Good morning!

The GIFT Nifty was down 111.5 points or 0.45% at 24,725 as of 7:40 a.m., indicating a gap-down open for the benchmark Nifty 50.

US and European stock futures ticked lower as investors weighed fresh tariff measures announced by President Donald Trump. The S&P 500 contracts traded 0.1% down, while Euro Stoxx 50 futures slid 0.2%.

Watch NDTV Profit Live

Markets On Home Turf

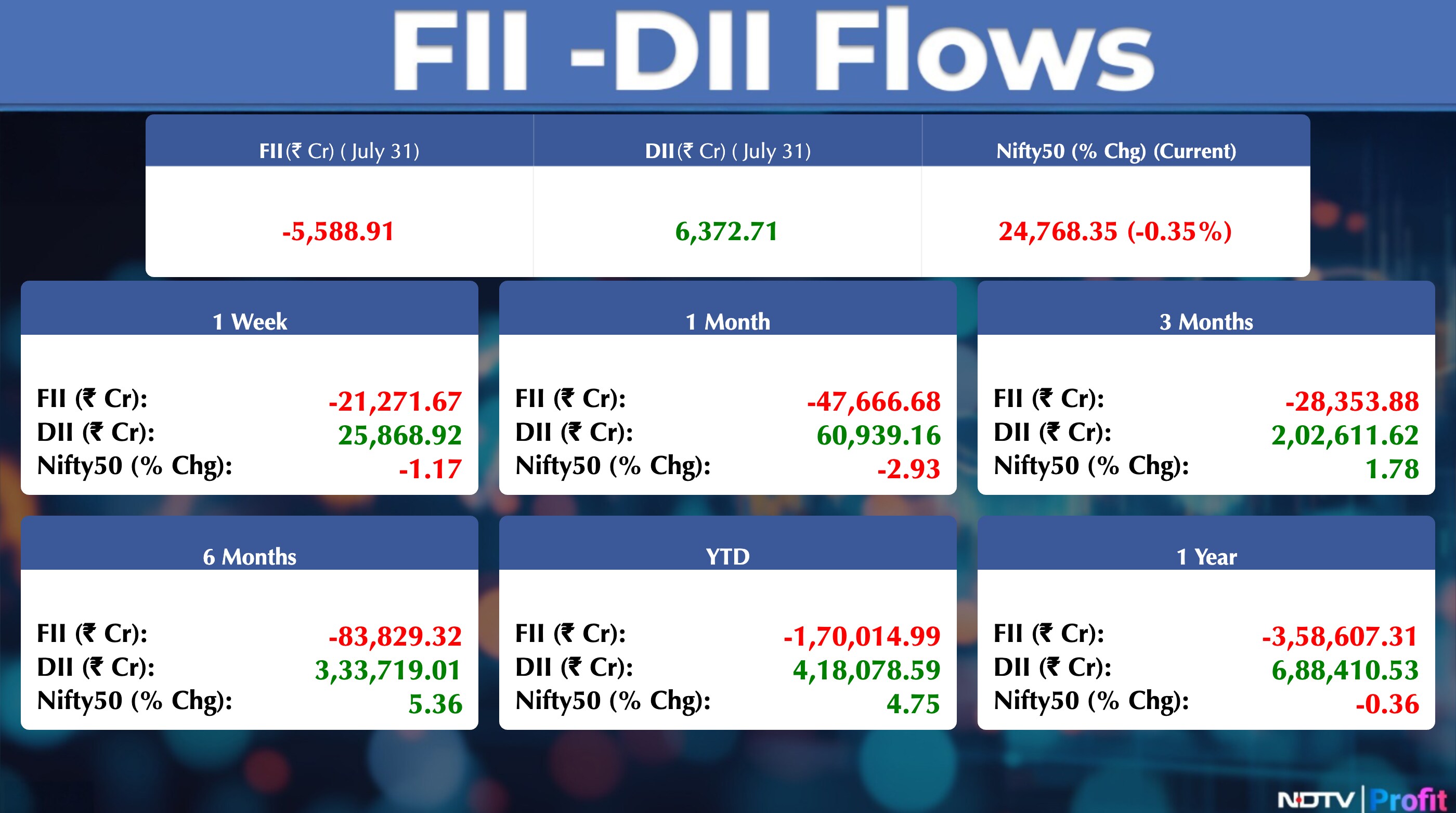

Indian stock markets snapped a four-month rally to end July in losses as simmering trade tensions with the US triggered a risk-off sentiment and caused a flight of foreign capital.

The Nifty settled 86.7 points or 0.35% lower at 24,768.35 on Thursday, when monthly futures contracts expired. The BSE Sensex lost 296.28 points or 0.36% to close at 81,185.58.

Foreign portfolio investors remained net sellers of Indian equity for the ninth consecutive session. They offloaded stocks worth Rs 5,538.2 crore, according to provisional data from the National Stock Exchange.

Asia Market Update

Asian stocks fell for a sixth straight session — the longest losing streak this year — as President Donald Trump announced new tariff rates and as solid earnings from megacap tech firms failed to lift broader market sentiment. The MSCI Asia Pacific Index dropped 0.4% at the open.

Nikkei down 0.6%

Topix up 0.25%

Kospi down 3%

S&P/ASX 200 down 0.66%

Hang Seng down 0.12%

Wall Street Recap

A rally in stocks sputtered ahead of Donald Trump's tariff deadline, with the White House asking drugmakers to cut US prices. Bonds wavered in the run-up to jobs data. The dollar saw its best month in 2025.

The S&P 500 erased a 1% gain for the first time since April. The index ended 0.4% lower while Nasdaq Composite was flat. The Dow Jones Industrial Average slid 0.7%.

Commodities Check

Oil was set for the biggest weekly gain since mid-June after President Donald Trump ramped up pressure on Russia, as the market braced for the fallout from US tariffs that take effect on Friday. West Texas Intermediate was steady above $69 a barrel, while Brent traded below $72.

Copper down 0.9%

Aluminium down 1.4%

Nickel down 0.6%

Zinc down 0.9%

Lead down 0.6%

Earnings To Watch

Adani Power, UPL, Godrej Properties, ITC, MCX, Narayana Hrudayalaya, Tata Power, Alivus Life Sciences, Aditya Vision, Capri Global Capital, Delhivery, Dhanuka Agritech, GlaxoSmithKline Pharmaceuticals, Go Fashion (India), Graphite India, G R Infraprojects, HealthCare Global Enterprises, Honeywell Automation India, JK Lakshmi Cement, Jupiter Life Line Hospitals, Kirloskar Brothers, LIC Housing Finance, PC Jeweller, Procter & Gamble Health, Ratnamani Metals & Tubes, Ramkrishna Forgings, Safari Industries India, Shakti Pumps India, Steel Strips Wheels, Baazar Style Retail, Symphony, Transformers and Rectifiers (India), Tube Investments of India.

Earnings Post Market Hours

Swiggy Q1 Highlights (Consolidated, QoQ)

Revenue up 12.5% to Rs 4,961 crore versus Rs 4,410 crore.

Net loss at Rs 1,197 crore versus loss of Rs 1,081 crore.

Ebitda loss of Rs 954 crore versus loss of Rs 962 crore.

Food delivery business grew 18.1% YoY, 10% QoQ

Quick commerce grew 114% YoY, 17% QoQ

Teamlease Services Q1 Highlights (Consolidated, YoY)

Revenue up 12.1% to Rs 2,891 crore versus Rs 2,580 crore.

Ebitda up 37.7% to Rs 30.6 crore versus Rs 22.3 crore.

Margin at 1.1% versus 0.9%

Net Profit up 27.7% to Rs 26.5 crore versus Rs 20.8 crore.

Thermax Q1 Highlights (YoY)

Revenue down 1.6% to Rs 2,150 crore versus Rs 2,184 crore.

Ebitda up 59.5% to Rs 225 crore versus Rs 141 crore.

Margin at 10.5% versus 6.5%.

Net Profit up 31.6% to Rs 152 crore versus Rs 116 crore.

Restaurant Brands Asia Q1 Highlights (Consolidated, YoY)

Revenue up 7.9% to Rs 698 crore versus Rs 647 crore.

Ebitda up 15.5% to Rs 72.8 crore versus Rs 63 crore.

Margin at 10.4% versus 9.7%.

Net loss of Rs 41.9 crore versus Rs 49.4 crore.

Neuland Labs Q1 Highlights (Consolidated, YoY)

Revenue down 33.4% to Rs 293 crore versus Rs 440 crore.

Ebitda down 72% to Rs 34.4 crore versus Rs 123 crore.

Margin at 11.8% versus 28.1%.

Net profit down 85.8% to Rs 13.9 crore versus Rs 97.9 crore.

City Union Bank Q1 Highlights (YoY)

Net interest income grew 14.7% to Rs 625 crore versus Rs 545 crore.

Net profit up 15.7% to Rs 306 crore versus Rs 264 crore.

Operating profit grew 20.7% to Rs 451 crore versus Rs 373 crore.

Provisions grew 79.5% to Rs 70 crore versus Rs 39 crore.

Net NPA at 1.2% versus 1.25% (QoQ).

Gross NPA at 2.99% versus 3.09% (QoQ).

JSW Holdings Q1 Highlights (Consolidated, YoY)

Total income grew 10.4% to Rs 30.1 crore versus Rs 27.2 crore.

Net profit down 35.7% to Rs 33.8 crore versus Rs 52.6 crore.

Coal India Q1 Highlights (Consolidated, QoQ)

Revenue falls 5.25% to Rs 35,842 crore versus Rs 37825 crore (Estimates : Rs 35,012 crore)

EBITDA up 6.2% to Rs 12,521 crore versus Rs 11,790 crore (Estimates : Rs 11,282 crore)

Margins up 376 basis points at 34.93% versus 31% (Estimate: 32.2%)

Net Profit fall 8.96% to Rs 8,743 crore versus Rs 9,604 crore (Estimate: Rs 8,322 crore)

Eicher Motors Q1 Highlights (Consolidated, YoY)

Revenue up 14.8% to Rs 5,041.84 crore versus Rs 4,393.05 crore.

Ebitda up 3% to Rs 1,202.78 crore versus Rs 1,165.43 crore.

Margin at 23.9% versus 26.5%.

Net Profit up 9.4% to Rs 1,205 crore versus Rs 1,101 crore.

TCPL Packaging Q1 Highlights (Consolidated, YoY)

Revenue up 4.7% to Rs 424.68 crore versus Rs 405.59 crore.

Ebitda up 2% to Rs 72.61 crore versus Rs 71.42 crore.

Margin at 17.1% versus 17.6%.

Net Profit down 30% to Rs 22.32 crore versus Rs 31.72 crore.

Mankind Pharma Q1 Highlights (Consolidated, YoY)

Revenue up 24.5% to Rs 3,570 crore versus Rs 2,868 crore.

Ebitda up 26.1% to Rs 847 crore versus Rs 671.56 crore.

Margin at 23.7% versus 23.4%.

Net Profit down 18.3% to Rs 438 crore versus Rs 536 crore.

Niva Bupa Health Insurance Co Q1 Highlights (YoY)

Net premium income up 19.8% to Rs 1,220 crore versus Rs 1,018 crore.

Net loss at Rs 91.4 crore versus Rs 18.8 crore.

Chambal Fertilisers Chemicals Q1 Highlights (Consolidated, YoY)

Revenue up 15.5% to Rs 5,697.61 crore versus Rs 4,933.23 crore.

Ebitda up 1% to Rs 760.97 crore versus Rs 752.02 crore.

Margin at 13.4% versus 15.2%.

Net Profit up 22% to Rs 548.96 crore versus Rs 448.36 crore.

Aarti Industries Q1 Highlights (Consolidated, YoY

Revenue down 9.5% to Rs 1,675 crore versus Rs 1,851 crore.

Ebitda down 34.4% to Rs 196 versus Rs 299 crore.

Margin at 11.7% versus 16.2%.

Net Profit down 68.6% to Rs 43 crore versus Rs 137 crore.

Sundram Fasteners Q1 Highlights (Consolidated, YoY)

Revenue up 2.4% to Rs 1,533 crore versus Rs 1,498 crore.

Ebitda flat at Rs 247 crore.

Margin at 16.1% versus 16.5%.

Net Profit up 4.6% to Rs 148 crore versus Rs 142 crore.

Indegene Q1 Highlights (Consolidated, YoY)

Revenue up 12.5% to Rs 761 crore versus Rs 677 crore.

Ebitda up 20.5% to Rs 155 versus Rs 129 crore.

Margin at 20.4% versus 19.1%.

Net Profit up 32.7% to Rs 116 crore versus Rs 87.7 crore.

JSW Energy Q1 Highlights (Consolidated, YoY)

Revenue up 78.6% to Rs 5,143 crore versus Rs 2,879 crore.

Ebitda up 96.7% to Rs 2,789 versus Rs 1,418 crore.

Margin at 54.2% versus 49.2%.

Net Profit up 42.4% to Rs 743 crore versus Rs 522 crore.

Barbeque-Nation Hospitality Q1 Highlights (Consolidated, YoY)

Revenue down 2.8% to Rs 296.98 crore versus Rs 305.69 crore.

Ebitda down 10% to Rs 46.01 versus Rs 50.90 crore.

Margin at 15.5% versus 16.7%.

Net loss at Rs 16.41 crore versus loss of Rs 4.86 crore.

Pricol Q1 Highlights (Consolidated, YoY)

Revenue up 44.35% at Rs 895 crore versus Rs 620 crore.

Ebitda up 21.75% at Rs 99.02 crore versus Rs 81.33 crore.

Ebitda margin down 205 basis points at 11.06% versus 13.11%.

Net profit up 9.74% at Rs 50 crore versus Rs 45.56 crore.

Great Eastern Shipping Q1 Highlights (Consolidated, YoY)

Revenue down 20.3% to Rs 1,201 crore versus Rs 1,508 crore.

Ebitda down 30.9% to Rs 628 versus Rs 908 crore.

Margin at 52.3% versus 60.2%.

Net Profit down 37.9% to Rs 505 crore versus Rs 812 crore.

Sanofi India Q1 Highlights (Consolidated, YoY)

Revenue down 12.4% to Rs 406 crore versus Rs 464 crore.

Ebitda down 18% to Rs 94.9 versus Rs 116 crore.

Margin at 23.4% versus 25%.

Net Profit at Rs 69.5 crore versus Rs 10.3 crore.

Indegene Q1 Highlights (Consolidated, YoY)

Revenue up 12.5% to Rs 761 crore versus Rs 677 crore.

Ebitda up 20.5% to Rs 155 versus Rs 129 crore.

Margin at 20.4% versus 19.1%

Net Profit up 32.7% to Rs 116 crore versus Rs 87.7 crore.

RR Kabel Q1 Highlights (Consolidated, YoY)

Revenue up 13.9% to Rs 2,059 crore versus Rs 1,808 crore.

Ebitda up 49.7% to Rs 142 versus Rs 94.9 crore.

Margin at 6.9% versus 5.3%.

Net Profit up 39.4% at Rs 89.8 crore versus Rs 64.4 crore.

LG Balakrishnan & Bros Q1 Highlights (Consolidated, YoY)

Revenue up 15% to Rs 657 crore versus Rs 571 crore.

Ebitda up 8.9% to Rs 97.1 versus Rs 89.2 crore.

Margin at 14.8% versus 15.6%.

Net Profit up 2.7% at Rs 66.9 crore versus Rs 65.2 crore.

Timken India Q1 Highlights (Consolidated, YoY)

Revenue up 3.2% to Rs 809 crore versus Rs 784 crore.

Ebitda up 1% to Rs 142 versus Rs 141 crore.

Margin at 17.6% versus 18%.

Net Profit up 8.2% at Rs 104 crore versus Rs 96.3 crore.

Chalet Hotels Q1 Highlights (Consolidated, YoY)

Revenue up 147.8% to Rs 894.55 crore versus Rs 361.01 crore

Ebitda at Rs 357.28 crore versus Rs 140.24 crore

Margin at 39.9% versus 38.8%

Net Profit at Rs 203.15 crore versus Rs 60.67 crore

PDS Q1 Highlights (Consolidated, YoY)

Revenue up 14.4% to Rs 2,999 crore versus Rs 2,621 crore.

Ebitda down 31.1% to Rs 50.5 versus Rs 73.3 crore.

Margin at 1.7% versus 2.8%.

Net Profit down 34.7% at Rs 13 crore versus Rs 19.9 crore.

PB Fintech Q1FY26 Highlights (Consolidated, QoQ)

Revenue down 10.6% to Rs 1,348 crore versus Rs 1,508 crore (Estimate Rs 1,283 crore)

Ebitda down 69.8% to Rs 34.3 crore versus Rs 113.5 crore

EBITDA margin down 498 bps at 2.5% versus 7.5%

Net profit down 50.2% to Rs 84.6 crore versus Rs 170 crore (Estimate Rs 90.5 crore)

Company to grant Rs 300 crore unsecured loan to subsidiary Policybazaar Insurance

Company to grant Rs 100 crore unsecured loan to subsidiary Paisabazaar Marketing

3i Infotech Q1FY26 Highlights (Consolidated, QoQ)

Net profit down 71.7% to Rs 7.6 crore versus Rs 26.9 crore

Revenue down 8.8% to Rs 171 crore versus Rs 187 crore

EBIT loss of Rs 3.3 crore versus profit of Rs 3.8 crore

Credo Brands Marketing Q1FY26 Highlights (Consolidated, YoY)

Revenue down 3.2% to Rs 120 crore versus Rs 124 crore

Ebitda down 6.9% to Rs 30.9 crore versus Rs 33.3 crore

Margin at 25.8% versus 26.9%

Net profit down 35.5% to Rs 6.3 crore versus Rs 9.8 crore

KRN Heat Exchanger and Refrigeration Q1FY26 Highlights (Consolidated, YoY)

Revenue up 20.4% to Rs 115.3 crore versus Rs 95.8 crore

Ebitda down 0.6% to Rs 17.6 crore versus Rs 17.7 crore

Margin down 321 bps at 15.3% versus 18.5%

Net profit up 3.8% to Rs 12.4 crore versus Rs 12 crore

Nahar Spinning Mills Q1FY26 Highlights

Revenue down 0.3% to Rs 819 crore versus Rs 821 crore

Ebitda up 10.7% to Rs 58.9 crore versus Rs 53.3 crore

Margin up 70 bps at 7.2% versus 6.5%

Net profit at Rs 16 crore versus Rs 6.6 crore

Profit increased on account of lower interest cost

Stocks In News

DOMS Industries: The company's board has approved the acquisition of an additional 13.0% stake in its subsidiary, Pioneer Stationery Pvt. Ltd.

Gujarat Gas: The company and Waaree Energy have partnered to develop sustainable energy solutions and reduce carbon footprints.

NCC: The company received two orders worth Rs 792 crore in July. Of this, Rs 461.39 crore pertains to the Buildings Division and Rs 330.15 crore pertains to the Electrical Division.

Nuvama: The company has confirmed the Income Tax Department is conducting a survey at their premises, stating they are fully cooperating, and business operations remain uninterrupted.

Punjab National Bank: The company has cut its MCLR (Marginal Cost of Funds based Lending Rate) by five basis points for all loan tenures up to three years.

Indian Bank: The company has cut its Treasury Bills Linked Lending Rate (TBLR) for loans up to three months by five basis points to 5.35% but increased it by five basis points to 5.55% for six-month to three-year loans.

PNB Housing Finance: The company's CEO, Girish Kousgi, has resigned, effective Oct. 28.

NBCC: The company has entered into an agreement with Madhya Pradesh Gramin Bank to develop a modern institutional campus in Indore, valued at Rs 45.3 crore. The company has also signed an accord with the India Department of Post for the development of various land parcels across India.

Godrej Properties: The company has entered the Vadodara market by acquiring nearly 34 acres of land for a plotted development, with an estimated saleable area of about 0.9 lakh square feet.

Nestle: The company's Chairman & Managing Director, Suresh Narayanan, is retiring, effective July 31, 2025.

Muthoot Microfin: The company has allotted commercial paper worth Rs 45 crore on July 31, 2025.

Tata Steel: The company's arm is acquiring a 40% equity stake in its JV, TSN Wires Company Ltd., from Nichia Steel Works Ltd. for a consideration worth Rs 270 crore.

Mankind Pharma: The company has approved the acquisition of the Branded Generic Business related to the Women Health Rx Portfolio from its arm, Bharat Serums and Vaccines Ltd., via slump sale on a going concern basis for a lump sum consideration.

Dodla Dairy: The company has completed the 100% acquisition of HR Food Processing for a total consideration of Rs 5.2 crore.

Endurance Technologies: The company's arms in Italy, Endurance Engineering S.r.l. and Endurance S.p.A., will merge with Endurance Castings S.p.A..

Equitas Small Finance Bank: The company has allotted 50,000 Non-Convertible Debentures worth Rs 500 crore through a private placement.

IndusInd Bank: Jyoti Prasad Ratho, Head of Internal Audit at IndusInd Bank, is no longer a Senior Management Personnel due to his superannuation from services.

Bank of India : The bank will cut its one-year MCLR by 10 basis points to 8.9% effective tomorrow.

Arihant Superstructures: The GST Department is conducting a search and seizure operation at the company and its arm, Vatika Realty, with the company assuring full compliance and uninterrupted operations.

Mahindra and Mahindra: Mahindra Ideal Lanka is no longer an associate of M&M.

Neogen Chemicals: The company has incorporated a step-down arm, Neogen Morita New Materials.

Cantabil Retail: The company has opened seven new showrooms, bringing the total number of showrooms to 614.

Paisalo Digital: The company's board will meet on Aug. 5 to consider raising funds on a private placement basis.

Maharashtra Scooters: Sanjay Uttekar has resigned as CEO of the company.

MedPlus: The company's health arm has received two suspension orders for a drug license for a store in Telangana.

IPO Listing

Shanti Gold: The company's shares will debut on the stock exchange on Friday. The Rs 360.11-crore IPO was subscribed 13.21 times on its third and final day. The bids were led by institutional investors (0.17 times), retail investors (12.18 times), non-institutional investors (33.01 times).

IPO Offerings

Laxmi India Finance: The public issue was subscribed to 1.87 times on day 3. The bids were led by Qualified institutional investors (1.3 times), non-institutional investors (1.84 times), retail investors (2.22 times) and reserved for employees (1.57 times).

Aditya InfoTech: The public issue was subscribed to 100.69 times on day 3. The bids were led by Qualified institutional investors (133.21 times), non-institutional investors (72 times), retail investors (50.87 times) and reserved for employees (8.5 times).

Sri Lotus Developers and Realty: The public issue was subscribed to 10.34 times on day 2. The bids were led by Qualified institutional investors (8.69 times), non-institutional investors (15.96 times), retail investors (8.9 times) and reserved for employees (7.83 times).

M&B Engineering: The public issue was subscribed to 2.94 times on day 2. The bids led by Qualified institutional investors (0.02 times), non-institutional investors (4.34 times), retail investors (9.57 times) and reserved for employees (3.6 times).

NSDL: The public issue was subscribed to 5.03 times on day 2. The bids were led by Qualified institutional investors (1.96 times), non-institutional investors (11.08 times), retail investors (4.17 times) and reserved for employees (7.7 times).

Bulk And Block Deals

SG Mart: Abakkus, through its arms, sold 16 lakh shares (1.26%) at Rs 325 apiece.

Epack Durable: India Advantage Fund S4-I sold 20 lakh shares (2.08%) at Rs 380.37 apiece.

Dam Capital Advisors: Gazania Advisory sold 4.46 lakh shares at Rs 222.1 apiece, while Madhavan Kunniyur bought 4.46 lakh shares (0.63%) at Rs 222.17 apiece.

V2 Retail: Motilal Oswal Mutual Fund sold 1.9 lakh shares (0.55%) at Rs 1,868 apiece.

Insider Trading

Geojit Financial Services: Promoter BNP Paribas SA sold 55,046 shares on July 30.

Shoppers Stop: Promoter Anbee Constructions LLP and Cape Trading LLP bought 25,000 shares on July 30.

Trading Tweaks

List Of Securities Shortlisted In Short-Term ASM Framework Stage - I: Pondy Oxides & Chemicals.

List Of Securities To Be Excluded From ASM Framework: Garuda Construction and Engineering, Hind Rectifiers, Vertoz.

List Of Securities Shortlisted In Long-Term ASM Framework Stage – I:

Ex-Dividend: Endurance Tech, United Spirits, Amara Raja Energy, Arkade Developers, Galaxy Surfactants, Gandhar Oil Refinery, Balaji Amines, BHEL, City Union Bank, Data Patterns, Eicher Motors, Marico, Maruti Suzuki, Varun Beverages.

Price Band Change From 10% To No Band: Nuvama Wealth Management, Suzlon Energy.

Price Band Change From 20% To 10%: Zuari Agro Chemicals.

Price Band Change From 5% To 20%: Valor Estate.

Price Band Change From No Band To 20%: Aarti Industries, ACC, Balkrishna Industries, Birlasoft, Chambal Fertilizers & Chemicals, Hindustan Copper, Mahindra & Mahindra Financial Services, Mahanagar Gas, Piramal Enterprises, Tata Communications.

F&O Cues

Nifty August Futures down by 0.36% to 24871.60 at a premium of 103 points.

Nifty August futures open interest up by 24%.

Nifty Options Aug. 7 Expiry: Maximum Call open interest at 26000 and Maximum Put open interest at 24,000.

Securities in Ban Period: Nil.

Currency/Bond Update

The Indian rupee closed 17 paise weaker at 87.6 against the dollar on Thursday, extending its decline amid rising India-US trade tensions and firm crude oil prices. The yield on the benchmark 10-year bond settled flat at 6.37%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.