The GIFT Nifty is up 46 points or 0.16% at 25,277 as of 8:25 a.m., indicating a higher start for the benchmark Nifty 50.

US stock futures are down after benchmark indices closed near record highs. European contracts also rose, while sentiment in Asia was subdued.

S&P 500 futures down 0.13%

Euro Stoxx futures up 0.5%

Watch NDTV Profit Live

Markets On Home Turf

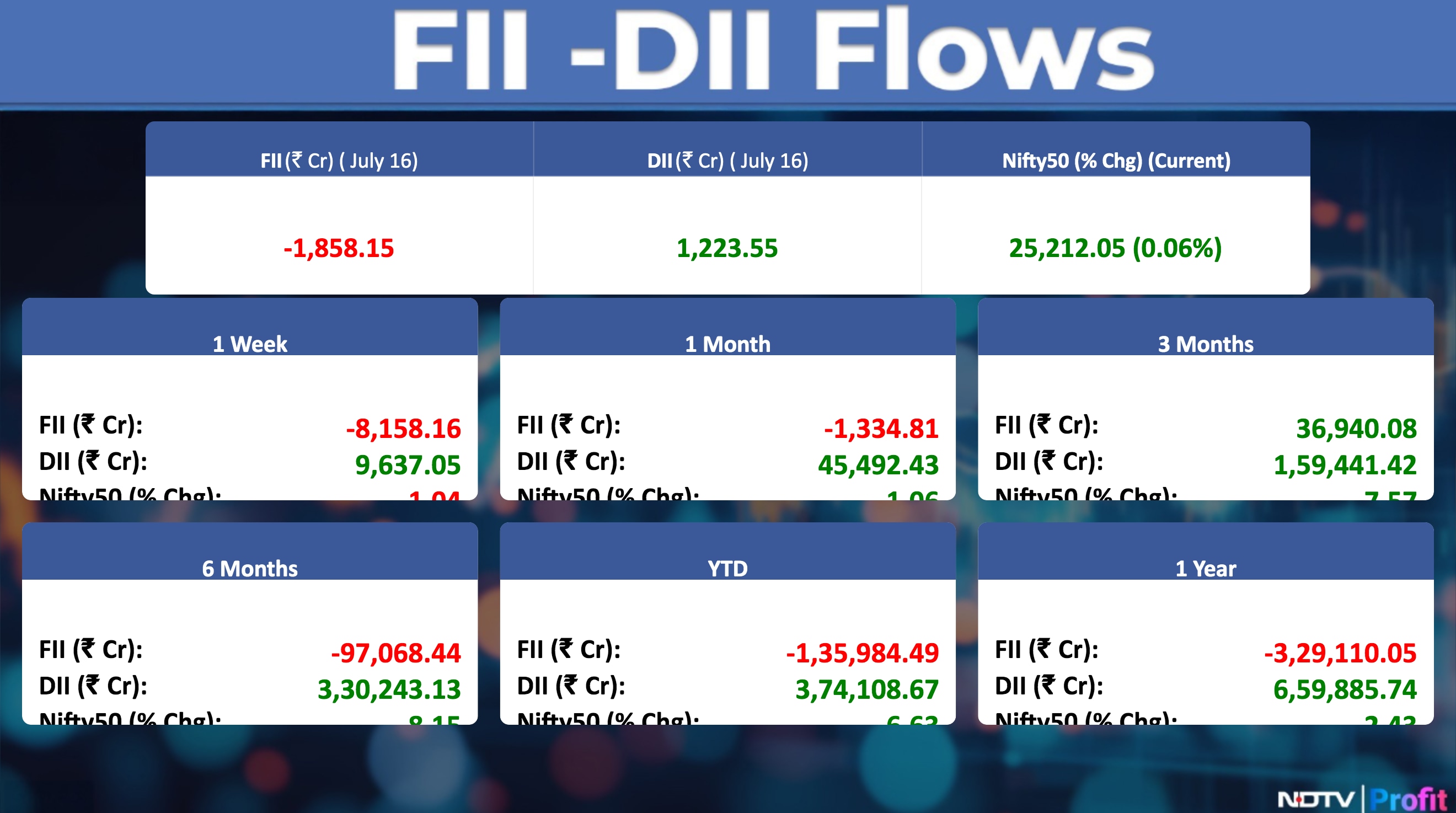

India's benchmark indices ended flat on Wednesday, supported by strength in Infosys Ltd., Mahindra & Mahindra Ltd. and State Bank of India that offset a wider decline amid a dip across Asian markets due to a pickup in US inflation.

The NSE Nifty 50 ended 16.25 points or 0.06% higher at 25,212.05, while the BSE Sensex closed 63.57 points or 0.08% up at 82,634.48. After a morning dip, both gauges managed to pull up from noon.

Asia Market Update

Asian stocks struggled for direction at the open after US markets had a volatile session amid speculation about the future of Federal Reserve Chair Jerome Powell.

Nikkei down 0.3%

Topix up 0.5%

Kospi down 1%

S&P/ASX 200 up 0.5%

Hang Seng futures down 0.2%

Wall Street Recap

The S&P 500 finished within striking distance of all-time highs after whipsawing on whether President Donald Trump will fire Powell. The Nasdaq Composite rose 0.25% to a fresh record and Dow Jones Industrial Average added 0.5%.

Commodities Check

Oil edged higher after a three-day drop as traders tracked US stockpiles and the latest twists in the Washington-led trade wars. Brent rose toward $69 a barrel after shedding more than 2% over the previous three sessions, while West Texas Intermediate was near $67.

Prices of most industrial metals declined on the London Metal Exchange.

Copper down 0.1%

Aluminium down 0.1%

Nickel down 0.8%

Zinc up 0.5%

Lead down 1%

Key Data To Watch

Europe is going to announce its core CPI numbers on Thursday. US will release its core retail sales data. While Uk will announce its unemployment rate, US will release its Jobless claims data. US will also release its export and import price index on Thursday. Among important speeches are Fed Waller and FOMC Member Daly.

Earnings In Focus

Wipro, Axis Bank, 360 One WAM, Ceat, Clean Science and Technology, HDFC AMC, Heritage Foods, Indian Hotels Company, Jio Financial Services, LTIMindtree, Newgen Software Technologies, Nuvoco Vistas Corporation, Polycab India, Route Mobile, Shoppers Stop, South Indian Bank, Sunteck Realty, Sterling and Wilson Renewable Energy, Tata Communications, Waaree Renewable Technologies.

Earnings Post-Market Hours

Tech Mahindra Q1 FY26 Highlights (Consolidated, QoQ)

Revenue flat at Rs 13,351.20 crore versus Rs 13,384 crore (Bloomberg Estimate: Rs 13,422 crore).

EBIT up 7% at Rs 1,477.10 crore versus Rs 1,378 crore (Bloomberg Estimate: Rs 1,480 crore).

Margin at 11.1% versus 10.3% (Bloomberg Estimate: 11%).

Net profit down 2% to Rs 1,140.60 crore versus Rs 1,166.70 crore (Bloomberg Estimate: Rs 1,198 crore).

USD revenue of $1,564 million up 1% QoQ, up 0.4% YoY.

Revenue (in cc) down 1.4 % QoQ, down 1% YoY.

INR revenue of Rs 13,351 crore down 0.2% QoQ, up 2.7% YoY.

IT segment up 0.7% QoQ, BPS segment up 2.9% QoQ.

12-month IT attrition stands at 12.6% versus 11.8% (QoQ).

L&T Technology Services Q1 FY26 Highlights (Consolidated, QoQ)

Revenue down 3.9% to Rs 2,866 crore versus Rs 2,982 crore. (Bloomberg estimate: Rs 2,931 crore).

EBIT down 3% to Rs 381.30 crore versus Rs 394 crore. (Bloomberg estimate: Rs 399 crore).

EBIT margin at 13.3% vs 13.2% (Bloomberg estimate: 13.6%).

Net profit up 1% to Rs 315.70 crore versus Rs 311 crore. (Bloomberg estimate: Rs 317 crore).

Expect to clock double-digit growth in FY26

Maintain medium-term outlook of $2 billion revenue.

Le Travenues Q1 FY26 (Consolidated, YoY)

Revenue up 73% to Rs 314 crore versus Rs 182 crore

Ebitda up 52% at Rs 25.5 crore versus Rs 16.8 crore

Margin at 8.1% versus 9.2%

Net profit up 28.48% to Rs 19.08 crore versus Rs 14.85 crore

JTL Industries Q1 FY26 (Consolidated, YoY)

Revenue up 5.5% to Rs 544 crore versus Rs 516 crore

Ebitda down 41.5% at Rs 23.4 crore versus Rs 40 crore

Margin at 4.3% versus 7.8%

Net profit down 46.8% to Rs 16.3 crore versus Rs 30.7 crore

Angel One Q1 FY26 (Consolidated, QoQ)

Total Income up 8.03% at Rs 1,143 crore versus Rs 1,058 crore.

Net profit down 34.48% at Rs 114 crore versus Rs 174 crore.

Total number of orders grew by 4.8% to 34.3 crore versus 32.7 crore.

F&O orders grew by 4.5% to 24.1 crore versus 23 crore.

Cash orders remained flat at 7.5 crore.

AUM as of June 2025 stood at Rs 340 crore.

Wealth management grew by 33.6% to Rs 5,070 crore as of June 2025.

Turnover Market share

Based on Option Premium Turnover

Overall Equity degrew by 17 bps QoQ at 19.7% versus 19.9%

F&O degrew by 47 bps QoQ at 21% versus 21.4%

Cash grew by 46 bps QoQ at 18% versus 17.5%

Commodity degrew by 72 bps QoQ at 57% versus 57.7%

Stocks in News

SBI: The bank has opened its Qualified Institutional Placement issue and approved a floor price of Rs 811.05 per share. It may offer a discount of up to 5% on the floor price.

Lupin: The company has launched Loteprednol Etabonate Ophthalmic Suspension, 0.5%, in the US market. The drug, used to treat steroid-responsive inflammatory conditions, had estimated annual sales of $55 million in the US.

Infosys: The company announced the launch of the Infosys Enterprise Innovation Lab for SAP Solutions at its German facility. The lab, part of a collaboration with SAP, will help enterprises explore AI and data-driven opportunities.

Reliance Power: The board has approved fundraising of up to Rs 6,000 crore through equity and Rs 3,000 crore via non-convertible debentures.

Nazara Tech: Subsidiary Nodwin Gaming has proposed to raise fresh capital from existing shareholders to support growth in esports and youth media. Nazara has opted out of the round, which will reduce its stake in Nodwin below 50%, aligning with its focus on core gaming IPs.

Godrej Properties: The company acquired a 50-acre land parcel in Raipur, Chhattisgarh, with an estimated saleable area of around 9.5 lakh square feet.

PNC Infratech: Emerged as the lowest bidder in an NHPC tender for setting up 1,200 MW of interstate transmission-connected solar power projects.

Glenmark Pharma: The investigational drug ISB 2301 is expected to enter clinical development in calendar year 2027. Two new oncology programmes are also advancing, with annual strategic investments projected to remain around $70 million.

Karnataka Bank: Raghavendra S Bhat has taken charge as the new MD & CEO.

Waaree Renewable Technologies: Clarified that it is unaware of the reasons behind the recent spike in share volumes, attributing the movement to market forces.

Manali Petrochemicals: Inaugurated a new Propylene Glycol facility in Manali, Chennai.

Emcure Pharma: Signed an agreement with Sanofi India to expand the reach of its oral anti-diabetic drug portfolio.

SRF: The board will meet on July 23 to consider raising up to Rs 750 crore via NCDs.

Eraaya Lifespaces: The board will undertake a strategic business performance review on July 21.

Sanofi India: Appointed Rachid Ayari as interim Managing Director.

Hindustan Zinc: Declared preferred bidder for a composite licence for a Potash & Halite block in Rajasthan.

Zydus Life: US FDA inspection at its Gujarat unit concluded with zero observations related to the prior approval supplement for atorvastatin calcium tablets.

Aditya Birla Real Estate: The board will meet on July 23 to consider fundraising through securities.

Maruti Suzuki: Announced standardisation of six airbags in the Ertiga and Baleno models. This results in an average ex-showroom price increase of 1.4% for Ertiga and 0.5% for Baleno, effective today.

Godawari Power & Ispat: Received government approval to set up a 2 million tonne integrated steel plant in Raipur, Chhattisgarh.

MedPlus Health: One of its stores in Maharashtra received a drug licence suspension order.

JSW Energy: The Supreme Court has overturned a High Court ruling that had capped free electricity supply to Himachal Pradesh at 18%. The earlier cap was 13%.

LTIMindtree: Dissolved its step-down subsidiary Syncordis, effective immediately.

Neogen Chemicals: Received an additional Rs 30 crore from an insurance company related to fire damage. The total insurance claim received so far is Rs 80 crore.

Arvind Fashions: Appointed Amisha Jain as the new MD & CEO.

Omaxe: Approved the allotment of 398 NCDs worth Rs 39.8 crore on a private placement basis.

Capital India Finance: Approved a proposal to raise up to Rs 50 crore via NCDs through private placement.

TVS Motor: Launched the TVS Apache RTR 310 with prices starting at Rs 2.39 lakh.

Shipping Corporation of India: Subsidiary SCI Land & Assets has received stamp duty exemption from the Maharashtra government for the demerger scheme.

Listing day

Smartworks Coworking Spaces: The company's shares will debut on the stock exchange on Wednesday at an issue price of Rs 407 apiece. The Rs 582.56-crore IPO was subscribed 13.45 times on its third and final day.

IPO Offering

Anthem Biosciences: The public issue was subscribed to 63.86 times on day 3. The bids were led by Qualified institutional investors (182.65 times), non-institutional investors (42.36 times), retail investors (5.64 times) and reserved for employees (6.6 times).

Stock On Brokerage Radar

Kotak Securities On Thermax

Maintain 'Add' and hike target price to Rs 3,800 from Rs 3,500.

The company anticipates a busy year for launches, alongside the scaling up of fledgling businesses, new partnerships, and increased R&D efforts.

Its dominant share of business is on a solid footing regarding both growth and margin performance.

There is a strong case for Earnings Per Share (EPS) to grow at a CAGR exceeding 20% over FY25-28.

Investec On Angel One Q1 Results

Maintain 'Buy' with a target price of Rs 2,700.

The company's performance was better than expectations.

The beat in net profit was primarily driven by lower costs compared to our estimates.

Earnings growth is projected to improve quarter-on-quarter.

While new initiatives are showing traction, they currently contribute only 3% of the total revenue.

Bulk Deals

Marathon Nextgen Realty: Sageone Investment Managers bought 3.7 lakh shares (0.79%) at Rs 740 apiece.

Pledge shares details

Genus Power Infrastructures: Promoter Sharda Todi created a pledge of 16 lakh shares.

Trading Tweaks

List of securities shortlisted in Short - Term ASM Framework Stage - I: Neuland Laboratories.

List of securities to be excluded from ASM Framework: Sharda Motor Industries.

Price Band change to 5% from 2%: Onward Technologies

Ex-Dividend: Oriental Hotels, PDS, Graphite India, GHCL, Coromandel International.

F&O Cues

Nifty July futures down by 0.11% to 25,236 at a premium of 24 points.

Nifty July futures open interest up by 0.53%.

Nifty Options 17 July Expiry: Maximum Call open interest at 25,500 and Maximum Put open interest at 25,000.

Securities in ban period: Angel One, Hindustan Copper.

F&O Cues

The Indian rupee closed weaker on Wednesday, slipping by 13 paise to trade at 85.94 against the US dollar after the currency had appreciated slightly a day ago. The yield on the benchmark 10-year bond settled flat at 6.31% on Wednesday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.