- GIFT Nifty down 93.5 points at 24,536 indicating lower open for Nifty 50

- Foreign investors sold Indian shares worth Rs 4,999 crore on Wednesday

- US stocks rose with S&P 500 up 0.7%, Nasdaq 100 gained 1.3% on corporate earnings

Good morning!

The GIFT Nifty is down 93.5 points or 0.4% at 24,536 as of 6:30 a.m., indicating a lower open for the benchmark Nifty 50.

US and European index futures climbed in early trading on Thursday, as investors looked past President Donald Trump's threat of a 100% tariff on chip exports to the US.

S&P 500 futures up 0.3%

Euro Stoxx 50 futures up 0.1%

Markets On Home Turf

The Indian equity benchmark indices closed lower for the second consecutive day as Wipro, Sun Pharma, Jio Finance along with others weighed on the index. The NSE Nifty 50 benchmark ended 75 points, or 0.31% lower at 24,574, and the 30-stock BSE Sensex ended 166.26 points, or 0.21% lower at 80,543.

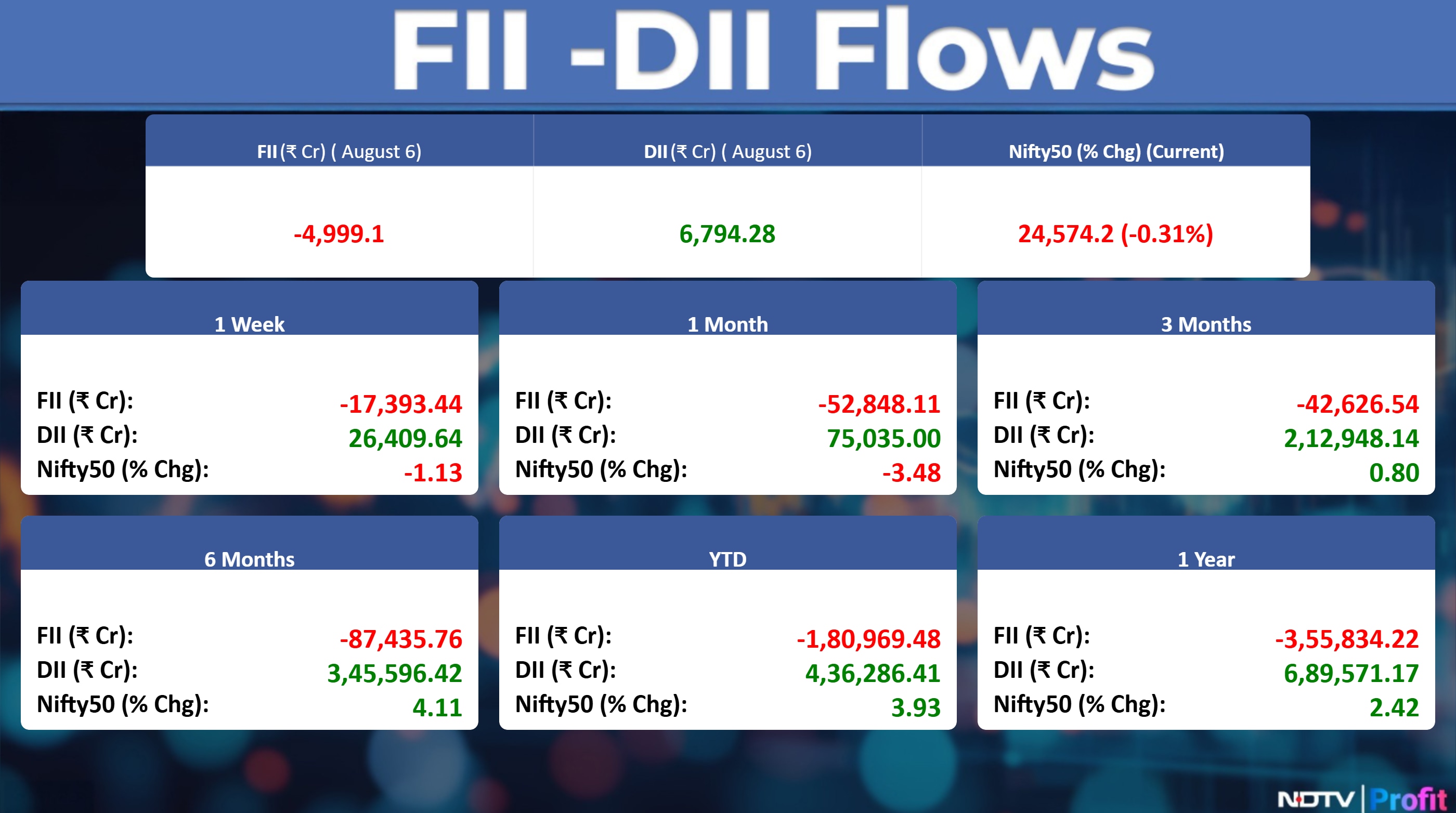

Foreign portfolio investors stayed net sellers of Indian shares on Wednesday and sold stocks worth approximately Rs 4,999 crore, according to provisional data from the National Stock Exchange.

Wall Street Recap

US stocks rose, driven by a rally in some of the biggest technology companies, as investors shifted their focus to corporate earnings. The S&P 500 Index jumped 0.7% and the Nasdaq 100 gained 1.3%. The Dow Jones Industrial Average climbed 0.2%.

Asia Market Update

A gauge of Asian shares gained 0.3% ahead of data set for release includes trade for Australia and China, inflation expectations in New Zealand and industrial production in Malaysia.

Nikkei up 0.7%

Topix up 0.7%

Kospi up 0.6%

S&P/ASX 200 down 0.1%

Hang Seng futures up 0.2%

Commodities Check

Oil edged higher after a five-day decline as investors looked beyond US efforts to punish buyers of Russian crude like India. Brent traded near $67 a barrel after closing at the lowest since June, while West Texas Intermediate was below $65.

Gold held a moderate loss, as traders looked past uncertainty created by Trump's latest trade moves, including threatening a 100% tariff on chip imports. Bullion was steady around $3,370 an ounce after a 0.3% decline in the previous session, Bloomberg News reported.

Earnings To Watch

3M India, Apollo Pipes, Apollo Tyres, Bajaj Electricals, Biocon, Birlasoft, Caplin Point Laboratories, Carborundum Universal, Century Plyboards (India), Crompton Greaves Consumer Electricals, Cummins India, Data Patterns (India), DCX Systems, Edelweiss Financial Services, Emcure Pharmaceuticals, FDC, General Insurance Corporation of India, GMM Pfaudler, Godrej Consumer Products, Greenlam Industries, Gujarat State Fertilizers & Chemicals, Hindustan Construction Company, Hikal, Hindustan Petroleum Corporation, Igarashi Motors India, India Glycols, India Shelter Finance Corporation, Indigo Paints, Innova Captab, IOL Chemicals & Pharmaceuticals, Kalyan Jewellers India, Kewal Kiran Clothing, Kalpataru Projects International, KRBL, KSB, Life Insurance Corporation of India, Linde India, Lumax Auto Technologies, Global Health, Metro Brands, Metropolis Healthcare, Max Financial Services, National Aluminium Company, Navneet Education, NBCC (India), NLC India, NOCIL, Page Industries, Pitti Engineering, Prism Johnson, PTC India, Quick Heal Technologies, The Ramco Cements, RateGain Travel Technologies, Shree Renuka Sugars, Repco Home Finance, Sai Life Sciences, Sandhar Technologies, Schneider Electric Infrastructure, Solar Industries India, Subros, Sun TV Network, Titan and Varroc Engineering.

Earnings Post Market Hours

Sanghvi Movers Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 81.5% to Rs 273.36 crore versus Rs 150.61 crore.

Ebitda up 34% to Rs 99.55 crore versus Rs 74.33 crore.

Margin at 36.4% versus 49.4%.

Net Profit up 24% to Rs 50.26 crore versus Rs 40.49 crore.

Jindal Stainless Q1 FY26 Highlights (Consolidated, QoQ)

Revenue flat at Rs 10,207.14 crore.

Net Profit up 21% to Rs 714.16 crore versus Rs 590.99 crore.

Ebitda up 23% to Rs 1,309.80 crore versus Rs 1,060.88 crore.

Margin at 12.8% versus 10.4%.

HUDCO Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 34.2% to Rs 2,937.31 crore versus Rs 2,188.35 crore.

Net Profit up 13% to Rs 630.23 crore versus Rs 557.75 crore.

NII rises 33.4% to Rs 948 crore versus Rs 711 crore.

Impairment loss of Rs 103 crore versus loss of Rs 18.7 crore.

Lumax Industries Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 20.5% to Rs 922.52 crore versus Rs 765.79 crore.

Net Profit up 6% to Rs 36.19 crore versus Rs 34.18 crore.

Ebitda up 42% to Rs 81.81 crore versus Rs 57.75 crore.

Margin at 8.9% versus 7.5%.

Prince Pipes And Fittings Q1 FY26 Highlights (YoY)

Revenue down 4.0% to Rs 580.42 crore versus Rs 604.47 crore.

Ebitda down 32% to Rs 39.57 crore versus Rs 58.30 crore.

Margin at 6.8% versus 9.6%.

Net Profit down 80% to Rs 4.82 crore versus Rs 24.68 crore.

Gujarat Narmada Valley Fertilizers Q1 FY26 Highlights (Consolidated, YoY)

Revenue down 20.8% to Rs 1,601 crore versus Rs 2,021 crore.

Net Profit down 30% to Rs 83 crore versus Rs 118 crore.

Ebitda down 80% to Rs 31 crore versus Rs 153 crore.

Margin at 1.9% versus 7.6%.

MM Forgings Q1 FY26 Highlights (Consolidated, YoY)

Revenue down 5.4% to Rs 361.64 crore versus Rs 382.19 crore.

Net Profit down 36% to Rs 19.19 crore versus Rs 30.11 crore.

Ebitda down 13% to Rs 63.31 crore versus Rs 73.12 crore.

Margin at 17.5% versus 19.1%.

Kirloskar Oil Engines Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 8.1% to Rs 1,763.80 crore versus Rs 1,631.87 crore.

Net Profit down 11% to Rs 141.88 crore versus Rs 159.30 crore.

Ebitda up 1% to Rs 326.67 crore versus Rs 324.64 crore.

Margin at 18.5% versus 19.9%.

Trent Q1 FY26 Highlights (Standalone, YoY)

Revenue up 19.8% to Rs 4,781.25 crore versus Rs 3,991.74 crore.

Net Profit up 24% to Rs 422.59 crore versus Rs 342.15 crore.

Ebitda up 37% to Rs 837.73 crore versus Rs 611.20 crore.

Margin at 17.5% versus 15.3%

Hero MotoCorp Q1 FY26 Highlights (Standalone, YoY)

Revenue down 5.6% to Rs 9,578.86 crore versus Rs 10,143.73 crore.

Net Profit flat at Rs 1,125.70 crore versus Rs 1,122.63 crore.

Ebitda down 5% to Rs 1,381.71 crore versus Rs 1,459.75 crore.

Margin flat at 14.4%.

Sula Vineyards Q1 FY26 Highlights (Consolidated, YoY)

Revenue down 9.3% to Rs 109.64 crore versus Rs 120.93 crore.

Net Profit down 87% to Rs 1.94 crore versus Rs 14.63 crore.

Ebitda down 46% to Rs 18.30 crore versus Rs 33.96 crore.

Margin at 16.7% versus 28.1%.

Ircon International Q1 FY26 Highlights (Consolidated, YoY)

Revenue down 21.9% to Rs 1,786.29 crore versus Rs 2,287.13 crore.

Net Profit down 27% to Rs 164.56 crore versus Rs 224.02 crore.

Ebitda down 20% to Rs 199.90 crore versus Rs 250.51 crore.

Margin at 11.2% versus 11.0%.

BHEL Q1 FY26 Highlights (Consolidated, YoY)

Revenue flat at Rs 5,486.91 crore versus Rs 5,484.92 crore.

Net loss at Rs 455.50 crore versus Rs 211.40 crore.

Ebitda loss at Rs 537.14 crore versus Rs 169.35 crore.

VIP Industries Q1 FY26 Highlights (Consolidated, YoY)

Revenue down 12.1% to Rs 561.43 crore versus Rs 638.89 crore.

Net loss at Rs 13.10 crore versus profit of Rs 4.04 crore.

Ebitda down 50% to Rs 24.65 crore versus Rs 49.31 crore.

Margin at 4.4% versus 7.7%.

Datamatics Global Services Q1 FY26 Highlights (Consolidated, QoQ)

Revenue down 6.0% to Rs 467.56 crore versus Rs 497.15 crore.

Net Profit up 12% to Rs 50.38 crore versus Rs 44.86 crore.

Ebit up 3% to Rs 56.43 crore versus Rs 54.54 crore.

Margin at 12.1% versus 11.0%.

Raymond Lifestyle Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 17.2% to Rs 1,430.43 crore versus Rs 1,220.12 crore.

Net loss at Rs 19.82 crore versus loss of Rs 23.21 crore.

Ebitda up 29% to Rs 77.00 crore versus Rs 59.72 crore.

Margin at 5.4% versus 4.9%.

Gopal Snacks Q1 FY26 Highlights (Consolidated, YoY)

Revenue down 9.1% to Rs 322.17 crore versus Rs 354.32 crore.

Net Profit down 90% to Rs 2.52 crore versus Rs 24.30 crore.

Ebitda down 16% to Rs 107.42 crore versus Rs 128.44 crore.

Margin at 33.3% versus 36.2%.

Balmer Lawrie Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 6.7% to Rs 680.66 crore versus Rs 638.16 crore.

Net Profit up 8% to Rs 68.93 crore versus Rs 63.83 crore.

Ebitda up 30% to Rs 83.18 crore versus Rs 63.93 crore.

Margin at 12.2% versus 10.0%

Bajaj Holdings Q1 FY26 Highlights (Consolidated, YoY)

Total income at Rs 338 crore versus Rs 148 crore.

Net profit at Rs 3,487 crore versus Rs 1,610 crore.

The surge in profit was from the sale of shares in Bajaj Finserv.

Fortis Healthcare Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 16.6% to Rs 2,166.72 crore versus Rs 1,858.90 crore.

Net Profit up 57% to Rs 260.28 crore versus Rs 165.96 crore.

Ebitda up 43% to Rs 490.67 crore versus Rs 342.52 crore.

Margin at 22.6% versus 18.4%.

SKF Q1 FY26 Highlights (Consolidated, YoY)

Revenue rises 6.4% to Rs 1,283 crore versus Rs 1,206 crore.

Ebitda files 13.6% to Rs 167.3 crore versus Rs 194 crore.

Margin at 13% versus 16%

Net profit declines 25.6% to Rs 118 crore versus Rs 159 crore.

Rain Industries Q1 FY26 Highlights (Consolidated, YoY)

Revenue rises 7.5% to Rs 4,401 crore versus Rs 4,094 crore.

Ebitda up 88.8% at Rs 658 crore versus Rs 349 crore.

Margin at 15% versus 8.5%.

Net profit at Rs 60.7 crore versus loss of Rs 77.9 crore.

Protean eGov Technologies Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 7.3% to Rs 210.84 crore versus Rs 196.54 crore.

Net Profit up 13% to Rs 23.85 crore versus Rs 21.09 crore.

Ebitda up 9% to Rs 16.41 crore versus Rs 15.11 crore.

Margin at 7.8% versus 7.7%.

Raymond Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 16.6% to Rs 524.29 crore versus Rs 449.81 crore.

Net Profit down 9% to Rs 20.62 crore versus Rs 22.62 crore.

Ebitda up 25% to Rs 56.28 crore versus Rs 44.88 crore.

Margin at 10.7% versus 10.0%.

(Exceptional item are excluded)

Hinduja Global Q1 FY26 Highlights (Consolidated, YoY)

Revenue down 3.3% to Rs 1,056 crore versus Rs 1,092 crore.

Ebitda rises 71.6% to Rs 28.7 crore versus Rs 16.7 crore.

Margin at 2.7% versus 1.5%.

Net Profit down 89.5% at Rs 17.4 crore versus Rs 166 crore.

Stocks In News

Schneider Electric Infrastructure: Gujarat High Court granted a stay order against an Income Tax Department demand for Rs 18.53 crore.

Sanghvi Movers: The company appointed Pradeep Mehta as the chief financial officer.

Paras Defence and Space Technologies: The company signed a teaming agreement with High Performance Space Structure Systems GmBH, Germany. The agreement is signed with the intention of working for projects related to Defence & Space in the Indian region.

Jash Engineering: The company updated its order book details. As of Aug. 1, the consolidated order book stood at Rs 875 crore, with an addition of Rs 78 crore during the month of July 2025.

Tata Steel: The company's arm has acquired 40% equity stake in TSN Wires, thereby making it an indirect wholly-owned foreign subsidiary.

IRB Infrastructure: The company has posted an update on project-wise toll revenue for July 2025. The gross toll collection for July 2025 increased by around 10% year-on-year.

MOIL: The company has posted a monthly update for July. It produced 1.45 lakh tonnes of manganese ore, up 11.4% over the corresponding year-ago period. Sales during April–July period stood at 4.53 lakh tonnes, compared to 5.02 lakh tonnes during April–July 2024.

Balmer Lawrie & Company: The company announced cancellation of the project for setting up of a 200 KLPD grain based ethanol plant in Andhra Pradesh. The risk-reward scenario for the aforesaid project had turned unfavourable.

RBL Bank: The lender received approval from Reserve Bank of India for acquisition of an aggregate shareholding exceeding 5% in Utkarsh Small Finance Bank due to the amalgamation of Utkarsh Coreinvest Limited with USFBL, with the condition that the bank's total holding remains below 10%.

CreditAccess Grameen: The company has appointed Ganesh Narayanan as MD & CEO.

Kirloskar Oil Engines: The company's board approved an investment of Rs 18 crore in its US subsidiary, Kirloskar Americas, to support business expansion in the US market.

Thyrocare Technologies: The company appointed Rahul Guha as MD and CEO of the company.

Bharat Forge: The company entered into a business transfer agreement with KSSL to transfer assets and other related obligations relating to the defence business on an itemised sale basis for consideration of Rs 453 crore.

Hindustan Copper: The company has executed a memorandum of understanding with GAIL. This MoU aims to jointly participate in copper, critical minerals block auctions; develop and operationalise blocks for exploration and mining; mining and processing of minerals and share risks across the value chain.

Puravankara: The company's arm has received a letter of intent for Rs 83.51 crore for construction of civil works of commercial project “Luxon” from Krishil WhiteAlpha.

Patanjali Foods: The company has received an intimation from Principal Commissioner of GST, Meerut, which has filed an appeal against a previous order that had reduced the tax demand to Rs 44.82 lakh, with a potential liability for the company of Rs 27.46 crore.

Omaxe: The company has informed about the cessation of Manoj Kumar Dua as its chief financial officer.

Enviro Infra Engineers: The company announced cumulative orders worth Rs 1,178.3 crore from various government authorities in its areas of water treatment plants, sewage treatment plants and common effluent treatment plants.

Medplus Health Services: The company's arm Optival Health Solutions has received eight suspension orders for a drug license for various stores.

Jindal Worldwide: The company has sold a 51% stake in its wholly owned subsidiary, Goodcore Spintex, for Rs 12.75 crore, reducing its holding from 100% to 49%.

Waaree Energies: The company, being the promoter of Indosolar, is selling 12.5 lakh equity shares (3% stake) via an offer for sale to meet the minimum public shareholding requirements.

Tinna Rubber and Infrastructure: The company approved investment for an amount of Rs 5 crore, including the existing investments made, in Mbodla Investments, South Africa, joint venture of the company.

Aditya Birla Capital: The company's arm updated on its tax litigations, with an earlier income tax demand of Rs 210.3 crore for 2016-17 being nullified, and a tax demand of Rs 184.5 crore for AY 2022-23 being stayed, subject to adjustment of Rs 15.24 crore adjusted from a refund.

Lemon Tree Hotels: The company announced the opening of Lemon Tree Hotel, Chandausi. This is the eighth property of the group in Uttar Pradesh.

Sharda Motor: The company has received GST show cause Notices for the financial years from 2020-21 to 2023-24 from Office of the Joint Commissioner (State Tax), Chennai.

Shriram Finance: The company is initiating a buyback offer for its non-convertible debentures worth up to Rs 900 crore, maturing on Dec. 19, 2025. The offer opens on Aug. 28, 2025, and closes on Sept. 1, 2025, and is being made to eligible debenture holders on a first-come, first-served basis.

Kirloskar Brothers: The company has received a demand notice from the Andhra Pradesh State Tax Department for Rs.15.48 crore in alleged tax arrears for the year 2017-18.

Glenmark Pharmaceuticals: The company's US arm is facing antitrust lawsuits. The drugmaker has agreed to a $37.75 million settlement with the direct purchaser class to resolve the dispute without admitting any liability.

NESCO: The company has received a notice from the BMC for unpaid assessment tax and a penalty of Rs 2.59 crore for the period from FY 2015-16 to FY 2025-26.

Allcargo Logistics: The company's arm Ecuhold N.V. has acquired an additional 30% stake in Ecu-Line Saudi Arabia for a consideration of SAR 10 million, increasing its total holding to 100%.

Wipro: The company formed Wipro Digital, a wholly owned subsidiary in the US, to explore new business opportunities and investments in the areas of information technology, consulting and services.

Knowledge Marine & Engineering: The company has completed three acquisitions, gaining full ownership of Indian Ports Dredging and Knowledge Infra Ports for approximately Rs 41.53 lakh and Rs 34.44 lakh, respectively, and a 51% controlling stake in Kamal Marine & Engineering Works for Rs 1.22 crore.

Stocks On Brokerage Radar

Jefferies On Bharat Forge

Maintain 'Underperform' with target price of Rs 950.

Tough Q1; export outlook weakens.

Weak macro and rising US-India tariffs have significantly impacted export outlook.

On the positive side, ramp-up of large Indian guns order should boost growth starting Q4.

FY26-28 estimates EPS are 9-14% below expectation.

View stock as expensive.

Morgan Stanley On Divi's Lab

Maintain 'Overweight' and reduce target price to Rs 7,024 from Rs 7,185.

Q1 earnings miss but rising capex keeps us bullish.

Given B2B nature of business and limited information from the company, capex tends to be a key leading indicator.

To adjust for Q1 miss and higher capex spend guidance, cut FY26 EPS by 7.7%, driven by lower revenue growth.

IPO Update

Highway Infrastructure: The public issue was subscribed to 72.92 times on day 2. The bids were led by Qualified institutional investors (7.10 times), non-institutional investors (97.70 times), retail investors (73.55 times).

Knowledge Realty Trust: The public issue was subscribed to 0.18 times on day 2. The bids were led by Qualified institutional investors (0.09 times), other investors (0.30 times).

IPO Incoming

All Time Plastics: The company will offer shares for bidding on Thursday. The price band is set from Rs 260-275 per share. The IPO is for a size of Rs 400.6 crore, out of which Rs 280 crore is fresh issue rest is OFS. Tentative listing date fixed as Tuesday.

JSW Cement: The company will offer shares for bidding on Thursday. The price band is set from Rs 139-147 per share. The IPO is for a size of Rs. 3,600 crore, out of which Rs 1,600 crore is fresh issue rest is OFS.

Bulk & Block Deals

Adani Energy Solutions: Envestcom Holding Rsc sold 1.09 crore shares (0.91%) at Rs. 790 apiece.

Bikaji: ICICI Prudential Life Insurance bought 6.74 lakh shares (0.27%), Tata Mutual Fund bought 7.43 lakh shares (0.30%), HDFC Life Insurance bought 8.1 lakh shares (0.32%), Aditya Birla Sun Life bought 1.37 lakh shares (0.05%), Alphamine Absolute Return bought 1.37 lakh shares (0.05%) while Deepak Agarwal sold 12.5 lakh share (0.5%) & Shiv Ratan Agarwal sold 12.5 lakh share (0.5%), all the transaction took place at Rs 732 apiece.

Laxmi India Finance: BofA Securities Europe Sa sold 2.64 lakh shares at Rs. 125.01 apiece.

Spandana Sphoorty: ACM Global Fund VCC bought 1.38 lakh shares (0.19%) at 9.95 a piece.

Tube Invest of India: Motilal Oswal Mutual Fund bought 10.7 lakh shares (0.55%) at Rs. 2919.02 apiece.

Pledge Shares Details

Baazar Style Retail: Rohit Kedia, Promoter & Director of the company, acquired 1 lakh shares.

D. B. Corp: D B Power, Promoter Group of the company, has acquired 62,645 shares.

Arkade Developers: Amit Mangilal Jain, Promoter & Director of the company, acquired 1 lakh shares.

Shakti Pumps India: Vintex Tools & Machineries, Promotor of the company, acquired 11,600 shares.

Trading Tweaks

List of securities to be excluded from ASM Framework: Brightcom Group, Jaiprakash Power Ventures, Prime Focus.

Price Band change from 10% to 20%: Aether Industries, Apollo Micro Systems, EPACK Durable, Gabriel India, Godfrey Phillips India, Ideaforge Technology, Panacea Biotec, PC Jeweller, Protean e-gov Technologies, Sagility India, Transformers and Rectifiers (India), Zaggle Prepaid Ocean Services.

Price Band change from 5% to 10%: Aditya Birla Money, E2E Networks, Emcure Pharmaceuticals, Garware Hi-Tech Films, Heads Up Ventures, Kalyani Forge, Kamdhenu Ventures, Senco Gold, SKY Gold and Diamonds, V2 Retail, VIP Clothing.

Ex-Dividend: Avanti Feeds, Bayer CropScience, CCL Products, Karur Vysya Bank, PI Industries.

F&O Cues

Nifty Aug futures are down by 0.32% to 24,628 at a premium of 53.8 points.

Nifty Aug futures open interest up by 0.48%.

Nifty Options Aug 7 Expiry: Maximum Call open interest at 25000 and Maximum Put open interest at 24,000.

Securities in ban period: PNB Housing.

Currency/Bond Update

The Indian rupee closed stronger against the US dollar on Wednesday after the Reserve Bank of India's monetary policy committee kept repo rates unchanged. The local currency closed 7 paise stronger at 87.73 against the greenback compared to previous close at 87.80. The yield on the benchmark 10-year bond settled 8 basis points higher at 6.42%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.