Good morning!

The GIFT Nifty is trading flat at 26,139, indicating a muted open for the benchmark Nifty 50.

US and European index futures are trading higher during Asian trading hours.

S&P 500 futures up 0.08%

Euro Stoxx 50 futures decline 0.21%

Market Recap

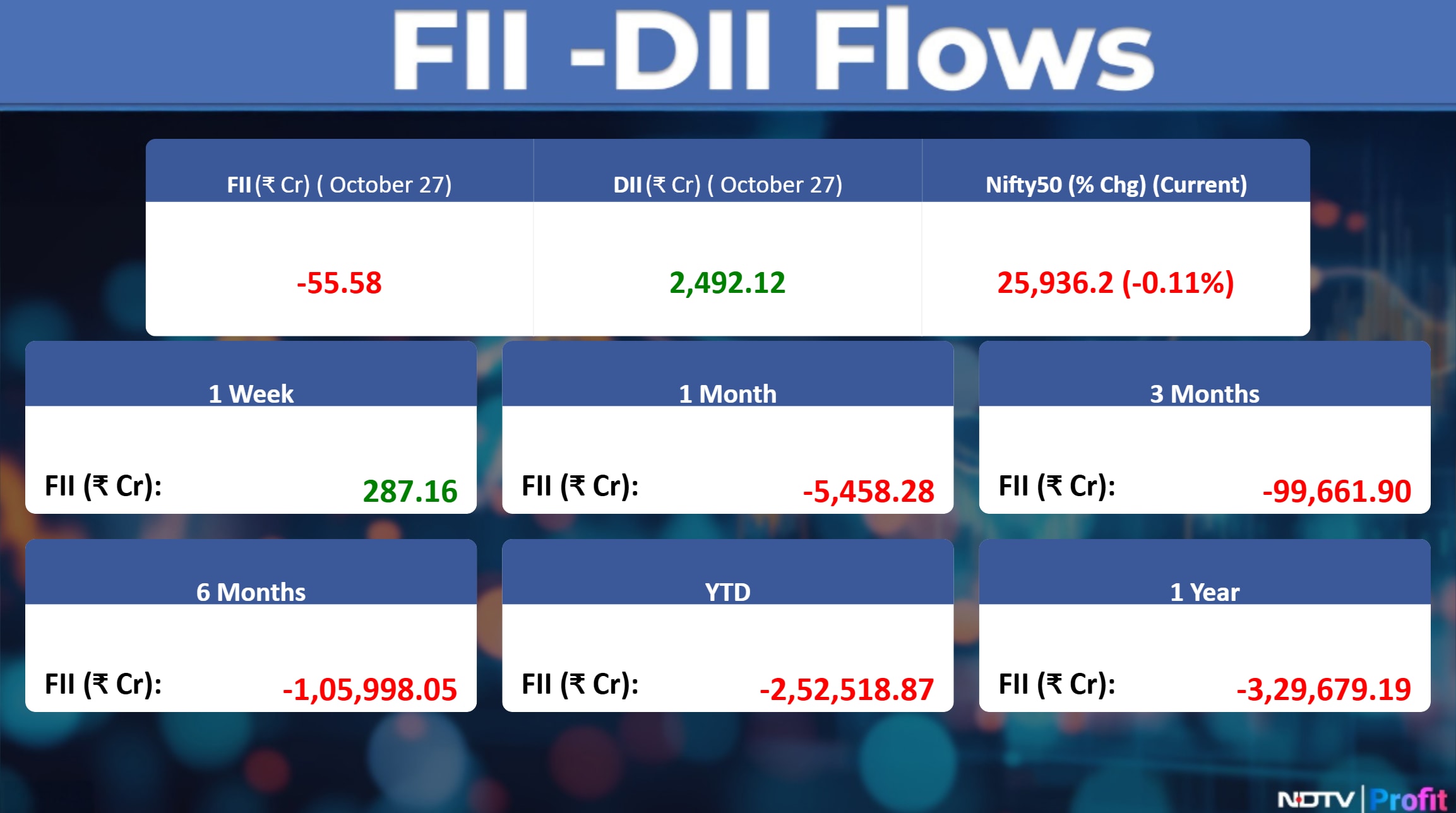

The Nifty ended in the red on Tuesday; however it closed above the 25,900 mark. At the close, the Sensex fell 492.23 points, or 0.58%, to 84,286.61, while the Nifty slipped 29.85 points, or 0.11%, to 25,936.20.

"The market remained highly volatile on the NSE monthly F&O expiry day. However, the overall chart setup on the daily timeframe remains intact, with the Nifty trading well above the 21EMA, keeping the bullish bias intact," said Rupak De, Senior Technical Analyst at LKP Securities.

US Market Wrap

US stocks extended their climb to fresh highs as Wall Street awaited a roll out of financial results from some of the so-called Magnificent Seven technology companies this week and the Federal Reserve commenced its two-day meeting.

The S&P 500 Index rose 0.2% in New York while the Nasdaq 100 Index ended up 0.7%, both benchmarks at fresh closing records, reports Bloomberg.

Asian Market Wrap

Asian stocks opened higher, buoyed by Wall Street optimism that artificial intelligence will keep fueling profits at major technology firms and growing bets of a Federal Reserve interest-rate cut, reports Bloomberg.

Shares in Japan and South Korea rose. SK Hynix Inc. jumped as much as 4% in Seoul after reporting a record profit on Wednesday. Hong Kong is closed for a public holiday on Wednesday.

Commodity Check

Oil held a three-day drop as investors assessed the impact of Western sanctions against leading Russian crude producers, alongside a mixed industry estimate of US inventory changes.

Global benchmark Brent traded below $65 a barrel after falling more than 2% over the prior three sessions, while West Texas Intermediate was near $60.

Gold steadied after a three-day rout as appetite for riskier assets strengthened on hopes of a US-China trade breakthrough.

Bullion was near $3,950 an ounce on Wednesday, a day before a scheduled meeting between Presidents Donald Trump and Xi Jinping.

Gold's rise and retreat have been a hot topic at the London Bullion Market Association's precious metals conference in the Japanese city of Kyoto this week. The overall mood was bullish, with a survey of 106 attendees projecting that gold will be trading at nearly $5,000 an ounce in a year's time, reports Bloomberg.

Copper steadied around $11,000 a ton. Copper was up 0.1% and settled at $11,038.50 a ton at 5:51 p.m. in London. However, all other metals were higher.

Key Events To Watch

Prime Minister Narendra Modi to address at Maritime Leaders Conclave in Mumbai.

Ministry of Coal to launch 14th round of commercial coal mine auctions.

Earnings Post Market Hours

Tata Capital Q2FY26 Highlights (YoY, Consolidated)

Total Income up 7.7% to Rs 7,750 crore versus Rs 7,192 crore.

Net Profit up 2% to Rs 1,097 crore versus Rs 1,076 crore.

Shree Cement Q2FY26 Highlights (YoY, Consolidated)

Revenue up 17.4% to Rs 4,761 crore versus Rs 4,054 crore.

Ebitda up 58.8% to Rs 974 crore versus Rs 613 crore.

Margin at 20.5% versus 15.1%.

Net Profit at Rs 309 crore versus Rs 76.4 crore.

To pay interim dividend of Rs 80 per share.

M&M Financial Q2FY26 Highlights (YoY, Consolidated)

Total Income up 12.7% to Rs 5,049 crore versus Rs 4,479 crore.

Net Profit up 45% to Rs 564 crore versus Rs 389 crore.

Adani Green Q2FY26 Highlights (YoY, Consolidated)

Revenue nearly flat at Rs 3,008 crore versus Rs 3,005 crore.

Ebitda up 17.4% to Rs 2,603 crore versus Rs 2,217 crore.

Margin at 86.5% versus 73.8%.

Net Profit up 25% to Rs 644 crore versus Rs 515 crore.

TVS Holdings Q2FY26 Highlights (YoY, Consolidated)

Revenue up 27.1% to Rs 14,549 crore versus Rs 11,450 crore.

Ebitda up 35.5% to Rs 2,273 crore versus Rs 1,678 crore.

Margin at 15.6% versus 14.7%.

Net Profit up 59.2% to Rs 443 crore versus Rs 278 crore.

Jindal Steel Q2FY26 Highlights (QoQ, Consolidated)

Revenue down 5% to Rs 11,686 crore versus Rs 12,294 crore.

Ebitda down 30.8% to Rs 2,081 crore versus Rs 3,006 crore.

Margin at 17.8% versus 24.4%.

Net Profit down 57.3% to Rs 638 crore versus Rs 1,494 crore.

Appoints Gautam Malhotra as CEO.

Go Digit Q2FY26 Highlights (YoY)

Total Income up 10.7% to Rs 2,408 crore versus Rs 2,175 crore.

Net Profit up 30.2% to Rs 117 crore versus Rs 89.5 crore.

Adani Total Gas Q2FY26 Highlights (QoQ, Consolidated)

Revenue up 5.3% to Rs 1,451 crore versus Rs 1,379 crore.

Ebitda up 0.8% to Rs 295 crore versus Rs 293 crore.

Margin at 20.4% versus 21.3%.

Net Profit down 1.1% to Rs 163 crore versus Rs 165 crore.

Blue Dart Q2FY26 Highlights (YoY, Consolidated)

Revenue up 7% to Rs 1,549 crore versus Rs 1,448 crore.

Ebitda up 15.6% to Rs 252 crore versus Rs 218 crore.

Margin at 16.3% versus 15.1%.

Net Profit up 29.5% to Rs 81.4 crore versus Rs 62.8 crore.

CreditAccess Grameen Q2FY26 Highlights (YoY, Consolidated)

Total Income up 3.8% to Rs 1,509 crore versus Rs 1,454 crore.

Net Profit down 32.4% to Rs 126 crore versus Rs 186 crore.

Star Health Q2FY26 Highlights (YoY)

Net Premium Earned up 10.2% to Rs 4,081 crore versus Rs 3,704 crore.

Net Profit down 50.7% to Rs 54.9 crore versus Rs 111 crore.

Samhi Hotels Q2FY26 Highlights (YoY, Consolidated)

Revenue up 11.8% to Rs 293 crore versus Rs 262 crore.

Ebitda up 16.4% to Rs 107 crore versus Rs 92 crore.

Margin at 36.6% versus 35.1%.

Net Profit at Rs 92.4 crore versus Rs 12.6 crore.

Sundram Fasteners Q2FY26 Highlights (YoY, Consolidated)

Revenue up 2.4% to Rs 1,521 crore versus Rs 1,486 crore.

Ebitda up 3.2% to Rs 252 crore versus Rs 245 crore.

Margin at 16.6% versus 16.5%.

Net Profit up 5.8% to Rs 151 crore versus Rs 142 crore.

To pay interim dividend of Rs 3.75 per share.

Happiest Minds Q2FY26 Highlights (QoQ, Consolidated)

Revenue up 4.3% to Rs 574 crore versus Rs 550 crore.

EBIT up 6.7% to Rs 76.5 crore versus Rs 71.7 crore.

Margin at 13.3% versus 13%.

Net Profit down 5.4% to Rs 54 crore versus Rs 57.1 crore.

ICRA Q2FY26 Highlights (YoY, Consolidated)

Total Income up 7.7% to Rs 157 crore versus Rs 146 crore.

Net Profit up 30.2% to Rs 47.8 crore versus Rs 36.7 crore.

DCM Shriram Q2FY26 Highlights (YoY, Consolidated)

Revenue up 10.6% to Rs 3,272 crore versus Rs 2,957 crore.

Ebitda up 70.6% to Rs 309 crore versus Rs 181 crore.

Margin at 9.4% versus 6.1%.

Net Profit at Rs 158 crore versus Rs 62.9 crore.

Declares interim dividend of Rs 3.6 per share.

Premier Energies Q2FY26 Highlights (YoY, Consolidated)

Revenue up 20.3% to Rs 1,837 crore versus Rs 1,527 crore.

Ebitda up 47.4% to Rs 561 crore versus Rs 381 crore.

Margin at 30.5% versus 24.9%.

Net Profit up 71.6% to Rs 353 crore versus Rs 206 crore.

Ideaforge Tech Q2FY26 Highlights (YoY, Consolidated)

Revenue up 9.7% to Rs 40.7 crore versus Rs 37.1 crore.

Ebitda loss at Rs 11.4 crore versus loss of Rs 15.9 crore.

Net Loss at Rs 19.6 crore versus loss of Rs 13.7 crore.

CAMS Q2FY26 Highlights (QoQ, Consolidated)

Revenue up 6.4% to Rs 377 crore versus Rs 354 crore.

EBIT up 7.2% to Rs 143 crore versus Rs 133 crore.

Margin at 38% versus 37.7%.

Net Profit up 5.4% to Rs 115 crore versus Rs 109 crore.

Declares interim dividend of Rs 14 per share.

IPO Openings

Orkla India: The firm is offering a diverse range of food products, from breakfast to lunch and dinner, snacks, beverages, and desserts.

The company shares are set to open tomorrow that is Oct. 29, IPO is of size Rs 1,667.54 crores (entirely OFS) and has a price band of Rs 695 to Rs 730 per share.

Stocks In News

Lupin: The company inaugurates new corporate offices in New Jersey.

Redtape: The company launches a new product folio of “Sunglasses”

Swan Defence: The company enters a pact with Mazagon Dock for design and construction of Landing Platform Docks for the Indian Navy.

Shriram Finance: The company allots non-convertible debentures worth Rs. 750 crore on a private placement basis.

Arvind SmartSpaces: The company appoints Dharmesh Vyas as chief operations officer.

Havells India: The company to invest Rs. 60 crore to expand washing machine production capacity.

National Fertilizers: The company receives a GST demand notice worth Rs. 15.2 crore from the Vijayapur tax body.

SEAMEC: The company enters into a pact with the Directorate General of Shipping for a Rs. 1,000 crore investment.

Veranda Learning: SNVA Edutech allots 15,432 shares to the company and 2,902 shares to its arm, Veranda Administrative Learning Solutions.

Bosch: The company flags a possible hit to production due to supply issues with vendor Nexperia; working to avoid and minimise disruptions.

CESC: The company's arm secures an order from Solar Energy Corporation of India for power supply from a 300 MW solar power project with energy storage system.

Kothari Industrial Corp: The company appoints V. Anand as chief financial officer.

RBL Bank: Emirates NBD announces an open offer to acquire a 26% stake at Rs. 280 per share, valuing the deal at Rs. 11,636 crore.

PNB Housing Finance: The company's managing director and chief executive officer Girish Kousgi, vacates office. Regulatory approvals are under process for the appointment of a new MD and CEO.

DCM Shriram: The company to acquire 100% stake in four companies for Rs. 175 crore — Shree Raj Salt & Chemical Works, Devjagan Salt Farm, Maruti Salt Farm, and Manek Salt Works.

Exide Industries: The company invests Rs. 65 crore in its arm, Exide Energy Solutions, on a rights basis.

Arisinfra Solutions: The company's arm partners with Transcon Group and Amogaya Projects for Rs. 48.35 crore to unlock over Rs. 12,000 crore in real estate value.

Aegis Vopak: The company to acquire a 96% stake in Aegis Terminal (Pipavav) from Aegis Gas (LPG).

Rubicon Research: The company enters into a pact with Neuronasal Inc to acquire a 10.5% stake for $2.5 million.

HUDCO: The company signs MoUs with IIM Calcutta, Paradip Port Authority (up to Rs. 5,100 crore), and Visakhapatnam Port Authority (up to Rs. 487 crore) to explore and provide funding. It also signs an MoU with Mumbai Port Authority for development of a ‘Maritime Iconic Structure' in Mumbai.

BPCL: The company enters into a pact with Oil India, Numaligarh Refinery, and FACT to collaborate on growth across refining, petrochemicals, and green energy.

CMS Info Systems: The company completes acquisition of 12 lakh shares in Securens Systems, increasing its holding to 99.5%.

Trualt Bioenergy: The company approves investment of up to Rs. 20 crore in arm Trualt Gas and a corporate guarantee worth 51% of project cost in favour of NABARD.

NTPC Green: The company is categorised as a ‘Schedule A' Central Public Sector Undertaking by the government.

Thermax: The company's arm, First Energy 11, ceases to be its wholly-owned subsidiary.

Saatvik Green: The company's arm receives an Rs. 18 crore order for supply of solar PV modules.

MPS: The company's arm completes acquisition of the remaining 17.5% stake in Liberate Learning Pty and App-eLearn Pty, and 35% in Liberate eLearning. Post-acquisition, MPSi holds 100% in the Liberate Group, which becomes a wholly-owned subsidiary.

Aegis Logistics: The company's associate, Aegis Vopak, to acquire a 96% stake in Aegis Terminal (Pipavav) from Aegis Gas (LPG).

Valor Estate: The company incorporates two wholly-owned subsidiaries.

Unichem Labs: The company to pay 16.7 million euros to the European Commission in Brussels in the Perindopril drug matter.

KRBL: The company says a review is currently underway, and findings will be submitted to respective board committees.

Samhi Hotels: The company to extend a corporate guarantee of up to Rs. 380 crore.

Reliance Power: The company appoints Zohra Chatterji as independent director.

RRP Semiconductor: The company clarifies it has never exported or received any order for ASIC chips under the government's Semiconductor Mission.

EFC: The company allots Compulsorily Convertible Debentures worth Rs. 20 crore against conversion of an existing unsecured loan.

Syrma SGS Technology: The company's subsidiary, Syrma Strategic Electronics Private Limited, receives approval under the Electronic Components Manufacturing Scheme (ECMS).

Oil India: The company, along with BPCL, signs a non-binding agreement to set up a new refinery with an investment of Rs 1 lakh crore.

Signature Global: The company raises Rs 875 crore via IFC-backed NCDs to fund sustainable mid-income housing, marking the first listed debt issue.

Bulk & Block Deals

Aditya Birla Capital: Jomei Investments sold 5.32 crore shares (2.08%) at Rs 308 apiece, Goldman Sachs Bank Europe Bought 15.7 Lakh Shares (0.061%), HDFC Life Insurance Bought 25 Lakh Shares (0.098%), ICICI Prudential Life Insurance Bought 10.5 Lakh Shares (0.04%), ITI Mutual Bought 22.7 Lakh Shares (0.08%), Morgan Stanley Asia Bought 39.7 Lakh Shares (0.1%), Motilal Oswal Mutual Bought 13 Lakh Shares (0.05%), Norges Bank On Account Bought 32.5 Lakh Shares (0.12%), Plutus Wealth Bought 65 Lakh Shares (0.25%), SBI Mutual Fund Bought 16.23 Lakh Shares (0.063%), Viridian Asia Opportunities Bought 16.5 Lakh Shares (0.06%), National Pension Bought 48.7 Lakh Shares (0.19%), Societe Generale Bought 46 Lakh Shares (0.18%), Manulife Global Fund India Bought 33.5 Lakh Shares (0.13%) At Rs 308 apiece

Sai Silks (Kalamandir): Nidhi Singhania bought 9.3 lakh shares (0.6%) at Rs. 215.33 a piece

Tolins Tyres: BOFA Securities Europe bought 2 lakh shares (0.53%) at Rs. 189.99 a piece

Utkarsh Small Fin: Olympus ACF sold 1.46 Crore (1.33%) at Rs. 2.84 apiece

Corporate Actions

Shares to Exit Anchor Lock-In

Epack Prefab: 4%

Jain Resources Recycling: 4%

Godavari Biorefineries: 19%

Earnings In Focus

Brigade Enterprises, CG Power and Industrial Solutions, Coal India, Hindustan Petroleum Corporation, Le Travenues Technology, LIC Housing Finance, Larsen & Toubro

Price Band

Price band change from 20% to 5%: Kalyani Investment Company, Maharashtra Scooters, Nalwa Sons Investments, Pilani Investment And Industries Corporation , Tvs Holdings, Vardhman Holdings, Welspun Investments And Commercials.

F&O Cues

Nifty Nov futures is down 0.27 to 26,099 at a premium of 162 points.

Nifty Nov futures open interest up by 41.55%

Nifty Options 4th Nov Expiry: Maximum Call open interest at 27,000 and Maximum Put open interest at 25,500.

Securities in ban period: Sammaan Capital Ltd.

Currency/Bond Market

The rupee depreciated by 8 paise to close at 88.27 against the US dollar on Tuesday on weak domestic stock markets and foreign fund outflows. The yield on the 10-year bond ended one point lower at 6.54%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.