Good morning!

The GIFT Nifty rose 0.1% 24,826 as of 6:45 am, signning a positive start to the Indian equities.

US equity futures edged lower alongside declines in Asian markets, following Tuesday's selloff on Wall Street. The pullback came as weaker-than-expected US economic data raised concerns over growth, sending investors towards bonds ahead of the Federal Reserve's policy announcement.

Markets At Home Turf

The benchmark equity indices resumed their decline on Tuesday, dragged by share prices of HDFC Bank Ltd. and Reliance Industries Ltd. The NSE Nifty 50 ended 93.1 points or 0.37% lower at 24,853.4, while the BSE Sensex closed 212.85 points or 0.26% down at 81,583.3.

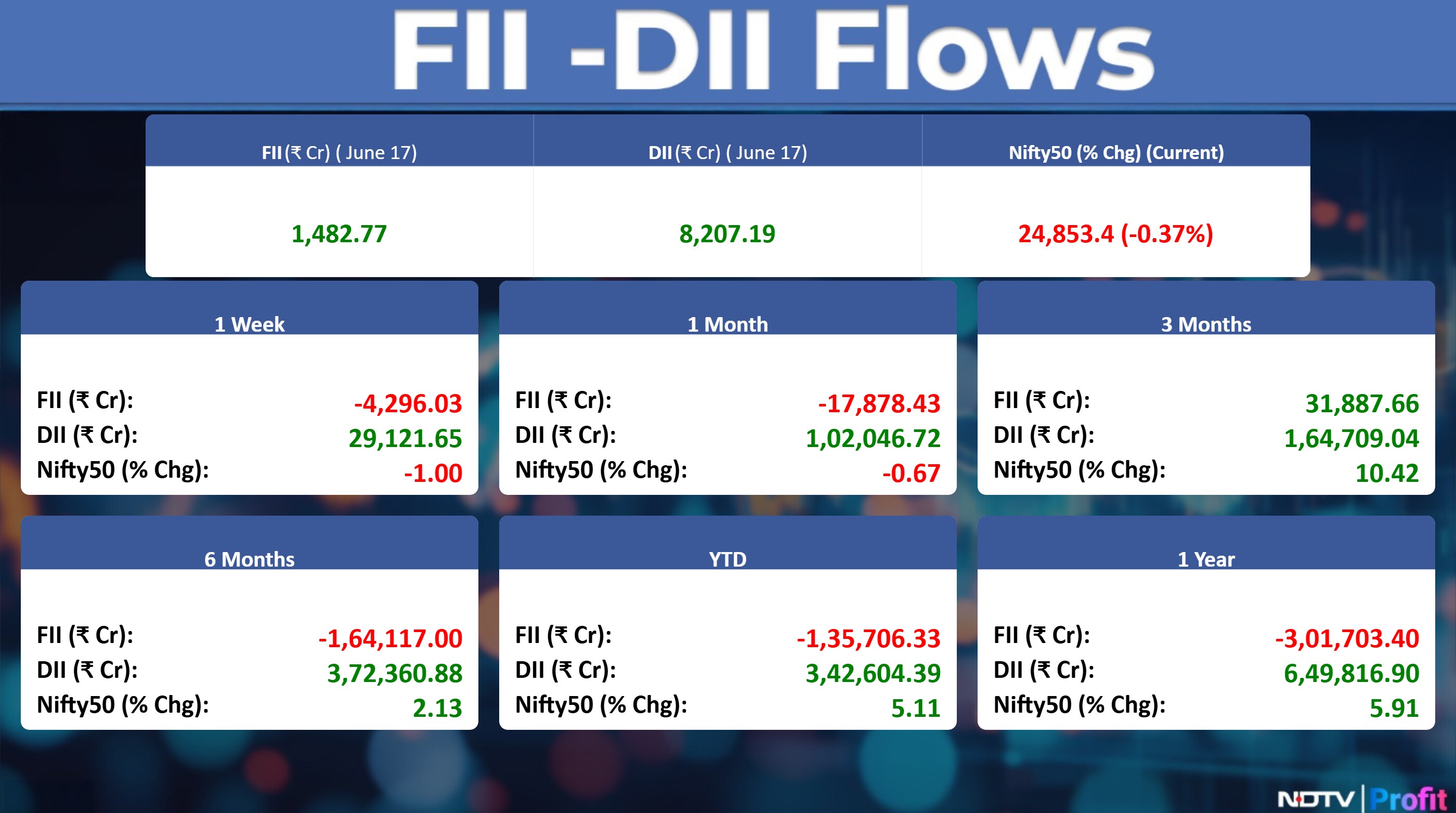

Foreign portfolio investors turned net buyers of Indian equities on Tuesday after four sessions of selling, mopping stocks worth Rs 1,616.2 crore, according to the provisional data from the National Stock Exchange. Domestic institutional investors continued to stay net buyers for the 23rd straight session as they obtained equities worth Rs 7,796.6 crore, the data showed.

Global Market Cues

S&P 500 futures declined 0.1%.

Futures linked to Hong Kong's Hang Seng Index fell 0.7%.

Japan's Topix index remained largely unchanged.

Australia's S&P/ASX 200 slipped 0.1%.

Euro Stoxx 50 futures dropped 0.9%.

The downturn followed Tuesday's Wall Street retreat, triggered by softer-than-expected US economic indicators, which raised concerns about growth and fuelled demand for bonds ahead of the Federal Reserve's upcoming policy decision.

The S&P 500 closed down 0.84% at 5,982.72.

The Nasdaq Composite dropped 0.91% to 19,521.09.

The Dow Jones Industrial Average lost 299.29 points, or 0.70%, ending at 42,215.80.

Commodity Cues

WTI declined for the second consecutive trading session, down 0.7%.

Brent crude declined 0.1% lower.

London Metal Exchange

Copper ended 0.4% lower.

Aluminium extended gains for the second day, ended 1.5% higher.

Zinc resumed losses after a one-day breather, closed 0.7% lower.

Nickel ended lower for the eighth consecutive trading session, closed 0.7% lower.

Lead slumps for the third consecutive trading session, down 1.3%.

Earnings After Market Hours

Procter & Gamble Health Q4 Highlights (YoY)

Revenue up 23.2% to Rs 311 crore versus Rs 252 crore.

Ebitda up 20% at Rs 81 crore versus Rs 67.4 crore.

Margin at 26% versus 26.7%.

Net profit up 31.4% to Rs 61.2 crore versus Rs 46.6 crore.

Stocks To Watch

BSE: SEBI approved Thursday as the revised expiry day for BSE's derivative contracts, with NSE being allotted Tuesday.

Ugro Capital: The bank announced it will acquire SME lending company Profectus Capital for Rs 1,400 crore payable in a single tranche.

Electrosteel Castings: The company is to carry out a planned shutdown of its MBF production facility at Khardah works unit and main plant, from June 18, for a period of approximately 10-12 days for maintenance work.

Punjab National Bank: The bank completed the sale of its entire stake (20.90%) in associate company, 'Mis India SME Asset Reconstruction Company' for Rs 34 crore.

Heranba Industries: Rajkumar Bafna resigned as the Chief Financial Officer.

Polycab India: The company is in an agreement with BSNL for an order worth Rs 6,447.54 crore. The agreement with BSNL for design, supply, construction and installation of Bharat Net in Karnataka, Goa and Puducherry Telecom Circle.

Railtel Corp: The company received a letter of intent for Rs 43.9 crore order from Zoram Electronics.

EMS: The company becomes the lowest bidder for an order worth Rs 184 crore from UP Jal Nigam.

Bharat Forge: The company signed MoU with Turgis Gaillard to offer AAROK UAV in alignment to India's Defence Ministry. AAROK performs long-range surveillance missions while flying at high altitude & for long periods.

Avenue Supermarts: The company opened a new store at Ratan Mall in Agra, and the total number of stores stands at 421.

GMR Airports: Total airport passenger traffic in May rose 0.8% to 1 crore year-on-year.

Sanghvi Movers: The government approved the change of name of arm to Sangreen BioRenew from Samo Renewables.

DCX India: The company received Rs 28.59 crore export purchase order from overseas and domestic customers.

Ventive Hospitality: Board approved merger of Eon-Hinjewadi Infra, Wellcraft Infra & Restocraft Hospitality into the company.

Alembic Pharma: the pharmaceutical company issued $22 million corporate guarantee for term loan for US subsidiaries.

Nuvoco Vistas: The Chhattisgarh High Court disposed of written petitions filed by the company in a case involving transfer of cement plant at Sonadhi.

Mahindra and Mahindra: The CCI approved the proposed acquisition of SML Isuzu.

Neuland Laboratories: The company received SEBI Administrative Warning Letter on Insider Trading Procedure Lapse.

Manba Finance: The company is set to consider fresh issue of NCDs or other debt securities up to Rs 200 crore on private placement basis.

IPO Offering

Oswal Pumps: The public issue was subscribed to 1.61 times on day 2. The bids were led by qualified institutional investors (0.27 times), non-institutional investors (4.5 times), retail investors (1.12 times).

Arisinfra Solutions: The company will offer shares for bidding on Wednesday. The price band is set from Rs 210 to Rs 222 per share. The Rs 499.6-crore IPO is entirely a fresh Issue. The company raised 225 crores from anchor investors.

Block Deals

Zydus Wellness: PPPFAS Mutual Fund bought 46.27 lakh shares (7.27%) at Rs 1900 apiece, while Threpsi Care LLP sold 46.27 lakh shares (7.27%) at Rs 1900 apiece.

TVS Supply Chain Solutions: Authum Investment & Infrastructure Limited sold 39.5 lakh shares (0.89%) at Rs 144 apiece, while TVS Motor Company bought 39.5 lakh shares (0.89%) at Rs 144 apiece.

Bulk Deals

Vishal Mega Mart: Samayat Services LLP sold 90 crore shares (19.57%) at Rs 113.51 apiece, while SBI Mutual Fund bought 16.58 crore shares (3.60%), Kotak Mahindra Mutual Fund bought 7.95 crore shares (1.72%), HDFC Mutual Fund bought 7.5 crore shares (1.63%), SBI Mutual Fund bought 7.15 crore shares (1.55%) at Rs 113.5 apiece.

Awfis Space Solutions: QRG Investments and Holdings sold 4 lakh shares (0.56%) at Rs 685 apiece.

Trading Tweaks

Price Band change from 10% to 5%: Cyber Media (India).

Price Band change from 20% to 10%: Sterlite Technologies.

Price Band change from 5% to 10%: Scoda Tubes.

List of securities to be included from LT-ASM Framework: Shankara Building Products.

List of securities to be included from ST-ASM Framework: Subros.

List of securities to be excluded from ST-ASM Framework: Universal Cables, Shankara Building Products.

Ex- Dividend: eMudhra.

Shares to Exit Anchor Lock-In: Inventurus Knowledge Solutions (61%), One Mobikwik Systems (49%).

F&O Cues

Nifty June Futures down by 0.55% to 24,859 at a premium of 7 points.

Nifty June futures open interest down by 1.54%.

Nifty Options June 19 Expiry: Maximum Call open interest at 26,000 and Maximum Put open interest at 24,000.

Securities in ban period: Aditya Biral Fashion, Birlasoft, CDSL, Chambal Fertilizer, Hudco, Ireda, Manappuram, RBL Bank, Titagarh.

Currency/Bond Update

The Indian rupee closed 18 paise weaker, at a two-month low against the US dollar, at 86.24.

The yield on the benchmark 10-year government bond ended lower at 6.32%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.