That's all for today folks. While the markets have closed and the holiday season gets closer I am sure you are planning a trip somewhere. But if you are planning to go to Goa, maybe you can instead shift the location to Thailand as the hotel prices in Goa gets costlier than Thailand.

Read more here.

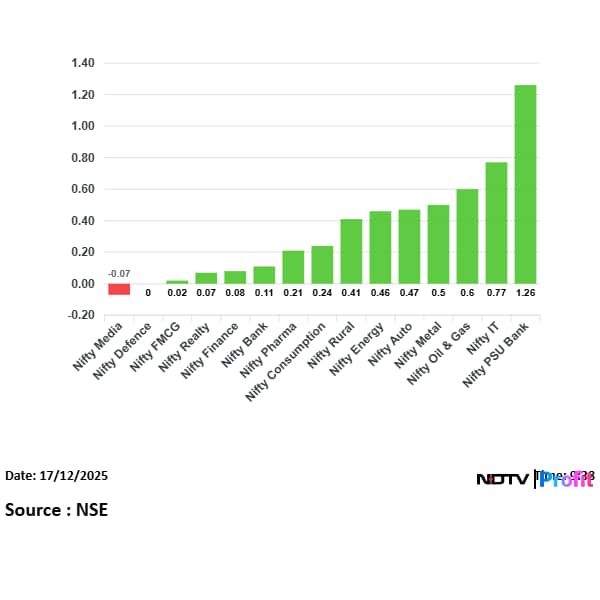

Most sectoral indices fell with Nifty Media leading the decline. Nifty PSU Bank and Nifty IT were in the green.

Nifty Media fell over 2% in trade and emerged as the top losing sector for the day.

Nifty Realty fell for the third consecutive day with Raymond and Sobha as the top losers.

Nifty Auto fall for the 3rd consecutive day

The market breadth was skewed in the favour of sellers, as 2,684 stocks declined, 1,481 advanced and 183 remained unchanged on the BSE.

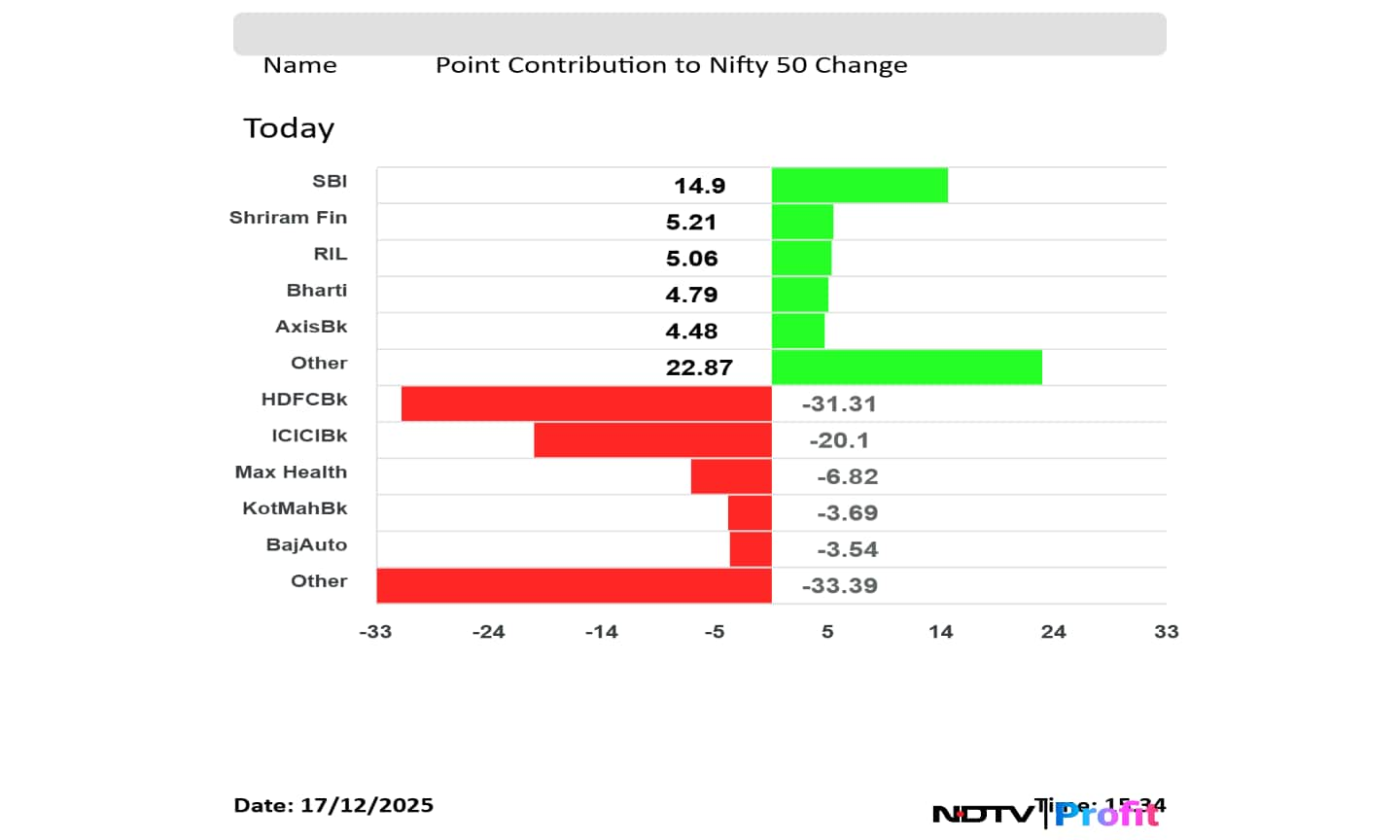

SBI, Shriram Finance, RIL, Bharti Airtel and Axis Bank emerged as the top gainers for the day.

On the other hand, HDFC Bank, ICICI Bank, Max Health, Kotak Mahindra Bank and Bajaj Auto were the worst performers of the Nifty 50 index.

Most sectoral indices fell with Nifty Media leading the decline. Nifty PSU Bank and Nifty IT were in the green.

Nifty Media fell over 2% in trade and emerged as the top losing sector for the day.

Nifty Realty fell for the third consecutive day with Raymond and Sobha as the top losers.

Nifty Auto fall for the 3rd consecutive day

The market breadth was skewed in the favour of sellers, as 2,684 stocks declined, 1,481 advanced and 183 remained unchanged on the BSE.

SBI, Shriram Finance, RIL, Bharti Airtel and Axis Bank emerged as the top gainers for the day.

On the other hand, HDFC Bank, ICICI Bank, Max Health, Kotak Mahindra Bank and Bajaj Auto were the worst performers of the Nifty 50 index.

The benchmark equity indices extend loosing streak for the third day on Wednesday.

Intraday, both Nifty and Sensex had fallen nearly 0.35%.

Nifty ends 41.55 points or 0.16% lower at 25,818.55.

Sensex ends 102.88 points or 0.12% down at 84,577.

Broader indices also closed lower. Nifty Midcap 150 ended 0.55% lower with Indian Overseas Bank and FACT as the top losers in trade.

Nifty Smallcap 250 closed 0.72% lower extending decline for the second consecutive day. Decline was led by Saregama and Data Patterns.

The benchmark equity indices extend loosing streak for the third day on Wednesday.

Intraday, both Nifty and Sensex had fallen nearly 0.35%.

Nifty ends 41.55 points or 0.16% lower at 25,818.55.

Sensex ends 102.88 points or 0.12% down at 84,577.

Broader indices also closed lower. Nifty Midcap 150 ended 0.55% lower with Indian Overseas Bank and FACT as the top losers in trade.

Nifty Smallcap 250 closed 0.72% lower extending decline for the second consecutive day. Decline was led by Saregama and Data Patterns.

Nifty that has underperformed in comparison to its global peers is likely to touch 30,000 in the coming years as the worst phase of earnings downgrades and macro pressures is behind India, setting the stage for a stronger performance over the next year.

Check what brokerages have to say. Click here.

The medium- and heavy-commercial-vehicle (MHCV) cycle is turning after a prolonged slowdown. The GST cut from 28% to 18% has lowered ownership costs and improved fleet profitability. This is expected to translate into higher demand, with Ambit Capital estimating that MHCV industry volumes will grow at a 4.2% CAGR over FY25–FY28.

Read full story here.

Over 1 million shares of Eternal were traded via a block deal on Wednesday. The share of Power Grid rose as much as 2.13% to Rs 290.50 apiece.

India VIX below 10 intra-day

20EMA remains key levels for Nifty, Nifty Bank

Rupee remains volatile

Options data suggest bearish sentiment

US macro data announcements this week

Threat of unwinding of yen carry trade

European markets open with negative bias

Tata Chemicals Ltd. on Wednesday said it has raised Rs 1,500 crore through the allotment of non-convertible debentures (NCDs) on a private placement basis.

Source: PTI

NTPC has 1.2 million shares change hands in a block deal. Shares of the company are currently trading 0.047% down, at Rs 320.85 apiece.

Power Grid is set to invest Rs 1,227 crore for the refurbishment of the Bhadrawati project in Maharashtra.

Source: Exchange Filing

Among other news updates, the iconic Tata Sierra on Wednesday announced that they have recorded over 70,000 confirmed bookings on the very first day of bookings.

Additionally, 1.35 lakh prospective customers also submitted their preferred configuration as they are progressing to complete booking formalities, the Mumbai-based auto major said.

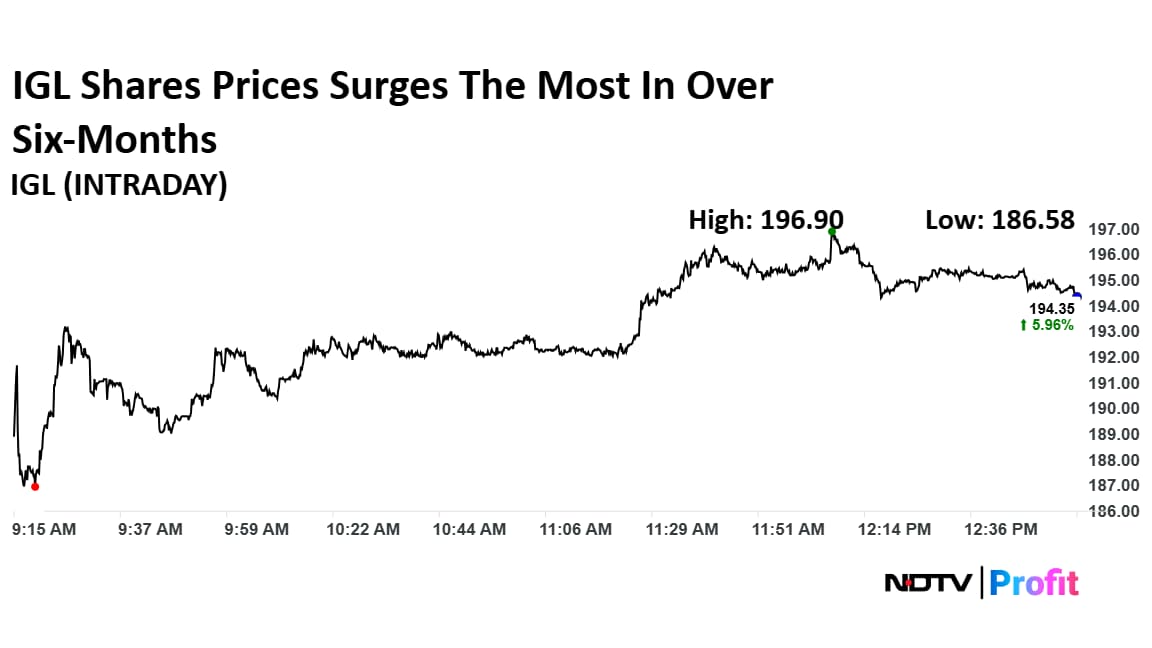

Indraprastha Gas Ltd. shares jumped over 7% intra-day, marking the stock’s biggest single-session move in over six-months, as multiple positive triggers came together to revive investor confidence after a sharp correction.

Read more to find out the reasons. Click here.

Indraprastha Gas Ltd. shares jumped over 7% intra-day, marking the stock’s biggest single-session move in over six-months, as multiple positive triggers came together to revive investor confidence after a sharp correction.

Read more to find out the reasons. Click here.

Persistent global uncertainties and constant selling from foreign investors have dampened sentiment in Indian markets, leading to a significant drop in cash market volumes, according to Anand Rathi Share & Stockbroking CMD Pradeep Gupta.

Speaking to NDTV Profit, Gupta highlighted how the market is currently grappling with a 'hangover' in sentiment, even as market experts see major tailwinds heading into 2026.

Indian equities were trading lower extending decline for the third day. Nifty fell nearly 0.22% at 25,801.80 and Sensex fell nearly 194.61 points to 84,485.25 as of 12 p.m.

Intraday, both Nifty and Sensex fell nearly 0.30%.

Nifty fell 0.27% at 25,789.05.

Sensex fell 0.69% to 84,437.91.

Broader indices were trading lower. Nifty Midcap 150 fell 0.33%; Nifty Smallcap 250 was trading 0.31% lower.

Most sectoral indices fell, led by Nifty Media and Nifty Defence.

Nifty Bank fell 0.21%, Nifty IT was up nearly 0.23%.

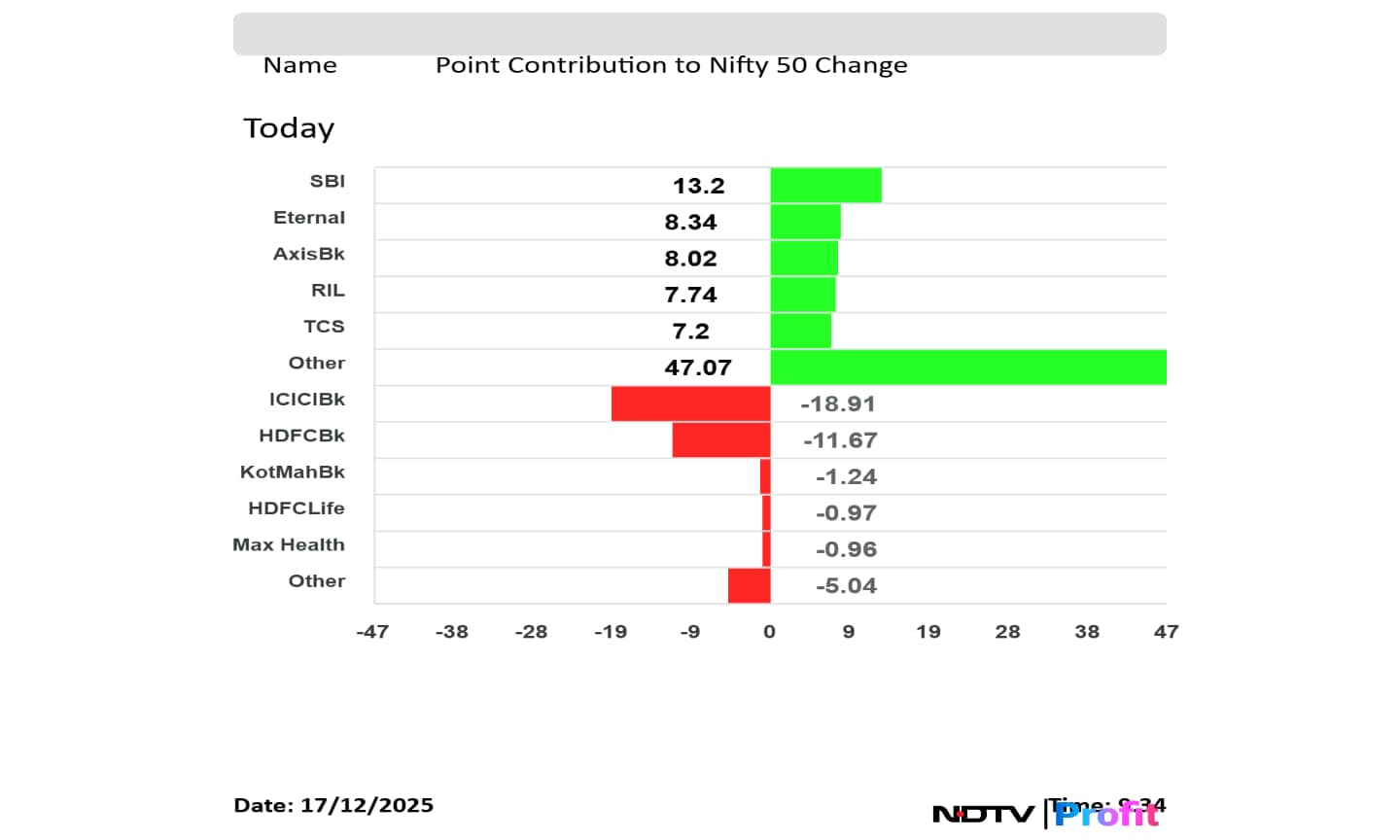

SBI, Axis Bank, Shriram Finance, TCS and Hindalco were top Nifty gainers.

HDFC Bank, ICICI Bank, Max Health, Kotak Mahindra Bank and Mahindra & Mahindra were top Nifty losers.

Over 4.06 million shares of Power Grid were traded via a block deal on Wednesday. The share of Power Grid rose as much as 0.92% to Rs 262.75 apiece.

The board on Wednesday approved allotment of 1 crore warrants at Rs 470.3 apiece.

The company will issue warrants to promoter entity Quyosh Energia.

Source: Exchange Filing

Ahluwalia Contracts stock was already in focus on Wednesday, but adding to the positive sentiment the company announced that it has received Rs 888 crore civil construction order from Bihar State Tourism Development Corp.

Source: Exchange Filing

The Reserve Bank of India (RBI) conducted $5-billion dollar–rupee buy–sell swap with a three-year tenure on Tuesday, a move that has drawn attention amid renewed pressure on the rupee.

While the terminology may sound complex, the transaction is best understood as a temporary exchange of dollars and rupees between the RBI and banks, designed primarily to inject liquidity into the system rather than directly defend the currency.

Read full story here.

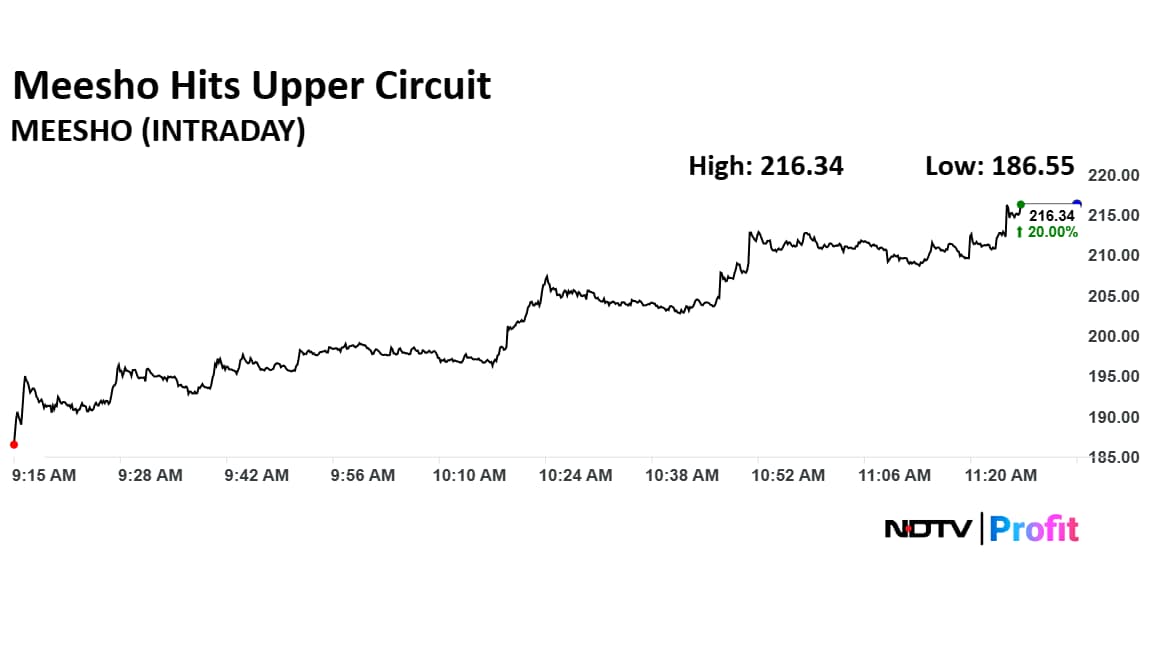

The shares of Meesho hit an upper circuit on Wednesday, after an initiation from UBS, which has put out a positive note on the counter.

The shares of Meesho hit an upper circuit on Wednesday, after an initiation from UBS, which has put out a positive note on the counter.

Shares of RBL Bank has faced pressure in trade today, falling well beyond 1.2% amid fears of expected credit loss (ECL) impact, as detailed in a recent Citi report.

The stock is currently trading at Rs 296, which is significantly lower than Tuesday's closing price of Rs 300. However, it must be noted that the stock has gone up 87% on a year-to-date basis.

Read full story here.

Diamond Power shares came into focus on Wednesday after it received Rs 55.5 crore letter of award from Bondada Engineering for the supply of power cables.

Source: Exchange Filing

The shares of L&T came into focus on Wednesday after the company announced through an exchange filing that it has won orders worth Rs 2,500 crore- Rs 5,000 crore for building and factories business in Madhya Pradesh.

Shares of Akzo Nobel India Ltd. fell as much as 15% on Wednesday after a large block deal in the stock, in line with market expectations.

About 5.19 crore shares, representing 11.4% of the company’s equity, changed hands in a block deal worth Rs 1,638.5 crore at a price of Rs 3,159 per share. The identities of the buyers and sellers were not immediately disclosed.

Shares of Park Medi World Ltd. listed at a discount on the National Stock Exchange, at a 1.98% dip from their IPO price of Rs 162. The company's stock debuted at Rs 158.80 apiece on the stock exchange. On the BSE, shares listed at Rs 160 apiece, marking a 1.23% dip.

Over 1.58 million shares of Bank of Baroda were traded via a block deal on Wednesday. The share of Bank of Baroda rose as much as 1.24% to Rs 286.35 apiece.

The scrip fell as much as 2.25% to Rs 1,779.50 apiece on Wednesday, the lowest level since Nov. 26. It pared gains to trade 2.13% lower at Rs 1,781.70 apiece, as of 10:30 a.m. This compares to a 0.18% decline in the NSE Nifty 50 Index.

It has fallen 16.57% in the last 12 months and 15.56% year-to-date. Total traded volume so far in the day stood at 0.35 times its 30-day average. The relative strength index was at 31.98.

The management of RBL Bank anticipated ECL impact to range between 10-15% of current net worth, it said in Citi Conference.

In the second call, they had guided for 6-8% of the net worth impact.

The shares of RBL Bank fell as much as 1.68% on Wednesday.

The government is not expected to take an immediate decision on a relief package for Vodafone Idea (Vi), with the Centre adopting a measured and cautious approach, according to government sources familiar with the matter.

Sources said the government is careful about taking any step that could have a direct bearing on the company’s valuation, particularly given its 49% equity stake in the telecom operator following the conversion of statutory dues into equity. Any policy move, sources indicated, is being assessed not just for its fiscal impact but also for potential market implications.

Nephrocare Health Services Ltd. listed on the National Stock Exchange on Wednesday at Rs 490 apiece, a premium of 6.52% over its issue price of Rs 460 apiece.

On the BSE, the stock debuted at Rs 491.70, a 6.89% premium.

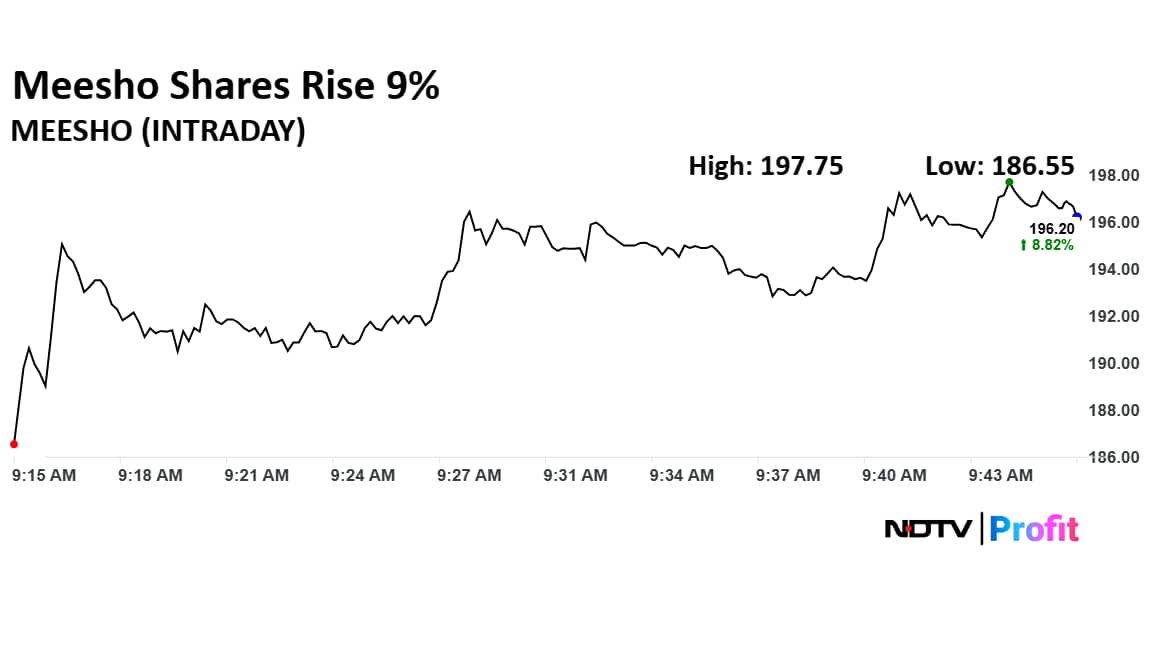

Shares of Meesho are buzzing in trade on Wednesday, rising more than 9% after an initiation from UBS, which has put out a positive note on the counter.

Read full story here.

Shares of Meesho are buzzing in trade on Wednesday, rising more than 9% after an initiation from UBS, which has put out a positive note on the counter.

Read full story here.

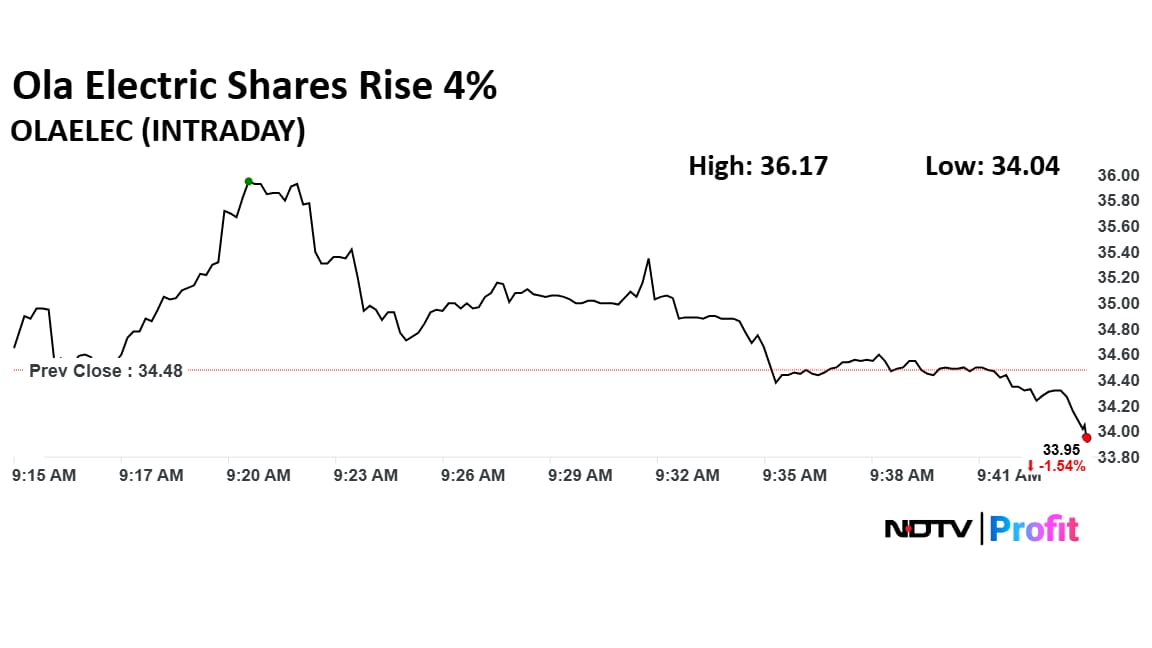

Shares of Ola Electric Mobility Ltd. on Wednesday rose by 4.6% at Rs 35.95 a piece.

The stock was keenly watched pre-market open following the bulk deal on Tuesday, where founder Bhavish Aggarwal sold over 2.6 crore shares, approximately 0.6% of the equity worth around Rs 92 crore.

Shares of Ola Electric Mobility Ltd. on Wednesday rose by 4.6% at Rs 35.95 a piece.

The stock was keenly watched pre-market open following the bulk deal on Tuesday, where founder Bhavish Aggarwal sold over 2.6 crore shares, approximately 0.6% of the equity worth around Rs 92 crore.

Indian rupee rises 1%, its largest gain since May, as the central bank stepped in to support the currency. The Reserve Bank of India is intervening through dollar sales in the onshore currency market to support the rupee, people familiar with the transactions told Bloomberg.

(Source: Bloomberg)

On NSE, 13 of the 15 sectors were in the green. Nifty PSU Bank rose the most while Nifty Media was the only sector in red.

Broader markets were also in the green, with the NSE Midcap 150 trading 0.19% higher and NSE Smallcap was trading 0.21% higher.

On NSE, 13 of the 15 sectors were in the green. Nifty PSU Bank rose the most while Nifty Media was the only sector in red.

Broader markets were also in the green, with the NSE Midcap 150 trading 0.19% higher and NSE Smallcap was trading 0.21% higher.

ICICI Bank, HDFC Bank, Kotak Mahindra Bank, HDFC Life and Max Health weighed on the Nifty 50 index after the Lok Sabha approved the Insurance Amendment Bill.

SBI, Eternal, Axis Bank, RIL, TCS added to the Nifty 50 index.

ICICI Bank, HDFC Bank, Kotak Mahindra Bank, HDFC Life and Max Health weighed on the Nifty 50 index after the Lok Sabha approved the Insurance Amendment Bill.

SBI, Eternal, Axis Bank, RIL, TCS added to the Nifty 50 index.

Over 75.67 lakh shares of PolyCab India were traded via a block deal on Wednesday. The share of PolyCab India fell as much as 4.49% to Rs 7,031 apiece.

Over 1.2 million shares of Honasa Consumer were traded via a block deal on Wednesday. The share of Honasa Consumer fell as much as 2.02% to Rs 254.65 apiece.

Over 4.88 million shares of Akzo Nobel were traded via a block deals on Wednesday. The share of Ola Electric fell as much as 15.01%% to Rs 3,080.20 apiece.

Over 1.37 million shares of Ola Electric were traded via a block deals on Wednesday. The share of Ola Electric rose as much as 2.49% to Rs 35.34 apiece.

At pre-open, the NSE Nifty 50 was trading 42.30 points or 0.16% higher at 25,902.40. The BSE Sensex was up 0.21% or 176.40 points at 84,856.26.

Rupee opens 3 paise weaker at 91.06 against US Dollar. It closed at 91.03 on Wednesday.

Source: Bloomberg

The dollar index is up at 97.95. Brent crude was trading 1.07% higher at $59.55.

China's stock market has surged this year, on the back of foreign institutional flows, global tech rally, resilient export growth and despite trade frictions with the United States.

The benchmark CSI 300 index, composed of big Chinese companies traded in Shanghai or Shenzhen, is up 16% year-to-date. Comparatively, Hong Kong's Hang Seng index has gained 24% during this period. MSCI Asia Pacific Index, the broadest gauge for the region, is up 28%.

Read more here.

Shares of RailTel will be in focus on Wednesday's trading session amid reports of the company being in talks with Starlink.

As Elon Musk's Starlink gears up for India launch, RailTel is one of the Indian companies looking to partner with the satellite internet provider, according to a report from LiveMint.

Brokerages see limited near-term impact of the Sabka Bima Sabki Raksha, 2025 insurance bill, which was passed in Lok Sabha on Tuesday night, with shares of PB Fintech in focus.

The bill, which proposes to raise foreign direct investment (FDI) in the insurance sector from 74% to 100%, in addition to introducing a series of other amendments to insurance laws, may also lead to foreign and niche players entering the space, according to brokerages.

Nifty December futures down to 25,932 at a premium of 72 points.

Nifty December futures open interest up by 1.69%.

Nifty Options on Dec 23: Maximum Call open interest at 27,000 and Maximum Put open interest at 25,000.

The US Dollar index is down 0.10% at 97.962.

Euro was down 0.08% at 1.1738.

Pound was down 0.11% at 1.3409.

Yen was up 0.15% at 154.93.

Asian stocks opened slightly lower after weak US jobs data failed to lift expectations of further interest-rate cuts by the Federal Reserve.

MSCI’s regional equity index slipped 0.1%, marking a third straight day of declines. The cautious tone followed a mixed session on Wall Street, where the S&P 500 fell for a third consecutive day, while the Nasdaq 100 edged up 0.3%. Tesla Inc. shares dropped more than 1% in extended trading, after reports that its sales in California could be suspended for 30 days. US Treasuries and the dollar were little changed after slipping earlier in the session.

The GIFT Nifty was trading above 25,900 early on Tuesday. The futures contract based on the benchmark Nifty 50 rose 0.05% at 25,928 as of 7:09 a.m. indicating a positive start for the Indian markets.

In the previous session on Tuesday, the benchmark equity extended decline for the second day. The NSE Nifty 50 ended 167.20 points or 0.64% lower at 25,860.10, while the BSE Sensex closed 533.50 points or 0.63% lower at 84,679.86.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.