Good morning!

The GIFT Nifty, an early indicator of Nifty 50 performance in India, traded little changed at 24,980.50 as of 7 a.m.

Asian equities opened lower on Friday, breaking their longest stretch of gains since January. Investors turned cautious as uncertainty persisted around the timing of potential interest rate cuts by the US Federal Reserve, dampening risk appetite. However, US stock futures moved higher in early Friday trading after Intel issued an optimistic sales forecast.

In early Asia trading, Japan's Nikkei 225 slipped 0.24%, while the broader Topix index fell 0.55%. South Korea's Kospi was little changed. Australia's S&P/ASX 200 also declined, down 0.41%.

US Markets Update

The S&P 500 and the Nasdaq Composite ended Thursday's session at new record closing highs, after both indices touched fresh intraday peaks earlier in the day.

Shares of Alphabet rose sharply following strong quarterly results, boosting overall sentiment toward large-cap stocks in the artificial intelligence space. In contrast, Tesla declined after its earnings report fell short of market expectations.

At the close on Thursday, the S&P 500 edged up 0.07% to finish at 6,363.35, while the Nasdaq Composite added 0.18% to end the session at 21,057.96. Meanwhile, the Dow Jones Industrial Average fell 316.38 points, or 0.7%, to settle at 44,693.91.

Markets On Home Turf

The benchmark equity indices closed lower on Thursday, weighed down by shares of Reliance Industries Ltd., Infosys Ltd. and HDFC Bank Ltd.

The NSE Nifty 50 ended 157.8 points or 0.63% lower at 25,062.1, while the BSE Sensex closed 542.47 points or 0.66% down at 82,184.17.

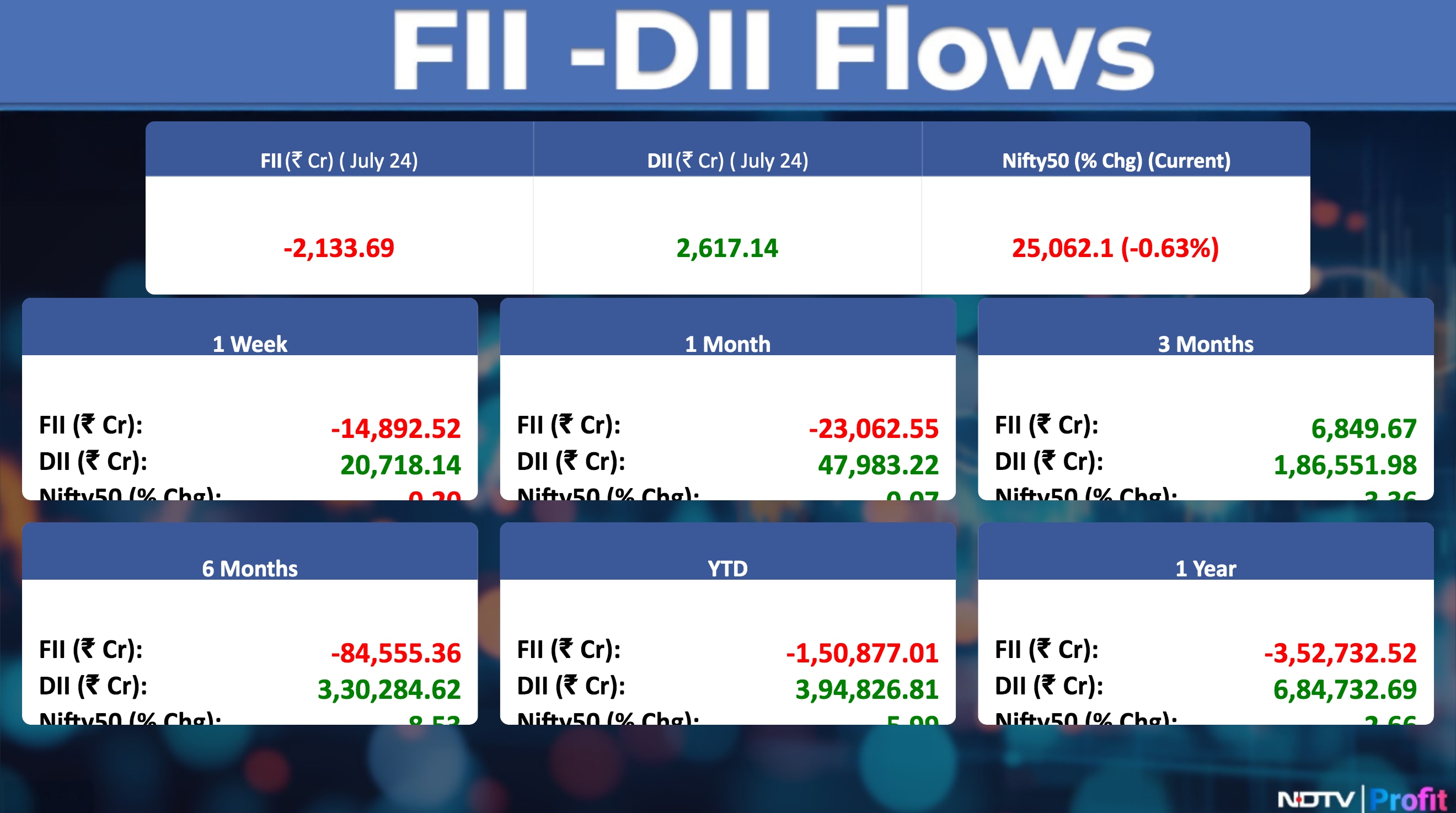

Foreign portfolio investors remained net sellers of Indian shares for the fourth consecutive day on Thursday as they sold stocks worth Rs 2,307.9 crore, according to provisional data from the National Stock Exchange.

The domestic institutional investors, who stayed buyers for the 14th straight session, acquired stocks worth Rs 2,692.4 crore.

London Metal Exchange:

Copper snapped five-day rally, ended 0.5% lower

Aluminium ended lower for the second consecutive trading session, down 0.15%

Nickel halted a five-day gaining streak, closed 0.7% lower

Zinc halted a six-day winning streak, ended 0.6% lower

Lead closed 0.5% lower after rallying over 1% on Wednesday

Key Events/Data To Watch

India's foreign exchange reserves data for July is due; the previous level was $696.7 billion.

Prime Minister Narendra Modi will begin a state visit to the Maldives from July 25-26.

Commerce Secretary Sunil Barthwal will hold a press briefing in New Delhi at 2:45 p.m. on the India-UK Free Trade Agreement.

The India Steel Conclave 2025 will begin at 9:30 a.m. in New Delhi. Speakers include JSW Steel's Sushil Nowal, Jindal Steel's Sanjay Kumar Singh, and Tata Steel's Koustuv Kakati.

At 11 a.m., Electronics Ministry Secretary S Krishnan will address FICCI's Bhashantara 2025 in New Delhi.

Earnings To Watch

Aadhar Housing Finance, Acme Solar Holdings, Avantel, Bajaj Finserv, Bank of Baroda, Chennai Petroleum Corporation, Cipla, Prataap Snacks, Gujarat Mineral Development Corporation, Grindwell Norton, HFCL, Home First Finance Company India, Intellect Design Arena, Jammu & Kashmir Bank, Laurus Labs, Mahindra Lifespace Developers, Orient Cement, Orient Electric, Paras Defence and Space Technologies, Petronet LNG, Poonawalla Fincorp, RPG Life Sciences, Steel Authority of India, SBI Cards and Payment Services, Schaeffler India, Sharda Cropchem, Shriram Finance, Sobha , Solara Active Pharma Sciences, Sterlite Technologies, Tata Chemicals, Tamilnad Mercantile Bank, Vardhman Special Steels

Earnings Reaction To Watch

Bajaj Finance Key highlights (YoY)

Net Profit up 22% to Rs 4,765 crore versus Rs 3,912 crore.

Impairments on financial instruments rose to Rs 2,120 crore as against Rs 1.684 crore.

NII rises 21% at Rs 12,610 crore versus Rs 10,418 crore.

GNP ratio rose to 1.03% versus 0.96% (QoQ).

Net NPA ratio rose to 0.50% versus 0.44% (QoQ).

SBI Life Key highlights (YoY)

Net Premium Income rises 13.7% at Rs 17,179 crore versus Rs 15,105 crore.

Solvency Ratio Flat At 1.96% (QoQ)

61st Month Persistency Ratio at 59.16% versus 61.51% (QoQ).

13th Month Persistency Ratio At 84.23% versus 86.64% (QoQ) .

Net Profit rises 14.4% at Rs 594 crore versus Rs 520 crore.

VNB Margin down 300 basis points at 27.46% vs 30.46% (QoQ).

APE up at 9% at Rs 3,970 crore versus Rs 3,640 crore.

VNB up 12.3% at Rs 1090 crore versus Rs 970 crore.

REC Q1FY26 Cons (YoY)

Net interest income at Rs 5,258 crore versus Rs 4,480 crore year-on-year, up 17% year-on-year, down 11% quarter-on-quarter.

Provisions reversal at Rs 610 crore vs Rs 467 crore year-on-year.

Profit at Rs 4,466 crore versus Rs 3,460 crore year-on-year, up 29% year-on-year, up 4% quarter-on-quarter.

Gross Credit Impaired Assets Ratio at 1.05% vs 1.35%, down 30bps quarter-on-quarter.

Net Credit Impaired Assets Ratio at 0.24% vs 0.38%, down 14bps quarter-on-quarter.

Net income margin at 3.74% vs 3.64% YoY

CAR at 23.98% versus 25.99%, down -201bps quarter-on-quarter.

Loan Assets at Rs 5,84,568 crore versus Rs 5,29,739 crore year-on-year, up 10% year-on-year, up 3% quarter-on-quarter.

Disbursements at Rs 59,508 crore versus Rs 43,652 crore year-on-year, up 36% year-on-year, up 31% quarter-on-quarter.

KFin Tech Key highlights (Consolidated, YoY)

Revenue up 15.4% to Rs 274.06 crore versus Rs 237.56 crore.

Ebitda up 14% to Rs 113.86 crore versus Rs 99.67 crore.

Margin at 41.5% versus 42%.

Net Profit up 14% to Rs 77.26 crore versus Rs 68.07 crore.

Tanla Platforms Key highlights (Consolidated, QoQ)

Revenue rises 1.6% to Rs 1,041 crore versus Rs 1,024 crore.

Ebitda inches up 0.3% to Rs 164 crore versus Rs 163 crore.

Margin at 15.8% versus 16%.

Net profit up 0.9% at Rs 118 crore versus Rs 117 crore.

Phoenix Mills Key highlights (Consolidated, YoY)

Revenue rises 5.4% to Rs 953 crore versus Rs 904 crore.

Ebitda grows 6.3% to Rs 564 crore versus Rs 531 crore.

Margin at 59.2% versus 58.7%.

Net profit up 3.5% at Rs 241 crore versus Rs 233 crore.

Anant Raj Key highlights (Consolidated, YoY)

Revenue rises 25.6% to Rs 592 crore versus Rs 472 crore.

Ebitda climbs 46.3% to Rs 151 crore versus Rs 103 crore.

Margin at 25.4% versus 21.8%.

Net profit up 38.3% at Rs 126 crore versus Rs 91 crore.

IEX Key highlights (Consolidated, YoY)

Revenue up 14.7% at Rs 142 crore versus Rs 124 crore

EBITDA up 16.1% at Rs 115 crore versus Rs 99.3 crore

Margin at 81.3% Vs 80.4%

Net Profit up 25% at Rs 121 crore versus Rs 96.4 crore.

Johnson Controls-Hitachi

Revenue declines 14.4% to Rs 853 crore versus Rs 996 crore.

Ebitda falls 35.6% to Rs 36.4 crore versus Rs 56.6 crore.

Margin at 4.3% versus 5.7%.

Net profit down 57.8% at Rs 15.3 crore versus Rs 36.15 crore.

Cyient Key highlights (Consolidated, QoQ)

Revenue down 10.3% to Rs 1,712 crore versus Rs 1,910 crore.

EBIT down 31% to Rs 163 crore versus Rs 235 crore.

Margin at 9.5% versus 12.3%.

Net Profit down 10% to Rs 154 crore versus Rs 171 crore.

Trident Key highlights (Consolidated, YoY)

Revenue declines 2.1% to Rs 1,707 crore versus Rs 1,743 crore.

Net profit up 89.8% at Rs 140 crore versus Rs 73.7 crore.

EBITDA rises 31.5% to Rs 289 crore versus Rs 220 crore.

Margin at 16.9% versus 12.6%.

The board approves raising up to Rs 500 crore via NCDs.

UTI AMC Key highlights (Consolidated, QoQ)

Revenue rises 45.5% to Rs 547 crore versus Rs 376 crore.

Net Profit at Rs 237 crore versus Rs 87.5 crore.

Sambhv Steel Tubes Key highlights (Consolidated, QoQ)

Revenue up 12.92% at Rs 559 crore versus Rs 495 crore.

Ebitda up 53.87% at Rs 73.4 crore versus Rs 47.7 crore.

Ebitda margin up 349 bps at 13.13% versus 9.63%.

Net profit up 101.21% at Rs 33 crore versus Rs 16.4 crore.

Aether Industries Key highlights (Consolidated, YoY)

Revenue rises 42.3% to Rs 256 crore versus Rs 180 crore.

Ebitda advances 87.2% to Rs 80.7 crore versus Rs 43.1 crore.

Margin at 31.5% versus 23.9%.

Net profit up 57.2% at Rs 47 crore versus Rs 29.9 crore.

Tatva Chintan Key highlights (Consolidated, YoY)

Revenue rises 10.9% to Rs 117 crore versus 105 crore.

Ebitda advances 38.4% to 17.4 crore versus Rs 12.5 crore.

Margin at 14.8% versus 11.9%.

Net Profit up 27.6% at Rs 6.7 crore versus Rs 5.2 crore.

Stocks in News

Railtel Corporation of India: The company secured a domestic work order worth Rs 10.05 crore from the Government of Odisha. The order is for implementing comprehensive IT solutions. Further, it received an order worth Rs 40 crore from Central Coalfields.

Aeroflex: The company acquired an additional 13% equity stake in M R Organisation for Rs 16.7 crore.

Thirumalai Chemicals: The company clarified that the Rs 110.62 crore allocated for general corporate purposes from the Rs 450.62 crore preferential share issue will not be used for investments in subsidiaries, joint ventures, or associates.

Tatva Chintan Pharma Chem: The board accepted the resignation of Ashok Bothra as CFO, effective Aug. 30.

Bajaj Consumer Care: The board approved a buyback of up to 64.3 lakh equity shares (4.69% of total capital) at Rs 290 per share, totalling up to Rs 186 crore via a tender offer, with promoters not participating. The board also approved an arrangement for the demerger of the manufacturing and distribution business of its wholly owned subsidiary, Vishal Personal Care, into Bajaj Consumer Care Limited, aiming for synergy.

Indian Energy Exchange: The Central Electricity Regulatory Commission has issued a suo-moto order to initiate market coupling in a phased manner. This includes a directive to couple the Day-Ahead Market of power exchanges by January 2026. It also issued directions to explore market coupling in other segments, specifically the Real-Time Market and Term-Ahead Market, marking a proposed change in the current market mechanism within DAM.

Thomas Cook India: The company became the first Indian Forex card provider to enable contactless cross-border payments by partnering with Google Pay and Visa, allowing users to make secure mobile transactions globally.

UTI Asset Management: The company has provided a Rs 45 crore unsecured working capital loan to its wholly owned subsidiary, UTI Alternatives, at an interest rate based on the 1-year SBI MCLR, repayable by March 31, 2028.

Intellect Design Arena: A Tier 1 Canadian bank has expanded its relationship with the company to accelerate real-time transaction modernisation of its US operations.

Sun Pharmaceutical: Subsidiaries Sun Pharmaceutical and Taro Pharmaceuticals USA have agreed to pay $200 million to settle the "In re Generic Pharmaceuticals Pricing Antitrust Litigation" with End Purchaser Plaintiffs in the US, without admitting wrongdoing, pending court approval.

Muthoot Capital Services: The board approved the private placement of 15,000 NCDs, each with a face value of Rs 1 lakh, totalling up to Rs 150 crore.

Wipro: The company has secured a multi-year "Smart Grid" contract with Saudi Electric Company-National Grid SA to implement a smart meter data management system for their transmission network.

GMR Airports: The board will meet on July 29 to consider issuance of NCDs of up to Rs 6,000 crore.

Epack Durable: The company has formed a joint venture with South Korea's Bumjin Electronics. It will hold a 66.67% stake in the JV, which will manufacture and sell TV speakers, soundbars, and other audio devices for the Indian market, with an option to expand.

The Phoenix Mills: The board approved the acquisition of the remaining 49% equity stake in its material subsidiary, Island Star Mall Developers, from Canada Pension Plan Investment Board for Rs 5,449.16 crore, making ISMDPL a wholly owned subsidiary.

Global Health: The Government of Assam approved allotment of 3.5 acres of land on a 60-year lease for the company's hospital project in Guwahati, replacing a previously offered 3-acre parcel, for an upfront lease charge of Rs 56 crore.

Keystone Realtors: The company incorporated a wholly owned subsidiary, Keymidtown Developers, to develop new real estate and construction projects in India.

Satin Creditcare Network: The company allotted 4,000 non-convertible debentures, each with a face value of Rs 1 lakh, totalling Rs 40 crore.

Mankind Pharma: The company announced the incorporation of its wholly owned subsidiary, Mankind Pharma Lanka, in Sri Lanka.

Optiemus Infracom: The board approved an additional investment of Rs 26.86 crore in its wholly owned subsidiary, GDN Enterprises, by acquiring 6.88 lakh equity shares at Rs 390 each.

Enviro Infra Engineers: The company received two letters of acceptance from Bangalore Water Supply and Sewerage Board for domestic EPC and O&M contracts — Rs 80.01 crore for a wastewater treatment plant in Byatarayanapura and Rs 141.25 crore for a similar plant in Mahadevapura, with a combined order value of Rs 221.26 crore.

Lumax Auto Technologies: The company incorporated LUMAX AUTOCOMP in New Delhi as a wholly owned subsidiary to expand its presence and address growth opportunities in the automotive components sector.

Tata Steel: The company completed acquisition of a 100% stake in Neelachal Ispat Nigam.

Arisinfra: The company announced a supply chain partnership with The House of W, unlocking over Rs 300 crore of annual sanitaryware capacity to boost project execution.

Sonata Software: The company partnered with the Wharton AI & Analytics Initiative at the University of Pennsylvania to advance understanding of agentic AI in enterprise operations.

Adani Enterprises: The company signed an agreement with MetTube Mauritius to divest 50% of its wholly owned subsidiary, Kutch Copper Tubes, and simultaneously acquire a 50% stake in MetTube Copper India, a wholly owned subsidiary of MetTube, aiming to leverage combined expertise in the copper tube business.

BEL: The company received an order worth Rs 563 crore for navigation system guns, communication equipment, and active antenna array units.

Nestle India: The company announced that Manish Tiwary will assume office as Chairman and Managing Director, effective 1 August 2025.

Som Distilleries: The company launched "Mahavat Whisky", a new mid-premium segment offering, priced at Rs 1,000–1,100.

Shilpa Medicare: Wholly owned subsidiary Shilpa Pharma committed to a strategic investment of US\$ 2 million via a SAFE note in Alveolus Bio, a biotech startup focused on lung diseases.

Triveni Engineering & Industries: The company received a letter from the Office of the Assistant Excise Commissioner demanding Rs 46.78 crore in export fees on denatured alcohol.

Thermax: Wholly owned subsidiary First Energy 11 allotted 8.4 crore shares to another wholly owned subsidiary, First Energy, to fund renewable energy projects, increasing FE11's paid-up capital to Rs 84 crore.

Nazara Technologies: Wholly owned subsidiary Paper Boat Apps entered into a loan agreement to grant an unsecured loan of approximately Rs 12 crore to its wholly owned subsidiary Kiddopia, which in turn entered into a similar agreement to lend the same to Nazara Technologies UK.

Power Grid Corporation of India: Wholly owned subsidiary Powergrid ERWR Power Transmission has fully commissioned its "Inter-regional ER-WR Interconnection".

G R Infraprojects: The company emerged as the L-1 bidder for an EPC project to construct the Giridih Bypass Road (26.672 km), with a contract price of Rs 290.23 crore and a completion period of 24 months.

Lloyds Engineering Works: The company signed an agreement with FINCANTIERI SpA to enhance product offerings in the defence and naval sector.

Fortis Healthcare: The company, through its arm, consummated a definitive agreement for acquisition of the entire business operations of Shrimann Superspecialty Hospital.

Tata Power: The company completed the first tranche of investment in Khorlochhu Hydro Power, a Bhutanese entity, by investing Rs 120 crore to acquire 1.2 crore shares (40% of KHPL's capital), as part of a total planned investment of approximately Rs 830 crore in the 600 MW project.

eMudhra: Subsidiary eMudhra B.V. completed the acquisition of a 51% interest in Cryptas International GmbH, Austria. It also entered into an agreement to acquire 100% stake in AI Cyber Forge Inc, USA, for an immediate cash consideration of $ 4.8 million, to expand cybersecurity product offerings.

Saurashtra Cement: The company's kiln at its Gujarat plant will be shut down for annual maintenance starting tomorrow for about 20 days.

HCL Technologies: The board approved the reappointment of C. Vijayakumar as CEO and MD.

Media Reports

India eases quality control norms on key chemicals imported from the US, China: Mint

Brokerage Radar

On Bajaj Finance

Jefferies

Maintained Buy rating

Raised price target to Rs 1,100 from Rs 1,044

Growth remained healthy despite a slight rise in MSME loans

FY26 guidance remains unchanged; Q2 trends will be important

Credit costs ticked higher and may stay elevated for two to three quarters

Reduced profit estimates by 1–2%

CEO succession plan to be submitted in six months

Macquarie

Maintained Underperform rating with price target of Rs 800

Q1 PAT was in line; lower provisioning offset weaker income

SME segment stress drove higher credit costs

Market has yet to factor in growth guidance cuts and rising credit costs

Citi

Maintained Neutral rating with price target of Rs 983

MSME-related stress and growth risks are emerging

Net interest margin upside and cost control offer some cushion

Succession plan to be detailed in six months, with transition near March 2028

Earnings estimates largely unchanged

On SBI Life

Jefferies

Maintained Buy rating

Increased price target to Rs 2,180 from Rs 2,000

Q1 saw slower growth but better mix and attachment products supported margins and VNB

Management remains confident on bancassurance and regulatory outlook

Valuation may offer scope for re-rating

Macquarie

Maintained Neutral rating with price target of Rs 1,720

Q1 saw a small VNB beat due to higher-than-expected margin

Management expects VNB margin to remain in the 26–28% range

Regulatory risk and near-term growth concerns support Neutral view

Morgan Stanley

Maintained Overweight rating with price target of Rs 2,115

Q1 was strong; SBI Life remains a preferred large cap pick

Offers attractive risk-reward with limited downside

Among life insurers, remains cheapest on P/VNB despite highest return on embedded value

On Nestle India

Jefferies

Maintained Hold rating with price target of Rs 2,350

Q1 results fell short of expectations

Sales growth driven equally by volumes and realisations

Milk and nutrition segments underperformed, while e-commerce gained through quick commerce

Higher input costs led to margin contraction, impacting Ebitda

EPS estimate reduced by 4–5%

Macquarie

Maintained Neutral rating

Cut price target to Rs 2,250 from Rs 2,375

Q1 results missed estimates; near-term growth concerns remain

Gross margin underperformed and higher other expenses offset largely in-line sales

Milk and nutrition sales have yet to recover

Softer coffee prices may limit pricing growth in beverages

Manufacturing cost pressure raises risk to FY26 EPS

See limited upside at current 67x FY27 EPS valuation

Bulk Deals

Cigniti Technologies: Morgan Stanley Asia Singapore bought 1.65 lakh shares (0.6%) at Rs 1,5991 apiece.

Indian Energy Exchange: PICTET - Indian Equities sold 6 lakh shares (0.67%) at 131.5 apiece.

JTL Industries: JINDAL Oil and Fats bought 22.1 lakh shares (0.6%) at Rs 79.63 apiece.

IPO Offering

Indiqube Spaces: The public issue was subscribed to 2.54 times on day 2. The bids were led by Qualified institutional investors (1.42 times), non-institutional investors (1.84 times), retail investors (6.9 times) and reserved for employees (4.47 times).

GNG Electronics: The public issue was subscribed to 26.93 times on day 2. The bids were led by Qualified institutional investors (2.21 times), non-institutional investors (68.7 times), retail investors (23.02 times).

Brigade Hotel Ventures: The public issue was subscribed to 0.63 times on day 1. The bids were led by Qualified institutional investors (0.08 times), non-institutional investors (0.42 times), retail investors (2.5 times), Employee Reserved (0.29 times), Reserve for shareholders (0.9 times).

Shanti Gold International: The company will offer shares for bidding on Friday. The price band is set from Rs 189 to Rs 199 per share. The Rs 360.11-crore IPO is entirely a fresh issue.

Bulk & Block Deals

Kajaria Ceramics: Long Term India Fund bought 12.5 lakh shares (0.78%) at Rs 1,180 per share.

Kilburn Engineering: Khivraj Motors sold 5 lakh shares (1.03%) at Rs 505.06 apiece. SBI Funds Management bought 7.56 lakh shares (1.56%) at Rs 505 apiece. Niraj Rajnikant Shah bought 1 lakh shares (0.21%) at Rs 519.74 apiece and sold 4.51 lakh shares (0.93%) at Rs 505.3 apiece.

Veranda: Necta Bloom VCC sold and Rakhi bought 4.75 lakh shares at Rs 228.

Pledge Shares Details

D. B. Corp Ltd: Promoter group D B Power Limited acquired 9.61 lakh shares.

Trading Tweaks

List of securities shortlisted in Short - Term ASM Framework Stage - I: InfoBeans Technologies, Rossell Techsys & Sambhv Steel Tubes.

List of securities to be excluded from ASM Framework: Neuland Laboratories, Rajoo Engineers, Sterlite Technologies

F&O Cues

Nifty July futures down by 0.68% to 25,082 at a premium of 19.9 points.

Nifty July futures open interest down by 3.09%.

Nifty Options 31 July Expiry: Maximum Call open interest at 26000 and Maximum Put open interest at 24,000.

Securities in ban period: RBL bank, IEX

Currency & Bond

The Indian rupee ended Thursday's trading session flat against the US dollar, settling at 86.41. The yield on the benchmark 10-year bond settled two basis points higher at 6.32%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.