Nifty ends in green, above the 26,000 mark

Nifty reclaims the 26,000 mark

All sectors end in green baring Nifty FMCG & Media

Nifty Metal emerges as a top sectoral gainer, sees technical support

Gains in Nifty Metals were led by Hindustan Zinc & Hindustan Copper

Nifty ends in green, above the 26,000 mark

Nifty reclaims the 26,000 mark

All sectors end in green baring Nifty FMCG & Media

Nifty Metal emerges as a top sectoral gainer, sees technical support

Gains in Nifty Metals were led by Hindustan Zinc & Hindustan Copper

ITC has 5.05 million shares traded in a block deal on Friday. Shares of the company are trading 0.84% lower at Rs 400.60 apiece, as of 3:20 p.m.

Shares of insurance companies gained during the trade after the Union Cabinet on Friday approved the Insurance Amendment Bill, removing the capping of foreign direct investments into the sector.

Shares of New India Assurance advanced over 6%. Shares of LIC rose 1.1%, while share of SBI Life Insurance rose 0.9%. Shares of ICICI Prudential Life rose 1.7% and shares of Canara HSBC Life Insurance rose 2.4%.

Shares of Walchandnagar Industries rose as much as 13% to Rs 173.99 apiece on Friday after the Union Cabinet on Friday approved the Atomic Energy Bill 2025.

The new bill is set to open doors for private participation in nuclear sector.

Walchandnagar Industries has worked with India's nuclear energy sector for over 40 years, supplying equipment for nuclear power plants. It has partnerships with Nuclear Power Corporation of India, Bhabha Atomic Research Centre, and Bharatiya Nabhikiya Vidyut Nigam. WIL is approved to supply critical components to these organisations.

Indian Oil Corporation Ltd on Friday announced an interim dividend of Rs 5 per share, according to its notification to the exchanges.

PNB Housing Finance's Board appoints Ajai Kumar Shukla as the MD & CEO effective Dec. 18 for five years.

Source: Exchange Filing

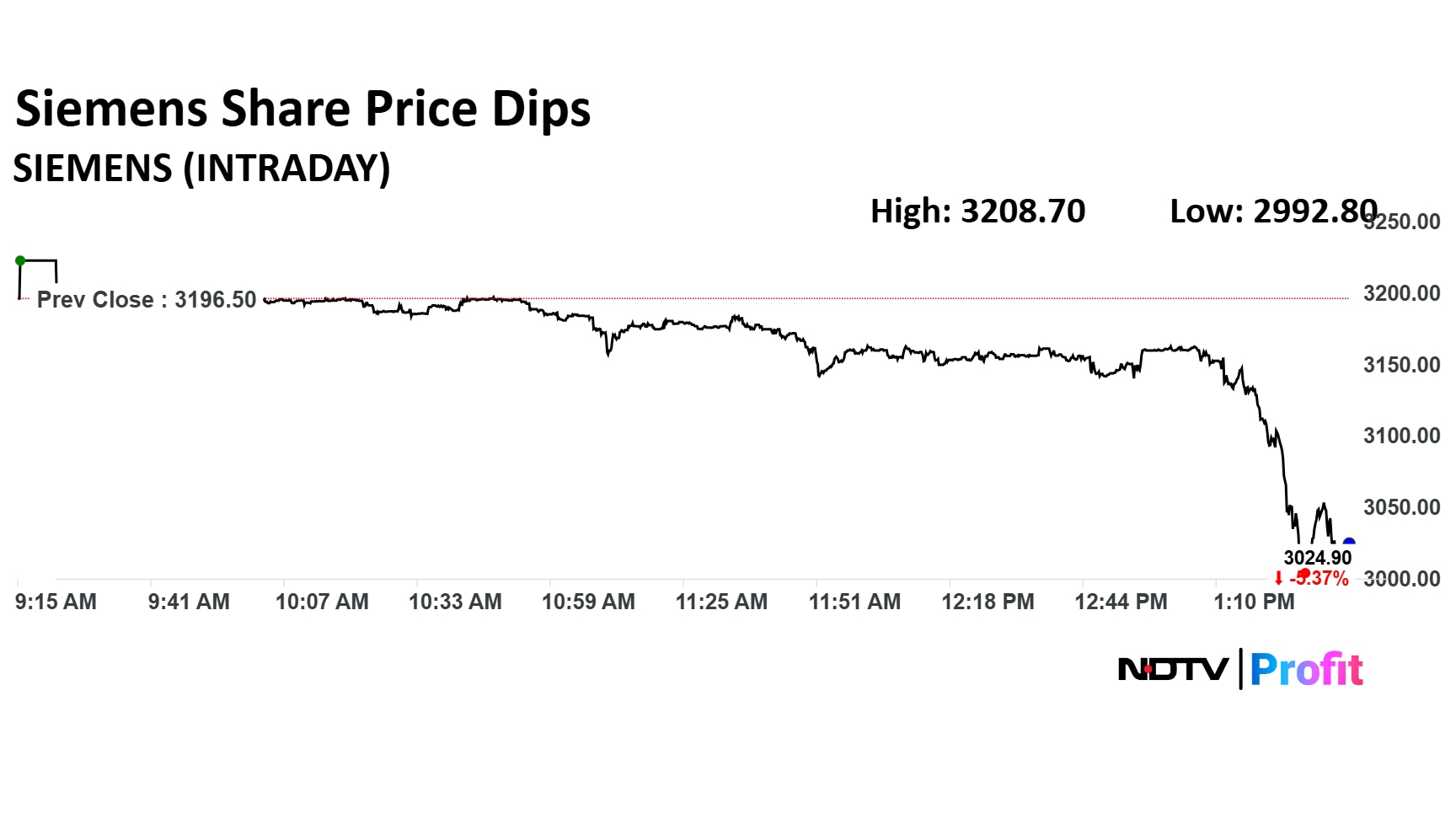

Shares of the company are currently trading over 5% lower at Rs 3,025 apiece.

Shares of the company are currently trading over 5% lower at Rs 3,025 apiece.

Analysts expect big margin fall

No guidance given for any segment - key negative

JSW Energy's arm signs purchase agreement with Karnataka DISCOM to supply 400 MW power for 25 years.

Source: Exchange Filing

The board of Krsnaa Diagnostics approves fundraise worth Rs 430 crore via NCDs on private placement basis.

Source: Exchange filing

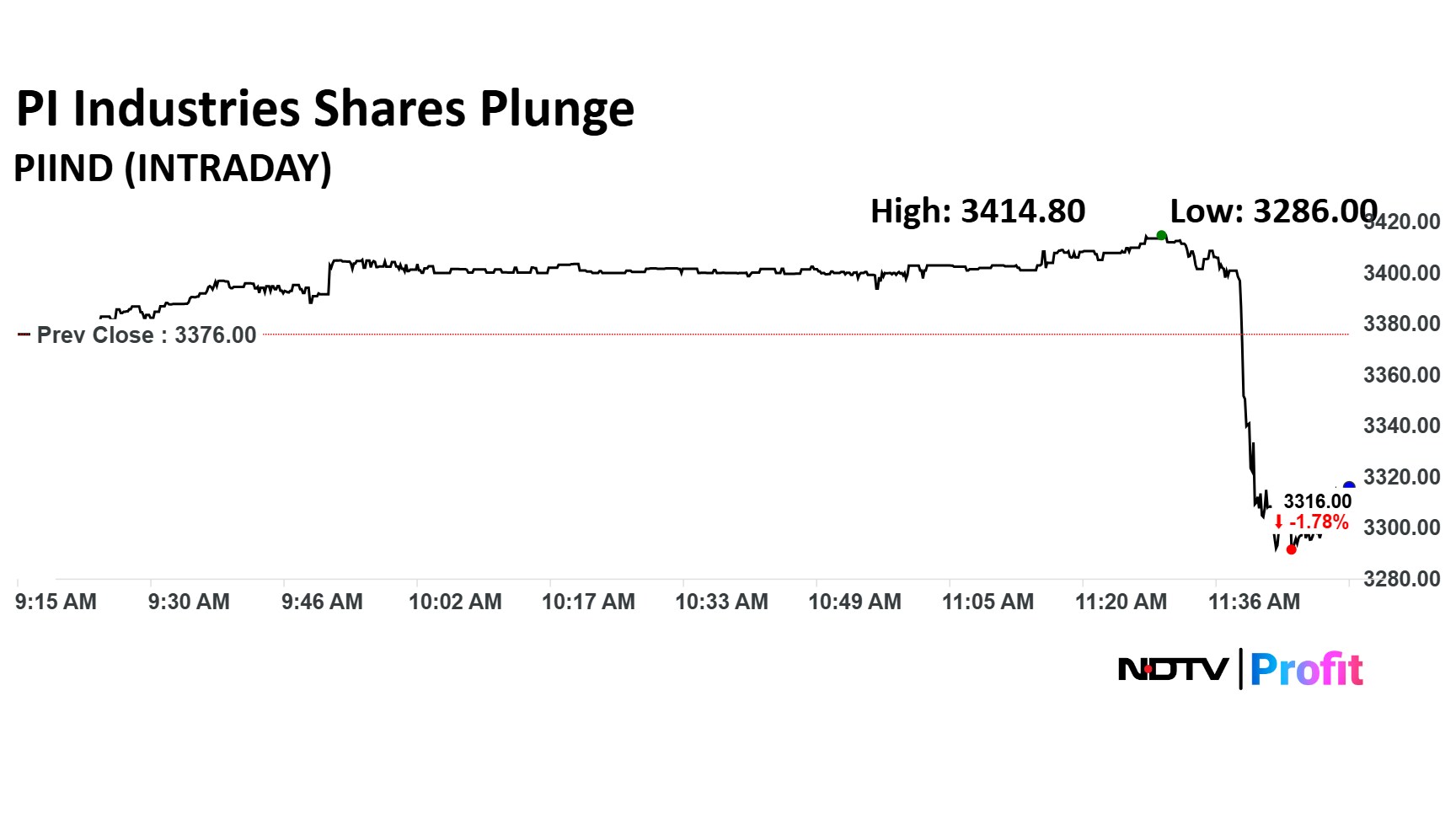

Emkay:

Kumiai will negotiate with suppliers – PI Industries - to reduce the costs of various ingredients and raw materials

This may lead to some downward price revisions at PI’s end

B&K Securities:

Believe Kumiai’s lowered guidance shall have a negative bearing for PI for FY27E for Pyroxasulfone sales

Additionally, Kumiai’s renegotiation of ingredients/ RM pricing with suppliers may impact pricing for Pyroxasulfone

Short to medium term negative for PI Industries till new products in CSM scale up materially

Vikrant Shrotriya, MD, Novo Nordisk India:

Ozempic now available in India as a once-weekly injectable formulation of semaglutide

75 lakh people worldwide on Ozempic

Ozempic 0.25 mg priced at Rs 2200 per week, minimum dose for 4 weeks

Ozempic 0.5 mg priced at Rs 10,170 for 4 weeks (Rs 2,542 per week)

Ozempic 1 mg priced at Rs 11,175 for 4 weeks (Rs 2,793 per week)

Swiggy's share price rose as much as 5%, and is currently trading 3.61% higher at Rs 415.70 apiece.

Swiggy's share price rose as much as 5%, and is currently trading 3.61% higher at Rs 415.70 apiece.

The board of HUDCO approves fundraise worth Rs 1,905 crore via NCDs on a private placement basis.

Source: Exchange Filing

Eternal sees 1.91 million shares traded in a block deal from Friday. Shares of the company are trading 1.65% up at Rs 295.75 apiece.

Kumiai sees 5% fall in FY26 revenue

Kumiai sees 32% fall in FY26 operating profit

Kumiai sees 5% fall in FY26 revenue

Kumiai sees 32% fall in FY26 operating profit

Honasa Consumer is making a decisive push into men’s personal care, noted brokerage firm HSBC. The company has agreed to buy 95% of BTM Ventures Pvt. Ltd., the parent of Reginald Men.

But HSBC remains unimpressed by the acquisition. Click here to know why.

Railtel Corp gets a Rs 35 crore order from the Greater Mumbai Municipal Corp. The company is set to provide communication solutions for five years to Disaster Management Dept.

Source: Exchange Filing

The ICICI Prudential AMC IPO was subscribed 3% so far on Friday.

Qualified Institutional Buyers (QIBs): nil

Non-Institutional Investors (NIIS): 4%

Retail Individual Investors: 5%

Employee Reserved: nil

Reservation For Shareholders: 6%

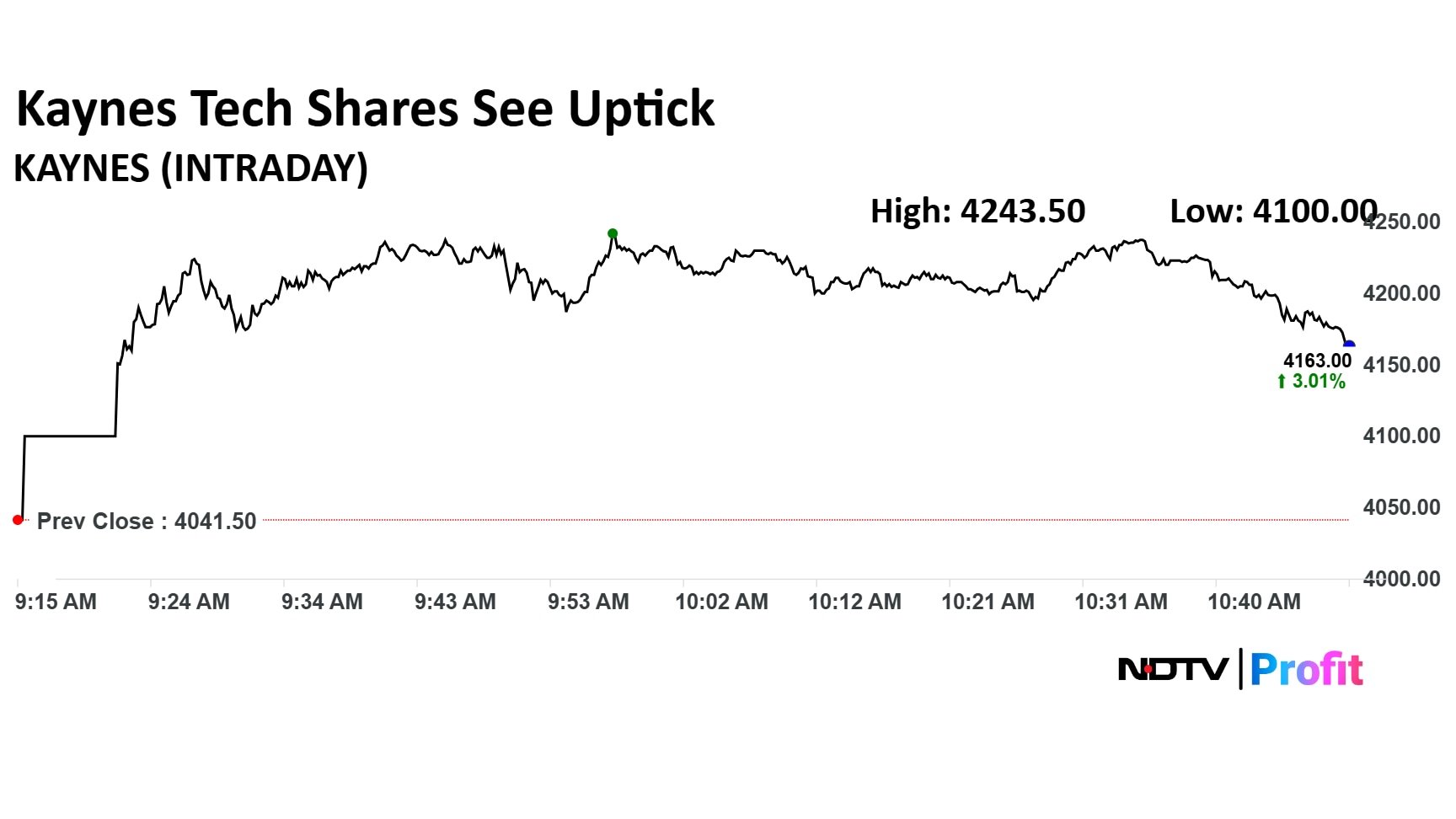

Kaynes Tech share price rose as much as 5% in the day, and is currently trading over 3% higher at Rs 4,166.50 apiece.

Kaynes Tech share price rose as much as 5% in the day, and is currently trading over 3% higher at Rs 4,166.50 apiece.

The company signed a third-party manufacturing arrangement for new facility at Chhattisgarh to support servicing of trade partners, and enhance market reach.

Chhattisgarh platform has installed capacity of 2,240 MTPA.

Source: Exchange Filing

Initiate Sell with target price of Rs 900

The good is already priced in

Margins: Improvement is certain but only at a gradual pace

Asset quality: Worst is already behind, but prefer to remain watchful

Cost-to-income matrix: Expect a gradual improvement

Playing to the strength: Focus remains on growing core secured assets

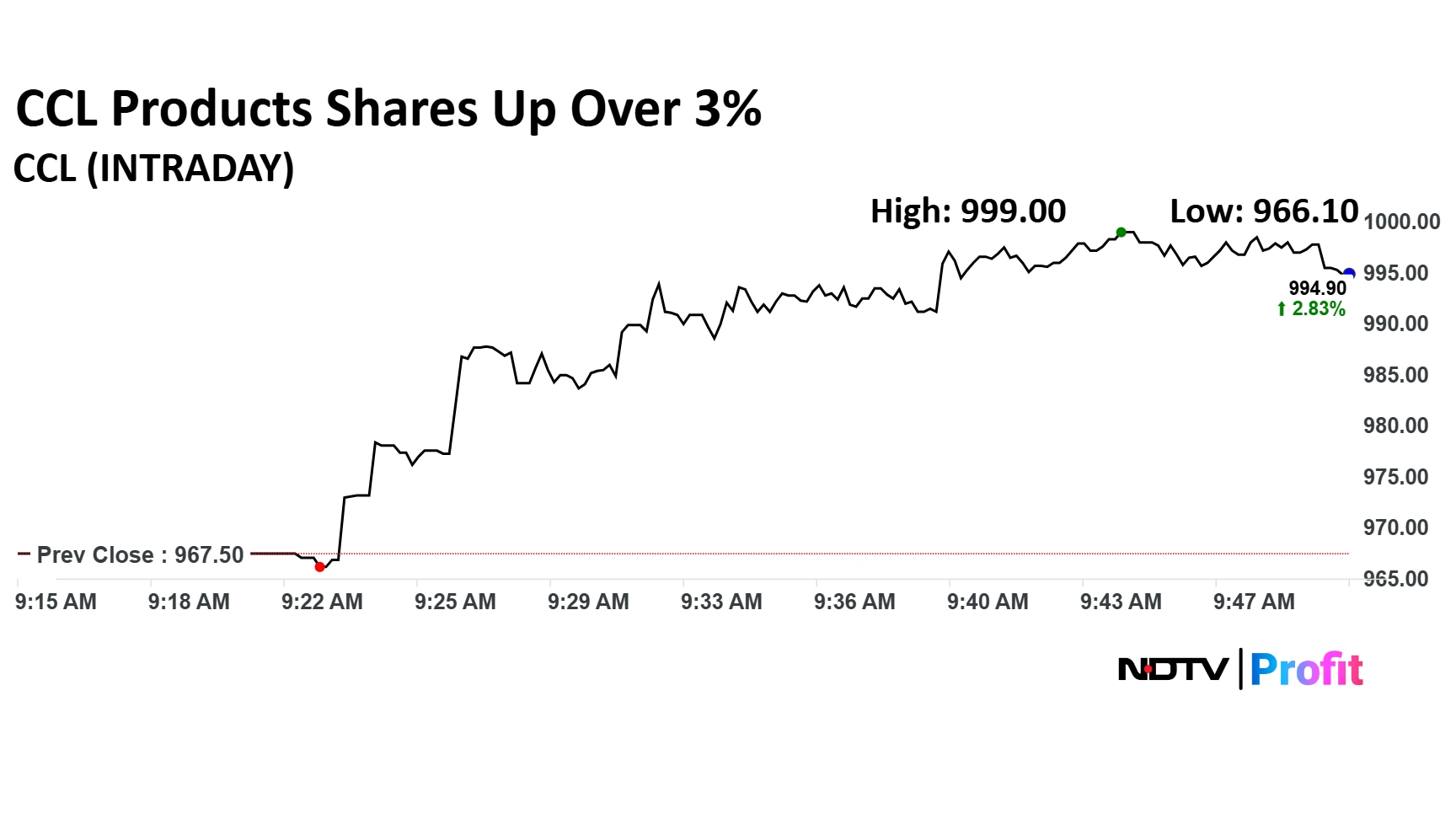

Shares of CCL Products rose as much as 3.2% to Rs 999 on Friday.

Shares of CCL Products rose as much as 3.2% to Rs 999 on Friday.

This simply adjusts tariffs in the individual zones to keep the integrated pipeline tariffs the same, hence there is no benefit or impact, says Nuvama.

HDFC Life has 3.9 million shares traded in a block deal on Friday. Shares of the company are up 0.26% at Rs 777.20 apiece.

Kotak Securities Says:

Competitive intensity could remain elevated for another 12-18 months

Birla Opus continuing to gain market share

JSW-Akzo Nobel also expected to gain share in the next 2-3 years

Asian Paints and Berger likely to grow 100-150 bps below industry growth

Sustained Birla Opus-led aggression to delay meaningful margin recovery at least FY28

The Indian rupee weakens below 90.56 against the US dollar. The downward pressure in rupee comes against the backdrop of Commerce Minister Piyush Goyal confirming that trade negotiations with the United States are going well.

Sona Selection files draft papers for IPO. The IPO will include only a fresh issue of upto 1.4 crore shares.

Source: DRHP

Dr Reddy's is set to achieve net zero greenhouse gas emissions across value chain by FY45.

The company is set to:

Reduce absolute scope 1 & 2 greenhouse gas emissions by 80% by FY30

Reduce scope 3 emissions by 51.6% by FY30

Reduce absolute scope 1, 2 & 3 emissions by 90% by FY45

Alert: FY23 to be used as the base year.

Source: Exchange Filing

GMR Power's board is set to meet on Dec. 17 to consider a Rs 1,200 crore fundraise.

Source: Exchange Filing

Gold prices in India rose slightly to Rs 1,32,720, with silver also witnessing a slight uptick at Rs 1,98,980 on Friday, according to the India Bullion Association.

Copper surged to a new record, along with most other industrial metals, following the Fed’s widely anticipated rate cut and its upgraded US growth outlook. Copper jumped as much as 3% to $11,906 a ton in London, surpassing Monday’s peak.

Gold held steady after three straight sessions of gains, buoyed by expectations of further US monetary easing. Silver hovered near a record high. Bullion was little changed at around $4,280 an ounce, after rising 1.2% in the previous session.

Oil rebounded from its lowest close in nearly two months, supported by optimism across financial markets. West Texas Intermediate approached $58 a barrel after a 1.5% drop in the prior session, while global benchmark Brent settled above $61.

InterGlobe Aviation: The DGCA has asked CEO Pieter Elbers to appear before its officers committee on December 12. Petitioners Akhil Rana and Utkarsh Sharma have filed a writ petition before the Delhi High Court against the Ministry of Civil Aviation, DGCA, and the company in connection with operational disruptions leading to flight cancellations.

Suzlon Energy: The Mumbai tax authority has reduced the company’s tax demand from Rs 21.9 crore to nil.

Honasa Consumer: The company will acquire a 95% stake in BTM Ventures for an enterprise value of Rs 195 crore and plans to acquire the remaining 5% stake within 12 months after completing the initial acquisition; The company enters men's personal care category with acquisition of Reginald Men.

Vedanta: The company has emerged as the successful bidder for the Genjana block containing nickel, chromium, and PGE (Platinum Group Elements).

The GIFT Nifty is trading marginally higher at 26,140, indicating a positive-bias open for the benchmark index.

The BSE Sensex closed 426.86 points or 0.51% higher at 84,818.13, and the Nifty 50 gained 140.55 points or 0.55% to settle at 25,898.55 on Thursday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.