Good morning!

The GIFT Nifty is trading with 0.12% gains at 26,166, indicating a positive open for the benchmark Nifty 50.

US and European index futures are trading higher during Asian trading hours.

S&P 500 futures up 0.21%

Euro Stoxx 50 futures up 0.35%

Markets On Home Turf

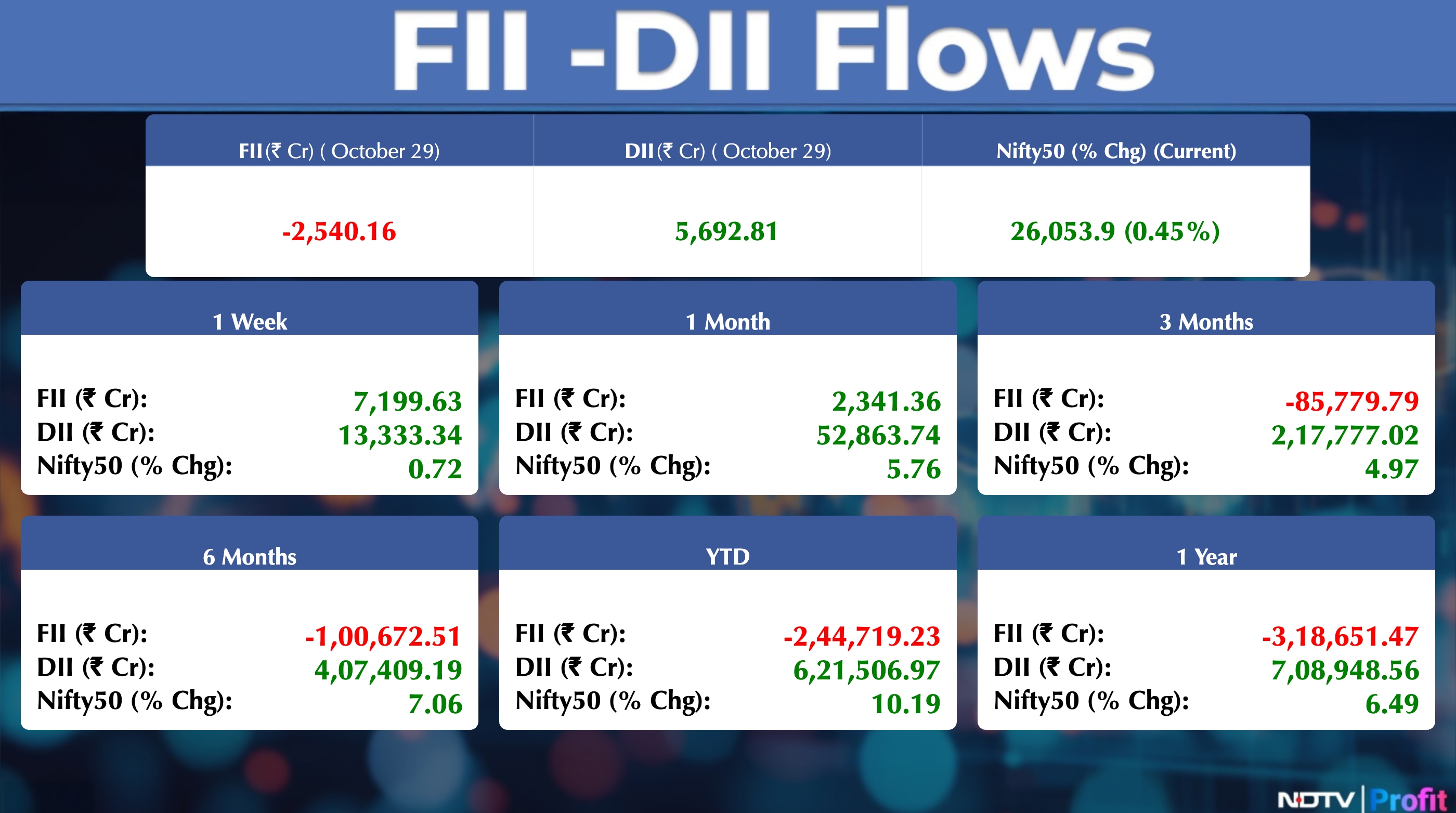

The Nifty ended in the green on Wednesday closing above the 26,053 mark. At the close, the Sensex rose 368.97 points, or 0.44%, to 84,997.13, while the Nifty rose 117.70 points, or 0.45%, to 26,053.90.

The FPIs sold stocks worth approximately Rs 2,540 crore, according to provisional data from the National Stock Exchange. The DIIs stayed net buyers for the fourth day and bought stake worth Rs 5,693 crore.

US Market Wrap

Wall Street was shaken due to the division at the Federal Reserve over the future of monetary policy that whipsawed stocks and pushed bond yields higher. The S&P 500 wiped out its gain. Nvidia Corp. became the first $5 trillion company. In late hours, Alphabet Inc. reported solid sales. Meta Platforms Inc. saw total expenses to significantly rise in 2026. Microsoft Corp.'s expansion in its Azure unit failed to inspire traders.

The yield on two-year Treasuries jumped 11 basis points to 3.6%. The dollar advanced, reports Bloomberg.

Asian Market Wrap

Asian stocks struggled for direction after Federal Reserve Chair Jerome Powell cautioned about further interest-rate reductions, reports Bloomberg.

Shares in South Korea jumped more than 1% after Seoul struck a trade deal with the US. Samsung Electronics Co. reported better-than-expected earnings, which also led to the rise.

Commodity Check

Gold climbed higher after four days of losses. Bullion traded near $3,950 an ounce on Thursday, after falling 0.6% in the previous session. The yellow metal has retreated sharply in recent days following a rally that drove prices to a record above $4,380 an ounce last week.

Oil steadied as traders counted down to a summit between US President Donald Trump and Chinese counterpart Xi Jinping and, beyond that, an OPEC+ meeting that may endorse another supply hike. Brent was little changed below $65 a barrel while West Texas Intermediate was near $60, reports Bloomberg.

Copper hit a record in London. Three-month futures climbed to $11,200 a ton on the London Metal Exchange, topping a previous peak set in 2024

Key Events To Watch

Narendra Modi will visit Gujarat and launch development projects worth over 11.4 billion rupees in Ekta Nagar.

Communications & DNER Minister Jyotiraditya Scindia will chair the Review of Q2 Performance of BSNL with CGMs.

Earnings Post Market Hours

Satin Creditcare Q2 Highlights (Consolidated, YoY)

Revenue up 19.9% to Rs 788 crore versus Rs 657 crore.

EBITDA up 24.3% to Rs 415 crore versus Rs 334 crore.

Margin at 52.7% versus 50.8%.

Net Profit up 18.9% to Rs 53.2 crore versus Rs 44.7 crore.

Fino Payments Bank Q2 Highlights (Standalone, YoY)

NII up 43.1% to Rs 32.5 crore versus Rs 22.7 crore.

Operating Profit down 18.2% to Rs 21.2 crore versus Rs 25.9 crore.

Net Profit down 27.4% to Rs 15.4 crore versus Rs 21.2 crore.

Apollo Pipes Q2 Highlights (Consolidated, YoY)

Revenue down 5.9% to Rs 236 crore versus Rs 250 crore.

EBITDA down 18.7% to Rs 15.8 crore versus Rs 19.4 crore.

Margin at 6.7% versus 7.7%.

Net Profit down 61.2% to Rs 1.6 crore versus Rs 4.2 crore.

Mahanagar Gas Q2 Highlights (Consolidated, QoQ)

Revenue down 1.6% to Rs 2,050 crore versus Rs 2,083 crore.

EBITDA down 32.5% to Rs 338 crore versus Rs 501 crore.

Margin at 16.5% versus 24%.

Net Profit down 39.9% to Rs 191 crore versus Rs 319 crore.

Astec Lifesciences Q2 Highlights (Consolidated, YoY)

Revenue down 25.2% to Rs 73.7 crore versus Rs 98.5 crore.

EBITDA loss at Rs 6.7 crore versus loss of Rs 19.7 crore.

Net Loss at Rs 24.4 crore versus loss of Rs 38.6 crore.

PB Fintech Q2 Highlights (Consolidated, YoY)

Revenue up 38.2% to Rs 1,614 crore versus Rs 1,167 crore.

EBITDA at Rs 97.8 crore versus loss of Rs 7.8 crore.

Margin at 6.1%.

Net Profit at Rs 135 crore versus Rs 50.7 crore.

Bharat Heavy Electricals Q2 Highlights (Consolidated, YoY)

Revenue up 14.1% to Rs 7,512 crore versus Rs 6,584 crore.

EBITDA at Rs 581 crore versus Rs 275 crore.

Margin at 7.7% versus 4.2%.

Net Profit at Rs 375 crore versus Rs 106 crore.

VST Industries Q2 Highlights (Standalone, YoY)

Revenue down 6.7% to Rs 336 crore versus Rs 360 crore.

EBITDA up 16.3% to Rs 78.6 crore versus Rs 67.6 crore.

Margin at 23.4% versus 18.8%.

Net Profit up 24.5% to Rs 59.2 crore versus Rs 47.6 crore.

Transport Corporation of India Q2 Highlights (Consolidated, YoY)

Revenue up 7.5% to Rs 1,205 crore versus Rs 1,121 crore.

EBITDA up 8.2% to Rs 127 crore versus Rs 117 crore.

Margin at 10.5% versus 10.4%.

Net Profit up 5.8% to Rs 113 crore versus Rs 106 crore.

Larsen & Toubro Q2 Highlights (Consolidated, YoY)

Revenue up 10.4% to Rs 67,984 crore versus Rs 61,555 crore.

EBITDA up 7% to Rs 6,806 crore versus Rs 6,362 crore.

Margin at 10% versus 10.3%.

Net Profit up 15.6% to Rs 3,926 crore versus Rs 3,395 crore.

Hindustan Petroleum Q2 Highlights (Standalone, QoQ)

Revenue down 9% to Rs 1.01 lakh crore versus Rs 1.11 lakh crore.

EBITDA down 9.3% to Rs 6,891 crore versus Rs 7,602 crore.

Margin at 6.8% versus 6.9%.

Net Profit down 12.4% to Rs 3,830 crore versus Rs 4,371 crore.

SAIL Q2 Highlights (Consolidated, QoQ)

Revenue up 3% to Rs 26,704 crore versus Rs 25,922 crore.

EBITDA down 8.7% to Rs 2,528 crore versus Rs 2,769 crore.

Margin at 9.5% versus 10.7%.

Net Profit down 43.8% to Rs 419 crore versus Rs 745 crore.

Le Travenues Technology Q2 Highlights (Consolidated, YoY)

Revenue up 37% to Rs 283 crore versus Rs 206 crore.

EBITDA loss at Rs 3.7 crore versus profit of Rs 17.9 crore.

Net Loss at Rs 3.1 crore versus profit of Rs 13 crore.

NTPC Green Energy Q2 Highlights (Consolidated, YoY)

Revenue up 21.5% to Rs 612 crore versus Rs 504 crore.

EBITDA up 26.1% to Rs 529 crore versus Rs 420 crore.

Margin at 86.5% versus 83.3%.

Net Profit at Rs 87.5 crore versus Rs 38 crore.

RailTel Corporation Q2 Highlights (Standalone, YoY)

Revenue up 12.8% to Rs 951 crore versus Rs 843 crore.

EBITDA up 19.5% to Rs 154 crore versus Rs 129 crore.

Margin at 16.2% versus 15.3%.

Net Profit up 4.7% to Rs 76.1 crore versus Rs 72.6 crore.

Declares interim dividend of Re 1 per share.

United Breweries Q2 Highlights (Consolidated, YoY)

Revenue down 3% to Rs 2,053 crore versus Rs 2,117 crore.

EBITDA down 42.9% to Rs 130 crore versus Rs 227 crore.

Margin at 6.3% versus 10.7%.

Net Profit down 64.8% to Rs 46.5 crore versus Rs 132 crore.

Sagility Q2 Highlights (Consolidated, QoQ)

Revenue up 7.8% to Rs 1,658 crore versus Rs 1,539 crore.

EBITDA up 19.9% to Rs 415 crore versus Rs 346 crore.

Margin at 25% versus 22.5%.

Net Profit up 68.9% to Rs 251 crore versus Rs 149 crore.

LIC Housing Finance Q2 Highlights (Consolidated, YoY)

Calculated NII up 3.3% to Rs 2,048 crore versus Rs 1,981 crore.

Net Profit up 1.6% to Rs 1,349 crore versus Rs 1,328 crore.

Capri Global Capital Q2 Highlights (Consolidated, YoY)

Calculated NII up 57.5% to Rs 480 crore versus Rs 305 crore.

Net Profit at Rs 236 crore versus Rs 96.9 crore.

Laxmi Organic Industries Q2 Highlights (Consolidated, YoY)

Revenue down 9.3% to Rs 700 crore versus Rs 771 crore.

EBITDA down 50.4% to Rs 37 crore versus Rs 74.6 crore.

Margin at 5.3% versus 9.7%.

Net Profit down 60.7% to Rs 11 crore versus Rs 28 crore.

Quess Corp Q2 Highlights (Consolidated, YoY)

Revenue up 3.4% to Rs 3,832 crore versus Rs 3,705 crore.

EBITDA up 10.9% to Rs 76.7 crore versus Rs 69.2 crore.

Margin at 2% versus 1.9%.

Net Profit up 2% to Rs 51.5 crore versus Rs 50.5 crore.

Brigade Enterprises Q2 Highlights (Consolidated, YoY)

Revenue up 29% to Rs 1,383 crore versus Rs 1,072 crore.

EBITDA up 12.3% to Rs 328 crore versus Rs 292 crore.

Margin at 23.7% versus 27.2%.

Net Profit up 36.7% to Rs 163 crore versus Rs 119 crore.

Stocks In News

Infosys: The company extends its strategic partnership with Metro Bank and Workday for the transition of finance operations.

Titan: The company announces the resignation of Ambuj Narayan as CEO of its Indian Dress Wear Division.

JSW Steel: The company's arm increases its economic interest in M Res NSW HCC Pty to 83.33% from 66.67%. The arm purchases non-voting Class B shares from M Res NSW HCC Holdings Pty for $24 million and subscribes to additional shares worth $36 million. The proceeds are used by M Res NSW to acquire an additional 6% stake in Golden M NSW Pty, taking its total stake to 36%. Consequently, JSW Steel's effective economic interest in Illawarra Metallurgical Coal rises to 30% from 20%.

Wipro: The company enters into a multi-year partnership with HanesBrands Inc to drive GenAI-led IT 2.0 transformation.

Kalyani Investment: The company's CEO and CFO, Shekhar D. Shivpathaki, resigns from his position.

Ultramarine & Pigments: The company to participate in fund raising by Thirumalai Chemicals through equity share issuance.

Optiemus Infracom: The company to incorporate a joint venture entity named The Factory Private.

Container Corp: The company enters into an agreement with Jawaharlal Nehru Port Authority for rail handling operations at Vadhvan Port.

Colgate: The company launches its first-ever Visible White Purple Serum.

Shyam Metalics: The company's arm, Shyam Sel and Power, acquires 100% stake in Star Metalworks for Rs 1 lakh.

Vedanta: The NCLT Mumbai Bench heard the company's demerger petition today and posted the matter for final hearing on November 12. Vedanta reiterates its commitment to the proposed demerger aimed at creating independent, sector-specific entities across aluminium, oil & gas, power, and iron & steel.

Ceigall India: The company incorporates two new subsidiaries — Ceigall Green Energy MH1 and Ceigall Green Energy MH2.

Craftsman Automation: The company's arm to set up a new factory in the Chennai Metropolitan Area with an investment of Rs 280 crore.

Reliance Infrastructure: The group strongly condemns Cobrapost's proposed malicious campaign to tarnish its reputation, calling it agenda-driven and aimed at misleading stakeholders. The company accuses Aniruddha Bahal of using coercive tactics and alleges the campaign is intended to crash stock prices.

Tata Steel: The company acquires 159 crore shares of T Steel Holdings Pte for Rs 1,409 crore, making it a wholly-owned foreign subsidiary.

Dr Reddy's Laboratories: The company receives a non-compliance notice from Canadian authorities regarding the abbreviated new drug submission for Semaglutide injection and will respond at the earliest.

Texmaco Rail & Engineering: The company secures an order worth Rs 33.89 crore from Central Railway and also received an order worth Rs 44.6 crore from Maharashtra Metro Rail Corporation.

SPML Infra: The company secures a Rs 505 crore credit facility to fast-track projects and support growth.

Sri Lotus Developers: The company incorporates a new subsidiary named ASVI Projects Private Limited.

NBCC: The company receives orders worth Rs 79 crore from the Institute of Chartered Accountants of India for construction work.

BLS International: The company's arm subscribes to 100% share capital of BLS International Services (Senegal) and BLS International Cyprus.

Zydus Lifesciences: The US FDA issues an Establishment Inspection Report (EIR) with “Voluntary Action Indicated” classification for the company's Baddi manufacturing facility, following an inspection conducted from August 4–13.

Ola Electric: The company receives an email from the Central Consumer Protection Authority (CCPA) enclosing an investigation report and directing it to provide comments within seven days. A hearing is scheduled for November 10, 2025, over alleged violations of consumer rights, service deficiencies, and misleading advertisements.

Dilip Buildcon: The company secures an order worth Rs 307 crore from ISC Projects.

Aditya Birla Capital: The company invests Rs 382 crore in its arm, Aditya Birla Sun Life.

Sharda Motor Industries: The company signs a technology licence agreement with Donghee Industries for advanced suspension products in India.

Tata Steel: The company files a writ petition challenging a demand letter seeking Rs 2,411 crore.

Raymond Realty: The company incorporates Chembur Realty as a wholly-owned subsidiary.

Adani Ports: The company clarifies that it has signed two non-binding MoUs with Jawaharlal Nehru Port Authority to explore participation in container terminal and offshore projects at Vadhavan Port. It will take part in the bidding process once tenders are issued, denying reports of a Rs 53,000 crore investment.

Firstsource Solutions: The company incorporates a step-down subsidiary in Canada.

Lemon Tree Hotels: The company launches a 69-room hotel in Morbi, Gujarat, which will be managed by its arm, Carnation Hotels.

Samvardhana Motherson: The company to acquire the business and assets of the Rubbertec Group for $3.3 million through an indirect subsidiary.

IRB Infrastructure: The company signs a management agreement to act as project manager for projects operated by its SPVs. The arrangement will take effect after the transfer of 100% stake of each project SPV from IRB Infra Trust to the Public InvIT.

5paisa Capital: SEBI has advised the company to surrender its Research Analyst registration certificate. The company will initiate the process accordingly, noting that the move will have no material impact on its operations or financials.

Vedanta: The promoter group has created additional encumbrance on shares; however, no new pledges have been made.

Ceigall India : Incorporated two wholly owned subsidiaries, Ceigall Green Energy MH1 and Ceigall Green Energy MH2 both engaged in the renewable energy sector.

V-Guard Industries: The company received GST order dropping Rs 20.7 crore tax and interest demand for FY18–FY25 after review of company submissions.

Allcargo Terminals: VSSC filed a case with TSLSA seeking Rs 13.53 crore for cargo damage during transit, jointly against Aspinwall and ATL.

Muthoot Microfin: The company approved private placement of NCDs worth up to Rs 125 crore and Rs 250 crore.

KIMS Hospitals: The company informed that its subsidiary Arunodaya Hospitals issued shares through a preferential allotment, leading to dilution of KIMS' stake from 70.67% to 64.36%.

Rashi Peripherals: The company updates that proceedings dropped by Mumbai Customs worth Rs 135 crore demand likely nullified.

Thomas Cook (India): The company's Dubai arm Desert Adventures Tourism acquired the remaining 50% stake in Desert Adventures Tourism Co., Jordan, making it a 100% subsidiary; no consideration involved.

Samvardhana Motherson: The company informs that, Kunal Malani elevated as President – Group Strategy & Transformation; Gandharv Tongia appointed Group CFO.

Zydus Wellness: The company's arm ZWPL gets GST order for Rs 56.33 crore; demand relates to pre-acquisition period and is covered by Heinz Italia.

IPO Offering

Orkla India: The company offers a diverse range of food products, from breakfast to lunch and dinner, snacks, beverages, and desserts

The public issue was subscribed to 79% on day 1. The bids were led by institutional investors (1.53 times), retail investors (90%), QIBS (2%).

IPO Opening

Studds Accessories: The company manufactures two-wheeler helmets and motorcycle accessories based in Faridabad, Haryana, India.

The company shares are set to open today. The IPO is worth Rs 455.49 crores (entirely OFS) and has a price band of Rs 557 to Rs 585 per share.

Bulk & Block Deals

Dynamatic Tech: Samena Special Situations sold 53,949 shares at Rs 7,712.34 apiece.

Corporate Actions

Shares to Exit Anchor Lock-In: TruAlt Bioenergy, Jinkushal Industries, Aditya Infotech, Laxmi India Finance

Earnings In Focus

Aditya Birla Capital, Adani Power, ASK Automotive, Automotive Axles, Bandhan Bank, Bhansali Engineering Polymers, Canara Bank, Carborundum Universal, Cemindia Projects, Cipla, Coromandel International, Dabur India, Datamatics Global Services, DLF, Exide Industries, Gillette India, Gravita India, Grindwell Norton, Hyundai Motor India, Indian Energy Exchange, IFB Industries, IIFL Finance, Indegene, Indostar Capital Finance, ITC, JBM Auto, Jain Irrigation Systems, Lodha Developers, LT Foods, Manappuram Finance, Vedant Fashions, Motilal Oswal Financial Services, Mphasis, Nippon Life India Asset Management, Navin Fluorine International, NTPC, Pidilite Industries, Rajratan Global Wire, Restaurant Brands Asia, Sharda Cropchem, Swiggy, TD Power Systems, Union Bank of India, United Spirits, Welspun Corp

Pledge Share Details

Shanti Educational Initiatives: Promoter Vineeta Chiripal disposed 8 lakh shares

DB Corp: DB Power, the promoter group acquired 1.5 lakh shares

Trading Tweaks

List of securities shortlisted in Short - Term ASM Framework Stage – I : Hatsun Agro Product

Price Band change from 10% to 5%: Infobeans Techno

Price Band change from 20% to 10%: Cartrade Tech

F&O Cues

Nifty Nov futures is up 0.66% to 26,261.30 at a premium of 207 points.

Nifty Nov futures open interest up by 3.66%

Nifty Options 4th Nov Expiry: Maximum Call open interest at 27,000 and Maximum Put open interest at 26,000.

Securities in ban period: Sammaan Capital

Currency/Bond Market

The rupee closed seven paise stronger at 88.20 against the US dollar on Wednesday. The yield on the 10-year bond ended unchanged at 6.54%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.