Good morning!

The GIFT Nifty was up 0.57% at 24,986 as of 06:50 a.m., signaling a gap down start to Indian markets today.

Stocks fell on Monday after US strikes on Iran's nuclear sites over the weekend. However, US stock-futures dropped on Monday morning. Additionally, Brent jumped over 2.6% on Monday and dollar rose against the euro and most other peers.

Watch NDTV Profit Live

Markets On The Home Turf

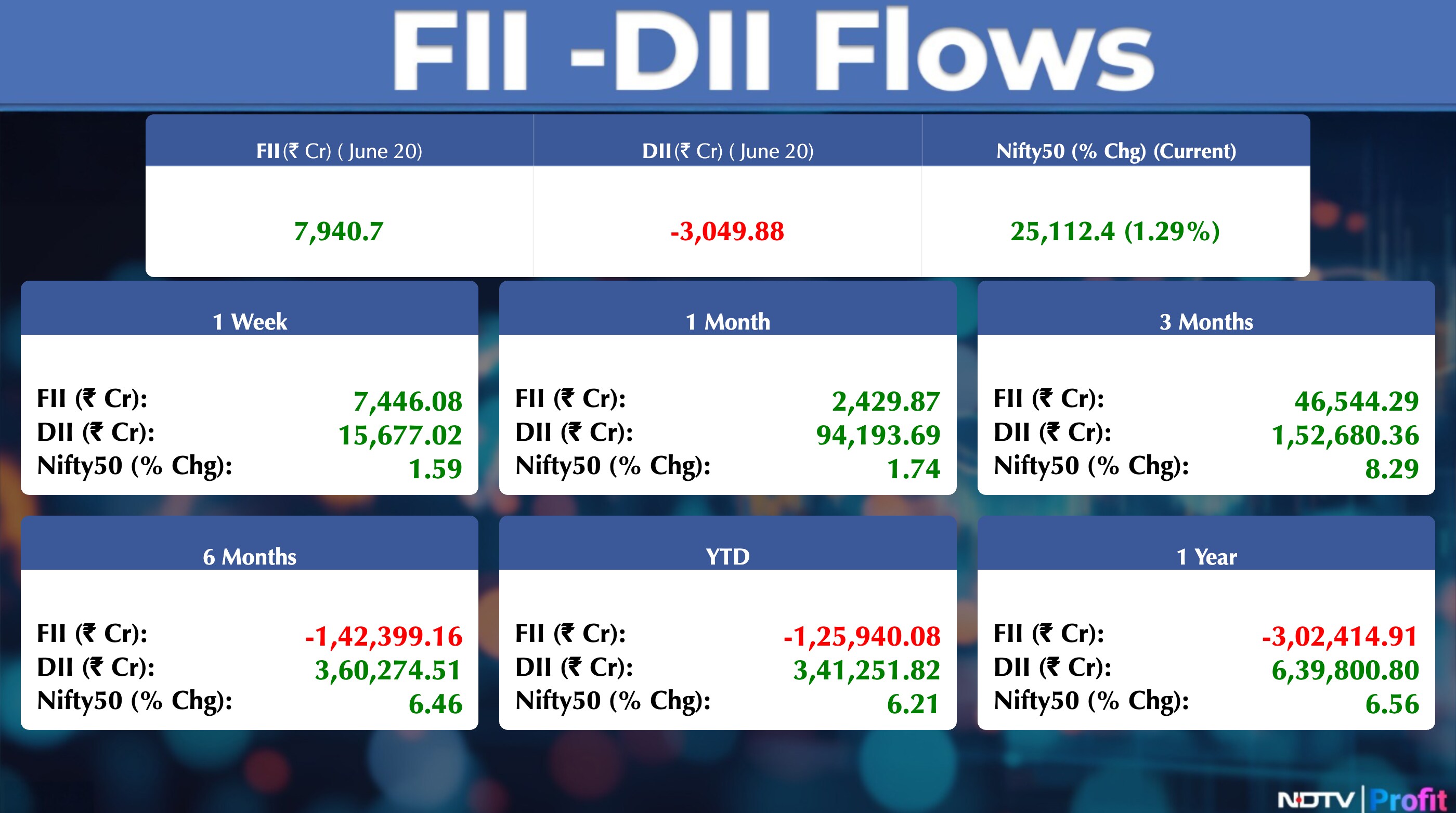

The benchmark equity indices reversed their declining streak as they ended the week with gains on Friday. The NSE Nifty 50 ended 319.15 points or 1.29% higher at 25,112.40, while the BSE Sensex closed 1,046 points or 1.29% higher at 82,408.

Foreign portfolio investors continued buying Indian equities for the fourth consecutive session on Friday. The FPIs net bought shares worth Rs 7,704 crore, according to the provisional data from the National Stock Exchange. Domestic institutional investors turned sellers for the first time after 25 sessions as they offloaded equities worth approximately Rs 3,658 crore, the data showed.

Asian Markets Update

S&P 500 futures fell 0.4%.

Hang Seng index futures were down 0.5%.

Futures for the Nikkei 225 was down 0.6%.

Japan's Topix index fell 0.5%.

Australia's S&P/ASX 200 index fell 0.4%.

Euro Stoxx 50 futures were down 0.6%.

Commodity Check

West Texas Intermediate crude rose 2.7% to trade at $75.87 per barrel.

Spot gold declined by 0.10% to $3,364.95 per ounce.

Brent crude rose 2.82% to $79.18.

London Metal Exchange

Copper was up 0.28%.

Aluminium snapped two day gaining streak and fell 0.15%.

Zinc was flat after it declined 0.09% after in the previous session.

Nickel was flat after it advanced in the previous session.

Lead snaps five day losing streak to rise 0.15%.

US Market Updates

Wall Street ended the last week with losses as geopolitical tensions continued to mount with the escalation in the Iran-Israel war, with S&P 500 index closing 0.2% lower at 5,967.84, Nasdaq 100 index ended 0.4% lower at 21,626.39 and Dow Jones Industrial Average rose 0.8% to 42,206.82.

Stocks In News

HDFC Bank: The bank is set to hold AGM on August 8.

Hindustan Aeronautics: The company became a successful bidder for the manufacturing and design technology of the Small Satellite Launch Vehicle, developed by ISRO.

Tata Consultancy Services: The company set up two new automotive delivery centres in Germany and an engineering centre in Romania.

Granules India: The US FDA concluded inspection at the company's Hyderabad API plant and issued one Form 483 observation. The inspection was done from June 16 to June 20. The company will respond to this observation within the stipulated time.

Vidhi Specialty: Gujarat Industrial Development Corp allots land for a new manufacturing plant.

Tanla Platforms: The company's arm Karix Mobile incorporated a subsidiary, Karix Mobile LLC, at Saudi Arabia.

LT Foods: The United States Department of Commerce, International Trade Administration during its administrative review of the countervailing duty order on organic soybean meal from India for the period from Jan 1, 2023, to Dec 31, 2023, applied the ‘adverse facts available' methodology to arm Ecopure Specialities. As a result, the highest possible CVD rate of 340.27% has been imposed on Ecopure's exports of organic soybean meal to the United States.

HG Infra Engineering: The company received a letter of intent from PFC Consulting to establish interstate transmission system.

Servotech Renewable Power: The company acquired a 27% stake in Rhine Solar.

Bank of India: The company is to consider fund raising by issue of long-term bonds on June 26.

Rashtriya Chemical Fertilisers: The company approved an unsecured loan of Rs 233 crore to JV company Talcher Fertilisers.

Bharat Electronics: The company secured additional orders worth Rs 585 crore. Major orders received include fire control and sighting system for missiles, communication equipment, jammers, spares, services etc.

Datamatics Global: The company acquired remaining 20% stake in Dextara Digital for Rs 33 crore.

Adani Green: Ardour Opts to convert 21.2 lakh warrants to shares at a premium of Rs 1,470.75 per share.

Exicom Tele-Systems: The company is to consider raising funds by way of rights issue on June 25.

Dr Reddy's Laboratories: The company received the US FDA's approval for Carbidopa and Levodopa.

ONGC: The company is to provide corporate guarantee of up to $412 million for fundraise by OVL overseas IFSC.

Adani Ports and Special Economic Zone: The company's arm Adani Logistics enters into a JV termination agreement with Riddhi Infocom to sell 49% stake in Veracity. Veracity is a JV between Adani Logistics & Riddhi. Adani Logistics continues holding a 1% stake in Veracity.

Lemon Tree: The company executed a hotel operation agreement for arm Carnation Hotels in Uttar Pradesh.

Waaree Renewable: Solar EPC order has been revised upwards by Rs 247 crore to Rs 1,480 crore.

Signatureglobal (India): The company completed acquisition of a remaining 4.15 lakh shares of Indeed Fincap. Indeed now becomes a wholly owned arm of the company.

Ceat: The company to consider raising funds via money market instruments or other means on June 25.

NTPC: The company is to issue up to Rs.18,000 crore NCD's through private placement. It will also declare commercial operation of 2nd and last part capacity of 52 mw out of 245 mw of Rajasthan plant.

Bajel: The company has secured Ultra Mega Power Transmission order for Rs 400 crore.

Interarch: The company has secured an order from Ather Energy Ltd. for Rs 80 crore.

Avantel: The company received a purchase order worth of Rs13.67 crore, for development of SDRs from Defence Electronics Applications Laboratory. It has also received order from Mazagoan Dock for Rs 11.06 crore.

Unichem Laboratory: US FDA concludes inspection at the company's Roha API facility with three observations.

Manba Finance: The company approves raising up to Rs 200 crore via debt securities.

Brigade Enterprises: The company launches Morgan Heights, a residential project in Chennai. The gross development value of this project is approximately Rs 2,100 crore.

Union Bank of India: The board of the company is to mull fund raise on June 25.

Yes Bank: The bank gets Rs 201 crore as one-time settlement for NPA Account.

NLC India: The company gets letter of award from Tamil Nadu Green Energy Corp. for development of battery storage system and also receives LOA for development of battery energy storage system with capacity of 250 mw/500 mwh.

Zen Technologies: The company announces Strategic Acquisition of Majority Stake in TISA Aerospace.

P N Gadgil: The company opened new stores at Wakad and Kharadi in Pune.

IPO Offering

ArisInfra Solutions: The public issue was subscribed to 2.65 times on day 3. There bids were led by qualified institutional investors (1.42 times), non-institutional investors (3.14 times), retail investors (5.59 times).

Block Deals

Sai Life Sciences: TPG ASIA VII SF PTE sold 2.08 crore shares (10%) at Rs 722 apiece, while Nippon India Mutual Fund bought 49.86 lakh shares (2.39%), Aditya Birla Sun Life Mutual Fund bought 27.70 lakh shares (1.32%), Max Life Insurance Company and Axis Max Life Insurance bought 13.85 lakh shares (0.66%) each, and many other buyers at Rs 722 apiece.

Bulk Deals

Radiant Cash Management Services: Ascent India Fund Iii sold 17.6 lakh shares (1.64%) at Rs 60.76 apiece.

SG Finserve: Bandhan Mutual Fund bought 8.86 lakh shares (1.58%) at Rs 405 apiece, Sahil Gupta sold 12.5 lakh shares (2.23%) at Rs 405.08 apiece.

The India Cements: Franklin Templeton Mutual Fund bought 20.37 lakh shares (0.65%) at Rs 310.17 apiece.

Northern Arc Capital: 360 One Special Opportunities Fund - Series 4 sold 74.83 lakh shares (4.63%) at Rs 195.71 apiece. 360 One Special Opportunities Fund - SERIES 5 sold 61.55 lakh shares (3.81%) at Rs 196.85 apiece, 360 One Special Opportunities Fund - Series 7 sold 57.61 lakh shares (3.57%) at Rs 198.74 apiece, while BNP Paribas Financial Markets 8.67 lakh shares (0.53%) at Rs 202.46 apiece, Cohesion Mk Best Ideas Sub-Trust bought 10 lakh shares (0.61%) 208.83 apiece.

Vishal Mega Mart: Vanguard Emerging Markets Stock Index Fund bought 2.39 crore shares (0.52%) at Rs 129.74 apiece, while Vanguard Total International bought 2.65 crore shares (0.57%) at Rs 129.74 apiece.

Insider Trading

NCL Industries: Promoter P Varalakshmi sold 28012 shares.

Ultramarine & Pigments: Promoter Narayan S sold 1550 shares.

Crest Ventures: Promoter Priyanka Finance Pvt. Ltd. bought 16522 shares.

Jindal Stainless: Promoter JSL Overseas Holding bought 1.28 lakh shares.

DB Corp: Promoter D B Power Ltd. bought 32,314 shares.

Salasar Techno Engineering: Promoter Base Engineering LLP sold 2.79 lakh shares.

Trading Tweaks

List of securities to be excluded from ST-ASM Framework: Apollo Micro Systems, Godavari Biorefineries, Oriana Power, HLE Glascoat, Standard Glass Lining Technology, Unimech Aerospace and Manufacturing, Valiant Organics.

List of Securities to be excluded from LT-ASM Framework: One Mobikwik Systems, PG Electroplast, Senco Gold, Shakti Pumps (India), Suven Life Sciences.

Ex- Dividend: Dalmia Bharat, Dynamic Cables, GNA Axles, Hindustan Unilever, Kalpataru Projects, Samvardhan Motherson International, Motherson Sumi Wiring, Kansai Nerolac Paints.

Ex- Bonus Issue: V-Mart Retail (3:1).

Shares to Exit Anchor Lock-In: Borana Weaves (6%), Credo Brands (21%), Suraj Estate Developers (20%).

F&O Cues

Nifty June Futures up by 1.18% to 25,096 at a discount of 16 points.

Nifty June futures open interest down by 2%.

Nifty Options June 26 Expiry: Maximum Call open interest at 26,000 and Maximum Put open interest at 25,000.

25,000 PE saw the highest open interest change.

Securities in ban period: Aditya Birla Fashion, Biocon, RBL Bank, Titagarh.

Currency/Bond Update

The Indian rupee closed 14 paise stronger against the US dollar at 86.59.

The yield on the benchmark 10-year government bond ended flat at 6.38%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.