The GIFT Nifty futures traded 7.5 points higher at 25,534 at 7:45 a.m., indicating a flat start for the 50-stock benchmark later in the morning.

Asian markets were mixed, with Japanese stocks down while Australia was flat. US index futures were down.

S&P 500 futures down 0.4%

Euro Stoxx 50 futures up 0.1%

Watch NDTV Profit LIVE

Markets On Home Turf

Benchmark indices broke a two-day losing streak to settle higher on Friday but on a weekly basis the Nifty 50 and Sensex declined over 0.75%.

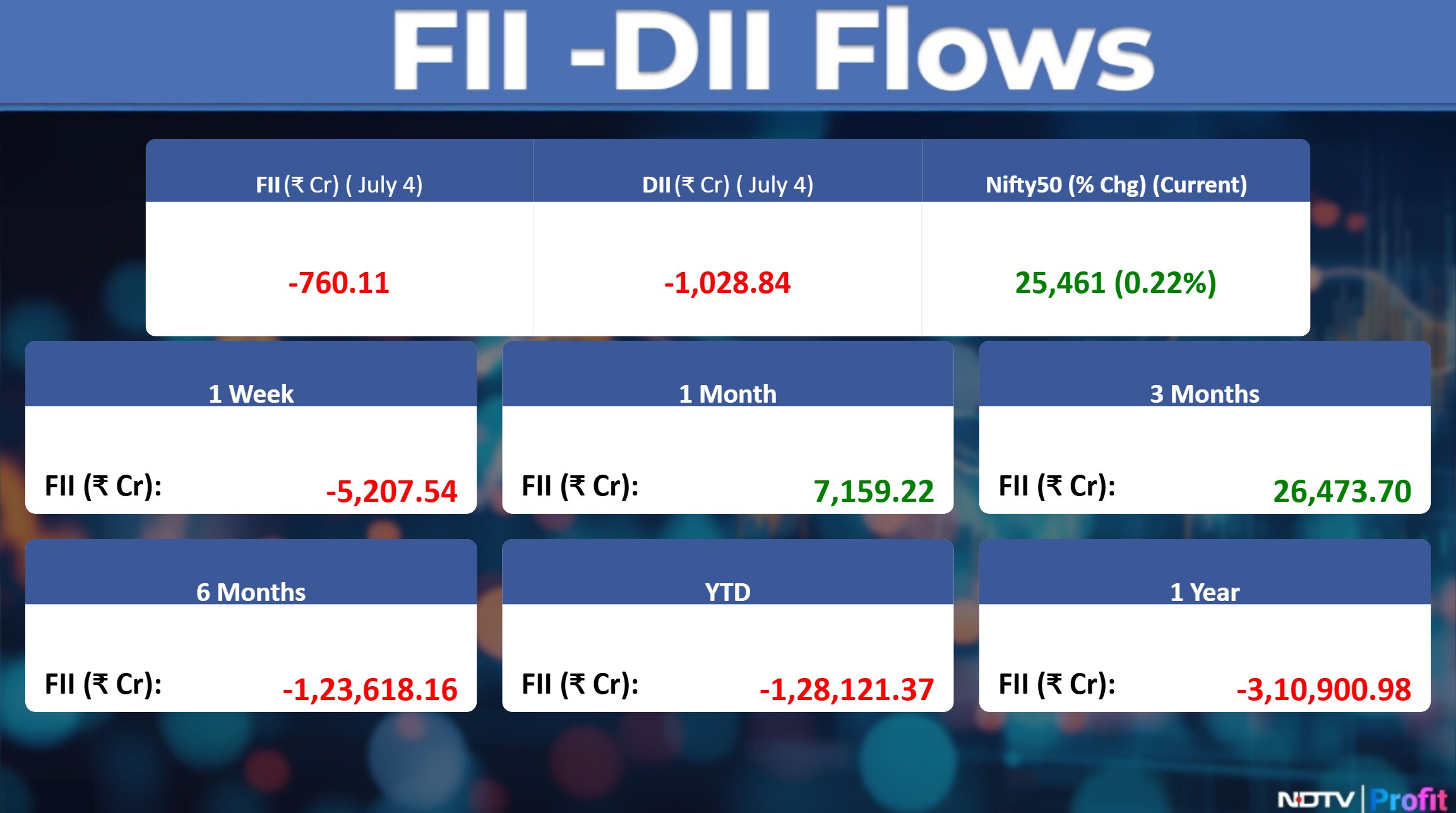

The NSE Nifty 50 ended 55.70 points or 0.22% higher at 25,461, while the BSE Sensex closed 193.42 points or 0.23% up at 83,432.89.

Last week, the broader market indices outperformed the benchmark indices, with the Nifty and Sensex experiencing declines after two consecutive weeks of gains.

Wall Street Recap

US stocks advanced in Thursday's trading session, with the Dow Jones, Nasdaq, and S&P 500 all posting gains following the release of strong US jobs data by the Labor Department. Markets remained closed on Friday in observance of Independence Day.

The S&P 500 and the tech-focused Nasdaq Composite climbed 0.8% and 1%, respectively, both marking record closes for the fourth time in five sessions. Meanwhile, the Dow Jones Industrial Average rose 0.8%, or nearly 350 points, ending the day just below its first new all-time high since December.

Asian Market Update

Asian shares posted modest moves at the open as investors awaited progress on trade deals with the US ahead of the July 9 deadline imposed by President Donald Trump.

Indexes in Japan, Australia and South Korea posted small declines after Trump administration officials signaled Aug. 1 as the date for higher levies to kick in and said some countries may get more time to negotiate deals.

Nikkei down 0.23%

Topix down 0.4%

S&P/ASX 200 flat

Kospi down 0.3%

Hang Seng futures down 0.4%

Commodities Update

Oil extended declines after OPEC+ agreed to a bigger-than-expected production increase next month, raising concerns about oversupply just as US tariffs fan fears about the demand outlook. Brent slid as much as 1.6% toward $67 a barrel after falling 0.7% on Friday, and West Texas Intermediate was below $66.

Prices of industrial commodities declined on the London Metal Exchange.

Copper down 0.9%

Aluminium down 0.6%

Nickel down 1%

Zinc down 1%

Lead down 0.3%

Stocks In News

Dhanlaxmi Bank: Total deposits rose 14.7% year-on-year to Rs 16,570 crore in the first quarter. Within this, CASA deposits increased by 3.8% to Rs 4,675 crore. Gross advances grew 17.3% to Rs 12,484 crore, led by a 28.1% surge in gold loans, which stood at Rs 4,039 crore.

Utkarsh Small Finance Bank: CASA deposits grew 22.1% year-on-year to Rs 4,218 crore, while Retail Term Deposits rose 33.7% year-on-year to Rs 11,675 crore. However, Joint Liability Group loans declined 23.1% to Rs 8,578 crore. Liquidity Coverage Ratio stood strong at 238% as of June 30, 2025.

ESAF Small Finance Bank: Total deposits increased 8.7% year-on-year to Rs 22,698 crore. However, gross advances declined by 3% to Rs 18,224 crore. CASA ratio was flat at 24.8% compared to the previous quarter.

IDBI Bank: Total deposits rose 7% year-on-year to Rs 2.96 lakh crore. Total business increased 8% to Rs 5.08 lakh crore, while net advances grew 9% to Rs 2.11 lakh crore.

Bank of India: Global deposits rose 9.1% year-on-year to Rs 8.3 lakh crore, with global gross advances up 12% at Rs 6.7 lakh crore. Domestic gross advances grew 11.2% to Rs 5.64 lakh crore, and domestic deposits increased 9.6% to Rs 7.1 lakh crore.

IndusInd Bank: Net advances declined 3.1% quarter-on-quarter to Rs 3.34 lakh crore. Deposits also declined by 3.3% quarter-on-quarter and 0.3% year-on-year to Rs 3.97 lakh crore. CASA ratio fell to 31.5% from 32.81% in the previous quarter.

Equitas Small Finance Bank: Gross advances stood at Rs 38,034 crore, marking a 9.1% year-on-year increase. Total deposits rose 18.3% year-on-year to Rs 44,379 crore. CASA ratio remained stable at 29%.

Dabur India: The company expects consolidated revenue to grow in low single digits, impacted by a decline in the beverages segment due to unseasonal rains and a shorter summer. Profit growth is likely to lag revenue growth slightly. However, the Home & Personal Care division is expected to perform well, supported by strong demand in oral care, home care, and skin care categories.

Godrej Consumer Products: Standalone Ebitda margin is expected to fall below the company's normative range in first quarter, though a recovery is anticipated. Excluding soaps, the standalone business is likely to show strong performance, with the Home Care segment projected to deliver double-digit value growth.

Senco Gold: Retail revenue grew 24% year-on-year, with same-store sales growth at 19%. The company added nine new showrooms in the first quarter of financial year 2026, expanding its total jewellery store count to 179.

Jubilant Foodworks: Consolidated revenue from operations increased 17% year-on-year to Rs 2,261 crore, while standalone revenue rose 18.2% to Rs 1,702 crore. Domino's India reported 11.6% like-for-like growth. Domino's Turkey, however, posted a 2.2% decline in LFL growth. The JFL Group added 73 new stores during the quarter, taking the total store count to 3,389.

Metropolis Healthcare: Specialty segment revenue grew 15% year-on-year, while the TruHealth Wellness segment posted a 20% increase. B2C revenue also rose 15% year-on-year, reflecting solid traction in direct-to-consumer diagnostics. Specialty revenues surged over 35% year-on-year. Overall, consolidated revenue grew 23% year-on-year, reflecting a stronger business mix and operational momentum.

Thyrocare Technologies: The company has fixed July 25 as the record date for entitlement to final dividend for fiscal 2025.

FSN E-Commerce Ventures (Nykaa): In the first quarter consolidated net revenue is expected to grow at the lower end of the mid-20% range, while GMV growth is projected to exceed that, crossing into the upper mid-20% range. The Beauty segment is expected to lead, with strong growth from the House of Nykaa Brands. The Fashion vertical shows sequential improvement, with GMV growth expected in the mid-20s and revenue growth improving to mid-teens. Growth was impacted by softer consumer sentiment during its flagship sale due to geopolitical tensions.

Vishal Mega Mart: A fire broke out on July 4, at a New Delhi retail outlet, resulting in two fatalities. The incident is under investigation by Delhi Police. The company stated that affected assets are insured and assessment of the damage is ongoing.

Shyam Metalics: Stainless Steel sales in June fell 19% year-on-year to 5,665 MT and in the first quarter it was down 18% year-on-year to 19,813 MT. Sponge Iron June sales were down 4% to 86,123 MT and in the quarter ended June sales were up 5% to 2.56 lakh MT. Carbon Steel June sales were up 6% to 1.27 lakh MT and in the quarter sales were down 9% to 4.1 lakh MT. Shareholders approved Brij Bhushan Agarwal's appointment as Executive Chairman & MD, effective May 10.

Tata Steel: Received a demand notice for Rs 1,903 crore from the Jajpur deputy director of mines, citing shortfall in mineral supply from Sukinda Chromite block under the mine development agreement for the fourth year running.

India Cements: The company is under probe by the CCI for alleged cartelisation, but no findings or penalties have been made so far. The company is currently evaluating the DG's report and considering legal options.

UltraTech Cement: Clarified that it is not under investigation in the alleged cement cartelisation case. However, its arm India Cements is part of the ongoing CCI probe.

Hazoor Multi Projects: Received Rs 913 crore order for a 200 MW solar PV power project in Gujarat.

Cochin Shipyard: Signed MoU with HD Korea Shipbuilding & Offshore Engineering for long-term collaboration in shipbuilding and maritime development.

Texmaco Rail: Received Rs 36.3 crore order for 2 rakes with an option for 8 additional rakes from Transport Corporation of India.

Titagarh Rail Systems: Board to meet on July 9 to consider fundraising via QIP, rights issue or other routes.

Mahindra Lifespace: Launched a new residential tower at Mahindra Citadel in Pune with a gross development value of Rs 2,500 crore.

RVNL: Received letter of acceptance worth Rs 143 crore from Southern Railway for upgradation work.

BEML: Secured two export orders worth $6.23 million.

Tejas Networks: Chief Supply Chain Officer Sembian Venkatesan resigned; his last working day will be July 14, 2025.

Adani Enterprises: Announced Rs 1,000 crore NCD issue with an effective yield of up to 9.30% p.a.; issue opens July 9 and closes July 22.

IIFL Finance: COO Abhiram Bhattacharjee resigned.

PNB Gilts: AMC Repo Clearing waived off penalty imposed on the company.

Tourism Finance Corp: Board to meet on July 10 to consider stock split proposal.

Karur Vysya Bank & Tamilnad Mercantile Bank: Both banks cut MCLR across various tenors by 10–35 basis points.

360 ONE WAM: Received NSE approval for acquisition of Credit Suisse Securities (India)'s stock broking business via its subsidiary.

CG Power: Approved allotment of 4.5 crore shares worth Rs 3,000 crore to QIBs at Rs 660/share, a 2.8% discount to the floor price.

Shipping Corp: To induct 2 second-hand VLGCs with 82,000 CBM capacity during second quarter of this fiscal.

Garware Technical Fibres: Acquired 9 lakh shares in UK arm for GBP 9.3 million.

India Glycols: Received GMP certification from NSF International for its Dehradun plant.

Premier Synthetics: Signed MoU with Sunsky Seals for polycarbonate seal manufacturing.

Religare Enterprises: Bombay HC directed reassessment of GST demand issued to Care Health Insurance.

NHPC: Assessing flood damage at Parbati-II & Parbati-III; partial restoration expected by July 14.

Adani Ports: Inaugurated the world's first steel slag road at Hazira Port.

JP Associates: 17th CoC meeting to be held on July 7; total debt as of June 30 at Rs 55,394 crore.

Dalmia Bharat: Clarified that the CCI probe relates to 2013–18 ONGC tenders; no penalty imposed yet.

Shakti Pumps: To allot 31.9 lakh shares to QIBs at Rs 918/share, raising Rs 293 crore.

DEE Development: Cumulative order inflow at Rs 264 crore and execution at Rs 231 crore as of June 30.

Elitecon International: Deferred fundraising decision; appointed Sachin Ashok Sabale as CFO.

Unimech Aerospace: Commerce Minister Piyush Goyal visited its Bengaluru facility on July 5.

Blue Cloud Softech Solutions: Launched new office in Grenoble, France.

Borosil: Glassware revenue up 27.2% to Rs 252 crore; Non-glassware up 17.2% to Rs 453 crore. Opalware (Larah) led with Rs 384 crore revenue. Working capital increased due to higher inventory in appliances and Hydra categories.

Windlas Biotech: Annual manufacturing capacity surpassed 8.5 billion tablets & capsules; utilisation rose to 63%. All five facilities remain WHO-GMP compliant. Export growth driven by expansion in semi-regulated international markets.

Devyani International: Surpassed 2,000 store milestone in third quarter last year, ahead of guidance. Added 257 net new outlets to reach 2,039. Signed Master Franchise deals for Tealive, New York Fries, and Sanook Kitchen. Added 18 new KFC stores in Thailand, taking the total to 306.

IPO Offering

Crizac: The public issue was subscribed to 59.82 times on day 3. The bids were led by Qualified institutional investors (134.35 times), non-institutional investors (76.15 times), retail investors (10.24 times).

Travel Food Services: The company will offer shares for bidding on Monday. The price band is set from Rs 1,045 to Rs 1,100 per share. The Rs 2,000-crore IPO is entirely an offer for sale. The company raised 598.8 crores from anchor investors.

Bulk Deals

Dreamfolks Services: Bajaj Finance sold 3.09 lakh shares (0.58%) at Rs 196.32 apiece.

Emcure Pharmaceuticals: BC Investments IV sold 45 lakh shares (2.37%) at Rs 1,250 apiece.

Gensol Engineering: Kshitij Portfolio sold 2 lakh shares (0.52%) at Rs 51.42 apiece.

Godavari Biorefineries: 360 One Equity Opportunity Fund sold 3.19 lakh shares (0.62%) at Rs 256.75 apiece while Turnaround Opportunities Fund sold 2.59 lakh shares (0.5%) at Rs 256.75 apiece.

JTL Industries: Jindal Oil and Fats sold 19.50 lakh shares (0.49%) at Rs 75.45 apiece.

Trading Tweaks

List of securities shortlisted in Short - Term ASM Framework Stage - I: SML Isuzu

List of securities to be excluded from ASM Framework: Concord Biotech, Lloyds Enterprises

Ex-Dividend: Dodla Dairy, Sun Pharma

Ex-Rights Issue: Exicom Tele-Systems (3:20)

Shares to Exit Anchor Lock-In: Vraj Iron and Steel

F&O Cues

Nifty July Futures up by 0.17% to 25,552 at a premium of 91 points.

Nifty July futures open interest down by 1.73%.

Nifty Options July 10 Expiry: Maximum Call open interest at 26,500 and Maximum Put open interest at 25,000.

Securities in ban period: RBL Bank.

Currency & Bond Markets Update

The rupee closed 8 paise weaker against US Dollar at 85.40 on Friday. The benchmark yield on the 10-year bond settled flat at 6.30% on Friday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.