Overseas investors remained net sellers of Indian equities for the eleventh day in a row on Wednesday

Foreign portfolio investors offloaded stocks worth Rs 84.6 crore, according to provisional data from the National Stock Exchange.

Domestic institutional investors remained net buyers and mopped up equities worth Rs 524.5 crore, the NSE data showed.

Foreign institutions have been net buyers of Rs 92,521 crore worth of Indian equities so far in 2023, according to data from the National Securities Depository Ltd., updated till the previous trading day.

The yield on the 10-year bond closed flat at 7.27% on Wednesday.

Source: Bloomberg

The local currency closed flat at 83.28 against the U.S dollar on Wednesday.

Source: Bloomberg

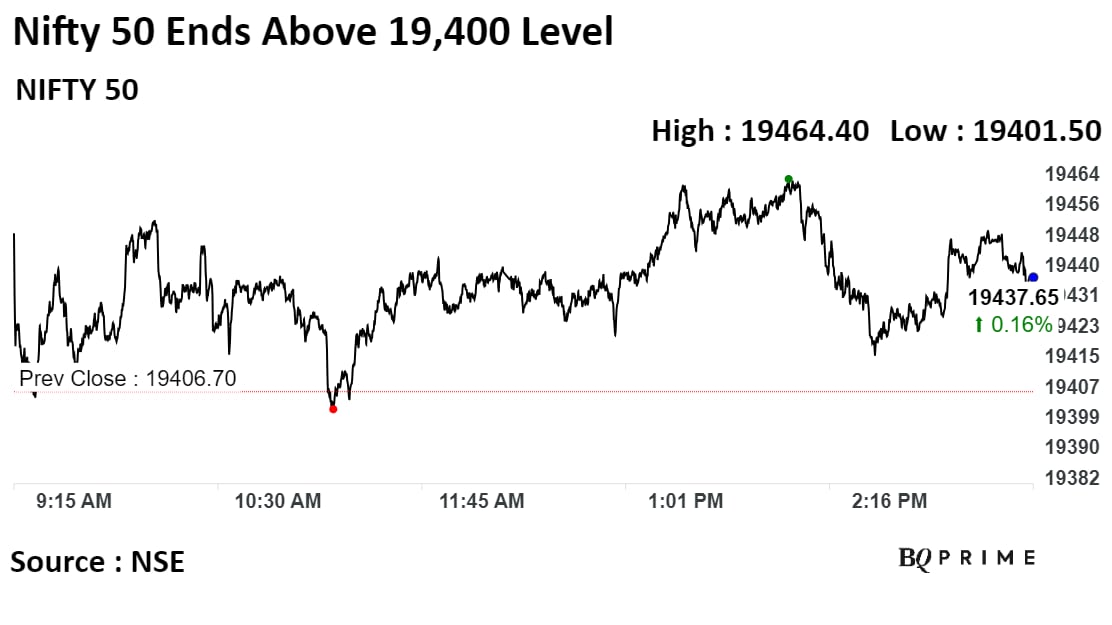

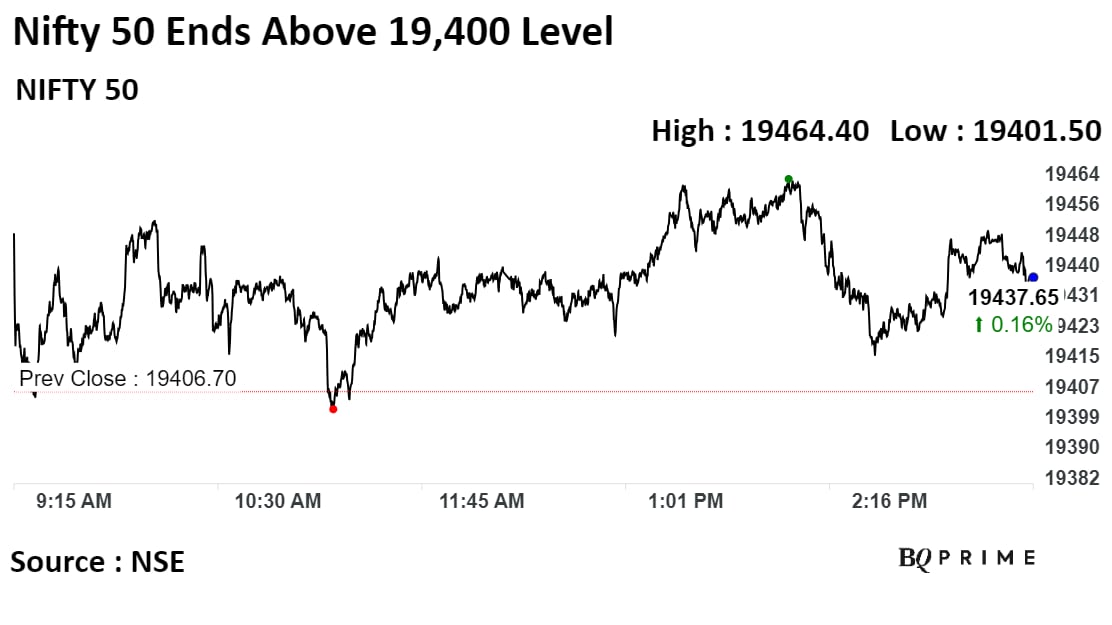

India's benchmark stock indices resumed advance after one-day fall as it ended marginally higher on Wednesday. Pharma, realty and energy sectors advanced, whereas I.T. and non-banking financial companies were under pressure.

Currently, there are three significant trends in equity markets, as per Dr. V K Vijayakumar, chief investment strategist at Geojit Financial Services.

"One, global markets are stable as indicated by the seven-day winning streak in Dow and S&P 500. Two, a risk on is evident in markets primarily driven by the sharp correction in the U.S. 10-year bond yield. Three, the crash in Brent crude from around $94 to below $82 now indicates that the market doesn’t expect the Israel-Gaza conflict to aggravate into a wider regional conflict."

In brief, the market construct is favourable for the continuation of the rally despite the geopolitical uncertainties, he said.

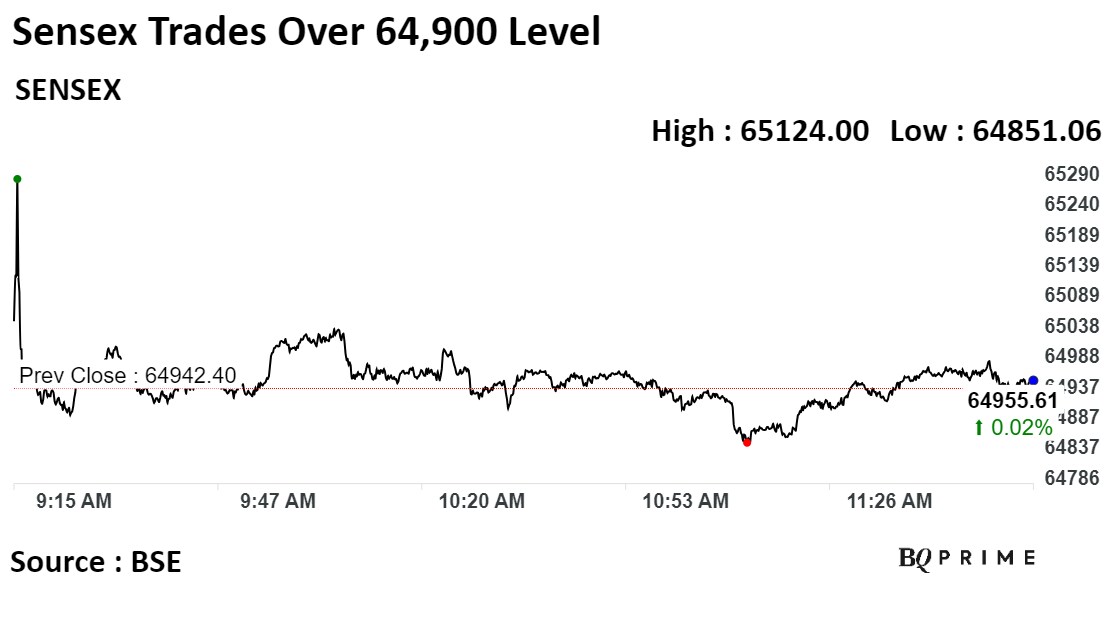

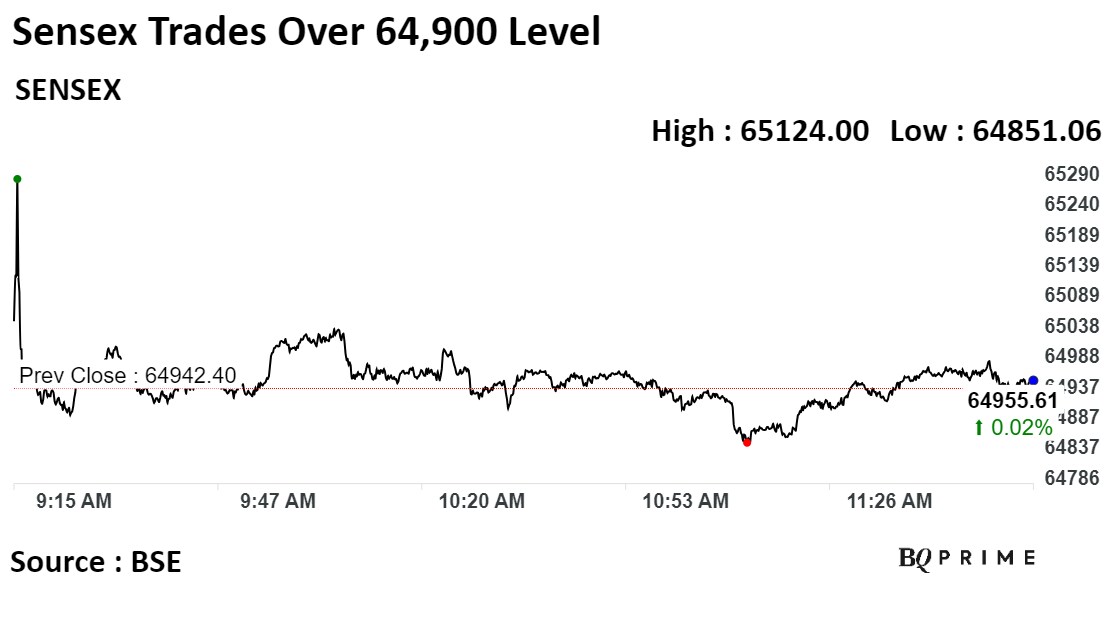

Intraday, Sensex jumped over 65,100 level to end over 100 points below day's high and Nifty 50 scaled over 19,460 mark, both rising over highest level in over two weeks since Oct. 23.

The S&P BSE Sensex closed up 33 points, or 0.05%, at 64,975.61 while the NSE Nifty 50 was 37 points or 0.19% higher at 19,443.59.

The price action is witnessing contraction ahead of the 78.6% retracement level acting of its prior swing high and low as overhead resistance near the 19,437 level, Avdhut Bagkar Technical and Derivatives Analyst, StoxBox said. "The index is anticipated to attract further bullish strength on reclaiming the retracement level in the pullback rally."

Stocks edged lower as investors awaited clues on the path of interest rates from a raft of central bank officials including Federal Reserve Chair Jerome Powell. Europe’s Stoxx 600 fell 0.2% and U.S. equity futures traded little changed.

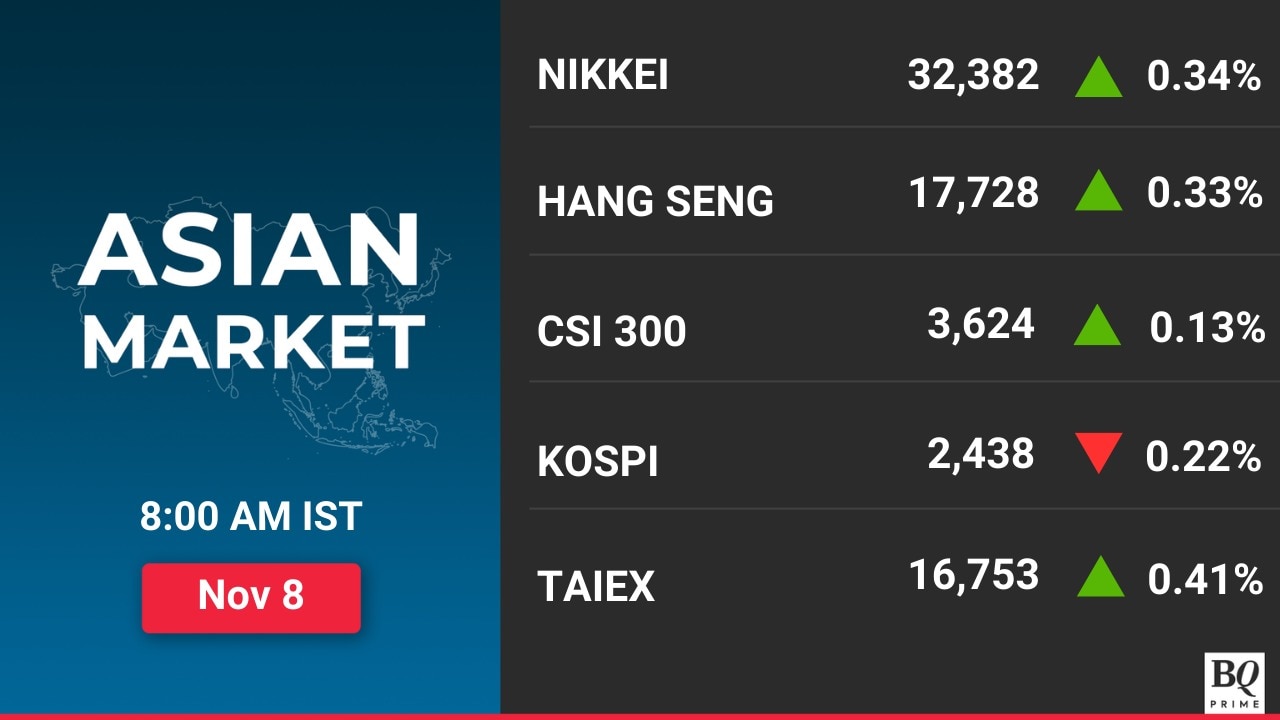

Australian and Taiwanese markets were marginally higher, whereas Japanese, Hong Kong, Chinese and South Korean markets fell. Japanese banks extended their drop on falling yields that tempered expectation of higher profitability.

India's benchmark stock indices resumed advance after one-day fall as it ended marginally higher on Wednesday. Pharma, realty and energy sectors advanced, whereas I.T. and non-banking financial companies were under pressure.

Currently, there are three significant trends in equity markets, as per Dr. V K Vijayakumar, chief investment strategist at Geojit Financial Services.

"One, global markets are stable as indicated by the seven-day winning streak in Dow and S&P 500. Two, a risk on is evident in markets primarily driven by the sharp correction in the U.S. 10-year bond yield. Three, the crash in Brent crude from around $94 to below $82 now indicates that the market doesn’t expect the Israel-Gaza conflict to aggravate into a wider regional conflict."

In brief, the market construct is favourable for the continuation of the rally despite the geopolitical uncertainties, he said.

Intraday, Sensex jumped over 65,100 level to end over 100 points below day's high and Nifty 50 scaled over 19,460 mark, both rising over highest level in over two weeks since Oct. 23.

The S&P BSE Sensex closed up 33 points, or 0.05%, at 64,975.61 while the NSE Nifty 50 was 37 points or 0.19% higher at 19,443.59.

The price action is witnessing contraction ahead of the 78.6% retracement level acting of its prior swing high and low as overhead resistance near the 19,437 level, Avdhut Bagkar Technical and Derivatives Analyst, StoxBox said. "The index is anticipated to attract further bullish strength on reclaiming the retracement level in the pullback rally."

Stocks edged lower as investors awaited clues on the path of interest rates from a raft of central bank officials including Federal Reserve Chair Jerome Powell. Europe’s Stoxx 600 fell 0.2% and U.S. equity futures traded little changed.

Australian and Taiwanese markets were marginally higher, whereas Japanese, Hong Kong, Chinese and South Korean markets fell. Japanese banks extended their drop on falling yields that tempered expectation of higher profitability.

India's benchmark stock indices resumed advance after one-day fall as it ended marginally higher on Wednesday. Pharma, realty and energy sectors advanced, whereas I.T. and non-banking financial companies were under pressure.

Currently, there are three significant trends in equity markets, as per Dr. V K Vijayakumar, chief investment strategist at Geojit Financial Services.

"One, global markets are stable as indicated by the seven-day winning streak in Dow and S&P 500. Two, a risk on is evident in markets primarily driven by the sharp correction in the U.S. 10-year bond yield. Three, the crash in Brent crude from around $94 to below $82 now indicates that the market doesn’t expect the Israel-Gaza conflict to aggravate into a wider regional conflict."

In brief, the market construct is favourable for the continuation of the rally despite the geopolitical uncertainties, he said.

Intraday, Sensex jumped over 65,100 level to end over 100 points below day's high and Nifty 50 scaled over 19,460 mark, both rising over highest level in over two weeks since Oct. 23.

The S&P BSE Sensex closed up 33 points, or 0.05%, at 64,975.61 while the NSE Nifty 50 was 37 points or 0.19% higher at 19,443.59.

The price action is witnessing contraction ahead of the 78.6% retracement level acting of its prior swing high and low as overhead resistance near the 19,437 level, Avdhut Bagkar Technical and Derivatives Analyst, StoxBox said. "The index is anticipated to attract further bullish strength on reclaiming the retracement level in the pullback rally."

Stocks edged lower as investors awaited clues on the path of interest rates from a raft of central bank officials including Federal Reserve Chair Jerome Powell. Europe’s Stoxx 600 fell 0.2% and U.S. equity futures traded little changed.

Australian and Taiwanese markets were marginally higher, whereas Japanese, Hong Kong, Chinese and South Korean markets fell. Japanese banks extended their drop on falling yields that tempered expectation of higher profitability.

India's benchmark stock indices resumed advance after one-day fall as it ended marginally higher on Wednesday. Pharma, realty and energy sectors advanced, whereas I.T. and non-banking financial companies were under pressure.

Currently, there are three significant trends in equity markets, as per Dr. V K Vijayakumar, chief investment strategist at Geojit Financial Services.

"One, global markets are stable as indicated by the seven-day winning streak in Dow and S&P 500. Two, a risk on is evident in markets primarily driven by the sharp correction in the U.S. 10-year bond yield. Three, the crash in Brent crude from around $94 to below $82 now indicates that the market doesn’t expect the Israel-Gaza conflict to aggravate into a wider regional conflict."

In brief, the market construct is favourable for the continuation of the rally despite the geopolitical uncertainties, he said.

Intraday, Sensex jumped over 65,100 level to end over 100 points below day's high and Nifty 50 scaled over 19,460 mark, both rising over highest level in over two weeks since Oct. 23.

The S&P BSE Sensex closed up 33 points, or 0.05%, at 64,975.61 while the NSE Nifty 50 was 37 points or 0.19% higher at 19,443.59.

The price action is witnessing contraction ahead of the 78.6% retracement level acting of its prior swing high and low as overhead resistance near the 19,437 level, Avdhut Bagkar Technical and Derivatives Analyst, StoxBox said. "The index is anticipated to attract further bullish strength on reclaiming the retracement level in the pullback rally."

Stocks edged lower as investors awaited clues on the path of interest rates from a raft of central bank officials including Federal Reserve Chair Jerome Powell. Europe’s Stoxx 600 fell 0.2% and U.S. equity futures traded little changed.

Australian and Taiwanese markets were marginally higher, whereas Japanese, Hong Kong, Chinese and South Korean markets fell. Japanese banks extended their drop on falling yields that tempered expectation of higher profitability.

India's benchmark stock indices resumed advance after one-day fall as it ended marginally higher on Wednesday. Pharma, realty and energy sectors advanced, whereas I.T. and non-banking financial companies were under pressure.

Currently, there are three significant trends in equity markets, as per Dr. V K Vijayakumar, chief investment strategist at Geojit Financial Services.

"One, global markets are stable as indicated by the seven-day winning streak in Dow and S&P 500. Two, a risk on is evident in markets primarily driven by the sharp correction in the U.S. 10-year bond yield. Three, the crash in Brent crude from around $94 to below $82 now indicates that the market doesn’t expect the Israel-Gaza conflict to aggravate into a wider regional conflict."

In brief, the market construct is favourable for the continuation of the rally despite the geopolitical uncertainties, he said.

Intraday, Sensex jumped over 65,100 level to end over 100 points below day's high and Nifty 50 scaled over 19,460 mark, both rising over highest level in over two weeks since Oct. 23.

The S&P BSE Sensex closed up 33 points, or 0.05%, at 64,975.61 while the NSE Nifty 50 was 37 points or 0.19% higher at 19,443.59.

The price action is witnessing contraction ahead of the 78.6% retracement level acting of its prior swing high and low as overhead resistance near the 19,437 level, Avdhut Bagkar Technical and Derivatives Analyst, StoxBox said. "The index is anticipated to attract further bullish strength on reclaiming the retracement level in the pullback rally."

Stocks edged lower as investors awaited clues on the path of interest rates from a raft of central bank officials including Federal Reserve Chair Jerome Powell. Europe’s Stoxx 600 fell 0.2% and U.S. equity futures traded little changed.

Australian and Taiwanese markets were marginally higher, whereas Japanese, Hong Kong, Chinese and South Korean markets fell. Japanese banks extended their drop on falling yields that tempered expectation of higher profitability.

India's benchmark stock indices resumed advance after one-day fall as it ended marginally higher on Wednesday. Pharma, realty and energy sectors advanced, whereas I.T. and non-banking financial companies were under pressure.

Currently, there are three significant trends in equity markets, as per Dr. V K Vijayakumar, chief investment strategist at Geojit Financial Services.

"One, global markets are stable as indicated by the seven-day winning streak in Dow and S&P 500. Two, a risk on is evident in markets primarily driven by the sharp correction in the U.S. 10-year bond yield. Three, the crash in Brent crude from around $94 to below $82 now indicates that the market doesn’t expect the Israel-Gaza conflict to aggravate into a wider regional conflict."

In brief, the market construct is favourable for the continuation of the rally despite the geopolitical uncertainties, he said.

Intraday, Sensex jumped over 65,100 level to end over 100 points below day's high and Nifty 50 scaled over 19,460 mark, both rising over highest level in over two weeks since Oct. 23.

The S&P BSE Sensex closed up 33 points, or 0.05%, at 64,975.61 while the NSE Nifty 50 was 37 points or 0.19% higher at 19,443.59.

The price action is witnessing contraction ahead of the 78.6% retracement level acting of its prior swing high and low as overhead resistance near the 19,437 level, Avdhut Bagkar Technical and Derivatives Analyst, StoxBox said. "The index is anticipated to attract further bullish strength on reclaiming the retracement level in the pullback rally."

Stocks edged lower as investors awaited clues on the path of interest rates from a raft of central bank officials including Federal Reserve Chair Jerome Powell. Europe’s Stoxx 600 fell 0.2% and U.S. equity futures traded little changed.

Australian and Taiwanese markets were marginally higher, whereas Japanese, Hong Kong, Chinese and South Korean markets fell. Japanese banks extended their drop on falling yields that tempered expectation of higher profitability.

India's benchmark stock indices resumed advance after one-day fall as it ended marginally higher on Wednesday. Pharma, realty and energy sectors advanced, whereas I.T. and non-banking financial companies were under pressure.

Currently, there are three significant trends in equity markets, as per Dr. V K Vijayakumar, chief investment strategist at Geojit Financial Services.

"One, global markets are stable as indicated by the seven-day winning streak in Dow and S&P 500. Two, a risk on is evident in markets primarily driven by the sharp correction in the U.S. 10-year bond yield. Three, the crash in Brent crude from around $94 to below $82 now indicates that the market doesn’t expect the Israel-Gaza conflict to aggravate into a wider regional conflict."

In brief, the market construct is favourable for the continuation of the rally despite the geopolitical uncertainties, he said.

Intraday, Sensex jumped over 65,100 level to end over 100 points below day's high and Nifty 50 scaled over 19,460 mark, both rising over highest level in over two weeks since Oct. 23.

The S&P BSE Sensex closed up 33 points, or 0.05%, at 64,975.61 while the NSE Nifty 50 was 37 points or 0.19% higher at 19,443.59.

The price action is witnessing contraction ahead of the 78.6% retracement level acting of its prior swing high and low as overhead resistance near the 19,437 level, Avdhut Bagkar Technical and Derivatives Analyst, StoxBox said. "The index is anticipated to attract further bullish strength on reclaiming the retracement level in the pullback rally."

Stocks edged lower as investors awaited clues on the path of interest rates from a raft of central bank officials including Federal Reserve Chair Jerome Powell. Europe’s Stoxx 600 fell 0.2% and U.S. equity futures traded little changed.

Australian and Taiwanese markets were marginally higher, whereas Japanese, Hong Kong, Chinese and South Korean markets fell. Japanese banks extended their drop on falling yields that tempered expectation of higher profitability.

India's benchmark stock indices resumed advance after one-day fall as it ended marginally higher on Wednesday. Pharma, realty and energy sectors advanced, whereas I.T. and non-banking financial companies were under pressure.

Currently, there are three significant trends in equity markets, as per Dr. V K Vijayakumar, chief investment strategist at Geojit Financial Services.

"One, global markets are stable as indicated by the seven-day winning streak in Dow and S&P 500. Two, a risk on is evident in markets primarily driven by the sharp correction in the U.S. 10-year bond yield. Three, the crash in Brent crude from around $94 to below $82 now indicates that the market doesn’t expect the Israel-Gaza conflict to aggravate into a wider regional conflict."

In brief, the market construct is favourable for the continuation of the rally despite the geopolitical uncertainties, he said.

Intraday, Sensex jumped over 65,100 level to end over 100 points below day's high and Nifty 50 scaled over 19,460 mark, both rising over highest level in over two weeks since Oct. 23.

The S&P BSE Sensex closed up 33 points, or 0.05%, at 64,975.61 while the NSE Nifty 50 was 37 points or 0.19% higher at 19,443.59.

The price action is witnessing contraction ahead of the 78.6% retracement level acting of its prior swing high and low as overhead resistance near the 19,437 level, Avdhut Bagkar Technical and Derivatives Analyst, StoxBox said. "The index is anticipated to attract further bullish strength on reclaiming the retracement level in the pullback rally."

Stocks edged lower as investors awaited clues on the path of interest rates from a raft of central bank officials including Federal Reserve Chair Jerome Powell. Europe’s Stoxx 600 fell 0.2% and U.S. equity futures traded little changed.

Australian and Taiwanese markets were marginally higher, whereas Japanese, Hong Kong, Chinese and South Korean markets fell. Japanese banks extended their drop on falling yields that tempered expectation of higher profitability.

ICICI Bank Ltd., Infosys Ltd., NTPC Ltd., Bajaj Finance Ltd., and Kotak Mahindra Bank Ltd. were negatively adding to the change in the Nifty 50 Index.

Whereas, Larsen & Toubro Ltd., Reliance Industries Ltd., ITC Ltd., HDFC Bank Ltd., and Asian Paints Ltd. were positively contributing to the change.

The broader markets outperformed larger peers; the S&P BSE MidCap Index was up 0.82%, whereas S&P BSE SmallCap Index was 0.61% higher.

The tug of war between the FIIs and DIIs continues with sustained selling by the FIIs and sustained buying by the DIIs. Since the buy on dips strategy is working, retail investors are buying in the broader market on every dip, Dr. V K Vijayakumar, chief investment strategist at Geojit Financial Services, said.

"There is no selling pressure in the broader market since FII selling is confined to large caps. The best opportunity for long-term investors is in high quality large caps since these stocks will do well when FIIs eventually turn buyers," he added.

Fifteen out of the 20 sectors compiled by BSE advanced while five declined. S&P BSE Realty and S&P BSE Services rose the most.

The market breadth was skewed in the favour of the buyers. About 2,020 stocks rose, 1,678 declined, while 141 remained unchanged on the BSE.

For investors with long positions, it is advisable to continue trailing their stop loss to protect their gains, Mandar Bhojane, Research Analyst at Choice Broking said. "As for traders, it is recommended to consider buying the dips, but exercise caution by setting a strict stop loss near the 19,200 levels to manage risks effectively."

Revenue at Rs 276.3 crore vs Rs 253.9 crore, up 9% YoY

Ebitda at Rs 65.7 crore vs Rs 45.7 crore, up 43.7% YoY

Margin at 23.8% vs 18% YoY

Reported profit at Rs 49.7 crore vs Rs 35.5 crore, up 40% YoY

Revenue at Rs 171.3 crore vs Rs 167.1 crore, up 3% YoY

Ebitda at Rs 11.3 crore vs Rs 8.6 crore, up 31.8% YoY

Margin at 6.6% vs 5% YoY

Reported profit at Rs 13.97 crore vs Rs 5.46 crore

Revenue at Rs 171.3 crore vs Rs 167.1 crore, up 3% YoY

Ebitda at Rs 11.3 crore vs Rs 8.6 crore, up 31.8% YoY

Margin at 6.6% vs 5% YoY

Reported profit at Rs 13.97 crore vs Rs 5.46 crore

Revenue at Rs 3,938 crore vs Rs 4,021 crore, down 2% YoY

Ebitda at Rs 266 crore vs Rs 220 crore, up 20.5% YoY

Margin at 6.74% vs 5.47% YoY

Reported profit at Rs 165 crore vs Rs 219 crore, down 24.9% YoY

Shares of Adani Group companies extended gains on Wednesday, with Adani Ports and Special Economic Zone Ltd. leading the advance.

Adani Enterprises Ltd. was trading above 2%, whereas Adani Energy Solutions Ltd., and ACC Ltd. was an outlier as it was trading marginally lower.

Adani Group stocks added Rs 21,089 crore in investor wealth, taking their total market capitalisation to Rs 10.47 lakh crore, intraday.

As of 1:44 p.m., the shares added Rs 14,772 crore in market value taking the capitalisation to Rs 10.39 lakh crore.

The group has proposed to the Sri Lankan government to set up the wind project in the northwestern region at an initial investment of $750 million, Karan Adani, chief executive officer of Adani Ports and Special Economic Zone Ltd., told BQ Prime at a post-event interaction in Colombo.

Adani Group plans to set up a 500 megawatt wind power project in Sri Lanka after successful completion of a $553 million debt financing from the U.S. International Development Finance Corp. for its Colombo West International Terminal.

Adani Ports is planning to add more strategic locations to its portfolio of international ports that at present are in Israel's Haifa and Sri Lanka.

The Adani Group is exploring green energy opportunities in Bhutan, billionaire Gautam Adani said after meeting Bhutanese monarch who is on an India visit.

"It was truly an honour to meet His Majesty King of Bhutan Jigme Khesar Namgyel Wangchuck," Adani posted on X (formerly Twitter). The Adani Group is "excited to explore opportunities" to contribute to green infrastructure development for "one of our happy and warm neighbours", he said.

In three-year pact with AWS for providing technology solutions in Europe, Middle East and Africa

To offer cloud solutions to financial organizations like NatWest Group

Source: Exchange filing

Revenue at Rs 584 crore vs Rs 475 crore, up 23% YoY

Ebitda at Rs 66.1 crore vs Rs 50.3 crore, up 31.3% YoY

Margin at 11.30% vs 10.59% YoY

Reported profit at Rs 45.1 crore vs Rs 30.1 crore, up 49.8% YoY

Revenue at Rs 825.3 crore vs Rs 721.3 crore, up 14% YoY

Ebitda at Rs 31.04 crore vs Rs 26.2 crore, up 18.6% YoY

Margin at 3.76% vs 3.62% YoY

Reported profit at Rs 16.4 crore vs Rs 14.6 crore, up 11.5% YoY

Prince Pipes And Fittings at 41.48x its 30-day average

Apollo Tyres at 6.29x its 30-day average

Dollar Industries at 6.27x its 30-day average

Alkem Laboratories at 6.02x its 30-day average

Shoppers Stop at 5.45x its 30-day average

Source: Cogencis

Sectoral Indices Trade Mixed At 1:00 p.m.

Nifty 50 down up 0.16%, BSE Sensex up 0.04%

Top Gainers: Nifty Realty (1.68), Nifty Pharma (1.54%), Nifty Oil & Gas (0.93%)

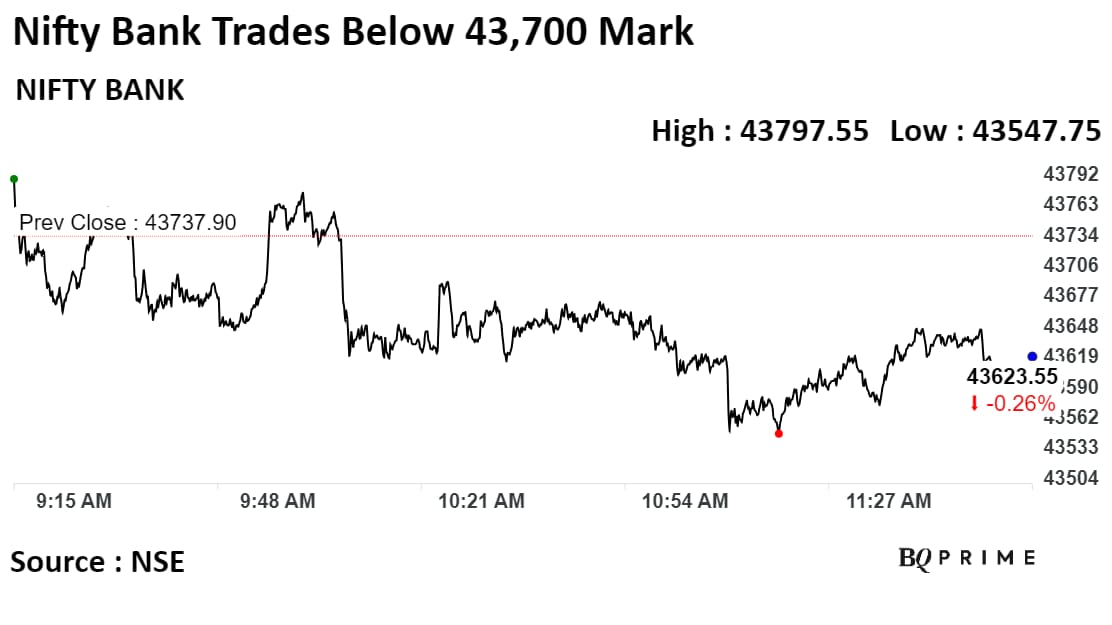

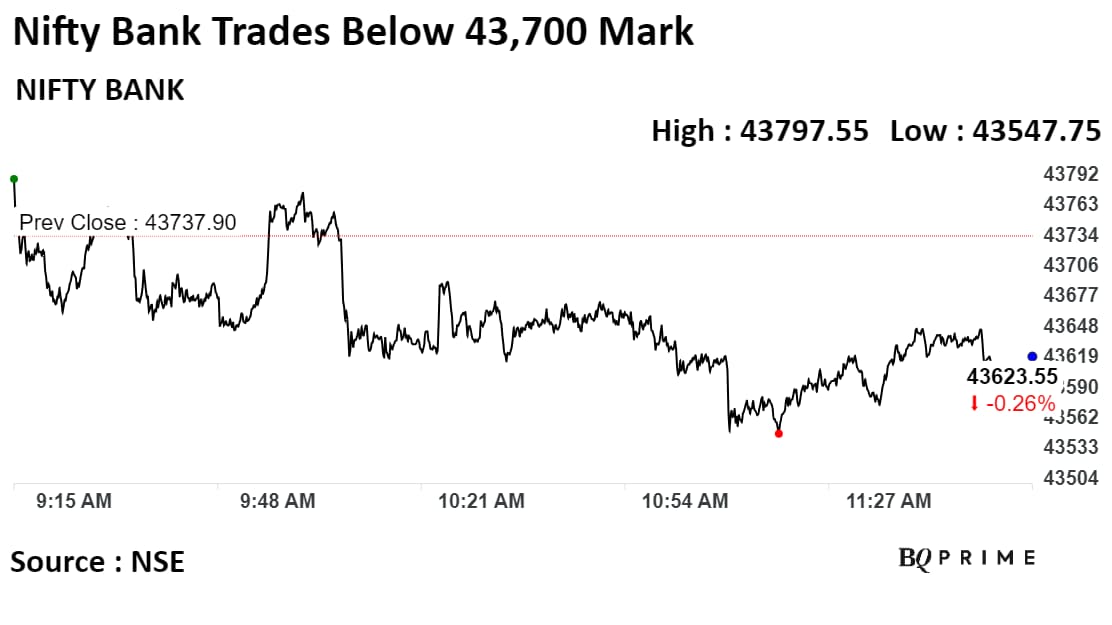

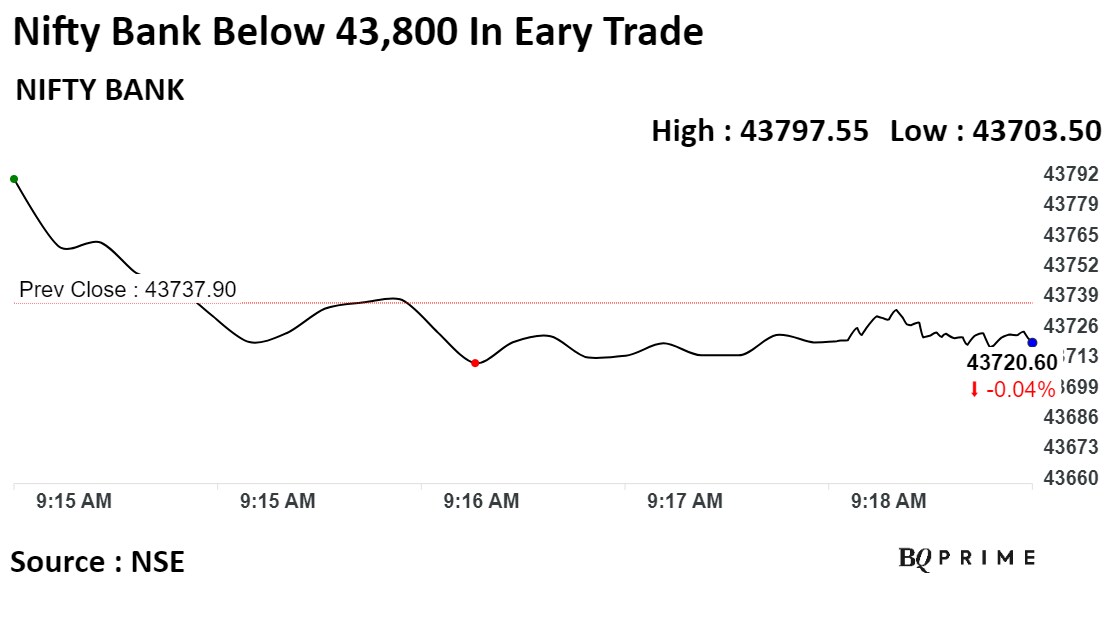

Top Losers: Nifty Bank (-0.28%), Nifty Media (-0.11%)

Source: Cogencis

Revenue at Rs 252.6 crore vs Rs 226.4 crore, up 11.57% YoY

Ebitda at 150.7 crore vs Rs 120 crore, up 25.5% YoY

Margin at 59.65% vs 53.04% YoY

Reported profit at Rs 92.3 crore vs Rs 72.1 crore, up 28% YoY

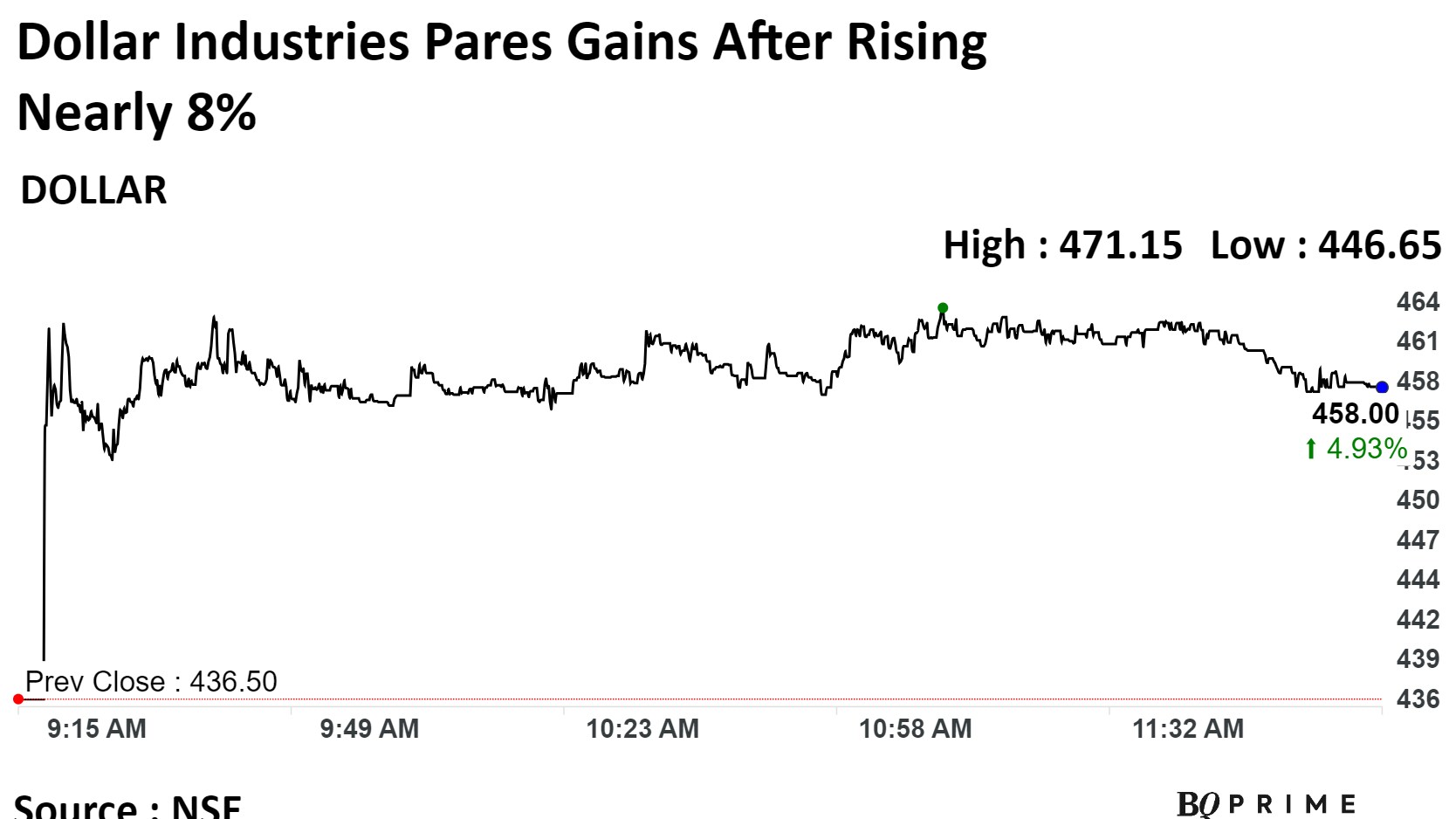

Shares of Dollar Industries Ltd. surged nearly 8% after its profit jumped in the second quarter.

The company's net profit rose 43.9% year-on-year to Rs 24.87 crore in the quarter ended September, according to an exchange filing.

Dollar Industries Q2 FY24 Highlights (Consolidated, YoY)

Revenue up 21.2% at Rs 412.5 crore.

Ebitda up 37.62% at Rs 41.7 crore.

Margin at 10.11% vs. 8.9%.

Net profit up 43.9% at Rs 24.87 crore.

Shares of Dollar Industries rose as much as 7.94% to 471.15 apiece before paring gains to trade 4.93% higher at Rs 458.00 apiece as of 12:11 p.m. This compares to a 0.12% advance in the NSE Nifty 50 Index.

The stock has risen 9.67% on a year-to-date basis. Total traded volume so far in the day stood at 13 times of its 30-day average. The relative strength index was at 65.69.

Out of four analysts tracking the company, 2 maintain a 'buy' rating, one recommends a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an downside/upside of 11.1%.

Shares of Dollar Industries Ltd. surged nearly 8% after its profit jumped in the second quarter.

The company's net profit rose 43.9% year-on-year to Rs 24.87 crore in the quarter ended September, according to an exchange filing.

Dollar Industries Q2 FY24 Highlights (Consolidated, YoY)

Revenue up 21.2% at Rs 412.5 crore.

Ebitda up 37.62% at Rs 41.7 crore.

Margin at 10.11% vs. 8.9%.

Net profit up 43.9% at Rs 24.87 crore.

Shares of Dollar Industries rose as much as 7.94% to 471.15 apiece before paring gains to trade 4.93% higher at Rs 458.00 apiece as of 12:11 p.m. This compares to a 0.12% advance in the NSE Nifty 50 Index.

The stock has risen 9.67% on a year-to-date basis. Total traded volume so far in the day stood at 13 times of its 30-day average. The relative strength index was at 65.69.

Out of four analysts tracking the company, 2 maintain a 'buy' rating, one recommends a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an downside/upside of 11.1%.

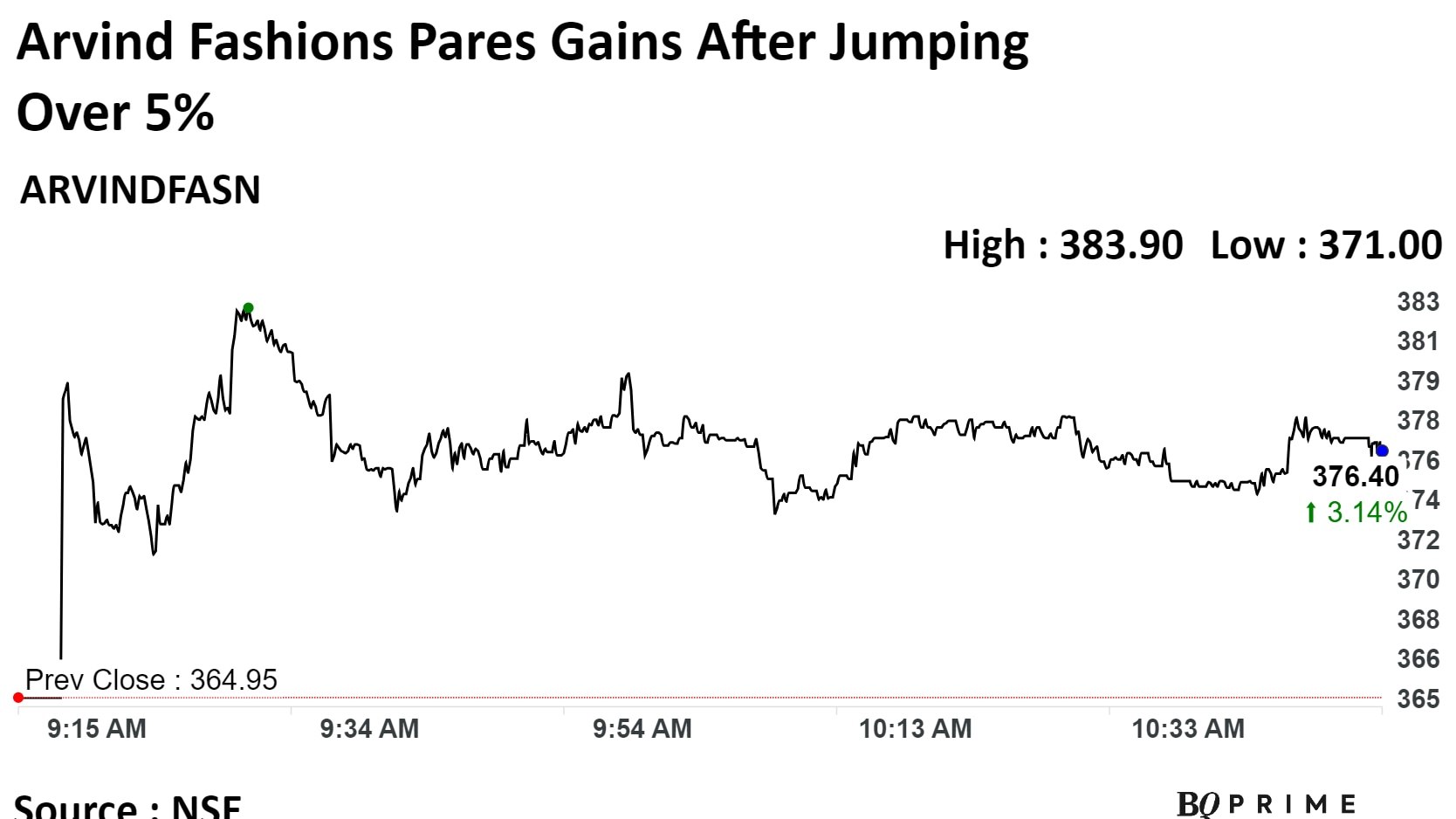

Shares of Arvind Fashions Ltd. rose to a 52-week high on Wednesday after its profit surged in the second quarter.

The company's net profit rose 31.9% year-on-year to Rs 37 crore in the quarter ended September, according to an exchange filing. Its revenue rose 7% to Rs 1,267 crore, despite soft consumer demand.

Revenue up 7.2% at Rs 1,267 crore.

Ebitda up 26.6% at Rs 147.1 crore.

Margin at 11.6% vs 9.82%.

Reported profit up 31.9% at Rs 37 crore.

Shares of the company rose as much as 5.19% before paring gains to trade 3.4% higher at 11:30 a.m. This compares to a 0.13% advance in the NSE Nifty 50.

The stock has risen 8.31% on a year-to-date basis. Total traded volume so far in the day stood at 6.5 times its 30-day average. The relative strength index was at 66.

All four analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month analyst consensus price target implies an upside of 25.6%.

Shares of Arvind Fashions Ltd. rose to a 52-week high on Wednesday after its profit surged in the second quarter.

The company's net profit rose 31.9% year-on-year to Rs 37 crore in the quarter ended September, according to an exchange filing. Its revenue rose 7% to Rs 1,267 crore, despite soft consumer demand.

Revenue up 7.2% at Rs 1,267 crore.

Ebitda up 26.6% at Rs 147.1 crore.

Margin at 11.6% vs 9.82%.

Reported profit up 31.9% at Rs 37 crore.

Shares of the company rose as much as 5.19% before paring gains to trade 3.4% higher at 11:30 a.m. This compares to a 0.13% advance in the NSE Nifty 50.

The stock has risen 8.31% on a year-to-date basis. Total traded volume so far in the day stood at 6.5 times its 30-day average. The relative strength index was at 66.

All four analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month analyst consensus price target implies an upside of 25.6%.

HPCL advances to highest in 15 weeks; trades at 8.5x its 30-day average

Dr Lal PathLabs hits all-time high for second straight session

Apollo Tyres advances most in 10 months as Q2 profit beat estimates

Alkem Labs hits record high as earnings beat estimates

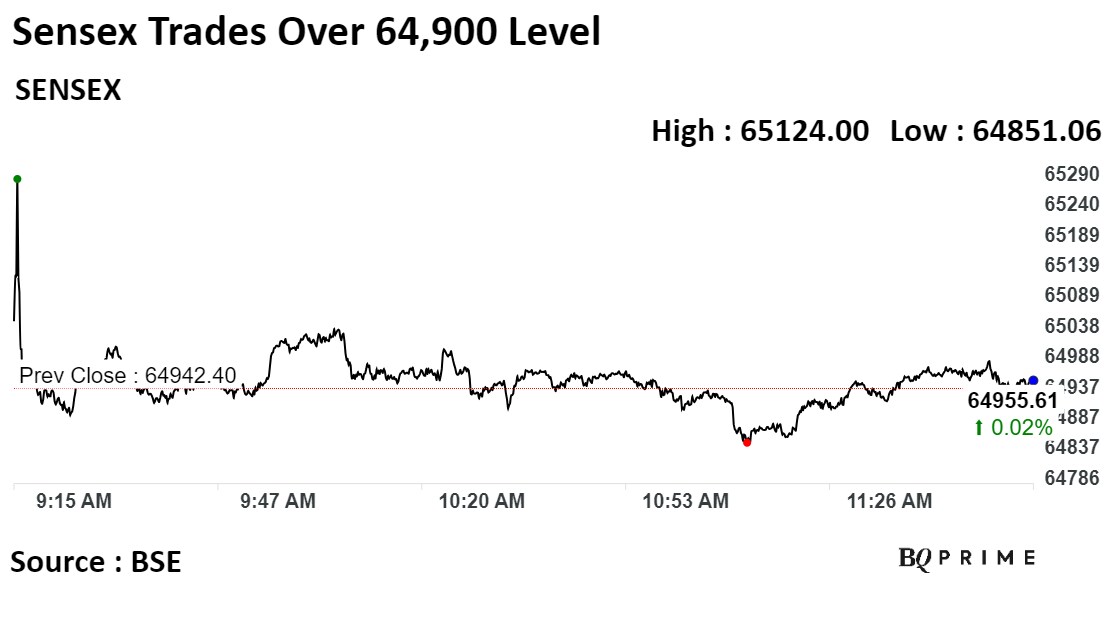

India's benchmark stock indices swung between gains and losses through midday on Wednesday. Pharma, realty and energy sectors advanced, whereas banks and non-banking financial companies were under pressure.

Intraday, Sensex jumped over 65,100 and it was trading over 100 points below day's high and Nifty 50 scaled over 19,450 mark, both rising over highest level in over two weeks since Oct. 23.

As of 12:02 p.m., the S&P BSE Sensex was up 14 points, or 0.02%, at 64,956.62 while the NSE Nifty 50 was 29 points or 0.15% higher at 19,435.80.

"Buoyed by Wall Street's winning streak, Nifty appears to be the standout Diwali theme. With technical targets at 19,500 and 19,789, Nifty remains optimistic, especially as WTI crude oil prices tumble. Anticipating a dovish Federal Reserve, tech stocks are poised for outperformance," Prashanth Tapse, senior vice president (research), Mehta Equities Ltd., said.

Stocks in Asia ticked lower on Wednesday as investors waited to hear more from Federal Reserve officials who are due to speak this week, including Chair Jerome Powell.

Japan’s Topix led declines. Japanese banks extended their drop on falling yields that tempered expectation of higher profitability. Chinese benchmarks fluctuated between gains and losses.

Australian and Taiwanese markets were marginally higher while China, South Korean and Hong Kong shares declined. U.S. equities were little changed.

India's benchmark stock indices swung between gains and losses through midday on Wednesday. Pharma, realty and energy sectors advanced, whereas banks and non-banking financial companies were under pressure.

Intraday, Sensex jumped over 65,100 and it was trading over 100 points below day's high and Nifty 50 scaled over 19,450 mark, both rising over highest level in over two weeks since Oct. 23.

As of 12:02 p.m., the S&P BSE Sensex was up 14 points, or 0.02%, at 64,956.62 while the NSE Nifty 50 was 29 points or 0.15% higher at 19,435.80.

"Buoyed by Wall Street's winning streak, Nifty appears to be the standout Diwali theme. With technical targets at 19,500 and 19,789, Nifty remains optimistic, especially as WTI crude oil prices tumble. Anticipating a dovish Federal Reserve, tech stocks are poised for outperformance," Prashanth Tapse, senior vice president (research), Mehta Equities Ltd., said.

Stocks in Asia ticked lower on Wednesday as investors waited to hear more from Federal Reserve officials who are due to speak this week, including Chair Jerome Powell.

Japan’s Topix led declines. Japanese banks extended their drop on falling yields that tempered expectation of higher profitability. Chinese benchmarks fluctuated between gains and losses.

Australian and Taiwanese markets were marginally higher while China, South Korean and Hong Kong shares declined. U.S. equities were little changed.

India's benchmark stock indices swung between gains and losses through midday on Wednesday. Pharma, realty and energy sectors advanced, whereas banks and non-banking financial companies were under pressure.

Intraday, Sensex jumped over 65,100 and it was trading over 100 points below day's high and Nifty 50 scaled over 19,450 mark, both rising over highest level in over two weeks since Oct. 23.

As of 12:02 p.m., the S&P BSE Sensex was up 14 points, or 0.02%, at 64,956.62 while the NSE Nifty 50 was 29 points or 0.15% higher at 19,435.80.

"Buoyed by Wall Street's winning streak, Nifty appears to be the standout Diwali theme. With technical targets at 19,500 and 19,789, Nifty remains optimistic, especially as WTI crude oil prices tumble. Anticipating a dovish Federal Reserve, tech stocks are poised for outperformance," Prashanth Tapse, senior vice president (research), Mehta Equities Ltd., said.

Stocks in Asia ticked lower on Wednesday as investors waited to hear more from Federal Reserve officials who are due to speak this week, including Chair Jerome Powell.

Japan’s Topix led declines. Japanese banks extended their drop on falling yields that tempered expectation of higher profitability. Chinese benchmarks fluctuated between gains and losses.

Australian and Taiwanese markets were marginally higher while China, South Korean and Hong Kong shares declined. U.S. equities were little changed.

India's benchmark stock indices swung between gains and losses through midday on Wednesday. Pharma, realty and energy sectors advanced, whereas banks and non-banking financial companies were under pressure.

Intraday, Sensex jumped over 65,100 and it was trading over 100 points below day's high and Nifty 50 scaled over 19,450 mark, both rising over highest level in over two weeks since Oct. 23.

As of 12:02 p.m., the S&P BSE Sensex was up 14 points, or 0.02%, at 64,956.62 while the NSE Nifty 50 was 29 points or 0.15% higher at 19,435.80.

"Buoyed by Wall Street's winning streak, Nifty appears to be the standout Diwali theme. With technical targets at 19,500 and 19,789, Nifty remains optimistic, especially as WTI crude oil prices tumble. Anticipating a dovish Federal Reserve, tech stocks are poised for outperformance," Prashanth Tapse, senior vice president (research), Mehta Equities Ltd., said.

Stocks in Asia ticked lower on Wednesday as investors waited to hear more from Federal Reserve officials who are due to speak this week, including Chair Jerome Powell.

Japan’s Topix led declines. Japanese banks extended their drop on falling yields that tempered expectation of higher profitability. Chinese benchmarks fluctuated between gains and losses.

Australian and Taiwanese markets were marginally higher while China, South Korean and Hong Kong shares declined. U.S. equities were little changed.

India's benchmark stock indices swung between gains and losses through midday on Wednesday. Pharma, realty and energy sectors advanced, whereas banks and non-banking financial companies were under pressure.

Intraday, Sensex jumped over 65,100 and it was trading over 100 points below day's high and Nifty 50 scaled over 19,450 mark, both rising over highest level in over two weeks since Oct. 23.

As of 12:02 p.m., the S&P BSE Sensex was up 14 points, or 0.02%, at 64,956.62 while the NSE Nifty 50 was 29 points or 0.15% higher at 19,435.80.

"Buoyed by Wall Street's winning streak, Nifty appears to be the standout Diwali theme. With technical targets at 19,500 and 19,789, Nifty remains optimistic, especially as WTI crude oil prices tumble. Anticipating a dovish Federal Reserve, tech stocks are poised for outperformance," Prashanth Tapse, senior vice president (research), Mehta Equities Ltd., said.

Stocks in Asia ticked lower on Wednesday as investors waited to hear more from Federal Reserve officials who are due to speak this week, including Chair Jerome Powell.

Japan’s Topix led declines. Japanese banks extended their drop on falling yields that tempered expectation of higher profitability. Chinese benchmarks fluctuated between gains and losses.

Australian and Taiwanese markets were marginally higher while China, South Korean and Hong Kong shares declined. U.S. equities were little changed.

India's benchmark stock indices swung between gains and losses through midday on Wednesday. Pharma, realty and energy sectors advanced, whereas banks and non-banking financial companies were under pressure.

Intraday, Sensex jumped over 65,100 and it was trading over 100 points below day's high and Nifty 50 scaled over 19,450 mark, both rising over highest level in over two weeks since Oct. 23.

As of 12:02 p.m., the S&P BSE Sensex was up 14 points, or 0.02%, at 64,956.62 while the NSE Nifty 50 was 29 points or 0.15% higher at 19,435.80.

"Buoyed by Wall Street's winning streak, Nifty appears to be the standout Diwali theme. With technical targets at 19,500 and 19,789, Nifty remains optimistic, especially as WTI crude oil prices tumble. Anticipating a dovish Federal Reserve, tech stocks are poised for outperformance," Prashanth Tapse, senior vice president (research), Mehta Equities Ltd., said.

Stocks in Asia ticked lower on Wednesday as investors waited to hear more from Federal Reserve officials who are due to speak this week, including Chair Jerome Powell.

Japan’s Topix led declines. Japanese banks extended their drop on falling yields that tempered expectation of higher profitability. Chinese benchmarks fluctuated between gains and losses.

Australian and Taiwanese markets were marginally higher while China, South Korean and Hong Kong shares declined. U.S. equities were little changed.

India's benchmark stock indices swung between gains and losses through midday on Wednesday. Pharma, realty and energy sectors advanced, whereas banks and non-banking financial companies were under pressure.

Intraday, Sensex jumped over 65,100 and it was trading over 100 points below day's high and Nifty 50 scaled over 19,450 mark, both rising over highest level in over two weeks since Oct. 23.

As of 12:02 p.m., the S&P BSE Sensex was up 14 points, or 0.02%, at 64,956.62 while the NSE Nifty 50 was 29 points or 0.15% higher at 19,435.80.

"Buoyed by Wall Street's winning streak, Nifty appears to be the standout Diwali theme. With technical targets at 19,500 and 19,789, Nifty remains optimistic, especially as WTI crude oil prices tumble. Anticipating a dovish Federal Reserve, tech stocks are poised for outperformance," Prashanth Tapse, senior vice president (research), Mehta Equities Ltd., said.

Stocks in Asia ticked lower on Wednesday as investors waited to hear more from Federal Reserve officials who are due to speak this week, including Chair Jerome Powell.

Japan’s Topix led declines. Japanese banks extended their drop on falling yields that tempered expectation of higher profitability. Chinese benchmarks fluctuated between gains and losses.

Australian and Taiwanese markets were marginally higher while China, South Korean and Hong Kong shares declined. U.S. equities were little changed.

India's benchmark stock indices swung between gains and losses through midday on Wednesday. Pharma, realty and energy sectors advanced, whereas banks and non-banking financial companies were under pressure.

Intraday, Sensex jumped over 65,100 and it was trading over 100 points below day's high and Nifty 50 scaled over 19,450 mark, both rising over highest level in over two weeks since Oct. 23.

As of 12:02 p.m., the S&P BSE Sensex was up 14 points, or 0.02%, at 64,956.62 while the NSE Nifty 50 was 29 points or 0.15% higher at 19,435.80.

"Buoyed by Wall Street's winning streak, Nifty appears to be the standout Diwali theme. With technical targets at 19,500 and 19,789, Nifty remains optimistic, especially as WTI crude oil prices tumble. Anticipating a dovish Federal Reserve, tech stocks are poised for outperformance," Prashanth Tapse, senior vice president (research), Mehta Equities Ltd., said.

Stocks in Asia ticked lower on Wednesday as investors waited to hear more from Federal Reserve officials who are due to speak this week, including Chair Jerome Powell.

Japan’s Topix led declines. Japanese banks extended their drop on falling yields that tempered expectation of higher profitability. Chinese benchmarks fluctuated between gains and losses.

Australian and Taiwanese markets were marginally higher while China, South Korean and Hong Kong shares declined. U.S. equities were little changed.

ICICI Bank Ltd., NTPC Ltd., Bajaj Finance Ltd., Kotak Mahindra Bank Ltd., and Infosys Ltd. were negatively adding to the change in the Nifty 50 Index.

Whereas, Reliance Industries Ltd., Tata Consultancy Services Ltd., Titan Co., Asian Paints Ltd., and Adani Ports & Special Economic Zone Ltd. were positively contributing to the change.

The broader markets outperformed larger peers; the S&P BSE MidCap Index was up 0.71%, whereas S&P BSE SmallCap Index was 0.78% higher.

Seventeen out of the 20 sectors compiled by BSE advanced while three declined. S&P BSE Healthcare and S&P BSE Realty rose the most.

The market breadth was skewed in the favour of the buyers. About 2,112 stocks rose, 1,403 declined, while 141 remained unchanged on the BSE.

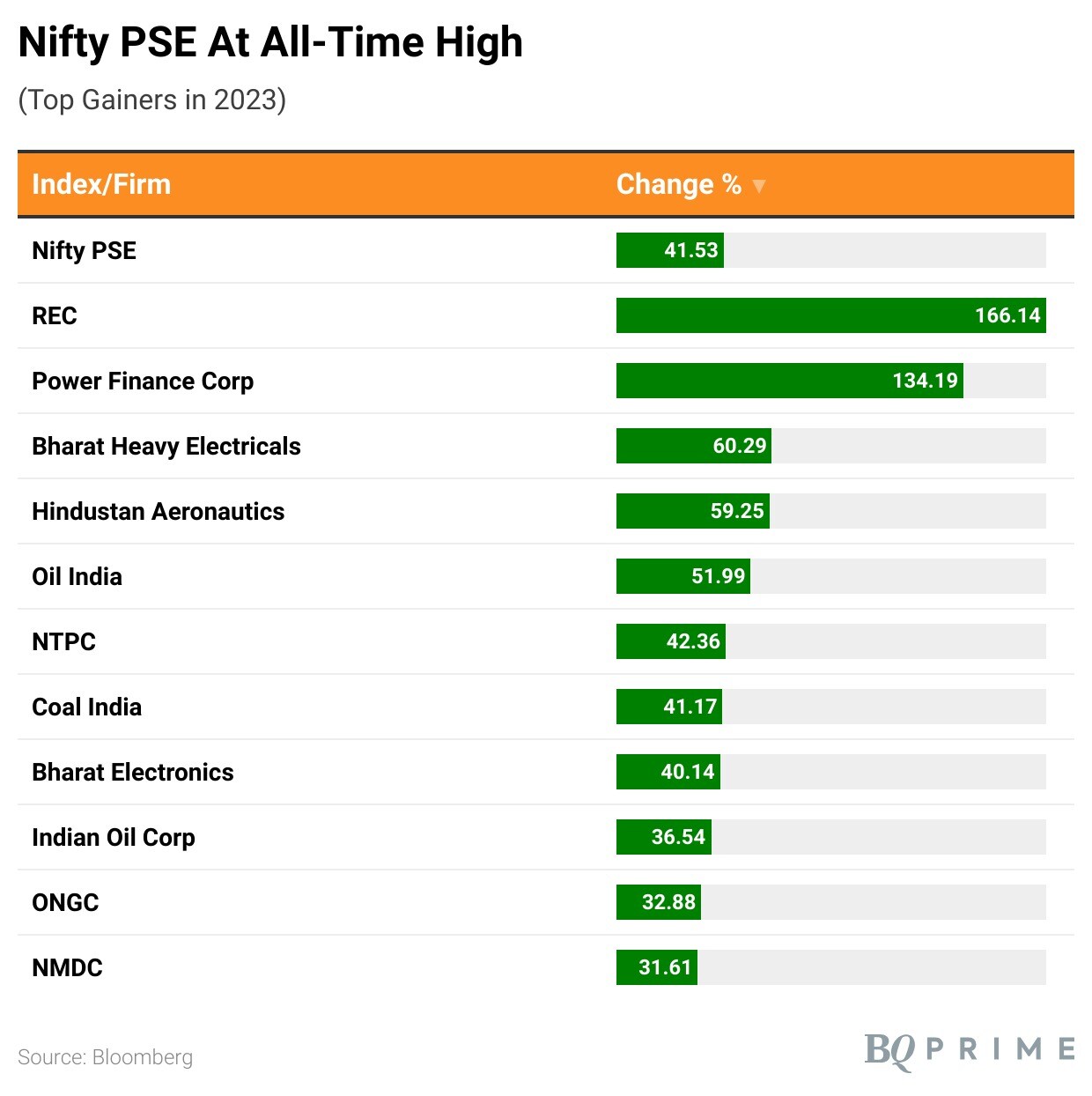

Nifty PSE gains 0.8% intraday to touch all-time high of 6,201.45

Nifty PSE gains for five consecutive days

Nifty PSE gains 43.22% in 2023

Top gainers in 2023: REC (166.14%), Power Finance Corp (134.19%), BHEL (60.3%)

Nifty PSE gains 0.8% intraday to touch all-time high of 6,201.45

Nifty PSE gains for five consecutive days

Nifty PSE gains 43.22% in 2023

Top gainers in 2023: REC (166.14%), Power Finance Corp (134.19%), BHEL (60.3%)

Standalone total Income at Rs 263 crore vs Rs 238 crore, up 10.33% YoY

Standalone net profit at Rs 81.4 crore vs Rs 69.7 crore, up 16.79% YoY

Board approves interim dividend of Rs 10 per share

16 lakh shares changed hands in a large trade

0.01% equity changed hands at Rs 433.1 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Gets U.S. FDA EIR for Visakhapatnam Sterile Oncology plant

EIR indicates closure of GMP inspection

Alert: GMP stands for Good Manufacturing Practice

Source: Exchange Filing

To raise Rs 500 crore via NCD for new manufacturing units at Chennai, Gujarat.

Source: Exchange Filing

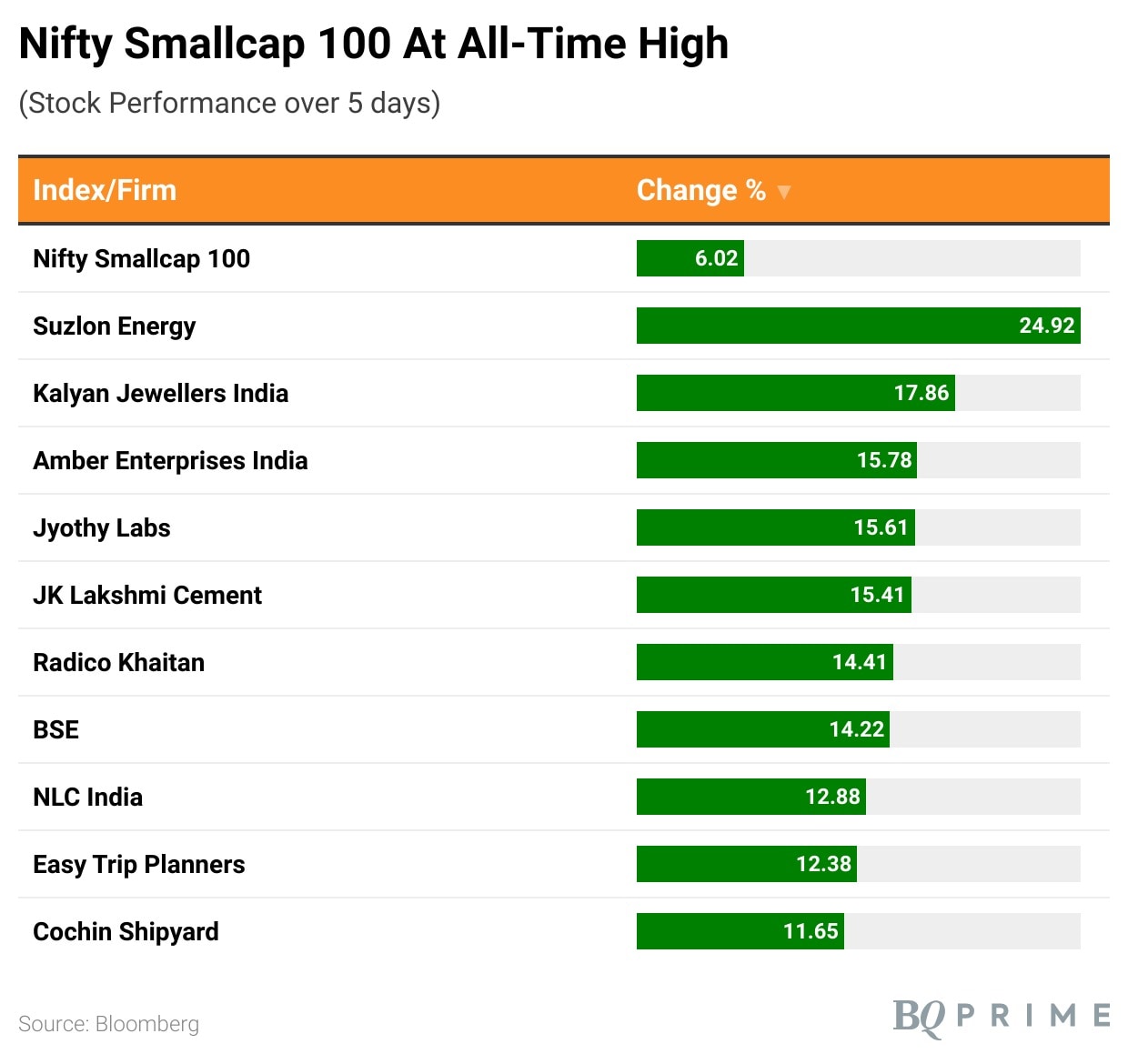

Nifty Smallcap 100 gains 1.2% to touch all-time high of 13,401.6

Nifty Smallcap 100 gains for five consecutive days

Nifty Smallcap 100 gains 6.02% over five days

Top gainers in 5 days: Suzlon Energy (24.92%), Kalyan Jewellers (17.86%), Amber Enterprises (15.78%)

Nifty Smallcap 100 gains 1.2% to touch all-time high of 13,401.6

Nifty Smallcap 100 gains for five consecutive days

Nifty Smallcap 100 gains 6.02% over five days

Top gainers in 5 days: Suzlon Energy (24.92%), Kalyan Jewellers (17.86%), Amber Enterprises (15.78%)

Unit Mahindra Aerospace Australia to sell entire stake in multiple subsidiaries

MAAPL decides to exit aircraft manufacturing business

Alert: MAAPL stands for Mahindra Aerospace Australia Pty Limited

Source: Exchange Filing

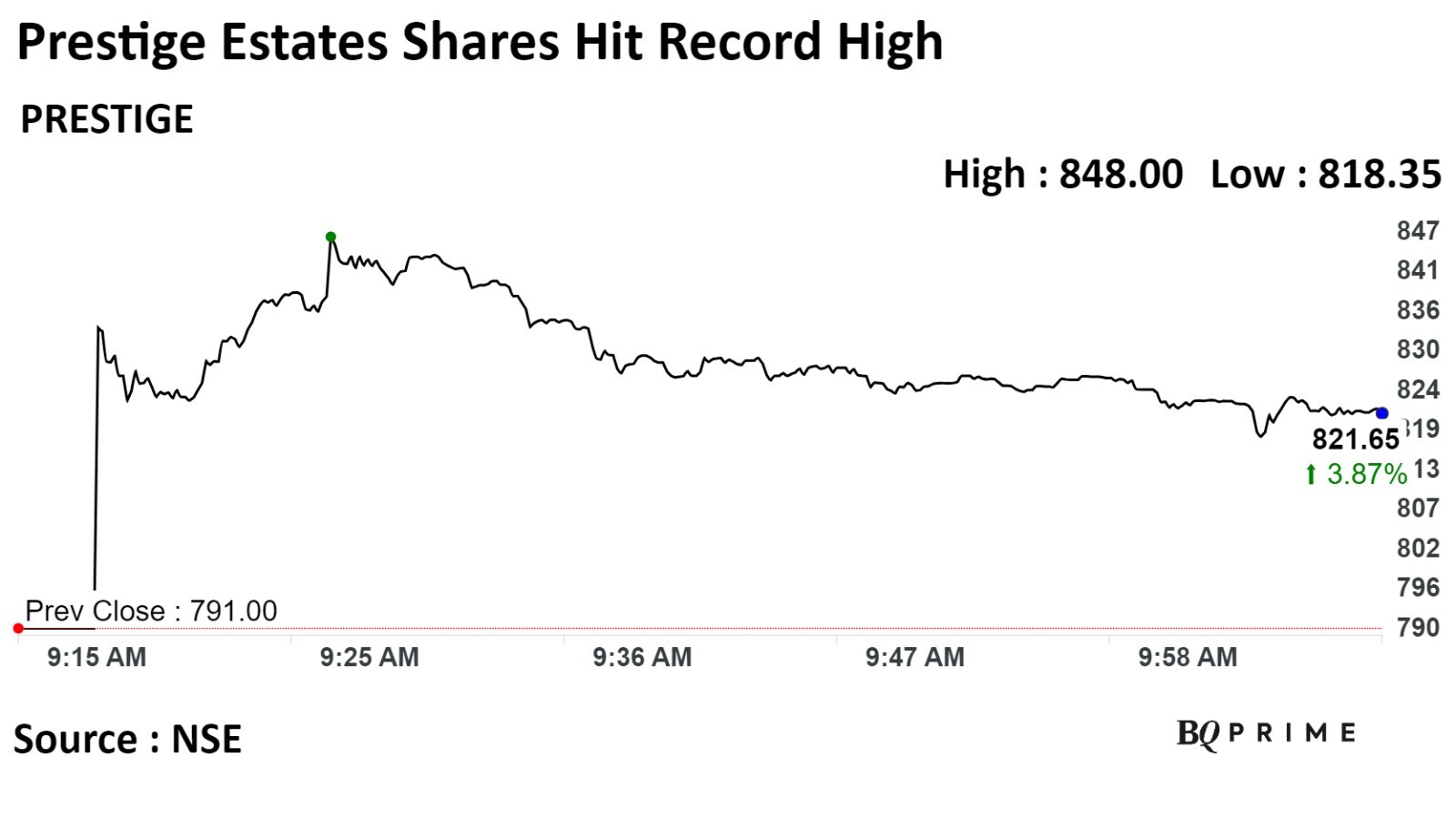

Shares of Prestige Estates Ltd. rose over 7% to hit a record high after company's consolidated net profit increased to Rs 910 crore in the second quarter of fiscal 2024, beating analysts' estimates.

The real estate developer's profit rose to Rs 910 crore, on the back of other income, as compared with Rs 148.6 crore in the same quarter last year, according to an exchange filing on Tuesday. Analysts polled by Bloomberg had estimated a profit of Rs 235 crore.

Its other income rose to Rs 1,019 crore from Rs 47 crore. The Bengaluru-based firm's expenses grew 48% to Rs 2,082 crore as against Rs 1,408 crore year-on-year.

Revenue rose 56.6% to Rs 2,236 crore vs Rs 1,427 crore (Bloomberg estimate: Rs 1,989.6 crore).

Ebitda up 61% at Rs 592 crore vs Rs 368 crore.

Ebitda margin at 26.4% vs 25.8%.

Net profit at Rs 910 crore vs Rs 148 crore.

Shares of rose as much as 7.21%, to a new record high. The scrip is trading 3.87% higher at 821.6 at 10:10 a.m. This compares to a 0.13% advance in the NSE Nifty 50.

The stock has risen 77.73% on a year-to-date basis. Total traded volume so far in the day stood at 4.5 times its 30-day average. The relative strength index was at 73 suggesting stock may be overbought.

Shares of Prestige Estates Ltd. rose over 7% to hit a record high after company's consolidated net profit increased to Rs 910 crore in the second quarter of fiscal 2024, beating analysts' estimates.

The real estate developer's profit rose to Rs 910 crore, on the back of other income, as compared with Rs 148.6 crore in the same quarter last year, according to an exchange filing on Tuesday. Analysts polled by Bloomberg had estimated a profit of Rs 235 crore.

Its other income rose to Rs 1,019 crore from Rs 47 crore. The Bengaluru-based firm's expenses grew 48% to Rs 2,082 crore as against Rs 1,408 crore year-on-year.

Revenue rose 56.6% to Rs 2,236 crore vs Rs 1,427 crore (Bloomberg estimate: Rs 1,989.6 crore).

Ebitda up 61% at Rs 592 crore vs Rs 368 crore.

Ebitda margin at 26.4% vs 25.8%.

Net profit at Rs 910 crore vs Rs 148 crore.

Shares of rose as much as 7.21%, to a new record high. The scrip is trading 3.87% higher at 821.6 at 10:10 a.m. This compares to a 0.13% advance in the NSE Nifty 50.

The stock has risen 77.73% on a year-to-date basis. Total traded volume so far in the day stood at 4.5 times its 30-day average. The relative strength index was at 73 suggesting stock may be overbought.

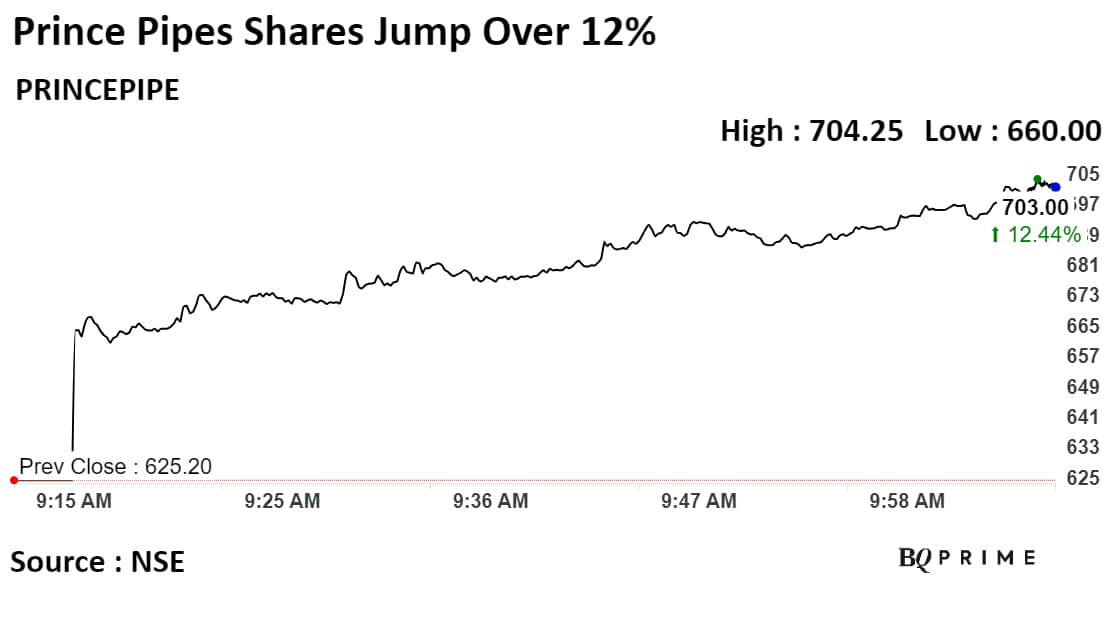

Shares of Prince Pipes and Fittings Ltd. rose after it reported profit in the September quarter of the fiscal 2024.

The company reported a consolidated net profit of Rs 70.63 crore on a year-over-year basis in the July to September quarter, according to its exchange filing. This compares to a loss of Rs 24.11 crore in the same quarter of the previous financial year.

Exceptional item for quarter and half year ended Sept. 30 represents a net gain of Rs 17.93 crore towards settlement of registration of Corporate office, at The Ruby, Dadar, Mumbai, based on the valuation report, as per its investor presentation.

Prince Pipes and Fittings Q2 FY24 (Consolidated, YoY)

Revenue up 3.13% at Rs 656.45 crore vs Rs 636.48 crore.

Ebitda at Rs 194.18 crore vs loss of Rs 11.36 crore.

Margin at 29.58%.

Reported profit at Rs 70.63 crore vs loss of Rs 24.11 crore.

The scrip rose as much as 12.64% to 704.25 apiece, the highest level since Oct. 20. It pared gains to trade 10.70% higher at Rs 692.10 apiece, as of 10:01 a.m. This compares to a 0.22% advance in the NSE Nifty 50 Index.

It has risen 16.7% on a year-to-date basis. Total traded volume so far in the day stood at 66 times its 30-day average. The relative strength index was at 61.8.

Out of the 13 analysts tracking the company, 12 maintain a 'buy' rating, one recommends a 'hold,' and none suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 17.3%.

Shares of Prince Pipes and Fittings Ltd. rose after it reported profit in the September quarter of the fiscal 2024.

The company reported a consolidated net profit of Rs 70.63 crore on a year-over-year basis in the July to September quarter, according to its exchange filing. This compares to a loss of Rs 24.11 crore in the same quarter of the previous financial year.

Exceptional item for quarter and half year ended Sept. 30 represents a net gain of Rs 17.93 crore towards settlement of registration of Corporate office, at The Ruby, Dadar, Mumbai, based on the valuation report, as per its investor presentation.

Prince Pipes and Fittings Q2 FY24 (Consolidated, YoY)

Revenue up 3.13% at Rs 656.45 crore vs Rs 636.48 crore.

Ebitda at Rs 194.18 crore vs loss of Rs 11.36 crore.

Margin at 29.58%.

Reported profit at Rs 70.63 crore vs loss of Rs 24.11 crore.

The scrip rose as much as 12.64% to 704.25 apiece, the highest level since Oct. 20. It pared gains to trade 10.70% higher at Rs 692.10 apiece, as of 10:01 a.m. This compares to a 0.22% advance in the NSE Nifty 50 Index.

It has risen 16.7% on a year-to-date basis. Total traded volume so far in the day stood at 66 times its 30-day average. The relative strength index was at 61.8.

Out of the 13 analysts tracking the company, 12 maintain a 'buy' rating, one recommends a 'hold,' and none suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 17.3%.

Gets order worth Rs 2,259.9 crore for appointment of AMISPs from various State Electricity Board

Order for installation, commissioning with FMS of 27.33 lakhs Smart Prepaid Meter

Alert: AMISPs stands for Advanced Metering Infrastructure Service Providers

Source: Exchange Filing

20.9 lakh shares changed hands in a large trade

0.1% equity changed hands at Rs 238.9 apiece

Buyers and sellers not known immediately

Source: Bloomberg

The broader markets were trading higher; the S&P BSE MidCap Index was up 0.59%, whereas S&P BSE SmallCap Index was 0.63% higher.

Nineteen out of the 20 sectors compiled by BSE advanced while Nifty Bank declined. S&P BSE Oil & Gas and S&P BSE Realty rose the most.

The market breadth was skewed in the favour of the buyers. About 1,896 stocks rose, 708 declined, while 94 remained unchanged on the BSE.

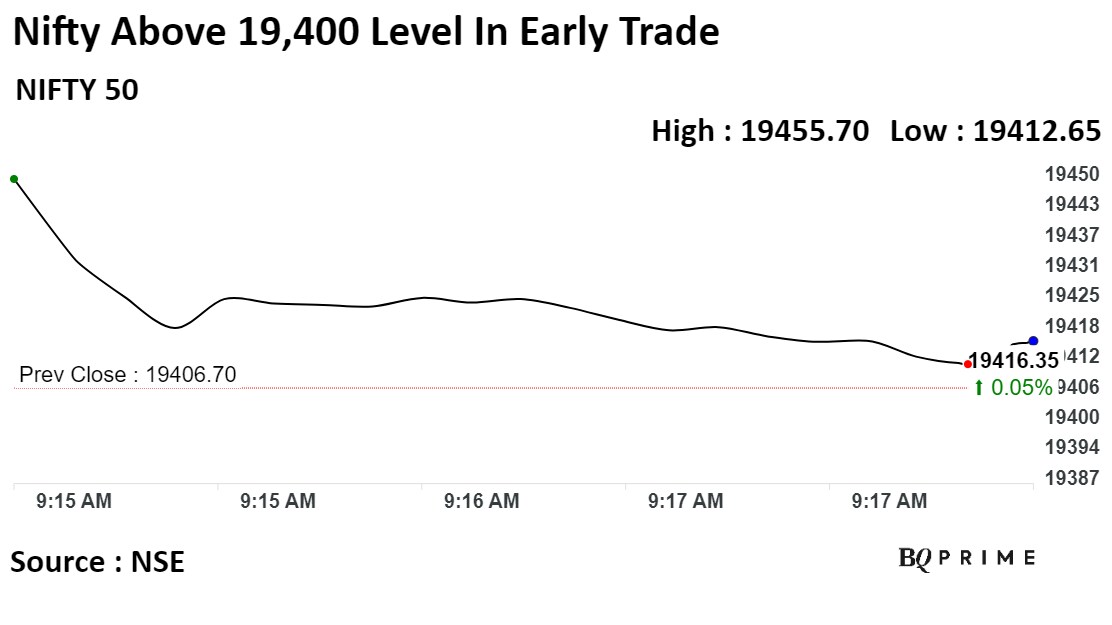

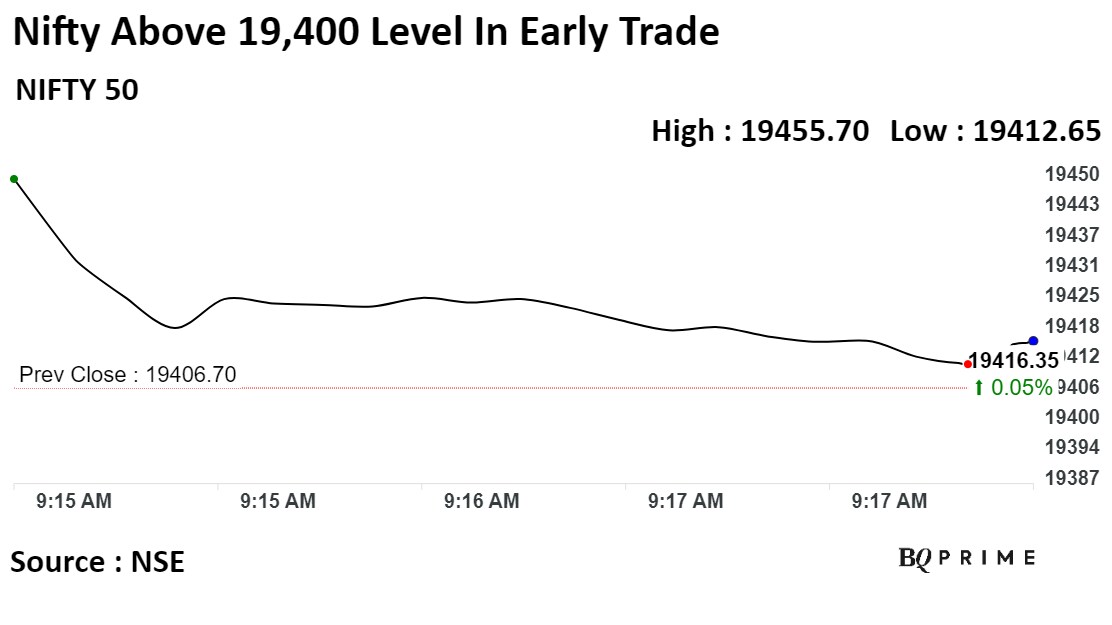

India's benchmark stock indices opened higher and swung to trade mixed on Wednesday. The headline indices snapped three days of gains on Tuesday.

"Buoyed by Wall Street's winning streak, Nifty appears to be the standout Diwali theme. With technical targets at 19,500 and 19,789, Nifty remains optimistic, especially as WTI crude oil prices tumble. Anticipating a dovish Federal Reserve, tech stocks are poised for outperformance," Prashanth Tapse, senior vice president (research), Mehta Equities Ltd., said.

At pre-open, the S&P BSE Sensex was up 160 points, or 0.25%, at 65,101.95 while the NSE Nifty 50 was 43 points or 0.22% higher at 19,449.60. The indices opened at the highest level in over two-week since Oct. 23, 2023.

Stocks in Asia were mixed after a rally in big tech saw the S&P 500 notch up its longest streak of gains in two years.

Australian, Japanese and Taiwanese markets were marginally higher while China, South Korean and Hong Kong shares declined. U.S. equities were little changed after some central bank officials emphasized that bringing inflation fully down to the 2% goal is their main focus.

India's benchmark stock indices opened higher and swung to trade mixed on Wednesday. The headline indices snapped three days of gains on Tuesday.

"Buoyed by Wall Street's winning streak, Nifty appears to be the standout Diwali theme. With technical targets at 19,500 and 19,789, Nifty remains optimistic, especially as WTI crude oil prices tumble. Anticipating a dovish Federal Reserve, tech stocks are poised for outperformance," Prashanth Tapse, senior vice president (research), Mehta Equities Ltd., said.

At pre-open, the S&P BSE Sensex was up 160 points, or 0.25%, at 65,101.95 while the NSE Nifty 50 was 43 points or 0.22% higher at 19,449.60. The indices opened at the highest level in over two-week since Oct. 23, 2023.

Stocks in Asia were mixed after a rally in big tech saw the S&P 500 notch up its longest streak of gains in two years.

Australian, Japanese and Taiwanese markets were marginally higher while China, South Korean and Hong Kong shares declined. U.S. equities were little changed after some central bank officials emphasized that bringing inflation fully down to the 2% goal is their main focus.

India's benchmark stock indices opened higher and swung to trade mixed on Wednesday. The headline indices snapped three days of gains on Tuesday.

"Buoyed by Wall Street's winning streak, Nifty appears to be the standout Diwali theme. With technical targets at 19,500 and 19,789, Nifty remains optimistic, especially as WTI crude oil prices tumble. Anticipating a dovish Federal Reserve, tech stocks are poised for outperformance," Prashanth Tapse, senior vice president (research), Mehta Equities Ltd., said.

At pre-open, the S&P BSE Sensex was up 160 points, or 0.25%, at 65,101.95 while the NSE Nifty 50 was 43 points or 0.22% higher at 19,449.60. The indices opened at the highest level in over two-week since Oct. 23, 2023.

Stocks in Asia were mixed after a rally in big tech saw the S&P 500 notch up its longest streak of gains in two years.

Australian, Japanese and Taiwanese markets were marginally higher while China, South Korean and Hong Kong shares declined. U.S. equities were little changed after some central bank officials emphasized that bringing inflation fully down to the 2% goal is their main focus.

India's benchmark stock indices opened higher and swung to trade mixed on Wednesday. The headline indices snapped three days of gains on Tuesday.

"Buoyed by Wall Street's winning streak, Nifty appears to be the standout Diwali theme. With technical targets at 19,500 and 19,789, Nifty remains optimistic, especially as WTI crude oil prices tumble. Anticipating a dovish Federal Reserve, tech stocks are poised for outperformance," Prashanth Tapse, senior vice president (research), Mehta Equities Ltd., said.

At pre-open, the S&P BSE Sensex was up 160 points, or 0.25%, at 65,101.95 while the NSE Nifty 50 was 43 points or 0.22% higher at 19,449.60. The indices opened at the highest level in over two-week since Oct. 23, 2023.

Stocks in Asia were mixed after a rally in big tech saw the S&P 500 notch up its longest streak of gains in two years.

Australian, Japanese and Taiwanese markets were marginally higher while China, South Korean and Hong Kong shares declined. U.S. equities were little changed after some central bank officials emphasized that bringing inflation fully down to the 2% goal is their main focus.

At pre-open, the S&P BSE Sensex was up 160 points, or 0.25%, at 65,101.95 while the NSE Nifty 50 was 43 points or 0.22% higher at 19,449.60.

Source: Bloomberg

The yield on the 10-year bond opened flat at 7.27% on Wednesday.

Source: Bloomberg

The local currency opened flat at 83.26 against the U.S dollar on Wednesday.

Source: Bloomberg

Brent crude up 0.27% at $81.75/barrel

Brent crude down 16.8% from the 52-week high of $98.30/barrel

Nymex crude down 0.04% at $77.36/barrel

To debut in U.K., key European countries with electric vehicles

To enter European markets such as Spain, France and U.K. by mid-2024

Source: Exchange Filing

U.S. Dollar Index at 105.6

U.S. 10-year bond yield at 4.58%

Brent crude down 0.40% at $81.28 per barrel

Nymex crude down 0.62% at $76.89 per barrel

GIFT Nifty was up 27 points of 0.14% at 19,522.5 as of 8:15 a.m.

Bitcoin was down 0.30% at $35,396.69

Price band revised from 20% to 10%: Drone Destination, Jaiprakash Power Ventures.

Record Date Dividend: Birlasoft, Great Eastern Shipping Co., Oberoi Realty, RITES, Supreme Petrochem.

Protean eGov Technologies: The IPO was subscribed to 3.21 times on its second day. The bids were led by non-institutional investors (6.23 times), retail investors (3.89 times), reserved for employees (0.76 times, 76%), and institutional investors (0.07 times, 7%).

ASK Automotive: The IPO has been subscribed 0.38 times, or 38%, on its first day. The bids were led by retail investors (0.56 times or 56%), non-institutional investors (0.41 times or 41%), and institutional investors (0.03 times or 3%).

Choice International: Promoter Patodia Properties bought 75,000 shares on Nov. 6.

ISMT: Promoters BR Taneja, Asscher Enterprise and Baldevraj Topanram Taneja sold 3.14 lakh shares, 1.44 crore shares and 1.45 lakh shares, respectively on Nov. 3.

Inox Wind: The company will raise Rs 500 crore through the issue of preference shares. The board approved the raising of funds by way of the issuance of 0.01% non-convertible, non-cumulative, participating, redeemable preference shares of the face value of Rs 10 each.

Lupin: The company received U.S. FDA tentative approval for the Invokamet generic.

Voltas: The company denied news reports that the Tata Group is considering selling the home appliance operations of the company.

Westlife Foods: McDonald's Ahmednagar restaurant franchisee received a licence suspension notice from the Maharashtra FDA, though the suspension has been stayed.

SJVN: The company received a letter of intent for the purchase of 200 megawatts of solar power from Uttarakhand Power Corp. UPCL to purchase solar power for Rs 2.57 per unit from the company’s 1,000 MW Bikaner plant.

InterGlobe Aviation: The airline anticipates aircraft on the ground in the mid-thirties in Q4 due to accelerated engine removals. It reconfirmed capacity guidance for Q3, along with FY24 guidance for the upper range of mid-teens.

Alert: Earlier this year, Pratt & Whitney highlighted the impact of the powder metal issue that has affected its new generation GTF aircraft engine.

Anupam Rasayan: The Board appointed Anuj Hemantbhai Thakar as executive director w.e.f. Nov. 7 for a period of five years, subject to approval of the members of the company within 3 months from the date of appointment.

Cummins India: The company's board appointed Jennifer Bush as chairperson of the board w.e.f. Nov. 7.

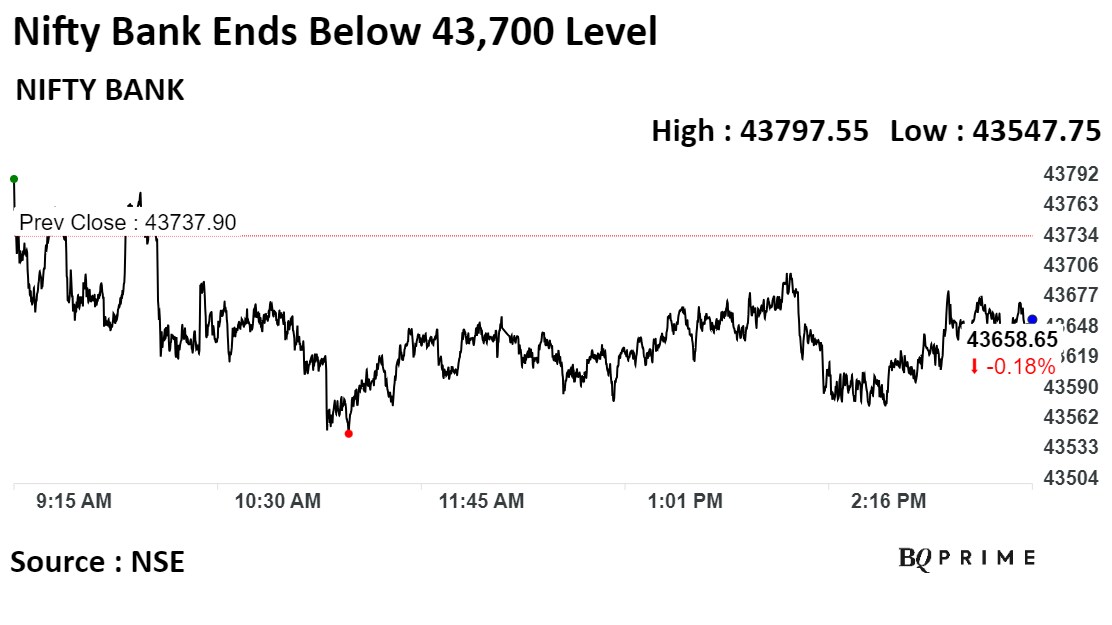

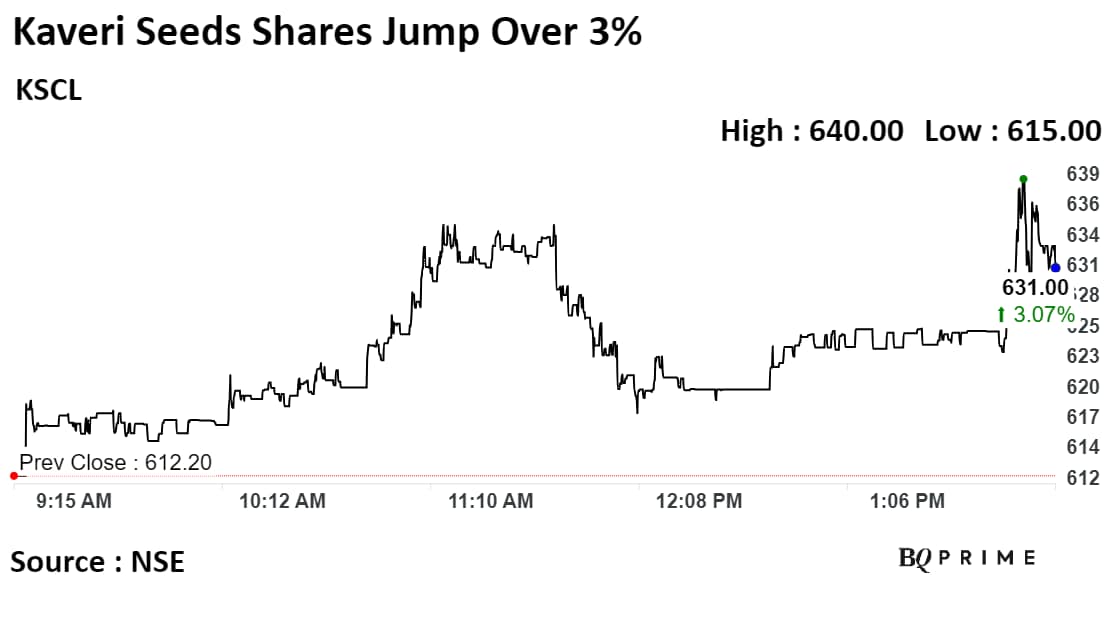

Pidilite Industries, Power Finance Corporation, Tata Power Co., United Spirits, Lupin, PI Industries, Patanjali Foods, Bharat Heavy Electricals, Mazagon Dock Shipbuilders, The Phoenix Mills, Oil India, Skf India, Grindwell Norton, The New India Assurance Company, Endurance Technologies, Godrej Industries, Bata India, KIOCL, Sanofi India, Tata Investment Corporation, Elgi Equipments, Brigade Enterprises, Rhi Magnesita India, Century Plyboards (I), Multi Commodity Exchange Of India, Raymond, Concord Biotech, Eris Lifesciences, Welspun Corp, CESC, Computer Age Management Services, Firstsource Solutions, Gujarat Narmada Valley Fertilizers & Chemicals, Shree Renuka Sugars, GE T&D India, Birla Corporation, Medplus Health Services, E.I.D.-Parry (India), Mtar Technologies, Easy Trip Planners, Reliance Infrastructure, Balaji Amines, HEG, Gujarat Pipavav Port, EPL, FDC, Nazara Technologies, Hindustan Foods, Restaurant Brands Asia, Gujarat Alkalies & Chemicals, Wonderla Holidays, Moil, Borosil, Nesco, Sansera Engineering, Pricol, Ami Organics, Tasty Bite Eatables, Sandur Manganese & Iron Ores, Teamlease Services, Neogen Chemicals, T D Power Systems, Ashoka Buildcon, Sai Silks (Kalamandir), Emudhra, HMA Agro Industries, Kaveri Seed Company, Automotive Axles, Hindware Home Innovation, Samhi Hotels, Avalon Technologies, Landmark Cars, Pearl Global Industries, Somany Ceramics, Lumax Auto Technologies, Best Agrolife, Mayur Uniquoters, Dishman Carbogen Amcis, Precision Wires India, Vishnu Chemicals, Vidhi Specialty Food Ingredients, Alembic, Axiscades Technologies, Artemis Medicare Services.

IRCTC Q2 FY24 (Consolidated, YoY)

Revenue up 23.44% at Rs 995 crore vs Rs 806 crore.

Ebitda up 19.91% at Rs 366 crore vs Rs 305 crore.

Margin at 36.8% vs 37.89%.

Reported profit up 31.56% at Rs 296 crore vs Rs 225 crore.

Shree Cement Q2 FY24 (Consolidated, YoY)

Revenue up 18.87% at Rs 4,800 crore vs Rs 4,038 crore.

Ebitda up 63.82% at Rs 885.8 crore vs Rs 540.7 crore.

Ebitda margin at 18.45% vs 13.39%.

Reported profit up 2.44 times at Rs 446.6 crore vs Rs 183.2 crore.

JB Chemicals Q2 FY24 (Consolidated, YoY)

Revenue up 8.93% at Rs 881.74 crore vs Rs 809.44 crore.

Ebitda up 31.94% at Rs 243.54 crore vs Rs 184.58 crore.

Margin at 27.62% vs 22.8%.

Net profit up 35.56% at Rs 150.59 crore vs Rs 111.08 crore.

Lux Industries Q2 FY24 (Consolidated, YoY)

Revenue up 0.56% at Rs 639.3 crore vs Rs 635.7 crore.

Ebitda down 14.9% at Rs 55.1 crore vs Rs 64.7 crore.

Margin at 8.6% vs 10.2% YoY.

Reported profit down 12.63% at Rs 35.9 crore vs Rs 41.1 crore.

SJS Enterprises Q2 FY24 (Consolidated, YoY)

Revenue up 39.6% at Rs 163 crore vs Rs 117 crore.

Ebitda up 16.5% at Rs 36 crore vs Rs 30.9 crore.

Margin at 22.05% vs 26.43%.

Reported profit down 3% at Rs 19.3 crore vs Rs 19.94 crore.

Kingfa Science Technology (India) Q2 FY24 (Consolidated, YoY)

Revenue down 0.13% at Rs 351 crore vs Rs 351 crore.

Ebitda up 26.7% at Rs 42.9 cr vs Rs 33.8 crore.

Margin at 12.22% vs 9.63%.

Reported profit up 33.9% at Rs 29.6 crore vs Rs 22.1 crore.

Vinati Organics Q2 FY24 (Consolidated, YoY)

Revenue down 20.9% at Rs 448.13 crore vs Rs 566.29 crore.

Ebitda down 25.4% at Rs 110.79 crore vs Rs 148.46 crore.

Margin at 24.72% vs 26.21%, down 149 bps.

Reported profit down 27.4% at Rs 84.16 crore vs Rs 115.93 crore.

Greaves Cotton Q2 FY24 (Consolidated, YoY)

Revenue up 3.9% at Rs 727 crore vs Rs 699 crore.

Ebitda up 7.1% at Rs 45.9 crore vs Rs 42.9 crore.

Margin at 6.31% vs 6.13%.

Reported loss at Rs 374.59 crore vs profit of Rs 32.3 crore.

Arvind Fashions Q2 FY24 (Consolidated, YoY)

Revenue up 7.2% at Rs 1,267 crore vs Rs 1,181.8 crore.

Ebitda up 26.6% at Rs 147.1 crore vs Rs 116.2 crore.

Margin at 11.6% vs 9.82%.

Reported profit up 31.9% at Rs 37 crore vs Rs 28.1 crore.

Balrampur Chini Mills Q2 FY24 (Consolidated, YoY)

Revenue up 38.3% at Rs 1,540 crore vs Rs 1,113 crore.

Ebitda at Rs 165 crore vs loss of Rs 15.9 crore.

Margin at 10.71%.

Reported profit at Rs 166 crore vs loss of Rs 28.9 crore.

Schneider Electric Infrastructure Q2 FY24 (Consolidated, YoY)

Revenue up 17.82% at Rs 495.81 crore vs Rs 420.81 crore.

Ebitda at Rs 62.63 crore vs Rs 18.86 crore.

Margin at 12.63% vs 4.48%.

Reported profit at Rs 42.86 crore vs Rs 8.84 crore.-

Crisil Q3 CY23 (Consolidated, YoY)

Total income up 7.74% at Rs 735.9 crore vs Rs 683 crore.

Reported profit up 2.8% at Rs 152 crore vs Rs 147.9 crore.

Prince Pipe Q2 FY24 (Consolidated, YoY)

Revenue up 3.13% at Rs 656.45 crore vs Rs 636.48 crore.

Ebitda at Rs 194.18 crore vs loss of Rs 11.36 crore.

Margin at 29.58%.

Reported profit at Rs 70.63 crore vs loss of Rs 24.11 crore.

Ind-Swift Labs Q2 FY24 (Consolidated, YoY)

Revenue down 6% at Rs 270.3 crore vs Rs 287.5 crore.

Ebitda up 11.6% at Rs 63.4 crore vs Rs 56.8 crore.

Margin at 23.45% vs 19.75%.

Net profit up 25.3% at Rs 30.1 crore vs Rs 24 crore.

Yatharth Hospital Q2 FY24 (Consolidated, YoY)

Revenue up 33.9% at Rs 171.3 crore vs Rs 127.9 crore.

Ebitda up 35.8% at Rs 45.5 crore vs Rs 33.5 crore.

Margin at 26.56% vs 26.19%.

Net profit up 70.37% at Rs 27.6 crore vs Rs 16.2 crore.

Krishna Institute Of Medical Sciences Q2 FY24 (Consolidated, YoY)

Revenue up 15.7% at Rs 652.5 crore vs Rs 564.1 crore.

Ebitda up 16.3% at Rs 177.3 crore vs Rs 152.5 crore.

Margin at 27.17% vs 27.03%.

Net profit down 4.52% at Rs 101.3 crore vs Rs 106.1 crore.

FIEM Industries Q2 FY24 (Consolidated, YoY)

Revenue down 3.01% at Rs 509.4 crore vs Rs 525.2 crore.

Ebitda down 5.7% at Rs 68.1 crore vs Rs 72.2 crore.

Margin at 13.4% vs 13.7%.

Reported profit up 6.63% at Rs 43.48 crore vs Rs 40.77 crore.

GOCL Corp. Q2 FY24 (Consolidated, YoY)

Revenue down 15.9% at Rs 163.3 crore vs Rs 194 crore.

Ebitda at Rs 7.9 crore vs Ebitda loss of Rs 20.9 crore.

Margin at 4.8%.

Net profit down 61.1% at Rs 15.7 crore vs Rs 40.4 crore.

Power Grid Corp Q2 FY24 (Consolidated, YoY)

Revenue up 1.04% at Rs 11,267 crore vs Rs 11,151 crore.

Ebitda up 5.1% at Rs 9,908 crore vs Rs 9,426 crore.

Margin at 87.9% vs 84.5%.

Reported profit up 3.4% at Rs 3,781 crore vs Rs 3,650 crore.

Note: The board announced an interim dividend of Rs 4 per share.

Gujarat State Fertilizers and Chemicals Q2 FY24 (Consolidated, YoY)

Revenue up 25.4% at Rs 3,118.7 crore vs Rs 2,487.7 crore.

Ebitda down 39.3% at Rs 237.3 crore vs Rs 390.9 crore.

Margin at 7.6% vs 15.71%.

Net profit up 8.3% at Rs 308.9 crore vs Rs 285.3 crore.

Zaggle Prepaid Q2 FY24 (Consolidated, QoQ)

Revenue up 55.5% at Rs 184 crore vs. Rs 118.5 crore.

EBIT at Rs 12.6 crore vs. Rs 5.9 crore.

Margin at 6.9% vs. 5%.

Reported profit at Rs 7.6 crore vs. Rs 2.1 crore.

Mishra Dhatu Nigam Q2 FY24 (Consolidated, YoY)

Revenue up 25.71% at Rs 227.49 crore vs. Rs 180.95 crore.

Ebitda down 38.23% at Rs 36.29 crore vs. Rs 58.75 crore.

Margin at 15.95% vs. 32.46%.

Net profit down 58.54% at Rs 13.93 crore vs. Rs 33.6 crore.

Dollar Industries Q2 FY24 (Consolidated, YoY)

Revenue up 21.2% at Rs 412.5 crore vs. Rs 340.4 crore.

Ebitda up 37.62% at Rs 41.7 crore vs. Rs 30.3 crore.

Margin at 10.11% vs. 8.9%.

Reported profit up 43.9% at Rs 24.87 crore vs. Rs 17.28 crore.

Updater Services Q2 FY24 (Consolidated, QoQ)

Revenue up 4.1% at Rs 600.1 crore vs. Rs 576.4 crore.

Ebitda down 19.8% at Rs 26.3 crore vs. Rs 32.8 crore.

Margin at 4.38% vs. 5.69%.

Net profit down 25.8% at Rs 9.2 crore vs. Rs 12.4 crore.

Apollo Tyres Q2 FY24 (Consolidated, YoY)

Revenue up 5.4% at Rs 6,279.7 crore vs. Rs 5,956.1 crore.

Ebitda up 62.9% at Rs 1,160 crore vs. Rs 711.9 crore.

Margin at 18.47% vs. 11.95%.

Net profit up 164.4% at Rs 474.3 crore vs. Rs 179.4 crore.

Cummins India Q2 FY24 (Consolidated, YoY)

Revenue down 1.8% at Rs 1,921.8 crore vs. Rs 1,957.3 crore.

Ebitda up 19.5% at Rs 346.4 crore vs. Rs 289.8 crore.

Margin at 18.02% vs. 14.8%.

Net profit up 23.1% at Rs 329.1 crore vs. Rs 267.3 crore.

Deepak Nitrite Q2 FY24 (Consolidated, YoY)

Revenue down 9.4% at Rs 1,778.1 crore vs. Rs 1,961.7 crore.

Ebitda up 11.6% at Rs 302.2 crore vs. Rs 270.9 crore.

Margin at 16.99% vs. 13.8%.

Net profit up 17.5% at Rs 205.1 crore vs. Rs 174.5 crore.

Skipper Q2 FY24 (Consolidated, YoY)

Revenue up 67% at Rs 772.4 crore vs. Rs 462 crore.

Ebitda up 85% at Rs 73.7 crore vs. Rs 39.8 crore.

Margin at 9.5% vs. 8.6%.

Reported profit at Rs 19.78 crore vs. Rs 3 crore.

Dilip Buildcon Q2 FY24 (Consolidated, YoY)

Revenue up 9.7% at Rs 2,849 crore vs. Rs 2,596 crore.

Ebitda down 3% at Rs 340.6 crore vs. Rs 351.9 crore.

Margin at 11.95% vs. 13.55%.

Reported profit at Rs 73.2 crore vs. Rs 13.02 crore.

Prestige Estates Project Q2 FY24 (Consolidated, YoY)

Revenue up 56.6% at Rs 2,236.4 crore vs. Rs 1,427.7 crore.

Ebitda up 60.7% at Rs 592.5 crore vs. Rs 368.6 crore.

Margin at 26.49% vs. 25.81%.

Net profit at Rs 910.3 crore vs. Rs 148.6 crore.

Stocks in Asia were mixed after a rally in big tech saw the S&P 500 notch up its longest streak of gains in two years.

Australian, Japanese and Taiwanese markets were marginally higher, while China, South Koream and Hong Kong shares declined. U.S. equities were little changed after some central bank officials emphasised that bringing inflation fully down to the 2% goal is their main focus.

The yield on the 10-year U.S. bond was trading at 4.58%, and Bitcoin was above the $35,000 level. Brent crude was trading below $82 a barrel, whereas WTI crude was below the $77 mark.

At 8:15 a.m., the GIFT Nifty, an early indicator of the Nifty 50 Index’s performance in India, was up 27 points or 0.14% at 19,522.5.

India's benchmark stock indices snapped three sessions of gains to end lower on Tuesday, weighed by losses in index heavyweights HDFC Bank and Reliance Industries.

The Sensex rebounded over 300 points from the day's low, while the Nifty closed over 80 points above the day's low. The pharmaceutical and energy sectors rose, while the real estate and media sectors were trading lower.

Overseas investors remained net sellers of Indian equities for the tenth day in a row on Tuesday. While foreign portfolio investors offloaded stocks worth Rs 497.2 crore, domestic institutional investors mopped up equities worth Rs 700.3 crore, the NSE data showed.

The Indian rupee weakened 5 paise to close at 83.27 against the U.S. dollar on Tuesday.

Stocks in Asia were mixed after a rally in big tech saw the S&P 500 notch up its longest streak of gains in two years.

Australian, Japanese and Taiwanese markets were marginally higher, while China, South Koream and Hong Kong shares declined. U.S. equities were little changed after some central bank officials emphasised that bringing inflation fully down to the 2% goal is their main focus.

The yield on the 10-year U.S. bond was trading at 4.58%, and Bitcoin was above the $35,000 level. Brent crude was trading below $82 a barrel, whereas WTI crude was below the $77 mark.

At 8:15 a.m., the GIFT Nifty, an early indicator of the Nifty 50 Index’s performance in India, was up 27 points or 0.14% at 19,522.5.

India's benchmark stock indices snapped three sessions of gains to end lower on Tuesday, weighed by losses in index heavyweights HDFC Bank and Reliance Industries.

The Sensex rebounded over 300 points from the day's low, while the Nifty closed over 80 points above the day's low. The pharmaceutical and energy sectors rose, while the real estate and media sectors were trading lower.

Overseas investors remained net sellers of Indian equities for the tenth day in a row on Tuesday. While foreign portfolio investors offloaded stocks worth Rs 497.2 crore, domestic institutional investors mopped up equities worth Rs 700.3 crore, the NSE data showed.

The Indian rupee weakened 5 paise to close at 83.27 against the U.S. dollar on Tuesday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.