Good morning!

The GIFT Nifty is trading marginally higher near 25,985, indicating a negative open for the benchmark Nifty 50.

US and European index futures are trading lower during Asian trading hours.

S&P 500 futures trade down 0.04%

Euro Stoxx 50 futures down 0.31%

Markets On The Home Turf

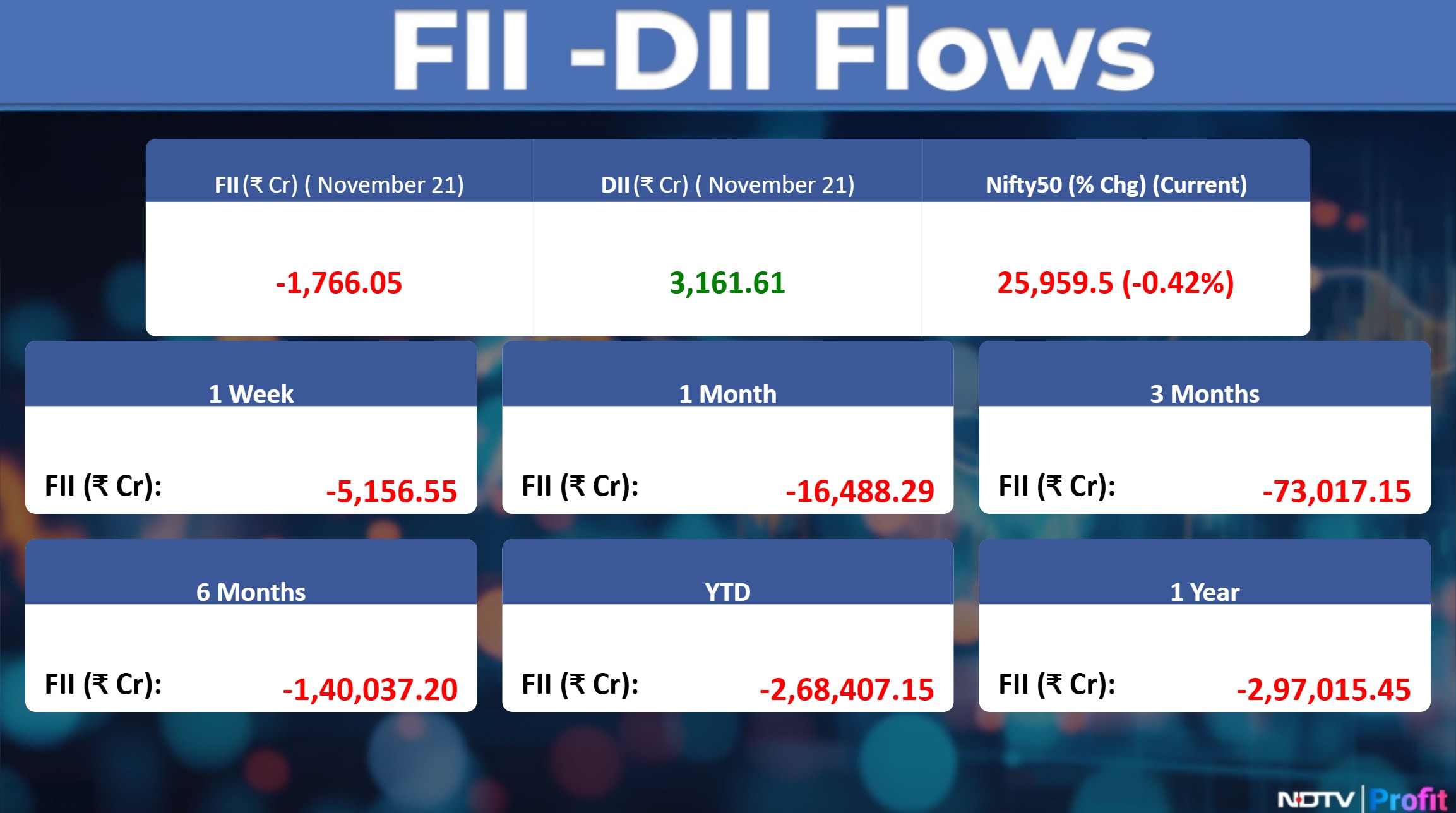

The NSE Nifty 50 closed 108.65 points or 0.42% lower at 25,959.5, while the BSE Sensex ended 331.21 points or 0.39% down at 84,900.71 on Monday.

The midcap index eased by 0.3% and the smallcap index fell by 0.9%. Nifty IT was the lone outperformer. In contrast, Defence and Realty indices were the biggest sectoral losers, shedding over 2%.

US Market Wrap

US futures held steady after a positive session on Wall Street, where tech stocks bounced back from recent losses amid a renewed wave of optimism around artificial intelligence.

The rebound followed weeks of heavy selling in the sector, driven by mounting worries over stretched AI-driven valuations: pressure that had weighed sharply on Wall Street.

The S&P 500 jumped 1.6% to 6,705.08, the NASDAQ Composite surged 2.7% to 22,872.01, and the Dow Jones Industrial Average rose 0.4% to 46,448.27. Equities were also supported by revived expectations of another Fed rate cut in December.

Asian Market Wrap

Asian markets mirrored Wall Street's strength as confidence grew around a potential December Fed cut and tech shares recovered. Stocks rose in Japan — which reopened after a holiday — and in South Korea. A gauge of US-listed Chinese companies climbed 2.8% after Presidents Donald Trump and Xi Jinping held their first talks since last month's tariff truce.

Commodity Check

Gold edged up 0.1% on Tuesday after a 1.8% jump in the previous session, with lower rates boosting the appeal of non-yielding bullion.

Oil was steady as broader risk-on sentiment offset the impact of progress in Ukraine peace talks, which could eventually increase crude supplies.

Stocks In News

Bharat Electronics: The company and Safran Electronics & Defence signed a Joint Venture Cooperation Agreement for the production of the HAMMER Smart Precision Guided Air-to-Ground Weapon in India. (Source: Ministry of Defence)

Rossari Biotech: The company's arm received approval from GIDC on Nov. 24, 2025, for the transfer of rights in leasehold land measuring about 12,608 square meters in the Dahej industrial estate, Gujarat.

Cello World: The company entered into a zero-royalty agreement to lease the "Cello Brand" trademark for Stationery and Writing Instruments from CPIW and plans to invest approximately Rs 50 crore over one year to enhance its manufacturing infrastructure. It anticipates generating Rs 200 crore in revenues from the brand in its first year of operation starting Jan. 2026.

Canara Bank: The company announced the appointment of Sunil Kumar Chugh as Executive Director for three years; he previously headed the Hyderabad Zone of Punjab National Bank.

Speciality Restaurants: The company signed a pact with Coal Mines Associated Traders to develop 2.03 acres of leasehold land in West Bengal.

Balaji Amines: The company received a summon order from the Ahmedabad Court Authority for an alleged violation of the Drugs and Cosmetics Act and has been directed to appear before the court on Dec. 4.

Kesar India: The company acquired a 99% stake in Kesar Capital Llp.

Indian Bank: The company announced the appointment of Mini TM as Executive Director for three years.

India Glycols Limited: The company allotted 51.04 lakh equity shares on a preferential basis for approximately Rs 467 crore.

Capri Global: The company raised Rs 50 crore via Non-Convertible Debentures (NCDs) on a private placement basis.

Diamond Power Infra: The company received a Letter of Intent (LoI) for a Rs 276 crore order from Adani Energy Solutions to supply AL-59 Zebra conductors for the Khavda project.

Premier Explosives: The company secured a Rs 73.1 crore international order for supplying defence products.

Surya Roshni Limited: The company obtained a domestic order for the supply of Spiral Pipes with external 3 LPE Coating, valued at Rs 105.18 crore, to be executed by March 31, 2026.

Eris Lifesciences: The company approved acquiring the remaining 30% stake in Swiss Parenterals for Rs 423.3 crore via a share-swap. The deal makes Swiss a 100% subsidiary, strengthening consolidation and synergies.

Tilaknagar Industries: The company approved the allotment of 9.3 lakh equity shares to promoter Amit Dahanukar upon conversion of warrants at an exercise price of Rs 382 per warrant, raising Rs 26.64 crore.

Paras Defense: The company signed a Memorandum of Understanding (MoU) with Inter-University Accelerator Centre (Iuac), New-Delhi, to develop a commercial-grade MRI magnet system for indigenous manufacturing, aiming to make India self-reliant in superconducting MRI Magnet technology.

Stallion India Fluorochemicals: The company reaffirmed its financial year 2026 revenue growth guidance of 30–35%.

Sunteck Realty: The company's arbitration with Joint Venture partner Grand Valley General Trading was terminated following claim withdrawal, as confirmed by the London Court of International Arbitration.

Ceigall India: The company received an LoI from REC PDCL to establish and maintain the Velgaon substation, earning Rs 58.5 crore annually for 35 years.

Solex Energy: The company commenced commercial production of 2.2 Gigawatt (GW) solar photovoltaic modules at its Surat facility.

City Union Bank: The company opened three new branches in Agra, Rewa, and Madurai, taking its total branch count in India to 900.

Muthoot Microfin: The company's board will meet on Nov. 27 to consider raising funds via NCDs on a private placement basis.

Magellanic Cloud: The company secured a Rs 6 crore order from East Coast Railway to commission a crew voice and video recording system for electric locomotives.

Sudarshan Chemical: The company launched a new chemical, Sudaperm Yellow 2921C, for pigment coating applications.

Suryoday Small Finance Bank: The company received RBI approval for 1729 Capital and its associates to acquire a 7.14% stake in the bank.

Dr. Reddy's: The company received European Commission approval to market AVT03, a biosimilar of Prolia and Xgeva used for treating osteoporosis and bone complications.

Shriram Finance: The company's board approved raising Rs 250 crore via NCDs on a private placement basis.

Voltas: The company saw Life Insurance Corporation (Lic) raise its stake by 2%, increasing Lic's shareholding to 7% from 5% earlier.

Punjab National Bank: The company announced the appointment of Amit Kumar Srivastava as Executive Director for three years.

Housing and Urban Development Corporation (Hudco): The company signed an MoU with the National Institute of Urban Affairs to collaborate on urban infrastructure development and explore partnerships with multiple funding agencies.

Esaf Small Finance Bank: The company received a revised Scheme of Arrangement from its Promoter, ESAF Financial Holdings, which aims to comply with RBI regulations by reducing the Promoter's stake from 52.87% to 45.58% and ensuring Dia Vikas Capital's shareholding remains below 5%. The final plan is now awaiting approval from the RBI and National Company Law Tribunal (Nclt).

Sri Adhikari Brothers: The company's board approved renaming it to Aqylon Nexus and cleared a proposal to set up a 50 Megawatt (MW) Artificial Intelligence (AI) & green data centre campus in Telangana.

Hexaware Tech: The company's promoter CA Silkie pledged a 74.55% stake in favour of Hsbc Singapore as the offshore security agent.

Earnings In Focus

Q4 EARNINGS (YoY)

Revenue up 27.3% At Rs 2,646 crore Vs Rs 2,079 crore

Ebitda up 24.5% At Rs 479 Cr Vs Rs 385 crore

Margin At 18.1% Vs 18.5%

Net Profit up 31.4% At Rs 360 Cr Vs Rs 274 crore

Small Deals

Borana Weaves: SBShah Financial Pvt Ltd sold 1.41 lakh shares (0.53%) at Rs 292 apiece, while PAD Family Trust bought 2.53 lakh shares (0.95%) at Rs 292 apiece.

Orient Electric: iShares Core MSCI Emerging Markets ETF sold 12.63 lakh shares (0.59%) at Rs 164.45 apiece

Rain Industries: iShares Core MSCI Emerging Markets ETF sold 17.83 lakh shares (0.53%) at Rs 106.13 apiece.

IPO Offering

Sudeep Pharma: The company is a manufacturer of pharmaceutical excipients, food-grade minerals, and specialty nutrition ingredients serving over 100 countries.The public issue was subscribed to 5.09x on day 2. The bids were led by Qualified institutional investors (0.13x), non-institutional investors (12x), retail investors (4.97x).

Trading Tweaks

Price Band change from 20% to 10%: Mangalam Drugs And Owais Metal

Ex -Dividend: Ingersoll Rand

Shares to exit anchor Lock-in: Go Digit General Insurance(20%)

Board meeting : Enviro Infra Engineers (Fund Raising/Other business matters)

List of securities shortlisted in Short-Term ASM Framework: ARC Insulation, Mangalam Drugs, Capital Trust

List of securities shortlisted in Long-Term ASM Framework: Globesecure Tech

F&O Cues

Nifty Nov futures is down by 0.44% to 25,996 at a premium of 37 points.

Nifty Nov futures open interest down by 25 %

Nifty Options 18 Nov Expiry: Maximum Call open interest at 26100 and Maximum Put open interest at 26000.

Securities in Ban : SAIL, SAMMAANCAP

Currency/Bond Market

The rupee closed 17 paise stronger at 89.24 against the US Dollar. Yield on the 10-year bond ended 5 points lower at 6.52.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.