Good morning!

The GIFT Nifty is trading flat at 26, 031, indicating a muted open for the benchmark Nifty 50.

US and European index futures are trading higher during Asian trading hours.

S&P 500 futures up 0.63%

Euro Stoxx 50 down 0.14%

Market Recap

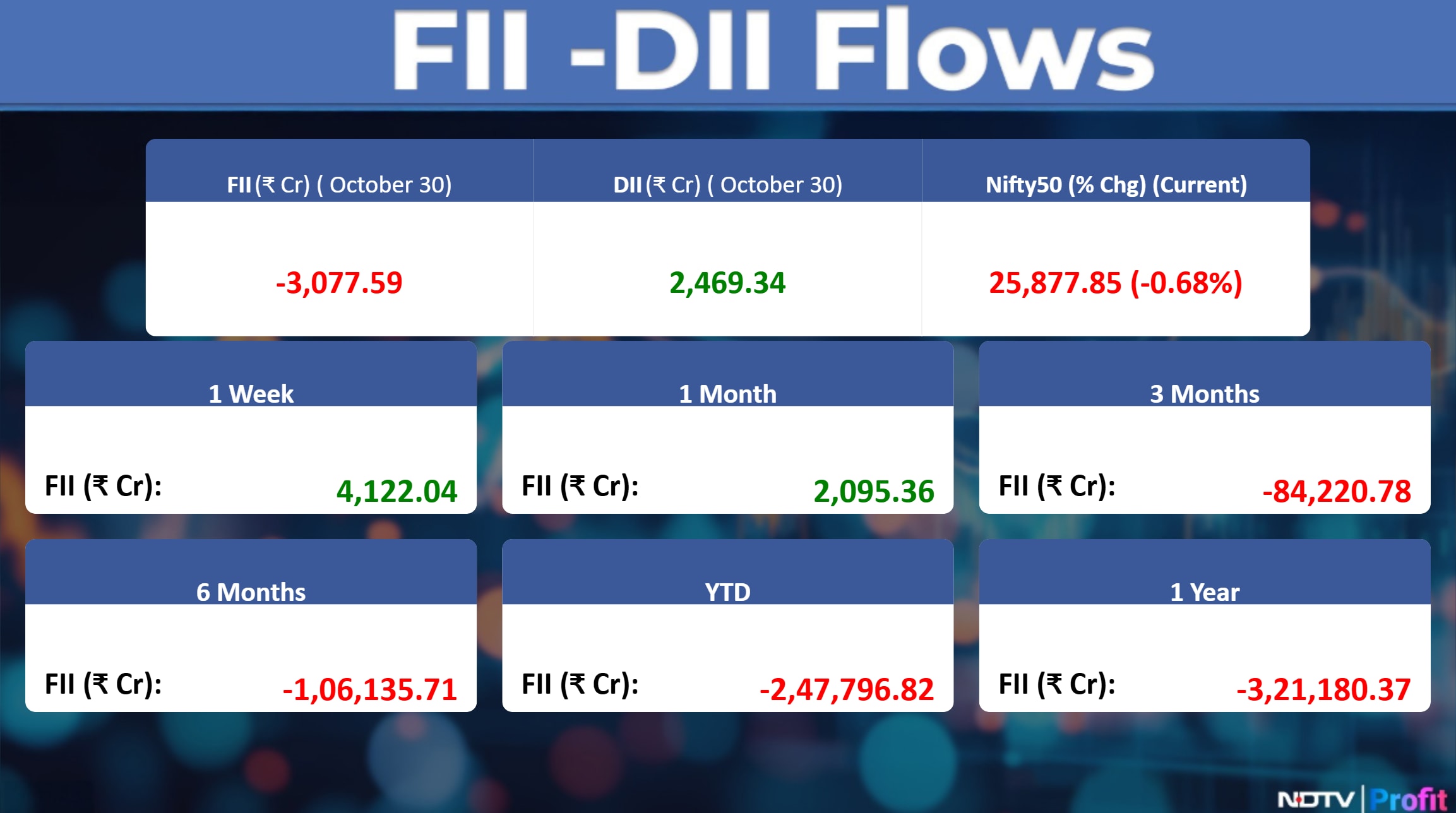

The Nifty ended in the red on Thursday closing below the 26,000 mark. At the close, the Sensex fell 592.67 points, or 0.70%, to 84,404.46, while the Nifty slipped 176.05 points, or 0.68%, to 25,877.85. The Nifty was down as much as 0.80% during the day at 25,845.25, while the Sensex was also down 0.81% to 84,312.65.

"Technically, after a gap-down open, the entire day market witnessed selling pressure at higher levels," said Shrikant Chouhan, Head Equity Research, Kotak Securities.

US Market Wrap

US equity-index futures grew as strong earnings from Amazon.com Inc. and Apple Inc. lifted sentiment after a brief pause in the global stock rally. MSCI's regional stocks index grey by 0.4%

Amazon grew 13% in extended trading after reporting its fastest cloud unit growth in nearly three years. Futures on the S&P 500 rose 0.7% and those on the Nasdaq 100 gained 1.2% after the underlying indexes slipped Thursday amid weakness in tech stocks, reports Bloomberg.

Asian Market Wrap

Asian equities climbed close to their record, and Japanese shares advanced 1%. The yen grew after inflation in Tokyo advanced at a faster pace.

The MSCI China Index fell 2.5% in October, ending a five-month winning streak. That lags well behind the MSCI Asia Pacific Index's 4.2% gain, reports Bloomberg.

Commodity Check

Gold consolidated gains from a day earlier, holding above $4,000 an ounce as traders weighed a US-China trade truce that failed to quash concerns about long-term competition between the world's two largest economies.

Bullion edged higher on Friday, after climbing 2.4% in the previous session, reports Bloomberg. Spot gold declined 0.2% to $4,016.21 an ounce at 9:55 a.m. in Singapore.

Key Events To Watch

Finance Minister Nirmala Sitharaman on official visit to Bhutan till Nov. 2.

Government to release fiscal deficit for April-Sept. period.

RBI to conduct government bond and variable rate repo auctions.

Earnings Post Market Hours

Nippon Life Q2 Highlights (Consolidated, QoQ)

Net Profit down 13% to Rs 345 crore versus Rs 396 crore.

Total Income down 7.7% to Rs 695 crore versus Rs 753 crore.

To pay interim dividend of Rs 9/share.

Welspun Corp Q2 Highlights (Consolidated, YoY)

Revenue up 32.5% to Rs 4,374 crore versus Rs 3,302 crore.

Ebitda up 47.9% to Rs 591 crore versus Rs 400 crore.

Margin at 13.5% versus 12.1%.

Net Profit up 53.2% to Rs 440 crore versus Rs 287 crore.

Gillette India Q2 Highlights (YoY)

Revenue up 3.7% to Rs 811 crore versus Rs 782 crore.

Ebitda up 9.1% to Rs 208 crore versus Rs 190 crore.

Margin at 25.6% versus 24.4%.

Net Profit up 10.9% to Rs 49.1 crore versus Rs 44.2 crore.

Manappuram Finance Q2 Highlights (Consolidated, YoY)

Calculated NII down 15.9% to Rs 1,376 crore versus Rs 1,635 crore.

Net Profit down 61.5% to Rs 220 crore versus Rs 571 crore.

Swiggy Q2 Highlights (Consolidated, YoY)

Revenue up 54.4% to Rs 5,561 crore versus Rs 3,601 crore.

Ebitda loss at Rs 798 crore versus loss of Rs 554 crore.

Net Loss widens to Rs 1,092 crore versus loss of Rs 626 crore.

Dabur Q2 Highlights (Consolidated, YoY)

Revenue up 5.4% to Rs 3,191 crore versus Rs 3,029 crore.

Ebitda up 6.4% to Rs 588 crore versus Rs 553 crore.

Margin at 18.4% versus 18.2%.

Net Profit up 6.5% to Rs 453 crore versus Rs 425 crore.

To pay interim dividend of Rs 2.75/share.

ITC Q2 Highlights (YoY)

Revenue down 3.4% to Rs 18,021 crore versus Rs 18,649 crore.

Ebitda up 2.1% to Rs 6,252 crore versus Rs 6,123 crore.

Margin at 34.7% versus 32.8%.

Net Profit up 2% to Rs 5,180 crore versus Rs 5,078 crore.

Navin Fluorine Q2 Highlights (Consolidated, YoY)

Revenue up 46.3% to Rs 758 crore versus Rs 519 crore.

Ebitda up to Rs 246 crore versus Rs 107 crore.

Margin at 32.5% versus 20.7%.

Net Profit at Rs 148 crore versus Rs 58.8 crore.

To pay interim dividend of Rs 6.5/share.

Bandhan Bank Q2 Highlights (YoY)

NII down 11.8% to Rs 2,589 crore versus Rs 2,934 crore.

Operating Profit down 29.4% to Rs 1,310 crore versus Rs 1,855 crore.

Provisions up 90.1% to Rs 1,153 crore versus Rs 606 crore.

Net Profit down 88.1% to Rs 112 crore versus Rs 937 crore.

Gross NPA at 5.02% versus 4.96%; Net NPA at 1.37% versus 1.36%.

Cemindia Projects Q2 Highlights (Consolidated, YoY)

Revenue up 9.3% to Rs 2,175 crore versus Rs 1,991 crore.

Ebitda up 11.9% to Rs 203 crore versus Rs 182 crore.

Margin at 9.3% versus 9.1%.

Net Profit up 49.4% to Rs 108 crore versus Rs 72 crore.

IEX Q2 Highlights (Consolidated, YoY)

Revenue up 10.4% to Rs 154 crore versus Rs 139 crore.

Ebitda up 11.3% to Rs 133 crore versus Rs 120 crore.

Margin at 86.7% versus 86%.

Net Profit up 13.9% to Rs 123 crore versus Rs 108 crore.

Motilal Oswal Q2 Highlights (Consolidated, QoQ)

Total Income down 32.2% to Rs 1,860 crore versus Rs 2,744 crore.

Net Profit down 68.8% to Rs 362 crore versus Rs 1,162 crore.

Carborundum Universal Q2 Highlights (Consolidated, YoY)

Revenue up 6% to Rs 1,298 crore versus Rs 1,224 crore.

Ebitda down 19.8% to Rs 156 crore versus Rs 195 crore.

Margin at 12% versus 15.9%.

Net Profit down 35.7% to Rs 74.5 crore versus Rs 116 crore.

JBM Auto Q2 Highlights (Consolidated, YoY)

Revenue up 6.4% to Rs 1,368 crore versus Rs 1,286 crore.

Ebitda down 5.5% to Rs 156 crore versus Rs 165 crore.

Margin at 11.4% versus 12.8%.

Net Profit up 6.3% to Rs 52.6 crore versus Rs 49.5 crore.

LT Foods Q2 Highlights (Consolidated, YoY)

Revenue up 31.2% to Rs 2,766 crore versus Rs 2,108 crore.

Ebitda up 35% to Rs 309 crore versus Rs 229 crore.

Margin at 11.2% versus 10.9%.

Net Profit up 10.4% to Rs 164 crore versus Rs 148 crore.

ASK Automotive Q2 Highlights (Consolidated, YoY)

Revenue up 8.2% to Rs 1,054 crore versus Rs 974 crore.

Ebitda up 17.4% to Rs 137 crore versus Rs 117 crore.

Margin at 13% versus 12%.

Net Profit up 18.6% to Rs 79.8 crore versus Rs 67.3 crore.

TD Power Q2 Highlights (Consolidated, YoY)

Revenue up 47.7% to Rs 452 crore versus Rs 306 crore.

Ebitda up 48.6% to Rs 82.6 crore versus Rs 55.6 crore.

Margin at 18.3% versus 18.1%.

Net Profit up 45.8% to Rs 60.2 crore versus Rs 41.3 crore.

Restaurant Brands Q2 Highlights (Consolidated, YoY)

Revenue up 11.2% to Rs 703 crore versus Rs 632 crore.

Ebitda up 12.2% to Rs 70.9 crore versus Rs 63.2 crore.

Margin at 10.1% versus 10%.

Net Loss at Rs 58.6 crore versus loss of Rs 60.2 crore.

Datamatics Global Services Q2 Highlights (Consolidated, QoQ)

Revenue up 4.84% to Rs 490.23 crore versus Rs 467.56 crore.

Ebit up 22.13% to Rs 68.92 crore versus Rs 56.43 crore.

Ebit Margin up 198 bps at 14.05% versus 12.06%.

Net Profit up 25.52% to Rs 63.24 crore versus Rs 50.38 crore.

IIFL Finance Q2 Highlights (Consolidated, QoQ)

Calculated NII up 11.1% to Rs 1,439 crore versus Rs 1,295 crore.

Net Profit up 61.3% to Rs 376 crore versus Rs 233 crore.

United Spirits Q2 Highlights (YoY)

Revenue up 11.5% to Rs 3,170 crore versus Rs 2,843 crore.

Ebitda up 32.5% to Rs 672 crore versus Rs 507 crore.

Margin at 21.2% versus 17.8%.

Net Profit up 40.9% to Rs 472 crore versus Rs 335 crore.

DLF Q2 Highlights (Consolidated, YoY)

Revenue down 16.8% to Rs 1,643 crore versus Rs 1,975 crore.

Ebitda down 43.5% to Rs 284 crore versus Rs 502 crore.

Margin at 17.3% versus 25.4%.

Net Profit down 14.6% to Rs 1,180 crore versus Rs 1,381 crore.

NTPC Q2 Highlights (Consolidated, YoY)

Revenue up 0.2% to Rs 44,786 crore versus Rs 44,706 crore.

Ebitda up 10% to Rs 12,816 crore versus Rs 11,665 crore.

Margin at 28.6% versus 26.1%.

Net Profit down 3.9% to Rs 5,067 crore versus Rs 5,275 crore.

Indostar Capital Finance Q2 Highlights (Consolidated, YoY)

Calculated NII up 39% to Rs 151 crore versus Rs 108 crore.

Net Profit down 66.9% to Rs 10.5 crore versus Rs 31.7 crore.

Lodha Developers Q2 Highlights (Consolidated, YoY)

Revenue up 44.7% to Rs 3,799 crore versus Rs 2,626 crore.

Ebitda up 57.4% to Rs 1,109 crore versus Rs 705 crore.

Margin at 29.2% versus 26.8%.

Net Profit up 86.5% to Rs 789 crore versus Rs 423 crore.

Pidilite Industries Q2 Highlights (Consolidated, YoY)

Revenue up 9.9% to Rs 3,554 crore versus Rs 3,235 crore.

Ebitda up 10.7% to Rs 851 crore versus Rs 769 crore.

Margin at 23.9% versus 23.8%.

Net Profit up 8.4% to Rs 579 crore versus Rs 535 crore.

Gravita India Q2 Highlights (Consolidated, YoY)

Revenue up 11.7% to Rs 1,036 crore versus Rs 927 crore.

Ebitda up 60.7% to Rs 102 crore versus Rs 63.5 crore.

Margin at 9.9% versus 6.8%.

Net Profit up 33.3% to Rs 96 crore versus Rs 72 crore.

Automotive Axles Q2 Highlights (YoY)

Revenue down 6.9% to Rs 462 crore versus Rs 495 crore.

Ebitda down 5.6% to Rs 48.2 crore versus Rs 51.1 crore.

Margin at 10.4% versus 10.3%.

Net Profit flat at Rs 36 crore.

Indegene Q2 Highlights (Consolidated, YoY)

Revenue up 17.1% to Rs 804 crore versus Rs 687 crore.

Ebitda up 11.5% to Rs 141 crore versus Rs 126 crore.

Margin at 17.5% versus 18.4%.

Net Profit up 11.3% to Rs 102 crore versus Rs 91.7 crore.

IFB Industries Q2 Highlights (Consolidated, YoY)

Revenue up 12.4% to Rs 1,370 crore versus Rs 1,219 crore.

Ebitda up 41.6% to Rs 99.8 crore versus Rs 70.5 crore.

Margin at 7.3% versus 5.8%.

Net Profit up 61.7% to Rs 50.8 crore versus Rs 31.4 crore.

Stocks In News

Bharat Electronics: The company has received additional orders worth Rs 732 crore since its last disclosure on Oct. 22.

Concord Control: The company has acquired Fusion Electronics.

LTIMindtree: The company has launched its new platform ‘BlueVerse' for autonomous IT service management solutions.

TCS: The company has entered into a five-year agreement with Tata Motors to digitize ESG data.

Swiggy: The company will consider raising up to Rs 10,000 crore via QIP or other fundraising routes on Nov. 7.

BEML: The company has signed three MoUs for a value of Rs 350 crores with Dredging Corporation of India to supply cable and suction dredgers.

IIFL Finance: The company's arm, IIFL Home Finance, has appointed Girish Kousgi as Managing Director and chief executive officer.

Reliance Industries: The company has signed an agreement with Google to offer AI solutions and will provide Jio users free access to Google AI Pro for 18 months, valued at Rs. 35,100 per user.

MTAR Technologies: The company has secured an international order worth Rs 264 crore from an existing customer.

Tata Motors PV: The company has changed the name of TML Commercial Vehicles to Tata Motors.

V2 Retail: The company has opened its QIP and approved a floor price of Rs. 2,245.75 per share.

Biocon: The company's arm, Biocon Biologics UK, has been de-registered as a public company and renamed Biocon Biologics UK PLC.

Pidilite Industries: The company will fully acquire its arm, Pidilite C-Techos Walling, by purchasing the remaining 40% stake.

Reliance Industries: Thailand-based REC Systems has ceased to be a subsidiary of the company.

Sunteck Realty: The company has incorporated a wholly-owned arm, Adyanta Constructions.

Britannia Industries: Urjit Patel has resigned as a non-executive independent director.

Bank of Baroda: The Australia branch has concluded borrowing of 125 million australian dollars through a syndicated term loan facility for one year.

Great Eastern Shipping: The company has signed a contract to buy a Japanese bulk carrier of 63,500 DWT.

Escorts Kubota: Shareholders have approved the appointment of Akira Kato as Whole-Time Director.

Orchid Pharma: The company has completed the purchase of assets of Allecra Therapeutics GmbH.

Adani Green: The company's arms, Adani Solar Energy Jodhpur Six and Adani Renewable Energy Forty One, have signed an agreement to supply 60 MW of solar-wind hybrid power to a commercial and industrial customer.

Tata Communications: The company's arm, MGAGE SA de CV, has been wound up and deemed liquidated effective Oct. 1, 2025.

Everest Kanto: The company has received a GST demand order of Rs. 11 crore from the Kandla Special Economic Zone tax authority.

Vardhman Special Steels: The company has further invested Rs. 1.1 crore in Sone Solar.

NRB Bearings: Promoter Harshbeena Sahney Zaveri will acquire a 27.9% stake in the company.

HG Infra: The company has received a tax demand of Rs. 1.4 crore from the Income Tax Department.

Sunteck Realty: The company will acquire 100% stake in Shreejikrupa Hotels & Properties for an enterprise value of Rs. 100 crore.

Authum Investment & Infrastructure: The company has acquired cumulative compulsorily convertible participating preference shares of Rivaara Labs.

Time Technoplast: The company has received an order worth Rs. 190 crore for supply of HDPE pipe products, taking its total order book for this segment to around Rs. 280 crore.

LT Foods: The company has approved an additional equity infusion of 5 million pounds in its arm, LT Foods UK.

DEN Networks: The company's demand for tax, interest, and penalty amounting to Rs. 33.2 crore has been quashed.

Airfloa Rail: The company has received an order worth Rs. 3.1 crore from Modern Coach Factory in Uttar Pradesh, taking its total new orders to over Rs. 113 crore within a week.

Hero MotoCorp: The company has completed the acquisition of a 26% stake in SPV Clean Max Karakoram for Rs. 26,000.

Bank of Maharashtra: The bank has reduced its MCLR by 10–25 basis points for overnight to three-month tenures.

Hindustan Unilever: The company has received NCLT approval to demerge its ice cream business into Kwality Wall's India Ltd.

Hexaware Technologies: The company's step-down subsidiary in Canada has been voluntarily liquidated.

Exicom Tele-Systems: The Directorate of Revenue has conducted a search at the company's Gurugram offices. The company confirmed full cooperation and stated that operations remain unaffected.

Indegene: The company will invest 8.5 million euros in its subsidiary, Indegene Ireland.

IPO Offering

Orkla India: The Company offering a diverse range of food products, from breakfast to lunch and dinner, snacks, beverages, and desserts

The public issue was subscribed to 2.7x on day 2. The bids were led by institutional investors (7.6x), retail investors (2.1x), QIBS (6%).Studds Accessories: The Company manufactures two-wheeler helmets and motorcycle accessories based in Faridabad, Haryana, India. The public issue was subscribed to 1.5x on day 1. The bids were led by institutional investors (2.1x times), retail investors (2.2x), QIBS (2%).

IPO To Open

Lenskart Solutions: The Company operates as eyewear retailer with technology-focus. As of FY25, company operates over 2,700 stores globally, with 2,067 in India. The Company shares are set to open tomorrow that is 31th October, IPO is of size Rs.7,278.02 crore ( fresh issue of Rs.2,150 crores and offer for sale of Rs.5,128.02 crores) & has a price band of Rs.382 to Rs.402 per share

Bulk & Block Deals

Reliance Industries: BOFA Securities Europe bought & Kadensa Master Fund sold 2.95 lakh shares at Rs. 1,475.50 a piece.

Asso Alcohols & Brew: Equity Intelligence India bought 1 lakh shares at Rs. 1,160.60 apiece.

Chennai Petroleum Corp: BOFA Securities Europe bought 7.7 lakh shares at Rs. 868.59 apiece,BOFA Securities Europe sold 9,817 shares at Rs.880.63 a piece.

Corporate Actions

Bonus Shares Issue: Finotex chemical (4:1)

Interim dividend: Coforge: Rs. 4. Nrb Bearing: Rs.2.5. Laurus Labs: Rs.0.8. Pds Ltd.: Rs.1.65. Supreme Petro Chem: Rs.2.5

Shares to Exit Anchor Lock-In: Pace Digitek (3%)

Earnings In Focus

ACC, Aptus Value Housing Finance India, Bajaj Electricals, Balkrishna Industries, Bank of Baroda, Bharat Electronics, Bharat Petroleum Corporation, Dhanuka Agritech, Equitas Small Finance Bank, GAIL (India), Godrej Consumer Products, Intellect Design Arena, Jubilant Pharmova, Kalpataru Projects International, Dr. Lal PathLabs, LG Balakrishnan & Bros, Mahindra Lifespace Developers, Maruti Suzuki India, Medplus Health Services, Mahindra Holidays & Resorts India, NOCIL, Northern Arc Capital, Patanjali Foods, The Phoenix Mills, Prism Johnson, R R Kabel, Sammaan Capital, Schaeffler India, Shriram Finance, Spandana Sphoorty Financial, Strides Pharma Science, Tatva Chintan Pharma Chem, Vedanta, Zensar Technologies

Trading Tweaks

List of securities to be excluded from ASM Framework: Banco Products, V2 Retail

Price Band change from 5% to 20%: SKF India

Price Band change from 20% to 5%: Dalmi Bharat Sugar And Industries.

F&O Cues

Nifty Nov futures is down 0.77% to 26,037.40 at a discount of 16 points.

Nifty Nov futures open interest up by 6.81%

Nifty Options 4th Nov Expiry: Maximum Call open interest at 26,000 and Maximum Put open interest at 25,600.

Currency Update

The rupee depreciated 48 paise to close at 88.70 (provisional) against the American currency on Thursday on a strong US dollar, weak domestic markets, and a hawkish US Fed. The yield on the 10-year bond ended unchanged at 6.54%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.