The GIFT Nifty was up 15 points at 25,167 as of 6:40 a.m., indicating a flat start for the benchmark Nifty 50.

Asian equities followed the US in posting modest gains even as trade tensions continued to hover. Futures on Wall Street were marginally down while European contracts edged up.

S&P 500 futures down 0.13%

Euro Stoxx 50 futures up 0.1%

Markets On Home Turf

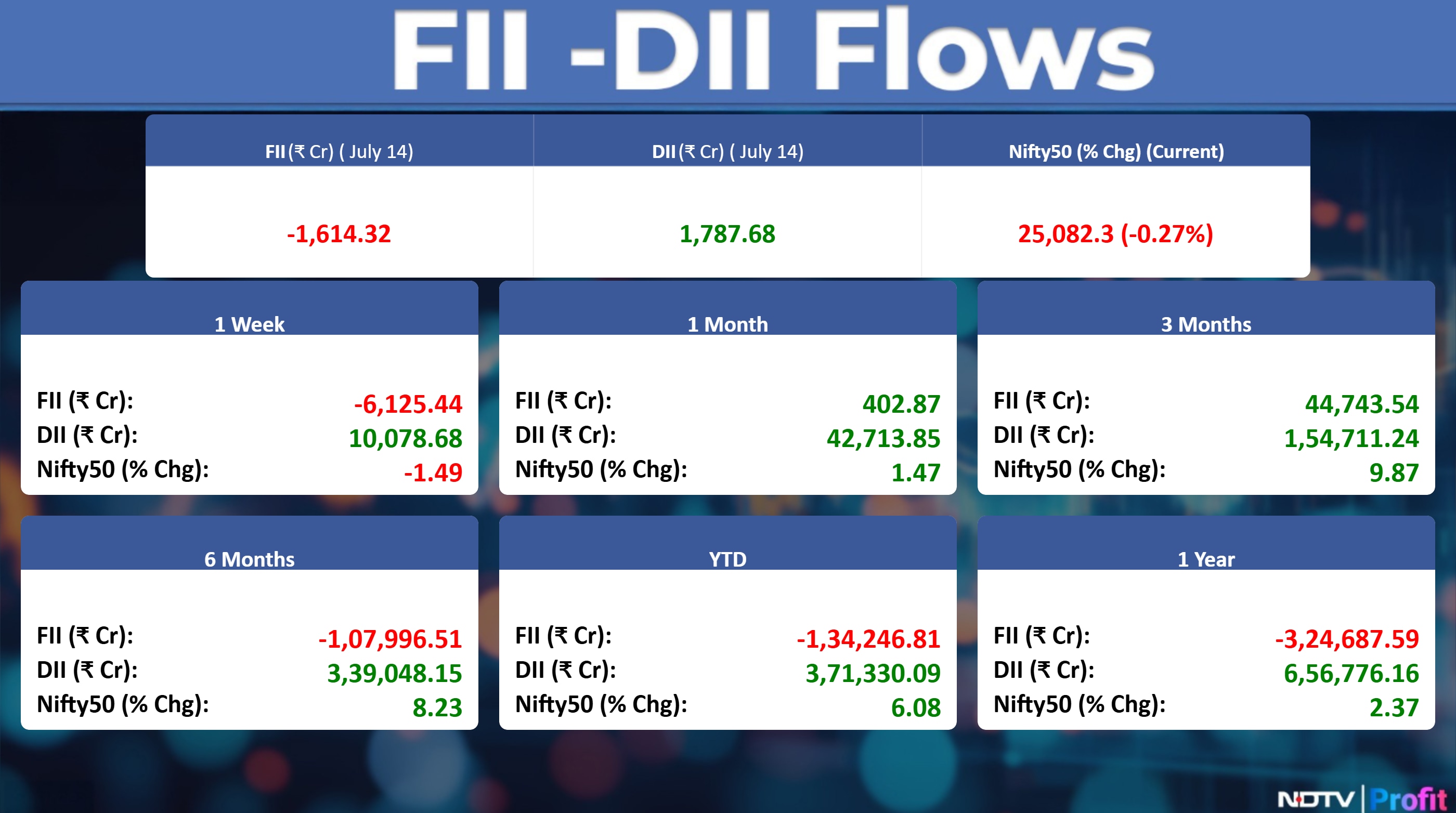

India's benchmark equity indices extended losses to a fourth session on Monday, following a decline in Asian shares and US index futures. Information technology, defence and financial stocks took a beating.

The NSE Nifty 50 ended 67.55 points or 0.27% lower at 25,082.3, while the BSE Sensex closed 247.01 points or 0.3% down at 82,253.46. Intraday, the Nifty and Sensex slipped 0.6%.

Of the 50 stocks on the Nifty, 27 declined. The market capitalisation of the blue-chip pack shed over Rs 56,600 crore.

Wall Street Recap

US stocks eked out gains on Monday near fresh all-time highs, as President Donald Trump's latest salvo of tariff threats for Europe and Mexico kept investors on edge as corporate earnings season kicks off this week.

The S&P 500 Index edged up 0.1%, extending a two-week winning streak. That left the equities benchmark less than 0.2% from its July 10 record after climbing above the psychologically important 6,200 level. The Nasdaq 100 Index climbed 0.3% and the Dow Jones Industrial Average added 0.2%.

Asia Market Update

Asian equities followed the US in posting a modest gain as traders brushed off Trump's latest tariff threats as bargaining tactics that are unlikely to derail global trade. Shares in Australia and Japan rose while those in South Korea retreated at the open on Tuesday.

Nikkei down 0.1%

Topix up 0.1%

Kospi down 0.2%

S&P/ASX 200 up 0.3%

Hang Seng futures up 0.2%

Commodities Check

Oil held a drop — after slumping by more than 2% on Monday — as Trump's latest plan to pressure Russia refrained from immediate new measures aimed at hindering Moscow's energy exports. US benchmark West Texas Intermediate traded near $67 a barrel, while Brent settled near $69 in the previous session.

Prices of all key industrial metals fell on the London Metal Exchange

Copper down 0.4%

Aluminium down 0.4%

Nickel down 0.9%

Zinc down 0.3%

Lead down 0.9%

Key Data To Watch

US is going to announce its core CPI numbers on Tuesday. Europe will also release its industrial production.

Earnings In Focus

GM Breweries, HDB Financial Services, HDFC Life Insurance, Himadri Special Chemicals, ICICI Lombard General Insurance, ICICI Prudential Insurance, Just Dial.

Earnings Post-Market Hours

HCLTech Q1 FY26 (Cons, QoQ)

Revenue up 0.34% at Rs 30349 crore versus Rs 30246 crore. (Estimate Rs 30,288 crore).

EBIT down 9.18% at Rs 4942 crore versus Rs 5442 crore. (Estimate Rs 5,286 crore).

EBIT margin down 170 bps at 16.28% versus 17.99%. (Estimate 17.45%).

Net profit down 10.77% at Rs 3843 crore versus Rs 4307 crore. (Rs 4,259 crore).

IT and Business Services up 1.2% at Rs 22454 crore versus Rs 22186 crore.

Engineering and R&D services up 0.23% at Rs 5174 crore versus Rs 5162 crore.

First quarter fiscal 2026 Results misses EBIT Margin Estimates at 16.3% vs estimate of 17.4%.

Lower end of FY26 Guidance revised from 2-5% earlier to 3-5% now.

FY26 EBIT margin Guidance lowered from 18% – 19% to 17%-18% now.

Deal wins lower than estimate at $1.8 bn vs estimate of $2.3 billion.

Employee Expenses up 2% QoQ vs revenue growth of 0.3%.

Tata Tech Q1 FY26 Highlights (Cons, QoQ)

Revenue down 3.2% to Rs 1,244.29 crore versus Rs 1,285.65 crore.

EBIT down 17% to Rs 168.81 crore versus Rs 202.26 crore.

Margin at 13.6% versus 15.7%.

Net Profit down 10% to Rs 170.28 crore versus Rs 188.87 crore.

Rallis India Q1 FY26 Highlights (YoY)

Revenue up 22.2% at Rs 957 crore versus Rs 783 crore.

Ebitda up 56.3% at Rs 150 crore versus Rs 96 crore.

Margin at 15.7% versus 12.3%.

Net profit up 98% at Rs 95 crore versus Rs 48 crore.

Soil & Plant Health business registered growth of 33%

Improved PAT Margin due to product mix and cost optimization.

Revenue growth driven by strong volume-led performance across Crop Care, Seeds, and Soil & Plant Health segments.

Launched 9 new crop protection products and 14 new seed products

Maintains optimistic outlook on export recovery.

Tejas Networks Q1 FY26 Highlights (Consolidated, YoY)

Revenue down 87% at Rs 202 crore versus Rs 1,563 crore.

Ebitda loss of Rs 135.67 crore versus profit of Rs 230 crore.

Net loss of Rs 193.87 crore versus profit of Rs 77.5 crore.

Stocks in News

Brigade Enterprises: The company approved raising up to Rs 1,500 crore via NCDs on a private placement basis in one or more tranches.

Deepak Fertilizer: The company signed a regasification agreement with Petronet LNG. Under the terms of the agreement, Petronet LNG will regasify approximately 25 TBTUs of LNG annually. The size of the contract in value terms is Rs 1200 crore with an additional outlay of up to 20%, over the contract duration.

Sun Pharma: The company has settled its US patent litigation with Incyte Corporation over LEQSELVI. The company to receive a non-exclusive license for non-oncology uses, including alopecia areata, in the US and announced the launch of LEQSELVI (deuruxolitinib) in the US for the treatment of severe Alopecia Areata.

Unicommerce: Sennheiser to power online sales with the company's convertway.

AstraZeneca Pharma: The company received Government nod to Import for the sale and distribution of Durvalumab Solution for Infusion. Imfinzi is used for the treatment of adult patients with muscle invasive bladder cancer.

UNO Minda: The company clarified that no proposal has been put up to board regarding making rare earth magnets in India.

MTNL: The Government extended the additional charge of a Robert J Ravi as CMD for further three months.

Tata Communication: The board to consider the proposal to raise funds Via NCDs in its board meeting on July 17.

RVNL: The company received a letter of acceptance for an order worth Rs 447 crore from Delhi Metro Rail Corp.

RailTel: Secured a Rs 264 crore order from East Central Railway for implementing the Kavach Train Collision Avoidance System.

Valor Estate: Advent hotels international appointed Rahul Pandit as Managing Director and Chief Executive Officer and Ajit Jain as CFO.

Inox Wind: The board to meet on July 17 to consider proposal for raising funds via equity, others.

Patanjali Foods: The board meets on July 17 to consider proposal for the issue of bonus shares.

Sambhv Steel Tubes: The company, in its first quarter business update, reported a 47% year-on-year growth in total value-added products at 79,717 tonnes and total intermediate products grew by 50% year-on-year at 92,706 tonnes.

Oberoi Realty: The Committee of Creditors of Hotel Horizon approved a Rs 919 crore resolution plan. The plan was submitted by a consortium including Oberoi Realty, Shree Naman Developers, and JM Financial. The plan settles all creditor claims and CIRP costs, with payment to be made within 45 days of NCLT approval.

ONGC: The board of directors considered and approved the appointment of Shri Om Prakash Sinha as Director (Exploration) of the company.

Indian Overseas Bank: The bank reduces MCLR by 10 basis points across tenures effective tomorrow.

Power Mech Projects: The company secured an order worth Rs 498 crore from SJVN thermal for Buxar thermal power project and Rs 53 crore order from Jhabua power for maintenance of boiler, turbine and generator.

Rallis India: Bhaskar Swaminathan to replace Subhra Gourisaria as CFO effective August 7.

The Phoenix Mills: The company approved the proposal for a voluntary strike of three arms.

Stocks On Brokerage Radar

JM Financial On Kalyan Jewellers

Initiate 'Buy' with a target price of Rs 700.

Huge unorganised market providing a large growth opportunity.

Moats built earlier will drive future growth.

Asset-light mode of store expansion.

Expect revenue, Ebitda and profit CAGR of 25%, 23% and 31% over FY25-28.

JM Financial On Ventive Hospitality

Initiate 'Buy' with a target price of Rs 890.

The company is well positioned to benefit from industry tailwinds in India and Maldives.

Multiple levers are expected to drive strong Ebitda growth over FY25-FY28.

Robust free cash flows provide the financial strength to aggressively pursue acquisitions.

Estimate revenue and Ebitda CAGR of 13% and 15% respectively over FY25-28.

Morgan Stanley On Sun Pharma

Maintain 'Overweight' with a target price of Rs 1,960.

The US launch and settlement for Leqselvi is positive.

The launch, expected in the second half of fiscal 2026, happened earlier, supporting the overweight thesis.

Project Leqselvi's sales at $61 million for FY26 and $83 million for FY27.

IPO Offering

Smartworks Coworking Spaces: The public issue was subscribed to 13.45 times on day 3. The bids were led by Qualified institutional investors (24.41 times), non-institutional investors (22.78 times), retail investors (3.53 times) and reserved for employees (2.38 times).

Anthem Biosciences: The public issue was subscribed to 0.73 times on day 1. The bids were led by Qualified institutional investors (0.37 times), non-institutional investors (1.55 times), retail investors (0.58 times) and reserved for employees (0.98 times).

Trading Tweaks

Price Band change to 20% from 10%: Jaiprakash Power Ventures.

Price Band change to 5% from 20%: Raymond Realty, Globe Civil Projects.

Ex-Dividend: IDBI Bank, Aditya Birla Real Estate, Mahindra and Mahindra Financial Services, CAMS, Kirloskar Pneumatic, Grindwell Norton.

F&O Cues

Nifty July futures down by 0.2% to 25,173 at a premium of 91 points.

Nifty July futures open interest up by 1.83%.

Nifty Options 17 July Expiry: Maximum Call open interest at 25,500 and Maximum Put open interest at 25,000.

Securities in ban period: Glenmark Pharma, Hindustan Copper, RBL Bank.

Currency & Bond Markets Update

The Indian rupee closed weaker against the US Dollar on Monday, ending the session at Rs 85.99—down 19 paise from Friday's closing rate of Rs 85.80.

The yield on the benchmark 10-year bond settled flat at 6.32% on Tuesday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.