Good morning!

The GIFT Nifty traded 0.66% higher at 25,714.5 as of 6:49 am, signalling a positive start to Indian equities.

US stock-index futures were little changed while, the futures indicted decline in Hong Kong and Europe.

Watch NDTV Profit Live

Markets On The Home Turf

The benchmark equity indices closed with gains on Thursday, led by share prices of Shriram Finance Ltd. and Jio Financial Services Ltd., as Nifty Bank and Finance surged to hit all-time high levels.

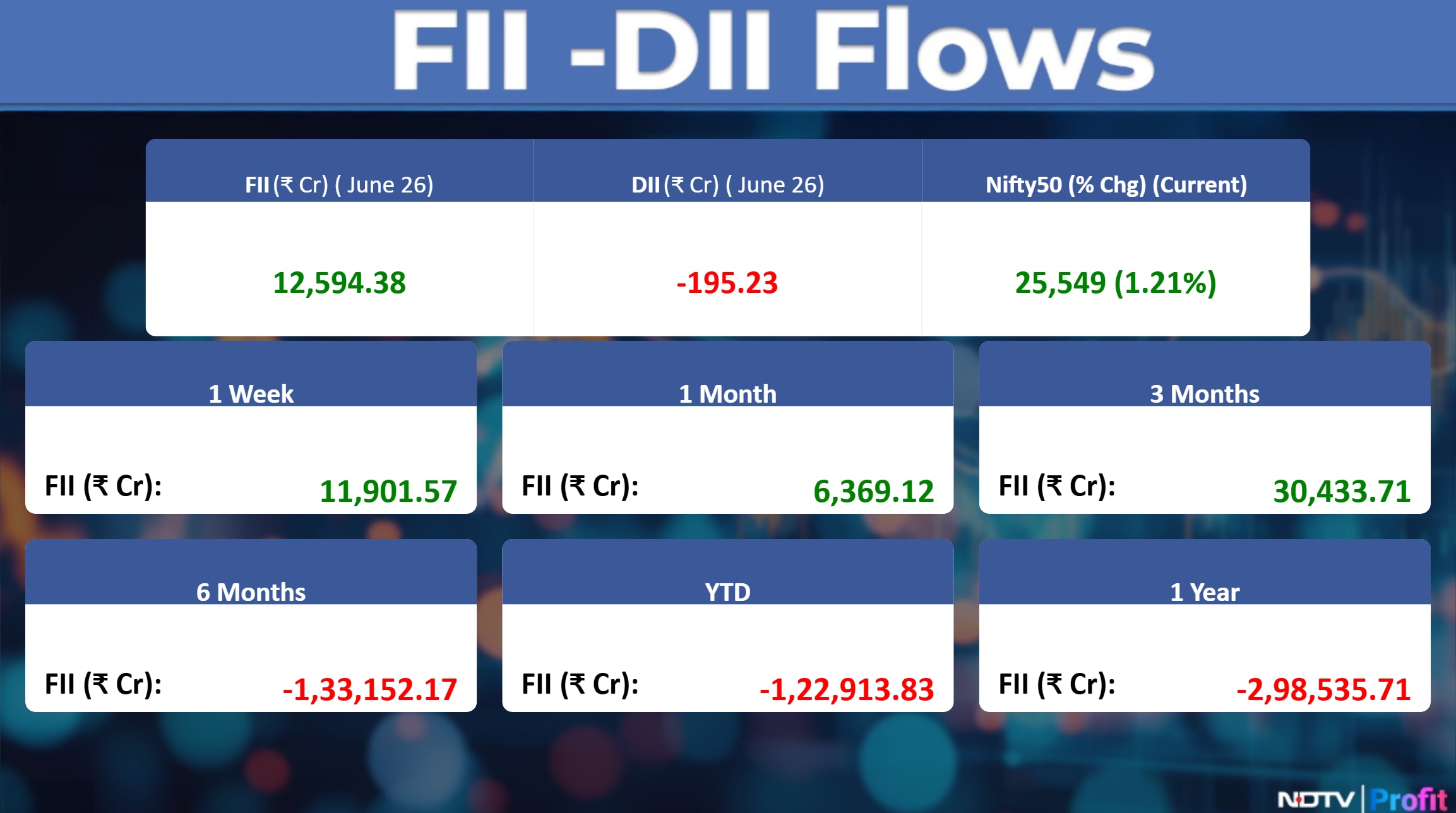

The NSE Nifty 50 ended 304.25 points, or 1.21% higher at 25,549, while the BSE Sensex closed 1,000 points, or 1.21% up at 83,755.87. During the day, the Nifty rose 1.27% to trade at 25,565.30 and the Sensex rose 1.28% to 83,812.09.

Commodity Check

Oil was steady on Thursday as focus once again moves towards trade from the Middle East conflict. Oil is likely to post its biggest weekly decline in nearly two years with Brent down nearly 12% for the week.

While Brent crude was up 0.50%, West Texas Intermediate crude oil rose 0.51%.

London Metal Exchange

Copper declines after it rose for two consecutive sessions, down 0.31%.

Aluminium extended gains and was up 0.08%.

Nickel was up 0.26%.

Zinc fell 0.18%.

Lead extended decline for the third session with a 0.02% decline.

Asian Markets Update

S&P 500 futures remained largely flat.

Euro Stoxx 50 futures rose 0.6%.

Futures for Hong Kong's Hang Seng Index were unchanged.

Nikkei 225 futures rose 1.6%.

Japan's Topix index rose 1.2%.

Australia's S&P/ASX 200 rose 0.6%.

US Market Updates

Wall Street extended its gains with S&P 500 continuing to be in near its all time high and closed 0.8%. Technology heavy Nasdaq 100 index rose 0.9% extending its advance. The Dow Jones Industrial Average was up 0.9%.

Stocks In News

HCL Tech: The company expanded its partnership with the sales force to accelerate enterprise adoption of Agentic AI with new services.

Hitachi Energy: The company received an order worth delivering 765 kV transformers to Power Grid Corp to advance the country's grid expansion.

NTPC: The company commissioned 660 MW unit-3 of Barh super thermal power project stage-I from July 1, 2025.

New India Assurance: The company received show cause notice for Rs 2,298 crore GST demand for period between April 2018-March 2023.

Embassy Developments: The company acquired 100% stake of squadron developers private for Rs 456.6 crore.

Gujarat Alkalies: 75 MW Solar Power project By GIPCL is now fully operative.

Sterling Tools: The company received show cause notice proposing GST demand Of Rs 9.7 crore from Dehradun GST body.

L&T Finance: The company allotted 22,500 secured NCDs aggregating Rs 225 crore via private placement basis.

Premier Energies: The company commissioned a new 1.2 GW TOPCon solar cell manufacturing line in Hyderabad.

Associated Alcohols: The company launched premium whisky 'Hillfort' in Uttar Pradesh.

Sagility India: The company approved a change in company name to Sagility.

GMR Airports: ESR GMR Logistics Park becomes the arm of GMR Hyderabad international airport.

Biocon: The company approved to buy 1,125 optionally convertible debentures of arm for $198.50 million.

Hindustan Copper: The entered tripartite agreement with Alankit Assignments (New RTA) and CB Management Services (Previous RTA).

Ultratech Cement: The company commissioned a second cement grinding mill with 1.8 MTPA capacity at the company's unit in Madhya Pradesh.

Styrenix Performance: The company completed the merger of arm Styrenix Polymers with arm Styrenix performance materials.

Power Mech Projects: The company received an order worth Rs 159 crore from Bihar state power generation company to develop grid connected solar power plants.

Sky Gold: The company approved the allotment of 2.07 lakh shares on the Conversion Of 2.07 lakh warrants at issue price of Rs 1,017 per share and further approved the allotment of 18.6 lakh shares under bonus issue in the ratio of 9:1.

Nucleus Software: The company re-appointed Parag Bhise as whole-time director for eight years and Ritika Dusad as whole-time director for a further five years.

Deep Industries: The company received an order worth Rs 45 crore from Oil India for hiring a number of mobile works over Rig Package.

Kaynes Technology: The company incorporated wholly owned arm Kaynes Space Technology.

Suryoday Small Finance Bank: The company re-appointed Baskar Babu Ramachandran as managing director, chief executive officer for a further three years.

Crest Ventures: The company's stake in terms of Arm Crest Residency reduces to 76% from 100% Earlier.

Choice International: The company incorporated a step-down-arm choice of green energy solutions.

REC: Incorporated step-down arm Ananthapuram II Power Transmission.

Western Carriers: The company received Rs 230 crore an order from Jindal Stainless for an end-to-end EXIM agreement for rail transportation of EXIM containers.

Diamond Power: The company announced recommissioning of EHV testing laboratory with NABL accreditation.

JK Paper: l-T commissioner disposes appeal of Rs 65.6 crore for AY21, grants substantial relief to the company. Tax demand raised earlier will be reduced to Nil

Share India Securities: The company approved Rs 41-crore investment in Master Trust by acquiring up to 27 lakh shares.

Pokarna: Paras Kumar Jain resigned as CEO of arm.

Bansal Wire Industries: The company received show cause notice of Rs 127 crore including interest and penalty from Ghaziabad GST body for FY19.

Bharti Airtel: Telecom department imposed a penalty of Rs 6.48 lakh.

IPO Offering

Globe Civil Projects: The public issue was subscribed to 86.04 times on day 3. The bids were led by qualified institutional investors (99.76 times), non-institutional investors (143.15 times), and retail investors (53.72 times).

Ellenbarrie Industrial Gases: The public issue was subscribed to 22.19 times on day 3. The bids were led by qualified institutional investors (64.23 times), non-institutional investors (15.21 times), and retail investors (2.14 times).

Kalpataru: The public issue was subscribed 2.26 times on day 3. The bids were led by qualified institutional investors (3.12 times), non-institutional investors (1.31 times), retail investors (1.29 times) and reserved for employees (0.7 times).

Sambhv Steel Tubes: The public issue was subscribed to 1.76 times on day 2. The bids were led by qualified institutional investors (0.61 times), non-institutional investors (3.12 times), retail investors (1.84 times) and reserved for employees (1.52 times).

HDB Financial Services: The public issue was subscribed to 1.16 times on day 2. The bids were led by qualified institutional investors (0.9 times), non-institutional investors (2.29 times), retail investors (0.64 times) and reserved for employees (2.97 times), reserved for shareholders (1.69 times).

Indogulf Cropsciences: The public issue was subscribed to 0.4 times on day 1. The bids were led by qualified institutional investors (0.05 times), non-institutional investors (0.27 times), retail investors (0.69 times) and reserved for employees (0.05 times).

Block Deals

PB Fintech: Yashish Dahiya sold 34 lakh shares (0.74%) at Rs 1821.5 apiece, Alok Bansal sold 16.5 lakh shares (0.36%), HDFC Life Insurance Company Limited bought 7.13 lakh shares (0.15%), Societe Generale bought 5.24 lakh shares (0.11%) and many others.

Delhivery: Nexus Ventures sold 1.02 crore shares (1.38%) at Rs 387 apiece, while Nexus Opportunity Fund Ltd sold 17 lakh shares (0.23%). Morgan Stanley Asia Singapore Pte bought 47.72 lakh shares (0.64%), Tata Mutual Fund bought 16.45 lakh shares (0.22%), Hill Fort India Fund Lp bought 13.3 lakh shares (0.18%), HDFC Mutual Fund bought 10.97 lakh shares (0.14%).

Bulk Deals

One Mobikwik Systems: NET 1 Applied Technologies Netherlands B.V sold 62.15 lakh shares (8%) at Rs 230.16 apiece, Pelican Portfolio Services sold 8.02 lakh shares (1.46%) at Rs 260.16 apiece, Musigma Securities sold 4.89 lakh shares (1.28%) at Rs 261.6 apiece while Citigroup Global Markets Mauritius bought 11.37 lakh shares (1.46%), Societe Generale bought 9.39 lakh shares (1.2%) at Rs 230 apiece, HDFC Mutual Fund bought 7.04 lakh shares (0.9%) at Rs 230 apiece.

360 One WAM: New World Fund, Inc bought 20.94 lakh shares (0.57%) at Rs 1170 apiece.

Insider Trading

NCL Industries: Promoter P S Raju sold 10000 shares, Promoter NCL Holdings (A&S) sold 36,886 shares, Promoter NCL Holdings (A&S) Ltd sold 34778 shares.

Bliss GVS Pharma: Promoter Gagan Harsh Sharma bought 32,818 shares.

Suprajit Engineering: Promoter Supriyajith Family Trust bought 73,259 shares.

Valor Estate: Promoter Vinod K. Goenka bought 4 lakh shares.

Aarti Pharmalabs: Promoter Tulip Family Trust (Gloire Trusteeship Services Private Limited) sold 50000 shares.

Trading Tweaks

List of securities to be included from LT-ASM Framework: Quality Power Electrical Equipments

List of securities to be excluded from ASM Framework: Quality Power Electrical Equipments.

Price Band change from 20% to No Band: 360 One WAM, Amber Enterprises India, KFIN Technologies, PG Electroplast.

Ex-Dividend: Allied Blenders and Distillers, RPG Life Sciences, Jayant Agro Organics, Bajaj Finserv, Bajaj Holdings and Investment, Maharashtra scooters, Care Ratings, Cipla, HDFC Bank, Swaraj Engines, Welspun Living, Rainbow Children Medicare.

Shares to Exit Anchor Lock-In: Ventive Hospitality, Dam Capital Advisor and Transrail Lighting.

F&O Cues

Nifty July Futures up by 1.06% to 25,618 at a premium of 69 points.

Nifty July futures open interest up by 13.38%.

Nifty Options July 3 Expiry: Maximum Call open interest at 26,500 and Maximum Put open interest at 25,000.

Securities in ban period: Nil.

Currency/Bond Update

The Indian rupee closed 39 paise stronger at 85.70 against the US dollar on Thursday

The yield on the benchmark 10-year government bond ended 5 bps lower at 6.325%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.