Good morning!

The GIFT Nifty is trading 76 points higher or 0.3% at 25,160, as of 7:55 a.m., indicating a positive start for the benchmark Nifty 50. Meanwhile, US and European index futures rose amid a rally in Asian equities.

S&P 500 futures up 0.2%

Euro Stoxx futures up 0.6%

Watch NDTV Profit Live

Markets On Home Turf

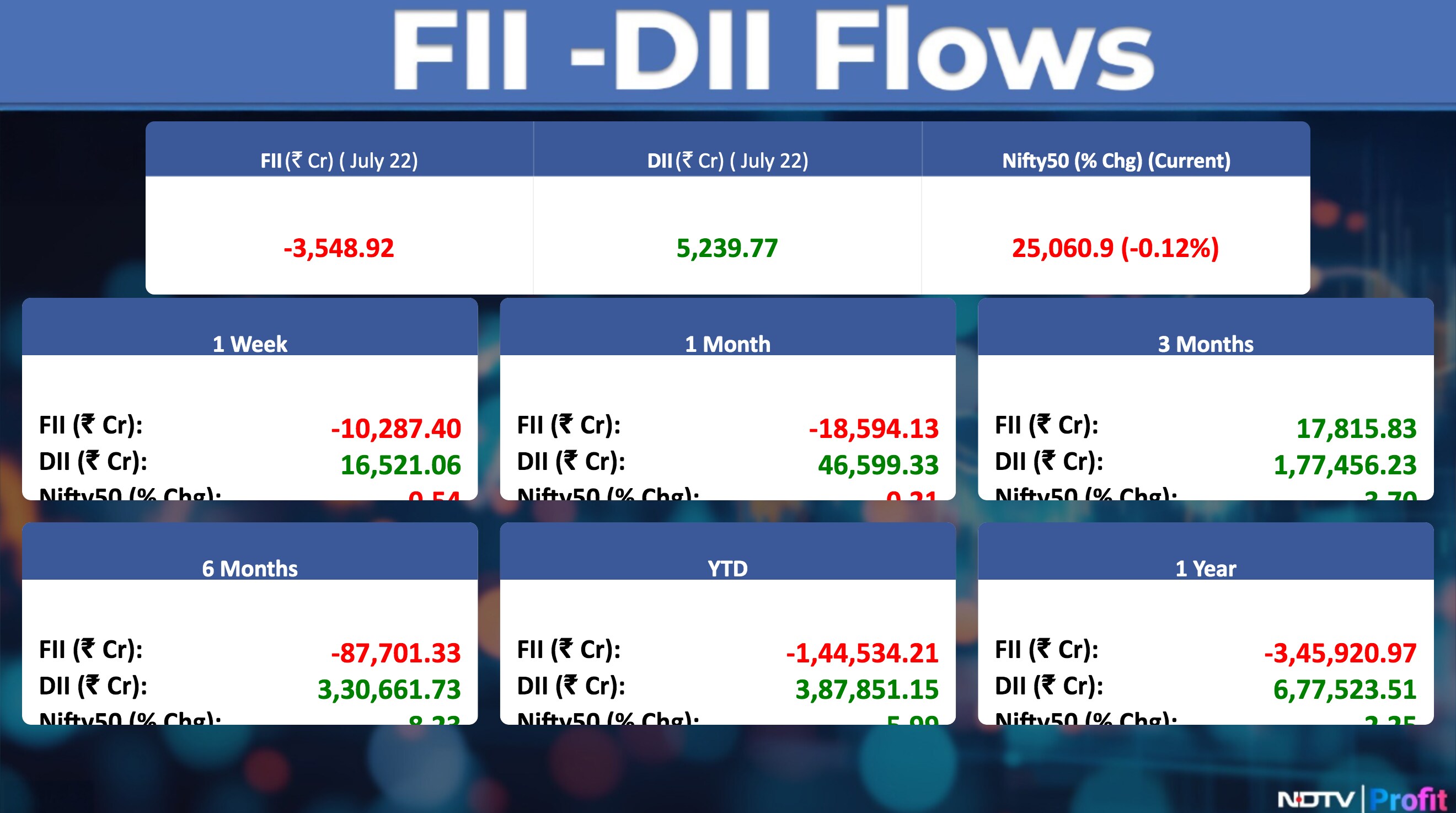

The benchmark equity indices ended the session on a flat note on Tuesday as shares of Reliance Industries Ltd. and Infosys Ltd. weighed.

The NSE Nifty 50 ended 29.8 points or 0.12% lower at 25,060.9, while the BSE Sensex closed 13.53 points or 0.02% down at 82,186.81.

Wall Street Recap

The S&P 500 reversed earlier losses to set a fresh record on Tuesday, as investors rotated into defensive areas while technology stocks struggled. The stock benchmark closed 0.06% higher, after shuffling between gains and losses for most of the session. The tech-heavy Nasdaq 100 Index fell 0.5%. The 30-stock Dow Jones Industrial Average settled 0.4% higher.

Asia Market Update

Asian shares rose at the open after President Donald Trump said the US reached a trade deal with Japan, Phillipines and Indonesia. The MSCI gauge of Asian shares gained 0.7%.

Nikkei up 2.35%

Topix up 2.4%

Kospi down 0.1%

S&P/ASX 200 up 0.35%

Hang Seng futures up 1%

Commodities Check

Oil edged higher as investors monitored progress on tariff talks between the US and its key trade partners. Brent rose toward $69 a barrel after a three-day decline, while West Texas Intermediate was near $66 a barrel.

Prices of most industrial metals traded higher on the London Metal Exchange, amid brighter demand outlook following US trade deal announcement.

Copper up 0.6%

Aluminium up 0.4%

Nickel flat

Zinc up 0.7%

Lead down 0.2%

Earnings In Focus

Aditya Birla Real Estate, Bajaj Housing Finance, Bikaji Foods International, Cigniti Technologies, CMS Info Systems, Coforge, Dr Reddy's Laboratories, Force Motors, Infosys, Maharashtra Scooters, MAS Financial Services, Mahindra Holidays & Resorts India, Oracle Financial Services Software, PCBL Chemical, Persistent Systems, Sapphire Foods India, Sky Gold and Diamonds, Supreme Petrochem, SRF, Syngene International, Syrma SGS Technology, Tata Consumer Products, Thyrocare Technologies, Westlife Foodworld.

Earnings Post Market Hours

One 97 Communications Q1 FY26 Highlights (Cons, QoQ)

Revenue up 0.31% at Rs 1917 crore versus Rs 1911 crore.

Ebitda at Rs 71 crore versus loss of Rs 89.5 crore.

Ebitda margin 3.7%

Net profit Rs 122.5 crore versus loss of Rs 544.6 crore.

EBbitda and profit turned profitable due to AI-led operational leverage, better cost structure and higher other income.

Revenue from distribution of financial services up 100% to Rs 561 crore.

Distribution of financial services was driven by an increase in merchant loans, trail revenue from DLG portfolio and better collections.

Marketing expenses down 65% YoY, ESOP cost down 88% is aiding Profitability.

Zensar Tech Q1FY26 (Cons QoQ)

Revenue is up 1.9% at Rs 1,385 crore versus Rs 1,359 crore (estimate Rs 1375 crore)

EBIT down 0.6% at Rs 188 crore versus Rs 189 crore

EBIT margin at 13.5% versus 13.9%.

Net Profit is up 3.2% at Rs 182 crore versus Rs 176 crore (estimate Rs 172 crore)

Co reports 1.9% in constant currency growth

US region saw a sequential QoQ growth of 4.3%

Europe region saw a sequential QoQ decline of 5.8%

Highest growth was seen in Media and Technology of 5.5% QoQ

Deal wins for Q1 stands at $172 M vs $213.5M in Q4

Attrition for Q1 at 9.8% vs 9.9% in Q4

Dixon Technologies Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 95.1% to Rs 12,835.66 crore versus Rs 6,579.80 crore.

Ebitda up 95% to Rs 482.37 crore versus Rs 247.90 crore.

Margin at 3.8% versus 3.8%.

Net Profit up 68% to Rs 224.97 crore versus Rs 133.68 crore.

Dalmia Bharat Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 0.4% to Rs 3,636 crore versus Rs 3,621 crore.

Ebitda up 32% to Rs 883 crore versus Rs 669 crore.

Margin at 24.3% versus 18.5%.

Net Profit up 179% to Rs 393 crore versus Rs 141 crore.

Exceptional loss of 113 crore in Q1 FY25.

United Breweries Q1 Earnings Key Highlights (Standalone, YoY)

Revenue rises 15.7% to Rs 2,862 crore versus Rs 2,472 crore.

Ebitda up 9% to Rs 310.52 crore versus Rs 284.74 crore.

Margin at 10.8% versus 11.5%.

Net Profit up 6% to Rs 183.71 crore versus Rs 173.28 crore.

Jana Small Finance Bank Q1 Earnings Highlights

NII down 2.4% at Rs 595 crore vs Rs 609 crore.

Gross NPA at 2.91% Vs 2.71% (QoQ).

Net NPA Flat at 0.94% (QoQ).

Net Profit down 40.2% at Rs 101.9 crore vs Rs 170.5 crore.

Huhtamaki Q1 Earnings Key Highlights (YoY)

Revenue drops 4.3% to Rs 612 crore versus Rs 639 crore.

Ebitda rises 33.3% to Rs 42.6 crore versus Rs 32 crore.

Margin at 7% versus 5%.

Net profit falls 35.3% to Rs 24.9 crore versus Rs 38.5 crore.

CreditAccess Grameen Q1 Earnings Key Highlights (YoY)

Total Income falls 3.2% at Rs 1,464 crore versus Rs 1,513 crore.

Net Profit falls 84.9% to 60.2 crore versus Rs 398 crore.

NII down 2.27% at Rs 906 crore versus Rs 927 crore.

Impairment at Rs 571 cr vs 174 cr.

GNPA at 4.7% vs 4.76% (QoQ)

NNPA at 1.78% vs 1.73% (QoQ)

Welspun Specialty Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue rises 24.2% at Rs 201 crore versus Rs 162 crore.

Ebitda falls 60.4% to Rs 4.3 crore versus Rs 10.9 crore.

Margin contracts to 2.1% versus 6.7%.

Net loss at Rs 8 lakh versus profit of Rs 2 crore.

KEI Industries Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 25.4% to Rs 2,590.32 crore versus Rs 2,065.02 crore.

Net Profit up 30% to Rs 195.75 crore versus Rs 150.25 crore.

Ebitda up 18% to Rs 258.01 crore versus Rs 219.08 crore.

Margin at 10% versus 10.6%.

JSW Infrastructure Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 21.2% to Rs 1,223.85 crore versus Rs 1,009.77 crore.

Net Profit up 32% to Rs 384.68 crore versus Rs 292.44 crore.

Ebitda up 32% to Rs 581.16 crore versus Rs 440.12 crore.

Margin at 47.5% versus 43.6%.

Cyient DLM Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 8.0% to Rs 278.43 crore versus Rs 257.89 crore.

Net Profit down 30% to Rs 7.46 crore versus Rs 10.60 crore.

Ebitda up 25% to Rs 25.07 crore versus Rs 19.99 crore.

Margin at 9% versus 7.8%

Stocks In News

BGR Energy: Tamil Nadu Power Corporation has terminated BGR Energy's Rs 2,600 crore contract due to non-fulfilment of project obligations, incomplete critical systems, and insurance compliance issues.

Oberoi Realty, Lodha Developers: A clean-up trade by Invesco Developing Markets Fund is reportedly set to take place, with Goldman Sachs acting as banker for both transactions. The block deal in Oberoi Realty is valued at $230 million, with shares offered at a floor price of Rs 1,753.2, representing a 4% discount to the market price. Similarly, the Lodha Developers deal is pegged at $165 million at a 4% discount, with a floor price of Rs 1,384.6.

Siemens Energy India: A Russian arbitration court has ordered the company to pay Rs 443.76 million plus 8% interest after invalidating a transferred supply contract and advance payments.

Jindal Steel & Power: The company has officially changed its name to Jindal Steel Limited, effective July 22, 2025, to reflect a sharper focus on its core steel business.

Sandhar Tech: The company has entered into a power purchase agreement with clean renewable energy firm KK 1A for contracted energy procurement.

Shyam Metallics and Energy: The company proposes to raise up to Rs 4,500 crore through issuance of equity shares and/or other eligible securities via private placement (including QIP), further public issue, preferential issue, or any other permissible route.

Tilaknagar Industries: The company issued a clarification that it explores strategic opportunities from time to time, but no event has occurred warranting a stock exchange disclosure. This comes in response to media reports linking Tilaknagar to a potential acquisition of the Imperial Blue brand, which led to a spike in its share price.

Vardhman Special Steels: The company has executed amended agreements with ASG HOLDCO BETA and Sone Solar for a 55 MW DC solar plant in Punjab.

KNR Constructions: The Delhi High Court ruled that the NHAI suspension order against KNR Ramanattukara Infra, a wholly owned subsidiary, has expired, thus lifting its disqualification from bidding on new projects.

Zensar Technologies: The board has granted in-principle approval to set up a new entity in the Republic of Serbia for software and allied services.

Simplex Infrastructures: The Committee of Directors approved the allotment of 10 lakh equity shares worth Rs 29.40 crore to ICICI Bank and 1.7 lakh shares worth Rs 5.09 crore to National Asset Reconstruction Company, both at Rs 294 per share, via conversion of outstanding dues.

Hyundai Motor India: The company has received a GST Compensation Cess demand order of Rs 258.67 crore, along with an equal penalty, totalling Rs 517.34 crore, for alleged short payment on certain SUV models from September 2017 to March 2020.

Dalmia Bharat: Subsidiary Dalmia Cement will increase clinker capacity by 3.6 MT and cement capacity by 6 MT at its Kadapa plant.

Kirloskar Ferrous Industries: The company has emerged as the preferred bidder in the e-auction of an iron ore mine.

Man Infra: The board has approved conversion of 1.58 crore convertible warrants into equity shares, aggregating to Rs 184 crore.

Cholamandalam Investment: The board will meet on 31 July to consider the issuance of non-convertible debentures.

HFCL: The board will consider fund raising via equity-linked instruments on 25 July.

Patel Engineering: The board will meet on 25 July to decide on matters related to issuance of debentures.

Denta Water: The company has secured new orders worth Rs 183 crore across seven projects and has reappointed Manish Jayasheel Shetty as Managing Director for another three years.

Oswal Pumps: The company has completed the acquisition of 5.2 crore equity shares in Oswal Solar Structure, a wholly owned subsidiary, for Rs 303.76 crore.

Infosys: The company has announced an extended strategic collaboration with AGCO Corporation to transform its IT infrastructure and HR operations.

Exide Industries: The company has invested an additional Rs 100 crore via rights issue in its wholly owned subsidiary Exide Energy Solutions, bringing total investment to Rs 3,702.23 crore.

Uno Minda: Through its step-down subsidiary Minda Industries Vietnam Company, the company has completed the acquisition of Friwo Vietnam Company's e-Drives business assets.

DCW: The company has commissioned the first phase of its CPVC capacity expansion ahead of schedule, adding 20,000 MT and taking total capacity to 40,000 MT.

Shoppers Stop: The company will begin operations at its new warehouse in Lakkenahalli Village, Bengaluru, Karnataka.

Hero MotoCorp: The company has launched the new HF Deluxe Pro motorcycle, priced at Rs 73,550.

Veranda Learning: The company has closed its QIP and approved allocation of 1.58 crore shares at Rs 225.2 per share.

IPO Offering

Indiqube Spaces: The company will offer shares for bidding on Wednesday. The price band is set from Rs 225 to Rs 237 per share. The Rs 700-crore IPO is a combination of fresh issue of Rs 650 crore and rest offer for sale. The company raised Rs 314 crore from anchor investors.

GNG Electronics: The company will offer shares for bidding on Wednesday. The price band is set from Rs 225 to Rs 237 per share. Rs 460.43-crore IPO is a combination of fresh issue of Rs 400 crore and rest offer for sale. The company raised Rs 138 crores from anchor investors.

Bulk & Block Deals

Polyplex Corporation: First water fund bought and Haresh Tikamdas Kaswani sold 2 lk shares (0.63%) at rs.1125 per share

Vintage Coffee: Jitendra Rasiklal Sanghavi bought 4.75 lk shares (0.37%) at Rs. 147.92 apiece

360 ONE WAM: BC Asia Investments x Limited sold 1.5 crore shares or 3.71% at an avg price of Rs.1160.76 per share.

Sambhv Steel Tubes: SSPL Securities bought 15 lk shares (0.51%) at Rs. 142.44 apiece.

Pledge Shares Details

Geojit Financial Services Ltd: Promoter BNP Paribas SA disposed of 2.01lk shares.

Trading Tweaks

Ex-Dividend: D. B Corp, Aditya Birla Sun Life AMC, Advanced Enzyme Tech, Nesco, Greaves Cotton, Sonata Software, Heritage foods, Pidilite Industries, Route Mobile, K.P.R Mills.

Ex-Buyback- Tanla Platforms.

Ex-Rights Issue: Mahindra Logistics.

F&O Cues

Nifty July futures down by 0.13% to 25,095 at a premium of 34.1 points.

Nifty July futures open interest down by 0.48%.

Nifty Options 24 July Expiry: Maximum Call open interest at 25100 and Maximum Put open interest at 25,000.

Securities in ban period: Bandhan Bank, RBL Bank, IEX.

Currency And Bond

The Indian rupee weakened 8 paise to end lower against the US Dollar, settling at 86.37, effectively extending its losing streak to five consecutive days. The yield on the benchmark 10-year bond settled one basis points higher at 6.31%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.