Good morning!

The GIFT Nifty is trading in red at 26,239 as of 6:40 a.m., indicating a weak open for the benchmark Nifty 50.

US and European futures were down during Asian trading hours.

S&P 500 futures up 0.05%

Euro Stoxx 50 futures down 0.27%

Markets On Home Turf

The Indian markets witnessed a highly volatile one-hour trading session on Tuesday to mark the start of Samvat 2082. The NSE Nifty 50 and BSE Sensex ended flat after it pared most gains from the beginning of the special session.

The Nifty 50 ended 0.10% higher at 25,868.60, and the Sensex ended 0.07% higher at 84,426. ICICI Bank Ltd., Kotak Mahindra Bank Ltd., Bharti Airtel Ltd., HCLTech Ltd., and Tata Consultancy Services Ltd. were among the major laggards.

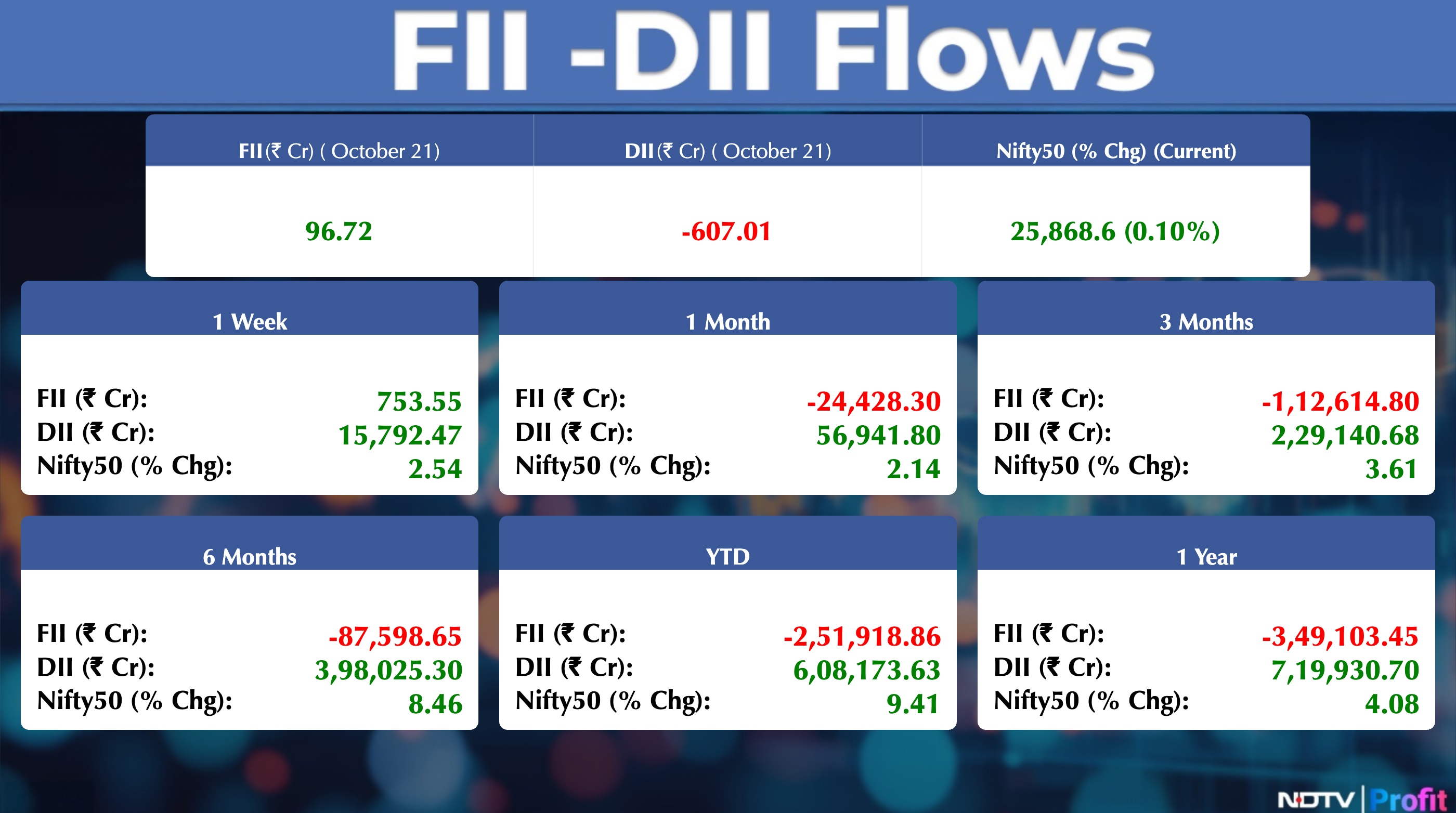

The foreign portfolio investors on Tuesday stayed net buyers of Indian shares for the fourth straight session. FPIs bought stocks worth approximately Rs 97 crore, according to provisional data from the National Stock Exchange.

On the other hand, domestic institutional investors turned net sellers after remaining buyers for over a month. They sold stake worth Rs 607 crore.

Wall Street Recap

Volatility returned to Wall Street as stocks, gold, and cryptocurrencies all declined amid renewed trade jitters. Reports that the Trump administration may impose restrictions on software exports to China added to market unease, reports Bloomberg.

After a strong recent rally, investors appeared ready for a pause. The Nasdaq 100 fell 1%, pressured by a weak outlook from Texas Instruments Inc. and a 10% drop in Netflix Inc. shares. In after-hours trading, Tesla Inc. also slipped as earnings missed expectations despite a surge in sales.

Asian Market Update

Asian stocks, on the other hand, opened lower as well in the wake of the volatile trading session on Wall Street.

Equity benchmarks in Japan and South Korea fell more than 1% in early Asian trading, Bloomberg reports. The Nasdaq 100 lost 1% after a tepid outlook from Texas Instruments Inc. and a 10% slump in Netflix Inc. In late hours, Tesla Inc. slid as earnings missed estimates despite a sales surge.

Commodity Check

Oil prices jumped after the US imposed sanctions on Russia's largest energy producers, as President Donald Trump increased pressure on Vladimir Putin to negotiate an end to the war in Ukraine.

Brent crude rose as much as 2.9%, climbing above $64 a barrel, while West Texas Intermediate also advanced after Washington blacklisted state-run Rosneft PJSC and Lukoil PJSC, citing Moscow's failure to commit to peace efforts.

Meanwhile, gold extended its decline for a third straight session, easing from record highs on signs of an overheated rally. Spot gold slipped to around $4,090 an ounce in early Asian trading Thursday, edging closer to the $4,000 mark as investors reassessed safe-haven demand.

The pullback came as markets weighed the potential for progress on a US-China trade deal, which could ease geopolitical tensions that had fueled gold's sharp gains in recent weeks.

Stocks In News

Manali Petrochemicals: The company's subsidiary, AMCHEM, has entered into a share purchase agreement with Coim S.p.A. to sell its entire stake in Notedome Ltd, UK.

Ola Electric Mobility: The company has clarified recent media reports, stating that no chargesheet has been filed and it is cooperating fully with the ongoing investigation.

Dr Reddy's Laboratories: The company has received an Establishment Inspection Report (EIR) from the US FDA with a ‘Voluntary Action Indicated' classification for its manufacturing facility in Andhra Pradesh.

Federal Bank: The company has clarified that no board decision has been taken regarding the rollout of a preferential issue for a 9.99% stake.

Expleo Solutions: The company has approved the closure of its Competence Centre in Coimbatore. The exact date of closure will be announced in due course.

LTIMindtree: The company has announced the resignation of Nachiket Deshpande as Whole-Time Director and President, effective October 31.

Gulshan Polyols: The company has secured an order worth Rs 1,185 crore to supply ethanol to Oil Marketing Companies under the Ethanol Blended Petrol Programme.

Lloyds Metals and Energy: The company has approved the allotment of 19.6 lakh shares at Rs 1,460.5 per share, amounting to Rs 286 crore, to Adler Industrial Services.

Filatex India: The company, along with Revti Business and Wastewear, has signed a Memorandum of Understanding to collaborate on textile recycling, product innovation, and sustainable manufacturing.

Rubicon Research: The company's wholly owned subsidiary, Advagen Holdings, has entered into a definitive agreement with GEn1E Lifesciences Inc. to acquire Series Prime Preferred Stock in tranches for a total consideration of up to $3 million.

Bulk & Block Deals

Shilchar Technologies: Alchemy Emerging Leaders Of Tomorrow bought 90,000 shares (0.79%) at Rs 4,347.43 apiece & Alay Jitendra Shah sold 1.17 lakh shares (1.02%) at Rs 4,350.26.

F&O Cues

Nifty Oct futures is down 0.19% to 25,865.10 at a discount of 3.5 points.

Nifty Oct futures open interest up by 0.47%

Nifty Options 28th Oct Expiry: Maximum Call open interest at 26,000 and Maximum Put open interest at 25,000.

Securities in ban period: Sammaan Capital

Currency Market

The rupee rose 9 paise to close at 87.93 against the US dollar on Monday, supported by foreign fund inflows and lower crude oil prices.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.