Good morning!

The GIFT Nifty is trading at 24,952 as of 7:20 a.m., indicating a muted open for the benchmark Nifty 50 index.

Meanwhile, US and European equity futures were trading higher in Asia.

S&P 500 furures up 0.2%

Euro Stoxx 50 futures up 0.1%

Markets On Home Turf

The benchmark indices on Wednesday snapped their eight-day losing streak and ended in green.

At close, Sensex rose 715.69 points, or 0.89%, to 80,983.31, while Nifty was up 225.20 points, or 0.92%, to 24,836.30. Nifty rose as much as 1.04% during the day to 24,867.95, while Sensex was also up 1% at 81,068.43.

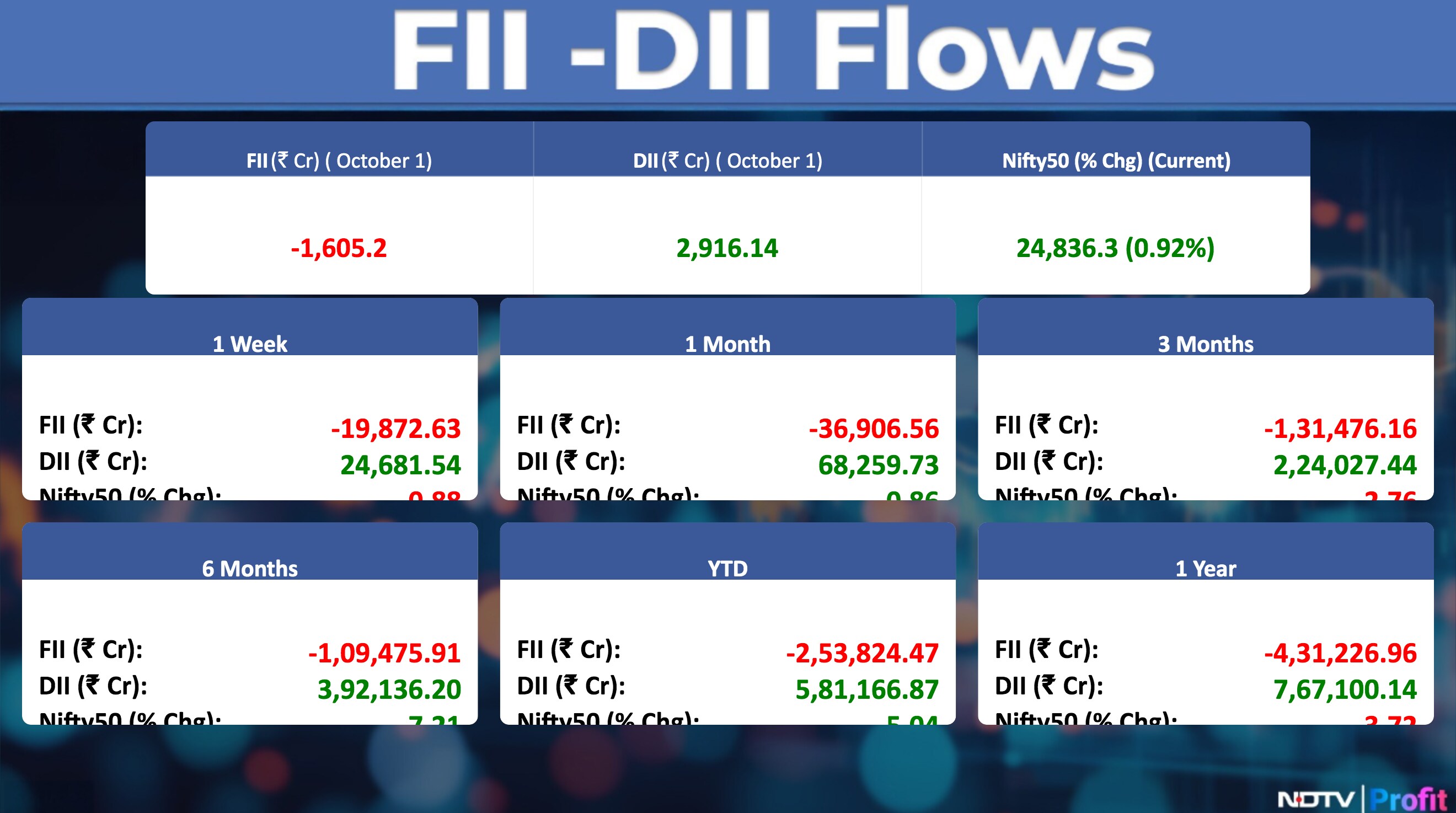

Foreign portfolio investors (FPIs) extended their selling streak of Indian equities for the eighth straight session on Wednesday. The overseas investors offloaded stocks worth Rs 1,605.20 crore, according to provisional data from the National Stock Exchange (NSE). Domestic institutional investors remained buyers for the 27th session and mopped up equities worth Rs 2916.14 crore.

Wall Street Recap

US technology shares rallied, defying weakness in other parts of the stock market, after an OpenAI share sale valued the artificial intelligence company at $500 billion.

The Nasdaq 100 rose 0.4% in its fourth consecutive day of gains. The S&P 500 gained 0.1% while Dow Jones Industrial Average up 0.2%.

Asia Market Update

Asian stock markets rose at the open on Friday, poised for their fourth gain in five weeks, as optimism around artificial intelligence propelled global equities to fresh records, Bloomberg reported.

Nikkei up 1.6%

Kospi up 2.7%

S&P/ASX 200 up 0.3%

Hang Seng down 0.5%

Commodities Watch

Oil was on track for the biggest weekly decline since late June, ahead of an OPEC+ meeting that's expected to result in the return of more idled barrels, exacerbating concerns around oversupply. Brent traded near $64 a barrel, down around 8% for the week, while West Texas Intermediate was below $61.

Gold prices headed for a seventh weekly advance, as the US government shutdown added another layer of uncertainty for investors seeking signals on the Federal Reserve's monetary-easing path. Bullion held near $3,860 an ounce.

Key Events To Watch

Finance Minister Nirmala Sitharaman will inaugurate the fourth edition of Kautilya Economic Conclave 2025 hosted from Oct. 3-5. Speakers at the event include S Jaishankar; RBI Governor Sanjay Malhotra; 15th Finance

Commission Chairman N.K. Singh; Former RBI Governor Shaktikanta

Das; Communications and Jyotiraditya Scindia.

Stocks In News

Sammaan Capital: Avenir Investment to invest Rs 8,850 crore via shares and warrants at Rs 139 apiece, 18% discount to current market price. Post investment, it will hold 43.46% and make an open offer; Rs 4,587 crore via shares and the balance via warrants in two tranches.

CSB Bank: Second quarter total deposits rose 25% year-on-year to Rs 39,651 crore and gross advances was up 29% year-on-year to Rs 34,730 crore.

SKF India: Fixed Oct. 15 as record date for entitlement of SKF Industrial shares. NCLT had earlier approved the demerger with SKF Industrial.

PTC Industries: Arm Trac Precision Solutions won a multi-million-pound project with Coolbook to supply machine and cast components for Rotodynamic heater.

PC Jeweller: Standalone revenue grew 63% YoY in the second quarter and it reduced bank debt by 23%.

Nestle: Added new Maggi noodles production line at Sanand, Gujarat with an investment of Rs 85 crore.

Ashoka Buildcon: Arm Viva Highways acquired 7.46 crore shares in Jaora-Nayagaon Toll Road Company for Rs 166 crore.

Hexaware Technologies: Natsoft Corp and Updraft LLC filed complaints in the US alleging patent infringement and breach of contract; the company has not received any notices.

TBO Tek: Arm TBO LLC completed acquisition of 100% in Classic Vacations, LLC, which will become a step-down subsidiary.

Tata Power: Arm signed agreement with Tata Power Mumbai Distribution to set up 80 MW firm and dispatchable renewable energy project.

Lemon Tree Hotels: Opened a 111-room property in Andhra Pradesh.

Alivus Life: Received a tax demand of Rs 2.6 crore from Ankleshwar Tax Body.

BLS International: Arm BLS UK Hotels acquired 100% of Trefeddian Hotel, Aberdovey for Rs 78.3 crore.

Adani Green Energy: Commissioned 50 MW solar and 31.2 MW wind projects at Khavda, Gujarat, raising total operational renewable capacity to 16,679.8 MW.

Bansal Wire: Second quarter sales volume rose 45.9% YoY to 1.15 lakh metric tonnes.

Hyundai Motor India: Commenced passenger vehicle production at its Pune plant.

Coal India: September coal production fell 3.9% year-on-year to 48.97 MT.

V-Mart Retail: The second quarter revenue rose 22% year-on-year to Rs 807 crore, supported by 11% same store sales growth and 25 new stores.

Goodluck India: Obtained industrial licence to produce empty shells; trial production to begin in third quarter.

Maruti Suzuki: September sales up 2.7% year-on-year to 1.89 lakh units while exports surged 52% year-on-year. Production rose 26.4% year-on-year to 2.01 lakh units and GST reforms boosted festive deliveries to a record 1.65 lakh in eight days.

Sai Silks: Second quarter turnover rose 28% year-on-year to Rs 444 crore. The company opened five stores, planning 10 more.

Diffusion Engineers: Secured Rs 22.9 crore order to supply fan statics and rotary air preheater statics.

PVR Inox: Evaluating legal options after CCI probe into virtual print fee (VPF) charged to film producers.

Eveready Industries: Arbitration proceedings against the company withdrawn after tribunal passed consent award.

TVS Motor: September sales up 12% year-on-year to 5.41 lakh units, driven by scooters (+17%), motorcycles (+9%) and EVs (+8%).

Lemon Tree Hotels: Signed pact for 52-room hotel in Haridwar, opened 67-room hotel in Navi Mumbai and rebranded Delhi property.

Shriram Finance: Approved Rs 500 crore NCD issue via private placement. In addition, the company denied reports of MUFG seeking 20% stake.

Capital Trust: Launched gold loan business with first branch in Aligarh, Uttar Pradesh.

Niva Bupa: Meerut Tax Authority dropped alleged GST demand of Rs 124 crore.

Religare Enterprises: Appointed Gurumurthy Ramanathan as non-executive chairperson until Dec. 31, 2025.

SKF India: Scheme of arrangement with SKF Industrial effective Oct. 1, 2025.

Wipro: Step-down subsidiary in the Philippines voluntarily dissolved.

Aditya Vision: Opened six new showrooms across Bihar, Jharkhand and Uttar Pradesh.

Man Infra: Diluted stake in MICL Developers to 69.99%.

Zydus Lifesciences: USFDA issued complete response letter for CUTX-101 citing CGMP inspection issues; company to request meeting with regulator.

Hero MotoCorp: September sales rose 7.9% year-on-year to 6.87 lakh units and exports were up 95% year-on-year. Scooters sales was up 54.4% year-on-year to 61,003 units.

Unimech Aerospace: Anticipates second quarter revenue and profit decline due to US tariffs despite strong order book.

Pondy Oxides: Signed share purchase pact to acquire Rs 4.5 crore stake in ACE Green Recycling Inc.

John Cockerill: Won contract from Godawari Power & Ispat to supply 6 Hi Reversible Cold Rolling Mill at Raipur.

CreditAccess Grameen: Raised Rs 3,530 crore in the second quarter funding.

Hariom Pipe: In the first quarter sales were up 7% year-on-year to 60,150 MT and value-added product sales up 6% to 58,224 MT.

IFB Agro: Voluntarily liquidated its wholly owned marine seafood trading subsidiary in the UAE.

CMS Info Systems: Raised stake in Securens Systems to 56.17% after acquiring additional 2.28%.

KRBL: Won bid for immovable properties in Panipat, Haryana at Rs 402.86 crore.

RBL Bank: Received show cause notice from Mumbai Tax Body for alleged GST demand of Rs 92 crore.

Fortis Healthcare: O&M pact for Gleneagles BGS Hospital in Karnataka effective from today.

Nuvama Wealth: Received SEBI nod to launch mutual fund business and to set up wholly owned trustee arm.

Biocon: Approved early redemption of NCDs worth Rs 1,070 crore.

Indian Bank: Business up 12.4% year-on-year to Rs 13.9 lakh crore as of Sept. 30, deposits rose 12% year-on-year to Rs 7.8 lakh crore and advances were up 12.9% YoY to Rs 6.2 lakh crore.

Waaree Energies: Approved Rs 8,000 crore capex to expand lithium-ion storage plant to 20 GWh; The company also approved electrolyser and inverter plant expansions.

Nazara Tech: Extended timeline to acquire remaining 25.1% in Nextwave to Oct. 31.

Utkarsh Small Finance Bank: Approved equity fundraise of up to Rs 750 crore.

Anup Engineering: Mutually agreed with Graham Corp to discontinue manufacturing and supply pact effective Oct. 2.

United Spirits: Bombay High Court set aside Rs 443 crore water charge demand and directed interim deposit of Rs 66.5 crore.

GNG Electronics: Arm signed facility lease pact with Ajman Free Zones Authority.

Authum Investment: Subscribed Rs 1,102 crore to Omkara Trust's Rs 1,225 crore issue and allotted 1.1 crore security receipts.

Religare Enterprises: Arm received GST demand of Rs 40 crore from Faridabad Tax Body.

Hind Rectifiers: Approved allotment of 2 lakh equity shares at Rs 1,368.23 each to promoter group.

South Indian Bank: As of Sept. 30, gross advances were up 9% year-on-year at Rs 92,287 crore. Deposits were up 10% year-on-year at Rs 1.15 lakh crore and CASA was up 10% year-on-year at Rs 36,841 crore.

MCX: Bombay HC dismissed commercial suit filed in 2014 and imposed Rs 20 lakh penalty.

Swelect Energy Systems: Arm commissioned additional 2 MW solar plant in Tamil Nadu.

Aditya Birla Real Estate: Assigned leasehold rights of Gujarat Industrial Development Corp land to UltraTech Cement for Rs 93 crore.

HDFC Bank: Rahul Shyam Shukla resigned as senior management personnel.

Edelweiss: Subsidiary settled SEBI case by paying Rs 61.42 lakh and barred from engaging with entity for 12 months.

IPO Offering

Glottis : The Company operates in logistics solutions space that offers comprehensive transportation services through ocean, air, and road logistics. The public issue was subscribed to 2.05 times on day 3. The bids were led by Qualified institutional investors (1.87 times ), non-institutional investors (2.97 times), retail investors (1.42 times)

Om Freight Forwarders: The Company is a third-generation logistics company based in Mumbai, India. With over four decades of expertise, it operates across five continents, serving over 700 locations. The public issue was subscribed to 2.56 times on day 3. The bids were led by Qualified institutional investors (3.95 times), non-institutional investors (5.13 times), retail investors (1.32 times).

Fabtech Technologies : The company designs and delivers turnkey projects, including cleanroom facilities, modular systems, and customized engineering solutions. The public issue was subscribed to 2.03 times on day 3. The bids were led by Qualified institutional investors (2.02 times), non-institutional investors (1.97 times), retail investors (2.08 times).

Advance Agrolife : The company is engaged in the manufacturing of a wide range of agrochemical products that support the entire lifecycle of crops. The public issue was subscribed to 1.87 times on day 2. The bids were led by Qualified institutional investors (3.50 times ), non-institutional investors (1.22 times), retail investors (1.22 times).

WeWork India Management: The company will offer shares for bidding on Friday . The price band is set from Rs 615 to Rs 648 per share. The Rs 3000 crore IPO is entirely an Offer for Sale .

Listing Day

Jinkushal Industries: The company's shares will debut on the stock exchange on Friday at an issue price of Rs 121 apiece. The Rs 116 crore IPO was subscribed 65.10 times on its third and final day. The bids were led by Qualified institutional investors (35.66 times), non-institutional investors (146.39 times), retail investors (47.10 times).

Trualt Bioenergy: The company's shares will debut on the stock exchange on Friday at an issue price of Rs 496 apiece. The Rs 839 crore IPO was subscribed 71.92 times on its third and final day. The bids were led by Qualified institutional investors (159.22 times), non-institutional investors (98.56 times), retail investors (11 times).

Bulk And Block Deals

Bulk Deals

Samman Capital : Goldman Sachs (Singapore) bought 66.38 lakh shares (0.80% stake) at a price of Rs 164.67 per share.

RBL Bank: Morgan Stanley Asia Singapore bought 32.51 lakh shares (0.53% stake) at a price of Rs 274.44 per share.

BMW Ventures : Neomile growth Fund bought 5 lac shares at a price of Rs 78 per share.

Block Deals

Eternal: BOFA SECURITIES EUROPE SA bought 82 lac shares (0.09% stake) and GOLDMAN SACHS BANK EUROPE SE - ODI sold 82 lac shares (0.09% stake) at a price of Rs 325.5 per share.

Insider Trades

Everest Industries Ltd: Falak Investment Private Limited acquired 30,135 equity shares increasing its stake from 50.03% to 50.22%.

Natco Pharma: Sanjay Nannapaneni disposed of 1lac equity shares decreasing stake from 0.18% to 0.13%.

Trading Tweaks

Price band change from 10% to 5%: ANB Metal Cast, Prudential Sugar Corp.

Price band change from 20% to 5% : Manaksia aluminium, Madhav copper, Medico remedies, Natural capsules, Trigyn technologies, KCK Industries.

List of securities shortlisted in Short - Term ASM Framework Stage – I: De Neers Tools Limited, Destiny Logistics, Umiya Buildcon

Ex-Dividend : Sumeet Industries , Glenmark Pharmaceuticals, Fineotex Chemical.

Bonus: Shilpa Medicare (1:1 Bonus).

F&O Cues

Nifty October Futures up by 0.83% to 24,967 at a premium of 131 points.

Nifty October futures open interest up by 0.89%

Nifty Options 7 October Expiry: Maximum Call open interest at 25,000 and Maximum Put open interest at 24700

Securities in Ban Period: RBL Bank, Sammaan Capital.

Currency/Bond Market Update

The rupee recovered 9 paise from its all-time closing low to settle at 88.71 against US dollar on Wednesday, as the RBI in its monetary policy decision announced a host of measures to support exporters and bring stability to the domestic unit. The yield on the 10-year bond ended six points lower at 6.58%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.