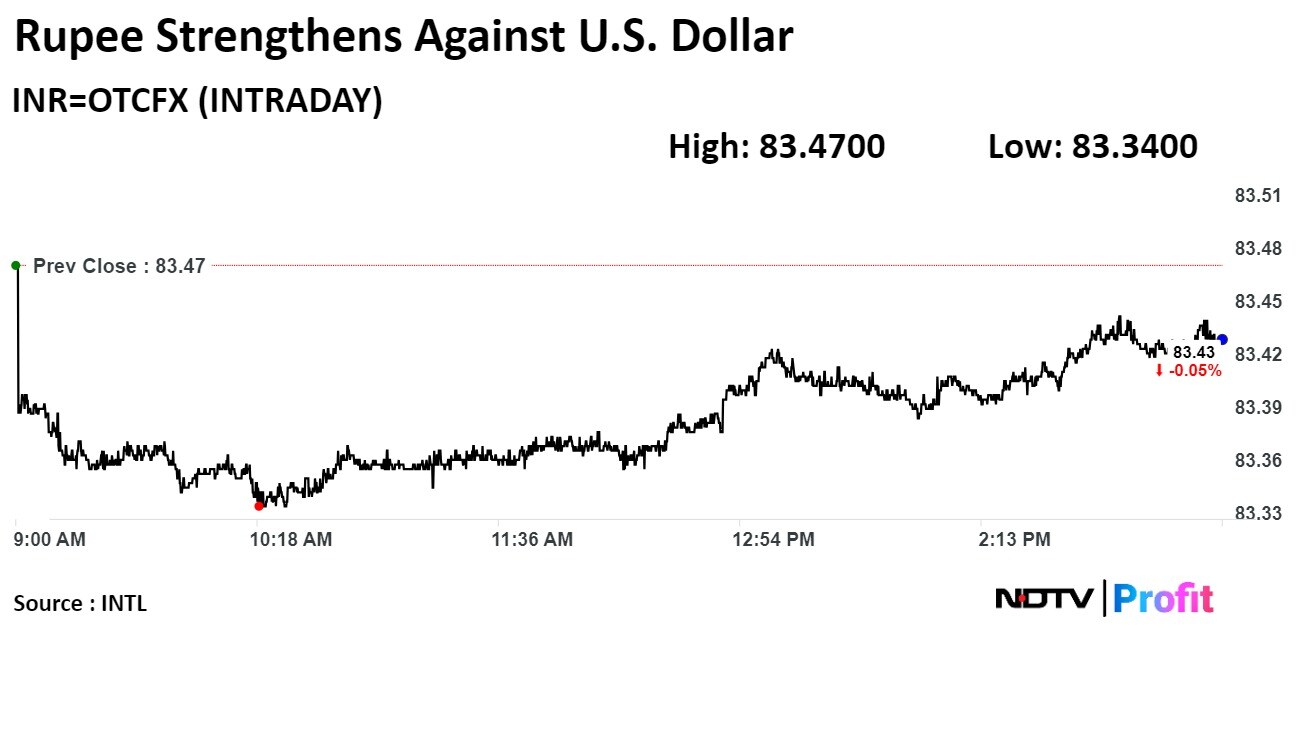

The local currency strengthened by 3 paise to close at 83.43 against the U.S dollar.

It closed at 83.46 on Thursday.

Source: Bloomberg

The local currency strengthened by 3 paise to close at 83.43 against the U.S dollar.

It closed at 83.46 on Thursday.

Source: Bloomberg

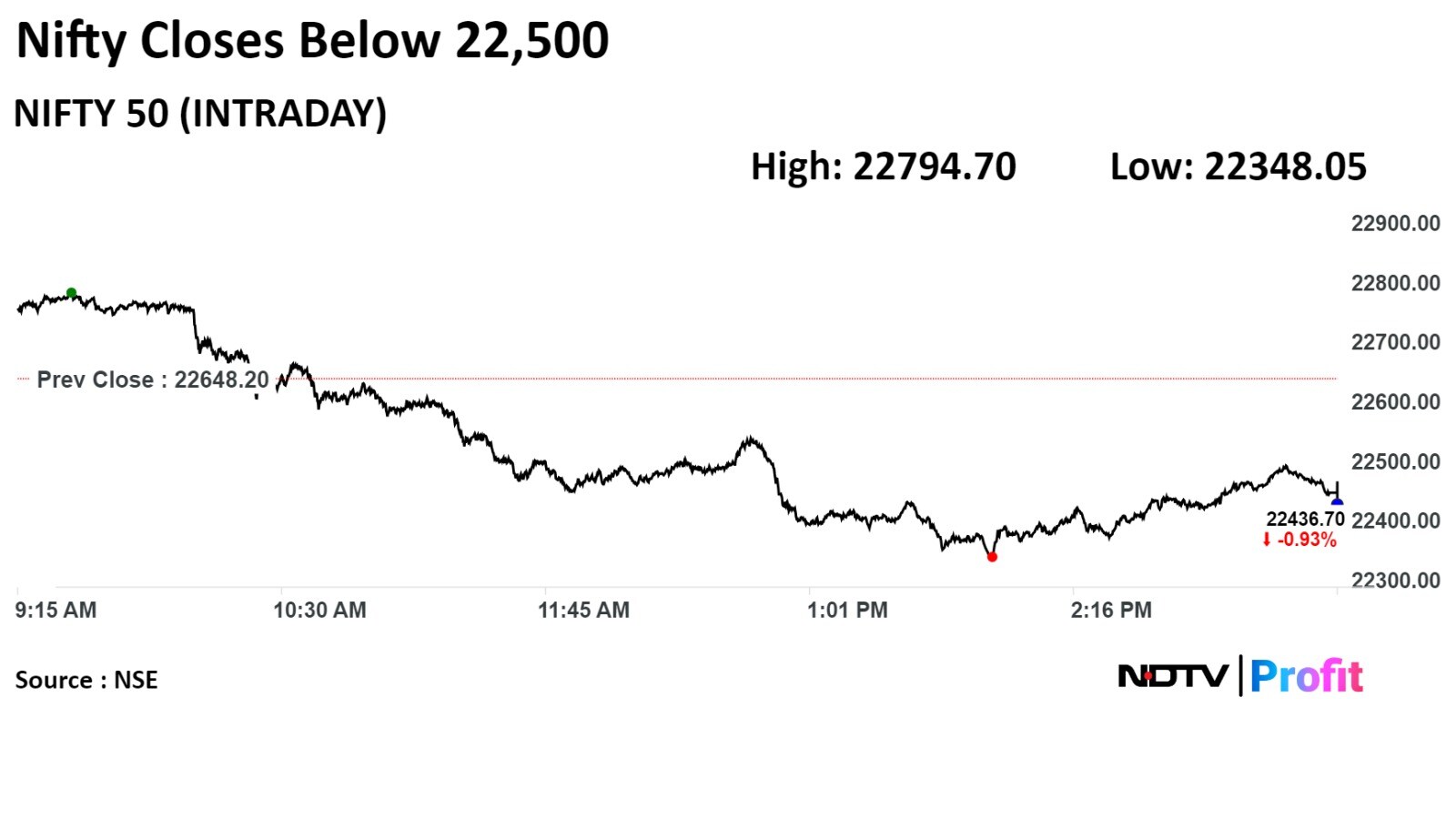

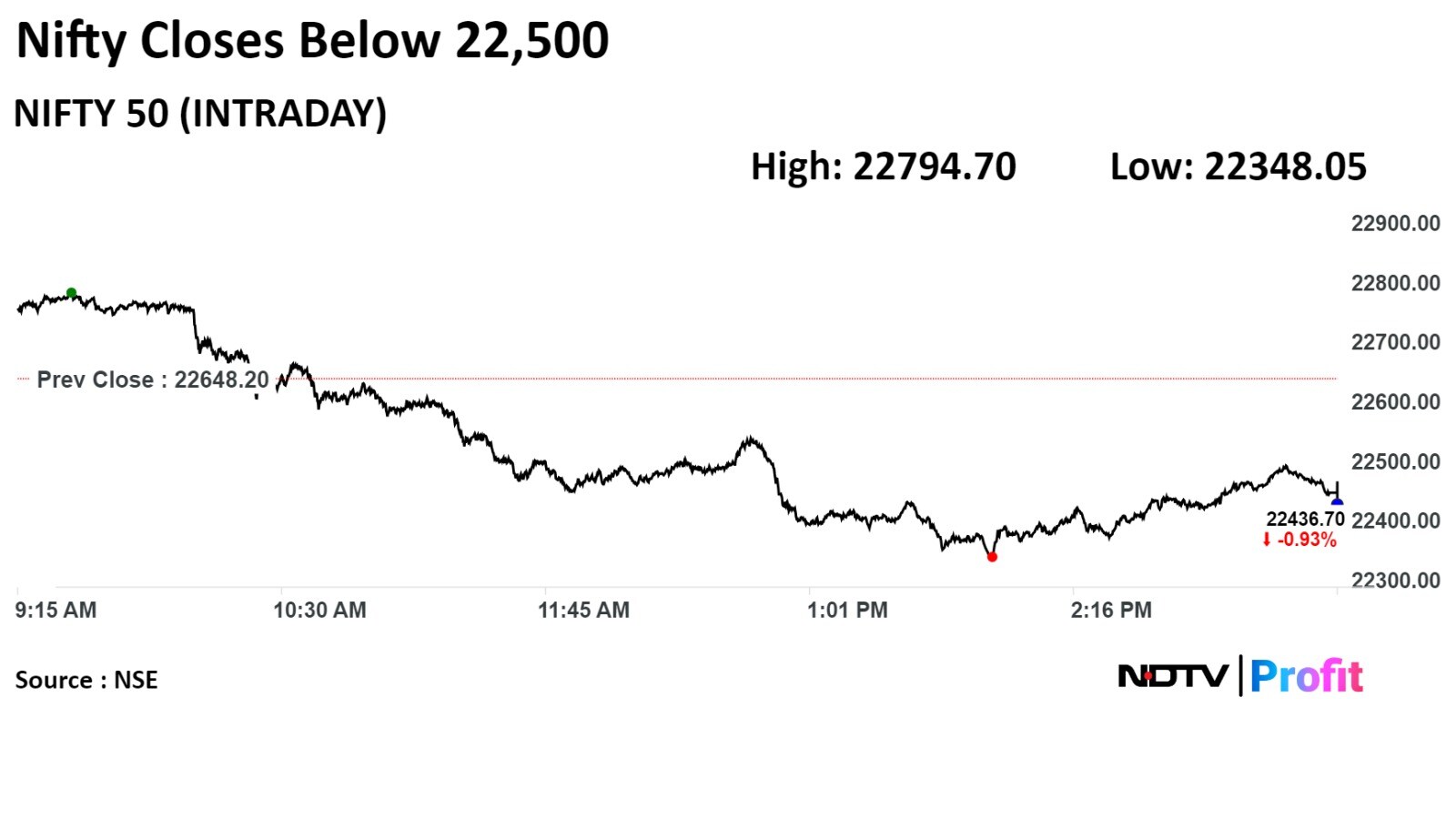

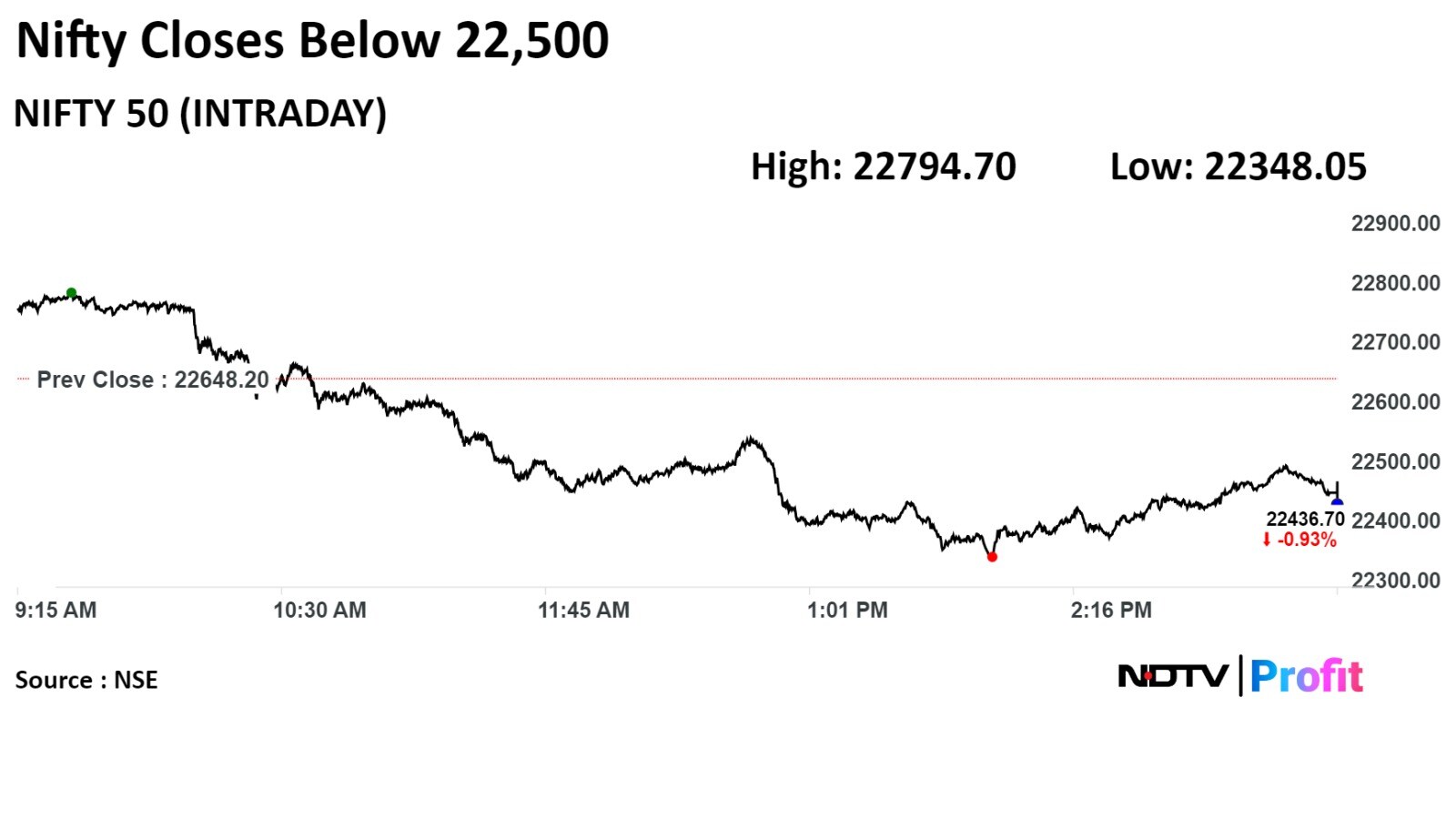

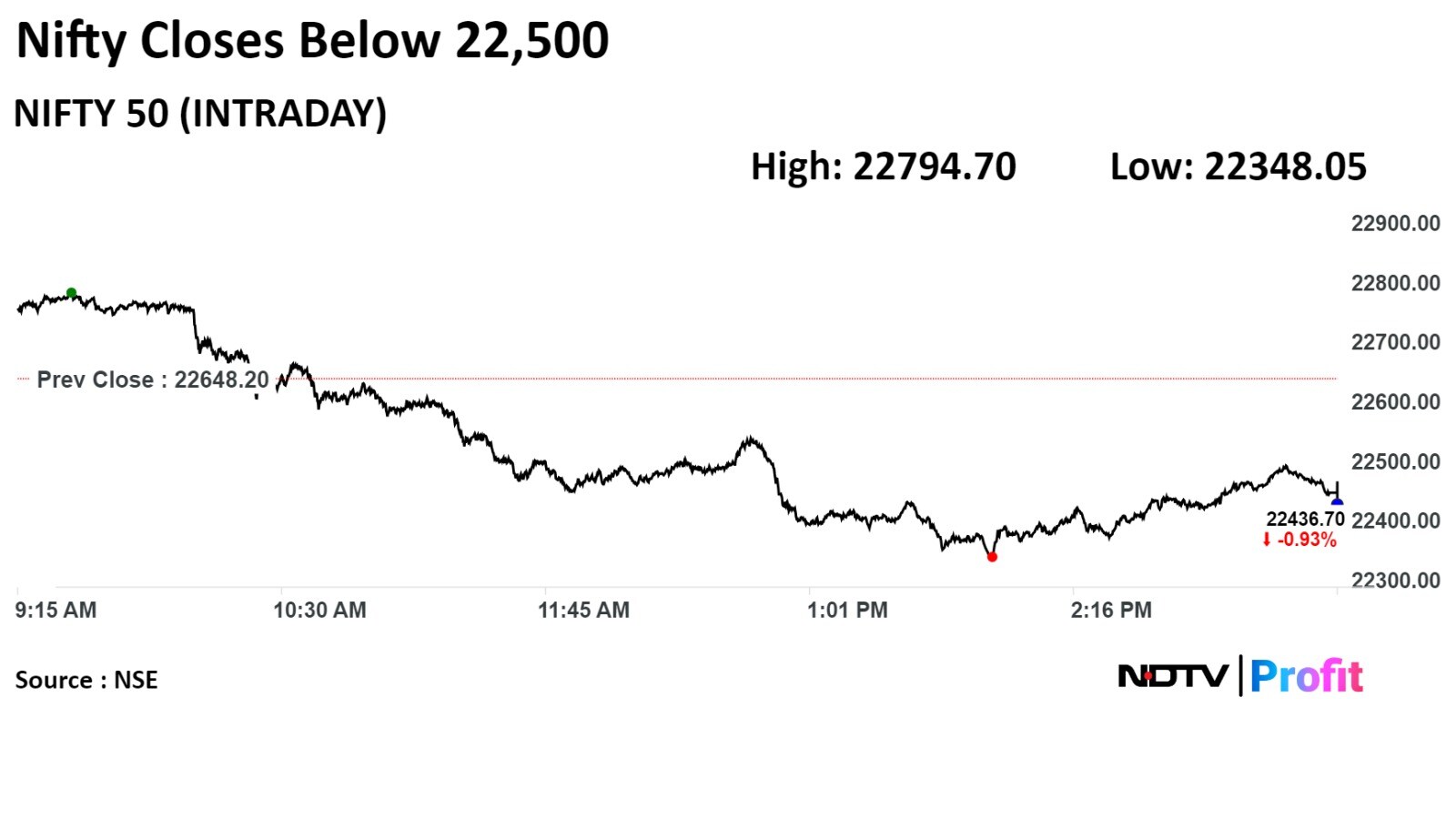

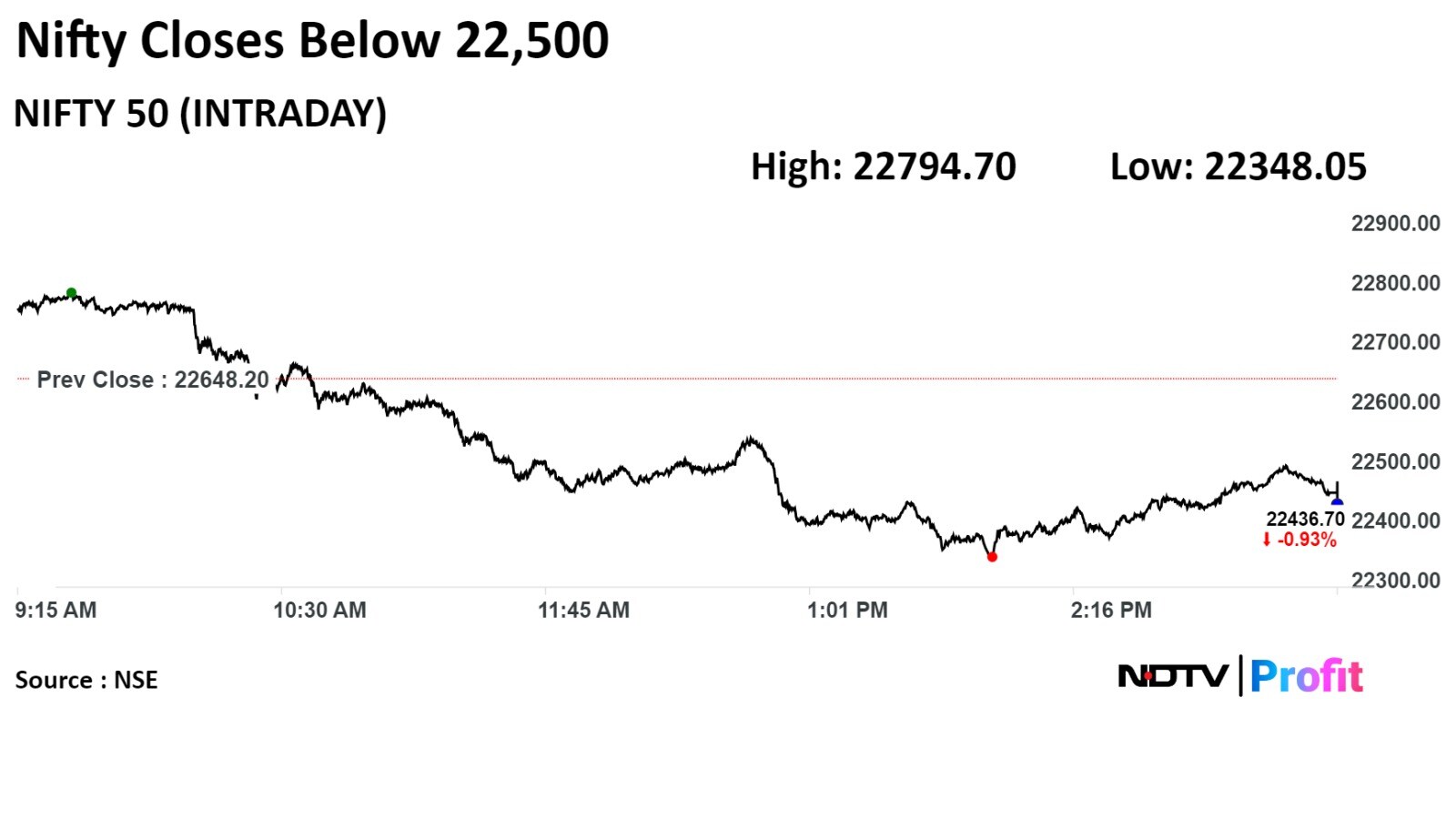

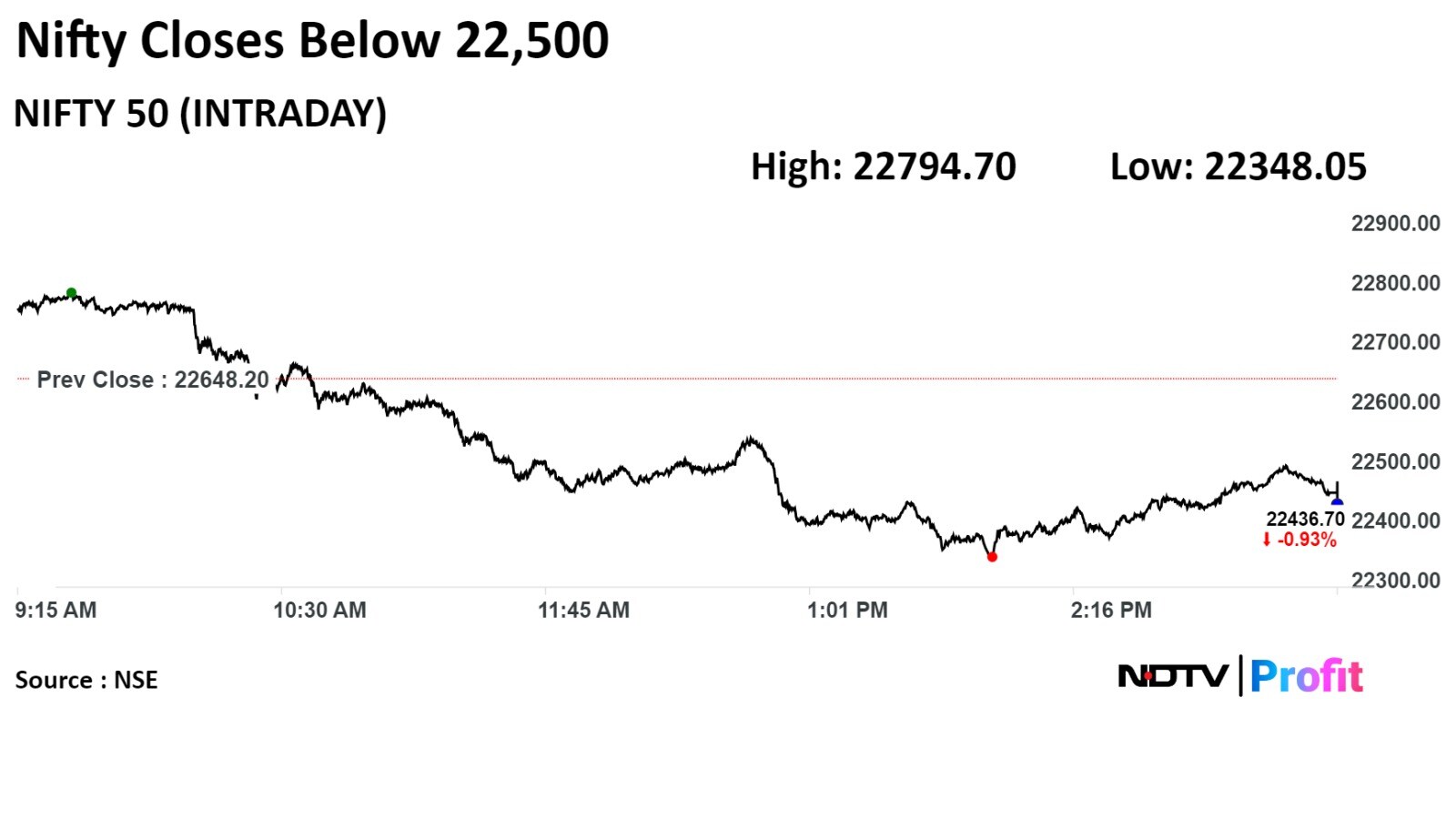

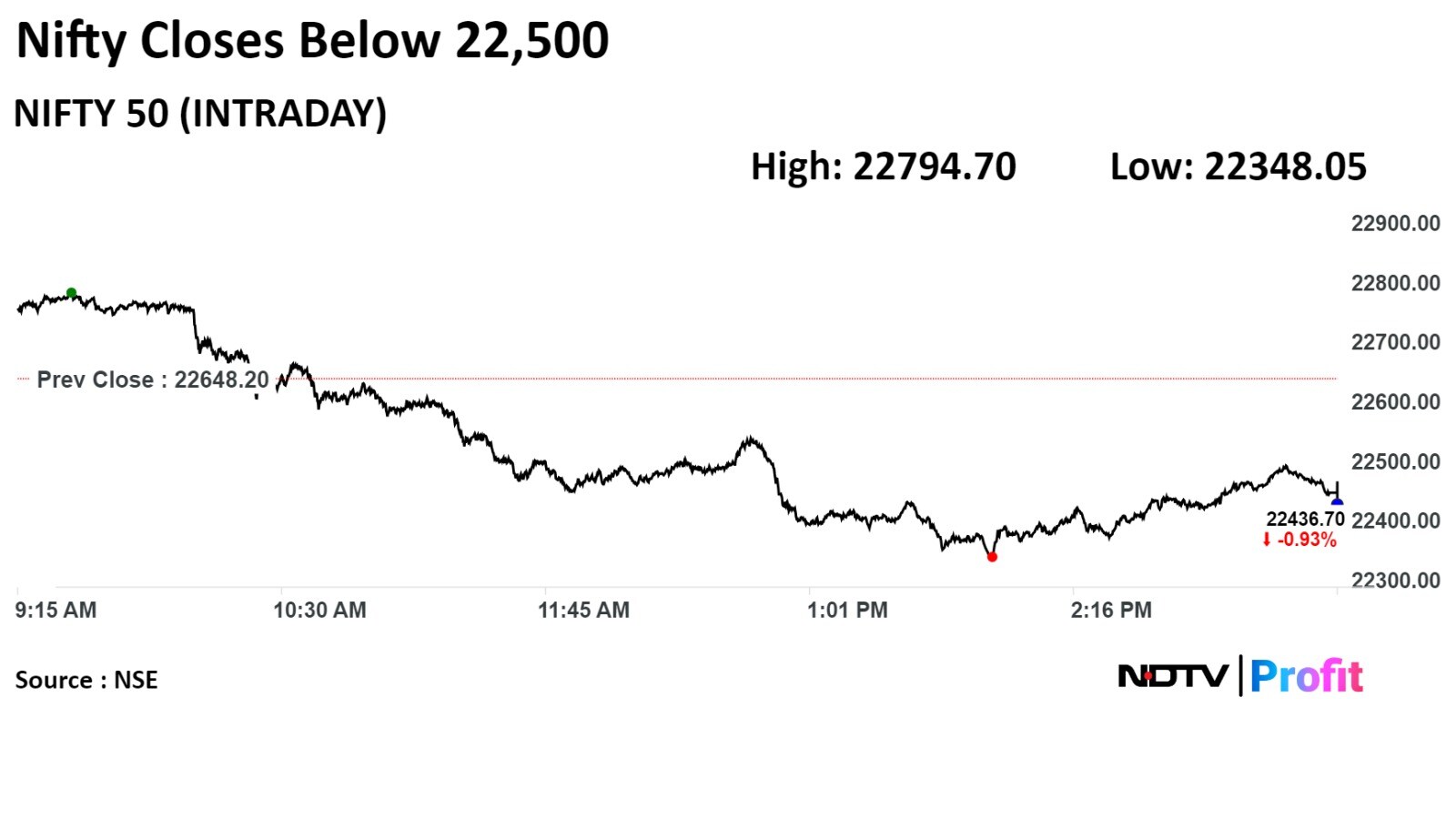

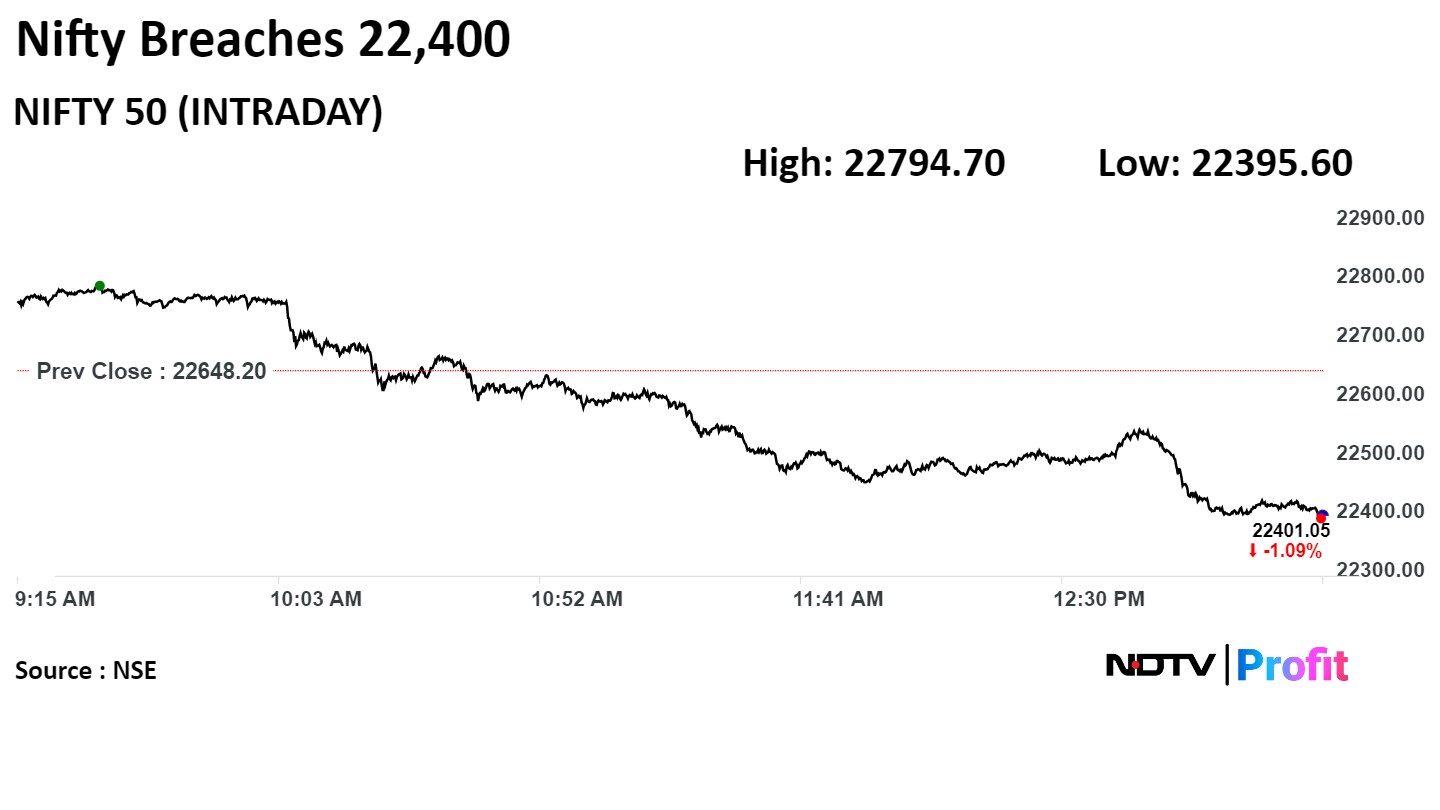

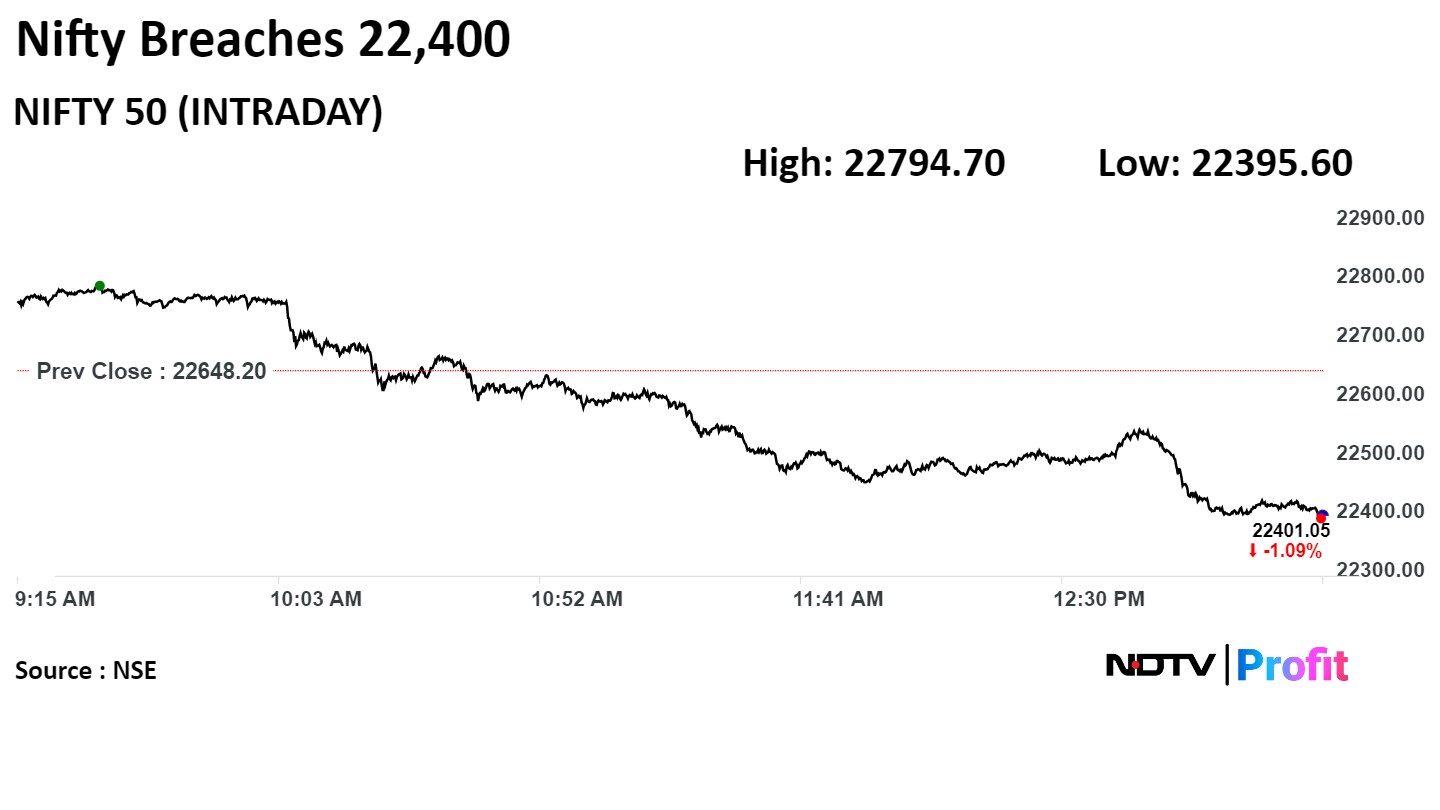

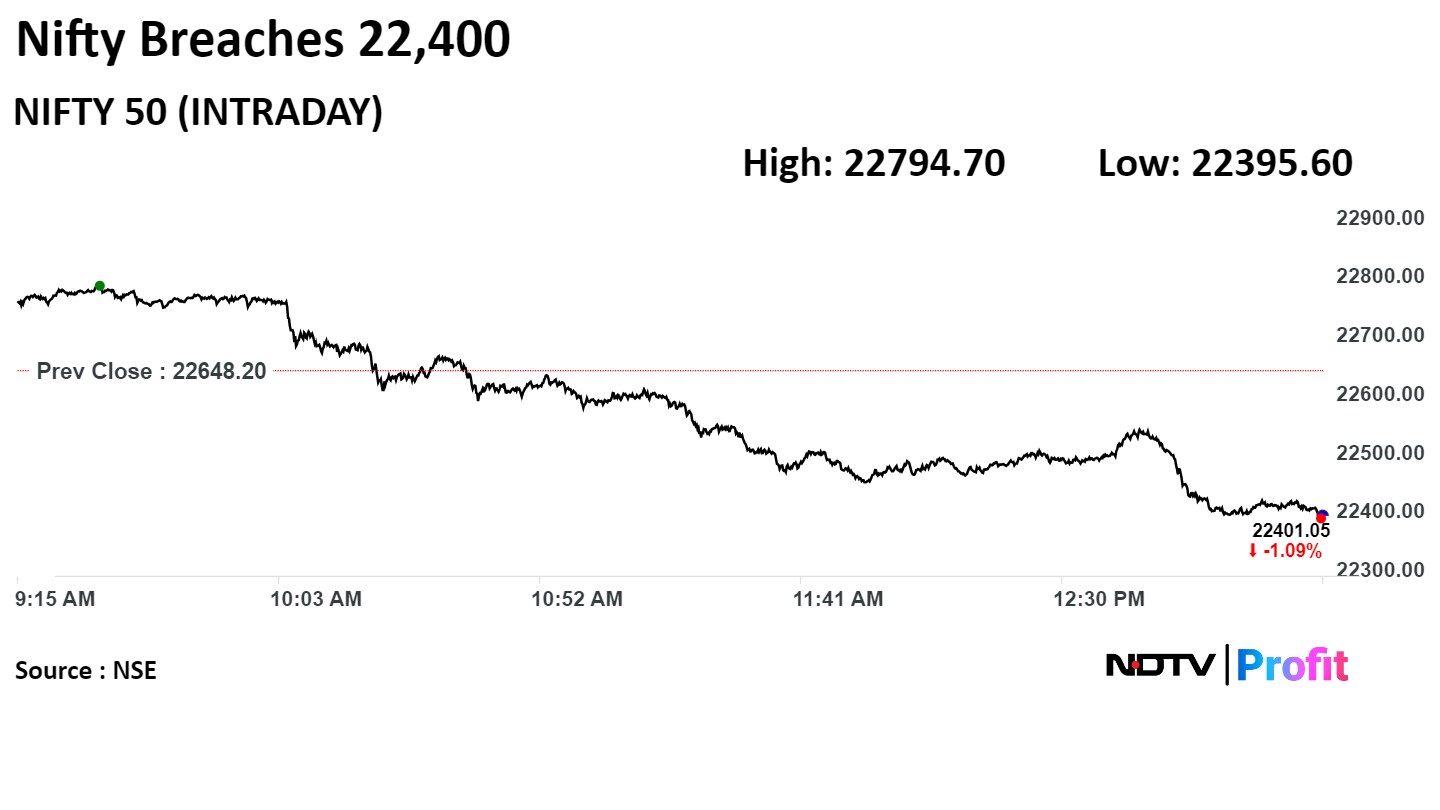

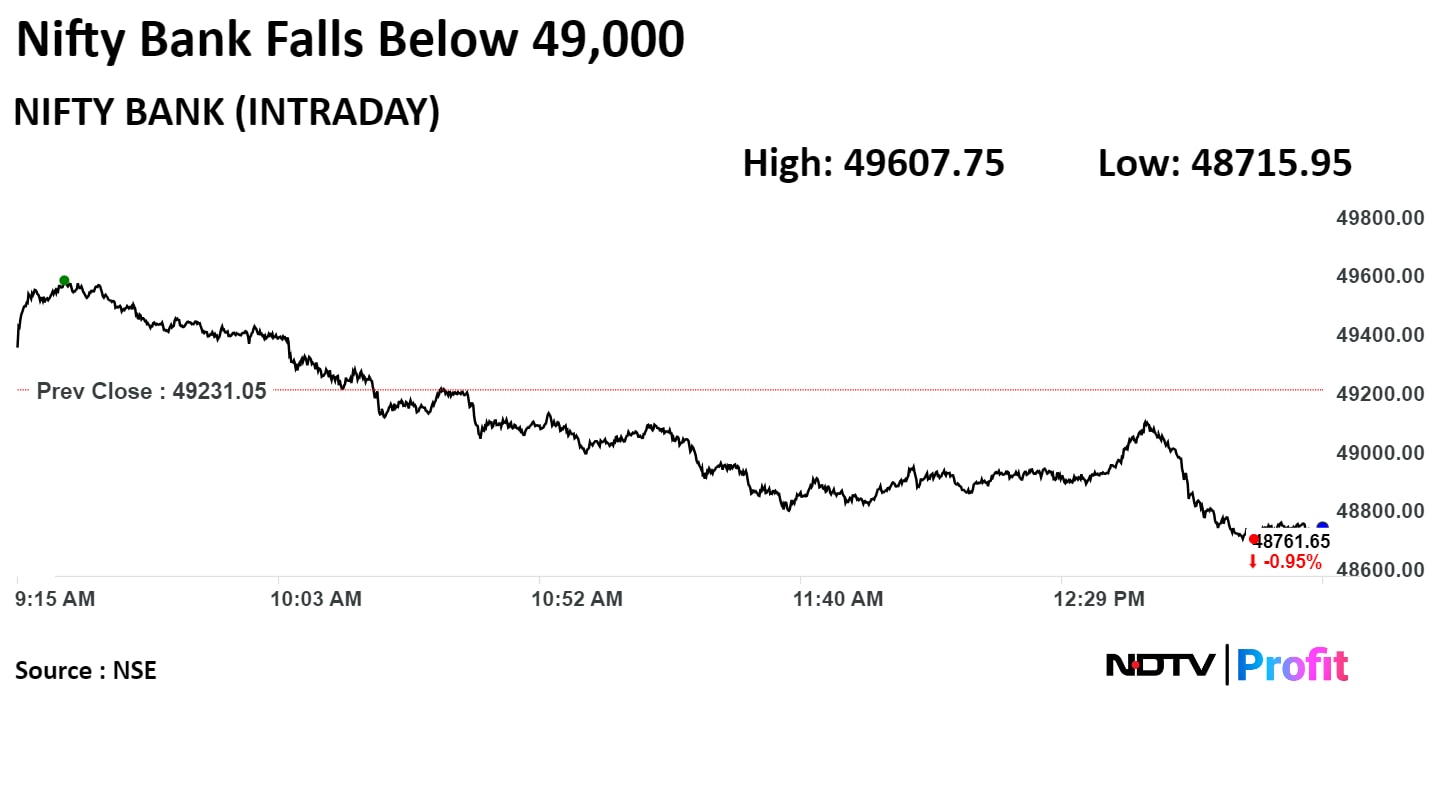

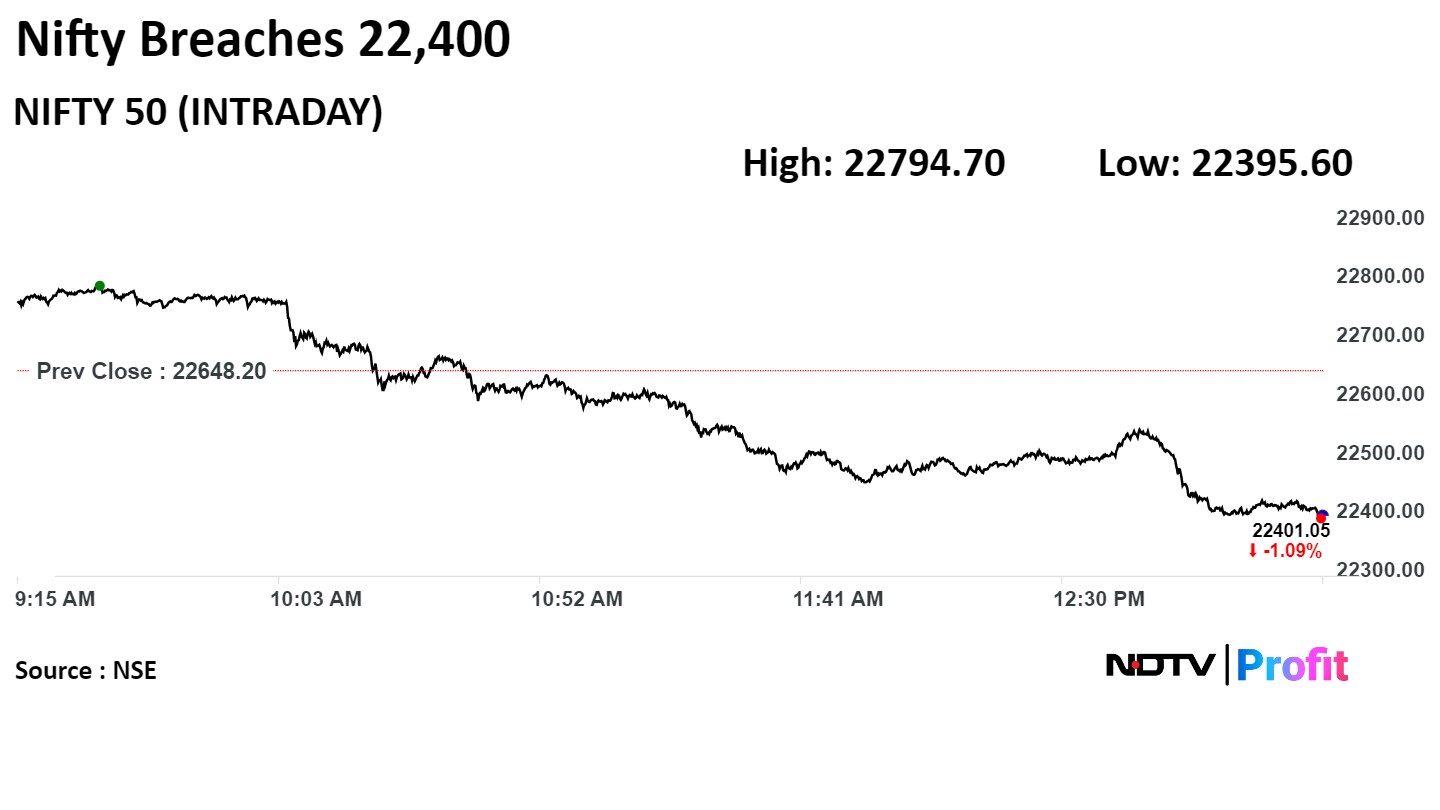

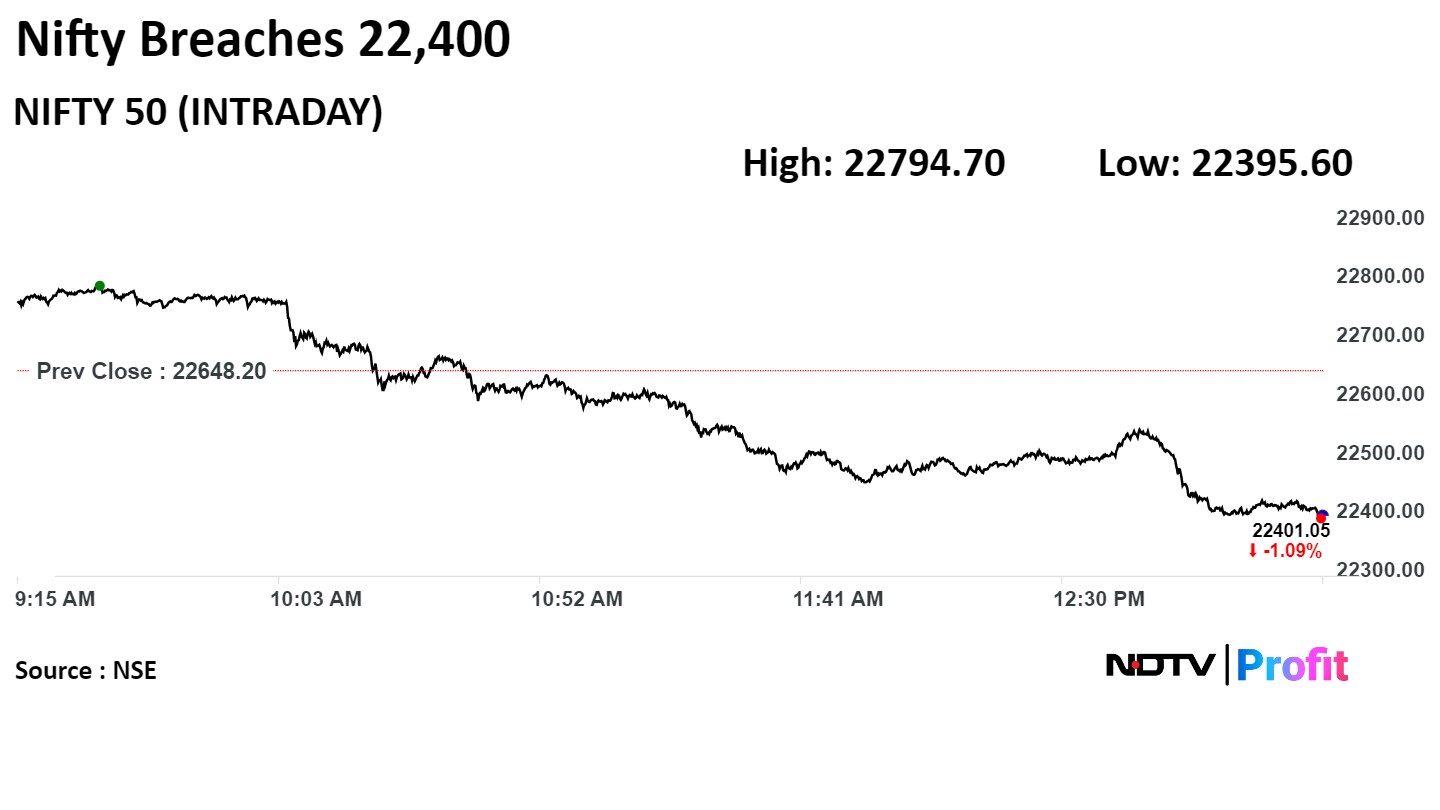

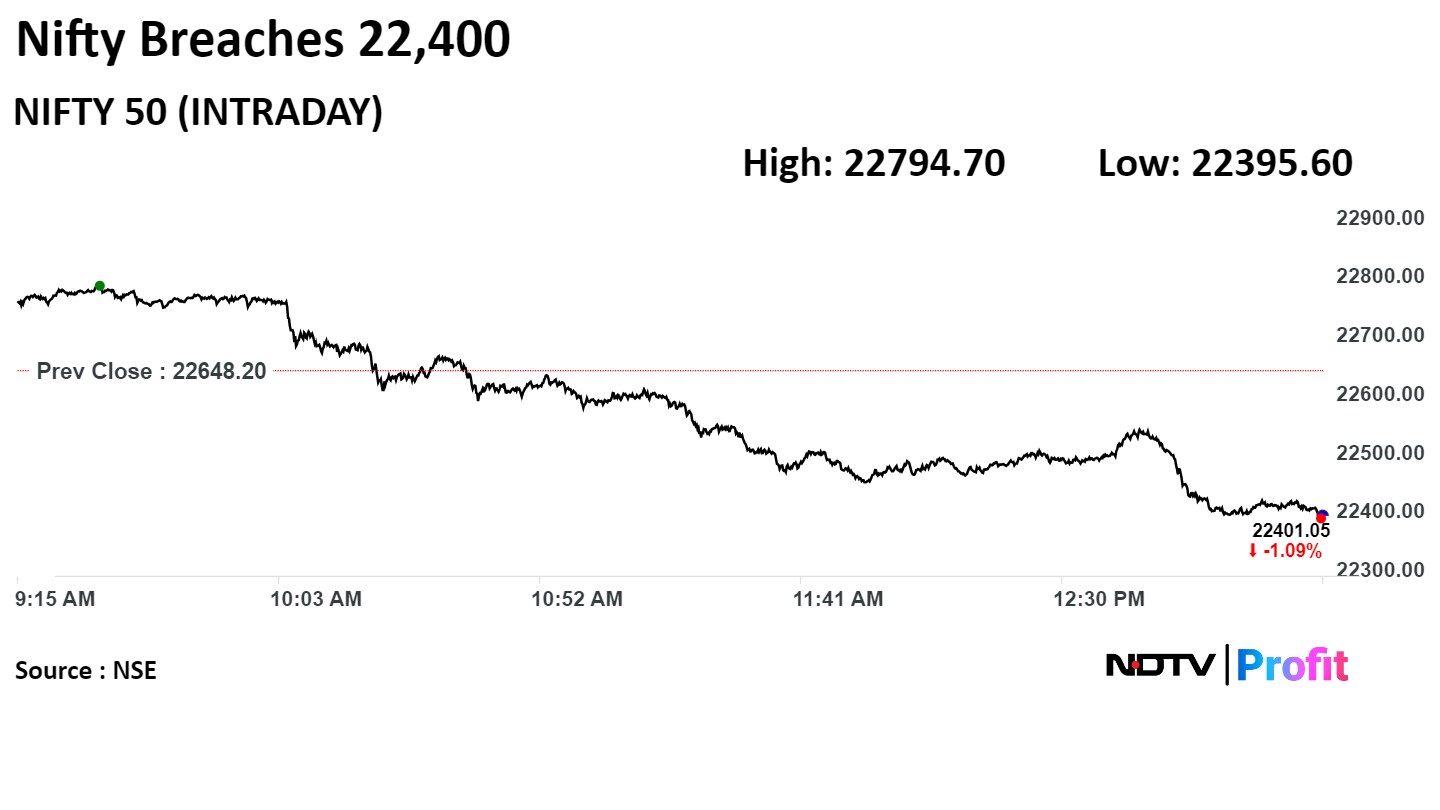

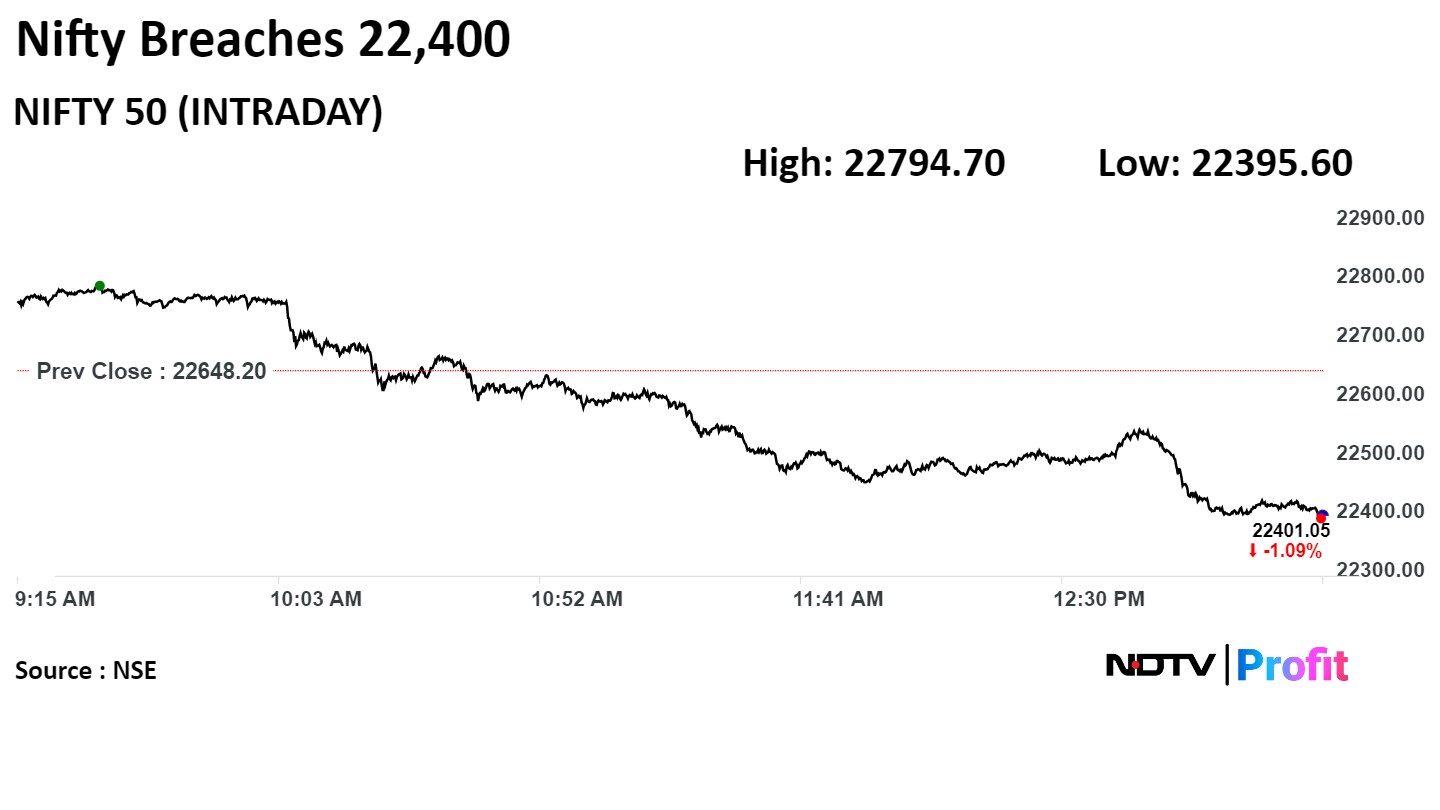

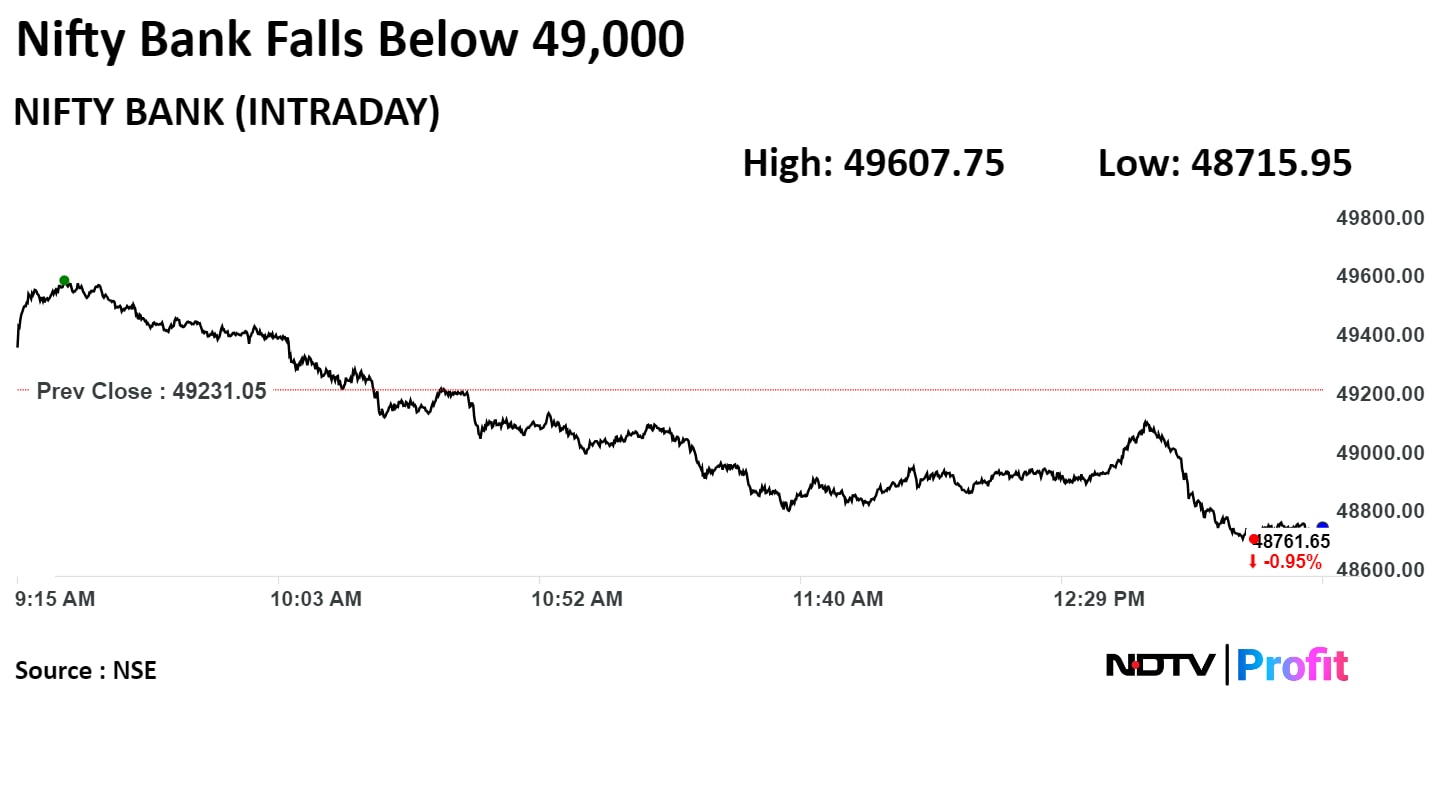

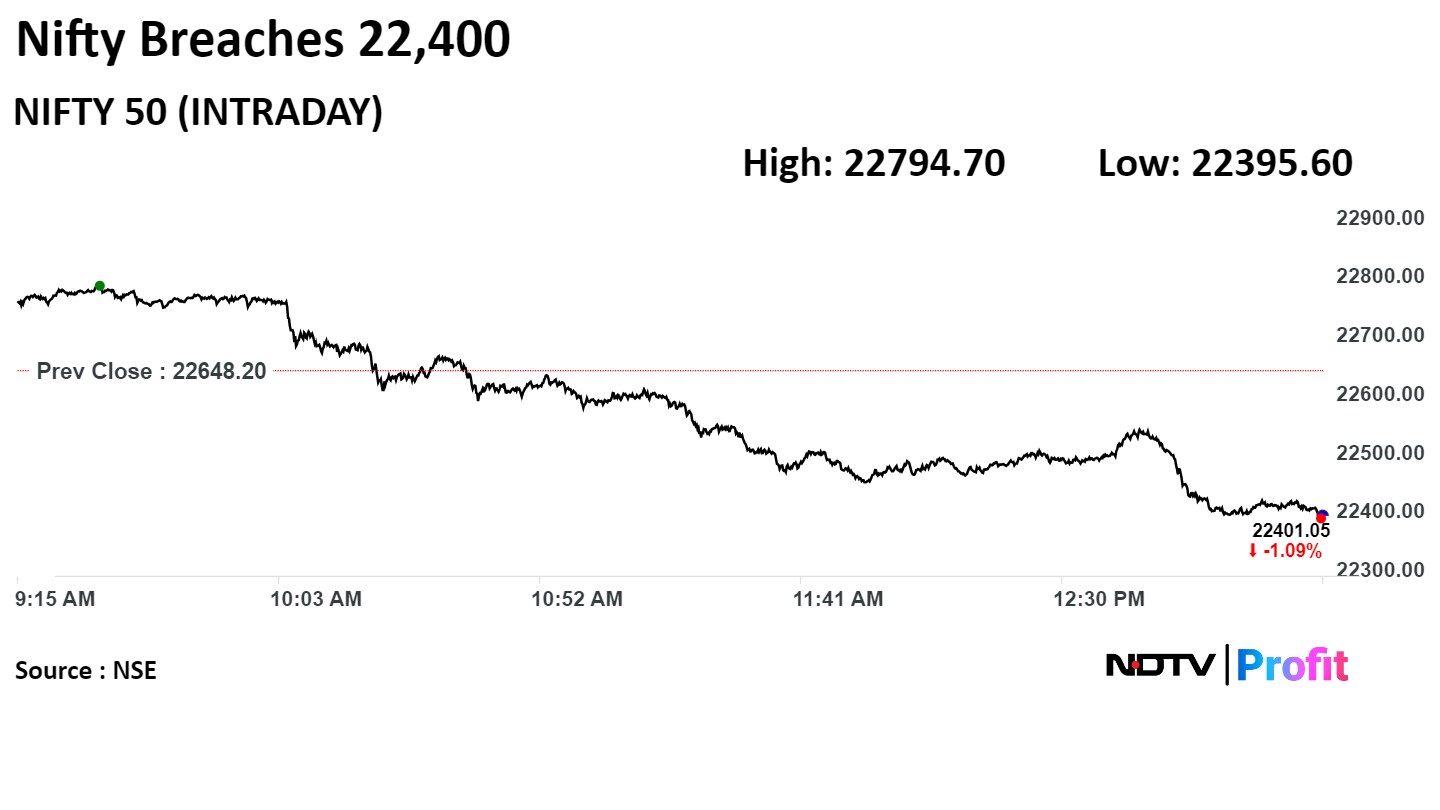

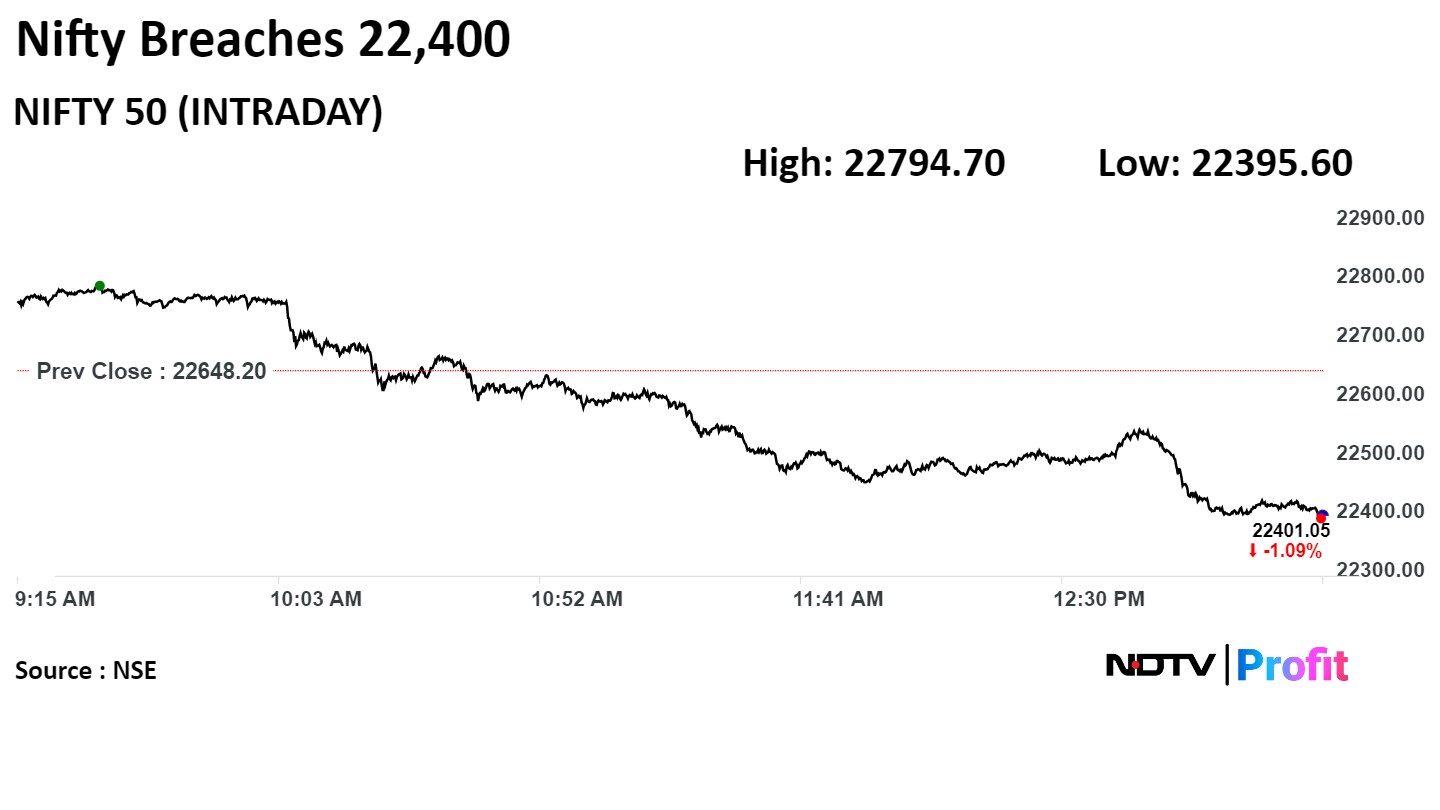

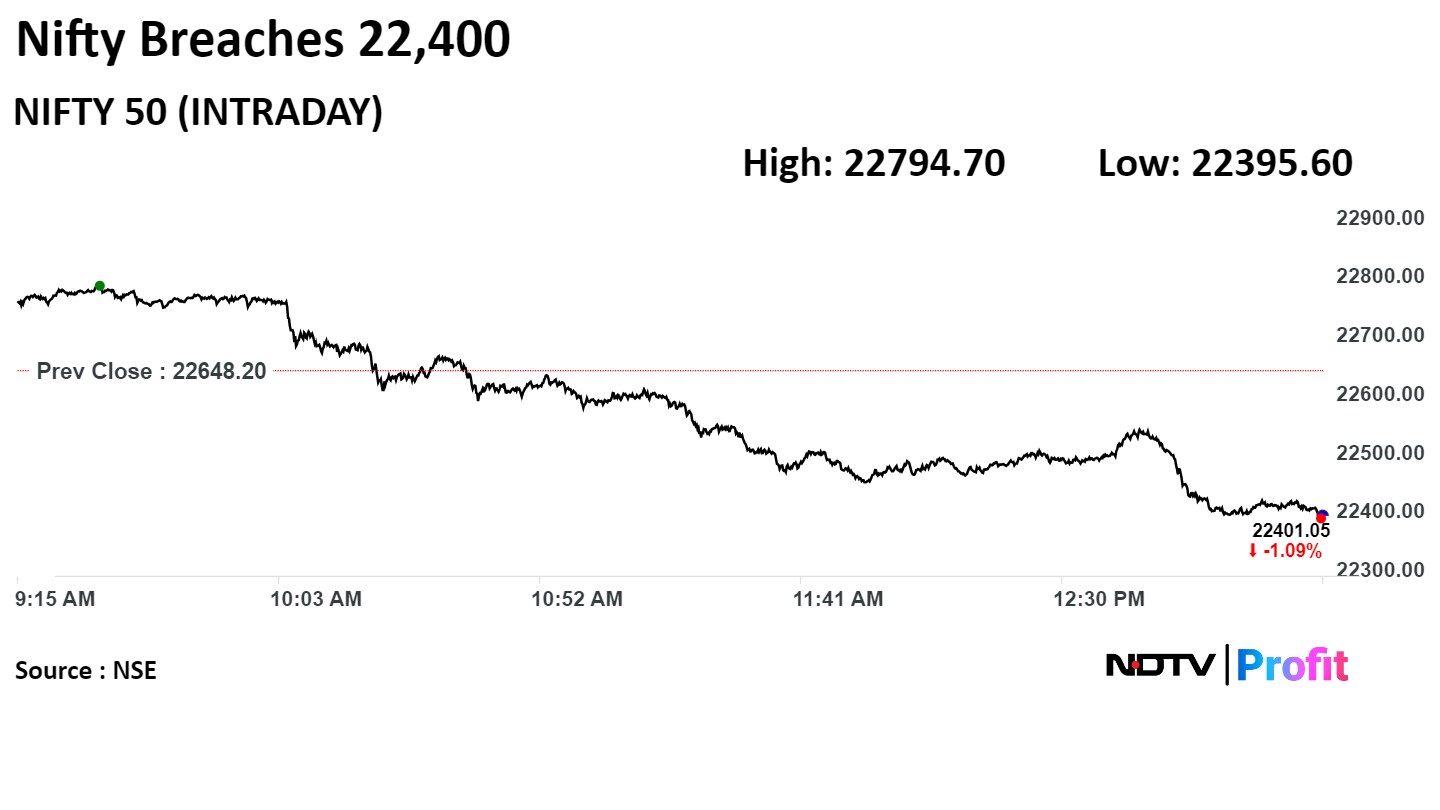

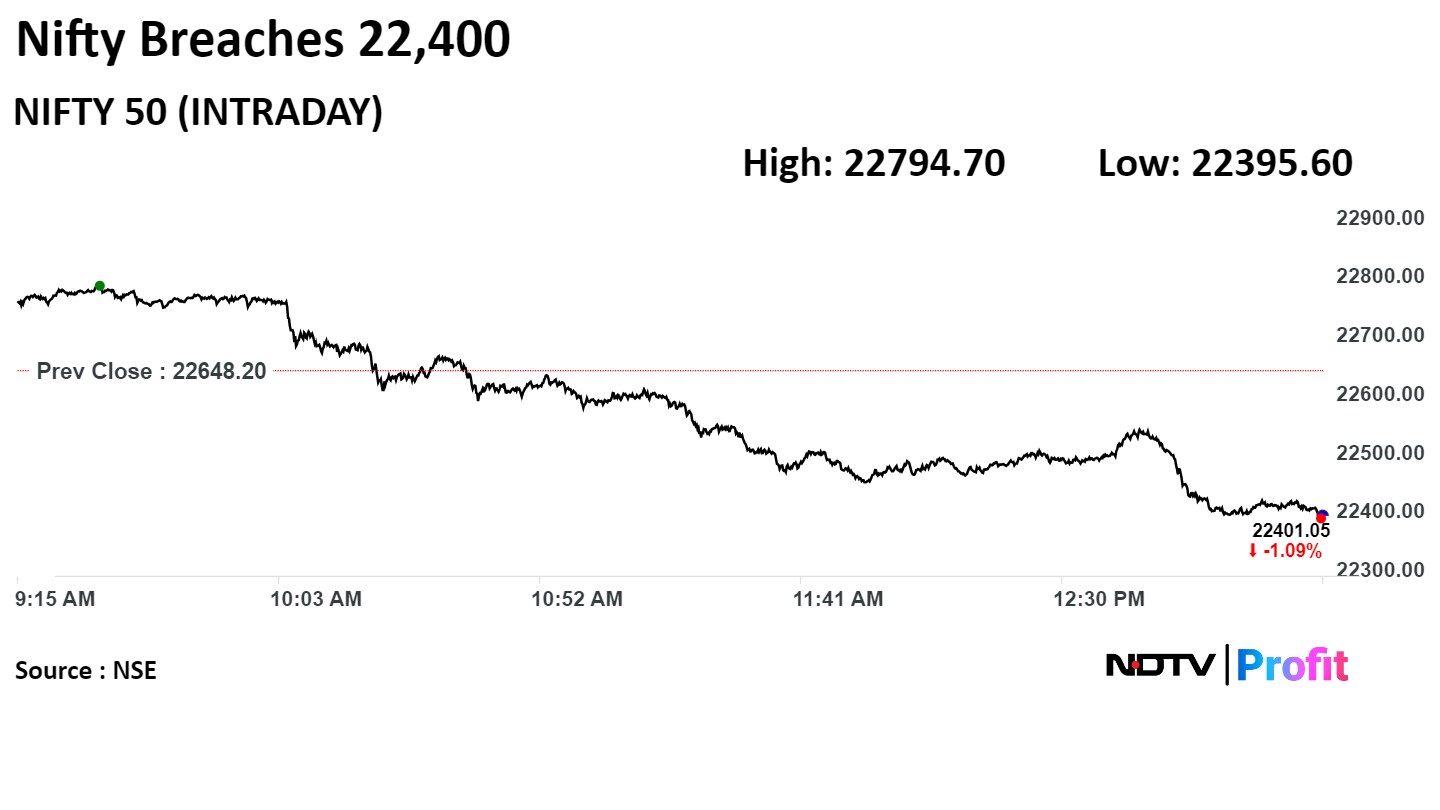

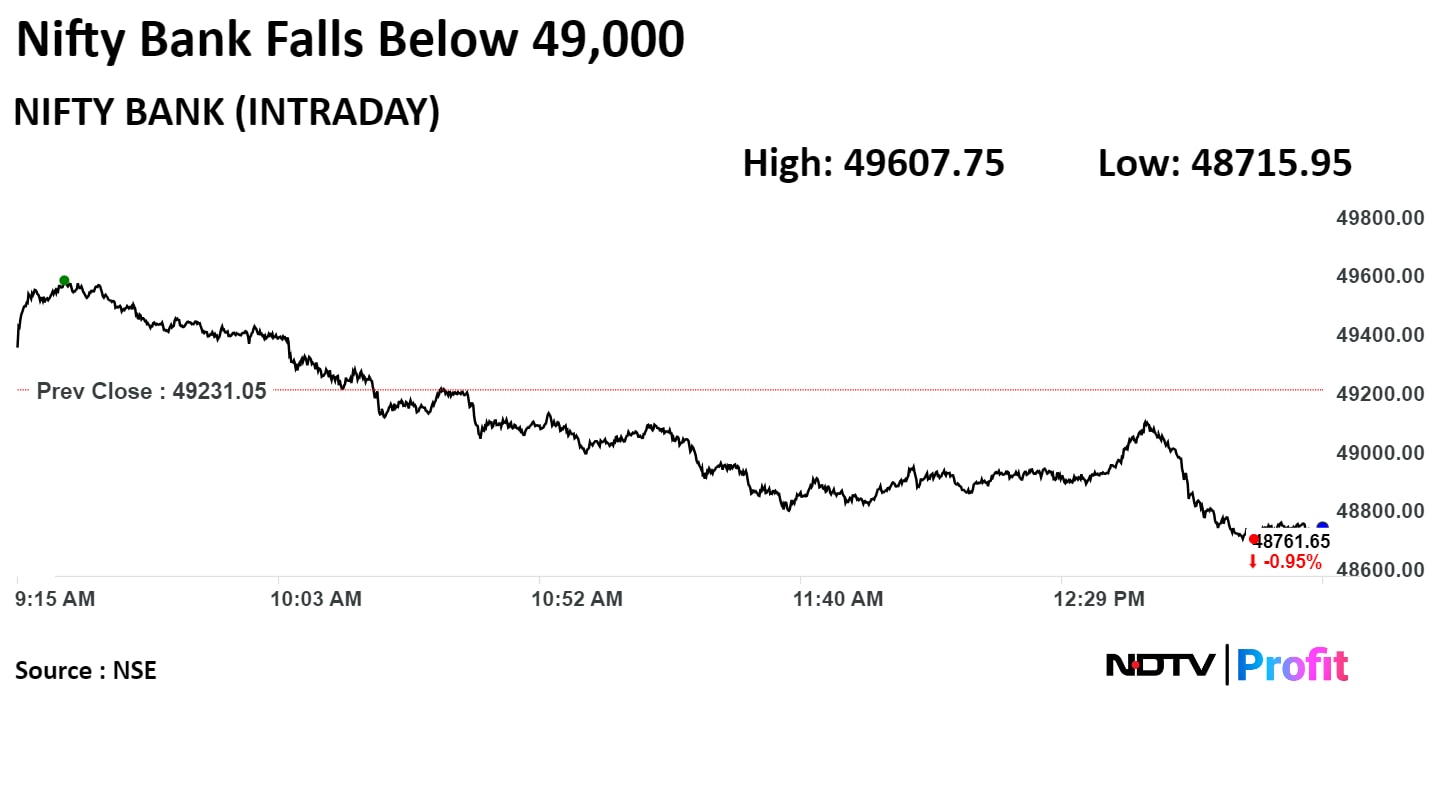

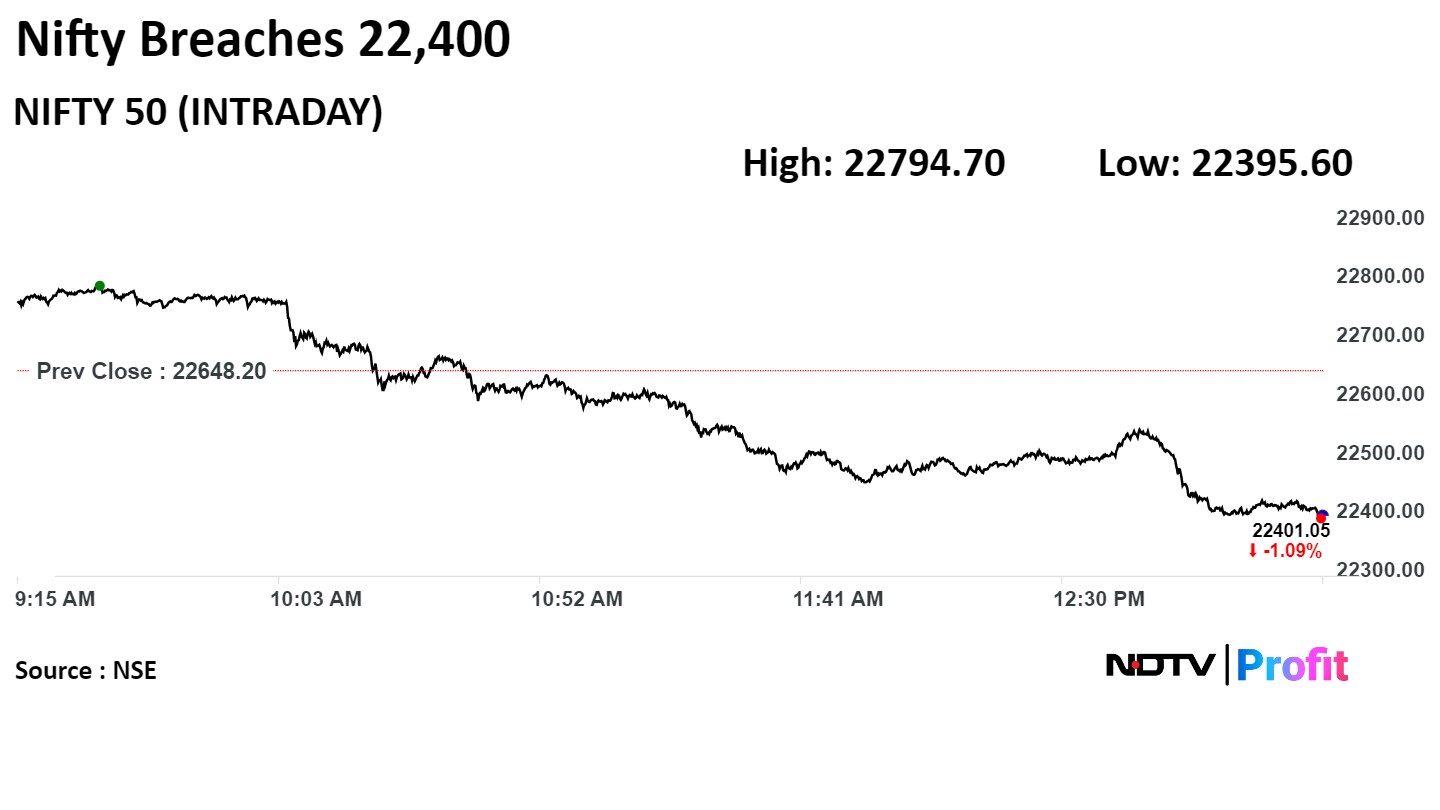

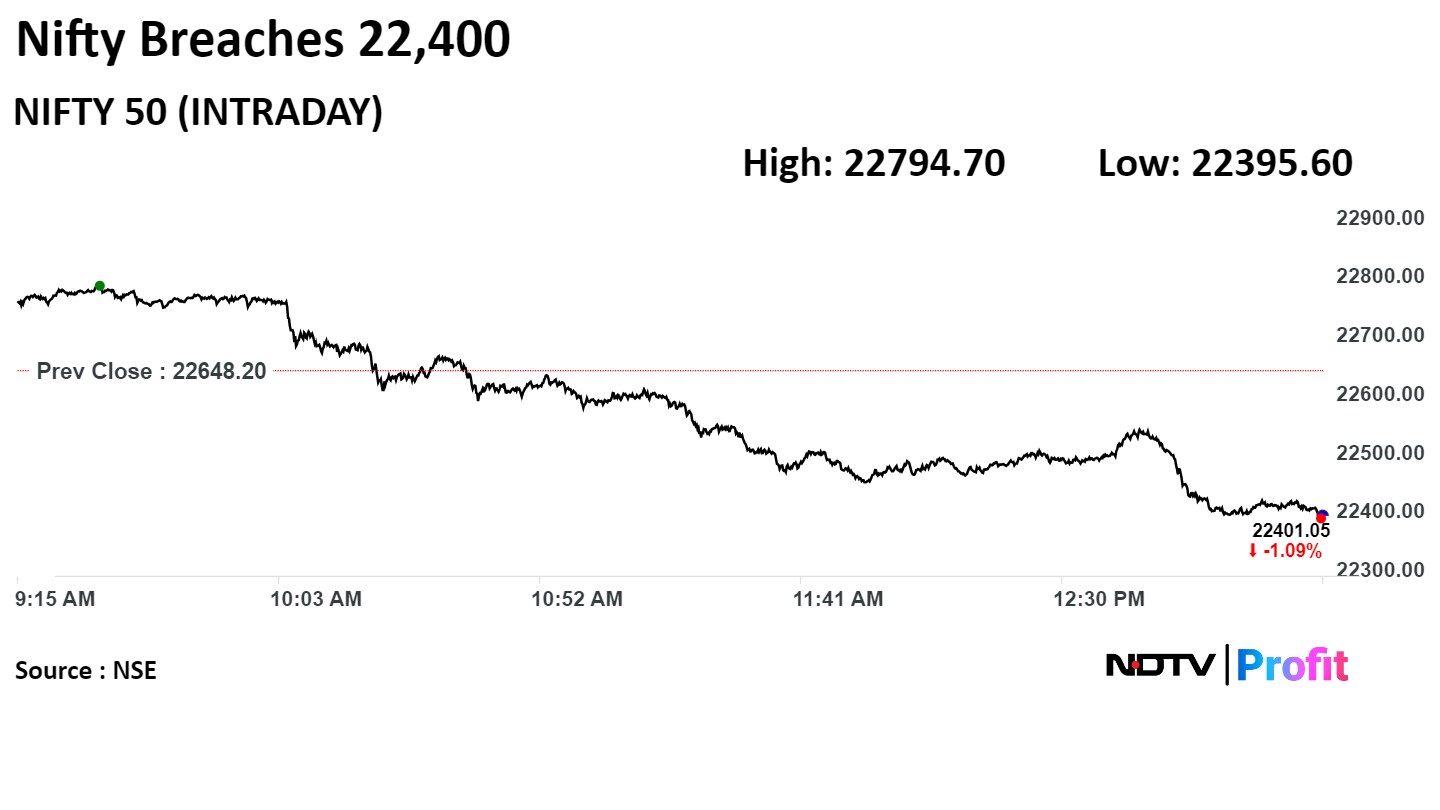

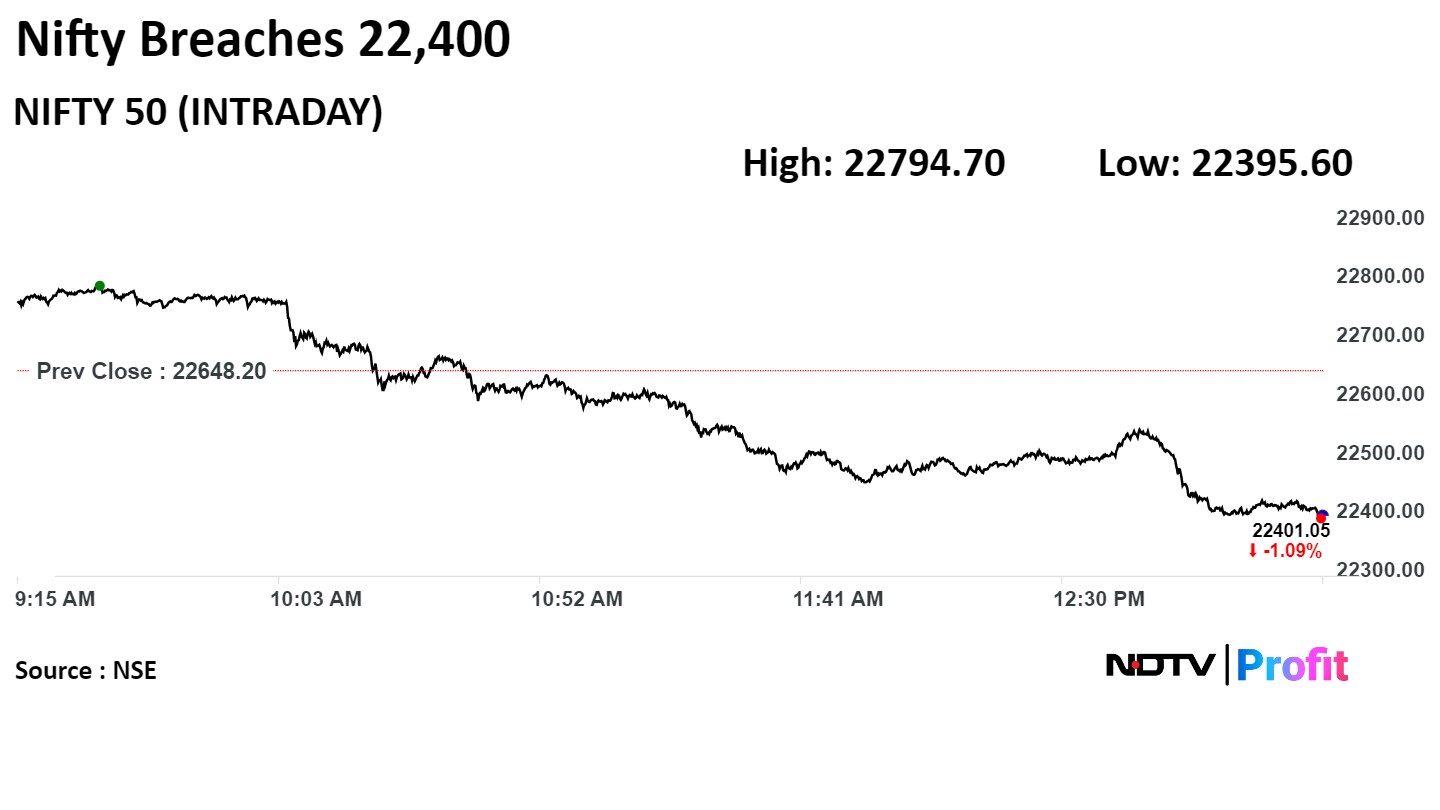

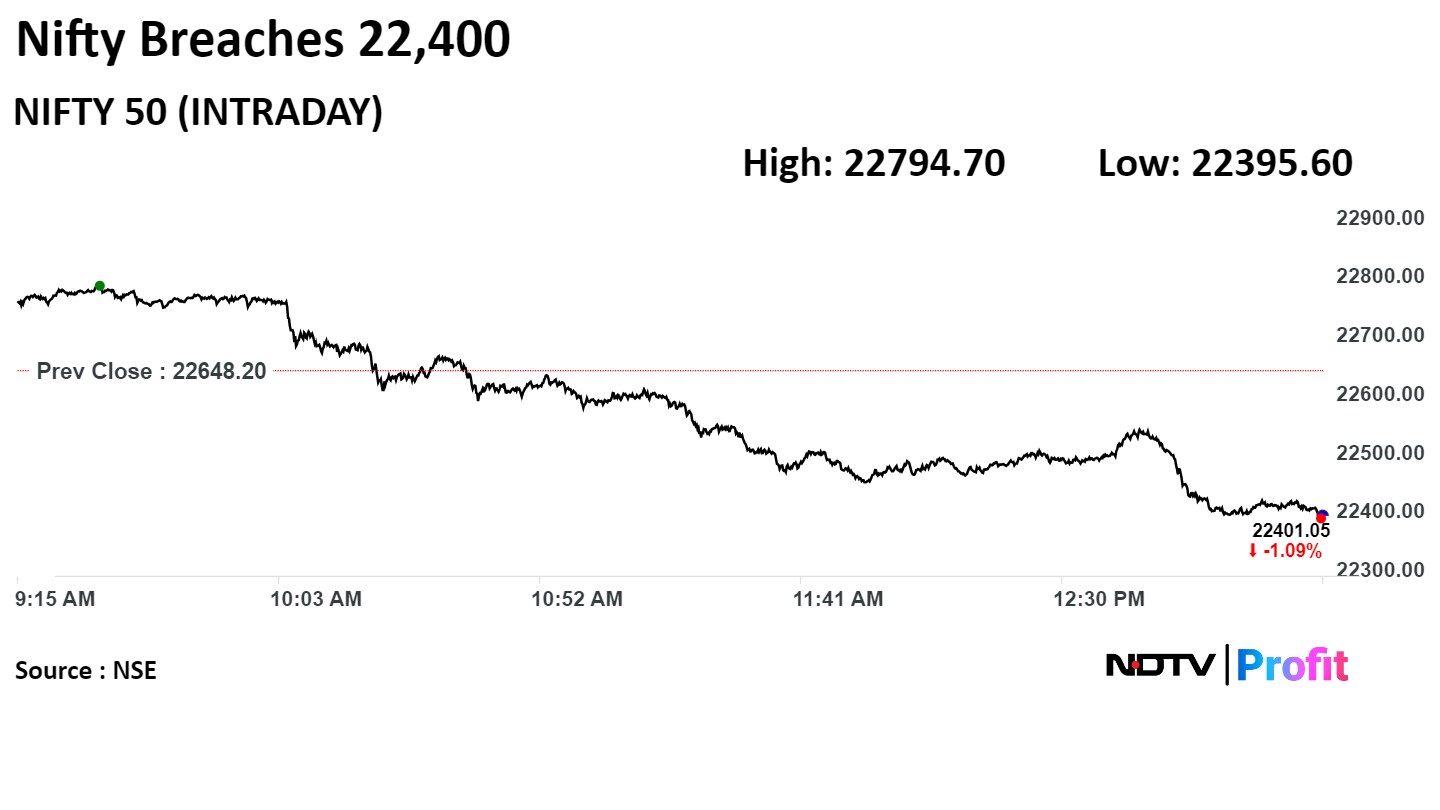

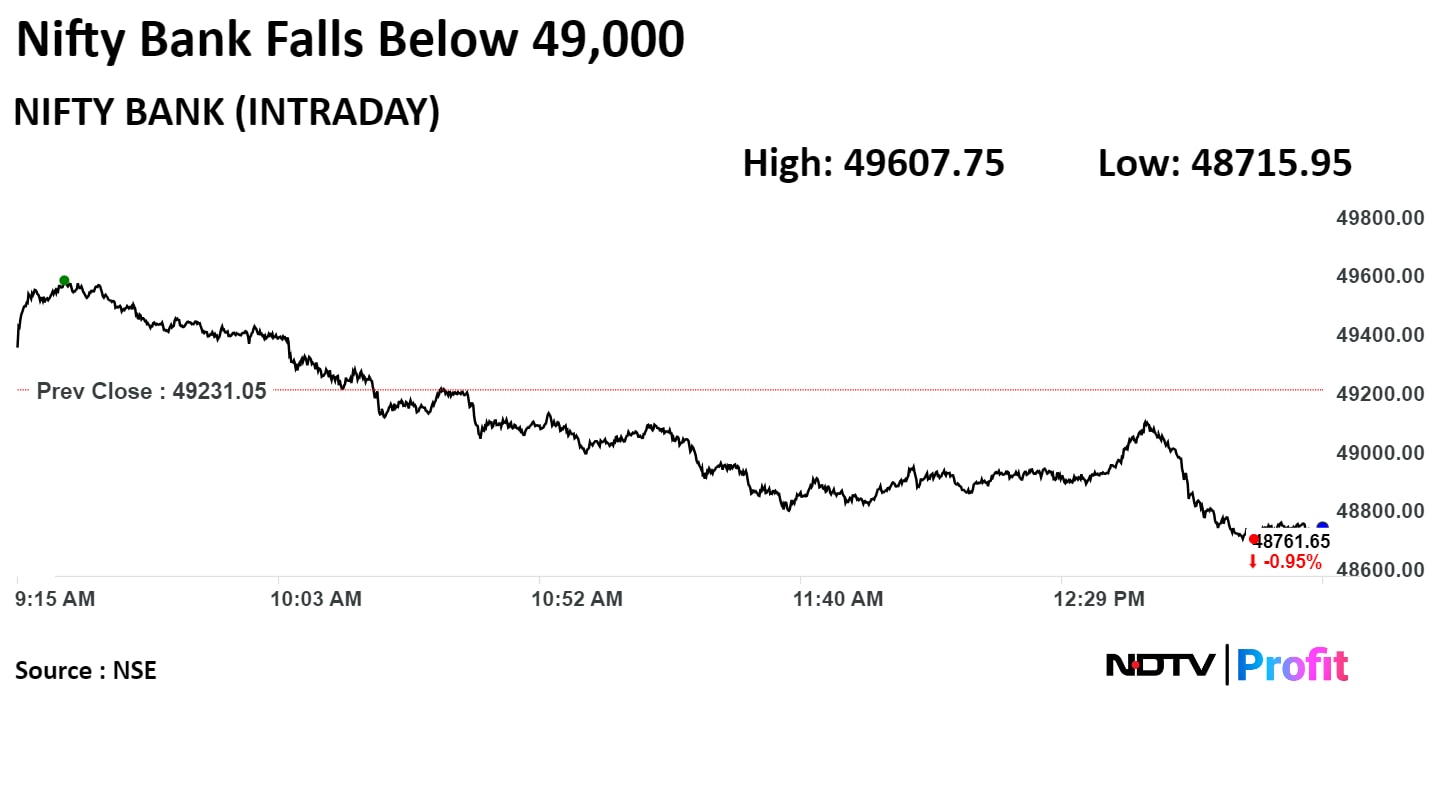

India's benchmark indices reversed early gains and ended lower on Friday as heavyweights Reliance Industries Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd. dragged.

However, on weekly basis, the NSE Nifty 50, and S&P BSE Sensex gained.

The NSE Nifty 50 ended 172.35 points or 0.76% lower at 22,475.85, and the S&P BSE Sensex ended 732.96 points or 0.98% down at 73,878.15.

Intraday, the NSE Nifty 50 declined 1.33% to 22,348.05, and the S&P BSE Sensex fell 1.53% to 73,467.73.

"Profit booking and a degree of caution ahead of the release of the US non-farm payroll resulted in selling pressure in the market. However, the absence of significant negative surprises in Q4 earnings thus far, along with a decline in oil prices, might help to mitigate the downside. Though the correction was broad-based, the large-cap stock was the key underperformer due to the moderation of FII's exposure to the domestic market," Vinod Nair, head, research, Geojit Financial Services.

India's benchmark indices reversed early gains and ended lower on Friday as heavyweights Reliance Industries Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd. dragged.

However, on weekly basis, the NSE Nifty 50, and S&P BSE Sensex gained.

The NSE Nifty 50 ended 172.35 points or 0.76% lower at 22,475.85, and the S&P BSE Sensex ended 732.96 points or 0.98% down at 73,878.15.

Intraday, the NSE Nifty 50 declined 1.33% to 22,348.05, and the S&P BSE Sensex fell 1.53% to 73,467.73.

"Profit booking and a degree of caution ahead of the release of the US non-farm payroll resulted in selling pressure in the market. However, the absence of significant negative surprises in Q4 earnings thus far, along with a decline in oil prices, might help to mitigate the downside. Though the correction was broad-based, the large-cap stock was the key underperformer due to the moderation of FII's exposure to the domestic market," Vinod Nair, head, research, Geojit Financial Services.

India's benchmark indices reversed early gains and ended lower on Friday as heavyweights Reliance Industries Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd. dragged.

However, on weekly basis, the NSE Nifty 50, and S&P BSE Sensex gained.

The NSE Nifty 50 ended 172.35 points or 0.76% lower at 22,475.85, and the S&P BSE Sensex ended 732.96 points or 0.98% down at 73,878.15.

Intraday, the NSE Nifty 50 declined 1.33% to 22,348.05, and the S&P BSE Sensex fell 1.53% to 73,467.73.

"Profit booking and a degree of caution ahead of the release of the US non-farm payroll resulted in selling pressure in the market. However, the absence of significant negative surprises in Q4 earnings thus far, along with a decline in oil prices, might help to mitigate the downside. Though the correction was broad-based, the large-cap stock was the key underperformer due to the moderation of FII's exposure to the domestic market," Vinod Nair, head, research, Geojit Financial Services.

India's benchmark indices reversed early gains and ended lower on Friday as heavyweights Reliance Industries Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd. dragged.

However, on weekly basis, the NSE Nifty 50, and S&P BSE Sensex gained.

The NSE Nifty 50 ended 172.35 points or 0.76% lower at 22,475.85, and the S&P BSE Sensex ended 732.96 points or 0.98% down at 73,878.15.

Intraday, the NSE Nifty 50 declined 1.33% to 22,348.05, and the S&P BSE Sensex fell 1.53% to 73,467.73.

"Profit booking and a degree of caution ahead of the release of the US non-farm payroll resulted in selling pressure in the market. However, the absence of significant negative surprises in Q4 earnings thus far, along with a decline in oil prices, might help to mitigate the downside. Though the correction was broad-based, the large-cap stock was the key underperformer due to the moderation of FII's exposure to the domestic market," Vinod Nair, head, research, Geojit Financial Services.

India's benchmark indices reversed early gains and ended lower on Friday as heavyweights Reliance Industries Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd. dragged.

However, on weekly basis, the NSE Nifty 50, and S&P BSE Sensex gained.

The NSE Nifty 50 ended 172.35 points or 0.76% lower at 22,475.85, and the S&P BSE Sensex ended 732.96 points or 0.98% down at 73,878.15.

Intraday, the NSE Nifty 50 declined 1.33% to 22,348.05, and the S&P BSE Sensex fell 1.53% to 73,467.73.

"Profit booking and a degree of caution ahead of the release of the US non-farm payroll resulted in selling pressure in the market. However, the absence of significant negative surprises in Q4 earnings thus far, along with a decline in oil prices, might help to mitigate the downside. Though the correction was broad-based, the large-cap stock was the key underperformer due to the moderation of FII's exposure to the domestic market," Vinod Nair, head, research, Geojit Financial Services.

India's benchmark indices reversed early gains and ended lower on Friday as heavyweights Reliance Industries Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd. dragged.

However, on weekly basis, the NSE Nifty 50, and S&P BSE Sensex gained.

The NSE Nifty 50 ended 172.35 points or 0.76% lower at 22,475.85, and the S&P BSE Sensex ended 732.96 points or 0.98% down at 73,878.15.

Intraday, the NSE Nifty 50 declined 1.33% to 22,348.05, and the S&P BSE Sensex fell 1.53% to 73,467.73.

"Profit booking and a degree of caution ahead of the release of the US non-farm payroll resulted in selling pressure in the market. However, the absence of significant negative surprises in Q4 earnings thus far, along with a decline in oil prices, might help to mitigate the downside. Though the correction was broad-based, the large-cap stock was the key underperformer due to the moderation of FII's exposure to the domestic market," Vinod Nair, head, research, Geojit Financial Services.

India's benchmark indices reversed early gains and ended lower on Friday as heavyweights Reliance Industries Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd. dragged.

However, on weekly basis, the NSE Nifty 50, and S&P BSE Sensex gained.

The NSE Nifty 50 ended 172.35 points or 0.76% lower at 22,475.85, and the S&P BSE Sensex ended 732.96 points or 0.98% down at 73,878.15.

Intraday, the NSE Nifty 50 declined 1.33% to 22,348.05, and the S&P BSE Sensex fell 1.53% to 73,467.73.

"Profit booking and a degree of caution ahead of the release of the US non-farm payroll resulted in selling pressure in the market. However, the absence of significant negative surprises in Q4 earnings thus far, along with a decline in oil prices, might help to mitigate the downside. Though the correction was broad-based, the large-cap stock was the key underperformer due to the moderation of FII's exposure to the domestic market," Vinod Nair, head, research, Geojit Financial Services.

India's benchmark indices reversed early gains and ended lower on Friday as heavyweights Reliance Industries Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd. dragged.

However, on weekly basis, the NSE Nifty 50, and S&P BSE Sensex gained.

The NSE Nifty 50 ended 172.35 points or 0.76% lower at 22,475.85, and the S&P BSE Sensex ended 732.96 points or 0.98% down at 73,878.15.

Intraday, the NSE Nifty 50 declined 1.33% to 22,348.05, and the S&P BSE Sensex fell 1.53% to 73,467.73.

"Profit booking and a degree of caution ahead of the release of the US non-farm payroll resulted in selling pressure in the market. However, the absence of significant negative surprises in Q4 earnings thus far, along with a decline in oil prices, might help to mitigate the downside. Though the correction was broad-based, the large-cap stock was the key underperformer due to the moderation of FII's exposure to the domestic market," Vinod Nair, head, research, Geojit Financial Services.

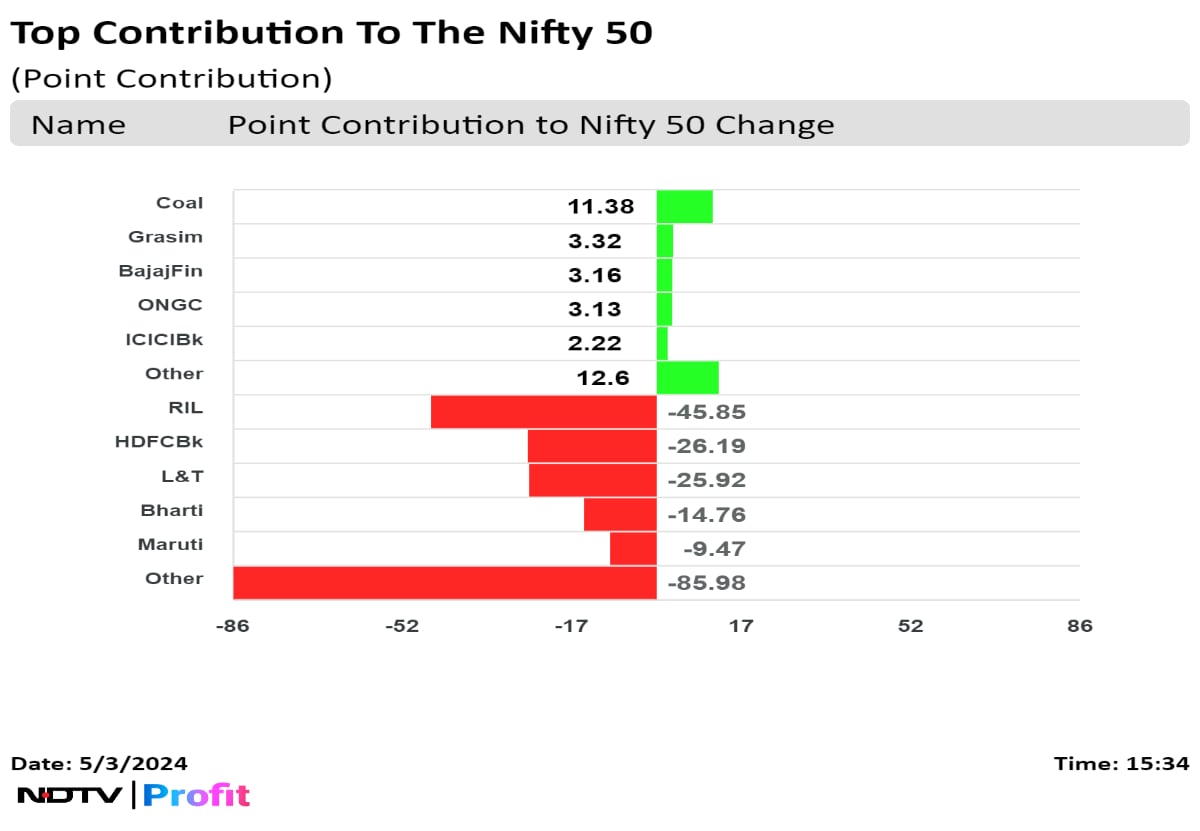

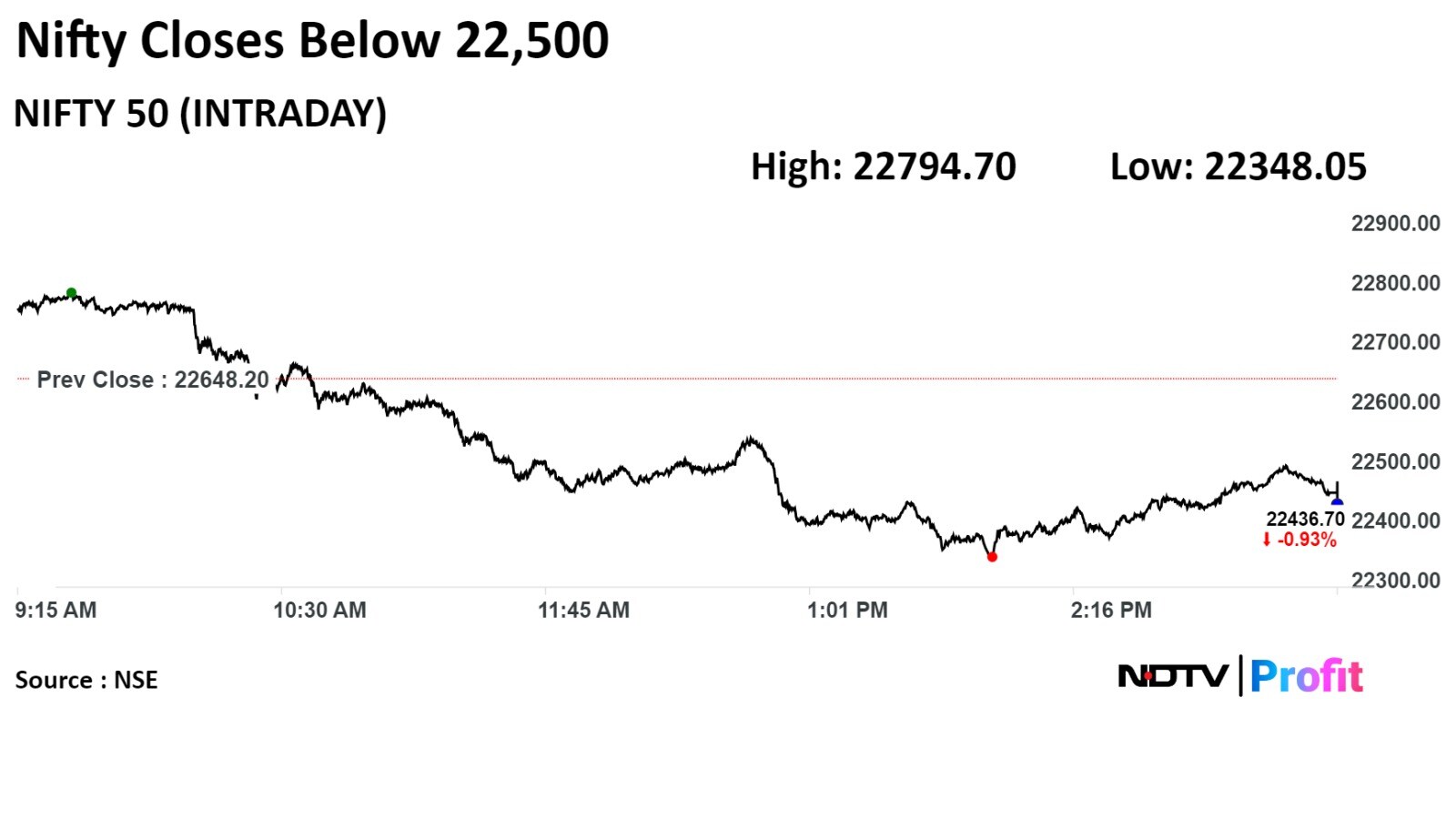

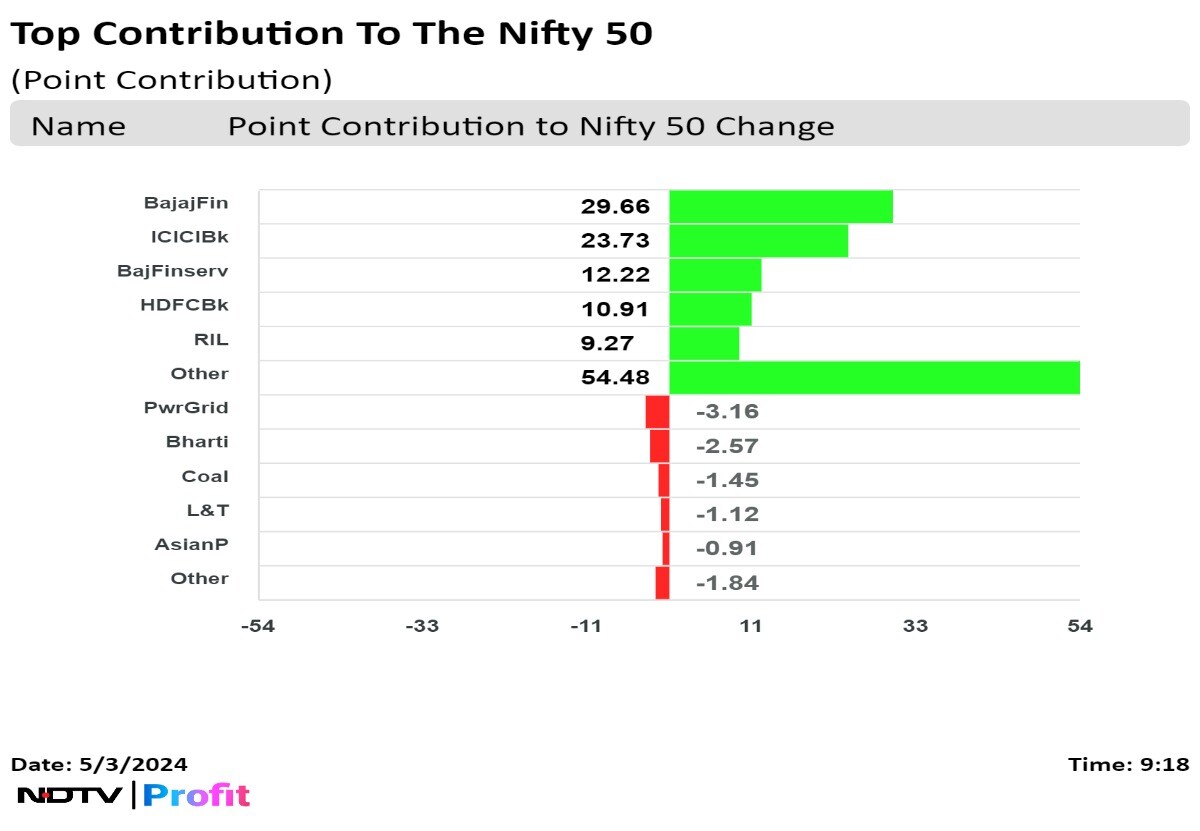

The benchmarks extended gains to second week, with the NSE Nifty 50 ending 0.25% higher, and the S&P BSE Sensex settled 0.20% in the week ended on May 3.

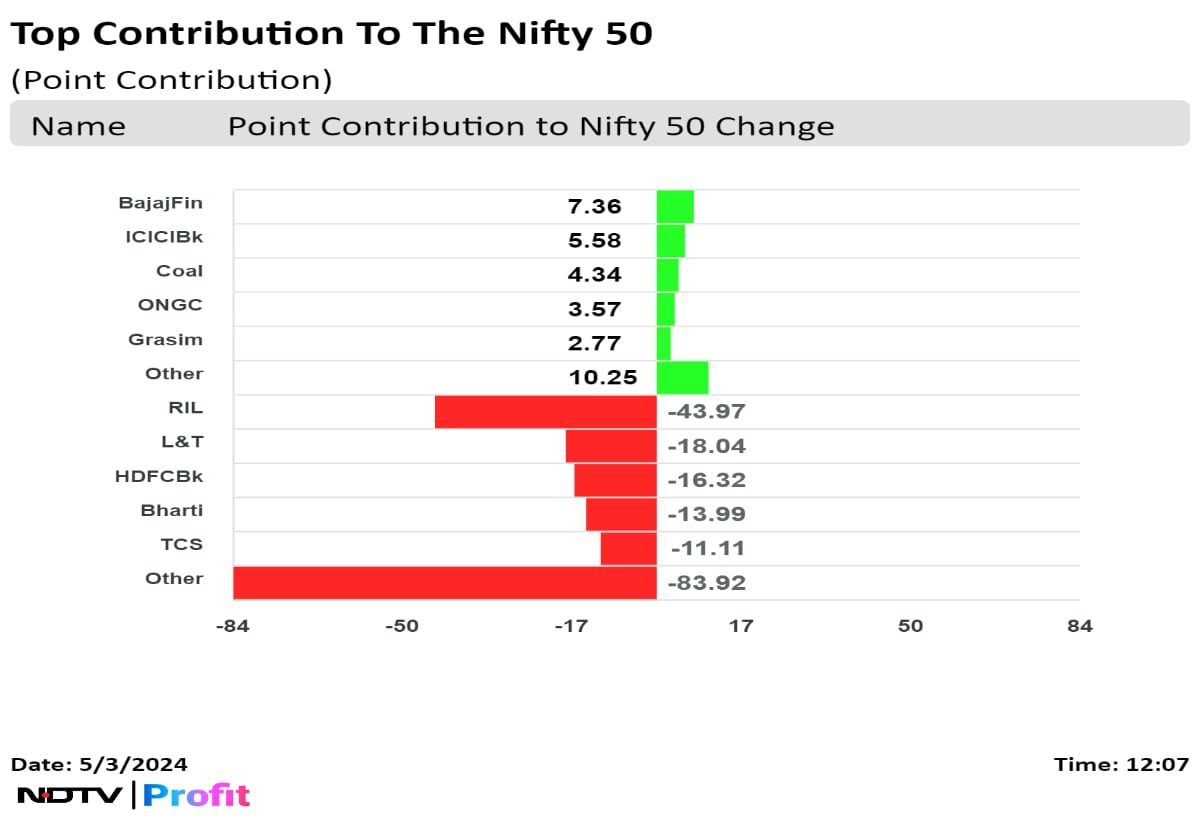

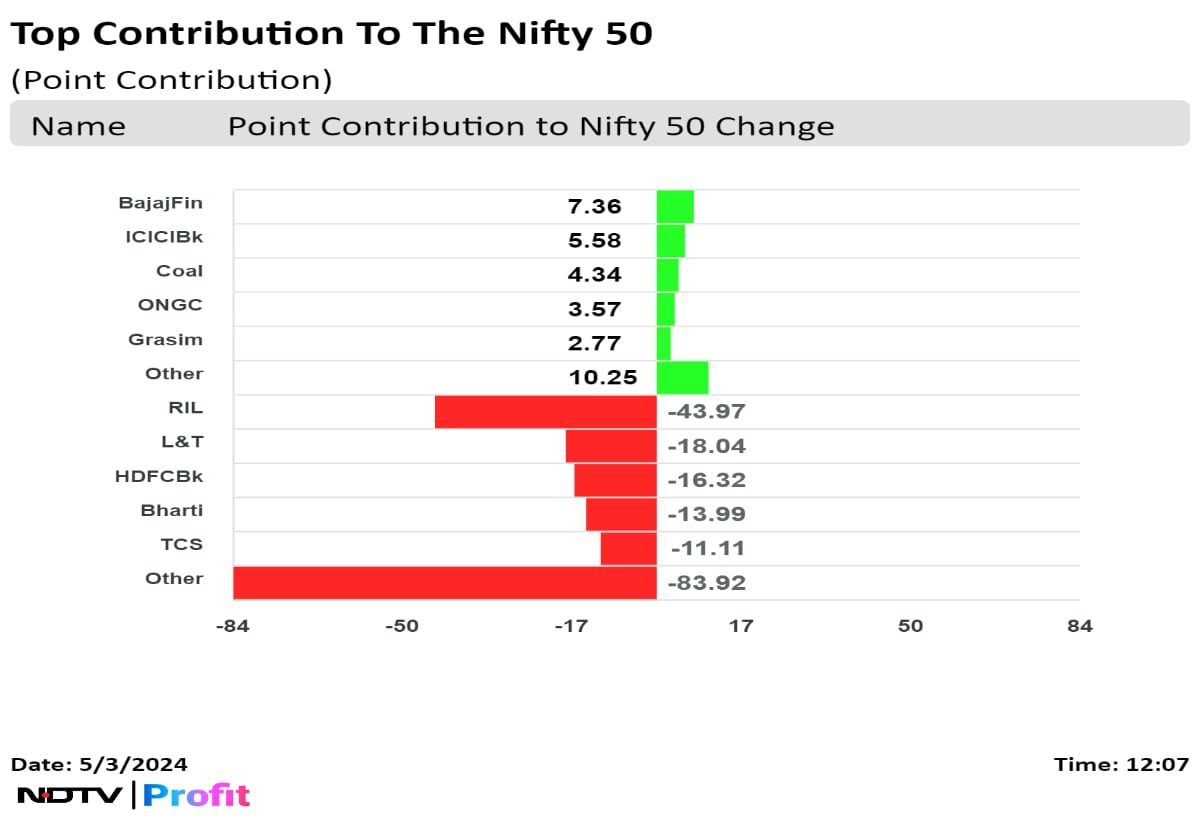

Reliance Industries Ltd., HDFC Bank Ltd., Larsen & Toubro Ltd., Bharti Airtel Ltd., and Maruti Suzuki India Ltd. weighed on the benchmark index.

Coal India Ltd., Grasim Industries Ltd., Bajaj Finance Ltd., Oil and Natural Gas Corporation of India Ltd., and ICICI Bank Ltd. supported the benchmark.

India's benchmark indices reversed early gains and ended lower on Friday as heavyweights Reliance Industries Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd. dragged.

However, on weekly basis, the NSE Nifty 50, and S&P BSE Sensex gained.

The NSE Nifty 50 ended 172.35 points or 0.76% lower at 22,475.85, and the S&P BSE Sensex ended 732.96 points or 0.98% down at 73,878.15.

Intraday, the NSE Nifty 50 declined 1.33% to 22,348.05, and the S&P BSE Sensex fell 1.53% to 73,467.73.

"Profit booking and a degree of caution ahead of the release of the US non-farm payroll resulted in selling pressure in the market. However, the absence of significant negative surprises in Q4 earnings thus far, along with a decline in oil prices, might help to mitigate the downside. Though the correction was broad-based, the large-cap stock was the key underperformer due to the moderation of FII's exposure to the domestic market," Vinod Nair, head, research, Geojit Financial Services.

India's benchmark indices reversed early gains and ended lower on Friday as heavyweights Reliance Industries Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd. dragged.

However, on weekly basis, the NSE Nifty 50, and S&P BSE Sensex gained.

The NSE Nifty 50 ended 172.35 points or 0.76% lower at 22,475.85, and the S&P BSE Sensex ended 732.96 points or 0.98% down at 73,878.15.

Intraday, the NSE Nifty 50 declined 1.33% to 22,348.05, and the S&P BSE Sensex fell 1.53% to 73,467.73.

"Profit booking and a degree of caution ahead of the release of the US non-farm payroll resulted in selling pressure in the market. However, the absence of significant negative surprises in Q4 earnings thus far, along with a decline in oil prices, might help to mitigate the downside. Though the correction was broad-based, the large-cap stock was the key underperformer due to the moderation of FII's exposure to the domestic market," Vinod Nair, head, research, Geojit Financial Services.

India's benchmark indices reversed early gains and ended lower on Friday as heavyweights Reliance Industries Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd. dragged.

However, on weekly basis, the NSE Nifty 50, and S&P BSE Sensex gained.

The NSE Nifty 50 ended 172.35 points or 0.76% lower at 22,475.85, and the S&P BSE Sensex ended 732.96 points or 0.98% down at 73,878.15.

Intraday, the NSE Nifty 50 declined 1.33% to 22,348.05, and the S&P BSE Sensex fell 1.53% to 73,467.73.

"Profit booking and a degree of caution ahead of the release of the US non-farm payroll resulted in selling pressure in the market. However, the absence of significant negative surprises in Q4 earnings thus far, along with a decline in oil prices, might help to mitigate the downside. Though the correction was broad-based, the large-cap stock was the key underperformer due to the moderation of FII's exposure to the domestic market," Vinod Nair, head, research, Geojit Financial Services.

India's benchmark indices reversed early gains and ended lower on Friday as heavyweights Reliance Industries Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd. dragged.

However, on weekly basis, the NSE Nifty 50, and S&P BSE Sensex gained.

The NSE Nifty 50 ended 172.35 points or 0.76% lower at 22,475.85, and the S&P BSE Sensex ended 732.96 points or 0.98% down at 73,878.15.

Intraday, the NSE Nifty 50 declined 1.33% to 22,348.05, and the S&P BSE Sensex fell 1.53% to 73,467.73.

"Profit booking and a degree of caution ahead of the release of the US non-farm payroll resulted in selling pressure in the market. However, the absence of significant negative surprises in Q4 earnings thus far, along with a decline in oil prices, might help to mitigate the downside. Though the correction was broad-based, the large-cap stock was the key underperformer due to the moderation of FII's exposure to the domestic market," Vinod Nair, head, research, Geojit Financial Services.

India's benchmark indices reversed early gains and ended lower on Friday as heavyweights Reliance Industries Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd. dragged.

However, on weekly basis, the NSE Nifty 50, and S&P BSE Sensex gained.

The NSE Nifty 50 ended 172.35 points or 0.76% lower at 22,475.85, and the S&P BSE Sensex ended 732.96 points or 0.98% down at 73,878.15.

Intraday, the NSE Nifty 50 declined 1.33% to 22,348.05, and the S&P BSE Sensex fell 1.53% to 73,467.73.

"Profit booking and a degree of caution ahead of the release of the US non-farm payroll resulted in selling pressure in the market. However, the absence of significant negative surprises in Q4 earnings thus far, along with a decline in oil prices, might help to mitigate the downside. Though the correction was broad-based, the large-cap stock was the key underperformer due to the moderation of FII's exposure to the domestic market," Vinod Nair, head, research, Geojit Financial Services.

India's benchmark indices reversed early gains and ended lower on Friday as heavyweights Reliance Industries Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd. dragged.

However, on weekly basis, the NSE Nifty 50, and S&P BSE Sensex gained.

The NSE Nifty 50 ended 172.35 points or 0.76% lower at 22,475.85, and the S&P BSE Sensex ended 732.96 points or 0.98% down at 73,878.15.

Intraday, the NSE Nifty 50 declined 1.33% to 22,348.05, and the S&P BSE Sensex fell 1.53% to 73,467.73.

"Profit booking and a degree of caution ahead of the release of the US non-farm payroll resulted in selling pressure in the market. However, the absence of significant negative surprises in Q4 earnings thus far, along with a decline in oil prices, might help to mitigate the downside. Though the correction was broad-based, the large-cap stock was the key underperformer due to the moderation of FII's exposure to the domestic market," Vinod Nair, head, research, Geojit Financial Services.

India's benchmark indices reversed early gains and ended lower on Friday as heavyweights Reliance Industries Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd. dragged.

However, on weekly basis, the NSE Nifty 50, and S&P BSE Sensex gained.

The NSE Nifty 50 ended 172.35 points or 0.76% lower at 22,475.85, and the S&P BSE Sensex ended 732.96 points or 0.98% down at 73,878.15.

Intraday, the NSE Nifty 50 declined 1.33% to 22,348.05, and the S&P BSE Sensex fell 1.53% to 73,467.73.

"Profit booking and a degree of caution ahead of the release of the US non-farm payroll resulted in selling pressure in the market. However, the absence of significant negative surprises in Q4 earnings thus far, along with a decline in oil prices, might help to mitigate the downside. Though the correction was broad-based, the large-cap stock was the key underperformer due to the moderation of FII's exposure to the domestic market," Vinod Nair, head, research, Geojit Financial Services.

India's benchmark indices reversed early gains and ended lower on Friday as heavyweights Reliance Industries Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd. dragged.

However, on weekly basis, the NSE Nifty 50, and S&P BSE Sensex gained.

The NSE Nifty 50 ended 172.35 points or 0.76% lower at 22,475.85, and the S&P BSE Sensex ended 732.96 points or 0.98% down at 73,878.15.

Intraday, the NSE Nifty 50 declined 1.33% to 22,348.05, and the S&P BSE Sensex fell 1.53% to 73,467.73.

"Profit booking and a degree of caution ahead of the release of the US non-farm payroll resulted in selling pressure in the market. However, the absence of significant negative surprises in Q4 earnings thus far, along with a decline in oil prices, might help to mitigate the downside. Though the correction was broad-based, the large-cap stock was the key underperformer due to the moderation of FII's exposure to the domestic market," Vinod Nair, head, research, Geojit Financial Services.

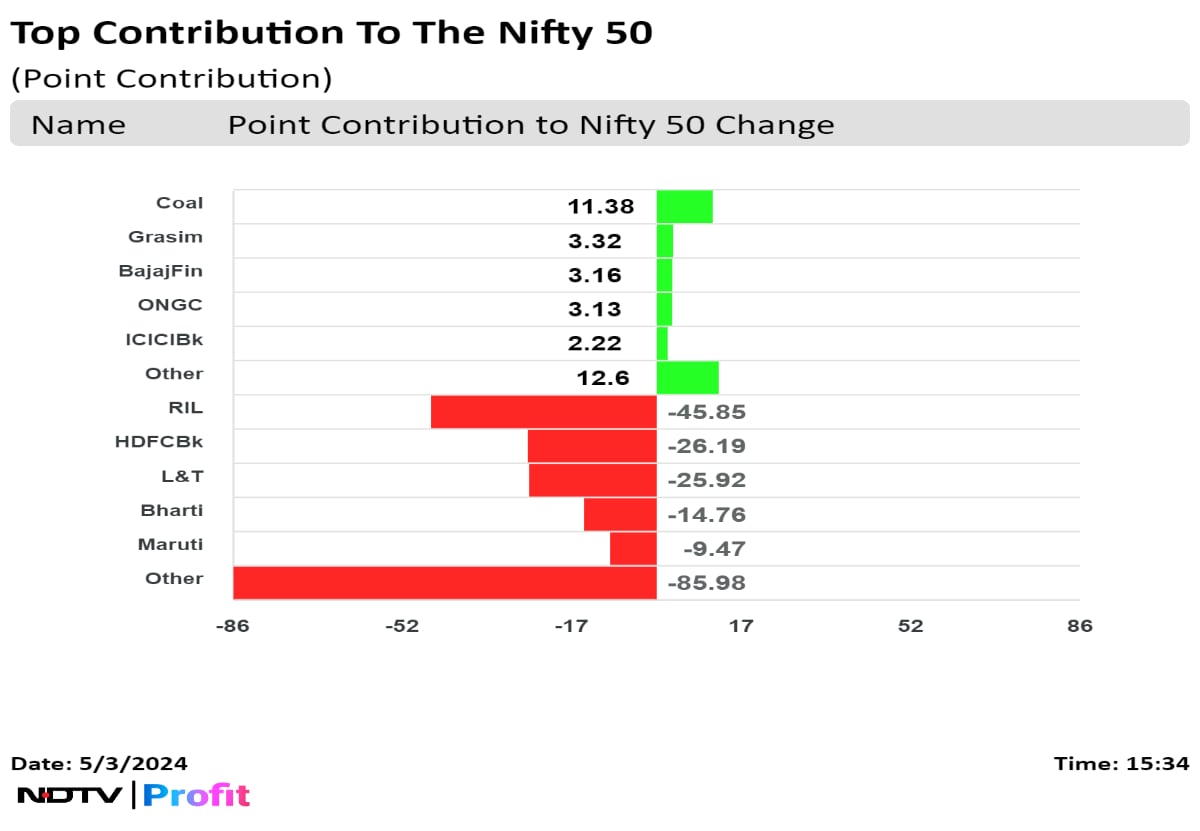

The benchmarks extended gains to second week, with the NSE Nifty 50 ending 0.25% higher, and the S&P BSE Sensex settled 0.20% in the week ended on May 3.

Reliance Industries Ltd., HDFC Bank Ltd., Larsen & Toubro Ltd., Bharti Airtel Ltd., and Maruti Suzuki India Ltd. weighed on the benchmark index.

Coal India Ltd., Grasim Industries Ltd., Bajaj Finance Ltd., Oil and Natural Gas Corporation of India Ltd., and ICICI Bank Ltd. supported the benchmark.

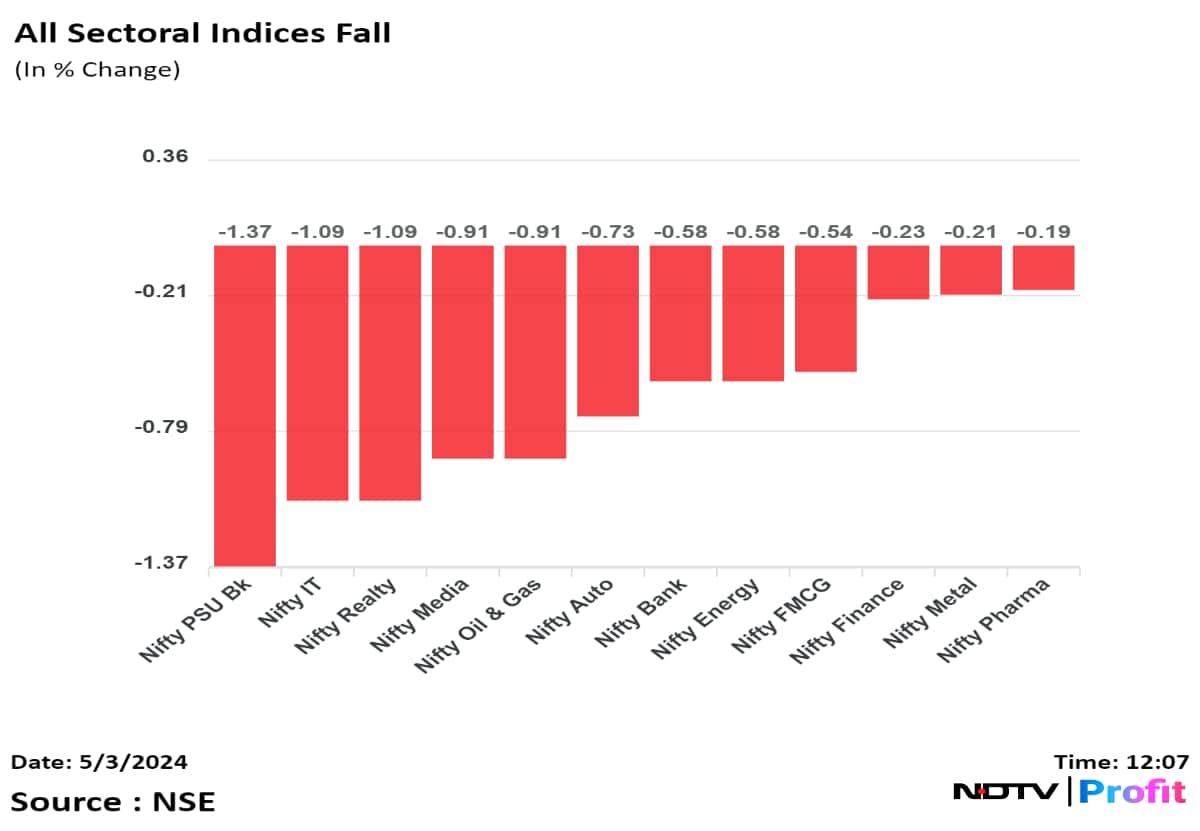

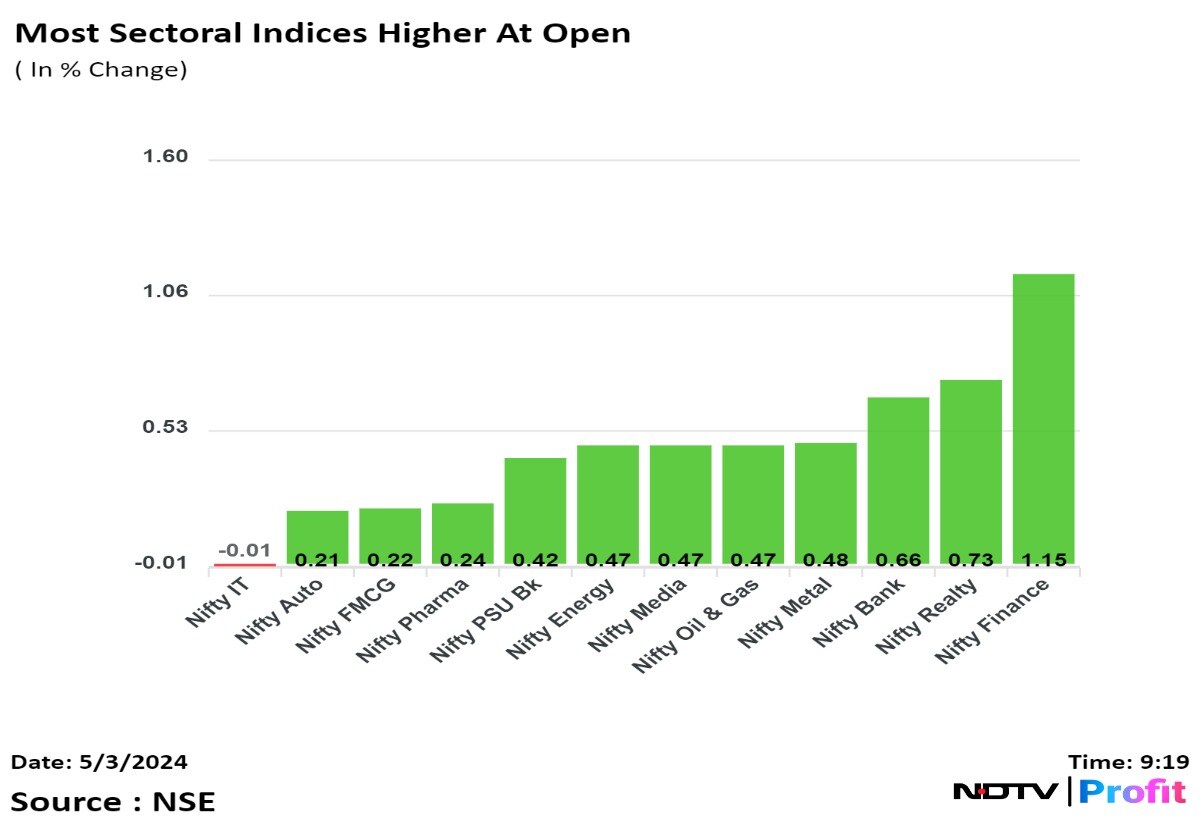

On NSE, eight sectors advanced, and four declined out of 12. The NSE Nifty Media was the top loser, and the NSE Nifty Finance was the top gainer.

India's benchmark indices reversed early gains and ended lower on Friday as heavyweights Reliance Industries Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd. dragged.

However, on weekly basis, the NSE Nifty 50, and S&P BSE Sensex gained.

The NSE Nifty 50 ended 172.35 points or 0.76% lower at 22,475.85, and the S&P BSE Sensex ended 732.96 points or 0.98% down at 73,878.15.

Intraday, the NSE Nifty 50 declined 1.33% to 22,348.05, and the S&P BSE Sensex fell 1.53% to 73,467.73.

"Profit booking and a degree of caution ahead of the release of the US non-farm payroll resulted in selling pressure in the market. However, the absence of significant negative surprises in Q4 earnings thus far, along with a decline in oil prices, might help to mitigate the downside. Though the correction was broad-based, the large-cap stock was the key underperformer due to the moderation of FII's exposure to the domestic market," Vinod Nair, head, research, Geojit Financial Services.

India's benchmark indices reversed early gains and ended lower on Friday as heavyweights Reliance Industries Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd. dragged.

However, on weekly basis, the NSE Nifty 50, and S&P BSE Sensex gained.

The NSE Nifty 50 ended 172.35 points or 0.76% lower at 22,475.85, and the S&P BSE Sensex ended 732.96 points or 0.98% down at 73,878.15.

Intraday, the NSE Nifty 50 declined 1.33% to 22,348.05, and the S&P BSE Sensex fell 1.53% to 73,467.73.

"Profit booking and a degree of caution ahead of the release of the US non-farm payroll resulted in selling pressure in the market. However, the absence of significant negative surprises in Q4 earnings thus far, along with a decline in oil prices, might help to mitigate the downside. Though the correction was broad-based, the large-cap stock was the key underperformer due to the moderation of FII's exposure to the domestic market," Vinod Nair, head, research, Geojit Financial Services.

India's benchmark indices reversed early gains and ended lower on Friday as heavyweights Reliance Industries Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd. dragged.

However, on weekly basis, the NSE Nifty 50, and S&P BSE Sensex gained.

The NSE Nifty 50 ended 172.35 points or 0.76% lower at 22,475.85, and the S&P BSE Sensex ended 732.96 points or 0.98% down at 73,878.15.

Intraday, the NSE Nifty 50 declined 1.33% to 22,348.05, and the S&P BSE Sensex fell 1.53% to 73,467.73.

"Profit booking and a degree of caution ahead of the release of the US non-farm payroll resulted in selling pressure in the market. However, the absence of significant negative surprises in Q4 earnings thus far, along with a decline in oil prices, might help to mitigate the downside. Though the correction was broad-based, the large-cap stock was the key underperformer due to the moderation of FII's exposure to the domestic market," Vinod Nair, head, research, Geojit Financial Services.

India's benchmark indices reversed early gains and ended lower on Friday as heavyweights Reliance Industries Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd. dragged.

However, on weekly basis, the NSE Nifty 50, and S&P BSE Sensex gained.

The NSE Nifty 50 ended 172.35 points or 0.76% lower at 22,475.85, and the S&P BSE Sensex ended 732.96 points or 0.98% down at 73,878.15.

Intraday, the NSE Nifty 50 declined 1.33% to 22,348.05, and the S&P BSE Sensex fell 1.53% to 73,467.73.

"Profit booking and a degree of caution ahead of the release of the US non-farm payroll resulted in selling pressure in the market. However, the absence of significant negative surprises in Q4 earnings thus far, along with a decline in oil prices, might help to mitigate the downside. Though the correction was broad-based, the large-cap stock was the key underperformer due to the moderation of FII's exposure to the domestic market," Vinod Nair, head, research, Geojit Financial Services.

India's benchmark indices reversed early gains and ended lower on Friday as heavyweights Reliance Industries Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd. dragged.

However, on weekly basis, the NSE Nifty 50, and S&P BSE Sensex gained.

The NSE Nifty 50 ended 172.35 points or 0.76% lower at 22,475.85, and the S&P BSE Sensex ended 732.96 points or 0.98% down at 73,878.15.

Intraday, the NSE Nifty 50 declined 1.33% to 22,348.05, and the S&P BSE Sensex fell 1.53% to 73,467.73.

"Profit booking and a degree of caution ahead of the release of the US non-farm payroll resulted in selling pressure in the market. However, the absence of significant negative surprises in Q4 earnings thus far, along with a decline in oil prices, might help to mitigate the downside. Though the correction was broad-based, the large-cap stock was the key underperformer due to the moderation of FII's exposure to the domestic market," Vinod Nair, head, research, Geojit Financial Services.

India's benchmark indices reversed early gains and ended lower on Friday as heavyweights Reliance Industries Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd. dragged.

However, on weekly basis, the NSE Nifty 50, and S&P BSE Sensex gained.

The NSE Nifty 50 ended 172.35 points or 0.76% lower at 22,475.85, and the S&P BSE Sensex ended 732.96 points or 0.98% down at 73,878.15.

Intraday, the NSE Nifty 50 declined 1.33% to 22,348.05, and the S&P BSE Sensex fell 1.53% to 73,467.73.

"Profit booking and a degree of caution ahead of the release of the US non-farm payroll resulted in selling pressure in the market. However, the absence of significant negative surprises in Q4 earnings thus far, along with a decline in oil prices, might help to mitigate the downside. Though the correction was broad-based, the large-cap stock was the key underperformer due to the moderation of FII's exposure to the domestic market," Vinod Nair, head, research, Geojit Financial Services.

India's benchmark indices reversed early gains and ended lower on Friday as heavyweights Reliance Industries Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd. dragged.

However, on weekly basis, the NSE Nifty 50, and S&P BSE Sensex gained.

The NSE Nifty 50 ended 172.35 points or 0.76% lower at 22,475.85, and the S&P BSE Sensex ended 732.96 points or 0.98% down at 73,878.15.

Intraday, the NSE Nifty 50 declined 1.33% to 22,348.05, and the S&P BSE Sensex fell 1.53% to 73,467.73.

"Profit booking and a degree of caution ahead of the release of the US non-farm payroll resulted in selling pressure in the market. However, the absence of significant negative surprises in Q4 earnings thus far, along with a decline in oil prices, might help to mitigate the downside. Though the correction was broad-based, the large-cap stock was the key underperformer due to the moderation of FII's exposure to the domestic market," Vinod Nair, head, research, Geojit Financial Services.

India's benchmark indices reversed early gains and ended lower on Friday as heavyweights Reliance Industries Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd. dragged.

However, on weekly basis, the NSE Nifty 50, and S&P BSE Sensex gained.

The NSE Nifty 50 ended 172.35 points or 0.76% lower at 22,475.85, and the S&P BSE Sensex ended 732.96 points or 0.98% down at 73,878.15.

Intraday, the NSE Nifty 50 declined 1.33% to 22,348.05, and the S&P BSE Sensex fell 1.53% to 73,467.73.

"Profit booking and a degree of caution ahead of the release of the US non-farm payroll resulted in selling pressure in the market. However, the absence of significant negative surprises in Q4 earnings thus far, along with a decline in oil prices, might help to mitigate the downside. Though the correction was broad-based, the large-cap stock was the key underperformer due to the moderation of FII's exposure to the domestic market," Vinod Nair, head, research, Geojit Financial Services.

The benchmarks extended gains to second week, with the NSE Nifty 50 ending 0.25% higher, and the S&P BSE Sensex settled 0.20% in the week ended on May 3.

Reliance Industries Ltd., HDFC Bank Ltd., Larsen & Toubro Ltd., Bharti Airtel Ltd., and Maruti Suzuki India Ltd. weighed on the benchmark index.

Coal India Ltd., Grasim Industries Ltd., Bajaj Finance Ltd., Oil and Natural Gas Corporation of India Ltd., and ICICI Bank Ltd. supported the benchmark.

India's benchmark indices reversed early gains and ended lower on Friday as heavyweights Reliance Industries Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd. dragged.

However, on weekly basis, the NSE Nifty 50, and S&P BSE Sensex gained.

The NSE Nifty 50 ended 172.35 points or 0.76% lower at 22,475.85, and the S&P BSE Sensex ended 732.96 points or 0.98% down at 73,878.15.

Intraday, the NSE Nifty 50 declined 1.33% to 22,348.05, and the S&P BSE Sensex fell 1.53% to 73,467.73.

"Profit booking and a degree of caution ahead of the release of the US non-farm payroll resulted in selling pressure in the market. However, the absence of significant negative surprises in Q4 earnings thus far, along with a decline in oil prices, might help to mitigate the downside. Though the correction was broad-based, the large-cap stock was the key underperformer due to the moderation of FII's exposure to the domestic market," Vinod Nair, head, research, Geojit Financial Services.

India's benchmark indices reversed early gains and ended lower on Friday as heavyweights Reliance Industries Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd. dragged.

However, on weekly basis, the NSE Nifty 50, and S&P BSE Sensex gained.

The NSE Nifty 50 ended 172.35 points or 0.76% lower at 22,475.85, and the S&P BSE Sensex ended 732.96 points or 0.98% down at 73,878.15.

Intraday, the NSE Nifty 50 declined 1.33% to 22,348.05, and the S&P BSE Sensex fell 1.53% to 73,467.73.

"Profit booking and a degree of caution ahead of the release of the US non-farm payroll resulted in selling pressure in the market. However, the absence of significant negative surprises in Q4 earnings thus far, along with a decline in oil prices, might help to mitigate the downside. Though the correction was broad-based, the large-cap stock was the key underperformer due to the moderation of FII's exposure to the domestic market," Vinod Nair, head, research, Geojit Financial Services.

India's benchmark indices reversed early gains and ended lower on Friday as heavyweights Reliance Industries Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd. dragged.

However, on weekly basis, the NSE Nifty 50, and S&P BSE Sensex gained.

The NSE Nifty 50 ended 172.35 points or 0.76% lower at 22,475.85, and the S&P BSE Sensex ended 732.96 points or 0.98% down at 73,878.15.

Intraday, the NSE Nifty 50 declined 1.33% to 22,348.05, and the S&P BSE Sensex fell 1.53% to 73,467.73.

"Profit booking and a degree of caution ahead of the release of the US non-farm payroll resulted in selling pressure in the market. However, the absence of significant negative surprises in Q4 earnings thus far, along with a decline in oil prices, might help to mitigate the downside. Though the correction was broad-based, the large-cap stock was the key underperformer due to the moderation of FII's exposure to the domestic market," Vinod Nair, head, research, Geojit Financial Services.

India's benchmark indices reversed early gains and ended lower on Friday as heavyweights Reliance Industries Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd. dragged.

However, on weekly basis, the NSE Nifty 50, and S&P BSE Sensex gained.

The NSE Nifty 50 ended 172.35 points or 0.76% lower at 22,475.85, and the S&P BSE Sensex ended 732.96 points or 0.98% down at 73,878.15.

Intraday, the NSE Nifty 50 declined 1.33% to 22,348.05, and the S&P BSE Sensex fell 1.53% to 73,467.73.

"Profit booking and a degree of caution ahead of the release of the US non-farm payroll resulted in selling pressure in the market. However, the absence of significant negative surprises in Q4 earnings thus far, along with a decline in oil prices, might help to mitigate the downside. Though the correction was broad-based, the large-cap stock was the key underperformer due to the moderation of FII's exposure to the domestic market," Vinod Nair, head, research, Geojit Financial Services.

India's benchmark indices reversed early gains and ended lower on Friday as heavyweights Reliance Industries Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd. dragged.

However, on weekly basis, the NSE Nifty 50, and S&P BSE Sensex gained.

The NSE Nifty 50 ended 172.35 points or 0.76% lower at 22,475.85, and the S&P BSE Sensex ended 732.96 points or 0.98% down at 73,878.15.

Intraday, the NSE Nifty 50 declined 1.33% to 22,348.05, and the S&P BSE Sensex fell 1.53% to 73,467.73.

"Profit booking and a degree of caution ahead of the release of the US non-farm payroll resulted in selling pressure in the market. However, the absence of significant negative surprises in Q4 earnings thus far, along with a decline in oil prices, might help to mitigate the downside. Though the correction was broad-based, the large-cap stock was the key underperformer due to the moderation of FII's exposure to the domestic market," Vinod Nair, head, research, Geojit Financial Services.

India's benchmark indices reversed early gains and ended lower on Friday as heavyweights Reliance Industries Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd. dragged.

However, on weekly basis, the NSE Nifty 50, and S&P BSE Sensex gained.

The NSE Nifty 50 ended 172.35 points or 0.76% lower at 22,475.85, and the S&P BSE Sensex ended 732.96 points or 0.98% down at 73,878.15.

Intraday, the NSE Nifty 50 declined 1.33% to 22,348.05, and the S&P BSE Sensex fell 1.53% to 73,467.73.

"Profit booking and a degree of caution ahead of the release of the US non-farm payroll resulted in selling pressure in the market. However, the absence of significant negative surprises in Q4 earnings thus far, along with a decline in oil prices, might help to mitigate the downside. Though the correction was broad-based, the large-cap stock was the key underperformer due to the moderation of FII's exposure to the domestic market," Vinod Nair, head, research, Geojit Financial Services.

India's benchmark indices reversed early gains and ended lower on Friday as heavyweights Reliance Industries Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd. dragged.

However, on weekly basis, the NSE Nifty 50, and S&P BSE Sensex gained.

The NSE Nifty 50 ended 172.35 points or 0.76% lower at 22,475.85, and the S&P BSE Sensex ended 732.96 points or 0.98% down at 73,878.15.

Intraday, the NSE Nifty 50 declined 1.33% to 22,348.05, and the S&P BSE Sensex fell 1.53% to 73,467.73.

"Profit booking and a degree of caution ahead of the release of the US non-farm payroll resulted in selling pressure in the market. However, the absence of significant negative surprises in Q4 earnings thus far, along with a decline in oil prices, might help to mitigate the downside. Though the correction was broad-based, the large-cap stock was the key underperformer due to the moderation of FII's exposure to the domestic market," Vinod Nair, head, research, Geojit Financial Services.

India's benchmark indices reversed early gains and ended lower on Friday as heavyweights Reliance Industries Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd. dragged.

However, on weekly basis, the NSE Nifty 50, and S&P BSE Sensex gained.

The NSE Nifty 50 ended 172.35 points or 0.76% lower at 22,475.85, and the S&P BSE Sensex ended 732.96 points or 0.98% down at 73,878.15.

Intraday, the NSE Nifty 50 declined 1.33% to 22,348.05, and the S&P BSE Sensex fell 1.53% to 73,467.73.

"Profit booking and a degree of caution ahead of the release of the US non-farm payroll resulted in selling pressure in the market. However, the absence of significant negative surprises in Q4 earnings thus far, along with a decline in oil prices, might help to mitigate the downside. Though the correction was broad-based, the large-cap stock was the key underperformer due to the moderation of FII's exposure to the domestic market," Vinod Nair, head, research, Geojit Financial Services.

The benchmarks extended gains to second week, with the NSE Nifty 50 ending 0.25% higher, and the S&P BSE Sensex settled 0.20% in the week ended on May 3.

Reliance Industries Ltd., HDFC Bank Ltd., Larsen & Toubro Ltd., Bharti Airtel Ltd., and Maruti Suzuki India Ltd. weighed on the benchmark index.

Coal India Ltd., Grasim Industries Ltd., Bajaj Finance Ltd., Oil and Natural Gas Corporation of India Ltd., and ICICI Bank Ltd. supported the benchmark.

On NSE, eight sectors advanced, and four declined out of 12. The NSE Nifty Media was the top loser, and the NSE Nifty Finance was the top gainer.

Broader markets outperformed. The S&P BSE Midcap ended 0.52% lower, and the S&P BSE Smallcap settled 0.21% lower.

On BSE, 19 sectors out of 20 declined, only S&P BSE Healthcare rose. The S&P BSE Telecommunication declined the most.

Market breadth skewed in the favour of sellers. Around 2,296 stocks fell, 1,540 stocks rose, and 122 stocks remained unchanged on BSE.

Revenue fell 7.47% to Rs 1,326.06 crore from Rs 1,432.98 crore

Ebitda rose 26.71% to Rs 195.68 crore from Rs 154.43 crore

Margin rose 397 bps to 14.75% from 10.77%

Net profit rose 38.99% to Rs 109.36 crore from Rs 78.68 crore

Revenue rose 20% to Rs 1,096 crore from Rs 915 crore

EBITDA rose 23% to Rs 581 crore from Rs 472 crore

EBITDA margin at 53% vs 51.5%

Net profit rose 9% to Rs 329 crore from Rs 302 crore

Revenue up 9% to Rs 2,527 crore from Rs 2,311 crore.

Ebitda up 5% at Rs 1,834 crore from Rs 1,742 crore.

Margin fell 280 bps at 72.6% from 75.4%.

Net profit up 21% at Rs 310 crore from Rs 256 crore.

RE target for 2030 revised upwards to 50 GW from 45 GW

Raymond Ltd. approved re-appointment of MD Gautam Hari Singhania for 5 years with effect from July 1.

Source: Exchange filing

Revenue grew 15% to Rs 182 crore from Rs 158 crore.

Ebitda rose 8% to Rs 54 crore from Rs 50 crore.

Margin fell 187 bps to 29.65% from 31.52%.

Net profit fell 13% to Rs 13 crore from Rs 15 crore.

Revenue grew 15% to Rs 182 crore from Rs 158 crore.

Ebitda rose 8% to Rs 54 crore from Rs 50 crore.

Margin fell 187 bps to 29.65% from 31.52%.

Net profit fell 13% to Rs 13 crore from Rs 15 crore.

Air India added Zurich to growing European network.

The airline will start non-stop Delhi-Zurich flight on June 16.

Source: Bloomberg

Revenue up 5% to Rs 1,670 crore from Rs 1,597 crore

Ebitda up 7% at Rs 183 crore from Rs 171 crore

Margin up 24 bps at 10.95% from 10.7%

Net profit up 3% at Rs 13.3 crore from Rs 12.9 crore

Revenue up 5% to Rs 1,670 crore from Rs 1,597 crore

Ebitda up 7% at Rs 183 crore from Rs 171 crore

Margin up 24 bps at 10.95% from 10.7%

Net profit up 3% at Rs 13.3 crore from Rs 12.9 crore

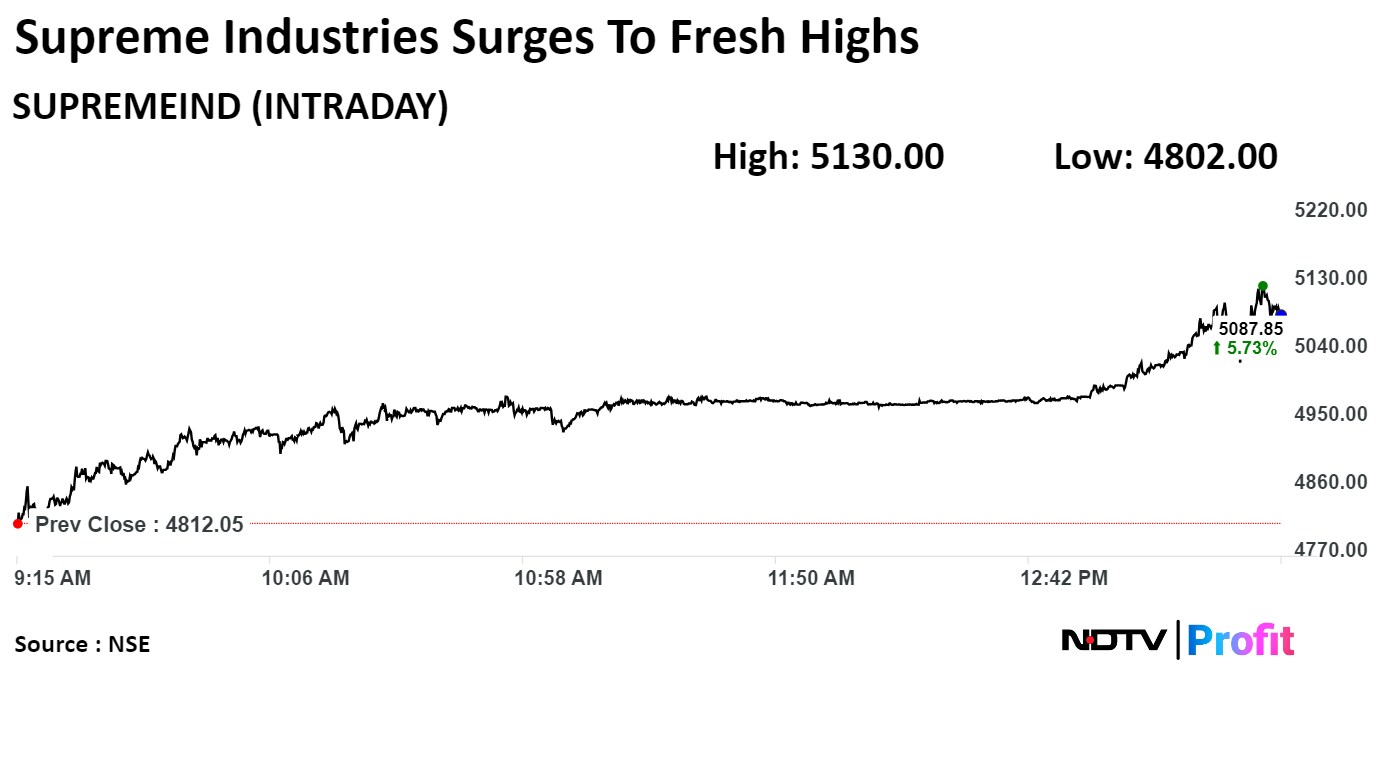

Supreme Industries Ltd. rose as much as 6.90% to Rs 4,802.00, the highest level since Jul 19, 1995. It was trading 6.35% up at 5,117.60 as of 1:38 p.m., compared to 1.17% decline in the NSE Nifty 50 index.

Supreme Industries Ltd. rose as much as 6.90% to Rs 4,802.00, the highest level since Jul 19, 1995. It was trading 6.35% up at 5,117.60 as of 1:38 p.m., compared to 1.17% decline in the NSE Nifty 50 index.

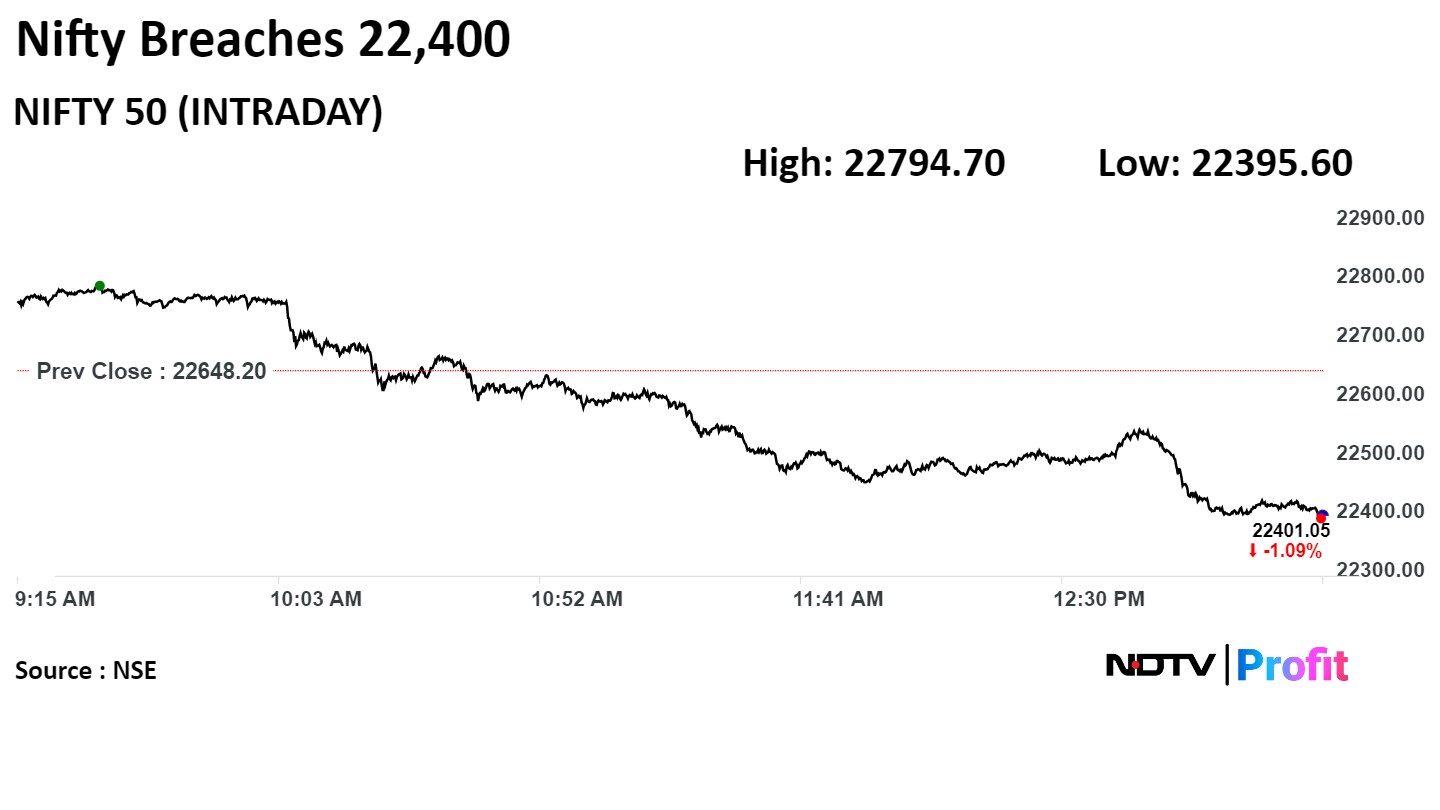

India's benchmark stock indices fell during midday on Friday after the Nifty set a fresh lifetime high and the Sensex was 30 points from its record high. This was due to the decline of index heavyweight Reliance Industries Ltd.

At 13:16 p.m., the NSE Nifty 50 fell 234.9 points, or 1.04%, to 22,413.30, while the S&P BSE Sensex was trading 927.63 points, or 1.24%, lower at 73,683.48.

Nifty has been on a structural bull run, according to Amit Goel, founder of Amit Ventures, who recommends using every dip as an opportunity.

However, he does not expect any tearaway moves in the market. He added that 22,500 will act as resistance and 22,300 as support.

India's benchmark stock indices fell during midday on Friday after the Nifty set a fresh lifetime high and the Sensex was 30 points from its record high. This was due to the decline of index heavyweight Reliance Industries Ltd.

At 13:16 p.m., the NSE Nifty 50 fell 234.9 points, or 1.04%, to 22,413.30, while the S&P BSE Sensex was trading 927.63 points, or 1.24%, lower at 73,683.48.

Nifty has been on a structural bull run, according to Amit Goel, founder of Amit Ventures, who recommends using every dip as an opportunity.

However, he does not expect any tearaway moves in the market. He added that 22,500 will act as resistance and 22,300 as support.

India's benchmark stock indices fell during midday on Friday after the Nifty set a fresh lifetime high and the Sensex was 30 points from its record high. This was due to the decline of index heavyweight Reliance Industries Ltd.

At 13:16 p.m., the NSE Nifty 50 fell 234.9 points, or 1.04%, to 22,413.30, while the S&P BSE Sensex was trading 927.63 points, or 1.24%, lower at 73,683.48.

Nifty has been on a structural bull run, according to Amit Goel, founder of Amit Ventures, who recommends using every dip as an opportunity.

However, he does not expect any tearaway moves in the market. He added that 22,500 will act as resistance and 22,300 as support.

India's benchmark stock indices fell during midday on Friday after the Nifty set a fresh lifetime high and the Sensex was 30 points from its record high. This was due to the decline of index heavyweight Reliance Industries Ltd.

At 13:16 p.m., the NSE Nifty 50 fell 234.9 points, or 1.04%, to 22,413.30, while the S&P BSE Sensex was trading 927.63 points, or 1.24%, lower at 73,683.48.

Nifty has been on a structural bull run, according to Amit Goel, founder of Amit Ventures, who recommends using every dip as an opportunity.

However, he does not expect any tearaway moves in the market. He added that 22,500 will act as resistance and 22,300 as support.

India's benchmark stock indices fell during midday on Friday after the Nifty set a fresh lifetime high and the Sensex was 30 points from its record high. This was due to the decline of index heavyweight Reliance Industries Ltd.

At 13:16 p.m., the NSE Nifty 50 fell 234.9 points, or 1.04%, to 22,413.30, while the S&P BSE Sensex was trading 927.63 points, or 1.24%, lower at 73,683.48.

Nifty has been on a structural bull run, according to Amit Goel, founder of Amit Ventures, who recommends using every dip as an opportunity.

However, he does not expect any tearaway moves in the market. He added that 22,500 will act as resistance and 22,300 as support.

India's benchmark stock indices fell during midday on Friday after the Nifty set a fresh lifetime high and the Sensex was 30 points from its record high. This was due to the decline of index heavyweight Reliance Industries Ltd.

At 13:16 p.m., the NSE Nifty 50 fell 234.9 points, or 1.04%, to 22,413.30, while the S&P BSE Sensex was trading 927.63 points, or 1.24%, lower at 73,683.48.

Nifty has been on a structural bull run, according to Amit Goel, founder of Amit Ventures, who recommends using every dip as an opportunity.

However, he does not expect any tearaway moves in the market. He added that 22,500 will act as resistance and 22,300 as support.

India's benchmark stock indices fell during midday on Friday after the Nifty set a fresh lifetime high and the Sensex was 30 points from its record high. This was due to the decline of index heavyweight Reliance Industries Ltd.

At 13:16 p.m., the NSE Nifty 50 fell 234.9 points, or 1.04%, to 22,413.30, while the S&P BSE Sensex was trading 927.63 points, or 1.24%, lower at 73,683.48.

Nifty has been on a structural bull run, according to Amit Goel, founder of Amit Ventures, who recommends using every dip as an opportunity.

However, he does not expect any tearaway moves in the market. He added that 22,500 will act as resistance and 22,300 as support.

India's benchmark stock indices fell during midday on Friday after the Nifty set a fresh lifetime high and the Sensex was 30 points from its record high. This was due to the decline of index heavyweight Reliance Industries Ltd.

At 13:16 p.m., the NSE Nifty 50 fell 234.9 points, or 1.04%, to 22,413.30, while the S&P BSE Sensex was trading 927.63 points, or 1.24%, lower at 73,683.48.

Nifty has been on a structural bull run, according to Amit Goel, founder of Amit Ventures, who recommends using every dip as an opportunity.

However, he does not expect any tearaway moves in the market. He added that 22,500 will act as resistance and 22,300 as support.

Shares of Reliance Industries Ltd. dragged the Nifty the most followed by Larsen & Toubro Ltd., HDFC Bank Ltd., Bharti Airtel Ltd., and Tata Consultancy Services Ltd.

While those of Bajaj Finance Ltd., ICICI Bank Ltd., Coal India Ltd., Oil & Natural Gas Corp., and Grasim Industries Ltd. cushioned the fall.

All sectoral indices slipped into loss with Nifty PSU Bank, Nifty IT, and Nifty Realty down over 1%.

India's benchmark stock indices fell during midday on Friday after the Nifty set a fresh lifetime high and the Sensex was 30 points from its record high. This was due to the decline of index heavyweight Reliance Industries Ltd.

At 13:16 p.m., the NSE Nifty 50 fell 234.9 points, or 1.04%, to 22,413.30, while the S&P BSE Sensex was trading 927.63 points, or 1.24%, lower at 73,683.48.

Nifty has been on a structural bull run, according to Amit Goel, founder of Amit Ventures, who recommends using every dip as an opportunity.

However, he does not expect any tearaway moves in the market. He added that 22,500 will act as resistance and 22,300 as support.

India's benchmark stock indices fell during midday on Friday after the Nifty set a fresh lifetime high and the Sensex was 30 points from its record high. This was due to the decline of index heavyweight Reliance Industries Ltd.

At 13:16 p.m., the NSE Nifty 50 fell 234.9 points, or 1.04%, to 22,413.30, while the S&P BSE Sensex was trading 927.63 points, or 1.24%, lower at 73,683.48.

Nifty has been on a structural bull run, according to Amit Goel, founder of Amit Ventures, who recommends using every dip as an opportunity.

However, he does not expect any tearaway moves in the market. He added that 22,500 will act as resistance and 22,300 as support.

India's benchmark stock indices fell during midday on Friday after the Nifty set a fresh lifetime high and the Sensex was 30 points from its record high. This was due to the decline of index heavyweight Reliance Industries Ltd.

At 13:16 p.m., the NSE Nifty 50 fell 234.9 points, or 1.04%, to 22,413.30, while the S&P BSE Sensex was trading 927.63 points, or 1.24%, lower at 73,683.48.

Nifty has been on a structural bull run, according to Amit Goel, founder of Amit Ventures, who recommends using every dip as an opportunity.

However, he does not expect any tearaway moves in the market. He added that 22,500 will act as resistance and 22,300 as support.

India's benchmark stock indices fell during midday on Friday after the Nifty set a fresh lifetime high and the Sensex was 30 points from its record high. This was due to the decline of index heavyweight Reliance Industries Ltd.

At 13:16 p.m., the NSE Nifty 50 fell 234.9 points, or 1.04%, to 22,413.30, while the S&P BSE Sensex was trading 927.63 points, or 1.24%, lower at 73,683.48.

Nifty has been on a structural bull run, according to Amit Goel, founder of Amit Ventures, who recommends using every dip as an opportunity.

However, he does not expect any tearaway moves in the market. He added that 22,500 will act as resistance and 22,300 as support.

India's benchmark stock indices fell during midday on Friday after the Nifty set a fresh lifetime high and the Sensex was 30 points from its record high. This was due to the decline of index heavyweight Reliance Industries Ltd.

At 13:16 p.m., the NSE Nifty 50 fell 234.9 points, or 1.04%, to 22,413.30, while the S&P BSE Sensex was trading 927.63 points, or 1.24%, lower at 73,683.48.

Nifty has been on a structural bull run, according to Amit Goel, founder of Amit Ventures, who recommends using every dip as an opportunity.

However, he does not expect any tearaway moves in the market. He added that 22,500 will act as resistance and 22,300 as support.

India's benchmark stock indices fell during midday on Friday after the Nifty set a fresh lifetime high and the Sensex was 30 points from its record high. This was due to the decline of index heavyweight Reliance Industries Ltd.

At 13:16 p.m., the NSE Nifty 50 fell 234.9 points, or 1.04%, to 22,413.30, while the S&P BSE Sensex was trading 927.63 points, or 1.24%, lower at 73,683.48.

Nifty has been on a structural bull run, according to Amit Goel, founder of Amit Ventures, who recommends using every dip as an opportunity.

However, he does not expect any tearaway moves in the market. He added that 22,500 will act as resistance and 22,300 as support.

India's benchmark stock indices fell during midday on Friday after the Nifty set a fresh lifetime high and the Sensex was 30 points from its record high. This was due to the decline of index heavyweight Reliance Industries Ltd.

At 13:16 p.m., the NSE Nifty 50 fell 234.9 points, or 1.04%, to 22,413.30, while the S&P BSE Sensex was trading 927.63 points, or 1.24%, lower at 73,683.48.

Nifty has been on a structural bull run, according to Amit Goel, founder of Amit Ventures, who recommends using every dip as an opportunity.

However, he does not expect any tearaway moves in the market. He added that 22,500 will act as resistance and 22,300 as support.

India's benchmark stock indices fell during midday on Friday after the Nifty set a fresh lifetime high and the Sensex was 30 points from its record high. This was due to the decline of index heavyweight Reliance Industries Ltd.

At 13:16 p.m., the NSE Nifty 50 fell 234.9 points, or 1.04%, to 22,413.30, while the S&P BSE Sensex was trading 927.63 points, or 1.24%, lower at 73,683.48.

Nifty has been on a structural bull run, according to Amit Goel, founder of Amit Ventures, who recommends using every dip as an opportunity.

However, he does not expect any tearaway moves in the market. He added that 22,500 will act as resistance and 22,300 as support.

Shares of Reliance Industries Ltd. dragged the Nifty the most followed by Larsen & Toubro Ltd., HDFC Bank Ltd., Bharti Airtel Ltd., and Tata Consultancy Services Ltd.

While those of Bajaj Finance Ltd., ICICI Bank Ltd., Coal India Ltd., Oil & Natural Gas Corp., and Grasim Industries Ltd. cushioned the fall.

All sectoral indices slipped into loss with Nifty PSU Bank, Nifty IT, and Nifty Realty down over 1%.

India's benchmark stock indices fell during midday on Friday after the Nifty set a fresh lifetime high and the Sensex was 30 points from its record high. This was due to the decline of index heavyweight Reliance Industries Ltd.

At 13:16 p.m., the NSE Nifty 50 fell 234.9 points, or 1.04%, to 22,413.30, while the S&P BSE Sensex was trading 927.63 points, or 1.24%, lower at 73,683.48.

Nifty has been on a structural bull run, according to Amit Goel, founder of Amit Ventures, who recommends using every dip as an opportunity.

However, he does not expect any tearaway moves in the market. He added that 22,500 will act as resistance and 22,300 as support.

India's benchmark stock indices fell during midday on Friday after the Nifty set a fresh lifetime high and the Sensex was 30 points from its record high. This was due to the decline of index heavyweight Reliance Industries Ltd.

At 13:16 p.m., the NSE Nifty 50 fell 234.9 points, or 1.04%, to 22,413.30, while the S&P BSE Sensex was trading 927.63 points, or 1.24%, lower at 73,683.48.

Nifty has been on a structural bull run, according to Amit Goel, founder of Amit Ventures, who recommends using every dip as an opportunity.

However, he does not expect any tearaway moves in the market. He added that 22,500 will act as resistance and 22,300 as support.

India's benchmark stock indices fell during midday on Friday after the Nifty set a fresh lifetime high and the Sensex was 30 points from its record high. This was due to the decline of index heavyweight Reliance Industries Ltd.

At 13:16 p.m., the NSE Nifty 50 fell 234.9 points, or 1.04%, to 22,413.30, while the S&P BSE Sensex was trading 927.63 points, or 1.24%, lower at 73,683.48.

Nifty has been on a structural bull run, according to Amit Goel, founder of Amit Ventures, who recommends using every dip as an opportunity.

However, he does not expect any tearaway moves in the market. He added that 22,500 will act as resistance and 22,300 as support.

India's benchmark stock indices fell during midday on Friday after the Nifty set a fresh lifetime high and the Sensex was 30 points from its record high. This was due to the decline of index heavyweight Reliance Industries Ltd.

At 13:16 p.m., the NSE Nifty 50 fell 234.9 points, or 1.04%, to 22,413.30, while the S&P BSE Sensex was trading 927.63 points, or 1.24%, lower at 73,683.48.

Nifty has been on a structural bull run, according to Amit Goel, founder of Amit Ventures, who recommends using every dip as an opportunity.

However, he does not expect any tearaway moves in the market. He added that 22,500 will act as resistance and 22,300 as support.

India's benchmark stock indices fell during midday on Friday after the Nifty set a fresh lifetime high and the Sensex was 30 points from its record high. This was due to the decline of index heavyweight Reliance Industries Ltd.

At 13:16 p.m., the NSE Nifty 50 fell 234.9 points, or 1.04%, to 22,413.30, while the S&P BSE Sensex was trading 927.63 points, or 1.24%, lower at 73,683.48.

Nifty has been on a structural bull run, according to Amit Goel, founder of Amit Ventures, who recommends using every dip as an opportunity.

However, he does not expect any tearaway moves in the market. He added that 22,500 will act as resistance and 22,300 as support.

India's benchmark stock indices fell during midday on Friday after the Nifty set a fresh lifetime high and the Sensex was 30 points from its record high. This was due to the decline of index heavyweight Reliance Industries Ltd.

At 13:16 p.m., the NSE Nifty 50 fell 234.9 points, or 1.04%, to 22,413.30, while the S&P BSE Sensex was trading 927.63 points, or 1.24%, lower at 73,683.48.

Nifty has been on a structural bull run, according to Amit Goel, founder of Amit Ventures, who recommends using every dip as an opportunity.

However, he does not expect any tearaway moves in the market. He added that 22,500 will act as resistance and 22,300 as support.

India's benchmark stock indices fell during midday on Friday after the Nifty set a fresh lifetime high and the Sensex was 30 points from its record high. This was due to the decline of index heavyweight Reliance Industries Ltd.

At 13:16 p.m., the NSE Nifty 50 fell 234.9 points, or 1.04%, to 22,413.30, while the S&P BSE Sensex was trading 927.63 points, or 1.24%, lower at 73,683.48.

Nifty has been on a structural bull run, according to Amit Goel, founder of Amit Ventures, who recommends using every dip as an opportunity.

However, he does not expect any tearaway moves in the market. He added that 22,500 will act as resistance and 22,300 as support.

India's benchmark stock indices fell during midday on Friday after the Nifty set a fresh lifetime high and the Sensex was 30 points from its record high. This was due to the decline of index heavyweight Reliance Industries Ltd.

At 13:16 p.m., the NSE Nifty 50 fell 234.9 points, or 1.04%, to 22,413.30, while the S&P BSE Sensex was trading 927.63 points, or 1.24%, lower at 73,683.48.

Nifty has been on a structural bull run, according to Amit Goel, founder of Amit Ventures, who recommends using every dip as an opportunity.

However, he does not expect any tearaway moves in the market. He added that 22,500 will act as resistance and 22,300 as support.

Shares of Reliance Industries Ltd. dragged the Nifty the most followed by Larsen & Toubro Ltd., HDFC Bank Ltd., Bharti Airtel Ltd., and Tata Consultancy Services Ltd.

While those of Bajaj Finance Ltd., ICICI Bank Ltd., Coal India Ltd., Oil & Natural Gas Corp., and Grasim Industries Ltd. cushioned the fall.

All sectoral indices slipped into loss with Nifty PSU Bank, Nifty IT, and Nifty Realty down over 1%.

India's benchmark stock indices fell during midday on Friday after the Nifty set a fresh lifetime high and the Sensex was 30 points from its record high. This was due to the decline of index heavyweight Reliance Industries Ltd.

At 13:16 p.m., the NSE Nifty 50 fell 234.9 points, or 1.04%, to 22,413.30, while the S&P BSE Sensex was trading 927.63 points, or 1.24%, lower at 73,683.48.

Nifty has been on a structural bull run, according to Amit Goel, founder of Amit Ventures, who recommends using every dip as an opportunity.

However, he does not expect any tearaway moves in the market. He added that 22,500 will act as resistance and 22,300 as support.

India's benchmark stock indices fell during midday on Friday after the Nifty set a fresh lifetime high and the Sensex was 30 points from its record high. This was due to the decline of index heavyweight Reliance Industries Ltd.

At 13:16 p.m., the NSE Nifty 50 fell 234.9 points, or 1.04%, to 22,413.30, while the S&P BSE Sensex was trading 927.63 points, or 1.24%, lower at 73,683.48.

Nifty has been on a structural bull run, according to Amit Goel, founder of Amit Ventures, who recommends using every dip as an opportunity.

However, he does not expect any tearaway moves in the market. He added that 22,500 will act as resistance and 22,300 as support.

India's benchmark stock indices fell during midday on Friday after the Nifty set a fresh lifetime high and the Sensex was 30 points from its record high. This was due to the decline of index heavyweight Reliance Industries Ltd.

At 13:16 p.m., the NSE Nifty 50 fell 234.9 points, or 1.04%, to 22,413.30, while the S&P BSE Sensex was trading 927.63 points, or 1.24%, lower at 73,683.48.

Nifty has been on a structural bull run, according to Amit Goel, founder of Amit Ventures, who recommends using every dip as an opportunity.

However, he does not expect any tearaway moves in the market. He added that 22,500 will act as resistance and 22,300 as support.

India's benchmark stock indices fell during midday on Friday after the Nifty set a fresh lifetime high and the Sensex was 30 points from its record high. This was due to the decline of index heavyweight Reliance Industries Ltd.

At 13:16 p.m., the NSE Nifty 50 fell 234.9 points, or 1.04%, to 22,413.30, while the S&P BSE Sensex was trading 927.63 points, or 1.24%, lower at 73,683.48.

Nifty has been on a structural bull run, according to Amit Goel, founder of Amit Ventures, who recommends using every dip as an opportunity.

However, he does not expect any tearaway moves in the market. He added that 22,500 will act as resistance and 22,300 as support.

India's benchmark stock indices fell during midday on Friday after the Nifty set a fresh lifetime high and the Sensex was 30 points from its record high. This was due to the decline of index heavyweight Reliance Industries Ltd.

At 13:16 p.m., the NSE Nifty 50 fell 234.9 points, or 1.04%, to 22,413.30, while the S&P BSE Sensex was trading 927.63 points, or 1.24%, lower at 73,683.48.

Nifty has been on a structural bull run, according to Amit Goel, founder of Amit Ventures, who recommends using every dip as an opportunity.

However, he does not expect any tearaway moves in the market. He added that 22,500 will act as resistance and 22,300 as support.

India's benchmark stock indices fell during midday on Friday after the Nifty set a fresh lifetime high and the Sensex was 30 points from its record high. This was due to the decline of index heavyweight Reliance Industries Ltd.

At 13:16 p.m., the NSE Nifty 50 fell 234.9 points, or 1.04%, to 22,413.30, while the S&P BSE Sensex was trading 927.63 points, or 1.24%, lower at 73,683.48.

Nifty has been on a structural bull run, according to Amit Goel, founder of Amit Ventures, who recommends using every dip as an opportunity.

However, he does not expect any tearaway moves in the market. He added that 22,500 will act as resistance and 22,300 as support.

India's benchmark stock indices fell during midday on Friday after the Nifty set a fresh lifetime high and the Sensex was 30 points from its record high. This was due to the decline of index heavyweight Reliance Industries Ltd.

At 13:16 p.m., the NSE Nifty 50 fell 234.9 points, or 1.04%, to 22,413.30, while the S&P BSE Sensex was trading 927.63 points, or 1.24%, lower at 73,683.48.

Nifty has been on a structural bull run, according to Amit Goel, founder of Amit Ventures, who recommends using every dip as an opportunity.

However, he does not expect any tearaway moves in the market. He added that 22,500 will act as resistance and 22,300 as support.

India's benchmark stock indices fell during midday on Friday after the Nifty set a fresh lifetime high and the Sensex was 30 points from its record high. This was due to the decline of index heavyweight Reliance Industries Ltd.

At 13:16 p.m., the NSE Nifty 50 fell 234.9 points, or 1.04%, to 22,413.30, while the S&P BSE Sensex was trading 927.63 points, or 1.24%, lower at 73,683.48.

Nifty has been on a structural bull run, according to Amit Goel, founder of Amit Ventures, who recommends using every dip as an opportunity.

However, he does not expect any tearaway moves in the market. He added that 22,500 will act as resistance and 22,300 as support.

Shares of Reliance Industries Ltd. dragged the Nifty the most followed by Larsen & Toubro Ltd., HDFC Bank Ltd., Bharti Airtel Ltd., and Tata Consultancy Services Ltd.

While those of Bajaj Finance Ltd., ICICI Bank Ltd., Coal India Ltd., Oil & Natural Gas Corp., and Grasim Industries Ltd. cushioned the fall.

All sectoral indices slipped into loss with Nifty PSU Bank, Nifty IT, and Nifty Realty down over 1%.

Broader markets also fell as S&P BSE Midcap was down 0.41% and S&P BSE Smallcap was 0.77% lower.

All 20 sectoral indices on the BSE fell, except S&P BSE Healthcare, which traded flat. S&P BSE Information Technology was the top loser.

The market breadth was skewed in the favour of sellers. Around 2,324 stocks fell, 1,308 rose and 159 were unchanged on the BSE.

Revenue up 21% at Rs 2,609 crore vs Rs 2150 crore

Ebitda up 29% at Rs 436 crore vs Rs 337 crore

Margin up 104 bps at 16.71% vs 15.66%

Net profit up 17% at Rs 230 crore vs Rs 196 crore

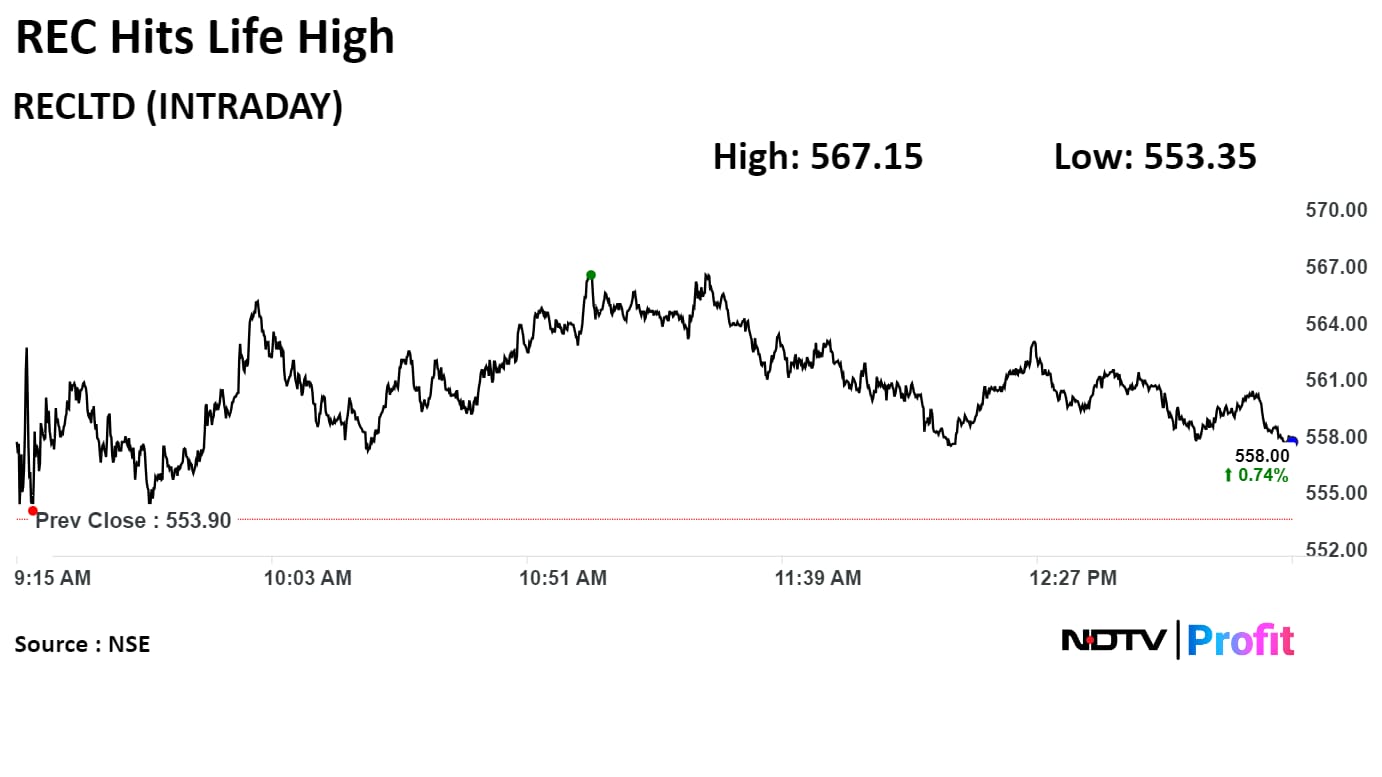

Shares of REC Ltd. rose as much as 2.4% to Rs 553.35, the highest level since its listing on March 12, 2008. It was trading 0.78% higher at Rs 558.20 as of 1:18 p.m., compared to 1.06% decline in the NSE Nifty 50 index.

The scrip gained 295.95% in 12 months, and on year-to-date basis, it has risen 35.4%. Total traded volume so far in the day stood at 2.13 times its 30-day average. The relative strength index was at 79.26, which implied the stock is overbought.

Shares of REC Ltd. rose as much as 2.4% to Rs 553.35, the highest level since its listing on March 12, 2008. It was trading 0.78% higher at Rs 558.20 as of 1:18 p.m., compared to 1.06% decline in the NSE Nifty 50 index.

The scrip gained 295.95% in 12 months, and on year-to-date basis, it has risen 35.4%. Total traded volume so far in the day stood at 2.13 times its 30-day average. The relative strength index was at 79.26, which implied the stock is overbought.

Revenue down 13.38% to Rs 1,426.09 crore from Rs 1,646.27 crore

Ebitda down 64.52% at Rs 1,22.75 crore from Rs 346.01 crore

Margin down 1,242 bps at 8.6% from 21.01%

Net profit up 5.31% at Rs 478.01 crore from Rs 453.87 crore

Revenue up 9% at Rs 6,349 crore vs Rs 5,842 crore

Ebitda up 7% at Rs 912 crore vs Rs 854 crore

Margin down 24 bps at 14.36% vs 14.61%

Net profit up 16% at Rs 396 crore vs Rs 341 crore

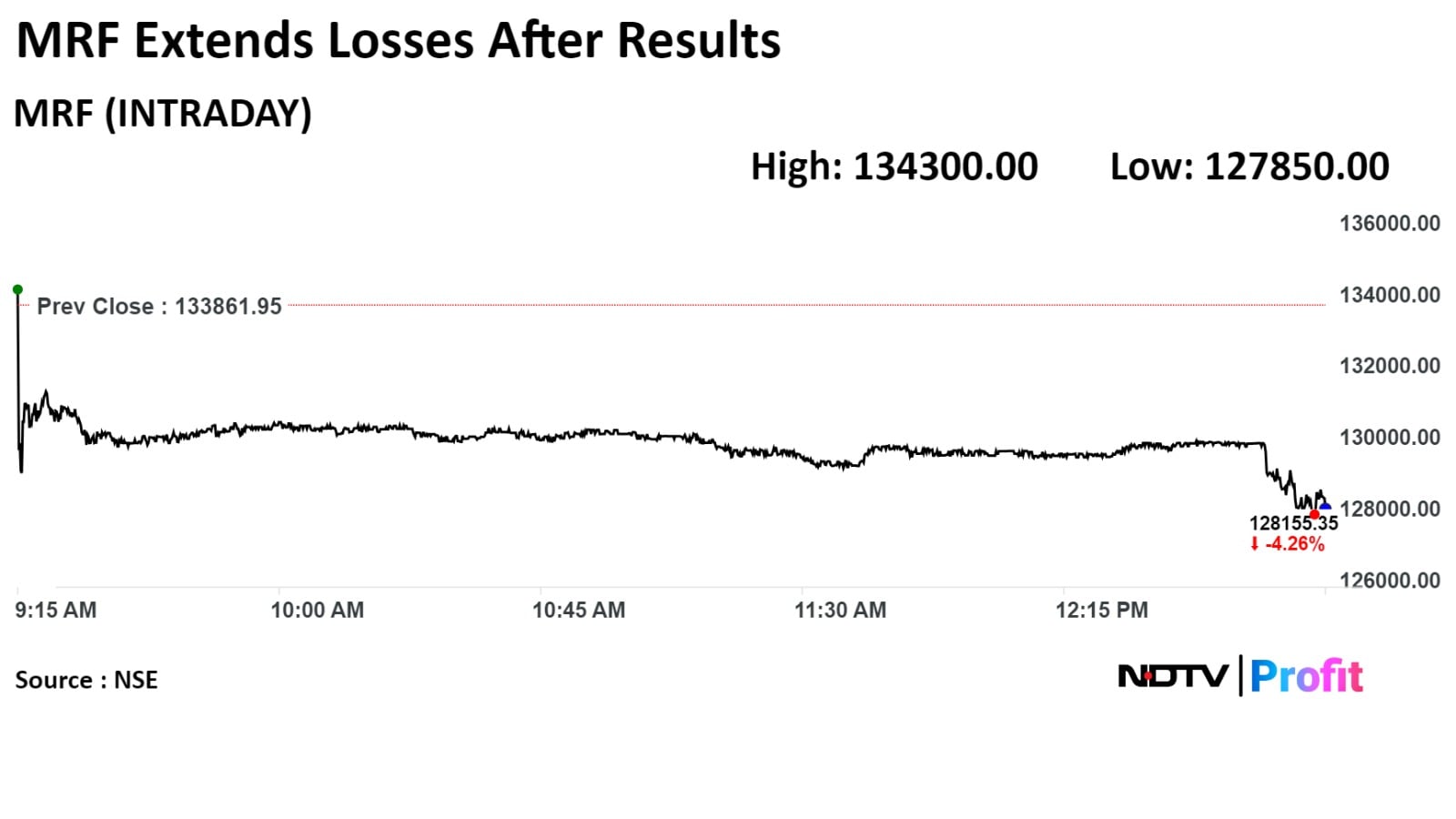

The scrip fell as much as 4.55% to Rs 1,27,767 apiece, the lowest level since April 19. It pared losses to trade 4% lower at Rs 1,28,499.80 apiece, as of 1:09 p.m. This compares to a 0.04% advance in the NSE Nifty 50 Index.

It has fallen 0.83% on a year-to-date basis and 32.18% in the last twelve months. Total traded volume so far in the day stood at 3.12times its 30-day average. The relative strength index was at 38.26.

Revenue up 9% at Rs 6,349 crore vs Rs 5,842 crore

Ebitda up 7% at Rs 912 crore vs Rs 854 crore

Margin down 24 bps at 14.36% vs 14.61%

Net profit up 16% at Rs 396 crore vs Rs 341 crore

The scrip fell as much as 4.55% to Rs 1,27,767 apiece, the lowest level since April 19. It pared losses to trade 4% lower at Rs 1,28,499.80 apiece, as of 1:09 p.m. This compares to a 0.04% advance in the NSE Nifty 50 Index.

It has fallen 0.83% on a year-to-date basis and 32.18% in the last twelve months. Total traded volume so far in the day stood at 3.12times its 30-day average. The relative strength index was at 38.26.

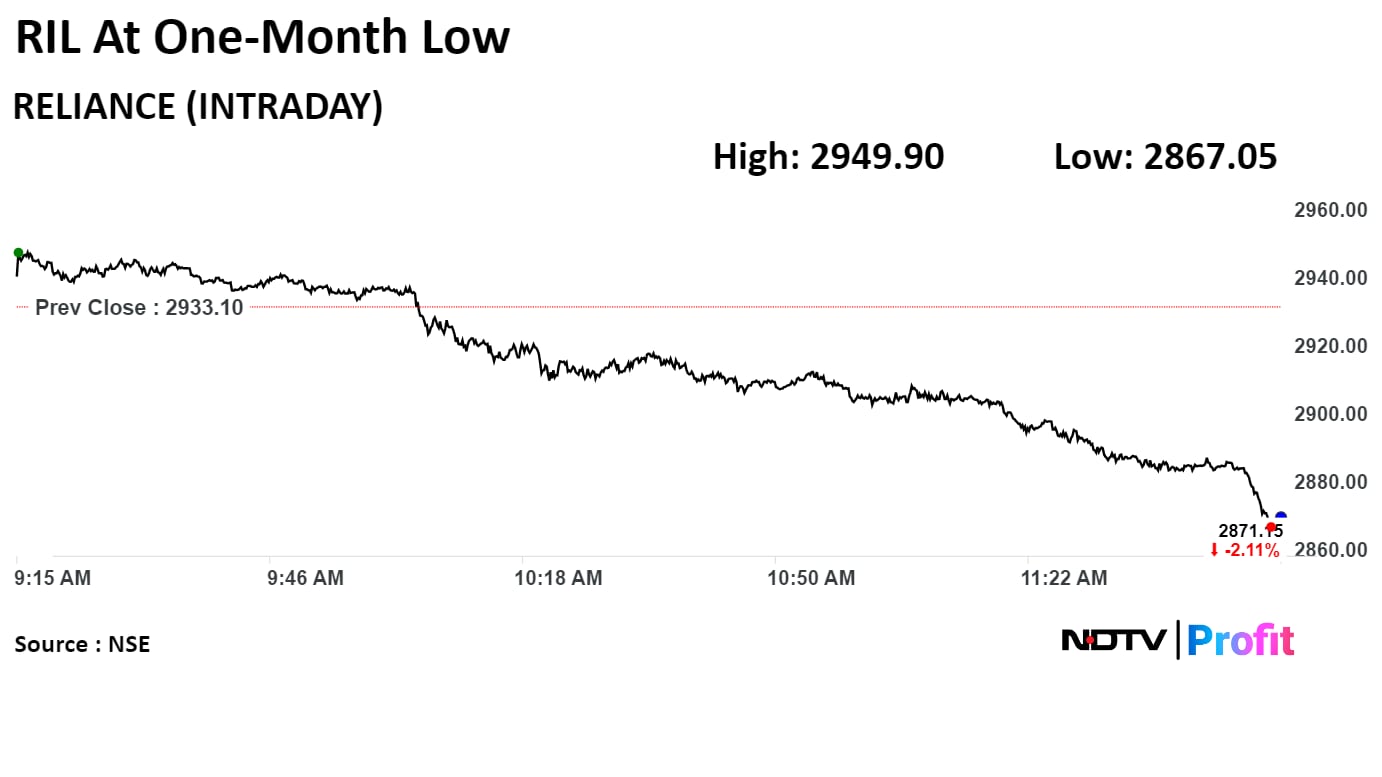

Shares of Reliance Industries Ltd. declined to Rs 2,867.05, the lowest level since 20 March. It was trading 2.16% lower at Rs 2,870.95 as of 11:56 a.m., compared to 0.77% decline in the NSE Nifty 50 index.

Shares of Reliance Industries Ltd. declined to Rs 2,867.05, the lowest level since 20 March. It was trading 2.16% lower at Rs 2,870.95 as of 11:56 a.m., compared to 0.77% decline in the NSE Nifty 50 index.

Shriram Properties has acquired 4 acre land parcel in Bengaluru with aggregate revenue potential of Rs 250 crore in 3 years.

Source: Exchange filing

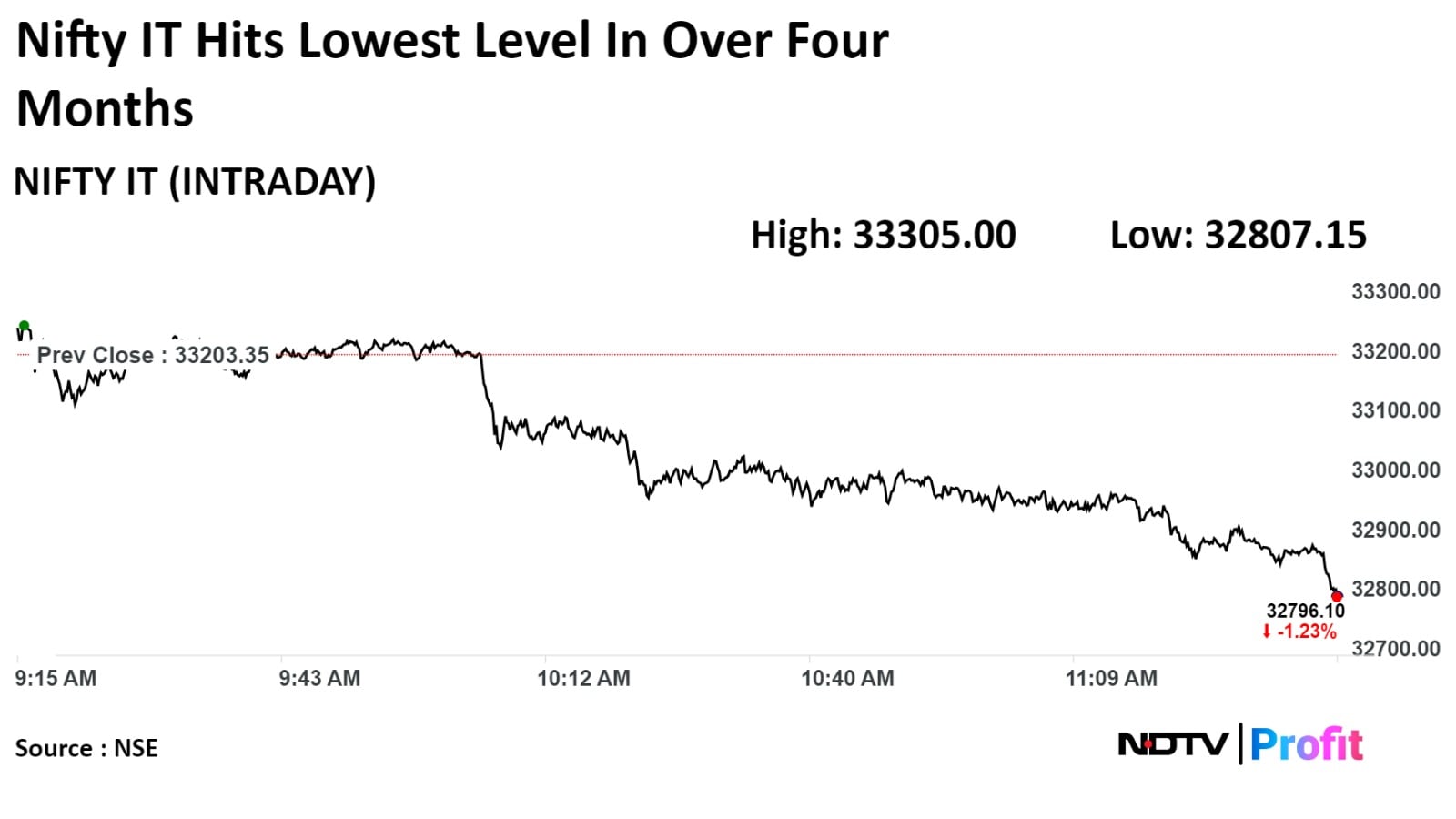

The NSE Nifty IT index declined 1.29% to 32,807.15, the lowest level since Dec 13, 2023.

The NSE Nifty IT index declined 1.29% to 32,807.15, the lowest level since Dec 13, 2023.

REC Ltd. plans to resolve all resolutions in FY25.

The company expects RS 1,500-2,000 crore of net write backs in FY25.

Targets to double AUM by 2023.

Current renewables portfolio at Rs 35,000 crore.

Targets renewables portfolio to reach Rs 3 lakh crore by 2030.

Thermal power is expected to give additional lever to increase loan book

The company expects AUM to grow 17-20% over next 3-4 years.

REC Ltd. expects net profit to grow more than 23-24% in next 3-4 years.

Source: REC Ltd. to NDTV Profit

Bajaj Auto has sold 1.8 lakh Pulsars till date across 59 countries.

The Pulsar brand has earned Rs 10,000 crore in revenue since launch in 2001.

Source: Media presentation

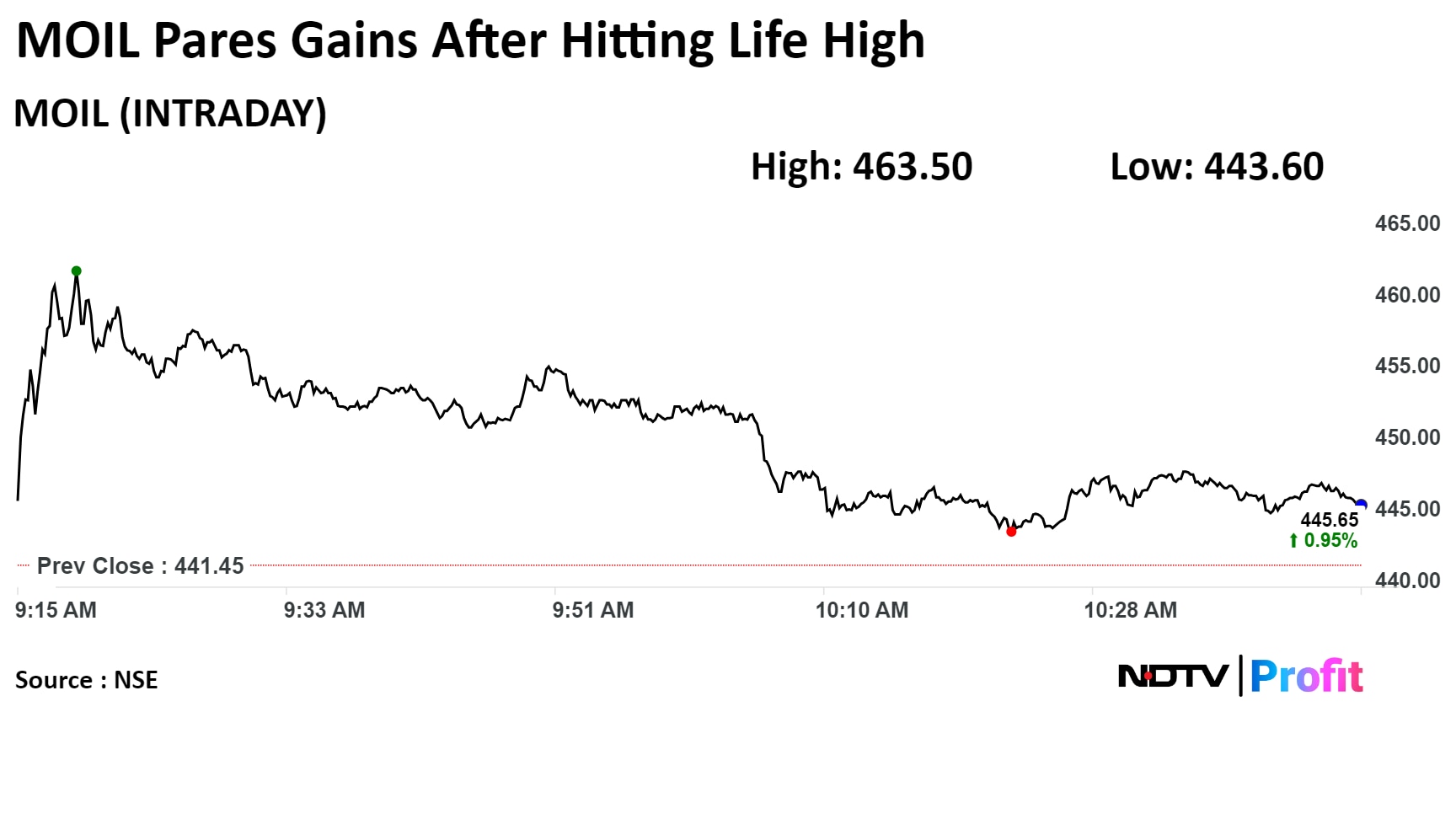

Shares of MOIL Ltd. hit their lifetime high today after the company recorded a 22% year-on-year growth in its April production to 1.60 lakh tonnes.

The scrip rose in the second consecutive session today to hit its lifetime high of Rs 463.5. It pared gains to trade 1.34% higher at Rs 447.35 as of 11:11 a.m. This compares to a 0.20% decline in the Nifty 50.

It has risen 44.56% on a year-to-date basis and 187.91% in the last twelve months. Total traded volume so far in the day stood at 0.85 times its 30-day average. The relative strength index was at 76.59, indicating that the stock may be overbought.

Out of the four analysts tracking the company, two maintain a 'buy' rating, one recommend a 'hold,' and one suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 13.9%.

Shares of MOIL Ltd. hit their lifetime high today after the company recorded a 22% year-on-year growth in its April production to 1.60 lakh tonnes.

The scrip rose in the second consecutive session today to hit its lifetime high of Rs 463.5. It pared gains to trade 1.34% higher at Rs 447.35 as of 11:11 a.m. This compares to a 0.20% decline in the Nifty 50.

It has risen 44.56% on a year-to-date basis and 187.91% in the last twelve months. Total traded volume so far in the day stood at 0.85 times its 30-day average. The relative strength index was at 76.59, indicating that the stock may be overbought.

Out of the four analysts tracking the company, two maintain a 'buy' rating, one recommend a 'hold,' and one suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 13.9%.

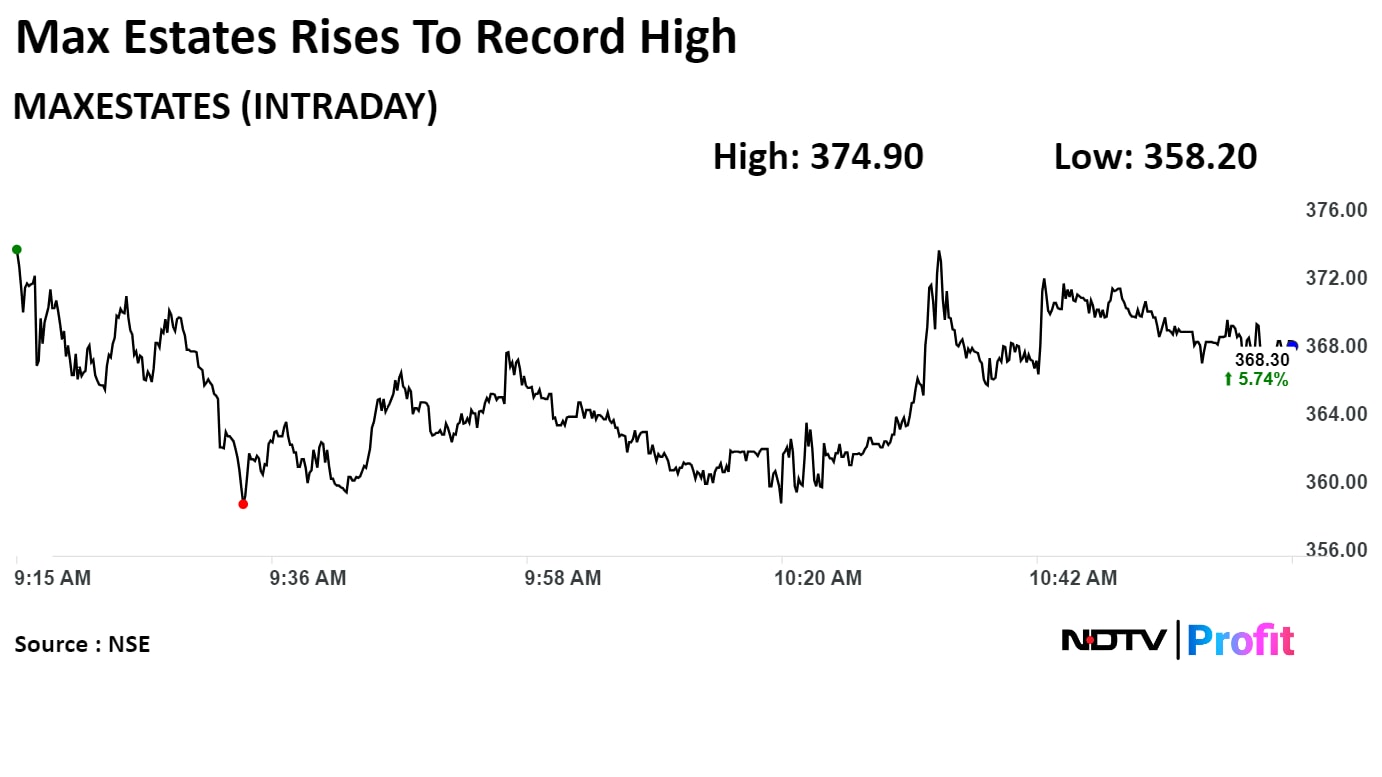

Max Estates Ltd. rose its highest level since its listing on the bourses as the company secured a housing residential development project in Gurugram.

Shares of Max Estates Ltd. rose as much as 7.64% Rs 374.90, the highest level since its listing on Oct 30, 2023. It was trading 5.63% higher at Rs 367.90 as of 11:06 a.m., compared to 0.22% decline in the NSE Nifty 50 index.

The scrip gained 29.98% in six months, and on year-to-date basis, it has risen 18.72%. Total traded volume so far in the day stood at 25 times its 30-day average. The relative strength index was at 82.73, which implied the stock is overbought.

One analyst tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 6.8%.

Max Estates Ltd. rose its highest level since its listing on the bourses as the company secured a housing residential development project in Gurugram.

Shares of Max Estates Ltd. rose as much as 7.64% Rs 374.90, the highest level since its listing on Oct 30, 2023. It was trading 5.63% higher at Rs 367.90 as of 11:06 a.m., compared to 0.22% decline in the NSE Nifty 50 index.

The scrip gained 29.98% in six months, and on year-to-date basis, it has risen 18.72%. Total traded volume so far in the day stood at 25 times its 30-day average. The relative strength index was at 82.73, which implied the stock is overbought.

One analyst tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 6.8%.

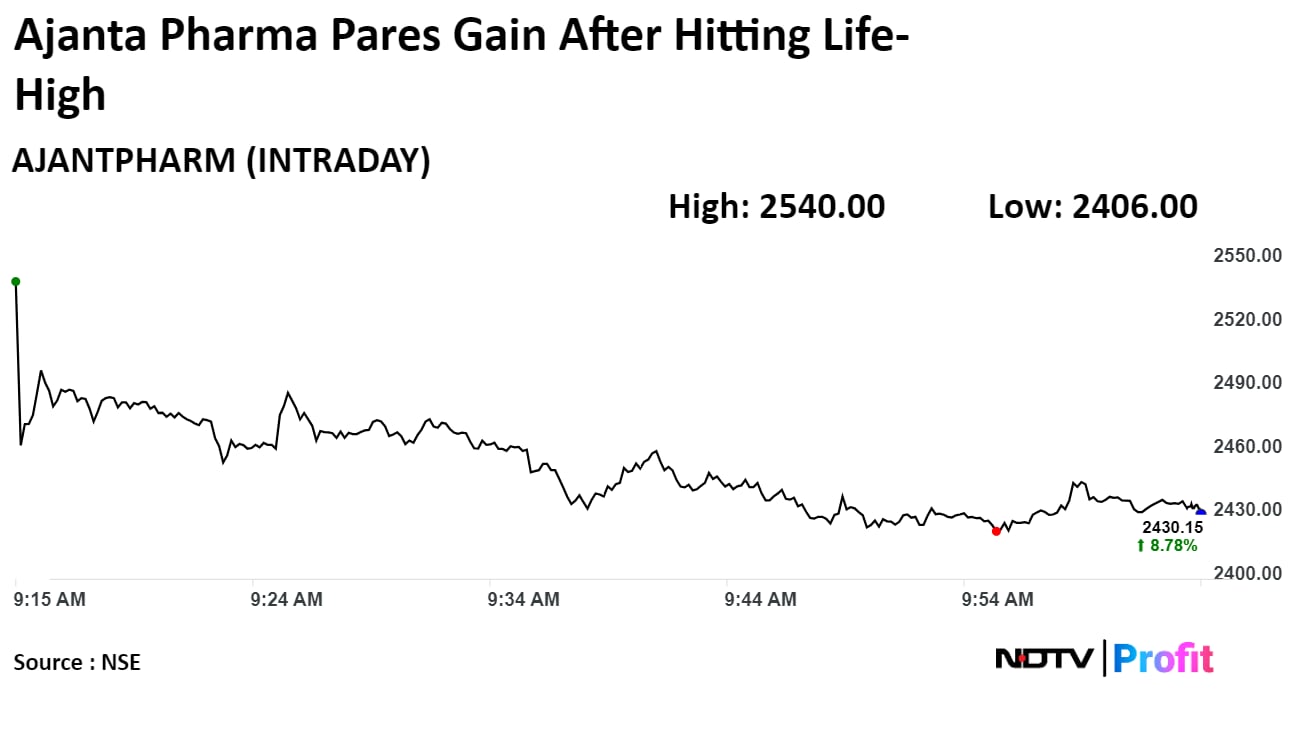

Shares of Ajanta Pharma Ltd. surged over 13% to a record high on Friday after its fourth-quarter profit surged, beating analysts' estimates, aided by robust sales across domestic and international markets.

Shares of the company rose as much as 13.7% during the day to a life high of Rs 2,540 apiece on the NSE. It was trading 8.59% higher at Rs 2,426 apiece, compared to a 0.56% advance in the benchmark Nifty 50 at 9:57 a.m.

The stock has risen 88.9% in the last 12 months and is up 11.25% year-to-date. The total traded volume so far today was 97 times its 30-day average. The relative strength index was at 78.

Twelve out of the 15 analysts tracking the company have a 'buy' rating on the stock, one recommends a 'hold' and two suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 3.5%.

Shares of Ajanta Pharma Ltd. surged over 13% to a record high on Friday after its fourth-quarter profit surged, beating analysts' estimates, aided by robust sales across domestic and international markets.

Shares of the company rose as much as 13.7% during the day to a life high of Rs 2,540 apiece on the NSE. It was trading 8.59% higher at Rs 2,426 apiece, compared to a 0.56% advance in the benchmark Nifty 50 at 9:57 a.m.

The stock has risen 88.9% in the last 12 months and is up 11.25% year-to-date. The total traded volume so far today was 97 times its 30-day average. The relative strength index was at 78.

Twelve out of the 15 analysts tracking the company have a 'buy' rating on the stock, one recommends a 'hold' and two suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 3.5%.

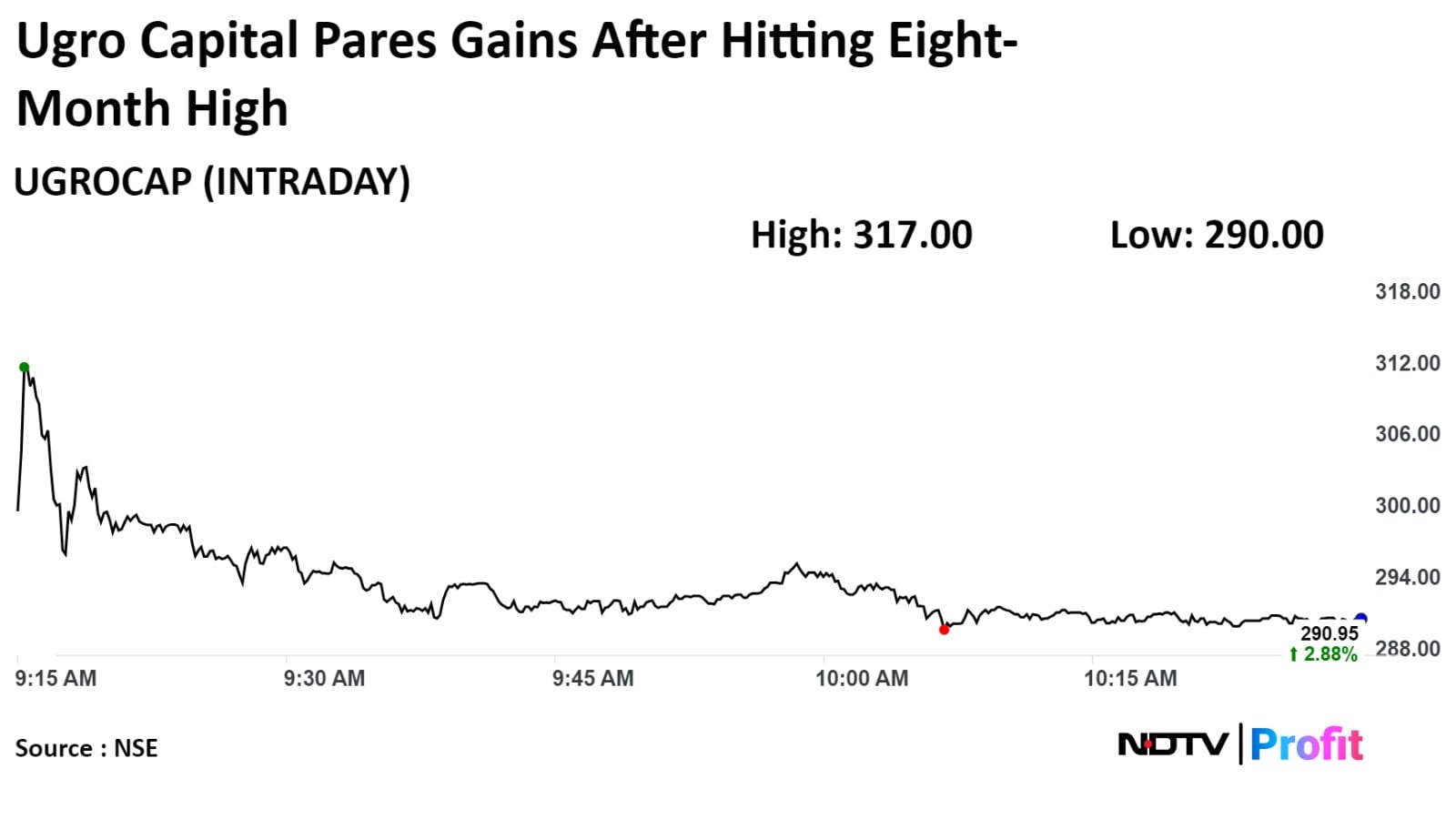

Shares of Ugro Capital jumped to hit an eight-month high today after the company reported an over 100% year-on-year increase in the its net profit to Rs 32.68 crore.

Shares of Ugro Capital jumped to hit an eight-month high today after the company reported an over 100% year-on-year increase in the its net profit to Rs 32.68 crore.

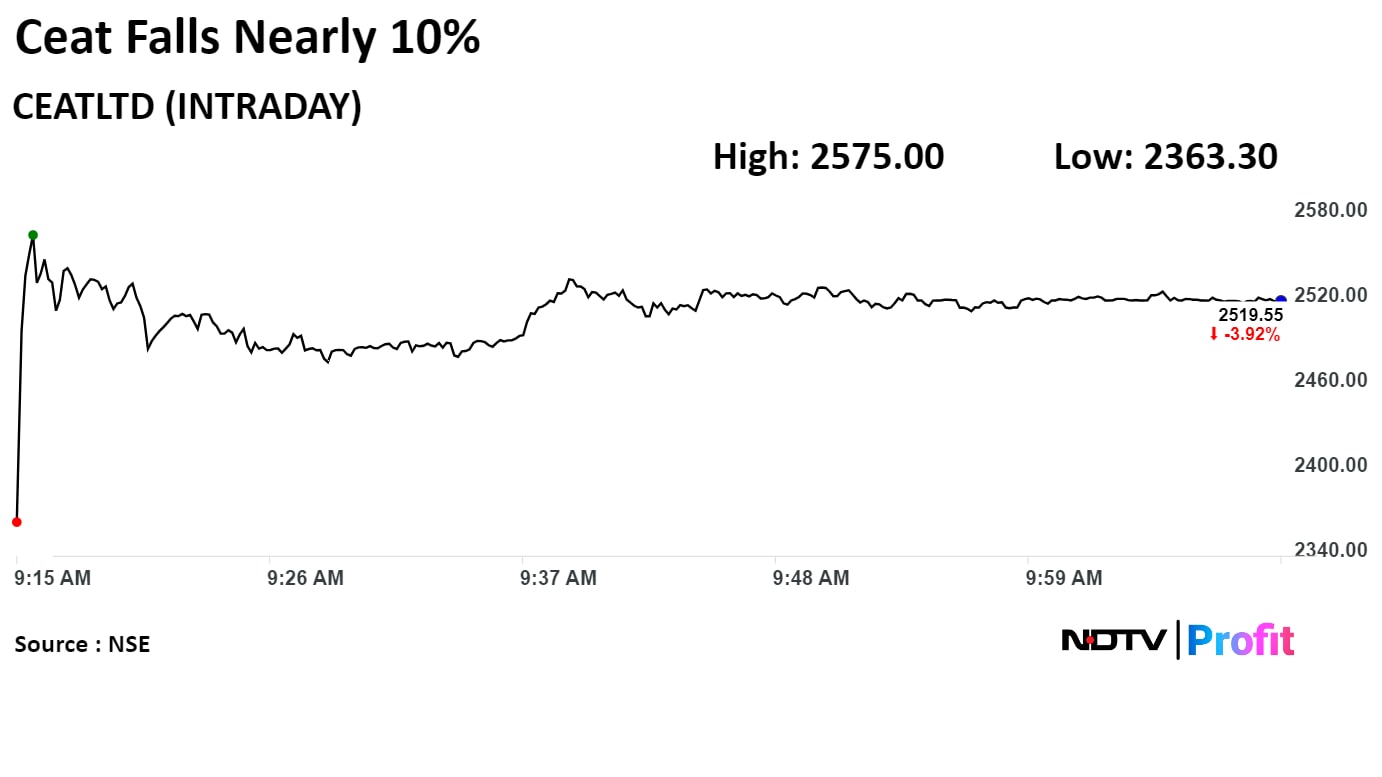

Shares of Ceat Ltd. slumped nearly 10% on Friday after the company reported a decline in the net profit.

The scrip fell 9.88% to Rs 2,363.30 apiece, the lowest level since XXX. It was trading 3.86% lower at Rs 2,521.05 apiece, as of 10:03 a.m. This compares to a 0.50% advance in the NSE Nifty 50 Index.

It has risen 53.82% in 12 months, and on year-to-date basis, it rose 3.74%. Total traded volume so far in the day stood at 18 times its 30-day average. The relative strength index was at 43.1.

Out of 23 analysts tracking the company, 15 maintain a 'buy' rating, three recommend a 'hold,' and five suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside 11.7%.

Shares of Ceat Ltd. slumped nearly 10% on Friday after the company reported a decline in the net profit.

The scrip fell 9.88% to Rs 2,363.30 apiece, the lowest level since XXX. It was trading 3.86% lower at Rs 2,521.05 apiece, as of 10:03 a.m. This compares to a 0.50% advance in the NSE Nifty 50 Index.

It has risen 53.82% in 12 months, and on year-to-date basis, it rose 3.74%. Total traded volume so far in the day stood at 18 times its 30-day average. The relative strength index was at 43.1.

Out of 23 analysts tracking the company, 15 maintain a 'buy' rating, three recommend a 'hold,' and five suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside 11.7%.

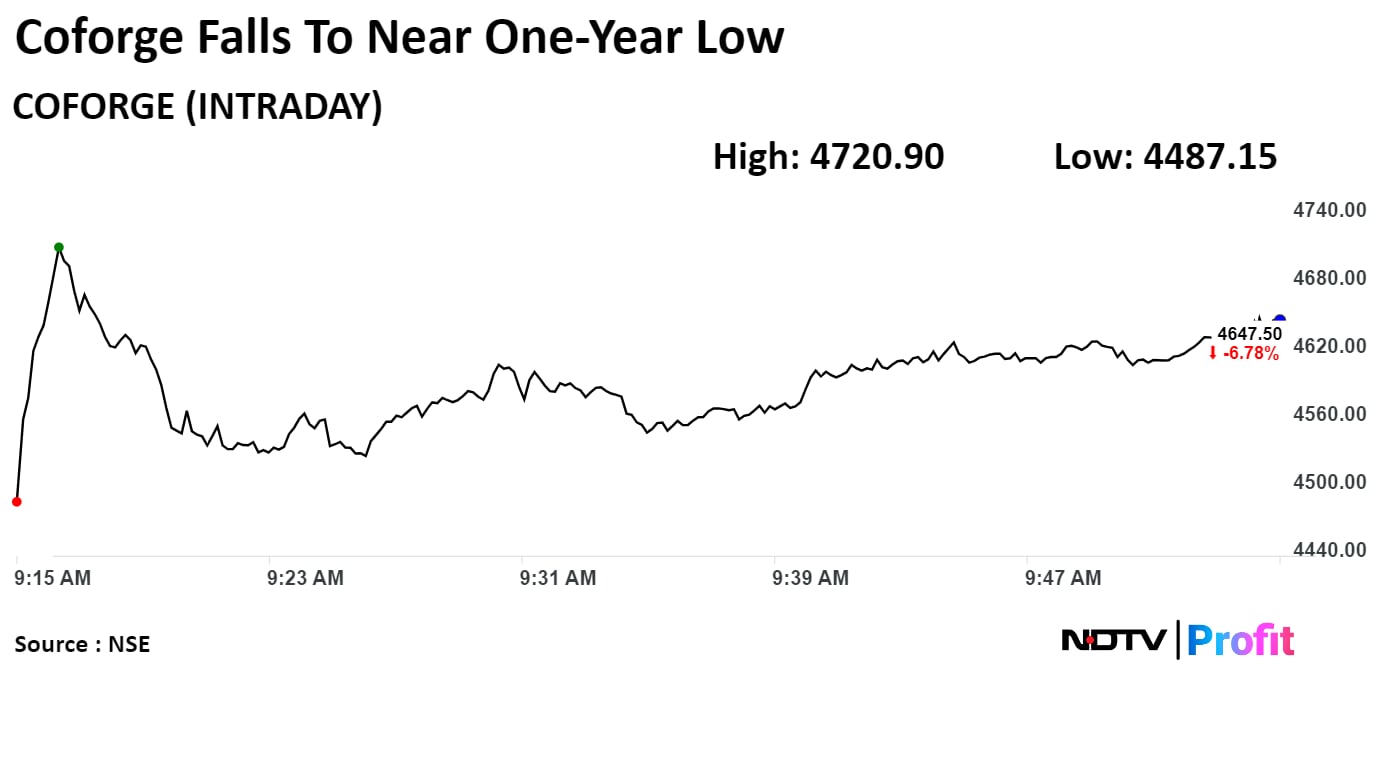

Coforge Ltd. reported strong growth in the fourth quarter of fiscal 2024, due to healthy order book. However challenging macro has led to slowdown in executable order book, leading to 17% year-on-year growth in FY24, compared to 20% YoY growth last year, and this indicates slowdown in revenue growth, according to brokerages.

Shares of Coforge Ltd. declined as much as 9.99% to Rs 4,487.15, the lowest level since Jun 26, 2023. It was trading 6.70% lower at Rs 4,651.50, as of 10:00 a.m., compared to 0.53% advance in the NSE Nifty 50 index.

The scrip declined 26.17% on year-to-date basis. Total traded volume so far in the day stood at 6.56 times its 30-day average. The relative strength index was at 19.49, which implied the stock is oversold.

Coforge Ltd. reported strong growth in the fourth quarter of fiscal 2024, due to healthy order book. However challenging macro has led to slowdown in executable order book, leading to 17% year-on-year growth in FY24, compared to 20% YoY growth last year, and this indicates slowdown in revenue growth, according to brokerages.

Shares of Coforge Ltd. declined as much as 9.99% to Rs 4,487.15, the lowest level since Jun 26, 2023. It was trading 6.70% lower at Rs 4,651.50, as of 10:00 a.m., compared to 0.53% advance in the NSE Nifty 50 index.

The scrip declined 26.17% on year-to-date basis. Total traded volume so far in the day stood at 6.56 times its 30-day average. The relative strength index was at 19.49, which implied the stock is oversold.

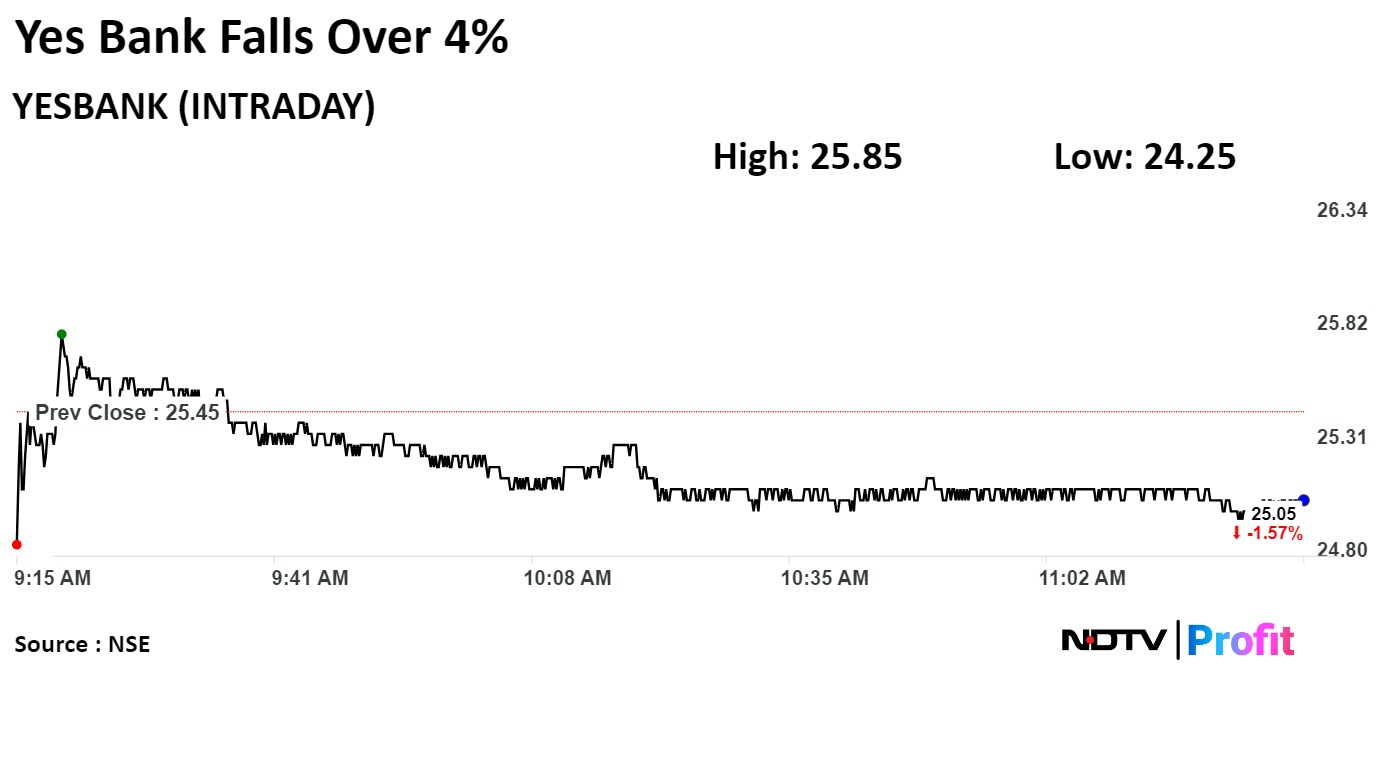

Yes Bank Ltd. had its 60.8 lakh shares change hands in bunch trades.

The lender's 2.1% of equity changed hands in nine bunch trades.

Buyers and sellers are not known immediately.

Source: Bloomberg

Yes Bank Ltd. had its 60.8 lakh shares change hands in bunch trades.

The lender's 2.1% of equity changed hands in nine bunch trades.

Buyers and sellers are not known immediately.

Source: Bloomberg

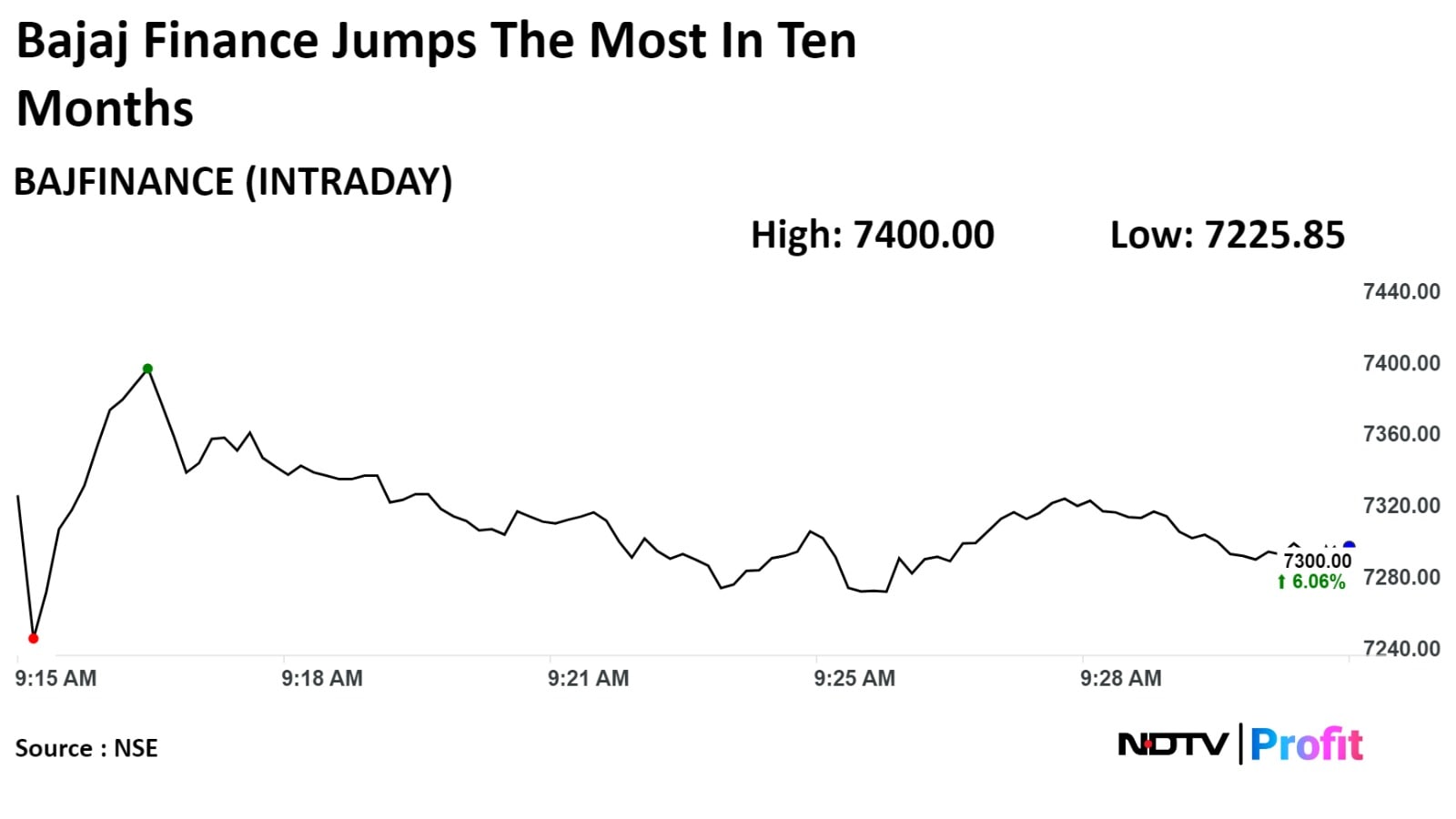

Bajaj Finance Ltd. jumped over 7% on Thursday as the Reserve Bank of India lifted restrictions on its eCOM, and online digital insta EMI card products with immediate effects.

The scrip rose as much as 7.52% to Rs 7,400 apiece, the highest level since April 24. It pared gains to trade 7.04% higher at Rs 7,367.30 apiece, as of 09:45 a.m. This compares to a 0.54% advance in the NSE Nifty 50 Index.

It has risen 0.56% on a year-to-date basis and 5.46% in the last twelve months. Total traded volume so far in the day stood at 1.40 times its 30-day average. The relative strength index was at 60.

Out of the 37 analysts tracking the company, 29 maintain a 'buy' rating, five recommend a 'hold,' and three suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 14.8%.

Bajaj Finance Ltd. jumped over 7% on Thursday as the Reserve Bank of India lifted restrictions on its eCOM, and online digital insta EMI card products with immediate effects.

The scrip rose as much as 7.52% to Rs 7,400 apiece, the highest level since April 24. It pared gains to trade 7.04% higher at Rs 7,367.30 apiece, as of 09:45 a.m. This compares to a 0.54% advance in the NSE Nifty 50 Index.

It has risen 0.56% on a year-to-date basis and 5.46% in the last twelve months. Total traded volume so far in the day stood at 1.40 times its 30-day average. The relative strength index was at 60.

Out of the 37 analysts tracking the company, 29 maintain a 'buy' rating, five recommend a 'hold,' and three suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 14.8%.

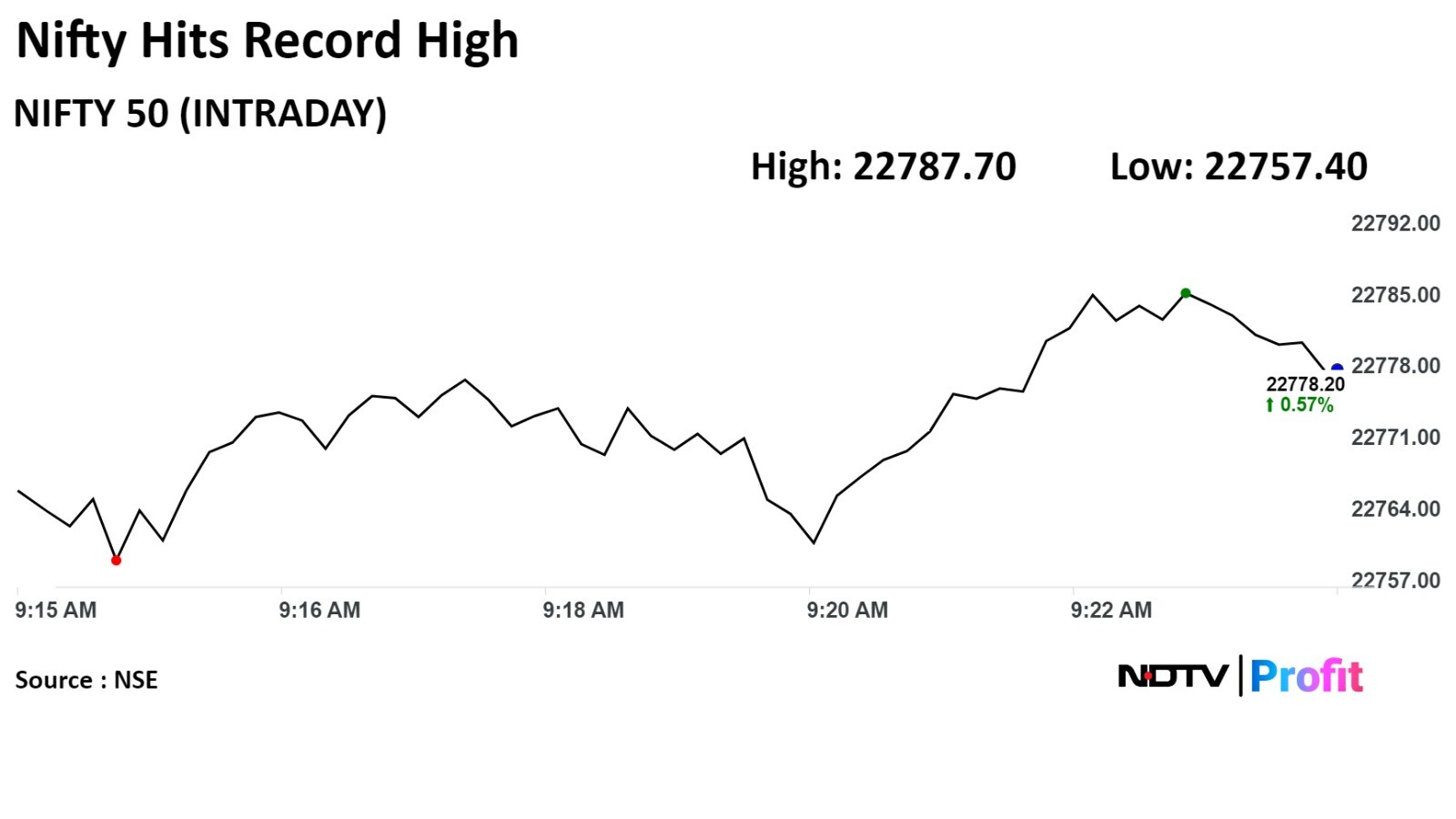

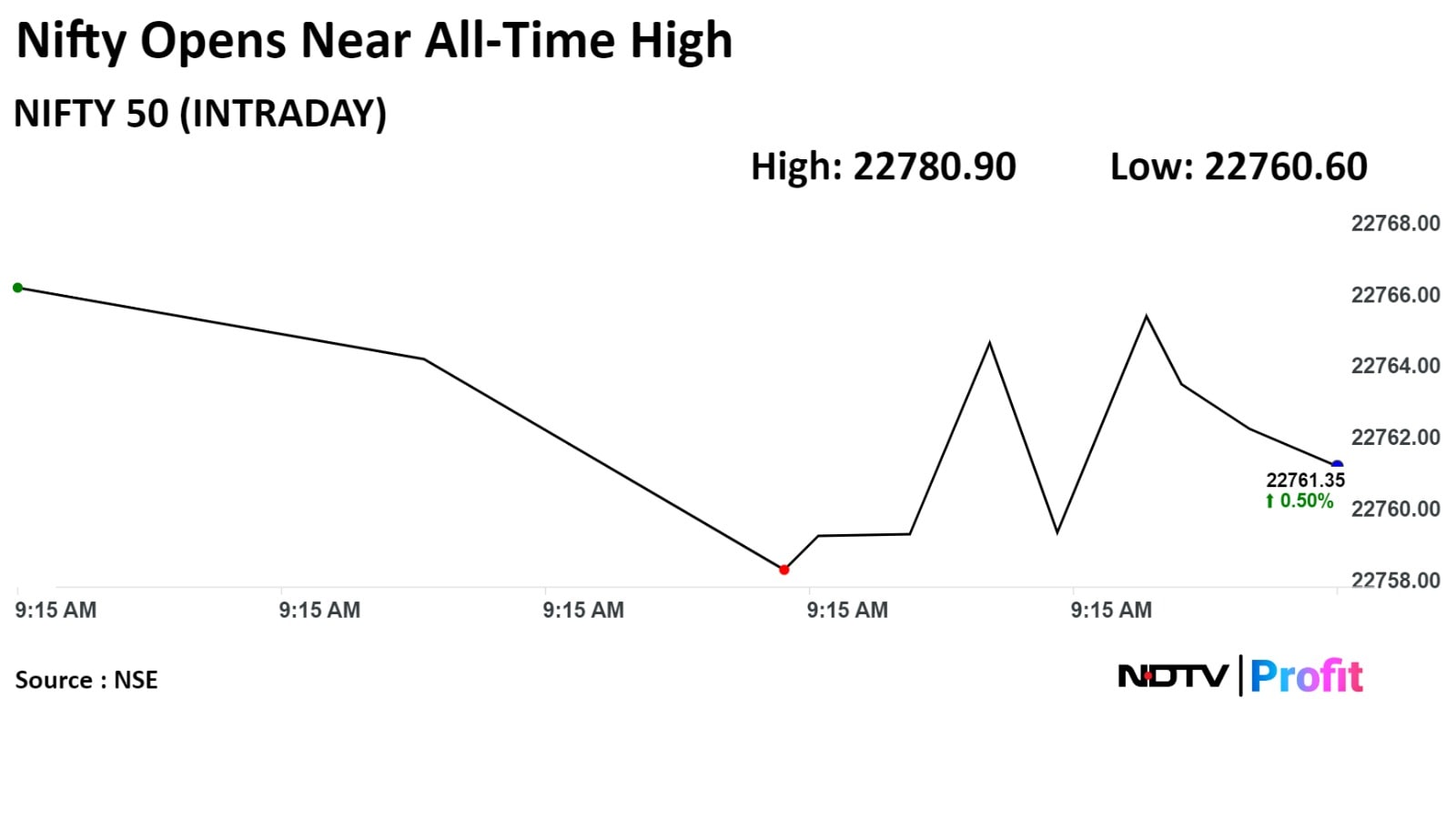

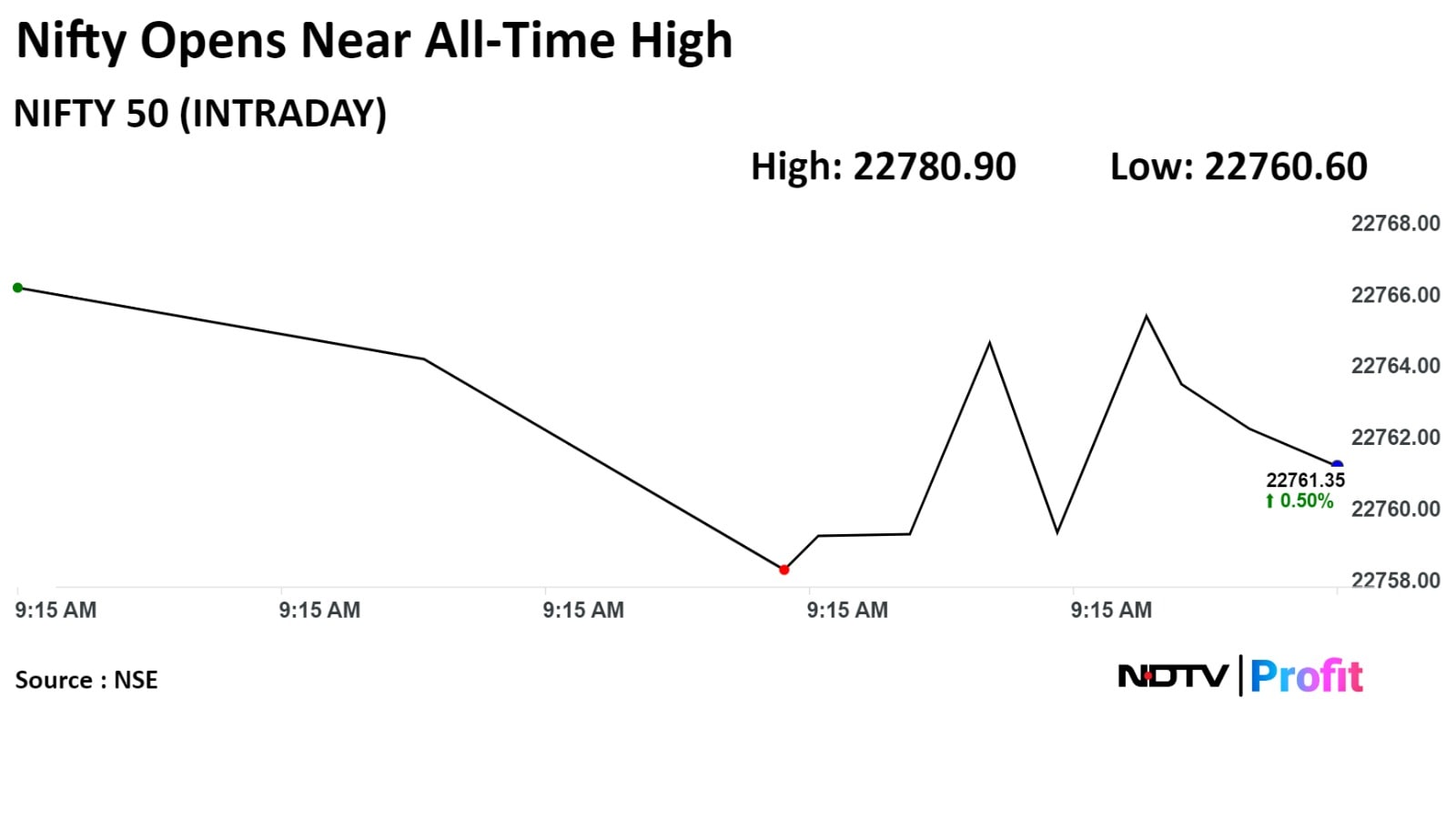

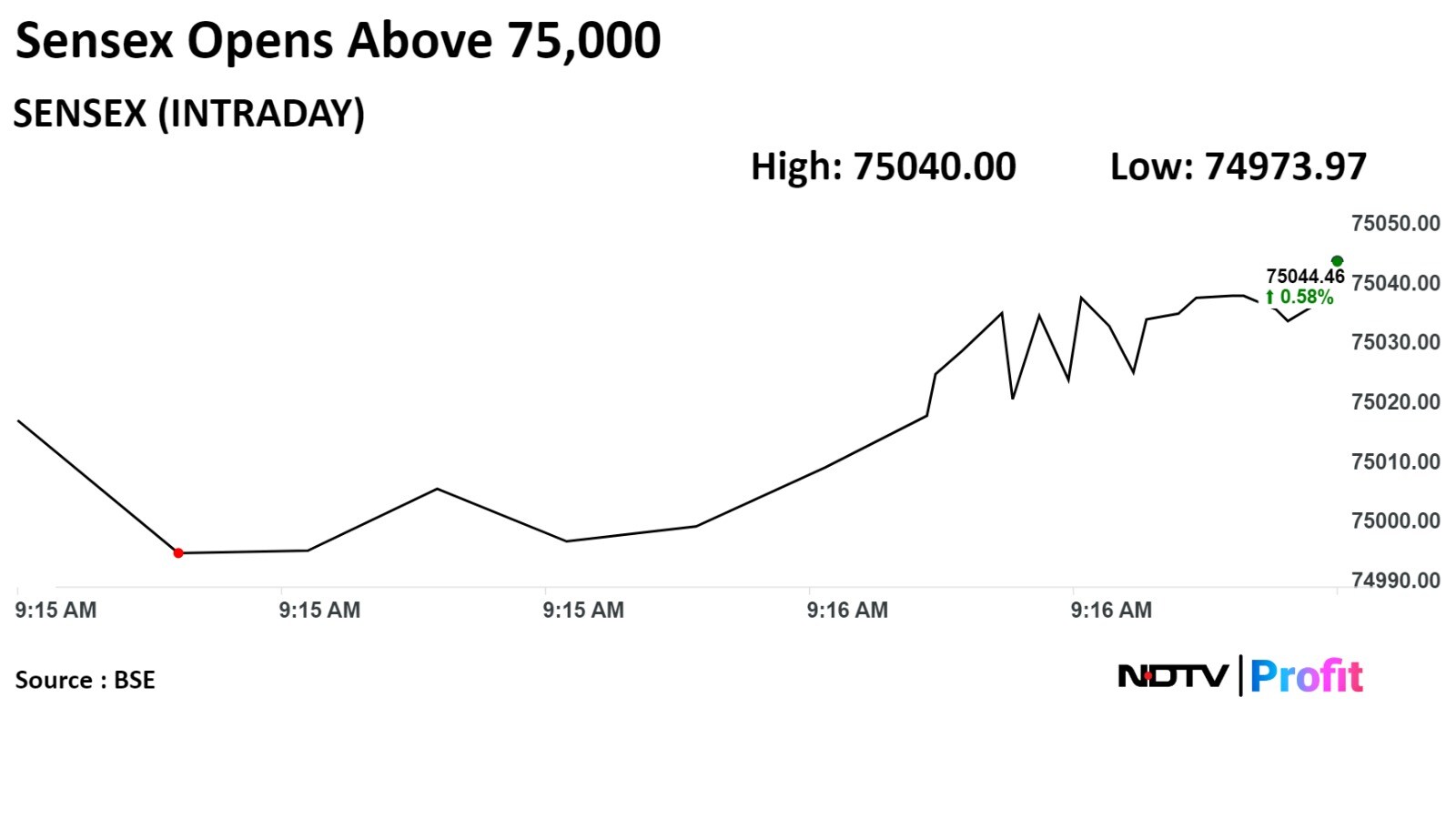

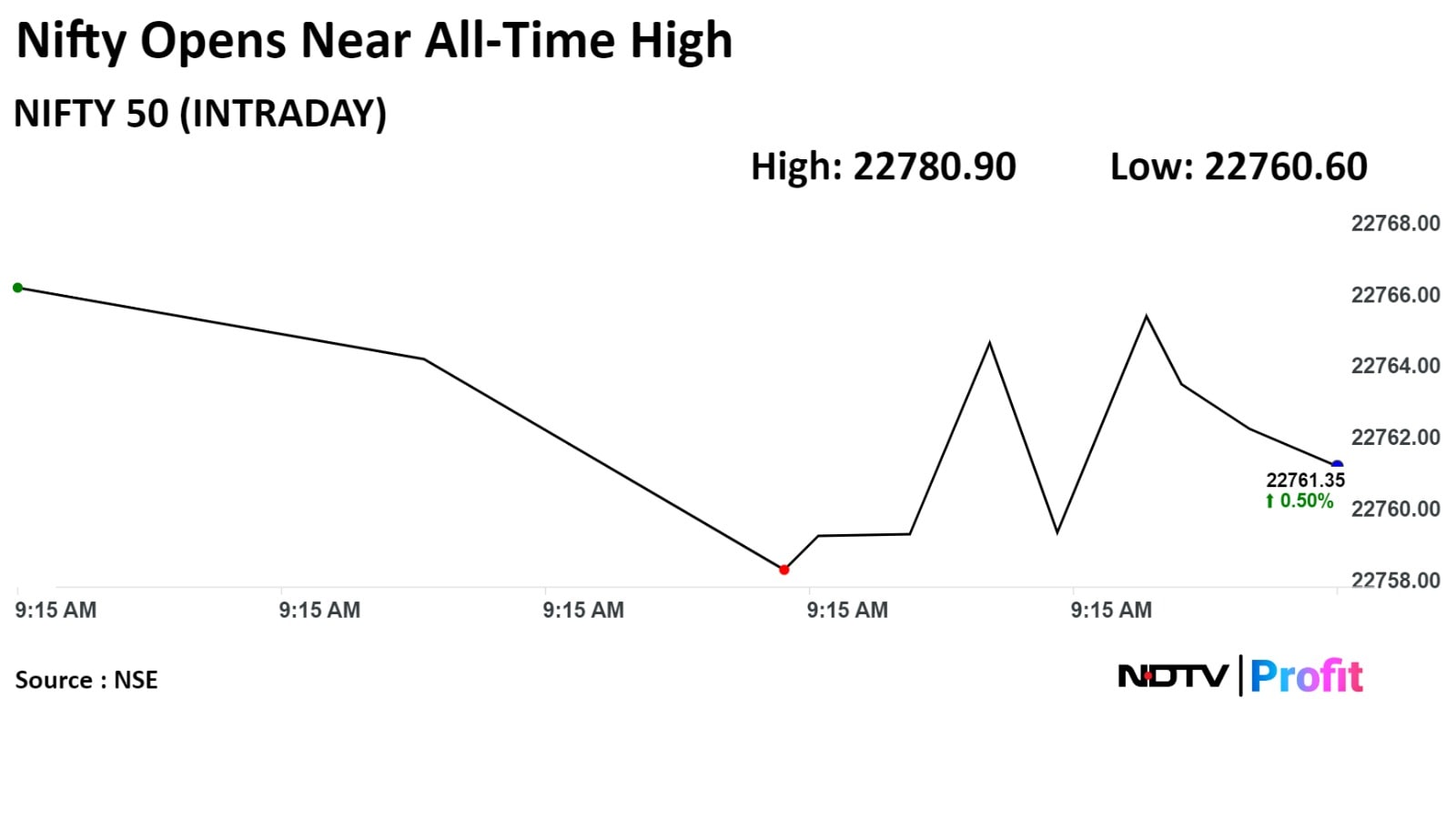

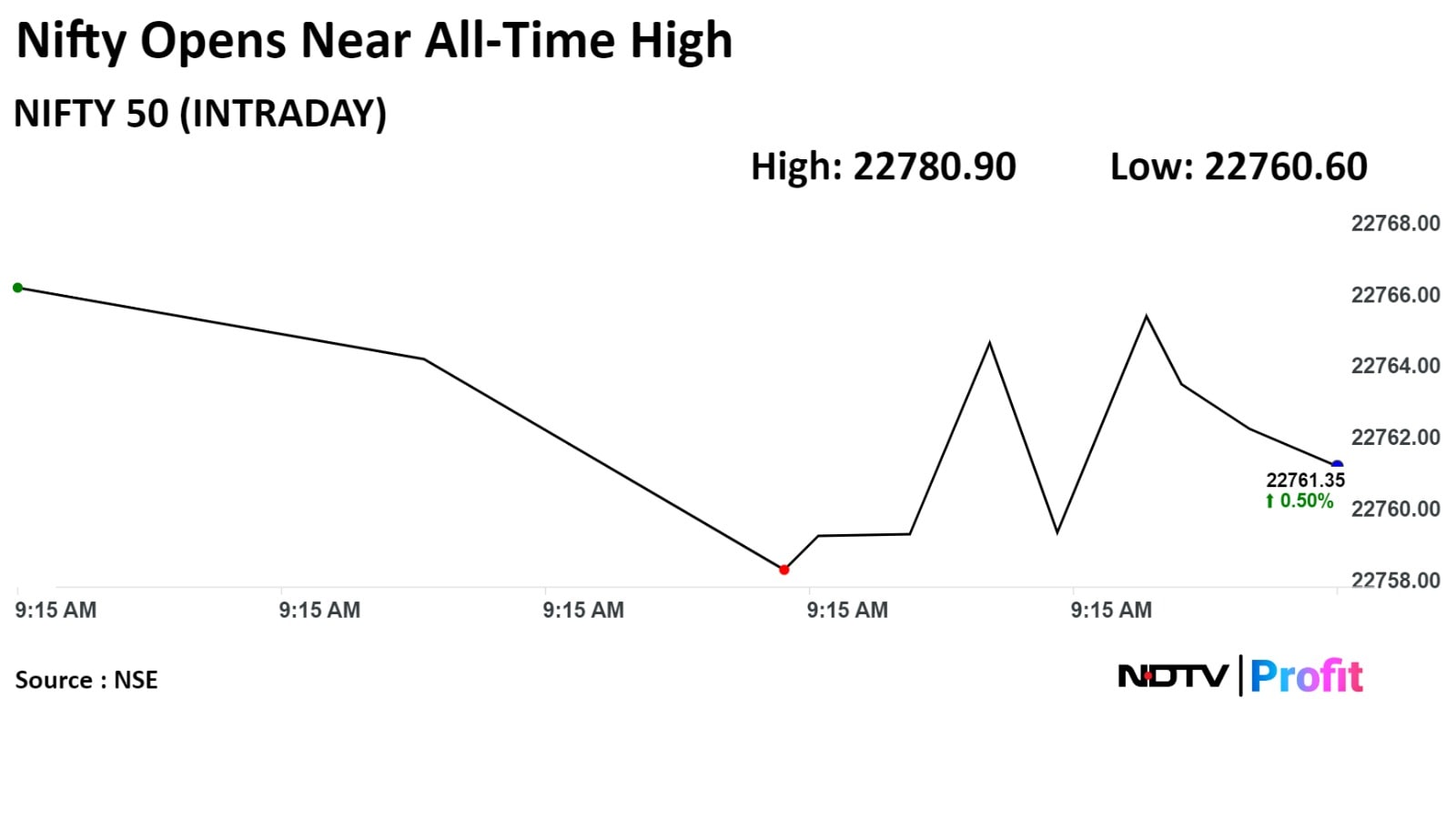

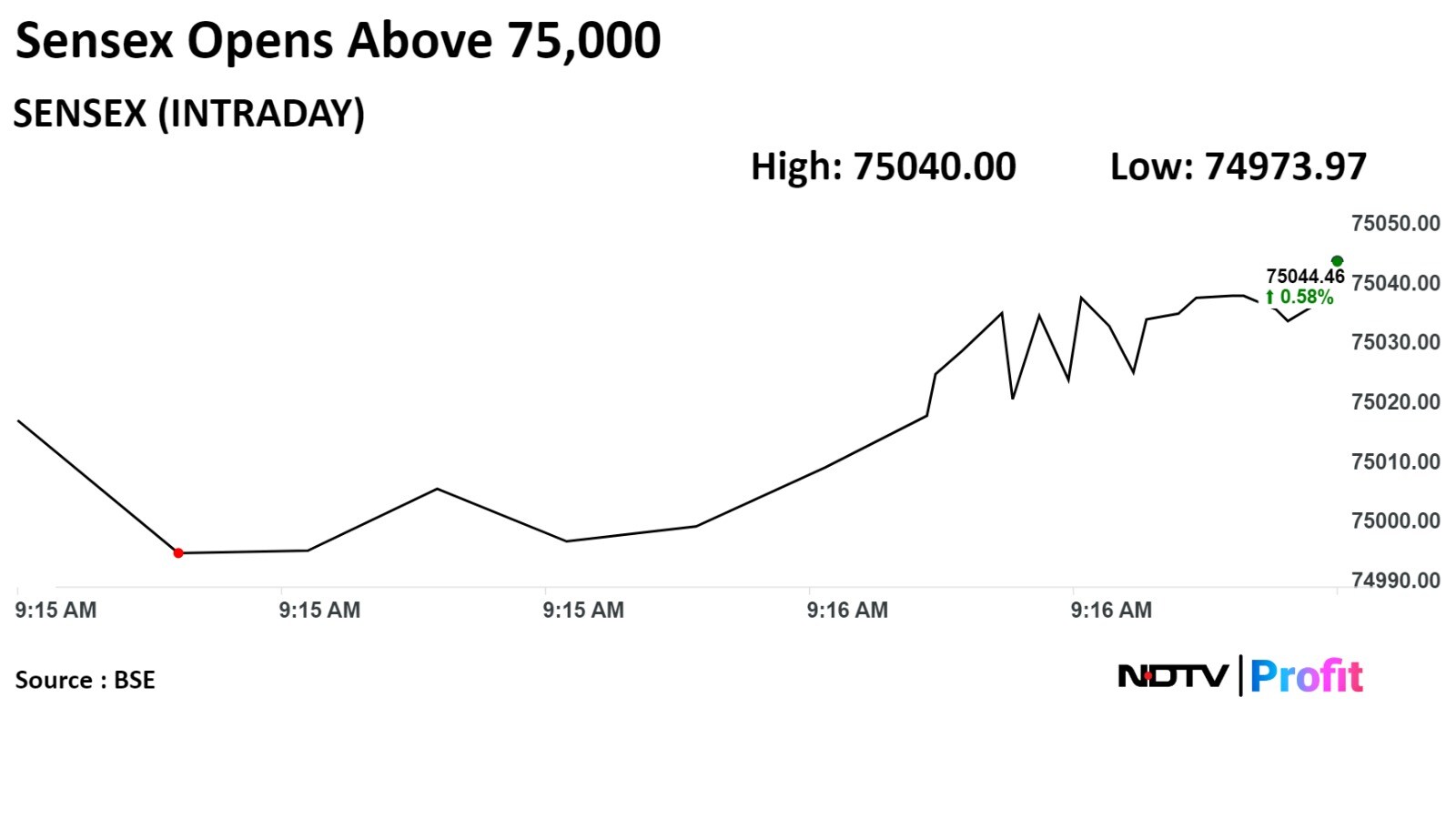

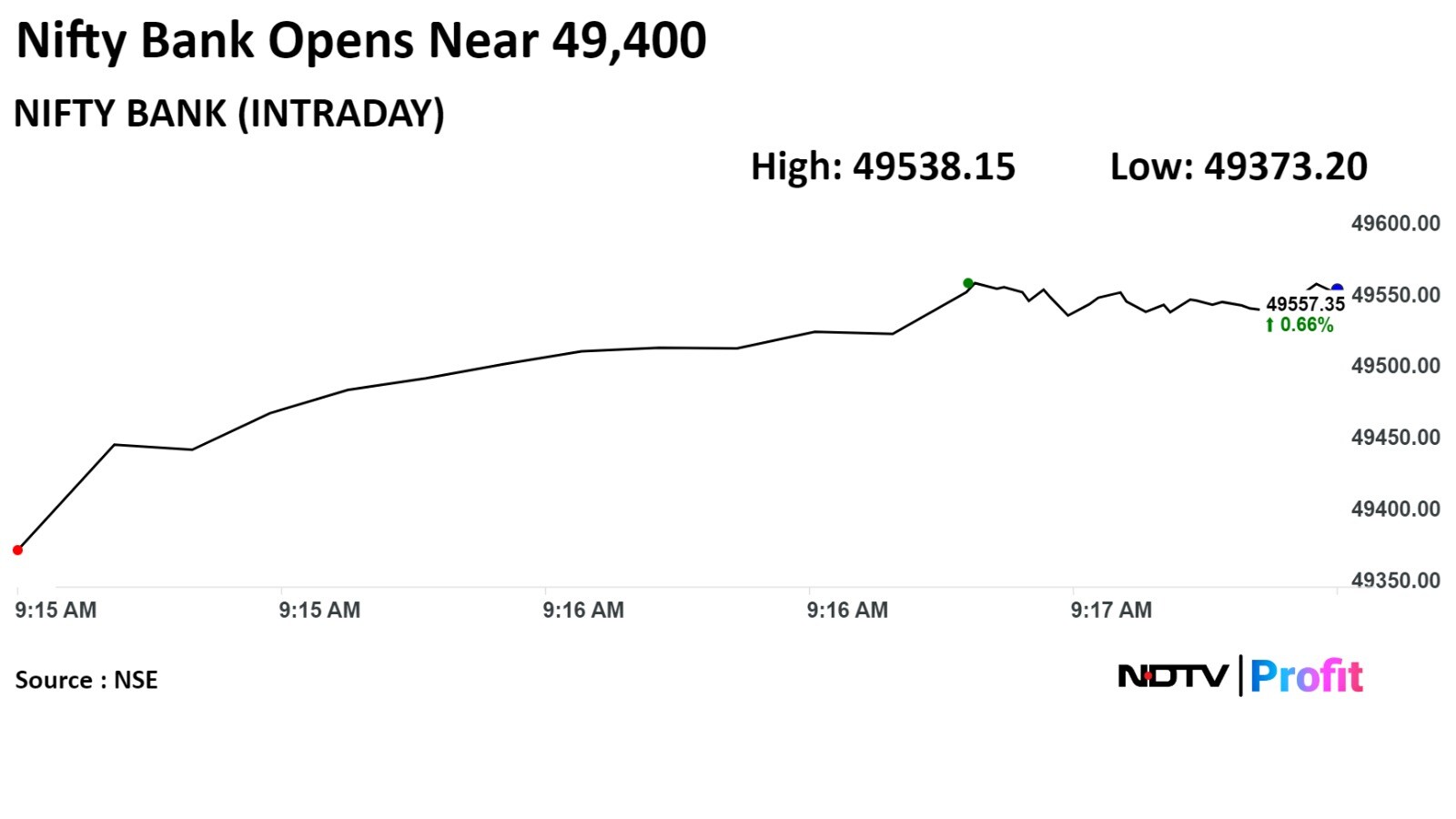

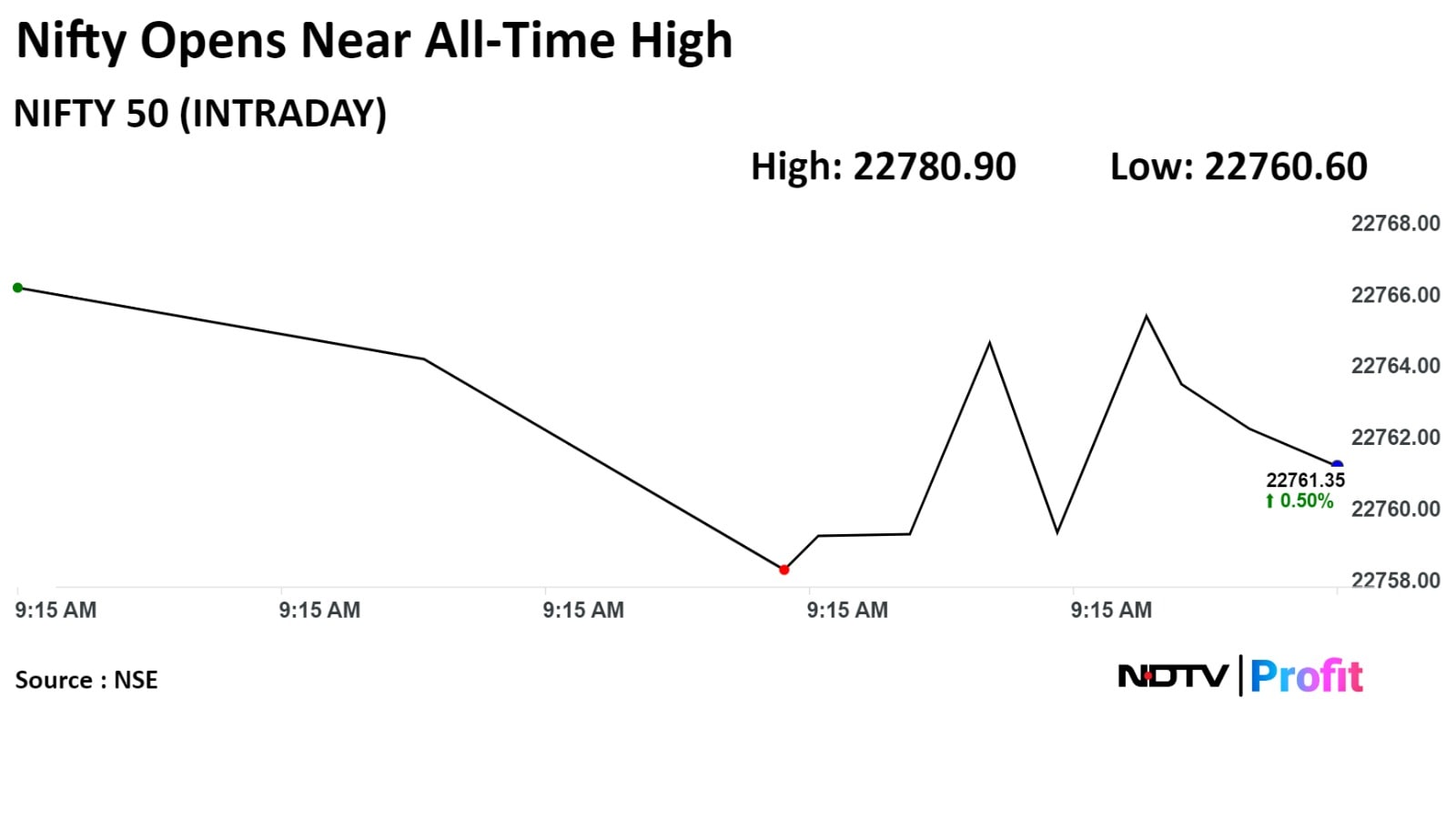

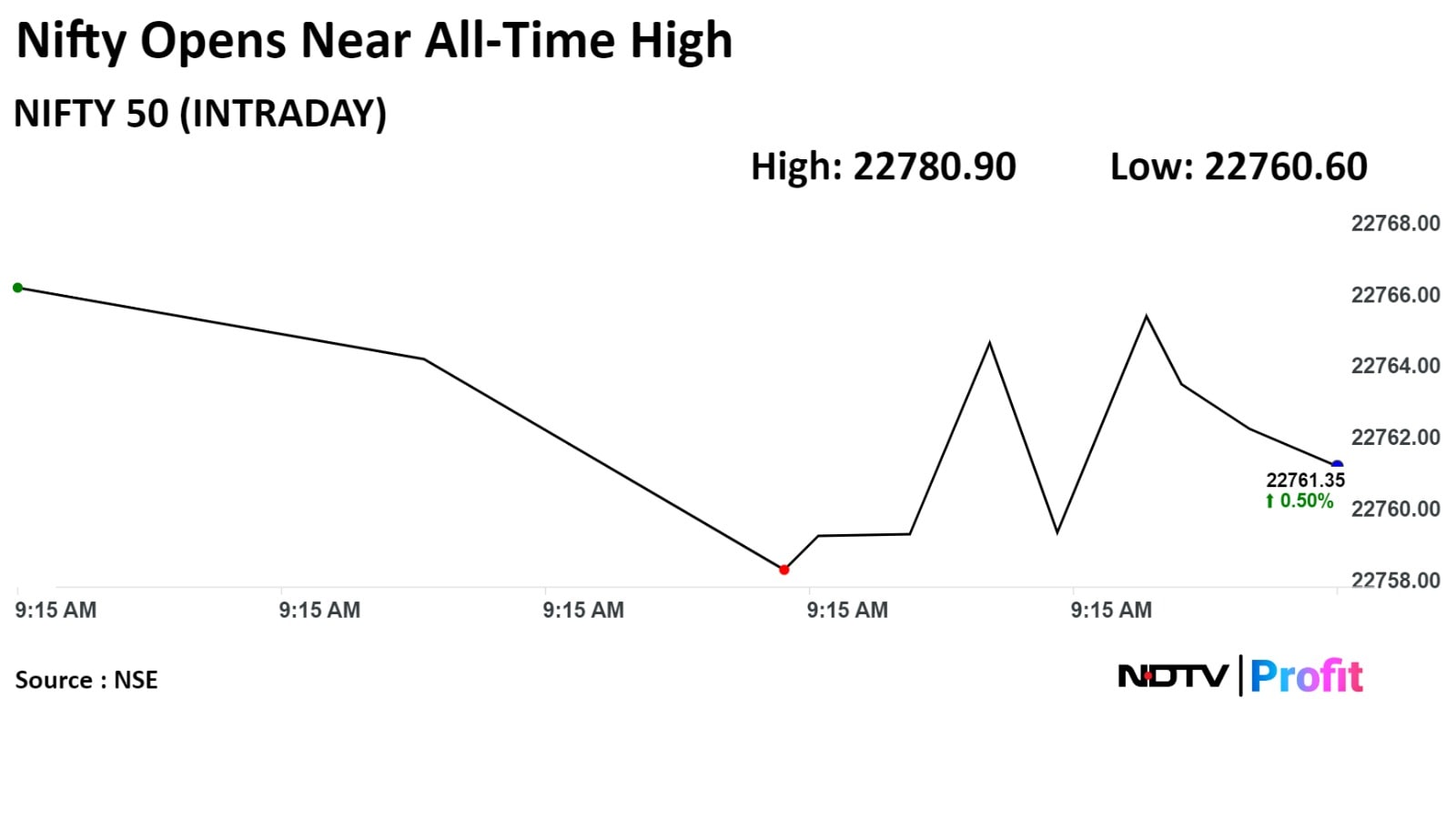

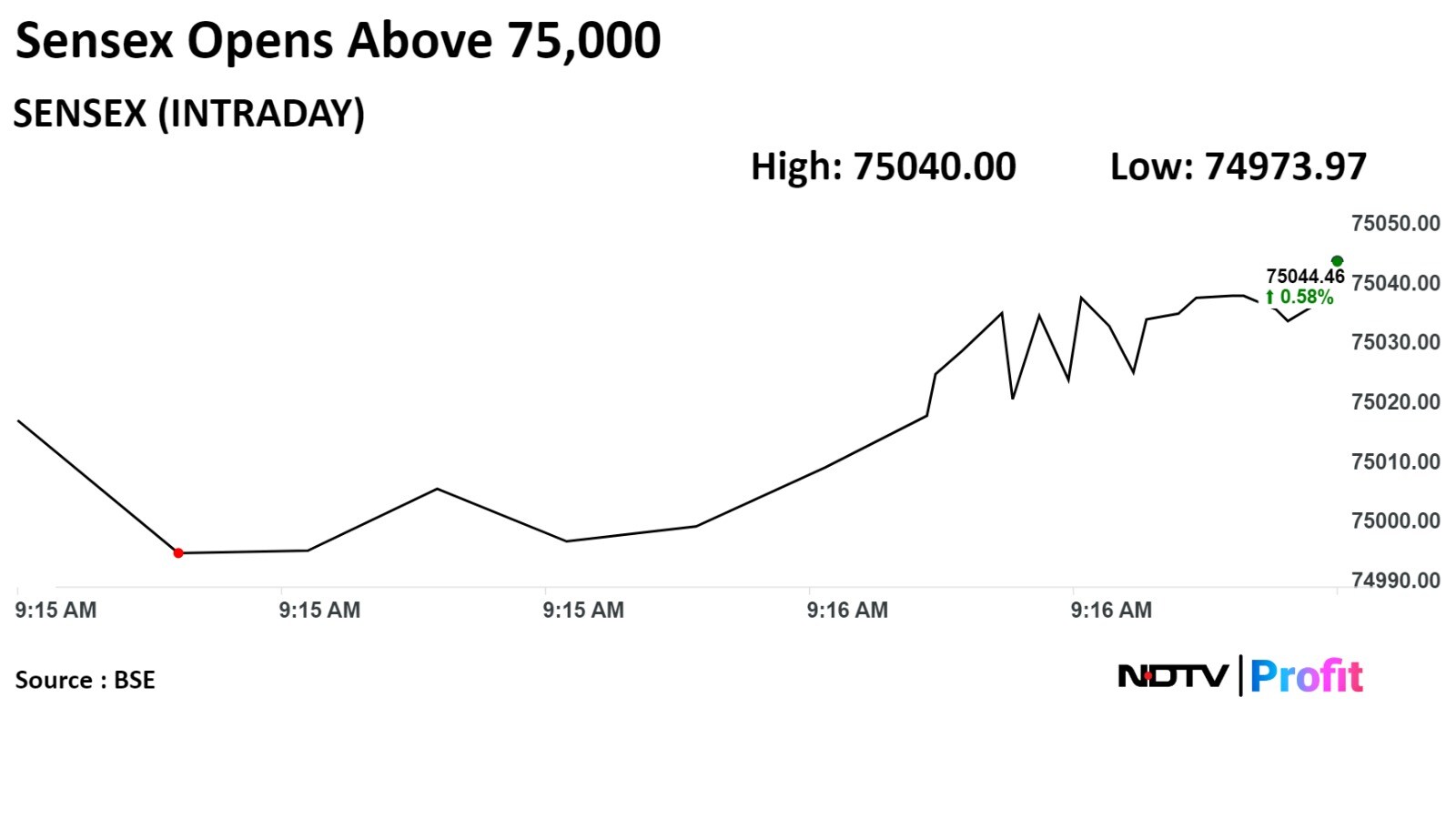

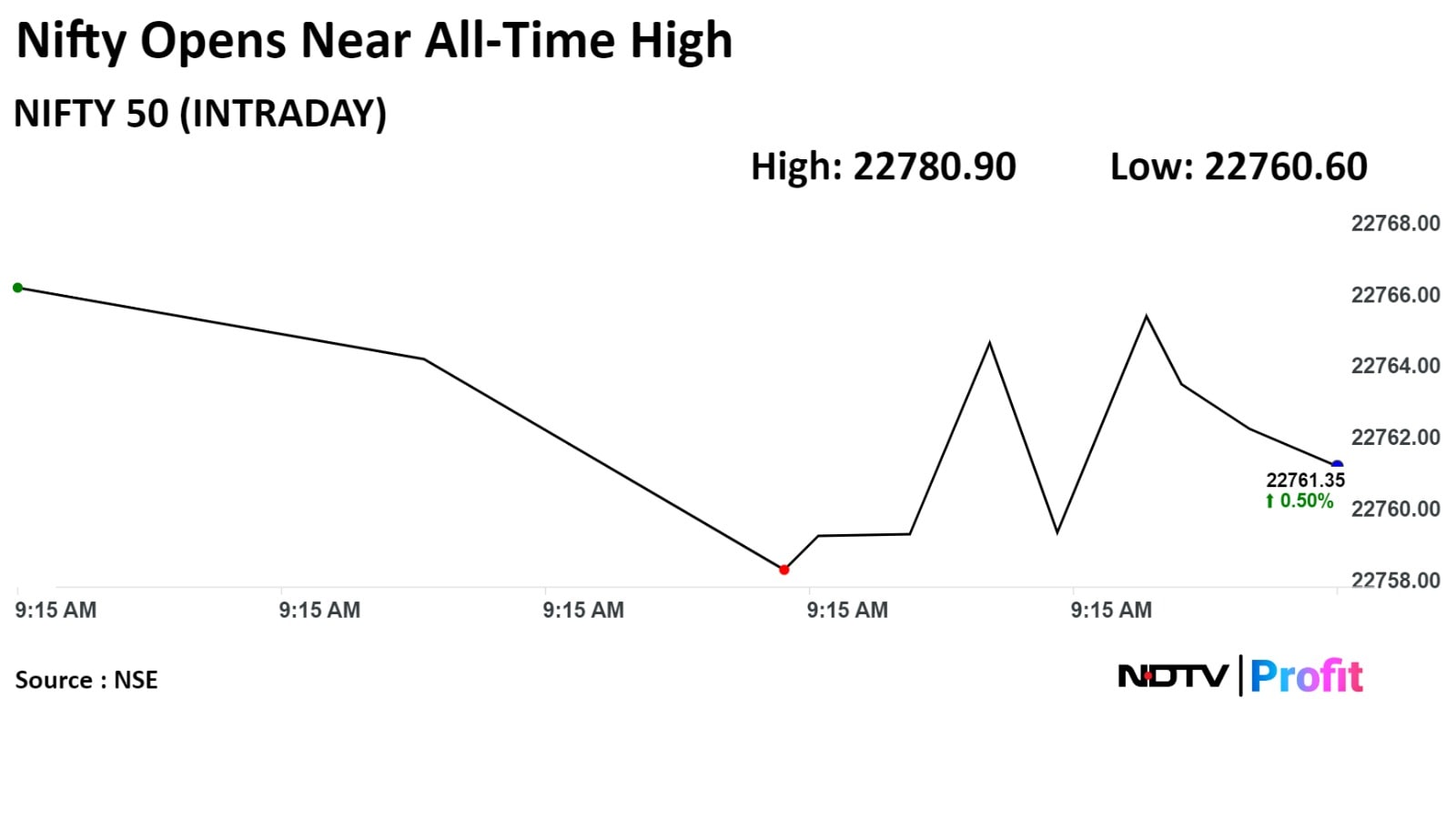

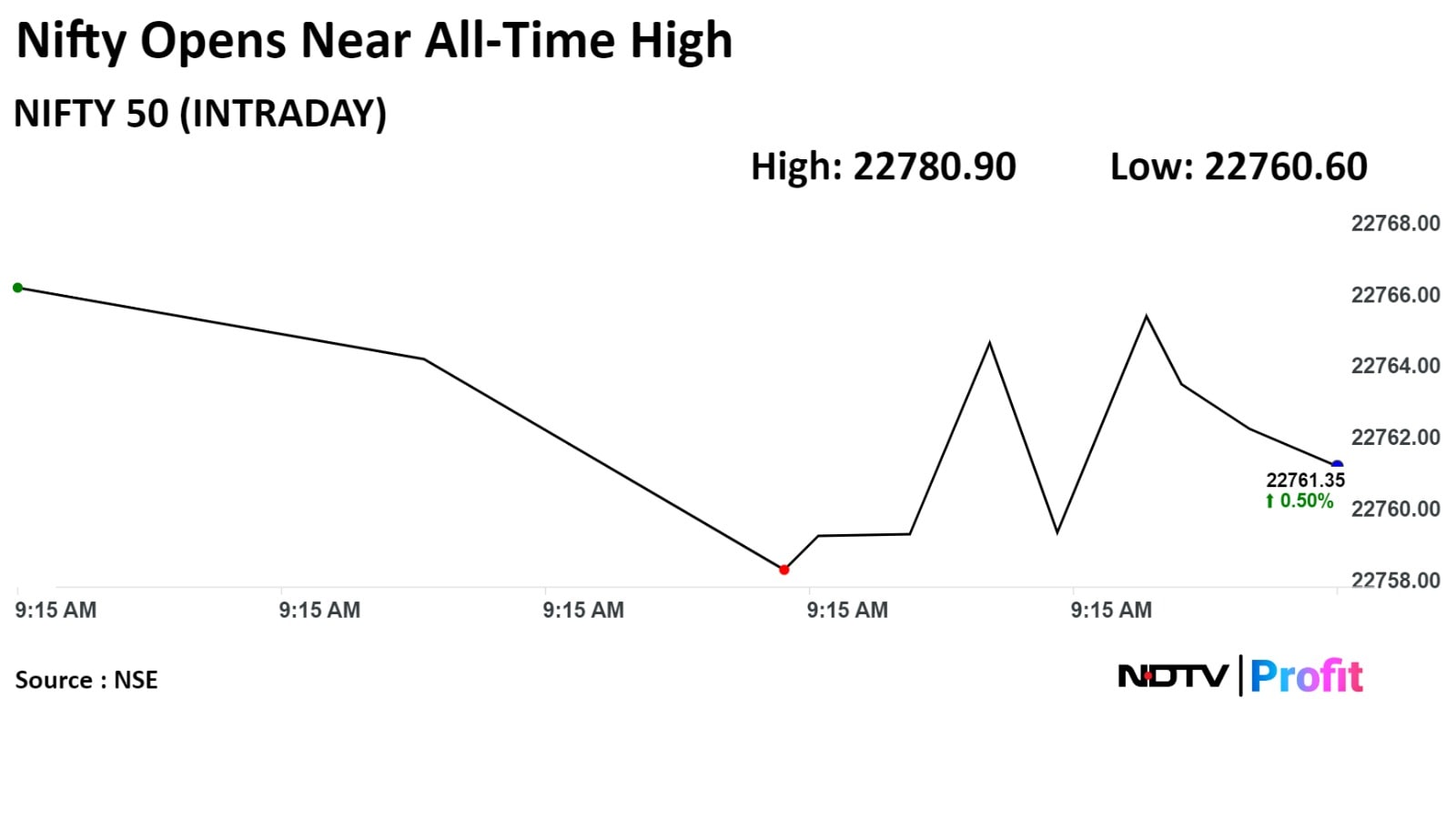

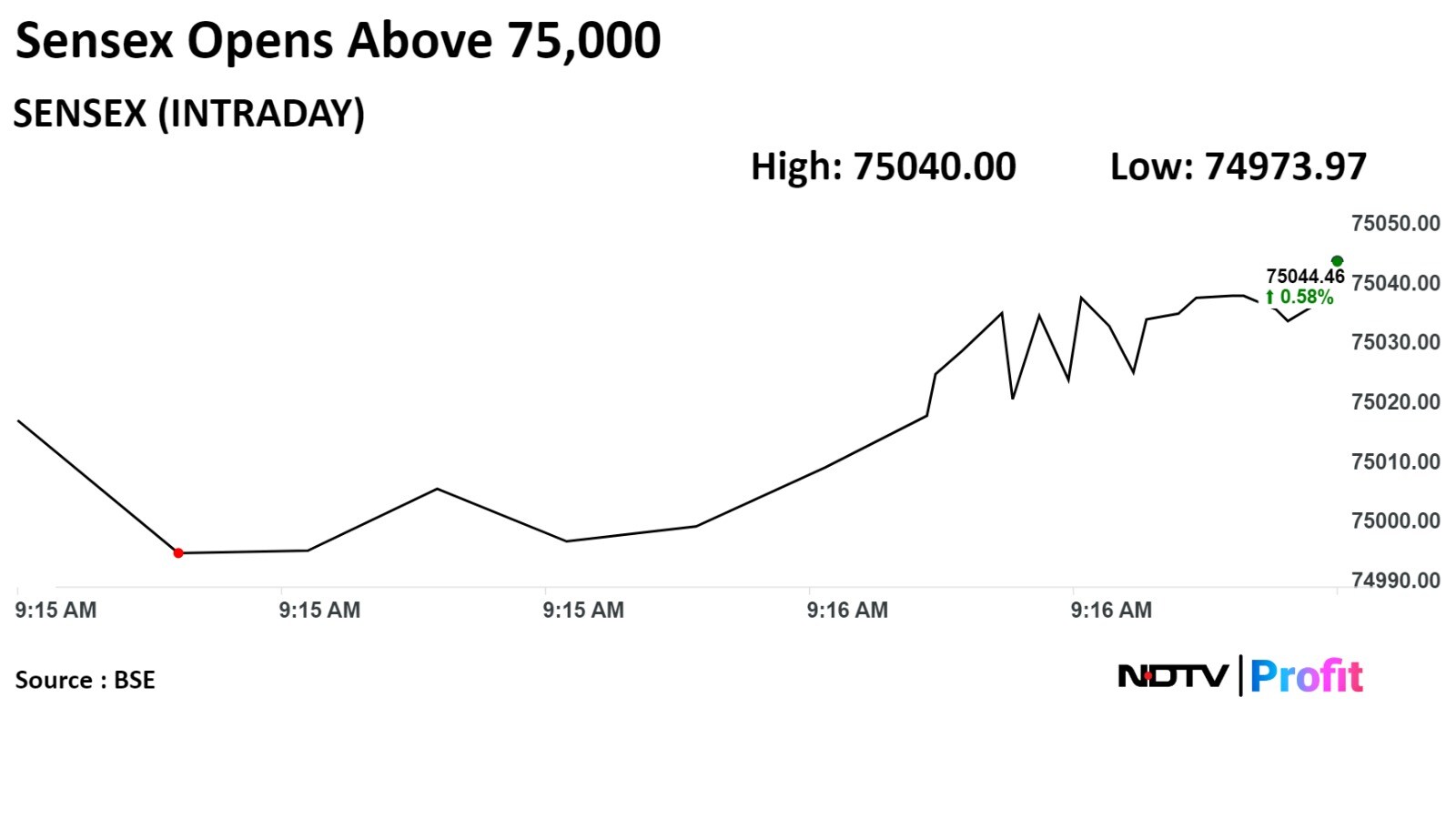

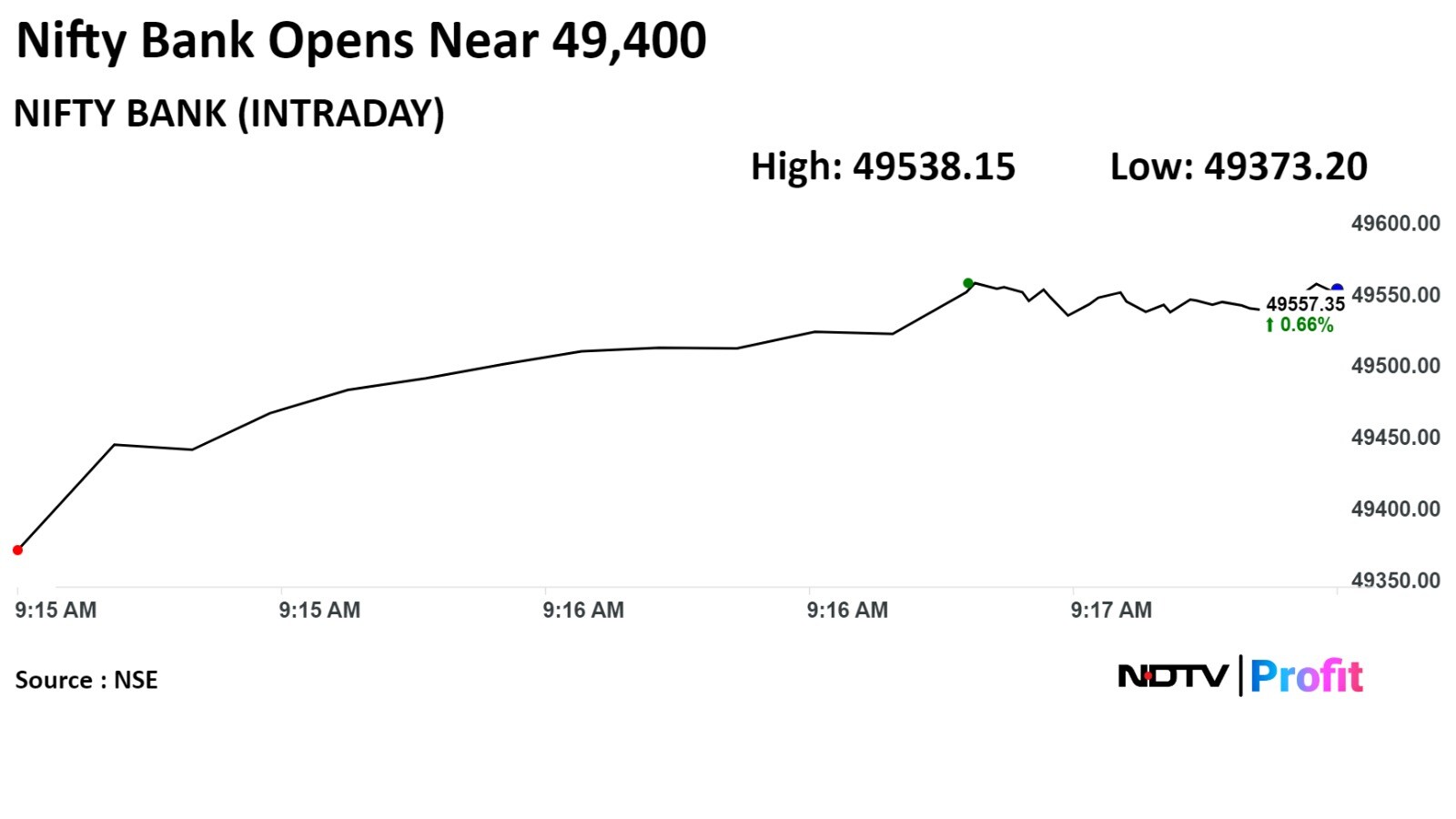

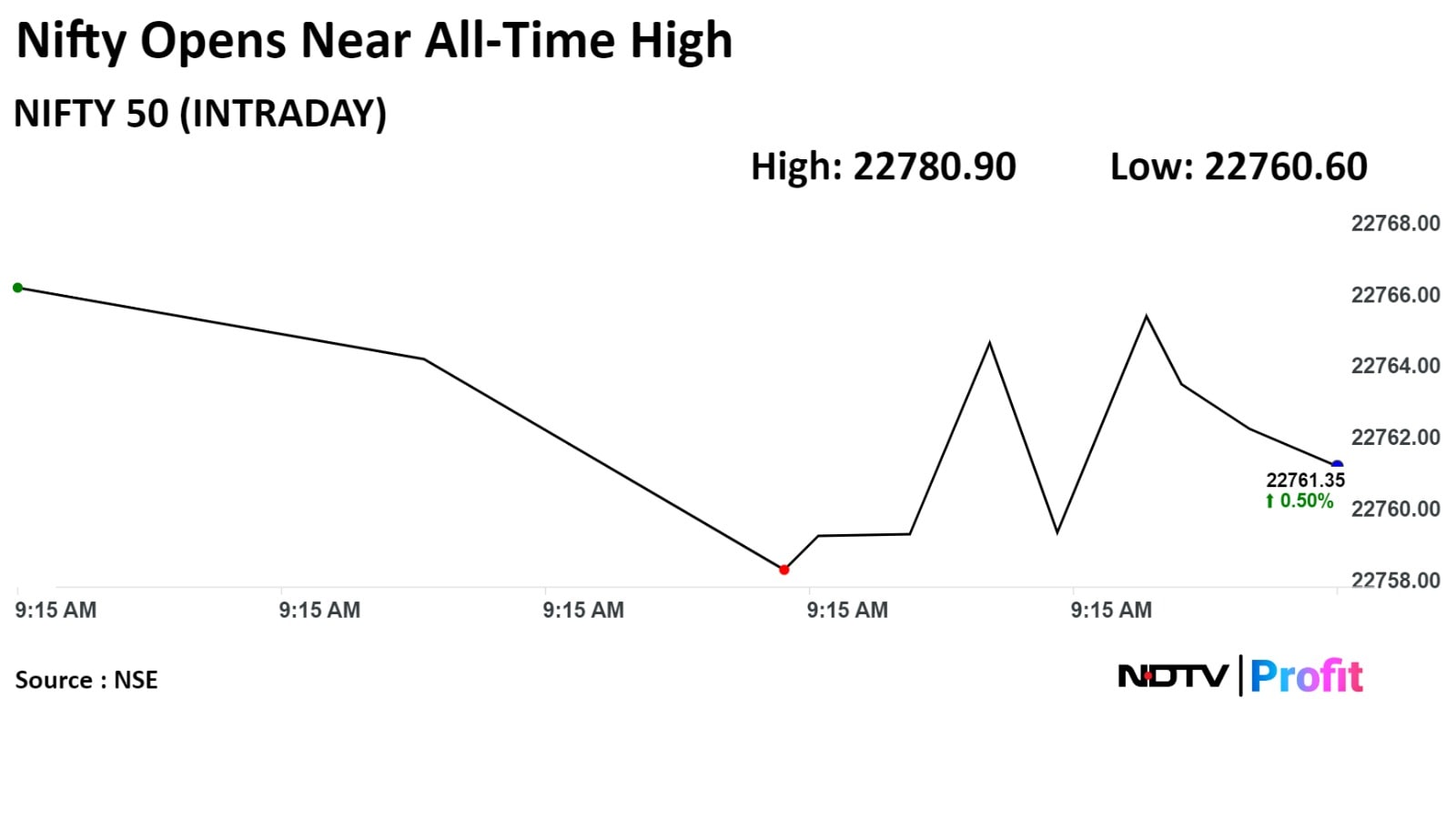

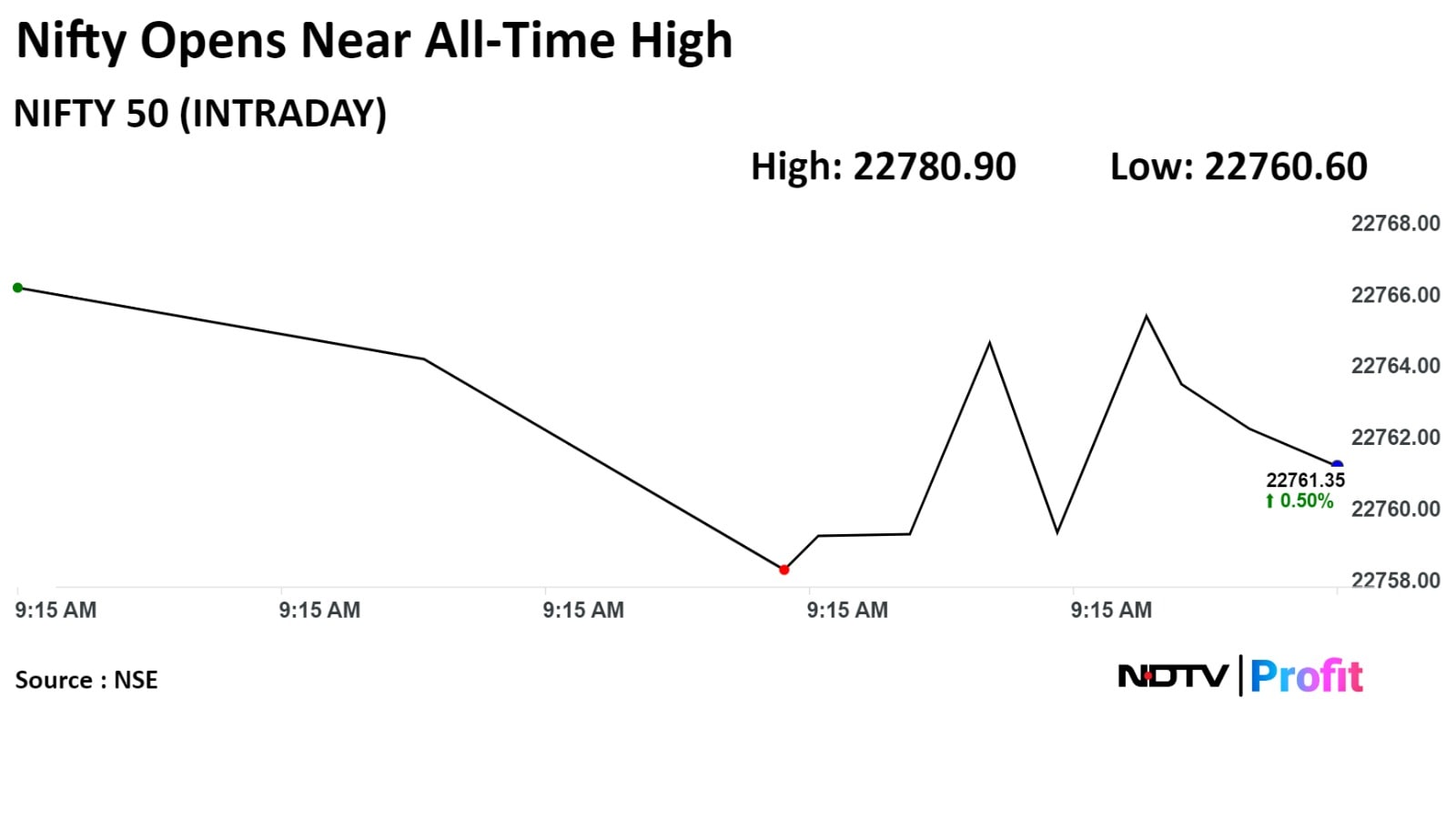

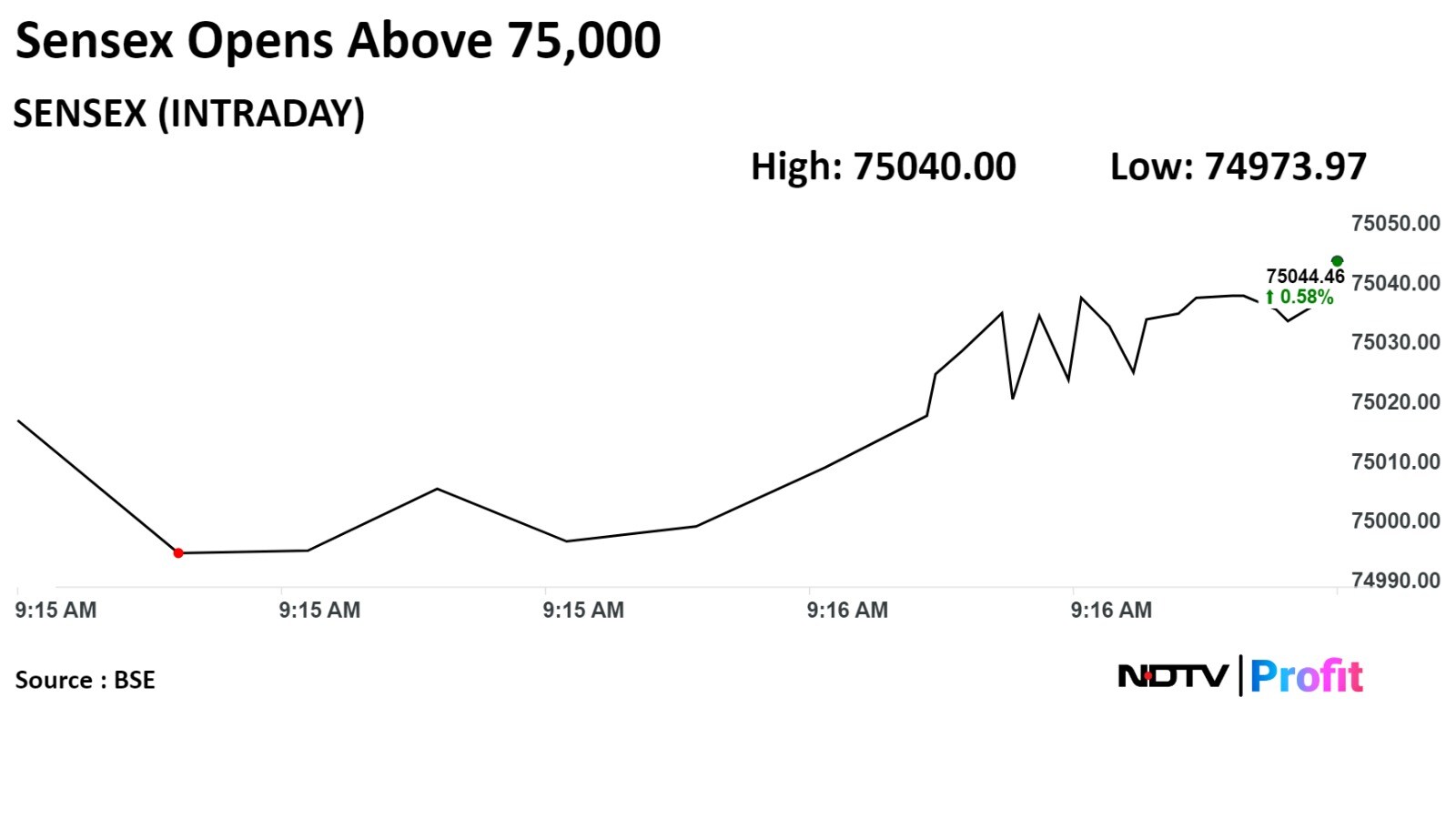

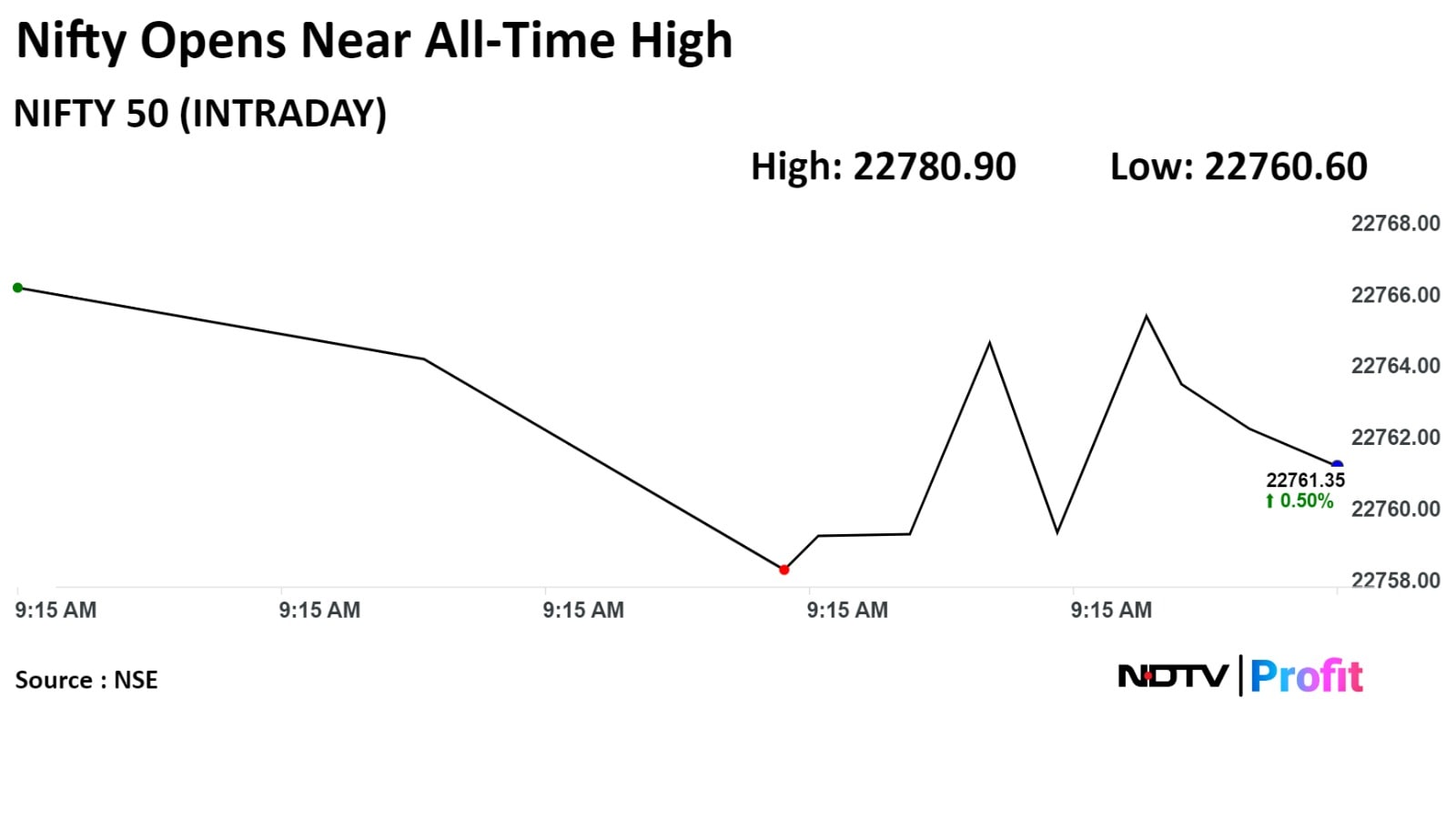

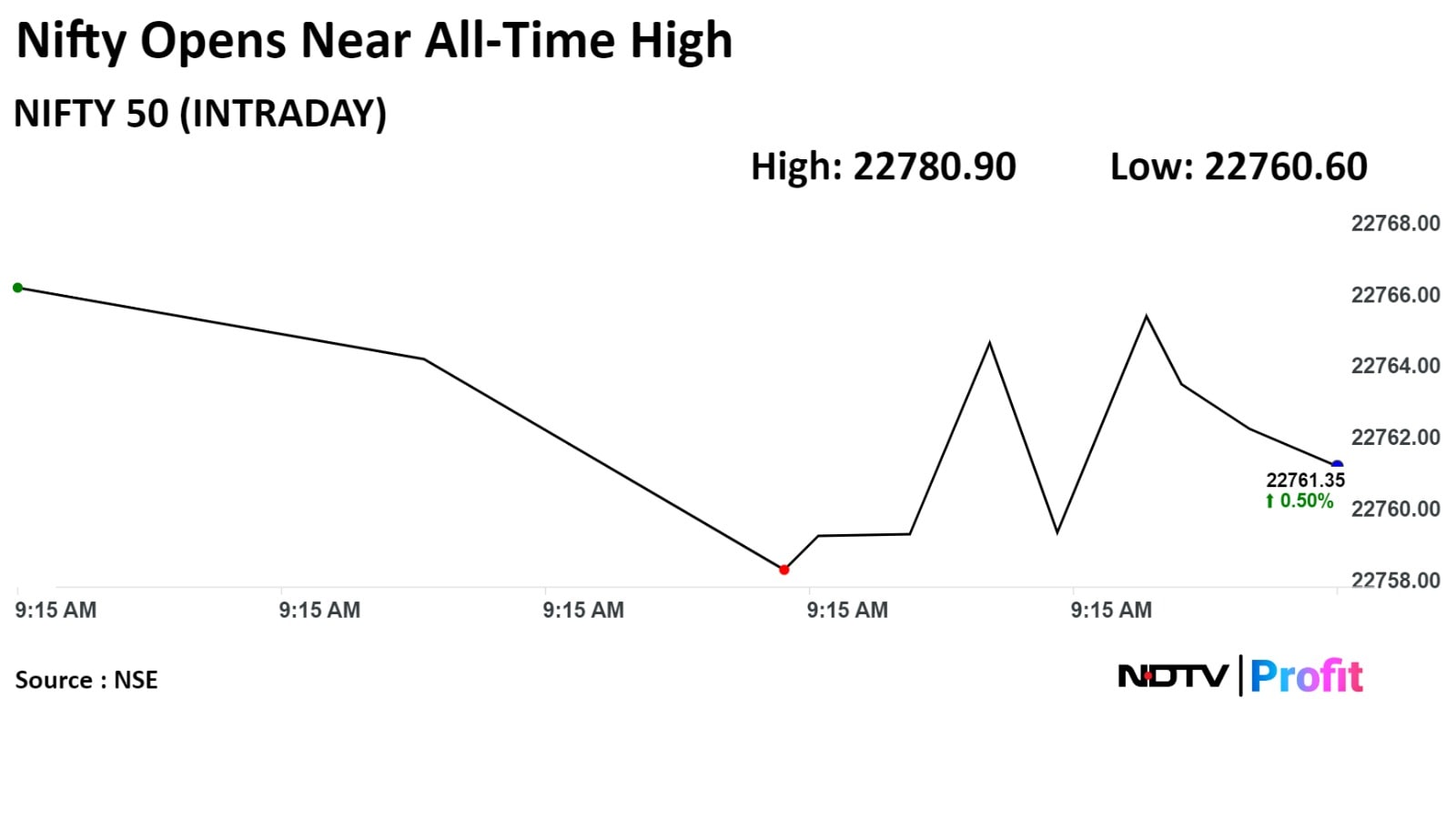

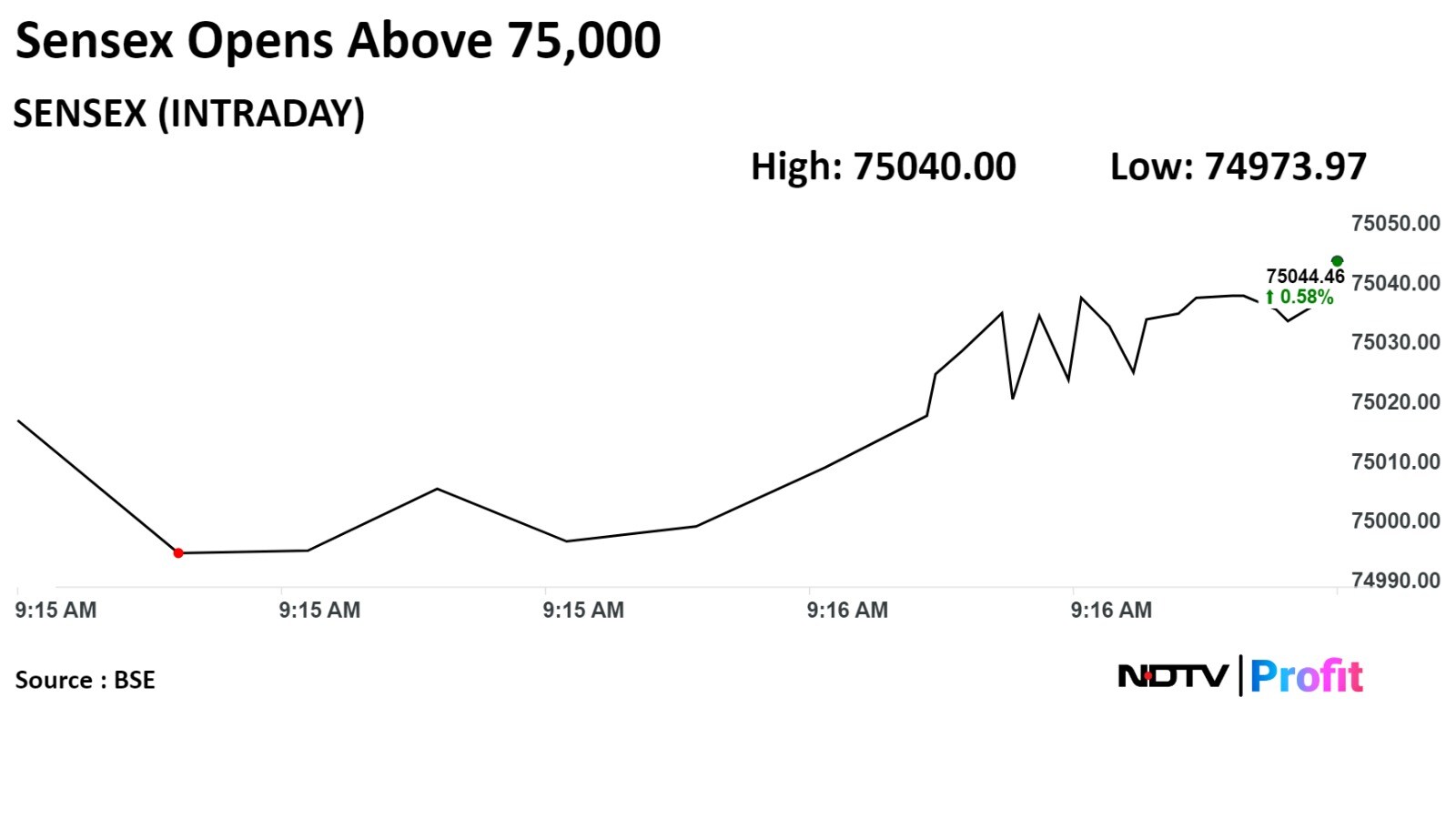

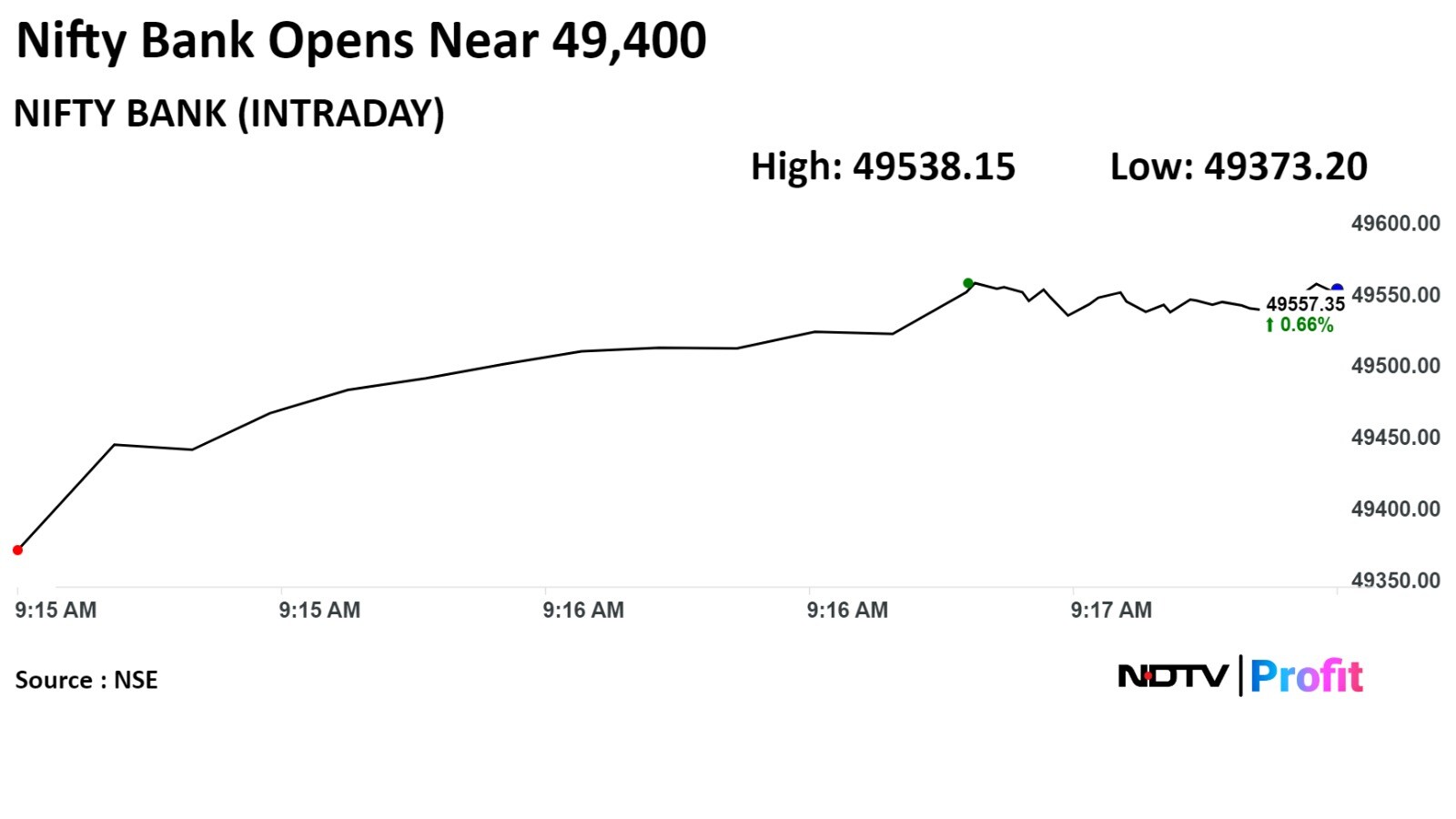

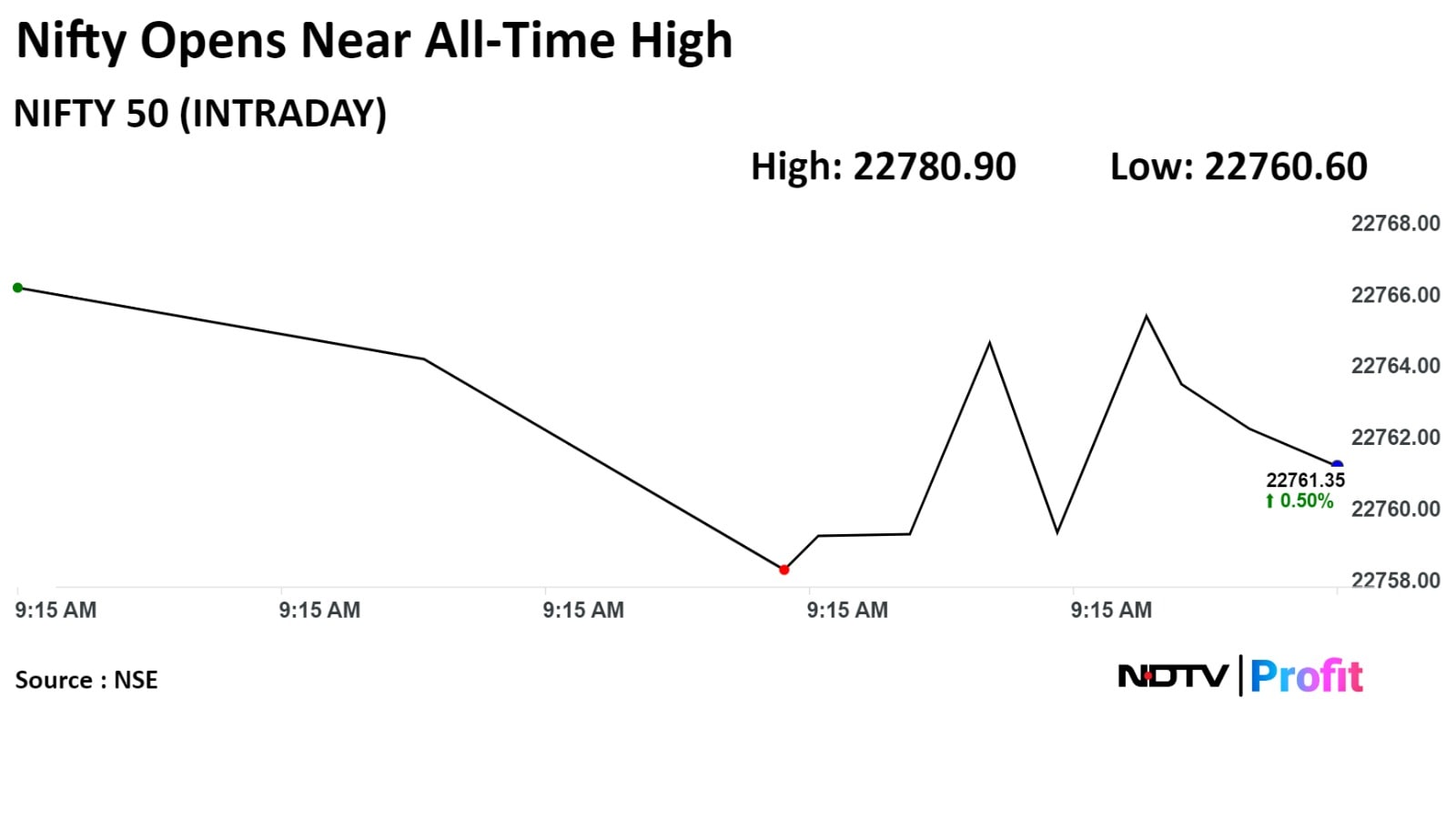

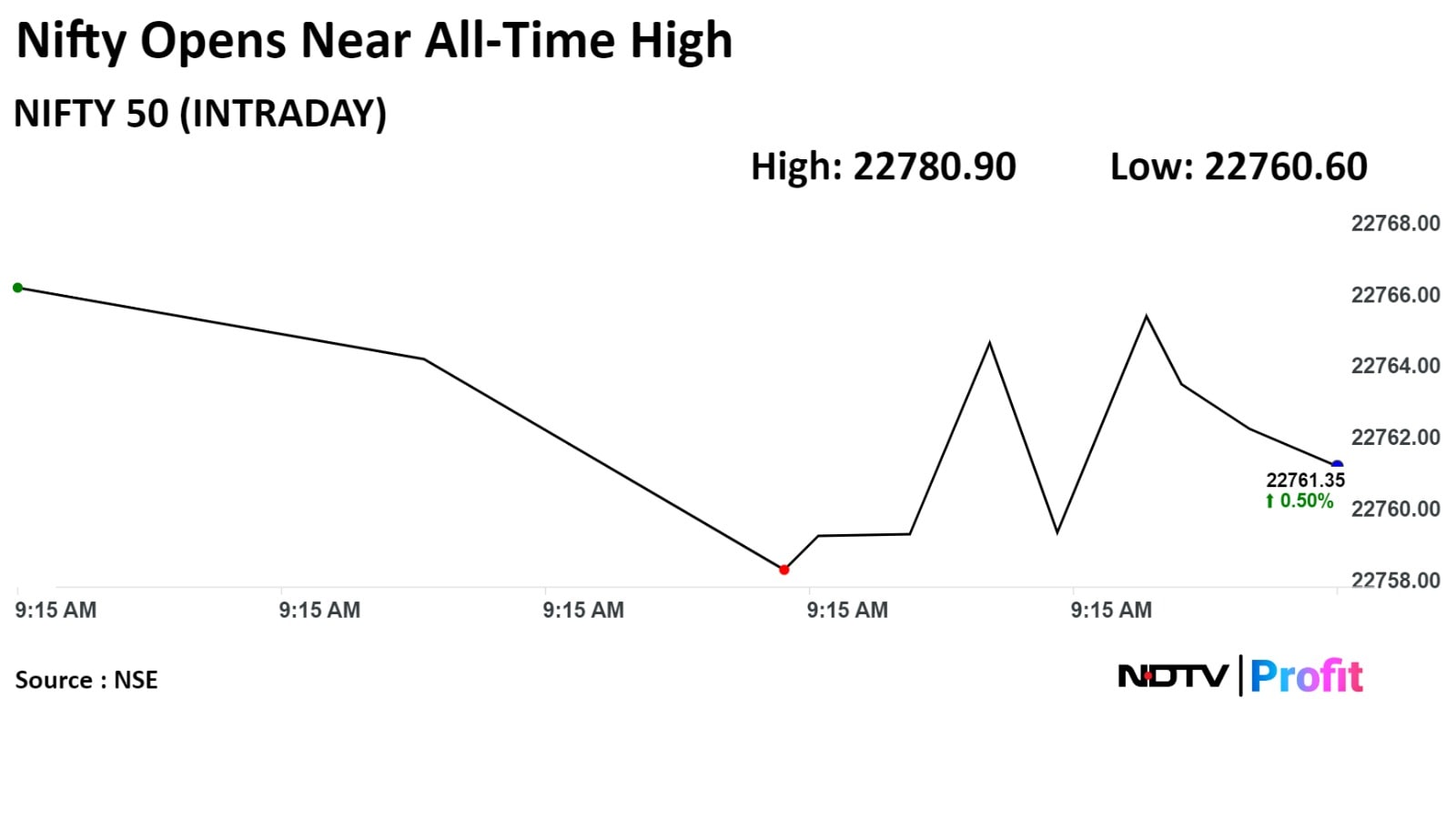

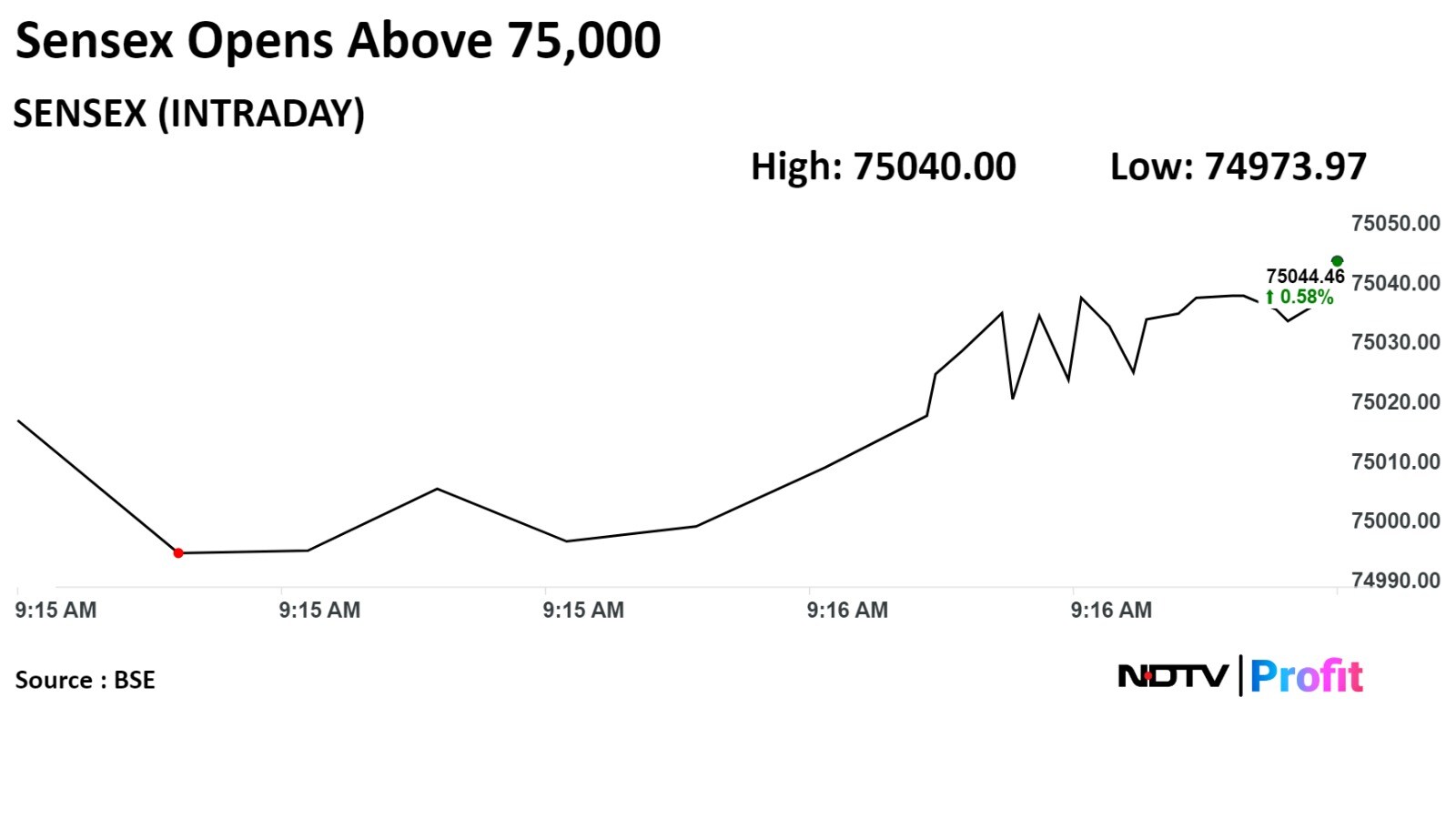

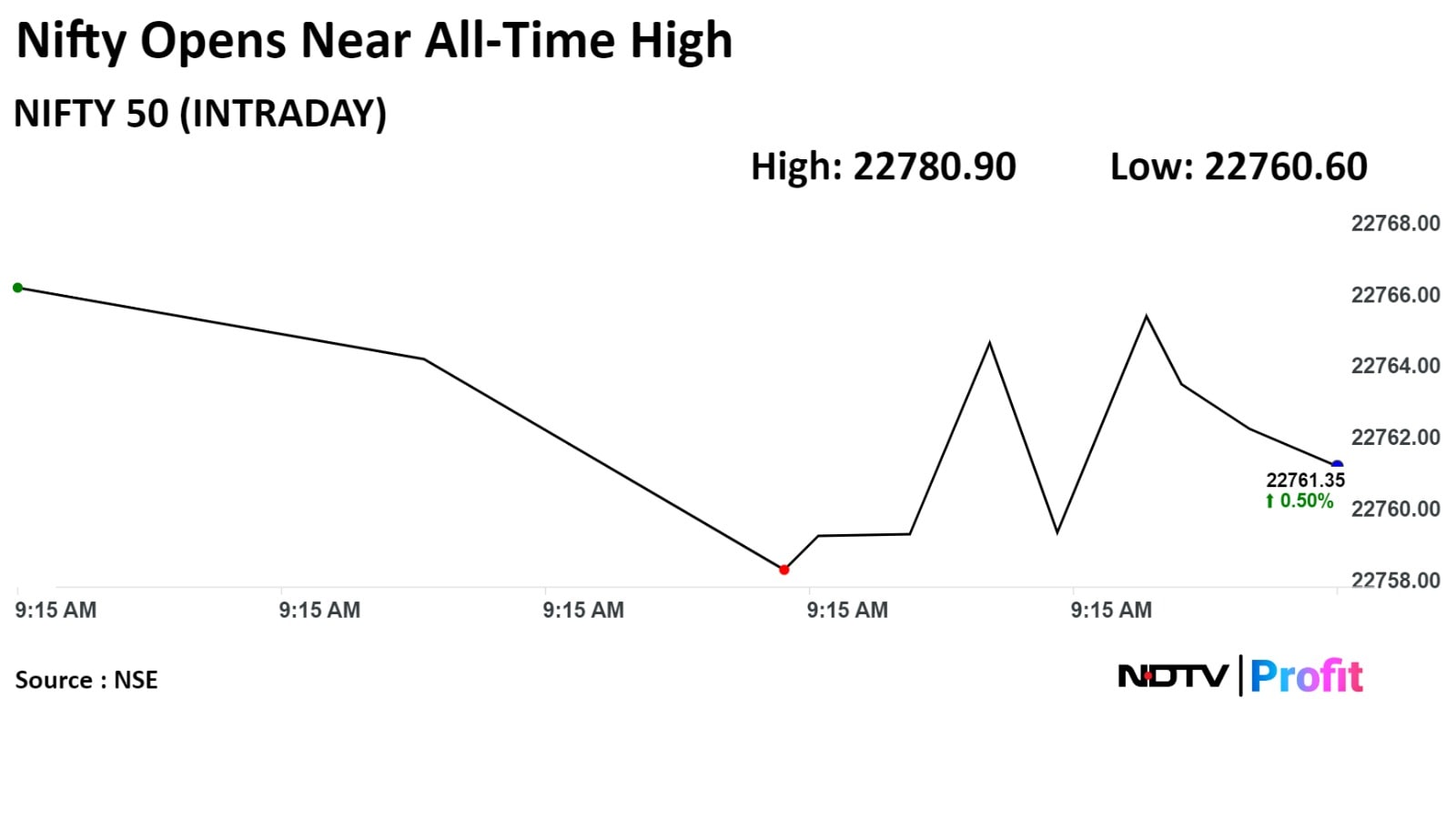

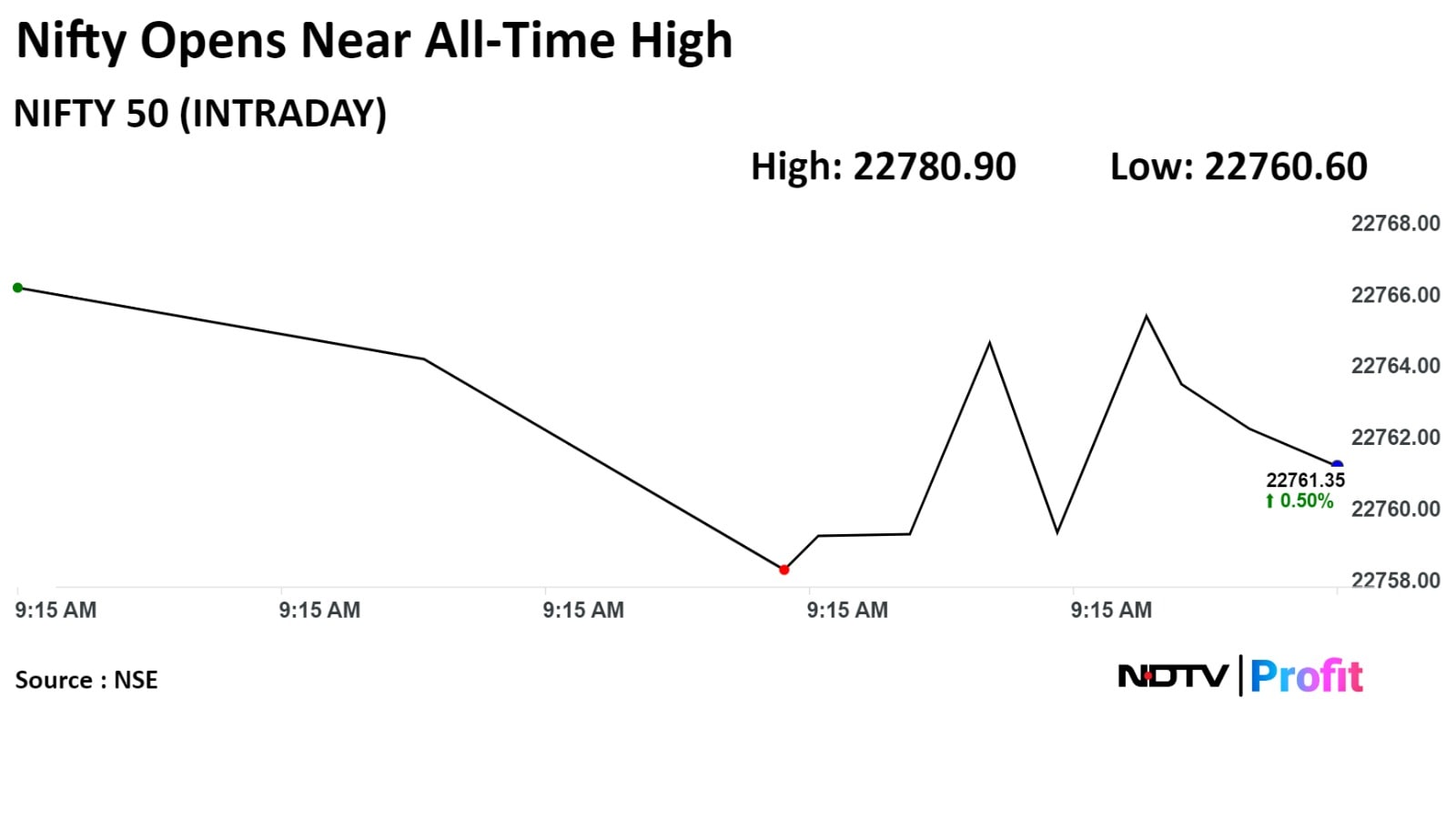

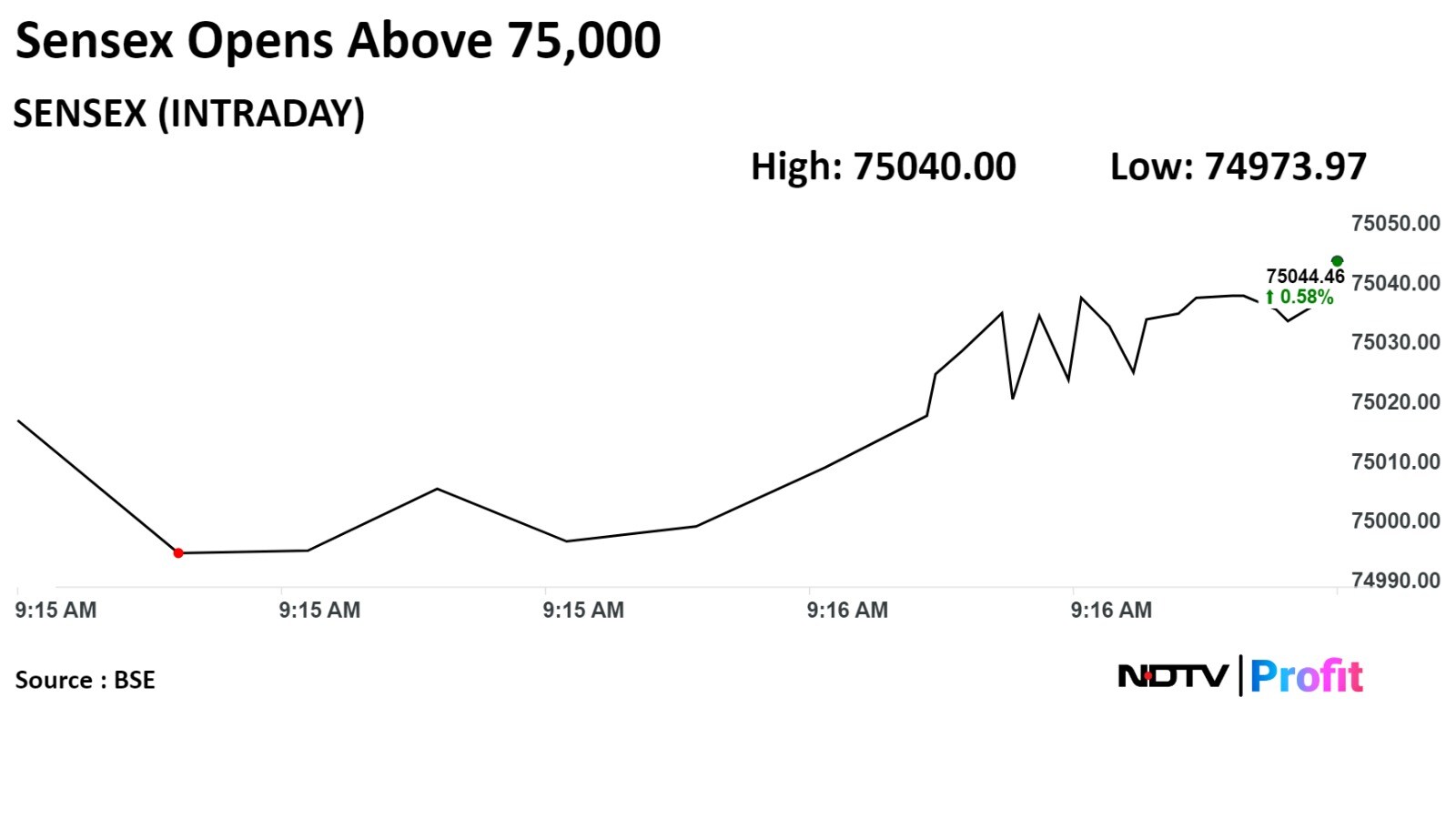

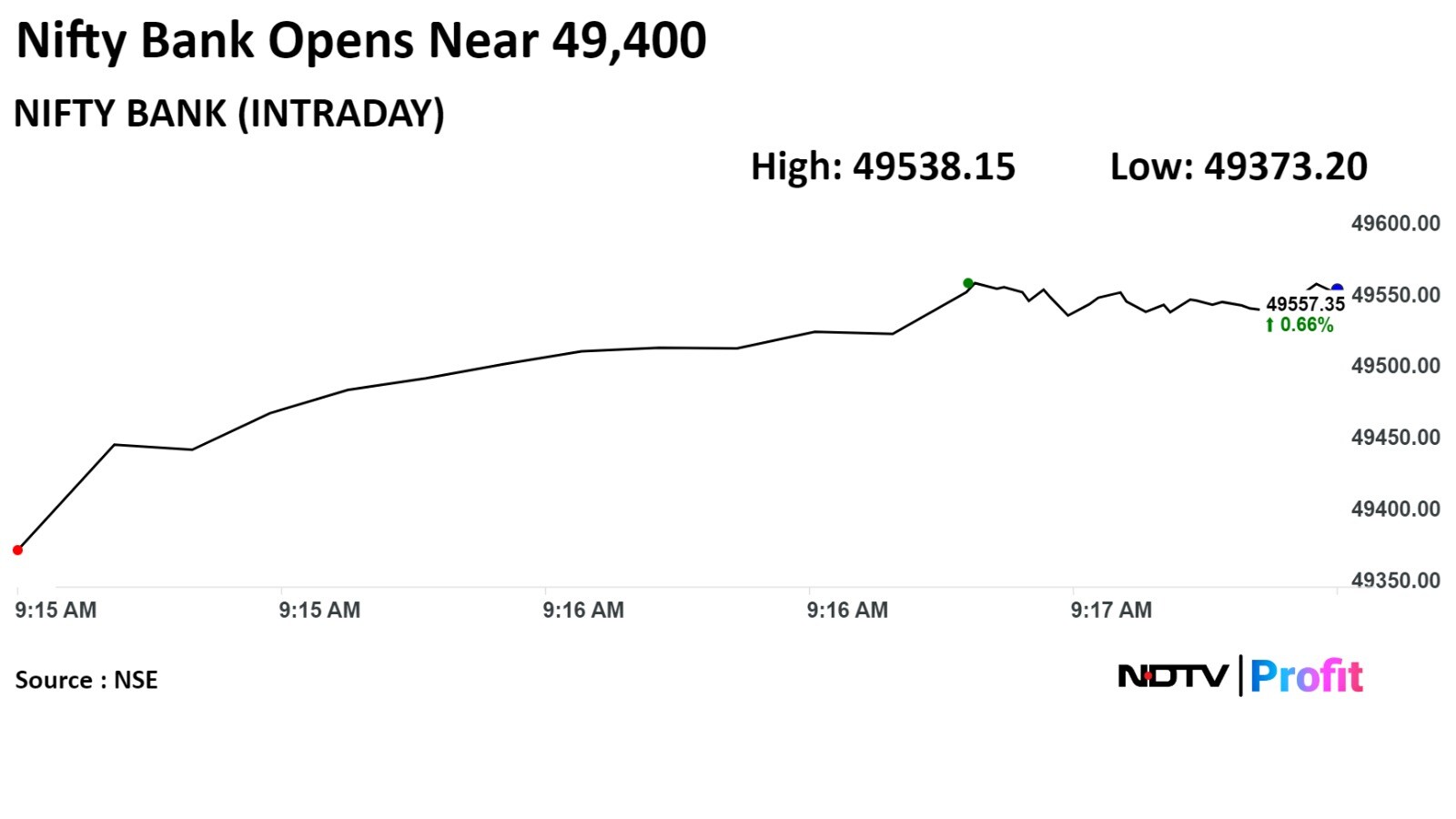

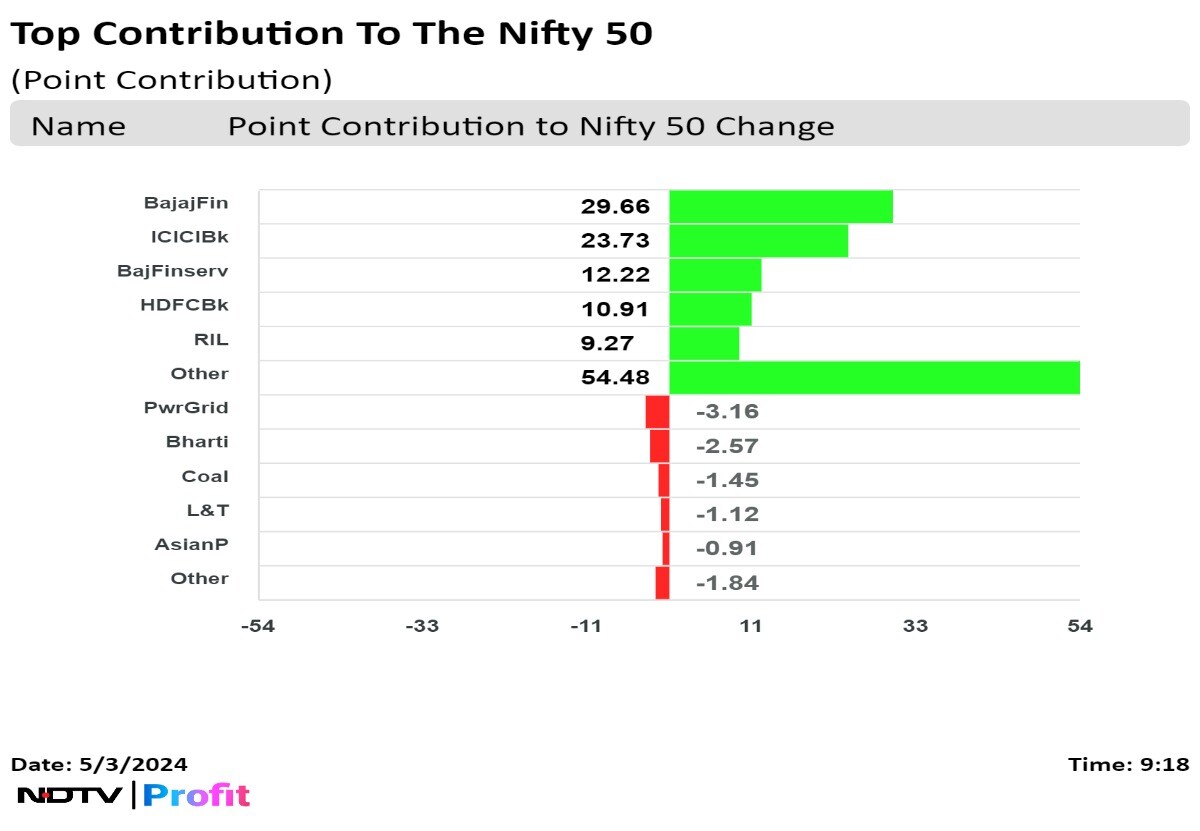

Extending gains, India's benchmarks opened higher on Friday, just shy of its record high levels, tracking a rise in Bajaj Finance Ltd., ICICI Bank Ltd.

As of 09:17 a.m., the NSE Nifty 50 was trading 128.75 points or 0.57% higher at 22,776.95, and the S&P BSE Sensex was 439.47 points or 0.59% higher at 75,050.58.

"Nifty may cross record high today due to strong global market," said Vikas Jain, senior research analyst at Reliance Securities. " US Federal Reserve downplayed the prospect of further interest-rate hikes lifted US market up to 1.5%. US Payroll data will be released today, an important parameter for US economy growth outlook."

Reliance Securities expects a rally on the domestic market to continue backed by strong local and global cues. Yesterday, the equity benchmark Index ended with marginally gain but action shifted to mid-cap and small cap stocks. Falling dollar Index to one-month low will be positive for metal stocks. The brokerage expected rally to continue on Auto, banking, midcap and small cap stocks, Jain added.

Extending gains, India's benchmarks opened higher on Friday, just shy of its record high levels, tracking a rise in Bajaj Finance Ltd., ICICI Bank Ltd.

As of 09:17 a.m., the NSE Nifty 50 was trading 128.75 points or 0.57% higher at 22,776.95, and the S&P BSE Sensex was 439.47 points or 0.59% higher at 75,050.58.

"Nifty may cross record high today due to strong global market," said Vikas Jain, senior research analyst at Reliance Securities. " US Federal Reserve downplayed the prospect of further interest-rate hikes lifted US market up to 1.5%. US Payroll data will be released today, an important parameter for US economy growth outlook."

Reliance Securities expects a rally on the domestic market to continue backed by strong local and global cues. Yesterday, the equity benchmark Index ended with marginally gain but action shifted to mid-cap and small cap stocks. Falling dollar Index to one-month low will be positive for metal stocks. The brokerage expected rally to continue on Auto, banking, midcap and small cap stocks, Jain added.

Extending gains, India's benchmarks opened higher on Friday, just shy of its record high levels, tracking a rise in Bajaj Finance Ltd., ICICI Bank Ltd.

As of 09:17 a.m., the NSE Nifty 50 was trading 128.75 points or 0.57% higher at 22,776.95, and the S&P BSE Sensex was 439.47 points or 0.59% higher at 75,050.58.

"Nifty may cross record high today due to strong global market," said Vikas Jain, senior research analyst at Reliance Securities. " US Federal Reserve downplayed the prospect of further interest-rate hikes lifted US market up to 1.5%. US Payroll data will be released today, an important parameter for US economy growth outlook."

Reliance Securities expects a rally on the domestic market to continue backed by strong local and global cues. Yesterday, the equity benchmark Index ended with marginally gain but action shifted to mid-cap and small cap stocks. Falling dollar Index to one-month low will be positive for metal stocks. The brokerage expected rally to continue on Auto, banking, midcap and small cap stocks, Jain added.

Extending gains, India's benchmarks opened higher on Friday, just shy of its record high levels, tracking a rise in Bajaj Finance Ltd., ICICI Bank Ltd.

As of 09:17 a.m., the NSE Nifty 50 was trading 128.75 points or 0.57% higher at 22,776.95, and the S&P BSE Sensex was 439.47 points or 0.59% higher at 75,050.58.

"Nifty may cross record high today due to strong global market," said Vikas Jain, senior research analyst at Reliance Securities. " US Federal Reserve downplayed the prospect of further interest-rate hikes lifted US market up to 1.5%. US Payroll data will be released today, an important parameter for US economy growth outlook."

Reliance Securities expects a rally on the domestic market to continue backed by strong local and global cues. Yesterday, the equity benchmark Index ended with marginally gain but action shifted to mid-cap and small cap stocks. Falling dollar Index to one-month low will be positive for metal stocks. The brokerage expected rally to continue on Auto, banking, midcap and small cap stocks, Jain added.