Good Morning!

The GIFT Nifty is trading marginally flat near 26,017, indicating a muted open for the benchmark Nifty 50.

US index futures are trading higher during Asian trading hours.

S&P 500 futures trade up 0.33%

Nasdaq futures trade up 0.59%

Market Recap

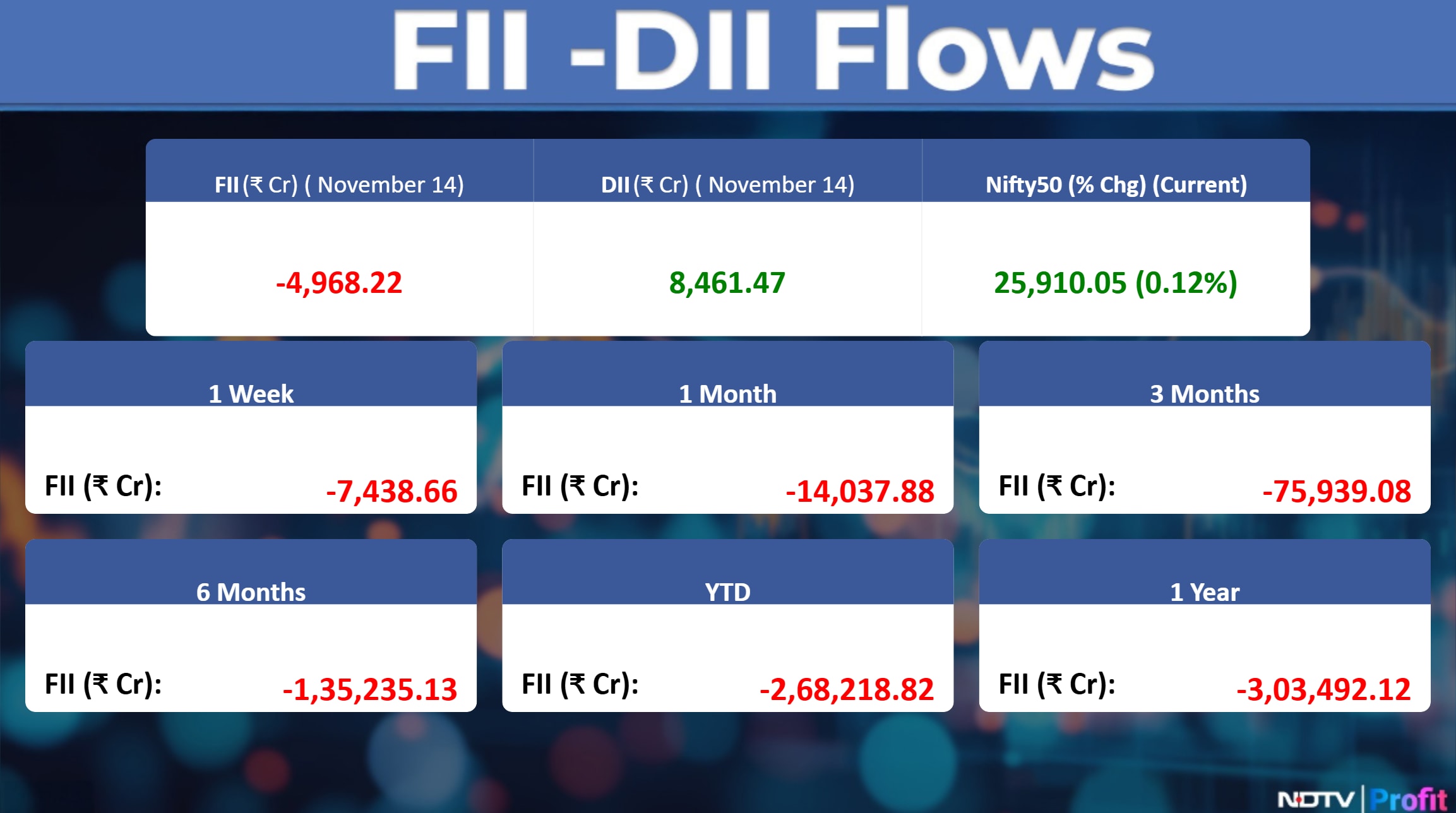

The NSE Nifty 50 Index snapped its two-week losing streak, gaining over 1.5% for the week. The index went up 0.12% and 30.90 up to end at 25,910.05. Benchmarks outperformed broader market indices.

US Market Wrap

A tech-led rebound faded last Friday as Wall Street turned cautious ahead of a busy week of economic data and doubts over a possible Fed rate cut in December. Bonds also slipped.

After recovering from an early 1.4% drop, the S&P 500 ended little changed. Nvidia gained ahead of its earnings, helping steady the market even as broader sentiment stayed guarded.

Asian Market Update

Asian stocks opened the week on a cautious note, with a wave of upcoming US economic data and results from AI giant Nvidia set to guide sentiment, Bloomberg reported.

The MSCI Asia Pacific Index edged up 0.2%, led by gains in South Korea's Kospi. Japan's Nikkei 225 slipped 0.5% after the economy shrank for the first time in six quarters. Tourism and retail shares in Japan dropped as tensions with China weighed on sentiment.

Commodity Check

Oil fell after operations resumed at Russia's Novorossiysk port on the Black Sea, easing supply concerns that had flared following a Ukrainian strike last week, Bloomberg reported.

Brent slipped below $64 a barrel after jumping more than 2% on Friday, while West Texas Intermediate retreated toward $59.

Gold steadied after two straight sessions of losses triggered by fading expectations of a US Federal Reserve rate cut next month, according to Bloomberg. Bullion traded just under $4,100 an ounce on Monday, extending last week's more than 2% decline.

Key Events To Watch

SEBI Chairman Tuhin Kanta Pandey and Chief Economic Advisor V Anantha Nageswaran to speak at an event in Mumbai.

Government to release trade data for October.

PM Modi to speak at an awards function.

Russian and Indian foreign ministers to meet in Moscow.

Earnings in Focus

Tata Motors Pv (Cons, YoY)

Revenue down 13.5% at Rs 72,349 crore vs Rs 83,656 crore

Ebitda loss at Rs 1,043 crore vs profit of Rs 9,478 crore

Net Profit at Rs 76,170 crore vs Rs 3,446 crore

Exceptional gain of Rs 2,608 crore in Q2

Net loss from continuing operations at Rs 6,368 crore vs profit of Rs 3,056 crore

Net profit from discontinued operations at Rs 82,616 crore vs Rs 465 crore

Godawari Power (Cons, YoY)

Revenue up 3.2% at Rs 1,308 crore vs Rs 1,268 crore

Ebitda up 5.5% at Rs 260 crore vs Rs 247 crore

Margin at 19.9% vs 19.5%

Net Profit up 1.5% at Rs 161 crore vs Rs 159 crore

Siemens (Cons, YoY)

Revenue up 16% at Rs 5,171 crore vs Rs 4,457 crore

Ebitda up 13.3% at Rs 617 crore vs Rs 545 crore

Margin at 11.9% vs 12.2%

Net Profit down 41.6% at Rs 485 crore vs Rs 831 crore

Inox Wind (Cons, YoY)

Revenue up 52.7% at Rs 1,119 crore vs Rs 733 crore

Ebitda up 37.2% at Rs 228 crore vs Rs 166 crore

Margin at 20.4% vs 22.7%

Net Profit at Rs 91.7 crore vs Rs 25.7 crore

Glenmark Pharma (Cons, YoY)

Revenue up 76.1% at Rs 6,047 crore vs Rs 3,434 crore

Ebitda at Rs 2,360 crore vs Rs 602 crore

Margin at 39% vs 17.5%

Net Profit up 72.3% at Rs 610 crore vs Rs 354 crore

Oil India (Cons, QoQ)

Revenue up 5.9% at Rs 8,394 crore vs Rs 7,929 crore

Ebitda down 2% at Rs 2,303 crore vs Rs 2,351 crore

Margin at 27.4% vs 29.7%

Net Profit down 24.7% at Rs 1,429 crore vs Rs 1,896 crore

Borana Weaves (YoY)

Revenue up 34.9% at Rs 95.5 crore vs Rs 70.8 crore

Ebitda up 85.4% at Rs 21.7 crore vs Rs 11.7 crore

Margin at 22.7% vs 16.5%

Net Profit at Rs 16.8 crore vs Rs 7.9 crore

Ahluwalia Contracts (Cons, YoY)

Revenue up 16.4% at Rs 1,177 crore vs Rs 1,011 crore

Ebitda up 75.2% at Rs 129 crore vs Rs 73.4 crore

Margin at 10.9% vs 7.3%

Net Profit at Rs 78.6 crore vs Rs 38.7 crore

Brainbees Solutions (Cons, YoY)

Revenue up 10.2% at Rs 2,099 crore vs Rs 1,905 crore

Ebitda up 8.7% at Rs 62.1 crore vs Rs 57.1 crore

Margin at 3% vs 2.9%

Net Loss at Rs 35 crore vs loss of Rs 50.2 crore

Utkarsh Small Finance Bank

NII down 37% at Rs 350 crore vs Rs 558 crore

Operating loss at Rs 3.3 crore vs profit of Rs 276 crore

Provisions at Rs 462 crore vs Rs 208 crore

Net loss at Rs 348 crore vs profit of Rs 51.4 crore

Gross NPA at 12.42% vs 11.42% (QoQ)

Net NPA at 5.02% vs 5% (QoQ)

Praveg (Cons, YoY)

Revenue up 19.3% at Rs 37.5 crore vs Rs 31.4 crore

Ebitda down 44.1% at Rs 3.6 crore vs Rs 6.4 crore

Margin at 9.6% vs 20.5%

Net loss at Rs 9.7 crore vs profit of Rs 1.4 crore

Sun Tv Network (Cons, YoY)

Revenue up 38.9% at Rs 1,300 crore vs Rs 936 crore

Ebitda up 45% at Rs 784 crore vs Rs 541 crore

Margin at 60.3% vs 57.8%

Net Profit down 13% at Rs 354 crore vs Rs 407 crore

Inox Green Energy (Cons, YoY)

Revenue up 55.6% at Rs 85.9 crore vs Rs 55.2 crore

Ebitda down 53.7% at Rs 8.6 crore vs Rs 18.6 crore

Margin at 10% vs 33.6%

Net Profit at Rs 27.9 crore vs Rs 6.4 crore

Gmr Power (Cons, YoY)

Revenue up 30.8% at Rs 1,810 crore vs Rs 1,384 crore

Ebitda down 12.7% at Rs 363 crore vs Rs 416 crore

Margin at 20.1% vs 30.1%

Net Profit at Rs 888 crore vs Rs 255 crore

Ems (Cons, YoY)

Revenue down 27.8% at Rs 172 crore vs Rs 239 crore

Ebitda down 34.3% at Rs 33.5 crore vs Rs 51.1 crore

Margin at 19.4% vs 21.4%

Net Profit down 25.4% at Rs 28.2 crore vs Rs 37.9 crore

Bajel Projects (Cons, YoY)

Revenue down 7.3% at Rs 614 crore vs Rs 662 crore

Ebitda up 35.9% at Rs 22.8 crore vs Rs 16.8 crore

Margin at 3.7% vs 2.5%

Net Profit down 1.9% at Rs 3.6 crore vs Rs 3.7 crore

Fineotex Chemical (Cons, YoY)

Revenue down 5.5% at Rs 138 crore vs Rs 146 crore

Ebitda down 14.8% at Rs 31 crore vs Rs 36.4 crore

Margin at 22.5% vs 25%

Net Profit down 18.4% at Rs 26 crore vs Rs 31.9 crore

Rashtriya Chemicals (Cons, YoY)

Revenue up 23.4% at Rs 5,293 crore vs Rs 4,290 crore

Ebitda up 6.4% at Rs 214 crore vs Rs 202 crore

Margin at 4% vs 4.7%

Net Profit up 33.4% at Rs 105 crore vs Rs 79 crore

Narayana Hrudayalaya (Cons, YoY)

Revenue up 20.3% at Rs 1,644 crore vs Rs 1,367 crore

Ebitda up 30.3% at Rs 403 crore vs Rs 309 crore

Margin at 24.5% vs 22.6%

Net Profit up 30.1% at Rs 258 crore vs Rs 199 crore

Swan Corp (Cons, YoY)

Revenue up 10.3% at Rs 1,138 crore vs Rs 1,032 crore

Ebitda down 95.8% at Rs 5 crore vs Rs 120 crore

Margin at 0.4% vs 11.6%

Net loss at Rs 3.8 crore vs profit of Rs 51.3 crore

Optiemus Infracom (Cons, YoY)

Revenue down 12.2% at Rs 418 crore vs Rs 477 crore

Ebitda up 16.2% at Rs 33.6 crore vs Rs 28.9 crore

Margin at 8% vs 6.1%

Net Profit up 22.2% at Rs 16.8 crore vs Rs 13.7 crore

Jai Balaji (Cons, YoY)

Revenue down 13.1% at Rs 1,353 crore vs Rs 1,557 crore

Ebitda down 68.5% at Rs 71.9 crore vs Rs 228 crore

Margin at 5.3% vs 14.7%

Net Profit down 82.7% at Rs 26.5 crore vs Rs 153 crore

Max Healthcare (Cons, YoY)

Revenue up 25.1% at Rs 2,135 crore vs Rs 1,707 crore

Ebitda up 27.7% at Rs 575 crore vs Rs 451 crore

Margin at 26.9% vs 26.4%

Net Profit up 74.3% at Rs 491 crore vs Rs 282 crore

V2 Retail (Cons, YoY)

Revenue up 86.5% at Rs 709 crore vs Rs 380 crore

Ebitda at Rs 85.4 crore vs Rs 33.1 crore

Margin at 12.1% vs 8.7%

Net Profit at Rs 17.2 crore vs loss of Rs 1.9 crore

Ashoka Buildcon (Cons, YoY)

Revenue down 25.6% at Rs 1,851 crore vs Rs 2,489 crore

Ebitda down 35.4% at Rs 585 crore vs Rs 905 crore

Margin at 31.6% vs 36.4%

Net Profit down 82.9% at Rs 78.1 crore vs Rs 457 crore

Skf India (Cons, YoY)

Revenue up 5.2% at Rs 1,309 crore vs Rs 1,244 crore

Ebitda up 34.1% at Rs 166 crore vs Rs 123.5 crore

Margin at 12.7% vs 9.9%

Net Profit up 12% at Rs 105 crore vs Rs 94.2 crore

Archean Chemical (Cons, YoY)

Revenue down 3% at Rs 233 crore vs Rs 240 crore

Ebitda down 16.2% at Rs 62.6 crore vs Rs 74.7 crore

Margin at 26.8% vs 31.1%

Net Profit up 84.3% at Rs 29.1 crore vs Rs 15.8 crore

Sequent Scientific (Cons, YoY)

Revenue up 15% at Rs 424 crore vs Rs 369 crore

Ebitda up 42.6% at Rs 55.6 crore vs Rs 39 crore

Margin at 13.1% vs 10.6%

Net Profit at Rs 14.7 crore vs Rs 2.6 crore

Monarch Networth (Cons, YoY)

Revenue down 20.1% at Rs 83.1 crore vs Rs 104 crore

Ebitda down 3.4% at Rs 63.8 crore vs Rs 66 crore

Margin at 76.7% vs 63.4%

Net Profit up 2.3% at Rs 45 crore vs Rs 44 crore

Balu Forge Industries (Cons, YoY)

Revenue up 34.4% at Rs 300 crore vs Rs 223 crore

Ebitda up 27% at Rs 82.8 crore vs Rs 65.2 crore

Margin at 27.6% vs 29.3%

Net Profit up 35.5% at Rs 65 crore vs Rs 48 crore

India Glycols (Cons, YoY)

Revenue up 13.6% at Rs 1,092 crore vs Rs 961 crore

Ebitda up 36.2% at Rs 158 crore vs Rs 116 crore

Margin at 14.4% vs 12%

Net Profit up 30.9% at Rs 65.1 crore vs Rs 49.7 crore

Stylam Industries (Cons, YoY)

Revenue up 11.3% at Rs 292 crore vs Rs 263 crore

Ebitda up 4% at Rs 56.6 crore vs Rs 54.4 crore

Margin at 19.3% vs 20.7%

Net Profit up 9.4% at Rs 37.3 crore vs Rs 34.1 crore

Carraro India (Cons, YoY)

Revenue up 33.1% at Rs 586 crore vs Rs 441 crore

Ebitda up 22.3% at Rs 52.4 crore vs Rs 42.9 crore

Margin at 8.9% vs 9.7%

Net Profit up 44.4% at Rs 31.7 crore vs Rs 22 crore

Max Healthcare (Cons, YoY)

Revenue up 21% At Rs 2580 crore Vs Rs 2125 crore

Net Profit up 59% At Rs 554 crore Vs Rs 349 crore

Ebitda up 23% At Rs 694 crore Vs Rs 566 crore

Margin At 26.9% Vs 26.6%

Carraro India (Cons, YoY)

Revenue up 33.1% At Rs 586 crore Vs Rs 441 crore

Net Profit up 44.4% At Rs 31.7 crore Vs Rs 22 crore

Ebitda up 22.3% At Rs 52.4 crore Vs Rs 42.9 crore

Margin At 8.9% Vs 9.7%

Valor Estate (Cons, YoY)

Revenue up At Rs 136.9 crore Vs Rs 3.48 crore

Net Profit At Rs 10.1 crore Vs Loss Of Rs 114.2 crore

Ebitda At Rs 166.1 crore Vs Loss Of Rs 3.7 crore

Rajesh Exports (Cons, YoY)

Net Profit up 128.3% At Rs 104.1 crore Vs Rs 46 crore

Revenue up 161.8% At Rs 175,211 crore Vs Rs 66,923 crore

Ebitda up 129.8% At Rs 176.2 crore Vs Rs 77 crore

Margin Flat At 0.1%

Pace Digitek (Cons, YoY)

Net Profit down 32.8% At Rs 64 crore Vs Rs 95.2 crore

Revenue down 37% At Rs 533 crore Vs Rs 846 crore

Ebitda down 49.7% At Rs 94 crore Vs Rs 187 crore

Margin down At 17.6% Vs 22.1%

GMR Airports October Air Traffic Data

Delhi Passenger Traffic Up 1.2% At 65.2 lakh (YoY)

Hyderabad Passenger Traffic Up 3.3% At 26.02 lakh (YoY)

Mopa (Goa) Passenger Traffic Up 28.1% At 4.5 lakh (YoY)

Medan (Indonesia) Passenger Traffic Up 2.5% At 5.6 lakh (YoY)

Cebu (Philippines) Passenger Traffic Down 9.1% At 8.3 lakh (YoY)

Total Passenger Traffic (Excluding Cebu) Up 3% at 1.01 crore

Delhi Aircraft Movements Up 2.3% At 39,881 (YoY)

Hyderabad Aircraft Movements Up 5.4% At 18,499 (YoY)

Mopa (Goa) Aircraft Movements Up 26.9% At 3,253 (YoY)

Medan (Indonesia) Aircraft Movements Down 3% At 4,033 (YoY)

Cebu (Philippines) Aircraft Movements Down 8.1% At 7,686 (YoY)

Total Aircraft Movements up 4% at 65,666 (YoY)

Stocks In News

Divi's Labs: The company's Telangana unit underwent a US FDA inspection from Nov 10–14, which concluded with no Form 483 observations.

Aurobindo Pharma: The company's arm received nine observations from the US FDA for its Rajasthan manufacturing unit.

Kotak Mahindra Bank: The company's board will consider a share split on Nov 21.

Bikaji Foods: The government has approved the incorporation of the company's arm, Bikaji Foundation.

Dr Reddy's Labs: The company's Andhra Pradesh unit completed a US FDA inspection conducted from Nov. 10–14, ending with zero observations.

Indian Hotels: The company will acquire nearly 51% stake in Sparsh Infratech for Rs 240 crore.

Fabtech Tech: The company gets an order worth Rs 69.2 crore from One of the Leading Cos in Saudi Arabia.

Godawari Power: The company will invest up to Rs 300 crore in its arm, Godawari New Energy, to set up a 250 MWp solar power plant in Chhattisgarh.

Minda Corp: Vinod Raheja has resigned as Group chief financial officer, effective Nov 30.

Hubtown: The company has received a ‘no adverse observations' remark from BSE for its scheme of arrangement with 25 West Realty.

Waaree Energies: The company has commenced operations of two solar module line manufacturing facilities in Gujarat, with a combined annual capacity of 1,050 MW.

Hindustan Zinc: The company has won the bid for the Tungsten & associated mineral block in Balepalyam, Kanaganapalle, covering a total area of 308.30 hectares.

Crest Ventures: The company's board has approved raising up to Rs 100 crore via NCDs.

Garden Reach Shipbuilders: The company has entered a pact with an Andhra Pradesh body to set up a greenfield shipyard.

L&T Technology Services: The company has appointed Mritunjay Kumar Singh as its Chief Operating Officer.

Infibeam Avenues: The company has received final authorisation from the RBI to operate as a payment aggregator.

Maruti Suzuki: The company will recall 39,506 units of Grand Vitara manufactured from Dec. 9, 2024, to April 29, 2025, to fix a gauge problem.

Ashoka Buildcon: The company's Rs 288.18 crore infra project with MMRDA has been cancelled due to administrative reasons, with revisions resulting in a 39% increase in deck area and overall cost escalation of 33.5%.

BEML: The company has inked an MoU with an Andhra Pradesh government body, Delhi Metro Rail, and Umeandus Tech.

IdeaForge Tech: The company has received an order worth Rs 75 crore to supply AFDS/Tactical Class UAVs with accessories to the Ministry of Defence. The company also received an order worth Rs 32 crore to supply Hybrid UAVs with accessories to the Ministry of Defence.

Caplin Point Laboratories : The company's arm, Triwin Pharma SA DE CV, Mexico, has acquired land measuring 5.5 acres in the Municipality of Capulhuac.

The Phoenix Mills: The company has acquired 62.7 crore shares of ISMDPL from CPP Investments, increasing its stake to 58.33% from 55.57%.

Amber Enterprises: The company's arm has entered into a share purchase pact and shareholders' agreement with Shogini Technoarts to acquire a majority stake in Shogini.

Adani Energy Solutions- Gets renewable energy contract from Rajasthan Power Transmission (Replaced with earlier contract given to BHEL).

TCS- Labour Commissioner Office, Pune has issued summons to Tata Consultancy Services (TCS) in multiple matters.

InterGlobe Aviation- Will start ops from Navi Mumbai International Airport from 25th December /Will connect NMIA to ten cities across India.

Aditya Birla Capital- Board approves merger of Aditya Birla Stressed Asset AMC with Aditya Birla Financial Shared Services.

Tata Steel- European arm to acquire Netherland's Vatenfall Power Generation for Rs 1450 crore.

IRB Infrastructure- Gets LoA from NHAI for project worth Rs 9,270 crore In Uttar Pradesh For 20 Years.

Amber Enterprises- Arm to acquire majority stake in Shogini Technoarts.

EPACK Durable- In pact with Andhra Pradesh body to invest Rs 1,083 crore for expansion.

Nuvoco Vistas- Arm approves allotment of 60,000 NCDs worth Rs 600 crore on private placement basis

UGRO Capital- Board to meet on Nov. 19 to consider raising funds via non-convertible debentures.

Lemon Tree Hotels- Signs license agreement in Mahoba, UP

Anant Raj- Arm signs MoU with Andhra Pradesh Govt and will invest Rs 4,500 crore For development of Data Center cum IT Park.

NMDC- Iron Ore Baila Lump Price fixed At Rs 5,600/Tonne/Iron Ore Baila Fines Price Fixed At Rs 4,750/Tonne.

TruAlt Bioenergy - Signs non-binding MoU with Andhra Pradesh Govt for Aviation Fuel Plant.

Privi Speciality Chemicals- The board approved withdrawal of scheme of Amalgamation of Privi Fine Sciences & Privi Biotechnologies with crompany.

Omax- Completes acquisition of 100% Stake in Next10 Realbuild & Next10 Land Developers.

Raymond Company- Setting up three manufacturing units in Andhra Pradesh.

Swiggy- To begin charging select parter restaurants a fees for Swiggy One orders from Nov 25.

Alembic Pharma- Receives USFDA approval for blood-pressure drug.

JM Financial- Receives Rs 223.32 crore as Income Tax Refund.

BHEL- Hitachi Energy, Co, Rajasthan Part I Power Transmission & AESL Projects executes pact.

Lupin- Announces closure of Inspection by US FDA at Nagpur facility with no observations.

Tata Tech- Board gives nod to issue corporate guarantee of $60 Million.

Balkrishna Paper Mills- Cyber-Security incident has occurred

Websol Energy- Arm signs MoU with APEDB to explore development of 4 GW solar cell.

Maharashtra Seamless, Jindal Drilling & Industries: Rig 'Jindal Explorer' Commences operations with ONGC at EDR of $35,138.71.

Ola Electric: Commences test rides of 4680 Bharat Cell-Powered vehicles at flagship stores across India.

IGL: Increased CNG prices by Rs1/kg in Noida, Greater Noida, Ghaziabad, and Kanpur effective Nov. 16, 2025.

Waaree Energies: Arm commences operations at 2 manufacturing units in Kutch. arm sets up two solar module line manufacturing units with total capacity of 1500 MW.

GMR Airports - Firm released October air traffic data.

Bulk And Block Deals

Bulk Deals

Sagility Limited: The company saw a major block deal at Rs 47.6 per share. On the selling side, Sagility B.V. offloaded 76.90 crore shares worth Rs 3,660.44 crore. On the buying side, Unifi Capital Pvt Ltd picked up 15.42 crore shares for Rs 733.86 crore, while Société Générale bought 8.48 crore shares amounting to Rs 403.76 crore. Unifi Blend Fund 2 acquired 3.92 crore shares worth Rs 186.73 crore, and Norges Bank purchased 3.71 crore shares for Rs 176.60 crore. ICICI Prudential Mutual Fund bought 3.14 crore shares amounting to Rs 149.39 crore, Morgan Stanley Asia Singapore Pte picked up 2.76 crore shares worth Rs 131.47 crore, and Unifi Capital Pvt Ltd made an additional purchase of 2.71 crore shares for Rs 129.07 crore.

Hindustan Media: The company witnessed a block trade around Rs 71 per share. Elimath Advisors Pvt Ltd purchased 30.85 lakh shares at Rs 71.02, valuing the transaction at Rs 21.91 crore, while Mathew Cyriac sold an equal 30.85 lakh shares at Rs 71.01 for Rs 21.90 crore.

Block Deals

Rain Industries: The company witnessed multiple block trades at Rs 120 per share. First Water Fund bought 26 lakh shares worth Rs 31.20 crore. On the selling side, Haresh Tikamdas Kaswani offloaded 12 lakh shares valued at Rs 14.40 crore, while K2 Family Private Trust sold 14 lakh shares amounting to Rs 16.80 crore.

Shaily Eng Plastics: The company witnessed multiple block trades at Rs 2,585.1 per share. On the buying side, Morgan Stanley IFSC Fund acquired 40,000 shares worth Rs 10.34 crore, S I Investments (Broking) Pvt Ltd bought 60,000 shares for Rs 15.51 crore, and Motilal Oswal Mutual Fund purchased a total of 50,000 shares amounting to Rs 12.92 crore. On the selling side, Amit Mahendra Sanghvi sold 1 lakh shares for Rs 25.85 crore, while Laxman Sanghvi offloaded 50,000 shares valued at Rs 12.93 crore.

IPO Offerings

Fujiyama power systems: The company manufactures products and provides solutions in the rooftop solar industry, including on-grid, off-grid, and hybrid solar systems The public issue was subscribed to 0.40x times on day 2 . The bids were led by Qualified institutional investors (0.81 times), non-institutional investors (0.10 times), retail investors (0.28 times)

Tenneco Clean Air India: The company operates within the Clean Air division, focusing on emission control technologies for both light and commercial vehicles. The public issue was subscribed to 58.83 times on day 3 . The bids were led by Qualified institutional investors (166.42 times), non-institutional investors (40.74 times), retail investors (5.11 times)

Capillary Technologies: The company is a leading Indian software-as-a-service (SaaS) company that specializes in customer loyalty and engagement solutions. The public issue was subscribed to 0.28 times on day 1. The bids were led by Qualified institutional investors (0.29 times), non-institutional investors (0.28 times), retail investors (0.26 times)

Trading Tweaks

Price Band change from 5% to 20%: SIL investments , Maharashtra Scooters, Dalmia Bharat Sugar

Ex -Dividend: Balrampur Chini Mills, EPL, Surya Roshni, GMM Pfaudler, Gopal Snacks.

Rights Issue : Adani Enterprises (Rights 3:25)

Shares to exit anchor Lock-in : Regaal Resources 4%

List of securities shortlisted in Short Term ASM Framework: Indigo Paints, Venus Remedies

F&O Cues

Nifty Nov futures is up 0.07 % to 25,951 at a premium of 41 points.

Nifty Nov futures open interest up by 4.35%

Nifty Options 18 Nov Expiry: Maximum Call open interest at 27000 and Maximum Put open interest at 26000.

Securities in Ban : SAIL

Currency Recap

The rupee closed 7 paise weaker at 88.74 against the US dollar on Friday. It closed at 88.67 a dollar on Thursday. The yield on the 10-year bond ended one point higher ending at 6.53.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.