Overseas investors stayed net sellers on Monday for the second straight session.

Foreign portfolio investors offloaded stocks worth Rs 1,874.54 crore, according to provisional data from the National Stock Exchange. Domestic institutional investors turned net buyers after a day of selling and mopped up equities worth Rs 3,548.97 crore, the NSE data showed.

Foreign institutions have been net sellers of Rs 23,839 crore worth of Indian equities so far in 2024, according to data from the National Securities Depository Ltd., updated till the previous trading day.

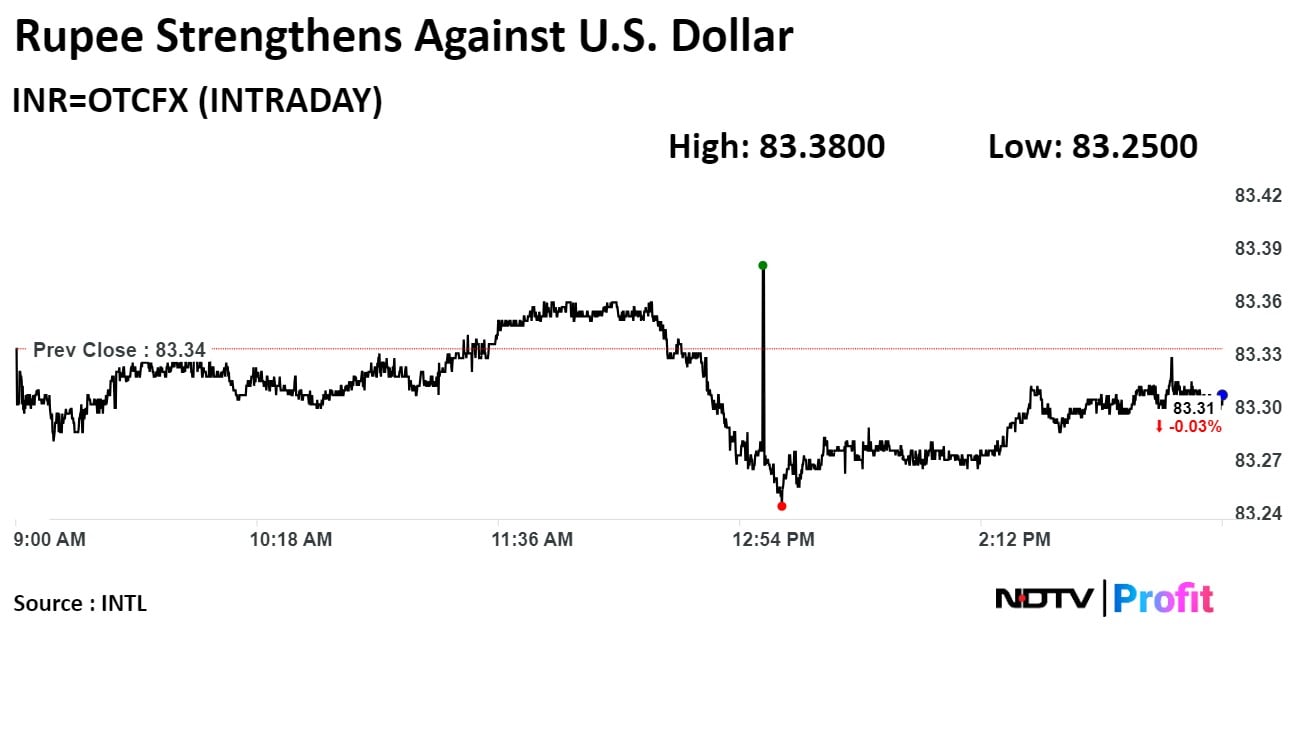

The local currency strengthened by 2 paise to close at 83.31 against the U.S dollar.

It closed at 83.33 on Friday.

Source: Bloomberg

The local currency strengthened by 2 paise to close at 83.31 against the U.S dollar.

It closed at 83.33 on Friday.

Source: Bloomberg

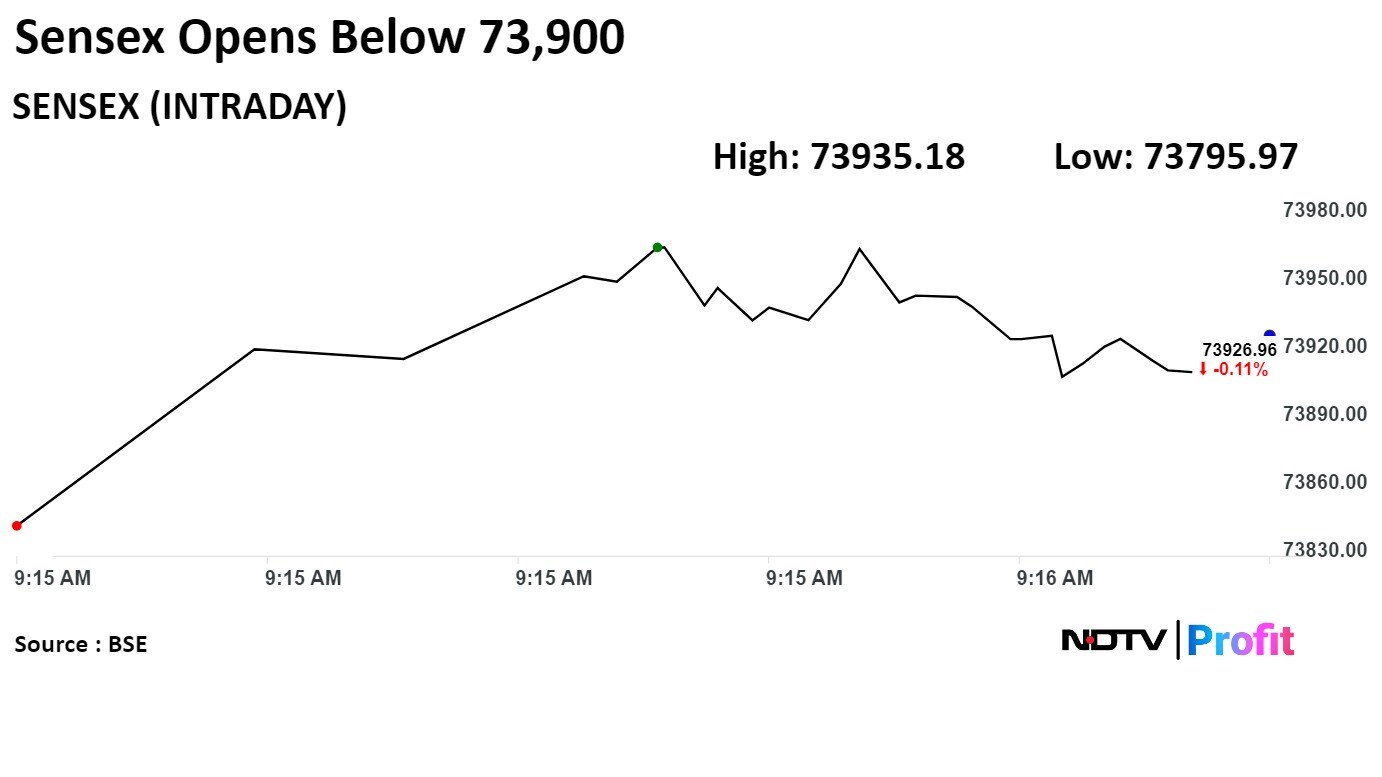

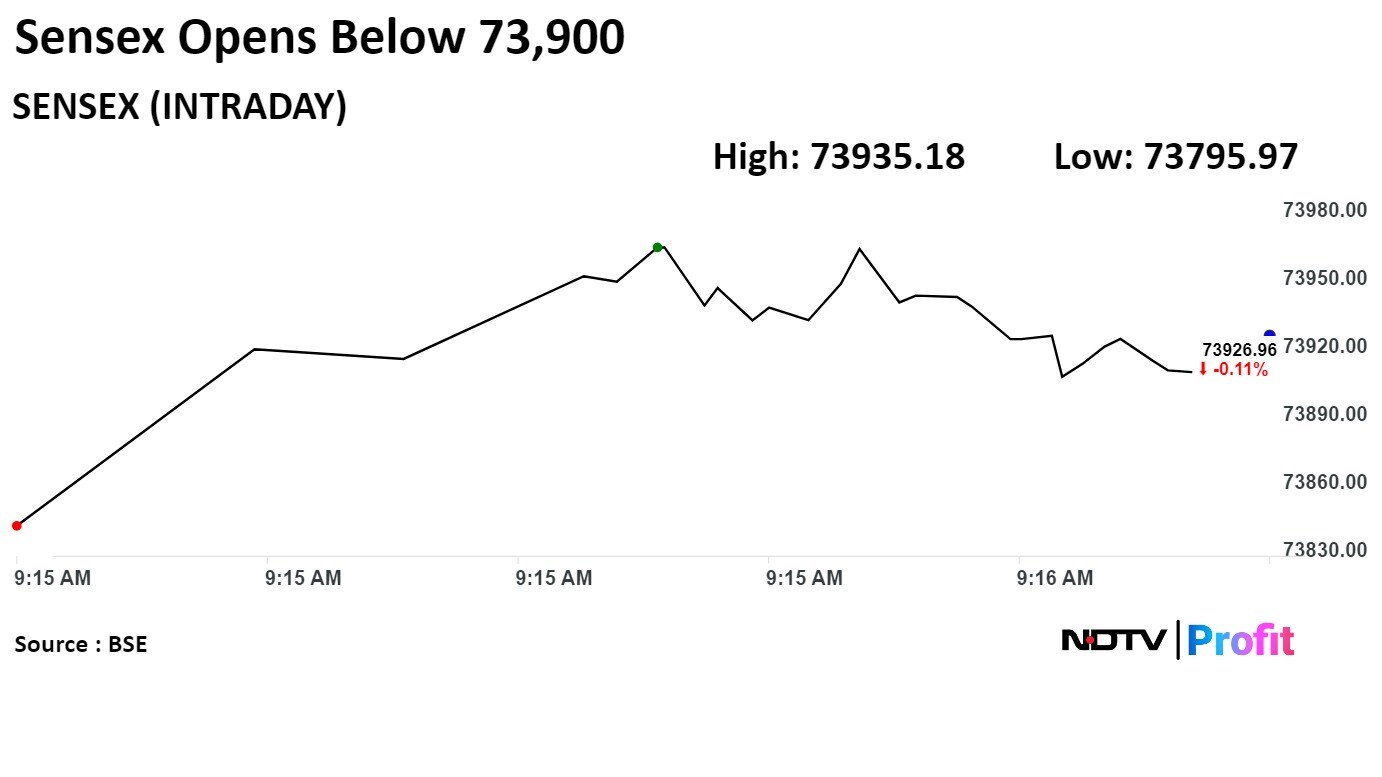

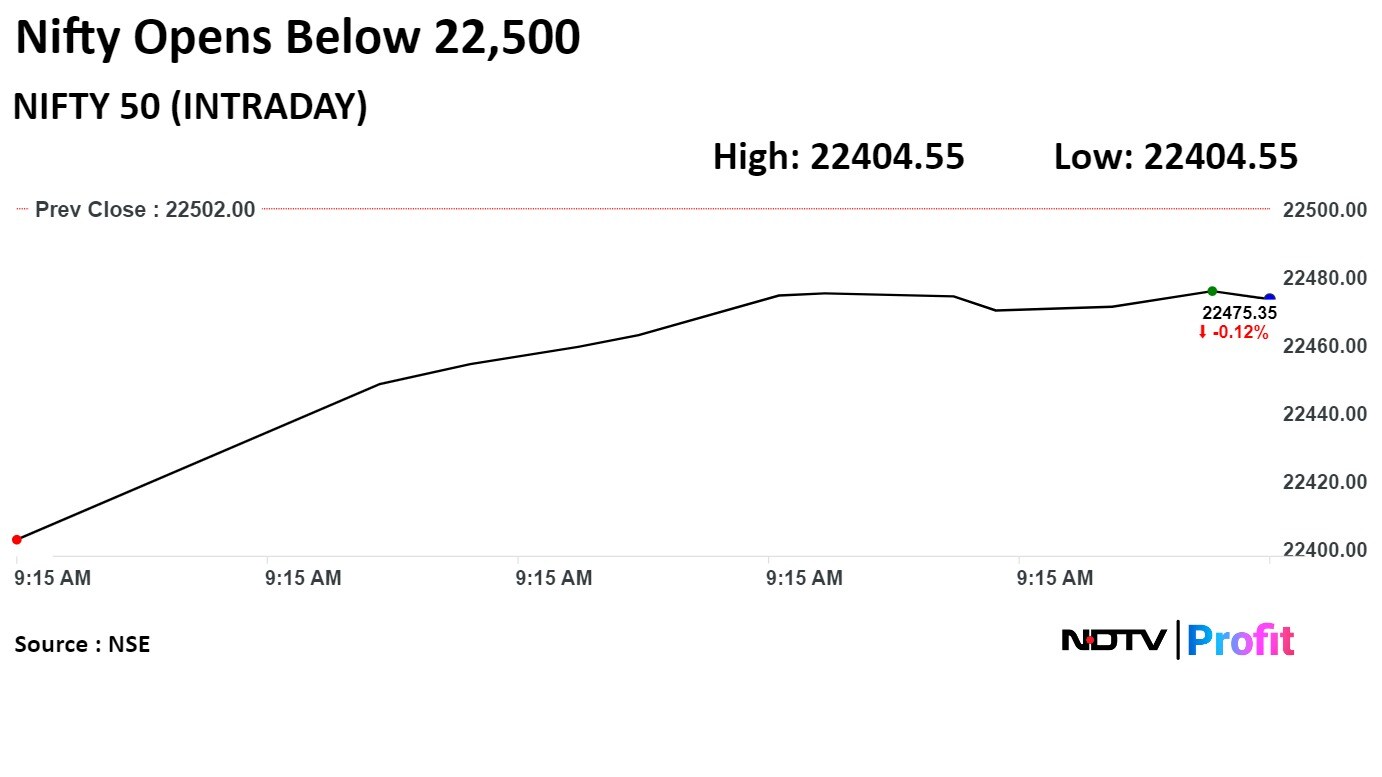

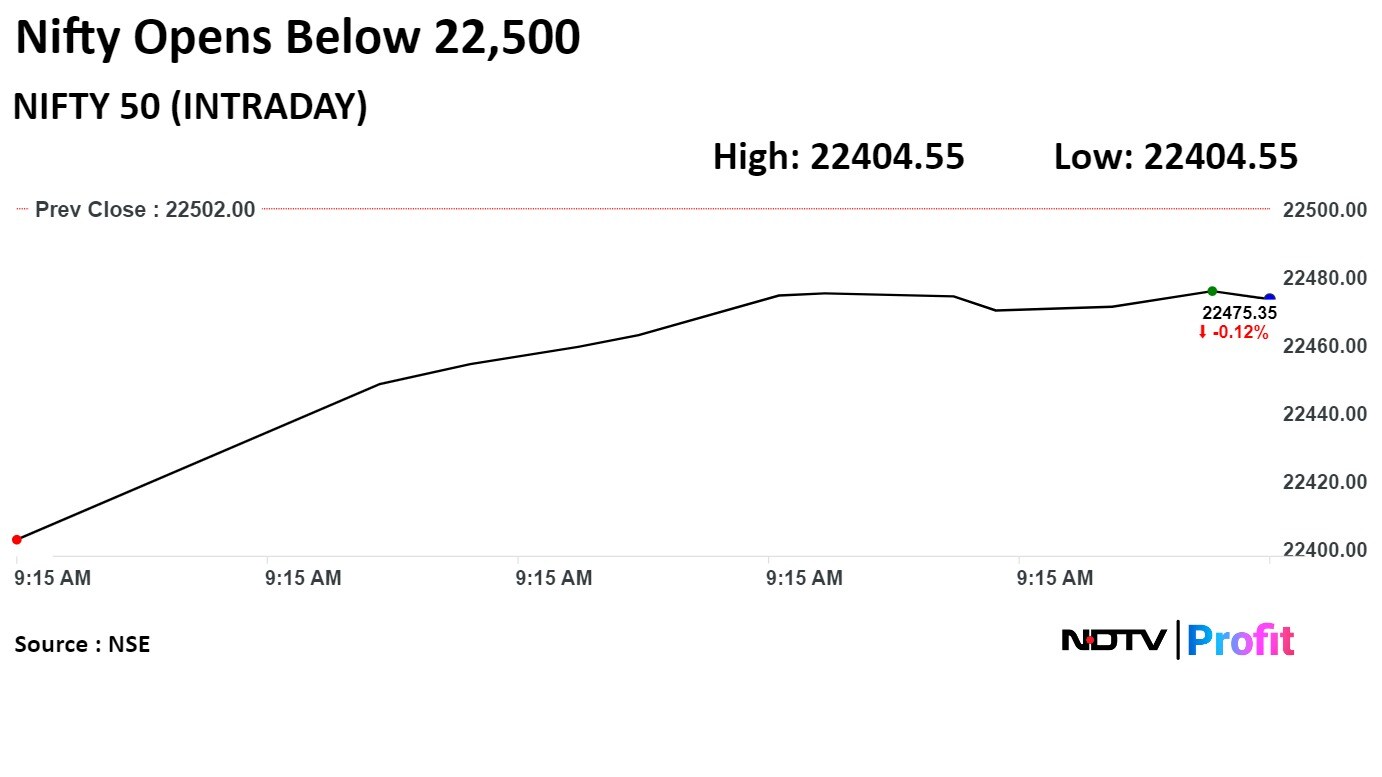

Indian benchmarks ended on a mixed note on Tuesday as Tata Steel Ltd., Hindalco Industries Ltd. rose, and ICICI Bank Ltd., HDFC Bank Ltd. declined.

The NSE Nifty 50 settled 27.05 or 0.12% higher at 22,529.05, and the S&P BSE Sensex ended 52.62 points or 0.071% lower at 73,953.31.

Further, markets struggled to find a direction as India moves closer to the election results day, when investors will proper insight about the country's political stability for coming years.

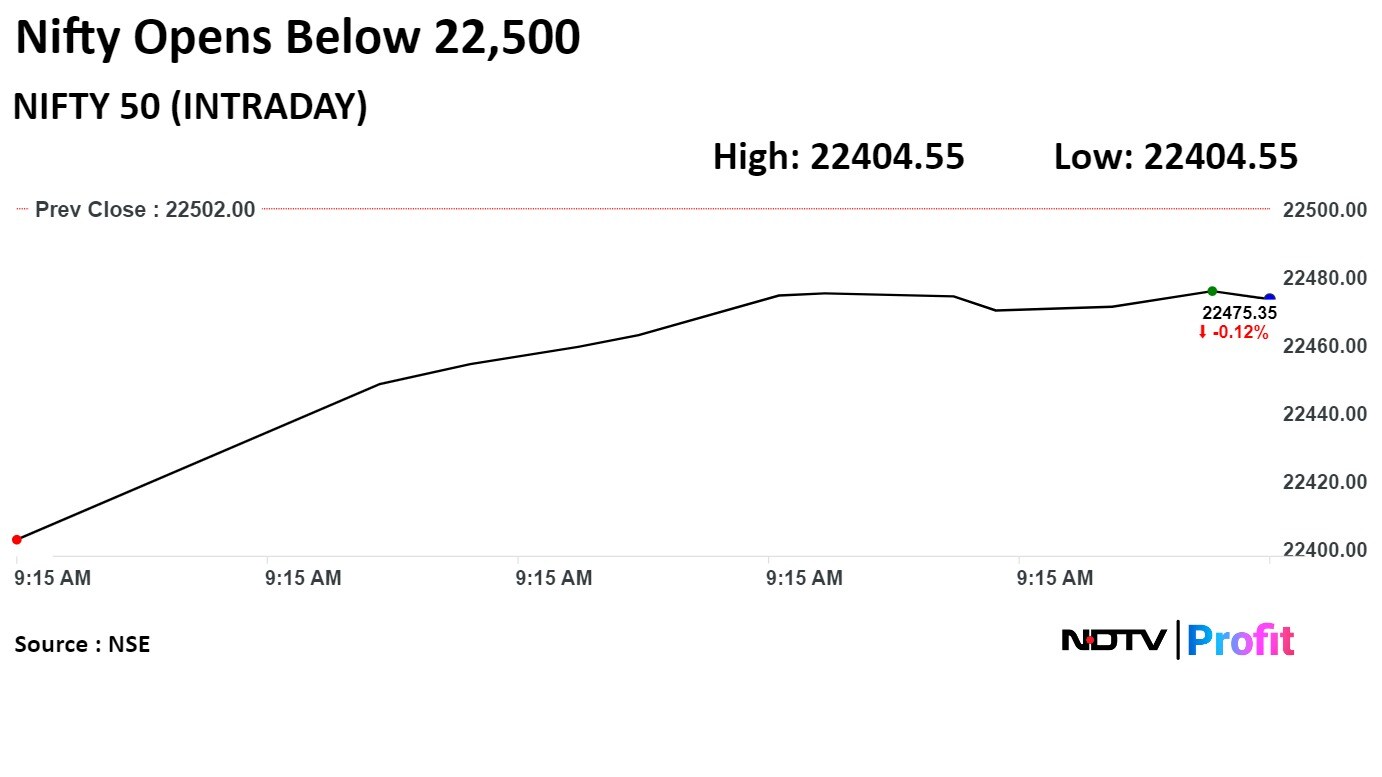

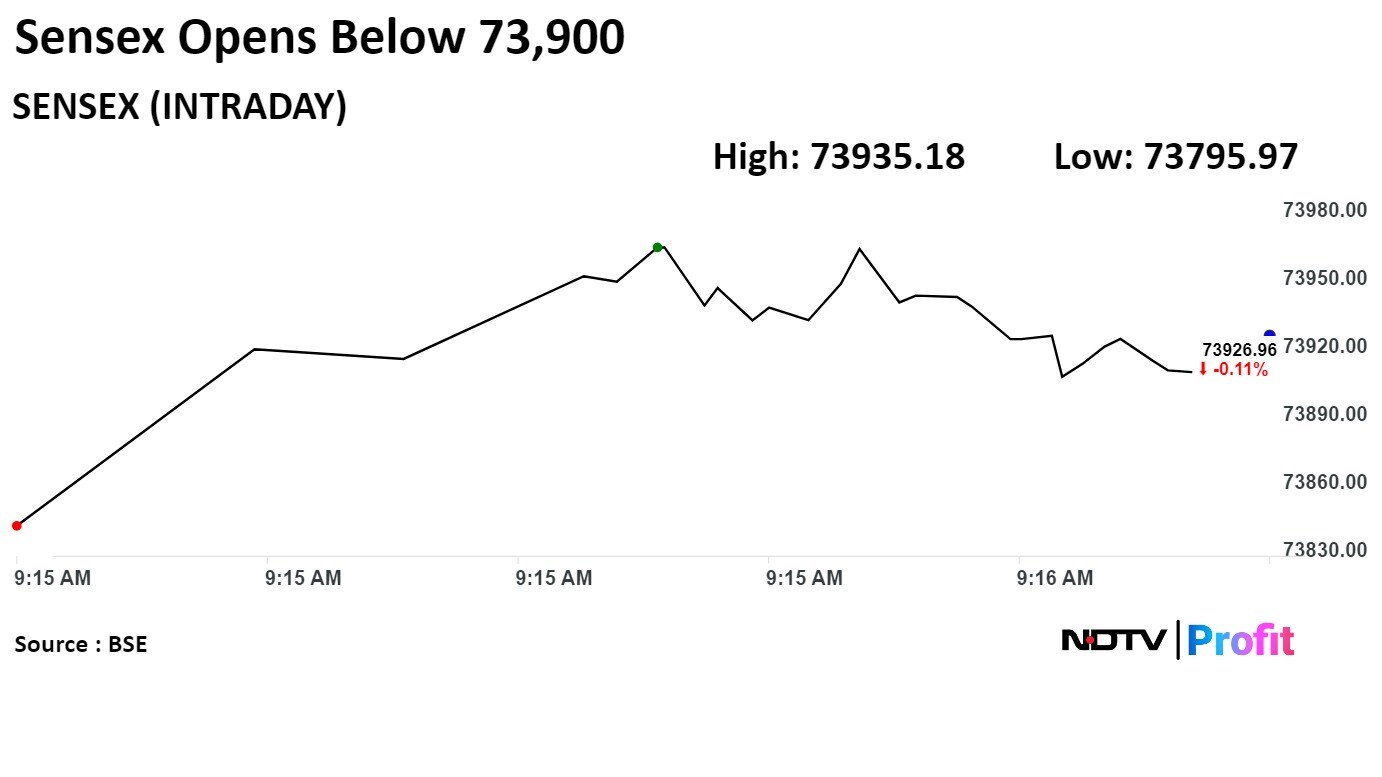

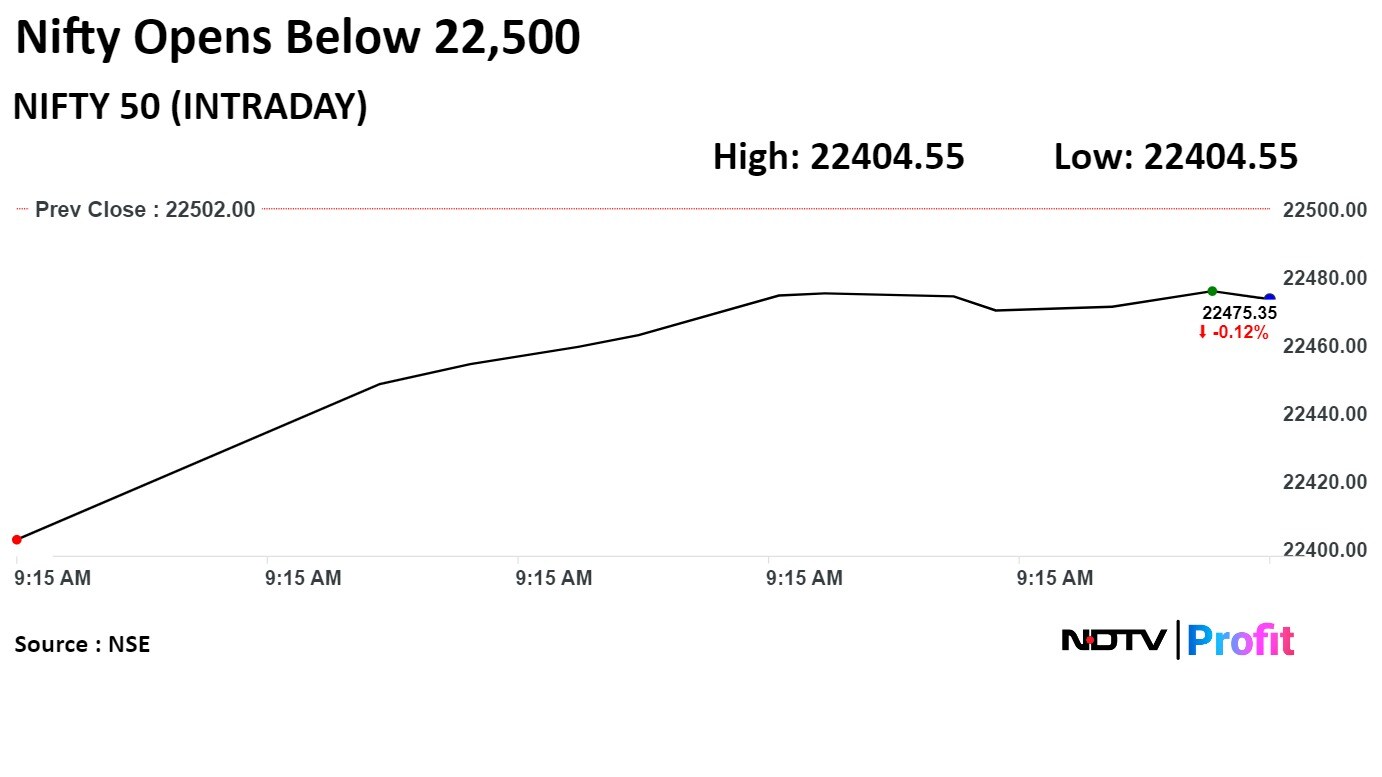

Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

Indian benchmarks ended on a mixed note on Tuesday as Tata Steel Ltd., Hindalco Industries Ltd. rose, and ICICI Bank Ltd., HDFC Bank Ltd. declined.

The NSE Nifty 50 settled 27.05 or 0.12% higher at 22,529.05, and the S&P BSE Sensex ended 52.62 points or 0.071% lower at 73,953.31.

Further, markets struggled to find a direction as India moves closer to the election results day, when investors will proper insight about the country's political stability for coming years.

Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

.png)

Indian benchmarks ended on a mixed note on Tuesday as Tata Steel Ltd., Hindalco Industries Ltd. rose, and ICICI Bank Ltd., HDFC Bank Ltd. declined.

The NSE Nifty 50 settled 27.05 or 0.12% higher at 22,529.05, and the S&P BSE Sensex ended 52.62 points or 0.071% lower at 73,953.31.

Further, markets struggled to find a direction as India moves closer to the election results day, when investors will proper insight about the country's political stability for coming years.

Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

Indian benchmarks ended on a mixed note on Tuesday as Tata Steel Ltd., Hindalco Industries Ltd. rose, and ICICI Bank Ltd., HDFC Bank Ltd. declined.

The NSE Nifty 50 settled 27.05 or 0.12% higher at 22,529.05, and the S&P BSE Sensex ended 52.62 points or 0.071% lower at 73,953.31.

Further, markets struggled to find a direction as India moves closer to the election results day, when investors will proper insight about the country's political stability for coming years.

Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

.png)

.png)

"Diverging from their strong global counterparts, Indian equities commenced the week on a tepid note but a strong rally in the Energy and Metal counters not only helped the Index to recuperate its losses but compounded its gains as well to end the session at 22,529.05 with gains of 27.05 points." said Aditya Gaggar, director, Progressive Shares.

In addition to Metal and Energy, PSU bank segment outperformed while FMCG was the major laggard. A mixed activity was observed in the Broader markets where Midcaps marginally outperformed while Smallcaps ended the day in red, Gaggar said.

The Index has formed a bullish engulfing candle on the daily chart which indicates presence of buyers at the lower levels. Once the Index breaches the level of 22,600, we can expect a retest of its previous high of 22,790 while the downside seems to be protected at 22,400, he added.

Indian benchmarks ended on a mixed note on Tuesday as Tata Steel Ltd., Hindalco Industries Ltd. rose, and ICICI Bank Ltd., HDFC Bank Ltd. declined.

The NSE Nifty 50 settled 27.05 or 0.12% higher at 22,529.05, and the S&P BSE Sensex ended 52.62 points or 0.071% lower at 73,953.31.

Further, markets struggled to find a direction as India moves closer to the election results day, when investors will proper insight about the country's political stability for coming years.

Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

Indian benchmarks ended on a mixed note on Tuesday as Tata Steel Ltd., Hindalco Industries Ltd. rose, and ICICI Bank Ltd., HDFC Bank Ltd. declined.

The NSE Nifty 50 settled 27.05 or 0.12% higher at 22,529.05, and the S&P BSE Sensex ended 52.62 points or 0.071% lower at 73,953.31.

Further, markets struggled to find a direction as India moves closer to the election results day, when investors will proper insight about the country's political stability for coming years.

Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

.png)

Indian benchmarks ended on a mixed note on Tuesday as Tata Steel Ltd., Hindalco Industries Ltd. rose, and ICICI Bank Ltd., HDFC Bank Ltd. declined.

The NSE Nifty 50 settled 27.05 or 0.12% higher at 22,529.05, and the S&P BSE Sensex ended 52.62 points or 0.071% lower at 73,953.31.

Further, markets struggled to find a direction as India moves closer to the election results day, when investors will proper insight about the country's political stability for coming years.

Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

Indian benchmarks ended on a mixed note on Tuesday as Tata Steel Ltd., Hindalco Industries Ltd. rose, and ICICI Bank Ltd., HDFC Bank Ltd. declined.

The NSE Nifty 50 settled 27.05 or 0.12% higher at 22,529.05, and the S&P BSE Sensex ended 52.62 points or 0.071% lower at 73,953.31.

Further, markets struggled to find a direction as India moves closer to the election results day, when investors will proper insight about the country's political stability for coming years.

Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

.png)

.png)

"Diverging from their strong global counterparts, Indian equities commenced the week on a tepid note but a strong rally in the Energy and Metal counters not only helped the Index to recuperate its losses but compounded its gains as well to end the session at 22,529.05 with gains of 27.05 points." said Aditya Gaggar, director, Progressive Shares.

In addition to Metal and Energy, PSU bank segment outperformed while FMCG was the major laggard. A mixed activity was observed in the Broader markets where Midcaps marginally outperformed while Smallcaps ended the day in red, Gaggar said.

The Index has formed a bullish engulfing candle on the daily chart which indicates presence of buyers at the lower levels. Once the Index breaches the level of 22,600, we can expect a retest of its previous high of 22,790 while the downside seems to be protected at 22,400, he added.

.png)

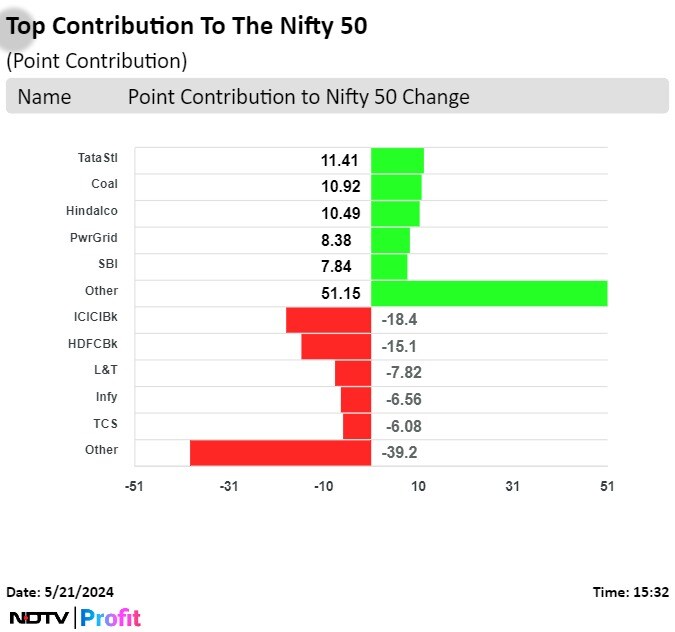

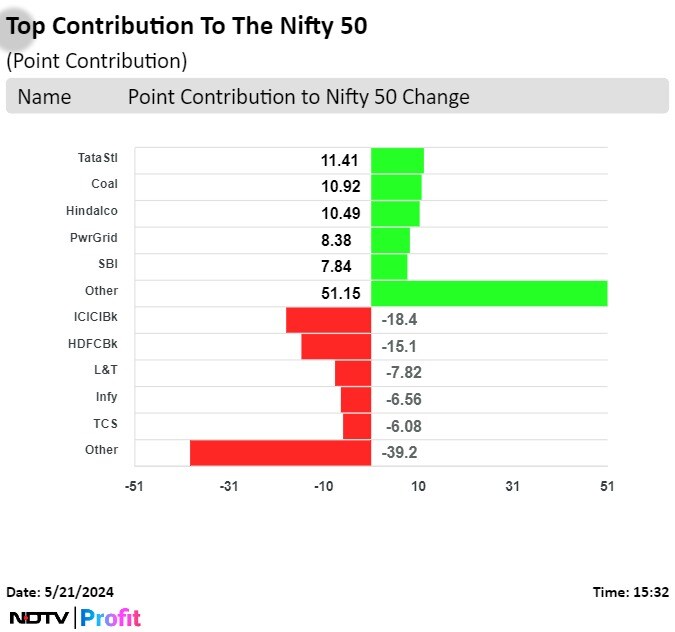

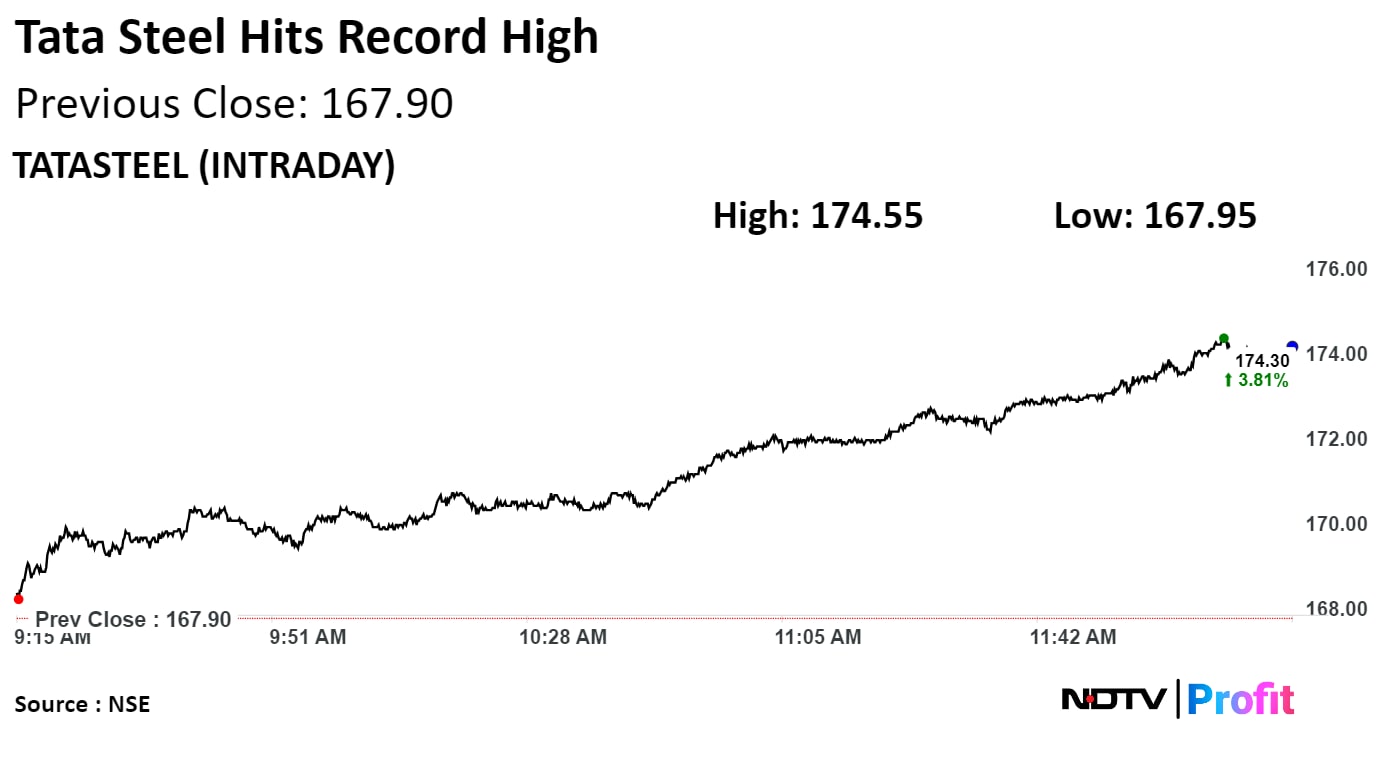

Tata Steel Ltd., Coal India Ltd., Hindalco Industries Ltd., Powergrid Corp of India Ltd., and State Bank of India added to the index.

ICICI Bank Ltd., HDFC Bank Ltd., Larsen & Toubro Ltd., Infosys Ltd., and Tata Consultancy Services Ltd. weighed on the benchmark.

Indian benchmarks ended on a mixed note on Tuesday as Tata Steel Ltd., Hindalco Industries Ltd. rose, and ICICI Bank Ltd., HDFC Bank Ltd. declined.

The NSE Nifty 50 settled 27.05 or 0.12% higher at 22,529.05, and the S&P BSE Sensex ended 52.62 points or 0.071% lower at 73,953.31.

Further, markets struggled to find a direction as India moves closer to the election results day, when investors will proper insight about the country's political stability for coming years.

Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

Indian benchmarks ended on a mixed note on Tuesday as Tata Steel Ltd., Hindalco Industries Ltd. rose, and ICICI Bank Ltd., HDFC Bank Ltd. declined.

The NSE Nifty 50 settled 27.05 or 0.12% higher at 22,529.05, and the S&P BSE Sensex ended 52.62 points or 0.071% lower at 73,953.31.

Further, markets struggled to find a direction as India moves closer to the election results day, when investors will proper insight about the country's political stability for coming years.

Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

.png)

Indian benchmarks ended on a mixed note on Tuesday as Tata Steel Ltd., Hindalco Industries Ltd. rose, and ICICI Bank Ltd., HDFC Bank Ltd. declined.

The NSE Nifty 50 settled 27.05 or 0.12% higher at 22,529.05, and the S&P BSE Sensex ended 52.62 points or 0.071% lower at 73,953.31.

Further, markets struggled to find a direction as India moves closer to the election results day, when investors will proper insight about the country's political stability for coming years.

Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

Indian benchmarks ended on a mixed note on Tuesday as Tata Steel Ltd., Hindalco Industries Ltd. rose, and ICICI Bank Ltd., HDFC Bank Ltd. declined.

The NSE Nifty 50 settled 27.05 or 0.12% higher at 22,529.05, and the S&P BSE Sensex ended 52.62 points or 0.071% lower at 73,953.31.

Further, markets struggled to find a direction as India moves closer to the election results day, when investors will proper insight about the country's political stability for coming years.

Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

.png)

.png)

"Diverging from their strong global counterparts, Indian equities commenced the week on a tepid note but a strong rally in the Energy and Metal counters not only helped the Index to recuperate its losses but compounded its gains as well to end the session at 22,529.05 with gains of 27.05 points." said Aditya Gaggar, director, Progressive Shares.

In addition to Metal and Energy, PSU bank segment outperformed while FMCG was the major laggard. A mixed activity was observed in the Broader markets where Midcaps marginally outperformed while Smallcaps ended the day in red, Gaggar said.

The Index has formed a bullish engulfing candle on the daily chart which indicates presence of buyers at the lower levels. Once the Index breaches the level of 22,600, we can expect a retest of its previous high of 22,790 while the downside seems to be protected at 22,400, he added.

Indian benchmarks ended on a mixed note on Tuesday as Tata Steel Ltd., Hindalco Industries Ltd. rose, and ICICI Bank Ltd., HDFC Bank Ltd. declined.

The NSE Nifty 50 settled 27.05 or 0.12% higher at 22,529.05, and the S&P BSE Sensex ended 52.62 points or 0.071% lower at 73,953.31.

Further, markets struggled to find a direction as India moves closer to the election results day, when investors will proper insight about the country's political stability for coming years.

Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

Indian benchmarks ended on a mixed note on Tuesday as Tata Steel Ltd., Hindalco Industries Ltd. rose, and ICICI Bank Ltd., HDFC Bank Ltd. declined.

The NSE Nifty 50 settled 27.05 or 0.12% higher at 22,529.05, and the S&P BSE Sensex ended 52.62 points or 0.071% lower at 73,953.31.

Further, markets struggled to find a direction as India moves closer to the election results day, when investors will proper insight about the country's political stability for coming years.

Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

.png)

Indian benchmarks ended on a mixed note on Tuesday as Tata Steel Ltd., Hindalco Industries Ltd. rose, and ICICI Bank Ltd., HDFC Bank Ltd. declined.

The NSE Nifty 50 settled 27.05 or 0.12% higher at 22,529.05, and the S&P BSE Sensex ended 52.62 points or 0.071% lower at 73,953.31.

Further, markets struggled to find a direction as India moves closer to the election results day, when investors will proper insight about the country's political stability for coming years.

Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

Indian benchmarks ended on a mixed note on Tuesday as Tata Steel Ltd., Hindalco Industries Ltd. rose, and ICICI Bank Ltd., HDFC Bank Ltd. declined.

The NSE Nifty 50 settled 27.05 or 0.12% higher at 22,529.05, and the S&P BSE Sensex ended 52.62 points or 0.071% lower at 73,953.31.

Further, markets struggled to find a direction as India moves closer to the election results day, when investors will proper insight about the country's political stability for coming years.

Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

.png)

.png)

"Diverging from their strong global counterparts, Indian equities commenced the week on a tepid note but a strong rally in the Energy and Metal counters not only helped the Index to recuperate its losses but compounded its gains as well to end the session at 22,529.05 with gains of 27.05 points." said Aditya Gaggar, director, Progressive Shares.

In addition to Metal and Energy, PSU bank segment outperformed while FMCG was the major laggard. A mixed activity was observed in the Broader markets where Midcaps marginally outperformed while Smallcaps ended the day in red, Gaggar said.

The Index has formed a bullish engulfing candle on the daily chart which indicates presence of buyers at the lower levels. Once the Index breaches the level of 22,600, we can expect a retest of its previous high of 22,790 while the downside seems to be protected at 22,400, he added.

.png)

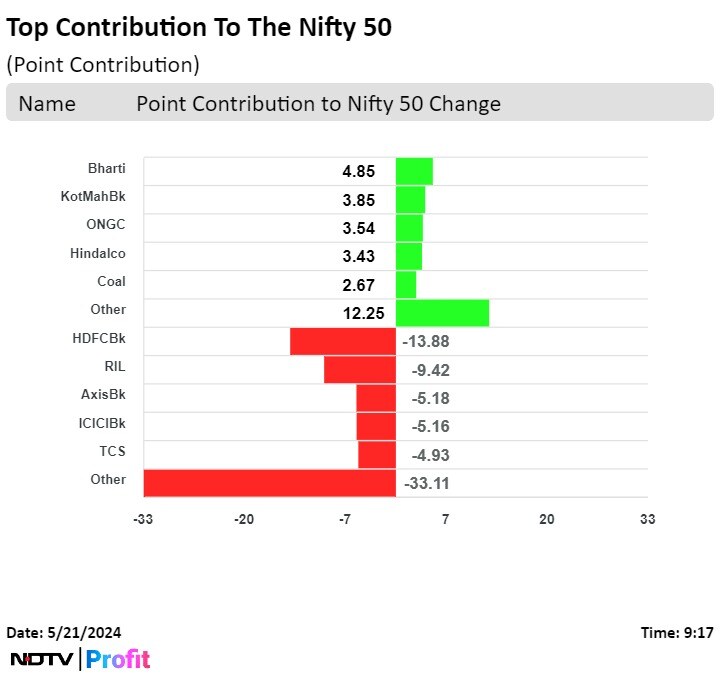

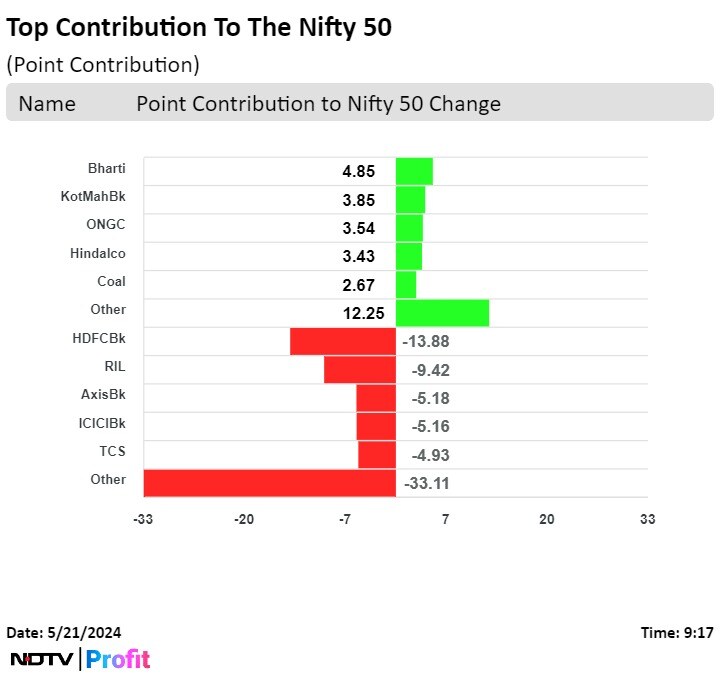

Tata Steel Ltd., Coal India Ltd., Hindalco Industries Ltd., Powergrid Corp of India Ltd., and State Bank of India added to the index.

ICICI Bank Ltd., HDFC Bank Ltd., Larsen & Toubro Ltd., Infosys Ltd., and Tata Consultancy Services Ltd. weighed on the benchmark.

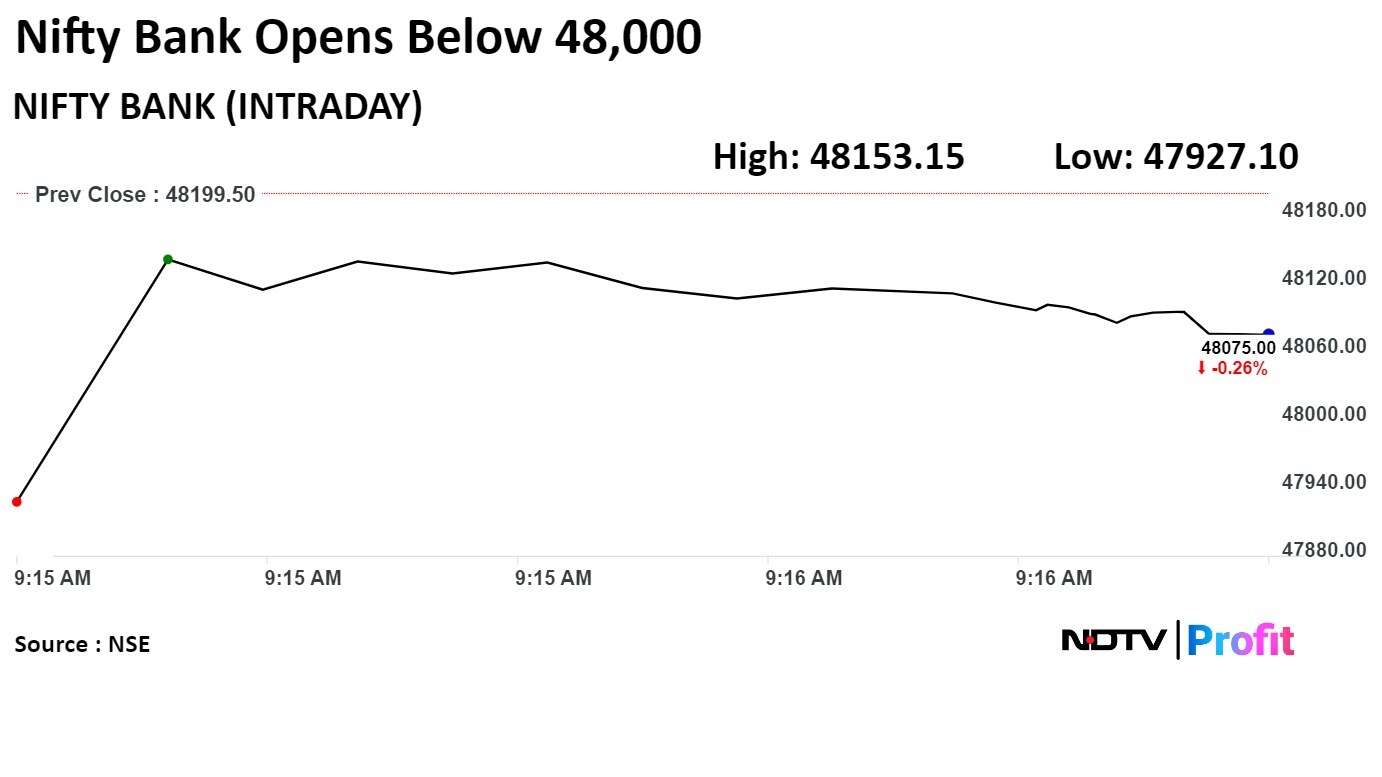

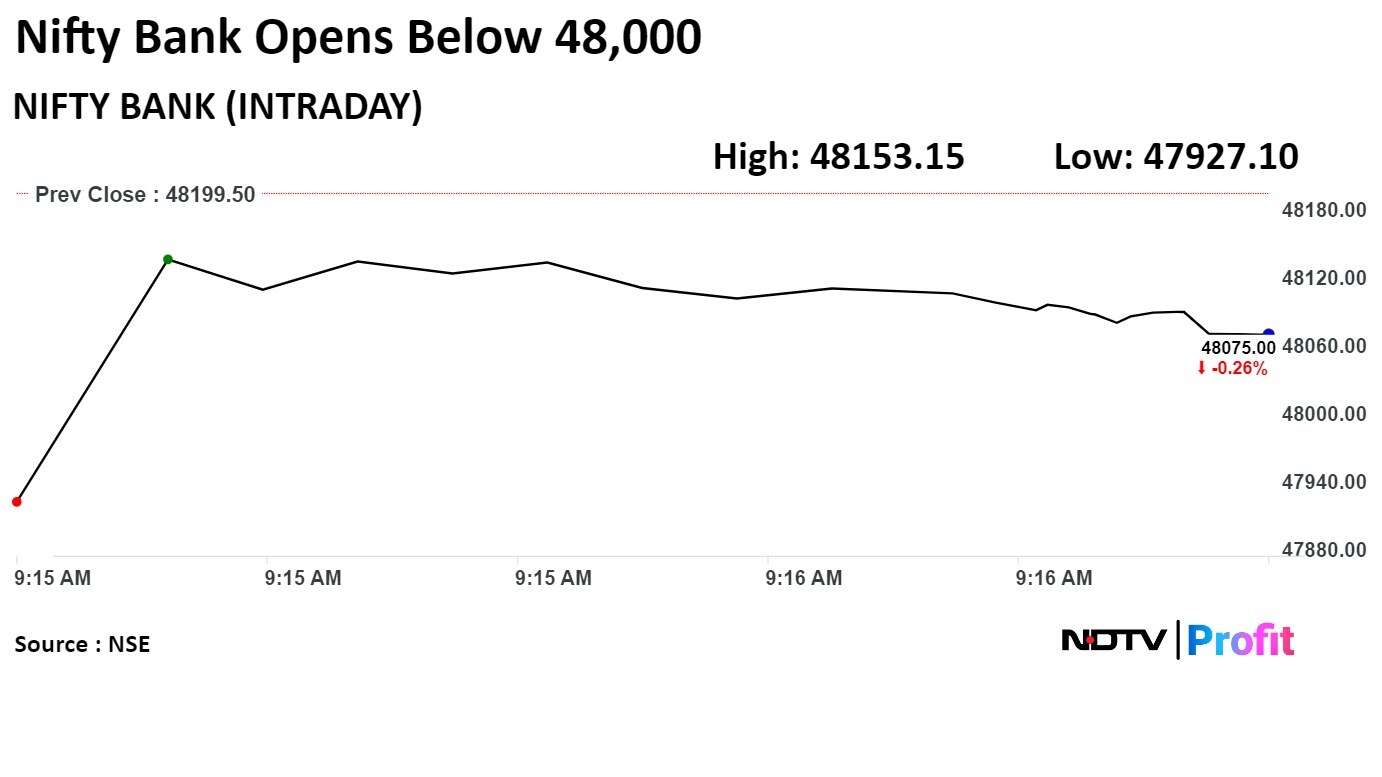

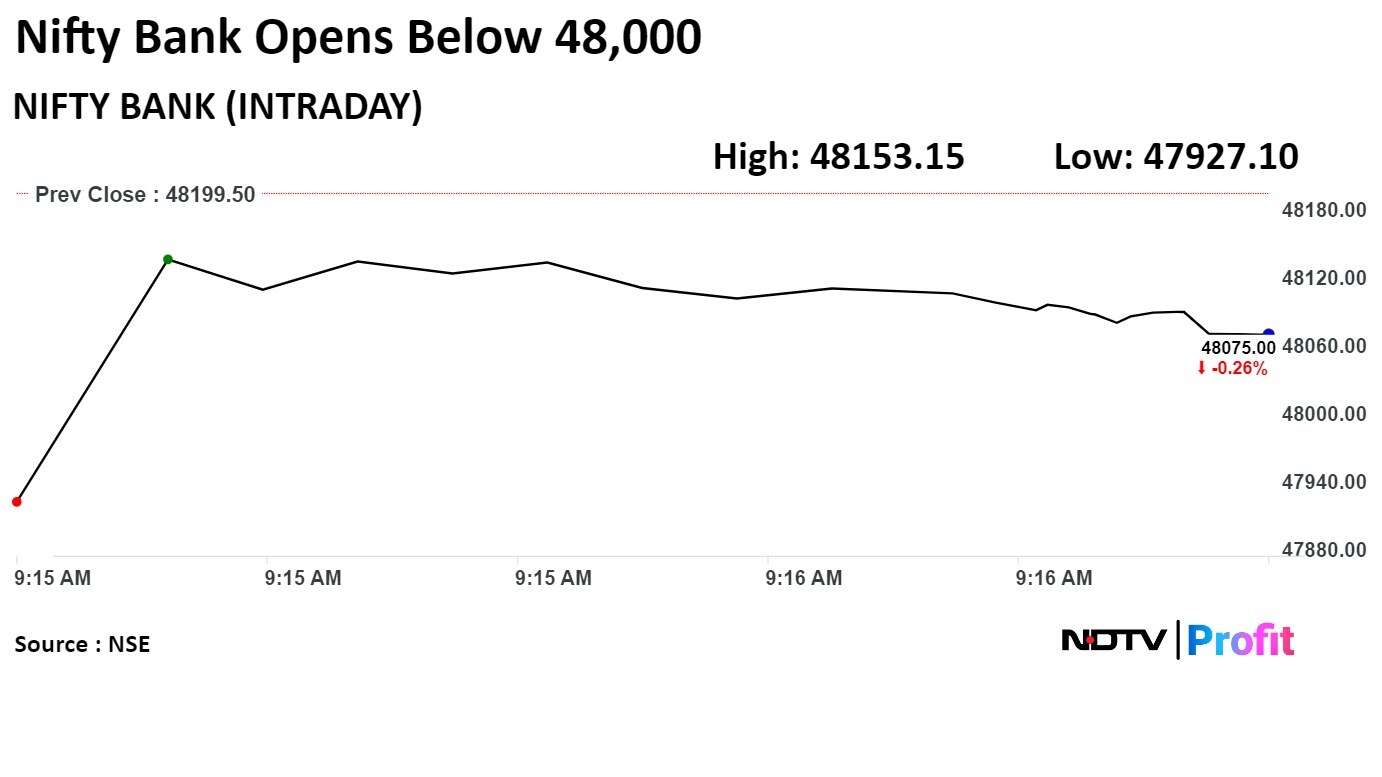

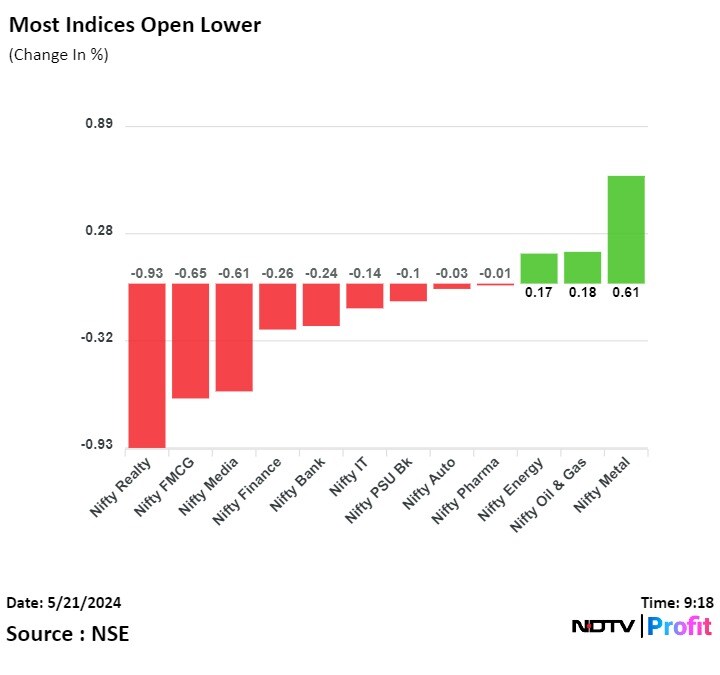

On NSE, six sectors advanced, and six declined out of 12. The NSE Nifty Bank was the top loser, and the NSE Nifty Metal was the top performing sector.

Indian benchmarks ended on a mixed note on Tuesday as Tata Steel Ltd., Hindalco Industries Ltd. rose, and ICICI Bank Ltd., HDFC Bank Ltd. declined.

The NSE Nifty 50 settled 27.05 or 0.12% higher at 22,529.05, and the S&P BSE Sensex ended 52.62 points or 0.071% lower at 73,953.31.

Further, markets struggled to find a direction as India moves closer to the election results day, when investors will proper insight about the country's political stability for coming years.

Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

Indian benchmarks ended on a mixed note on Tuesday as Tata Steel Ltd., Hindalco Industries Ltd. rose, and ICICI Bank Ltd., HDFC Bank Ltd. declined.

The NSE Nifty 50 settled 27.05 or 0.12% higher at 22,529.05, and the S&P BSE Sensex ended 52.62 points or 0.071% lower at 73,953.31.

Further, markets struggled to find a direction as India moves closer to the election results day, when investors will proper insight about the country's political stability for coming years.

Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

.png)

Indian benchmarks ended on a mixed note on Tuesday as Tata Steel Ltd., Hindalco Industries Ltd. rose, and ICICI Bank Ltd., HDFC Bank Ltd. declined.

The NSE Nifty 50 settled 27.05 or 0.12% higher at 22,529.05, and the S&P BSE Sensex ended 52.62 points or 0.071% lower at 73,953.31.

Further, markets struggled to find a direction as India moves closer to the election results day, when investors will proper insight about the country's political stability for coming years.

Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

Indian benchmarks ended on a mixed note on Tuesday as Tata Steel Ltd., Hindalco Industries Ltd. rose, and ICICI Bank Ltd., HDFC Bank Ltd. declined.

The NSE Nifty 50 settled 27.05 or 0.12% higher at 22,529.05, and the S&P BSE Sensex ended 52.62 points or 0.071% lower at 73,953.31.

Further, markets struggled to find a direction as India moves closer to the election results day, when investors will proper insight about the country's political stability for coming years.

Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

.png)

.png)

"Diverging from their strong global counterparts, Indian equities commenced the week on a tepid note but a strong rally in the Energy and Metal counters not only helped the Index to recuperate its losses but compounded its gains as well to end the session at 22,529.05 with gains of 27.05 points." said Aditya Gaggar, director, Progressive Shares.

In addition to Metal and Energy, PSU bank segment outperformed while FMCG was the major laggard. A mixed activity was observed in the Broader markets where Midcaps marginally outperformed while Smallcaps ended the day in red, Gaggar said.

The Index has formed a bullish engulfing candle on the daily chart which indicates presence of buyers at the lower levels. Once the Index breaches the level of 22,600, we can expect a retest of its previous high of 22,790 while the downside seems to be protected at 22,400, he added.

Indian benchmarks ended on a mixed note on Tuesday as Tata Steel Ltd., Hindalco Industries Ltd. rose, and ICICI Bank Ltd., HDFC Bank Ltd. declined.

The NSE Nifty 50 settled 27.05 or 0.12% higher at 22,529.05, and the S&P BSE Sensex ended 52.62 points or 0.071% lower at 73,953.31.

Further, markets struggled to find a direction as India moves closer to the election results day, when investors will proper insight about the country's political stability for coming years.

Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

Indian benchmarks ended on a mixed note on Tuesday as Tata Steel Ltd., Hindalco Industries Ltd. rose, and ICICI Bank Ltd., HDFC Bank Ltd. declined.

The NSE Nifty 50 settled 27.05 or 0.12% higher at 22,529.05, and the S&P BSE Sensex ended 52.62 points or 0.071% lower at 73,953.31.

Further, markets struggled to find a direction as India moves closer to the election results day, when investors will proper insight about the country's political stability for coming years.

Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

.png)

Indian benchmarks ended on a mixed note on Tuesday as Tata Steel Ltd., Hindalco Industries Ltd. rose, and ICICI Bank Ltd., HDFC Bank Ltd. declined.

The NSE Nifty 50 settled 27.05 or 0.12% higher at 22,529.05, and the S&P BSE Sensex ended 52.62 points or 0.071% lower at 73,953.31.

Further, markets struggled to find a direction as India moves closer to the election results day, when investors will proper insight about the country's political stability for coming years.

Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

Indian benchmarks ended on a mixed note on Tuesday as Tata Steel Ltd., Hindalco Industries Ltd. rose, and ICICI Bank Ltd., HDFC Bank Ltd. declined.

The NSE Nifty 50 settled 27.05 or 0.12% higher at 22,529.05, and the S&P BSE Sensex ended 52.62 points or 0.071% lower at 73,953.31.

Further, markets struggled to find a direction as India moves closer to the election results day, when investors will proper insight about the country's political stability for coming years.

Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

.png)

.png)

"Diverging from their strong global counterparts, Indian equities commenced the week on a tepid note but a strong rally in the Energy and Metal counters not only helped the Index to recuperate its losses but compounded its gains as well to end the session at 22,529.05 with gains of 27.05 points." said Aditya Gaggar, director, Progressive Shares.

In addition to Metal and Energy, PSU bank segment outperformed while FMCG was the major laggard. A mixed activity was observed in the Broader markets where Midcaps marginally outperformed while Smallcaps ended the day in red, Gaggar said.

The Index has formed a bullish engulfing candle on the daily chart which indicates presence of buyers at the lower levels. Once the Index breaches the level of 22,600, we can expect a retest of its previous high of 22,790 while the downside seems to be protected at 22,400, he added.

.png)

Tata Steel Ltd., Coal India Ltd., Hindalco Industries Ltd., Powergrid Corp of India Ltd., and State Bank of India added to the index.

ICICI Bank Ltd., HDFC Bank Ltd., Larsen & Toubro Ltd., Infosys Ltd., and Tata Consultancy Services Ltd. weighed on the benchmark.

Indian benchmarks ended on a mixed note on Tuesday as Tata Steel Ltd., Hindalco Industries Ltd. rose, and ICICI Bank Ltd., HDFC Bank Ltd. declined.

The NSE Nifty 50 settled 27.05 or 0.12% higher at 22,529.05, and the S&P BSE Sensex ended 52.62 points or 0.071% lower at 73,953.31.

Further, markets struggled to find a direction as India moves closer to the election results day, when investors will proper insight about the country's political stability for coming years.

Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

Indian benchmarks ended on a mixed note on Tuesday as Tata Steel Ltd., Hindalco Industries Ltd. rose, and ICICI Bank Ltd., HDFC Bank Ltd. declined.

The NSE Nifty 50 settled 27.05 or 0.12% higher at 22,529.05, and the S&P BSE Sensex ended 52.62 points or 0.071% lower at 73,953.31.

Further, markets struggled to find a direction as India moves closer to the election results day, when investors will proper insight about the country's political stability for coming years.

Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

.png)

Indian benchmarks ended on a mixed note on Tuesday as Tata Steel Ltd., Hindalco Industries Ltd. rose, and ICICI Bank Ltd., HDFC Bank Ltd. declined.

The NSE Nifty 50 settled 27.05 or 0.12% higher at 22,529.05, and the S&P BSE Sensex ended 52.62 points or 0.071% lower at 73,953.31.

Further, markets struggled to find a direction as India moves closer to the election results day, when investors will proper insight about the country's political stability for coming years.

Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

Indian benchmarks ended on a mixed note on Tuesday as Tata Steel Ltd., Hindalco Industries Ltd. rose, and ICICI Bank Ltd., HDFC Bank Ltd. declined.

The NSE Nifty 50 settled 27.05 or 0.12% higher at 22,529.05, and the S&P BSE Sensex ended 52.62 points or 0.071% lower at 73,953.31.

Further, markets struggled to find a direction as India moves closer to the election results day, when investors will proper insight about the country's political stability for coming years.

Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

.png)

.png)

"Diverging from their strong global counterparts, Indian equities commenced the week on a tepid note but a strong rally in the Energy and Metal counters not only helped the Index to recuperate its losses but compounded its gains as well to end the session at 22,529.05 with gains of 27.05 points." said Aditya Gaggar, director, Progressive Shares.

In addition to Metal and Energy, PSU bank segment outperformed while FMCG was the major laggard. A mixed activity was observed in the Broader markets where Midcaps marginally outperformed while Smallcaps ended the day in red, Gaggar said.

The Index has formed a bullish engulfing candle on the daily chart which indicates presence of buyers at the lower levels. Once the Index breaches the level of 22,600, we can expect a retest of its previous high of 22,790 while the downside seems to be protected at 22,400, he added.

Indian benchmarks ended on a mixed note on Tuesday as Tata Steel Ltd., Hindalco Industries Ltd. rose, and ICICI Bank Ltd., HDFC Bank Ltd. declined.

The NSE Nifty 50 settled 27.05 or 0.12% higher at 22,529.05, and the S&P BSE Sensex ended 52.62 points or 0.071% lower at 73,953.31.

Further, markets struggled to find a direction as India moves closer to the election results day, when investors will proper insight about the country's political stability for coming years.

Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

Indian benchmarks ended on a mixed note on Tuesday as Tata Steel Ltd., Hindalco Industries Ltd. rose, and ICICI Bank Ltd., HDFC Bank Ltd. declined.

The NSE Nifty 50 settled 27.05 or 0.12% higher at 22,529.05, and the S&P BSE Sensex ended 52.62 points or 0.071% lower at 73,953.31.

Further, markets struggled to find a direction as India moves closer to the election results day, when investors will proper insight about the country's political stability for coming years.

Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

.png)

Indian benchmarks ended on a mixed note on Tuesday as Tata Steel Ltd., Hindalco Industries Ltd. rose, and ICICI Bank Ltd., HDFC Bank Ltd. declined.

The NSE Nifty 50 settled 27.05 or 0.12% higher at 22,529.05, and the S&P BSE Sensex ended 52.62 points or 0.071% lower at 73,953.31.

Further, markets struggled to find a direction as India moves closer to the election results day, when investors will proper insight about the country's political stability for coming years.

Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

Indian benchmarks ended on a mixed note on Tuesday as Tata Steel Ltd., Hindalco Industries Ltd. rose, and ICICI Bank Ltd., HDFC Bank Ltd. declined.

The NSE Nifty 50 settled 27.05 or 0.12% higher at 22,529.05, and the S&P BSE Sensex ended 52.62 points or 0.071% lower at 73,953.31.

Further, markets struggled to find a direction as India moves closer to the election results day, when investors will proper insight about the country's political stability for coming years.

Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

.png)

.png)

"Diverging from their strong global counterparts, Indian equities commenced the week on a tepid note but a strong rally in the Energy and Metal counters not only helped the Index to recuperate its losses but compounded its gains as well to end the session at 22,529.05 with gains of 27.05 points." said Aditya Gaggar, director, Progressive Shares.

In addition to Metal and Energy, PSU bank segment outperformed while FMCG was the major laggard. A mixed activity was observed in the Broader markets where Midcaps marginally outperformed while Smallcaps ended the day in red, Gaggar said.

The Index has formed a bullish engulfing candle on the daily chart which indicates presence of buyers at the lower levels. Once the Index breaches the level of 22,600, we can expect a retest of its previous high of 22,790 while the downside seems to be protected at 22,400, he added.

.png)

Tata Steel Ltd., Coal India Ltd., Hindalco Industries Ltd., Powergrid Corp of India Ltd., and State Bank of India added to the index.

ICICI Bank Ltd., HDFC Bank Ltd., Larsen & Toubro Ltd., Infosys Ltd., and Tata Consultancy Services Ltd. weighed on the benchmark.

On NSE, six sectors advanced, and six declined out of 12. The NSE Nifty Bank was the top loser, and the NSE Nifty Metal was the top performing sector.

.jpeg)

Broader markets ended on a mixed note. The S&P BSE Midcap ended 0.34% higher, and the S&P BSE Smallcap settled 0.18% lower.

On BSE, 13 sectors advanced, and seven declined out of 20. The S&P BSE Metal index jumped over 4% to become the best performing sector on Tuesday. Meanwhile, the S&P BSE FMCG sector declined the most.

Market breadth was skewed in favour of sellers. Around 2,311 stocks declined, 1,622 stocks rose, and 154 stocks remained unchanged on BSE.

Revenue rose 3.7% to Rs 1,094 crore from Rs 1,055 crore

Ebitda rose 19.6% to Rs 135 crore from Rs 113 crore

Margin rose 170 basis points to 12.4% from 10.7%

Net profit rose 39.3% to Rs 40 crore from Rs 29 crore

Revenue rose 3.7% to Rs 1,094 crore from Rs 1,055 crore

Ebitda rose 19.6% to Rs 135 crore from Rs 113 crore

Margin rose 170 basis points to 12.4% from 10.7%

Net profit rose 39.3% to Rs 40 crore from Rs 29 crore

.png)

Net profit rose 23.8% Rs 50 crore from Rs 40 crore

Revenue rose 1.5% to Rs 256 crore from Rs 252 crore

EBIT rose 7.8% to Rs 45 crore from Rs 42 crore

EBIT margin rose 100 basis points to 17.5% vs 16.5%

Net profit rose 23.8% Rs 50 crore from Rs 40 crore

Revenue rose 1.5% to Rs 256 crore from Rs 252 crore

EBIT rose 7.8% to Rs 45 crore from Rs 42 crore

EBIT margin rose 100 basis points to 17.5% vs 16.5%

.png)

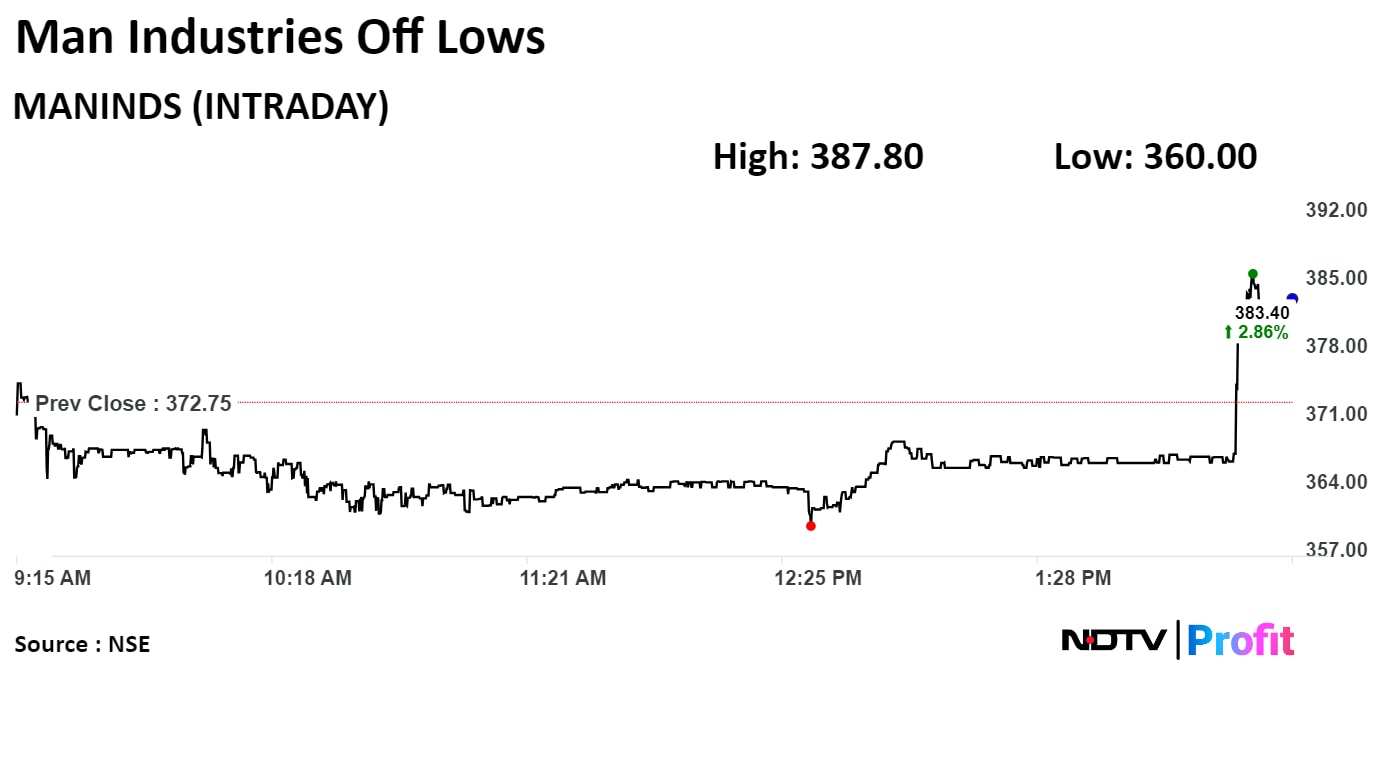

Man Industries Ltd. received a new export order worth Rs 505 crore.

Source: Exchange filing

Man Industries Ltd. received a new export order worth Rs 505 crore.

Source: Exchange filing

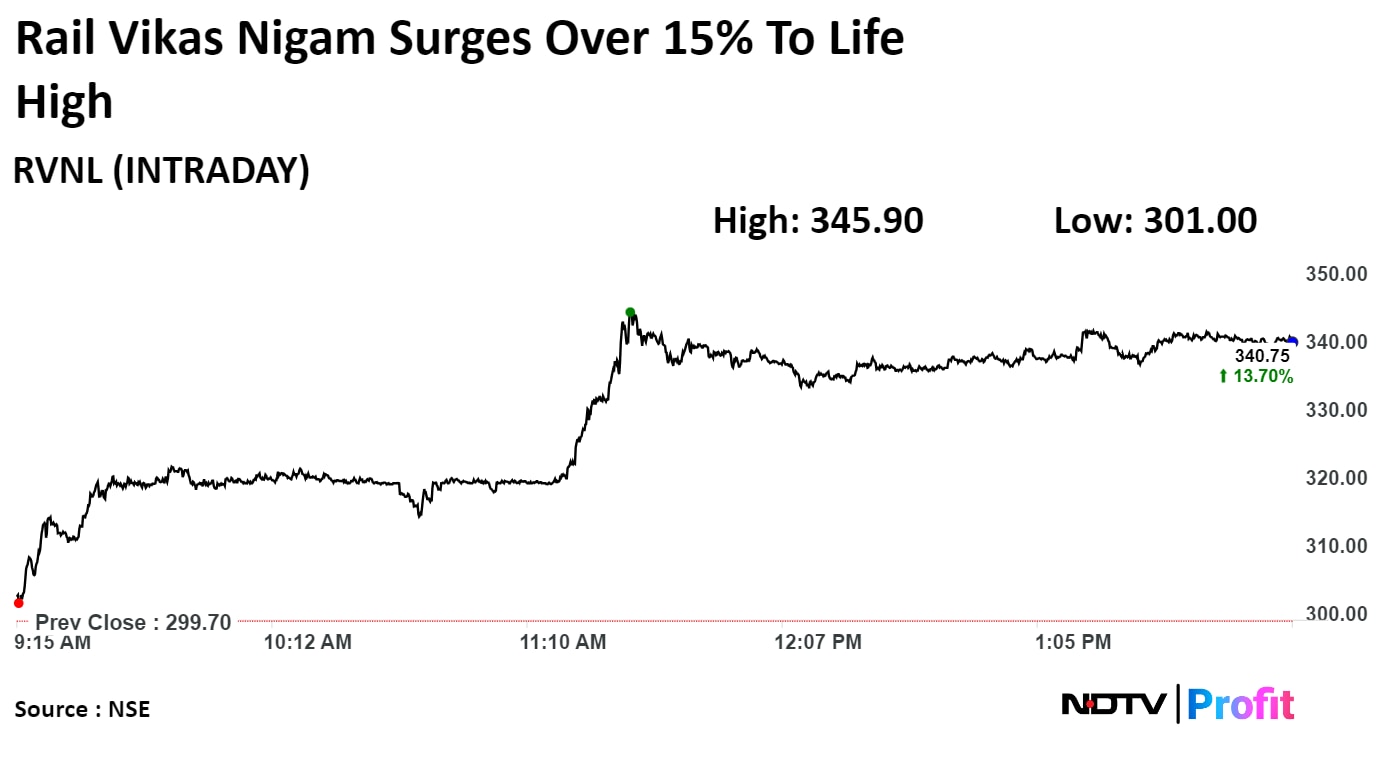

Shares of Rail Vikas Nigam surged over 15% to the highest level since the company's listing on the exchanges after it secured an order worth Rs 148 crore.

Shares of Rail Vikas Nigam Ltd. surged 15.42% to 345.90, the highest level since its listing on April 11, 2019. It was trading 13.05% higher at Rs 338.80 as of 2:17 p.m., as compared to 0.17% advance in the NSE Nifty 50 index.

The scrip gained 183.17% in 12 months, and on year to date basis, it has risen 87.14%. Total traded volume so far in the day stood at 6.30 times its 30-day average. The relative strength index was at 78.22, which implied the stock is overbought.

One analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies a downside of 21.4%.

Shares of Rail Vikas Nigam surged over 15% to the highest level since the company's listing on the exchanges after it secured an order worth Rs 148 crore.

Shares of Rail Vikas Nigam Ltd. surged 15.42% to 345.90, the highest level since its listing on April 11, 2019. It was trading 13.05% higher at Rs 338.80 as of 2:17 p.m., as compared to 0.17% advance in the NSE Nifty 50 index.

The scrip gained 183.17% in 12 months, and on year to date basis, it has risen 87.14%. Total traded volume so far in the day stood at 6.30 times its 30-day average. The relative strength index was at 78.22, which implied the stock is overbought.

One analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies a downside of 21.4%.

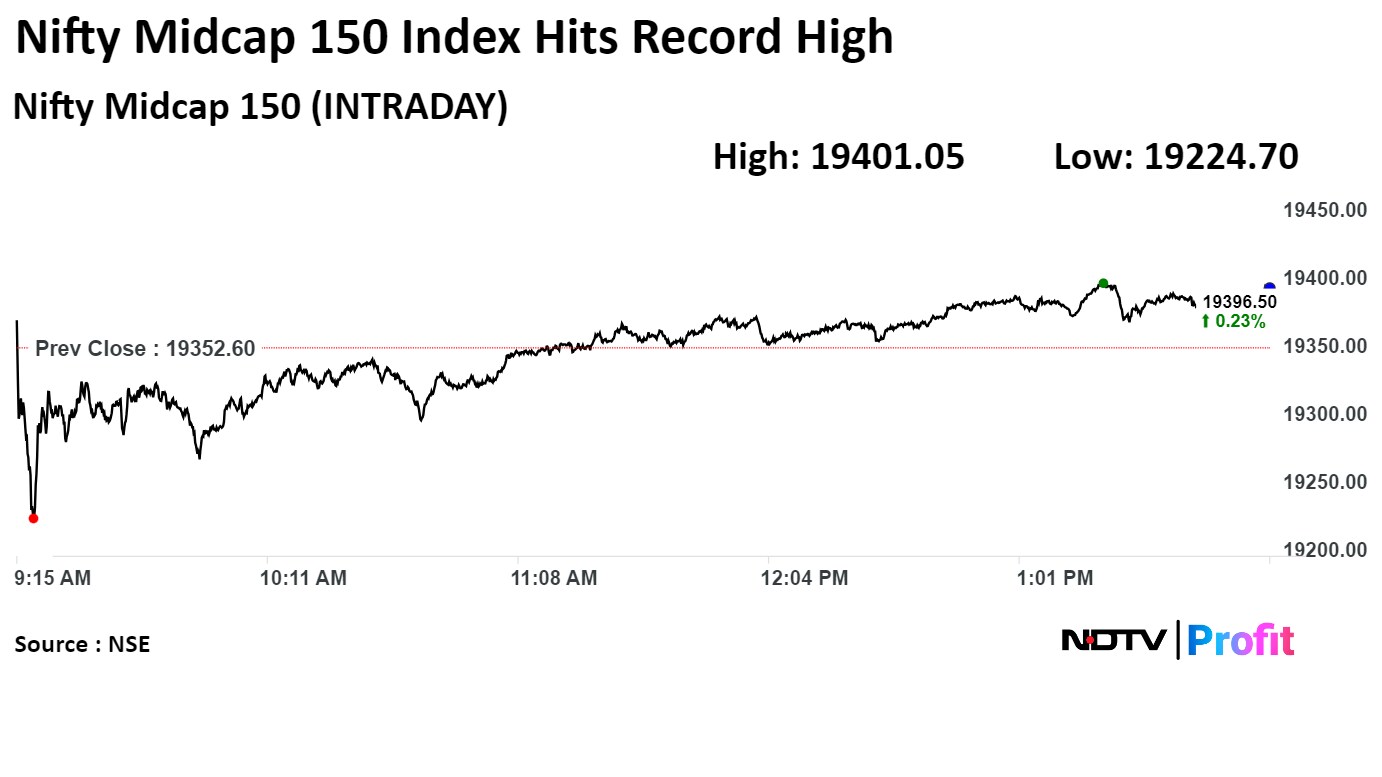

The NSE Nifty Midcap 150 rose 0.25% to 19,401.05, the highest level since its inception. It was trading 0.22% higher at 19,394.35 as of 1:59 p.m., as compared to 0.18% advance in the NSE Nifty index.

The NSE Nifty Midcap 150 rose 0.25% to 19,401.05, the highest level since its inception. It was trading 0.22% higher at 19,394.35 as of 1:59 p.m., as compared to 0.18% advance in the NSE Nifty index.

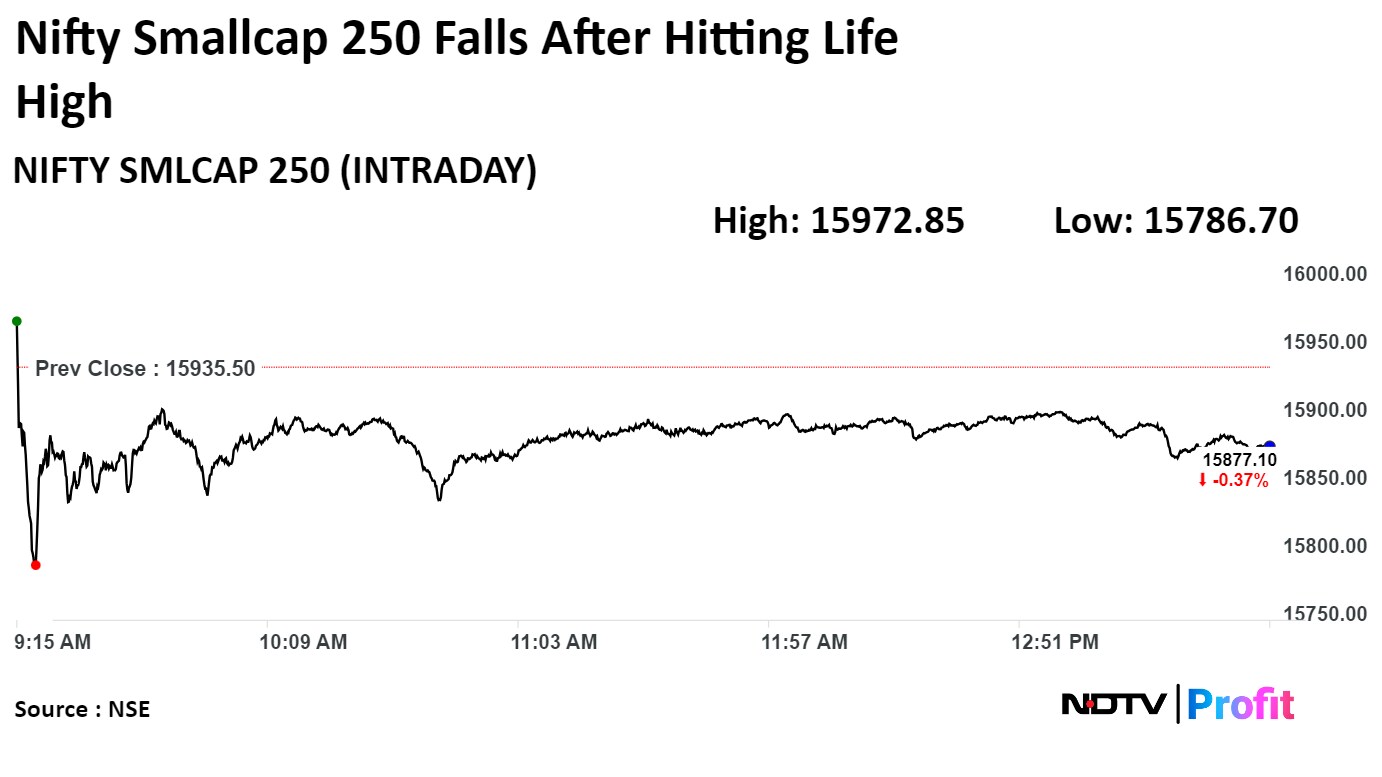

The NSE Nifty Smallcap 250 rose 0.23% to 15,972.85, the highest level since its incorporation. It erased all gains to trade 0.32% lower at 15,884.00 as of 1:55 p.m., as compared to 0.20% advance in the NSE Nifty 50 index.

The NSE Nifty Smallcap 250 rose 0.23% to 15,972.85, the highest level since its incorporation. It erased all gains to trade 0.32% lower at 15,884.00 as of 1:55 p.m., as compared to 0.20% advance in the NSE Nifty 50 index.

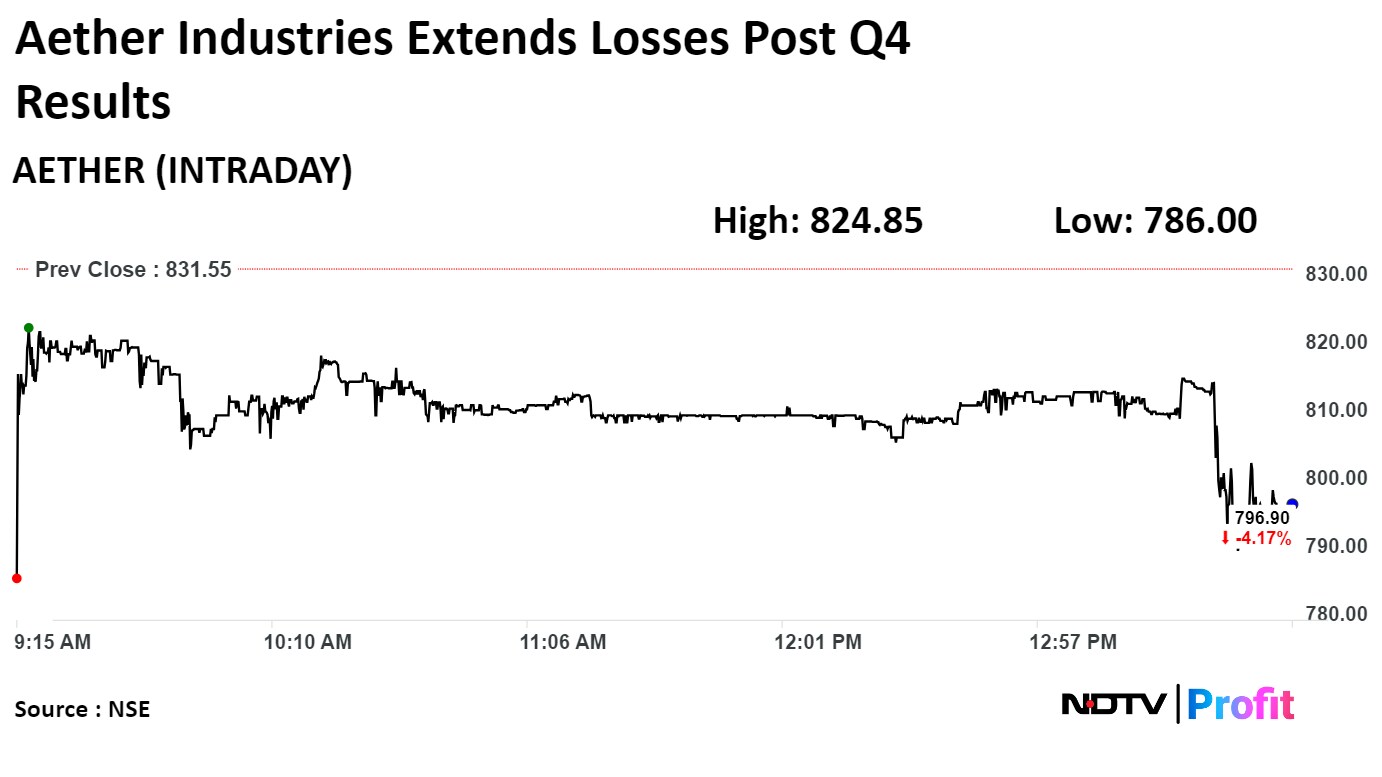

Net loss of Rs 1.4 crore against profit of Rs 37.5 crore

Revenue fell 36.1% to Rs 118 crore from Rs 184 crore

Ebitda fell 82.9 to Rs 10 crore from Rs 60 crore

Margin fell 2,380 basis points to 8.7% vs 32.5%

Net loss of Rs 1.4 crore against profit of Rs 37.5 crore

Revenue fell 36.1% to Rs 118 crore from Rs 184 crore

Ebitda fell 82.9 to Rs 10 crore from Rs 60 crore

Margin fell 2,380 basis points to 8.7% vs 32.5%

Vodafone Idea Ltd. is to raise Rs 2,075 crore via preferential allotment of shares.

The company approved allotment of shares to Oriana Investments, an Aditya Birla Group entity, at Rs 14.87 per share

Source: Exchange filing

.png)

Indian benchmark stock indices rebounded, erasing their morning losses, through midday on Tuesday, led by gains in Coal India Ltd. and Tata Steel Ltd.

At 12:01 p.m., the NSE Nifty 50 was trading 42.00 points or 0.19% higher at 22,544.00, and the S&P BSE Sensex was 46.29 points or 0.06% up at 74,052.23. Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

"Any decline (of Nifty 50) near the support of 22,250–22,300 will be a good entry point, and on the higher side, resistance is now placed at 22,650 levels. RSI is trading above the average line, and sustaining above these would continue to keep the market's momentum positive. The highest call OI has moved higher to 23,000 strike, while on the downside, the highest put OI is at 22,400 for the weekly expiry," said Vikas Jain, a senior research analyst at Reliance Securities.

Indian benchmark stock indices rebounded, erasing their morning losses, through midday on Tuesday, led by gains in Coal India Ltd. and Tata Steel Ltd.

At 12:01 p.m., the NSE Nifty 50 was trading 42.00 points or 0.19% higher at 22,544.00, and the S&P BSE Sensex was 46.29 points or 0.06% up at 74,052.23. Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

"Any decline (of Nifty 50) near the support of 22,250–22,300 will be a good entry point, and on the higher side, resistance is now placed at 22,650 levels. RSI is trading above the average line, and sustaining above these would continue to keep the market's momentum positive. The highest call OI has moved higher to 23,000 strike, while on the downside, the highest put OI is at 22,400 for the weekly expiry," said Vikas Jain, a senior research analyst at Reliance Securities.

.png)

Indian benchmark stock indices rebounded, erasing their morning losses, through midday on Tuesday, led by gains in Coal India Ltd. and Tata Steel Ltd.

At 12:01 p.m., the NSE Nifty 50 was trading 42.00 points or 0.19% higher at 22,544.00, and the S&P BSE Sensex was 46.29 points or 0.06% up at 74,052.23. Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

"Any decline (of Nifty 50) near the support of 22,250–22,300 will be a good entry point, and on the higher side, resistance is now placed at 22,650 levels. RSI is trading above the average line, and sustaining above these would continue to keep the market's momentum positive. The highest call OI has moved higher to 23,000 strike, while on the downside, the highest put OI is at 22,400 for the weekly expiry," said Vikas Jain, a senior research analyst at Reliance Securities.

Indian benchmark stock indices rebounded, erasing their morning losses, through midday on Tuesday, led by gains in Coal India Ltd. and Tata Steel Ltd.

At 12:01 p.m., the NSE Nifty 50 was trading 42.00 points or 0.19% higher at 22,544.00, and the S&P BSE Sensex was 46.29 points or 0.06% up at 74,052.23. Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

"Any decline (of Nifty 50) near the support of 22,250–22,300 will be a good entry point, and on the higher side, resistance is now placed at 22,650 levels. RSI is trading above the average line, and sustaining above these would continue to keep the market's momentum positive. The highest call OI has moved higher to 23,000 strike, while on the downside, the highest put OI is at 22,400 for the weekly expiry," said Vikas Jain, a senior research analyst at Reliance Securities.

.png)

.png)

Indian benchmark stock indices rebounded, erasing their morning losses, through midday on Tuesday, led by gains in Coal India Ltd. and Tata Steel Ltd.

At 12:01 p.m., the NSE Nifty 50 was trading 42.00 points or 0.19% higher at 22,544.00, and the S&P BSE Sensex was 46.29 points or 0.06% up at 74,052.23. Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

"Any decline (of Nifty 50) near the support of 22,250–22,300 will be a good entry point, and on the higher side, resistance is now placed at 22,650 levels. RSI is trading above the average line, and sustaining above these would continue to keep the market's momentum positive. The highest call OI has moved higher to 23,000 strike, while on the downside, the highest put OI is at 22,400 for the weekly expiry," said Vikas Jain, a senior research analyst at Reliance Securities.

Indian benchmark stock indices rebounded, erasing their morning losses, through midday on Tuesday, led by gains in Coal India Ltd. and Tata Steel Ltd.

At 12:01 p.m., the NSE Nifty 50 was trading 42.00 points or 0.19% higher at 22,544.00, and the S&P BSE Sensex was 46.29 points or 0.06% up at 74,052.23. Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

"Any decline (of Nifty 50) near the support of 22,250–22,300 will be a good entry point, and on the higher side, resistance is now placed at 22,650 levels. RSI is trading above the average line, and sustaining above these would continue to keep the market's momentum positive. The highest call OI has moved higher to 23,000 strike, while on the downside, the highest put OI is at 22,400 for the weekly expiry," said Vikas Jain, a senior research analyst at Reliance Securities.

.png)

Indian benchmark stock indices rebounded, erasing their morning losses, through midday on Tuesday, led by gains in Coal India Ltd. and Tata Steel Ltd.

At 12:01 p.m., the NSE Nifty 50 was trading 42.00 points or 0.19% higher at 22,544.00, and the S&P BSE Sensex was 46.29 points or 0.06% up at 74,052.23. Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

"Any decline (of Nifty 50) near the support of 22,250–22,300 will be a good entry point, and on the higher side, resistance is now placed at 22,650 levels. RSI is trading above the average line, and sustaining above these would continue to keep the market's momentum positive. The highest call OI has moved higher to 23,000 strike, while on the downside, the highest put OI is at 22,400 for the weekly expiry," said Vikas Jain, a senior research analyst at Reliance Securities.

Indian benchmark stock indices rebounded, erasing their morning losses, through midday on Tuesday, led by gains in Coal India Ltd. and Tata Steel Ltd.

At 12:01 p.m., the NSE Nifty 50 was trading 42.00 points or 0.19% higher at 22,544.00, and the S&P BSE Sensex was 46.29 points or 0.06% up at 74,052.23. Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

"Any decline (of Nifty 50) near the support of 22,250–22,300 will be a good entry point, and on the higher side, resistance is now placed at 22,650 levels. RSI is trading above the average line, and sustaining above these would continue to keep the market's momentum positive. The highest call OI has moved higher to 23,000 strike, while on the downside, the highest put OI is at 22,400 for the weekly expiry," said Vikas Jain, a senior research analyst at Reliance Securities.

.png)

.png)

.png)

Coal India Ltd., Tata Steel Ltd., State Bank of India, Hindalco Industries Ltd., and Power Grid Corp of India Ltd. added to the index.

ICICI Bank Ltd., HDFC Bank Ltd., Infosys Ltd., Tata Consultancy Services Ltd., and ITC Ltd. weighed on the benchmark.

Indian benchmark stock indices rebounded, erasing their morning losses, through midday on Tuesday, led by gains in Coal India Ltd. and Tata Steel Ltd.

At 12:01 p.m., the NSE Nifty 50 was trading 42.00 points or 0.19% higher at 22,544.00, and the S&P BSE Sensex was 46.29 points or 0.06% up at 74,052.23. Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

"Any decline (of Nifty 50) near the support of 22,250–22,300 will be a good entry point, and on the higher side, resistance is now placed at 22,650 levels. RSI is trading above the average line, and sustaining above these would continue to keep the market's momentum positive. The highest call OI has moved higher to 23,000 strike, while on the downside, the highest put OI is at 22,400 for the weekly expiry," said Vikas Jain, a senior research analyst at Reliance Securities.

Indian benchmark stock indices rebounded, erasing their morning losses, through midday on Tuesday, led by gains in Coal India Ltd. and Tata Steel Ltd.

At 12:01 p.m., the NSE Nifty 50 was trading 42.00 points or 0.19% higher at 22,544.00, and the S&P BSE Sensex was 46.29 points or 0.06% up at 74,052.23. Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

"Any decline (of Nifty 50) near the support of 22,250–22,300 will be a good entry point, and on the higher side, resistance is now placed at 22,650 levels. RSI is trading above the average line, and sustaining above these would continue to keep the market's momentum positive. The highest call OI has moved higher to 23,000 strike, while on the downside, the highest put OI is at 22,400 for the weekly expiry," said Vikas Jain, a senior research analyst at Reliance Securities.

.png)

Indian benchmark stock indices rebounded, erasing their morning losses, through midday on Tuesday, led by gains in Coal India Ltd. and Tata Steel Ltd.

At 12:01 p.m., the NSE Nifty 50 was trading 42.00 points or 0.19% higher at 22,544.00, and the S&P BSE Sensex was 46.29 points or 0.06% up at 74,052.23. Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

"Any decline (of Nifty 50) near the support of 22,250–22,300 will be a good entry point, and on the higher side, resistance is now placed at 22,650 levels. RSI is trading above the average line, and sustaining above these would continue to keep the market's momentum positive. The highest call OI has moved higher to 23,000 strike, while on the downside, the highest put OI is at 22,400 for the weekly expiry," said Vikas Jain, a senior research analyst at Reliance Securities.

Indian benchmark stock indices rebounded, erasing their morning losses, through midday on Tuesday, led by gains in Coal India Ltd. and Tata Steel Ltd.

At 12:01 p.m., the NSE Nifty 50 was trading 42.00 points or 0.19% higher at 22,544.00, and the S&P BSE Sensex was 46.29 points or 0.06% up at 74,052.23. Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

"Any decline (of Nifty 50) near the support of 22,250–22,300 will be a good entry point, and on the higher side, resistance is now placed at 22,650 levels. RSI is trading above the average line, and sustaining above these would continue to keep the market's momentum positive. The highest call OI has moved higher to 23,000 strike, while on the downside, the highest put OI is at 22,400 for the weekly expiry," said Vikas Jain, a senior research analyst at Reliance Securities.

.png)

.png)

Indian benchmark stock indices rebounded, erasing their morning losses, through midday on Tuesday, led by gains in Coal India Ltd. and Tata Steel Ltd.

At 12:01 p.m., the NSE Nifty 50 was trading 42.00 points or 0.19% higher at 22,544.00, and the S&P BSE Sensex was 46.29 points or 0.06% up at 74,052.23. Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

"Any decline (of Nifty 50) near the support of 22,250–22,300 will be a good entry point, and on the higher side, resistance is now placed at 22,650 levels. RSI is trading above the average line, and sustaining above these would continue to keep the market's momentum positive. The highest call OI has moved higher to 23,000 strike, while on the downside, the highest put OI is at 22,400 for the weekly expiry," said Vikas Jain, a senior research analyst at Reliance Securities.

Indian benchmark stock indices rebounded, erasing their morning losses, through midday on Tuesday, led by gains in Coal India Ltd. and Tata Steel Ltd.

At 12:01 p.m., the NSE Nifty 50 was trading 42.00 points or 0.19% higher at 22,544.00, and the S&P BSE Sensex was 46.29 points or 0.06% up at 74,052.23. Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

"Any decline (of Nifty 50) near the support of 22,250–22,300 will be a good entry point, and on the higher side, resistance is now placed at 22,650 levels. RSI is trading above the average line, and sustaining above these would continue to keep the market's momentum positive. The highest call OI has moved higher to 23,000 strike, while on the downside, the highest put OI is at 22,400 for the weekly expiry," said Vikas Jain, a senior research analyst at Reliance Securities.

.png)

Indian benchmark stock indices rebounded, erasing their morning losses, through midday on Tuesday, led by gains in Coal India Ltd. and Tata Steel Ltd.

At 12:01 p.m., the NSE Nifty 50 was trading 42.00 points or 0.19% higher at 22,544.00, and the S&P BSE Sensex was 46.29 points or 0.06% up at 74,052.23. Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

"Any decline (of Nifty 50) near the support of 22,250–22,300 will be a good entry point, and on the higher side, resistance is now placed at 22,650 levels. RSI is trading above the average line, and sustaining above these would continue to keep the market's momentum positive. The highest call OI has moved higher to 23,000 strike, while on the downside, the highest put OI is at 22,400 for the weekly expiry," said Vikas Jain, a senior research analyst at Reliance Securities.

Indian benchmark stock indices rebounded, erasing their morning losses, through midday on Tuesday, led by gains in Coal India Ltd. and Tata Steel Ltd.

At 12:01 p.m., the NSE Nifty 50 was trading 42.00 points or 0.19% higher at 22,544.00, and the S&P BSE Sensex was 46.29 points or 0.06% up at 74,052.23. Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

"Any decline (of Nifty 50) near the support of 22,250–22,300 will be a good entry point, and on the higher side, resistance is now placed at 22,650 levels. RSI is trading above the average line, and sustaining above these would continue to keep the market's momentum positive. The highest call OI has moved higher to 23,000 strike, while on the downside, the highest put OI is at 22,400 for the weekly expiry," said Vikas Jain, a senior research analyst at Reliance Securities.

.png)

.png)

.png)

Coal India Ltd., Tata Steel Ltd., State Bank of India, Hindalco Industries Ltd., and Power Grid Corp of India Ltd. added to the index.

ICICI Bank Ltd., HDFC Bank Ltd., Infosys Ltd., Tata Consultancy Services Ltd., and ITC Ltd. weighed on the benchmark.

.png)

On NSE, six sectors declined, five advanced and one was flat. The NSE Nifty FMCG declined the most among sectoral indices, while the NSE Nifty Metal index was the top gainer.

Indian benchmark stock indices rebounded, erasing their morning losses, through midday on Tuesday, led by gains in Coal India Ltd. and Tata Steel Ltd.

At 12:01 p.m., the NSE Nifty 50 was trading 42.00 points or 0.19% higher at 22,544.00, and the S&P BSE Sensex was 46.29 points or 0.06% up at 74,052.23. Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

"Any decline (of Nifty 50) near the support of 22,250–22,300 will be a good entry point, and on the higher side, resistance is now placed at 22,650 levels. RSI is trading above the average line, and sustaining above these would continue to keep the market's momentum positive. The highest call OI has moved higher to 23,000 strike, while on the downside, the highest put OI is at 22,400 for the weekly expiry," said Vikas Jain, a senior research analyst at Reliance Securities.

Indian benchmark stock indices rebounded, erasing their morning losses, through midday on Tuesday, led by gains in Coal India Ltd. and Tata Steel Ltd.

At 12:01 p.m., the NSE Nifty 50 was trading 42.00 points or 0.19% higher at 22,544.00, and the S&P BSE Sensex was 46.29 points or 0.06% up at 74,052.23. Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

"Any decline (of Nifty 50) near the support of 22,250–22,300 will be a good entry point, and on the higher side, resistance is now placed at 22,650 levels. RSI is trading above the average line, and sustaining above these would continue to keep the market's momentum positive. The highest call OI has moved higher to 23,000 strike, while on the downside, the highest put OI is at 22,400 for the weekly expiry," said Vikas Jain, a senior research analyst at Reliance Securities.

.png)

Indian benchmark stock indices rebounded, erasing their morning losses, through midday on Tuesday, led by gains in Coal India Ltd. and Tata Steel Ltd.

At 12:01 p.m., the NSE Nifty 50 was trading 42.00 points or 0.19% higher at 22,544.00, and the S&P BSE Sensex was 46.29 points or 0.06% up at 74,052.23. Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

"Any decline (of Nifty 50) near the support of 22,250–22,300 will be a good entry point, and on the higher side, resistance is now placed at 22,650 levels. RSI is trading above the average line, and sustaining above these would continue to keep the market's momentum positive. The highest call OI has moved higher to 23,000 strike, while on the downside, the highest put OI is at 22,400 for the weekly expiry," said Vikas Jain, a senior research analyst at Reliance Securities.

Indian benchmark stock indices rebounded, erasing their morning losses, through midday on Tuesday, led by gains in Coal India Ltd. and Tata Steel Ltd.

At 12:01 p.m., the NSE Nifty 50 was trading 42.00 points or 0.19% higher at 22,544.00, and the S&P BSE Sensex was 46.29 points or 0.06% up at 74,052.23. Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

"Any decline (of Nifty 50) near the support of 22,250–22,300 will be a good entry point, and on the higher side, resistance is now placed at 22,650 levels. RSI is trading above the average line, and sustaining above these would continue to keep the market's momentum positive. The highest call OI has moved higher to 23,000 strike, while on the downside, the highest put OI is at 22,400 for the weekly expiry," said Vikas Jain, a senior research analyst at Reliance Securities.

.png)

.png)

Indian benchmark stock indices rebounded, erasing their morning losses, through midday on Tuesday, led by gains in Coal India Ltd. and Tata Steel Ltd.

At 12:01 p.m., the NSE Nifty 50 was trading 42.00 points or 0.19% higher at 22,544.00, and the S&P BSE Sensex was 46.29 points or 0.06% up at 74,052.23. Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

"Any decline (of Nifty 50) near the support of 22,250–22,300 will be a good entry point, and on the higher side, resistance is now placed at 22,650 levels. RSI is trading above the average line, and sustaining above these would continue to keep the market's momentum positive. The highest call OI has moved higher to 23,000 strike, while on the downside, the highest put OI is at 22,400 for the weekly expiry," said Vikas Jain, a senior research analyst at Reliance Securities.

Indian benchmark stock indices rebounded, erasing their morning losses, through midday on Tuesday, led by gains in Coal India Ltd. and Tata Steel Ltd.

At 12:01 p.m., the NSE Nifty 50 was trading 42.00 points or 0.19% higher at 22,544.00, and the S&P BSE Sensex was 46.29 points or 0.06% up at 74,052.23. Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

"Any decline (of Nifty 50) near the support of 22,250–22,300 will be a good entry point, and on the higher side, resistance is now placed at 22,650 levels. RSI is trading above the average line, and sustaining above these would continue to keep the market's momentum positive. The highest call OI has moved higher to 23,000 strike, while on the downside, the highest put OI is at 22,400 for the weekly expiry," said Vikas Jain, a senior research analyst at Reliance Securities.

.png)

Indian benchmark stock indices rebounded, erasing their morning losses, through midday on Tuesday, led by gains in Coal India Ltd. and Tata Steel Ltd.

At 12:01 p.m., the NSE Nifty 50 was trading 42.00 points or 0.19% higher at 22,544.00, and the S&P BSE Sensex was 46.29 points or 0.06% up at 74,052.23. Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

"Any decline (of Nifty 50) near the support of 22,250–22,300 will be a good entry point, and on the higher side, resistance is now placed at 22,650 levels. RSI is trading above the average line, and sustaining above these would continue to keep the market's momentum positive. The highest call OI has moved higher to 23,000 strike, while on the downside, the highest put OI is at 22,400 for the weekly expiry," said Vikas Jain, a senior research analyst at Reliance Securities.

Indian benchmark stock indices rebounded, erasing their morning losses, through midday on Tuesday, led by gains in Coal India Ltd. and Tata Steel Ltd.

At 12:01 p.m., the NSE Nifty 50 was trading 42.00 points or 0.19% higher at 22,544.00, and the S&P BSE Sensex was 46.29 points or 0.06% up at 74,052.23. Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

"Any decline (of Nifty 50) near the support of 22,250–22,300 will be a good entry point, and on the higher side, resistance is now placed at 22,650 levels. RSI is trading above the average line, and sustaining above these would continue to keep the market's momentum positive. The highest call OI has moved higher to 23,000 strike, while on the downside, the highest put OI is at 22,400 for the weekly expiry," said Vikas Jain, a senior research analyst at Reliance Securities.

.png)

.png)

.png)

Coal India Ltd., Tata Steel Ltd., State Bank of India, Hindalco Industries Ltd., and Power Grid Corp of India Ltd. added to the index.

ICICI Bank Ltd., HDFC Bank Ltd., Infosys Ltd., Tata Consultancy Services Ltd., and ITC Ltd. weighed on the benchmark.

Indian benchmark stock indices rebounded, erasing their morning losses, through midday on Tuesday, led by gains in Coal India Ltd. and Tata Steel Ltd.

At 12:01 p.m., the NSE Nifty 50 was trading 42.00 points or 0.19% higher at 22,544.00, and the S&P BSE Sensex was 46.29 points or 0.06% up at 74,052.23. Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

"Any decline (of Nifty 50) near the support of 22,250–22,300 will be a good entry point, and on the higher side, resistance is now placed at 22,650 levels. RSI is trading above the average line, and sustaining above these would continue to keep the market's momentum positive. The highest call OI has moved higher to 23,000 strike, while on the downside, the highest put OI is at 22,400 for the weekly expiry," said Vikas Jain, a senior research analyst at Reliance Securities.

Indian benchmark stock indices rebounded, erasing their morning losses, through midday on Tuesday, led by gains in Coal India Ltd. and Tata Steel Ltd.

At 12:01 p.m., the NSE Nifty 50 was trading 42.00 points or 0.19% higher at 22,544.00, and the S&P BSE Sensex was 46.29 points or 0.06% up at 74,052.23. Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

"Any decline (of Nifty 50) near the support of 22,250–22,300 will be a good entry point, and on the higher side, resistance is now placed at 22,650 levels. RSI is trading above the average line, and sustaining above these would continue to keep the market's momentum positive. The highest call OI has moved higher to 23,000 strike, while on the downside, the highest put OI is at 22,400 for the weekly expiry," said Vikas Jain, a senior research analyst at Reliance Securities.

.png)

Indian benchmark stock indices rebounded, erasing their morning losses, through midday on Tuesday, led by gains in Coal India Ltd. and Tata Steel Ltd.

At 12:01 p.m., the NSE Nifty 50 was trading 42.00 points or 0.19% higher at 22,544.00, and the S&P BSE Sensex was 46.29 points or 0.06% up at 74,052.23. Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

"Any decline (of Nifty 50) near the support of 22,250–22,300 will be a good entry point, and on the higher side, resistance is now placed at 22,650 levels. RSI is trading above the average line, and sustaining above these would continue to keep the market's momentum positive. The highest call OI has moved higher to 23,000 strike, while on the downside, the highest put OI is at 22,400 for the weekly expiry," said Vikas Jain, a senior research analyst at Reliance Securities.

Indian benchmark stock indices rebounded, erasing their morning losses, through midday on Tuesday, led by gains in Coal India Ltd. and Tata Steel Ltd.

At 12:01 p.m., the NSE Nifty 50 was trading 42.00 points or 0.19% higher at 22,544.00, and the S&P BSE Sensex was 46.29 points or 0.06% up at 74,052.23. Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

"Any decline (of Nifty 50) near the support of 22,250–22,300 will be a good entry point, and on the higher side, resistance is now placed at 22,650 levels. RSI is trading above the average line, and sustaining above these would continue to keep the market's momentum positive. The highest call OI has moved higher to 23,000 strike, while on the downside, the highest put OI is at 22,400 for the weekly expiry," said Vikas Jain, a senior research analyst at Reliance Securities.

.png)

.png)

Indian benchmark stock indices rebounded, erasing their morning losses, through midday on Tuesday, led by gains in Coal India Ltd. and Tata Steel Ltd.

At 12:01 p.m., the NSE Nifty 50 was trading 42.00 points or 0.19% higher at 22,544.00, and the S&P BSE Sensex was 46.29 points or 0.06% up at 74,052.23. Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

"Any decline (of Nifty 50) near the support of 22,250–22,300 will be a good entry point, and on the higher side, resistance is now placed at 22,650 levels. RSI is trading above the average line, and sustaining above these would continue to keep the market's momentum positive. The highest call OI has moved higher to 23,000 strike, while on the downside, the highest put OI is at 22,400 for the weekly expiry," said Vikas Jain, a senior research analyst at Reliance Securities.

Indian benchmark stock indices rebounded, erasing their morning losses, through midday on Tuesday, led by gains in Coal India Ltd. and Tata Steel Ltd.

At 12:01 p.m., the NSE Nifty 50 was trading 42.00 points or 0.19% higher at 22,544.00, and the S&P BSE Sensex was 46.29 points or 0.06% up at 74,052.23. Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

"Any decline (of Nifty 50) near the support of 22,250–22,300 will be a good entry point, and on the higher side, resistance is now placed at 22,650 levels. RSI is trading above the average line, and sustaining above these would continue to keep the market's momentum positive. The highest call OI has moved higher to 23,000 strike, while on the downside, the highest put OI is at 22,400 for the weekly expiry," said Vikas Jain, a senior research analyst at Reliance Securities.

.png)

Indian benchmark stock indices rebounded, erasing their morning losses, through midday on Tuesday, led by gains in Coal India Ltd. and Tata Steel Ltd.

At 12:01 p.m., the NSE Nifty 50 was trading 42.00 points or 0.19% higher at 22,544.00, and the S&P BSE Sensex was 46.29 points or 0.06% up at 74,052.23. Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

"Any decline (of Nifty 50) near the support of 22,250–22,300 will be a good entry point, and on the higher side, resistance is now placed at 22,650 levels. RSI is trading above the average line, and sustaining above these would continue to keep the market's momentum positive. The highest call OI has moved higher to 23,000 strike, while on the downside, the highest put OI is at 22,400 for the weekly expiry," said Vikas Jain, a senior research analyst at Reliance Securities.

Indian benchmark stock indices rebounded, erasing their morning losses, through midday on Tuesday, led by gains in Coal India Ltd. and Tata Steel Ltd.

At 12:01 p.m., the NSE Nifty 50 was trading 42.00 points or 0.19% higher at 22,544.00, and the S&P BSE Sensex was 46.29 points or 0.06% up at 74,052.23. Intraday, the NSE Nifty 50 fell 0.43% to 22,404.55, and the S&P BSE Sensex fell 0.33% to 73,762.37.

"Any decline (of Nifty 50) near the support of 22,250–22,300 will be a good entry point, and on the higher side, resistance is now placed at 22,650 levels. RSI is trading above the average line, and sustaining above these would continue to keep the market's momentum positive. The highest call OI has moved higher to 23,000 strike, while on the downside, the highest put OI is at 22,400 for the weekly expiry," said Vikas Jain, a senior research analyst at Reliance Securities.

.png)

.png)

.png)

Coal India Ltd., Tata Steel Ltd., State Bank of India, Hindalco Industries Ltd., and Power Grid Corp of India Ltd. added to the index.

ICICI Bank Ltd., HDFC Bank Ltd., Infosys Ltd., Tata Consultancy Services Ltd., and ITC Ltd. weighed on the benchmark.

.png)

On NSE, six sectors declined, five advanced and one was flat. The NSE Nifty FMCG declined the most among sectoral indices, while the NSE Nifty Metal index was the top gainer.

.png)

Broader markets were mixed with the S&P BSE Midcap rising 0.17% and the S&P BSE Smallcap falling 0.17% through midday on Tuesday.

On BSE, 13 sectors advanced and three declined out of 20. The S&P BSE Utilities rose the most among sectoral indices, while the S&P BSE IT index declined the most.

Market breadth was skewed in favour of sellers. Around 2,098 stocks declined, 1,620 stocks rose, and 202 stocks remained unchanged on BSE.

Nibe Ltd. signed a technology transfer pact with the Defence Ministry for manufacture and sale of anti-terrorist vehicles to central and state defence agencies.

Source: Exchange filing

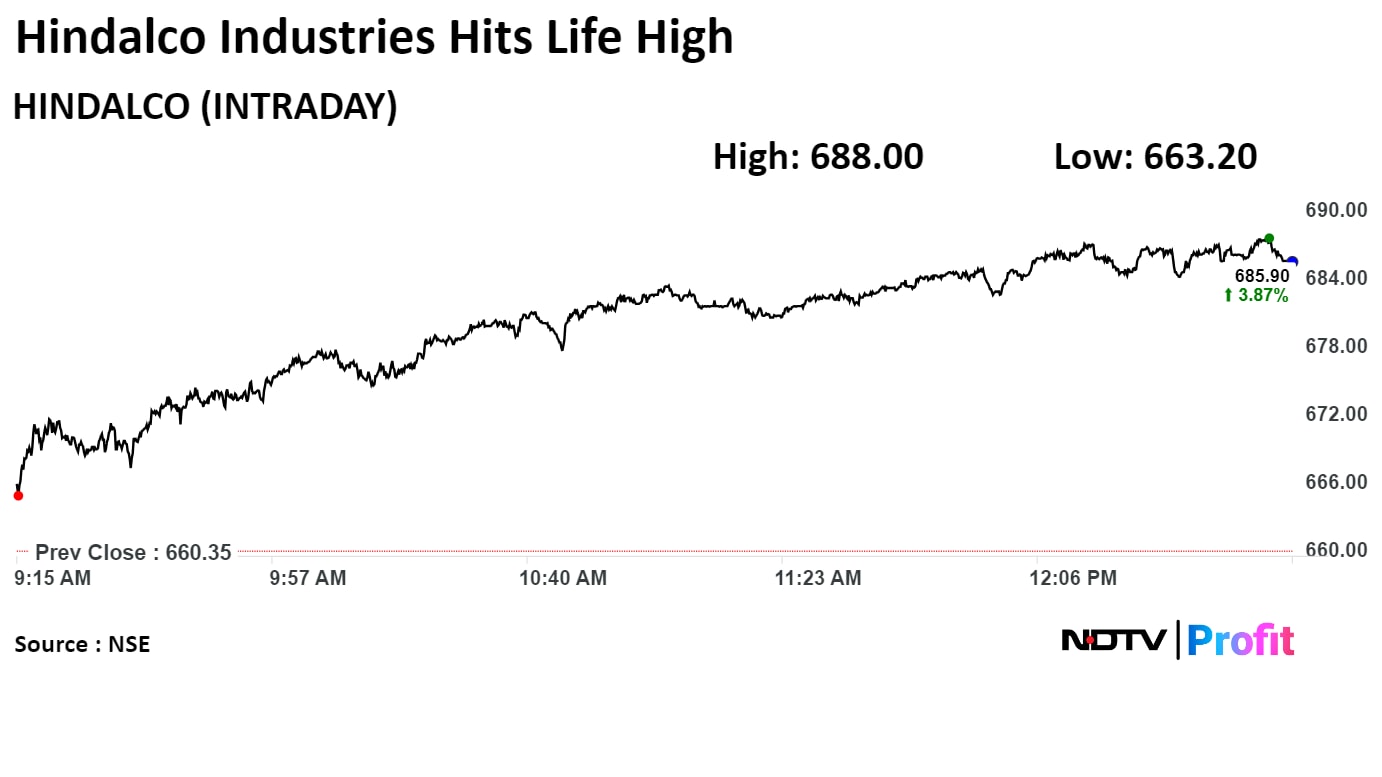

Shares of Hindalco Industries Ltd. rose 4.19% to Rs 688.00, the highest level since its listing on Jan 8, 1997. It was trading 3.88% higher at Rs 686.00 as of 12:50 p.m., as compared to 0.27% advance in the NSE Nifty 50 index.

The scrip gained 68.26% in 12 months, and on year to date basis, it has risen 11.5%. Total traded volume so far in the day stood at 2.0 times its 30-day average. The relative strength index was at 74.58.

Out of 27 analysts tracking the company, 24 maintain a 'buy' rating, one recommend a 'hold,' and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an downside of 2.4%.

Shares of Hindalco Industries Ltd. rose 4.19% to Rs 688.00, the highest level since its listing on Jan 8, 1997. It was trading 3.88% higher at Rs 686.00 as of 12:50 p.m., as compared to 0.27% advance in the NSE Nifty 50 index.

The scrip gained 68.26% in 12 months, and on year to date basis, it has risen 11.5%. Total traded volume so far in the day stood at 2.0 times its 30-day average. The relative strength index was at 74.58.

Out of 27 analysts tracking the company, 24 maintain a 'buy' rating, one recommend a 'hold,' and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an downside of 2.4%.

Tata Steel Ltd. rose to the highest level since listing Tuesday after the company signed a pact with National Grid for Port Talbot. National Grid will build new electrical infrastructure.

Tata Steel Ltd. rose to the highest level since listing Tuesday after the company signed a pact with National Grid for Port Talbot. National Grid will build new electrical infrastructure.

The NSE Nifty Metal index ros 3.07% to 9,903.80,the highest level since its incorporation on July 12, 2011. It was trading 3.05% higher at 9,901.0 as of 12:17 p.m., as compared to 0.20% advance in the NSE Nifty 50 index.

The index has been rising to the record level since Friday. In these three session the NSE Nifty Metal gained 3.81%.

The NSE Nifty Metal index ros 3.07% to 9,903.80,the highest level since its incorporation on July 12, 2011. It was trading 3.05% higher at 9,901.0 as of 12:17 p.m., as compared to 0.20% advance in the NSE Nifty 50 index.

The index has been rising to the record level since Friday. In these three session the NSE Nifty Metal gained 3.81%.

.png)

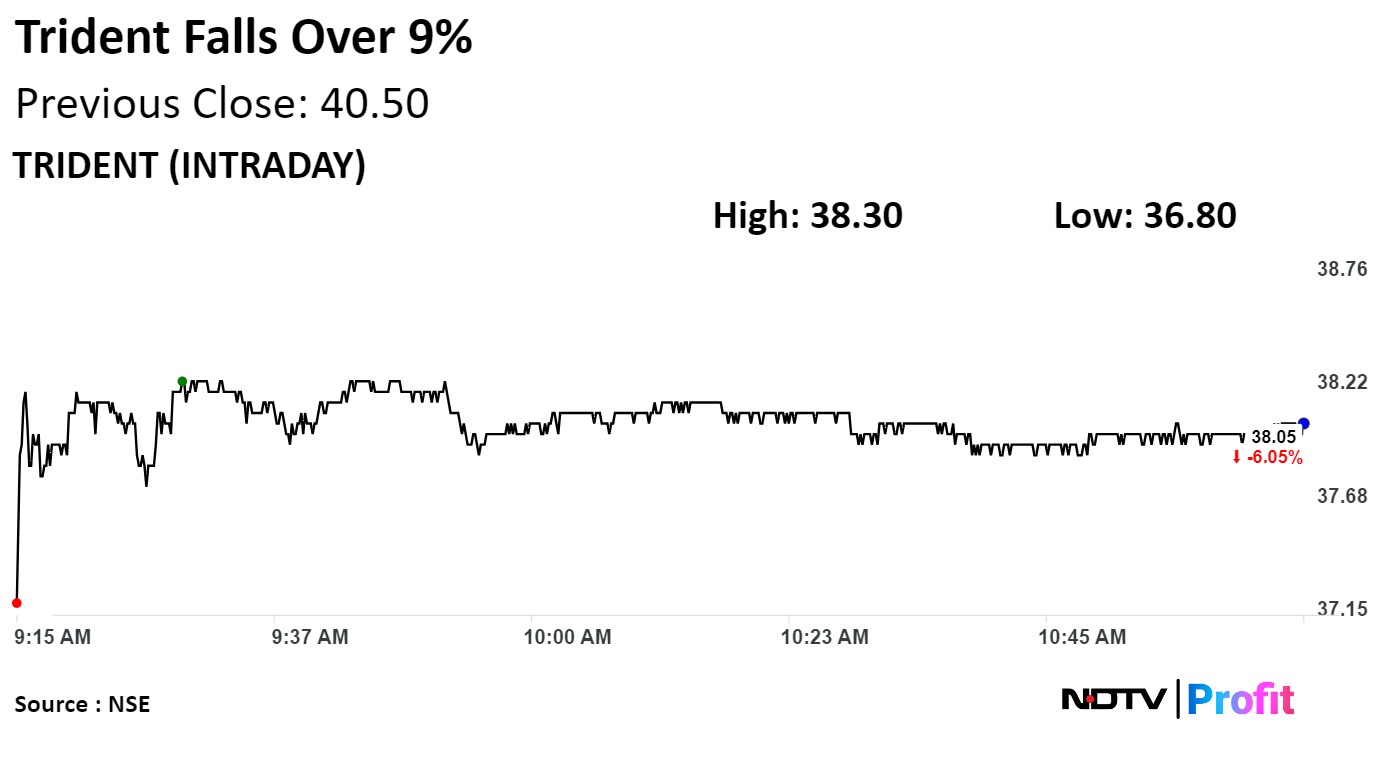

Trident Ltd. slipped to the lowest level in over one-week low after its net profit fell over 54% during January-March.

The textiles manufacturer's consolidated net profit declined 54.8% on the year to Rs 59 crore. Trident's profit margin also declined 490 basis points on the year to 12% in the quarter ended in March.

Shares of Trident Ltd. declined 9.14% to Rs 36.80, the lowest level since May 10. It pared losses to trade 6.17% down at Rs 38.00 as of 11:05 a.m., as compared to 0.01% decline in the NSE Nifty 50 index.

The scrip gained 10.63% in 12 months, and on year to date basis, it has risen 4.82%. Total traded volume so far in the day stood at 4.6 times its 30-day average. The relative strength index was at 43.87.

Two analysts tracking the company maintain a 'buy' rating, according to Bloomberg data.

Trident Ltd. slipped to the lowest level in over one-week low after its net profit fell over 54% during January-March.

The textiles manufacturer's consolidated net profit declined 54.8% on the year to Rs 59 crore. Trident's profit margin also declined 490 basis points on the year to 12% in the quarter ended in March.

Shares of Trident Ltd. declined 9.14% to Rs 36.80, the lowest level since May 10. It pared losses to trade 6.17% down at Rs 38.00 as of 11:05 a.m., as compared to 0.01% decline in the NSE Nifty 50 index.

The scrip gained 10.63% in 12 months, and on year to date basis, it has risen 4.82%. Total traded volume so far in the day stood at 4.6 times its 30-day average. The relative strength index was at 43.87.

Two analysts tracking the company maintain a 'buy' rating, according to Bloomberg data.

Axis Securities maintained a Hold with target price Rs 2,155, which implied a downside of 1%.

Q4 Revenues inline while EBITDA/PAT beat estimates

Strong order wins of Rs. 1199 cr, Europe at €31mn in FY24

Cumulative 5 year order book at 36% for EV, 48% Hybrids

FY24 Capex was at Rs. 383 cr, Rs 400 cr for FY25

Focus on product premiumization and targetted shift to 4W

View Endurance favourably as an auto sector investment

FY25E/FY26E Revenue estimate up by 0.3%, PE at 30X FY26

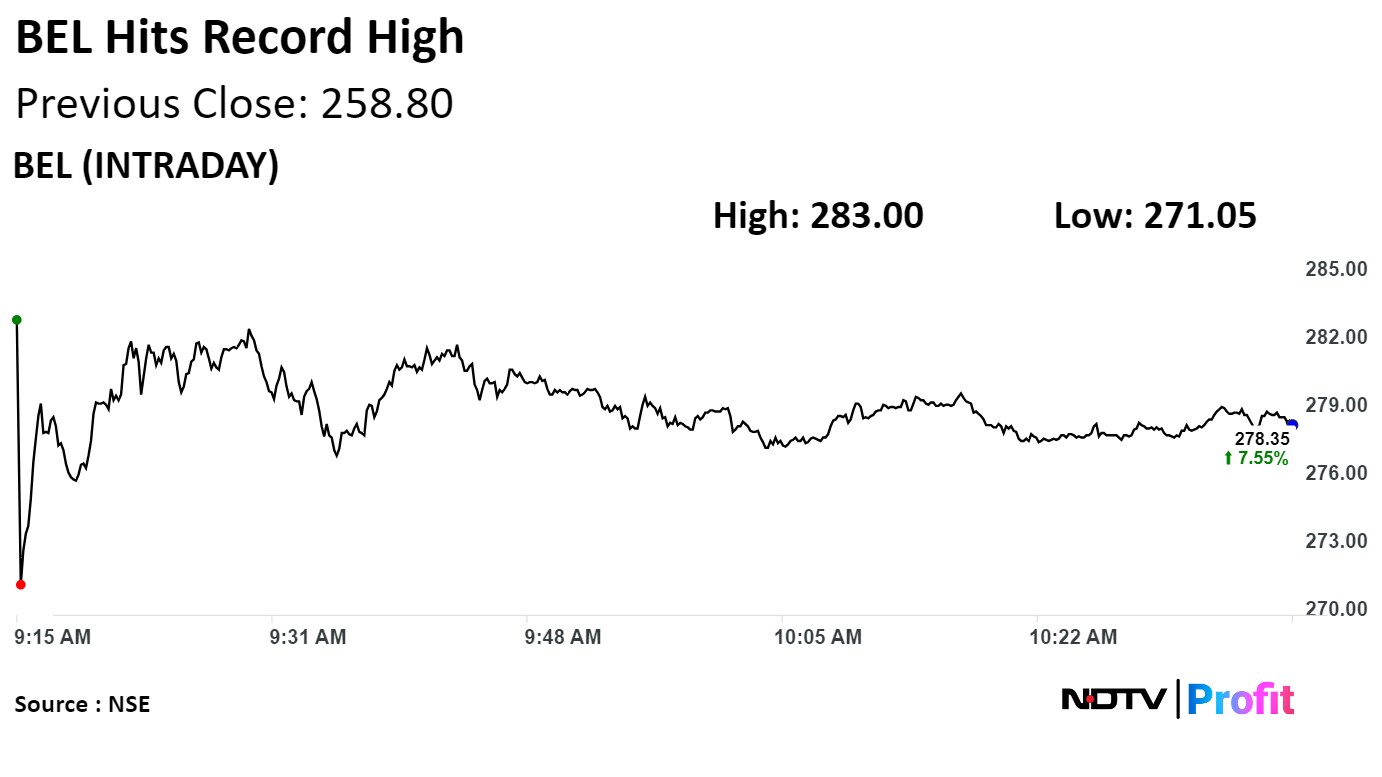

Bharat Electronics Ltd. rose to the highest level since its listing on bourses after the company posted 30% rise in its net profit during January-March.

The defense equipment manufacturer's consolidated net profit rose 30% on the year to Rs 1,797 crore in the quarter ended in March.

Shares of Bharat Electronics Ltd. rose 9.35% to Rs 283.00, the highest level since its listing on Jul 19, 2000. It was trading 7.34% higher at Rs 277.80 as of 10:45 a.m., as compared to 0.19% decline in the NSE Nifty 50 index.

The scrip gained 152.69% in 12 months, and on year to date basis, it has risen 51.38%. Total traded volume so far in the day stood at 8.5 times its 30-day average. The relative strength index was at 82.88, which implied the stock is overbought.

Out of 29 analysts tracking the company, 22 maintain a 'buy' rating, four recommend a 'hold,' and three suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an downside of 12.2%.

Bharat Electronics Ltd. rose to the highest level since its listing on bourses after the company posted 30% rise in its net profit during January-March.

The defense equipment manufacturer's consolidated net profit rose 30% on the year to Rs 1,797 crore in the quarter ended in March.

Shares of Bharat Electronics Ltd. rose 9.35% to Rs 283.00, the highest level since its listing on Jul 19, 2000. It was trading 7.34% higher at Rs 277.80 as of 10:45 a.m., as compared to 0.19% decline in the NSE Nifty 50 index.

The scrip gained 152.69% in 12 months, and on year to date basis, it has risen 51.38%. Total traded volume so far in the day stood at 8.5 times its 30-day average. The relative strength index was at 82.88, which implied the stock is overbought.

Out of 29 analysts tracking the company, 22 maintain a 'buy' rating, four recommend a 'hold,' and three suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an downside of 12.2%.

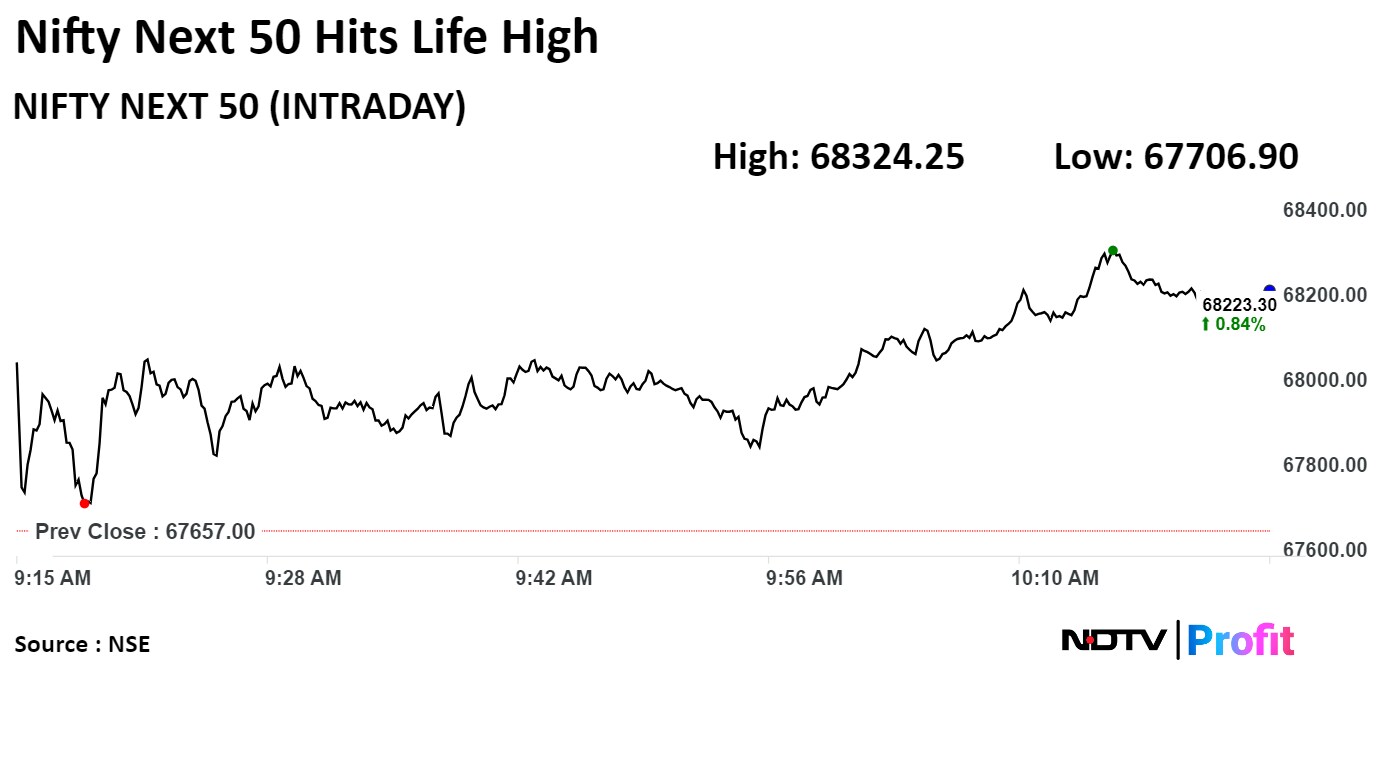

The NSE Nifty Next 50 index rose 0.99% to Rs 68,324.25, the highest level since its incorporation on December 24, 1996. It was trading 0.84% higher at Rs 68,227.25 as of 10:30 a.m., as compared to 0.10% decline in the NSE Nifty 50 index.

The NSE Nifty Next 50 index rose 0.99% to Rs 68,324.25, the highest level since its incorporation on December 24, 1996. It was trading 0.84% higher at Rs 68,227.25 as of 10:30 a.m., as compared to 0.10% decline in the NSE Nifty 50 index.

Shriram Properties Ltd. has signed a joint development agreement for 4 acre land parcel in Yelahanka, Bengaluru.

New project to have revenue potential of Rs 250 crore

Source: Exchange filing

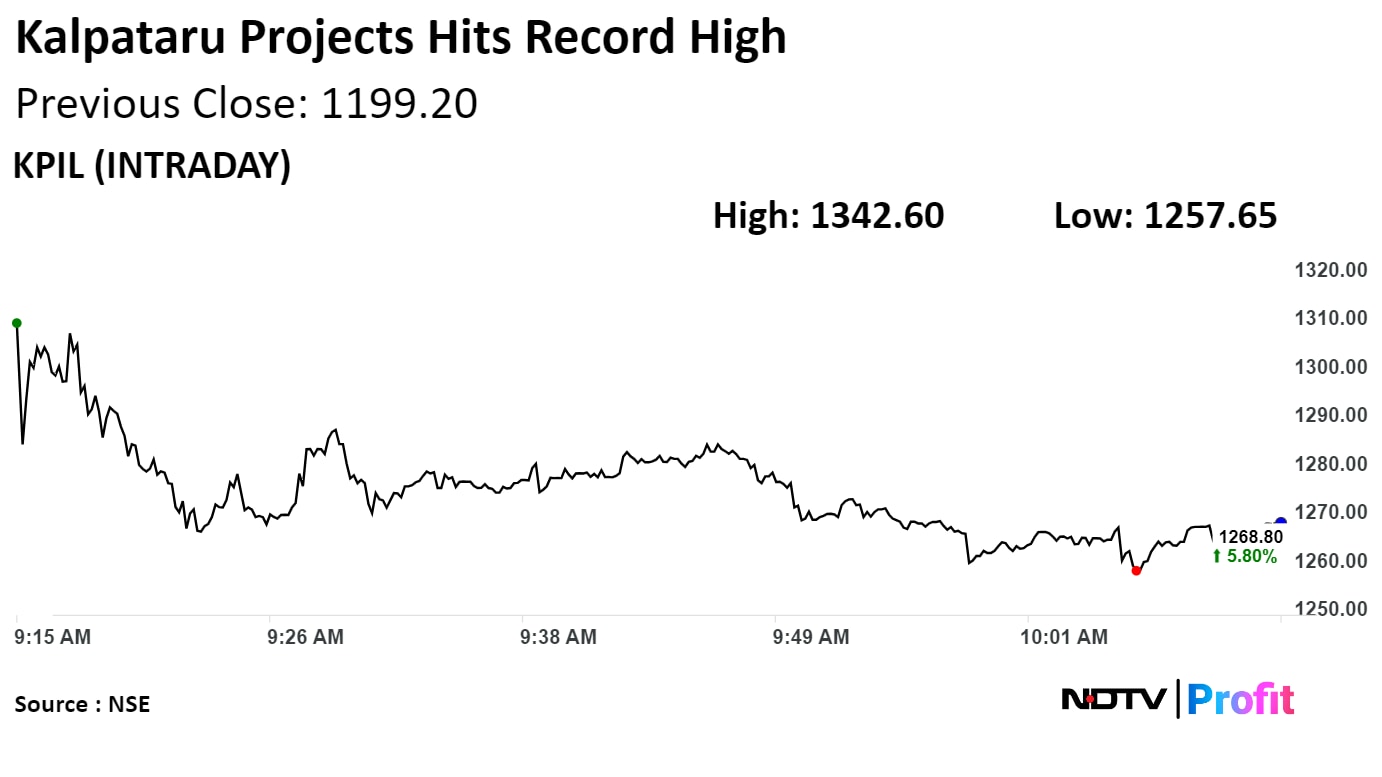

Shares of Kalpataru Projects International Ltd. jumped to the highest level since listing on bourses after it inked three Aramco contracts worth Rs 7,550 crore.

Kalpataru Projects International Ltd. jumped 14.24% to Rs 1,369.95, the highest level since its listing on Dec 15, 2000. It pared gains to trade 5.80% higher at Rs 1,268.80 as of 10:14 a.m., as compared to 0.15% decline in the NSE Nifty 50 index.

The scrip gained 146.70% in 12 months, and on year to date basis, it has gained 78.72%. Total traded volume so far in the day stood at 6.1 times its 30-day average. The relative strength index was at 64.88.

Out of 14 analysts tracking the company, 11 maintain a 'buy' rating, two recommend a 'hold,' and one suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 2.8%

Shares of Kalpataru Projects International Ltd. jumped to the highest level since listing on bourses after it inked three Aramco contracts worth Rs 7,550 crore.

Kalpataru Projects International Ltd. jumped 14.24% to Rs 1,369.95, the highest level since its listing on Dec 15, 2000. It pared gains to trade 5.80% higher at Rs 1,268.80 as of 10:14 a.m., as compared to 0.15% decline in the NSE Nifty 50 index.

The scrip gained 146.70% in 12 months, and on year to date basis, it has gained 78.72%. Total traded volume so far in the day stood at 6.1 times its 30-day average. The relative strength index was at 64.88.

Out of 14 analysts tracking the company, 11 maintain a 'buy' rating, two recommend a 'hold,' and one suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 2.8%

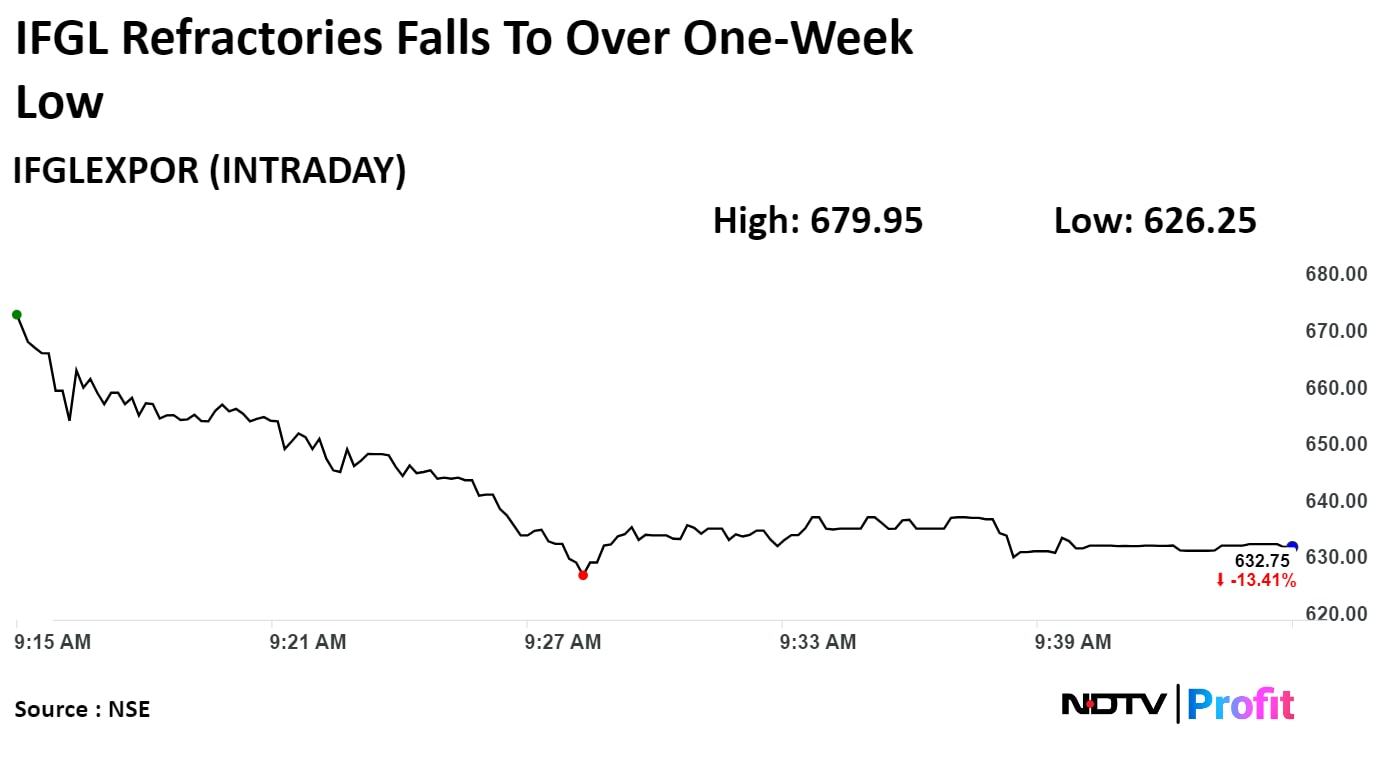

IFGL Refractories Ltd. declined to the lowest level since in over one-week after the company reported a fall in its net profit during January-March quarter. Its net consolidated net profit fell 57.3% on year to Rs 13 crore.

IFGL Refractories Ltd. declined to the lowest level since in over one-week after the company reported a fall in its net profit during January-March quarter. Its net consolidated net profit fell 57.3% on year to Rs 13 crore.

India's volatility gauge rose to an over 19-month high on Tuesday, a day after the fifth phase of elections, with Maharashtra recording the lowest voter turnout among other states on Monday.

The markets' fear gauge, India VIX, rose as high as 8.66% in early trade to 22.3, and was up 7.1% at 22.02 as of 10:02 a.m. The previous highest level was seen at 22.3 on Sept. 26, 2022.

India's volatility gauge rose to an over 19-month high on Tuesday, a day after the fifth phase of elections, with Maharashtra recording the lowest voter turnout among other states on Monday.

The markets' fear gauge, India VIX, rose as high as 8.66% in early trade to 22.3, and was up 7.1% at 22.02 as of 10:02 a.m. The previous highest level was seen at 22.3 on Sept. 26, 2022.

.png)

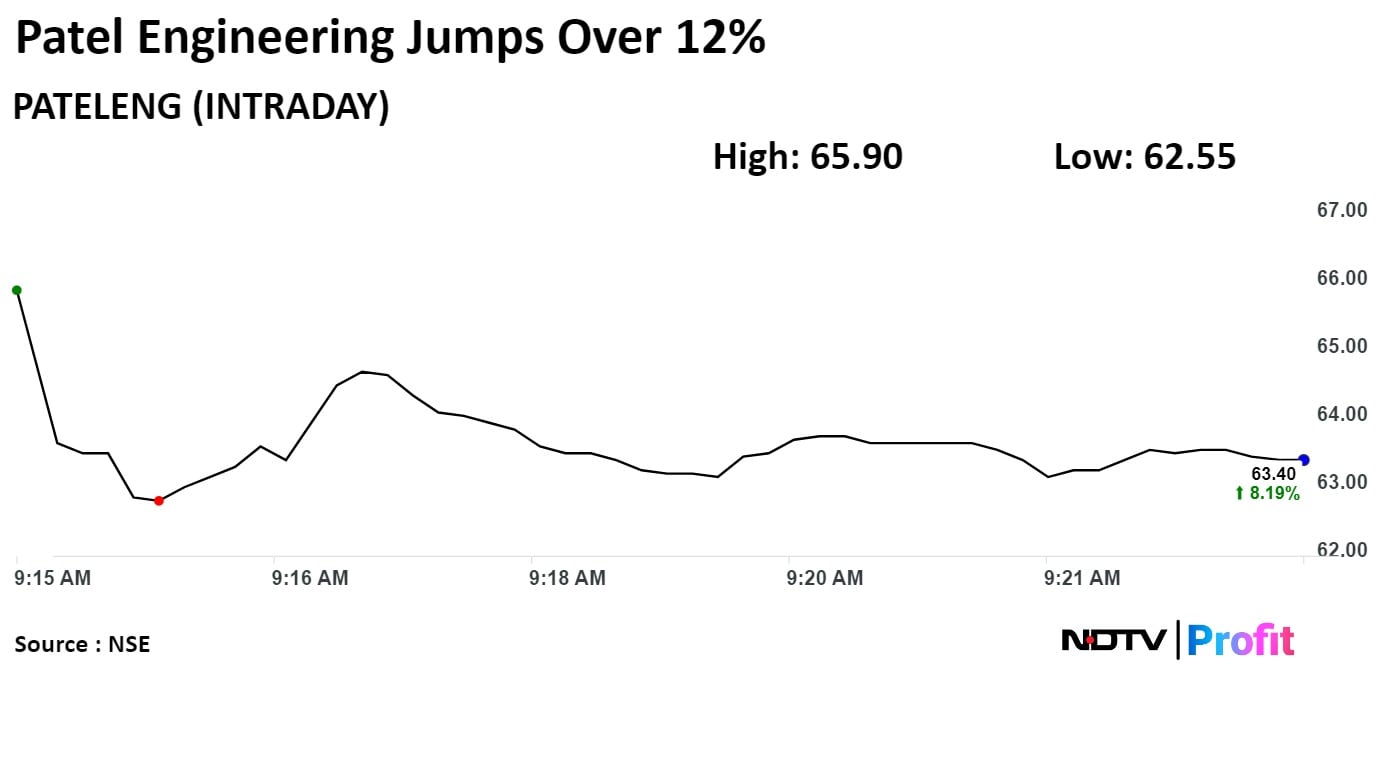

Patel Engineering jumped to the highest level in three weeks after the company said it will acquire stake in Shail Tunneling and Infra Pvt. Ltd. Shares of the company rose as much as 12.46% to Rs 65.90, the highest level since April 25.

Patel Engineering jumped to the highest level in three weeks after the company said it will acquire stake in Shail Tunneling and Infra Pvt. Ltd. Shares of the company rose as much as 12.46% to Rs 65.90, the highest level since April 25.

Shares of the company rose as much as 12.46% to Rs 65.90, the highest level since April 25. It pared gains to trade 8.70%

The scrip gained 153.28% in 12 months, and on year to date basis, it has gained 5.82%. Total traded volume so far in the day stood at 8.3 times its 30-day average. The relative strength index was at 62.23.

One analysts tracking the company maintains a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 26.0%

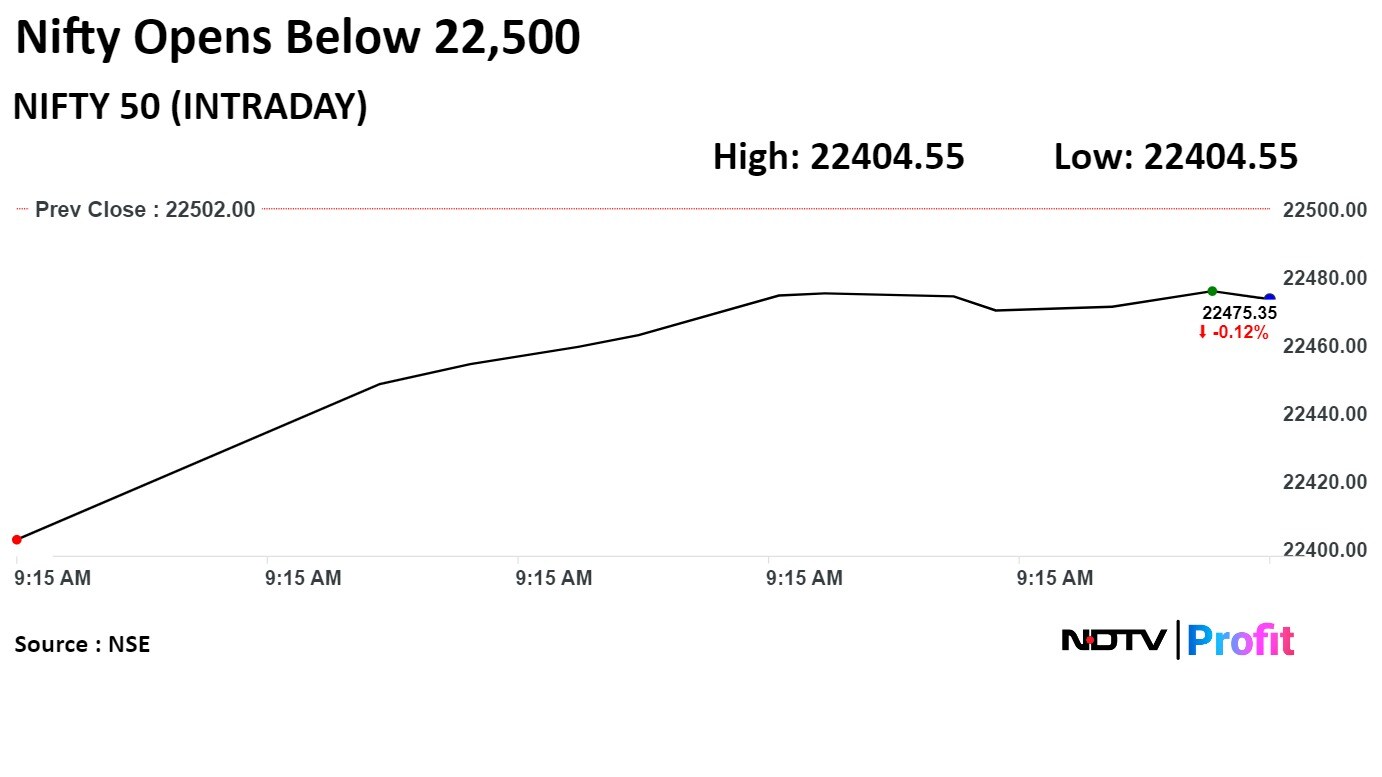

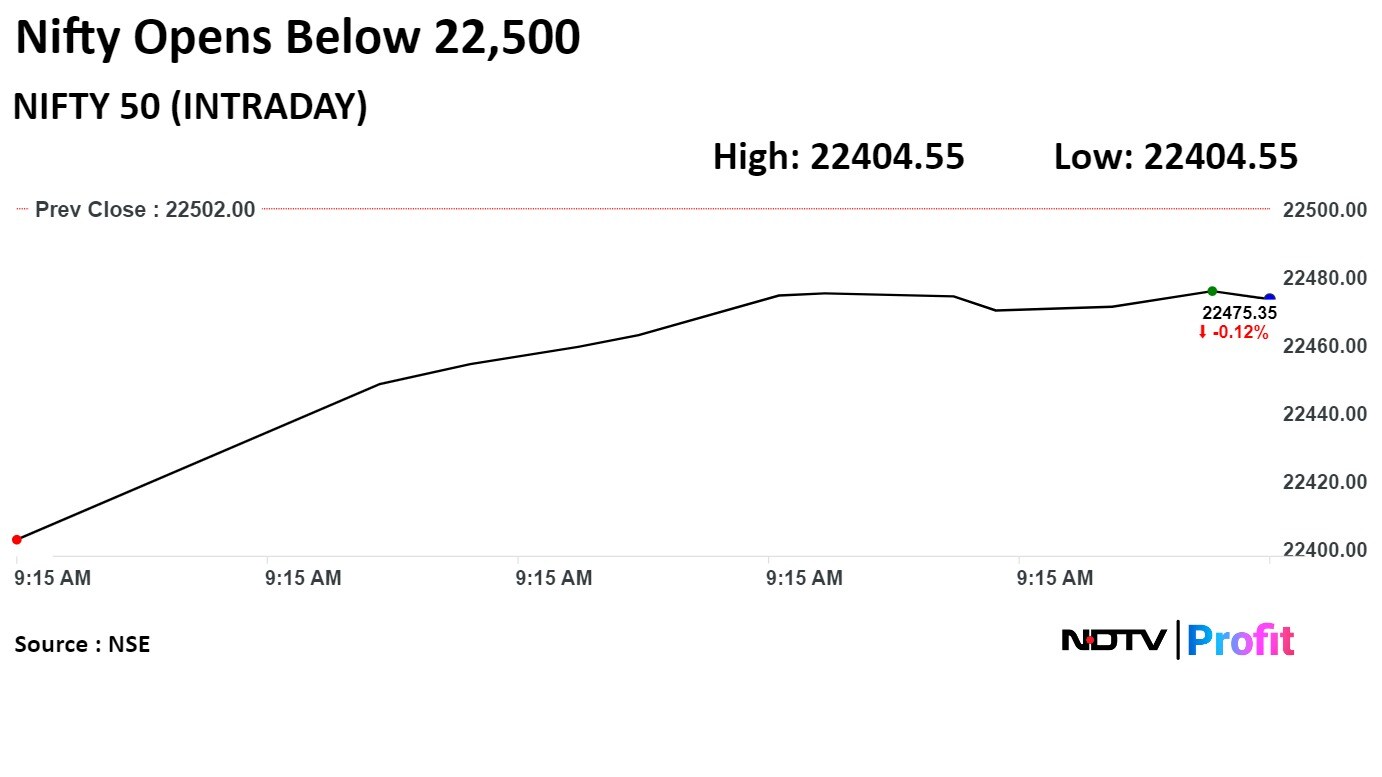

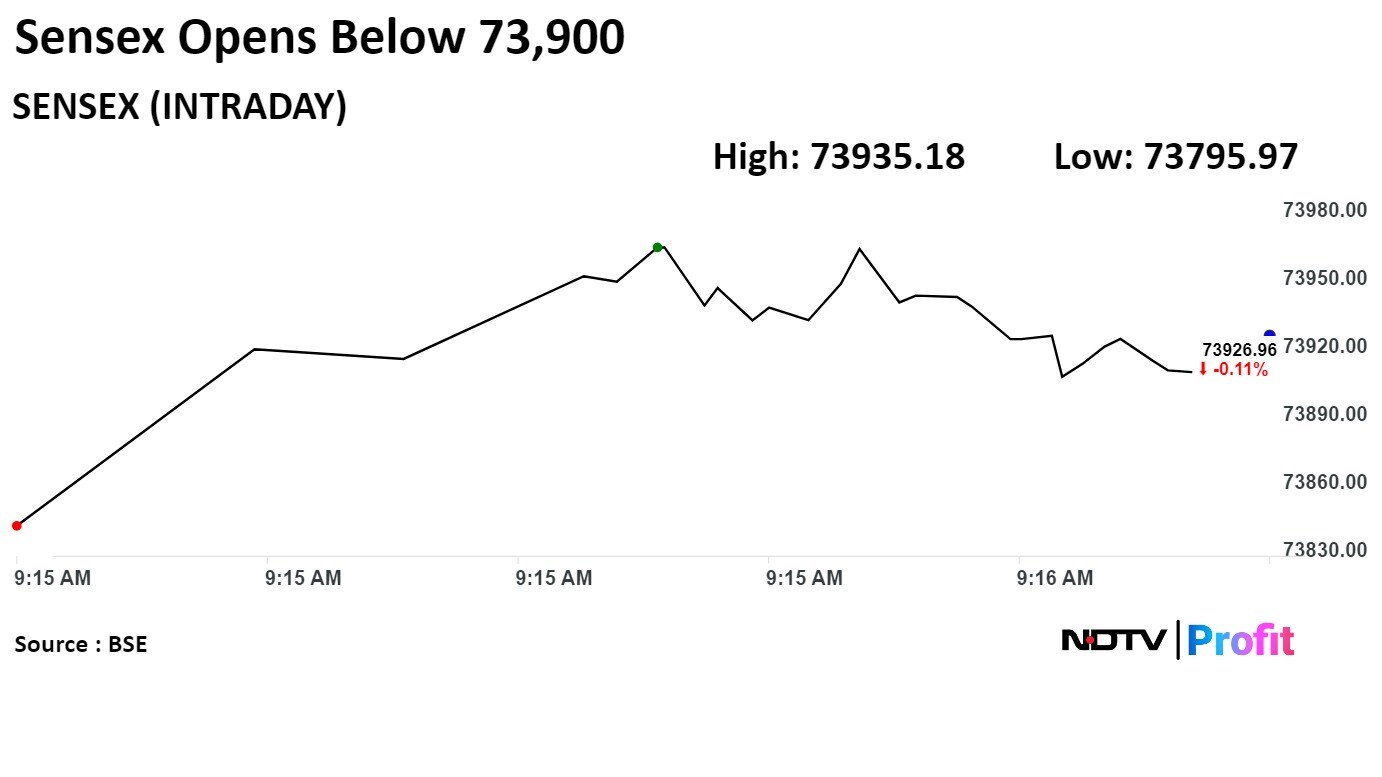

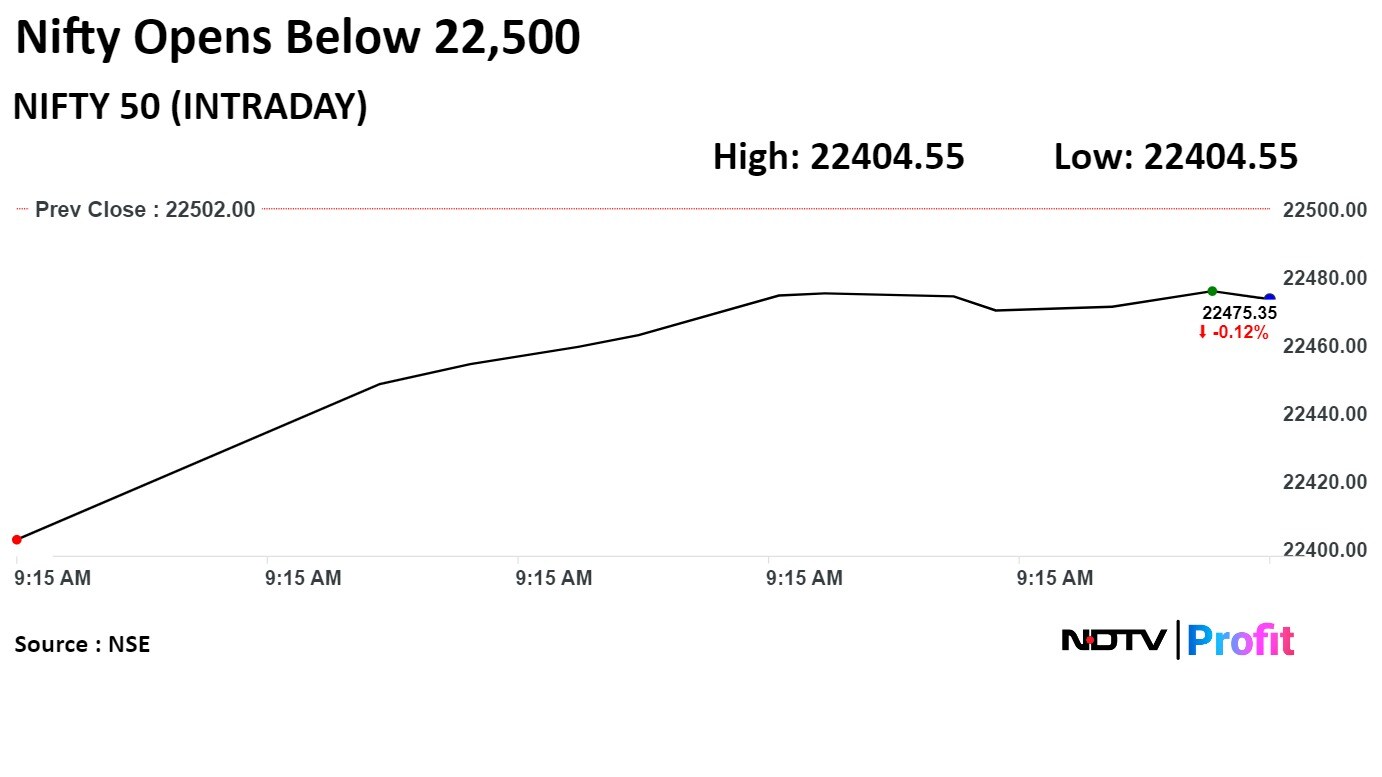

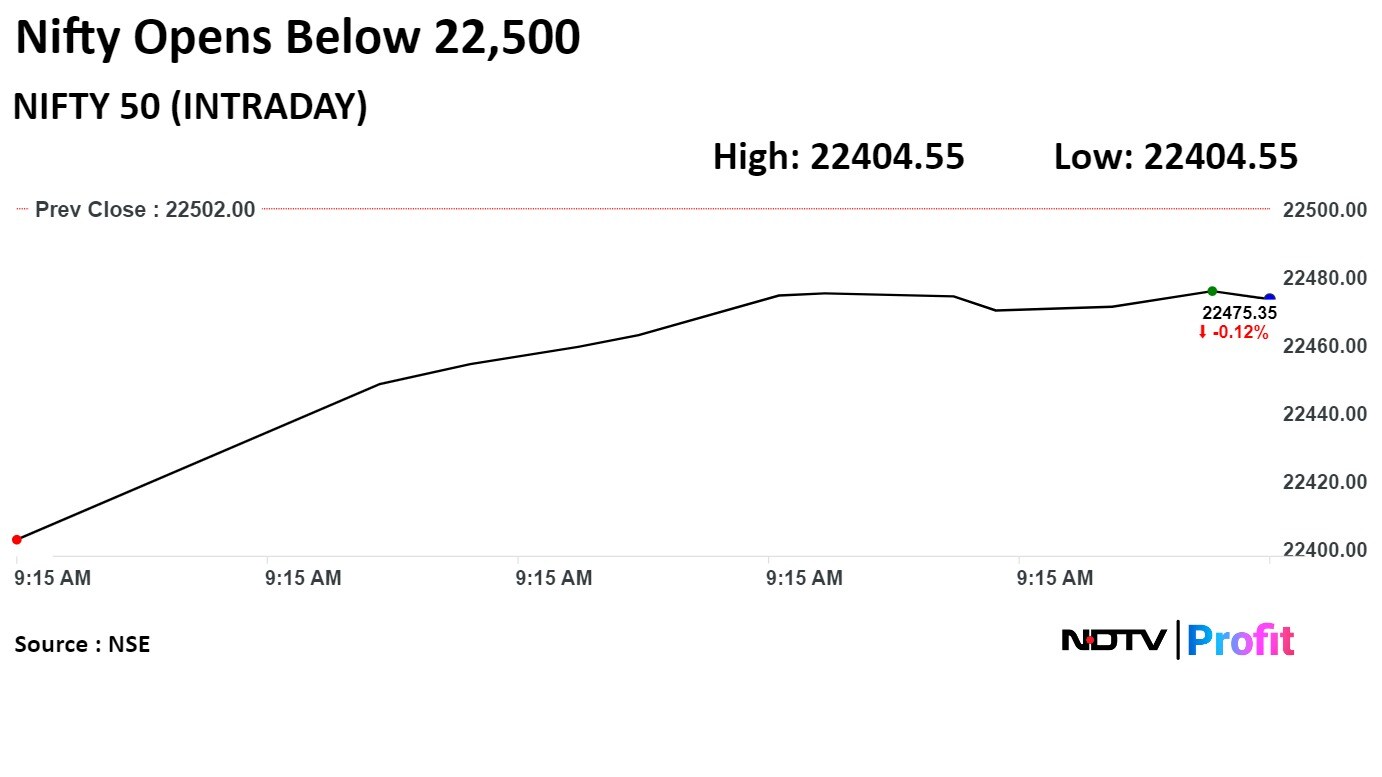

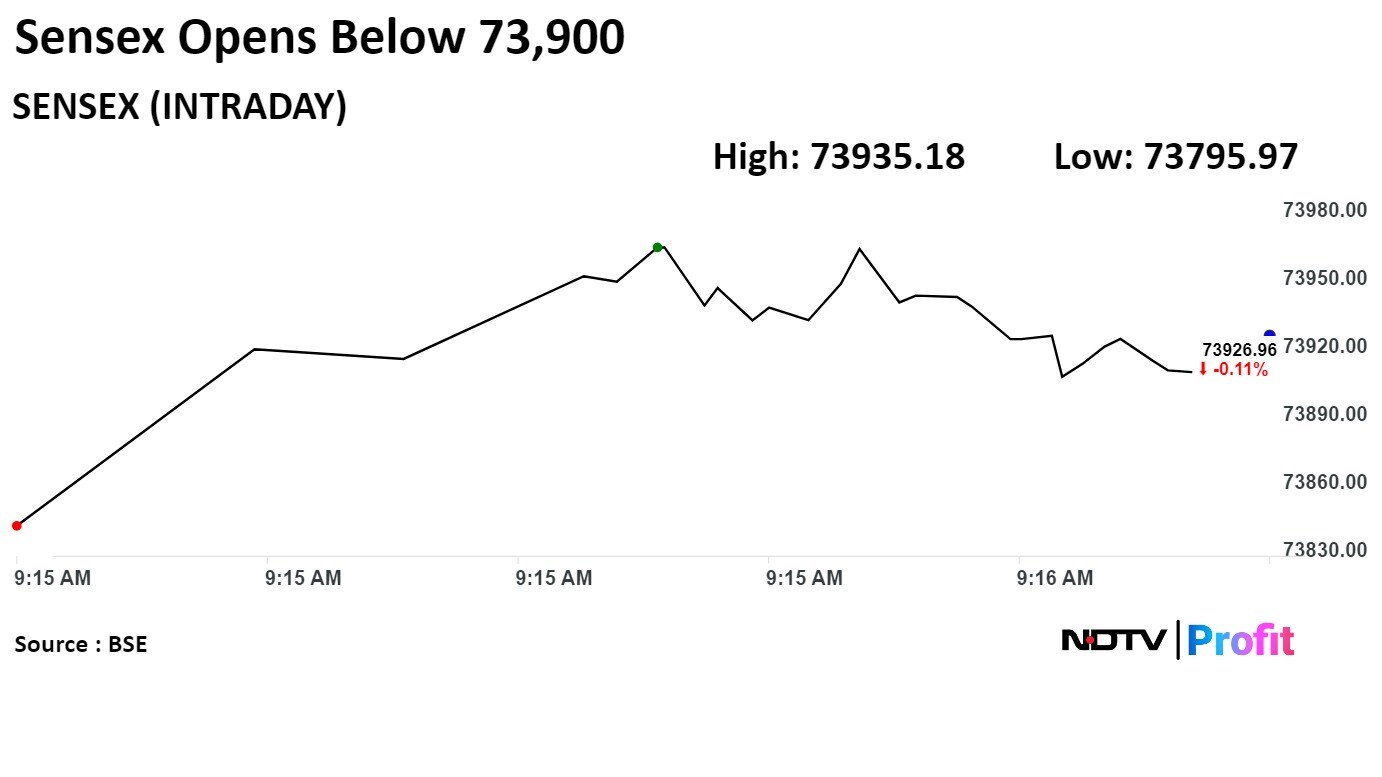

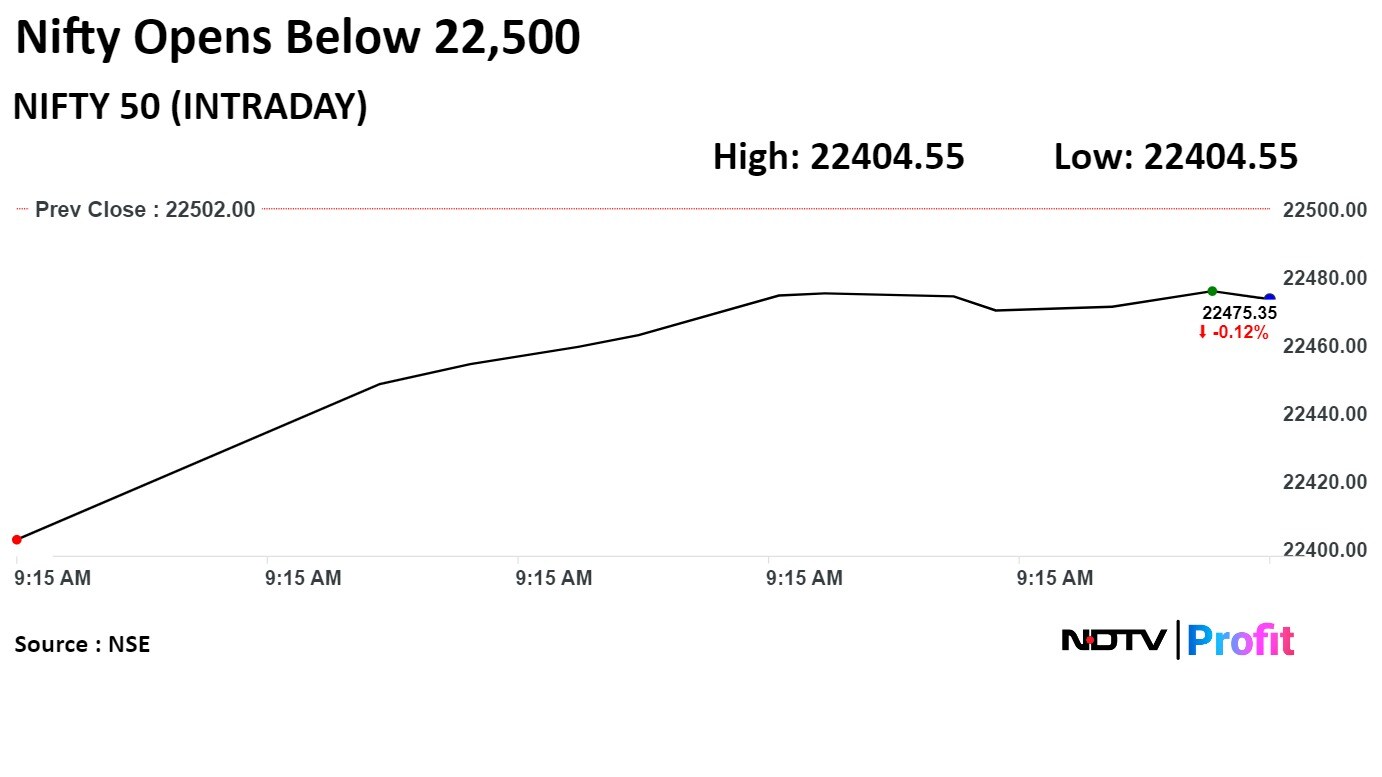

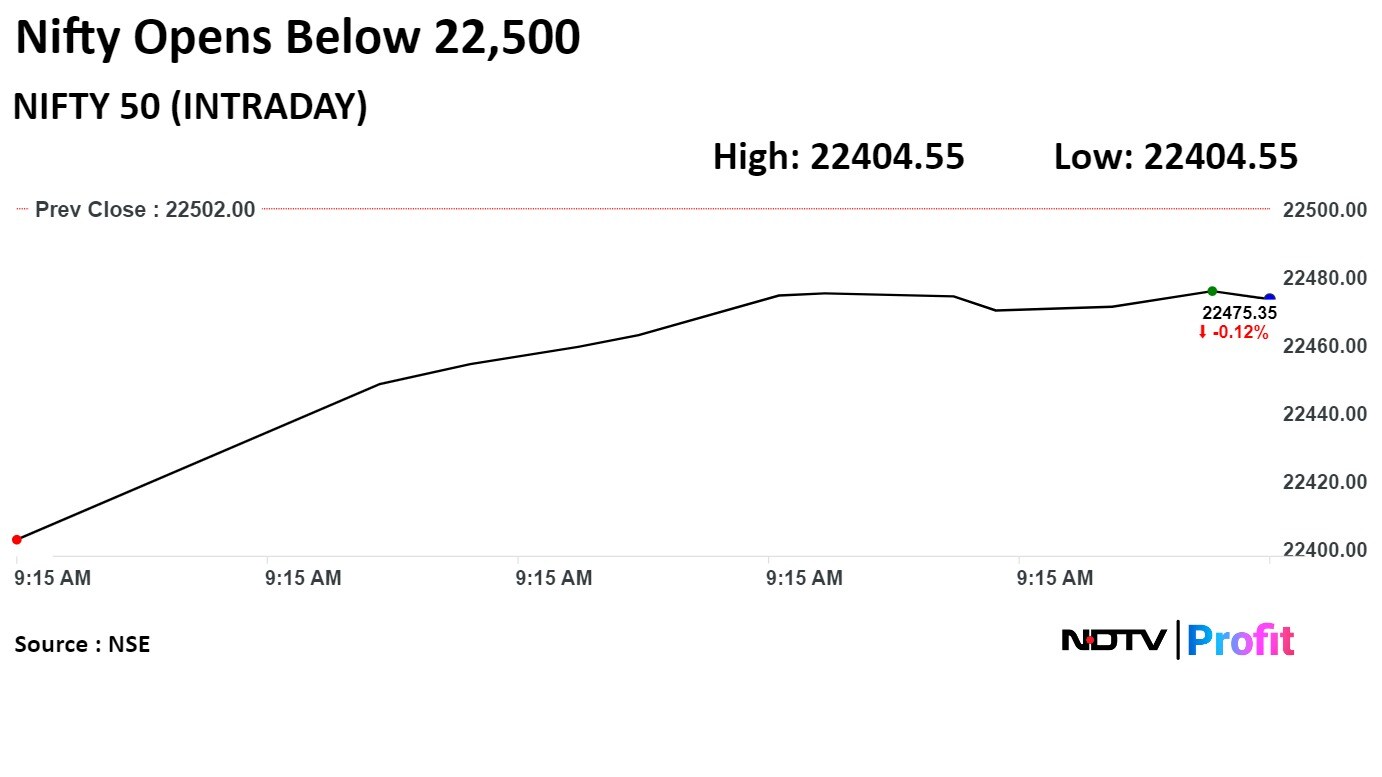

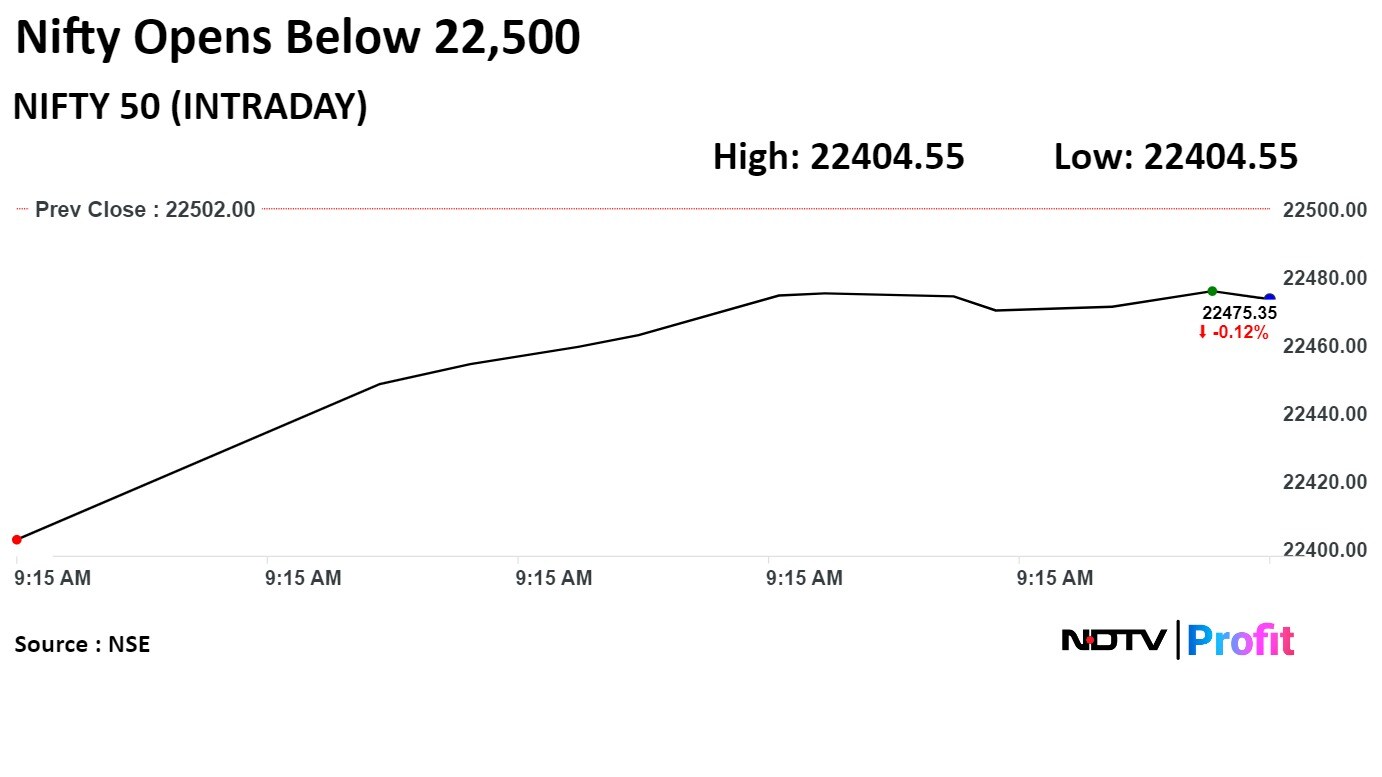

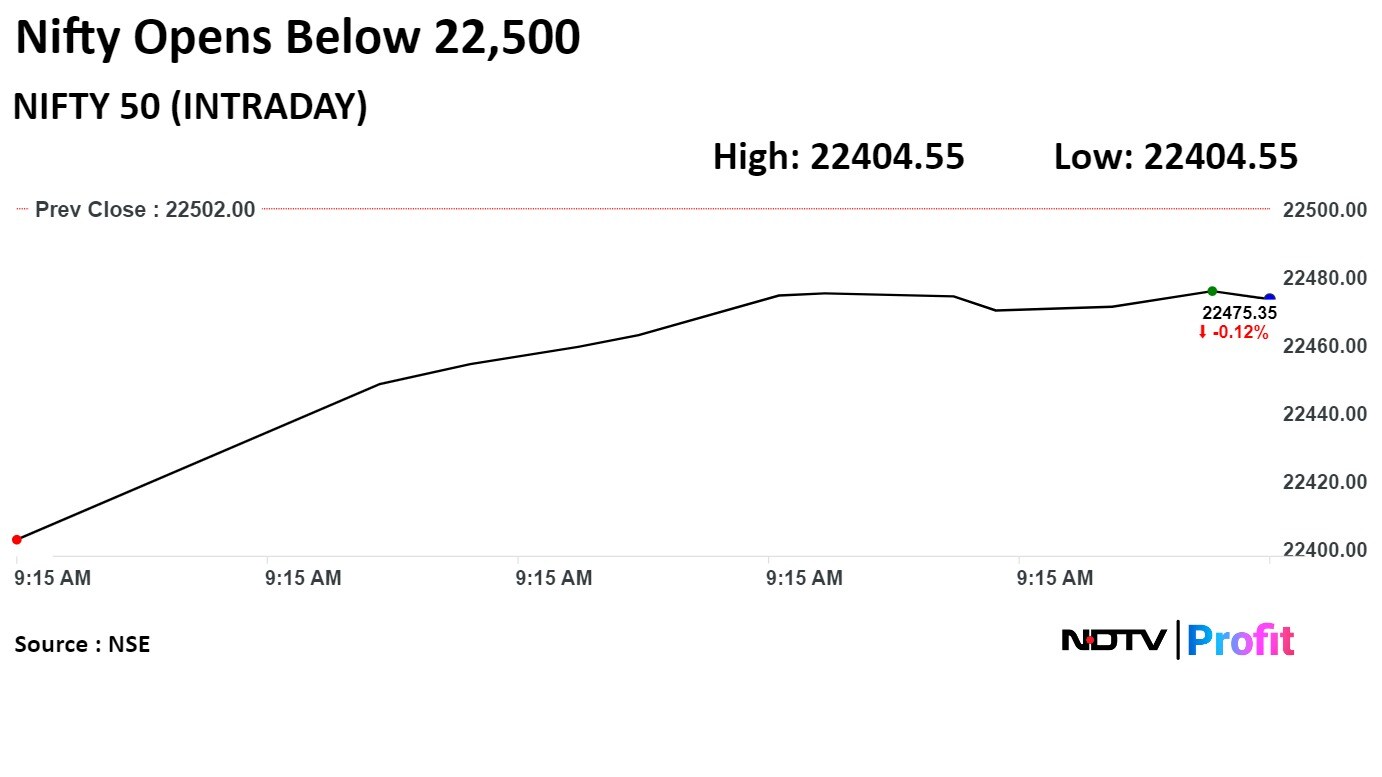

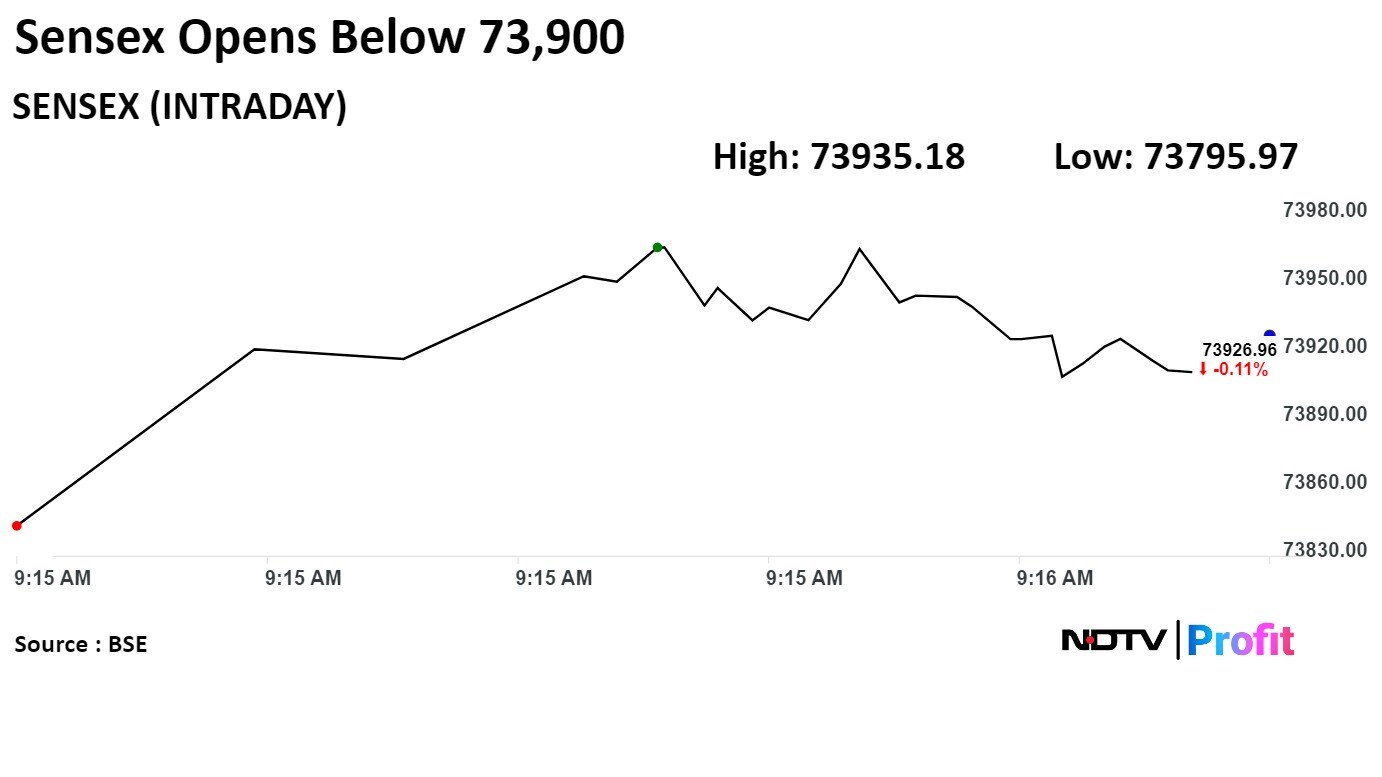

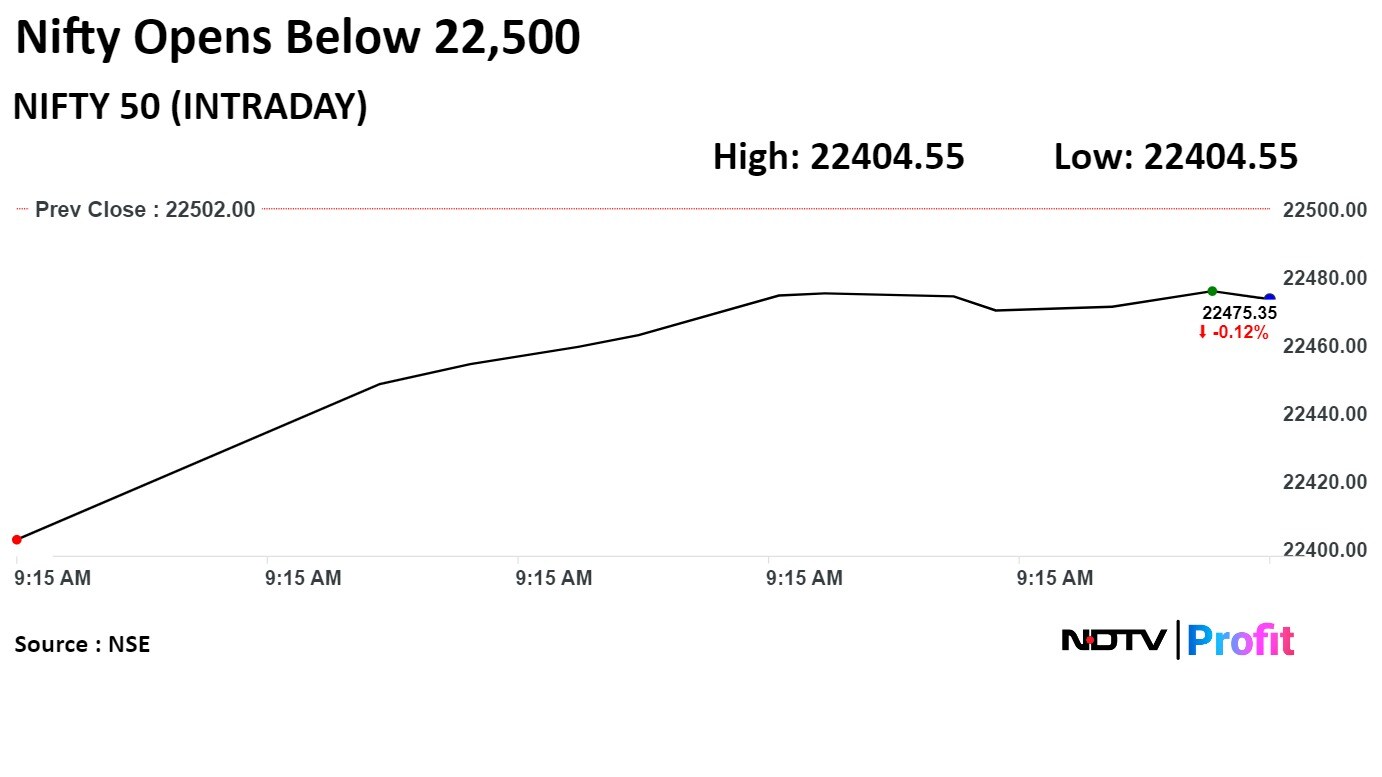

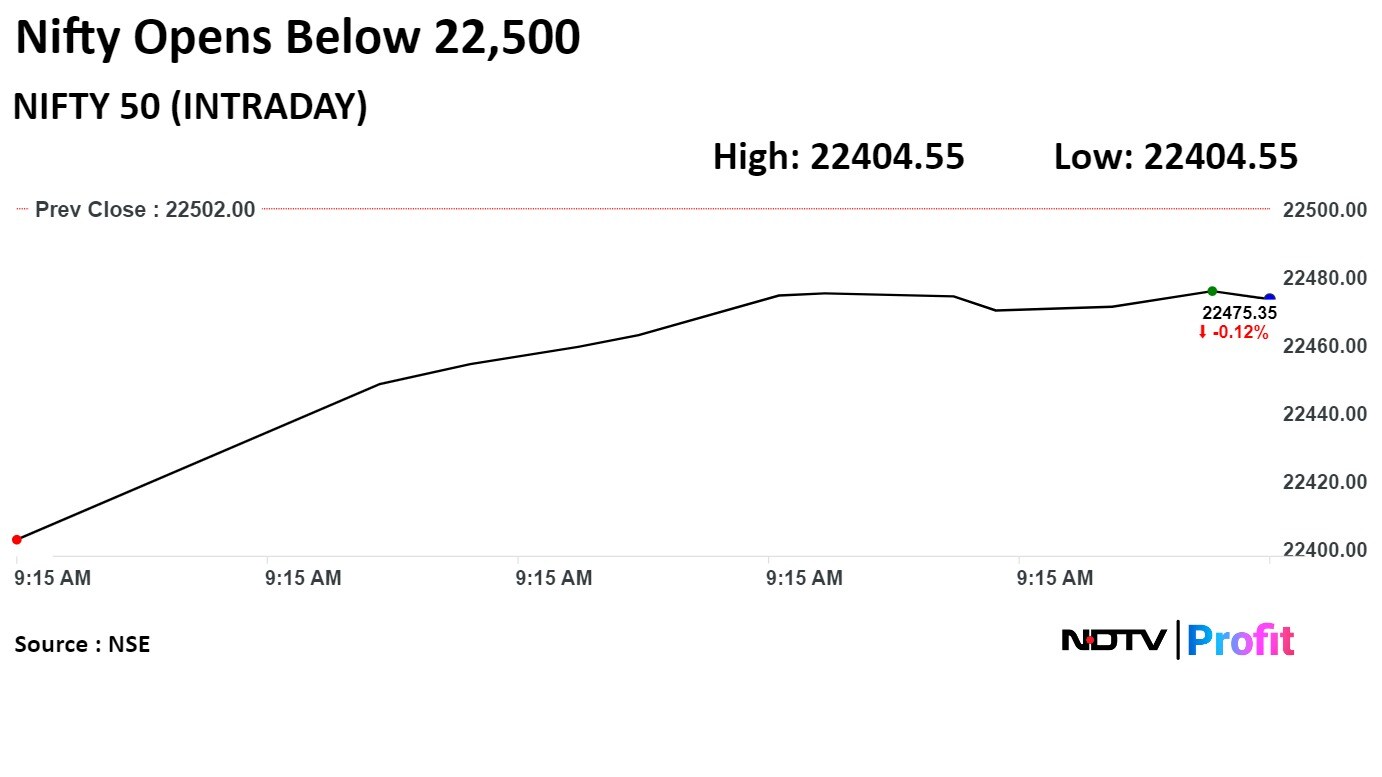

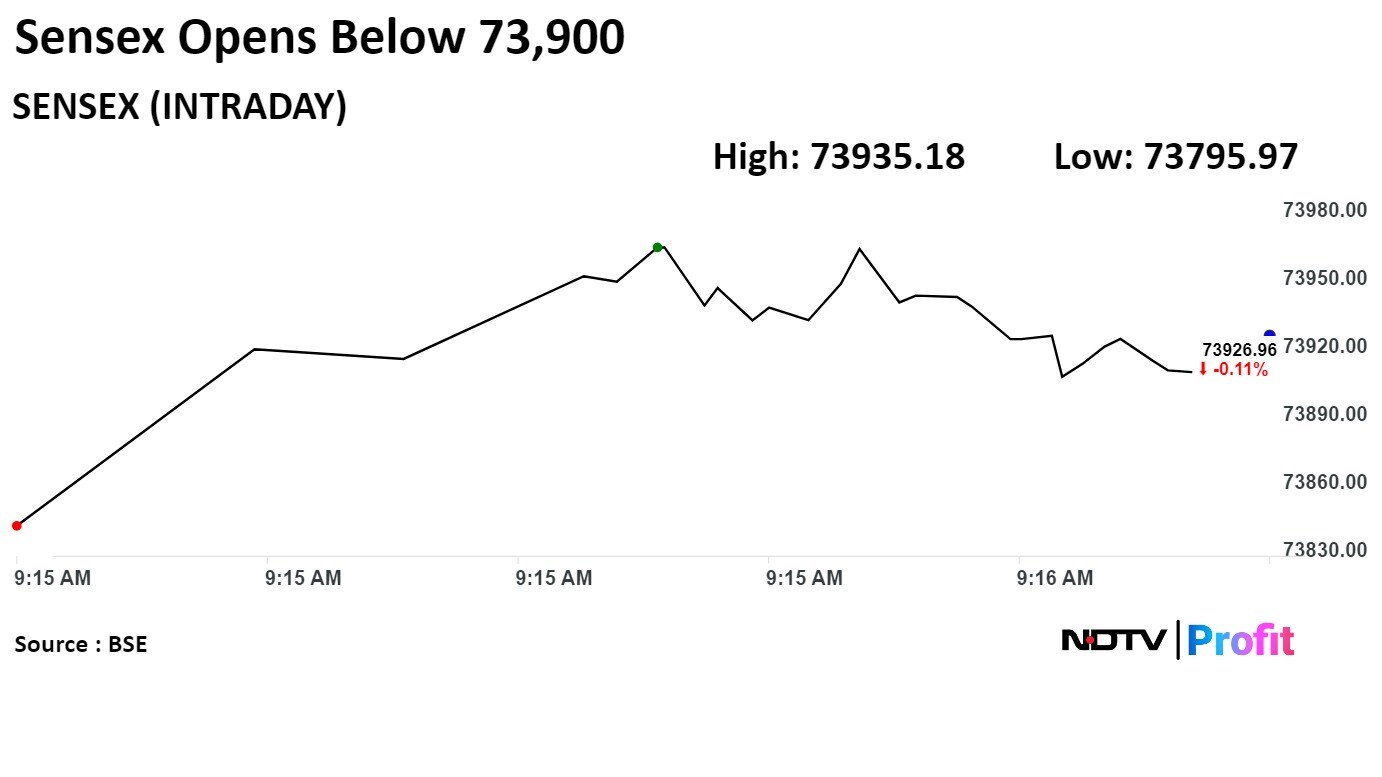

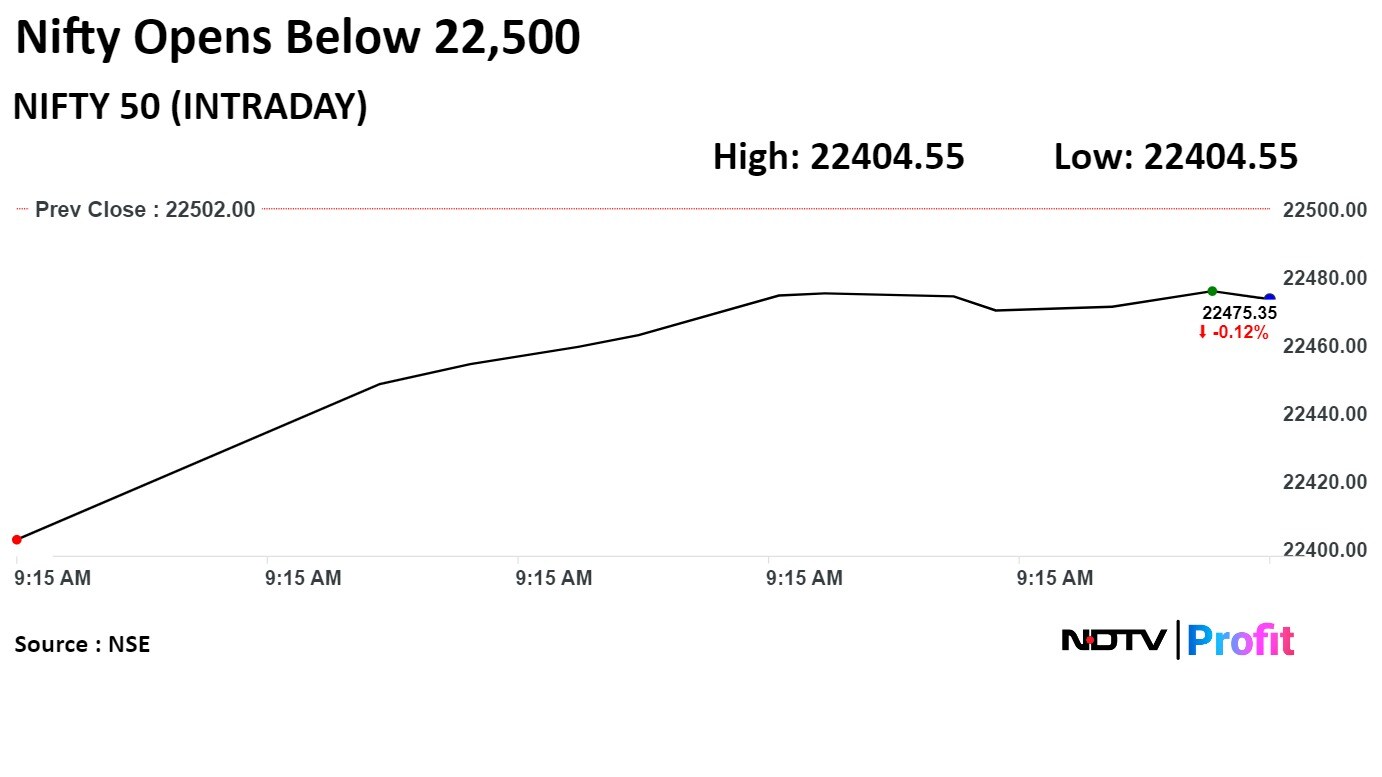

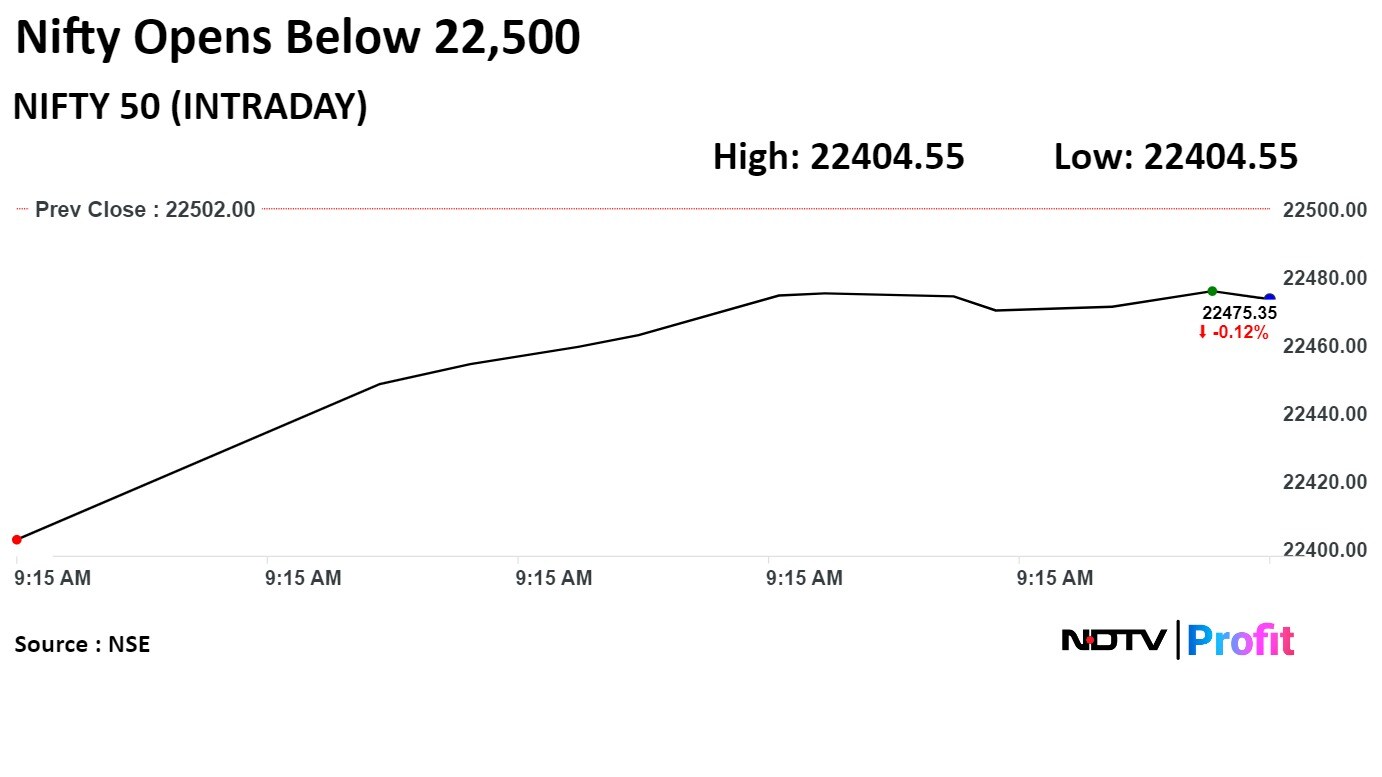

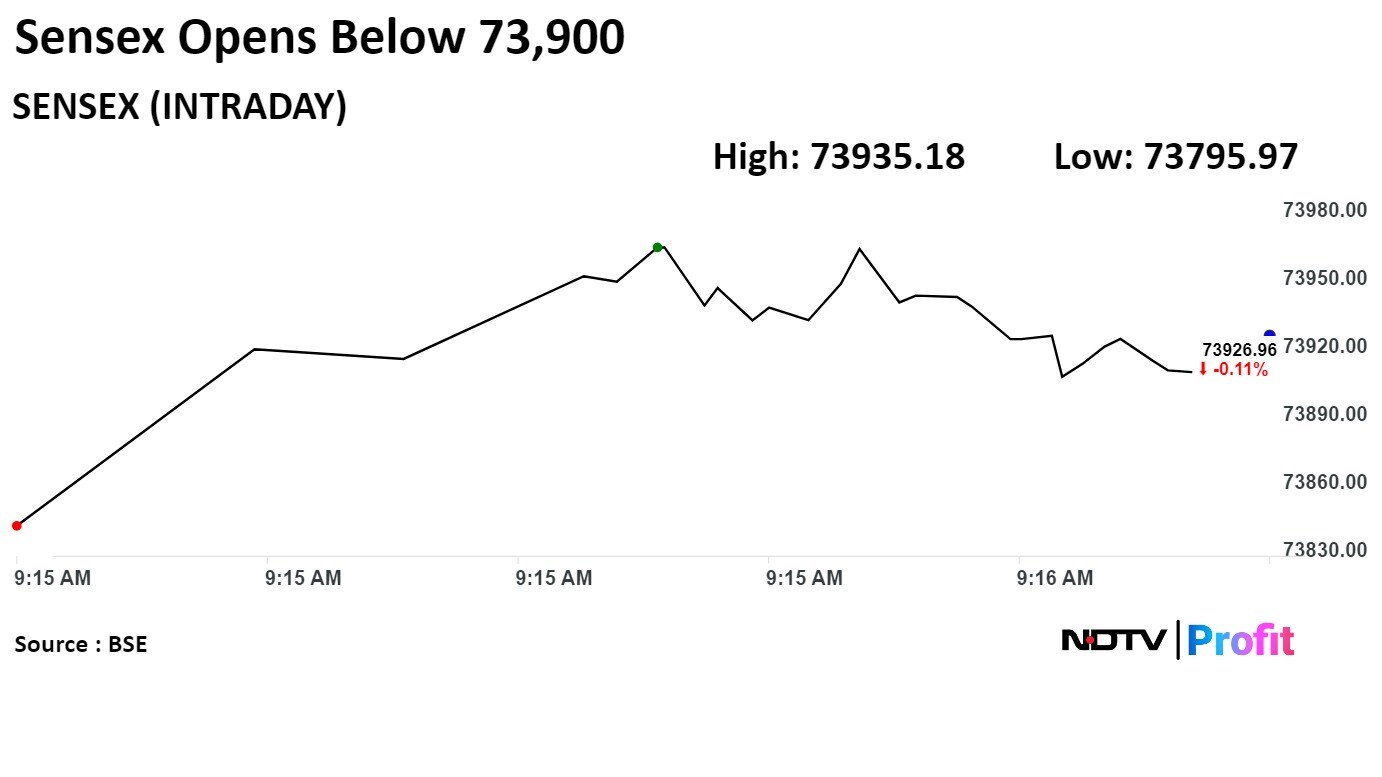

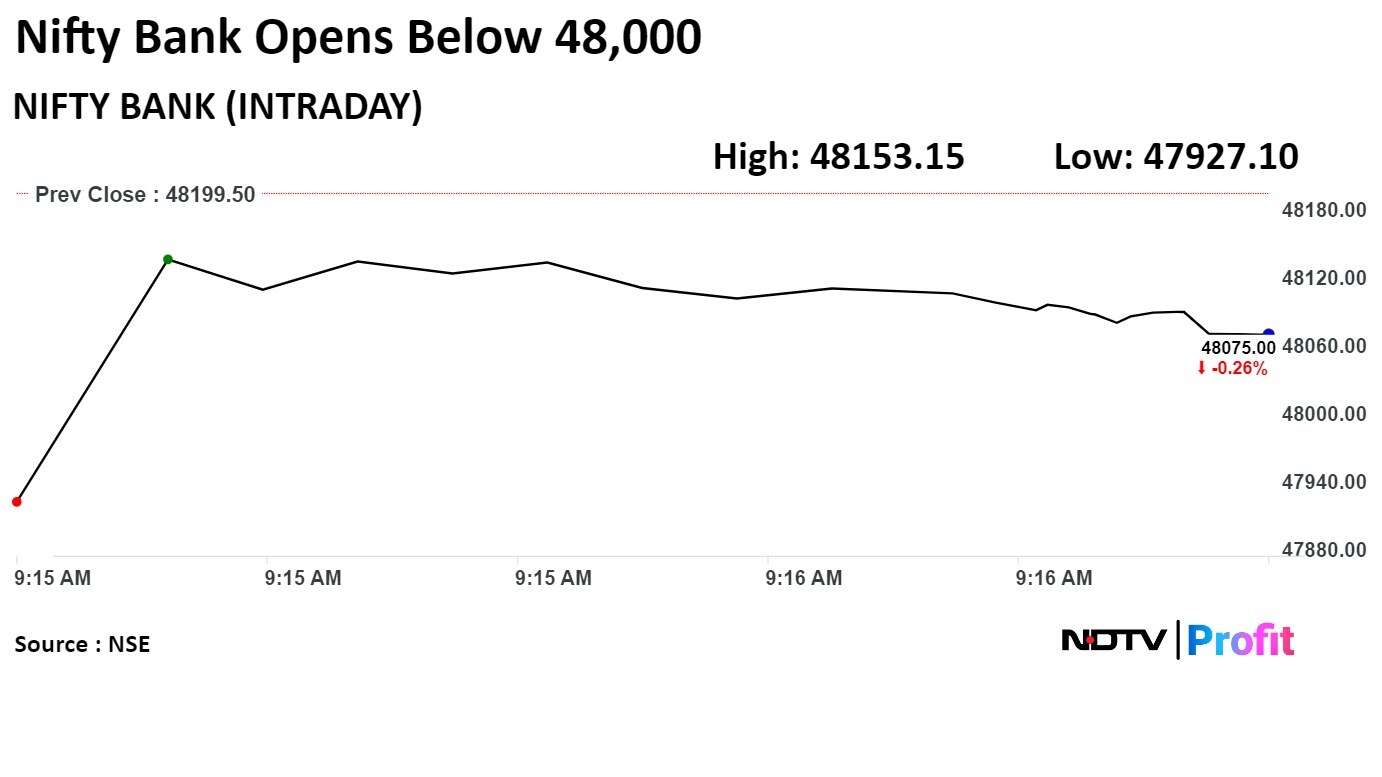

Benchmark equity indices opened lower after three consecutive sessions of gains as shares of HDFC Bank dragged.

At pre-open, the Nifty was down 97.45 points or 0.43% at 22,404.55 and the Sensex was at 73,842.9, down 162.98 points or 0.22%.

Any decline near to the support of 22,250-22,300 will be a good entry point and on the higher side now resistance is placed at 22,650 levels, said Vikas Jain, senior research analyst at Reliance Securities.

Benchmark equity indices opened lower after three consecutive sessions of gains as shares of HDFC Bank dragged.

At pre-open, the Nifty was down 97.45 points or 0.43% at 22,404.55 and the Sensex was at 73,842.9, down 162.98 points or 0.22%.

Any decline near to the support of 22,250-22,300 will be a good entry point and on the higher side now resistance is placed at 22,650 levels, said Vikas Jain, senior research analyst at Reliance Securities.

Benchmark equity indices opened lower after three consecutive sessions of gains as shares of HDFC Bank dragged.

At pre-open, the Nifty was down 97.45 points or 0.43% at 22,404.55 and the Sensex was at 73,842.9, down 162.98 points or 0.22%.

Any decline near to the support of 22,250-22,300 will be a good entry point and on the higher side now resistance is placed at 22,650 levels, said Vikas Jain, senior research analyst at Reliance Securities.

Benchmark equity indices opened lower after three consecutive sessions of gains as shares of HDFC Bank dragged.

At pre-open, the Nifty was down 97.45 points or 0.43% at 22,404.55 and the Sensex was at 73,842.9, down 162.98 points or 0.22%.

Any decline near to the support of 22,250-22,300 will be a good entry point and on the higher side now resistance is placed at 22,650 levels, said Vikas Jain, senior research analyst at Reliance Securities.

Benchmark equity indices opened lower after three consecutive sessions of gains as shares of HDFC Bank dragged.

At pre-open, the Nifty was down 97.45 points or 0.43% at 22,404.55 and the Sensex was at 73,842.9, down 162.98 points or 0.22%.

Any decline near to the support of 22,250-22,300 will be a good entry point and on the higher side now resistance is placed at 22,650 levels, said Vikas Jain, senior research analyst at Reliance Securities.

Benchmark equity indices opened lower after three consecutive sessions of gains as shares of HDFC Bank dragged.

At pre-open, the Nifty was down 97.45 points or 0.43% at 22,404.55 and the Sensex was at 73,842.9, down 162.98 points or 0.22%.

Any decline near to the support of 22,250-22,300 will be a good entry point and on the higher side now resistance is placed at 22,650 levels, said Vikas Jain, senior research analyst at Reliance Securities.

Benchmark equity indices opened lower after three consecutive sessions of gains as shares of HDFC Bank dragged.

At pre-open, the Nifty was down 97.45 points or 0.43% at 22,404.55 and the Sensex was at 73,842.9, down 162.98 points or 0.22%.

Any decline near to the support of 22,250-22,300 will be a good entry point and on the higher side now resistance is placed at 22,650 levels, said Vikas Jain, senior research analyst at Reliance Securities.

Benchmark equity indices opened lower after three consecutive sessions of gains as shares of HDFC Bank dragged.

At pre-open, the Nifty was down 97.45 points or 0.43% at 22,404.55 and the Sensex was at 73,842.9, down 162.98 points or 0.22%.

Any decline near to the support of 22,250-22,300 will be a good entry point and on the higher side now resistance is placed at 22,650 levels, said Vikas Jain, senior research analyst at Reliance Securities.

Shares of HDFC Bank Ltd., Reliance Industries Ltd., Axis Bank Ltd., ICICI Bank Ltd., and Tata Consultancy Services Ltd. dragged the index.