India's benchmark indices gave up all early gains to end lower tracking losses in heavy-weights Reliance Industries Ltd., Titan Co. Ltd., and Larsen & Toubro Ltd.

The NSE Nifty 50 ended 24.55 points or 0.11% lower at 22,641.75, and the S&P BSE Sensex settled 58.80 points or 0.079% down at 74,683.70.

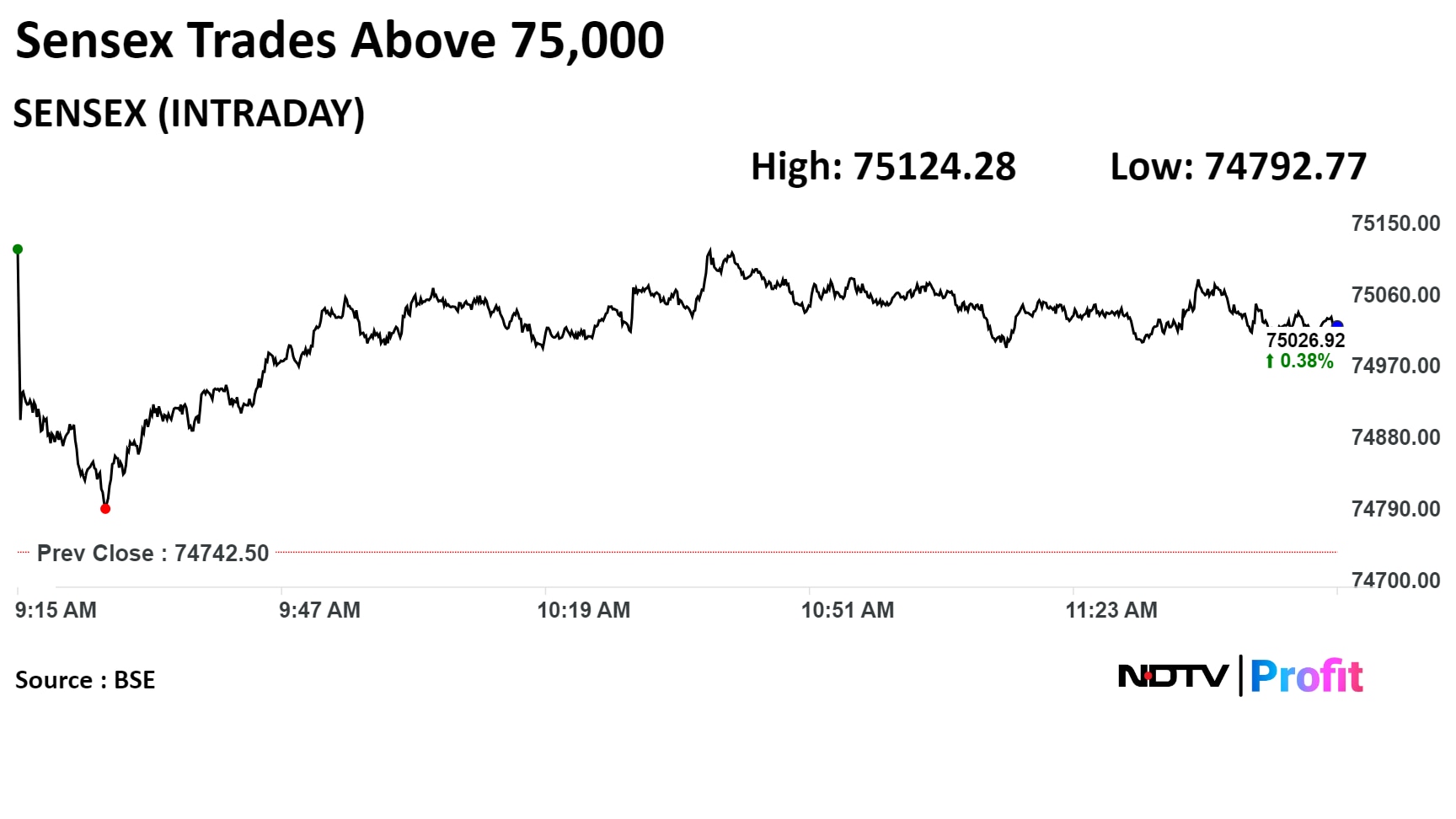

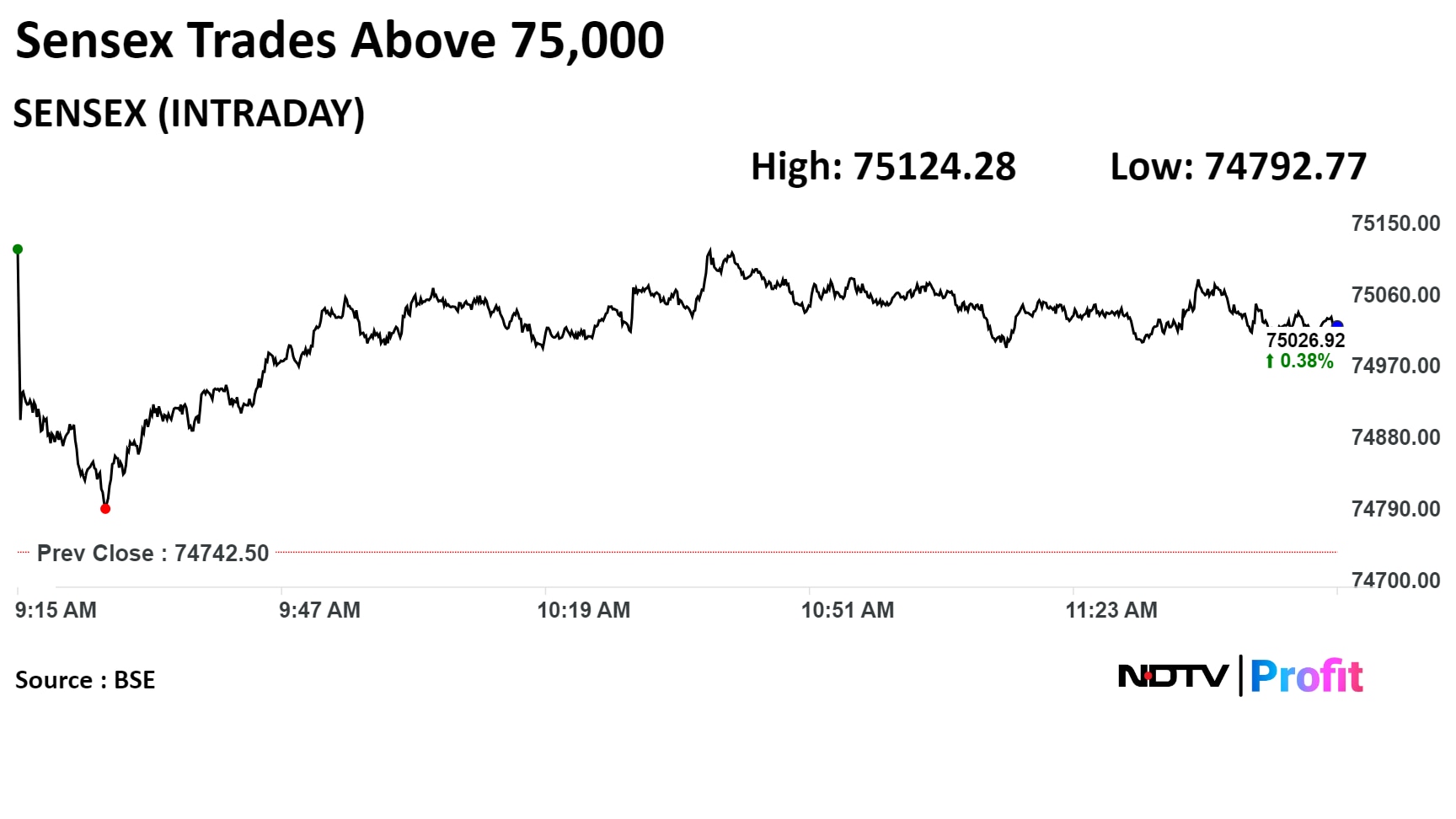

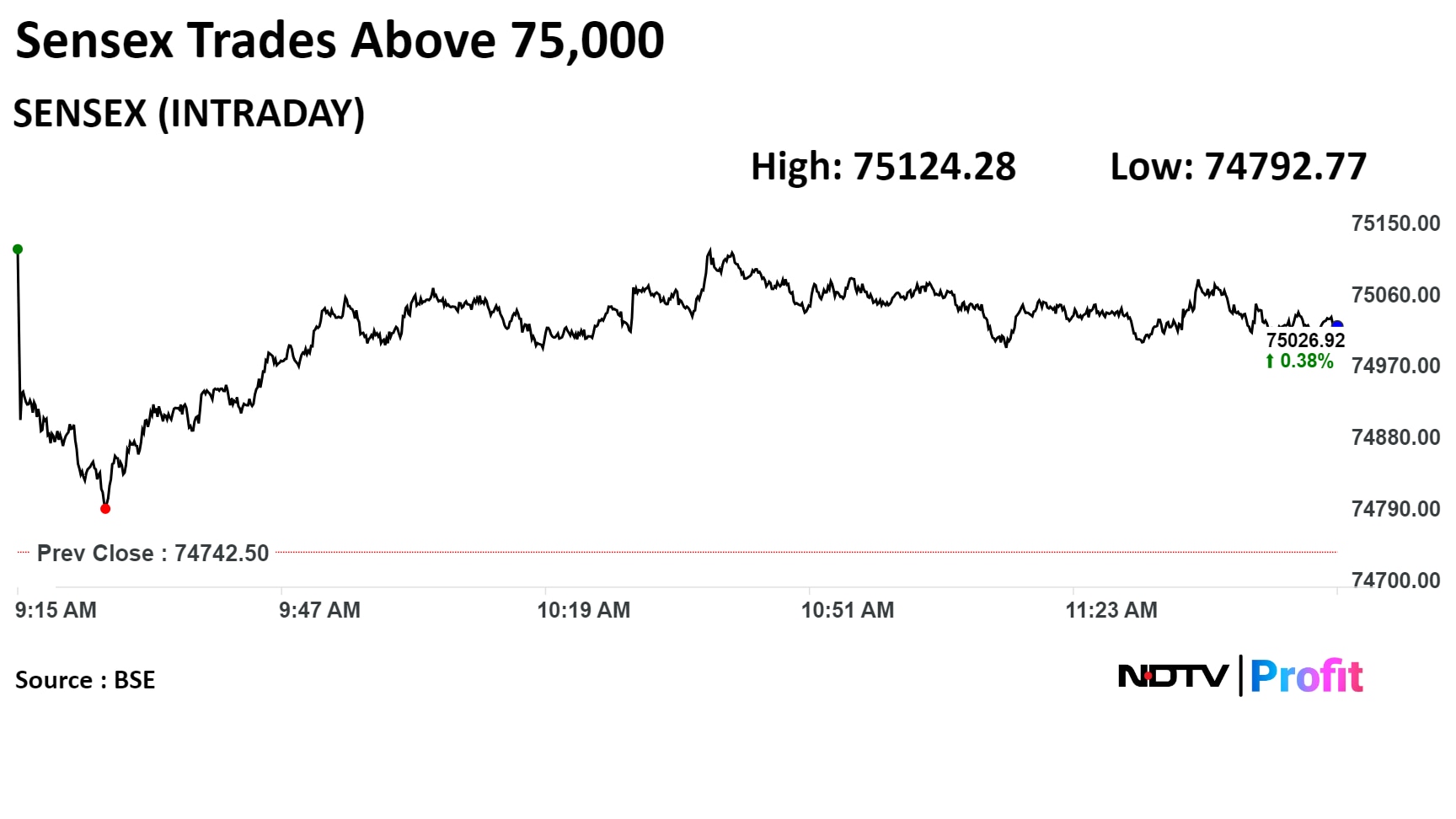

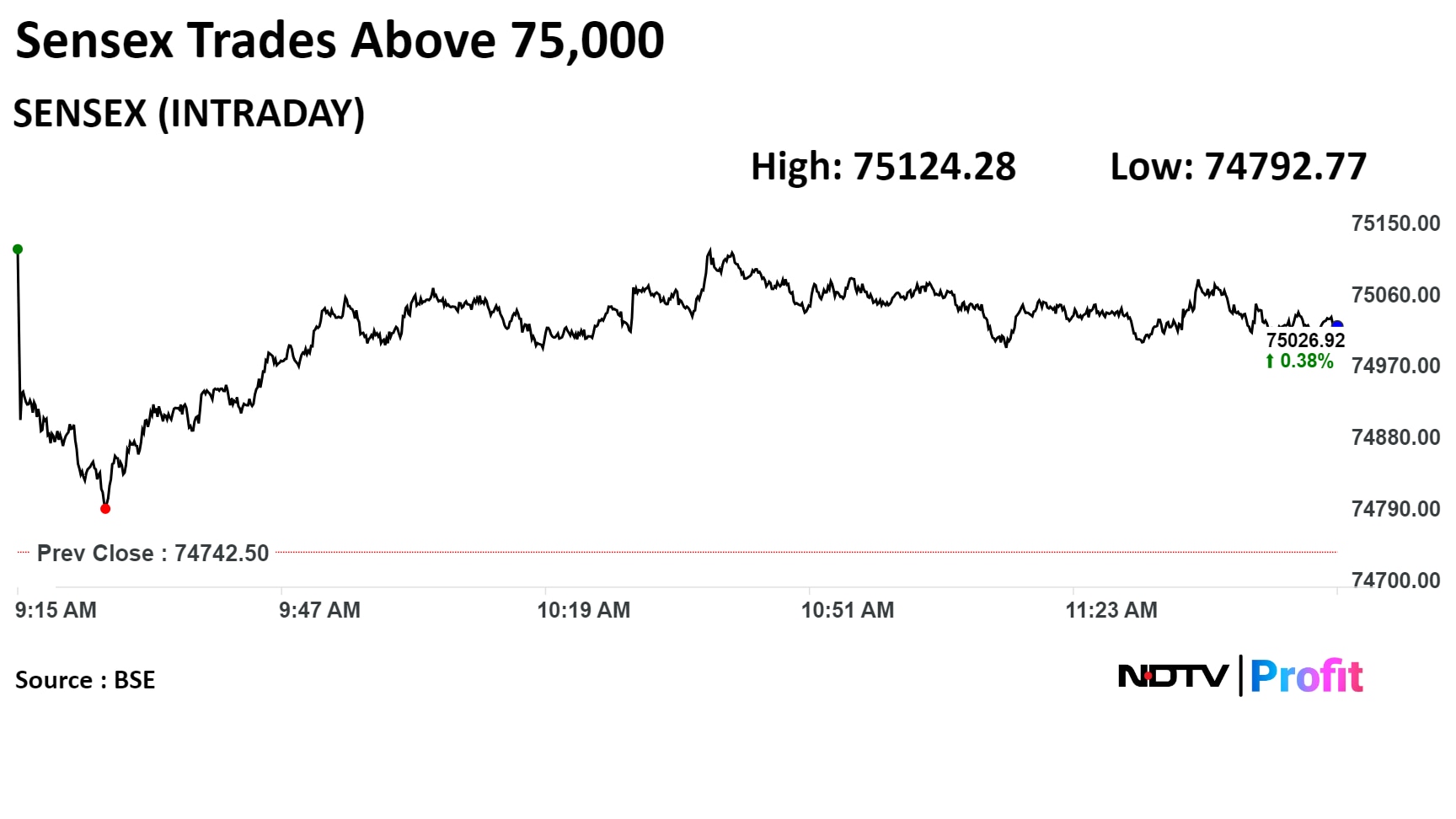

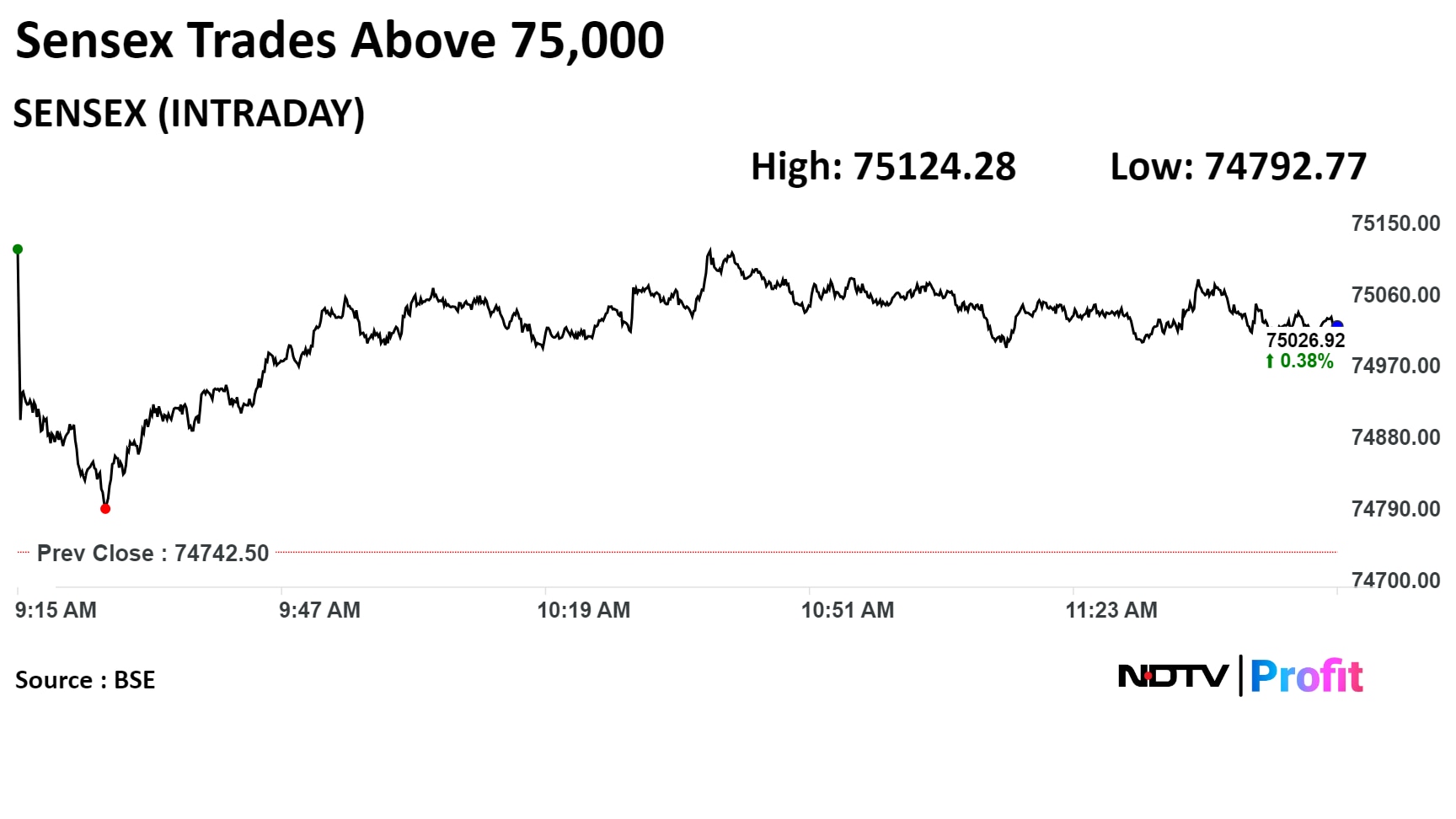

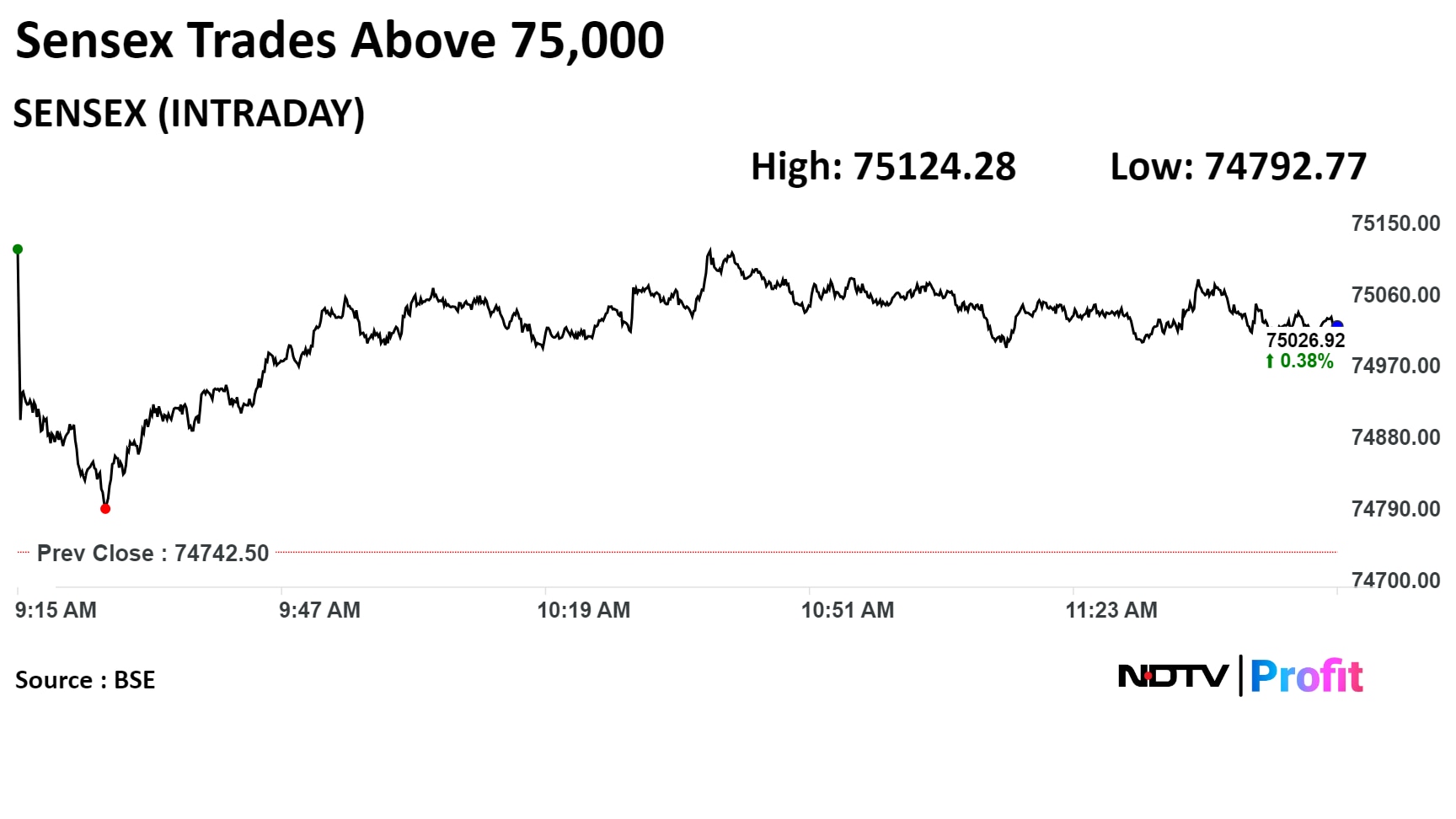

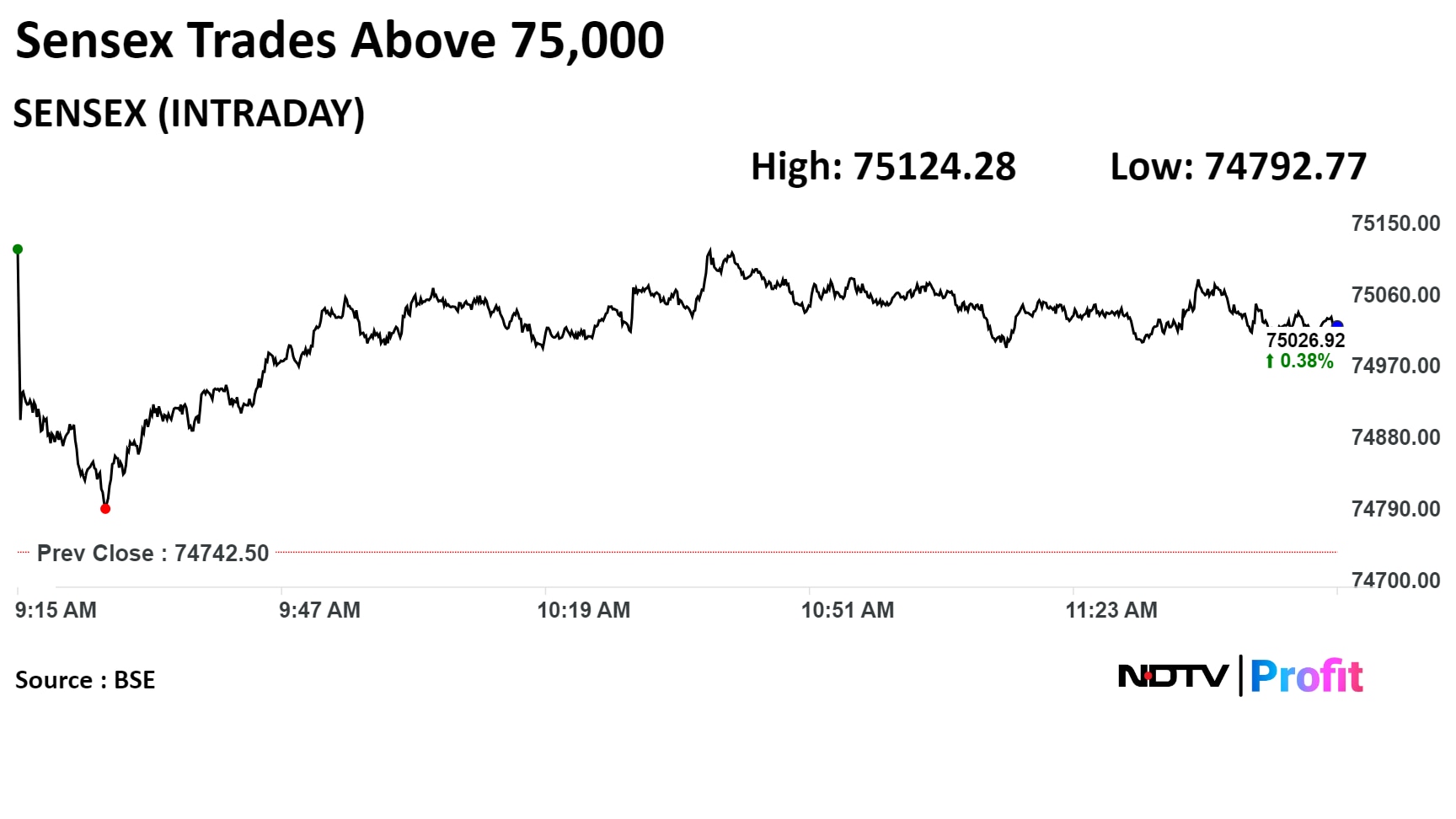

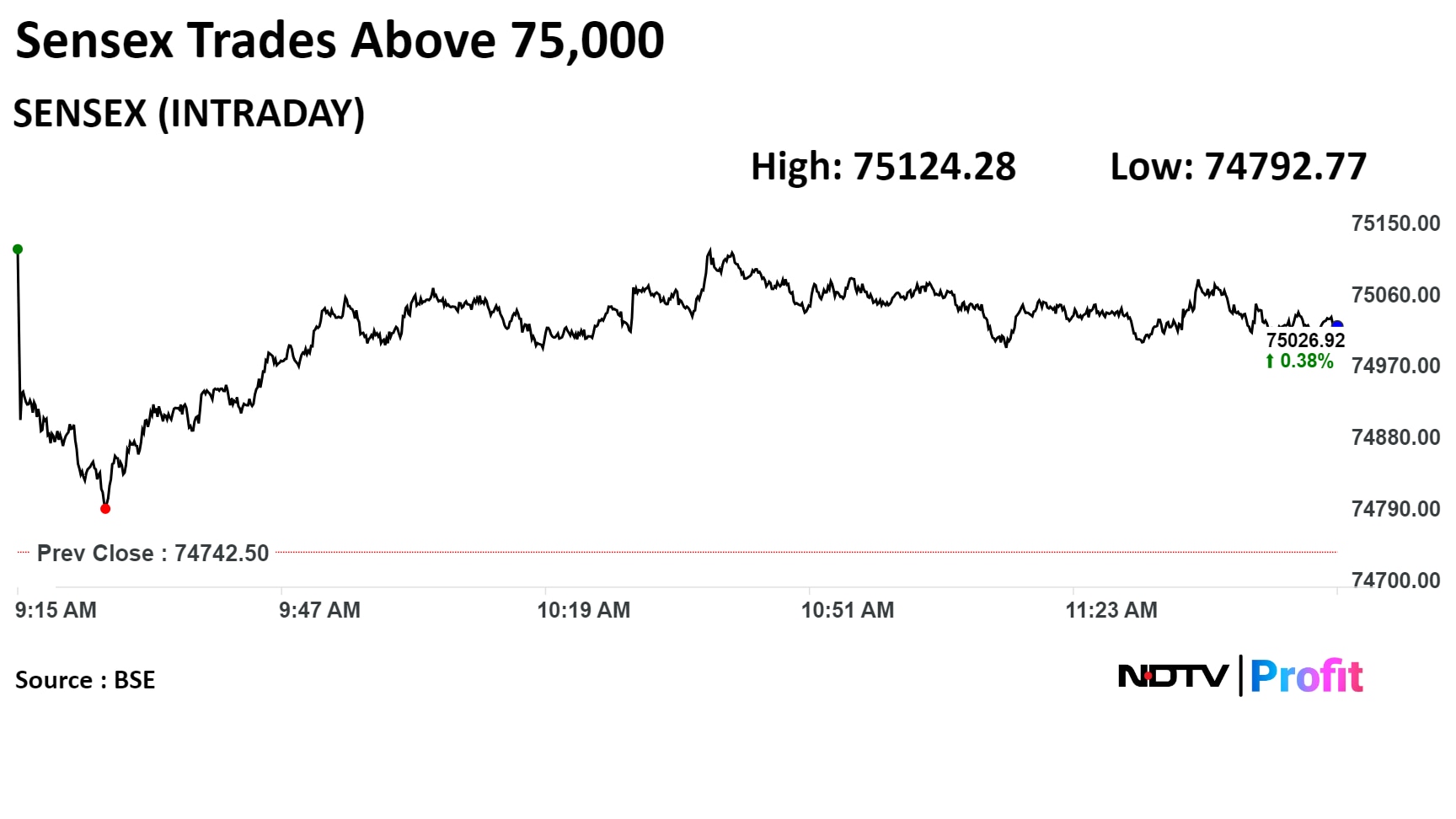

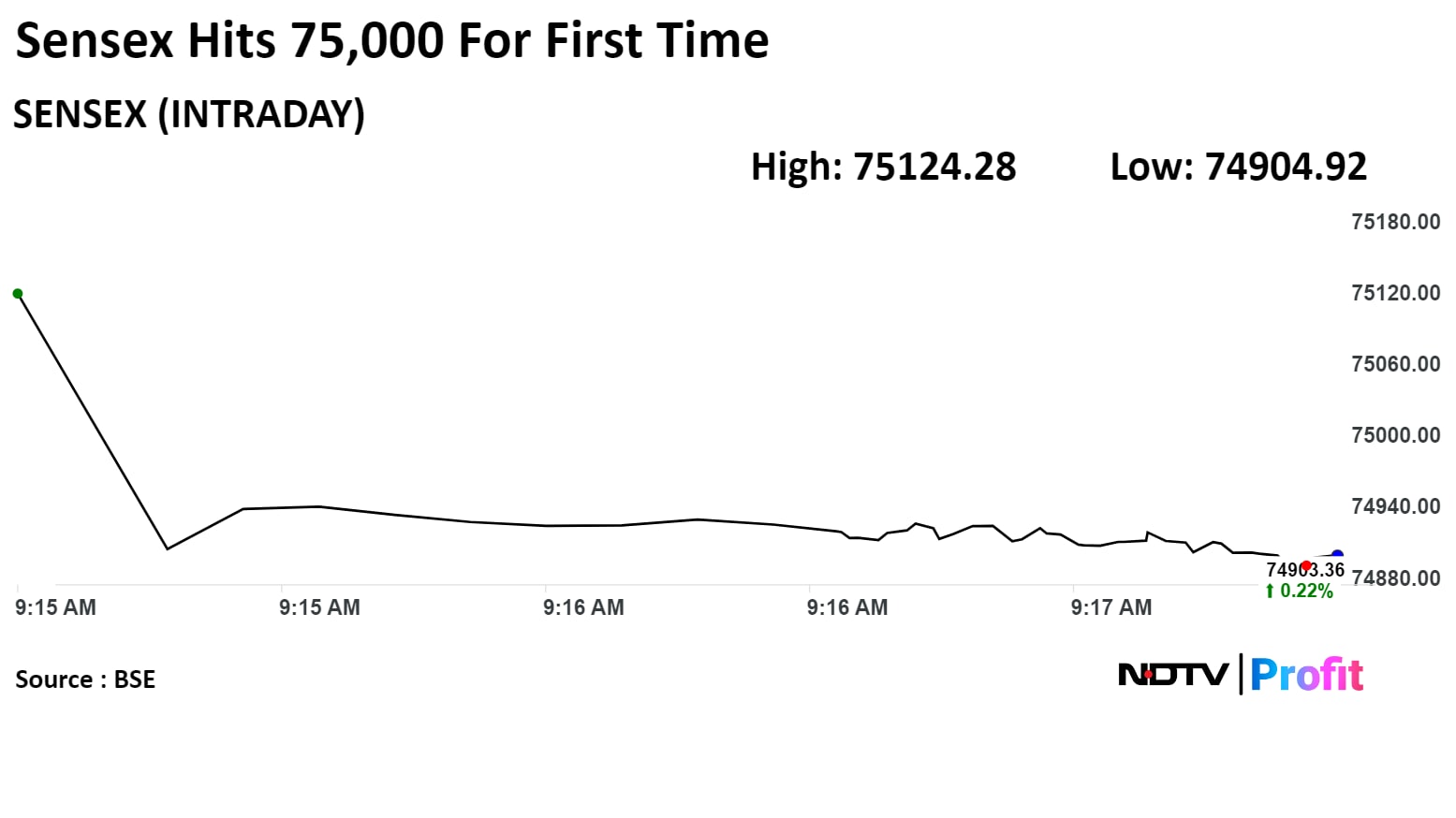

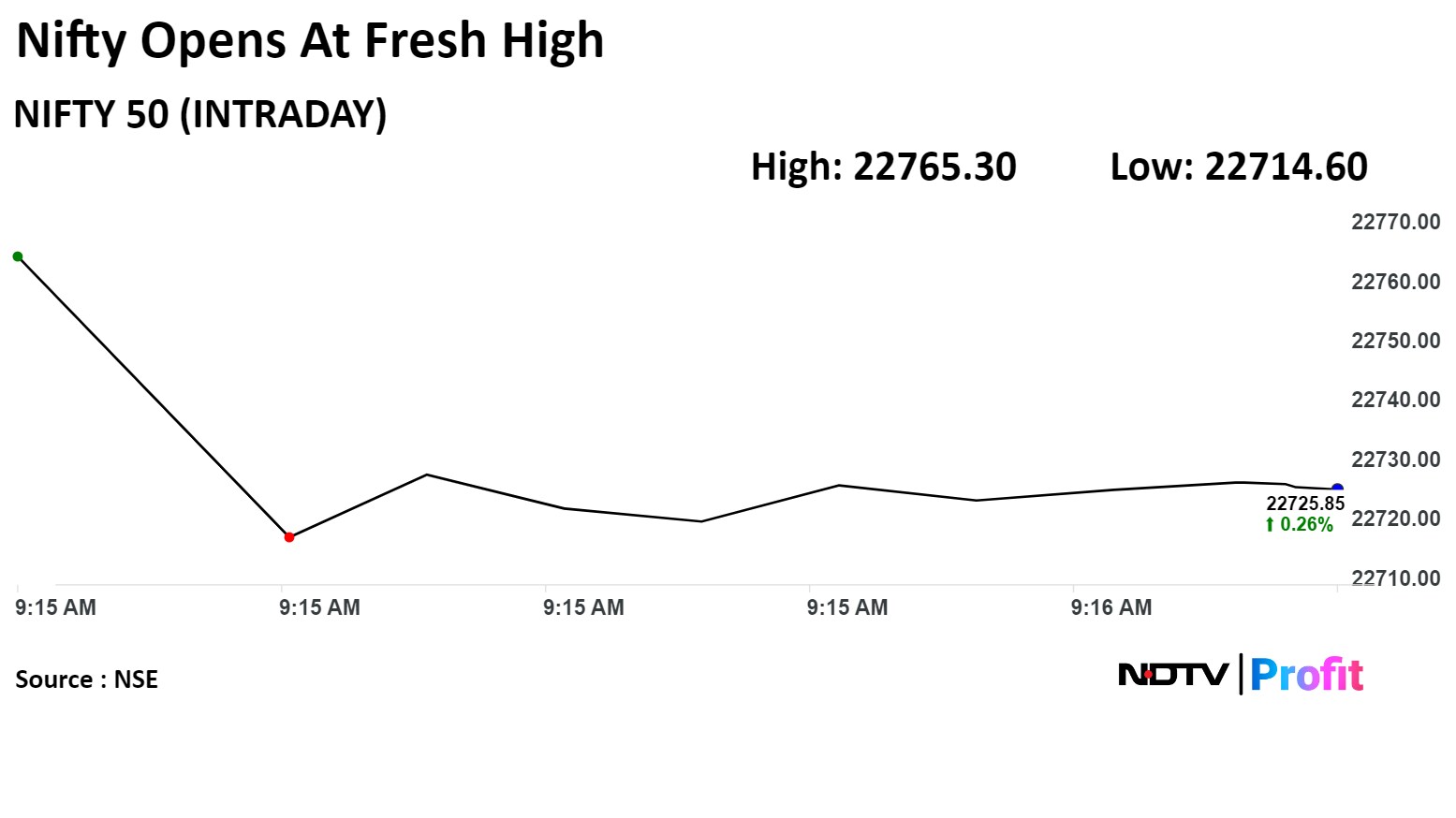

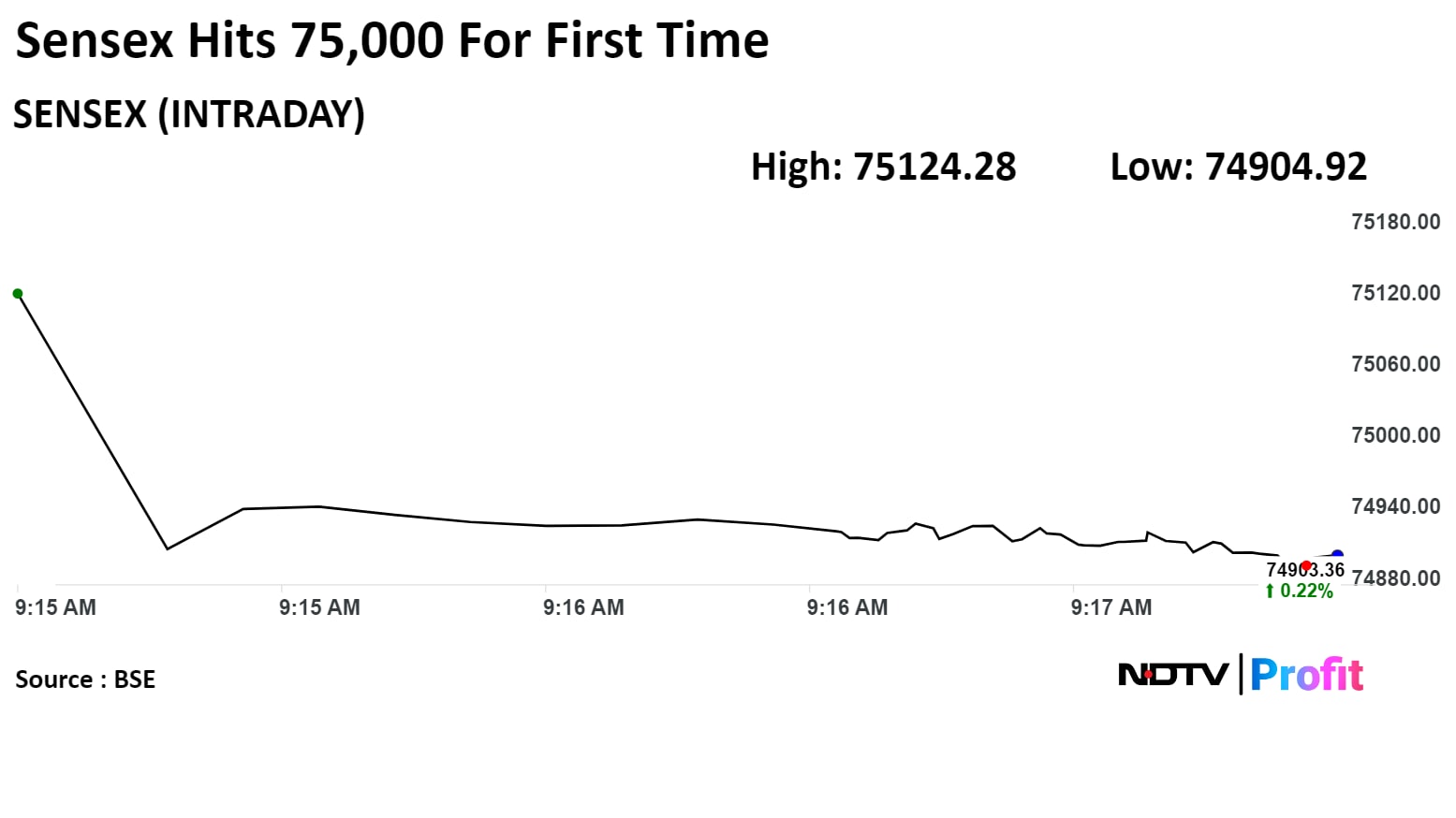

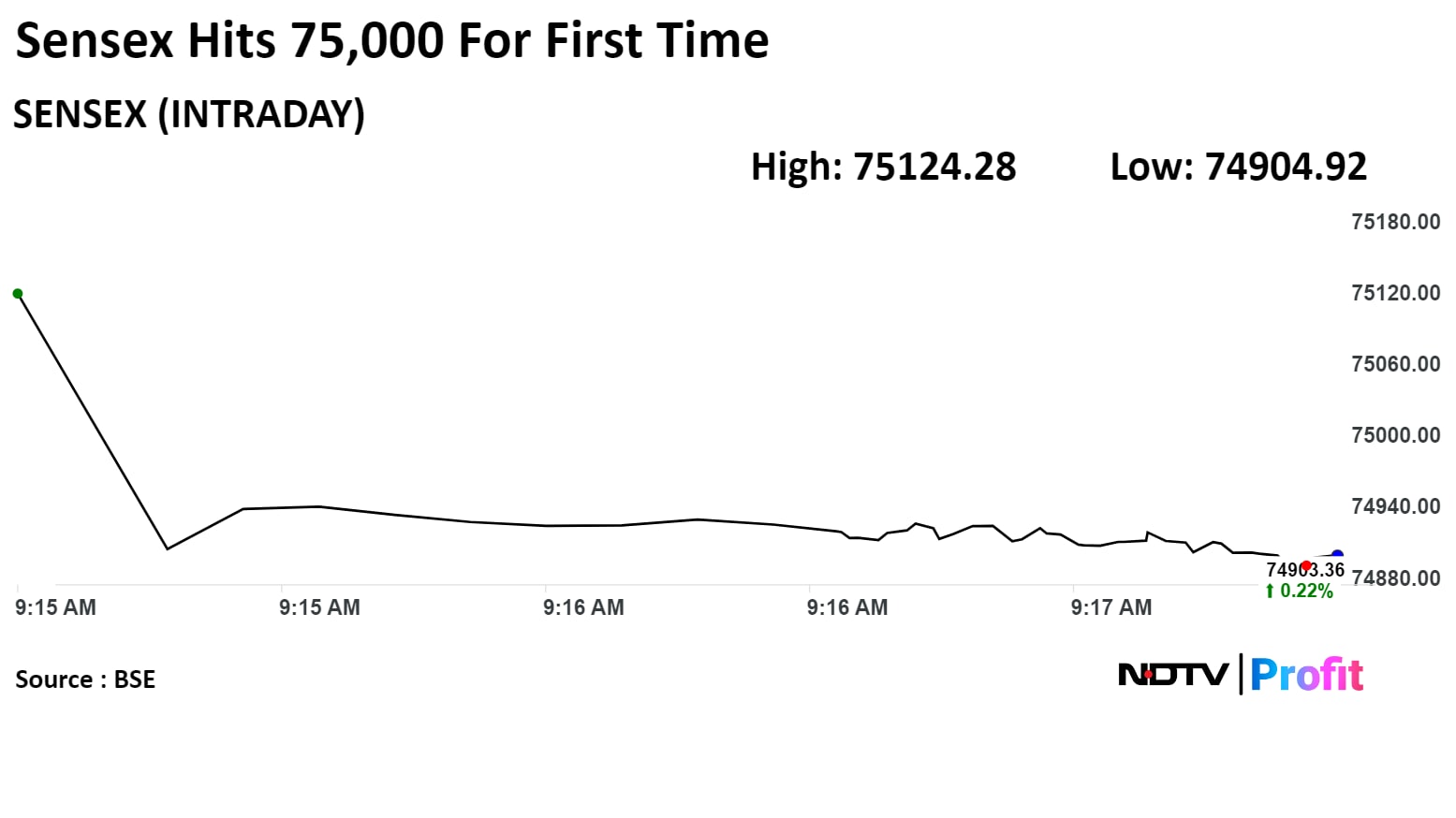

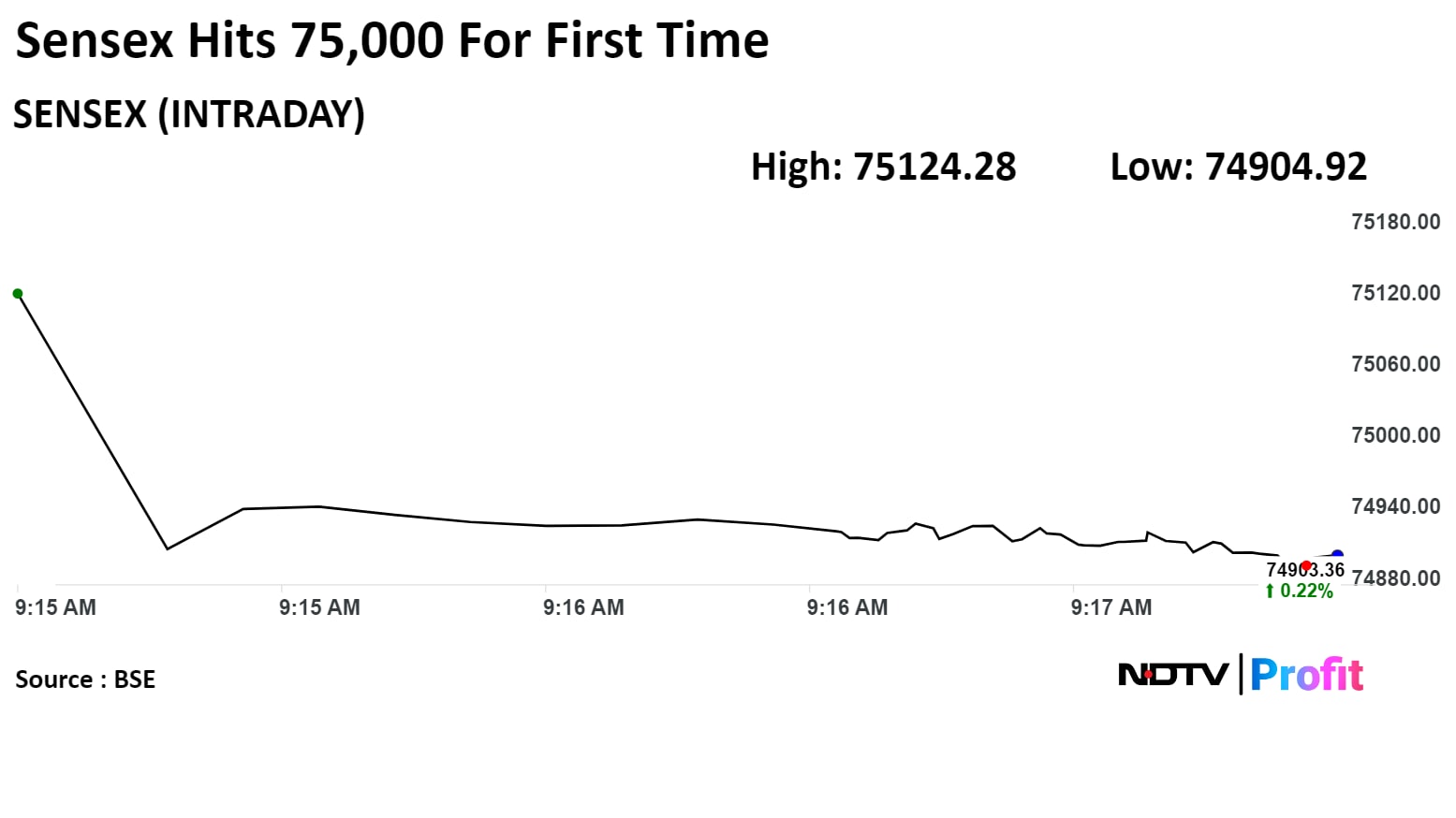

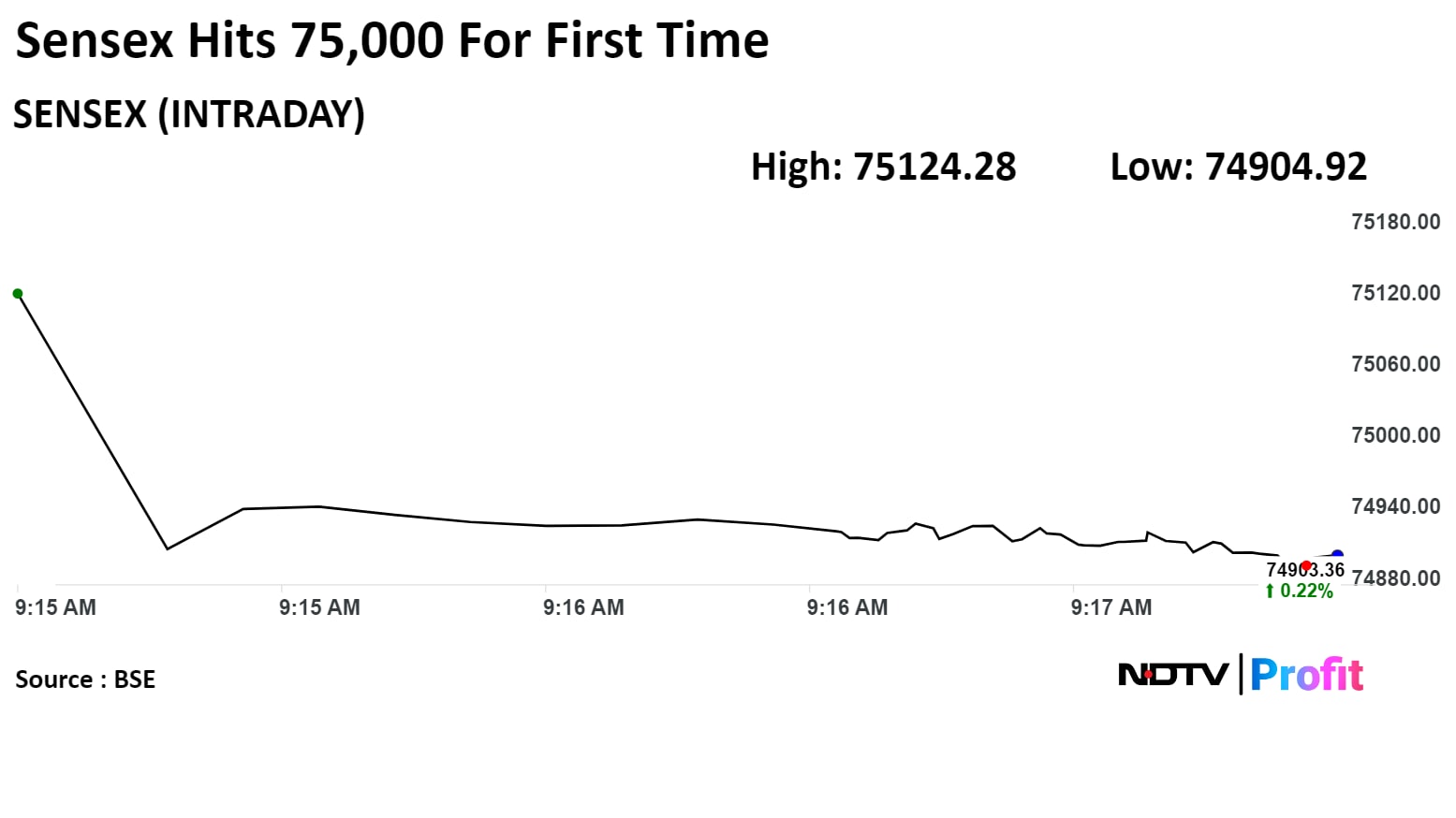

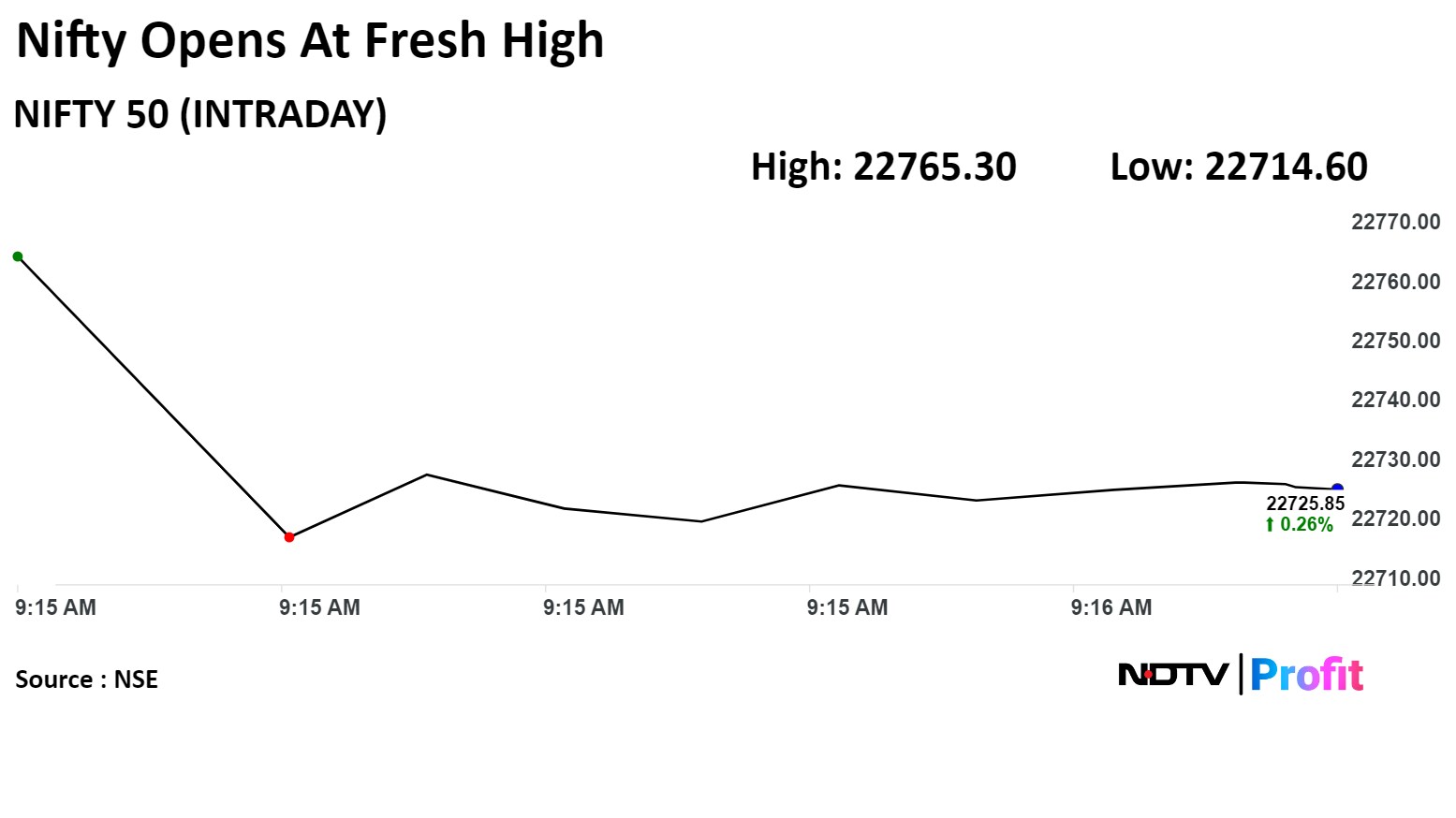

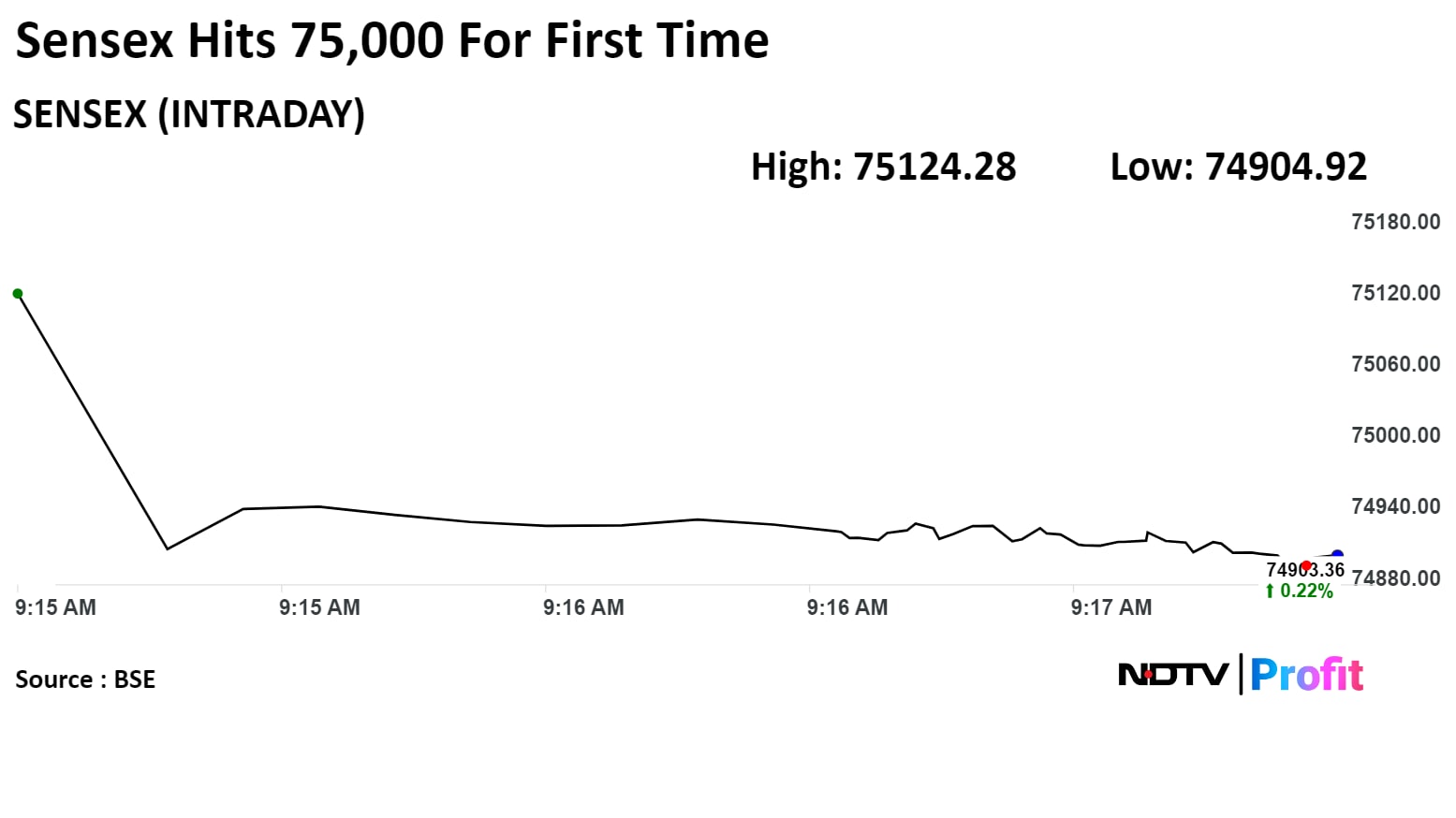

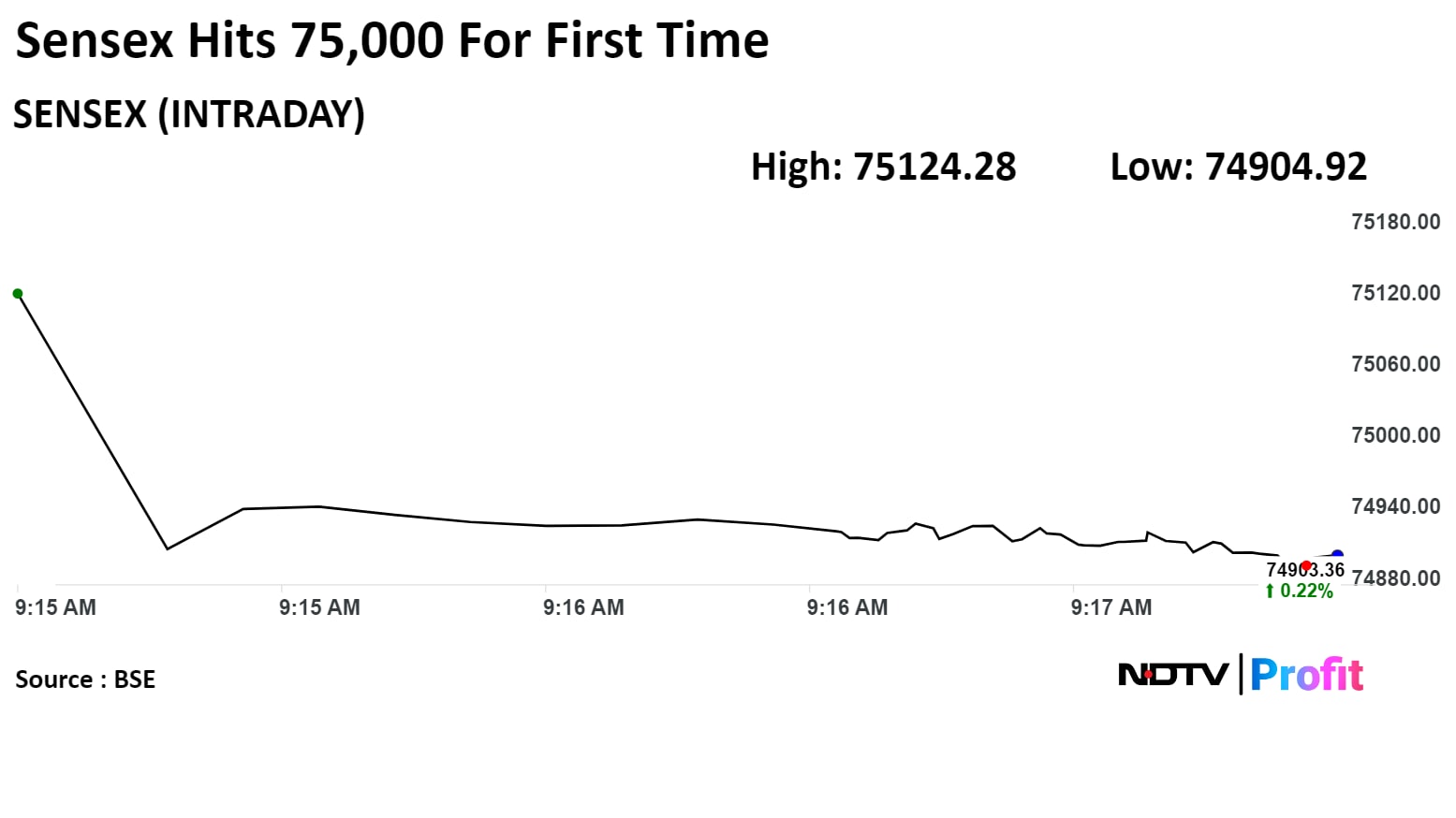

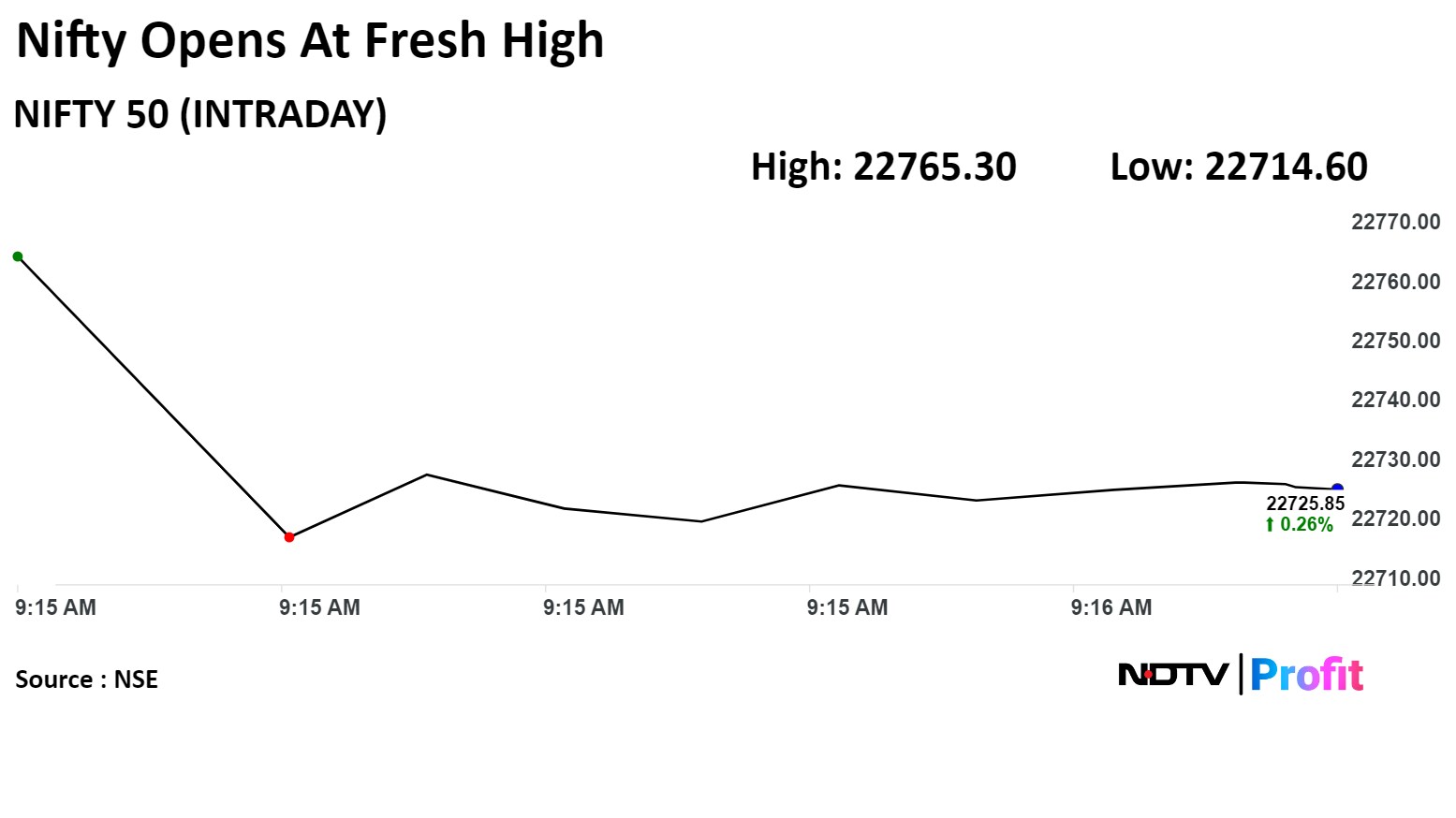

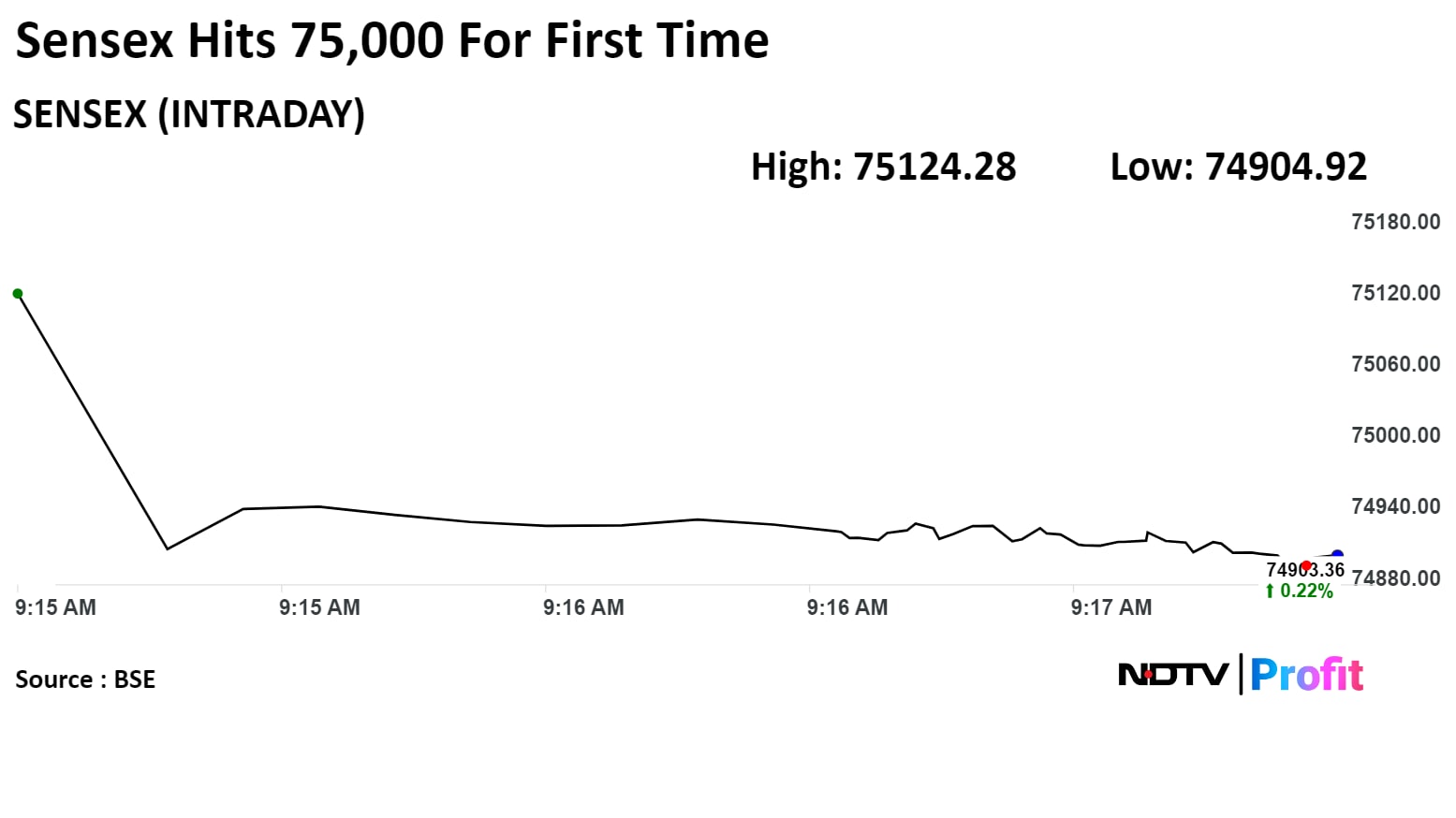

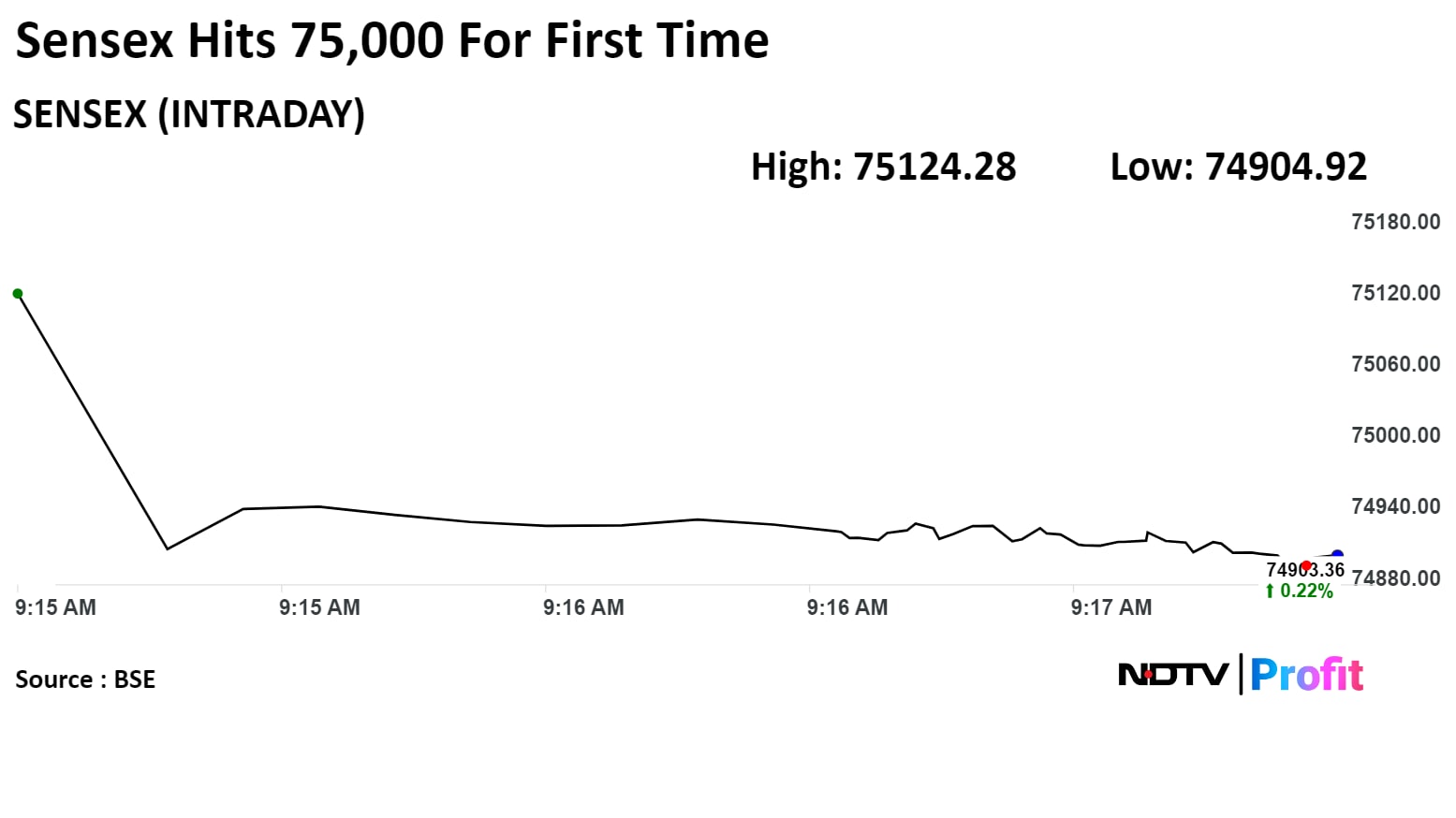

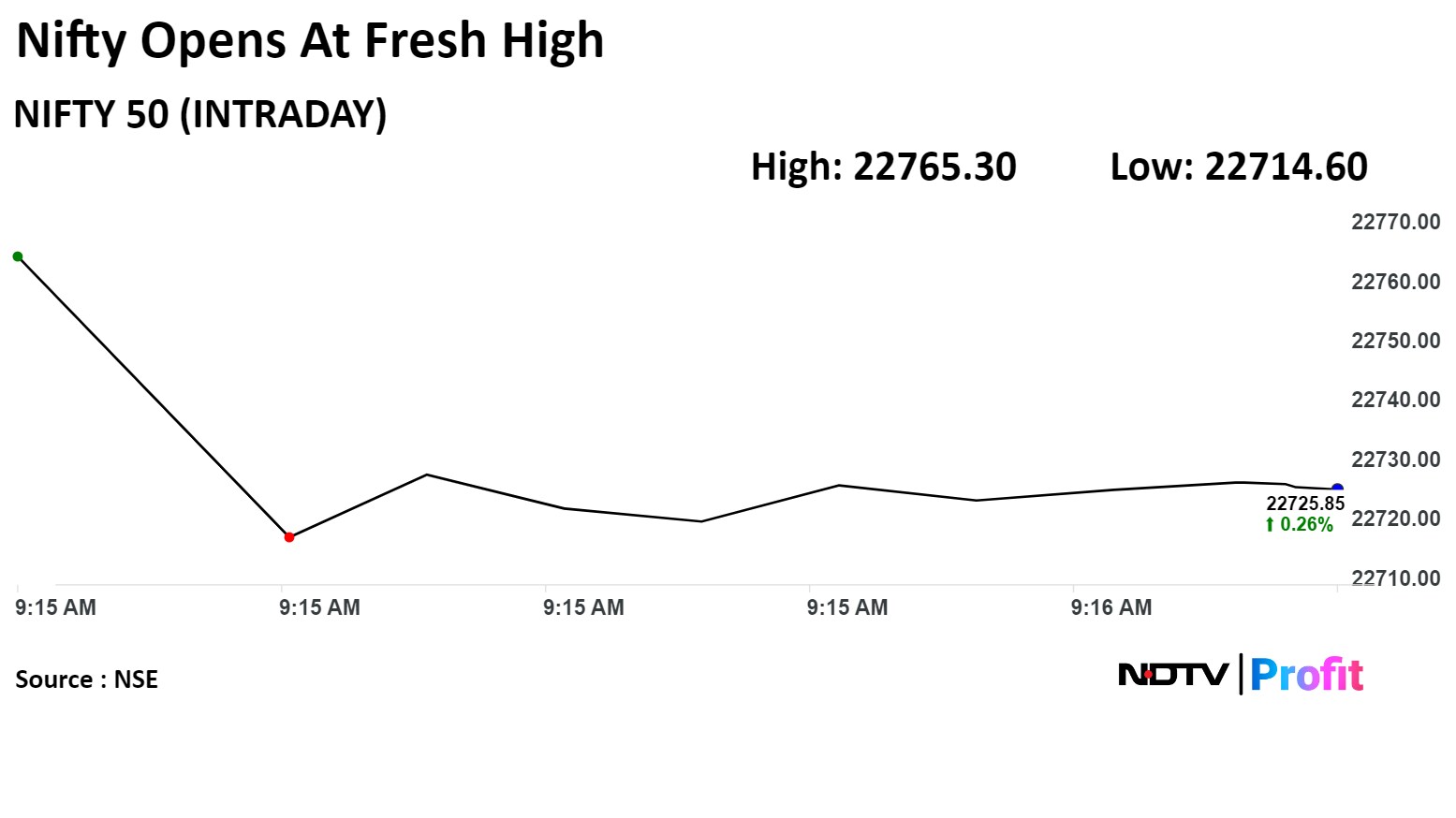

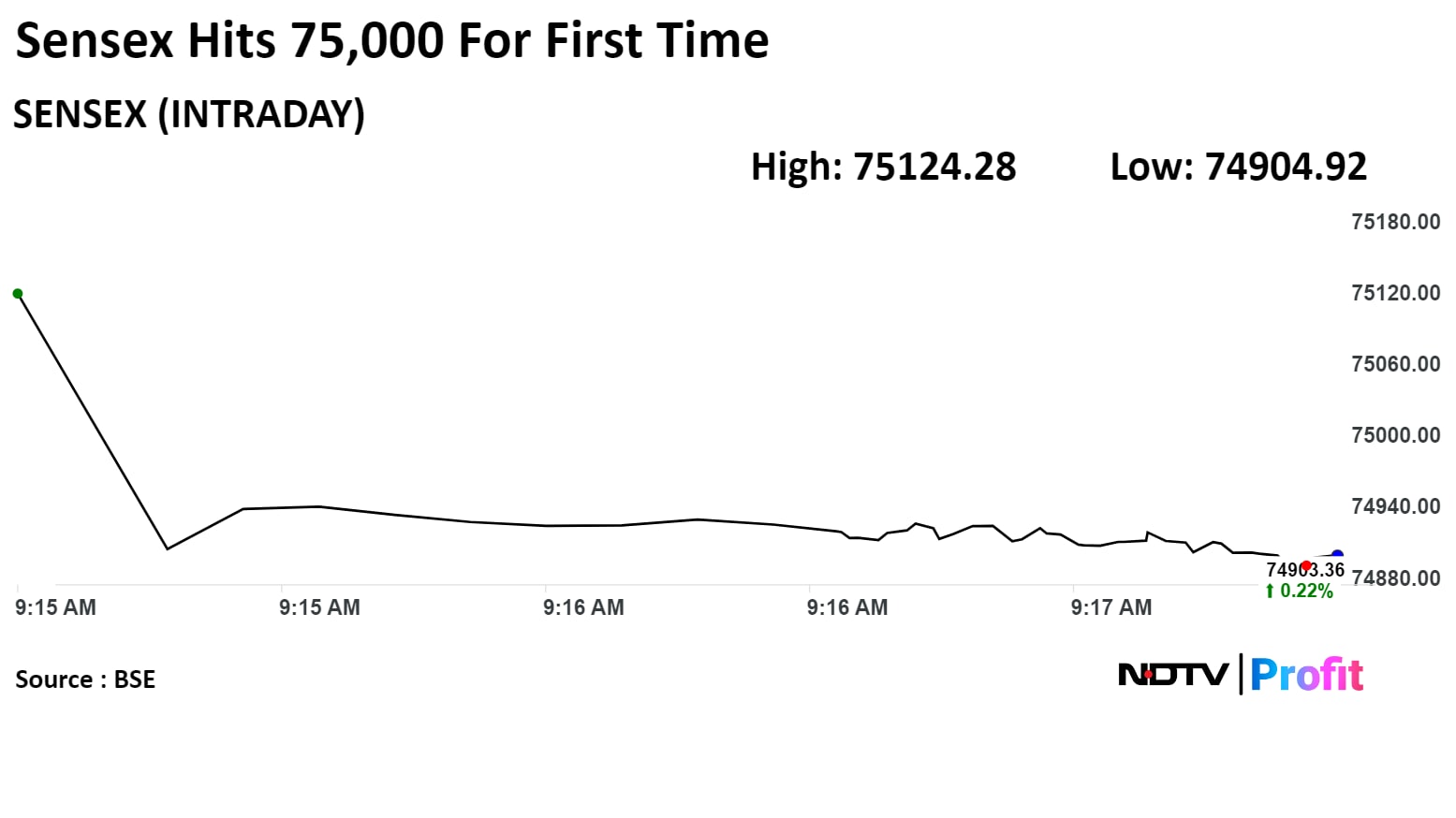

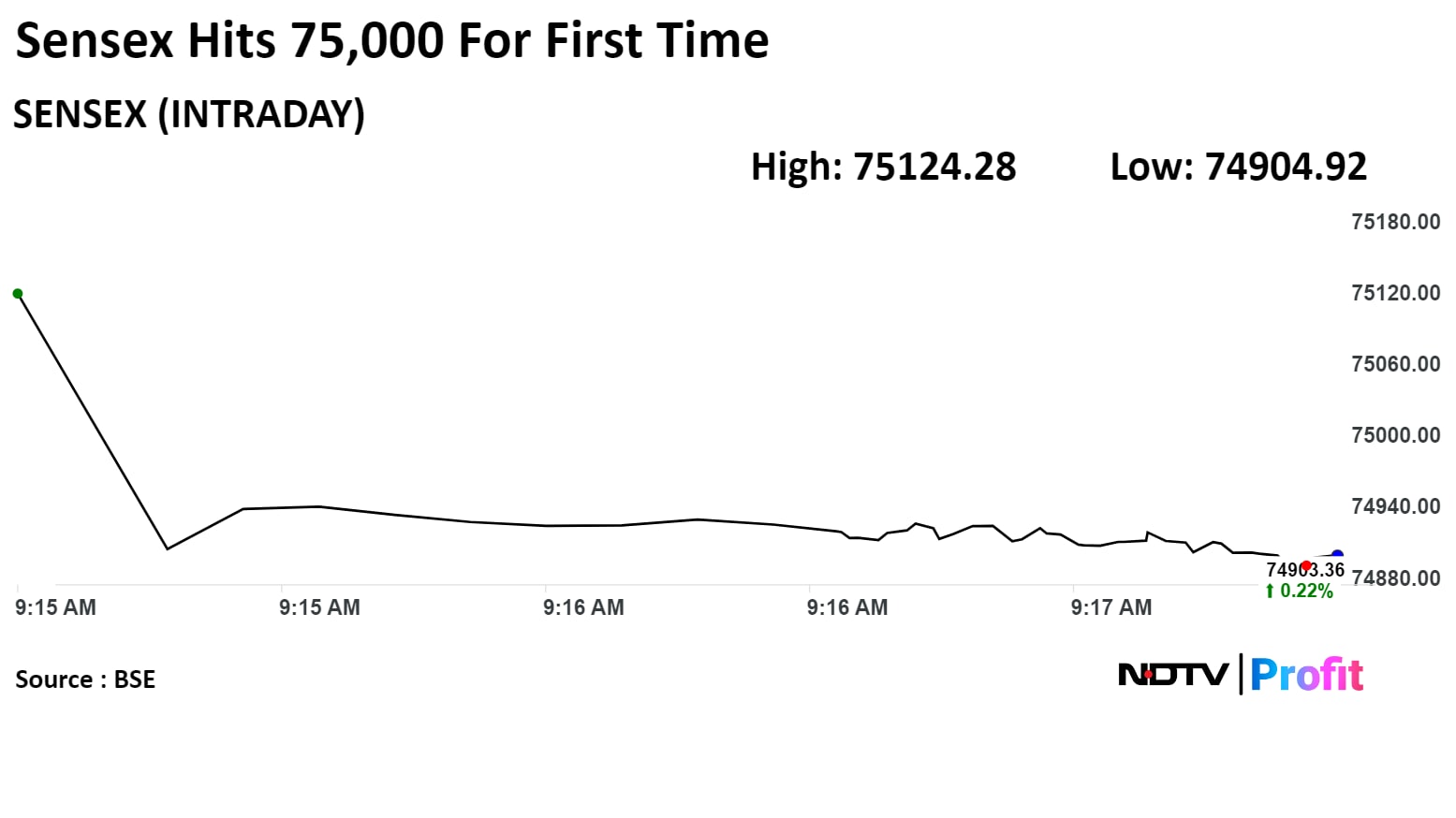

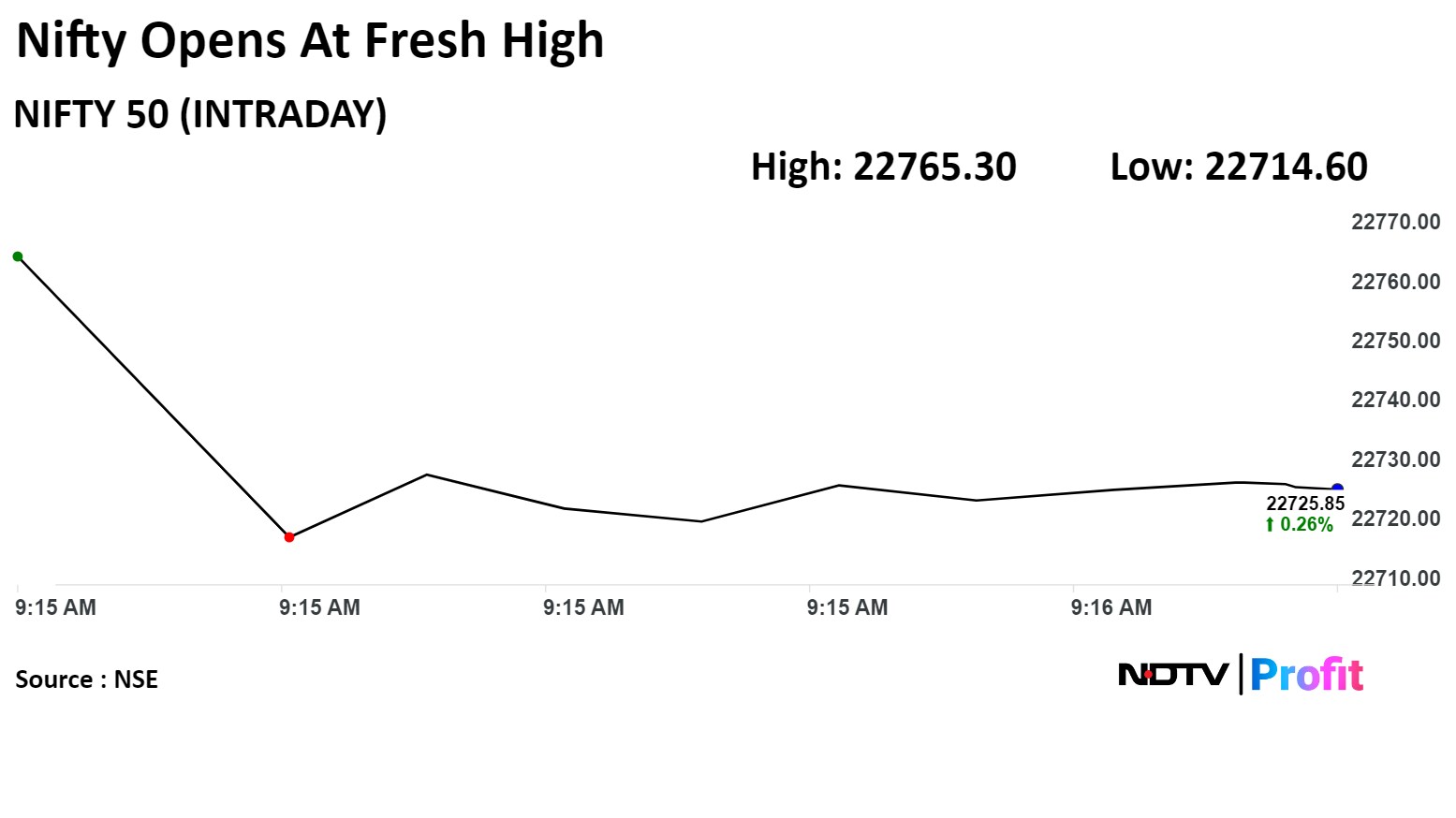

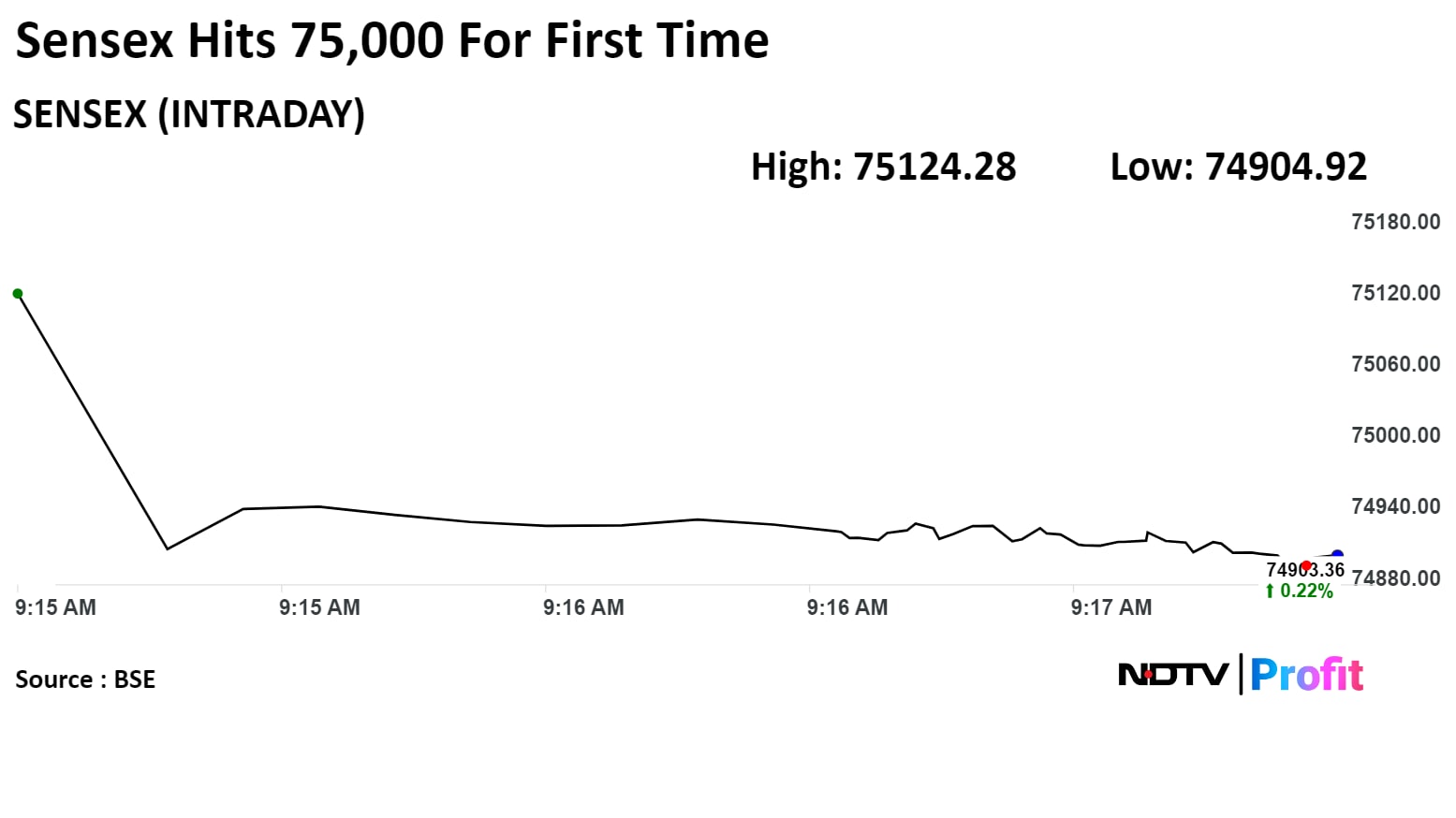

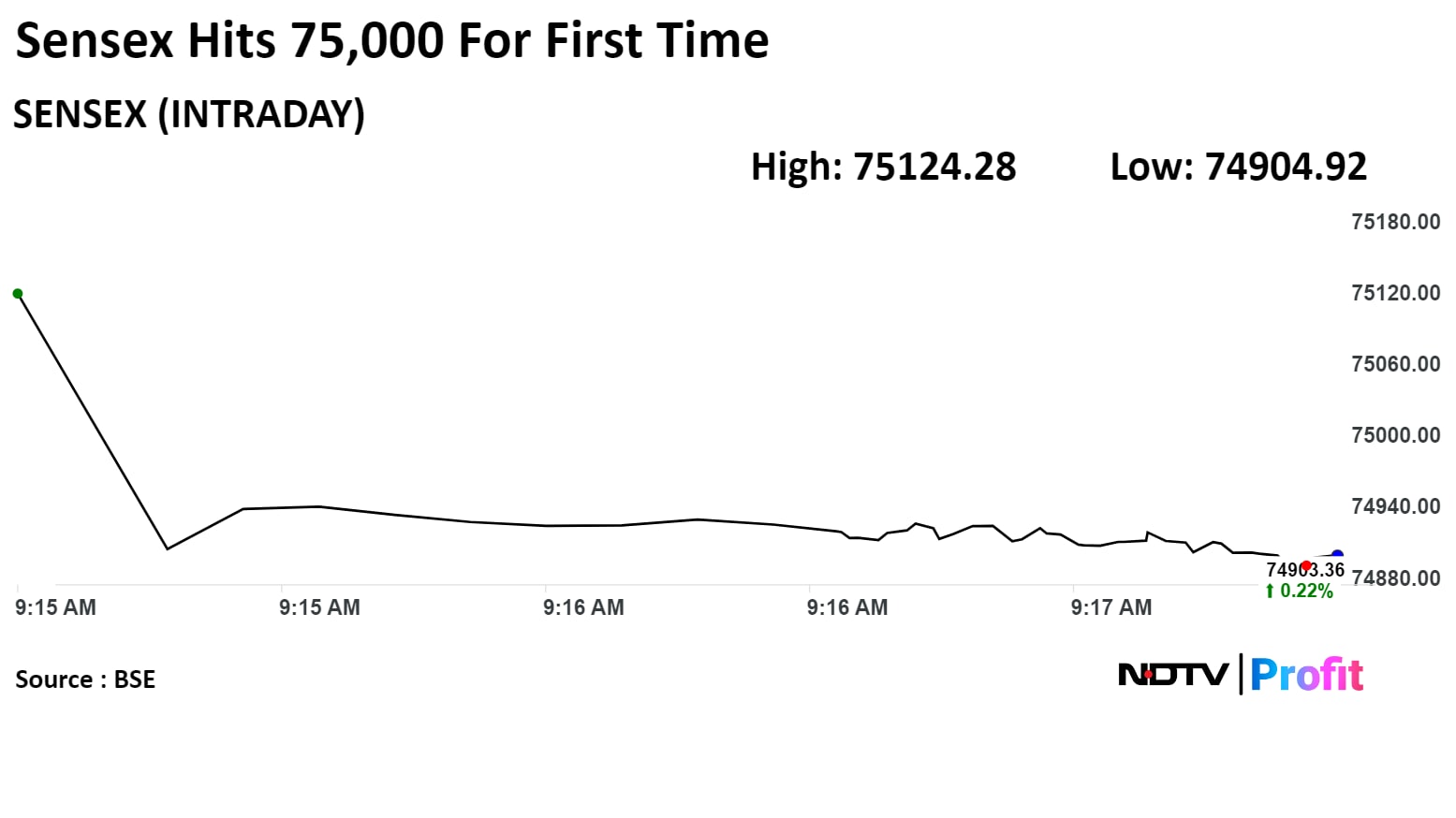

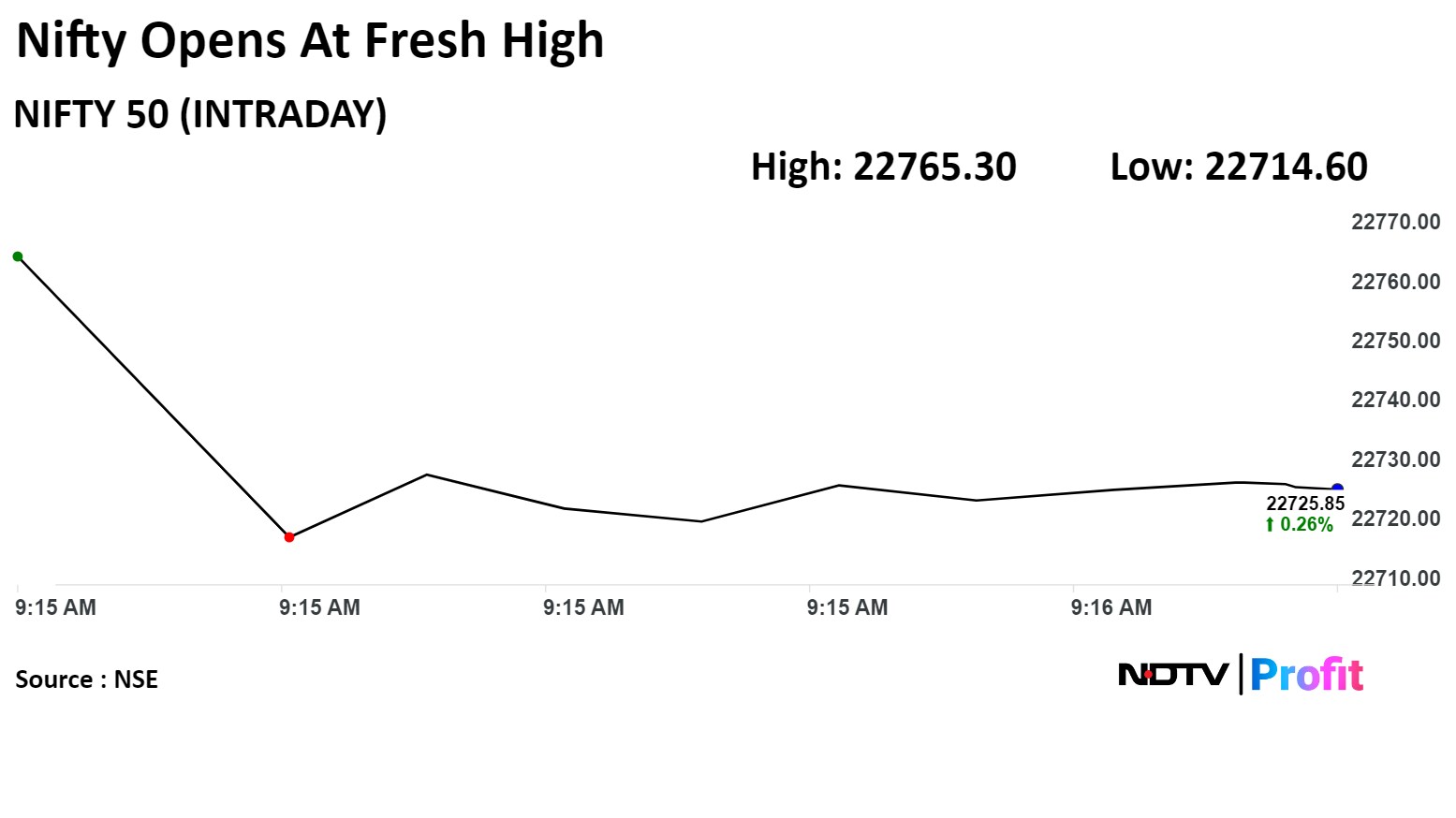

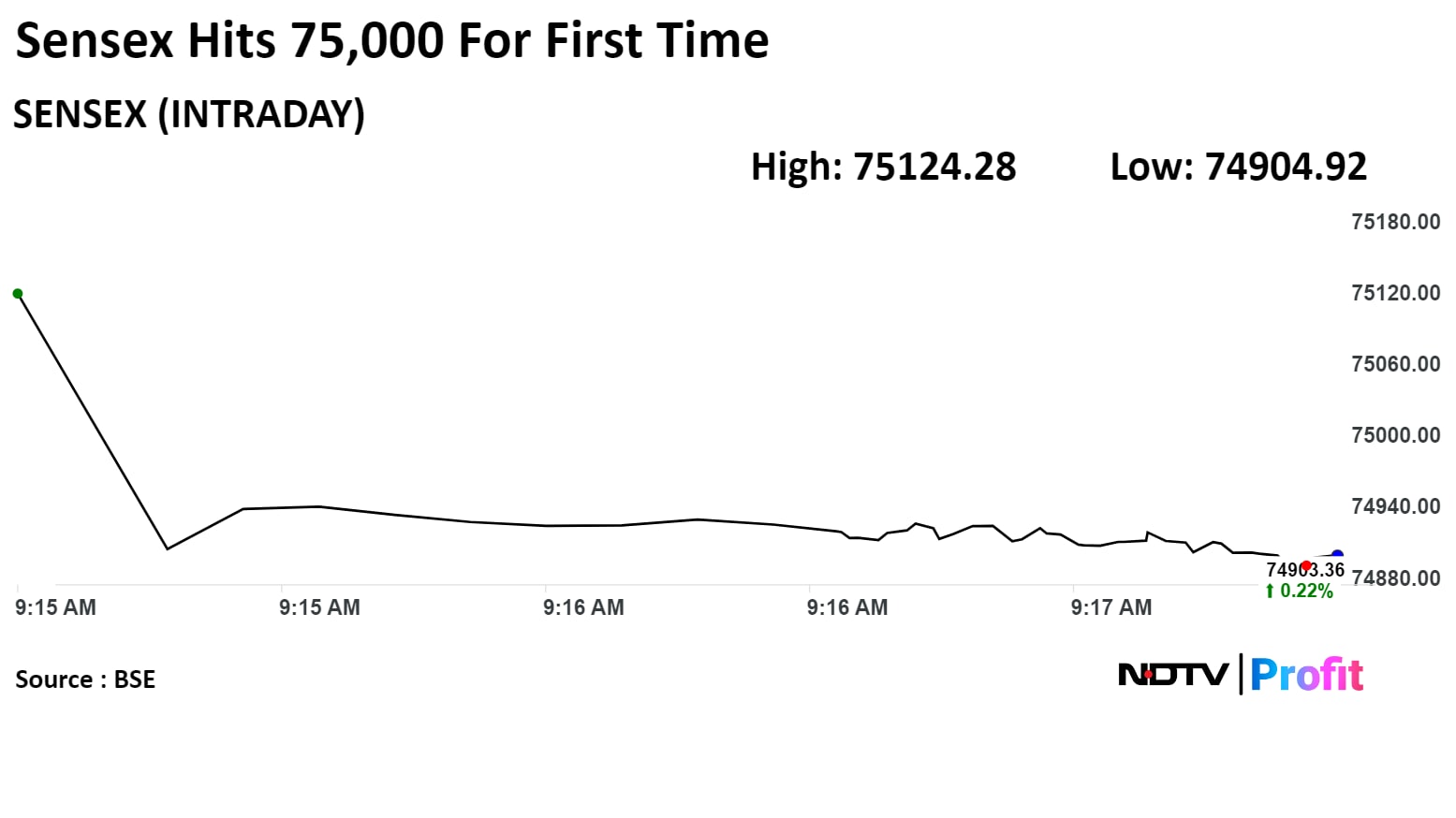

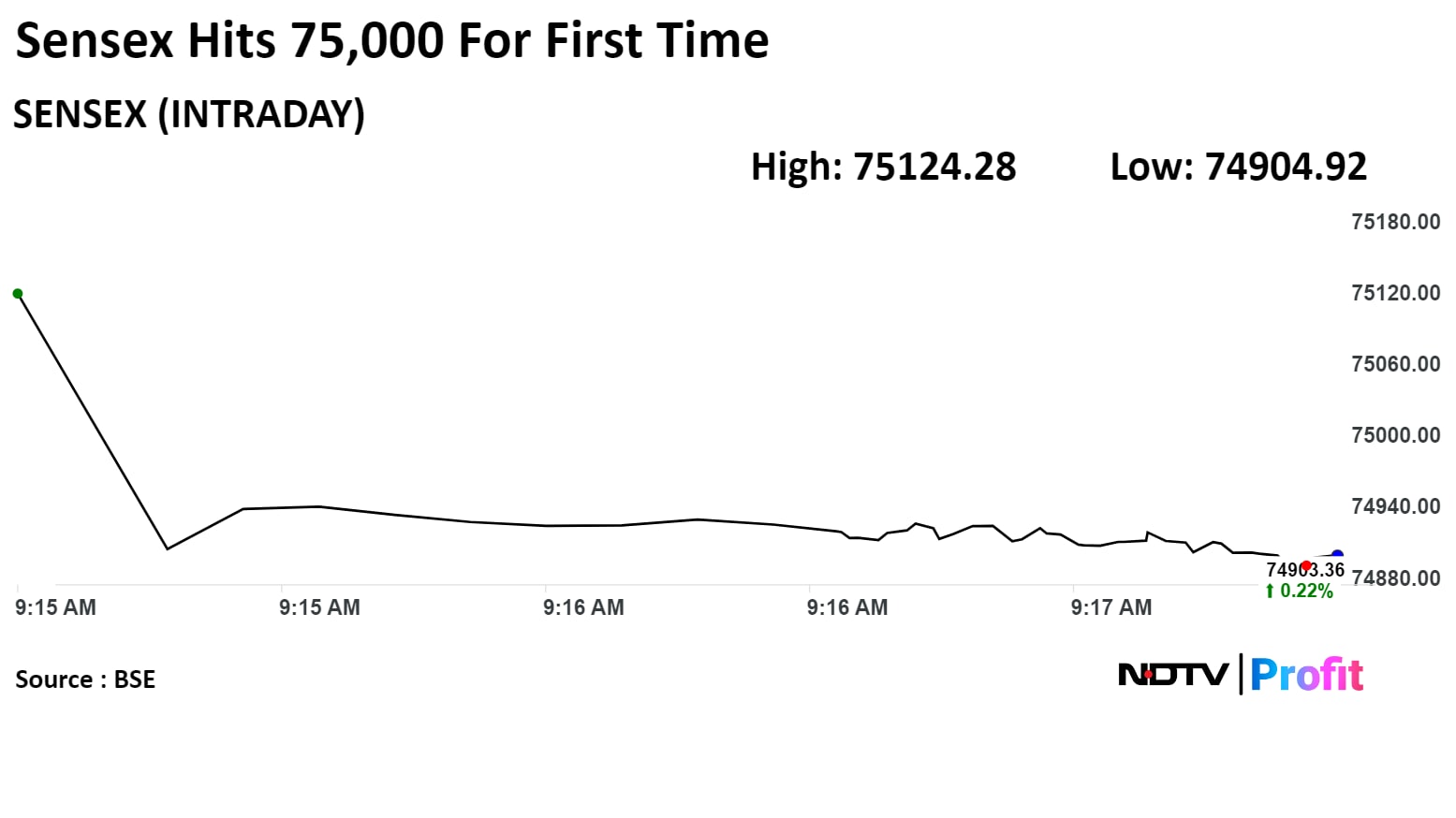

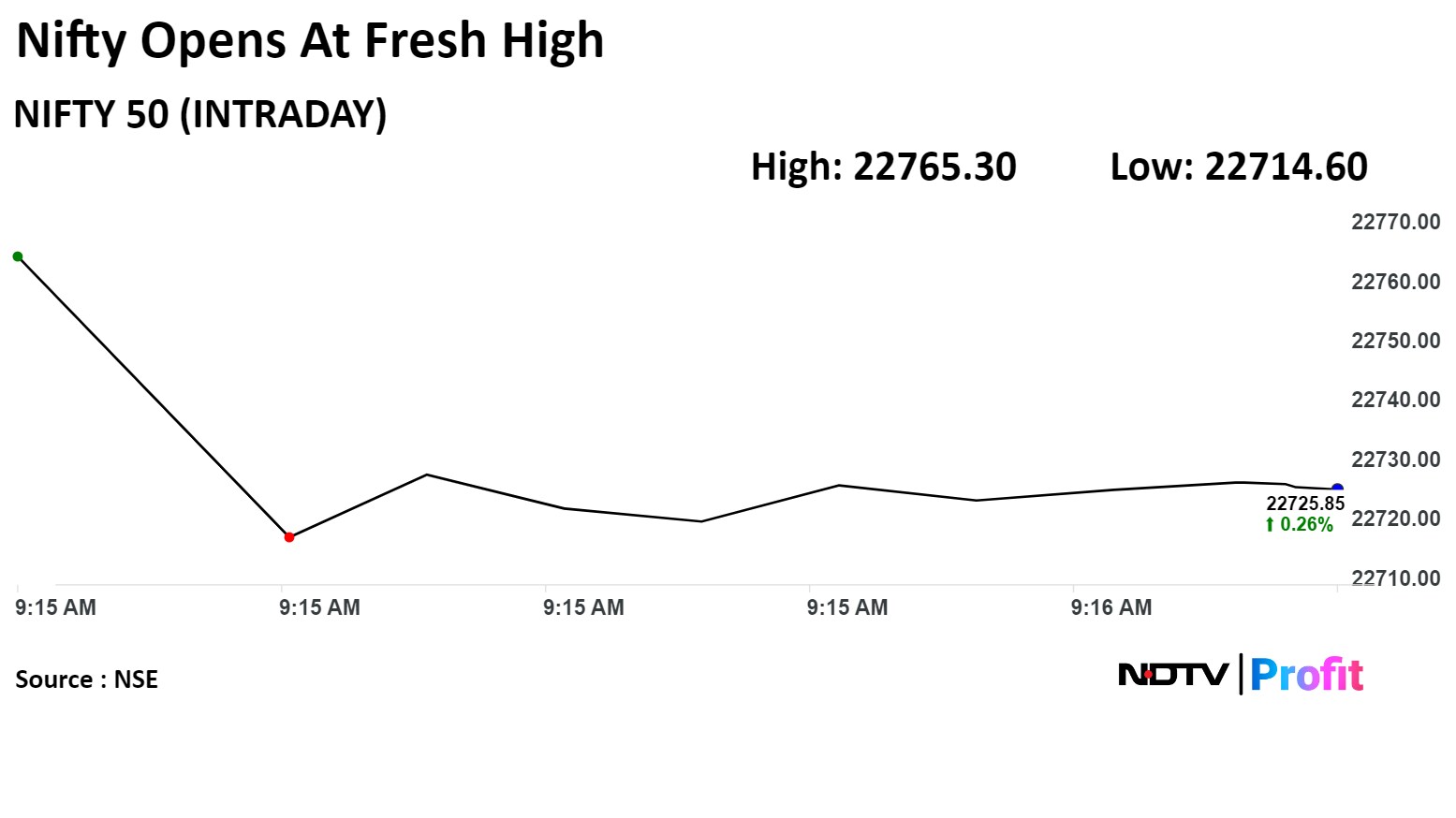

The NSE Nifty 50 rose to fresh high of 22,768.40, and the S&P BSE Sensex rose to a record high of 75,124.28.

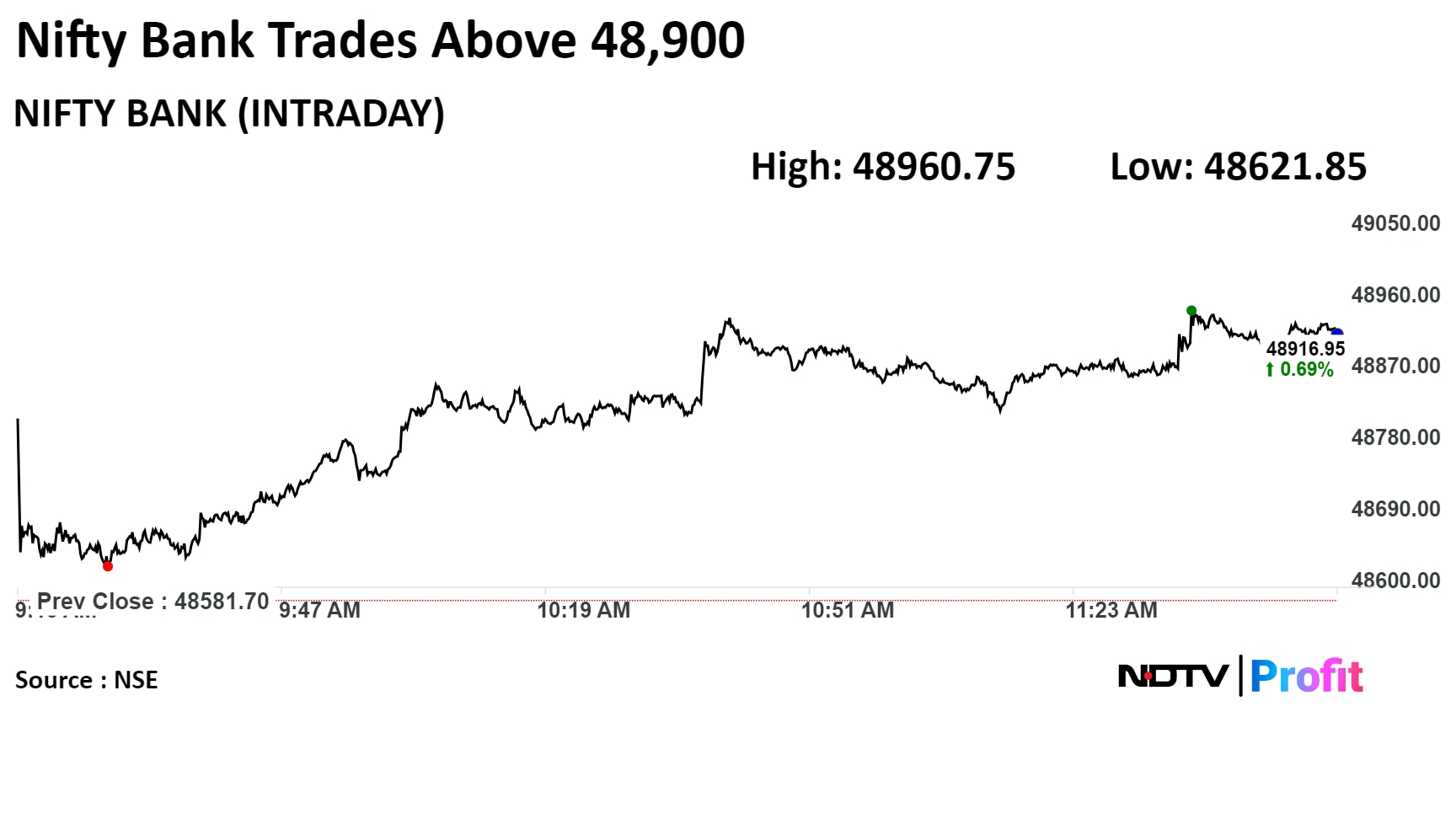

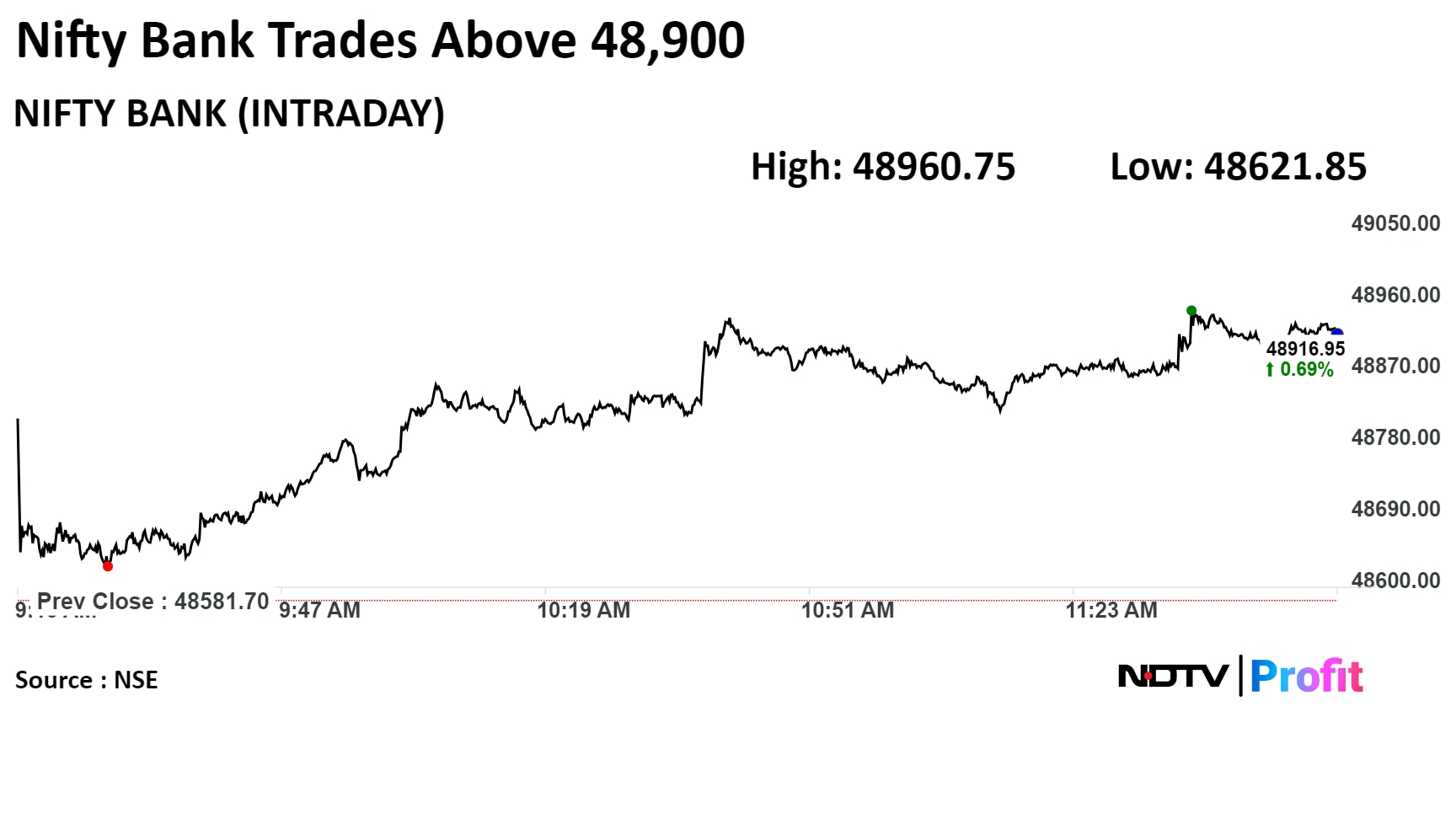

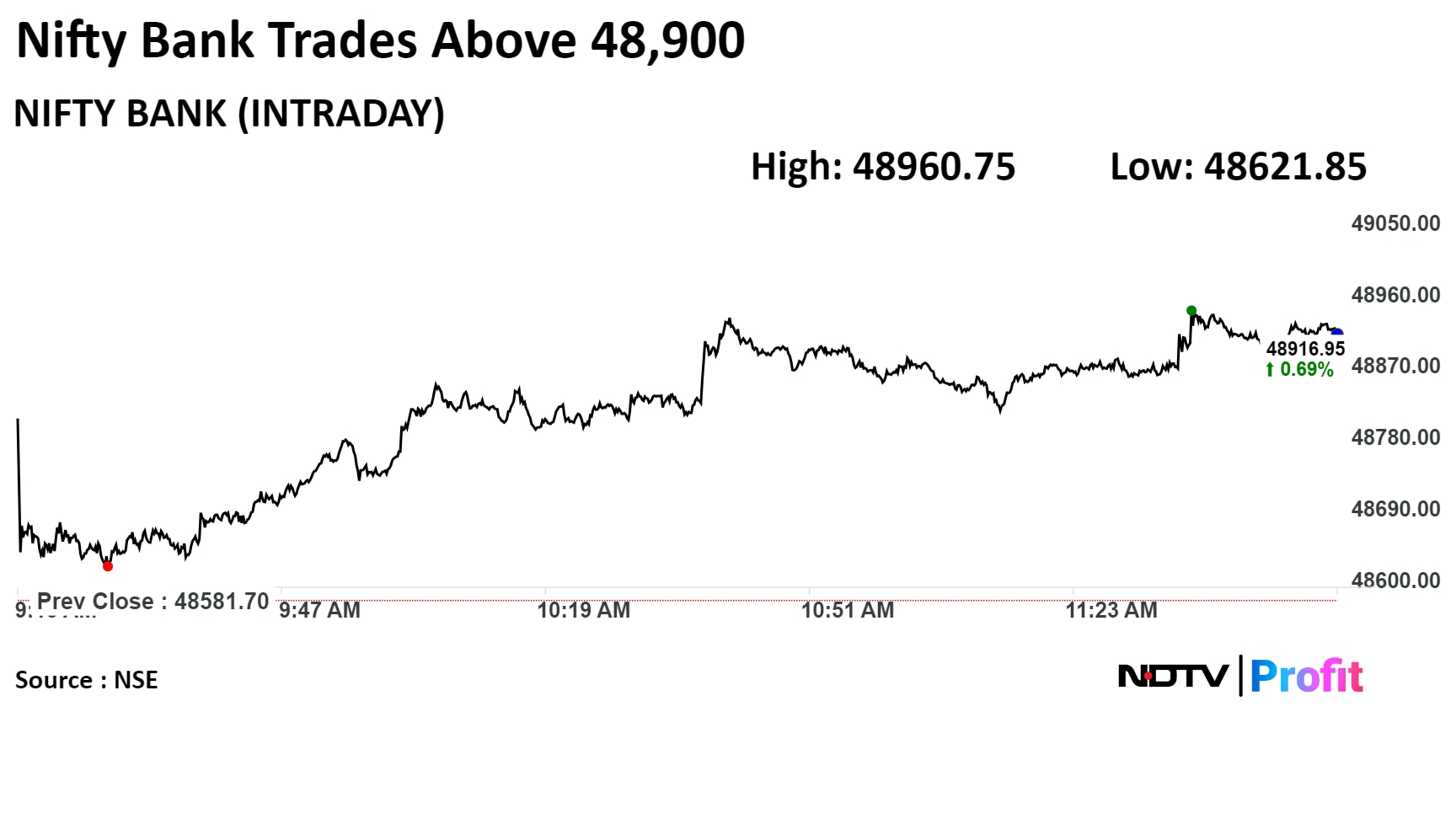

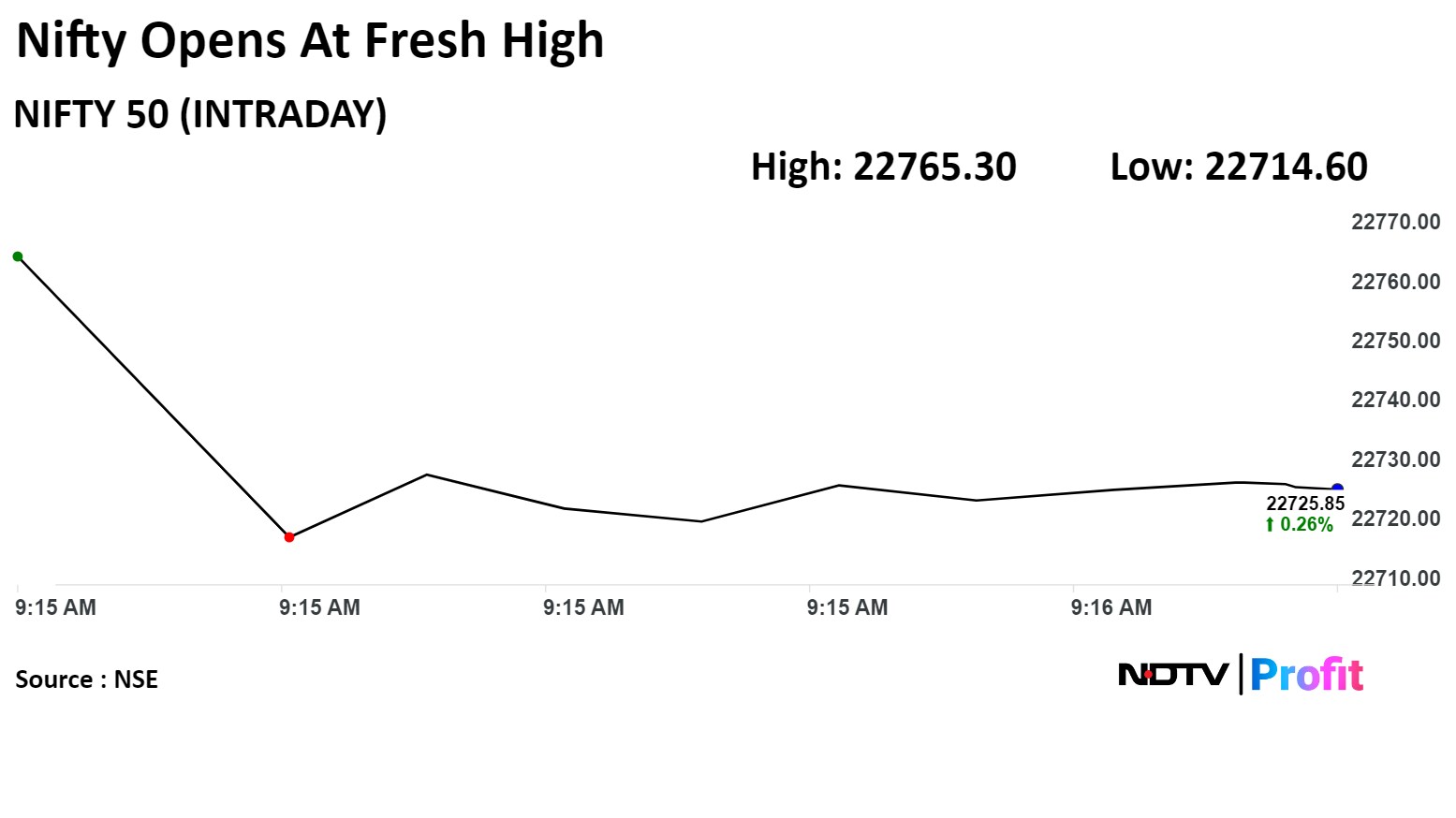

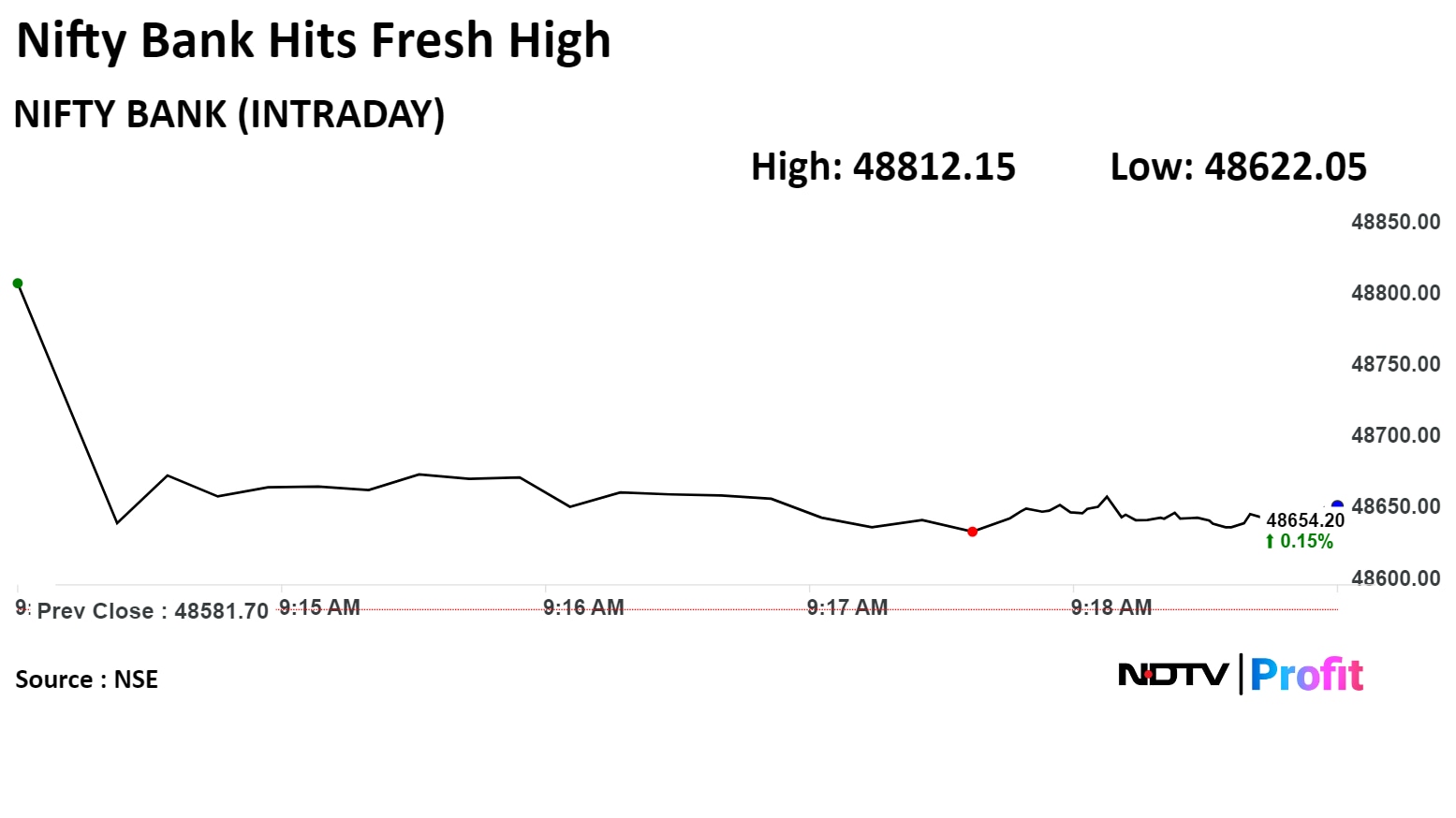

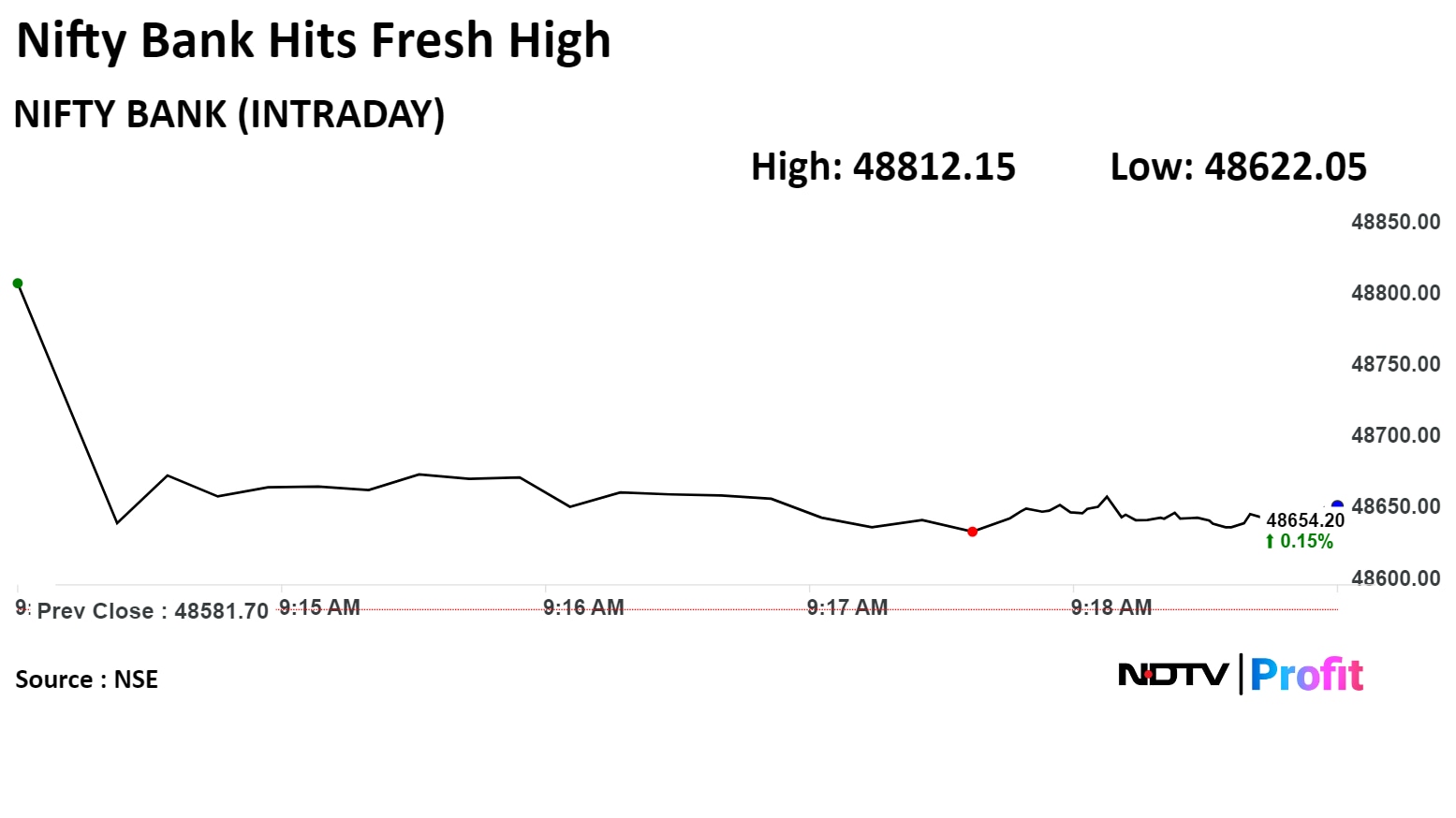

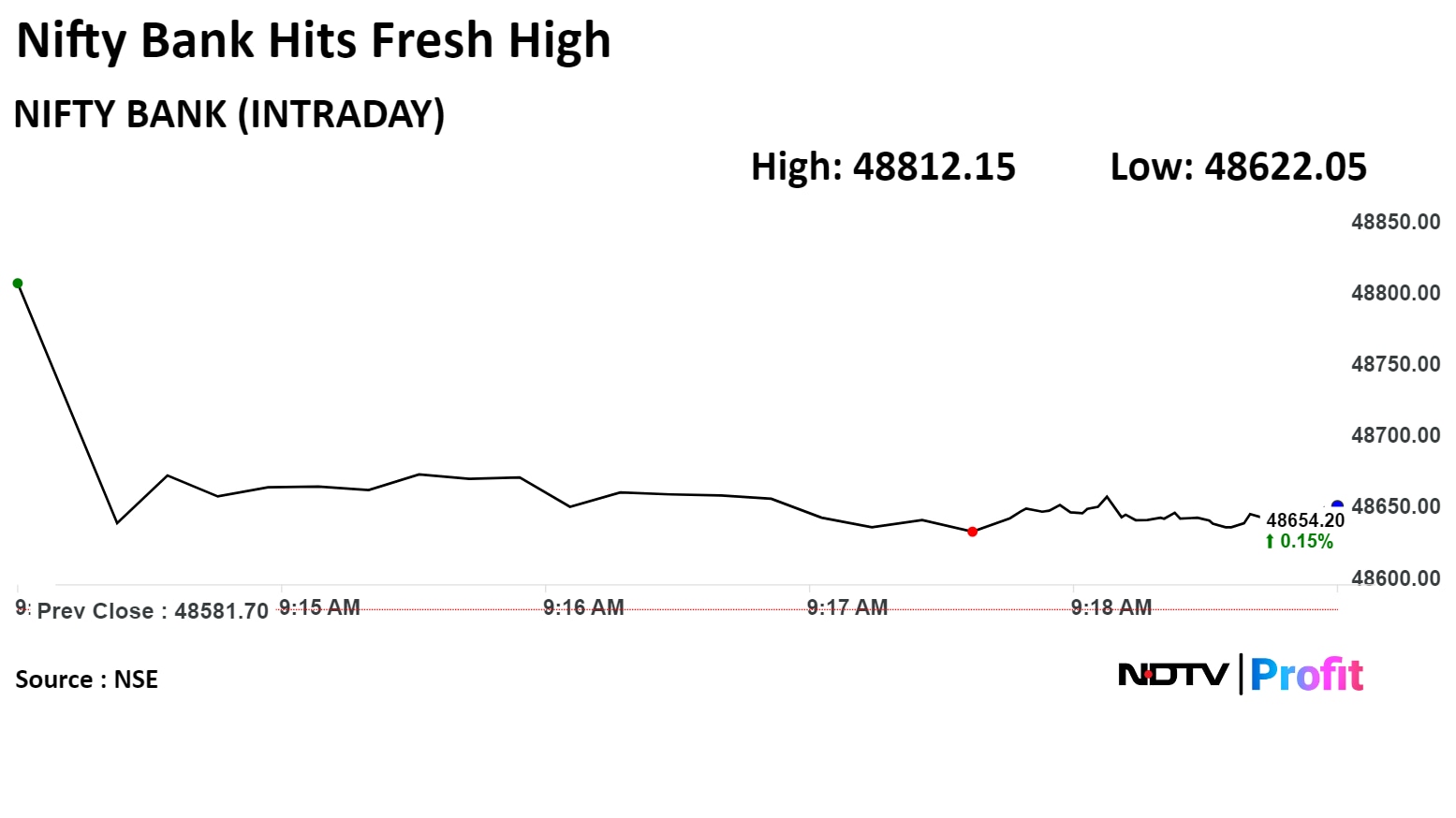

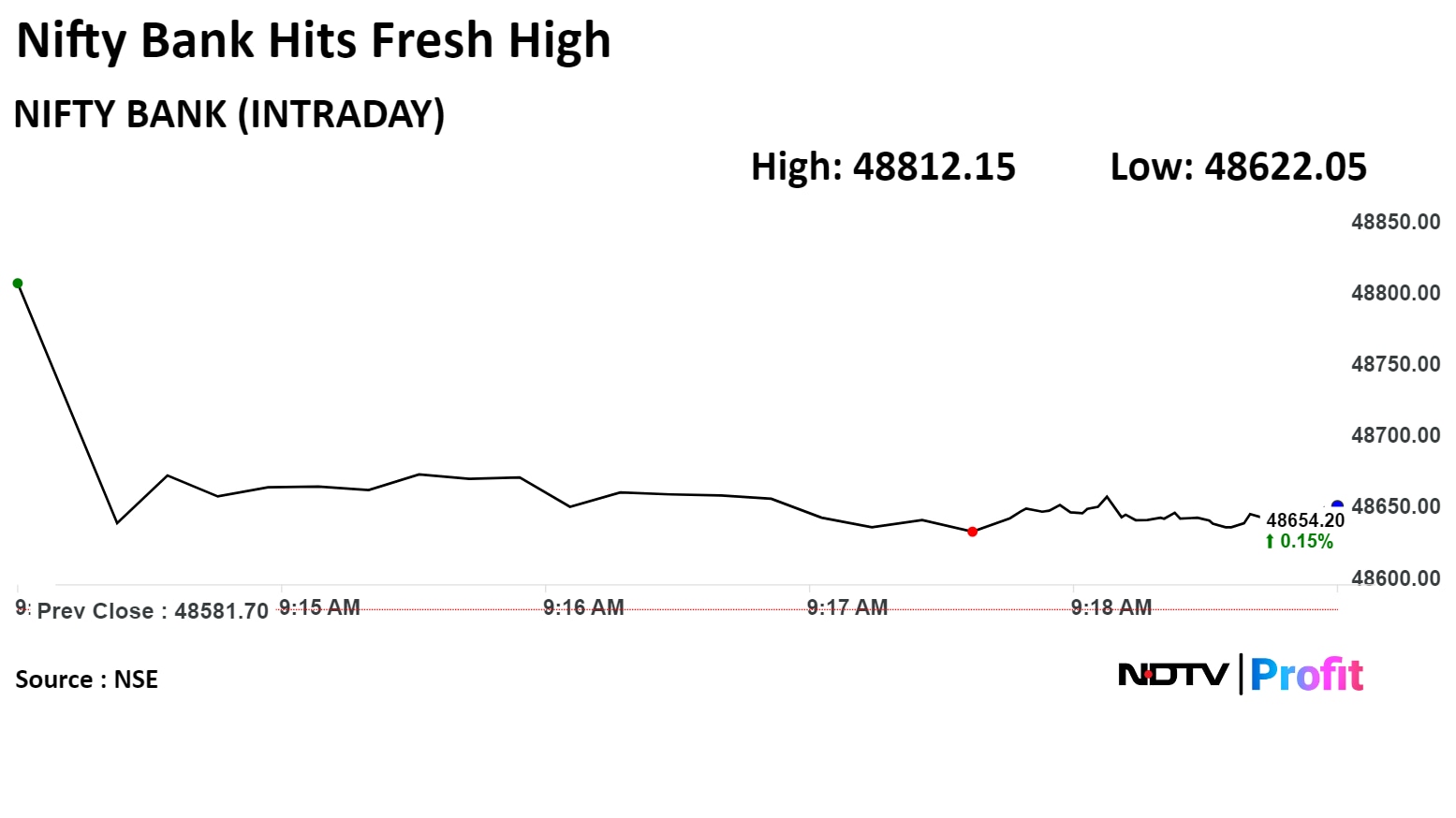

The NSE Nifty Bank index also scaled to a fresh high of 48,960.75, lead by gains in ICICI Bank Ltd., Axis Bank Ltd.

India's benchmark indices gave up all early gains to end lower tracking losses in heavy-weights Reliance Industries Ltd., Titan Co. Ltd., and Larsen & Toubro Ltd.

The NSE Nifty 50 ended 24.55 points or 0.11% lower at 22,641.75, and the S&P BSE Sensex settled 58.80 points or 0.079% down at 74,683.70.

The NSE Nifty 50 rose to fresh high of 22,768.40, and the S&P BSE Sensex rose to a record high of 75,124.28.

The NSE Nifty Bank index also scaled to a fresh high of 48,960.75, lead by gains in ICICI Bank Ltd., Axis Bank Ltd.

India's benchmark indices gave up all early gains to end lower tracking losses in heavy-weights Reliance Industries Ltd., Titan Co. Ltd., and Larsen & Toubro Ltd.

The NSE Nifty 50 ended 24.55 points or 0.11% lower at 22,641.75, and the S&P BSE Sensex settled 58.80 points or 0.079% down at 74,683.70.

The NSE Nifty 50 rose to fresh high of 22,768.40, and the S&P BSE Sensex rose to a record high of 75,124.28.

The NSE Nifty Bank index also scaled to a fresh high of 48,960.75, lead by gains in ICICI Bank Ltd., Axis Bank Ltd.

India's benchmark indices gave up all early gains to end lower tracking losses in heavy-weights Reliance Industries Ltd., Titan Co. Ltd., and Larsen & Toubro Ltd.

The NSE Nifty 50 ended 24.55 points or 0.11% lower at 22,641.75, and the S&P BSE Sensex settled 58.80 points or 0.079% down at 74,683.70.

The NSE Nifty 50 rose to fresh high of 22,768.40, and the S&P BSE Sensex rose to a record high of 75,124.28.

The NSE Nifty Bank index also scaled to a fresh high of 48,960.75, lead by gains in ICICI Bank Ltd., Axis Bank Ltd.

The Bank Nifty demonstrated resilience at higher levels, said Kunal Shah, senior technical and derivative analyst at LKP Securities. It finds support at 48,000, coinciding with significant open interest in put options. With a bullish undertone prevailing, downturns are seen as buying opportunities for the index.

India's benchmark indices gave up all early gains to end lower tracking losses in heavy-weights Reliance Industries Ltd., Titan Co. Ltd., and Larsen & Toubro Ltd.

The NSE Nifty 50 ended 24.55 points or 0.11% lower at 22,641.75, and the S&P BSE Sensex settled 58.80 points or 0.079% down at 74,683.70.

The NSE Nifty 50 rose to fresh high of 22,768.40, and the S&P BSE Sensex rose to a record high of 75,124.28.

The NSE Nifty Bank index also scaled to a fresh high of 48,960.75, lead by gains in ICICI Bank Ltd., Axis Bank Ltd.

India's benchmark indices gave up all early gains to end lower tracking losses in heavy-weights Reliance Industries Ltd., Titan Co. Ltd., and Larsen & Toubro Ltd.

The NSE Nifty 50 ended 24.55 points or 0.11% lower at 22,641.75, and the S&P BSE Sensex settled 58.80 points or 0.079% down at 74,683.70.

The NSE Nifty 50 rose to fresh high of 22,768.40, and the S&P BSE Sensex rose to a record high of 75,124.28.

The NSE Nifty Bank index also scaled to a fresh high of 48,960.75, lead by gains in ICICI Bank Ltd., Axis Bank Ltd.

India's benchmark indices gave up all early gains to end lower tracking losses in heavy-weights Reliance Industries Ltd., Titan Co. Ltd., and Larsen & Toubro Ltd.

The NSE Nifty 50 ended 24.55 points or 0.11% lower at 22,641.75, and the S&P BSE Sensex settled 58.80 points or 0.079% down at 74,683.70.

The NSE Nifty 50 rose to fresh high of 22,768.40, and the S&P BSE Sensex rose to a record high of 75,124.28.

The NSE Nifty Bank index also scaled to a fresh high of 48,960.75, lead by gains in ICICI Bank Ltd., Axis Bank Ltd.

India's benchmark indices gave up all early gains to end lower tracking losses in heavy-weights Reliance Industries Ltd., Titan Co. Ltd., and Larsen & Toubro Ltd.

The NSE Nifty 50 ended 24.55 points or 0.11% lower at 22,641.75, and the S&P BSE Sensex settled 58.80 points or 0.079% down at 74,683.70.

The NSE Nifty 50 rose to fresh high of 22,768.40, and the S&P BSE Sensex rose to a record high of 75,124.28.

The NSE Nifty Bank index also scaled to a fresh high of 48,960.75, lead by gains in ICICI Bank Ltd., Axis Bank Ltd.

The Bank Nifty demonstrated resilience at higher levels, said Kunal Shah, senior technical and derivative analyst at LKP Securities. It finds support at 48,000, coinciding with significant open interest in put options. With a bullish undertone prevailing, downturns are seen as buying opportunities for the index.

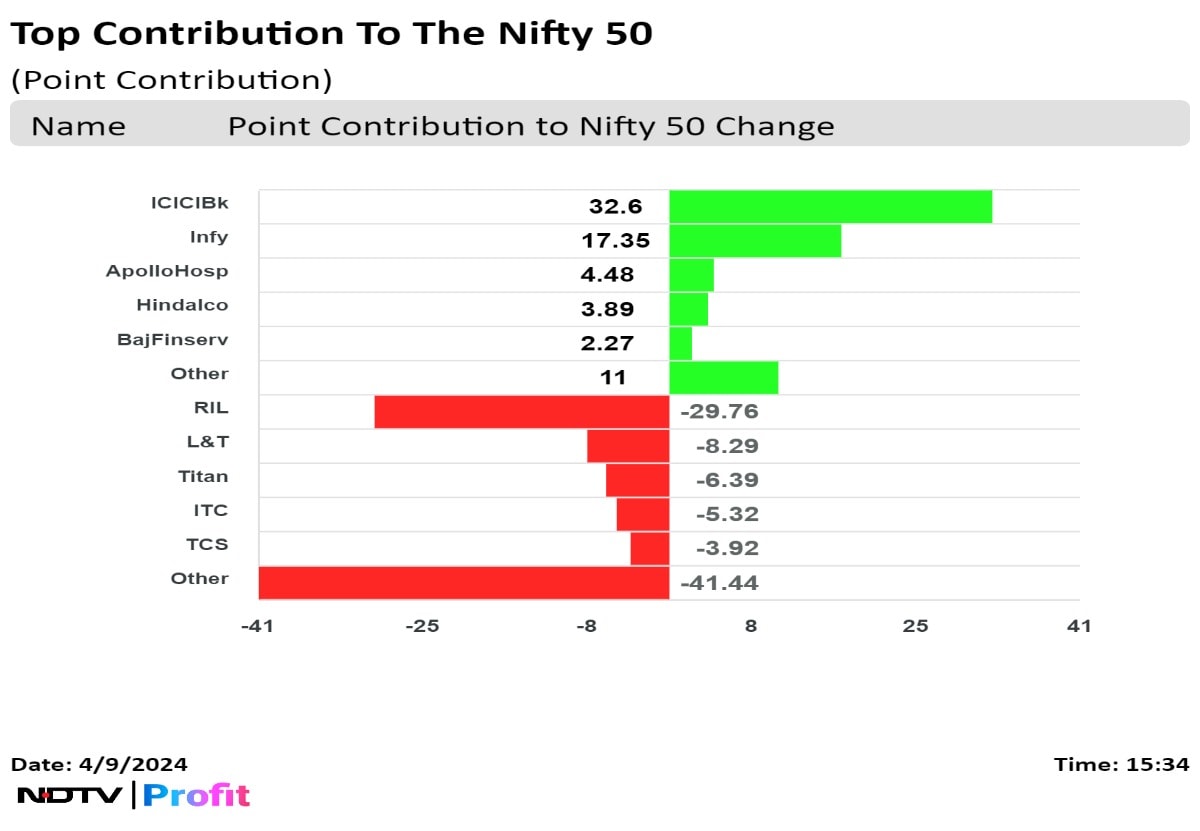

Reliance Industries Ltd., Larsen & Toubro Ltd., Titan Co. Ltd., ITC Ltd., and Tata Consultancy Services Ltd. put pressure on the index.

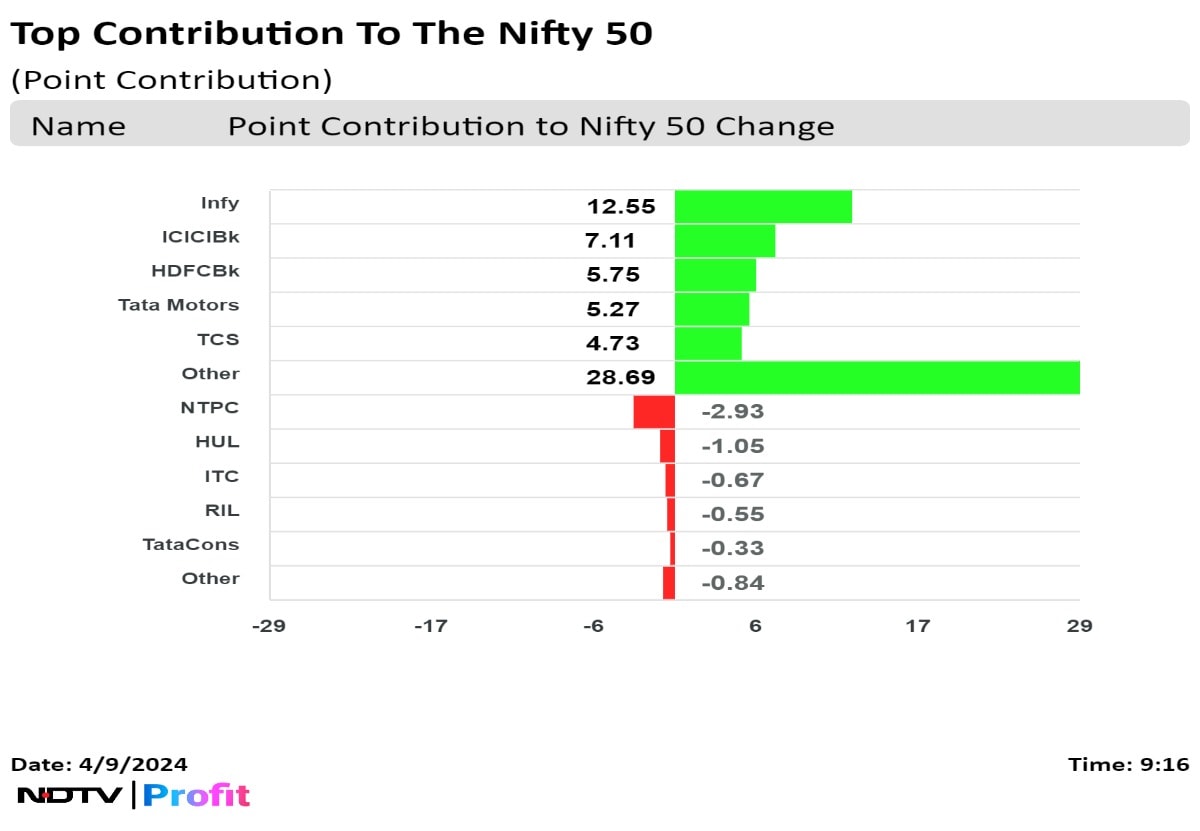

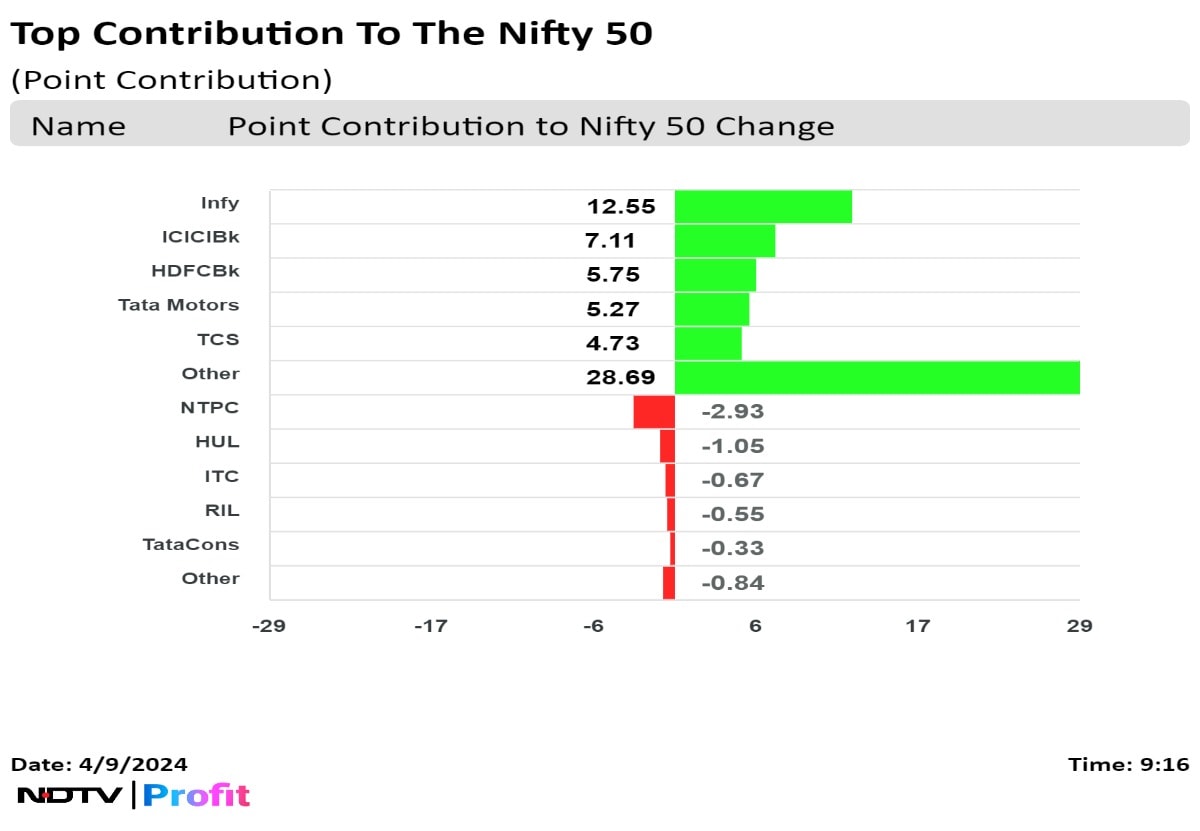

ICICI Bank Ltd., Infosys Ltd., Apollo Hospitals Enterprises Ltd., Hindalco Industries Ltd., and Bajaj Finserve Ltd. added to the gains in the index.

India's benchmark indices gave up all early gains to end lower tracking losses in heavy-weights Reliance Industries Ltd., Titan Co. Ltd., and Larsen & Toubro Ltd.

The NSE Nifty 50 ended 24.55 points or 0.11% lower at 22,641.75, and the S&P BSE Sensex settled 58.80 points or 0.079% down at 74,683.70.

The NSE Nifty 50 rose to fresh high of 22,768.40, and the S&P BSE Sensex rose to a record high of 75,124.28.

The NSE Nifty Bank index also scaled to a fresh high of 48,960.75, lead by gains in ICICI Bank Ltd., Axis Bank Ltd.

India's benchmark indices gave up all early gains to end lower tracking losses in heavy-weights Reliance Industries Ltd., Titan Co. Ltd., and Larsen & Toubro Ltd.

The NSE Nifty 50 ended 24.55 points or 0.11% lower at 22,641.75, and the S&P BSE Sensex settled 58.80 points or 0.079% down at 74,683.70.

The NSE Nifty 50 rose to fresh high of 22,768.40, and the S&P BSE Sensex rose to a record high of 75,124.28.

The NSE Nifty Bank index also scaled to a fresh high of 48,960.75, lead by gains in ICICI Bank Ltd., Axis Bank Ltd.

India's benchmark indices gave up all early gains to end lower tracking losses in heavy-weights Reliance Industries Ltd., Titan Co. Ltd., and Larsen & Toubro Ltd.

The NSE Nifty 50 ended 24.55 points or 0.11% lower at 22,641.75, and the S&P BSE Sensex settled 58.80 points or 0.079% down at 74,683.70.

The NSE Nifty 50 rose to fresh high of 22,768.40, and the S&P BSE Sensex rose to a record high of 75,124.28.

The NSE Nifty Bank index also scaled to a fresh high of 48,960.75, lead by gains in ICICI Bank Ltd., Axis Bank Ltd.

India's benchmark indices gave up all early gains to end lower tracking losses in heavy-weights Reliance Industries Ltd., Titan Co. Ltd., and Larsen & Toubro Ltd.

The NSE Nifty 50 ended 24.55 points or 0.11% lower at 22,641.75, and the S&P BSE Sensex settled 58.80 points or 0.079% down at 74,683.70.

The NSE Nifty 50 rose to fresh high of 22,768.40, and the S&P BSE Sensex rose to a record high of 75,124.28.

The NSE Nifty Bank index also scaled to a fresh high of 48,960.75, lead by gains in ICICI Bank Ltd., Axis Bank Ltd.

The Bank Nifty demonstrated resilience at higher levels, said Kunal Shah, senior technical and derivative analyst at LKP Securities. It finds support at 48,000, coinciding with significant open interest in put options. With a bullish undertone prevailing, downturns are seen as buying opportunities for the index.

India's benchmark indices gave up all early gains to end lower tracking losses in heavy-weights Reliance Industries Ltd., Titan Co. Ltd., and Larsen & Toubro Ltd.

The NSE Nifty 50 ended 24.55 points or 0.11% lower at 22,641.75, and the S&P BSE Sensex settled 58.80 points or 0.079% down at 74,683.70.

The NSE Nifty 50 rose to fresh high of 22,768.40, and the S&P BSE Sensex rose to a record high of 75,124.28.

The NSE Nifty Bank index also scaled to a fresh high of 48,960.75, lead by gains in ICICI Bank Ltd., Axis Bank Ltd.

India's benchmark indices gave up all early gains to end lower tracking losses in heavy-weights Reliance Industries Ltd., Titan Co. Ltd., and Larsen & Toubro Ltd.

The NSE Nifty 50 ended 24.55 points or 0.11% lower at 22,641.75, and the S&P BSE Sensex settled 58.80 points or 0.079% down at 74,683.70.

The NSE Nifty 50 rose to fresh high of 22,768.40, and the S&P BSE Sensex rose to a record high of 75,124.28.

The NSE Nifty Bank index also scaled to a fresh high of 48,960.75, lead by gains in ICICI Bank Ltd., Axis Bank Ltd.

India's benchmark indices gave up all early gains to end lower tracking losses in heavy-weights Reliance Industries Ltd., Titan Co. Ltd., and Larsen & Toubro Ltd.

The NSE Nifty 50 ended 24.55 points or 0.11% lower at 22,641.75, and the S&P BSE Sensex settled 58.80 points or 0.079% down at 74,683.70.

The NSE Nifty 50 rose to fresh high of 22,768.40, and the S&P BSE Sensex rose to a record high of 75,124.28.

The NSE Nifty Bank index also scaled to a fresh high of 48,960.75, lead by gains in ICICI Bank Ltd., Axis Bank Ltd.

India's benchmark indices gave up all early gains to end lower tracking losses in heavy-weights Reliance Industries Ltd., Titan Co. Ltd., and Larsen & Toubro Ltd.

The NSE Nifty 50 ended 24.55 points or 0.11% lower at 22,641.75, and the S&P BSE Sensex settled 58.80 points or 0.079% down at 74,683.70.

The NSE Nifty 50 rose to fresh high of 22,768.40, and the S&P BSE Sensex rose to a record high of 75,124.28.

The NSE Nifty Bank index also scaled to a fresh high of 48,960.75, lead by gains in ICICI Bank Ltd., Axis Bank Ltd.

The Bank Nifty demonstrated resilience at higher levels, said Kunal Shah, senior technical and derivative analyst at LKP Securities. It finds support at 48,000, coinciding with significant open interest in put options. With a bullish undertone prevailing, downturns are seen as buying opportunities for the index.

Reliance Industries Ltd., Larsen & Toubro Ltd., Titan Co. Ltd., ITC Ltd., and Tata Consultancy Services Ltd. put pressure on the index.

ICICI Bank Ltd., Infosys Ltd., Apollo Hospitals Enterprises Ltd., Hindalco Industries Ltd., and Bajaj Finserve Ltd. added to the gains in the index.

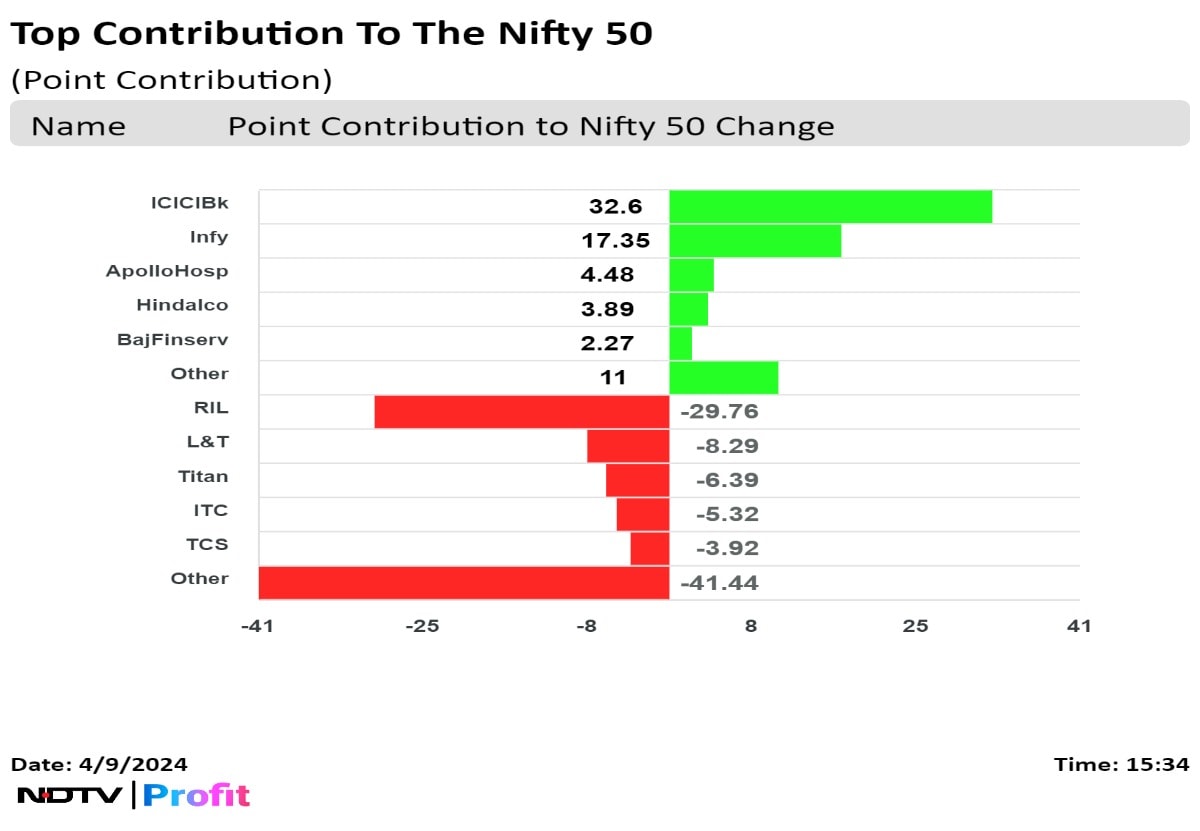

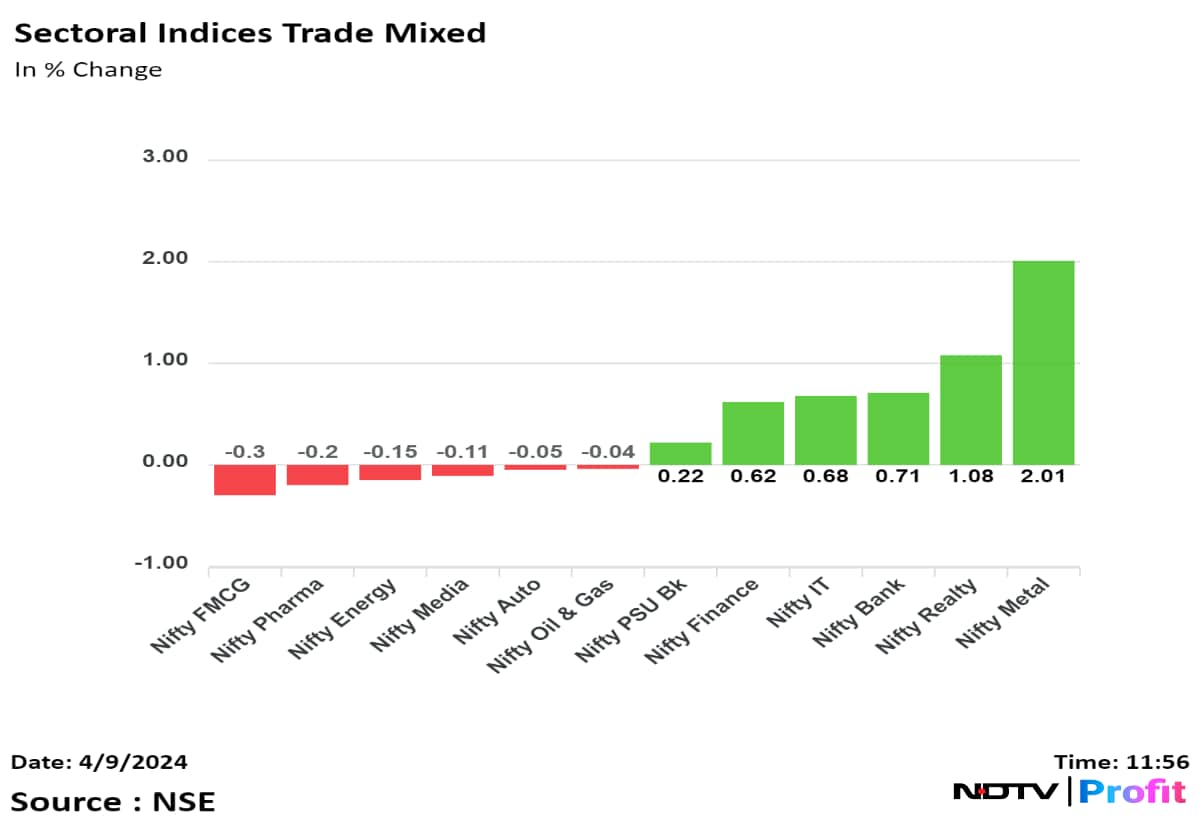

On NSE, seven stocks ended lower, and five ended higher out of 12. The NSE Nifty metal rose the most among its peers, and the NSE Nifty Media index fell the most among sectoral indices.

India's benchmark indices gave up all early gains to end lower tracking losses in heavy-weights Reliance Industries Ltd., Titan Co. Ltd., and Larsen & Toubro Ltd.

The NSE Nifty 50 ended 24.55 points or 0.11% lower at 22,641.75, and the S&P BSE Sensex settled 58.80 points or 0.079% down at 74,683.70.

The NSE Nifty 50 rose to fresh high of 22,768.40, and the S&P BSE Sensex rose to a record high of 75,124.28.

The NSE Nifty Bank index also scaled to a fresh high of 48,960.75, lead by gains in ICICI Bank Ltd., Axis Bank Ltd.

India's benchmark indices gave up all early gains to end lower tracking losses in heavy-weights Reliance Industries Ltd., Titan Co. Ltd., and Larsen & Toubro Ltd.

The NSE Nifty 50 ended 24.55 points or 0.11% lower at 22,641.75, and the S&P BSE Sensex settled 58.80 points or 0.079% down at 74,683.70.

The NSE Nifty 50 rose to fresh high of 22,768.40, and the S&P BSE Sensex rose to a record high of 75,124.28.

The NSE Nifty Bank index also scaled to a fresh high of 48,960.75, lead by gains in ICICI Bank Ltd., Axis Bank Ltd.

India's benchmark indices gave up all early gains to end lower tracking losses in heavy-weights Reliance Industries Ltd., Titan Co. Ltd., and Larsen & Toubro Ltd.

The NSE Nifty 50 ended 24.55 points or 0.11% lower at 22,641.75, and the S&P BSE Sensex settled 58.80 points or 0.079% down at 74,683.70.

The NSE Nifty 50 rose to fresh high of 22,768.40, and the S&P BSE Sensex rose to a record high of 75,124.28.

The NSE Nifty Bank index also scaled to a fresh high of 48,960.75, lead by gains in ICICI Bank Ltd., Axis Bank Ltd.

India's benchmark indices gave up all early gains to end lower tracking losses in heavy-weights Reliance Industries Ltd., Titan Co. Ltd., and Larsen & Toubro Ltd.

The NSE Nifty 50 ended 24.55 points or 0.11% lower at 22,641.75, and the S&P BSE Sensex settled 58.80 points or 0.079% down at 74,683.70.

The NSE Nifty 50 rose to fresh high of 22,768.40, and the S&P BSE Sensex rose to a record high of 75,124.28.

The NSE Nifty Bank index also scaled to a fresh high of 48,960.75, lead by gains in ICICI Bank Ltd., Axis Bank Ltd.

The Bank Nifty demonstrated resilience at higher levels, said Kunal Shah, senior technical and derivative analyst at LKP Securities. It finds support at 48,000, coinciding with significant open interest in put options. With a bullish undertone prevailing, downturns are seen as buying opportunities for the index.

India's benchmark indices gave up all early gains to end lower tracking losses in heavy-weights Reliance Industries Ltd., Titan Co. Ltd., and Larsen & Toubro Ltd.

The NSE Nifty 50 ended 24.55 points or 0.11% lower at 22,641.75, and the S&P BSE Sensex settled 58.80 points or 0.079% down at 74,683.70.

The NSE Nifty 50 rose to fresh high of 22,768.40, and the S&P BSE Sensex rose to a record high of 75,124.28.

The NSE Nifty Bank index also scaled to a fresh high of 48,960.75, lead by gains in ICICI Bank Ltd., Axis Bank Ltd.

India's benchmark indices gave up all early gains to end lower tracking losses in heavy-weights Reliance Industries Ltd., Titan Co. Ltd., and Larsen & Toubro Ltd.

The NSE Nifty 50 ended 24.55 points or 0.11% lower at 22,641.75, and the S&P BSE Sensex settled 58.80 points or 0.079% down at 74,683.70.

The NSE Nifty 50 rose to fresh high of 22,768.40, and the S&P BSE Sensex rose to a record high of 75,124.28.

The NSE Nifty Bank index also scaled to a fresh high of 48,960.75, lead by gains in ICICI Bank Ltd., Axis Bank Ltd.

India's benchmark indices gave up all early gains to end lower tracking losses in heavy-weights Reliance Industries Ltd., Titan Co. Ltd., and Larsen & Toubro Ltd.

The NSE Nifty 50 ended 24.55 points or 0.11% lower at 22,641.75, and the S&P BSE Sensex settled 58.80 points or 0.079% down at 74,683.70.

The NSE Nifty 50 rose to fresh high of 22,768.40, and the S&P BSE Sensex rose to a record high of 75,124.28.

The NSE Nifty Bank index also scaled to a fresh high of 48,960.75, lead by gains in ICICI Bank Ltd., Axis Bank Ltd.

India's benchmark indices gave up all early gains to end lower tracking losses in heavy-weights Reliance Industries Ltd., Titan Co. Ltd., and Larsen & Toubro Ltd.

The NSE Nifty 50 ended 24.55 points or 0.11% lower at 22,641.75, and the S&P BSE Sensex settled 58.80 points or 0.079% down at 74,683.70.

The NSE Nifty 50 rose to fresh high of 22,768.40, and the S&P BSE Sensex rose to a record high of 75,124.28.

The NSE Nifty Bank index also scaled to a fresh high of 48,960.75, lead by gains in ICICI Bank Ltd., Axis Bank Ltd.

The Bank Nifty demonstrated resilience at higher levels, said Kunal Shah, senior technical and derivative analyst at LKP Securities. It finds support at 48,000, coinciding with significant open interest in put options. With a bullish undertone prevailing, downturns are seen as buying opportunities for the index.

Reliance Industries Ltd., Larsen & Toubro Ltd., Titan Co. Ltd., ITC Ltd., and Tata Consultancy Services Ltd. put pressure on the index.

ICICI Bank Ltd., Infosys Ltd., Apollo Hospitals Enterprises Ltd., Hindalco Industries Ltd., and Bajaj Finserve Ltd. added to the gains in the index.

India's benchmark indices gave up all early gains to end lower tracking losses in heavy-weights Reliance Industries Ltd., Titan Co. Ltd., and Larsen & Toubro Ltd.

The NSE Nifty 50 ended 24.55 points or 0.11% lower at 22,641.75, and the S&P BSE Sensex settled 58.80 points or 0.079% down at 74,683.70.

The NSE Nifty 50 rose to fresh high of 22,768.40, and the S&P BSE Sensex rose to a record high of 75,124.28.

The NSE Nifty Bank index also scaled to a fresh high of 48,960.75, lead by gains in ICICI Bank Ltd., Axis Bank Ltd.

India's benchmark indices gave up all early gains to end lower tracking losses in heavy-weights Reliance Industries Ltd., Titan Co. Ltd., and Larsen & Toubro Ltd.

The NSE Nifty 50 ended 24.55 points or 0.11% lower at 22,641.75, and the S&P BSE Sensex settled 58.80 points or 0.079% down at 74,683.70.

The NSE Nifty 50 rose to fresh high of 22,768.40, and the S&P BSE Sensex rose to a record high of 75,124.28.

The NSE Nifty Bank index also scaled to a fresh high of 48,960.75, lead by gains in ICICI Bank Ltd., Axis Bank Ltd.

India's benchmark indices gave up all early gains to end lower tracking losses in heavy-weights Reliance Industries Ltd., Titan Co. Ltd., and Larsen & Toubro Ltd.

The NSE Nifty 50 ended 24.55 points or 0.11% lower at 22,641.75, and the S&P BSE Sensex settled 58.80 points or 0.079% down at 74,683.70.

The NSE Nifty 50 rose to fresh high of 22,768.40, and the S&P BSE Sensex rose to a record high of 75,124.28.

The NSE Nifty Bank index also scaled to a fresh high of 48,960.75, lead by gains in ICICI Bank Ltd., Axis Bank Ltd.

India's benchmark indices gave up all early gains to end lower tracking losses in heavy-weights Reliance Industries Ltd., Titan Co. Ltd., and Larsen & Toubro Ltd.

The NSE Nifty 50 ended 24.55 points or 0.11% lower at 22,641.75, and the S&P BSE Sensex settled 58.80 points or 0.079% down at 74,683.70.

The NSE Nifty 50 rose to fresh high of 22,768.40, and the S&P BSE Sensex rose to a record high of 75,124.28.

The NSE Nifty Bank index also scaled to a fresh high of 48,960.75, lead by gains in ICICI Bank Ltd., Axis Bank Ltd.

The Bank Nifty demonstrated resilience at higher levels, said Kunal Shah, senior technical and derivative analyst at LKP Securities. It finds support at 48,000, coinciding with significant open interest in put options. With a bullish undertone prevailing, downturns are seen as buying opportunities for the index.

India's benchmark indices gave up all early gains to end lower tracking losses in heavy-weights Reliance Industries Ltd., Titan Co. Ltd., and Larsen & Toubro Ltd.

The NSE Nifty 50 ended 24.55 points or 0.11% lower at 22,641.75, and the S&P BSE Sensex settled 58.80 points or 0.079% down at 74,683.70.

The NSE Nifty 50 rose to fresh high of 22,768.40, and the S&P BSE Sensex rose to a record high of 75,124.28.

The NSE Nifty Bank index also scaled to a fresh high of 48,960.75, lead by gains in ICICI Bank Ltd., Axis Bank Ltd.

India's benchmark indices gave up all early gains to end lower tracking losses in heavy-weights Reliance Industries Ltd., Titan Co. Ltd., and Larsen & Toubro Ltd.

The NSE Nifty 50 ended 24.55 points or 0.11% lower at 22,641.75, and the S&P BSE Sensex settled 58.80 points or 0.079% down at 74,683.70.

The NSE Nifty 50 rose to fresh high of 22,768.40, and the S&P BSE Sensex rose to a record high of 75,124.28.

The NSE Nifty Bank index also scaled to a fresh high of 48,960.75, lead by gains in ICICI Bank Ltd., Axis Bank Ltd.

India's benchmark indices gave up all early gains to end lower tracking losses in heavy-weights Reliance Industries Ltd., Titan Co. Ltd., and Larsen & Toubro Ltd.

The NSE Nifty 50 ended 24.55 points or 0.11% lower at 22,641.75, and the S&P BSE Sensex settled 58.80 points or 0.079% down at 74,683.70.

The NSE Nifty 50 rose to fresh high of 22,768.40, and the S&P BSE Sensex rose to a record high of 75,124.28.

The NSE Nifty Bank index also scaled to a fresh high of 48,960.75, lead by gains in ICICI Bank Ltd., Axis Bank Ltd.

India's benchmark indices gave up all early gains to end lower tracking losses in heavy-weights Reliance Industries Ltd., Titan Co. Ltd., and Larsen & Toubro Ltd.

The NSE Nifty 50 ended 24.55 points or 0.11% lower at 22,641.75, and the S&P BSE Sensex settled 58.80 points or 0.079% down at 74,683.70.

The NSE Nifty 50 rose to fresh high of 22,768.40, and the S&P BSE Sensex rose to a record high of 75,124.28.

The NSE Nifty Bank index also scaled to a fresh high of 48,960.75, lead by gains in ICICI Bank Ltd., Axis Bank Ltd.

The Bank Nifty demonstrated resilience at higher levels, said Kunal Shah, senior technical and derivative analyst at LKP Securities. It finds support at 48,000, coinciding with significant open interest in put options. With a bullish undertone prevailing, downturns are seen as buying opportunities for the index.

Reliance Industries Ltd., Larsen & Toubro Ltd., Titan Co. Ltd., ITC Ltd., and Tata Consultancy Services Ltd. put pressure on the index.

ICICI Bank Ltd., Infosys Ltd., Apollo Hospitals Enterprises Ltd., Hindalco Industries Ltd., and Bajaj Finserve Ltd. added to the gains in the index.

On NSE, seven stocks ended lower, and five ended higher out of 12. The NSE Nifty metal rose the most among its peers, and the NSE Nifty Media index fell the most among sectoral indices.

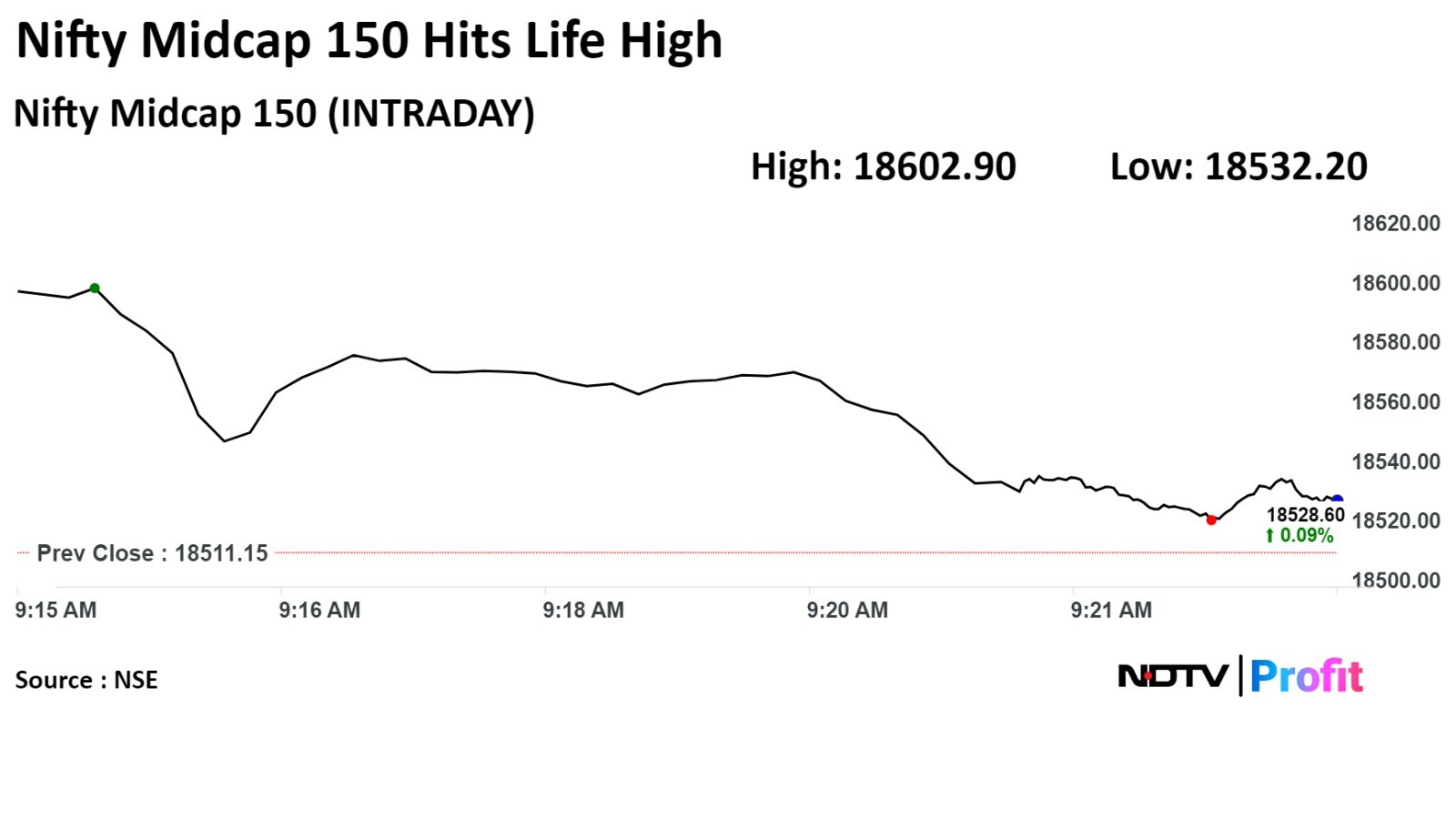

Broader markets were mixed. The S&P BSE Midcap index ended 0.47% lower and the S&P BSE Smallcap index ended 0.15% lower.

On BSE, 10 sectors advanced, and 10 sectors declined out of 20. The S&P BSE Consumer Durables fell the most.

Market breadth was skewed in favour of sellers. On BSE 2,228 stocks declined, 1,618 stocks advanced, and 105 remained unchanged.

ICICI Lombard General Insurance Co entered into a Strategic Partnership with Policybazaar.

Source: Exchange Filing

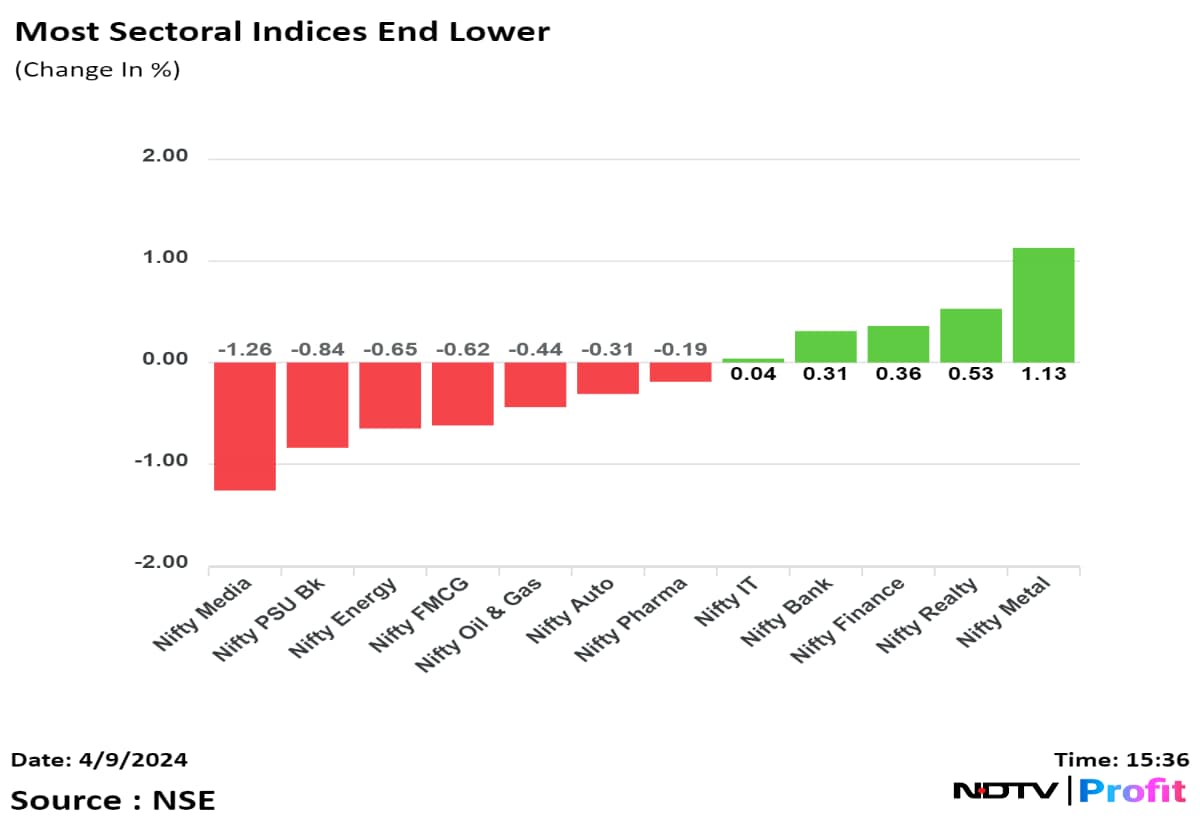

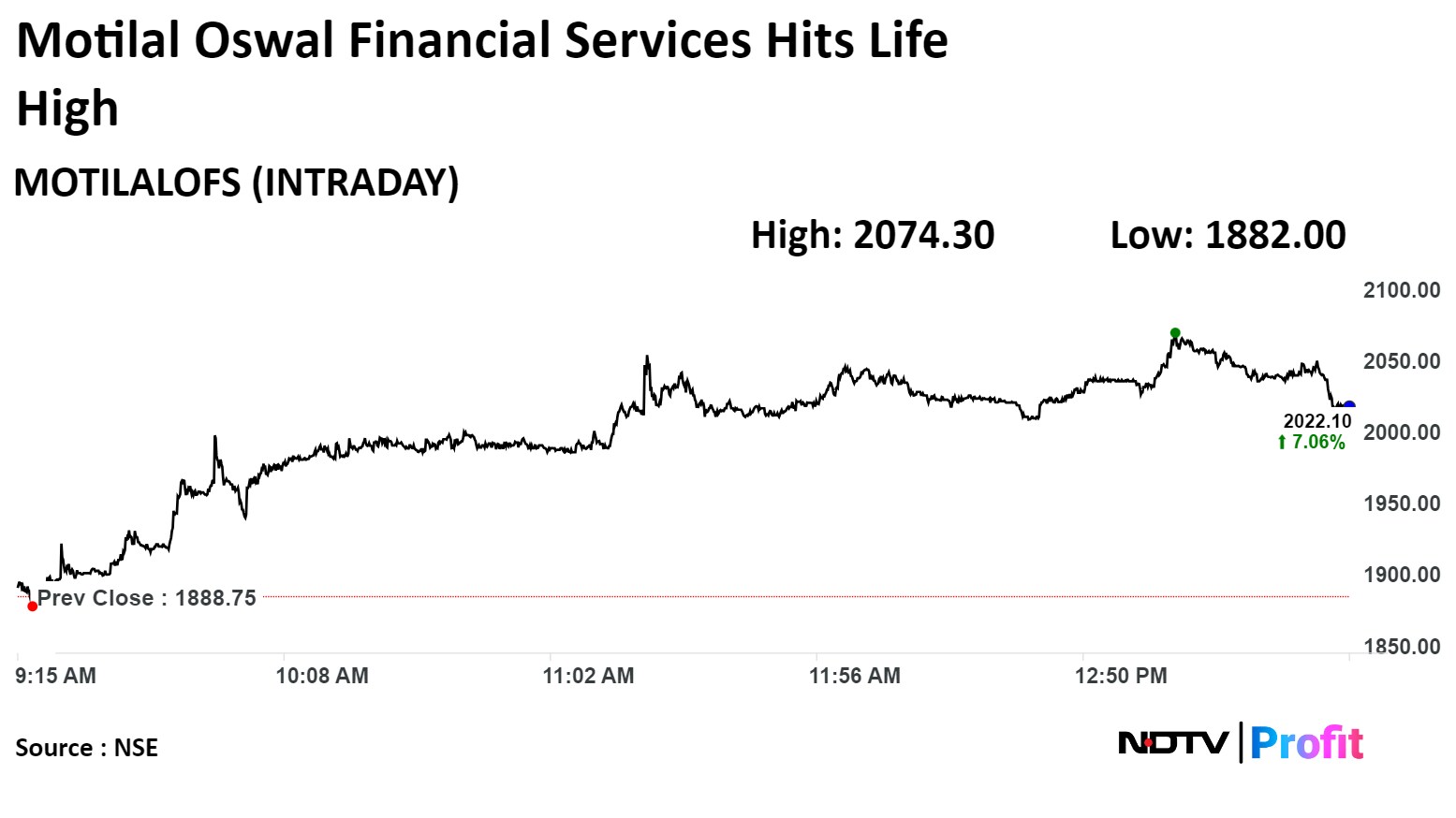

Shares of Motilal Oswal Financial Services Ltd. rose as much as 9.82% to Rs 2,074.30, the highest level since its listing on Sep 10, 2007. It was trading 6.95% higher at Rs 2,020.00 as of 1:46 p.m., as compared to 0.04% decline in the NSE Nifty 50 index.

Shares of Motilal Oswal Financial Services Ltd. rose as much as 9.82% to Rs 2,074.30, the highest level since its listing on Sep 10, 2007. It was trading 6.95% higher at Rs 2,020.00 as of 1:46 p.m., as compared to 0.04% decline in the NSE Nifty 50 index.

The benchmark equity indices continued their record run for the second consecutive session on Tuesday and traded near lifetime highs through the midday as ICICI Bank Ltd. contributed the most to the gains. As of 12:55 p.m., the NSE Nifty 50 was trading 28.30 points or 0.1% higher at 22,694.40 and the S&P BSE Sensex was trading 130.52 points or 0.2% up at 74,873.02.

During the day, the Nifty rose as much as 0.45% to an all-time high of 22,768.40 points and the Sensex jumped 0.51% to 75,124.28.

It is a buy-on-dip market, according to Amit Goel, founder of Amit Ventures. He advises investors to be cautious with every new lifetime high. His view on Nifty continues to remain bullish.

Accumulate at current levels and look for a potential breakout of close to 23,000 with the support for the index at 22,300–22,500, according to Goel.

The benchmark equity indices continued their record run for the second consecutive session on Tuesday and traded near lifetime highs through the midday as ICICI Bank Ltd. contributed the most to the gains. As of 12:55 p.m., the NSE Nifty 50 was trading 28.30 points or 0.1% higher at 22,694.40 and the S&P BSE Sensex was trading 130.52 points or 0.2% up at 74,873.02.

During the day, the Nifty rose as much as 0.45% to an all-time high of 22,768.40 points and the Sensex jumped 0.51% to 75,124.28.

It is a buy-on-dip market, according to Amit Goel, founder of Amit Ventures. He advises investors to be cautious with every new lifetime high. His view on Nifty continues to remain bullish.

Accumulate at current levels and look for a potential breakout of close to 23,000 with the support for the index at 22,300–22,500, according to Goel.

The benchmark equity indices continued their record run for the second consecutive session on Tuesday and traded near lifetime highs through the midday as ICICI Bank Ltd. contributed the most to the gains. As of 12:55 p.m., the NSE Nifty 50 was trading 28.30 points or 0.1% higher at 22,694.40 and the S&P BSE Sensex was trading 130.52 points or 0.2% up at 74,873.02.

During the day, the Nifty rose as much as 0.45% to an all-time high of 22,768.40 points and the Sensex jumped 0.51% to 75,124.28.

It is a buy-on-dip market, according to Amit Goel, founder of Amit Ventures. He advises investors to be cautious with every new lifetime high. His view on Nifty continues to remain bullish.

Accumulate at current levels and look for a potential breakout of close to 23,000 with the support for the index at 22,300–22,500, according to Goel.

The benchmark equity indices continued their record run for the second consecutive session on Tuesday and traded near lifetime highs through the midday as ICICI Bank Ltd. contributed the most to the gains. As of 12:55 p.m., the NSE Nifty 50 was trading 28.30 points or 0.1% higher at 22,694.40 and the S&P BSE Sensex was trading 130.52 points or 0.2% up at 74,873.02.

During the day, the Nifty rose as much as 0.45% to an all-time high of 22,768.40 points and the Sensex jumped 0.51% to 75,124.28.

It is a buy-on-dip market, according to Amit Goel, founder of Amit Ventures. He advises investors to be cautious with every new lifetime high. His view on Nifty continues to remain bullish.

Accumulate at current levels and look for a potential breakout of close to 23,000 with the support for the index at 22,300–22,500, according to Goel.

The benchmark equity indices continued their record run for the second consecutive session on Tuesday and traded near lifetime highs through the midday as ICICI Bank Ltd. contributed the most to the gains. As of 12:55 p.m., the NSE Nifty 50 was trading 28.30 points or 0.1% higher at 22,694.40 and the S&P BSE Sensex was trading 130.52 points or 0.2% up at 74,873.02.

During the day, the Nifty rose as much as 0.45% to an all-time high of 22,768.40 points and the Sensex jumped 0.51% to 75,124.28.

It is a buy-on-dip market, according to Amit Goel, founder of Amit Ventures. He advises investors to be cautious with every new lifetime high. His view on Nifty continues to remain bullish.

Accumulate at current levels and look for a potential breakout of close to 23,000 with the support for the index at 22,300–22,500, according to Goel.

The benchmark equity indices continued their record run for the second consecutive session on Tuesday and traded near lifetime highs through the midday as ICICI Bank Ltd. contributed the most to the gains. As of 12:55 p.m., the NSE Nifty 50 was trading 28.30 points or 0.1% higher at 22,694.40 and the S&P BSE Sensex was trading 130.52 points or 0.2% up at 74,873.02.

During the day, the Nifty rose as much as 0.45% to an all-time high of 22,768.40 points and the Sensex jumped 0.51% to 75,124.28.

It is a buy-on-dip market, according to Amit Goel, founder of Amit Ventures. He advises investors to be cautious with every new lifetime high. His view on Nifty continues to remain bullish.

Accumulate at current levels and look for a potential breakout of close to 23,000 with the support for the index at 22,300–22,500, according to Goel.

The benchmark equity indices continued their record run for the second consecutive session on Tuesday and traded near lifetime highs through the midday as ICICI Bank Ltd. contributed the most to the gains. As of 12:55 p.m., the NSE Nifty 50 was trading 28.30 points or 0.1% higher at 22,694.40 and the S&P BSE Sensex was trading 130.52 points or 0.2% up at 74,873.02.

During the day, the Nifty rose as much as 0.45% to an all-time high of 22,768.40 points and the Sensex jumped 0.51% to 75,124.28.

It is a buy-on-dip market, according to Amit Goel, founder of Amit Ventures. He advises investors to be cautious with every new lifetime high. His view on Nifty continues to remain bullish.

Accumulate at current levels and look for a potential breakout of close to 23,000 with the support for the index at 22,300–22,500, according to Goel.

The benchmark equity indices continued their record run for the second consecutive session on Tuesday and traded near lifetime highs through the midday as ICICI Bank Ltd. contributed the most to the gains. As of 12:55 p.m., the NSE Nifty 50 was trading 28.30 points or 0.1% higher at 22,694.40 and the S&P BSE Sensex was trading 130.52 points or 0.2% up at 74,873.02.

During the day, the Nifty rose as much as 0.45% to an all-time high of 22,768.40 points and the Sensex jumped 0.51% to 75,124.28.

It is a buy-on-dip market, according to Amit Goel, founder of Amit Ventures. He advises investors to be cautious with every new lifetime high. His view on Nifty continues to remain bullish.

Accumulate at current levels and look for a potential breakout of close to 23,000 with the support for the index at 22,300–22,500, according to Goel.

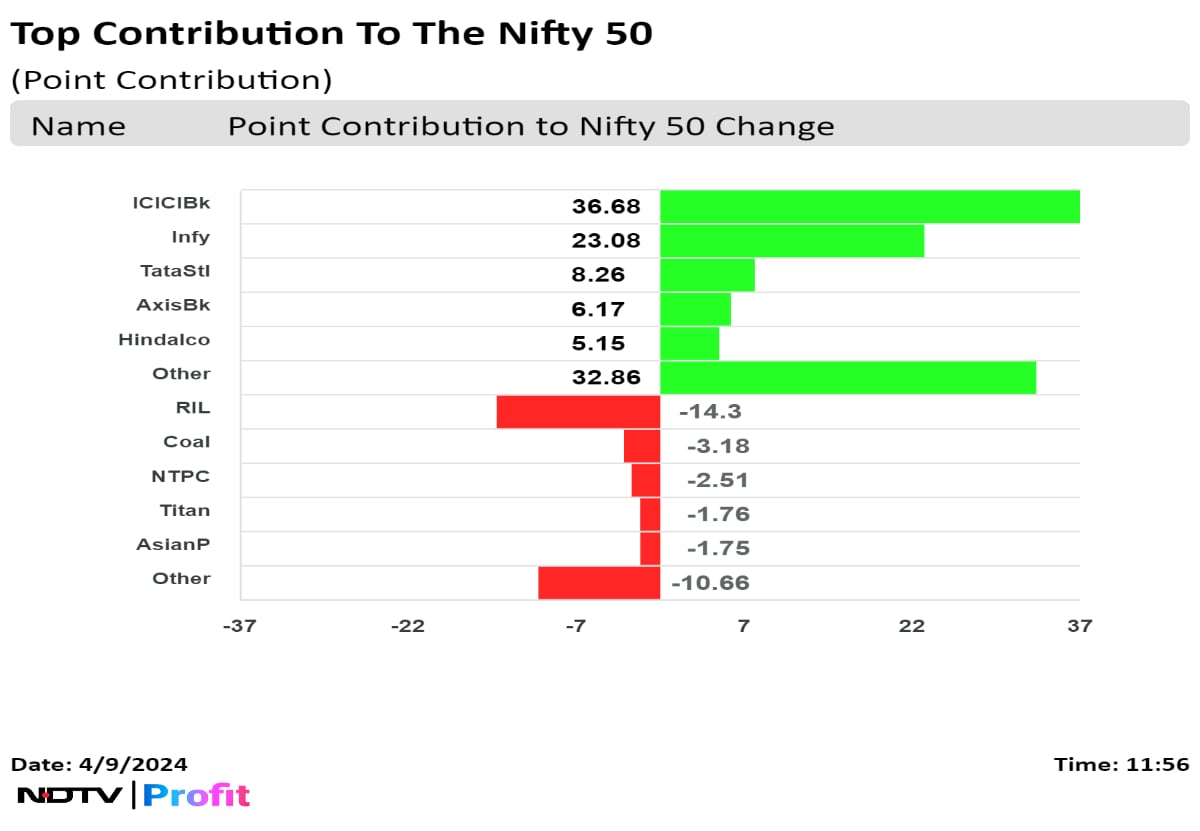

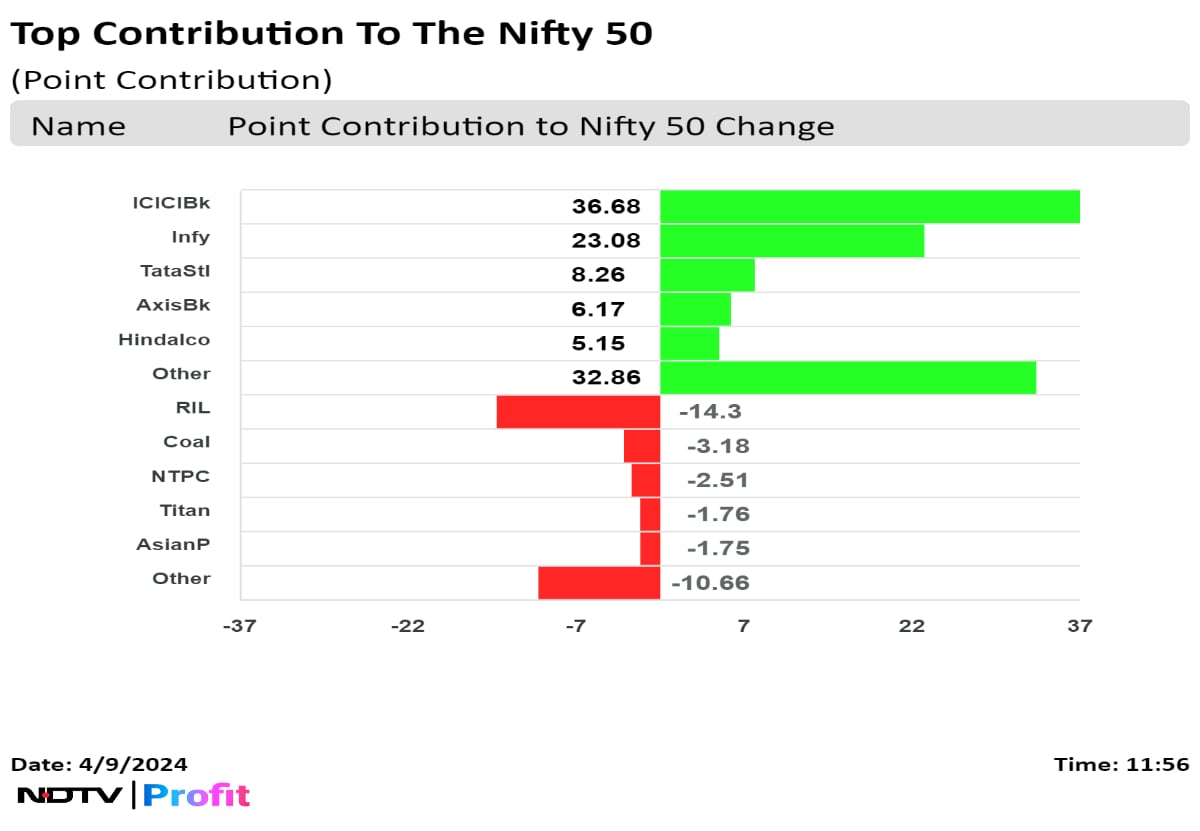

Shares of ICICI Bank Ltd., Infosys Ltd., Tata Steel Ltd., Axis Bank Ltd. and Hindalco Industries Ltd. contributed the most to the gains in the Nifty 50

Asian Paints Ltd., Titan Co., NTPC Ltd., Coal India Ltd. and Reliance Industries Ltd. minimised the gains the most.

The benchmark equity indices continued their record run for the second consecutive session on Tuesday and traded near lifetime highs through the midday as ICICI Bank Ltd. contributed the most to the gains. As of 12:55 p.m., the NSE Nifty 50 was trading 28.30 points or 0.1% higher at 22,694.40 and the S&P BSE Sensex was trading 130.52 points or 0.2% up at 74,873.02.

During the day, the Nifty rose as much as 0.45% to an all-time high of 22,768.40 points and the Sensex jumped 0.51% to 75,124.28.

It is a buy-on-dip market, according to Amit Goel, founder of Amit Ventures. He advises investors to be cautious with every new lifetime high. His view on Nifty continues to remain bullish.

Accumulate at current levels and look for a potential breakout of close to 23,000 with the support for the index at 22,300–22,500, according to Goel.

The benchmark equity indices continued their record run for the second consecutive session on Tuesday and traded near lifetime highs through the midday as ICICI Bank Ltd. contributed the most to the gains. As of 12:55 p.m., the NSE Nifty 50 was trading 28.30 points or 0.1% higher at 22,694.40 and the S&P BSE Sensex was trading 130.52 points or 0.2% up at 74,873.02.

During the day, the Nifty rose as much as 0.45% to an all-time high of 22,768.40 points and the Sensex jumped 0.51% to 75,124.28.

It is a buy-on-dip market, according to Amit Goel, founder of Amit Ventures. He advises investors to be cautious with every new lifetime high. His view on Nifty continues to remain bullish.

Accumulate at current levels and look for a potential breakout of close to 23,000 with the support for the index at 22,300–22,500, according to Goel.

The benchmark equity indices continued their record run for the second consecutive session on Tuesday and traded near lifetime highs through the midday as ICICI Bank Ltd. contributed the most to the gains. As of 12:55 p.m., the NSE Nifty 50 was trading 28.30 points or 0.1% higher at 22,694.40 and the S&P BSE Sensex was trading 130.52 points or 0.2% up at 74,873.02.

During the day, the Nifty rose as much as 0.45% to an all-time high of 22,768.40 points and the Sensex jumped 0.51% to 75,124.28.

It is a buy-on-dip market, according to Amit Goel, founder of Amit Ventures. He advises investors to be cautious with every new lifetime high. His view on Nifty continues to remain bullish.

Accumulate at current levels and look for a potential breakout of close to 23,000 with the support for the index at 22,300–22,500, according to Goel.

The benchmark equity indices continued their record run for the second consecutive session on Tuesday and traded near lifetime highs through the midday as ICICI Bank Ltd. contributed the most to the gains. As of 12:55 p.m., the NSE Nifty 50 was trading 28.30 points or 0.1% higher at 22,694.40 and the S&P BSE Sensex was trading 130.52 points or 0.2% up at 74,873.02.

During the day, the Nifty rose as much as 0.45% to an all-time high of 22,768.40 points and the Sensex jumped 0.51% to 75,124.28.

It is a buy-on-dip market, according to Amit Goel, founder of Amit Ventures. He advises investors to be cautious with every new lifetime high. His view on Nifty continues to remain bullish.

Accumulate at current levels and look for a potential breakout of close to 23,000 with the support for the index at 22,300–22,500, according to Goel.

The benchmark equity indices continued their record run for the second consecutive session on Tuesday and traded near lifetime highs through the midday as ICICI Bank Ltd. contributed the most to the gains. As of 12:55 p.m., the NSE Nifty 50 was trading 28.30 points or 0.1% higher at 22,694.40 and the S&P BSE Sensex was trading 130.52 points or 0.2% up at 74,873.02.

During the day, the Nifty rose as much as 0.45% to an all-time high of 22,768.40 points and the Sensex jumped 0.51% to 75,124.28.

It is a buy-on-dip market, according to Amit Goel, founder of Amit Ventures. He advises investors to be cautious with every new lifetime high. His view on Nifty continues to remain bullish.

Accumulate at current levels and look for a potential breakout of close to 23,000 with the support for the index at 22,300–22,500, according to Goel.

The benchmark equity indices continued their record run for the second consecutive session on Tuesday and traded near lifetime highs through the midday as ICICI Bank Ltd. contributed the most to the gains. As of 12:55 p.m., the NSE Nifty 50 was trading 28.30 points or 0.1% higher at 22,694.40 and the S&P BSE Sensex was trading 130.52 points or 0.2% up at 74,873.02.

During the day, the Nifty rose as much as 0.45% to an all-time high of 22,768.40 points and the Sensex jumped 0.51% to 75,124.28.

It is a buy-on-dip market, according to Amit Goel, founder of Amit Ventures. He advises investors to be cautious with every new lifetime high. His view on Nifty continues to remain bullish.

Accumulate at current levels and look for a potential breakout of close to 23,000 with the support for the index at 22,300–22,500, according to Goel.

The benchmark equity indices continued their record run for the second consecutive session on Tuesday and traded near lifetime highs through the midday as ICICI Bank Ltd. contributed the most to the gains. As of 12:55 p.m., the NSE Nifty 50 was trading 28.30 points or 0.1% higher at 22,694.40 and the S&P BSE Sensex was trading 130.52 points or 0.2% up at 74,873.02.

During the day, the Nifty rose as much as 0.45% to an all-time high of 22,768.40 points and the Sensex jumped 0.51% to 75,124.28.

It is a buy-on-dip market, according to Amit Goel, founder of Amit Ventures. He advises investors to be cautious with every new lifetime high. His view on Nifty continues to remain bullish.

Accumulate at current levels and look for a potential breakout of close to 23,000 with the support for the index at 22,300–22,500, according to Goel.

The benchmark equity indices continued their record run for the second consecutive session on Tuesday and traded near lifetime highs through the midday as ICICI Bank Ltd. contributed the most to the gains. As of 12:55 p.m., the NSE Nifty 50 was trading 28.30 points or 0.1% higher at 22,694.40 and the S&P BSE Sensex was trading 130.52 points or 0.2% up at 74,873.02.

During the day, the Nifty rose as much as 0.45% to an all-time high of 22,768.40 points and the Sensex jumped 0.51% to 75,124.28.

It is a buy-on-dip market, according to Amit Goel, founder of Amit Ventures. He advises investors to be cautious with every new lifetime high. His view on Nifty continues to remain bullish.

Accumulate at current levels and look for a potential breakout of close to 23,000 with the support for the index at 22,300–22,500, according to Goel.

Shares of ICICI Bank Ltd., Infosys Ltd., Tata Steel Ltd., Axis Bank Ltd. and Hindalco Industries Ltd. contributed the most to the gains in the Nifty 50

Asian Paints Ltd., Titan Co., NTPC Ltd., Coal India Ltd. and Reliance Industries Ltd. minimised the gains the most.

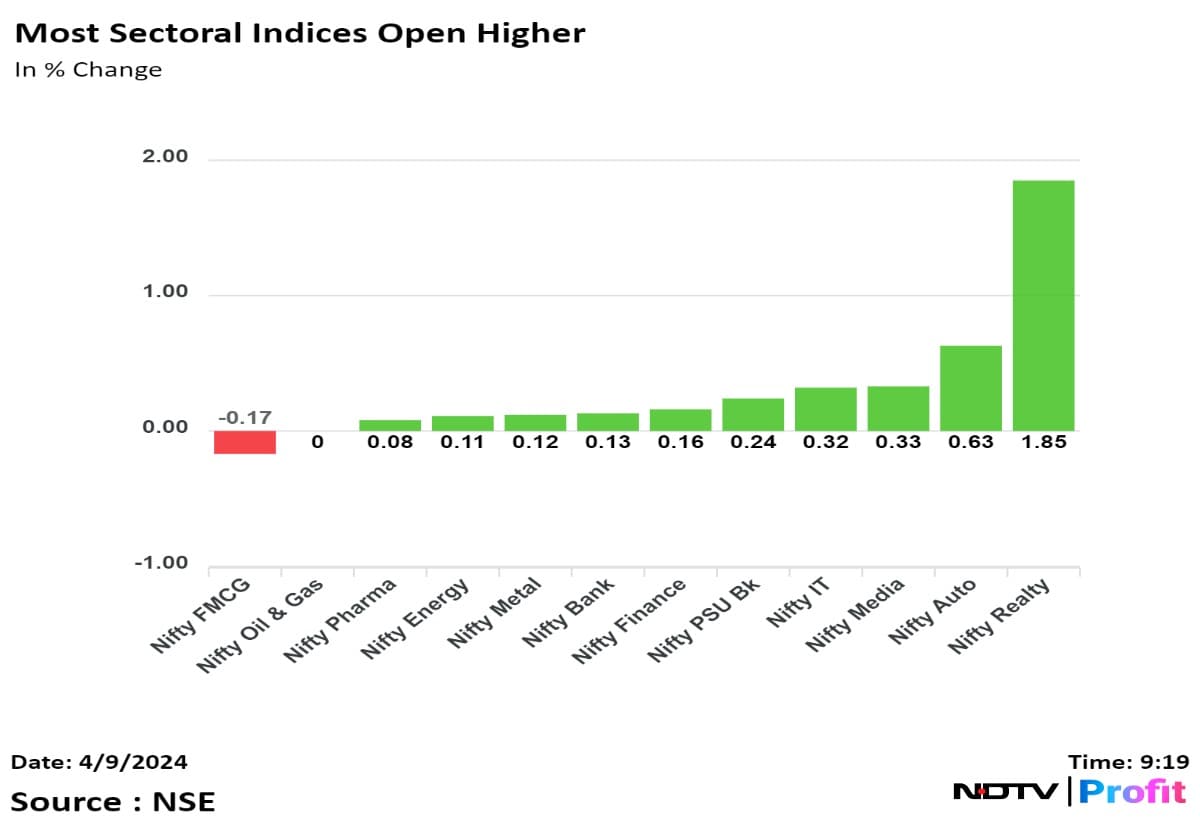

Sectoral indices on the NSE were mixed, with the Nifty Metal gaining the most by over 2%.

The benchmark equity indices continued their record run for the second consecutive session on Tuesday and traded near lifetime highs through the midday as ICICI Bank Ltd. contributed the most to the gains. As of 12:55 p.m., the NSE Nifty 50 was trading 28.30 points or 0.1% higher at 22,694.40 and the S&P BSE Sensex was trading 130.52 points or 0.2% up at 74,873.02.

During the day, the Nifty rose as much as 0.45% to an all-time high of 22,768.40 points and the Sensex jumped 0.51% to 75,124.28.

It is a buy-on-dip market, according to Amit Goel, founder of Amit Ventures. He advises investors to be cautious with every new lifetime high. His view on Nifty continues to remain bullish.

Accumulate at current levels and look for a potential breakout of close to 23,000 with the support for the index at 22,300–22,500, according to Goel.

The benchmark equity indices continued their record run for the second consecutive session on Tuesday and traded near lifetime highs through the midday as ICICI Bank Ltd. contributed the most to the gains. As of 12:55 p.m., the NSE Nifty 50 was trading 28.30 points or 0.1% higher at 22,694.40 and the S&P BSE Sensex was trading 130.52 points or 0.2% up at 74,873.02.

During the day, the Nifty rose as much as 0.45% to an all-time high of 22,768.40 points and the Sensex jumped 0.51% to 75,124.28.

It is a buy-on-dip market, according to Amit Goel, founder of Amit Ventures. He advises investors to be cautious with every new lifetime high. His view on Nifty continues to remain bullish.

Accumulate at current levels and look for a potential breakout of close to 23,000 with the support for the index at 22,300–22,500, according to Goel.

The benchmark equity indices continued their record run for the second consecutive session on Tuesday and traded near lifetime highs through the midday as ICICI Bank Ltd. contributed the most to the gains. As of 12:55 p.m., the NSE Nifty 50 was trading 28.30 points or 0.1% higher at 22,694.40 and the S&P BSE Sensex was trading 130.52 points or 0.2% up at 74,873.02.

During the day, the Nifty rose as much as 0.45% to an all-time high of 22,768.40 points and the Sensex jumped 0.51% to 75,124.28.

It is a buy-on-dip market, according to Amit Goel, founder of Amit Ventures. He advises investors to be cautious with every new lifetime high. His view on Nifty continues to remain bullish.

Accumulate at current levels and look for a potential breakout of close to 23,000 with the support for the index at 22,300–22,500, according to Goel.

The benchmark equity indices continued their record run for the second consecutive session on Tuesday and traded near lifetime highs through the midday as ICICI Bank Ltd. contributed the most to the gains. As of 12:55 p.m., the NSE Nifty 50 was trading 28.30 points or 0.1% higher at 22,694.40 and the S&P BSE Sensex was trading 130.52 points or 0.2% up at 74,873.02.

During the day, the Nifty rose as much as 0.45% to an all-time high of 22,768.40 points and the Sensex jumped 0.51% to 75,124.28.

It is a buy-on-dip market, according to Amit Goel, founder of Amit Ventures. He advises investors to be cautious with every new lifetime high. His view on Nifty continues to remain bullish.

Accumulate at current levels and look for a potential breakout of close to 23,000 with the support for the index at 22,300–22,500, according to Goel.

The benchmark equity indices continued their record run for the second consecutive session on Tuesday and traded near lifetime highs through the midday as ICICI Bank Ltd. contributed the most to the gains. As of 12:55 p.m., the NSE Nifty 50 was trading 28.30 points or 0.1% higher at 22,694.40 and the S&P BSE Sensex was trading 130.52 points or 0.2% up at 74,873.02.

During the day, the Nifty rose as much as 0.45% to an all-time high of 22,768.40 points and the Sensex jumped 0.51% to 75,124.28.

It is a buy-on-dip market, according to Amit Goel, founder of Amit Ventures. He advises investors to be cautious with every new lifetime high. His view on Nifty continues to remain bullish.

Accumulate at current levels and look for a potential breakout of close to 23,000 with the support for the index at 22,300–22,500, according to Goel.

The benchmark equity indices continued their record run for the second consecutive session on Tuesday and traded near lifetime highs through the midday as ICICI Bank Ltd. contributed the most to the gains. As of 12:55 p.m., the NSE Nifty 50 was trading 28.30 points or 0.1% higher at 22,694.40 and the S&P BSE Sensex was trading 130.52 points or 0.2% up at 74,873.02.

During the day, the Nifty rose as much as 0.45% to an all-time high of 22,768.40 points and the Sensex jumped 0.51% to 75,124.28.

It is a buy-on-dip market, according to Amit Goel, founder of Amit Ventures. He advises investors to be cautious with every new lifetime high. His view on Nifty continues to remain bullish.

Accumulate at current levels and look for a potential breakout of close to 23,000 with the support for the index at 22,300–22,500, according to Goel.

The benchmark equity indices continued their record run for the second consecutive session on Tuesday and traded near lifetime highs through the midday as ICICI Bank Ltd. contributed the most to the gains. As of 12:55 p.m., the NSE Nifty 50 was trading 28.30 points or 0.1% higher at 22,694.40 and the S&P BSE Sensex was trading 130.52 points or 0.2% up at 74,873.02.

During the day, the Nifty rose as much as 0.45% to an all-time high of 22,768.40 points and the Sensex jumped 0.51% to 75,124.28.

It is a buy-on-dip market, according to Amit Goel, founder of Amit Ventures. He advises investors to be cautious with every new lifetime high. His view on Nifty continues to remain bullish.

Accumulate at current levels and look for a potential breakout of close to 23,000 with the support for the index at 22,300–22,500, according to Goel.

The benchmark equity indices continued their record run for the second consecutive session on Tuesday and traded near lifetime highs through the midday as ICICI Bank Ltd. contributed the most to the gains. As of 12:55 p.m., the NSE Nifty 50 was trading 28.30 points or 0.1% higher at 22,694.40 and the S&P BSE Sensex was trading 130.52 points or 0.2% up at 74,873.02.

During the day, the Nifty rose as much as 0.45% to an all-time high of 22,768.40 points and the Sensex jumped 0.51% to 75,124.28.

It is a buy-on-dip market, according to Amit Goel, founder of Amit Ventures. He advises investors to be cautious with every new lifetime high. His view on Nifty continues to remain bullish.

Accumulate at current levels and look for a potential breakout of close to 23,000 with the support for the index at 22,300–22,500, according to Goel.

Shares of ICICI Bank Ltd., Infosys Ltd., Tata Steel Ltd., Axis Bank Ltd. and Hindalco Industries Ltd. contributed the most to the gains in the Nifty 50

Asian Paints Ltd., Titan Co., NTPC Ltd., Coal India Ltd. and Reliance Industries Ltd. minimised the gains the most.

The benchmark equity indices continued their record run for the second consecutive session on Tuesday and traded near lifetime highs through the midday as ICICI Bank Ltd. contributed the most to the gains. As of 12:55 p.m., the NSE Nifty 50 was trading 28.30 points or 0.1% higher at 22,694.40 and the S&P BSE Sensex was trading 130.52 points or 0.2% up at 74,873.02.

During the day, the Nifty rose as much as 0.45% to an all-time high of 22,768.40 points and the Sensex jumped 0.51% to 75,124.28.

It is a buy-on-dip market, according to Amit Goel, founder of Amit Ventures. He advises investors to be cautious with every new lifetime high. His view on Nifty continues to remain bullish.

Accumulate at current levels and look for a potential breakout of close to 23,000 with the support for the index at 22,300–22,500, according to Goel.

The benchmark equity indices continued their record run for the second consecutive session on Tuesday and traded near lifetime highs through the midday as ICICI Bank Ltd. contributed the most to the gains. As of 12:55 p.m., the NSE Nifty 50 was trading 28.30 points or 0.1% higher at 22,694.40 and the S&P BSE Sensex was trading 130.52 points or 0.2% up at 74,873.02.

During the day, the Nifty rose as much as 0.45% to an all-time high of 22,768.40 points and the Sensex jumped 0.51% to 75,124.28.

It is a buy-on-dip market, according to Amit Goel, founder of Amit Ventures. He advises investors to be cautious with every new lifetime high. His view on Nifty continues to remain bullish.

Accumulate at current levels and look for a potential breakout of close to 23,000 with the support for the index at 22,300–22,500, according to Goel.

The benchmark equity indices continued their record run for the second consecutive session on Tuesday and traded near lifetime highs through the midday as ICICI Bank Ltd. contributed the most to the gains. As of 12:55 p.m., the NSE Nifty 50 was trading 28.30 points or 0.1% higher at 22,694.40 and the S&P BSE Sensex was trading 130.52 points or 0.2% up at 74,873.02.

During the day, the Nifty rose as much as 0.45% to an all-time high of 22,768.40 points and the Sensex jumped 0.51% to 75,124.28.

It is a buy-on-dip market, according to Amit Goel, founder of Amit Ventures. He advises investors to be cautious with every new lifetime high. His view on Nifty continues to remain bullish.

Accumulate at current levels and look for a potential breakout of close to 23,000 with the support for the index at 22,300–22,500, according to Goel.

The benchmark equity indices continued their record run for the second consecutive session on Tuesday and traded near lifetime highs through the midday as ICICI Bank Ltd. contributed the most to the gains. As of 12:55 p.m., the NSE Nifty 50 was trading 28.30 points or 0.1% higher at 22,694.40 and the S&P BSE Sensex was trading 130.52 points or 0.2% up at 74,873.02.

During the day, the Nifty rose as much as 0.45% to an all-time high of 22,768.40 points and the Sensex jumped 0.51% to 75,124.28.

It is a buy-on-dip market, according to Amit Goel, founder of Amit Ventures. He advises investors to be cautious with every new lifetime high. His view on Nifty continues to remain bullish.

Accumulate at current levels and look for a potential breakout of close to 23,000 with the support for the index at 22,300–22,500, according to Goel.

The benchmark equity indices continued their record run for the second consecutive session on Tuesday and traded near lifetime highs through the midday as ICICI Bank Ltd. contributed the most to the gains. As of 12:55 p.m., the NSE Nifty 50 was trading 28.30 points or 0.1% higher at 22,694.40 and the S&P BSE Sensex was trading 130.52 points or 0.2% up at 74,873.02.

During the day, the Nifty rose as much as 0.45% to an all-time high of 22,768.40 points and the Sensex jumped 0.51% to 75,124.28.

It is a buy-on-dip market, according to Amit Goel, founder of Amit Ventures. He advises investors to be cautious with every new lifetime high. His view on Nifty continues to remain bullish.

Accumulate at current levels and look for a potential breakout of close to 23,000 with the support for the index at 22,300–22,500, according to Goel.

The benchmark equity indices continued their record run for the second consecutive session on Tuesday and traded near lifetime highs through the midday as ICICI Bank Ltd. contributed the most to the gains. As of 12:55 p.m., the NSE Nifty 50 was trading 28.30 points or 0.1% higher at 22,694.40 and the S&P BSE Sensex was trading 130.52 points or 0.2% up at 74,873.02.

During the day, the Nifty rose as much as 0.45% to an all-time high of 22,768.40 points and the Sensex jumped 0.51% to 75,124.28.

It is a buy-on-dip market, according to Amit Goel, founder of Amit Ventures. He advises investors to be cautious with every new lifetime high. His view on Nifty continues to remain bullish.

Accumulate at current levels and look for a potential breakout of close to 23,000 with the support for the index at 22,300–22,500, according to Goel.

The benchmark equity indices continued their record run for the second consecutive session on Tuesday and traded near lifetime highs through the midday as ICICI Bank Ltd. contributed the most to the gains. As of 12:55 p.m., the NSE Nifty 50 was trading 28.30 points or 0.1% higher at 22,694.40 and the S&P BSE Sensex was trading 130.52 points or 0.2% up at 74,873.02.

During the day, the Nifty rose as much as 0.45% to an all-time high of 22,768.40 points and the Sensex jumped 0.51% to 75,124.28.

It is a buy-on-dip market, according to Amit Goel, founder of Amit Ventures. He advises investors to be cautious with every new lifetime high. His view on Nifty continues to remain bullish.

Accumulate at current levels and look for a potential breakout of close to 23,000 with the support for the index at 22,300–22,500, according to Goel.

The benchmark equity indices continued their record run for the second consecutive session on Tuesday and traded near lifetime highs through the midday as ICICI Bank Ltd. contributed the most to the gains. As of 12:55 p.m., the NSE Nifty 50 was trading 28.30 points or 0.1% higher at 22,694.40 and the S&P BSE Sensex was trading 130.52 points or 0.2% up at 74,873.02.

During the day, the Nifty rose as much as 0.45% to an all-time high of 22,768.40 points and the Sensex jumped 0.51% to 75,124.28.

It is a buy-on-dip market, according to Amit Goel, founder of Amit Ventures. He advises investors to be cautious with every new lifetime high. His view on Nifty continues to remain bullish.

Accumulate at current levels and look for a potential breakout of close to 23,000 with the support for the index at 22,300–22,500, according to Goel.

Shares of ICICI Bank Ltd., Infosys Ltd., Tata Steel Ltd., Axis Bank Ltd. and Hindalco Industries Ltd. contributed the most to the gains in the Nifty 50

Asian Paints Ltd., Titan Co., NTPC Ltd., Coal India Ltd. and Reliance Industries Ltd. minimised the gains the most.

Sectoral indices on the NSE were mixed, with the Nifty Metal gaining the most by over 2%.

The broader markets were also mixed as the BSE MidCap was 0.12% higher and the SmallCap rose 0.36%.

On the BSE, 15 sectors advanced and five declined, with Metal rising the most.

The market breadth was skewed in favour of the buyers as 1,959 stocks advanced, 1,665 declined and 144 remained unchanged on the BSE.

Catch all the live stock market updates here.

Shares of Puravankara Ltd. rose as much as 15.66% to Rs 284.40, the highest level since May 9, 2008 after its announced it has acquired 51% at Rs 4.1 lakh stakes in its wholly owned subsidiary.

Purvankara has bought 4,100 equity shares at Rs 100 each through a private placement by the PPL Khondapur. After this, PPL Khondapur will now be step-down subsidiary.

The scrip gained 269.42% in 12 months, while it rose 50.43% on year-to-date basis. Total traded volume so far in the day stood at 9.6 times its 30-day average. The relative strength index was at 71.49, which implied the stock is overbought.

Two analysts tracking the company maintains a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 61.4%.

Shares of Puravankara Ltd. rose as much as 15.66% to Rs 284.40, the highest level since May 9, 2008 after its announced it has acquired 51% at Rs 4.1 lakh stakes in its wholly owned subsidiary.

Purvankara has bought 4,100 equity shares at Rs 100 each through a private placement by the PPL Khondapur. After this, PPL Khondapur will now be step-down subsidiary.

The scrip gained 269.42% in 12 months, while it rose 50.43% on year-to-date basis. Total traded volume so far in the day stood at 9.6 times its 30-day average. The relative strength index was at 71.49, which implied the stock is overbought.

Two analysts tracking the company maintains a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 61.4%.

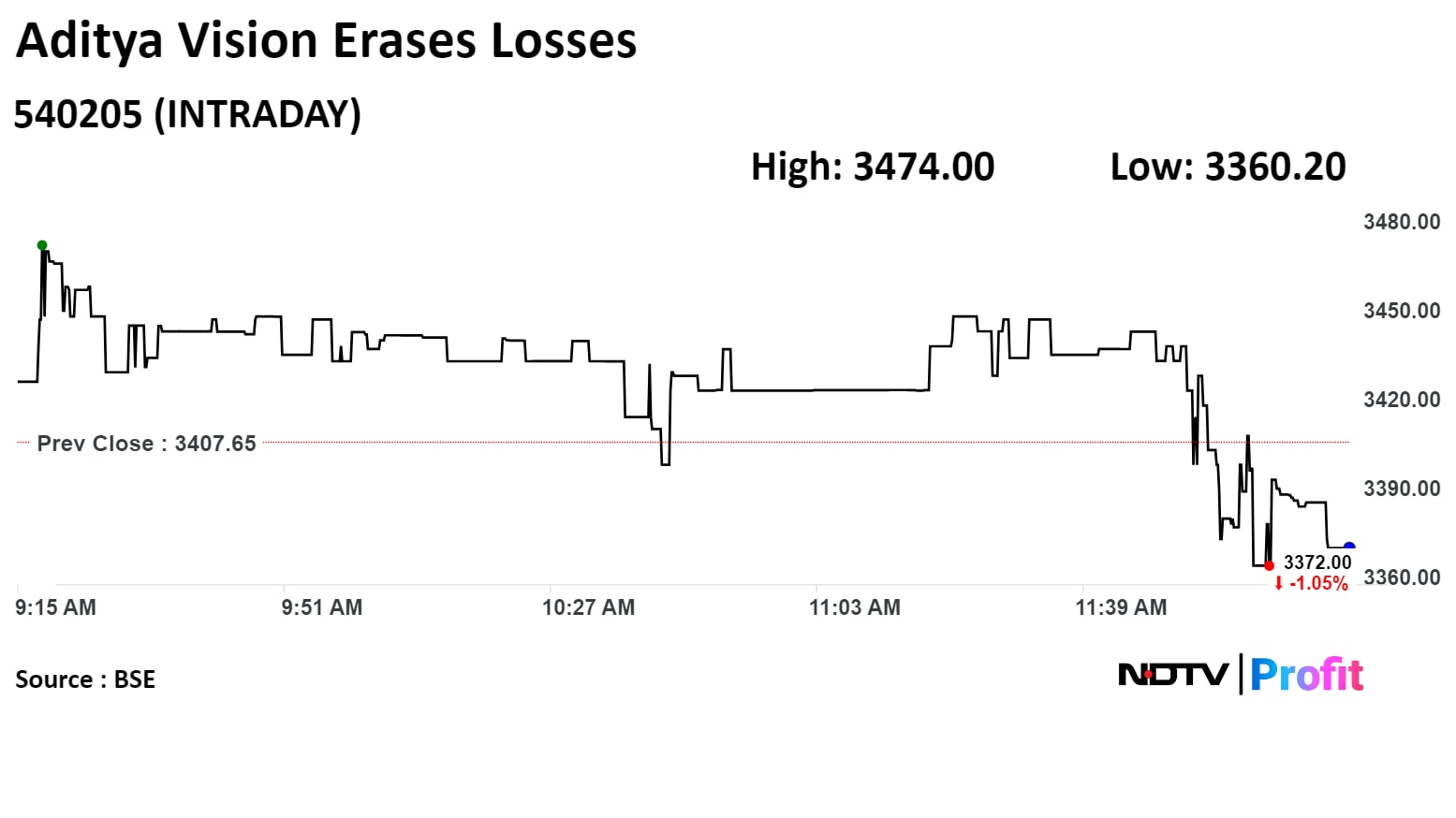

State GST Department conducted searches at all Aditya Vision Ltd.'s showrooms and warehouses in Uttar Pradesh.

The GST Department issued an order of seizure for 7 temporary warehouses & order of prohibition for 3 stores.

Source: Exchange filing

State GST Department conducted searches at all Aditya Vision Ltd.'s showrooms and warehouses in Uttar Pradesh.

The GST Department issued an order of seizure for 7 temporary warehouses & order of prohibition for 3 stores.

Source: Exchange filing

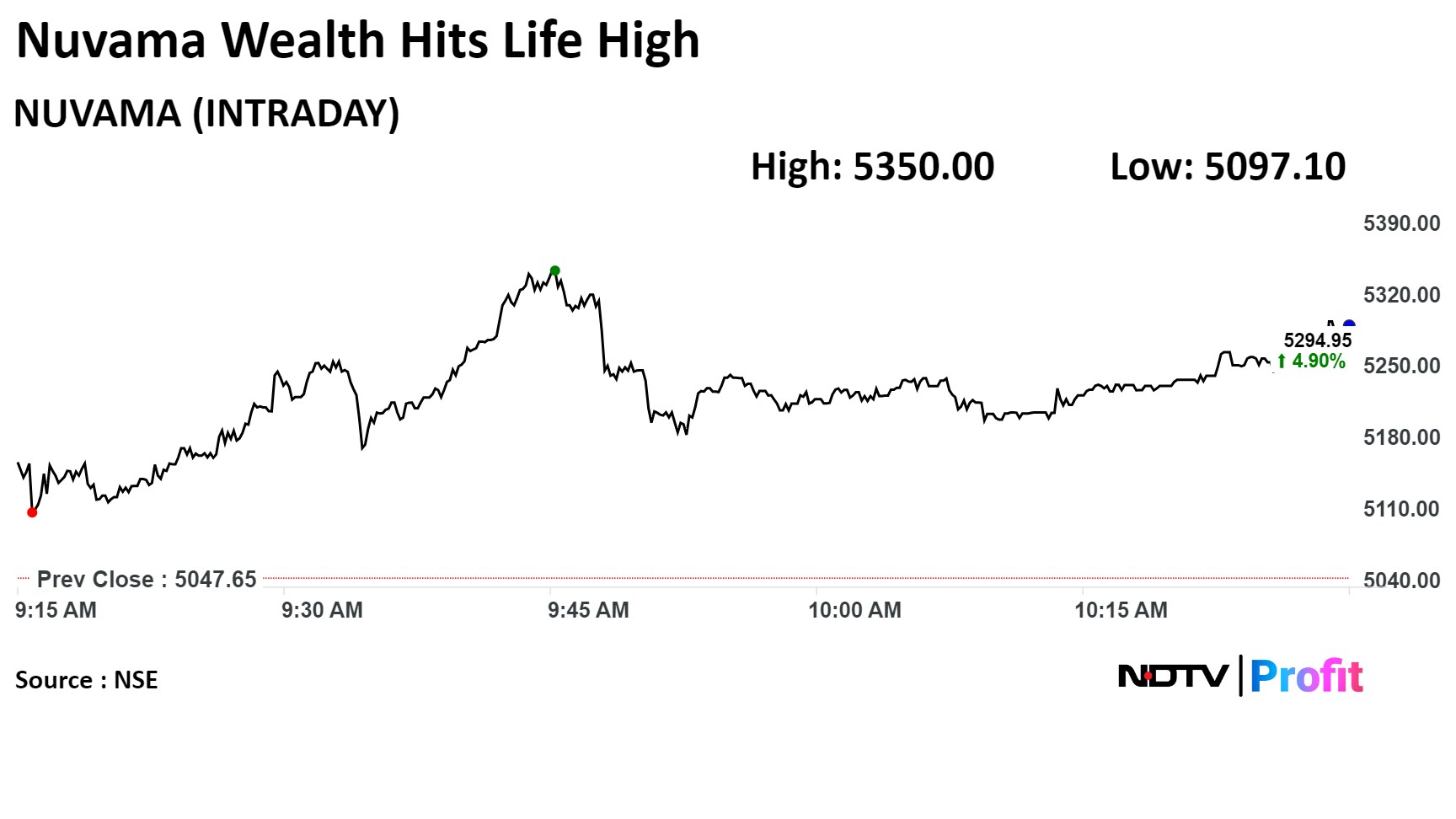

India's leading wealth managers are likely to deliver 20–22% annualised profit growth over FY24–27, given the strong economic growth in the country creating a larger opportunity in financialisation of savings, according to Jefferies. This would ensure strong inflows and operational efficiencies, it said.

The brokerage has initiated coverage on 360 One Wam Ltd. and Nuvama Wealth Management Ltd. with a 'buy' rating.

Shares of Nuvama Wealth Management rose for the sixth consecutive session on Tuesday to hit its lifetime high of Rs 5,350 apiece, while those of 360 One Wam hit their highest since Feb 28 at Rs 748.4 apiece.

India's leading wealth managers are likely to deliver 20–22% annualised profit growth over FY24–27, given the strong economic growth in the country creating a larger opportunity in financialisation of savings, according to Jefferies. This would ensure strong inflows and operational efficiencies, it said.

The brokerage has initiated coverage on 360 One Wam Ltd. and Nuvama Wealth Management Ltd. with a 'buy' rating.

Shares of Nuvama Wealth Management rose for the sixth consecutive session on Tuesday to hit its lifetime high of Rs 5,350 apiece, while those of 360 One Wam hit their highest since Feb 28 at Rs 748.4 apiece.

India's leading wealth managers are likely to deliver 20–22% annualised profit growth over FY24–27, given the strong economic growth in the country creating a larger opportunity in financialisation of savings, according to Jefferies. This would ensure strong inflows and operational efficiencies, it said.

The brokerage has initiated coverage on 360 One Wam Ltd. and Nuvama Wealth Management Ltd. with a 'buy' rating.

Shares of Nuvama Wealth Management rose for the sixth consecutive session on Tuesday to hit its lifetime high of Rs 5,350 apiece, while those of 360 One Wam hit their highest since Feb 28 at Rs 748.4 apiece.

India's leading wealth managers are likely to deliver 20–22% annualised profit growth over FY24–27, given the strong economic growth in the country creating a larger opportunity in financialisation of savings, according to Jefferies. This would ensure strong inflows and operational efficiencies, it said.

The brokerage has initiated coverage on 360 One Wam Ltd. and Nuvama Wealth Management Ltd. with a 'buy' rating.

Shares of Nuvama Wealth Management rose for the sixth consecutive session on Tuesday to hit its lifetime high of Rs 5,350 apiece, while those of 360 One Wam hit their highest since Feb 28 at Rs 748.4 apiece.

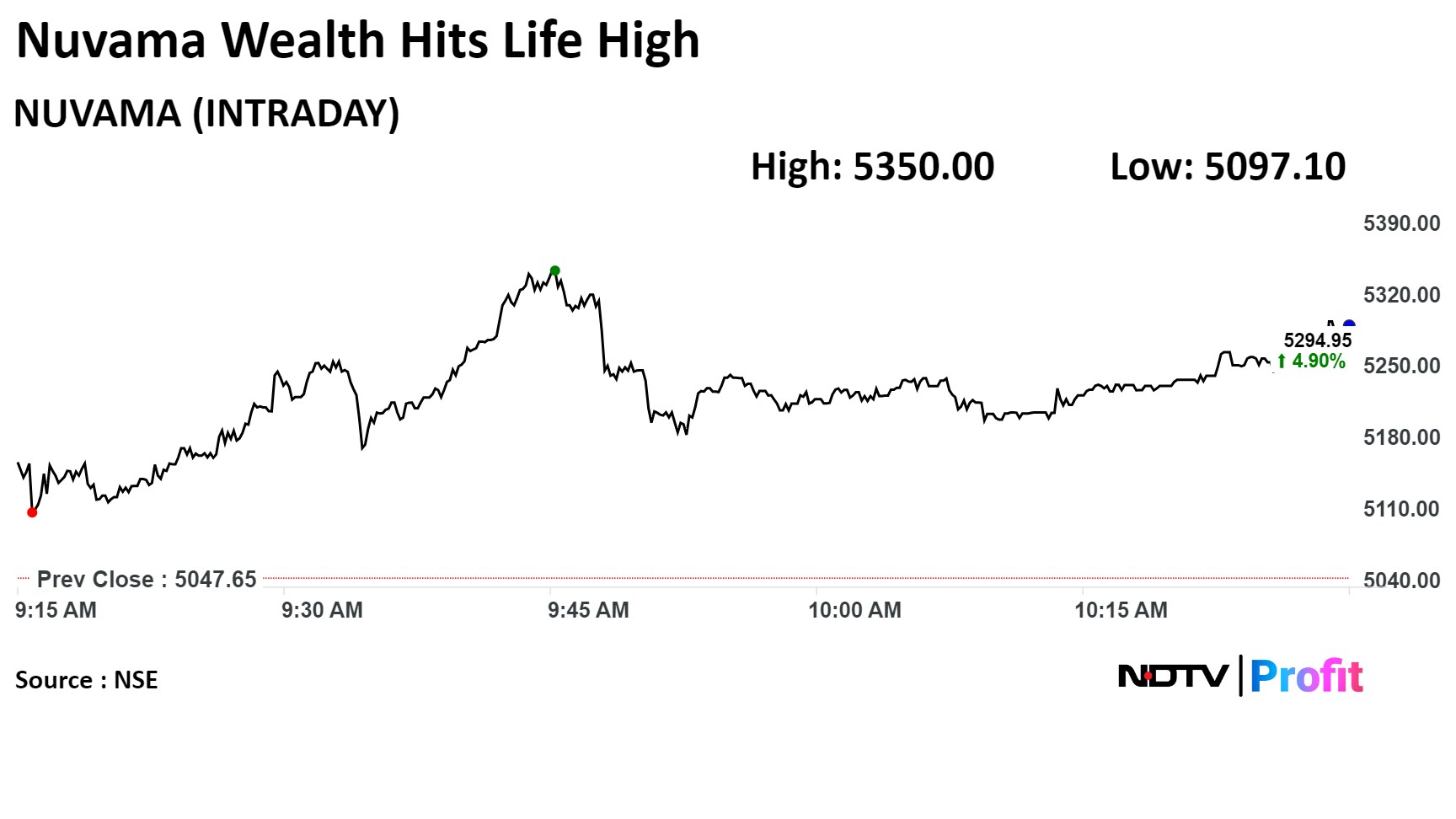

Maruti Suzuki expanded production capacity at Manesar facility by 1 lakh units.

A new assembly line brings additional capacity of 1 lakh units per annum.

Total manufacturing capacity of Manesar facility now stands at 9 lakh units per annum.

Brezza, Ertiga, XL6, Wagon R, Dzire, S-Presso, Ciaz and Celerio are manufactured at Manesar.

Source: Exchange filing

Maruti Suzuki expanded production capacity at Manesar facility by 1 lakh units.

A new assembly line brings additional capacity of 1 lakh units per annum.

Total manufacturing capacity of Manesar facility now stands at 9 lakh units per annum.

Brezza, Ertiga, XL6, Wagon R, Dzire, S-Presso, Ciaz and Celerio are manufactured at Manesar.

Source: Exchange filing

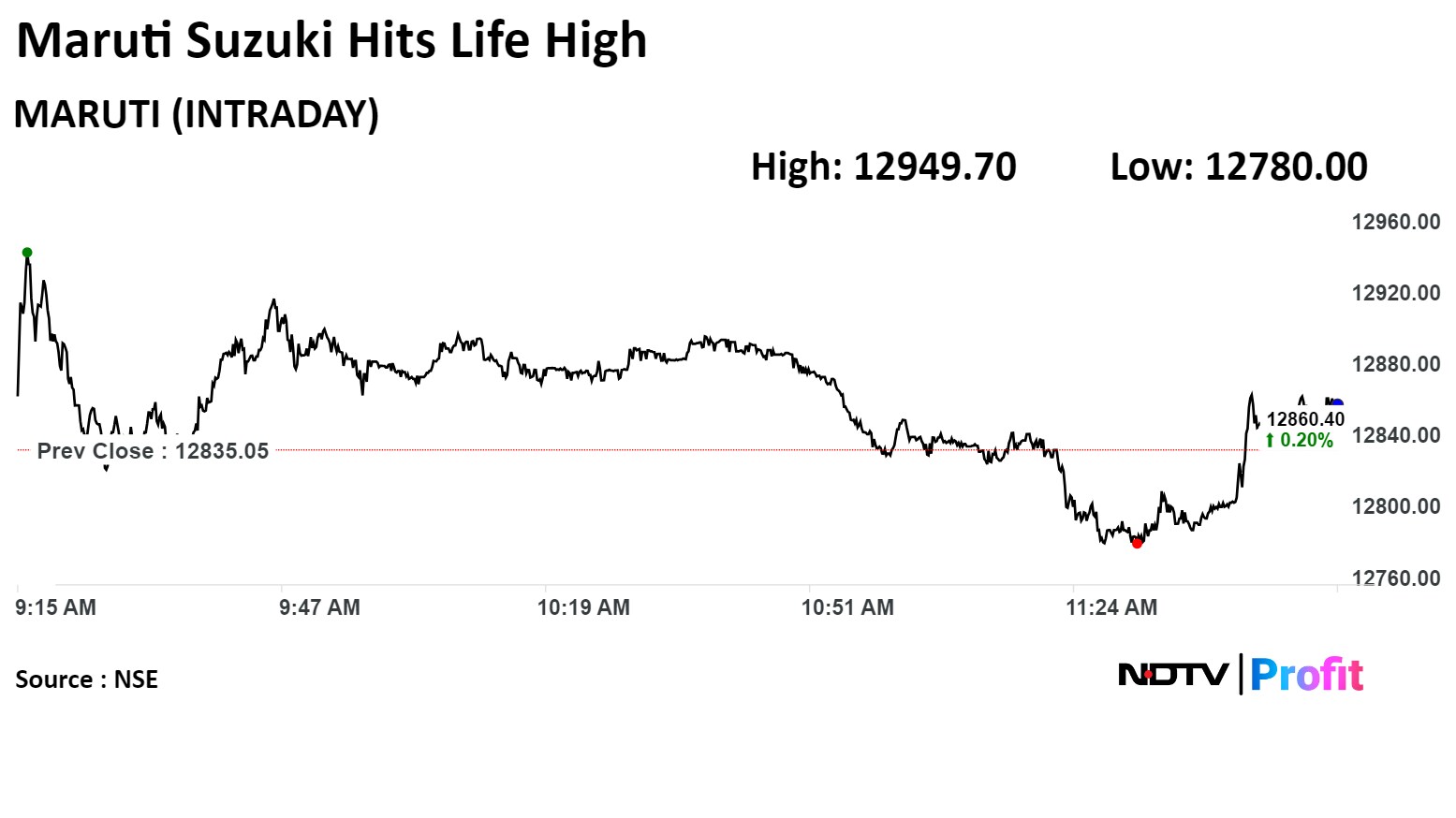

Paisalo Digital Ltd.'s Operations and Finance Committee's board of directors to meet on April 12 to consider and approve allotment of non-convertible debenture through private placement basis, according to an exchange filing.

Paisalo Digital Ltd. rose 7.00% to Rs 86.40 apiece, the highest level since March 12. It was trading 5.39% higher at Rs 85.10 apiece, as of 11:46 a.m. This compares to a 0.34% advance in the NSE Nifty 50 Index.

It has risen 210.02% in 12 months. Total traded volume so far in the day stood at 1.4 times its 30-day average. The relative strength index was at 64.24.

One analyst tracking the company maintained 'Buy' rating on Paisalo Digital Ltd. according to Bloomberg data. The average 12-month consensus price target implies an upside of 2.9%.

Paisalo Digital Ltd.'s Operations and Finance Committee's board of directors to meet on April 12 to consider and approve allotment of non-convertible debenture through private placement basis, according to an exchange filing.

Paisalo Digital Ltd. rose 7.00% to Rs 86.40 apiece, the highest level since March 12. It was trading 5.39% higher at Rs 85.10 apiece, as of 11:46 a.m. This compares to a 0.34% advance in the NSE Nifty 50 Index.

It has risen 210.02% in 12 months. Total traded volume so far in the day stood at 1.4 times its 30-day average. The relative strength index was at 64.24.

One analyst tracking the company maintained 'Buy' rating on Paisalo Digital Ltd. according to Bloomberg data. The average 12-month consensus price target implies an upside of 2.9%.

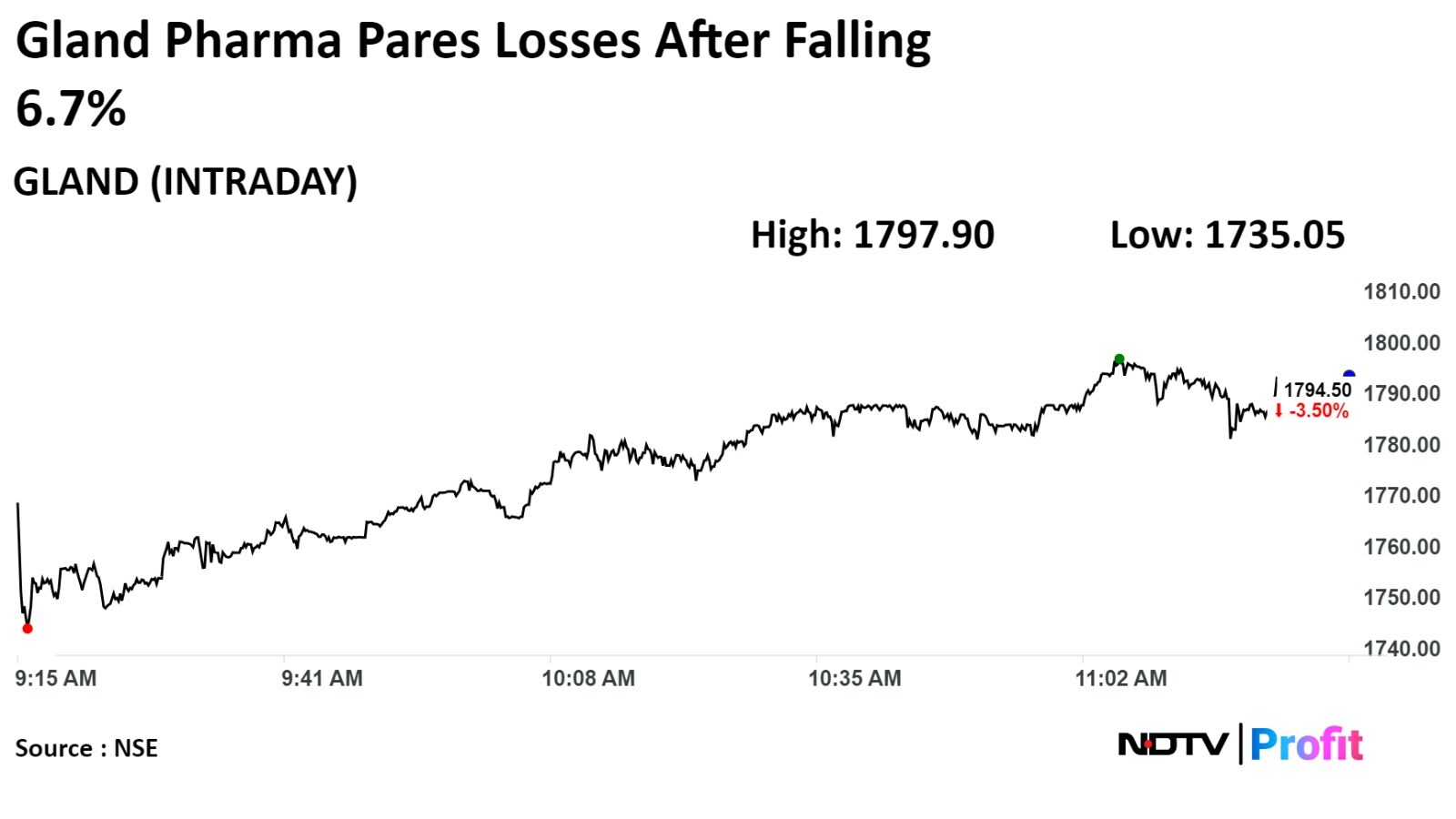

Gland Pharma Ltd. declined as much as 6.7% to Rs 1,735.05, the lowest level since March 21. It pared losses to trade 3.76% lower at Rs 1,789.60 as of 11:38 a.m., as compared to 0.38% advance in the NSE Nifty 50 index.

Gland Pharma Ltd. declined as much as 6.7% to Rs 1,735.05, the lowest level since March 21. It pared losses to trade 3.76% lower at Rs 1,789.60 as of 11:38 a.m., as compared to 0.38% advance in the NSE Nifty 50 index.

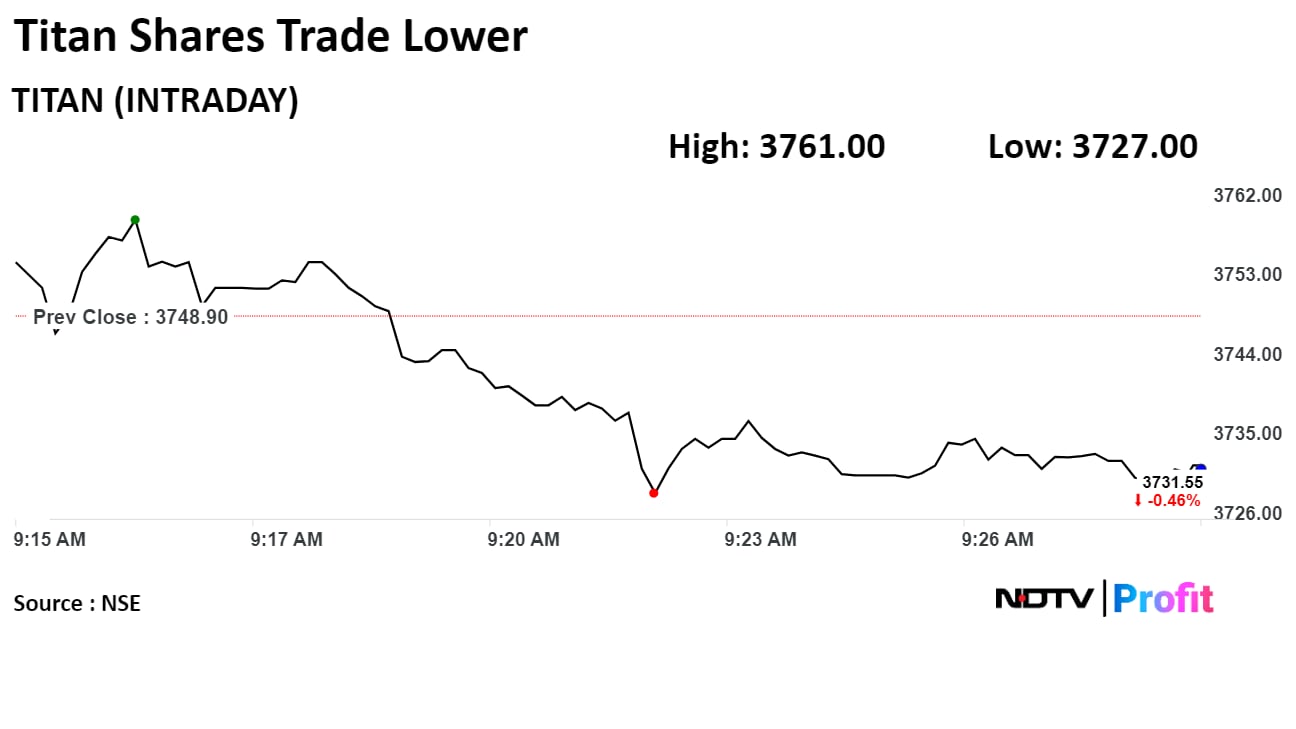

HSBC Global Research has raised the target price of Titan Co. on the back of solid jewellery momentum and aggressive network expansion.

The brokerage also attributed the bullish stance to the large opportunities available with the lab-grown diamonds.

It has reiterated a 'buy' rating with a raised target price of Rs 4,300 from Rs 4,200 apiece earlier, implying a potential upside of 15% from the previous day's close.

Titan's stock fell as much as 0.58% during the day to Rs 3,727 apiece on the NSE. It was trading 0.43% lower at Rs 3,732.65 per share, compared to a 0.16% advance in the benchmark Nifty 50 as of 9:28 a.m.

The share price has risen 44.47% in the last 12 months. The relative strength index was at 53.

Twenty-three out of the 33 analysts tracking the company have a 'buy' rating on the stock, six recommend 'hold' and four suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 3%.

HSBC Global Research has raised the target price of Titan Co. on the back of solid jewellery momentum and aggressive network expansion.

The brokerage also attributed the bullish stance to the large opportunities available with the lab-grown diamonds.

It has reiterated a 'buy' rating with a raised target price of Rs 4,300 from Rs 4,200 apiece earlier, implying a potential upside of 15% from the previous day's close.

Titan's stock fell as much as 0.58% during the day to Rs 3,727 apiece on the NSE. It was trading 0.43% lower at Rs 3,732.65 per share, compared to a 0.16% advance in the benchmark Nifty 50 as of 9:28 a.m.

The share price has risen 44.47% in the last 12 months. The relative strength index was at 53.

Twenty-three out of the 33 analysts tracking the company have a 'buy' rating on the stock, six recommend 'hold' and four suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 3%.

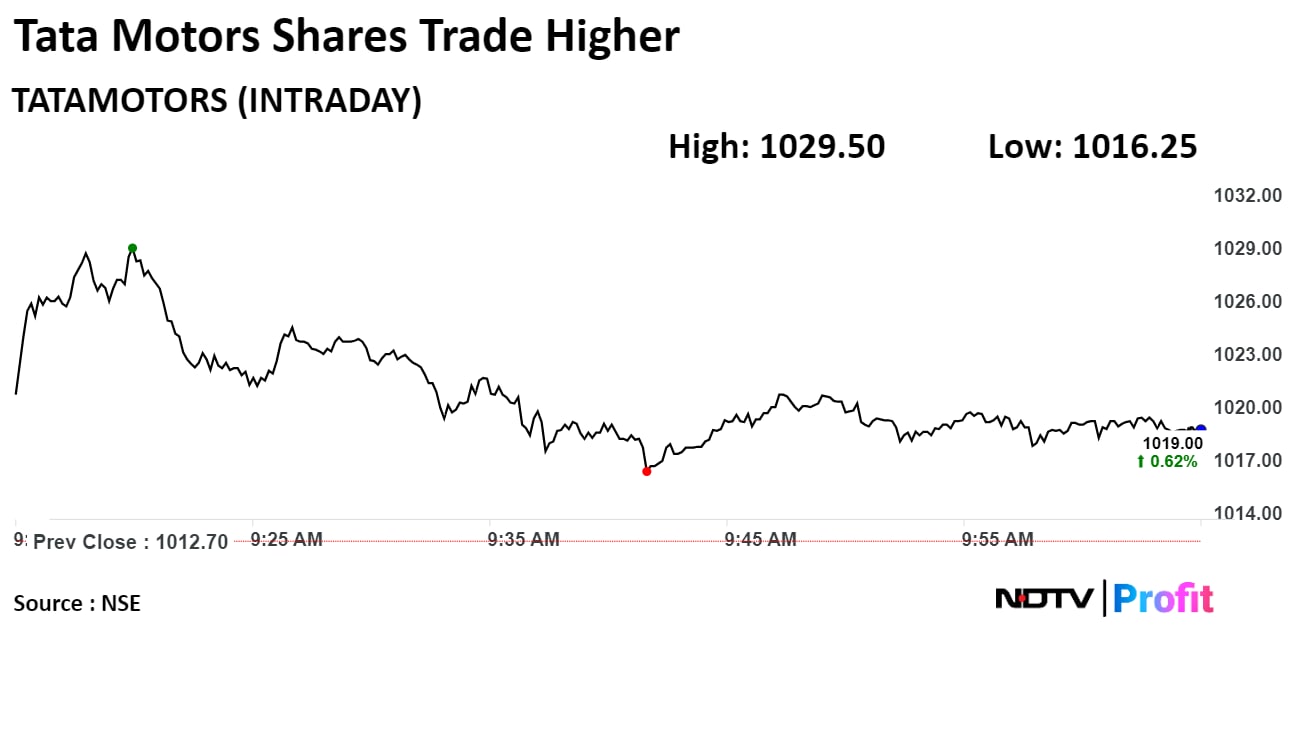

Shares of Tata Motors Ltd. gained on Tuesday after its luxury car unit reported a healthy fourth-quarter business update. The wholesale volume of Jaguar Land Rover Automotive Plc. rose 25% over the year earlier to 4,01,303 units in the fiscal ended March 31, 2024.

The brokerage remains "overweight" on the automaker with a target price of Rs 1,013 apiece, implying a downside of 0.5% from the current market price on BSE.

Shares of Tata Motors rose 1.62% intraday, the highest since March 12. They pared gains to trade 0.64% higher, compared to a 0.32% advance in the benchmark Nifty 50 as of 9:59 a.m.

The stock has risen 121% in the last 12 months. The relative strength index was at 63.

Of the 32 analysts tracking the company, 23 maintain a 'buy' rating on the stock, four recommend a 'hold' and five suggest a 'sell', according to Bloomberg data. The average of 12-month analysts' price targets implies a potential decline of 2.2%.

Shares of Tata Motors Ltd. gained on Tuesday after its luxury car unit reported a healthy fourth-quarter business update. The wholesale volume of Jaguar Land Rover Automotive Plc. rose 25% over the year earlier to 4,01,303 units in the fiscal ended March 31, 2024.

The brokerage remains "overweight" on the automaker with a target price of Rs 1,013 apiece, implying a downside of 0.5% from the current market price on BSE.

Shares of Tata Motors rose 1.62% intraday, the highest since March 12. They pared gains to trade 0.64% higher, compared to a 0.32% advance in the benchmark Nifty 50 as of 9:59 a.m.

The stock has risen 121% in the last 12 months. The relative strength index was at 63.

Of the 32 analysts tracking the company, 23 maintain a 'buy' rating on the stock, four recommend a 'hold' and five suggest a 'sell', according to Bloomberg data. The average of 12-month analysts' price targets implies a potential decline of 2.2%.

Battery major Exide Industries' partnership with Hyundai Motor Co. and Kia Corp. for EV battery localisation in India is viewed as a rerating trigger, according to Morgan Stanley.

The lithium battery business is a high capital-expenditure business with evolving technology and Exide is well placed in this sphere giving confidence about future business viability, it said.

The brokerage has reiterated an 'overweight' rating on the stock, with a target price of Rs 373 apiece, implying a potential upside of 16%.

Battery major Exide Industries' partnership with Hyundai Motor Co. and Kia Corp. for EV battery localisation in India is viewed as a rerating trigger, according to Morgan Stanley.

The lithium battery business is a high capital-expenditure business with evolving technology and Exide is well placed in this sphere giving confidence about future business viability, it said.

The brokerage has reiterated an 'overweight' rating on the stock, with a target price of Rs 373 apiece, implying a potential upside of 16%.

Shares of Exide rose as much as 5.26% during the day on the NSE before paring gains to trade 4.93% higher at 10:20 a.m., compared with a 0.33% advance in the benchmark Nifty.

The stock has risen 116.84% in the last 12 months. Of the 24 analysts tracking the company, 15 have a 'buy' rating on the stock, four recommend 'hold' and five suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 11.8%.

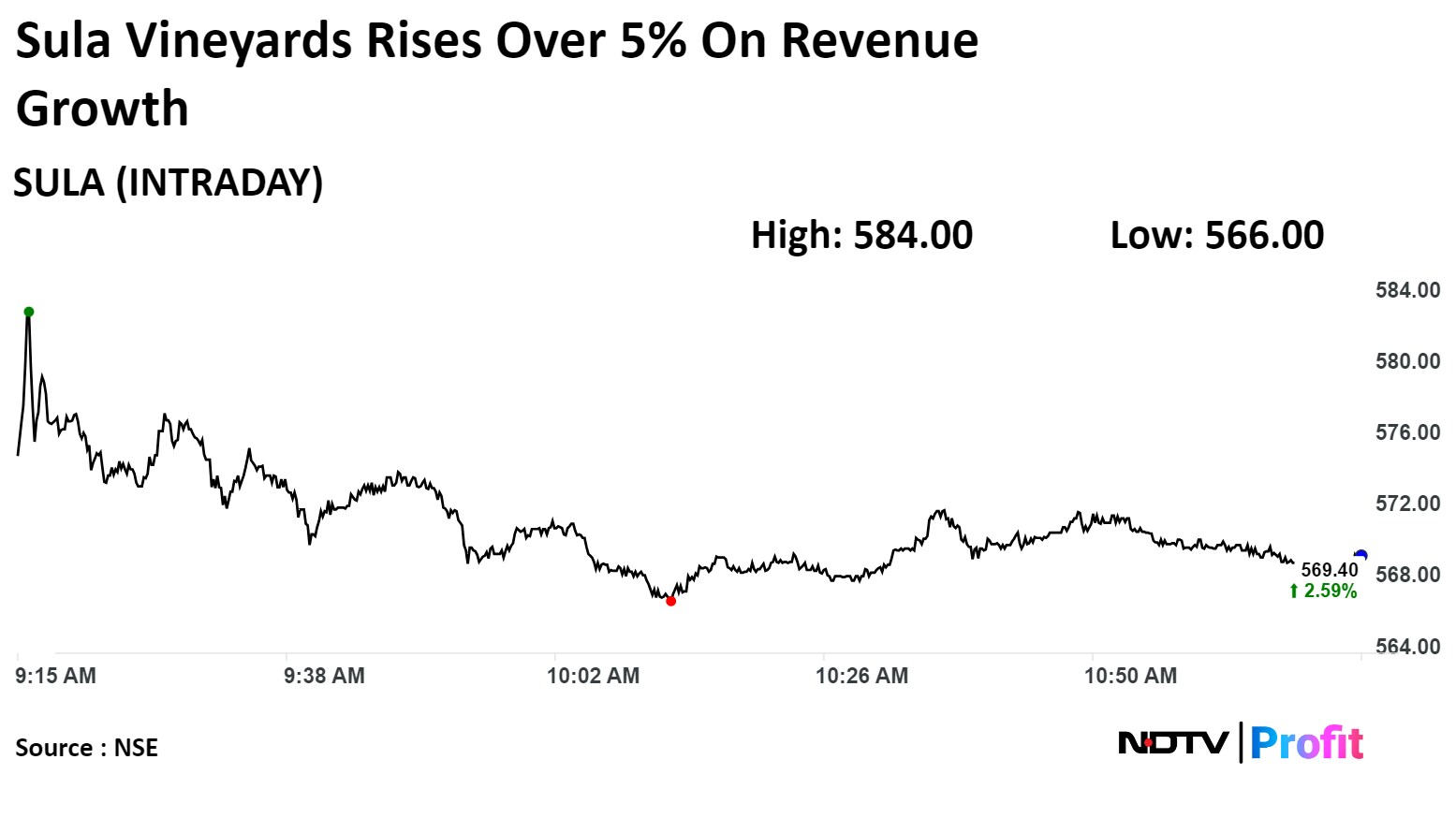

Shares of Sula Vineyards Ltd. rose over 5% after it reported highest ever revenue growth in January-March, lead by sales of its own premium brand sales.

India's largest wine producer's revenue rose 10% year-on-year in quarter four to Rs 131.8 crores. Sales of its own brands were up 9% on the year to Rs 113 crore.

Further, Sula Vineyards Ltd.'s revenue from wine tourism rose 31% to Rs 16.4 crore during fourth quarter, according to an exchange filing.

Shares of Sula Vineyards Ltd. rose over 5% after it reported highest ever revenue growth in January-March, lead by sales of its own premium brand sales.

India's largest wine producer's revenue rose 10% year-on-year in quarter four to Rs 131.8 crores. Sales of its own brands were up 9% on the year to Rs 113 crore.

Further, Sula Vineyards Ltd.'s revenue from wine tourism rose 31% to Rs 16.4 crore during fourth quarter, according to an exchange filing.

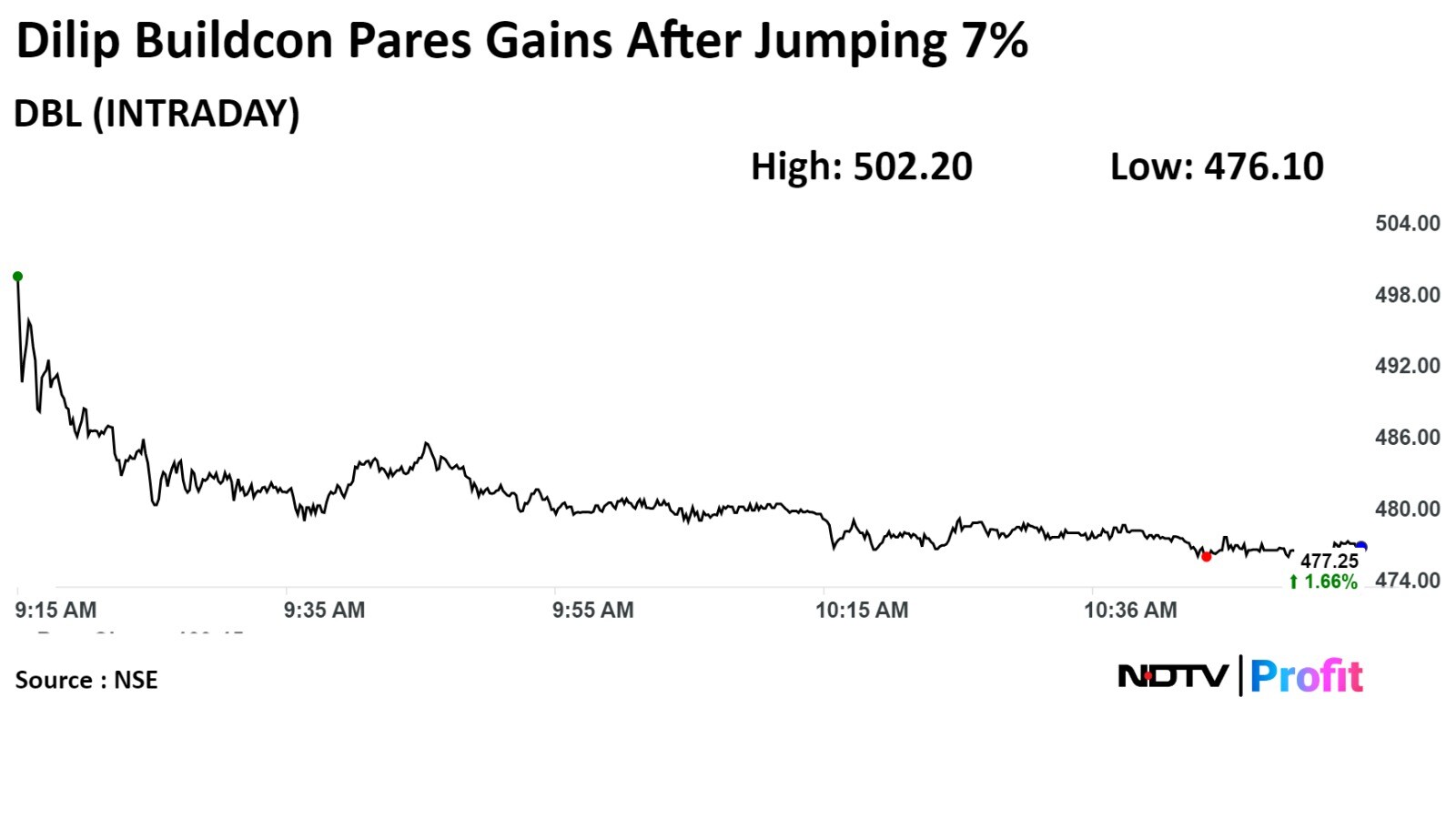

Shares of Dilip Buildcon jumped to hit its highest level in over a month after the company was declared as L-1 bidder for the tender floated by the Haryana Rail Infrastructure Development Corp Ltd. on EPC mode.

Shares of Dilip Buildcon jumped to hit its highest level in over a month after the company was declared as L-1 bidder for the tender floated by the Haryana Rail Infrastructure Development Corp Ltd. on EPC mode.

Yasho Industries Ltd. started production at Dahej Pakhajan plant set up at an approximate cost of Rs 470 crore.

Source: Exchange Filing

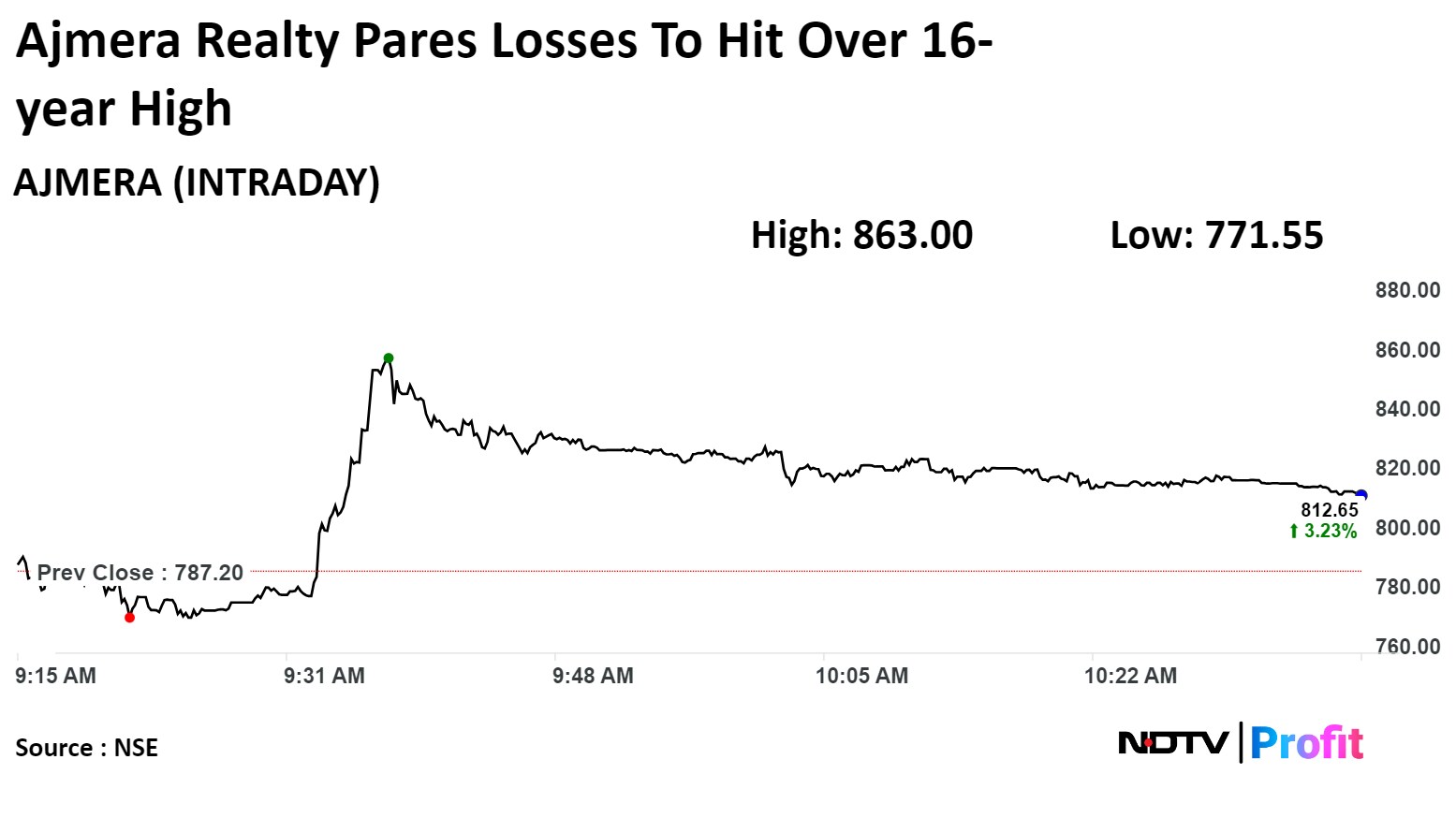

Shares of Ajmera Realty and Infra India Ltd. surged to over 16-year high on NSE after the company reported 104% year-on-year jump in its sales value during quarter four.

The real estate company's sales value in Q4 rose 104% on year to Rs. 287 crore from Rs 140 crore in the corresponding period of previous financial year. Its sales area rose 1,12,931 square feet in January-March, which is 63% annual rise, the exchange filing said.

Ajmera Realty and Infra India's collection rose 91% on year to Rs 197 crore, according to an exchange filing.

The scrip rose as much as 9.63% to Rs 863.00 apiece, the highest level since Feb 27, 2008. It was trading 3.75% higher at Rs 816.70 apiece, as of 10:34 a.m. This compares to a 0.38% advance in the NSE Nifty 50 Index.

It has risen 160.75% in 12 months. Total traded volume so far in the day stood at 8.7 times its 30-day average. The relative strength index was at 68.43.

Shares of Ajmera Realty and Infra India Ltd. surged to over 16-year high on NSE after the company reported 104% year-on-year jump in its sales value during quarter four.

The real estate company's sales value in Q4 rose 104% on year to Rs. 287 crore from Rs 140 crore in the corresponding period of previous financial year. Its sales area rose 1,12,931 square feet in January-March, which is 63% annual rise, the exchange filing said.

Ajmera Realty and Infra India's collection rose 91% on year to Rs 197 crore, according to an exchange filing.

The scrip rose as much as 9.63% to Rs 863.00 apiece, the highest level since Feb 27, 2008. It was trading 3.75% higher at Rs 816.70 apiece, as of 10:34 a.m. This compares to a 0.38% advance in the NSE Nifty 50 Index.

It has risen 160.75% in 12 months. Total traded volume so far in the day stood at 8.7 times its 30-day average. The relative strength index was at 68.43.

Maintains BUY and raises target price to Rs. 4,300, Upside potential of 14.5%.

Titan is to grow its jewellery business by a CAGR of 20% for the next five years.

The company is supported by aggressive network expansion.

Lab grown diamonds may well be a large opportunity for Titan

the brokerage doesn’t see much disruption to Titan with falling diamond prices.

Earnings are potentially set to double over the next four years.

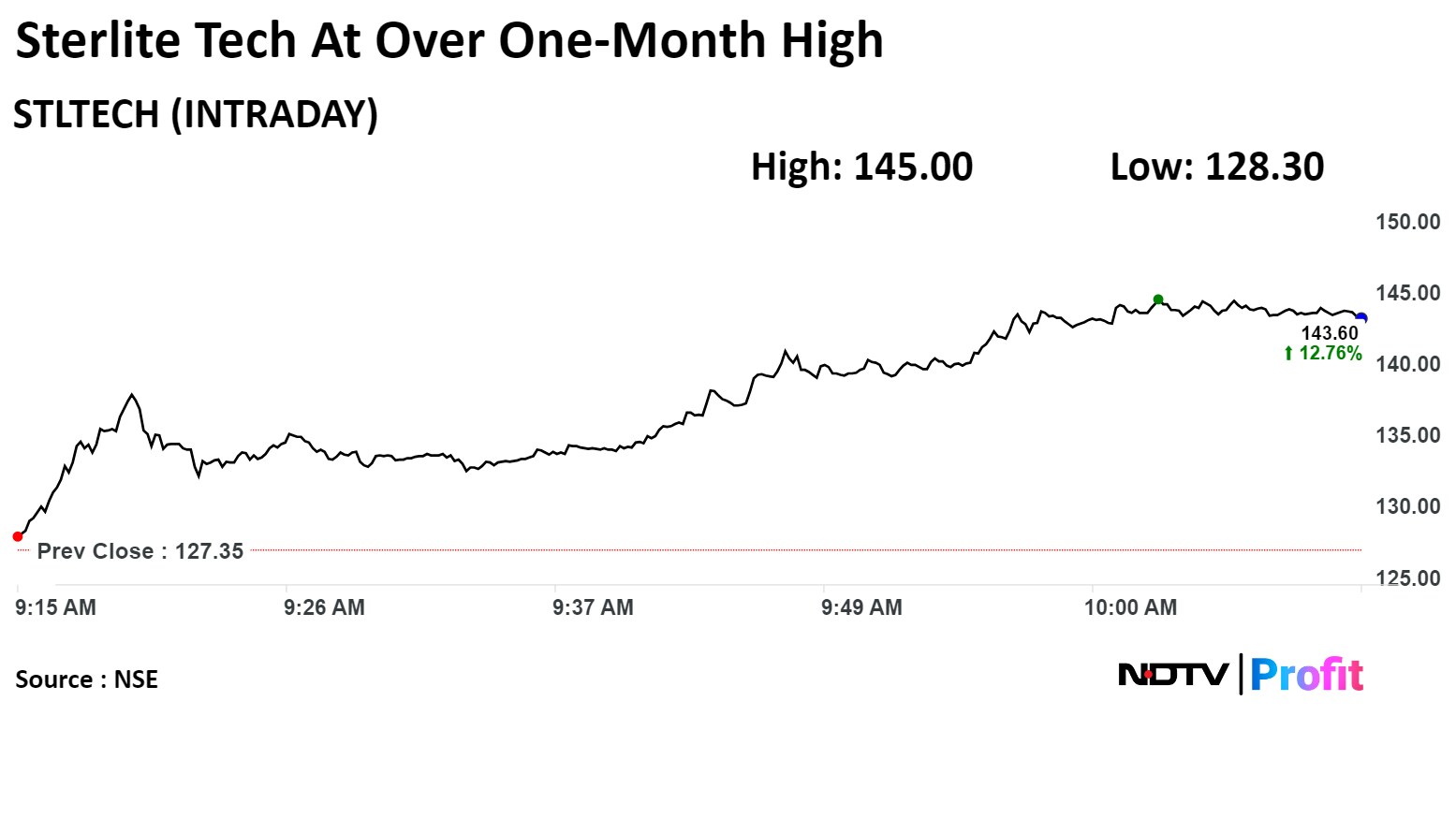

Shares of Sterlite Technlogies Ltd. were trading at over one-month high after it raised funds through qualified institutional placements on Monday.

The company set the floor price for the QIP at Rs 119 per share, which indicates a discount of 6.52% discount to Monday's closing.

The scrip jumped 13.86% to Rs 145.00 apiece, the highest level since Feb 27, 2024. It was trading 13.19% higher at Rs 144.15 apiece, as of 10:10 a.m. This compares to a 0.38% advance in the NSE Nifty 50 Index.

Shares of Sterlite Technlogies Ltd. were trading at over one-month high after it raised funds through qualified institutional placements on Monday.

The company set the floor price for the QIP at Rs 119 per share, which indicates a discount of 6.52% discount to Monday's closing.

The scrip jumped 13.86% to Rs 145.00 apiece, the highest level since Feb 27, 2024. It was trading 13.19% higher at Rs 144.15 apiece, as of 10:10 a.m. This compares to a 0.38% advance in the NSE Nifty 50 Index.

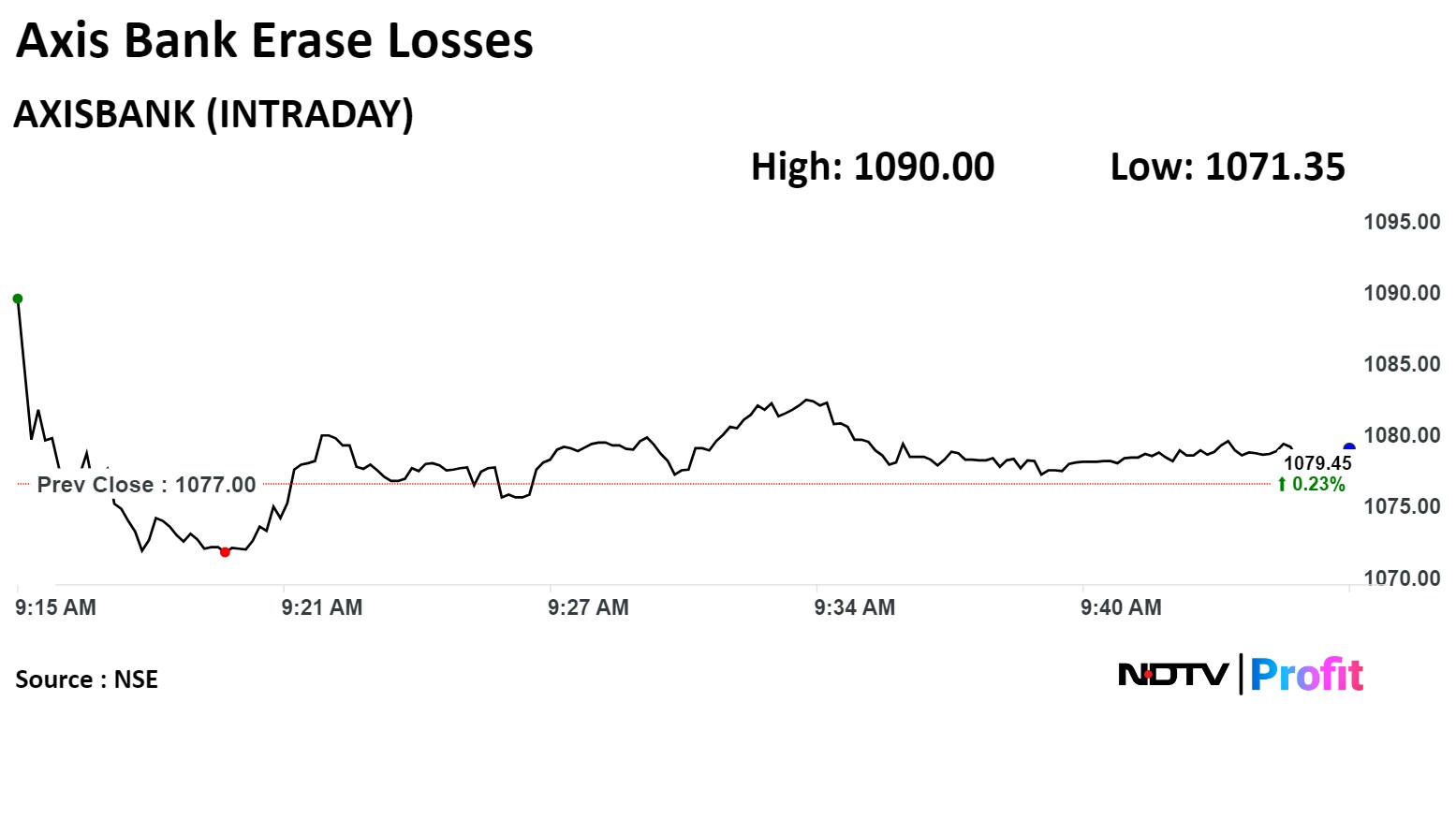

Axis Bank Ltd. erased losses to trade higher after reports said Bain Capital is looking to sell its entire stake in the private lender via block deal worth $430 million.

The private lender's 1.1% equity changed hands in a bunch, according to Bloomberg.

Bain Capital is looking to offload 33.37 million shares in Axis Bank through its various entities, which hold direct stake, according to term sheet viewed by the NDTV Profit.

The floor price is in the range of Rs 1,071-Rs 1,076 per share, which indicates a discount of 0.0%-0.47% compared to Monday's close of Rs 1,076.05 per share.

Shares of Axis Bank Ltd. rose as much as 1.30% to Rs 1,090.00 apiece, the highest level since March 13. It was trading 0.31% higher at Rs 1,079.35 apiece, as of 09:49 a.m. This compares to a 0.32% advance in the NSE Nifty 50 Index.

It has risen 27.38% in 12 months. Total traded volume so far in the day stood at 42 times its 30-day average. The relative strength index was at 55.58.

Out of 48 analysts tracking the company, 45 maintain a 'buy' rating, three recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an upside of 18.6%.

Axis Bank Ltd. erased losses to trade higher after reports said Bain Capital is looking to sell its entire stake in the private lender via block deal worth $430 million.

The private lender's 1.1% equity changed hands in a bunch, according to Bloomberg.

Bain Capital is looking to offload 33.37 million shares in Axis Bank through its various entities, which hold direct stake, according to term sheet viewed by the NDTV Profit.

The floor price is in the range of Rs 1,071-Rs 1,076 per share, which indicates a discount of 0.0%-0.47% compared to Monday's close of Rs 1,076.05 per share.

Shares of Axis Bank Ltd. rose as much as 1.30% to Rs 1,090.00 apiece, the highest level since March 13. It was trading 0.31% higher at Rs 1,079.35 apiece, as of 09:49 a.m. This compares to a 0.32% advance in the NSE Nifty 50 Index.

It has risen 27.38% in 12 months. Total traded volume so far in the day stood at 42 times its 30-day average. The relative strength index was at 55.58.

Out of 48 analysts tracking the company, 45 maintain a 'buy' rating, three recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an upside of 18.6%.

Q4 sales value at Rs 287 crore, up 104%

Q4 collections at Rs 197 crore, up 91%

Source: Exchange filing

NATCO PHARMA

Gets warning letter from US FDA following inspection at Telangana plant

Warning may cause delay/withholding of pending product approvals from site under inspection

Source: Exchange filing

India's benchmark indices extended its record rally on Tuesday and rose to fresh highs in early trade tracking gains in Tata Motors Ltd., Infosys Ltd., and ICICI Bank Ltd.

The BSE Sensex opened at record high level of 75,045.99, and the NSE Nifty 50 index opened at 22,765.10.

As of 09:25 a.m., the NSE Nifty 50 13.45 points or 0.059% higher at 22,679.75, and the BSE Sensex was trading 70.91points or 0.095% higher at 74,813.41.

Asian markets, however, defied the cautious mood in the U.S. and other asset classes and were trading in positive territory this morning, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

Volumes are likely to be muted on account of Gudi Padwa today. Markets will turn focus on the crucial CPI data due on Friday for further hints on rate cut expectations in India. Additionally, stock specific action would take centre stage with the commencement of earnings season, with TCS being the first major to report fourth-quarter earnings on Friday, Bagkar said.

India's benchmark indices extended its record rally on Tuesday and rose to fresh highs in early trade tracking gains in Tata Motors Ltd., Infosys Ltd., and ICICI Bank Ltd.

The BSE Sensex opened at record high level of 75,045.99, and the NSE Nifty 50 index opened at 22,765.10.

As of 09:25 a.m., the NSE Nifty 50 13.45 points or 0.059% higher at 22,679.75, and the BSE Sensex was trading 70.91points or 0.095% higher at 74,813.41.

Asian markets, however, defied the cautious mood in the U.S. and other asset classes and were trading in positive territory this morning, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

Volumes are likely to be muted on account of Gudi Padwa today. Markets will turn focus on the crucial CPI data due on Friday for further hints on rate cut expectations in India. Additionally, stock specific action would take centre stage with the commencement of earnings season, with TCS being the first major to report fourth-quarter earnings on Friday, Bagkar said.

India's benchmark indices extended its record rally on Tuesday and rose to fresh highs in early trade tracking gains in Tata Motors Ltd., Infosys Ltd., and ICICI Bank Ltd.

The BSE Sensex opened at record high level of 75,045.99, and the NSE Nifty 50 index opened at 22,765.10.

As of 09:25 a.m., the NSE Nifty 50 13.45 points or 0.059% higher at 22,679.75, and the BSE Sensex was trading 70.91points or 0.095% higher at 74,813.41.

Asian markets, however, defied the cautious mood in the U.S. and other asset classes and were trading in positive territory this morning, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

Volumes are likely to be muted on account of Gudi Padwa today. Markets will turn focus on the crucial CPI data due on Friday for further hints on rate cut expectations in India. Additionally, stock specific action would take centre stage with the commencement of earnings season, with TCS being the first major to report fourth-quarter earnings on Friday, Bagkar said.

India's benchmark indices extended its record rally on Tuesday and rose to fresh highs in early trade tracking gains in Tata Motors Ltd., Infosys Ltd., and ICICI Bank Ltd.

The BSE Sensex opened at record high level of 75,045.99, and the NSE Nifty 50 index opened at 22,765.10.

As of 09:25 a.m., the NSE Nifty 50 13.45 points or 0.059% higher at 22,679.75, and the BSE Sensex was trading 70.91points or 0.095% higher at 74,813.41.

Asian markets, however, defied the cautious mood in the U.S. and other asset classes and were trading in positive territory this morning, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

Volumes are likely to be muted on account of Gudi Padwa today. Markets will turn focus on the crucial CPI data due on Friday for further hints on rate cut expectations in India. Additionally, stock specific action would take centre stage with the commencement of earnings season, with TCS being the first major to report fourth-quarter earnings on Friday, Bagkar said.

The NSE Nifty Bank index also extended gains, and touched a fresh high for second day in a row. As of 09:28 a.m., the NSE Nifty Bank index was trading 60.50 points or 0.12% higher at 48,642.20.

India's benchmark indices extended its record rally on Tuesday and rose to fresh highs in early trade tracking gains in Tata Motors Ltd., Infosys Ltd., and ICICI Bank Ltd.

The BSE Sensex opened at record high level of 75,045.99, and the NSE Nifty 50 index opened at 22,765.10.

As of 09:25 a.m., the NSE Nifty 50 13.45 points or 0.059% higher at 22,679.75, and the BSE Sensex was trading 70.91points or 0.095% higher at 74,813.41.

Asian markets, however, defied the cautious mood in the U.S. and other asset classes and were trading in positive territory this morning, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

Volumes are likely to be muted on account of Gudi Padwa today. Markets will turn focus on the crucial CPI data due on Friday for further hints on rate cut expectations in India. Additionally, stock specific action would take centre stage with the commencement of earnings season, with TCS being the first major to report fourth-quarter earnings on Friday, Bagkar said.

India's benchmark indices extended its record rally on Tuesday and rose to fresh highs in early trade tracking gains in Tata Motors Ltd., Infosys Ltd., and ICICI Bank Ltd.

The BSE Sensex opened at record high level of 75,045.99, and the NSE Nifty 50 index opened at 22,765.10.

As of 09:25 a.m., the NSE Nifty 50 13.45 points or 0.059% higher at 22,679.75, and the BSE Sensex was trading 70.91points or 0.095% higher at 74,813.41.

Asian markets, however, defied the cautious mood in the U.S. and other asset classes and were trading in positive territory this morning, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

Volumes are likely to be muted on account of Gudi Padwa today. Markets will turn focus on the crucial CPI data due on Friday for further hints on rate cut expectations in India. Additionally, stock specific action would take centre stage with the commencement of earnings season, with TCS being the first major to report fourth-quarter earnings on Friday, Bagkar said.

India's benchmark indices extended its record rally on Tuesday and rose to fresh highs in early trade tracking gains in Tata Motors Ltd., Infosys Ltd., and ICICI Bank Ltd.

The BSE Sensex opened at record high level of 75,045.99, and the NSE Nifty 50 index opened at 22,765.10.

As of 09:25 a.m., the NSE Nifty 50 13.45 points or 0.059% higher at 22,679.75, and the BSE Sensex was trading 70.91points or 0.095% higher at 74,813.41.

Asian markets, however, defied the cautious mood in the U.S. and other asset classes and were trading in positive territory this morning, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

Volumes are likely to be muted on account of Gudi Padwa today. Markets will turn focus on the crucial CPI data due on Friday for further hints on rate cut expectations in India. Additionally, stock specific action would take centre stage with the commencement of earnings season, with TCS being the first major to report fourth-quarter earnings on Friday, Bagkar said.