Good morning!

The GIFT Nifty traded little changed at 25,769.5 as of 6:40 am, signalling a muted start to Indian equities.

Index futures for equities in the US and Europe rose, while key Asian benchmarks gained.

Watch NDTV Profit Live

Markets On The Home Turf

Indian benchmark equity indices closed with gains on Friday, led by share prices of Jio Financial Service Ltd. and Asian Paints Ltd.

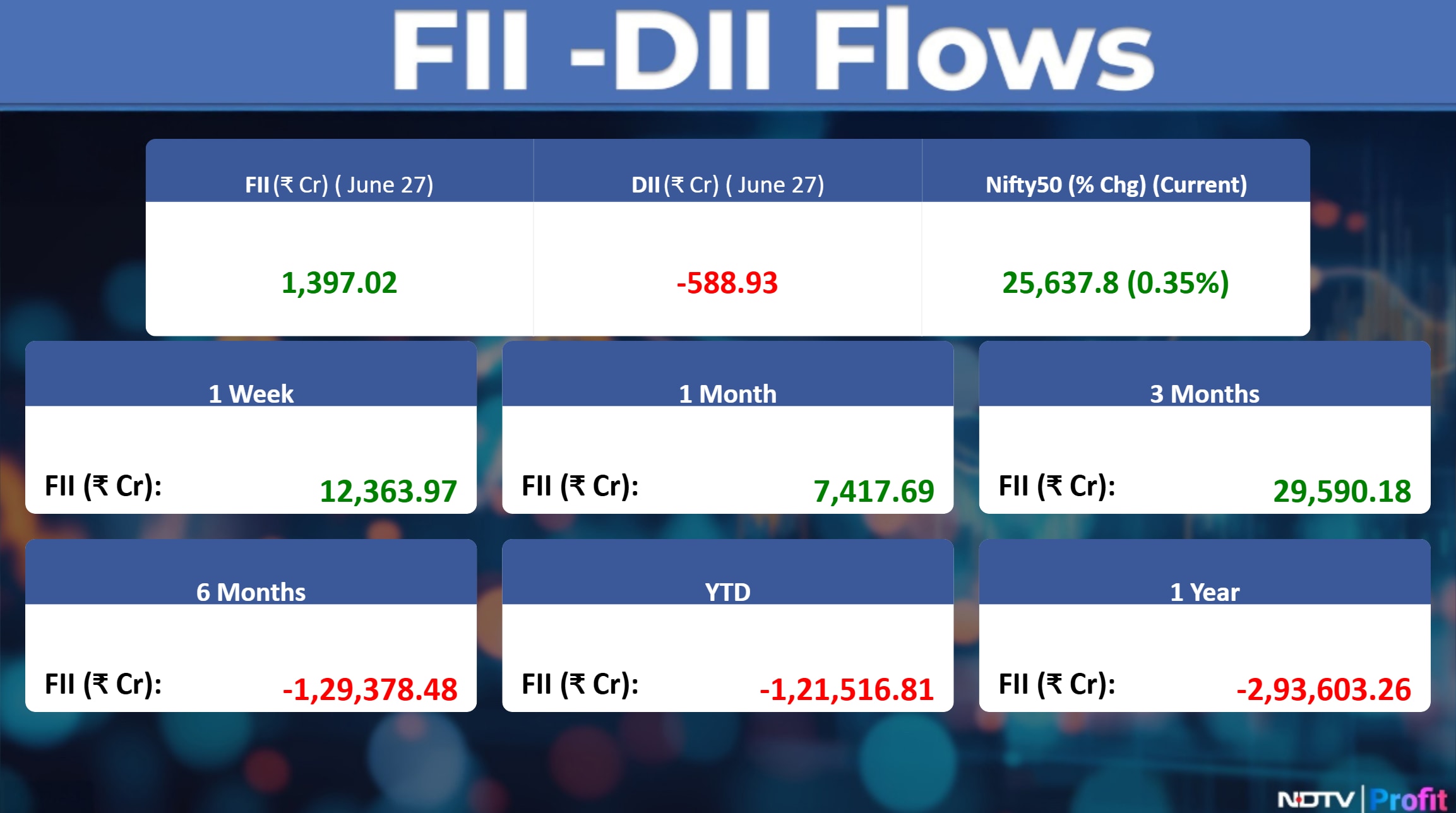

The NSE Nifty 50 ended 88.80 points, or 0.35% higher at 25,637.80, while the BSE Sensex closed 303.03 points, or 0.36% up at 84,058.90. During the day, Nifty rose 0.41% to trade at 25,654.20 and the Sensex advanced 0.40% to 84,089.35.

Nifty clocked its best weekly gain in the last six weeks. Both benchmark indices jumped by 2%, led by financial services stocks.

Commodity Check

Crude oil prices fell 1% as an easing of geopolitical risks in the Middle East and the prospect of another OPEC+ output hike in August boosted the supply outlook.

International benchmark Brent futures were down 0.97% at $67.11 a barrel, with the August contract expiring today. US West Texas Intermediate crude decreased 1.43% to $64.58 a barrel.

London Metal Exchange

Copper up 0.3%.

Aluminium up 0.25%.

Nickel down 0.25%.

Zinc down 0.3%.

Lead down 0.2%

Asian Markets Update

S&P 500 futures up 0.3%.

Euro Stoxx 50 futures up 0.43%.

Futures for Hong Kong's Hang Seng Index down 0.17%.

Nikkei 225 up 1.7%.

Japan's Topix index up 0.9%.

Kospi down 0.49%

Australia's S&P/ASX 200 up 0.17%.

US Market Updates

Stocks on Wall Street climbed to all-time highs on Friday, capping a week that saw tensions in the Middle East cool off and signs that the US economy is holding up amid subdued inflation.

The S&P 500 closed 0.5% higher at 6,173. Technology-heavy Nasdaq Composite also added 0.5%. The Dow Jones Industrial Average advanced 1%.

Key Events, Economic Data To Watch

At 4 p.m., the government will release industrial production figures for May, with year-on-year growth estimated at 2.3%, compared with 2.7% in April.

The Centre will also publish fiscal deficit data for April–May at 4 p.m. The previous reading was Rs 1.86 trillion.

Bank credit growth for May is scheduled for release on June 30. The prior year-on-year increase was 10.3%.

The Ministry of Cooperation will host a “Manthan Baithak” of Cooperation Ministers from states and Union Territories at Bharat Mandapam. Home Minister and Minister of Cooperation Amit Shah will chair the session.

Stocks In News

Torrent Pharma: To acquire controlling stake in JB Chemicals at equity valuation of Rs 25,689 crore, followed by merger.

JB Chemicals & Pharma: Appointed Nikhil Ashokkumar Chopra as CEO.

Karnataka Bank: CEO Srikrishnan Sarma and COO Sekar Rao and resign.

Hind Rectifiers: Won Rs 127 crore order from Indian Railways to be executed by FY27.

AU Small Finance Bank: Approved Rs 11,000 crore fundraising limits for 12 months and appointed Jagajit Mangal Prasad as independent director.

Gujarat Industries Power: Commissioned 105 MW of 600 MW Khavda solar project.

Devyani International: Sky Gate to acquire remaining stake in Blackvelvet and Say Chefs for Rs 18.91 crore in related-party deal.

Jindal Worldwide: Approved sale of 51% in Goodcore Spintex, which posted FY25 revenue of Rs 252 crore and PAT of Rs 8 crore.

Balaji Telefilms: BSE and NSE levied Rs 1.3 lakh fine on the company.

Tanla Platforms: Appointed Sandeep Kapoor as Chief AI, Data & Analytics Officer and Anshuman Kar as Chief Customer Officer.

Titagarh Rail Systems: Secured Rs 430 crore order for 12 additional Pune Metro trainsets.

Balrampur Chini Mills: Re-appointed Praveen Gupta as whole-time director.

Amber Enterprises: Amber Group to acquire majority stake in Power-One Micro Systems.

Rainbow Children's Medicare: To acquire 76% equity and 100% preference shares in Prashanthi Medicare, which runs a 100-bed hospital.

Neuland Laboratories: Received EIR from US FDA for Sangareddy facility.

Nazara Technologies: Subsidiary to infuse Rs 8.66 crore in Getstan Technologies.

Oriental Rail: Allotted 5 lakh shares to promoter at Rs 169 each.

Suzlon Energy: SEBI disposed adjudication proceedings.

Shilpa Medicare: NCLT approved merger with INM Technologies.

NLC India: Won NTPC order for 450 MW wind-solar hybrid project.

JM Financial: JM Financial Credit Solutions to become subsidiary.

Sarda Energy & Minerals: Received approval to operate coal gasifier plant.

Granules India: US FDA issued one observation to US unit.

Asian Paints: Acquired remaining 40% in White Teak for Rs 188 crore, now owns 100%.

NTPC: Commissioned additional 288.9 MW solar capacity at Khavda.

Medplus Health: Subsidiary received drug licence suspension for Tamil Nadu store, revenue impact ~Rs 38,000.

Aptus Value Housing: Credit rating upgraded to CARE AA: Stable.

Can Fin Homes: Met Elara Capital analysts on June 27.

Vodafone Idea: Reduced directorship threshold to 10% for non-government shareholders.

Tata Communications: Subsidiary settled tax issue with Canada Revenue Agency.

Cochin Shipyard: Bagged Rs 100–250 crore order from Polestar Maritime for two 70 T tugs.

Alembic Pharma: Received US FDA approval for cancer drug Doxorubicin Liposome injection.

NTPC Green Energy: Commissioned final 120 MW of 220 MW Shajapur solar project.

Tata Steel: Received Rs 1,007 crore GST demand notice, net exposure estimated at Rs 493 crore.

Aurobindo Pharma: Subsidiary resumed Penicillin-G production after regulatory clearance.

Hindustan Copper: Signed MoU with Indian Oil for critical minerals block auctions.

Signature Global: To invest Rs 2,200 crore in Gurugram housing project to be completed by 2031.

Kalpataru Projects: Subsidiary to issue termination notice to NHAI over defaults.

Mahindra Holidays: Received Rs 363 crore GST demand notice for FY19.

Zen Technologies: The company secured a patent for innovation in laser-based combat training; Ravi Kumar Midathala retired as whole-time director.

Remsons Industries: The company's arm Remsons Automotive received purchase order worth Rs 80 crore from Ford Otosan.

Bharti Airtel: The company appointed Ramjee Verma as head of internal assurance effective from Sept. 1.

eMudhra: The company acquired 51% stake in Cryptas International for 5 million euros.

Interarch Building: The company received Rs 77 crore construction order from Amara Raja Infra.

BHEL: The company received Rs 6,500 crore order from Adani Power for 6 thermal units of 800 MW.

REC: The company incorporated step-down arm Davanagere Power Transmission.

Waaree Energies: The company received an order for the supply of 540 MW solar modules from a renowned customer who is a developer and owner-operator of utility scale solar and energy storage projects across the United States.

Acutaas Chemicals: The company's arm Baba Advance Materials entered a JV with Materials, a South Korean Company, whereby BAML will hold 75% stake in JV company Indichem a South Korean company and the remaining 25% stake of the JV will be held by J & Materials.

Jyoti CNC Automation: A significant block deal is expected on June 30, involving the sale of 1.37 crore shares, representing a 6.02% stake in the company. This block deal, executed by non-promoters at a price of Rs 1,125.6 per share, amounted to a total value of Rs 1,542 crore.

Piramal Enterprises: Company to make an investment worth Rs 700 crore in arm Piramal finance via rights issue.

Rattanindia Enterprises: The company's board is set to meet on July 2 to consider proposal for fund raising.

Expleo Solutions: The company approved proposal to incorporate new arms in Gift City, Gujarat.

TVS Holdings: The company acquired additional 9.4 crore shares of arm Home Credit India finance for Rs 121.6 crore.

Ujjivan Small Finance Bank: The company re-appointed Carol Furtado as whole-time director for three years.

Torrent Pharma: The company issued commercial paper worth Rs 200 crore fully redeemed and repaid.

Tinna Rubber and Infra: The company approved allotment of 8.8 lakh shares aggregating to Rs 78.7 crore to eligible QIBs, at an issue price of Rs 888 per share.

Epack Durable: The company incorporated Arm Bumjin India Audio Products.

Zydus Life: Company to make an investment of Rs 3.9 crore for subscription of 22.06% stake in torrent Urja 25.

Himadri Speciality: The company allotted commercial paper of Rs 200 crore.

Hindustan Rectifiers: The company received Rs 101-crore order from Indian Railways.

Aditya Birla Capital: Company to issue bonds worth Rs 1,301 crore to Asian Infrastructure investment bank.

Neogen Chemicals: The company received Rs 50 crore towards an on-account payment for loss of property from insurance company.

ICICI Bank: The company allots bond worth Rs 1,000 crore bearing face value of Rs 1 crore each on private placement basis.

ITD Cementation: The company received an international marine contract worth nearly Rs 580 crore in Abu Dhabi.

GAIL: The company subscribed to a rights issue of 106.7 crore shares in JV company Talcher Fertilizer. Acquisition of share in TFL is expected to be completed on or before July 9.

Timex Group: Promoter Timex Group Luxury Watches B V sold 15% stake via OFS.

PB Fintech: The company will make an investment of Rs 10 crore in arm PB Pay.

Satin Creditcare: The company re-appointed Harvinder Pal Singh as chairman and managing director for five more years.

VRL Logistics: The board is to meet on July 4 to consider the issue of bonus shares.

RVNL: The company emerged as the lowest bidder for South Central Railways' Rs 213-crore project.

Arihant Foundation and Housing: The company is in an agreement with Prestige group to acquire 3.48-acre land in Chennai from Rane Madras.

Crompton Greaves Consumer: The company launched AC capacitor CapMaxx 2.5MFD in the B2C lighting category.

HAL: The company is set to pay final dividend of Rs 15 per share.

Sula Vineyards: The company will make an investment of Rs 13 crore by subscribing to rights issue of Artisan Spirits, comprising up to 98 lakh shares.

Panorama Studios: The company is in distribution agreement with Reliance Industries for Hindi language film MAA.

Hindustan Oil Exploration: The company stopped production at Block B-80 due to adverse weather.

Samvardhana Motherson: The company approved issuance of NCDs worth Rs 2,025 crore on private placement basis.

Kalpataru Projects: The company's arm received intention to Issue Termination Notice from NHAI. NHAI alleged continued default in payment of premium arbitrarily claiming Rs 351 crore.

Vesuvius India: The company's Visakhapatnam plant commenced commercial operations.

Nazara Technologies: The company's arm Sportskeeda acquired intellectual property rights of prime timer for Rs 4.28 crore.

Omaxe: The company arm received RERA registration certificate in project Omaxe new palwal phase-1 in Haryana.

Media Reports

Rosneft in talks with Reliance for stake sale in India unit:

PTIAltimetrik to buy India's SLK Software for $600m: Economic Times

Reliance Power participates in global bids for 1,500-MW gas-based power project: PTI

Finance Ministry asks PSBs to monetise investments in subsidiaries via listing on bourses: PTI

IPO Offering

Sambhv Steel Tubes: The public issue was subscribed 28.46 times on day three. The bids were led by qualified institutional investors (62.32 times), non-institutional investors (31.82 times), retail investors (7.99 times) and reserved for employees (5.34 times).

HDB Financial Services: The public issue was subscribed 16.69 times on the final day. The bids were led by qualified institutional investors (55.47 times), non-institutional investors (9.99 times), retail investors (1.41 times) and reserved for employees (5.72 times), reserved for shareholders (4.26 times).

Indogulf Cropsciences: The public issue was subscribed to 0.94 times on the second day. The bids were led by qualified institutional investors (0.05 times), non-institutional investors (0.85 times), retail investors (1.55 times) and reserved for employees (0.15 times).

Brokerage Radar

Nomura On Torrent Pharma

Maintain 'Neutral' with a target price of Rs 3,580.

Acquisition will not be a surprise to us, as inorganic expansion, particularly in India, has been a key strategy for Torrent.

Investors are likely to take comfort that Torrent has been successful in past acquisitions, as they have been value accretive.

In the case of JB, the India product portfolio is complementary to that of Torrent.

Deal size will be much larger than what Torrent has executed in the past.

The impact on Torrent's earnings is likely to be significantly negative given rising interest charges and amortisation.

Investec On SBFC Finance

Strength in structure, growth restrained.

Strong franchise in the secured MSME segment.

Achieved 40% AUM CAGR over past five years with improving profitability and stable asset quality.

Return on assets and asset quality metrics are not industry-leading, but they appear credible.

Resilience stems from a leadership team who have seen various credit cycles.

High employee attrition and low productivity are notable challenges.

See AUM growth of 27% CAGR over the next three years with exit RoE of more than 15% in FY28.

See challenges to scalability in MSME book (beyond Rs 20,000 crore) as employee productivity is low.

Jefferies India Strategy

Equity supply to cap market upside.

Sharp market rebound from March 2025 lows has triggered an equity supply response as expected.

75% driven by promoter/PE exits, May and June equity supply was $17 billion.

While the domestic flows have halved, improved foreign flows have helped.

With the supply pipeline remaining strong and valuations elevated, expect the broader index to move sideways.

See several bottom-up opportunities and overweight Bharti Airtel, financials, cement, two-wheelers and select real estate.

Jefferies On Power Utilities

Maintain 'Buy' with target price raised to Rs 285 from Rs 230.

Expecting RoA trajectory improvement to 45-50 bps driven by the much-awaited normalization of credit cost.

Stress in JGL/credit card is expected to further subside in the June quarter.

Slippages to moderate to 4.5% versus 4.7% in the March quarter.

Accelerated provisioning on JLG in Q4 and adequate provision in the cards portfolio to normalize credit cost to 2.2%.

Repricing of floating-rate portfolio, mix change in favor of secured segments will lead to 28-30 bps net interest margin pressure.

NIMs would bottom out sooner in the June quarter versus peers.

Expect industry average loan growth of 9% YoY and 2% QoQ and deposits growth of 10% YoY and 1% QoQ.

Nomura On India Consumer

June quarter demand is expected to improve marginally, but margins may still be pressured.

Rural demand to continue to show improvement, while urban demand may remain weak but stable.

Expect the summer portfolio across companies to be impacted on the back of an early monsoon.

Competitive intensity is moderate as companies are still coming out of margin pressure seen earlier due to high raw material prices.

Margins still impacted and lower than historical levels, but will improve from September quarter.

Click here to read more.

Block Deals

Prime Focus: A2R Holdings bought 1.51 crore shares (5.04%) at Rs 113 apiece, while Naresh Mahendranath Malhotra sold 1.51 crore shares (5.04%) at Rs 113 apiece.

Bulk Deals

Sundram Fasteners: HDFC Mutual Fund bought 13.7 lakh shares (0.65%) at Rs 1,000 apiece.

GMR Power and Urban Infra: Setu Securities Pvt. sold 37.5 lakh shares (0.62%) at Rs 107.06 apiece, while Four Dimensions Securities (India) Ltd. bought 37.02 lakh shares (0.61%) at Rs 107.47 apiece.

Insider Trading

Jindal Steel & Power: Promoter Jindal Power bought 17,020 shares.

Signpost India: Promoter Pramina Suchanti sold 63,717 shares.

360 ONE WAM: Promoter Yatin Shah sold 13 lakh shares. Promoter Shilpa Bhagat revoked a pledge for 11.03 lakh shares, Promoter Shilpa Bhagat revoked a pledge for 11.03 lakh shares, Promoter Shilpa Bhagat sold 18.03 lakh shares.

Patel Engineering: Promoter Janky Patel created a pledge for 2.93 crore shares.

Aarti Pharmalabs: Promoter Orchid Family Trust (Relacion Trusteeship Services Private Limited) sold 25,000 shares, Promoter Tulip Family Trust (Gloire Trusteeship Services Private Limited) sold 44,000 shares.

Salasar Techno Engineering: Promoter Shikhar Fabtech Pvt. sold 9.54 lakh shares, while Promoter Alok Kumar sold 2.83 lakh shares, Promoter Base Engineering LLP sold 80,170 shares.

Maharashtra Seamless: Promoter Brahmadev Holding and Trading Ltd. bought 2.09 lakh shares, Promoter Odd & Even Trades & Finance Ltd. bought 67,000 shares, Promoter Amruit Promoters and Finance LLP sold 1 lakh shares, Promoter Amruit Promoters and Finance LLP sold 1.75 lakh shares.

India Pesticides: Promoter Ansh Swarup Agarwal bought 2,225 shares.

D. B. Corp: Promoter D B Power bought 17,710 shares.

Trading Tweaks

List of securities to be included from ST-ASM Framework: Astec LifeSciences, Diamond Power Infrastructure, Thomas Scott (India).

Price Band change from 10% to 5% band: Thomas Scott (India).

Price Band change from 2% to 5% band: Gensol Engineering.

Ex-Dividend: Dalmia Bharat Sugar and Industries, The Indian Hotels.

Shares to Exit Anchor Lock-In: Prostarm Info Systems (4%), Aegis Vopak Terminals (2%), Schloss Bangalore (5%), Stanley Life Sciences (37%), Motisons Jewellers (20%), Senores Pharma (48%), Sai Life sciences (0.9%), Innova Captab (20%).

F&O Cues

Nifty July Futures up by 0.55% to 25,757 at a premium of 120 points.

Nifty July futures open interest up by 0.42%.

Nifty Options July 3 Expiry: Maximum Call open interest at 26,500 and Maximum Put open interest at 25,000.

Securities in ban period: Nil.

Currency/Bond Update

The Indian rupee closed 21 paise stronger at 85.49 against the US dollar on Friday in comparison to its previous close of Rs 85.70 on Thursday.

The yield on the benchmark 10-year government bond ended 4 bps higher at 6.31%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.