The GIFT Nifty is trading 20 points lower at 25,508 points as of 8:00 a.m., indicating a flat start for the 50-stock benchmark later in the morning.

US index futures are unchanged, while European contracts are marginally lower. There is positive momentum in Asian markets.

S&P 500 futures flat

Euro Stoxx 50 futures fell 0.1%

Markets On Home Turf

India's benchmark indices ended flat on Monday. The NSE Nifty 50 ended 0.30 points flat at 25,461.30, while the BSE Sensex closed 9.61 points flat at 83,422.50. On intraday basis, Nifty fell 0.21% to trade at 25,407.25 and Sensex declined 0.20% to 83,262.23.

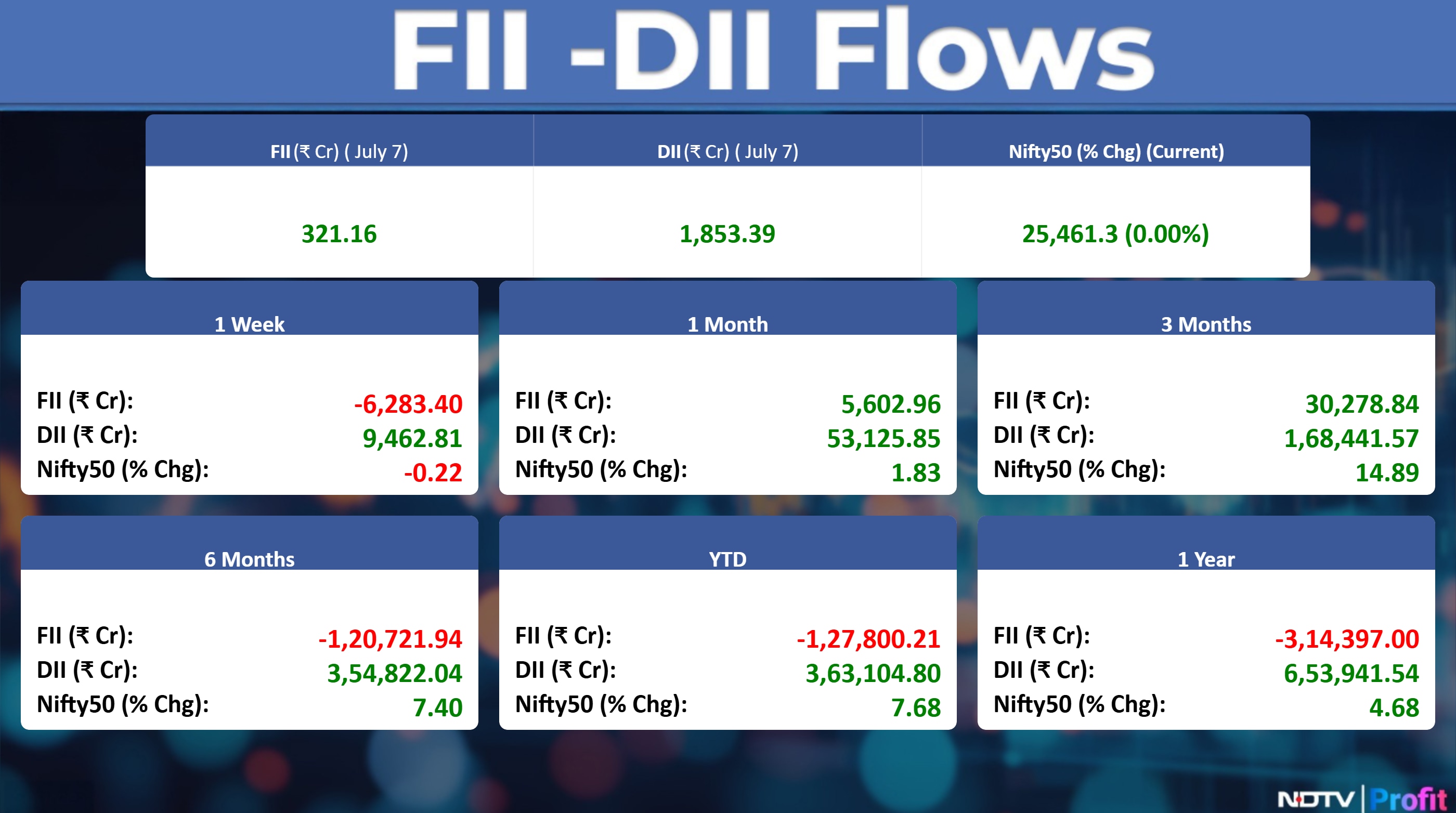

Foreign portfolio investors turned buyers of Indian equities, snapping a five-day selling streak on Monday. Overseas investors net sold shares worth Rs 323 crore, according to the provisional data from the National Stock Exchange.

Domestic institutional investors became net buyers after a session and bought equities worth Rs 1,740 crore, the data showed.

Watch NDTV Profit Live

Wall Street Update

US stocks tumbled Monday as trade fears returned in full force, with President Donald Trump set to impose 25% tariffs on Japan and South Korea.

The S&P 500 closed down 0.8%, with nine of the 11 sectors in the red. The Nasdaq 100 fell 0.8%, and the Dow Jones Industrial Average slipped 0.9%.

Asian Markets

Asian stock markets edged higher as Trump left the door open for additional negotiations after imposing new tariff rates on partners, including Japan and South Korea.

Nikkei up 0.4%

Topix up 0.2%

Kospi up 1.5%

S&P/ASX 200 up 0.1%

Hang Seng futures down 0.1%

Commodities Check

Oil steadied as investors turned their attention to the potential fallout from US levies and an escalation of hostilities in the Red Sea. Brent held near $69 a barrel after advancing 1.9% on Monday, and West Texas Intermediate was below $68.

Metal prices continued to decline on the London Metal Exchange.

Copper down 0.35%

Aluminium down 0.64%

Nickel down 0.75%

Zinc down 1.45%

Lead down 1%

Stocks In News

Mahindra & Mahindra: The company, in its monthly business update, reported that its sales surged by 14% year-on-year in June 2025, while exports stood at 2,634 units, marking a marginal uptick of 1% from 2,597 units exported in the same month last year. It production of vehicles soared by 20% year-on-year to 83,435 units in June which includes 23,255 units of commercial vehicles, as against 21,717 units in the same month last year.

Titan: The company reported a 20% year-on-year growth in its consumer business for the quarter ending in June. Between April and June, it expanded its retail footprint by adding 10 new outlets, bringing the total store count to 3,322. Its jewellery segment responsible for more than 75% of overall revenue, saw an 18% rise in domestic sales and welcomed 19 additional stores.

Tata Motors: JLR's retail sales in the first quarter saw a notable decline, dropping 15.1% year-on-year and 12.8% sequentially. This downturn was largely attributed to the halt in Jaguar production at Castle Bromwich in May 2024, as the plant transitions to electric vehicle manufacturing, and was further impacted by a pause in US shipments during April. Despite these challenges, there were positive developments: the sales mix improved during the quarter, with the Range Rover, Range Rover Sport, and Defender models collectively accounting for 77.2% of wholesale volumes. This marks a significant increase from their 66.3% contribution in Q1 FY25 and 67.8% in Q4 FY25, indicating a stronger demand for these higher-margin vehicles.

Macrotech Developers: The company in its quarterly business update reported pre-sales growth of 10% year-on-year at Rs 4,450 crore while collections grew by 7% year-on-year to 2,880 crore.

Kotak Mahindra Bank: The lender's net advances for the quarter ended June 30 grew by 14% year-on-year to Rs 4.4 lakh crore and total deposits grew by 14.6% year-on-year to Rs 5.1 lakh crore. CASA deposits grew by 8% year-on-year at 2.1 lakh crore.

Phoenix Mills: The company's retailer sales (consumption) across all operational malls grew by 12% year-on-year in first quarter of fiscal 2026, reflecting healthy underlying demand and continued momentum across the portfolio. Trading occupancy stood at 89% for the quarter, marginally lower than 91% in the fourth quarter of fiscal 2025, primarily due to planned transitional vacancy linked to these upgrades.

NLC India: The company approved to make an investment of up to Rs 1,631 crore in one or more tranches in its arm through equity and also approved to borrow $100 million from Sumitomo Mitsui Banking Corp.

SPML Infra: The company has secured an approval for increased credit facilities totaling to Rs 205 crore, with support from one of India's leading public sector banks.

Refex Industries: The company has received Rs 250 crore order for comprehensive ash disposal along with operation of fly ash systems.

Rama Steel: The company has issued corrigendum Rs 177 crore to be used for renewable energy acquisition.

P N Gadgil: The company's retail segment, representing 70.3% of total revenue, achieved a steady 19.4% year-on-year growth in the first quarter of fiscal 2026. In the non-retail segments, franchisee operations surged by 109% year-on-year, accounting for 15.7% of total revenue, driven by strong franchisee performance and broader market penetration.

PC Jeweller: The board will consider and approve fund raising through preferential allotment on July 10.

Royal Orchid Hotels: The company has launched a new property, Regenta Central Shivani' in Solapur.

Jyoti Structures: The company has filed an application before NCLT seeking directions against West Bengal State Electricity Distribution Co. The application is restraining them from recovering pre-corporate insolvency resolution process dues.

Navin Fluorine: The company has launched a qualified institutional placement of up to Rs 750 crore at an indicative issue price of Rs 4,680 per share, a 4.22% discount to the last closing price. The issue entails a dilution of 3.23% and involves issuing up to 16.03 lakh shares.

Krsnaa Diagnostics: The Rajasthan High Court has ruled in favour of Krsnaa Diagnostics and its consortium partner, Telecommunications Consultants India. Following the judgment, the government has issued a fresh letter of acceptance, paving the way for the consortium to sign an agreement with the National Health Mission, Rajasthan.

NMDC Steel: The company has extended Priyadarshini Gaddam's additional charge as Director (Finance) for another six months.

Utkarsh Small Finance Bank: The lender has received letter with 'no adverse observations' from BSE and 'no objection' from NSE.

Carnation Industries: Bhartendu Pratihasta has been appointed to succeed Anamika Gupta as the company's chief financial officer.

City Union Bank: The bank has opened two new branches in Tamil Nadu.

JSW Infra: The company has received a letter of award to develop container berths at Kolkata port.

Omaxe: The company's arm approved to issue NCDs worth Rs 19 crore on private placement basis.

Electronics Mart: The company has commenced the commercial operations of a new multi-brand store in Delhi.

Garware Technical Fibres: Offshore and Trawl Supply, along with Advanced Mooring Supply, have been designated as step-down subsidiaries of the company.

REC: The company has incorporated two subsidiary companies.

Kothari Industrial Corp: The company has announced the soft opening of a new retail showroom under brand ‘Kickers' in Indore.

Sandhar Tech: The company has completed Rs 61 crore property sale deed in Bangalore.

Vaibhav Global: The company has received a favorable order from Income Tax Appellate Tribunal for assessment year 2021 and assessment year 2022. The tax demand of Rs 91.8 crore for assessment year 2021 and Rs 58.8 crore for assessment year 2022 stands deleted.

IPO Offering

Travel Food Services: The public issue was subscribed to 0.1 times on day 1. The bids were led by qualified institutional investors (0.07 times), non-institutional investors (0.06 times), retail investors (0.14 times) and reserved for employees (0.37 times).

Stocks On Brokerage Radar

Morgan Stanley On Schloss Bangalore

Initiate 'Overweight' with a target price of Rs 549.

One of the limited ways to play the India luxury story.

Overweight rating driven by a higher-for-longer upcycle.

See strong demand for luxury experiences.

Has iconic assets with a low net debt position and attractive valuation.

Steady execution can drive re-rating but concentration risk is key to watch.

Jefferies On Adani Power

Initiate 'Buy' with a target price of Rs 690.

Poised for strong capacity addition on a comfortable balance sheet.

See risk profile also reducing gradually as incremental capacity is being locked in with profitable Power Purchase Agreements (PPAs).

Close coordination with BHEL for equipment delivery and in-house project management is ensuring capex is on schedule.

Recent payments from Bangladesh also ease investor concerns on the same.

HSBC On Divi's Laboratories

Upgrade to 'Buy' from 'Reduce'; Hike target price to Rs 7,900 from Rs 5,020.

See a long runway of growth for Divi's led by tirzepatide, other peptides, and contrast media in the medium term.

For Divi's, we see revenue potential of $450 million from peptides and $260 million from contrast media by 2030.

Expect EPS CAGR of 23% till FY28.

Bulk Deals

Infibeam Avenues: Mayur Mukundbhai Desai bought 10 lakh shares (0.36%) at Rs 15.2 apiece, while Sonal Desai sold 10 lakh shares (0.36%) at Rs 15.2 apiece.

Marathon Nextgen Realty: Necta Bloom VCC- Necta Bloom One sold 3.6 lakh shares (0.7%) at Rs 674.1 apiece, while Nomura Singapore sold 4.36 lakh shares (0.85%) at Rs 670.11 apiece.

Trading Tweaks

List of securities shortlisted in Short - Term ASM Framework Stage - I: PC Jeweller

List of securities to be excluded from ASM Framework: Diamond Power Infrastructure, Astec LifeSciences, Thomas Scott (India).

Price Band change to 10% from 20%: PC Jeweller.

Ex-Dividend: Aditya Vision, Ingersoll Rand, JK Cement, Solar Industries, Titan, JSW Steel.

F&O Cues

Nifty July Futures flat at 25,541 at a premium of 80 points.

Nifty July futures open interest down by 1.4%.

Nifty Options July 10 Expiry: Maximum Call open interest at 26,000 and Maximum Put open interest at 25,000.

Securities in ban period: RBL Bank.

Currency & Bond Markets Update

Rupee closed 46 paise weaker against US Dollar at 85.86, which is the lowest close level since June 25. The benchmark yield on the 10-year bond settled flat at 6.30% on Friday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.