- GIFT Nifty trades 0.17% higher at 24,459 indicating a positive start for Nifty 50

- NSE Nifty 50 closed 0.95% lower at 24,363 amid longest weekly losing streak in over five years

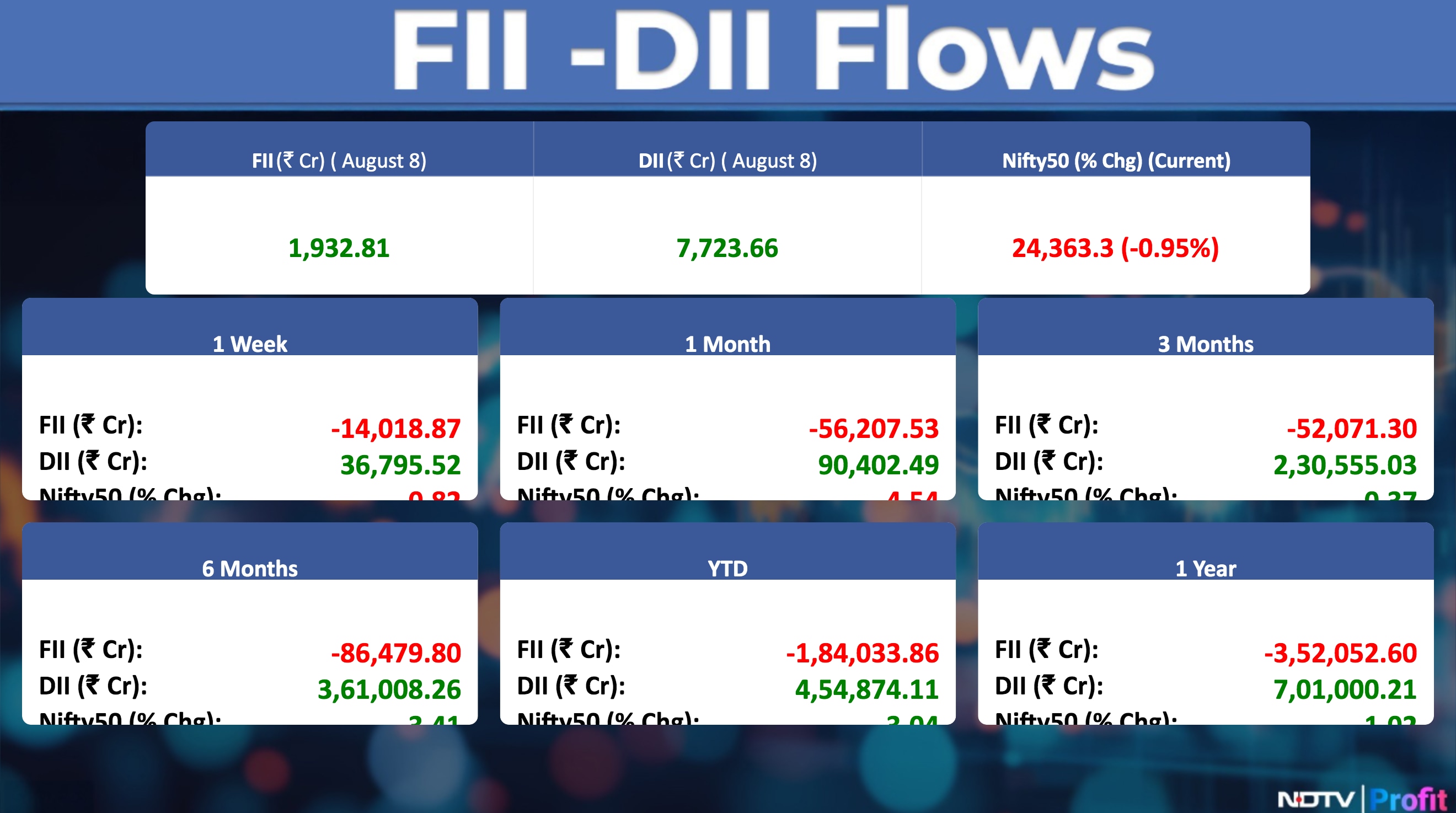

- Foreign portfolio investors turned net buyers with purchases worth Rs 7,437.4 crore on Friday

Good morning!

The GIFT Nifty is trading 0.17% or 41.5 points higher at 24,459 as of 7:00 a.m., indicating a positive start for the benchmark Nifty 50.

US and European index futures were up in early Asian trading hours.

S&P 500 futures up 0.2%

Euro Stoxx 200 up 0.2%

Key Events To Watch

Prime Minister Narendra Modi will inaugurate newly build multi-storey flats for members of Parliament at Baba Kharak Singh Marg, New Delhi and also address gathering.

The Association of Mutual Funds of India will release the monthly industry data for July.

Tesla will open a new experience centre in New Delhi as it expands foray into India.

Watch NDTV Profit Live

Markets On Home Turf

The Indian equity benchmarks closed in the red, closing with losses after a day of gains. The NSE Nifty 50 declined as much as 1.05% during the day. The market clocked in the longest weekly losing streak in over five years.

The NSE Nifty 50 ended 232 points, or 0.95% lower at 24,363 and the 30-stock BSE Sensex ended 765 points, or 0.95% lower at 79,857.

Foreign portfolio investors turned net buyers of Indian shares on Friday after 14 sessions of selling and bought stocks worth approximately Rs 7,437.4 crore, according to provisional data from the National Stock Exchange.

Wall Street Recap

The tech-heavy Nasdaq 100 rose to an all-time high on Friday to end a week filled with earnings reports and tariff updates. The S&P 500 closed 0.8% higher, posting its best week since June. The Nasdaq 100 jumped 0.9% while the Dow Jones Industrial Average climbed 0.5%.

Asia Market Update

Asian shares posted a modest gain at the open as investors stayed cautious ahead of key economic data this week and a looming deadline for the potential extension of US tariffs on Chinese exports, Bloomberg reported. Stocks rose in Australia while South Korea fluctuated.

Nikkei up 1.9%

Topix up 1.2%

Kospi flat

S&P/ASX 200 up 0.3%

Hang Seng up 0.35%

Commodities Check

Oil prices fell after their biggest weekly drop since the end of June, ahead of a meeting between US and Russian leaders on Friday, which raises the prospect of an end to the war in Ukraine and increased supply. Brent traded near $66 a barrel, after sliding 4.4% last week, while West Texas Intermediate was above $63.

US gold futures were down 1.2% in early trading in Asia on Monday. Meanwhile, spot gold slipped 0.3% to $3,387.14 an ounce.

Prices of key industrial metals on the London Metal Exchange traded mixed.

Copper up 0.8%

Aluminium flat

Nickel up 0.25%

Zinc up 0.5%

Lead down 0.1%

Earnings To Watch

Ashoka Buildcon, Astral, Awfis Space Solutions, Bajaj Consumer Care, Bata India, Belrise Industries, BEML, Capacite Infraprojects, Cello World, Dollar Industries, Esab India, Eureka Forbes, Goldiam International, Goodyear India, HLE Glascoat, Ipca Laboratories, JM Financial, KNR Constructions, Krsnaa Diagnostics, Man Industries (India), Muthoot Microfin, Patel Engineering, Praj Industries, Precision Camshafts, Rolex Rings, Sansera Engineering, Scoda Tubes, Som Distilleries & Breweries, Shaily Engineering Plastics, SJVN, Sunflag Iron & Steel Company, Tilaknagar Industries, Technocraft Industries (India), Time Technoplast, Titagarh Rail Systems, Travel Food Services, Ugro Capital, VST Tillers Tractors, Websol Energy System, West Coast Paper Mills.

Earnings Post Market Hours

Garware Technical Fibres Q1 Highlights (Cons, YoY)

Revenue rises 9.2% at Rs 367 crore versus Rs 336 crore.

Ebitda rises 5.8% at Rs 68.1 crore versus Rs 64.4 crore.

Margin at 18.5% versus 19.2%.

Net profit rises 13.5% at Rs 53.1crore versus Rs 46.8 crore.

Manappuram Finance Q1 Highlights (Cons, YoY)

Net Profit declines 75% to Rs 138 crore versus Rs 555 crore.

Calculated NII declines 10.2% to Rs 1,380 crore versus Rs 1,538 crore.

Impairment at Rs 559 crore versus Rs 229 crore.

Approves appointment of V P Nandakumar as Chairman effective Aug. 28.

Voltas Q1 Highlights (Cons, YoY)

Revenue down 20% to Rs 3,938.58 crore versus Rs 4,921.02 crore.

Net Profit down 58% to Rs 140.46 crore versus Rs 334.23 crore.

Ebitda down 58% to Rs 178.53 crore versus Rs 423.80 crore.

Margin at 4.5% versus 8.6%.

RHI Magnestia India

Net Profit falls 51.6% to Rs 35.3 crore versus Rs 72.9 crore.

Revenue rises 9.3% to Rs 960 crore versus Rs 879 crore.

Margin At 10.6% Vs 17.5%.

Ebitda fell 33.6% to Rs 102 crore versus Rs 154 crore.

Satin Creditcare Q1 Highlights (Cons, YoY)

Revenue rises 12% to Rs 709 crore versus Rs 633 crore.

Net profit declines 57.2% to Rs 45.1 crore versus Rs 105 crore.

Ebitda down 9.9% to Rs 357 crore versus Rs 396 crore.

Margin at 50.3% versus 62.6%.

Fine Organic Industries Q1 Highlights (Cons, YoY)

Revenue up 10% at Rs 559 crore versus Rs 508 crore.

Net profit down 6.2% to Rs 92.8 crore versus Rs 99 crore.

Ebitda declines 12% to Rs 107 crore versus Rs 122 crore.

Margin at 19.2% versus 24%.

Power Mech Q1 Highlights (Cons, YoY)

Revenue rises 28.4% to Rs 1,293 crore versus Rs 1,007 crore.

Net Profit falls 12.7% to Rs 52.5 crore versus Rs 60.1 crore.

Ebitda rises 50.4% to Rs 171 crore versus Rs 114 crore.

Margin At 13.2% versus 11.3%.

Concord Biotech Q1 Highlights (Cons, YoY)

Revenue declines 5.5% to Rs 204 crore versus Rs 216 crore.

Net profit drops 26% to Rs 44.1 crore versus Rs 59.6 crore.

Ebitda down 24.5% to Rs 61.4 crore versus Rs 81.3 crore.

Margin at 30.1% versus 37.6%.

Ceigall India Q1 Highlights (Cons, YoY)

Revenue rises 1.9% at Rs 838 crore versus Rs 822 crore.

Margin at 13% versus 17.5%.

Net Profit down 33% to Rs 53.1 crore versus Rs 79.4 crore.

Ebitda declines 24.2% to Rs109 crore versus Rs 144 crore.

PTC Industries Q1 Highlights (Cons, YoY)

Revenue at Rs 97.1 crore versus Rs 46.9 crore.

Margin at 9% versus 21.4%.

Ebitda down 12.6% at Rs 8.8 crore versus Rs 10 crore.

Net Profit rises 5.3% to Rs 5.2 crore versus Rs 4.9 crore

Afcons Infrastructure Q1 Highlights (Cons, YoY)

Revenue up 6.8% to Rs 3,370.38 crore versus Rs 3,154.36 crore.

Net Profit up 50% to Rs 137.40 crore versus Rs 91.59 crore.

Ebitda up 23% to Rs 435.29 crore versus Rs 353.48 crore.

Margin at 12.9% versus 11.2%.

Tata Motors Q1 Highlights (Cons, YoY)

Revenue down 2.5% to Rs 1.04 lakh crore versus Rs 1.07 lakh crore.

Net Profit down 63% to Rs 3,924 crore versus Rs 10,514 crore.

Ebitda down 35% to Rs 9,724.00 crore versus Rs 14,972.00 crore.

Margin at 9.3% versus 14.0%.

Genus Power Infrastructure Q1 Highlights (Cons, YoY)

Revenue up 127.6% to Rs 942.43 crore versus Rs 414.16 crore.

Net Profit up 184% to Rs 137.32 crore versus Rs 48.33 crore.

Ebitda up 215% to Rs 199.40 crore versus Rs 63.24 crore.

Margin at 21.2% versus 15.3%.

Hindustan Foods Q1 Highlights (Cons, YoY)

Revenue rises 14.6% to Rs 995 crore versus Rs 868 crore.

Net Profit rises 16.4% to Rs 31.7 crore versus Rs 27.3 crore.

Ebitda rises 10% at Rs 80 crore versus Rs 72.7 crore.

Margin at 8% versus 8.4%.

Akums Drugs And Pharmaceuticals Q1 Highlights (Cons, YoY)

Revenue up 0.5% to Rs 1,024.03 crore versus Rs 1,019.11 crore.

Net Profit up 5% to Rs 63.47 crore versus Rs 60.17 crore.

Ebitda up 1% to Rs 128.97 crore versus Rs 128.01 crore.

Margin flat at 12.6%.

Cupid Q1 Highlights (Cons, YoY)

Net Profit down 81.8% to Rs 15 crore versus Rs 82.5 crore.

Revenue rises 52.8% to Rs 59.8 crore versus Rs 39.1 crore.

Ebitda rises to Rs 16.5 crore versus Rs 6.7 crore.

Margin at 27.5% versus 17%.

DOMS Industries Q1 Highlights (Cons, YoY)

Net Profit rises 10.5% at Rs 57.3 crore versus Rs 51.8 crore.

Revenue rises 26.3% to Rs 562 crore versus Rs 445 crore.

Margin at 17.6% versus 19.4%.

Ebitda rises 14.3% to Rs 98.7 crore versus Rs 86.4 crore.

Purvankara Q1 Highlights (Cons, YoY)

Revenue declines 20.4% to Rs 524 crore versus Rs 658 crore.

Net loss at Rs 68.6 crore versus profit of Rs 14.8 crore.

Ebitda declines 48.8% to Rs 66.7 crore versus Rs 131 crore.

Margin at 12.7% versus 19.8%.

Gujarat Alkalies Q1 Highlights (Cons, YoY)

Revenue rises 13% to Rs 1,105 crore versus Rs 977 crore.

Ebitda rises 58% to Rs 117 crore versus Rs 73.8 crore.

Margin at 10.6% versus 7.5%.

Net loss of Rs 13.8 crore versus loss of Rs 44.5 crore.

Shipping Corporation Q1 Highlights (Cons, YoY)

Revenue down 13.1% to Rs 1,316.04 crore versus Rs 1,514.27 crore.

Net Profit up 22% to Rs 354.17 crore versus Rs 291.48 crore.

Ebitda down 4% to Rs 488.99 crore versus Rs 509.65 crore.

Margin at 37.2% versus 33.7%.

Sharda Motor Q1 Highlights (Cons, YoY)

Revenue rises 10.3% to Rs 756 crore versus Rs 685 crore.

Net Profit rises 30.1% to Rs 99.9 crore versus Rs 76.8 crore.

Ebitda rises 2.9% to Rs 98.4 crore versus Rs 95.6 crore.

Margin at 13% versus 14%.

DCW Q1 Highlights (Cons, YoY)

Revenue declines 4.8% to Rs 476 crore versus Rs 500 crore.

Net profit rises 69.3% to Rs 11.4 crore versus Rs 6.7 crore.

Ebitda rises 18.9% to Rs 53.7 crore versus Rs 45.2 crore.

Margin at 11.3% versus 9%.

S H Kelkar Q1 Highlights (Cons, YoY)

Net profit at Rs 25.6 crore versus loss of Rs 86.6 crore.

Revenue rises 23.5% to Rs 581 crore versus Rs 470 crore.

Margin at 12.6% versus 16.6%.

Ebitda down 6.7% to Rs 73 crore versus Rs 78.3 crore.

TVS Supply Chain Q1 Highlights (Standalone, YoY)

Revenue falls 0.2% to Rs 468 crore versus Rs 469 crore.

Net profit falls 62% to Rs 3.3 crore versus Rs 8.7 crore.

Ebitda declines 47.3% to Rs 21.5 crore versus Rs 40.8 crore.

Margin at 4.6% versus 8.7%.

Lemon Tree Hotels Q1 Highlights (Cons, YoY)

Revenue up 17.8% to Rs 315.77 crore versus Rs 268.02 crore.

Net profit up 93% to Rs 38.33 crore versus Rs 19.81 crore.

Ebitda up 22% to Rs 140.51 crore versus Rs 115.07 crore.

Margin at 44.5% versus 42.9%

Apeejay Surrendra Q1 Highlights (Cons, YoY)

Revenue rises 14.2% to Rs 154 crore versus Rs 135 crore.

Ebitda rises 15.7% to Rs 45.4 crore versus Rs 39.2 crore.

Net Profit of Rs 13.4 crore versus loss of Rs 1.9 crore.

Margin at 29.4% versus 29%.

Siemens Q3 Highlights (Cons, YoY)

Revenue up 15.5% to Rs 4,346.80 crore versus Rs 3,762.60 crore.

Net Profit down 27% to Rs 422.90 crore versus Rs 577.70 crore.

Ebitda up 7% to Rs 521.40 crore versus Rs 485.30 crore.

Margin at 12% versus 12.9%.

Yatra Q1 Highlights (Cons, YoY)

Revenue up 108.1% to Rs 209.81 crore versus Rs 100.81 crore.

Net Profit up 296% to Rs 16.00 crore versus Rs 4.04 crore.

Ebitda up 403% to Rs 23.07 crore versus Rs 4.59 crore.

Margin at 11.0% versus 4.6%.

Fusion Finance Q1 Highlights (Cons, YoY)

Net loss at Rs 92.3 crore versus loss of Rs 35.6 crore.

Calculated NII down 31.4% at Rs 273 crore versus Rs 398 crore.

Impairment down 48.7% at Rs179 crore versu Rs 349 crore.

Entero Healthcare Q1 Highlights (Cons, YoY)

Revenue up 28% at Rs 1,404 crore versus Rs 1,097 crore.

Ebitda up 66% at Rs 50 crore versus Rs 30.2 crore.

Margin at 3.6% versus 2.7%.

Garware Hi-Tech Films Q1 Highlights (Cons, YoY)

Revenue is up 4.3% at Rs 495 crore versus Rs.475 crore.

Margin at 22% Vs 25%.

Ebitda down 7.6% at Rs.110 crore versus Rs 119 crore.

Net profit down 6% at Rs 83 crore versus Rs 88.4 crore.

SMS Pharma Q1 Highlights (Cons, YoY)

Revenue up 19.2% at Rs 196 crore versus Rs 164 crore.

Ebitda up 17.5% at Rs. 39.4 crore versus Rs. 33.5 crore.

Margin at 20.1% versus 20.4%.

Net profit up 24.4% at Rs 20.5 crore versus Rs 16.5 crore.

Precision Wires Q1 Highlights (YoY)

Revenue up 16% at Rs 1,104 crore versus Rs 952 crore.

Ebitda up 11.7% at Rs 47.1 crore versus Rs. 42.2 crore.

Margin at 4.3% versus 4.4%.

Net profit up 21.5% at Rs 27 crore versus Rs 22.2 crore.

Suprajit Engineering Q1 Highlights (Cons, YoY)

Revenue up 17.4% at Rs 863 crore versus Rs 735 crore.

Ebitda down 5.3% at Rs 81.6 crore versus Rs 86.2 crore.

Margin at 9.5% versus 11.7%.

Net profit up 26% at Rs 48 crore versus Rs 38.1 crore.

Happy Forgings Q1 Highlights (Cons, YoY)

Revenue up 3.6% at Rs 354 crore versus Rs 341 crore.

Ebitda up 3.6% at Rs. 101 crore versus Rs. 97.6 crore.

Ebitda margin down 3 bps at 28.57% versus 28.6%.

Net Profit up 3% at Rs. 65.7 crore versus Rs. 63.8 crore.

Olectra Greentech Q1 Highlights (Cons, YoY)

Revenue up 10.6% at Rs 347 crore versus Rs 314 crore.

Ebitda up 9% at Rs 47.8 crore versus Rs 43.9 crore.

Margin at 13.8% versus 14%.

Net Profit up 8.5% at Rs 26 crore versus Rs. 24 crore.

HBL Engineering Q1 Highlights (Cons, YoY)

Revenue up 15.7% at Rs 602 crore versus Rs 520 crore.

Ebitda up 74% at Rs 192 crore versus Rs 110 crore.

Margin at 31.9% versus 21.2%.

Net profit up 79% at Rs 143 crore versus Rs 80 crore.

Stocks In News

Hitachi Energy: The company has received an order from the Joint Commissioner to recover an 'erroneously sanctioned' export refund totalling Rs 22.97 crore in GST, along with a Rs 2.30 crore penalty.

Lemon Tree Hotels: The company has approved the appointment of Neelendra Singh as Managing Director and Kapil Sharma as Executive Director and Chief Financial Officer.

Coforge: The company clarified that, contrary to recent media reports suggesting that Saber – one of its largest clients – reported weaker numbers which could impact the company, there has been no event or development that would have a material impact on its financial performance in relation to a specific customer.

IDFC First Bank: Platinum Invictus has received approval from the Reserve Bank of India to invest up to 9.99% of the bank's share capital. It plans to initially invest approximately Rs 2,624 crore, representing a 5.09% stake, as part of a preferential issue.

Adani Enterprises: The company's arm Mundra Synenergy has incorporated a wholly owned subsidiary, UP Syn-Gas & Chemicals.

Gokaldas Exports: The company has approved the amalgamation of BRFL Textiles with itself. The board has also approved increasing the shareholding in BTPL to 19%.

Shilpa Medicare: The company has received approval from the Central Drugs Standard Control Organisation to launch Nor Ursodeoxycholic Acid Tablets 500 mg in India, becoming the first globally to introduce a treatment for Non-Alcoholic Fatty Liver Disease, which affects an estimated 188 million people in India.

Sai Silks: The company has opened its 71st store under the Valli Silks format, located at Nizampet, Hyderabad.

Baazar Style: The company has opened a new Style Baazar store at Raiganj, West Bengal.

Power Mech Projects: The company has appointed Kishore Babu Sajja as Managing Director.

KEC International: The company has issued a corporate guarantee of SAR 123.75 million to an overseas bank that extended a facility to its subsidiary, Al Sharif Group & KEC.

Vedanta: The company has received an order from the Office of the Assistant Commissioner of Central Tax confirming a penalty of Rs 30,43,412.

BEML: The company has received its maiden overseas contract in the Rail and Metro segment from Malaysia for the retrofit and reconditioning of the Mass Rapid Transport System, valued at USD 1 million.

Lloyds Enterprises: The board has approved issuing equity shares on a rights basis in the ratio of 1:5 at Rs 39 per share.

NACL Industries: Coromandel International has completed the acquisition of a controlling stake in the company. The ongoing open offer to acquire an additional 26% from public shareholders remains in process.

Texmaco Rail: NCLT has sanctioned the scheme of arrangement for the merger of Texmaco West Rail with the company.

Arvind: NCLT has sanctioned the scheme of arrangement involving the slump sale of the company's advanced materials undertaking to its arm, Arvind Advanced Materials.

Sandur Manganese & Iron Ores: The board has approved issuing bonus shares in the ratio of 2:1. The company has also re-appointed Bahirji Ajai Ghorpade as Managing Director.

Samvardhana Motherson: The company has incorporated a wholly owned subsidiary, Motherson New Energy, focusing on renewable energy for captive use.

Coromandel International: The company has closed the share purchase agreement for acquiring a 53% stake in NACL Industries. The open offer to acquire up to 26% more from public shareholders is ongoing.

H.G. Infra Engineering: In a joint venture with D.E.C. Infrastructure and Projects, the company has received a Rs 2,195.68 crore project from the Rail Land Development Authority to redevelop New Delhi Railway Station and construct associated infrastructure, with a 45-month completion timeline.

Dr. Reddy's: The company has received a Voluntary Action Indicated classification from the USFDA following a GMP inspection at its API manufacturing facility in Miryalaguda.

KPIT Technologies: The company provided updates on three strategic investments: Caresoft: Acquisition cost finalised at up to $157 million to strengthen vehicle engineering and design capabilities. N-Dream AG: Increasing stake from 26% to 51% for Euro 6.5 million, making it a subsidiary, with plans to raise it to 90% in the current financial year. Helm.ai: Investing up to $10 million to strengthen its “Software-Defined Vehicles” strategy.

Nibe: The company has received a purchase order worth Rs 10.52 crore from Elbit Systems Land for manufacturing and supplying ship-mounted universal rocket launcher mechanical kits.

Zydus Lifesciences: The company has received final approval from the USFDA for Prucalopride Tablets, 1 mg and 2 mg.

Mahindra & Mahindra: July production stood at 82,862 units (vs 70,540 units in July 2024), total sales at 80,917 units, and exports at 2,774 units.

Authum Investment: The company has invested in 8.34 lakh shares of Star Aerospace, representing 6.63% of its expanded equity share capital. It now holds 14.59% in Star Aerospace. The company has also incorporated a subsidiary, Billion Dream Sports, to operate in the sports industry.

S.J.S. Enterprises: The company announced the resignation of Mahender Singh as Group COO.

Rane Holdings: Rane Steering Systems has repaid its entire Rs 50 crore loan from the company.

Shivam Autotech: The company has approved the allotment of 250 secured NCDs aggregating Rs 25 crore on a private placement basis.

Kiri Industries: The company's arm has formed Shanghai Claronex Technology as a subsidiary.

Birla Corporation: The company has issued commercial paper of Rs 5 lakh each, aggregating Rs 50 crore.

Cupid: The company is scaling its in-vitro diagnostic test kit business by pursuing CE certification for four products and expanding production capacity from 1 lakh to 4 lakh kits per day by the end of 2026.

Gujarat Alkalies and Chemicals: The company has approved forming a special purpose vehicle with GMDC to implement a 60 MW renewable energy project.

Diamond Power Infrastructure: The company has appointed Narayan Navik as Chief Information Technology Officer.

Puravankara: The company has re-appointed Ravi Puravankara as chairman and whole-time director.

Brigade Enterprises: The company has launched Brigade Cherry Blossom, a strategic JV in Malur (East Bengaluru), with a total development area of 4.51 lakh sq ft and projected revenue potential of over Rs 225 crore.

Shipping Corporation of India: The company has sold its crude oil tanker “M.T. Maharshi Parashuram” at Colombo Anchorage, Sri Lanka.

Prism Johnson: The company has acquired shares worth Rs 49.68 crore in Sentini Cermica.

JSW Energy: The company has commissioned the third and final 80 MW unit of the 240 MW Kutehr Hydro Power project in Himachal Pradesh, with power dispatch now commenced from the full capacity.

JM Financial: JM Financial Credit Solutions, a subsidiary, has entered into an agreement with Bajaj Allianz to sell a 2.1% stake in JM Financial Home Loans for Rs 65.5 crore.

IPOs Today

BlueStone Jewellery & Lifestyle: The company will offer shares for bidding on Monday. The price band is set from Rs 492-517 per share. The IPO is for a size of Rs 1,540.65 crore, out of which Rs 820 crore is fresh issue and rest is OFS. Tentative listing date fixed as Aug. 19, 2025.

All Time Plastics: The public issue was subscribed to 0.50 times on day 2. The bids were led by Qualified institutional investors (0.0 times), non-institutional investors (0.42 times), retail investors (0.81 times), Employees (1.68 times)

JSW Cement: The public issue was subscribed to 0.22 times on day 2. The bids were led by Qualified institutional investors (0.01 times), non-institutional investors (0.33 times), retail investors (0.29 times).

Bulk & Block Deals

Bharti Airtel: Indian Continent Investment sold 6 crore shares (0.98%) for average price of Rs 1871.18 apiece.

Zinka Logistic: Sands Capital Private Growth sold 10.6 lakh shares (0.59%) for Rs 520.47 apiece.

Centum: Hdfc Mutual Fund bought 2.15 lakh shares (1.46%), 3p India Equity bought 3 lakh shares (2.04%) at Rs 2300 apiece. Mallavarapu Venkata Apparao sold 6.65 lakh share (4.53%) at Rs 2300.93 apiece.

EPack: Premjayanti Enterprises bought 9.08 lakh shares (0.94%) at Rs 390 apiece, Tata Mutual Fund bought 15 lakh shares (1.56%) at Rs 390 apiece

Augusta Investments Zero sold 38.5 lakh shares (4%) at Rs 391.02 apiece.

Pledge Shares Details

Indoco Remedies: Aditi Panandikar, the Promoter acquired 20800 shares, Madhura Kare, the Promoter acquired 7300 shares, Mahika Milind Panandikar, the Promoter Group disposed 7,800 shares, Megh Milind Panandikar, the Promoter Group disposed 13,000 shares and Rohan Anup Ramani, the Promoter Group disposed 7,300 shares.

D. B. Corp: D B Power, the promoter group acquired 45,978 shares.

Kajaria Ceramics: Chetan Kajaria, The promoter group acquired 1 lakh shares and Rishi Kajaria, the promoter group acquired 1 lakh shares.

Trading Tweaks

List of securities to be excluded from ASM Framework: Pondy Oxides & Chemicals.

Ex-Dividend: Globus Spirits, Castrol India, Akzo Nobel India, Jio Financial Services, Indo Count Industries, KPI Green Energy, Kalyani Steels, GPT Infraprojects, Rashi Peripherals.

Shares to Exit Anchor Lock-in: APeejay Surrendra Park Hotels - 20%.

F&O Cues

Nifty Aug futures is down by 0.99% to 24,430 at a premium of 67 points.

Nifty Aug futures open interest up by 2.94%.

Nifty Options 14th Aug Expiry: Maximum Call open interest at 25000 and Maximum Put open interest at 22,800.

Currency/Bond Update

The Indian Rupee closed stronger against the US Dollar on Friday unbothered by additional 25% tariff by United States President Donald Trump on India for the purchase of Russian crude oil on Wednesday. The yield on the benchmark 10-year bond settled three basis points higher at 6.41%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.