Good morning!

The GIFT Nifty is down 39 points or 1.6% at 24,800 as of 6:25 a.m., indicating a lower start for the benchmark Nifty 50.

Meanwhile, futures contracts for US and European benchmark indices were up early Wednesday.

S&P 500 futures up 0.15%

Euro Stoxx 50 futures up 0.1%

Markets On Home Turf

India's benchmark equity indices snapped a three-session decline to close higher on Tuesday as investors bought into large-cap heavyweights Reliance Industries Ltd. and HDFC Bank Ltd. Realty and pharmaceutical stocks also surged.

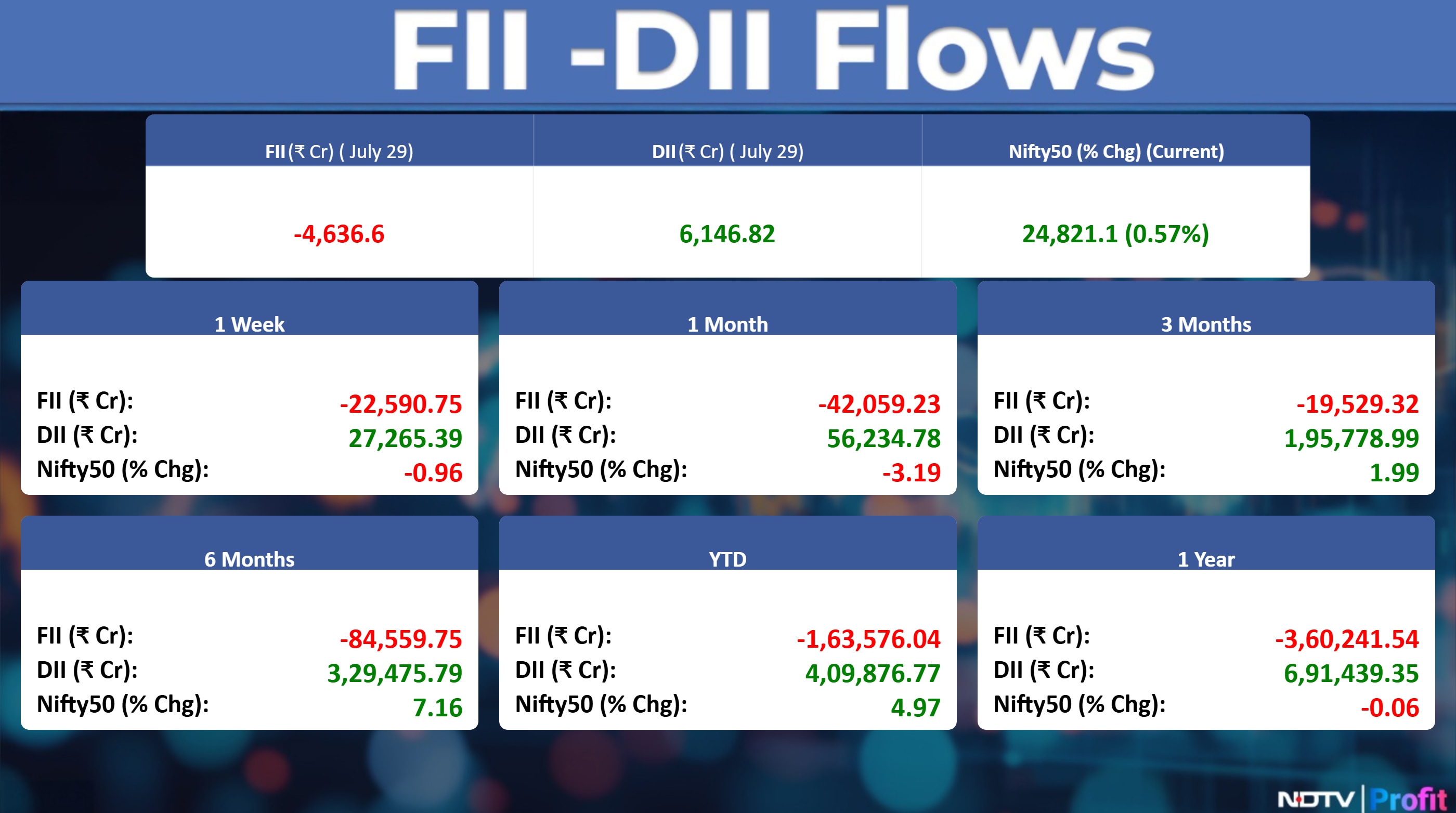

The NSE Nifty 50 settled 140 points or 0.57% higher at 24,821.1, managing to break the 24,800 resistance level. The BSE Sensex added 447 points or 0.55% to close at 81,337.95.

Wall Street Recap

The S&P 500 fell for the first time in seven trading sessions as investors shifted their focus from trade deals to economic data and corporate earnings. The US benchmark declined 0.3%, while the technology-heavy Nasdaq 100 Index fell 0.2%. The Dow Jones Industrial Average slide 0.5%.

Asia Market Update

Asian equities struggled for direction ahead of the Fed's policy decision, while a modest progress in US-China trade talks did little to boost sentiment. Shares in Japan fluctuated on Wednesday, while those in South Korea and Australia remained flat, a day after the S&P 500 snapped a six-day rally.

Nikkei down 0.3%

Topix down 0.1%

Kospi up 0.5%

S&P/ASX 200 up 0.2%

Hang Seng futures down 0.15%

Commodities Check

Oil held the biggest gain in six weeks after US President Donald Trump reiterated he may impose additional economic penalties on Russia unless a truce is reached with Ukraine. Brent was above $72 a barrel after closing 3.5% higher in the previous session, while West Texas Intermediate traded near $69.

Prices of industrial metals were mixed on the London Metal Exchange.

Copper flat

Aluminium down 1%

Nickel up 0.3%

Zinc down 0.4%

Lead flat

Earnings To Watch

Acutaas Chemicals, Adf Foods, Apcotex Industries, Asahi India Glass, Aster DM Healthcare, BASF India, Birla Corporation, Computer Age Management Services, CESC, Fino Payments Bank, Firstsource Solutions, Greaves Cotton, Greenpanel Industries, HEG, Hyundai Motor India, Indraprastha Gas, IIFL Finance, InterGlobe Aviation, Indus Towers, Ion Exchange India, ITD Cementation India, JB Chemicals & Pharmaceuticals, JBM Auto, Jaiprakash Power Ventures, Kaynes Technology India, KPIT Technologies, Maharashtra Seamless, Vedant Fashions, Mayur Uniquoters, Moil, Meghmani Organics, Navin Fluorine International, NESCO, PTC India Financial Services, Procter & Gamble Hygiene and Health Care, Punjab National Bank, Power Grid Corporation of India, Hitachi Energy India, Prudent Corporate Advisory Services, PSP Projects, Redington, Relaxo Footwears, Sagility India, SIS, Sonata Software, Tata Steel, TCI Express, Thomas Cook (India), Tips Music, V2 Retail, Welspun Living, Zydus Wellness.

Earnings Post Market Hours

Jagran Prakashan Q1FY26 Highlights (Consolidated, YoY)

Revenue up 3.6% to Rs 460 crore versus Rs 444 crore.

Ebitda down 2.6% to Rs 63.7 crore versus Rs 65.4 crore.

Margin at 13.9% versus 14.7%.

Net profit up 63.3% to Rs 67.2 crore versus Rs 41.2 crore.

Gallantt Ispat Q1FY26 Highlights (Consolidated, YoY)

Revenue down 2.8% to Rs 1,128 crore versus Rs 1,160 crore.

Ebitda up 15% to Rs 247 crore versus Rs 215 crore.

Margin at 21.9% versus 18.5%.

Net profit up 42.6% to Rs 174 crore versus Rs 122 crore.

Piramal Enterprises Q1FY26 Highlights (Consolidated, YoY)

Consol AUM up 22% YoY.

Impairment loss at Rs 227 crore versus Rs 488 crore.

Calculated NII up 23% to Rs 902 crore versus Rs 732 crore.

Net profit up 52.3% to Rs 276 crore versus Rs 181 crore.

Approves fundraise of up to Rs 1,000 crore via NCDs.

S.J.S. Enterprises Q1FY26 Highlights (Consolidated, YoY)

Revenue up 11.2% to Rs 209 crore versus Rs 188 crore.

Ebitda up 15.6% to Rs 55.7 crore versus Rs 48.2 crore.

Margin up 102 bps at 26.7% versus 25.6%.

Net profit up 22.7% to Rs 34.6 crore versus Rs 28.2 crore.

Bank Of India Q1 Highlights (Standalone, YoY)

Net interest income falls 3% to Rs 6,068.11 crore versus Rs 6,275.8 crore

Net Profit up 32% to Rs 2,252.12 crore versus Rs 1,702.73 crore

Gross NPA at 2.92% versus 3.27% (QoQ).

Net NPA at 0.75% versus 0.82% (QoQ).

Operating Profit rises 9% to Rs 4,009 crore versus Rs 3,677 crore

Provisions fall 15.2% to Rs 1,096 crore versus Rs 1,293 crore

Provisions decline 18% to Rs 1,096 crore versus Rs 1,338 crore (QoQ)

Triveni Engineering Q1 Highlights (Standalone, YoY)

Revenue up 22.9% to Rs 1,598.22 crore versus Rs 1,300.68 crore

Ebitda down 38% to Rs 53.50 crore versus Rs 86.24 crore.

Margin at 3.3% versus 6.6%

Net Profit down 86% to Rs 4.41 crore versus Rs 31.27 crore

International Gemmological Institute Q2 Highlights (Consolidated, YoY)

Revenue up15.8% at Rs 301 crore versus Rs 260 crore

Ebitda up 36.9% at Rs 173 crore versus Rs 127 crore

Margin at 57.6% versus 48.7%

Net profit up 62.6% at Rs126.5 crore versus Rs 77.8 crore

L&T Q1FY26 Results (Consolidated, YoY)

Revenue up 15.52% at Rs 63,678 crore versus Rs 55,119 crore

Ebitda up 12.5% at Rs 6,317 crore versus Rs 5,615 crore

Margin at 9.92% versus 10.18% down 26 basis points

Net profit up 29.84% at Rs 3,617 crore versus Rs 2,786 crore

Received orders worth Rs 94,453 crore, up 33% YoY

International orders stood at Rs 48,675 crore, accounting for 52% of total order inflow

Order book stood at Rs 6.12 lakh crore, up 6% over March 25

Ask Automotive Q1FY26 (Consolidated, YoY)

Revenue up 3.4% to Rs 891 crore versus Rs 862 crore

Ebitda up 19% to Rs 120 crore versus Rs 101 crore

Margin at 13.4% versus 11.7%

Net profit up 16.3% to Rs 66 crore versus Rs 56.8 crore

Nilkamal Q1FY26 (Standalone, YoY)

Revenue up 18.9% to Rs 883 crore versus Rs 743 crore

Net profit down 16.7% to Rs 15.2 crore versus Rs 18.3 crore

Ebitda up 2.9% to Rs 58 crore versus Rs 56.3 crore

Margin at 6.6% versus 7.6%

New India Assurance Q1FY26 (YoY)

Gross premiums written up 13.1% to Rs 13,445 crore versus Rs 11,888 crore

Net premium income rises 10.3% to Rs 9,424 crore versus Rs 8,547 crore.

Underwriting loss at Rs 1,754 crore versus loss of Rs 1,576 crore

Net profit rises 80.2% to Rs 391.01 crore versus Rs 216.97 crore.

Combined ratio at 116.03% versus 111.59% (QoQ)

Combined ratio at 116.03% versus 115.90% (YoY)

Novartis India Q1FY26 (Standalone, YoY)

Revenue down 5.1% to Rs 87.6 crore versus Rs 92.3 crore

Net profit up 7% to Rs 27.6 crore versus Rs 25.7 crore

Ebitda up 14% to Rs 27.2 crore versus Rs 24 crore

Margin at 31.1% versus 26%

GE Vernova T&D India Q1 Highlights (Consolidated, YoY)

Revenue up 38.8% to Rs 1,330 crore versus Rs 958 crore

Ebitda at Rs 388 crore versus Rs 182 crore

Margin at 29.1% versus 19%.

Net Profit at Rs 291 crore versus Rs 135 crore

Allied Blenders Q1FY26 (Consolidated, YoY)

Revenue up 21.8% to Rs 923 crore versus Rs 758 crore

Ebitda up 50.5% to Rs 112 crore versus Rs 74.1 crore

Margin at 12.1% versus 9.8%

Net profit at Rs 56.6 crore versus Rs 11.2 crore

Triveni Engineering Q1FY26 (Consolidated, YoY)

Revenue up 22.8% to Rs 1,598 crore versus Rs 1,301 crore

Ebitda down 38% to Rs 53.5 crore versus Rs 86.3 crore

Margin down 328 bps at 3.3% versus 6.6%

Net profit down 93.5% to Rs 2 crore versus Rs 31 crore

IFB Industries Q1FY26 (Consolidated, YoY)

Revenue up 5.4% to Rs 1,338 crore versus Rs 1,269 crore

Ebitda down 22.6% to Rs 63.2 crore versus Rs 81.7 crore

Margin at 4.7% versus 6.4%

Net profit down 30.3% to Rs 26.2 crore versus Rs 37.5 crore

Star Health and Allied Insurance Co Q1FY26 (Standalone, YoY)

Gross premium written up 3.7% to Rs 3,605 crore versus Rs 3,475 crore

Net premiums earned up 11.9% to Rs 3,938 crore versus Rs 3,520 crore

Underwriting profit down 48.8% to Rs 71.7 crore versus Rs 140 crore

Net profit down 17.7% to Rs 263 crore versus Rs 319 crore

Dilip Buildcon Q1FY26 (Consolidated, YoY)

Revenue down 16.4% to Rs 2,620 crore versus Rs 3,134 crore

Ebitda up 8.9% to Rs 520 crore versus Rs 478 crore

Margin at 19.9% versus 15.3%

Net profit up 91.6% to Rs 229 crore versus Rs 119 crore

Q1 Earnings Lloyds Engineering (Cons, QoQ)

Revenue down 6.5% At Rs 217 Crore Versus Rs 232 Crore

EBITDA down 23.5% At Rs 26.5 Crore Versus Rs 34.7 Crore

Margin At 12.2% Versus 14.9%

Net Profit down 65.4% At Rs 30.2 Crore Versus Rs 18.3 Crore

Lloyds Engineering Q1FY26 (Consolidated, QoQ)

Revenue down 6.5% to Rs 217 crore versus Rs 232 crore

Ebitda down 23.5% to Rs 26.5 crore versus Rs 34.7 crore

Margin at 12.2% versus 14.9%

Net profit down 65.4% to Rs 10.2 crore versus Rs 18.3 crore

NTPC Q1FY26 (Standalone, YoY)

Revenue down 4.2% to Rs 42,572.6 crore versus Rs 44,427.5 crore

Net profit up 6% to Rs 4,774.7 crore versus Rs 4,511 crore

Ebitda down 17% to Rs 10,283.8 crore versus Rs 12,454.9 crore

Margin at 24.2% versus 28%

GMR Airports Q1FY26 (Consolidated, YoY)

Revenue up 33.4% to Rs 3,205 crore versus Rs 2,402 crore

Ebitda up 45.4% to Rs 1,306 crore versus Rs 898 crore

Margin at 40.7% versus 37.4%

Net loss at Rs 212 crore versus loss of Rs 142 crore

Board approves non-convertible bonds issuance up to Rs 6,000 crore

Siyaram Silk Mills Q1FY26 (Consolidated, YoY)

Revenue up 26.9% to Rs 389 crore versus Rs 307 crore

Ebitda at Rs 20.8 crore versus Rs 9.7 crore

Margin at 5.3% versus 3.1%

Net profit down 59.7% to Rs 4.6 crore versus Rs 11.5 crore

Stocks In News

Cyient: The company incorporated a new entity, Cyient Semiconductors Singapore, in Singapore.

Elcid Investments: The company plans to invest up to Rs 7.5 crore in quick-commerce startup Zepto.

Tilaknagar Industries: The company received an extension from the Andhra Pradesh commissioner of distilleries and breweries to expand its bottling capacity by 200 lakh proof litres. The company also approved the issuance of up to 1.4 crore equity shares at Rs 382 per share, aggregating to Rs 549 crore, and up to 4.57 crore convertible warrants at Rs 382 per warrant, totalling Rs 1,746 crore, on a preferential basis.

Muthoot Microfin: The company expanded its footprint into Northeast India by opening its first branch in Guwahati.

Asian Paints: The company approved the amalgamation of its subsidiary, Asian Paints (Polymers), with the parent company to unlock synergies across procurement, logistics, supply chain, technology, and shared services.

Reliance Industries: The company signed a joint operating agreement with ONGC and BP Exploration (Alpha) for an exploration block.

Intellect Design Arena: The company launched a pilot implementation of its next-generation platform, eMACH.ai, for leading banks in South Africa.

Avenue Supermarts: The company opened a new DMart store in Pathankot, Punjab, bringing its total store count to 426.

L&T Finance: The company allotted Non-Convertible Debentures worth Rs 250 crore to identified investors via private placements.

GAIL (India): The company executed a joint venture agreement with RVUNL to transfer gas-based power plants in Dholpur and Ramgarh, Rajasthan, to a new JVC, and to develop 750 MW solar and 250 MW wind power projects through the JVC.

TARC: The company obtained a registration certificate for its TARC Trigun project — a luxury residential high-rise service apartment development in Chattarpur, New Delhi.

General Insurance Corp: The company received an appeal order from the Commissioner of CGST & Central Excise, Mumbai, raising a tax liability of Rs 3.78 crore.

IRCTC: The company received a notice regarding a service tax claim of Rs 6.79 crore related to the renting of immovable property from 2007 to 2011.

Focus Lighting: The company denied a media report dated July 29, 2025, suggesting that Panasonic is in talks to acquire a controlling stake in the company. It called the report speculative and factually incorrect.

KP Green Engineering: The company received a letter of award from MAHAPREIT for a 30 MW rooftop solar PV project in Goa. Additionally, it has secured the L1 bid for 5 MW rooftop solar projects on government buildings.

Nestle India: The company set August 8, 2025, as the record date for its 1:1 bonus share issuance.

HCL Technologies: The company partnered with Pearson to co-develop AI-powered products aimed at addressing skill gaps and accelerating skills development.

NTPC: The company reappointed Shri Gurdeep Singh as its Chairman & Managing Director.

KP Energy: The company fully disinvested its 51% stake in EMWPL, originally created as an SPV for a 30MW wind power project under a PPA with GUVNL. EMWPL is no longer its subsidiary.

CAMS: The company will acquire NSE Data & Analytics' KYC registration agency operations for Rs 7 crore.

Zaggle Prepaid: The company will acquire Rivpe Technology for Rs 22 crore to expand its UPI capabilities and enter the consumer credit card market.

MCX: The company announced the launch of Cardamom Futures and will hold a board meeting on August 1, 2025, to consider a stock split.

Quadrant Future Tek: The company appointed Abhigyan Kotnala as its new CEO and Amit Gaur as the new CFO, effective tomorrow.

Stanley Lifestyles: The company invested Rs 50 crore in its subsidiary Stanley Retail via a rights issue. SRL further invested Rs 2.48 crore in Sana Lifestyles Limited and Rs 5.67 crore in Staras Seating.

Zydus Lifesciences: The company completed the acquisition of an 85.6% stake in Amplitude Surgical.

Fermenta Biotech: The company received a suitability certificate from the European Directorate for its spray-dried variant, VITADEE 100 SD.

IPO Offering

Shanti Gold International: The public issue was subscribed to 81.17 times on day 3. The bids were led by Qualified institutional investors (117.33 times), non-institutional investors (151.48 times), retail investors (30.37 times).

Laxmi India Finance: The public issue was subscribed to 0.37 times on day 1. The bids were led by Qualified institutional investors (0.1 times), non-institutional investors (0.19 times), retail investors (0.6 times) and reserved for employees (0.41 times).

Aditya InfoTech: The public issue was subscribed to 2.05 times on day 1. The bids were led by Qualified institutional investors (0.01 times), non-institutional investors (3.16 times), retail investors (6.52 times) and reserved for employees (1.48 times).

Sri Lotus Developers and Realty: The company will offer shares for bidding on Wednesday. The price band is set from Rs 140 to Rs 150 per share. The Rs 792-crore IPO entirely a fresh Issue. The company raised Rs. 237 crores from anchor investors.

M&B Engineering: The company will offer shares for bidding on Wednesday. The price band is set from Rs 366 to Rs 385 per share. The Rs 650-crore is a combination of fresh Issue of Rs 275 crore and rest offer for sale. The company raised Rs. 292 crores from anchor investors.

NSDL: The company will offer shares for bidding on Wednesday. The price band is set from Rs 760 to Rs 800 per share. The Rs 4,011-crore is entirely offer for sale of Rs 275 crore The company raised Rs. 1,201 crores from anchor investors.

Listing Day

Indiqube Spaces: The company's shares will debut on the stock exchange on Wednesday. The Rs 700-crore IPO was subscribed 12.41 times on its third and final day. The bids were led by institutional investors (14.35 times), retail investors (12.9 times), non-institutional investors (8.27 times), reserved for employees (6.83 times)

GNG Electronics: The company's shares will debut on the stock exchange on Wednesday. The Rs 460.43-crore IPO was subscribed 147.93 times on its third and final day. The bids were led by institutional investors (266.21 times), retail investors (46.84 times), and non-institutional investors (227.67 times).

Insider Trade

Senores Pharmaceuticals: Promoter Renosen Pharmaceuticals bought 3,000 shares on July 28.

Trading Tweaks

List of securities shortlisted in Short-Term ASM Framework Stage - I: Vimta Labs.

List of securities shortlisted in Long-Term ASM Framework Stage – I: Sterlite Technologies

Ex-Dividend: VRL Logistics, Sinclair Hotels, MM Forgings, TD Power Systems, Aurionpro Solutions, BASF India, JB Chemical and Pharma, Nocil.

F&O Cues

Nifty July Futures down by 0.58% to 24,710 at a premium of 30 points.

Nifty July futures open interest down by 7.83%.

Nifty Options 31 July Expiry: Maximum Call open interest at 25000 and Maximum Put open interest at 24,000.

Securities in ban period: RBL Bank.

Currency/Rupee Update

The Indian rupee closed at its lowest level in over four months on Tuesday, ending the session at Rs 86.82 against the US dollar, down 15 paise from Rs 86.67 a day ago. The yield on the benchmark 10-year bond settled one basis points lower at 6.36%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.