Good morning!

The GIFT Nifty is trading at 24,967 as of 7:40 a.m., indicating a muted open for the benchmark Nifty 50 index.

Meanwhile, US and European equity futures were trading higher in Asia.

S&P 500 futures up 0.2%

Euro Stoxx 50 futures flat

Markets On Home Turf

The Indian benchmarks extended their gains into the second day this week and closed higher. The Nifty 50 closed 0.23% higher at 24,894.25 while Sensex closed 0.26% higher at 81191.58. All sectoral indices gain higher for the week.

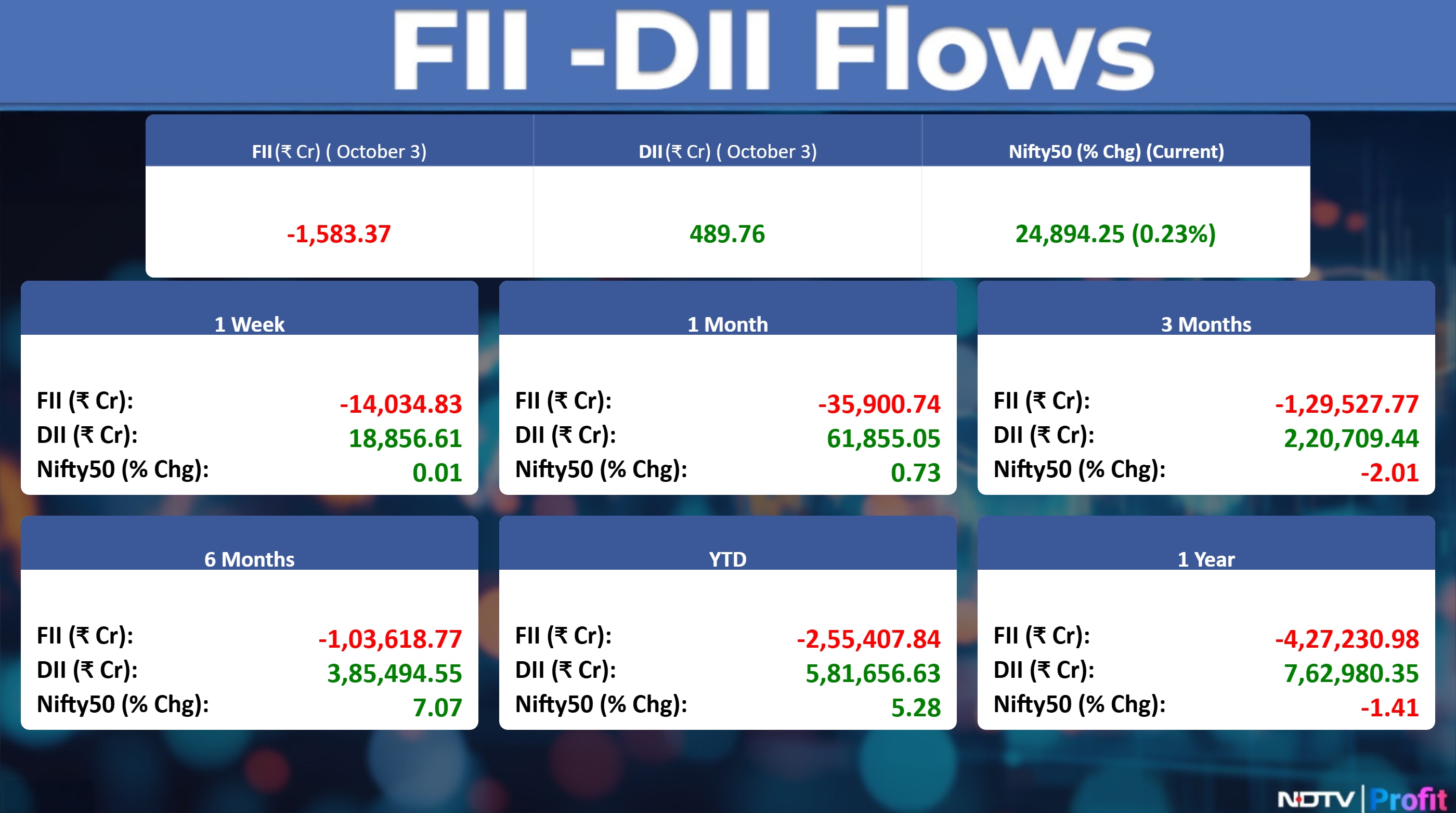

Foreign portfolio investors (FPIs) extended their selling streak of Indian equities for the ninth consecutive day on Friday. The overseas investors offloaded shares worth Rs 1,583.37 crore, according to provisional data from the National Stock Exchange (NSE).

Domestic institutional investors remained buyers for the 28th session and bought equities worth Rs 489.76 crore. On Wednesday they had bought stocks worth Rs 2916.14 crore.

Wall Street Recap

The rally in tech stocks took a breather on Friday, pulling back from this week's record highs.

The Nasdaq 100 fell 0.4%. Palantir Technologies Inc. was among the biggest decliners, the stock tumbled 7.5% after a report that the defense firm's battlefield communications system was seriously flawed, a claim the company refuted, reports Bloomberg.

Asian Market Update

Asian stocks climbed to a record, led by Japan, with the Nikkei 225 index jumping more than 4%, heading for the biggest one-day gain since April, after pro-stimulus lawmaker Sanae Takaichi was positioned to become the country's next prime minister, Bloomberg reported.

MSCI's gauge of Asian shares climbed for a sixth day, propelling the index to a new record.

Commodity Check

Oil prices gained on the back of OPEC+ agreeing to raise production by a modest amount.

Brent rose above $65 a barrel, while West Texas Intermediate was near $62. At a meeting on Sunday, the Organisation of the Petroleum Exporting Countries and partners including Russia backed a 137,000-barrel-a-day increment, well below some of the possible figures reported before the decision, Bloomberg reports.

Gold rose to another record — closing in on the $4,000 an ounce mark — as the US Federal government shutdown dragged on.

Bullion advanced to $3,920.63 an ounce, before paring some gains. The disruption in the US has delayed payroll data, which was due on Friday, making a murky economic outlook even more unclear.

Key Events To Watch

S&P Global and HSBC will release India Services PMI and Composite

PMI for September.

SEBI Chairman Tuhin Kanta Pandey will speak at NSE event on investor awareness and protection.

Road Transport Minister Nitin Gadkari, to address at FICCI's event.

Stocks In News

Infosys: The company partnered with Telenor Shared Services to modernize HR operations using Oracle Fusion Cloud Human Capital Management (HCM) solution.

Manali Petrochemicals: K Lalitha ceased to be CFO immediately, with Srishti M Bathija appointed as the new CFO for the MPL Group.

Ceigall: The company secured a Letter of Award worth Rs 712 crore from Maharashtra State Electricity Distribution Co. for setting up 190 MW (AC) solar power generating stations. The company has secured a Letter of Award from the Maharashtra State Electricity Distribution Co. for a Rs 597 crore project to construct a 147 MW solar plant across two districts of Maharashtra.

PNB: The Bank has come up with their business update for September, the bank recorded global business of Rs 27.9 lakh crore and domestic business of Rs 26.8 lakh crore, with both growing robustly at 10.6% year-on-year and 10.5% year-on-year, respectively. This growth was fuelled by global deposits reaching Rs 16.2 lakh crore up 10.9% year-on-year and domestic deposits at Rs 15.6 lakh crore, up 10.4% year-on-year, alongside strong global advances of Rs 11.7 lakh crore, up 10.3% year-on-year and domestic advances of Rs 11.2 lakh crore, up 10.7% year-on-year.

Marico: The second quarter saw consolidated revenue growth reaching the thirties due to pricing interventions and robust international business momentum (constant currency growth touching the twenties), resulting in modest year-on-year operating profit growth.

Piccadilly Agro: The company's brand Indri is No.1 Again, winning ‘Best World Whisky' with a near-perfect score of 99.1 points at the Las Vegas Global Spirits Awards 2025.

LTIMindtree: The LIC's stake in the company has risen from 7% to 9% via a market purchase.

Bondada Engineering: The company already strong order book is further bolstered as the company secured a sanction from Bank of Baroda for an enhancement in existing credit facilities, a move expected to strengthen the company's ability to execute projects efficiently. The company reported an opening order book of Rs 5,044 crore as of April 1,2025, with expectations for an additional Rs 6,250−7,000 crore in orders this year, leading to an estimated closing order book of nearly Rs 8,000 crore by March 2026.

Hemisphere Properties: The company announced that its e-auction process for plots in Pune concluded without receiving any bids, and the company is now reviewing the outcome to determine the next course of action in due course.

Hindustan Zinc: The company's refined Lead saw the largest surge, up 29% to 45,000 tonnes, followed by Silver production, which increased by 22% to 144 tonnes. Mined Metal production was up 1% at 2.58 lakh tonnes, while Refined Zinc and Wind Power production both saw a 2% increase, reaching 2.02 lakh tonnes and 132 million units, respectively.

Ethos: The company has opened a new Ethos Haute Horology boutique in Mumbai's Jio World Plaza, BKC and Arm Inaugurates RIMOWA Boutique at DLF Emporio In New Delhi.

Yes Bank: The bank's deposits grew by 7.1% to Rs 2.96 lakh crore, loans and advances increased by 6.5% to Rs 2.5 lakh crore, and CASA saw a 13.2% rise to Rs 1 lakh crore, resulting in a sequential improvement in the CASA ratio to 33.8% from 32.8%.

Bansal Wire: The company reported a fire incident at its Gautam Buddha Nagar plant, which temporarily disrupted operations at the company's 'C Shed'. However no injuries or casualties were reported, and the cause of the fire is yet to be determined.

TVS Electronics: The company received a Goods and Services Tax demand of Rs 25.65 crore from the Uttar Pradesh tax authorities.

TVS Motor: Arm TVS Motor (Singapore)Pte Ltd acquires 100% of share capital in Engines Engineering S.p.A from ACT S.r.l. Consequent to the same, Engines Engineering S.p.A has become a wholly owned subsidiary of TVS Motor (Singapore) Pte Ltd.

Bajaj Housing Finance: The company's AUM grew by 24% year-over-year to Rs 1.28 lakh crore as of Sept. 30, with Gross Disbursements showing a stronger increase of 32% to Rs 15,900 crore for the same period.

Bajaj Healthcare: Received CDSCO recommendation for Phase III trials of Suvorexant Tablets (for insomnia)

Krystal Integrated: Secured Rs 157 crore twin contracts for sanitation and security services in Delhi.

Torrent Pharma: NPPA imposed Rs 6.6 crore penalty for overcharging on five drugs.

Refex Industries: The company has approved the allotment of 75.7 lakh shares to its promoter, Refex Holding.

Insolation Energy: The company has incorporated five step-down subsidiaries as Special Purpose Vehicles to facilitate the setting up of solar power plants.

S Chand: The promoter, Neerja Jhunjhnuwala, significantly increased her stake in the company from 11.32% to 22.7%.

L&T FINANCE: The company showed a 25% year-over-year increase in Retail Disbursements, reaching Rs 18,850 crore, and a 17% rise in its Retail Loan Book, which now stands at Rs 1.04 lakh crore.

Lupin: The company has launched Liraglutide Injection in the U.S., a drug used to improve glycemic control in adults with Type 2 Diabetes. US FDA inspected pithampur unit-2 manufacturing facility from July 8-17. The inspection closed with four form-483 observations. Working with the US FDA to resolve compliance issues.

Fortis Healthcare: SEBI has approved IHH Healthcare Berhad's request to proceed with the pending open offers for Fortis Healthcare and its subsidiary, Fortis Malar Hospitals, which IHH will formally announce to Bursa Securities.

MOIL: The company reported a growth of 3.8% in Production at 1.52 lakh tonnes and growth of 10.3% inthe second quarter at 4.42 lakh tonnes year-on-year.

UGRO Capital: The company announced that its Board of Directors will convene on Oct. 8 to consider a proposal for raising funds through Non-Convertible Debentures (NCDs).

Dhanlaxmi Bank: The bank's total business grew by 17.5% year-on-year to reach Rs 30,147 crore. This growth was driven by a 16.9% increase in total deposits to Rs 17,103 crore and an 18.4% rise in gross advances to Rs 13,044 crore. The bank's low-cost CASA deposits also grew by 6.6% year-on-year to Rs 4,937 crore.

Asian Paints: The company announced that its Board of Directors will meet on Nov. 12 to consider and declare an interim dividend. The Record Date for determining the shareholders eligible to receive this interim dividend will be Nov. 18.

Avenue Supermarts: The company reported a standalone revenue from operations of Rs 16,219 crore for the second quarter, representing a year-on-year growth of 15.4%. The company's total store count as of Sept. 30 stands at 432.

Ujjivan SFB: The bank's deposits rose 14.8% and the Gross Loan Book increased 14% year-on-year, driven by a sharp 54.5% rise in the Total Secured Book.

Vodafone Idea: The company has announced a key management change, appointing Tejas Mehta as its new Chief Financial Officer, effective Oct. 6.

Kesar India: The Company has acquired an 8,100 square meter land parcel in Nagpur.Highway Infrastructure

Share India Securities: The company received a BSE Caution today regarding its March 31, 2025, shareholding pattern, which flagged the first-time inclusion of Neelam Jindal. The company clarified that Neelam, sister of Promoter Praveen Gupta, was categorized as a Promoter Group member due to a gift transaction from the Promoter, as she did not previously hold any shares. The company confirmed it has submitted a response to the caution.

Exicom Tele-Systems: The company has received a Show Cause Notice from the New Delhi Tax Body for a Goods and Services Tax (GST) demand of Rs 14.5 crore.

Suryoday Small Finance Bank: The bank's Gross Advances rose 23% to Rs 11,544 crore, Disbursements grew 49% and total deposits grew 35% to Rs 11,991 crore, supported by a 57% jump in CASA to Rs 2,477 crore and an improved CASA ratio of 20.7%.

Uflex: The company has announced the commissioning of a capacity enhancement at its Aseptic Packaging facility in Sanand, raising the total capacity to 12 billion packs per annum.

Tata Motors: The company transfers Entire Stake in Arms, Associates, JVs & Joint Operations to TMLCV Post-Demerger.

Emcure Pharma: The company Acquired 20.4% Stake of Zuventus Healthcare For Rs 724.9 crore.

Shukra Pharma: The company Approves Preferential Issue of 46.4 lakh Convertible Equity Warrants.

Uni Abex Alloy: The company is in a pact to sell land in Thane for Rs 244 C, the transaction is expected to be completed by Jan 31, 2026

Vishnu Prakash: The company clarified that Promoters sold a stake and MD's stake was pledged to generate liquidity. The proceeds are being injected into the company as an interest-free loan for immediate working capital and future growth needs. Management assures stakeholders of the company's strong financial health.

Jindal Poly Films: The company has approved an increase in the limits for loans, investments, and securities from Rs 12,000 crore to Rs 15,000 crore.

AstraZeneca Pharma: The company has received permission from the Central Drugs Standard Control Organisation to import, sell, and distribute Trastuzumab Deruxtecan (vial lyophilized powder) in India. This drug is used for the treatment of solid tumors.

Allcargo Logistics: The company's arm, ALX Shipping Agencies India, has filed a complaint with the Economic Offences Wing against its CEO, Sandeep Bakshi, and Vishal Mehta of Rushabh Sealink & Logistics, seeking criminal proceedings over alleged irregularities. The complaint stems from an internal probe which revealed attempts by Bakshi and Mehta to make ALX liable for payments to Rushabh.

RBL Bank: The bank saw an 8% year-on-year growth in total deposits, reaching Rs. 1.17 lakh crore, alongside a 14% year-on-year increase in gross advances to Rs. 1.02 lakh crore. The CASA Ratio saw a slight quarter-on-quarter dip to 31.9% from 32.5%, even as ASA grew by 3% year-on-year to Rs. 37,169 crore.

Ravindra Energy : The company has received two Letters of Award (LOA) from the Maha State Electricity Distribution Co.

Sandur Manganese : The company received approval from the Environment Ministry to divert forest land for establishing a downhill conveyor pipe system.

Websol Energy System: Sanjana Khaitan, Executive Director of the Company has ceased to be a Director of the Company. Her reappointment was not approved by the members at the Annual General Meeting held on 29 Sept., 2025.

Anand Rathi Wealth: Fixed Oct. 17 as record date for interim dividend.

Paradeep Phosphates: Customs search over alleged violation in imported urea; legal recourse being considered.

Karnataka Bank: RBI approved 1-month extension for MD and CEO Raghavendra Srinivas Bhat.

Jindal Steel: Appointed Parimal Rai as Independent Director and Sunil Agrawal as CFO.

Highway Infrastructure: Secured two EPC contracts under PM-eBus Seva scheme; total order book Rs 778.2 crore.

Hindustan Copper: Executed Kendadih Mining Lease Deed; step toward copper ore production restart.

Tata Steel: Received Rs 2,411 crore demand letter over Sukinda Chromite Block; pursuing legal remedy.

Angel One: NSE imposed penalty for incorrect margin reporting; advisory issued on collateral data. It also issued an advisory for incorrect reporting of data for segregation and monitoring of collateral at client level.

Reliance Communications: UCO Bank classified loan account as 'fraud'.

PTC India - Appoints Mini Ipe as an independent director.

Confidence Petroleum: Resignation of independent director Vandana Gupta citing personal reasons.

IPO Offering

Om Freight Forwarders: The company is a third-generation logistics company based in Mumbai, India. With over four decades of expertise, it operates across five continents, serving over 700 locations. The public issue was subscribed to 3.87 times on the last day. The bids were led by Qualified institutional investors (3.97 times), non-institutional investors (7.39 times), retail investors (2.75 times).

Advance Agrolife: The company is engaged in the manufacturing of a wide range of agrochemical products that support the entire lifecycle of crops. The public issue was subscribed to 56.85 times on day 3. The bids were led by Qualified institutional investors (27.31 times), non-institutional investors (175.30 times), retail investors (23.06 times)

WeWork India Management: The company is a flexible workspace operator in India.. The public issue was subscribed to 0.04 times on day 1. The bids were led by Qualified institutional investors (0.02 times), non-institutional investors (0.02 times), retail investors (0.14 times).

Tata Capital: The company will offer shares for bidding on Monday . The price band is set from Rs 310 to Rs 326 per share. The Rs 15,512 crore IPO is combination of fresh issue of Rs 6846 crore and rest offer for sale.

Listing Day

Pace Digitek : The company's shares will debut on the stock exchange on Monday at an issue price of Rs 219 apiece. The Rs 819 crore IPO was subscribed 1.59 times on its third and final day. The bids were led by Qualified institutional investors (1.60 times), non-institutional investors (2.90 times), retail investors (1.03 times).

Bulk And Block Deals

Samman Capital: BNP Paribas Financial Markets purchased 58 lakh equity shares at a price of Rs 164 per share for Rs 97 crore.

Eternal: BofA Securities Europe SA bought 1.08 crore shares (0.11% stake) and Goldman Sachs Bank Europe SE - ODI sold 1.08 crore shares (0.11% stake) at a price of Rs 329 per share.

Aditya Birla Lifestyle Brands: Flipkart Investments is set to divest a 6% equity stake through a block deal. The offering size is approximately 73 million shares, priced in the range of Rs 130.00 to Rs 136.45 per share, reflecting a discount of 0.00% to 4.73% to the last closing price of Rs 136.45 on the NSE.

Trading Tweaks

Shares to Exit anchor lock-in: Amanta Healthcare(4%), Crizac(3%), Arkade developers (46%), KRN Heat Exchanger (51%).

Price band change from 5% to 20%: Nahar capital , Ishan Dyes, Mindteck India, Linc Ltd, IRIS clothing, Onward Tech, Orbit Exports.

Price band change from 5% to 10%: Sumeet Industries, Tamilnadu Telecommunication.

List of securities shortlisted in Short - Term ASM Framework Stage – I: Sammaan Capital, Galaxy Medicare, Cybertech Systems, RACL Geartech.

F&O Cues

Nifty October Futures up by 0.16% to 25006 at a premium of 111 points.

Nifty October futures open interest up by 4.38%

Nifty Options Oct. 7 Expiry: Maximum Call open interest at 26,000 and Maximum Put open interest at 24,000

Securities in Ban Period: RBL Bank.

Currency/Bond Market Update

The rupee depreciated 7 paise to close at 88.78 (provisional) against the US dollar on Friday, near its all-time low level, on dollar demand from importers and persistent foreign fund outflows. The yield on the 10-year bond ended seven points lower at 6.51%.

Business Updates

HDFC Bank

Gross advances up 9.9% at Rs 27.69 lakh crore

Period end deposits up 12.1% at Rs 28.01 lakh crore

Period end CASA deposits up 7.4% at Rs 9.49 lakh crore

Kotak Mahindra Bank

Average net advances up 14.6% YoY at Rs 4.5 lakh crore

Period end net advances up 15.8% YoY at Rs 4.6 lakh crore

Period end total deposits up 14.6% YoY at Rs 5.3 lakh crore

Period end CASA up 11.2% YoY at Rs 2.2 lakh crore

Average CASA up 6.2% YoY at Rs 1.9 lakh crore

IDBI Bank

Total business up 12% YoY at Rs 5.3 lakh crore

Total deposits up 9% YoY at Rs 3 lakh crore

CASA deposit up 4% at Rs 1.4 lakh crore

Net advances up 15% at Rs 2.3 lakh crore

AU Small Finance Bank

Total deposits up 20.8% YoY at Rs 1.32 lakh crore

Gross advances up 22.4% YoY at Rs 1.17 lakh crore

CASA deposits up 9.7% YoY at Rs 38,960 crore

CASA ratio at 29.4% vs 29.2% (QoQ)

Bajaj Finance Business Update

AUM as of Sept 30 up 24% at Rs 4.62 lakh crore

Q2 new loans booked up 26% YoY at 12.17 million

ESAF SFB

Total deposits up 5.8% YoY at Rs 22,894 crore

Gross advances up 4.4% YoY at Rs 19,137 crore

CASA ratio stood at 24.6% vs 24.8% (QoQ)

UCO Bank

Total business up 13.3% YoY at Rs 5.37 lakh crore

Total advances up 16.7% YoY at Rs 2.31 lakh crore

Total deposits up 10.9% YoY at Rs 3.06 lakh crore

Domestic advances up 17.2% YoY at Rs 2.04 lakh crore

Domestic deposits up 9.9% YoY at Rs 2.9 lakh crore

Punjab & Sind Bank

Total business up 12.3% YoY at Rs 2.4 lakh crore

Total deposits up 9.4% YoY at Rs 1.4 lakh crore

CASA deposits up 9% YoY at Rs 41,130 crore

Gross advances up 16.2% YoY at Rs 1.05 lakh crore

Bandhan Bank

Total deposits up 10.9% YoY at Rs 1.6 lakh crore

CASA deposits down 6.5% YoY at Rs 44,214 crore

Bulk deposits down 1.5% YoY at Rs 45,222 crore

Q2 collection efficiency at 98%

IndusInd Bank

Net advances down 2% QoQ at Rs 3.3 lakh crore

Deposits down 2% QoQ at Rs 3.9 lakh crore

CASA ratio stood at 20.8% vs 31.5% (QoQ)

PNB

Global business at Rs 27.9 lakh crore and domestic business at Rs 26.8 lakh crore, up 10.6% YoY and 10.5% YoY respectively

Global deposits at Rs 16.2 lakh crore (up 10.9% YoY), domestic deposits at Rs 15.6 lakh crore (up 10.4% YoY)

Global advances at Rs 11.7 lakh crore (up 10.3% YoY), domestic advances at Rs 11.2 lakh crore (up 10.7% YoY)

Bajaj Housing Finance

AUM up 24% YoY at Rs 1.28 lakh crore

Gross disbursements up 32% YoY at Rs 15,900 crore

Yes Bank

Deposits up 7.1% YoY at Rs 2.96 lakh crore

Loans and advances up 6.5% YoY at Rs 2.5 lakh crore

CASA up 13.2% YoY at Rs 1 lakh crore

CASA ratio improved to 33.8% from 32.8%

L&T Finance

Retail disbursements up 25% YoY at Rs 18,850 crore

Retail loan book up 17% YoY at Rs 1.04 lakh crore

Dhanlaxmi Bank

Total business up 17.5% YoY at Rs 30,147 crore

Total deposits up 16.9% YoY at Rs 17,103 crore

Gross advances up 18.4% YoY at Rs 13,044 crore

CASA deposits up 6.6% YoY at Rs 4,937 crore

Ujjivan SFB

Deposits up 14.8% YoY

Gross loan book up 14% YoY

Total secured book up 54.5% YoY

Suryoday Small Finance Bank

Gross advances up 23% YoY at Rs 11,544 crore

Disbursements up 49% YoY

Total deposits up 35% YoY at Rs 11,991 crore

CASA up 57% YoY at Rs 2,477 crore

CASA ratio at 20.7%

RBL Bank

Total deposits up 8% YoY at Rs 1.17 lakh crore

Gross advances up 14% YoY at Rs 1.02 lakh crore

CASA ratio dipped to 31.9% from 32.5%

ASA up 3% YoY at Rs 37,169 crore

Bank Of Baroda

Global business up 10.5% YoY at Rs 27.8 lakh crore

Global deposits up 9.3% YoY at Rs 15 lakh crore

Global advances up 11.9% YoY at Rs 12.8 lakh crore

Domestic deposits up 9.7% YoY at Rs 12.7 lakh crore

Domestic advances up 11.5% YoY at Rs 10.5 lakh crore

Utkarsh Small Finance Bank

Total deposits up 10% YoY at Rs 21,447 crore vs Rs 19,496 crore

CASA deposits up 17.3% YoY

Gross loan portfolio down 2.3% YoY

Other Business Updates Q2FY26

Sobha

Total sales area up 50% YoY at 13.9 lakh sq ft

Total sales value up 61% YoY at Rs 1,903 crore

H1FY26 sales value up 30% YoY at Rs 3,981 crore

Vedanta

Total aluminum production up 1% YoY at 617 KT

Zinc India saleable metal down 6% YoY at 246 KT

Iron ore production down 19% YoY at 1.1 MT

Iron ore sales down 33% YoY at 0.7 MT

Steel production down 8% YoY at 274 KT

Saleable silver production down 22% YoY at 144 KT

Oil and gas average gross production down 15% YoY at 89.3 KBOEPD

Alert: KBOEPD stands for thousands of barrels of oil equivalent per day

AWL Agri Business

Volume growth up 5% YoY

Revenue up 24% YoY

Basmati rice, pulses & besan, sugar and poha saw double-digit volume growth

Quick commerce volume growth up 86% YoY in Q2

Revenue from alternate channels (modern trade + e-commerce) surpassed Rs 4,400 crore over the last 12 months

Sambhv Steel Tubes

Total sales volume up 53% YoY at 98,768 tonnes

Value-added products sales volume up 71% YoY at 89,562 tonnes

Intermediate products sales volume down 24.3% YoY at 9,206 tonnes

JSW Energy

Commissioned 114 MW of renewable energy capacity in September 2025

Solar capacity: 21 MW

Wind capacity: 93 MW

Total installed capacity now at 13,211 MW

Marico

Q2 consolidated revenue growth in the thirties

Constant currency international growth in the twenties

Modest YoY operating profit growth

Hindustan Zinc

Mined metal production up 1% YoY at 2.58 lakh tonnes

Refined zinc production up 2% YoY at 2.02 lakh tonnes

Refined lead production down 29% YoY at 45,000 tonnes

Silver production down 22% YoY at 144 tonnes

Wind power generation up 2% YoY at 132 million units

MOIL

September production up 3.8% YoY at 1.52 lakh tonnes

Q2 production up 10.3% YoY at 4.42 lakh tonnes

Avenue Supermarts

Q2 standalone revenue from operations at Rs 16,219 crore, up 15.4% YoY

Total store count as of September 30 stands at 432

JTL Industries

H1FY26 volumes up 3.5% YoY at 1.8 lakh MT

Q2 sales volume at 81,593 MT

Q2 export share increased to 12% from 6% in Q1

Force Motors (September Auto Sales)

Total sales up 1.8% YoY at 2,610 units

Domestic sales up 1.5% YoY at 2,486 units

Exports up 7.8% YoY at 124 units

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.