmark Nifty 50.

US and European futures were down during Asian trading hours.

S&P 500 futures down 0.1%

Eurp Stoxx 50 futures down 0.6%

Markets On Home Turf

The Nifty ended in the green for the second consecutive session on Thursday. The Sensex rose 862.23 points, or 1.04%, to 83,467.66, while the Nifty rose 261.75 points, or 1.03%, to 25,585.30.

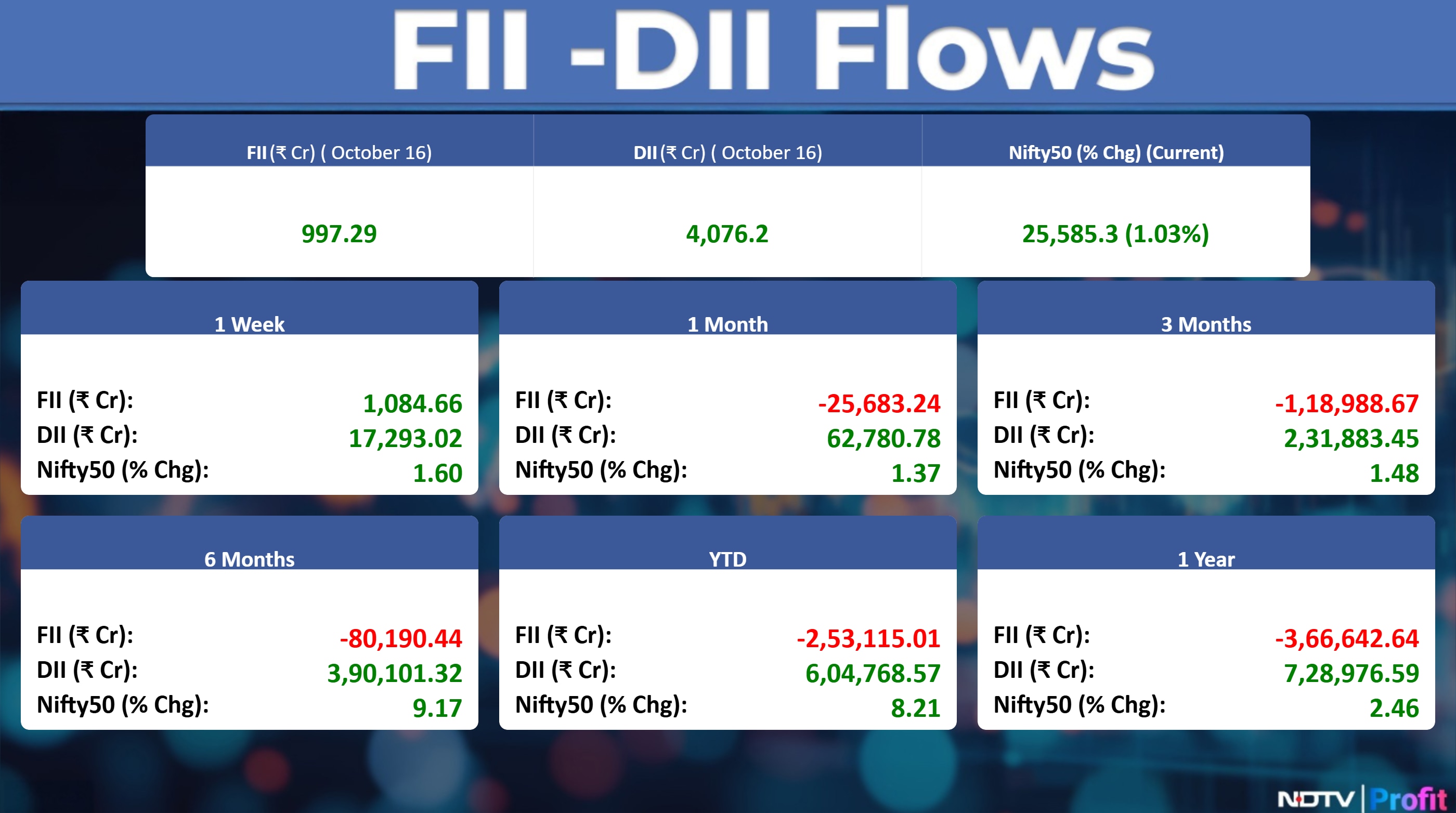

The foreign portfolio investors on Thursday turned net buyers of Indian shares, see-sawing between purchasing and selling in the last five sessions. The FPIs bought stocks worth approximately Rs 997 crore, according to provisional data from the National Stock Exchange. The DIIs that have stayed net buyers for over a month bought stake worth Rs 4,076 crore.

Wall Street Recap

US equities fell on Thursday as concerns over the quality of loans at regional American banks, the growth prospects of insurers and US-China tensions continued to weigh on investor sentiment.

The S&P 500 closed 0.6% down, the tech-heavy Nasdaq 100 dropped 0.4%. The Dow Jones Industrial Average slipped 0.6%

Asia Market Update

Asian shares slipped after risk sentiment dimmed on Wall Street as bad loans at two US banks heightened concerns about the credit market, Bloomberg reported. MSCI's regional stock gauge dropped 0.2% with financials the biggest drag. The yen was stronger against the dollar in early Friday trading, extending its run of three consecutive sessions of gains.

Nikkei down 0.3%

Kospi up 1%

S&P/ASX 200 down 0.5%

Hang Seng down 0.3%

Commodities Check

Oil prices headed for a third weekly decline as investors focused on oversupply and the fallout from renewed US-China trade tensions. Brent was near $61 a barrel as Trump said he would hold a second meeting with Putin.

Gold ($4,391.69) and silver ($53.76) touched all-time highs as fears about credit quality in the US economy and heightened US-China frictions strengthened demand.

Earnings In Focus

Reliance Industries, Dixon Technologies (India), JSW Energy, JSW Steel, Polycab India, 360 ONE WAM, Acutaas Chemicals, Atlanta Electricals, Atul, AU Small Finance Bank, Bank of India, CEAT, Central Bank of India, CESC, CRISIL, Dalmia Bharat, DCB Bank, Fedbank Financial Services, Havells India, HFCL, Himadri Speciality Chemical, India Cements, IndiaMART InterMESH, Jindal Saw, Jana Small Finance Bank, Kesoram Industries, L&T Technology Services, Oracle Financial Services Software, Orient Electric, PCBL Chemical, Poonawalla Fincorp, PSP Projects, PVR Inox, RPG Life Sciences, Sapphire Foods India, Shoppers Stop, Sobha, Sterling and Wilson Renewable Energy, Tanla Platforms, Tata Technologies, Tejas Networks, UCO Bank, Ujjivan Small Finance Bank

Earnings Post Market Hours

Wipro Q2FY26 Highlights (Consolidated, QoQ)

Key take aways

Numbers in line with estimates

QoQ CC growth up 0.3% versus down 2% in Q1

Launches Wipro Intelligence, to scale in AI-first world

Lower and upper end of IT revenue guidance increased to (-)0.5% to (+)1.5%

Large deal TCV at $2.9 billion versus $2.7 billion in Q1

Financials

Revenue up 2.5% to Rs 22,697.30 crore versus Rs 22,134.60 crore

Ebit up 4% to Rs 3,680.70 crore versus Rs 3,547.60 crore

Margin at 16.2% versus 16.0%

Net Profit down 3% to Rs 3,246.20 crore versus Rs 3,330.40 crore

Infosys Q2FY26 Highlights (Consolidated, QoQ)

Key takeaways

Numbers beat the estimates

QoQ CC growth at 2.2% vs 2.6% in Q1

Lower end of the guidance increased from 1%-3% to 2%-3%

Manufacturing & Hi-Tech has seen major uptick

Large deal TCV at $3.1 billion versus $3.8 billion in Q1

Financials

Revenue up 5.2% to Rs 44,490.00 crore versus Rs 42,279.00 crore (Estimate: Rs 44,008 crore)

Ebit up 6% to Rs 9,353.00 crore versus Rs 8,803.00 crore (Estimate: Rs 9,338 crore)

Margin at 21.0% versus 20.8% (Estimate: 21.21%)

Net Profit up 6% to Rs 7,364.00 crore versus Rs 6,921.00 crore (Estimate: Rs 7,222 crore)

LTIMindtree Q2FY26 Highlights (Consolidated, QoQ)

Revenue up 5.6% to Rs 10,394.30 crore versus Rs 9,840.60 crore (Estimate: Rs 10,264.50 crore)

Ebit up 17% to Rs 1,648.10 crore versus Rs 1,406.50 crore (Estimate: Rs 1,532 crore)

Margin at 15.9% versus 14.3% (Estimate: 14.9%)

Net Profit up 12% to Rs 1,401.10 crore versus Rs 1,254.10 crore (Estimate: Rs 1,282.70 crore)

Cyient Q2FY26 Highlights (Consolidated, QoQ)

Revenue up 4.0% to Rs 1,781.00 crore versus Rs 1,711.80 crore

Net Profit down 17% to Rs 127.50 crore versus Rs 153.80 crore

Ebit down 10% to Rs 146.60 crore versus Rs 162.70 crore

Margin at 8.2% versus 9.5%

To pay dividend of Rs 16 per share

Rallis India Q2FY26 Highlights (Consolidated, YoY)

Revenue up 7.2% at Rs 861 crore versus Rs 928 crore.

Ebitda down 7.2% at Rs 154 crore versus Rs 166 crore.

Ebitda margin flat at 17.9%

Net profit up 4.1% at Rs 102 crore versus Rs 98 crore.

JSW Infrastructure Q2FY26 Highlights (Consolidated, YoY)

Revenue up 26.37% at Rs 1,265 crore versus Rs 1,001 crore

Ebitda up 16.81% at Rs 608.59 crore versus Rs 521 crore

Ebitda margin down 393 bps at 48.1% versus 52.04%

Net profit down 2.69% at Rs 361 crore versus Rs 371 crore

Punjab Sind Bank Q2FY26 Highlights (YoY)

Net Profit up 22.9% at Rs 295 crore versus Rs 240 crore

NII up 8.8% at Rs 950 crore versus Rs 873 crore

Operating profit up 10.3% at Rs 505 crore versus Rs 458 crore

Provisions down 2% at Rs 148 crore versus Rs 151 crore

Margin at 15% versus 15.5%

Gross NPA at 2.9% versus 3.3% (QoQ)

Net NPA at 0.8% versus 0.9% (QoQ)

CIE Automotive Q2FY26 Highlights (Consolidated, YoY)

Net Profit up 9.6% at Rs 214 crore versus Rs 195 crore

Revenue up 11.1% at Rs 2,372 crore versus Rs 2,135 crore

Ebitda up 7.6% at Rs 356 crore versus Rs 331 crore

Margin at 15% versus 15.5%

Metro Brands Q2FY26 Highlights (Consolidated, YoY)

Net Profit down 2.7% at Rs 67.7 crore versus Rs 69.6 crore

Revenue up 11.2% at Rs 651 crore versus Rs 586 crore

Ebitda up 10.3% at Rs 171 crore versus Rs 155 crore

Margin at 26.2% versus 26.4%

Jio Financial Services Q2FY26 Highlights (Consolidated, YoY)

Net Profit up 0.9% at Rs 695 crore versus Rs 689 crore

Total Income up 44.5% at Rs 1,002 crore versus Rs 694 crore

Waaree Energies Q2FY26 Highlights (Consolidated, YoY)

Revenue up 69.7% to Rs 6,065.64 crore versus Rs 3,574.38 crore

Net Profit at Rs 842.55 crore versus Rs 361.65 crore

Ebitda at Rs 1,406.40 crore versus Rs 524.85 crore

Margin at 23.2% versus 14.7%

Sunteck Realty Q2FY26 Highlights (Consolidated, YoY)

Revenue up 49.3% at Rs 252 crore versus Rs 169 crore.

Ebitda at Rs 77.8 crore versus Rs 37.4 crore.

Ebitda margin at 30.8% versus 22.1%

Net profit up 41.4% at Rs 49 crore versus Rs 34.6 crore.

Business Update

Kalpataru (YoY)

Pre-Sales up 19% at Rs 1,329 crore

Collections up 37% at Rs 1,162 crore

Stocks In News

JK Paper: The initial acquisition of Borkar Packaging is yet to be completed. The acquisition is expected to be concluded within six weeks.

Biocon: Arm Biocon Biologics & Civica Expand Partnership. Launch Private-Label Insulin Glargine to broaden US diabetes treatment options.

HCL Technologies: The company expands partnership with Zscaler for AI-Powered security & network transformation.

Zaggle Prepaid: The company enters into amendment pact to Master Service agreement with BOBCARD.

BEML: The company in pact with Kineco for advanced composite manufacturing for Aerospace and Defence Applications.

Central Bank of India: The bank is in pact with Godrej Housing Finance to offer housing loans at competitive rates.

Whirlpool of India: Whirlpool India signs long-term brand and tech pacts with parent company till 2029. Agreements are valid till March 2029, replacing annual contracts.

Aegis Vopak: The company approves raising funds worth up to Rs 660 crore via NCDs on Private Placement Basis.

India Glycols: The board approve fundraise of up to Rs 467 crore on preferential basis.

Atlanta Electricals: The company receives Rs 183 crore order from BNC Power Projects for supply of Extra-High voltage equipment.

SIS: The company completed acquisition of compulsorily convertible preference shares in Wify.

Tata Motors: The company name shall be changed to Tata Motors Passenger Vehicles effective October 24. Symbol shall be changed to TMPV effective October 24.

Fortis Healthcare: IHH Healthcare, via its subsidiary Northern TK Venture Pte Ltd, will subscribe to 23.5 crore new equity shares of Fortis Healthcare via preferential allotment. The total investment amounts to Rs 235.2 crore. Following this, Northern TK Venture will launch a mandatory open offer to acquire up to 19.7 crore shares of Fortis Healthcare, representing approximately 26.1% of its expanded voting capital. Additionally, a separate open offer will be made to acquire up to 49 lakh equity shares of Fortis Malar Hospitals, representing around 26.1% of its voting share capital.

Mahanagar Gas: The company approves the appointment of Ajay Sinha as Whole-Time Director, Designated as Deputy MD.

LIC Housing Finance: Appoints Doraiswamy Ramachandran as chairman.

Godrej Industries: The company invests Rs 409 crore in arm Godrej Capital, increases stake In arm to 91.1% from 90.9%.

Vijaya Diagnostic: NCLT sanctions scheme of amalgamation among Medinova Diagnostic Services & Co.

PFC: Arm PFC consulting transferred to Power Grid Corp for Rs 19.8 crore.

Inventurus Knowledge: The company further invests $10 million in arm Inventurus Knowledge Solutions Inc.

Authum Investment: The company issued preference shares worth Rs 2,450 crore to Promoter Mentor Capital.

Canara Bank: The bank divests stake in arm Canara Robeco Asset Management Co via initial public offer to 38% from 51%.

Ventive Hospitality: The company completes acquisition of 76% stake in Soham Leisure Ventures.

Samvardhana Motherson International: Agencia De Recaudacion De Control Aduanero Tax Authority imposes penalty of ARS 56.43 Mn on Arm.

KNR Construction: The company's arm KRIPL is in settlement pact with National Highways Authority of India

Lemon Tree: The company signs pact for 78-room hotel in Maharashtra.

JSW Energy: The company's arm gets LoA from power co of Karnataka for 400 MW, 25-Year power supply arrangement effective April 1, 2026.

Sanofi Consumer: The company appoints Richard D'Souza as CFO.

Antony Waste: The company managed total tonnage of nearly 1.27 million tonnes in Q2.

Paradeep Phosphates: The company approves amalgamation with Mangalore Chemicals and Fertilizers.

Insolation Energy: The company incorporates six wholly owned arms as SPVs.

Sammaan Capital: The company raises $450 million by allotting senior secured social bonds.

Ceigall India: The company approves incorporation of two wholly-owned arms as SPVs.

HG Infra: The company gets completion certificate for Rajasthan Project.

Orient Technologies: The company acquires Red Hut Innovation Technology and minority takes of Athena IT and Telecom Solutions, AIT Internet Services for combined value of Rs 7.7 crore.

Ventive Hospitality: The company, through its material subsidiary Panchshil Corporate Park, is set to enter into a non-binding agreement with the target entity. This may lead to the acquisition of the target entity's subsidiary that holds exclusive rights for the expansion of Soho House in India, including the rights to operate Soho House Mumbai (Juhu).

IPO Offering

Midwest: The company is engaged in the business of exploration, mining, of natural stones. The public issue was subscribed to 11.73 times on day two. The bids were led by QIBs (1.84 times), NIIs (33.2 times) retail investors (8.19 times), Employee reserved (9.12 times).

IPO Listing

Canara HSBC Life Insurance: Canara HSBC Life Insurance Co is a private life insurance company in India. Promoted by Canara Bank and HSBC Insurance (Asia-Pacific) Holdings. The company's shares will debut on the stock exchange on Thursday. The public issue was subscribed to 2.3 times on day three. The bids were led by Qualified institutional investors (7.05 times), non-institutional investors (0.33 times), retail investors (0.42 times).

Bulk Deals

Cartrade Tech: Oxbow Master Fund sold 2.84 lakh shares (0.6%) at Rs 2445.08 apiece, while Plutus Wealth Management Llp bought 3.75 lakh shares (0.79%) at Rs 2454.98 apiece.

CMS Info Systems: PPFAS MF bought 20 lakh shares (1.22%) at Rs 358 apiece, while Wf Asian Reconnaissance Fund Limited sold 26.9 lakh shares (1.65%) at Rs 358.01 apiece.

Rubicon Research: Nomura Funds Ireland Plc Nomura Funds Ireland India Equity Fund bought 16.5 lakh shares (1%) at Rs 616.31 apiece.

Trading Tweaks

Ex-Dividend: Anand Rathi Wealth, HCL Technologies

Ex-Stock Split: Rolex Rings (Split from Rs 10/- Re 1/- per share)

F&O Cues

Nifty Oct futures is up by 0.88% to 25,648 at a premium of 63 points.

Nifty Oct futures open interest down by 0.97%.

Nifty Options 20th Oct Expiry: Maximum Call open interest at 26,000 and Maximum Put open interest at 24,500.

Securities in ban period: Sammaan Capital

Currency/Bond Market

The rupee closed appreciated 24 paise at 87.83 against the US dollar on Thursday. The yield on the 10-year bond ended two points higher at 6.50%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.