Good morning!

The GIFT Nifty, an early indicator of the Nifty 50's performance, was steady at 25,298 as of 7 a.m.

Asian stocks rose for a sixth straight session after a US-Japan trade agreement signalled potential for further deals, lifting market confidence across the region.

The MSCI Asia Pacific index gained 0.7%, marking its longest rally since January. Japan's equity benchmarks opened more than 1.3% higher. In the US, the S&P 500 closed 0.8% higher, setting a record for the third day in a row. US Treasury yields edged up as demand for safe-haven assets declined during Wednesday's session.

Markets On Home Turf

The benchmark equity indices closed higher on Wednesday, led by shares of HDFC Bank Ltd. and ICICI Bank Ltd.

The NSE Nifty 50 ended 159 points or 0.63% higher at 25,219.90, while the BSE Sensex closed 539.83 points or 0.66% up at 82,726.64.

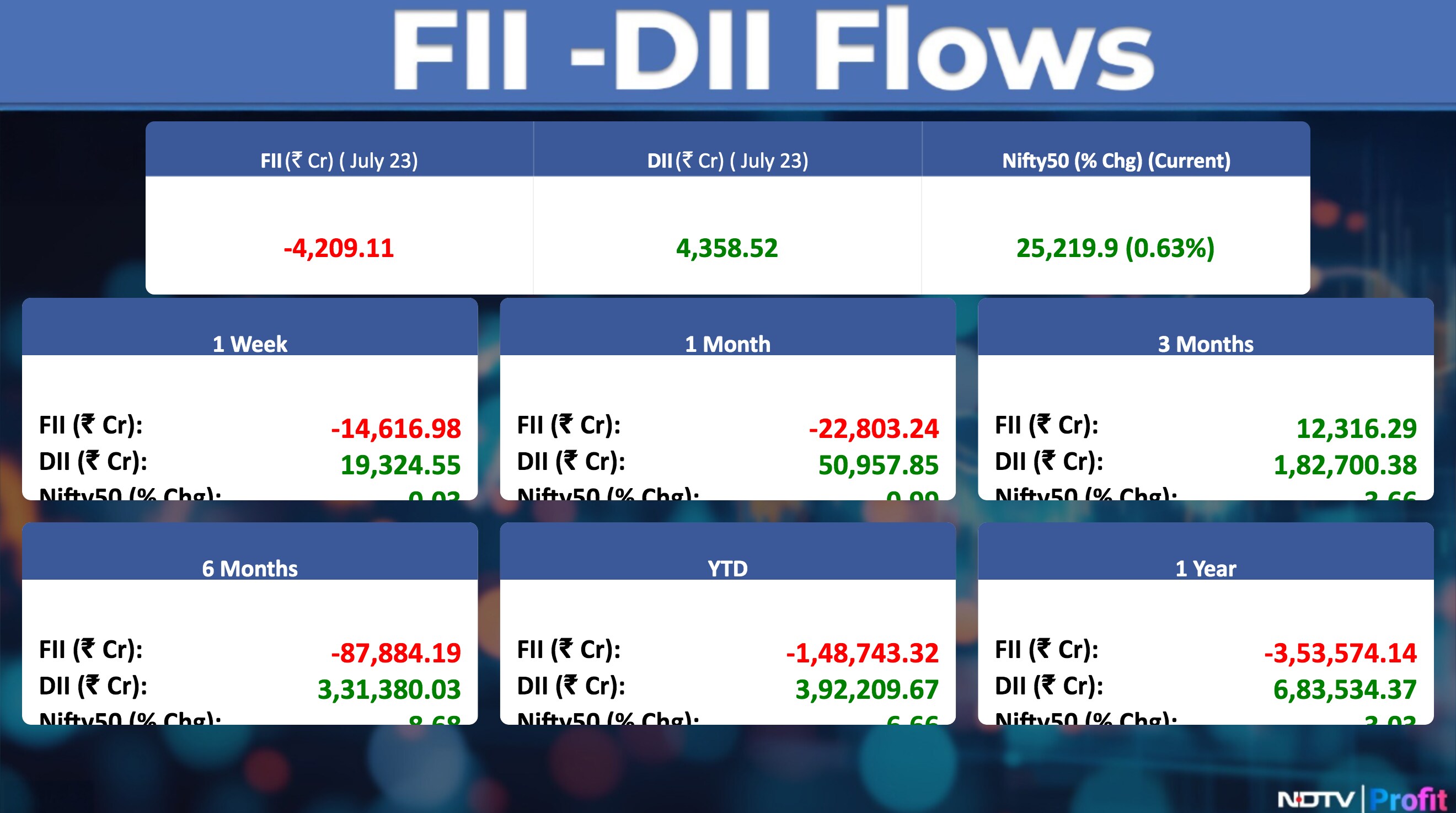

Foreign portfolio investors remained net sellers of Indian shares for the third consecutive day on Wednesday as they sold stocks worth Rs 4,209.11 crore, according to provisional data from the National Stock Exchange.

The domestic institutional investors, who stayed buyers for the 13th straight session, obtained stocks worth Rs 2,944.9 crore.

US Markets Update

The S&P 500 touched fresh highs amid reports that the US and European Union are nearing a trade agreement that would apply a 15% tariff to most goods. After market hours, Alphabet Inc. posted stronger-than-expected revenue but said its capital spending plans had increased. Tesla Inc. reported earnings below analysts' expectations.

The yield on 10-year US Treasuries rose by four basis points to 4.39%. A $13 billion sale of 20-year notes drew solid demand, but bond prices remained lower. Japan's 40-year bond auction attracted its weakest demand since 2011.

Earnings In Focus

Bajaj Finance, SBI Life Insurance, ACC, Mphasis, Nestle India, Adani Energy Solutions, V-Mart Retail, Aether Industries, Ajmera Realty & Infra India, Anant Raj, APL Apollo Tubes, Canara Bank, CG Power and Industrial Solutions, Coromandel International, Cyient, eClerx Services, Aditya Birla Sun Life AMC, eMudhra, IEX, Indian Bank, Indoco Remedies, Johnson Controls-Hitachi Air Conditioning India, KFin Technologies, LT Foods, Motilal Oswal Financial Services, The Phoenix Mills, REC, Supreme Industries, Tanla Platforms, Tatva Chintan Pharma Chem, Trident, Ujjivan Small Finance Bank, UTI Asset Management Company.

Earnings Post Markets

Infosys Q1 FY26 (Consolidated, QoQ)

Revenue up 3.3% to Rs 42,279.00 crore versus Rs 40,925 crore (Estimate: Rs 41,724 crore)

EBIT 3.3% to Rs 6,921 crore versus Rs 7,033 crore (Estimate: Rs 8,714 crore)

EBIT margin contracted by 20 basis points basis points at 20.8% versus 21% (Estimate: 20.91%)

Net profit down 2% to Rs 6,921 crore versus Rs 7,033 crore (Estimate: Rs 6,765 crore)

Large deal TCV at $3.8 billion versus $2.6 billion.

Attrition at 14.4% versus 14.1%.

Force Motors Q1 FY26 (Consolidated, YoY)

Revenue up 21.9% to Rs 2,297 crore versus Rs 1,885 crore.

Ebitda up 33.3% to Rs 332 crore versus Rs 249 crore.

Margin at 14.5% versus 13.2%.

Net profit up 52.4% to Rs 176 crore versus Rs 116 crore.

Cigniti Technologies Q1 FY26 (Consolidated, QoQ)

Revenue up 0.8% to Rs 534 crore versus Rs 530 crore.

EBIT flat at Rs 81.5 crore versus Rs 81.3 crore.

Margin stable at 15.3%.

Net profit down 10% to Rs 65.9 crore versus Rs 73.2 crore.

Bikaji Foods Q1 FY26 (Consolidated, YoY)

Revenue up 14.2% to Rs 653 crore versus Rs 572 crore.

Ebitda up 5% to Rs 96.2 crore versus Rs 91.6 crore.

Margin at 14.7% versus 16%.

Net profit up 2.8% to Rs 59.9 crore versus Rs 58.3 crore.

Tata Consumer Products Q1 FY26 (Consolidated, YoY)

Revenue up 9.8% to Rs 4,779 crore versus Rs 4,352 crore. (Estimate: Rs 4,813 crore).

Ebitda down 9% to Rs 607 crore versus Rs 667 crore. (Estimate: Rs 648 crore).

Margin at 12.7% versus 15.3%. (Estimate: 13.4%).

Net profit up 15.1% to Rs 334 crore versus Rs 290 crore. (Estimate: Rs 355 crore).

Key Highlights:

Strong growth in tea, salt and value-added salt (up 31%).

India packaged beverages revenue up 12%; coffee up 67%.

Tata Sampann continues momentum.

International business constant currency growth at 5%.

Dr Reddy's Laboratories Q1 FY26 (Consolidated, YoY)

Revenue up 11.4% to Rs 8,572 crore versus Rs 7,696 crore. (Estimate: Rs 8,693 crore).

Ebitda up 2% to Rs 2,174 crore versus Rs 2,130 crore. (Estimate: Rs 2,332 crore).

Margin at 25.4% versus 27.7%. (Estimate: 26.8%).

Net profit up 1.8% to Rs 1,418 crore versus Rs 1,392 crore. (Estimate: Rs 1,514 crore).

Segmental Performance:

North America: Rs 3,410 crore. (Down 11% YoY, down 4% QoQ).

Europe: Rs 1,270 crore. (Up 142% YoY, flat QoQ).

India: Rs 1,470 crore. (Up 11% YoY, up 13% QoQ).

Thyrocare Technologies Q1 FY26 (Consolidated, YoY)

Revenue up 23% to Rs 193 crore versus Rs 157 crore.

Ebitda up 35.5% to Rs 57.8 crore versus Rs 42.6 crore.

Margin at 29.9% versus 27.2%.

Net profit up 61% to Rs 38.9 crore versus Rs 24.2 crore.

Bajaj Housing Finance Q1 FY26 (YoY)

Total income up 18.6% to Rs 2,618.45 crore versus Rs 2,208.73 crore.

Net profit up 20.9% to Rs 583.3 crore versus Rs 482.61 crore. (Estimate: Rs 568 crore).

Persistent Systems Q1 FY26 (Consolidated, QoQ)

Revenue up 2.8% to Rs 3,334 crore versus Rs 3,242 crore.

EBIT up 2.5% to Rs 518 crore versus Rs 505 crore.

Margin at 15.5% versus 15.6%.

Net profit up 7.4% to Rs 425 crore versus Rs 396 crore.

Coforge Q1 FY26 (Consolidated, QoQ)

Revenue up 8.2% to Rs 3,688.6 crore versus Rs 3,409.9 crore. (Estimate: Rs 3,723 crore).

EBIT up 4% to Rs 417.8 crore versus Rs 401.6 crore. (Estimate: Rs 503 crore).

Margin at 11.3% versus 11.8%. (Estimate: 13.5%).

Net profit up 22% to Rs 317.4 crore versus Rs 261.2 crore. (Estimate: Rs 335 crore).

Oracle Financial Services Q1 FY26 (Consolidated, QoQ)

Net profit down 0.3% to Rs 642 crore versus Rs 644 crore.

Total income up 7% to Rs 1,925 crore versus Rs 1,798 crore.

Supreme Petrochem Q1 FY26 (YoY)

Revenue down 11.9% to Rs 1,387 crore versus Rs 1,573 crore.

Ebitda down 28.8% to Rs 115 crore versus Rs 161 crore.

Margin at 8.3% versus 10.2%..

Net profit down 33.6% to Rs 80.9 crore versus Rs 121.9 crore.

Stocks In News

MCX: The company clarified that trading started late today due to a delay in clearing technical processes, which has now been resolved.

Natco Pharma: The company acquired a 35.75% stake in Adcock Ingram for Rs 2,000 crore. The acquisition is aimed at incorporating an arm, Natco Pharma South Africa Proprietary, with an investment of up to Rs 2,100 crore.

Enviro Infra Engineers: Soltrix Energy Solution has become a step-down arm of the company.

Share India Securities: The board will meet on 30 July to consider raising funds via NCDs.

Rites: The company entered into an agreement with Coal India's arm to tap into mining and renewable energy operations.

Birlasoft: The company announced the resignation of Kamini Shah as CFO, effective Aug. 7, due to personal reasons. Chandrasekar Thyagarajan has been appointed CFO effective Aug. 8.

Sunteck Realty: The company signed a joint development agreement for a project on 3.5 acres of land in Mumbai.

Tanla Platforms: The company entered into an agreement with an overseas telecom operator for the deployment of its AI native platform.

Angel One: The company received approval to invest in LivWell Holding for a life insurance business. It has invested up to Rs 104 crore for a 26% stake in an insurance joint venture with LivWell Holding.

AllCargo Logistics: The company's LCL volume stood at 707,000 cubic metres in June 2025, a decline of 3% compared to the previous month and 9% compared to last year.

BEML: The company received an order worth Rs 294 crore from the Ministry of Defence for the supply of HMV 6x6 vehicles.

Inox Wind: The company approved a rights issue of 10 crore shares at an issue price of Rs 120 per share.

Religare Enterprises: The Reserve Bank of India has withdrawn all restrictions placed on Religare Finvest Ltd under the corrective action plan, marking the end of a more than seven-year regulatory curb.

IndusInd Bank: The company approved raising Rs 20,000 crore via debt securities on a private placement basis, and further approved a Rs 10,000 crore issue or placement of securities including ADR, GDR, and QIP.

Mukand: The company executed an agreement for the sale of land parcels in Thane for Rs 673 crore and received an advance of Rs 110 crore.

Fortis Healthcare: The company announced a collaboration with Gleneagles Healthcare India to strengthen business growth.

Satin Creditcare: The company approved the incorporation of a new arm, Satin Growth Alternatives.

Monarch Networth Capital: The company received in-principle approval from SEBI to set up a proposed mutual fund.

India Pesticides: The company approved the appointment of Udaya Bhaskar Mantripragada as an additional director in the capacity of Whole-Time Director.

Kolte Patil: The board will meet on July 29 to consider raising funds via debt.

Hinduja Global Solutions: Step-down arm Hinduja Global Solutions MENA FZ-LLC has been voluntarily liquidated.

Crompton Greaves: The company launched Star VegaNXT 20W and 30W lighting products for the domestic market.

Delhivery: The company completed the acquisition of the remaining 21.12% stake in Ecom Express.

Indian Metals & Ferro Alloys: The company incorporated a wholly owned arm, Metallix Aviation, for its aviation business.

Veranda Learning: The company initiated a restructuring process involving the demerger of its commerce vertical. It will also acquire the remaining 24% stake in its arm Veranda XL. Besides, the board will meet on July 28 to consider the issuance of securities on a preferential basis.

India Pesticides: The company will implement a 4,000 MT project at its Sandila plant with an expected investment of Rs 65 crore.

Welspun Corp: The company sold a further 9.9% stake in Nauyaan Shipyard to Reliance Strategic Business's arm for Rs 55 crore.

Tilaknagar Industries: The arm will acquire the Imperial Blue brand of Pernod Ricard for an enterprise value of Rs 4,150 crore on a slump sale basis.

Brokerage Radar

On Dr Reddy's Laboratories

Macquarie

Maintained Neutral rating with price target of Rs 1,190

Q1 FY26 results showed a modest miss

North America sales fell due to price erosion and order timing issues

Revlimid continues to face pricing pressure, with lower contribution expected in Q3

BofA Securities

Maintained Buy rating

Raised price target to Rs 1,600 from Rs 1,500

Margin performance was in line despite sharp erosion in gRevlimid

Multiple growth drivers support 25% margin outlook: semaglutide, core business growth, cost management

FY26 earnings reduced due to faster-than-expected erosion in Revlimid

FY27 EPS remains unchanged with core business performing steadily

Morgan Stanley

Maintained Equal-weight rating with price target of Rs 1,298

Q1 results were in line

Margin declined due to higher generic price erosion and lower operating leverage

Sema approval expected between October and November 2025; launch set for January 2026

On Infosys

Morgan Stanley

Maintained Equal-weight rating

Raised price target to Rs 1,700 from Rs 1,670

Q1 performance viewed as balanced relative to peers

Revenue growth for FY26 expected near the top end of guidance

Margins expected above midpoint

Infosys likely to post the strongest EBIT growth among large caps in FY26

BofA Securities

Maintained Buy rating with price target of Rs 1,840

Q1 beat highlights gains in market share and improved pricing

Commentary strong on participation in AI opportunity

Macquarie

Maintained Neutral rating

Cut price target to Rs 1,490 from Rs 1,500

Unbilled revenue rose QoQ, EBIT fell short of estimates

Top-end of guidance was not revised upward despite acquisition impact

Raised FY26–28 revenue forecast by 1.8–2.2%, lowered EBIT margin by 1–15 basis points

IPO Offering

Indiqube Spaces: The public issue was subscribed to 0.87 times on day 1. The bids were led by Qualified institutional investors (0.06 times), non-institutional investors (0.78 times), retail investors (3.41 times) and reserved for employees (2.83 times).

GNG Electronics: The public issue was subscribed to 8.99 times on day 1. The bids were led by Qualified institutional investors (1.68 times), non-institutional investors (18.85 times), retail investors (8.89 times).

Brigade Hotel Ventures: The company will offer shares for bidding on Thursday. The price band is set from Rs 85 to Rs 90 per share. The Rs 759.6-crore IPO is entirely a fresh issue.

Bulk Deals

Arisinfra Solutions: Neomile Corporate Advisory bought 14.8 lakh shares (1.83%) at Rs 146 apiece.

Lodha Developers: Invesco Developing Markets Fund sold 95.25 lakh shares (0.95%) at Rs 1,384 apiece.

Oberoi Realty: Invesco Developing Markets Fund sold 1.07 cr shares (2.95%) at 1,754 apiece, while SBI Mutual Fund bought 40.94 lakh shares (1.12%) at Rs 1,754 apiece.

Trading Tweaks

Ex-Dividend: UTI AMC, Cholamandalam Investment and Finance, Crompton Greaves Consumer Electronics, Hatsun Agro Product, Hero MotoCorp, Radico Khaitan, TCPL Packaging.

Ex-Rights Issue: Spandana Spoorty Financial.

Price Band change to 5% from 10%: SML Isuzu.

List of securities shortlisted in Short-Term ASM Framework Stage – I: Tilaknagar Industries, Vertoz.

List of securities to be excluded from ASM Framework: SML Isuzu, Bhagyanagar India.

List of securities shortlisted in Long - Term ASM Framework Stage – I: SML Isuzu.

F&O Cues

Nifty July futures up by 0.13% to 25,254 at a premium of 35 points.

Nifty July futures open interest down by 3.52%.

Nifty Options 24 July Expiry: Maximum Call open interest at 25500 and Maximum Put open interest at 25,100.

Securities in ban period: Bandhan Bank, RBL bank, IEX

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.