Good morning!

The GIFT Nifty is down 57 points or 0.23% at 24,727 as of 6:35 a.m., indicating a lower open for the benchmark Nifty 50.

US and European index futures were up in early Tuesday trading.

S&P 500 futures up 0.1%

Euro Stoxx 50 futures up 0.2%

Markets On Home Turf

The Indian equity benchmark indices closed higher, snapping a two-day slump, as Hero MotoCorp, Tata Steel stocks led gains.

The NSE Nifty 50 ended 157 points, or 0.64% up at 24,722, and the 30-stock BSE Sensex ended 418 points, or 0.52% higher at 81,018. The NSE Nifty Bank closed flat at 55,619.

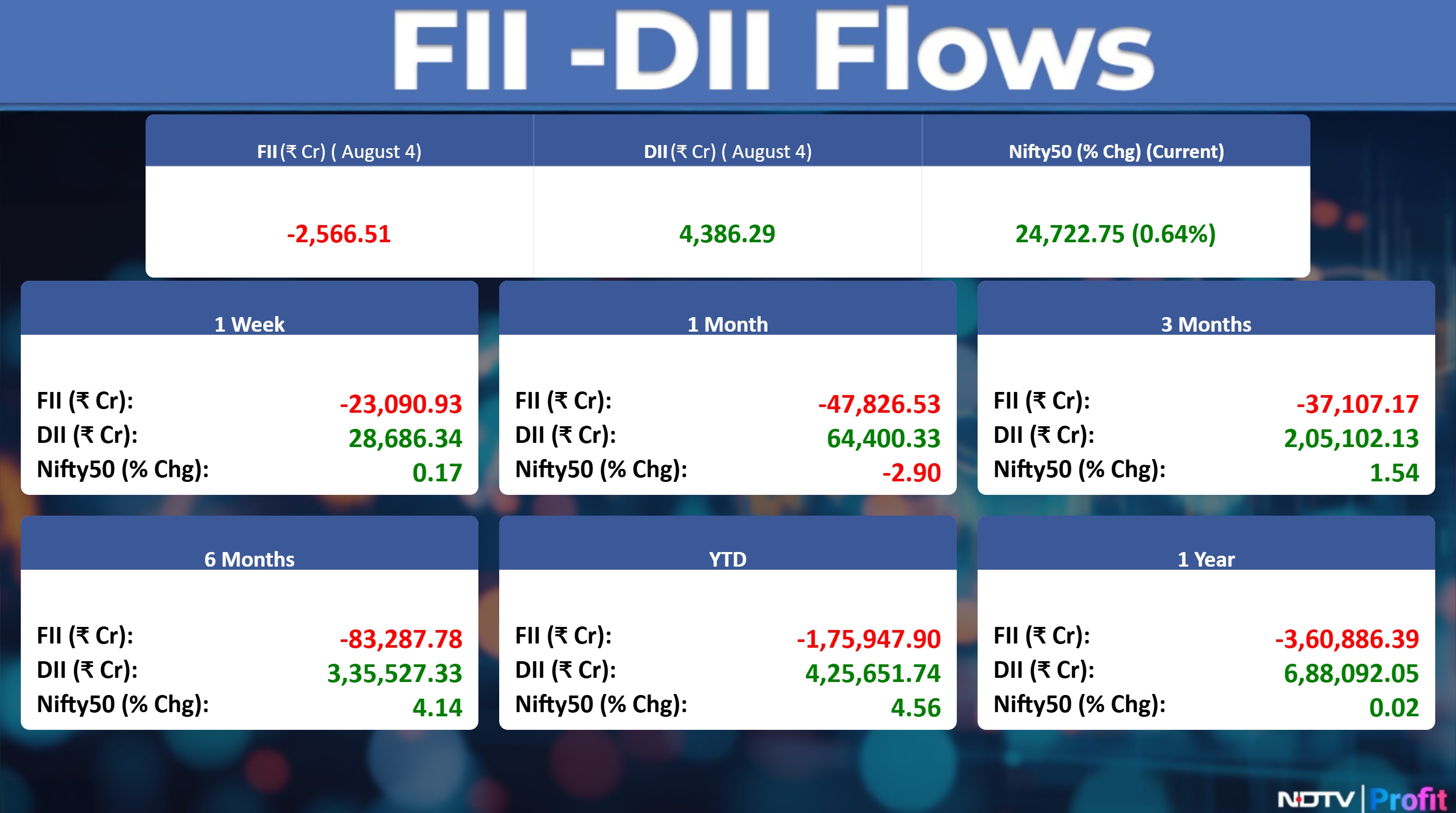

Foreign portfolio investors remained net sellers, selling stocks worth approximately Rs 2,404 crore, according to provisional data from the National Stock Exchange. The DIIs that have been buyers for the 21st session bought stocks worth Rs 4,256.55 crore.

Wall Street Recap

US stocks ended higher on Monday after the latest employment data showed a sharp slowdown in job growth, lifting expectations the Federal Reserve will cut interest rates to support the economy, Bloomberg reported. The S&P 500 Index rallied 1.5% in New York, while the technology-heavy Nasdaq 100 Index rallied 1.9%, the biggest gains for each benchmark since May.

Asia Market Update

Asian stocks rose at the open after a wave of dip buying and optimism about interest-rate cuts helped the S&P 500 post its biggest rally since May. Stocks in Japan, Australia and South Korea all gained and the broader MSCI Asia Pacific Index rose 0.4%.

Nikkei up 0.5%

Topix up 0.6%

Kospi up 1.8%

S&P/ASX 200 up 1.1%

Hang Seng futures up 1.8%

Commodities Watch

Oil prices steadied after a three-day drop as investors weighed risks to Russian supplies, with US President Donald Trump stepping up his threat to penalize India for buying Moscow's crude. Brent traded below $69 a barrel after shedding more than 6% over the prior three sessions, while West Texas Intermediate was near $66.

Gold held a small gain after traders became increasingly optimistic that the Fed would cut rates at its next meeting in September. Bullion was little changed near $3,375 an ounce early in Asia.

Prices of industrial metals on the London Metal Exchange were mixed.

Copper up 0.6%

Aluminium down 0.5%

Nickel up 0.5%

Zinc up 0.8%

Lead down 0.6%

Earnings To Watch

Adani Ports and Special Economic Zone, Bharti Airtel, Britannia Industries, Lupin, Torrent Power, The Anup Engineering, Alembic Pharmaceuticals, Automotive Axles, Avalon Technologies, Berger Paints India, Bharti Hexacom, BLS International Services, CARE Ratings, Castrol India, CCL Products (India), Centum Electronics, Container Corporation of India, Da006Cmia Bharat Sugar and Industries, EIH, Elantas Beck India, Ellenbarrie Industrial Gases, Electronics Mart India, EPL, Eris Lifesciences, Eveready Industries India, Exide Industries, Gujarat Fluorochemicals, Gland Pharma, Gokaldas Exports, Godawari Power and Ispat, Gujarat Gas, Jindal Saw, KPI Green Energy, Motisons Jewellers, MTAR Technologies, NCC, Prestige Estates Projects, Keystone Realtors, Sheela Foam, Tega Industries, Updater Services, Vaibhav Global, Yatharth Hospital & Trauma Care Services.

Earnings Post Market Hours

Sona BLW Precision Forgings Q1 Highlights (Standalone, YoY)

Revenue down 7.6% to Rs 767.00 crore versus Rs 830.00 crore.

Net Profit down 23% to Rs 120.00 crore versus Rs 154.90 crore.

Ebitda down 20% to Rs 191.80 crore versus Rs 239.00 crore.

Margin at 25.0% versus 28.8%.

DLF Q1 Highlights (Consolidated, YoY)

Revenue up 99.4% to Rs 2,716.70 crore versus Rs 1,362.35 crore.

Net Profit up 18% to Rs 762.67 crore versus Rs 645.61 crore.

Ebitda up 59% to Rs 364.16 crore versus Rs 228.62 crore.

Margin at 13.4% versus 16.8%.

Kansai Nerolac Paints Q1 Highlights (Consolidated, YoY)

Revenue up 1.4% to Rs 2,162.03 crore versus Rs 2,133.08 crore.

Net Profit down 4% to Rs 220.91 crore versus Rs 230.83 crore.

Ebitda down 8% to Rs 303.17 crore versus Rs 329.63 crore.

Margin at 14.0% versus 15.5%.

GPT Infra Q1 Highlights (Consolidated, YoY)

Revenue up 29.3% at Rs 313 core versus Rs 242 crore.

Ebitda up 15.3% at Rs 37 crore versus Rs 32.1 crore.

Margin at 11.8% vs 13.3%.

Net profit up 40% at Rs 23.5 crore versus Rs 16.8 crore.

Godfrey Phillips India Q1 Highlights (Consolidated, YoY)

Revenue up 36.5% to Rs 1,486 crore versus Rs 1,088 crore.

Net Profit up 55.9% to Rs 356 crore versus Rs 229 crore.

Ebitda up 25.1% to Rs 338 crore versus Rs 270 crore.

Margin at 22.7% versus 24.8%.

Board approves issuance of 2:1 bonus equity shares.

Triveni Turbine Q1 Highlights (Consolidated, YoY)

Revenue down 19.9% to Rs 371.00 crore versus Rs 463.00 crore.

Net Profit down 19% to Rs 64.50 crore versus Rs 80.00 crore.

Ebitda down 23% to Rs 73.50 crore versus Rs 95.00 crore.

Margin at 19.8% versus 20.5%.

Siemens Energy India Q1 Highlights (Consolidated, YoY)

Revenue up 20.2% to Rs 1,784.60 crore versus Rs 1,484.20 crore.

Net Profit up 84% to Rs 262.70 crore versus Rs 142.80 crore.

Ebitda up 59% to Rs 340.40 crore versus Rs 213.50 crore.

Margin at 19.1% versus 14.4%.

Inox India Q1 Highlights (Consolidated, YoY)

Revenue up 14.6% to Rs 339.62 crore versus Rs 296.4 crore.

Net Profit up 16% to Rs 61.12 crore versus Rs 52.64 crore.

Ebitda up 8% to Rs 76.13 crore versus Rs 70.21 crore.

Margin at 22.4% versus 23.7%.

Azad Engineering Q1 Highlights (Consolidated, YoY)

Revenue up 39.2% to Rs 137 crore versus Rs 98.4 crore.

Net Profit up 73.7% to Rs 29.7 crore versus Rs 17.1 crore.

Ebitda up 46% to Rs 49.1 crore versus Rs 33 crore.

Margin at 35.8% versus 33.5%.

Delta Corp Q1 Highlights (Consolidated, YoY)

Revenue up 3.5% to Rs 184.17 crore versus Rs 178.01 crore.

Net Profit up 36% to Rs 29.46 crore versus Rs 21.68 crore.

Ebitda down 17% to Rs 39.10 crore versus Rs 47.33 crore.

Margin at 21.2% versus 26.6%.

Aurobindo Pharma Q1 Highlights (Consolidated, YoY)

Revenue up 4.0% to Rs 7,868.00 crore versus Rs 7,567.00 crore (Estimate: Rs 8,196.60 crore).

Net Profit down 10% to Rs 824.70 crore versus Rs 919.00 crore (Estimate: Rs 940.00 crore).

Ebitda down 1% to Rs 1,602.90 crore versus Rs 1,619.40 crore (Estimate: Rs 1,726.60 crore).

Margin at 20.4% versus 21.4% (Estimate: 21.06%).

Bosch Q1 Highlights (Consolidated, YoY)

Revenue up 10.9% to Rs 4,788.00 crore versus Rs 4,316.80 crore

Net Profit at Rs 1,115.00 crore versus Rs 465.00 crore

Ebitda up 23% to Rs 638.70 crore versus Rs 520.00 crore

Margin at 13.3% versus 12.0%

The June quarter includes exceptional gain of Rs 556 crore.

Kitex Garments Q1 Highlights (Consolidated, YoY)

Revenue up 3.3% to Rs 196.69 crore versus Rs 190.43 crore

Net Profit down 24% to Rs 20.76 crore versus Rs 27.31 crore

Ebitda down 15% to Rs 34.18 crore versus Rs 40.38 crore

Margin at 17.4% versus 21.2%

Oswal Pumps Q1 Highlights (Consolidated, YoY)

Revenue up 36.8% to Rs 513.90 crore versus Rs 375.60 crore

Net Profit up 34% to Rs 94.60 crore versus Rs 70.50 crore

Ebitda up 39% to Rs 140.60 crore versus Rs 101.40 crore

Margin at 27.4% versus 27.0%

Stocks In News

One 97 Communications: Antfin in its clean out trade, to sell 5.84% stake at Rs 1020 apiece. The block deal size is Rs 3,800 crore, as per the sources told to NDTV profit.

NTPC Green: The company's arm emerges as successful bidder in E-Reverse auction conducted by SECI for 70,000 MT/Annum capacity of green ammonia

Smartworks Coworking Spaces: The company discloses relating Pendency of Litigation relating to the initial public offering of the equity shares of the company.

Gujarat State Fertilizers & Chemicals: The company has informed regarding resignation of Kamal Dayani as managing director of the company with effect from Aug. 1.

The Indian Hotels Company: The company was fined Rs 93.27 crore penalty on outstanding property taxes.

Network People Services Technologies: The Board has approved allotment of 14.4 lakh shares to the non-promoter group category of the company on a preferential basis. The shares were allocated for Rs 2,074 per share, aggregating to an amount up to Rs 300 crore.

Varun Beverages: The company to increase its stake in subsidiary company, The Beverage Company Proprietary in South Africa from existing 97.42% to 97.92%.

BEML: The company has bagged order from the Ministry of Defence for supply of HMV 8X8 with contract value of Rs 282 crores. Additionally, the board has informed regarding non-binding MoU

between BEML and TuTr Hyperloop. The MoU is for developing and deploying innovative high-speed mobility solutions and optimized transportation technologies.AGI Infra: The board has approved subdivision of shares in a ratio of 1:5.

Electronics Mart India: The company has commenced the commercial operations of a new Multi Brand Store under the brand name ‘Bajaj Electronics' in Telangana.

Craftsman Automation: The company has made investments in Altilium Solar 1 and Altilium Solar 3 for solar power under the Group Captive Scheme. The entities are engaged in the Generation and transmission of power. Total investment in Altilium Solar 1 is Rs 16.9 lakh and in Altilium Solar 3 its Rs 1.34 crore.

Info Edge: The company to invest Rs 25 crore in Startup Investments, a wholly owned subsidiary of the company. This was to explore investment opportunities and other general purposes.

BSE: The board announces resignation of Subhash Kelkar as Chief Information Officer Effective Nov. 4.

Optiemus Infracom: The company has incorporated a wholly owned subsidiary, Optiemus Micro Electronics.

Exicom Tele-Systems: The company announced successful completion of its rights issue, raising approximately Rs 259.41 crore through the issuance of fully paid-up equity shares.

Quality Power Electrical Equipments : The company has secured an export order valued at Rs 11.5 crore for the supply of oil-filled current limiting reactors to the US.

Protean eGOV: The company appoints Sandeep Mantri as Chief Financial and Impact Officer.

Mukka Proteins: The company enters into capital contribution transfer agreement for acquisition of 70% stake with Trần thị phúc.

Kitex Garments: The company announces the launch of its globally trusted “Little Star” USA brand in the Indian market.

Godfrey Phillips India: The company has approved the first bonus at the ratio of 2:1 with Sept. 16 as the record date.

Kalpataru Projects: The company's wholly owned subsidiary Wainganga Expressway, has received a termination notice from NHAI alleging premium payment default, which the company and its subsidiary view as baseless due to a prior favorable arbitration award, and believe it will have no significant financial implications.

Chambal Fertilizers: Jyotsna Poddar to acquire 0.56% stake from Akshay Poddar on Aug. 11.

SJVN: The company informed about the extension of Bhupender Gupta as Chairman and Managing Director.

SEPC: The Supreme Court had directed Co & Twarit Consultancy to deposit Rs.29.5 crore with interest. Twarit Consultancy fully complied by depositing Rs 39.5 crore in tranches. However, the company will not bear any financial impact from this order, it added.

Allcargo Logistics: Allcargo Worldwide a wholly owned subsidiary of the Company has been changed to Allcargo Global.

Kitex Garments: The company's Board of Directors have approved an increase in the authorised share capital from Rs 25 crore to Rs 50 crore.

Amber Enterprises: The company to merge its subsidiary IL JIN Electronics with Ever Electronics.

Escorts Kubota: The company confirms that there is no deviation in the use of proceeds from the objects stated in the Letter of Offer for Preferential Issues.

Adani Energy: The company has informed about Incorporation of Adani Electricity Kalyan Dombivli, Adani Electricity Pune & Adani Electricity Vidarbha.

Triveni Turbine: The company unveiled India's first CO2-based high-temperature heat pump, capable of delivering heat up to 122°C and achieving a Coefficient of Performance of 6.

Kansai Nerolac Paints: The board has proposed for further investment of Rs. 9 Crore in Kansai Paints Lanka, its Sri Lankan subsidiary.

Kaynes Technology: The company's arm has signed MOU with Tamil Nadu Government. Under the MoU, company proposes to invest Rs 4,995 crores over a period of six years for the establishment of manufacturing facilities

Brigade Hotel: The company has signed MOA to take on lease the premises located at World Trade Center, Chennai for admeasuring 67,977 square feet of Super Built-up area.

Brigade Enterprises: The board appoints Othayoth Palliyil Nandakumar as Chief Operating Officer for commercial office space.

Delta Corp: The company's arm Delta Penland have approved the acquisition of 107 Rooms Hotel in Alibagh, Maharashtra spread over approximately 2,239 square meter area.

Sanofi Consumer Healthcare: The board appointed Narahari Naidu as Chief Financial Officer of the company.

Onesource Specialty Pharma: The Board of Directors approved acquisition of Sterile Injectable CDMO and CMO businesses of Steriscience and Brooks Steriscience.

JSW Energy: The company has implemented the Settlement Plan and acquisition of majority shares of KSK Water Infrastructures.

Tata Motors: The board announces appointment Of P B Balaji as CEO of Jaguar Land Rover effective Nov. 17.

Kirloskar Ferrous: The board approves merger by absorption of arms Oliver Engineering & Adicca Energy Solutions.

Redington: The company's arm Arena Bilgisayar Sanayi ve Ticaret has received the approval from the Turkish Competition Authority to continue non-binding negotiations for the transfer of the Device Distribution and Supply Agreement signed between its subsidiary, Arena Connect Teknoloji Sanayi and Vodafone Dağıtım.

IPO Listing Day

Laxmi India Finance: The company's shares will debut on the stock exchange on Tuesday at an issue price of Rs 158 apiece. The Rs 254.26 crores. IPO was subscribed 1.85 times on its third and final day. The bids were led by institutional investors (1.30 times), retail investors (2.19 times), non-institutional investors (1.83 times).

Aditya Infotech: The company's shares will debut on the stock exchange on Tuesday at an issue price of Rs 675 apiece. The Rs 1,300 crores. IPO was subscribed 101 times on its third and final day. The bids were led by institutional investors (133.21times), retail investors (50.87 times), non-institutional investors (72 times) & reserved for employees (8.50 times).

IPO Offering

Highway Infrastructure: The company will offer shares for bidding on Tuesday. Issue period Aug 5 to Aug 7. The price band is set from Rs 65 - Rs 70 per share. The IPO is for a size of Rs 130 crore, out of which Rs 97.52 crore is fresh issue rest is OFS. Tentative listing date fixed as Tue, Aug 12, 2025. The company raises Rs 23.40 from anchor investor

Knowledge Realty Trust: The company will offer shares for bidding on Tuesday. Issue period Aug 5, to Aug 7. The price band is set from Rs 95 - Rs100 per share. The IPO is for a size of Rs 4800 crores & is a fresh issue. The company raises Rs 1,620 from anchor investor

Bulk & Block Deals

PSP Project: Adani Infra Bought 86.5 lakh (21.83%) shares at Rs 640 apiece and Prahaladbhai Shivrambhai Patel sold 91 lakh (22.96%) shares at Rs 640.01 apiece. Prahaladbhai Shivrambhai Patel sold 6 lakh shares (1.51%) at Rs 625 apiece.

Yatharth Hosp & Trauma Care Services: Purnartha Investment advisers bought 5.78 lakh shares (0.60%) at Rs 649.9 apiece.

Pledge Shares Details

Insolation Energy: Vikas Jain Huf, promotor group has acquired 16,000 shares.

SML Isuzu: Sumitomo Corporation, promotor disposed 63.62 lakh shares.

Trading Tweaks

List of securities to be excluded from ASM Framework: Hubtown, Indian Energy Exchange, Lloyds Engineering Works.

Price Band change to 5% from 10%: BCG.

Price Band change to 10% from 5%: Nil.

Ex-Dividend: Interim Dividend Automotive Axles, Berger Paints, Century Enka , Chambal Fertilizers & Chemicals, Hyundai Motor India, DCM Shriram, Alembic, IPCA Laboratories, Tips Music, J.G.Chemicals, VA Tech Wabag.

F&O Cues

Nifty Aug futures is up by 0.71% to 24,803 at a premium of 81 points.

Nifty Aug futures open interest down by 2.33%.

Nifty Options 7th Aug Expiry: Maximum Call open interest at 25000 and Maximum Put open interest at 23,500.

Securities in ban period: PNB Housing.

Currency/Bond Update

The Indian rupee closed weaker against the US dollar on Monday, resuming volatility after the currency showed signs of recovery at the start of trading session. The yield on the benchmark 10-year bond settled 5 basis points lower at 6.32%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.