Good morning!

The GIFT Nifty was up 81 points or 0.33% at 24,680 as of 8:10 a.m., indicating a higher open for the benchmark Nifty 50.

US index futures were up on Monday morning, coming off a volatile trading week that saw each of the three major indices end with significant losses. European contracts gained too.

S&P 500 futures up 0.2%

Euro Stoxx 50 futures up 0.3%

Watch NDTV Profit Live

Markets On Home Turf

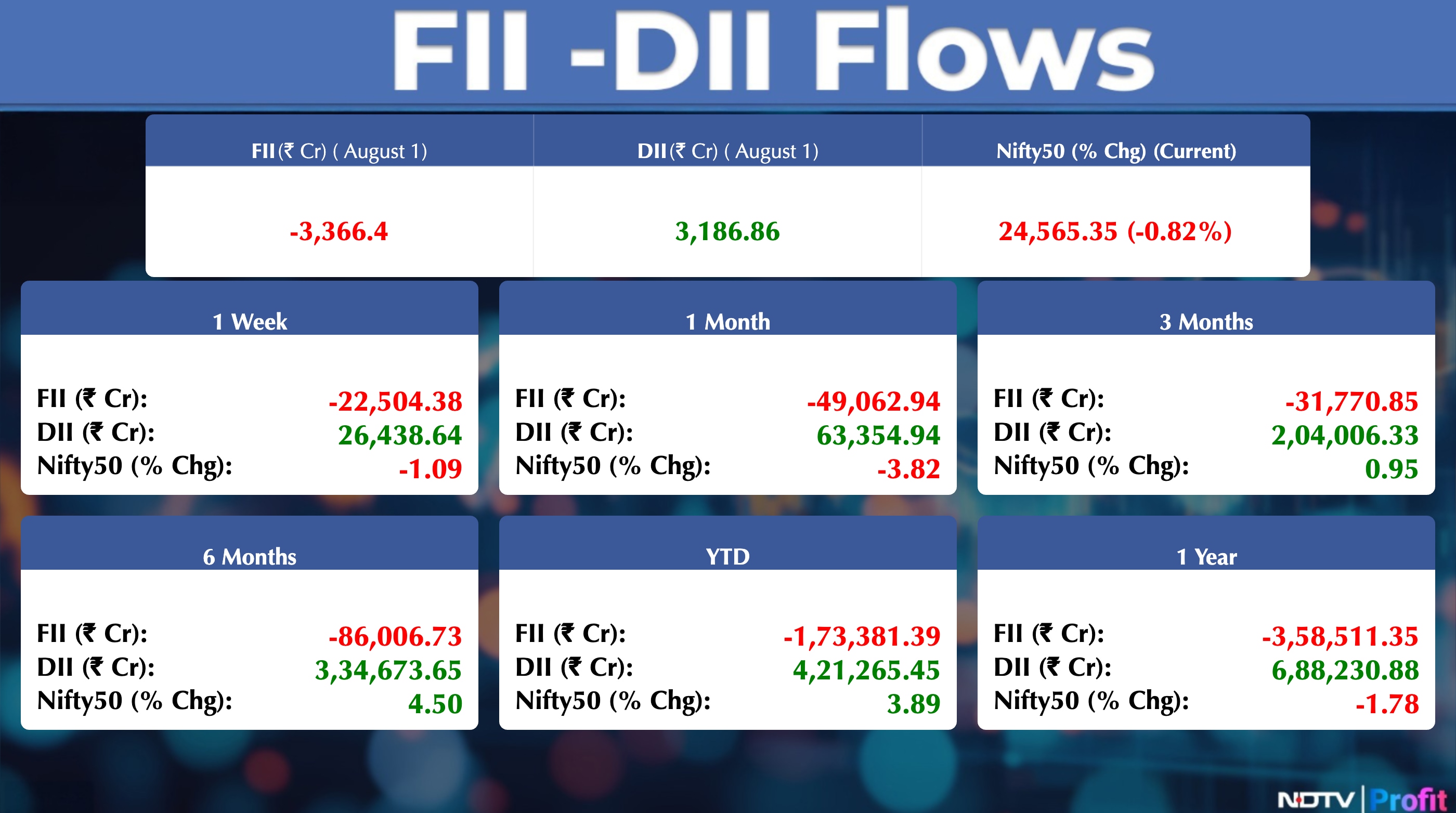

Indian stock markets logged their fifth consecutive week of losses on Friday amid trade uncertainties with the US and persistent foreign institutional outflows.

The NSE Nifty 50 settled 203 points or 0.82% lower at 24,565.35 and the Sensex lost 585.67 points or 0.72% to close at 80,599.91.

Foreign portfolio investors stayed net sellers of Indian equities for the tenth consecutive session on Friday, as they offloaded shares worth Rs 3,366 crore, according to provisional data from the National Stock Exchange.

Wall Street Update

US stocks dropped on Friday after data showed a marked slowdown in job growth and the unemployment rate rose, and US President Donald Trump unveiled a slew of new tariffs.

The S&P 500 ended 1.6% lower and the tech-heavy Nasdaq 100 dropped 2%, the biggest one-day declines in months for the two benchmarks.

Asia Market Update

A selloff in Asian stocks extended to a seventh day after weak US jobs data triggered a pullback in equities and fueled bets on an interest-rate cut by the Federal Reserve, Bloomberg reported. The MSCI Asia Pacific Index fell 0.3% as shares in Japan slumped more than 2%. South Korean shares fluctuated amid speculation about revising a capital gains tax.

Nikkei down 2.2%

Topix down 1.7%

Kospi up 0.8%

S&P/ASX 200 down 0.2%

Hang Seng futures up 0.7%

Commodities Check

Crude oil prices fell after OPEC+ agreed to another major output increase, stoking concerns about global oversupply just as the US-led trade war may be exacting a toll on economic growth and energy consumption, Bloomberg reported. Brent edged lower toward $69 a barrel, while West Texas Intermediate was near $67.

Gold was steady after gaining the most in two months on Friday, as traders weighed the implications of soft jobs data for the US economy and the Fed's interest-rate path. Bullion traded near $3,360 an ounce.

Prices of most industrial metals traded higher on the London Metal Exchange.

Copper up 0.2%

Aluminium flat

Nickel up 0.3%

Zinc down 1.2%

Lead flat

Earnings To Watch

DLF, Marico, Bosch, Aditya Birla Capital, Akzo Nobel India, Aurobindo Pharma, Azad Engineering, Borana Weaves, , Delta Corp, EIH Associated Hotels, Escorts Kubota, Globus Spirits, Godfrey Phillips India, INOX India, Kansai Nerolac Paints, Kirloskar Ferrous Industries, Oswal Pumps, Ramco Industries, Shree Cement, Sona BLW Precision Forgings Sun Pharma Advanced Research Company, Stove Kraft, Sumitomo Chemical India, TBO TEK, Triveni Turbine, Unichem Laboratories.

Earnings Post Market Hours

ITC Q1 Highlights (Standalone, YoY)

Revenue up 20.6% to Rs 19,749.91 crore versus Rs 16,374.02 crore (Estimate: Rs 20,925 crore).

Ebitda up 3% to Rs 6,261.27 crore versus Rs 6,086.77 crore (Estimate: Rs 6,417 crore).

Margin at 31.7% versus 37.2% (Estimate: 35.1%)

Net Profit down 0.1% to Rs 4,912.36 crore versus Rs 4,917.45 crore (Estimate : Rs 5,085 crore)

Multi Commodity Exchange of India Q1 Highlights (Consolidated, QoQ)

Revenue up 28.1% to Rs 373.21 crore versus Rs 291.33 crore (Estimate: Rs 389.13 crore).

Net Profit up 50% to Rs 203.19 crore versus Rs 135.46 crore (Estimate: Rs 200.57 crore).

Ebitda up 51% to Rs 241.66 crore versus Rs 160.19 crore (Estimate: Rs 267.73 crore).

Margin at 64.8% versus 55% (Estimate: 68.8%).

Approves share split in 1:5 ratio

Tata Power Q1 Highlights (Consolidated, YoY)

Revenue up 4.3% to Rs 18,035.07 crore versus Rs 17,293.62 crore (Estimate: Rs 17,865.52 crore).

Ebitda up 15% to Rs 4,139.01 crore versus Rs 3,586.66 crore (Estimate: Rs 3,530.28 crore).

Margin at 22.9% versus 20.7% (Estimate: 19.8%).

Net Profit up 9% to Rs 1,059.86 crore versus Rs 970.91 crore (Estimate: Rs 1,021.87 crore).

Honeywell Automation India Q1 Highlights (YoY)

Revenue up 23.2% to Rs 1,183.00 crore versus Rs 960.00 crore

Ebitda down 8% to Rs 141.30 crore versus Rs 153.40 crore

Margin at 11.9% versus 16.0%

Net Profit down 9% to Rs 125.00 crore versus Rs 137.00 crore

Delhivery Q1 Highlights (Consolidated, YoY)

Revenue up 5.6% to Rs 2,294.00 crore versus Rs 2,172.30 crore.

Ebitda up 53% to Rs 148.82 crore versus Rs 97.06 crore.

Margin at 6.5% versus 4.5%

Net Profit up 67% to Rs 91.05 crore versus Rs 54.36 crore.

Jupiter Lifeline Highlights (Consolidated, YoY)

Revenue up 20.5% to Rs 347.63 crore versus Rs 288.58 crore.

Ebitda up 20% to Rs 78.13 crore versus Rs 65.31 crore.

Margin at 22.5% versus 22.6%

Net Profit down 1% to Rs 43.84 crore versus Rs 44.47 crore.

JK Lakshmi Cement Q1 Highlights (Consolidated, YoY)

Revenue up 11.3% to Rs 1,741 crore versus Rs 1,564 crore.

Ebitda up 39.9% to Rs 311 crore versus Rs 222 crore.

Margin at 17.9% versus 14.2%.

Net Profit at Rs 150 crore versus Rs 56.9 crore.

Ramkrishna Forgings Q1 Highlights (Standalone, YoY)

Revenue up 5.7% to Rs 936.69 crore versus Rs 886.34 crore.

Ebitda down 8% to Rs 134.76 crore versus Rs 147.05 crore.

Margin at 14.4% versus 16.6%.

Net Profit down 49% to Rs 21.51 crore versus Rs 42.52 crore.

Alivus Life Sciences Q1 Highlights (Consolidated, YoY)

Revenue up 2.2% to Rs 601.80 crore versus Rs 588.60 crore.

Ebitda up 8% to Rs 172.20 crore versus Rs 159.40 crore.

Margin at 28.6% versus 27.1%.

Net Profit up 9% to Rs 121.50 crore versus Rs 111.40 crore.

PC Jeweller Q1 Highlights (Consolidated, YoY)

Revenue up 80.7% to Rs 724.91 crore versus Rs 401.15 crore.

Ebitda up 147% to Rs 127.31 crore versus Rs 51.57 crore .

Margin at 17.6% versus 12.9%.

Net Profit up 4% to Rs 161.93 crore versus Rs 156.06 crore.

Shakti Pumps India Q1 Highlights (Consolidated, YoY)

Revenue up 9.7% to Rs 622.50 crore versus Rs 567.65 crore .

Ebitda up 6% to Rs 143.57 crore versus Rs 135.95 crore .

Margin at 23.1% versus 23.9%.

Net Profit up 5% to Rs 96.83 crore versus Rs 92.66 crore.

Narayana Hrudayalaya Q1 Highlights (Consolidated, YoY)

Revenue up 15.4% to Rs 1,507 crore versus Rs 1,306 crore

Ebitda up 11.4% to Rs 337 crore versus Rs 302 crore

Margin at 22.4% versus 23.1%

Net Profit down 2.3% to Rs 197 crore versus Rs 201 crore

Baazar Style Retail Q1 Highlights (Consolidated, YoY)

Revenue up 37% to Rs 377.85 crore versus Rs 275.79 crore

Ebitda up 39% to Rs 58.20 crore versus Rs 41.88 crore

Margin at 15.4% versus 15.2%

Net Profit at Rs 2.05 crore versus loss of Rs 0.42 crore

HealthCare Global Enterprises Q1 Highlights (Consolidated, YoY)

Revenue up 16.6% to Rs 611.80 crore versus Rs 524.60 crore

Ebitda up 18% to Rs 106.45 crore versus Rs 89.91 crore

Margin at 17.4% versus 17.1%

Net Profit down 61% to Rs 4.75 crore versus Rs 12.10 crore

GR Infraprojects Q1 Highlights (Consolidated, YoY)

Revenue down 2.1% to Rs 1,987.78 crore versus Rs 2,030.00 crore

Ebitda up 8% to Rs 398.12 crore versus Rs 367.80 crore

Margin at 20.0% versus 18.1%

Net Profit up 57% to Rs 244.00 crore versus Rs 155.00 crore

LIC Housing Finance Q1 Highlights (Consolidated, YoY)

Net Profit up 4.4% to Rs 1,364 crore versus Rs 1,306 crore

Calculated NII up 3.9% to Rs 2,076 crore versus Rs 1,997 crore

Impairment up 34.8% to Rs 193 crore versus Rs 143.1 crore

Shriram Pistons Q1 Highlights (Consolidated, YoY)

Revenue up 15.05% at Rs 963 crore versus Rs 837 crore

Ebitda up 18.2% at Rs 195 crore versus Rs 165 crore

Margin flat at 20% versus 20%

Net profit up 15.3% at Rs 135 crore versus Rs 117 crore

ABB India Q2FY25 Highlights (YoY)

Revenue up 12.2% to Rs 3,175 crore versus Rs 2,831 crore

Ebitda down 23.7% to Rs 414 crore versus Rs 542 crore

Margin at 13% versus 19.2%

Net profit down 20.7% to Rs 352 crore versus Rs 443 crore

Stylam Industries Q1FY26 Highlights (Consolidated, YoY)

Revenue up 16.6% to Rs 283 crore versus Rs 243 crore

Ebitda up 26.5% to Rs 52.9 crore versus Rs 41.8 crore

Margin at 18.7% versus 17.3%

Net profit down 0.3% to Rs 28.3 crore versus Rs 28.36 crore

Epigral Q1FY26 Highlights (Consolidated, YoY)

Revenue down 6.8% to Rs 607 crore versus Rs 651 crore

Ebitda down 7.4% to Rs 163 crore versus Rs 176 crore

Margin at 26.9% versus 27%

Net profit up 87% to Rs 161 crore versus Rs 85.9 crore

Advanced Enzyme Tech Q1FY26 Highlights (Consolidated, YoY)

Revenue up 20.3% to Rs 186 crore versus Rs 155 crore

Ebitda up 7.3% to Rs 63.3 crore versus Rs 59 crore

Margin at 34% versus 38.2%

Net profit up 17% to Rs 39.9 crore versus Rs 34.1 crore

Gujarat Ambuja Exports Q1FY26 Highlights (Consolidated, YoY)

Revenue up 18.4% to Rs 1,291 crore versus Rs 1,090 crore

Ebitda down 8.9% to Rs 96.3 crore versus Rs 106 crore

Margin at 7.5% versus 9.7%

Net profit down 15.3% to Rs 65 crore versus Rs 76.7 crore

Sarda Energy Q1FY26 Highlights (Consolidated, YoY)

Revenue up 76.3% to Rs 1,633 crore versus Rs 926 crore

Ebitda at Rs 617 crore versus Rs 261 crore

Margin at 37.8% versus 28.1%

Net profit at Rs 434 crore versus Rs 199 crore

Federal Bank Q1FY26 Highlights (YoY unless mentioned)

Net profit down 14.6% to Rs 862 crore versus Rs 1,010 crore

Net NPA at 0.48% versus 0.44% (QoQ)

Gross NPA at 1.91% versus 1.84% (QoQ)

Net interest income up 2% to Rs 2,337 crore versus Rs 2,292 crore

Operating profit up 3.7% to Rs 1,556 crore versus Rs 1,501 crore

Provisions at Rs 400 crore versus Rs 144 crore (YoY) and Rs 138 crore (QoQ)

Vishnu Chemicals Q1FY26 Highlights (Consolidated, YoY)

Revenue up 2.4% to Rs 347 crore versus Rs 339 crore

Ebitda up 0.2% to Rs 55.7 crore versus Rs 55.6 crore

Margin at 16.1% versus 16.4%

Net profit up 5.8% to Rs 32.2 crore versus Rs 30.5 crore

Neogen Chemicals Q1FY26 Highlights (Consolidated, YoY)

Revenue up 3.8% to Rs 187 crore versus Rs 180 crore

Ebitda up 2.3% to Rs 31.5 crore versus Rs 30.8 crore

Margin at 16.9% versus 17.1%

Net profit down 10.5% to Rs 10.3 crore versus Rs 11.5 crore

MedPlus Health Q1FY26 Highlights (Consolidated, YoY)

Revenue up 3.6% to Rs 1,543 crore versus Rs 1,489 crore

Ebitda up 39.5% to Rs 131 crore versus Rs 93.7 crore

Margin at 8.5% versus 6.3%

Net profit at Rs 42.4 crore versus Rs 14.4 crore

Balaji Amines Q1FY26 Highlights (Consolidated, YoY)

Revenue down 6.9% to Rs 358 crore versus Rs 385 crore

Ebitda down 17.3% to Rs 54.7 crore versus Rs 66.1 crore

Net profit down 12.2% to Rs 37.9 crore versus Rs 43.3 crore

Margin at 15.3% versus 17.2%

Finolex Industries Q1FY26 Highlights (Consolidated, YoY)

Revenue down 8.5% to Rs 1,043 crore versus Rs 1,141 crore

EBITDA down 55% to Rs 94 crore versus Rs 207 crore

Margin at 9% versus 18.1%

Net profit down 80% to Rs 98 crore versus Rs 501 crore

Note: Base quarter included an exceptional gain of Rs 417 crore

Lower sales and higher raw material costs impacted performance

Management Update: Udipt Agarwal (currently Chief Commercial Officer at Alkyl Amines) appointed MD for 5 years starting November 1; Saurabh Dhanorkar to step down on October 25.

Utkarsh Small Finance Bank Q1FY26 Highlights (YoY)

Net interest income down 30% to Rs 402 crore versus Rs 573 crore

Operating profit down 71% to Rs 92 crore versus Rs 311 crore

Net loss of Rs 239 crore versus net profit of Rs 137 crore

Provisions surged 3.3 times YoY to Rs 411 crore versus Rs 125 crore

Provisions up 1.8x QoQ to Rs 411 crore versus Rs 223 crore

Gross NPA at 11.4% versus 9.4% (QoQ)

Net NPA at 5% versus 4.84% (QoQ)

NIM at 5.9% versus 9.4% (YoY)

Credit cost at 8.5% versus 2.7% (YoY)

Gross loan portfolio growth at 2.3% (YoY)

Stocks In News

Karnataka Bank: Ramaswamy Subramanian stepped down from his position as Chief Product Officer.

RHI Magnesita: The company has completed the acquisition of Ashwath Technologies for a total consideration of Rs 14.12 crore.

PNC INFRA: The company sold its stake in PNC Bareilly Nainital Highways for Rs 716 crore.

Lupin: The company has clarified it has not received a letter from the US government about reducing prices and is unaware of any undisclosed information.

Tata Motors - In July, Tata Motors reported a 7% year-on-year increase in commercial vehicle sales to 28,956 units, surpassing NDTV Profit's estimate of 25,967 units. However, passenger vehicle sales saw an 11% decline to 40,175 units, leading to a 6% drop in total domestic sales to 65,953 units compared to 70,161 units in the same period last year.

Oriental Rail: The company has received an order worth Rs 3.2 crore from Modern Coach Factory, Raebareli.

Blue Star: The company has appointed Sanjeev Agrawal as its new Group Chief Technology Officer.

Choice International: The company's arm has received a license from SEBI to launch and operate a mutual fund business.

Granules India: The US FDA completed a Pre-Approval Inspection at the company's Hyderabad facility from July 28 to August 1, issuing a Form 483 with one observation. The company has stated it will respond to the observation.

Lloyds Engineering: The company's subsidiary has entered into an agreement with Mumbai Railway Vikas Corporation to procure, install, and maintain escalators for the Central Railway. The agreement is valued at Rs 23 crore and is expected to be completed within 24 months.

Sun Pharmaceutical Industries: The company has clarified that it has not received any communication from the US government regarding a reduction in drug prices.

Samvardhana Motherson International: The company has approved a joint venture agreement with Macauto Industrial, a Taiwanese company, to manufacture window and roof sunshade systems.

Ambuja Cements: Adani Cementation stands amalgamated with Ambuja Cements and dissolved without being wound up.

ITC: The company has approved the amalgamation of its wholly owned subsidiaries, Sresta Natural Bioproducts Pvt. Ltd. and Wimco Ltd., with the company. The amalgamation aims to unlock value, drive synergies, and achieve more efficient operations.

NMDC: In July 2025, iron ore production increased by 42.39% to 3.09 MT compared to July 2024, and total sales were up by 13% at 3.46 MT for the same period.

JK Lakshmi Cement: The company is expanding its cement grinding capacity at its Surat grinding unit from 1.35 million tonnes to 2.7 million tonnes, with a project cost of Rs 225 crore. The company is also installing a railway siding at its Dug Cement Plant for Rs 325 crore and is expanding its clinker capacity. The company will acquire a 26% stake in Opera Vayu (Narmada) for Rs 4 crore.

HDFC Bank: The ADR holders of the Bank will receive a bonus issue in the ratio of 1:1.

Pidilite Industries: The board will meet on August 6 to consider a special interim dividend and a bonus share issue.

Harsha Engineers: The company has entered into an agreement with a leading multinational company to supply journal bearings valued at Rs 117 crore.

Maruti Suzuki: The company's total production in July rose 0.8% year-on-year to 1.87 lakh units, while total passenger vehicle production increased 0.2% to 1.83 lakh units.

Rites: The company has entered into an agreement with iSky Transport Systems to explore urban mobility solutions.

RailTel: The company has been awarded an order worth Rs 166 crore from BSNL.

Muthoot Capital: The company has completed a securitization transaction, raising Rs 136 crore by assigning two-wheeler loan receivables worth Rs 144 crore.

Hero MotoCorp: The company has reported its July auto sales data. total two-wheeler sales rose 21.5% year-over-year to 449,000 units, exceeding the NDTV Profit estimate of 446,000 units. Domestic sales grew by 18.7% YoY to 412,000 units, while exports saw a substantial surge of 64.3% YoY to 37,358 units.

Comfort Intech: The company has initiated arbitration to resolve a dispute with Orient Electric.

JSW Infrastructure: The company has incorporated a new arm named JSW Kolkata Container Terminal.

Panth Infinity: The company has received a work order worth Rs 35 crore from Richa Info Systems.

United Spirits: The company has received a tax demand of Rs 179 crore, from the tax authorities in Bengaluru.

Gujarat State Fertilizers: Kamal Dayani has resigned from his position of Managing Director of company upon reaching the age of superannuation.

Baazar Style Retail: The company has closed a store in Bihar.

Cipla: The company issued a clarification stating that it has not received any letter from the US government regarding a reduction in prices.

Crompton Greaves Consumer Electrical: The company has inaugurated an in-house Noise, Vibration & Harshness lab.

Manappuram Finance: The board will meet on Aug. 6 to consider raising up to $2 billion through senior secured notes.

JSW Energy: Commissions first 80 MW unit of 240 MW Kutehr Hydro Plant. With this capacity addition, the installed hydro capacity stands at 1,471 MW, solar at 2,157 MW, Wind at 3,562 MW, taking the share of renewables to 56%.

Religare Enterprises: Delhi High Court has quashed the ‘Fraud' classification put on company's subsidiary and has directed 14 banks to remove the ‘Fraud' classification from the RBI's Central Fraud Registry within 2 weeks of order.

Zuari Industries: Allahabad High Court allowed movement of trucks carrying industrial alcohol from distilleries, subject to the maintenance of proper records and submission of indemnity bonds by distillery operators.

Nuvama Wealth: IT Department concluded onsite survey. The company extended full co-operation.

PC Jeweller: Board approves fundraise of up to Rs 500 crore via preferential issue.

HPCL: Hindustan Petroleum Corporation Ltd. and Abu Dhabi Gas Liquefaction Company have signed Heads of Agreement (HOA) for procurement of liquefied natural gas for a 10-year term.

Jubilant Pharmova: US FDA ends pre-approval inspection at arm's Roorkee plants and issues four observations.

Uflex: The company incorporated joint venture firm with the name AMPIN C&I Power Twenty on Aug. 1, 2025.

Shakti Pumps: The firm has invested Rs 5 crore in arm Shakti EV mobility. The consolidated investment is Rs 55 crore after subscribing to 50 lakh shares.

Dilip Buildcon: The firm has been declared L-1 bidder via DBL-RBL joint venture for Rs 1,503.6 crore construction order by Gurugram metro rail.

GHV Infra Projects: The company got LOA for Rs 2,645-crore EPC contract from Rana Exim FZ-LLC.

Sanofi India: The drugmaker recorded 9% decline in net sales on a comparable basis of continuing business in domestic market.

CG Power: MPIDC handed over letter of allotment for granting 45.13 acres land on lease for 99 years in Madhya Pradesh.

Refex Industries: The firm has received Rs 50 crore order from NTPC for transportation and unloading of pond ash.

Torrent Pharma: The US FDA has concluded inspection at Andhra Pradesh plant with zero observation.

NIBE: The company has bagged Rs. 6.1-crore order from Elbit Systems for manufacturing and supply of GATR 70mm guided rocket.

Enviro Infra Engineers: The company has filed for Rs. 6.24-crore arbitration claims against Karnataka urban water supply and drainage board.

Jash Engineering: The firm's arm Shivpad Engineers commences commercial production at newly set-up plant at Kanchipuram.

Deep Industries: The company has received LOA for total estimated value of Rs 96.7 crore from Oil India.

Ambuja Cements: The board approved allotment of 87 lakh shares to eligible shareholders of Adani Cementation.

Man Industries: The company has approved the allotment of 12 lakh convertible warrants to promoter group entity man finance on preferential basis.

Medplus Health: The firm has received one suspension order for drug license for store situated in Karnataka.

IPO Offering

Sri Lotus Developers and Realty: The public issue was subscribed to 69.14 times on day 3. The bids were led by Qualified institutional investors (163.9 times), non-institutional investors (57.71 times), retail investors (20.28 times) and reserved for employees (19.84 times).

M&B Engineering: The public issue was subscribed to 36.2 times on day 3. The bids led by Qualified institutional investors (36.72 times), non-institutional investors (38.24 times), retail investors (32.55 times) and reserved for employees (8.13 times).

NSDL: The public issue was subscribed to 41.01 times on day 3. The bids were led by Qualified institutional investors (103.97 times), non-institutional investors (34.98 times), retail investors (7.73 times) and reserved for employees (15.42 times).

Bulk Deals

Belrise Industries: SR Foundation bought 44.75 lakh shares (0.5%) at Rs 141.58 apiece.

Trading Tweaks

List of securities shortlisted in Short - Term ASM Framework Stage - I: Zuari Agro Chemicals.

List of securities to be excluded from ASM Framework: Gabriel India.

Ex-Dividend: Greenply Industries, Britannia Industries, Deepak Nitrite, Praj Industries, Fairchem Organics, Emkay Global Financial Services.

F&O Cues

Nifty August Futures down by 1.02% to 24,618 at a premium of 62 points.

Nifty August futures open interest up by 8.34%.

Nifty Options Aug. 7 Expiry: Maximum Call open interest at 25000 and Maximum Put open interest at 24,200.

Securities in Ban Period: PNB Housing Finance.

Currency/Bond Update

The Indian rupee closed slightly higher, 6 paise stronger at 87.54 against US dollar versus its Thursday closing at 87.6 a dollar. The yield on the benchmark 10-year bond settled flat at 6.37%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.