Good morning!

The GIFT Nifty was down 0.04% at 25,028.5 as of 07:38 a.m., signaling a muted start to Indian markets today.

Asian shares opened cautiously on Tuesday as investors awaited new trade developments that could influence demand for US assets. Tariff-related news continued to dominate the market, with investors closely monitoring how President Donald Trump's administration is handling relations with Japan and India following earlier talks with China that had raised optimism.

Trade tensions and concerns over the US fiscal situation have dampened demand for US assets, a trend most evident in the weakening of the dollar.

In Japan, yields on super-long bonds declined ahead of a Wednesday auction expected to gauge demand after a recent sale that unsettled global markets.

Meanwhile, China's central bank instructed major lenders to increase the proportion of yuan used in cross-border trade, part of its ongoing efforts to promote the currency amid the global impact of US tariffs.

Watch NDTV Profit Live

Markets On The Home Turf

The benchmark equity indices closed higher on Monday as it continued to rise for a second session in row.

The NSE Nifty 50 closed 148 points, or 0.60% higher at 25,001 and the BSE Sensex ended 455.37 points, or 0.56% up at 82,176. During the day, the Nifty 50 gained 0.91% to 25,079.20, while the Sensex gained 0.94% to 82,492.24.

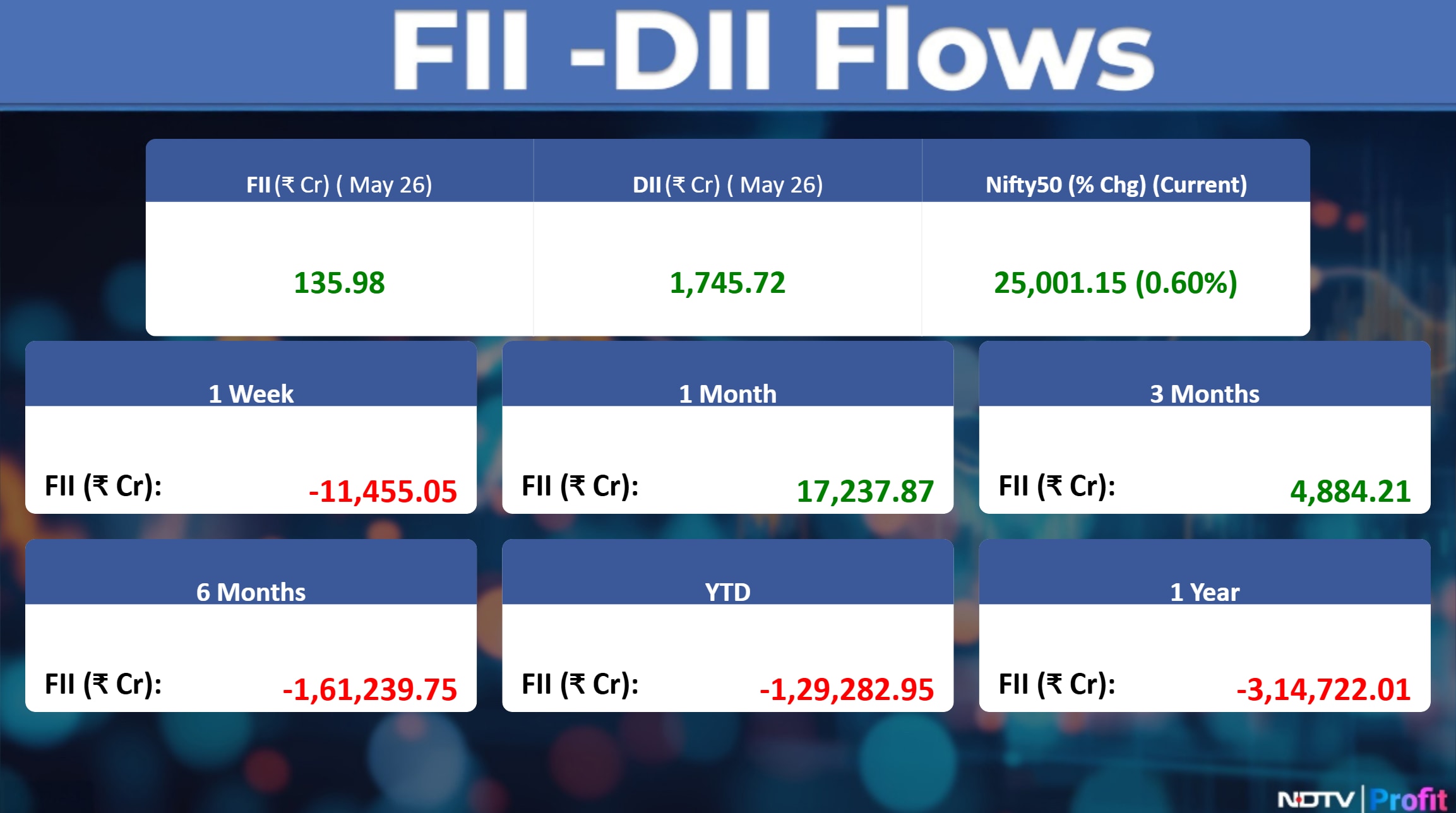

Foreign portfolio investors mopped up stocks worth Rs 136 crore, according to the provisional data from the National Stock Exchange.

Domestic institutional investors stayed net buyers for the fifth straight day as they bought equities worth Rs 1,746 crore, the data showed.

The FPIs had bought shares worth Rs 1,794.59 crore on Friday.

Here's everything that could influence Indian equities today:

Asian Markets Update

S&P 500 futures rose 0.98%.

Hang Seng index futures were down 1.09%.

Futures for the Nikkei 225 on the Osaka Exchange fell 0.31%.

Japan's Topix index dropped 0.13%.

Australia's S&P/ASX 200 index was also marginally down.

Euro Stoxx 50 futures were down 0.11%.

Commodity Check

West Texas Intermediate crude dipped 0.18% to trade at $61.42 per barrel.

Spot gold advanced by 0.09% to $3,344.92 per ounce.

Earnings To Watch

Life Insurance Corporation of India

Bharat Dynamics

Bosch

DCX Systems

Dynamatic Technologies

EID Parry India

Entero Healthcare Solutions

Esab India

Gujarat Fluorochemicals

Gateway Distriparks

Goodyear India

Hindustan Copper

ITI

JK Lakshmi Cement

Medplus Health Services

Minda Corporation

Info Edge (India)

NMDC

NMDC Steel

Procter & Gamble Hygiene and Health Care

Precision Camshafts

Rashtriya Chemicals and Fertilizers

Redtape

Sansera Engineering

Shriram Properties

Sky Gold and Diamonds

S.P. Apparels

Sunflag Iron & Steel Company

Supriya Lifescience

Tasty Bite Eatables

Techno Electric & Engineering Company

Time Technoplast

Triveni Engineering & Industries

TTK Prestige

V2 Retail

Earnings Post Market Hours

Aurobindo Pharma Q4 FY25 Highlights (Consolidated, YoY)

Revenue up 10.6% to Rs 8,382 crore versus Rs 7,580 crore (Bloomberg estimate: Rs 8,197 crore)

Ebitda up 7% at Rs 1,792 crore versus Rs 1,673 crore (Estimate: Rs 1,827 crore)

Margin narrows to 21.4% versus 22% (Estimate: 22.3%)

Net profit down 0.6% to Rs 903.5 crore versus Rs 909 crore (Estimate Rs 1,013 crore)

Brainbees Solutions Q4 FY25 Highlights (Consolidated, YoY)

Revenue up 15.84% at Rs 1,930 crore versus Rs 1,666 crore.

Ebitda down 51.51% at Rs 16 crore versus Rs 33 crore.

Ebitda margin down 115 bps at 0.82% versus 1.98%.

Net loss at Rs 76.7 crore versus loss of Rs 51.7 crore.

Exceptional loss of Rs 36.7 crore.

Hi-Tech Pipes Q4 FY25 Highlights (Consolidated, YoY)

Revenue up 7.7% to Rs 733.7 crore versus Rs 681 crore.

Ebitda down 1.1% to Rs 34.9 crore versus Rs 35.3 crore.

Margin at 4.8% versus 5.2%.

Net Profit up 58.5% to Rs 17.6 crore versus Rs 11.1 crore.

Schneider Electric Q4 FY25 Highlights (YoY)

Revenue up 24.4% to Rs 586.9 crore versus Rs 471.8 crore.

Ebitda up 18.5% to Rs 86.7 crore versus Rs 73.1 crore.

Margin at 14.8% versus 15.5%.

Net Profit at Rs 54.6 crore versus Rs 3.3 crore.

Shilpa Medicare Q4 FY25 Highlights (Consolidated, YoY)

Revenue up 13.4% to Rs 330.8 crore versus Rs 291.7 crore.

Ebitda up 9.5% to Rs 76.8 crore versus Rs 70.1 crore.

Margin at 23.2% versus 24%.

Net Profit down 40.8% to Rs 14.5 crore versus Rs 24.5 crore.

Exceptional Loss of Rs 28.08 crore.

Sumitomo Chemical Q4 FY25 Highlights (Consolidated, YoY)

Revenue up 1% to Rs 679 crore versus Rs 674 crore.

Ebitda down 14.7% to Rs 120 crore versus Rs 140 crore.

Margin at 17.6% versus 20.8%.

Net Profit down 9.2% to Rs 99.6 crore versus Rs 109.7 crore.

Akums Drugs Q4 FY25 Highlights (Consolidated, YoY)

Revenue up 11.8% to Rs 1,056 crore versus Rs 944.2 crore.

Ebitda at Rs 93.8 crore versus Rs 2.9 crore.

Margin at 8.9% versus 0.3%.

Net Profit at Rs 147.6 crore versus loss of Rs 41.3 crore.

Vadilal Industries Q4 FY25 Highlights (Consolidated, YoY)

Revenue up 9.2% to Rs 274.5 crore versus Rs 251.5 crore.

Ebitda down 15.3% to Rs 38.8 crore versus Rs 45.8 crore.

Margin at 14.1% versus 18.2%.

Net Profit down 20.3% to Rs 22 crore versus Rs 27.6 crore.

KEC International Q4 FY25 Highlights (Consolidated, YoY)

Revenue up 11.5% to Rs 6,872 crore versus Rs 6,165 crore.

Ebitda up 38.9% to Rs 538.8 crore versus Rs 388 crore.

Margin at 7.8% versus 6.3%.

Net Profit up 76.8% to Rs 268.2 crore versus Rs 151.7 crore.

Orchid Pharma Q4 FY25 Highlights (Consolidated, YoY)

Revenue up 9.4% to Rs 237.5 crore versus Rs 217.1 crore.

Ebitda down 3.3% to Rs 28 crore versus Rs 28.9 crore.

Margin at 11.8% versus 13.3%.

Net Profit down 32.4% to Rs 22.3 crore versus Rs 33 crore.

Awfis Space Solutions Q4 FY25 Highlights (Consolidated, YoY)

Revenue up 46.2% to Rs 340 crore versus Rs 232 crore.

Ebitda up 72.7% to Rs 116 crore versus Rs 67 crore.

Margin at 34% versus 29%.

Net Profit at Rs 11.23 crore versus Rs 1.37 crore.

PTC India Q4 FY25 Highlights (Consolidated, YoY)

Revenue down 14.3% to Rs 3,006 crore versus Rs 3,507 crore.

Ebitda down 16.5% to Rs 210 crore versus Rs 251 crore.

Net Profit at Rs 343 crore versus Rs 91.3 crore.

Olectra Greentech Q4 FY25 Highlights (Consolidated, YoY)

Revenue up 55.4% to Rs 449 crore versus Rs 289 crore.

Ebitda up 64% to Rs 56.5 crore versus Rs 34.5 crore.

Margin at 12.6% versus 12%.

Net Profit up 53.2% to Rs 21 crore versus Rs 13.7 crore.

Capacite Infraprojects Q4 FY25 Highlights (Consolidated, YoY)

Revenue up 12% to Rs 671 crore versus Rs 599 crore.

Ebitda down 22.7% to Rs 85.7 crore versus Rs 111 crore.

Margin at 12.8% versus 18.5%.

Net Profit up 1.5% to Rs 52.5 crore versus Rs 51.7 crore.

Other Income aided PAT, Other Income at Rs 33.5 crore versus Rs 9.9 crore.

Blue Dart Express Q4 FY25 Highlights (Consolidated, YoY)

Net Profit down 29% at Rs 55.2 crore versus Rs 77.8 crore.

Revenue up 7% at Rs 1,417 crore versus Rs 1,323 crore.

Ebitda down 5.7% at Rs 213 crore versus Rs 226 crore.

Margin at 15% versus 17%.

Bayer Crop Q4 FY25 Highlights (Consolidated, YoY)

Revenue up 32.1% to Rs 1,046 crore versus Rs 792 crore.

Ebitda up 75.4% to Rs 170.8 crore versus Rs 97.4 crore.

Margin at 16.3% versus 12.3%.

Net Profit up 49.3% to Rs 143.3 crore versus Rs 96 crore.

Lumax Industries Q4 FY25 Highlights (Consolidated, YoY)

Revenue up 24.3% to Rs 923.4 crore versus Rs 742.7 crore.

Ebitda up 20.4% to Rs 79.3 crore versus Rs 65.9 crore.

Margin at 8.6% versus 8.9%.

Net Profit up 21.7% to Rs 43.9 crore versus Rs 36.1 crore.

Stocks in News

Garden Reach Shipbuilders & Engineers: The order, worth $21 million (nearly Rs 180 crore), from the Directorate General Defence Purchase, Ministry of Defence, Bangladesh has been cancelled.

InterGlobe Aviation: Co-founder Rakesh Gangwal and a promoter entity are planning to offload up to a 3.4% stake in the company for nearly Rs 6,833 crore via open market transactions.

PG Electroplast: Promoter group to sell 1.59 crore shares (5.6%) via block on May 27. The offer price for the same is Rs 740, which is a 4% discount on the current market price. The offer size is Rs 1,177 crore.

KEI Industries: Delhi High Court quashes tax demand order of Rs 59 crore.

Sagility India: Promoter plans to sell 15.02% stake in the company via offer for sale at floor price Rs 38 per share which is 11.6% discount to current market price. Following this, promoters' shareholding will reduce to 67.4%.

Thirumalai Chemicals: The board is to meet on May 29 to consider raising funds worth Rs 100 crore via non-convertible debentures.

Adani Ports: The company incorporated “East Africa Ports FZCO”, a wholly owned subsidiary on May 26, 2025.

Centrum Capital: The board approved issue price of Rs 28.52 per warrant for Preferential Issue. Board approved the Issue of Rs 200 crore convertible warrants to promoter JBCG advisory services.

Dabur India: The board approved Scheme of Amalgamation of Sesa care with the company.

Media Reports

Edelweiss is in talks with Fidelity and others to sell AMC stake, CNBC reported.

US officials are likely to visit India for next round of talks on the interim trade deal, as per CNBC-TV18.

Byju's Learning app has been delisted from Google Playstore due to non-payment to vendor, PTI reported.

IPO Offering

Aegis Vopak Terminals: The public issue was subscribed to 0.26 times on day 1. The bids were led by qualified institutional investors (0.39 times), non-institutional investors (0.03 times), and retail investors (0.19 times).

Schloss Bangalore (Leela Hotels IPO): The public issue was subscribed 0.06 times on day 1. The bids were led by qualified institutional investors (0.03 times), non-institutional investors (0.03 times), retail investors (0.2 times).

Prostarm Info Systems: The company will offer shares for bidding on Tuesday. The price band is set from Rs 95 to Rs 105 per share. The Rs 168-crore IPO is entirely a fresh issue of shares.

Brokerage Radar

Morgan Stanley on Brainbees Solutions

Maintain 'overweight' rating with a target price of Rs 574.

The quarter ended March showed in-line topline but missed on margins.

The company improved disclosures, disclosing for the first time that the apparel and footwear category accounts for 52% of India multichannel gross merchandise value.

Management is focusing on improving offline growth in India and driving margin expansion in GlobalBees.

Goldman Sachs on Varun Beverages

Initiate 'buy' rating with a target price of Rs 600.

The company is unlocking market potential through superior execution.

Multiple drivers support outperformance in India's fast-growing ready-to-drink market.

International expansion offers additional opportunities, backed by a strong track record.

The impact of new entrant ‘Campa Cola' is not disruptive.

Inflection in free cash flow is likely as the high capital expenditure phase is behind.

CLSA on Fusion Finance

Maintain 'underperform' call with a target price of Rs 155.

The brokerage remains cautiously optimistic.

MFI segment growth guidance points to better clarity after the first quarter of this fiscal.

Over 13% customers on the current book have more than three lenders.

Catch all brokerage calls for Tuesday here.

Block Deals

Mangalam Cement: Pilani Investment and Industries Corp. sold 5 lakh shares at Rs 815 apiece, Rambara Trading bought 2.5 lakh shares at Rs 815 apiece, Vidula Consultancy Services bought 2.5 lakh shares at Rs 815 apiece.

Bulk Deals

Tourism Finance Corp: Aditya Kumar Halwasiya bought 10 lakh shares (1.07%) at Rs 213.82 apiece.

Trading Tweaks

Price Band change from 10% to 5%: Emcure Pharmaceuticals, Kernex Microsystems (India)

Price Band change from 20% to 10%: Khaitan (India), HLE Glascoat

Ex-Dividend: Trident, Man Infraconstruction, L&T Fianance, Infobeans Technologies.

F&O Cues

Nifty May Futures up by 0.62% to 25,035 at a premium of 34 points.

Nifty May futures open interest down by 9.42%.

Nifty Options May 29 Expiry: Maximum Call open interest at 26,000 and Maximum Put open interest at 24,000.

Securities in ban period: Chambal Fertilizer, Hindustan Copper, Manappuram, RBL Bank and Titagarh.

Currency Update

The Indian rupee strengthened by 12 paise to close at 85.1 against the US dollar on Monday amid various global and domestic economic factors influencing the currency markets.

Disclaimer: NDTV is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.