Good morning!

The GIFT Nifty was largely unchanged at 24,759 as of 07:55 a.m., signaling a muted start to Indian markets today.

Asian shares opened lower Thursday, following Wall Street's sharp losses driven by concerns over the US's expanding budget deficit. The S&P 500 index closed down 1.6% on Wednesday, marking its steepest drop in a month, while US equity futures remained mostly steady early Thursday.

Gold extended its rally for a fourth consecutive session, benefiting from safe-haven demand amid market uncertainty. Conversely, oil prices continued to decline, pressured by rising US crude inventories and ongoing concerns about an oversupplied market, alongside geopolitical tensions.

Meanwhile, Bitcoin reached a new all-time high, surpassing its January peak with intraday prices hitting around $109,500.

Watch NDTV Profit Live

Markets On The Home Turf

The benchmark equity indices closed higher, breaking a three-session losing streak on Wednesday, amid volatility in the domestic stock markets.

The NSE Nifty 50 closed 129.55 points, or 0.52% higher at 24,813.5 and the BSE Sensex ended 410 points, or 0.51% up at 81,596.

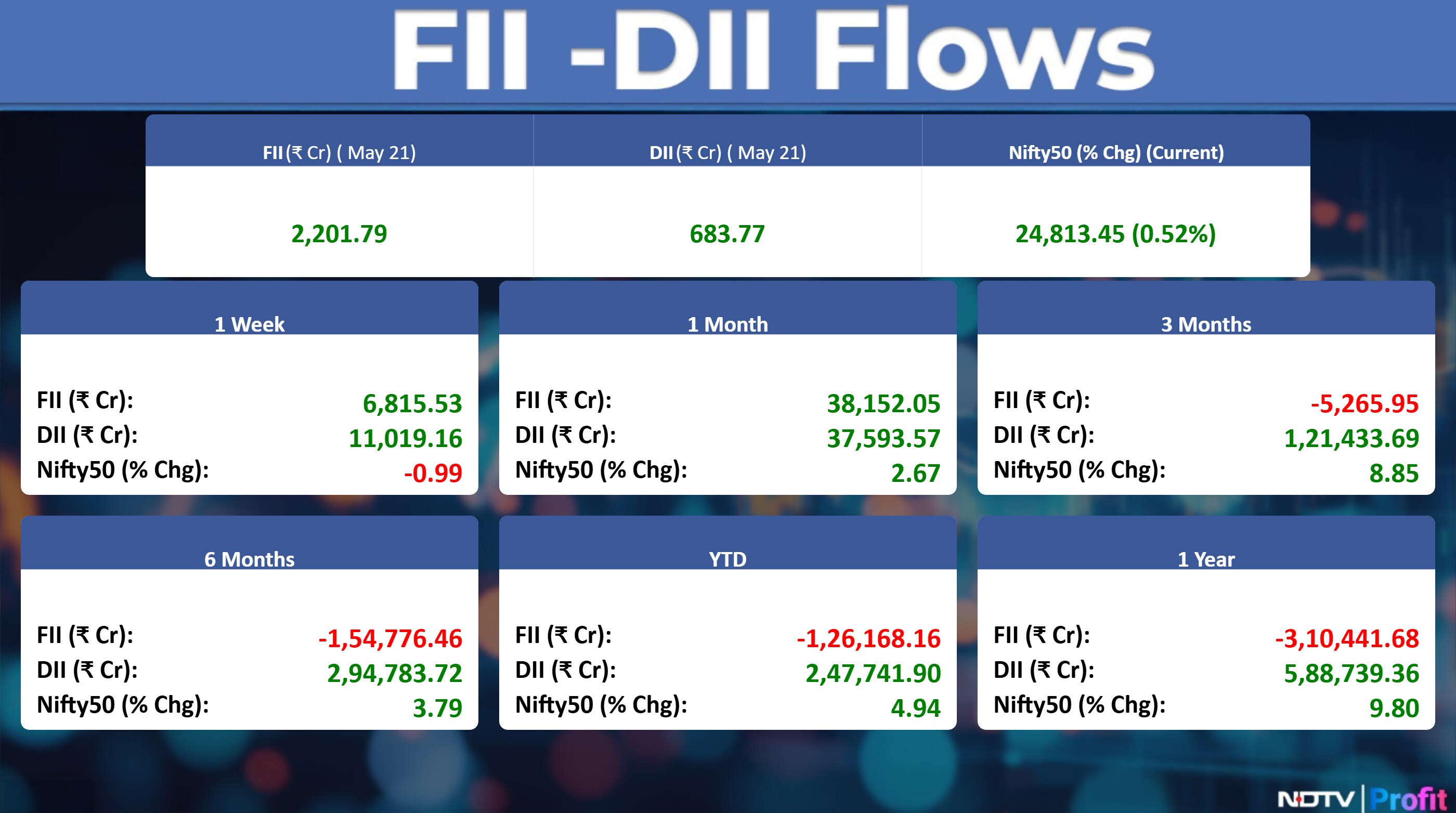

Foreign portfolio investors turned net buyers of Indian equities after two days of selling on Wednesday as they mopped up stocks worth Rs 2,201.79 crore, according to the provisional data from the National Stock Exchange.

Domestic institutional investors stayed net buyers for the second straight day as they bought equities worth Rs 683.77 crore, the data showed.

Here's everything that could influence Indian equities today:

Asian Markets Update

S&P 500 futures rose 0.15%.

Hang Seng index futures were marginally down.

Futures for the Nikkei 225 on the Osaka Exchange rose 0.62%.

Japan's Topix index fell by 0.34%.

Australia's S&P/ASX 200 index also slipped 0.34%.

Euro Stoxx 50 futures were down 0.68%.

Commodity Check

West Texas Intermediate crude fell 0.57% to trade at $61.22 per barrel.

Spot gold increased by 0.18% to $3,321.17 per ounce.

London Metal Exchange

Copper rose 0.15%, reversing losses.

Nickel was up 0.54%, snapping downward trend.

Aluminium was largely flat.

Zinc was up 1.27%, reversing two-day losses.

Lead rose 0.97%, reversing declines.

US Market Updates

Wall Street's concerns over the rapidly growing US deficit, which threatens the country's status as a global safe haven, were underscored by a lackluster $16 billion Treasury auction on Wednesday. Demand for 20-year bonds was weak, pushing yields higher and sparking declines in stocks, bonds, and the dollar.

The S&P 500 suffered its worst session in a month, dropping 1.6%, while the Nasdaq 100 fell 1.3% and the Dow Jones Industrial Average slid 1.9%.

Nifty Earnings To Watch

Grasim Industries Ltd

ITC Ltd

Sun Pharmaceutical Industries Ltd

Other Earnings To Watch

Astra Microwave Products

Barbeque-Nation Hospitality

Centum Electronics

Clean Science and Technology

Container Corporation of India

Deepak Fertilisers & Petrochemicals Corporation

Emcure Pharmaceuticals

Gandhar Oil Refinery (India)

GMR Airports

Goodluck India

Grasim Industries

Greenpanel Industries

Gujarat State Petronet

HFCL

Honasa Consumer

Igarashi Motors India

Indoco Remedies

Max Estates

Metro Brands

MTAR Technologies

Power Mech Projects

Premier Explosives

The Ramco Cements

Sandhar Technologies

Strides Pharma Science

Subros

Sun Pharmaceutical Industries

TBO TEK

Unichem Laboratories.

Earnings Post Market Hours

IndusInd Bank Q4 Highlights (Consolidated, YoY)

Loss of Rs 2,329 crore versus Net Profit of Rs 2,349 crore (NDTV Profit estimate of Rs 318 crore Loss)

NII down 43% At Rs 3,048 crore versus Rs 5,376 crore

Provisions up 165% at Rs 2,522 crore versus Rs 950 crore (NDTV Profit estimate of Rs 3,371 crore)

NIM at 2.25% versus 3.96% (QoQ)

Operating Loss at Rs 4,909 crore Vs Operating Profit of Rs 4,082 crore.

GNPA at 3.13% versus 2.25% (QoQ)

NNPA at 0.95% versus 0.68% (QoQ)

ONGC Q4 FY25 Results Highlights (Standalone, QoQ)

Revenue up 3.8% to Rs 34,982 crore versus Rs 33,717 crore (Bloomberg estimate: Rs 33,709 crore)

Ebitda down 0.3% to Rs 19,007.5 crore versus Rs 19,057 crore (Bloomberg estimate: Rs 17,974 crore)

Margin at 54.3% versus 56.5% (Bloomberg estimate: 53.3%)

Net Profit down 21.7% to Rs 6,448 crore versus Rs 8,240 crore (Bloomberg estimate: Rs 8,810 crore)

InterGlobe Aviation Q4 FY25 Earnings Highlights (YoY)

Revenue up 24.3% to Rs 22,151 crore versus Rs 17,825 crore (Bloomberg estimate: Rs 21,887 crore)

Ebitdra (adjusted for forex) at Rs 6,817 crore versus Rs 4,545 crore

Ebitdar margin at 30.8% versus 25%

Net profit up 62% to Rs 3,067 crore versus Rs 1,895 crore (Bloomberg estimate: Rs 2,574 crore)

Strong growth aided by higher air traffic, lower fuel cost and higher ticket prices

Net profit also aided by higher other income – jump 39% YoY to Rs 946 crore

IndiGo says capacity growth for Q1FY26 to be in mid-teens

Colgate Palmolive India Q4 FY25 Results Highlights (YoY)

Revenue down 1.9% at Rs 1,462 crore versus Rs 1,490 crore (Bloomberg estimate: Rs 1,522 crore)

Ebitda down 6.4% at Rs 498.1 crore versus Rs 532.2 crore (Bloomberg estimate: Rs 501 crore)

Margin at 34.1% versus 35.7% (Bloomberg estimate: 32.9%)

Net profit down 6.5% at Rs 355 crore versus Rs 380 crore (Bloomberg estimate: Rs 361 crore

Ebitda down due to an 8% and 7% uptick in Employee Expenses and Advertising Expenses.

Ircon International Q4 FY25 Results Highlights (Standalone, YoY)

Revenue down 11.1% to Rs 3,243 crore versus Rs 3,649 crore

Ebitda down 44.5% to Rs 137 crore versus Rs 247.00 crore

Margin at 4.2% versus 6.8%

Net Profit down 23.8% to Rs 218 crore versus Rs 286 crore

GMM Pfaudler Q4 FY25 Results Highlights (Consolidated, YoY)

Revenue up 8.9% at Rs 806.6 crore versus Rs 740.7 crore

Ebitda down 7.3% at Rs 83.2 crore versus Rs 89.8 crore

Margin at 10.3% versus 12.1%

Net Loss at Rs 27 crore versus a profit of Rs 27.6 crore

Exceptional Loss of Rs 47 crore.

Other income at loss of 4.73 crore versus Rs 10.53 crore.

EBITDA down due to higher Other Expenses (+12%), Labour Charges (+17%) and Cost of Materials (+6%).

Astral Q4 FY25 Results Highlights (Consolidated, YoY)

Revenue up 3.5% at Rs 1,681 crore versus Rs 1,625 crore (Bloomberg estimate: Rs 1746 crore)

Ebitda up 3.6% at Rs 301.9 crore versus Rs 291.5 crore (Bloomberg estimate: Rs 290 crore)

Margin at 18% versus 17.9% (Bloomberg estimate: 16.6%)

Net Profit down 1.3% at Rs 179.3 crore versus Rs 181.6 crore (Bloomberg estimate: Rs 169 crore)

National Aluminium Company Q4 FY25 Results Highlights (Consolidated, QoQ)

Revenue up 13% to Rs 5,267.83 crore versus Rs 4,662.22 crore

Ebitda up 27.4% to Rs 2,829.74 crore versus Rs 2,222 crore

Margin at 53.7% versus 47.7%

Net profit up 32% to Rs 2,067.23 crore versus Rs 1,566.32 crore

Chemicals revenue up 0.8% to Rs 2,536.66 crore

Aluminium revenue up 25% to Rs 3,250.26 crore

Prince Pipes Q4 FY25 Earnings Highlights (YoY)

Revenue down 2.8% at Rs 720 crore versus Rs 740 crore

Ebitda down 40.6% at Rs 54.7 crore versus Rs 92 crore

Margin at 7.6% versus 12.4%

Net profit down 56% at Rs 24 crore versus Rs 54.6 crore

Volumes degrew by 2%.

EBITDA down due to uptick in Employee Expenses by 24% and Cost of Materials by 3%.

Teamlease Services Q4 FY25 Results Highlights (Consolidated, QoQ)

Revenue down 2.2% at Rs 2,858 crore versus Rs 2,921 crore (Bloomberg estimate: Rs 2,909 crore)

EBIT up 58% at Rs 34.1 crore versus Rs 21.6 crore

EBIT Margin at 1.2% versus 0.7%

Net Profit up 23% at Rs 35 crore versus Rs 28.4 crore (Bloomberg estimate: Rs 36 crore)

EBIT up due to fall in Employee Expenses of 3%

VRL Logistics Q4 FY25 Results Highlights (Consolidated, YoY)

Revenue up 5.3% to Rs 809 crore versus Rs 768 crore (Bloomberg estimate: Rs 839 crore)

Ebitda up 78.1% to Rs 187 crore versus Rs 105 crore (Bloomberg estimate: Rs 152 crore)

Margin at 23.1% versus 13.7% (Bloomberg estimate: 18.1%)

Net Profit up 245% to Rs 74.2 crore versus Rs 21.5 crore (Bloomberg estimate: Rs 48.5 crore)

EBITDA up due to reduction in Freight, Handling and Servicing Cost by 9%

Increase in Freight Rates and Discontinuation of low margin business leads to improvement in realisation and margins.

Oil India Q4 FY25 Results Highlights (Standalone, QoQ)

Revenue up 5.3% to Rs 5,519 crore versus Rs 5,240 crore (Bloomberg estimate: Rs 5,371 crore).

Ebitda down 7% to Rs 1,984 crore versus Rs 2,133 crore (Bloomberg estimate: Rs 2,266 crore).

Margin at 35.9% versus 40.7% (Bloomberg estimate: 42.2%).

Net Profit up 30.2% to Rs 1,591 crore versus Rs 1,222 crore (Bloomberg estimate: Rs 1,629 crore).

H.G. Infra Engineering Q4 FY25 Results Highlights (Consolidated, YoY)

Revenue down 20.3% at Rs 1,361 crore versus Rs 1,708 crore

Ebitda down 28% at Rs 239.3 crore versus Rs 332.4 crore

Margin at 17.6% versus 19.5%

Net profit down 22.7% at Rs 146.9 crore versus Rs 190 crore

Star Cement Q4 Highlights (Consolidated, YoY)

Revenue up 15.2% to Rs 1,052.09 crore versus Rs 913.53 crore.

Ebitda up 46% to Rs 262.72 crore versus Rs 179.71 crore.

Margin at 25.0% versus 19.7%.

Net Profit up 41% to Rs 123.17 crore versus Rs 87.57 crore.

Gallantt Ispat Q4 FY25 Results Highlights (Consolidated, YoY)

Revenue down 8.9% at Rs 1,072 crore versus Rs 1,177 crore

Ebitda down 0.2% at Rs 183 crore versus Rs 183.5 crore

Margin at 17.1% versus 15.6%

Net profit up 22% at Rs 116 crore versus Rs 95.4 crore

Other Income aided Profit, Other Income to 11.62 crore versus Rs 3.36 crore.

Mankind Pharma Q4 Highlights (Consolidated, YoY)

Revenue up 27.1% to Rs 3,079.37 crore versus Rs 2,422.24 crore (Bloomberg estimate: Rs 3,096 crore)

Ebitda up 17% to Rs 683.19 crore versus Rs 586.30 crore (Bloomberg estimate: Rs 791 crore).

Margin at 22.2% versus 24.2% (Bloomberg estimate: 25.6%)

Net profit down 10% to Rs 425 crore versus Rs 471.6 crore (Bloomberg estimate: Rs 366 crore)

GULF OIL Highlights Q4 Earnings (Consolidated, YoY)

Revenue up 9.6% at Rs 952.7 crore versus Rs 869.6 crore

Ebitda up 9.8% at Rs 128.8 crore versus Rs 117.3 crore

Margin Flat At 13.5%

Net Profit up 6.9% at Rs 92.2 crore versus Rs 86.2 crore

To pay final dividend of Rs 28 per share

Stocks In News

IndusInd Bank: After receiving reports of investigations carried out by an external professional firm and internal audit department, the board of Bank said that it suspects the occurrence of fraud against the lender. The board suspects involvement of certain employees having a significant role in the accounting and financial reporting of the bank. The lender said that Rs 173 crore has been incorrectly recorded in the microfinance portfolio.

Infosys: The IT major announced its strategic collaboration with LogicMonitor, a leading SaaS-based hybrid observability platform powered by artificial intelligence (AI). The collaboration seeks to enhance the observability of IT operations, improving performance, reliability and customer experience across complex systems.

Ireda: The company files an application against Gensol Engineering in the Debt Recovery Tribunal for the default amount of Rs 510 crore and Rs 219 crore.

Mastek: The board appointed Raghavendra Jha as CFO.

KEI Industries: The company acquired land for Rs 93.58 crore for future expansion from Rajasthan State Industrial Development & Investment Corp.

Hindustan Zinc: The company received letter of intent from government of Andhra Pradesh for grant of composite licence for e-auction of Balepalyam Tungsten and Associated Mineral Block conducted by Ministry of Mines.

Indian Hotels: The company signed an agreement with Tripura govt for Agartala hotel. Increases footprint in Northeast to fourteen Hotels.

Capital India Finance: Capital India Home Loans, a Material subsidiary of Capital India Finance received prior approval from RBI for the sale and change in control of Capital India Home Loans.

Garden Reach Shipbuilders: Government of Bangladesh has cancelled 21 million USD order for the Construction of an Advanced Ocean-Going Tug. The order was received on July 1, 2024.

Thomas Cook: The company expands foreign exchange distribution Tapping into Forex Demand in Kerala.

IIFL Finance: The company approved Issuance of NCDs aggregating to Rs 200 crore Including Green Shoe Option.

NBCC India: The company received a work order of Rs 161.6 crore for interior works in new delhi.

BN Holdings: The board appointed Chintan Ajaykumar Shah as CEO Effective Tomorrow. Ashutosh Sharma Resigns as Director of the company.

Havells India: The company to make an investment of Rs 7-10 crore for new EV equipment operations.

ITC: The company acquires 594 equity shares and 2,201 Compulsorily Convertible Preference Shares of Mother Sparsh Baby Care for Rs 50.6 crore.

Medplus Health Services: The arm received a suspension order for a drug license store in Karnataka.

REC: Incorporates 3 wholly owned subsidiaries.

Aarti Industries, Birlasoft, Hindustan Copper, Mahanagar Gas & Piramal Enterprises to be excluded from F&O effective August 1.

Jindal Poly Films: A fire incident occurred at the arm's plant in Nashik. Production Operation. A part of the plant temporarily disturbed.

PDS: The company completed share transfer of arm Poeticgem to Anuj Banaik, MD. Arm Poeticgem ceases to be wholly owned step-down subsidiary post share transfer. Anuj Bainik has been holding 25% economic interest in arm Poeticgem business verticals.

GMR Airports: The arm in share purchase agreement to acquire a 70% stake in ESR GMR Logistics Park at Rs 41.33 crore.

Brokerage Radar

Investec on International Gemological Institute

Maintain Buy rating with a target price of Rs 489.

See IGI as a leader with resilient growth and a top player in a high-growth market.

Risks are overstated; model disruption is unlikely.

IGI is expected to remain pivotal in the diamond jewellery value chain globally over the longer term.

Strong industry growth, best-in-class margins, strong earnings prospects, and a return on capital employed above 35% call for a higher price-to-earnings multiple.

HSBC on Hexaware Technologies

Initiate Buy rating with a target price of Rs 950.

The company is well positioned to grow at a top-quartile sector rate, driven by balanced sales and client-mining capabilities.

Two-year earnings per share growth is over 20%, with a price-to-earnings ratio of 34 times, making the stock attractive based on valuation versus growth.

Key risks include exposure to US government-related entities and potential stake sale by private equity investors.

Macquarie on Swiggy

Maintain Underperform rating with a target price of Rs 260.

Swiggy outpaced Zomato in the past two quarters but downside to the 18-22% gross order value growth target is expected.

Swiggy is expected to continue closing the adjusted Ebitda margin gap with Zomato.

With shares trading 20% below the initial public offering price, the market views Instamart as a free option; Macquarie disagrees.

Food delivery is valued at Rs 180 per share and net cash at Rs 20 per share, combined at still one-third below the current price.

Bulk Deals

Blackbuck: VEF AB (PUBL) sold 9.27 lakh shares (0.52%) at 467 apiece.

Data Patterns India: Government Of Singapore sold 2.84 lakh shares (0.5%) at Rs 2728.56 apiece.

Gensol Engineering: Ashwin Stocks and Investment sold 2.1 lakh shares (0.55%) at Rs 68.79 apiece, Epitome Trading and Investments sold 3.25 lakh shares (0.85%) at Rs 68.79 apiece.

KPR Mill: ICICI Prudential Life Insurance bought 17.54 lakh shares (0.51%) at Rs 1140.1 apiece, while Kpd Sigamani sold 36 lakh shares (1.05%) at Rs 1140.1 apiece, K P Ramasamy sold 36 lakh shares (1.05%) at Rs 1140.33 apiece and P Nataraj sold 36 lakh shares (1.05%) at Rs 1140.1 apiece.

IPO Offering

Belrise Industries: The public issue was subscribed to 0.67 times on day 1. The bids were led by qualified institutional investors (0.42 times), non-institutional investors (1.44 times), retail investors (0.48 times).

Borana Weaves: The public issue was subscribed to 29.46 times on day 2. The bids were led by qualified institutional investors (1.76 times), non-institutional investors (53.07 times), retail investors (77.16 times).

Trading Tweaks

Price Band change from 20% to 10%: Suven Life Sciences.

Price Band change from 20% to 5%: Krystal Integrated Services, Banco Products (I).

Ex-Dividend: Ashok Leyland, GM Breweries, Emami.

List of securities to be included from ASM Framework: HLE Glascoat.

F&O Cues

Nifty May Futures up by 0.17% to 24,817 at a premium of four points.

Nifty May futures open interest down by 2.13%.

Nifty Options May 22 Expiry: Maximum call open interest at 25,500 and maximum Put open interest at 24,000.

Securities in ban period: RBL Bank, Manappuram Finance, Titagarh Railways.

Currency Update

The rupee closed flat at 85.64 against US Dollar. While the Government bond closed 2 basis points lower at 6.24, on Wednesday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.