Good morning!

The GIFT Nifty is trading flat at 26,060, indicating a muted open for the benchmark Nifty 50.

US and European index futures are trading higher during Asian trading hours.

S&P 500 futures trade flat

Euro Stoxx 50 futures trade flat

Markets On Home Turf

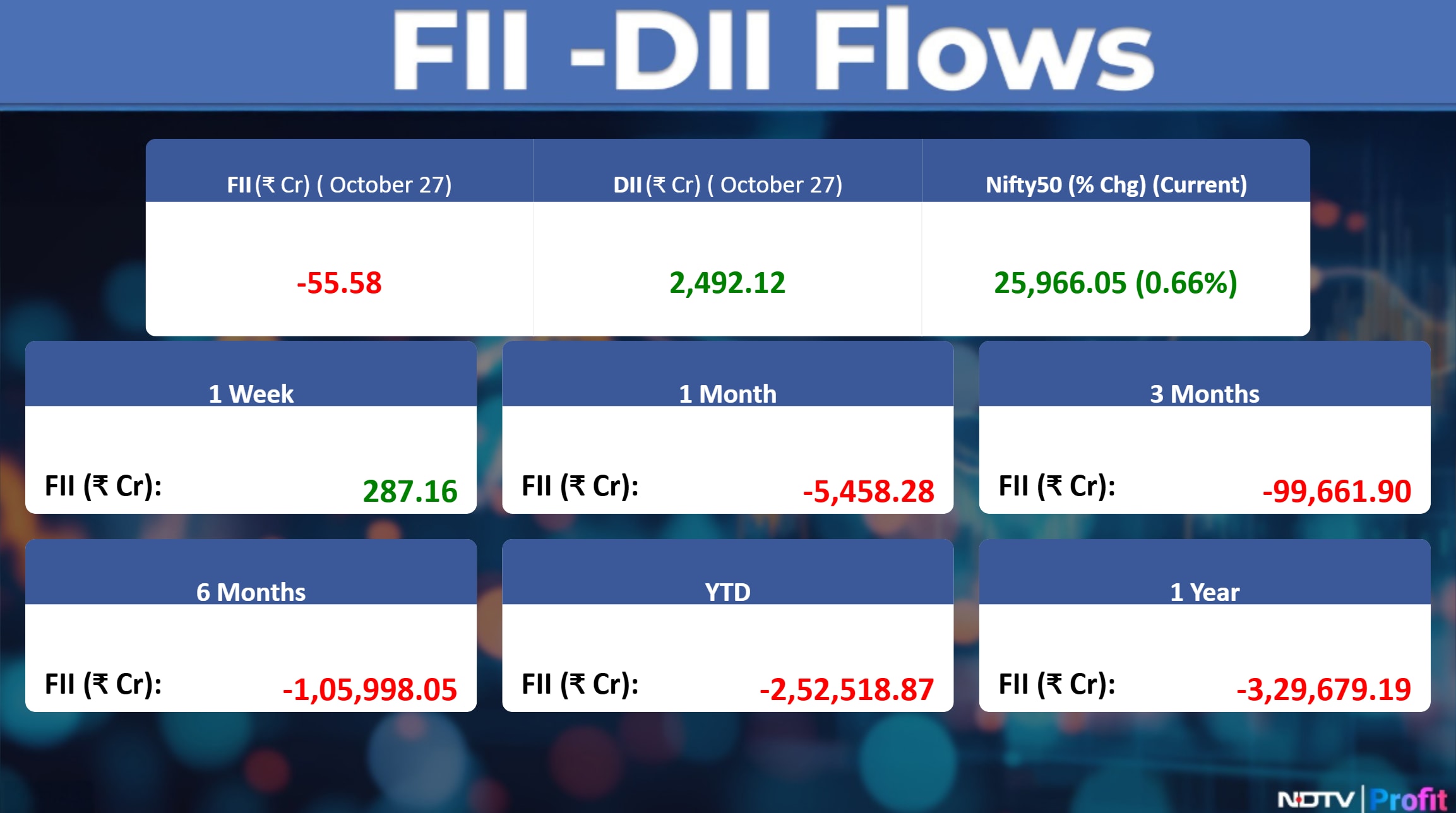

The Nifty ended in the green on Monday. At the close, the Sensex rose 566.96 points, or 0.67%, to 84,778.84, while the Nifty rose 170.9 points, or 0.66%, to 25,966.05. During the day Sensex rose 0.85% to 84,932.08 and Nifty briefly touched the 26,000 mark.

"Investor sentiment remained upbeat, supported by signs of improving economic momentum, festive-season consumption, and steady government spending," said Ponmudi R, CEO of Enrich Money, a SEBI - registered online trading and wealth tech firm.

US Market Wrap

On Monday, US indices closed at all-time highs as Chinese and US trade negotiators lined up an array of diplomatic wins for Donald Trump and Xi Jinping to unveil at a summit this week. An index of US-listed Chinese shares rose 1.6%.

The S&P 500 climbed 1.2% and topped 6,875 - notching its best three-day rally since May. Corporate America remains fairly unscathed by tariffs, with firms protecting margins through price hikes and cost cuts. Sales beats for S&P 500 companies are currently at a four-year high.

Treasury two-year yields rose two basis points to 3.5%, reports Bloomberg.

Asian Market Wrap

The record-setting advance in global equities took a breather in early Asian trading Tuesday, as investors braced for a flurry of megacap technology earnings and policy announcements from major central banks this week.

Equity gauges in Japan and South Korea retreated from record highs. The yen gained after seven consecutive days of weakening, as a minister stated that the government would monitor the currency's weakness.

South Korea's GDP expanded by 1.2% in the three months through September from the previous quarter, according to Bank of Korea data.

Commodity Check

Oil was steady after a two-day drop as investors weighed signs of a glut and the fallout from US sanctions on Russian producers.

Brent traded above $65 a barrel, while West Texas Intermediate was near $61.

Gold clawed back some losses after plunging below $4,000 an ounce as US-China trade talks progressed, weakening the demand for haven assets.

Bullion edged higher after tumbling 3.2% in the previous session

Gold has pulled back decisively from a record above $4,380 an ounce last Monday following a blistering rally. It's still up more than 50% this year, with central-bank buying and the debasement trade — in which investors avoid sovereign debt and currencies to protect themselves from runaway budget deficits providing support and attracting retail investors, reports Bloomberg.

Key Events To Watch

Commerce Minister Piyush Goyal in Brussels for the second day of his visit to discuss India-EU FTA.

India's federal cabinet to meet; Government to release industrial production data for September.

Earnings Post Market Hours

Indian Oil – Q2FY26 Highlights (QoQ)

Revenue down 7.3% to Rs 1.79 lakh crore vs Rs 1.93 lakh crore

Ebitda up 15.7% to Rs 14,583 crore vs Rs 12,607 crore

Margin at 8.2% vs 6.5%

Net Profit up 33.8% to Rs 7,610.5 crore vs Rs 5,689 crore

Revenue up 7.2% to Rs 1,121 crore vs Rs 1,045 crore

Ebitda up 8.8% to Rs 136 crore vs Rs 126 crore

Margin at 12.1% vs 11.9%

Net Profit up 17.7% to Rs 69.5 crore vs Rs 59 crore

Total Income down 11% to Rs 108 crore vs Rs 121 crore

Net Profit down 20.1% to Rs 48.7 crore vs Rs 61 crore

Revenue up 10.8% to Rs 1,685 crore vs Rs 1,521 crore

Ebitda up 28.2% to Rs 85.1 crore vs Rs 66.4 crore

Margin at 5% vs 4.4%

Net Loss at Rs 10.4 crore vs Rs 10.8 crore

Revenue up 23.4% to Rs 1,138 crore vs Rs 922 crore

Ebitda up 12.7% to Rs 284 crore vs Rs 252 crore

Margin at 24.9% vs 27.3%

Net Profit up 20% to Rs 173 crore vs Rs 144 crore

Revenue up 6.7% to Rs 6,594 crore vs Rs 6,184 crore

Ebitda up 28.1% to Rs 2,289 crore vs Rs 1,787 crore

Margin at 34.7% vs 28.9%

Net Profit down 20.9% to Rs 534 crore vs Rs 675 crore

Revenue up 10.8% to Rs 4,011 crore vs Rs 3,622 crore

Ebitda up 23.8% to Rs 521 crore vs Rs 421 crore

Margin at 13% vs 11.6%

Net Profit up 64% to Rs 221 crore vs Rs 135 crore

Net Premium Income up 23.5% to Rs 2,260 crore vs Rs 1,829 crore

Net Profit up 10.7% to Rs 40.8 crore vs Rs 36.9 crore

Revenue down 4.3% to Rs 801 crore vs Rs 837 crore

Ebitda down 16.7% to Rs 145 crore vs Rs 174 crore

Margin at 18.1% vs 20.8%

Net Profit down 73.4% to Rs 13.8 crore vs Rs 51.9 crore

Revenue up 11.4% to Rs 528 crore vs Rs 474 crore

Ebitda up 11.4% to Rs 43.3 crore vs Rs 38.8 crore

Margin flat at 8.2%

Net Profit down 81% to Rs 11.4 crore vs Rs 60.1 crore

Total Income up 13.4% to Rs 2,131 crore vs Rs 1,880 crore

Net Profit up 23.8% to Rs 582 crore vs Rs 470 crore

Revenue up 12.9% to Rs 309 crore vs Rs 274 crore

Ebitda up 19.3% to Rs 136 crore vs Rs 114 crore

Margin at 43.9% vs 41.5%

Net Profit up 20.9% to Rs 93.3 crore vs Rs 77.2 crore

Revenue up 9.7% to Rs 8,188 crore vs Rs 7,465 crore

Ebitda down 6% to Rs 4,613 crore vs Rs 4,907 crore

Margin at 56.3% vs 65.7%

Net Profit down 17.3% to Rs 1,839 crore vs Rs 2,224 crore

Net Interest Income up 0.2% to Rs 597 crore vs Rs 596 crore (YoY)

Operating Profit down 2.7% to Rs 452 crore vs Rs 465 crore (YoY)

Provisions down 69.2% to Rs 20 crore vs Rs 64.9 crore (YoY); Rs 20 crore vs Rs 8.3 crore (QoQ)

Gross NPA at 1.01% vs 1.22% (QoQ); Net NPA at 0.26% vs 0.33% (QoQ)

Net Profit up 4.7% to Rs 318 crore vs Rs 303 crore (YoY)

Revenue up 3.4% to Rs 3,419 crore vs Rs 3,306 crore

Ebitda down 28.3% to Rs 103 crore vs Rs 144 crore

Margin at 3% vs 4.3%

Net Profit down 55.5% to Rs 30 crore vs Rs 67.5 crore

Interim dividend of Rs 1.65/share

Revenue up 6.3% to Rs 2,929 crore vs Rs 2,757 crore

Ebitda up 36% to Rs 695 crore vs Rs 511 crore

Margin at 23.7% vs 18.5%

Net Profit up 28.1% to Rs 749 crore vs Rs 585 crore

First interim dividend of Rs 6/share

Revenue up 11.3% to Rs 162 crore vs Rs 146 crore

Ebitda up 8.4% to Rs 52.9 crore vs Rs 48.8 crore

Margin at 32.6% vs 33.5%

Net Profit down 23.8% to Rs 42.7 crore vs Rs 56 crore

Stocks In News

Sai Life Sciences: The company announces the groundbreaking of a new research and development centre at its Hyderabad campus; the facility is expected to double process R&D capacity and become operational by September 2026.

Vodafone Idea: The company states that the Supreme Court has permitted the government to consider its grievances on AGR-related issues; it looks forward to working closely with the DoT to resolve the matter.

Vishnu Chemicals: The company announces that its subsidiary, Vishnu International Trading FZE, is undergoing a voluntary winding-up process expected to be completed within six months.

Magellanic Cloud: The company's arm Provigil Surveillance has received an LoA worth Rs. 3.2 crore from Southern Railway, Madurai Division, for provision of CCTV cameras

RBL Bank: The company clarified on news report titled “RBL in talks to onboard 160 million Zerodha clients” is incorrect, company routinely explores partnerships, no such event warranting disclosure has occurred and the article has no material impact on the Bank

Allcargo Logistics: The company reported September LCL volumes down 4% MoM and 6% YoY at 717'000 cm, FCL volumes flat at 53,921 TEUs, while air volumes rose 14% YoY and 1% MoM to 3,012 tonnes.

Paisalo Digital: The company to consider raising funds via non-Convertible Debentures on a private placement basis at its board committee meeting on Oct. 30, 2025.

Oriental Hotels: The company's wholly owned subsidiary OHL International has allotted 63,000 equity shares of $10 each at an issue price of $28 per share as part of its ongoing acquisition process.

Sanofi India: The company appoints Deepak Arora as managing director for a term of three years, while Rachid Ayari steps down as interim managing director.

Rail Vikas Nigam: The company emerges as the lowest bidder from North Eastern Railway for a construction order worth Rs. 165.5 crore.

Havells India: The company appoints Pankaj Mohan Arora as executive president – finance.

SRF: The Company announces the resignation of Rahul Jain as chief financial officer, effective Dec. 12.

Jaiprakash Power Ventures: The company states that India Debt Resolution, acting on behalf of NARCL, has demanded repayment of dues under a corporate guarantee; the matter remains sub judice.

Mahindra Logistics: The company approves an investment of up to Rs. 50 crore in its subsidiary, MLL Express Services.

IOL Chemicals & Pharmaceuticals: The company receives a Certificate of Suitability from the European Directorate for the Quality of Medicines & HealthCare for its API product ‘Sitagliptin Phosphate Monohydrate'.

KNR Constructions: The company receives a provisional certificate of completion for its six-laning project in Kerala

Shilpa Medicare: The company enters into an agreement with Ash Ingredients Inc. and Varcatalyst LLP to sell its 31% stake in Sravathi Advance Process Technologies for Rs. 49.6 crore.

HPCL: The company sourced 54.6 MT of crude oil from the B-80 Mumbai Offshore Oilfield of Hindustan Oil Exploration Co. for processing at its Mumbai refinery

NIIT: The company and its amalgamating entities have completed submission of the amalgamation application with NCLT; the board had earlier approved the merger of NIIT Institute and RPS Consulting on Oct. 9.

Paisalo Digital: The company's board to meet on Oct. 30 to consider raising funds through issuance of NCDs.

EPACK Prefab: The company secures three orders worth Rs. 140 crore from JK Cement, Technical Associates Transformers, and CG Power.

ITC: The company's board to meet on Oct. 30 to consider voluntary delisting of its ordinary shares from the Calcutta Stock Exchange.

Dilip Buildcon: The company is declared as the L-1 bidder for an order worth Rs. 879.3 crore from the National Highways Authority of India in Tamil Nadu.

Gulshan Polyols: The company announces that its subsidiary, Gulshan Overseas-FZCO, has been de-registered as it had not commenced any business or operations since incorporation.

Tata Chemicals: The company's arm Tata Chemicals Magadi wins Rs. 783 crore Kenya land revenue case.

Zydus Wellness: The company appoints Manish Lal as Head of Global Demand & Supply Organisation.

Panorama Studios: The company to commence production of an upcoming Malayalam psychological supernatural thriller.

Blue Dart Express: The company says its investors website is in migration phase from Prime Database to new vendor Euroland IR.

Infibeam Avenues: The company's arm IA Fintech receives IFSCA approval to act as Payment Service Provider in GIFT-IFSC.

Samhi Hotels: The company's arm receives communication from MIDC confirming extension of development period for project land in Navi Mumbai.

Inox Green Energy: The company allots 49 lakh shares at Rs. 145 per share to non-promoter warrant holder

Hexaware Technologies: The company denies all allegations in the lawsuit filed by Natsoft, calling the claims meritless. It believes it will be vindicated on all counts and does not expect any material financial or operational impact.

NTPC Green: The company enters into a pact with Paradip Port Authority to explore collaboration in green hydrogen.

IDFC First Bank: The company approves allotment of 43.71 crore shares to Platinum Invictus B 2025 RSC through conversion of CCPS issued at Rs. 60 apiece, aggregating to nearly Rs. 2,623 crore.

Everest Industries: The company receives environmental clearance amendment for sale of land at Podanur for a total consideration of Rs. 133.86 crore, payable in tranches.

Adani Enterprises: The company incorporates a wholly-owned subsidiary named Shri Kedarnath Ropeways.

Bulk And Block Deals

Dhani Services: Goldman Sachs Bank Europe bought 41.1 lakh shares at Rs. 51.26 apiece

Utkarsh Small Fin Bank: Olympus ACE PTE sold 64.1 lakh shares at Rs. 3.53 apiece

Corporate Actions

Merger: Indiabulls Enterprises Ltd. and Dhani Services Ltd.

Shares To Exit Anchor Lock-In: Shanti Gold International Ltd.

Board Meet : Shree Ram Proteins Ltd. (Fund raising), Aditya Birla Real Estate Ltd. (Fund raising)

Key Earnings To Watch

Aditya Birla Real Estate Ltd., Adani Green Energy Ltd., Adani Total Gas Ltd., Blue Dart Express Ltd., Ideaforge Technology Ltd., Jindal Steel Ltd., Novartis India Ltd., Premier Energies Ltd., TVS Motor Ltd.

Pledge Shares Details

D. B. Corp: D B Power, promoter group acquired 59,137 shares.

Thyrocare Technologies : Docon Technologies, The promoter disposed 53.3 lakh shares.

Trading Tweaks

List of securities shortlisted in Short - Term ASM Framework Stage – I : EPack Prefab Technologies, Jain Resource Recycling

List of securities to be excluded from ASM Framework: GM Breweries

F&O Cues

Nifty Oct futures is up 0.86% to 26,036.70 at a premium of 70 points.

Nifty Oct futures open interest down by 34.79%

Nifty Options 28th Oct Expiry: Maximum Call open interest at 26,500 and Maximum Put open interest at 25,900.

Securities in ban period: SAIL, SAMMAANCAP

Currency/Bond Market

The rupee depreciated 12 paise to 87.95 against the US dollar in early trade on Monday, weighed down by rising crude oil prices supported by optimism over a potential US-China deal. The yield on the 10-year bond ended one point lower at 6.55%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.