Good morning!

The GIFT Nifty gained 95 points or 0.38% to 25,184 as of 7:25 a.m., indicating a higher start for the benchmark Nifty 50.

Watch NDTV Profit Live

Markets On Home Turf

The benchmark equity indices snapped three sessions of losses on Monday as shares of ICICI Bank Ltd. and HDFC Bank Ltd. led the gains.

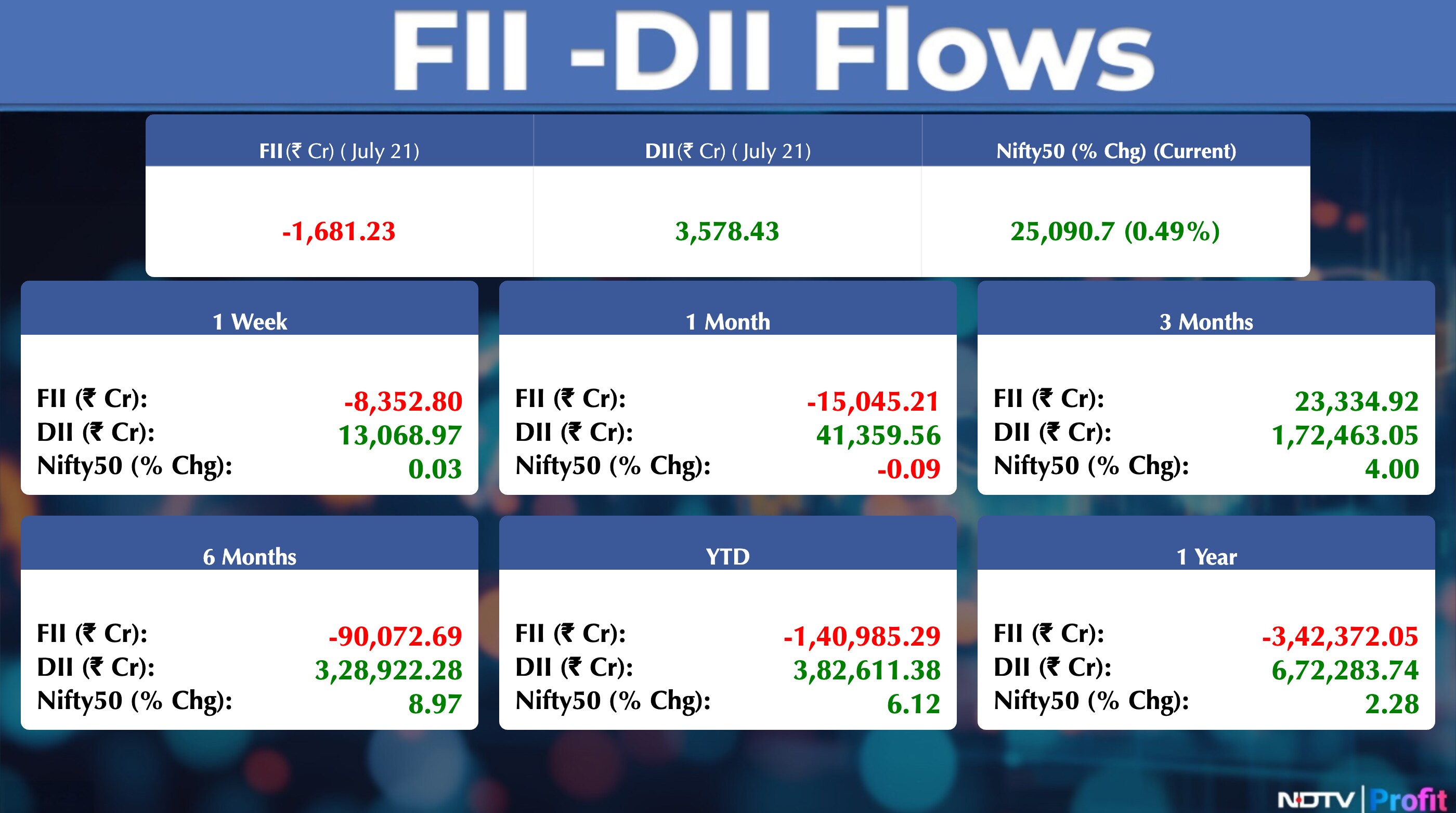

The NSE Nifty 50 ended 122.3 points or 0.49% higher at 25,090.7, while the BSE Sensex gained 442.61 points or 0.54% to close at 82,200.34.

Wall Street Recap

US stocks reached new record highs on Monday, propelled by a busy earnings week featuring upcoming quarterly reports from big names like Tesla Inc. and Alphabet Inc.

The S&P 500 closed at an all-time high of 6305.60, up 0.1% after trimming earlier advances. The Nasdaq 100, heavily weighted in technology stocks, also hit a new high, ending the day with a 0.5% gain. The Dow Jones Industrial Average was flat.

Asia Market Update

Asian stocks posted a modest gain with Japanese markets staging a relief rally after Prime Minister Shigeru Ishiba said he would carry on as leader even after the ruling coalition lost its majority in the upper house election. The MSCI regional stock gauge advanced 0.1% after the S&P 500 index closed above 6,300 for the first time.

Nikkei up 0.25%

Topix up 0.2%

Kospi down 0.5%

S&P/ASX 200 flat

Hang Seng futures flat

Commodities Check

Oil was little changed after two modest declines as talks between the US and its trading partners gain urgency ahead of next week's deadline. International benchmark Brent traded near $69 a barrel while West Texas Intermediate was around $67.

Price of key industrial metals were up on the London Metal Exchange.

Copper up 0.8%

Aliminium up 0.65%

Nickel up 2%

Zinc up 0.7%

Lead up 0.2%

Earnings In Focus

Aurionpro Solutions, Blue Jet Healthcare, Colgate Palmolive (India), CreditAccess Grameen, Cyient DLM, Dalmia Bharat, Dixon Technologies (India), Goodluck India, Huhtamaki India, Ideaforge Technology, IRFC, Jana SFB, JSW Infra, Kajaria Ceramics, KEI Industries, Kirloskar Pneumatic Company, Mahindra & Mahindra Financial Services, Mahanagar Gas, One 97 Communications, Shyam Metalics and Energy SML Isuzu, United Breweries, VST Industries, Vardhman Textiles, Welspun Specialty Solutions, Zee Entertainment Enterprises, Zensar Technologies.

Earnings Post Markets

Sagar Cements Q1FY26 Highlights (Consolidated, YoY)

Revenue up 19.6% at Rs 671 crore versus Rs 561 crore.

Ebitda at Rs 121 crore versus Rs 46.8 crore.

Margin at 18.1% versus 8.3%.

Net Profit at Rs 1.2 crore versus loss of Rs 28.3 crore.

CIE Automotive Q1FY26 Highlights (Consolidated, YoY)

Revenue up 3.3% at Rs 2,369 crore versus Rs 2,293 crore.

Ebitda down 6.4% at Rs 337 crore versus Rs 360 crore.

Margin at 14.2% versus 15.7%.

Net Profit down 6.1% at Rs 204 crore versus Rs 217 crore.

Agi Greenpac Q1FY26 Highlights (Consolidated, QoQ)

Revenue down 2.4% at Rs 688 crore versus Rs 705 crore.

Ebitda down 7.9% at Rs 142 crore versus Rs 154 crore.

Margin at 20.7% versus 21.9%.

Net Profit down 7.1% at Rs 88.9 crore versus Rs 95.6 crore.

Oberoi Realty Q1FY26 Highlights (Consolidated, YoY)

Revenue down 29.7% at Rs 988 crore versus Rs 1,405 crore.

Ebitda down 36.2% at Rs 520 crore versus Rs 815 crore.

Margin at 52.7% versus 58%.

Net Profit down 27.9% at Rs 421 crore versus Rs 585 crore.

DCM Shriram Q1FY26 Highlights (Consolidated, YoY)

Revenue up 13.4% at Rs 3,262 crore versus Rs 2,876 crore.

Ebitda up 22.9% at Rs 305 crore versus Rs 248 crore.

Margin at 9.3% versus 8.6%.

Net Profit up 13% at Rs 113 crore versus Rs 100 crore.

PNB Housing Finance Q1FY26 Highlights (Standalone, YoY)

Net interest income up 16% to Rs 733.57 crore versus Rs 631.25 crore.

Net Profit down 6.2% at Rs 531.73 crore versus Rs 567.11 crore.

Total income up 13.6% at Rs 2,070.61 crore versus Rs 1,822.01 crore.

Parag Milk Foods Q1 FY26 (Cons, YoY)

Revenue up 12.26% at Rs 851 crore versus Rs 758 crore.

Ebitda up 2.32% at Rs 57.3 crore versus Rs 56 crore.

Ebitda margin down 65 bps at 6.73% versus 7.38%.

Net profit up 0.73% at Rs 27.5 crore versus Rs 27.3 crore

Havells India Q1FY26 Highlights (Cons, YoY)

Revenue down by 6% at Rs. 5,455 crores versus Rs. 5,806 crores

EBITDA down 9.9% At Rs. 516 crores versus Rs. 572 crores

Margin at 9.5% vs 9.9%.

Net Profit down 14.8% At Rs. 348 crores versus Rs. 408 crores

Stocks In News

Bajaj Finance: Managing Director Anup Saha resigned due to personal reasons. Rajeev Jain will assume leadership as Vice Chairman and MD until March 2028, ensuring smooth succession and business continuity.

360 One WAM: Bain Capital (BC Asia Investments X) is selling 15 million shares or 3.7% stake in 360 One WAM. The block deal is worth approximately USD 202 million. The floor price is set at Rs 1,160 per share, implying a 5% discount on the last closing price. The seller will be under a 120-day lock-up post-sale.

State Bank of India: The company closed a QIP and approved the allocation of 30.6 crore shares at issue price of Rs 817 per share.

Afcons Infra: The company secured a major railway project in Croatia worth €677 million (Rs 6,800 crore). The project covers railway reconstruction, new track construction, electrification, and signalling works.

LIC: The company increased its stake in SBI to 9.49% from 9.21%. The company bought 6.12 crore shares at Rs 817 per share.

Dr.Reddy's: USFDA end Inspection at New York Facility & issued establishment inspection report with voluntary action indicated classification.

Simplex Infrastructures: The company approved the conversion of 8.65 lakh convertible warrants into equivalent number of shares at issue price of Rs 289.

Zota Health Care: The company approved the allotment of 2.1 lakh shares at an issue price of Rs 509 per share upon conversion of warrants. The allottees includes Ramesh S Damani (1 lakh shares) and Akshat Greentech (1.1 lakh shares)

BL Kashyap: The company received a Rs 910 crore order for the construction & supervision of Civil structure work from BPTP.

Samvardhana Motherson International: The company approved allotment of Rs 352 crore bonus shares aggregating to Rs 352 crore.

Arisinfra Solutions: The company received Rs 340 crore order for the supply of construction materials for the Transcon group's ongoing projects in Mumbai.

Quality Power: The company received an order worth Rs 10 crore for supply of dry-type shunt reactors for a hyperscale data centre project in Finland.

Rajoo Engineers: The company closed QIP, approved allocation of 1.47 crore shares at an issue price of Rs 109 per share.

CCL Products: The company re-appointed Challa Rajendra Prasad as Executive Chairman effective April 1, 2026.

Titan Co: The company to acquire 67% stake in Damas LLC. The valuation of the acquisition is arrived at an enterprise value of AED 103.8 million.

Jtekt: The company approved the rights issue of 2.3 crore shares up to Rs 250 crore at an issue price of Rs 108.1 per share.

Cummins India: The company approved the appointment of Soma Dilip Ghosh as Chief Financial Officer.

IIFL Capital Services: The company's arm IIFL Wealth (UK) voluntarily dissolves.

Torrent Pharma: The board is to meet on July 28 to consider the issue of NCDs or bonds via private placement.

Arvind Smartspaces: The company appointed Priyansh Kapoor as whole-time director and CEO effective August 9.

Brigade Enterprises: The Brigade Group acquired 20-acre land in Bengaluru for Rs 588 crore.

Cipla: The company entered into definitive agreements to acquire 20% voting rights in iCaltech innovations.

Stocks On Brokerage Radar

Morgan Stanley On PNB Housing

Maintain 'Overweight' with a target price of Rs 1,350.

Q1 Pnet profit beat expectations, driven by Pre-Provisioning Operating Profit (PPOP) and credit costs.

The PAT beat was specifically owing to a higher than expected credit cost reversal.

Investor focus during the earnings call is likely to be on the guidance for NIM progression, reflecting the impact of rate cuts on prime home loan book yields.

Jefferies On Can Fin Homes

Maintain 'Buy'; Hike target price to Rs 950 from Rs 900.

Q1 results showed subdued growth, but it is expected to gradually improve.

Net Interest Margins (NIMs) could expand further in the near term despite recent cuts in home loan rates.

Asset quality and credit costs are anticipated to remain stable.

We expect a 13% EPS CAGR and 16-18% Return on Equity (ROE) over FY26-28.

Valuations currently appear reasonable.

Bulk Deals

Jayaswal Neco: Assets care and reconstruction sold 85.5 lakh shares or 0.88% of equity at 38.55 per share.

Pledge Shares

Algoquant Fintech Ltd: Promoter Algoquant Financials LLP revoked 75,000 shares.

Trading Tweaks

List of securities shortlisted in Short-Term ASM Framework Stage - I: Garuda Construction and Engineering, Safe Enterprises Retail Fixtures.

List of securities to be excluded from ASM Framework: Sambhv Steel Tubes, Veranda Learning Solutions.

Price Band change to 5% from 10%: Jaiprakash Power Ventures.

Ex-Dividend: Strides Pharma Science, Happy Forgings, Siyaram Silk Mills, Voltamp Transformers, Happy Forgings, Hindustan Rectifiers.

F&O Cues

Nifty July Futures down by 0.43% to 25,139.70 at a premium of 49 points.

Nifty July futures open interest down by 3.31%.

Nifty Options 24 July Expiry: Maximum Call open interest at 26,000 and Maximum Put open interest at 24,000.

Securities in ban period: Bandhan Bank, RBL Bank.

Currency And Bond

The Indian rupee closed 14 paise weaker at 86.29 against the US dollar on Monday, marking its lowest closing level since June 23. The yield on the benchmark 10-year bond settled one basis points lower at 6.30%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.