- GIFT Nifty rose 0.05% to 24,645 points indicating a muted Nifty 50 open

- Nifty 50 ended 0.09% higher at 24,596, Sensex down 0.10% despite US tariff hike

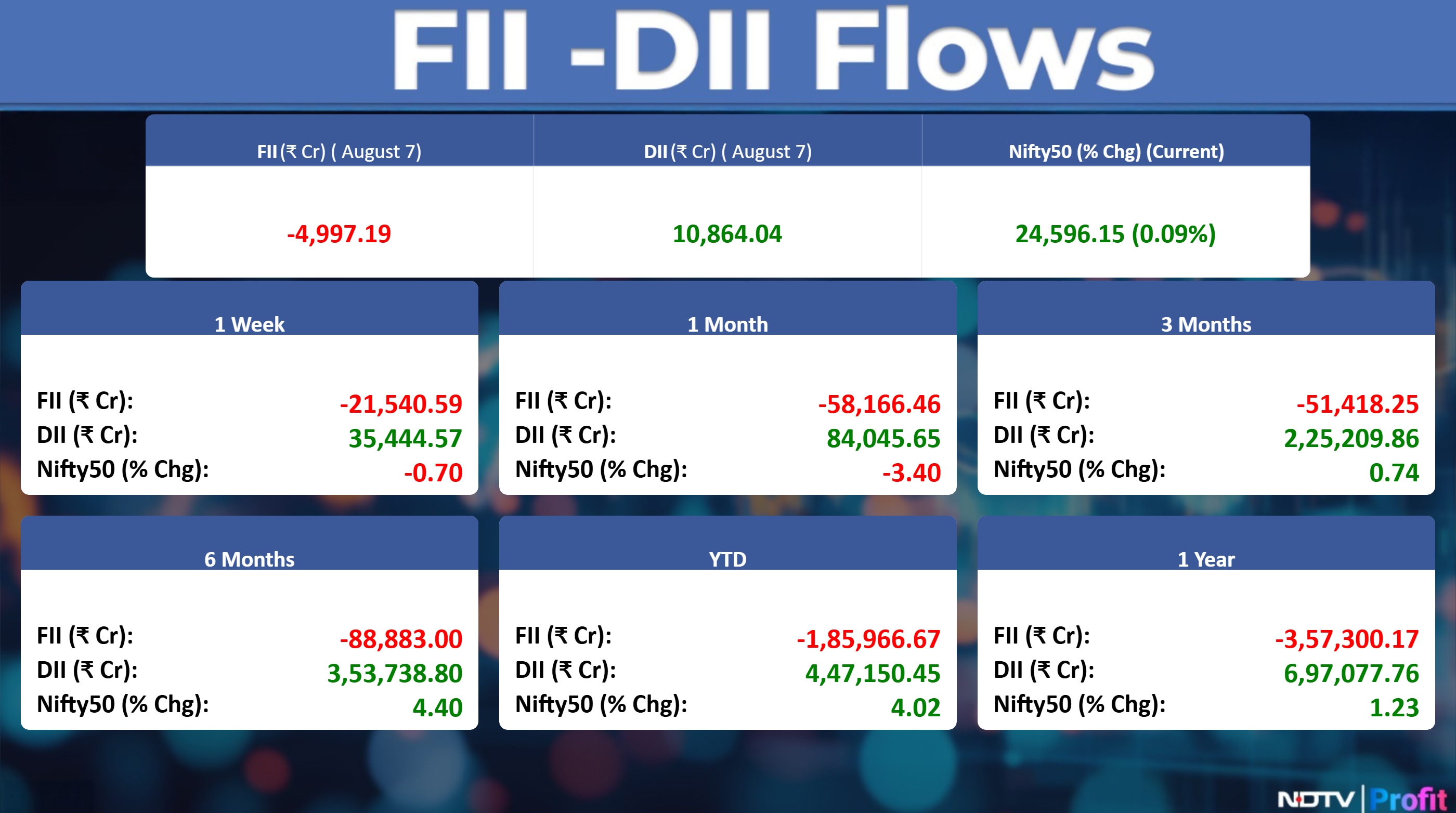

- Foreign investors sold Rs 4,997 crore in equities; DIIs bought Rs 10,864 crore

Good morning!

The GIFT Nifty was marginally higher by 0.05% at 24,645 points as of 7:50 a.m., indicating a muted open for the benchmark Nifty 50.

US and European index futures rose on Friday during Asian trading hours.

S&P 500 futures up 0.3%

Euro Stoxx 50 futures up 0.4%

Watch NDTV Profit Live

Markets On Home Turf

The Indian equity benchmarks closed in the green, recovering sharply during the last hour of trade, to snap its two-day decline. The NSE Nifty 50 had declined as much as 0.94% during the day, as investors turned jittery following the doubling of import tariffs on India by US President Donald Trump. A fight back from the bulls, however, ensured that the market settled with gains.

The NSE Nifty 50 benchmark ended 21 points, or 0.09% higher at 24,596 and the 30-stock BSE Sensex ended 79 points, or 0.10% lower at 80,623.

Foreign portfolio investors stayed net sellers of Indian equities for the 14th straight session on Thursday, Aug. 7, and sold stocks worth approx. Rs 4,997 crore, according to provisional data from the National Stock Exchange. The DIIs that have been buyers for the 24th session bought stocks worth Rs 10,864 crore.

Wall Street Recap

US stocks erased some of their earlier gains as Treasuries fell after a sale of 30-year bonds showed weak demand for longer-term debt. The S&P 500 Index ended flat, the Nasdaq 100 rose 0.3% while the Dow Jones Industrial Average declined 0.5%.

Asia Market Update

Asian stocks edged up at the open Friday, poised for a fifth consecutive day of gains, as technology shares lifted Japanese equities. The MSCI Asia Pacific Index rose 0.5%, helped by a surge in the Nikkei-225 index.

Nikkei up 1.9%.

Topix up 1.4%

Kospi down 0.4%

S&P/ASX 200 down 0.1%

Hang Seng down 0.6%

Commodities Check

Oil headed for the biggest weekly loss since June, as traders judged that US efforts to end to the war in Ukraine would not impact supplies, even as Washington imposed penalties on India for importing Moscow's crude, Bloomberg reported. West Texas Intermediate traded below $64 a barrel, while Brent closed at near $66.

Gold was on track for its biggest weekly climb in a month as a slew of US tariffs came into effect and as President Donald Trump named a temporary Federal Reserve governor expected to echo his calls for lower interest rates. The precious metal traded near $3,400, eyeing a 1% weekly gain.

Earnings To Watch

Grasim Industries, State Bank of India, Siemens, Tata Motors, Action Construction Equipment, Afcons Infrastructure, Akums Drugs and Pharmaceuticals, Ceigall India, Cholamandalam Financial Holdings, Concord Biotech, Cupid, DCW, DOMS Industries, Entero Healthcare Solutions, Equitas Small Finance Bank, Fine Organic Industries, Fusion Finance, Gandhar Oil Refinery (India), Garware Technical Fibres, Genus Power Infrastructures, Garden Reach Shipbuilders & Engineers, Garware Hi-Tech Films, Gujarat Alkalies and Chemicals, Hi-Tech Pipes, Hindustan Foods, Infibeam Avenues, JK Tyre & Industries, Lemon Tree Hotels, Manappuram Finance, Max Estates, Info Edge (India), NIIT, Apeejay Surrendra Park Hotels, PG Electroplast, Poly Medicure, Power Mech Projects, PTC Industries, Puravankara, Rhi Magnesita India, Satin Creditcare Network, Shipping Corporation of India, Sequent Scientific, Sharda Motor Industries, S H Kelkar and Company, Star Cement, TVS Supply Chain Solutions, Venkys (India), Voltas, Wockhardt, Yatra Online.

Earnings Post Market Hours

Schneider Electric Infrastructure Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 4.8% to Rs 621.63 crore versus Rs 592.91 crore.

Ebitda down 15% to Rs 69.33 crore versus Rs 81.72 crore.

Margin at 11.2% versus 13.8%.

Net Profit down 15% to Rs 41.24 crore versus Rs 48.48 crore.

Global Health Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 19.7% to Rs 1,030.84 crore versus Rs 861.08 crore.

Ebitda up 22% to Rs 226.99 crore versus Rs 186.33 crore.

Margin at 22.0% versus 21.6%.

Net Profit up 50% to Rs 159.01 crore versus Rs 106.29 crore.

Titan Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 24.6% to Rs 16,523.00 crore versus Rs 13,266.00 crore.

Ebitda up 47% to Rs 1,830.00 crore versus Rs 1,247.00 crore.

Margin at 11.1% versus 9.4%.

Net Profit up 53% to Rs 1,091.00 crore versus Rs 715.00 crore.

LIC Q1 Earnings Key Highlights (Consolidated, YoY)

Net premium income up 4.71% at Rs 1.20 lakh crore versus Rs 1.14 lakh crore.

Profit up 4.11% at Rs 10,985 crore versus Rs 10,551 crore.

13th month persistency ratio at 70.9% vs 68.62% (QoQ).

61st month persistency ratio at 58.31% vs 58.54% (QoQ).

APE grew by 9.45% to Rs 12, 652 crore vs 11,560 crore.

Value of New Business grew by 20.75% to Rs 1,944 crore versus 1,610 crore.

VNB Margin at 15.4% vs 13.9%.

HPCL Q1 Earnings Key Highlights (Standalone, QoQ)

Revenue up 1.2% to Rs 1,10,767.40 crore versus Rs 1,09,492.37 crore.

Ebitda up 31% to Rs 7,601.77 crore versus Rs 5,803.76 crore.

Margin at 6.9% versus 5.3%.

Net Profit up 30% to Rs 4,370.87 crore versus Rs 3,354.98 crore.

India Glycols Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 7.4% to Rs 1,040.46 crore versus Rs 968.64 crore.

Ebitda up 19% to Rs 149.64 crore versus Rs 125.56 crore.

Margin at 14.4% versus 13.0%.

Net Profit up 21% to Rs 73.25 crore versus Rs 60.38 crore.

India Shelter Finance Q1 Earnings Key Highlights (Consolidated, YoY)

Impairment rises 54.2% to Rs 10.2 crore versus Rs 6.6 crore.

Calculated NII up 35% to Rs 179 crore versus Rs 133 crore.

Net Profit rises 43% to Rs 119 crore versus Rs 83.5 crore.

Metro Brands Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 9.1% to Rs 628.24 crore versus Rs 576.08 crore.

Ebitda up 8% to Rs 193.90 crore versus Rs 180.37 crore.

Margin at 30.9% versus 31.3%.

Net Profit up 7% to Rs 98.51 crore versus Rs 91.73 crore.

CE Info Systems Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue down 15.3% to Rs 121.61 crore versus Rs 143.55 crore.

Ebitda down 9% to Rs 48.99 crore versus Rs 54.00 crore.

Margin at 40.3% versus 37.6%.

Net Profit down 5% to Rs 46.11 crore versus Rs 48.57 crore.

Innova Captab Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue rises 19.5% to Rs 352 crore versus Rs 294 crore.

Ebitda rises 23.5% to Rs 52.1 crore versus Rs 42.2 crore.

Margin at 14.8% versus 14.3%.

Net profit rises 5.2% to Rs 31 crore versus Rs 29.5 crore.

Cummins India Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 26.2% to Rs 2,906.82 crore versus Rs 2,304.19 crore.

Ebitda up 33% to Rs 623.50 crore versus Rs 467.33 crore.

Margin at 21.4% versus 20.3%.

Net Profit up 40% to Rs 589.27 crore versus Rs 419.80 crore.

BSE Q1 Earnings Key Highlights (Consolidated, QoQ)

Revenue up 13.1% to Rs 1,037.45 crore versus Rs 916.97 crore.

Ebitda up 27% to Rs 704.99 crore versus Rs 554.54 crore.

Margin at 68.0% versus 60.5%.

Net Profit up 9% to Rs 539.41 crore versus Rs 494.42 crore.

KSB Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue rises 3.2% to Rs 667 crore versus Rs 646 crore.

Ebitda rises 0.9% to Rs 91.4 crore versus Rs 90.6 crore.

Margin at 13.7% versus 14%.

Net profit rises 3.4% to Rs 70.4 crore versus Rs 68.1 crore.

The Ramco Cement Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue down 0.9% to Rs 2,074.02 crore versus Rs 2,093.55 crore.

Ebitda up 24% to Rs 397.53 crore versus Rs 320.17 crore.

Margin at 19.2% versus 15.3%

Net Profit up 129% to Rs 85.03 crore versus Rs 37.16 crore.

Shree Renuka Sugars Q1 Earnings Key Highlights (Consolidated, YoY)

Net Loss of Rs 263 crore versus loss of Rs 166 crore.

Ebitda loss of Rs 76.9 crore versus profit of Rs 84.7 crore.

Revenue declines 34.2% at Rs 2,010 crore versus Rs 3,054 crore.

DCX Systems Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 60.9% to Rs 222.16 crore versus Rs 138.08 crore.

Ebitda at Rs 0.27 crore versus loss of Rs 4.81 crore.

Margin at 0.1%.

Net Profit up 38% to Rs 4.06 crore versus Rs 2.94 crore.

Pitti Engineering Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 16.6% to Rs 456.56 crore versus Rs 391.45 crore.

Ebitda up 30% to Rs 75.34 crore versus Rs 58.02 crore.

Margin at 16.5% versus 14.8%.

Net Profit up 18% to Rs 22.88 crore versus Rs 19.36 crore.

Indigo Paints Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue declines 0.7% to Rs 309 crore versus Rs 311 crore.

Ebitda falls 6.4% to Rs 44.3 crore versus Rs 47.4 crore.

Margin at 14.3% versus 15.2%.

Net Profit falls 1% to Rs 25.9 crore versus Rs 26.2 crore.

Datta Patterns Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue down 4.6% to Rs 99.33 crore versus Rs 104.08 crore.

Ebitda down 14% to Rs 32.08 crore versus Rs 37.18 crore.

Margin at 32.3% versus 35.7%.

Net Profit down 22% to Rs 25.50 crore versus Rs 32.79 crore.

Repco Home Finance Q1 Earnings Key Highlights (Consolidated, YoY)

Net profit rises 2.4% to Rs 108 crore versus Rs 105 crore.

Calculated NII rises 8.3% to Rs 182 crore versus Rs 168 crore.

Impairment Loss at Rs 2.7 crore versus profit of Rs 1.4 crore.

Max Financial Q1 Earnings Key Highlights (Consolidated, YoY)

Net Profit declines 45.3% to Rs 69.6 crore versus Rs 127 crore.

Impairment loss at Rs 4 lakh versus loss of Rs 7 lakh.

Calculated NII rises 17% to Rs 132 crore versus Rs 113 crore.

PTC India Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue declines 12% to Rs 4,009 crore versus Rs 4,555 crore.

Ebitda up 18.2% to Rs 288 crore versus Rs 244 crore.

Margin at 7.2% versus 5.4%.

Net Profit rises 44.2% to Rs 195 crore versus Rs 135 crore.

KRBL Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue rises 32% to Rs 1,584 crore versus Rs 1,199 crore.

Ebitda rises 64.4% to Rs 193 crore versus Rs 117 crore.

Margin at 12.2% versus 9.8%.

Net Profit rises 74% to Rs 151 crore versus Rs 86.4 crore.

GIC Q1 Earnings Key Highlights (Consolidated, YoY)

Net Profit rises 80.7% to Rs 2,531 crore versus Rs 1,401 crore.

Net Premium Income up 11.6% to Rs 11,274 crore versus Rs 10,098 crore.

Biocon Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 14.8% to Rs 3,941.90 crore versus Rs 3,432.90 crore.

Ebitda up 21% to Rs 748.90 crore versus Rs 620.40 crore.

Margin at 19.0% versus 18.1%

Net Profit down 95% to Rs 31.40 crore versus Rs 659.70 crore.

Greenlam Industries Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue rises 11.4% to Rs 674 crore versus Rs 605 crore.

Ebitda fell 31.2% to Rs 44.1 crore versus Rs 64 crore.

Margin at 6.5% versus 10.6%

Net loss at Rs 15.4 crore versus Profit of Rs 20.3 crore.

NLC India Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 13.2% to Rs 3,825.61 crore versus Rs 3,378.17 crore.

Ebitda down 13% to Rs 936.76 crore versus Rs 1,082.12 crore.

Margin at 24.5% versus 32.0%.

Net Profit up 43% to Rs 797.59 crore versus Rs 559.42 crore.

Singatureglobal Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 116.1% to Rs 865.67 crore versus Rs 400.61 crore.

Ebitda at Rs 33.18 crore versus loss of Rs 1.48 crore.

Margin at 3.8%.

Net Profit up 408% to Rs 34.42 crore versus Rs 6.77 crore.

Subros Q1 Earnings Key Highlights (Cons, YoY)

Revenue up 8.5% to Rs 878 crore versus Rs 810 crore.

Ebitda up 6.2% to Rs 82 crore versus Rs 77.2 crore.

Margin at 9.3% versus 9.5%

Net Profit up 16.7% to Rs 40.8 crore versus Rs 34.9 crore.

Stocks In News

AU Small Finance Bank: The company received an in-principal approval for a universal banking license from the RBI.

Triveni Engineering & Industries: The company received 'No Objection' from National Stock Exchange of India in relation to the proposed composite scheme of arrangement amongst the company, Sir Shadi Lal Enterprises and Triveni Power Transmission and their respective shareholders and their respective creditors.

Blue Dart Express: The company appoints Sagar Patil as Chief Financial Officer.

Dreamfolks Services: The company approved appointment of Liberatha Peter Kallat as Chairperson and Managing Director, effective from Feb. 19, 2026 to Feb. 18, 2031.

Persistent Systems: The company appoints Jaideep Dhok as the new Chief Operating Officer - Technology, effective Aug. 12, 2025. Dhanashree Bhat has resigned from her position as the COO for personal reasons.

Atul: The Board of Directors approved a joint venture with Buckman Laboratories, Singapore, a Buckman Group company. This is a 50:50 partnership. The company will provide land, utilities and site services.

Medi Assist Healthcare: The company approved raising of up to Rs 198 crores by issuing up to 37.01 lakh shares at Rs 535 per share to Massachusetts Institute of Technology and 238 Plan Associates LLC via a preferential allotment, subject to shareholder and regulatory approvals.

Zydus Lifesciences: The company has received NOC from Health Canada for ZDS-Varenicline tablets 0.5 &1 mg. This is the group's first NOC approval in Canada. Varenicline is used as an aid in smoking cessation.

Gujarat State Fertilizers & Chemicals: The company has appointed Sanjeev Kumar, IAS as Managing Director of the company from Aug. 01, 2025.

Ram Ratna Wires: The company is expanding into a new line of business for production of Bulk Molding Compound.

GMM Pfaudler: The company has informed regarding resignation of Aseem Joshi as Chief Executive Officer. Tarak Patel, the current Managing Director, will assume Joshi's responsibilities.

Metropolis Healthcare: The Board approved a Business Transfer Agreement with Dr. Rajendra Sadashiv Patil, proprietor of Dr. RS Patil's Ambika Pathology Laboratory for the acquisition of the entire business consisting of pathology laboratories in Kolhapur, Maharashtra on a slump sale basis.

Sangam: The company is acquiring a running manufacturing unit for Recycled Polyester Staple Fibre from Eminent Dealers in Bhilwara, Rajasthan, for up to Rs 52.51 Crores, to use its production as a raw material for its other units.

C.E. Info Systems: The company's board approved an investment of approximately Rs 25 crores to acquire 43,759 equity shares of its subsidiary, Gtropy Systems at Rs 5,713 per share, increasing its stake from 75.98% to 96% with the option to acquire the remaining 4% within four years. The company has also approved an investment of Rs 25 crores to acquire 75.19 lakh Compulsorily Convertible Preference Shares in the quick-commerce company "Zepto" at a price of Rs 33.25 per share. This is a strategic move to enhance its solutions for the fast-growing quick-commerce industry.

India Shelter Finance Corporation: The board of directors approved the issuance of NCDs worth up to Rs.1,000 Crores through private placement or public issuances in one or more tranches.

Kolte-Patil Developers: The company's arm Kolte-Patil Lifespaces has retired as a partner from the partnership firm Amco Landmarks Realty, where it previously held a 36% stake, through a Deed of Retirement

Tata Communications: The company has approved the private placement of 1 lakh Non-Convertible Debentures with a face value of Rs.1 lakh each, raising a total of Rs.1,000 crore. These NCDs have a fixed coupon rate of 6.77% and a 3-year tenure.

GTL Infrastructure: The company has approved the appointment of Ajit Shanbhag as the new Chief Financial Officer effective Aug. 8, while the current CFO, Bhupendra Kiny, will transition to a new role within the company.

NIBE: The company has secured new orders worth Rs 29.22 crore from a domestic infrastructure and defence company for the supply of constructional details trackway and Breech Casings.

Oil India: The company has signed a Memorandum of Understanding with IREL in Mumbai to cooperate and collaborate for development of Critical Minerals.

Karur Vysya Bank: The bank is set to inaugurate three new branches, one in Trichy, one in Kurnool, Andhra Pradesh, and one in Mumbai.

The Ramco Cements: The company has approved acquisition of an additional 28.50% equity stake in its subsidiary, Ramco Windfarms, for Rs 28.50 lakh.

Cholamandalam Investment and Finance: The company has completed a private placement of 100 unsecured perpetual non-convertible securities, raising Rs 100 crore at a coupon rate of 9.25%. The total issue size was Rs 400 crore.

Pitti Engineering: The company's board has approved Rs 150 crore capital expenditure to increase its manufacturing capacities, including a boost in sheet metal capacity from 90,000 MT to 108,000 MT, machining hours from 6.48 lakh to 7.20 lakh, and foundry capacity from 18,600 MT to 24,000 MT.

Aditya Birla Capital: The company has allotted 41,000 unsecured, rated, and listed Non-Convertible Debentures with a face value of Rs 1 lakh each, raising a total of Rs 410 crore through a private placement to multiple investors on Aug. 7.

Piramal Pharma: The company's inventory, valued at an estimated Rs 45 crore, was affected by a fire at a third-party warehouse in Annaram, Telangana.

GAIL: The company and Hindustan Copper have signed a MoU to jointly explore and develop critical mineral resources.

Syrma SGS Technology: The company has approved a Qualified Institutional Placement to issue equity shares with a face value of Rs 10 each, aiming to raise Rs 1,000 crore from qualified institutional buyers. The floor price for issue is at Rs.735.61.

R R Kabel: The company has launched a new product line in the wire category.

Biocon: The company has approved a plan to acquire a 26% stake in Pro-zeal Green Power Sixteen and enter into a Power Purchase Agreement with them to buy solar power from a captive off-site solar energy plant.

Adani Enterprises: The company's arm Mundra Synenergy incorporates a subsidiary Nagpur Syn-Gas & Chemicals

AGI Greenpac: The company's Vice President Nitesh Raj will transition to a different role within Somay Impressa Group.

ITD Cementation: The company's shareholders approve the change of name of company to 'Cemindia Projects' from ITD Cementation India.

Mamata Machinery: The company gets its maiden export order for Rs 8.5 crore. The order is for a 9-layer blown film plant from a Latin American customer.

ArisInfra Solutions: The Company gets Rs 40 crore development management mandate from AVS Group in Mumbai.

IPO Update

Highway Infrastructure: The public issue was subscribed to 194.19 times on day 3. The bids were led by Qualified institutional investors (328.94 times), non-institutional investors (276.90 times), retail investors (92.83 times).

Knowledge Realty Trust: The public issue was subscribed to 1.72 times on day 3. The bids were led by Qualified institutional investors (2.33 times), other investors (1.00 times).

All Time Plastics: The public issue was subscribed to 0.19 times on day 1. The bids were led by Qualified institutional investors (0.0 times), non-institutional investors (0.16 times), retail investors (0.31 times), Employees (0.99 times).

JSW Cement: The public issue was subscribed to 0.09 times on day 1. The bids were led by Qualified institutional investors (0.0 times), non-institutional investors (0.1 times), retail investors (0.14 times).

Bulk & Block Deals

Zinka Logistics: Ithan Creek Master sold 9.9 lakh shares (0.55%) at Rs 540.54 apiece.

Eternal: Antfin Singapore sold 14.1 crore shares (1.46%) at Rs 289.91 apiece.

Kotak Mahindra Bank: Oppenheimer Funds sold 1.03 crore shares (0.52%) at Rs 1965.2 apiece.

Tourism Finance Corp: Aditya Kumar Halwasiya bought 9.09 lakh shares (0.98%) at Rs 288.79 apiece.

Pledge Shares Details

Insolation Energy: Vikas Jain Huf, Promoter Group has acquired 10,000 shares.

PSP Projects: Prahaladbhai S. Patel, Promoter and Director disposed of 1.01 crore shares.

Shakti Pumps India: Vintex Tools & Machineries, Promoter acquired 12,000 shares.

Trading Tweaks

List of securities shortlisted in Short - Term ASM Framework Stage – I : Sarda Energy & Minerals.

Ex-Dividend: ABB India, Indian Oil Corporation, Vishnu Chemical, Varroc Engineering, Jtekt India, Quess Corp, Mankind Pharma, Matrimony.Com, Alkem Laboratories, Computer Age Management Services, Ceat, Flair Writing Industries, Sonata Software.

Bonus Issue: Nestle India (1:1).

F&O Cues

Nifty Aug futures is up by 0.33% to 24,715 at a premium of 118.85 points.

Nifty Aug futures open interest up by 0.43%.

Nifty Options 14h Aug Expiry: Maximum Call open interest at 25000 and Maximum Put open interest at 23,500.

Securities in ban period: PNB Housing.

Currency/Bond Update

The Indian Rupee closed stronger against the US Dollar on Thursday, even after United States President Donald Trump slapped an additional 25% tariff on India for the purchase of Russian crude oil on Wednesday. The yield on the benchmark 10-year bond settled three basis points lower at 6.39%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.