Good morning!

The GIFT Nifty is trading 0.11% or 27 points down at 25,094 as of 6:15 a.m., indicating a lower start for the benchmark Nifty 50.

US and European futures were unchanged during early Asian trade.

S&P 500 futures flat

Euro Stoxx 50 futures flat

Key Events/Data To Watch

A meeting of the Index Maintenance Sub-Committee (Equity) of NSE Indices will be held after the market hours to conduct a semi-annual and quarterly review of stocks in various Nifty equity indices.

SEBI Chairman Tuhin Kanta Pandey will address at the AMFI Foundation Day.

Markets On Home Turf

The benchmark equity indices closed in the green for the sixth straight session on Thursday, recording the longest winning streak since April.

The NSE Nifty 50 ended 33.2 points or 0.13% higher at 25,083.75 and the BSE Sensex closed 142.87 points or 0.17% up at 82,000.71.

The Nifty breached the resistance level of 25,100 but could not sustain. It was also the expiry day for Nifty weekly contracts.

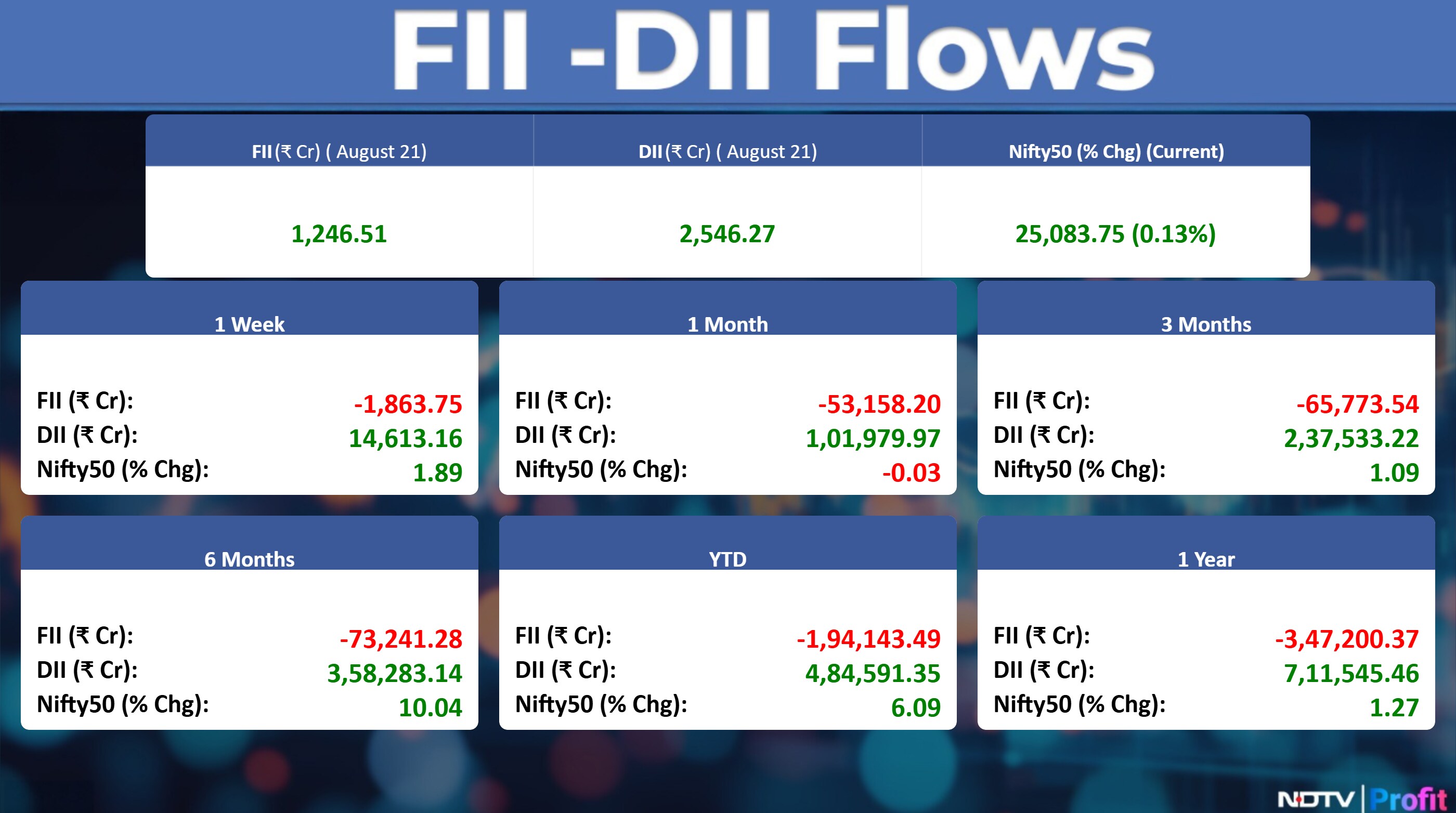

The FPIs bought stocks worth approximately Rs 1,247 crore, according to provisional data from the National Stock Exchange. The DIIs, who have been buyers for the 33rd straight session, mopped up stocks worth Rs 2,546 crore.

Wall Street Recap

US stocks closed out their fifth straight day of losses on Thursday, the longest slide since the turn of the year, after retail bellwether Walmart Inc. posted a rare profit miss, jobless claims ticked higher and a Federal Reserve official downplayed the need for a near-term interest-rate cut.

The S&P 500 sank 0.4%. The Nasdaq 100 declined 0.5%, while the blue chip Dow Jones Industrial retreated 0.3%.

Asian Market Update

Asian equities traded within a narrow range after US stocks and bonds fell as traders pared back wagers on imminent Federal Reserve interest-rate cuts. Shares in Japan and Australia declined while South Korea advanced.

Nikkei flat

Kospi up 1%

S&P/ASX 200 down 0.3%

Hang Seng futures up 0.1%

Commodities Check

Oil was steady as the market weighed the outlook for Russian crude flows to India after a Trump administration official ramped up his criticism over the trade ahead of an expected tariff increase. Brent held below $68 a barrel, on track for the biggest weekly gain since early July, while West Texas Intermediate was near $63.

Gold was steady as traders lowered their bets on rate cuts ahead of the Federal Reserve's symposium at Jackson Hole, as strong US manufacturing data added to policymakers' concerns over inflation. Bullion was trading around $3,335 an ounce early in Asia, barely changed from the start of the week.

Stocks in News

NIIT Learning Systems: The company has issued a corporate guarantee of up to Euro 15.75 million to ICICI Bank UK for a term loan of Euro 15 million being taken by its wholly owned subsidiary, NIIT (Ireland).

India Cements: Shares under offer-for-sale by promoter UltraTech Cement for non-retail investors gets 2.75 times subscription. Retail investors can bid on Aug. 22.

Waaree Energies: The company has confirmed that its acquisition of Enel Green Power India is under review and that certain commercial terms are being renegotiated. The company stated that a news report claiming the deal's collapse is speculative.

Goldiam: The company raises Rs 202 crore via QIP to fast-track growth plans. The company targets 70‐90 ORIGEM stores in 18–24 months.

City Union Bank: The bank has opened a new branch in Delhi, taking the total to 887 branches.

Seamec: The company updates on vessel "SEAMEC II" it has completed its scheduled drydocking and returned to Mumbai and will resume its contract with ONGC.

NTPC Green: The company's arm NTPC Renewable Energy has declared the third part capacity of its Khavda Solar Energy Project in Gujarat, a 49.125 MW solar unit. This adds to the 142.2 MW and 32.8 MW capacities already declared operational in June 2025.

PTC Industries: The Company has successfully bagged an order worth Rs 110 crore from BrahMos Aerospace for the supply of critical titanium castings.

Enviro Infra Engineers: The company's arm EIE Renewables has completed the acquisition of Vento Power Infra from PTC India Financial Services having won the bid.

Intellect Design Arena: The company's UK subsidiary has approved a Memorandum of Understanding to form a joint venture with UK-based ITIXA.

Crisil: The company's arm received an approval for the incorporation of a step-down subsidiary in the name of “Crisil Canada Inc” in Canada.

Wipro: The company to acquire 100% of Harman Connected Services and its subsidiaries for up to $375 million.

Piramal Pharma: The company's business vertical Piramal Pharma Solutions and New Amsterdam Pharma invest in dedicated suite to enhance oral solid dosage production capabilities at Piramal's Sellersville, Pennsylvania Site.

H.G. Infra Engineering: The Company's arm H.G. Narol Sarkhej Highway has received a letter from National Highway Division to begin the Rs 781.11 crore project.

Hikal: The company has received a Warning Letter from the US FDA for its manufacturing facility in Jigani, Bengaluru.

GMR AIRPORTS: The company's board of directors has approved a plan to raise up to Rs 5,000 crore through various securities. The Company has also approved the formation of a wholly owned subsidiary (Special Purpose Vehicle) to handle the Cargo City Project at the Indira Gandhi International Airport in New Delhi.

Lloyds Metals and Energy: The board has approved the public issuance of Non-Convertible Debentures for an amount not exceeding Rs 2,500 crore.

Hindustan Unilever: The company appointment of Niranjan Gupta as the Executive Director, Finance and Chief Financial Officer of the company. The company informs cessation of Ritesh Tiwari as Executive Director, Finance and Chief Financial Officer of the Company

Texmaco Rail & Engineering: The company has been awarded a Rs 103.16 crore order by Leap Grain Rail Logistics to supply BCBFG wagons and a BVCM Brake Van.

Innova Captab : The company has entered into the purchase for the land property admeasuring approximately 20 Bighas 16 Biswas situated in Himachal Pradesh

Uniparts India: The company informs that Amiya Vikram, Chief Human Resource Officer, Senior Management Personnel of the Company, has resigned due to personal reasons.

Sunteck Realty: The company has incorporated a wholly owned subsidiary viz. Amenity Buildcon.

Avenue Supermarts: The company has opened a new store at Gangashahar Road, Bikaner. The total number of stores as on date stands at 429.

Hindustan Foods: The company has executed a Share Subscription Agreement and paid the consideration to acquire 24,643 Series B Compulsorily Convertible Preference Shares, representing a 25.07% stake in Asar Green Kabadi.

Usha Martin: The company has entered into an agreement to sell its leasehold land of approximately 10.11 acres, along with the structures and machinery, located in Sriperumbudur, Tamil Nadu, to UGP Engineering for a consideration of Rs 29.52 crore.

IKIO Technologies: The company has appointed Sanjeet Singh as the Chief Executive Officer of the company.

SJVN: The company has successfully synchronised first unit of 1320 MW Buxar thermal power project with the National Grid.

Titagarh Rail Systems: The company has secured a letter of Intent from Garden Reach Shipbuilders & Engineers for Ship Construction of 2 vessels. The order is valued at Rs 445 crore without GST.

Eternal: The company incorporates Blinkit Foods a wholly owned subsidiary.

Ramco Cements: The company completes acquisition of 28.5% stake in Ramco Windfarms.

Grauer & WEIL: The company's Chinese arm applies for striking off subject to approval of relevant regulatory authorities.

Midwest Gold: The company approves Scheme of Amalgamation between company and its Arm Midwest Energy.

GHV Infra Projects: The company gets Rs 2,000 crore EPC contract from Valor Estate for PAP & Police housing project In Mumbai.

Royal Orchid: The Company announces opening of Hotel Regenta Place in Ahmedabad, Gujarat.

Apollo Hospital Enterprises: Suneetha Reddy Pottipatti, the promoter likely to sell shares 1.8 million shares.

R Systems International: The Board of Directors approved the acquisition of 100% equity shares of Novigo Solutions. The Company has also approved the issuance Non-Convertible Debentures with a face value of Rs 1 lakh each, to raise up to Rs 275 crore via a private placement.

IPO Offering

Shreeji Shipping Global: The public issue was subscribed to 58 times on day 3. The bids were led by Qualified institutional investors (110.41 times), non-institutional investors (72.70 times), retail investors (21.94 times).

Gem Aromatics: The public issue was subscribed to 30.27 times on day 3. The bids were led by Qualified institutional investors (55.28 times), non-institutional investors (45.06 times), retail investors (10.31 times).

Vikram Solar: The public issue was subscribed to 54.63 times on day 3. The bids were led by Qualified institutional investors (142.79 times), non-institutional investors (50.90 times), retail investors (7.65 times) & Employees (4.84 times).

Patel Retail: The public issue was subscribed to 95.70 times on day 3. The bids were led by Qualified institutional investors (272.43 times), non-institutional investors (108.18 times), retail investors (42.49 times) & Employees (25.37 times).

Mangal Electrical Industrie: The public issue was subscribed to 1.98 times on day 2. The bids were led by Qualified institutional investors (0.13 times), non-institutional investors (4.20 times), retail investors (2.08 times).

Bulk & Block Deals

Clean Science trade: Sellers: Spark Institutional Equities sold 3.22 crore shares (30.31%) at Rs 1078.57 apiece, Asha Ashok Boob sold 70 lakh shares (6.58%) at Rs 1077.57 apiece, Ashok Ramnarayan Boob sold 49.84 lakh shares (4.69%) at Rs 1078.03 apiece, Shradha Anish Kariwala sold 32.05 lakh shares (3.01%) at Rs 1077.63 apiece, Parth Ashok Maheshwari sold 30 lakh shares (2.82%) at Rs 1078.81 apiece, Krishnakumar Ramnarayan Boob sold 26 lakh shares (2.44%) at Rs 1080.48 apiece, Nilima Krishnakumar Boob sold 23.6 lakh shares (2.22%) at Rs 1085.32 apiece and Ashok Ramnarayan Boob sold 23.34 lakh shares (2.19%) at Rs 1079.51 apiece among others. Buyers: Spark Institutional Equities Private Limited bought 322.37 lakh shares (30.34%) at Rs 1078 apiece, Irage Broking Services LLP bought 30.52 lakh shares (2.87%) at Rs 1102.32 apiece, Nippon India Mutual Fund bought 22.52 lakh shares (2.11%) at Rs 1075.2 apiece, SBI Mutual Fund bought 21.62 lakh shares (2.03%) at Rs 1075.2 apiece and Norges Bank On Account Of The Government Pension Fund Global bought 14.62 lakh shares (1.37%) at Rs 1077.68 apiece among others.

Nexus Select Trust: Goldman Sachs (Singapore) sold & Goldman Sachs Bank Europe bought 12.3 lakh shares at Rs 150 a piece.

Afcom Holdings: Seyyadurai Nagarajan sold 1.27 lakh shares (0.51%) at Rs. 885.91 a piece.

Marathon Nextgen Realty: Zeta Global Funds sold & Venus Investments Vcc bought 3.4 lakh shares (0.66%) at Rs. 652.11 a piece.

Tata Communication: Fs Inv Icvc Stewart Investors sold 19.85 lakh shares (0.69%) at Rs. 1,590.01 apiece. NWBP As Dp Of First State Asia sold 14.7 lakh shares (0.51%) at Rs. 1,602.34 apiece

Cupid: Unity Associates bought 15 lakh shares (0.55%) at Rs.171.9 apiece.

Pledge Share Details

Man Infraconstruction: Parag K. Shah, the Promoter & Director acquired 5 lakh shares.

Nirlon: Shital Trading & Interiors, the Promoter Group disposed of 5,000 shares.

Usha Martin: Peterhouse Investments India, the Promoter Group disposed of 2 lakh shares.

D. B. Corp: D B Power Ltd, The Promoter Group acquired 11,340 shares.

Kross: Sudhir Rai, the Promoter & Director group acquired 50,000 shares.

MTAR Technologies: MITTA MADHAVI, the Promoter disposed of 60,000 shares.

Power Mech Projects: Sivaramakrishna Prasad Sajja, The Promoter Group disposed of 600 shares.

Trading Tweaks

List of securities shortlisted in Short - Term ASM Framework Stage – I : Kingfa Science & Technology, Ola Electric Mobility, Southern Petrochemicals Industries.

List of securities to be excluded from ASM Framework: PG Electroplast.

Ex-Dividend: Procter & Gamble Health, Kalyani Forge, Paradeep Phosphates, Kfin Technologies, Deep Industries, Lodha Developers, Godfrey Phillips India, Indigo Paints, APL Apollo Tube, Jindal Steel & Power, Sarda Energy & Minerals.

F&O Cues

Nifty Aug futures are up by 0.11% to 25,110.40 at a premium of 26.65 points.

Nifty Aug futures open interest down by 5.64%.

Nifty Options 28 Aug. Expiry: Maximum Call open interest at 26,000 and Maximum Put open interest at 25,000.

Securities in ban period: RBL Bank, PGEL.

Currency/Bond Update

The Indian Rupee closed 25 paise weaker against the US Dollar on Thursday at 87.26 a dollar. It closed at 87.1 a dollar on Wednesday. The yield on the benchmark 10-year bond settled 3 basis points higher at 6.53%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.