Good morning!

The GIFT Nifty is trading 43 points or 0.2% higher at 24,595 as of 7:20 a.m., indicating a positive open for the benchmark Nifty 50.

US and European index futures are up during early trading hours in Asia.

S&P 500 futures up 0.1%

Euro Stoxx 50 futures up 0.1%

Key Data To Watch

The government will release the July Consumer Price Index-based inflation data. Retail inflation is estimated to fall tp 1.4%, as per Bloomberg survey, compared to 2.1% in June.

Markets On Home Turf

The Indian equity benchmarks closed in the green on Monday as shares of HDFC Bank Ltd., Reliance Industries Ltd. and State Bank of India led the gains.

The NSE Nifty 50 ended 221.75 points or 0.91% higher at 24,585.05 and the BSE Sensex ended 746.29 points or 0.93% up at 86,604.08. The NSE Nifty 50 gained as much as 0.98% during the day.

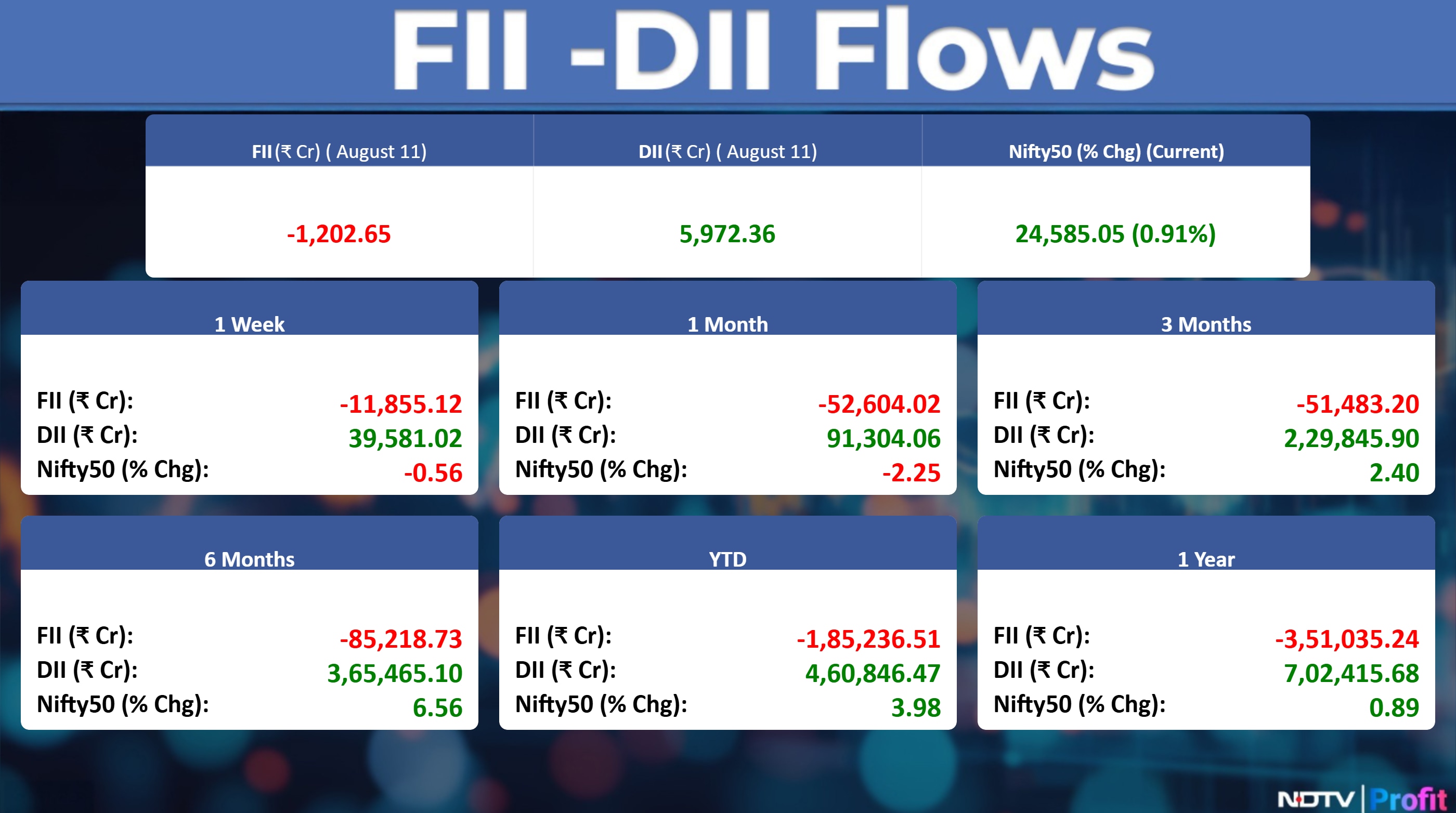

The FPIs sold stocks worth approximately Rs 1,202.65 crore, according to provisional data from the National Stock Exchange. The DIIs, which have been buyers for the 26th session, bought stocks worth Rs 5,972.36 crore.

Wall Street Recap

US stocks fell on Monday as risk appetite was subdued ahead of a data-filled week that could influence how quickly the Federal Reserve resumes its interest-rate cuts. The S&P 500 closed down 0.3%, having touched a record high during the session before pulling back. The Nasdaq 100 Index fell 0.4%.

Asian Market Update

Asian stocks opened higher after a US-China tariff truce offered relief to markets ahead of a key US inflation report expected to shape the Federal Reserve's interest-rate path, Bloomberg reported. The MSCI Asia Pacific Index rose 0.4% as Japan's Nikkei-225 index soared to a record high.

Nikkei up 2%

Topix up 1.2%

Kospi up 0.8%

S&P ASX 200 up 0.1%

Hang Seng futures up 0.1%

Commodities Watch

Oil prices wemt up after President Donald Trump extended a pause of high US tariffs on China. International benchmark Brent traded just shy of $67 a barrel, but remained near the lowest in two months, while West Texas Intermediate was near $64.

Gold held a loss after Trump said imports of bullion won't be subject to US tariffs. Spot bullion traded near $3,350 an ounce as markets opened in Asia, following a 1.6% drop on Monday.

Price of most industrial metals were down on the London Metal Exchange.

Copper down 0.3%

Aluminium down 0.8%

Nickel up 1.3%

Zinc down 0.2%

Lead down 0.5%

Earnings To Watch

AAVAS Financiers, Abbott India, Alkem Laboratories, Allcargo Logistics, Apollo Hospitals Enterprise, Ashiana Housing, Balrampur Chini Mills, Bombay Burmah Trading Corporation, Bharat Dynamics, Carysil, Cochin Shipyard, Elgi Equipments, EMS, Fineotex Chemical, Finolex Cables, Granules India, Gujarat State Petronet, Hindalco Industries, Hindware Home Innovation, Honasa Consumer, Honda India Power Products, Indian Hume Pipe Company, Ingersoll-Rand (India), Jupiter Wagons, Jyothy Labs, Kirloskar Industries, Karnataka Bank, Lux Industries, Marksans Pharma, Minda Corporation, MRF, Natco Pharma, Nazara Technologies, NHPC, NMDC, NMDC Steel, FSN E-Commerce Ventures,Oil India, Oil and Natural Gas Corporation, Orchid Pharma, PI Industries, P N Gadgil Jewellers, Polyplex Corporation, Premier Explosives, Rashtriya Chemicals and Fertilizers, Rupa & Company, Rail Vikas Nigam, Senco Gold, Shriram Properties, Suzlon Energy, Tarc, Tarsons Products, Techno Electric & Engineering Company, Unicommerce Esolutions, Usha Martin, Vadilal Industries, Venus Pipes & Tubes, VA Tech Wabag, Zydus Lifesciences.

Earnings Post Market Hours

Praj Industries Q1FY26 Highlights (Consolidated, YoY)

Revenue down 8.4% to Rs 640.00 crore versus Rs 699.00 crore.

Net Profit down 94% to Rs 5.30 crore versus Rs 84.00 crore.

Ebitda down 59% to Rs 35.30 crore versus Rs 86.80 crore.

Margin at 5.5% versus 12.4%.

Goldiam International Q1FY26 Highlights (Consolidated, YoY)

Revenue up 38.6% to Rs 229.73 crore versus Rs 165.80 crore.

Net Profit up 53% to Rs 33.62 crore versus Rs 22.04 crore.

Ebitda up 36% to Rs 41.16 crore versus Rs 30.26 crore.

Margin at 17.9% versus 18.3%.

Travel Food Services Q1FY26 Highlights (Consolidated, YoY)

Revenue down 8.5% to Rs 375.00 crore versus Rs 409.80 crore.

Net Profit up 66% to Rs 91.70 crore versus Rs 55.40 crore.

Ebitda up 43% to Rs 146.10 crore versus Rs 102.20 crore.

Margin at 39.0% versus 24.9%.

Novelis Q1FY26 Highlights (Consolidated, QoQ)

Revenue up 2.83 % at $4,717 million versus $4,587 million.

Ebitda down 30% at $361 million versus $520 million.

Margin down at 7.65% versus 11.33%.

Net profit down 67% at $96 million versus $294 million.

Adjusted Ebitda per tonne at $432 versus $494.

Astral Q1FY26 Highlights (Consolidated, YoY)

Revenue down 1.6% to Rs 1,361.00 crore versus Rs 1,383.00 crore.

Net Profit down 33% to Rs 81.10 crore versus Rs 120.40 crore.

Ebitda down 14% to Rs 185.20 crore versus Rs 214.20 crore.

Margin at 13.6% versus 15.5%.

Awfis Space Solutions Q1FY26 Highlights (Consolidated, YoY)

Revenue up 29.9% to Rs 334.70 crore versus Rs 257.70 crore.

Net Profit at Rs 9.90 crore versus Rs 2.70 crore.

Ebitda up 60% to Rs 126.50 crore versus Rs 78.90 crore.

Margin at 37.8% versus 30.6%.

Precision Camshafts Q1FY26 Highlights (Consolidated, YoY)

Revenue down 23.5% to Rs 195.00 crore versus Rs 255.00 crore.

Net Profit up 62% to Rs 18.80 crore versus Rs 11.60 crore.

Ebitda down 39% to Rs 14.70 crore versus Rs 24.10 crore.

Margin at 7.5% versus 9.5%.

Rolex Rings Q1FY26 Highlights (Consolidated, YoY)

Revenue down 6.0% to Rs 292.00 crore versus Rs 310.70 crore.

Net Profit down 2% to Rs 49.10 crore versus Rs 49.90 crore.

Ebitda down 13% to Rs 62.10 crore versus Rs 71.50 crore.

Margin at 21.3% versus 23.0%.

Ugro Capital Q1FY26 Highlights (YoY)

Net Profit up 12.5% at Rs 34.1crore versus Rs 30.4 crore.

Impairment up 43.8% at Rs 47.7 crore versus Rs 33.16 crore.

Net interest income up 3% at Rs 98.9 crore versus Rs 95.8 crore.

HLE Glascoat Q1FY26 Highlights (Consolidated, YoY)

Revenue up 25.1% to Rs 283.94 crore versus Rs 227.00 crore.

Net Profit at Rs 14.76 crore versus Rs 3.40 crore.

Ebitda up 74% to Rs 37.88 crore versus Rs 21.80 crore.

Margin at 13.3% versus 9.6%.

Sansera Engineering Q1FY26 Highlights (Consolidated, YoY)

Revenue rises 3% to Rs 766 crore versus Rs 744 crore.

Ebitda increases 3.7% to Rs 132 crore versus Rs 127 crore.

Margin at 17.2% versus 17.1%.

Net profit up 25.5% to Rs 62.2 crore versus Rs 49.6 crore.

KNR Construction Q1FY26 Highlights (Consolidated, YoY)

Revenue down 37.8% at Rs 612.72 crore vs Rs 984.99 crore

Ebitda down 34.34% at Rs 182.94 crore vs Rs 278.59 crore

Margin at 29.85% vs 28.28% up 157 bps

Net profit down 31.79% at Rs 121.17 crore vs Rs 177.65 crore

Dollar Industries Q1FY26 Highlights (Consolidated, YoY)

Revenue rises 19.6% to Rs 399 crore versus Rs 334 crore.

Ebitda rises 17.6% to Rs 41.9 crore versus Rs 35.6 crore.

Margin at 10.5% versus 10.7%.

Net profit up 39.3% to Rs 21.3 crore versus Rs 15.3 crore.

Technocraft Industries Q1FY26 Highlights (Consolidated, YoY)

Revenue rises 2% to Rs 633 crore versus Rs 620 crore.

Ebitda declines 3.6% to Rs 112 crore versus Rs 116 crore.

Margin at 17.7% versus 18.7%.

Net profit falls 1.8% to Rs 82.3 crore versus Rs 83.9 crore.

Sunflag Iron Q1FY26 Highlights (Consolidated, YoY)

Revenue rises 13.2% to Rs 1,013 crore versus Rs 895 crore.

Ebitda up 38% to Rs 109 crore versus Rs 79.3 crore.

Margin at 10.8% versus 8.9%.

Net profit at Rs 62.6 crore versus Rs 27.9 crore.

Bata India Q1FY26 Highlights (Consolidated, YoY)

Revenue down 0.3% to Rs 941.85 crore versus Rs 944.63 crore.

Net Profit down 70% to Rs 52.00 crore versus Rs 174.06 crore.

Ebitda up 8% to Rs 198.82 crore versus Rs 184.61 crore.

Margin at 21.1% versus 19.5%.

Tilaknagar Industries Q1FY26 Highlights (Consolidated, YoY)

Revenue rises 30.6% to Rs 409 crore versus Rs 313 crore.

Ebitda rises 88% to Rs 94.4 crore versus Rs 50.2 crore.

Margin at 23.1% versus 16%.

Net profit at Rs 88.5 crore versus Rs 40.1 crore.

Scoda Tubes Q1FY26 Highlights (YoY)

Revenue rises 6.1% to Rs 97.4 crore versus Rs 91.9 crore.

Ebitda declines 3.2% to Rs 14.2 crore versus Rs 14.7 crore.

Margin at 14.6% versus 14.7%.

Net profit rises 48.1% to Rs 7.1 crore versus Rs 4.8 crore.

Muthoot Microfin Q1FY26 Highlights (YoY)

Net Profit down 94.5% at Rs 6.2 crore versus Rs 113 crore.

Impairment up 77% at Rs 125 crore versus Rs 70.8 crore.

Net interest income up 17% at Rs 309 crore versus Rs 370 crore.

Man Industries Q1FY26 Highlights (Consolidated, YoY)

Revenue down 0.9% to Rs 742 crore versus Rs 749 crore.

Net Profit up 45% to Rs 27.6 crore versus Rs 19.1 crore.

Ebitda up 30% to Rs 49.1 crore versus Rs 37.8 crore.

Margin at 6.6% versus 5%.

Krsnaa Diagnostics Q1FY26 Highlights (Consolidated, YoY)

Revenue up 13.4% to Rs 193 crore versus Rs 170 crore.

Net Profit up 14.5% to Rs 20.52 crore versus Rs 17.9 crore.

Ebitda up 20.5% to Rs 51.4 crore versus Rs 42.7 crore.

Margin at 26.6% versus 25.1%.

Som Distilleries Breweries Q1FY26 Highlights (Consolidated, YoY)

Revenue up 3% to Rs 528.37 crore versus Rs 513.07 crore.

Net Profit up 3.7% to Rs 42.1 crore versus Rs 40.5 crore.

Ebitda up 10% to Rs 70.34 crore versus Rs 64.16 crore.

Margin at 13.3% versus 12.5%.

Ashoka Buildcon Q1FY26 Highlights (Consolidated, YoY)

Revenue down 23.4% to Rs 1,887.00 crore versus Rs 2,465.00 crore.

Net Profit up 45% to Rs 217.39 crore versus Rs 150.32 crore.

Ebitda flat at Rs 599 crore.

Margin at 31.7% versus 24.3%.

ESAB Q1FY26 Highlights (Consolidated, YoY)

Revenue rises 6.8% to Rs 352 crore versus Rs 330 crore.

Ebitda decreases 4.7% to Rs 59.2 crore versus Rs 62.1 crore.

Margin at 16.8% versus 18.8%.

Net profit down 7.9% to Rs 40.9 crore versus Rs 44.5 crore.

Cello World Q1FY26 Highlights (Consolidated, YoY)

Revenue rises 5.7% to Rs 529 crore versus Rs 501 crore.

Ebitda decreases 15.6% to Rs 109 crore versus Rs 129 crore.

Margin at 15.6% versus 25.8%.

Net profit down 11.6% to Rs 73 crore versus Rs 82.6 crore.

Titagarh Rail Systems Q1FY26 Highlights (Consolidated, YoY)

Revenue down 24.8% to Rs 679 crore versus Rs 903 crore.

Ebitda down 26.3% to Rs 75.1 crore versus Rs 102 crore.

Margin at 11.1% versus 11.3%.

Net profit down 54% to Rs 30.9 crore versus Rs 67 crore.

Technoplast Q1FY26 Highlights (Consolidated, YoY)

Revenue up 10% to Rs 1,353 crore versus Rs 1,230 crore.

Ebitda up 11.7% to Rs 195 crore versus Rs 174 crore.

Margin at 14.4% versus 14.2%.

Net profit up 20% to Rs 95.1 crore versus Rs 79.3 crore

Approves issue of bonus shares in the ratio 1:1.

Belrise Industries Q1FY26 Highlights (Consolidated, YoY)

Revenue rises 27% to Rs 2,262.2 crore versus Rs 1,780.9 crore.

Ebitda increases 16.9% to Rs 280.54 crore versus Rs 240.05 crore.

Margin at 12.4% versus 13.5%.

Net profit up 56% to Rs 112 crore versus Rs 71.6 crore.

Stocks In News

Adani Enterprises: The company's arm has executed a pact to acquire 100% stake in Indamer Technics, while Adani Defence & Aerospace has partnered with Prime Aero to expand its aviation MRO footprint.

Infosys: The company has implemented the nCino platform for ABN AMRO to transform the bank's lending process.

ESAF Small Finance Bank: A robbery has occurred at the ESAF Small Finance Bank branch in Sihora, Jabalpur, where gold and valuables worth Rs 14 crore were stolen. The bank has stated that the loss is fully insured, and the incident will have no impact on its operations.

Kansai Nerolac Paints: The company has approved a scheme of amalgamation to merge its arm Nerofix Private Ltd., with the parent company.

Wipro: The company has successfully completed an ERP system transformation for AusNet & Co. by implementing SAP S/4HANA Cloud.

Jaykay Enterprises: The company's arm has received a letter of intent worth Rs 95 crore from BrahMos Aerospace Private and a letter of intent worth Rs 15.9 crore from Bharat Dynamics.

Astral: The company is set to acquire an 80% stake in Nexelon Chem for Rs 120 crore.

Thomas Cook: The company has opened its first outlet in Davangere, Karnataka, to tap into the state's expanding travel market, increasing consumer access to 19 locations in the state.

Insecticides India: The company is in a pact with Corteva Agriscience to launch the insecticide ‘SPARCLE'.

Lloyds Enterprises: The company has approved the issue of 25 crore shares worth Rs 992 crore on a rights basis at Rs 39 per share.

Tamilnad Mercantile Bank: The bank has partnered with Bajaj Allianz General Insurance to expand its non-life insurance offerings.

Intellect Design: The company has launched its Purple Fabric platform in the US, which it describes as the world's first open business impact AI platform.

Indian Overseas Bank: The Bank has reduced its MCLR by 10 basis points across all tenures and its base rate by 20 basis points to 9.8%, with both changes becoming effective from Aug. 15.

Craftsman Automation: The company has commenced commercial operations at its new plant in Faridabad.

SEAMEC: The company secured a Rs 61.13 crore vessel charter contract with A.D. Engineers & Contractors LLP for its vessel SEAMEC III.

Capital India Finance: The company has divested its entire stake in Capital India Home Loans to Weaver Services for Rs 266.5 crore.

Ceigall India: The company has been identified as the lowest bidder for a Rs 225 crore project for the development of a Bulk Drug Park.

Bank of Baroda: The bank has cut MCLR across tenures.

Refex Industries: The company has increased its stake in its subsidiary, VRPL, by 8.5% through an infusion of capital.

Pfizer: The company has launched its 20-valent pneumococcal conjugate vaccine (PCV20) for adults in India.

Lodha Developers: The company has approved the issuance of Non-Convertible Debentures and has increased its fundraising limit from Rs 3,000 crore to Rs 5,000 crore.

Medplus Health Services: The company has reported that its subsidiary has received a suspension order for a drug license for one of its stores in Karnataka.

Federal-Mogul Goetze: Amit Mittal has been appointed as the new Chief Financial Officer, replacing Manish Chadha and Gangasagar Neminath Hemade has been named the new Chief Executive Officer.

Indian Hotels: The company to acquire 51% stake for Rs 110 crore in ANK Hotels and 51% Stake for Rs 94 crore in Pride Hospitality

Karur Vysya Bank: The Bank has opened a new branch at Lingam Nagar in Trichy.

Insolation Energy: The company has incorporated a step-down arm, ENS Green Infra.

Greenply Industries: The company's arm has temporarily shut down manufacturing operations at its MDF plant in Gujarat.

Tilaknagar industries: The company will expand its Prag Distillery, from 6 lakh to 36 lakh cases per year with a capital expenditure of Rs 25 crore.

Rainbow Children's Medicare: The company has acquired 76% stake in Pratiksha Women & Child Care Hospital for Rs 126 crore and 100% of its Non-Convertible Redeemable Preference Shares for Rs 41.04 crore.

AFCOM Holdings: The company has uplifted the highest-ever volume of transshipment cargo at Velana International Airport.

NELCO: The company has signed an agreement with Eutelsat to deliver OneWeb's low Earth orbit satellite connectivity services in India.

IPOs Offering

Regaal Resources: The company will offer shares for bidding on Tuesday. The price band is set from Rs 96-102 per share. The IPO is for a size of Rs 306 crores, out of which Rs 210 crore is fresh issue, and rest is offer for sale. The company issue Rs 92 crore from anchor investors.

JSW Cement: The public issue was subscribed to 7.77 times on day 3. The bids were led by Qualified institutional investors (15.8 times), non-institutional investors (10.97 times), retail investors (1.81 times).

All Time Plastics: The public issue was subscribed to 8.34 times on day 3. The bids were led by Qualified institutional investors (10.15 times), non-institutional investors (13.47 times), retail investors (5.14 times) and reserved for employees (7.82 times).

Listing Day

Highway Infrastructure: The company's shares will debut on the stock exchange on Tuesday at an issue price of Rs 70 apiece. The Rs 130-crore IPO was subscribed 316.64 times on its third and final day. The bids were led by institutional investors (432.71 times), retail investors (164.48 times), non-institutional investors (473.1 times).

Block Deals

Bikaji Foods International: Deepak Agarwal and Shiv Ratan Agarwal sold 12.5 lakh shares (0.49%) each, at Rs 732 apiece. while HDFC Life Insurance bought 8.1 lakh shares (0.32%) at Rs 732 apiece, Tata Mutual Fund bought 7.42 lakh shares (0.29%) and others at Rs 732 apiece.

Home First Finance Industries: Orange Clove Investments B.V. sold 1.09 crore shares (10.63%) at Rs 1,190 apiece, while Kotak Mahindra Mutual Fund bought 50 lakh shares (4.84%), Fidelity Funds through its arms bought 26.76 lakh shares (2.59%), TATA AIG General Insurance company bought 6.99 lakh shares (0.68%) and many others at Rs 1,190 apiece.

Bulk Deals

Repco Home Finance: HDFC Mutual Fund sold 4.81 lakh shares (0.76%) at Rs 384.55 apiece.

Insider Deals

Maharashtra Seamless: Promoter Haryana Capfin bought 25,200 shares on Aug. 5, Promoter odd & even trades & finance bought 75,000 shares on Aug. 5.

Trading Tweaks

Price Band change from 20% to 10%: Mirc Electronics.

Ex-dividend: Rites, India Pesticides, Dwarikesh Sugar Industries, Grasim Industries, Arvind Fashions, ICICI Bank.

Ex-Stock Split: India Glycols — from Rs 10 per share to Rs 5 per share.

F&O Cues

Nifty August Futures up by 0.71% to 24,628 at a premium of 43 points.

Nifty August futures open interest down by 1.88%.

Nifty Options 14 August Expiry: Maximum Call open interest at 25000 and Maximum Put open interest at 23500

Securities in Ban Period: PGEL, PNB Housing, RBL Bank.

Currency/Bond Update

The Indian Rupee closed flat against the US Dollar on Monday at 87.65 a dollar. The yield on the benchmark 10-year bond settled three basis points higher at 6.44%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.