Good morning!

The GIFT Nifty was up 0.02% at 25,163.50 as of 06:30 a.m., signaling a marginally positive start to Indian markets today.

Asian stocks opened higher on Monday as the United States and China prepared to resume trade negotiations, while encouraging jobs data from the world's largest economy helped ease concerns about a potential recession.

Equities in Japan and South Korea rose at the start of trading, while S&P 500 futures remained flat after the index closed at its highest level since February. Trade tensions between President Donald Trump and China's Xi Jinping appeared to ease after a deadlock over critical minerals was resolved, clearing the way for further discussions.

Markets On The Home Turf

India's benchmark equity indices closed higher for third straight session on Friday, after the Reserve Bank of India Monetary Policy Committee slashed the key lending rate by 50 basis point to bring it to 5.5%.

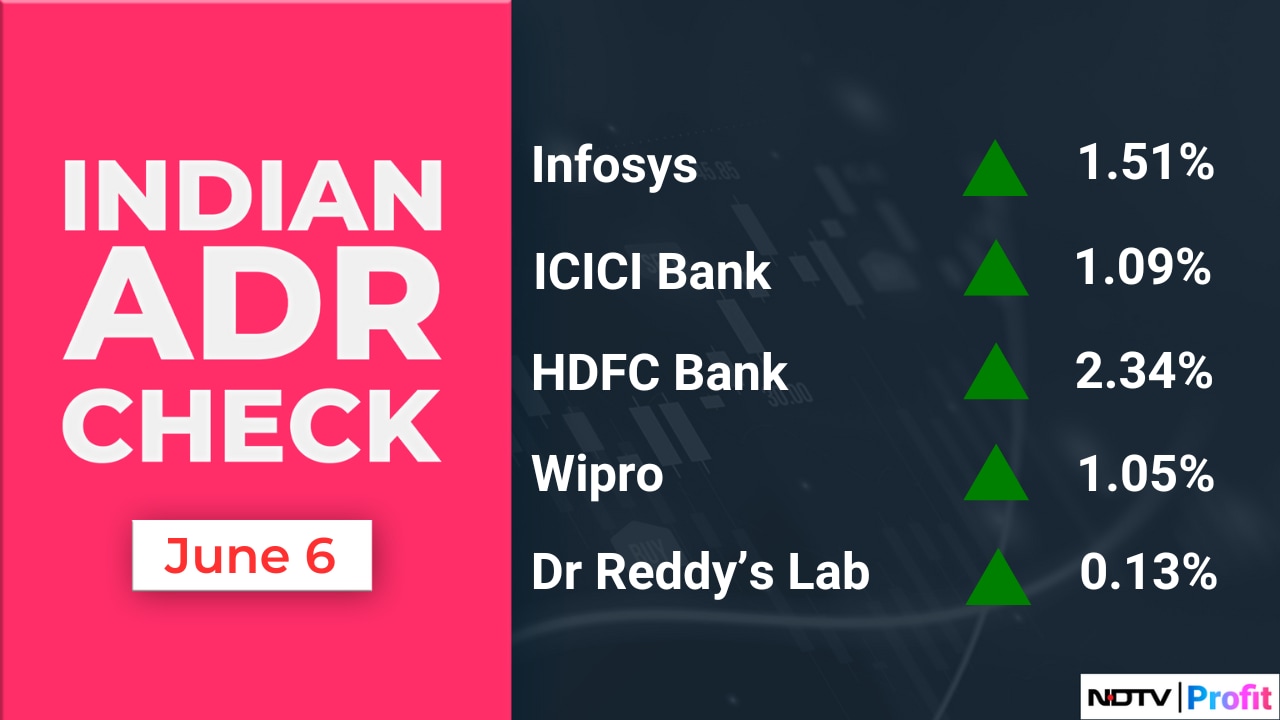

The NSE Nifty 50 ended 252 points, or 1.02% higher at 25,003, while the BSE Sensex closed 746.95 points, or 0.92% up at 82,188.99.

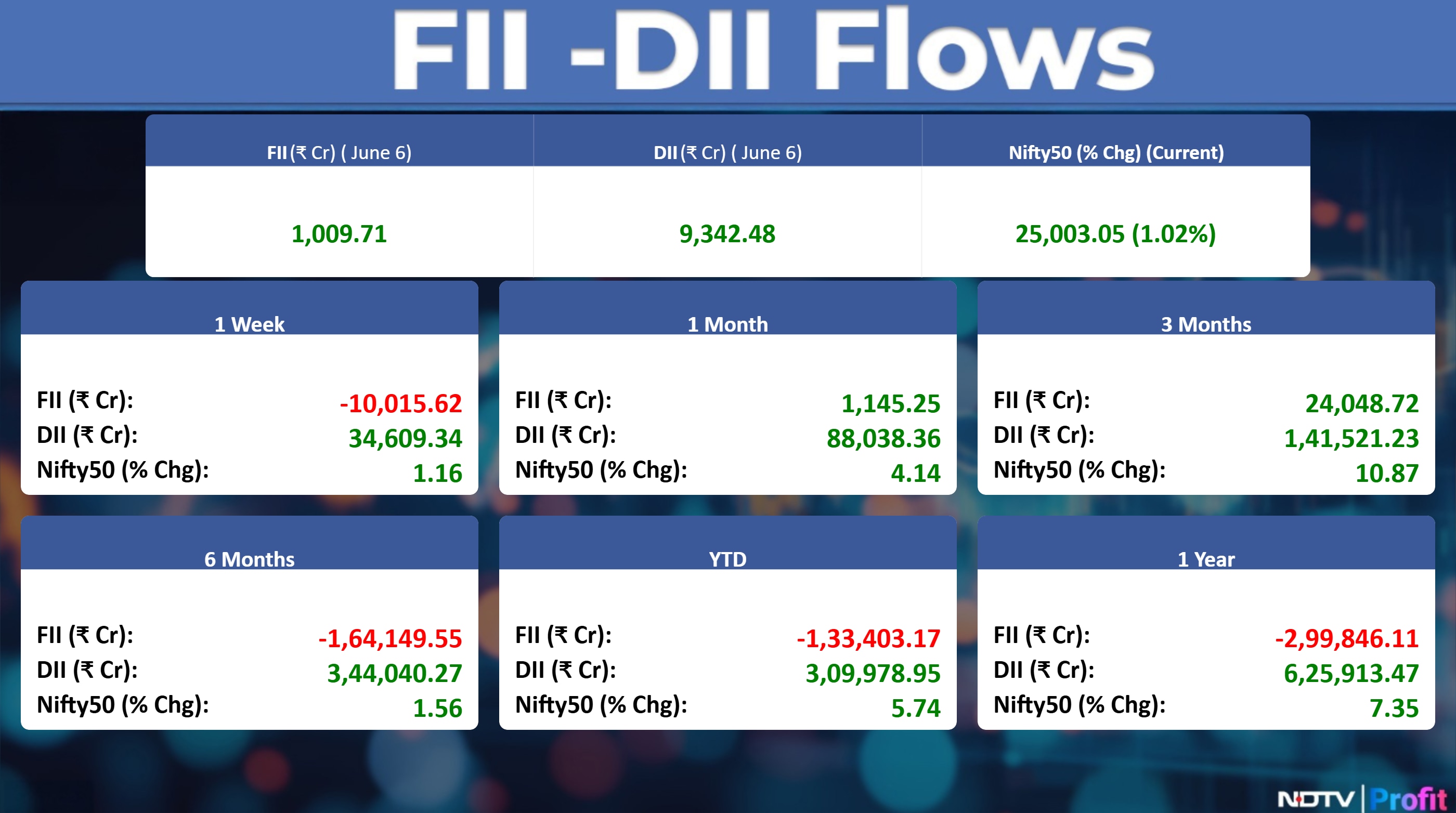

Foreign portfolio investors turned net buyers of Indian equities buying up stocks worth Rs 1,009.7 crore, according to the provisional data from the NSE. Domestic institutional investors stayed net buyers for the 14th straight session as they bought equities worth Rs 9,342.5 crore.

Asian Markets Update

S&P 500 futures fell marginally.

Hang Seng index futures were down 0.08%.

Futures for the Nikkei 225 on the Osaka Exchange rose 1.13%.

Japan's Topix index rose 0.65%.

Australia's S&P/ASX 200 index fell 0.27%.

Euro Stoxx 50 futures were down 0.02%.

Commodity Check

West Texas Intermediate crude fell 0.09% to trade at $64.52 per barrel.

Spot gold declined by 0.24% to $3,302.24 per ounce.

London Metal Exchange

Copper fell 0.48%, reversing gains.

Nickel was down 0.23%.

Aluminium was down 1.11%, snapping upward trend.

Zinc was down 0.74%, extending losses.

Lead advanced 0.03%, reversing losses.

US Market Updates

Stocks closed at their highest levels since February as bond yields rose on stronger-than-expected jobs data, easing fears of an imminent economic slowdown. Equities also gained on optimism that US-China trade tensions are easing, with President Donald Trump announcing that negotiators would hold talks on Monday.

The S&P 500 advanced 1%, pushing the index to the 6,000 mark, with all major sectors posting gains. Following the data release on Friday, Trump intensified his pressure on Federal Reserve Chair Jerome Powell by calling for a full percentage point rate cut. The Nasdaq 100 and the Dow Jones Industrial Average each rose 1% as well.

Stocks To Watch

Mahindra and Mahindra: The company total production in May increased by 27.6% year-over-year, reaching 89,626 units compared to 70,261 units in the same period last year. Total sales for M&M also saw a rise of 16.6% year-over-year, with 80,458 units sold compared to 69,011 units previously. Furthermore, M&M's total exports in May significantly grew by 36.7% year-over-year, from 2,671 units to 3,652 units.

MCX: The company received approval from SEBI to launch electricity derivatives.

Bikaji Foods International: NCLT approved the scheme of amalgamation of Vindhyawasini Sales with the company.

Rites: The company in an agreement with Hindustan Copper to develop critical mineral supply chain.

Hyundai Motor India: The company released Rs 16 crore as first tranche towards subscription of 23.6 lakh shares of FPEL TN Wind Farm.

CG Power: The company clarified on reports citing company's chip plans rocked by turmoil at wafer company Wolfspeed. The company said that the media report is not based on any official statement from Renesas and contains several inaccuracies.

Bank of India: The bank revised RBLR to 8.35% from 8.85%.

Punjab National Bank: The bank revised RLLR to 8.35% from 8.85% effective June 9.

GHV Infra Projects: The company received Rs 546 crore construction order from GHV (India).

MedPlus Health Services: The company received three suspension orders for a drug license for stores in Karnataka, Andhra Pradesh and Tamil Nadu.

UPL: Associate company Serra Bonita to sell entire assets for $125 million.

VIP Industries: Jiaxing Bianca travel goods company files a commercial suit against the company in Bombay Civil Court.

Hindustan Zinc: The board to mull first interim dividend for FY26 on June 11.

Seamec: The company signed an agreement with Mubarak Bridge, Dubai for charter hire of Vessel SEAMEC III.

Nazara Technologies: Smaaash Entertainment becomes a wholly owned arm. The company extends inter-corporate loan of Rs 116 crore to Smaaash.

Electronics Mart: The company commenced commercial operations of the New Store in Andhra Pradesh.

JK Cement: The company completed the acquisition of 60% stake of Saifco cements for Rs 150 crore.

UCO Bank: The bank cuts MCLR by 10 basis points across tenures effective June 10.

Orchid Pharma: NCLT to dispose-off dispute on lease rentals with DBS Bank India.

Indian Bank: The bank revised RBLR to 8.20% from 8.70% effective June 9.

Persistent Systems: The company re-appointed Anand Deshpande as MD.

Baazar Style Retail: The company opened a new store in Uttar Pradesh.

Ethos: The company raised Rs 410 crore via rights issue.

Balaji Telefilms: Netflix and Ekta Kapoor's Balaji Telefilms enter into a long-term creative collaboration.

LIC Housing Finance: Siddhartha Mohanty ceases to be CEO & MD upon completion of his term.

Garden Reach Shipbuilders: The company signed an MoU with Sweden-based Berg Propulsion for supply of marine propulsion systems, and with Denmark-based SunStone for partnership in areas of expedition cruise vessels.

Enviro Infra Engineers: The company's subsidiary EIE Renewables acquired Sunaxis, and became a step-down wholly-owned subsidiary post acquisition.

Afcons Infrastructure: The company received a letter of award for Rs 700 crore order from Reliance Industries for construction works of vinyl projects at Dahej, Gujarat.

Nibe: The company entered a licensing agreement with Defence Ministry for transfer of Modular Bridging System Technology.

Hindustan Copper: The company signed an MoU with Rites to secure supply chain of metals and minerals, including critical minerals.

Lupin: The drug-market received a tentative nod from the USFDA for Oxcarbazepine Extended-Release Tablets, which will be manufactured at Lupin's Nagpur facility in India. Oxcarbazepine ER Tablets are used to treat partial onset seizures in patients 6 years of age & older.

Bank of Baroda: The bank cut its repo based lending rates by 50 basis points across some tenures.

PNC Infra: The company received a letter of acceptance from Rajasthan government for a Rs 240-crore construction order for construction of a flyover in Bharatpur, Rajasthan, with a completion period of 24 months.

Infosys: The IT major received huge relief on GST. DGGI closed its Rs 32,403 crore pre-show cause notice. Infosys's net profit for fiscal 2025 stood at Rs 26,713 crore. The notice was for services availed from its overseas branches for five years starting 2017.

HDFC Bank: Regarding the media article, HDFC Bank states that it and its CEO are being targeted by a family trying to avoid repaying a long-overdue loan of around Rs 65.22 crore from Splendour Gems Limited, which defaulted in 2001. The bank asserts that the allegations by the Mehta family, including a recent complaint through Lilavati Hospital trust, are false, malicious, and a misuse of legal process to obstruct recovery. HDFC Bank maintains its commitment to ethical conduct and will continue to pursue all legal remedies for recovery and to defend its reputation.

RailTel Corporation of India: The company has received awork order from Department Of Education Samagra Shiksha for supply of UPS and printers amounting to Rs 15.97 crore.

Life Insurance Corp: The Finance Ministry entrusts MD Sat Pal Bhanoo with additional charges of CEO for three months.

Block Deals

Bajaj Finserv: Bajaj Holdings and Investment sold 1.04 crore shares (0.65%), Jamnalal Sons Private Limited sold 1.82 crore shares (1.13%) at Rs 1,925.2 apiece., while ICICI Prudential Mutual Fund bought 77.92 lakh shares (0.48%) at Rs 1,925.2 apiece, SBI Mutual Fund bought 77.92 lakh shares (0.48%) at Rs 1,925.2 apiece, among others.

ZF Commercial: Wabco Asia sold 6 lakh shares (3.16%) at Rs 13,191 apiece, while Franklin Templeton Mutual Fund bought 1.4 lakh shares (0.73%) at Rs 13,191 apiece, Sundaram Mutual Fund bought 1.23 lakh shares (0.64%) at Rs 13,191 apiece, Aditya Birla Sunlife Mutual Fund bought 1.23 lakh shares (0.64%) at Rs 13,191 apiece, among others.

Bulk Deals

RBL Bank: Oxbow Master Fund sold 38.7 lakh shares (0.63%) at Rs 210.34 apiece.

Azad Engineering: Rakesh Chopdar sold 31.67 lakh shares (5.35%) at Rs 1623.78 apiece, while Nomura India Investment Fund Mother Fund bought 4.1 lakh shares (0.69%) at Rs 1,616.85 apiece.

Trading Tweaks

Price Band change from 2% to 5%: RBZ Jewellers.

Price Band change from 5% to 20%: Tolins Tyres.

Ex- Dividend: NELCO.

F&O Cues

Nifty June Futures up by 0.92% to 25,090 at a premium of 87 points.

Nifty June futures open interest down by 1.11%.

Nifty Options June 12 Expiry: Maximum Call open interest at 26,000 and Maximum Put open interest at 24,000.

Securities in ban period: Manappuram Finance, Hindustan Copper, Aditya Birla Fashion, Chambal Fertilizer.

Money Market Update

The rupee closed 16 paise stronger at 85.64 against US Dollar after the RBI rate decision.

The yield on the 10-year government bond ended four basis points higher at 6.29%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.