Overseas investors stay net buyers for two consecutive sessions on Friday.

Foreign portfolio investors bought stocks worth Rs 2,625.21 crore, according to provisional data from the National Stock Exchange.

Domestic institutional investors continued as buyers and purchased stocks worth Rs 134.46 crore, the NSE data showed.

Foreign institutions have been net buyers of Rs 96,349 crore worth of Indian equities so far in 2023, according to data from the National Securities Depository Ltd., updated till the previous trading day.

The yield on the 10-year bond closed flat at 7.27% on Friday.

Source: Bloomberg

The local currency depreciated 4 paise to close at all time weakest level of 83.38 against the U.S. dollar on Friday.

It closed at 83.34 on Thursday

Source: Bloomberg

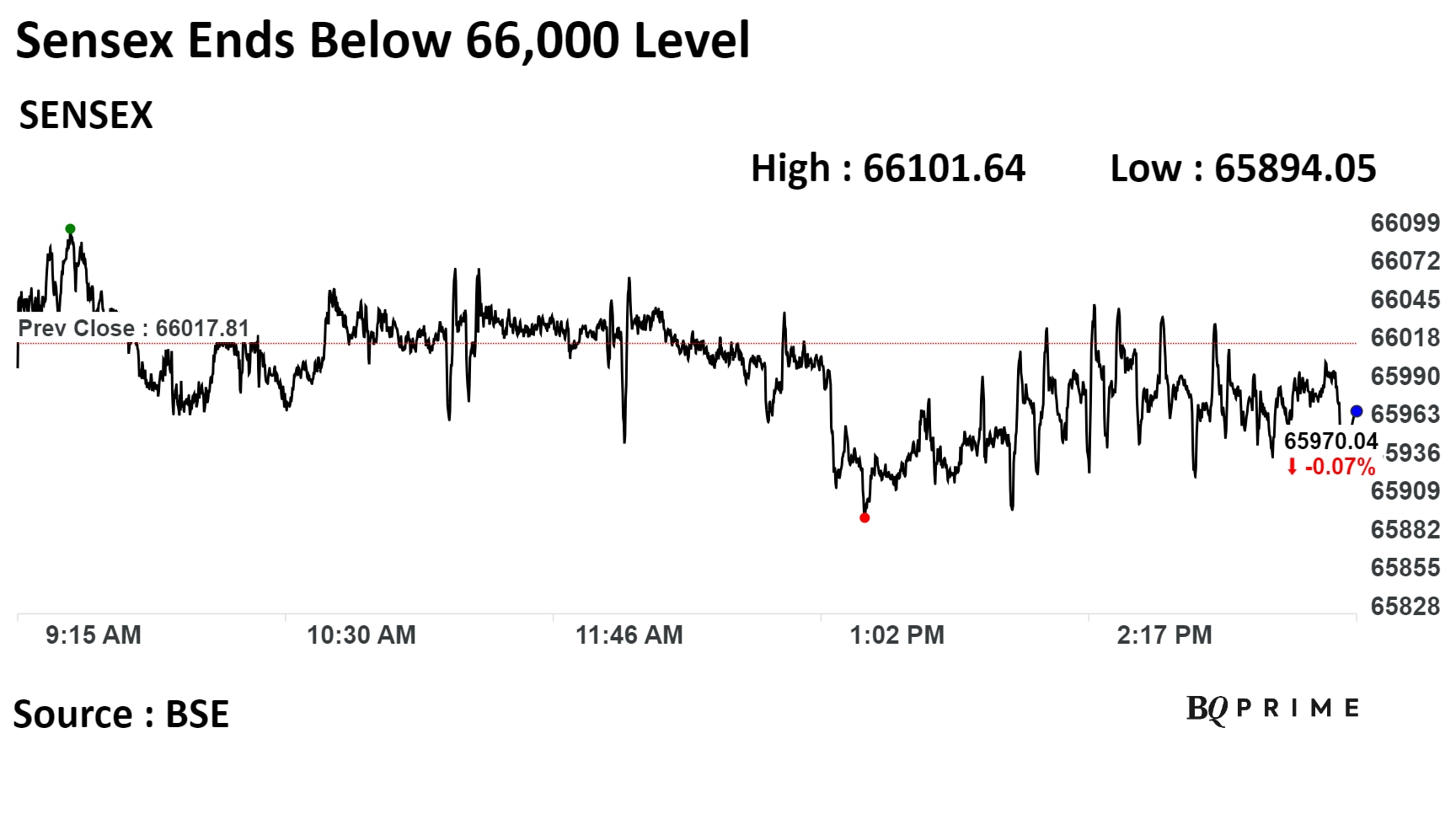

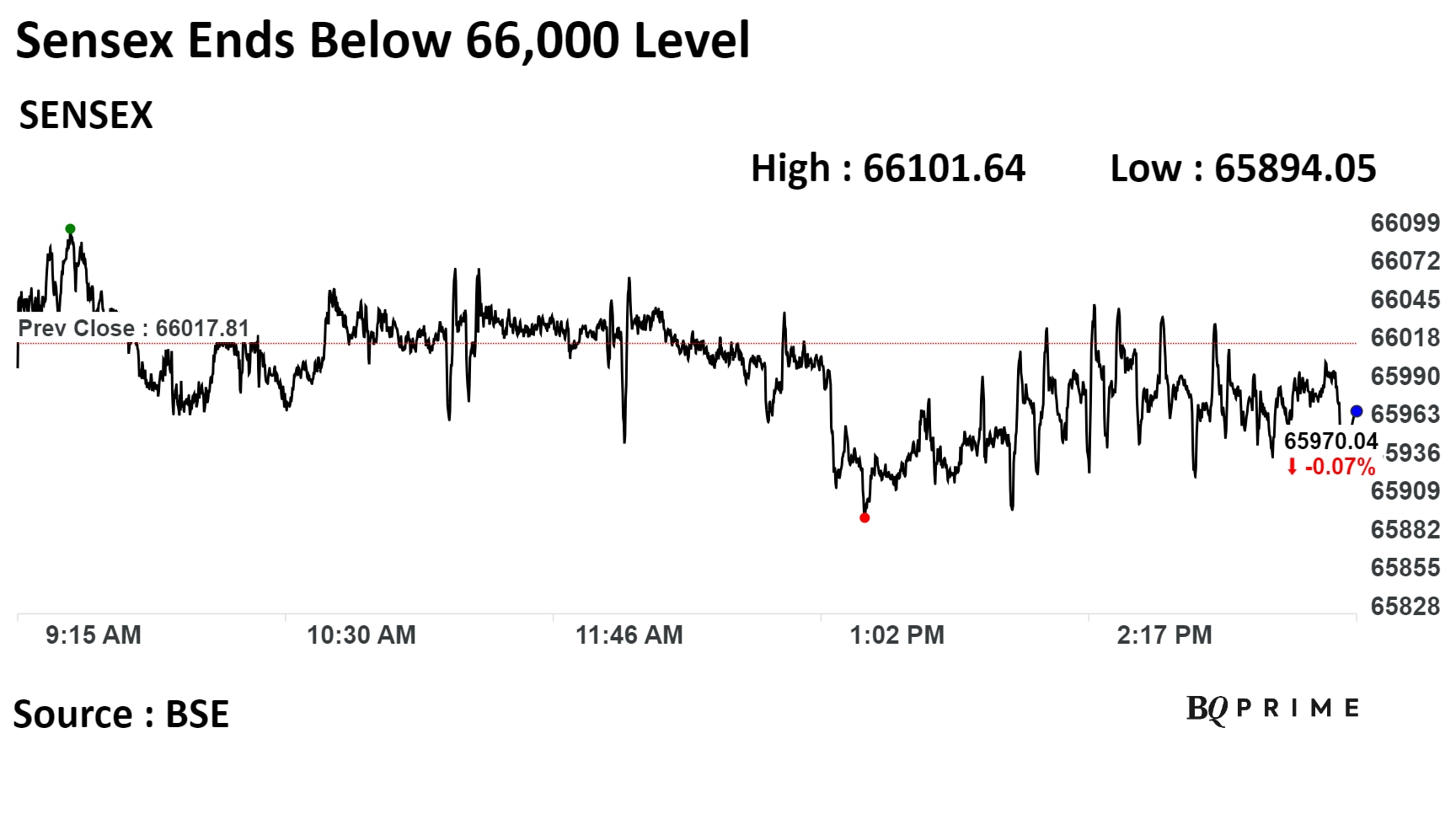

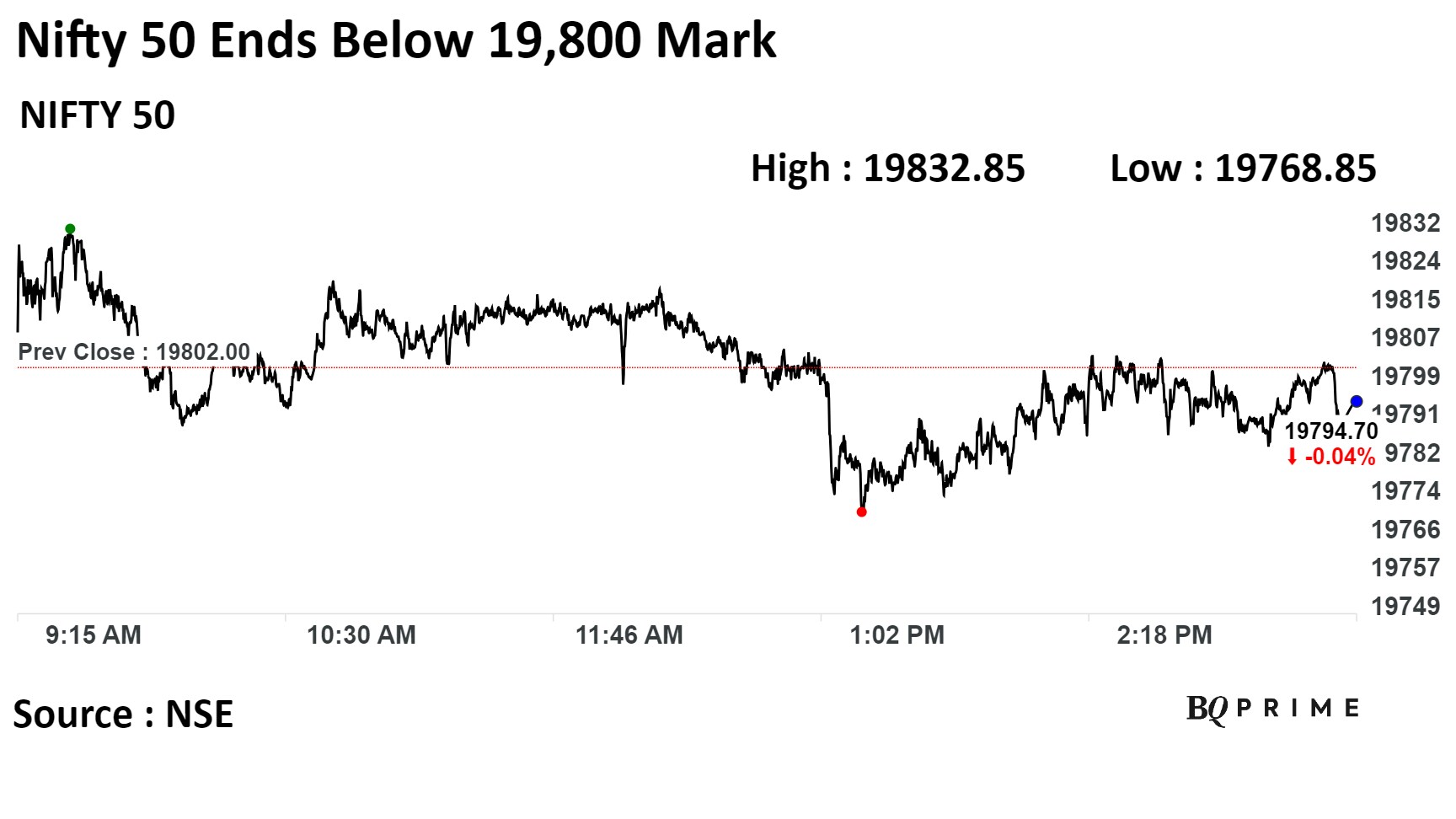

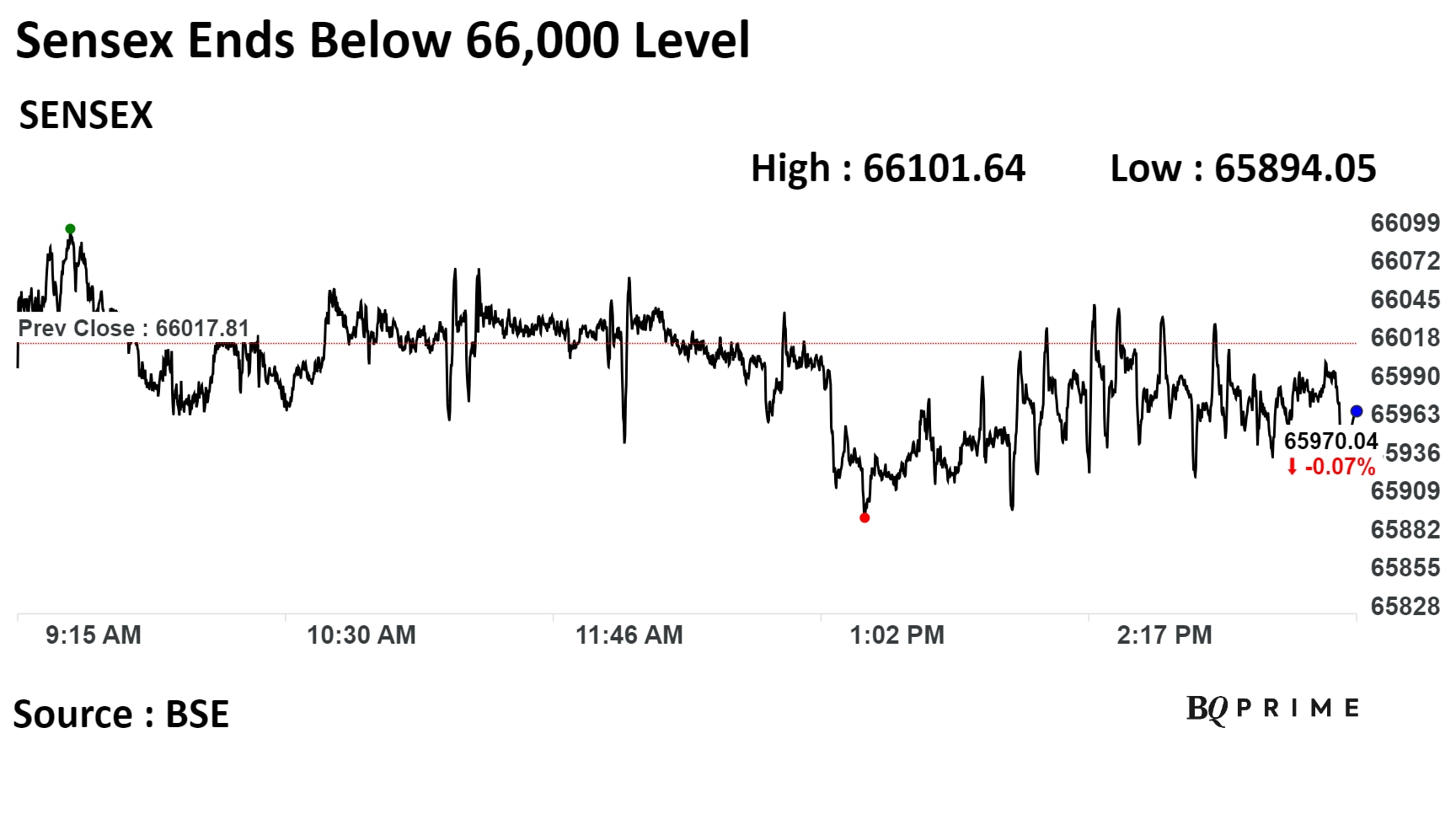

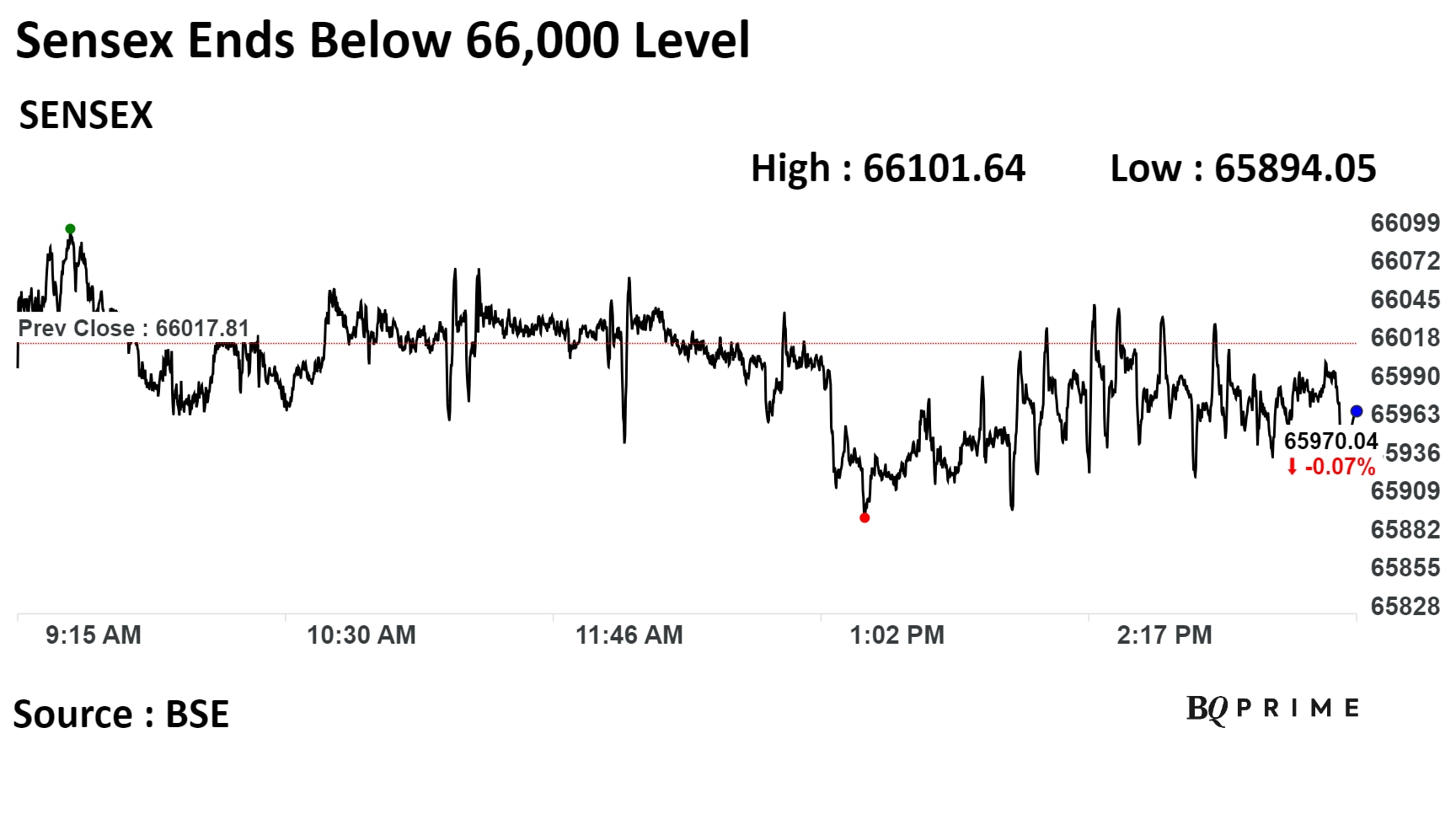

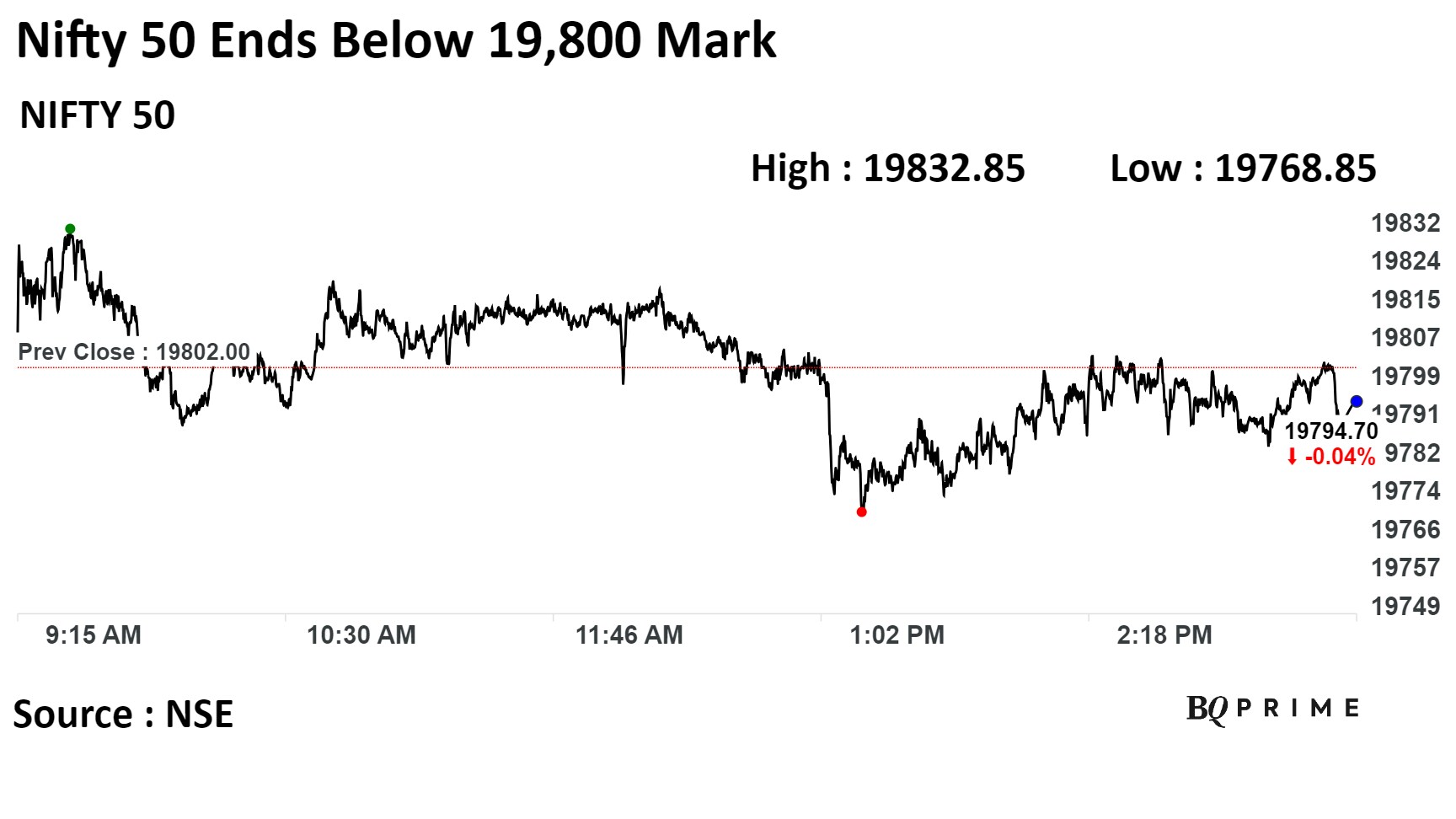

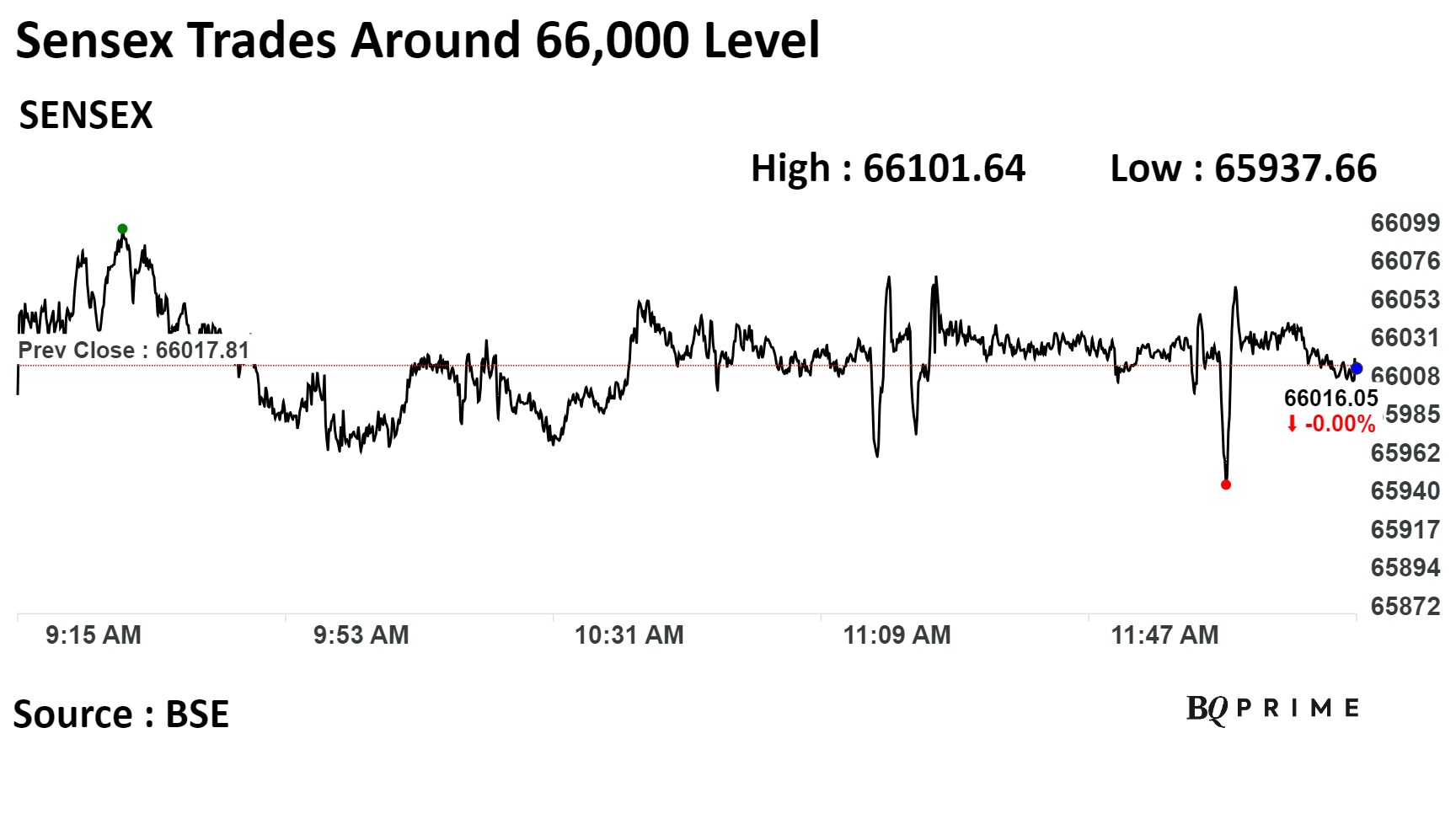

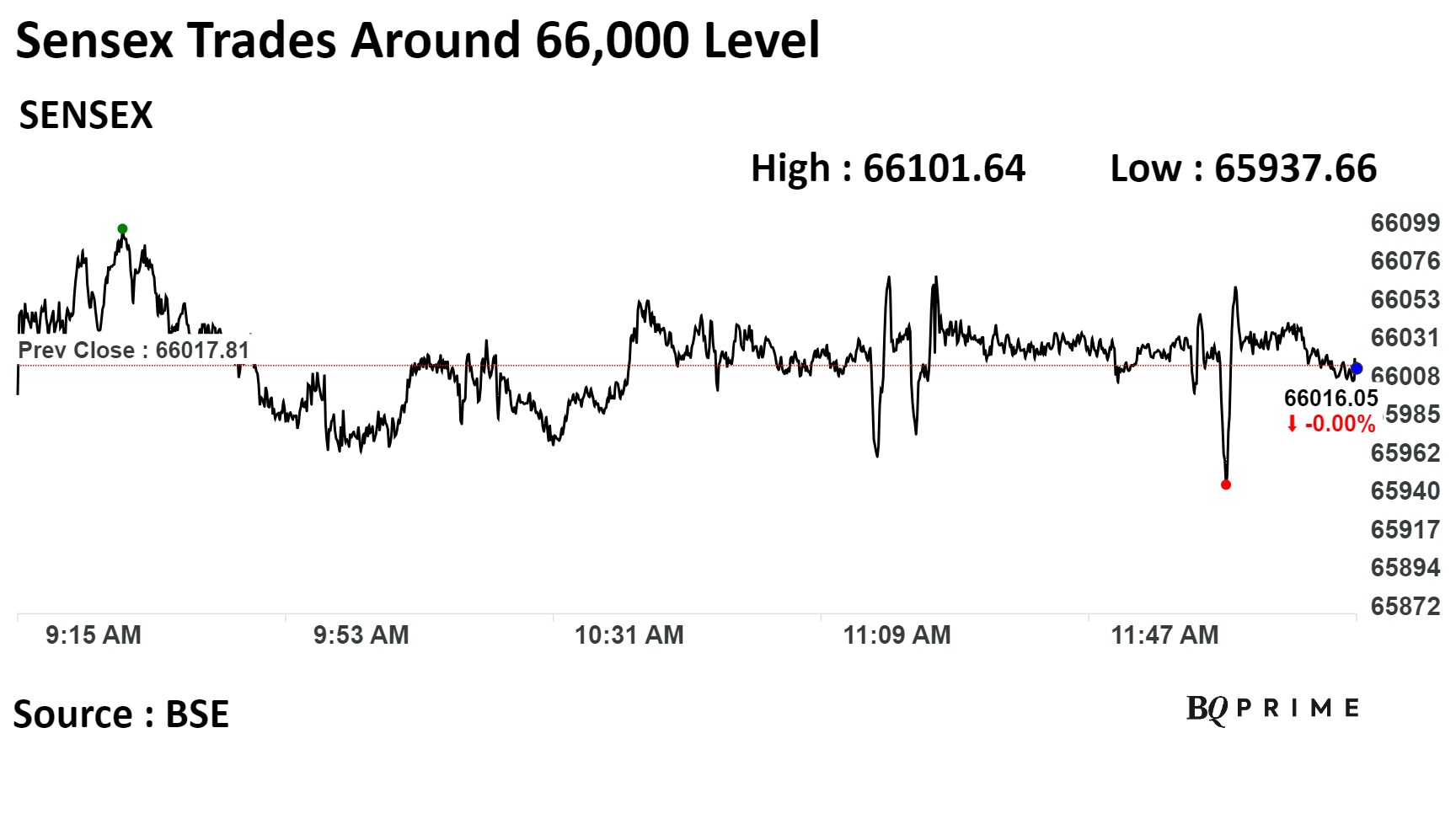

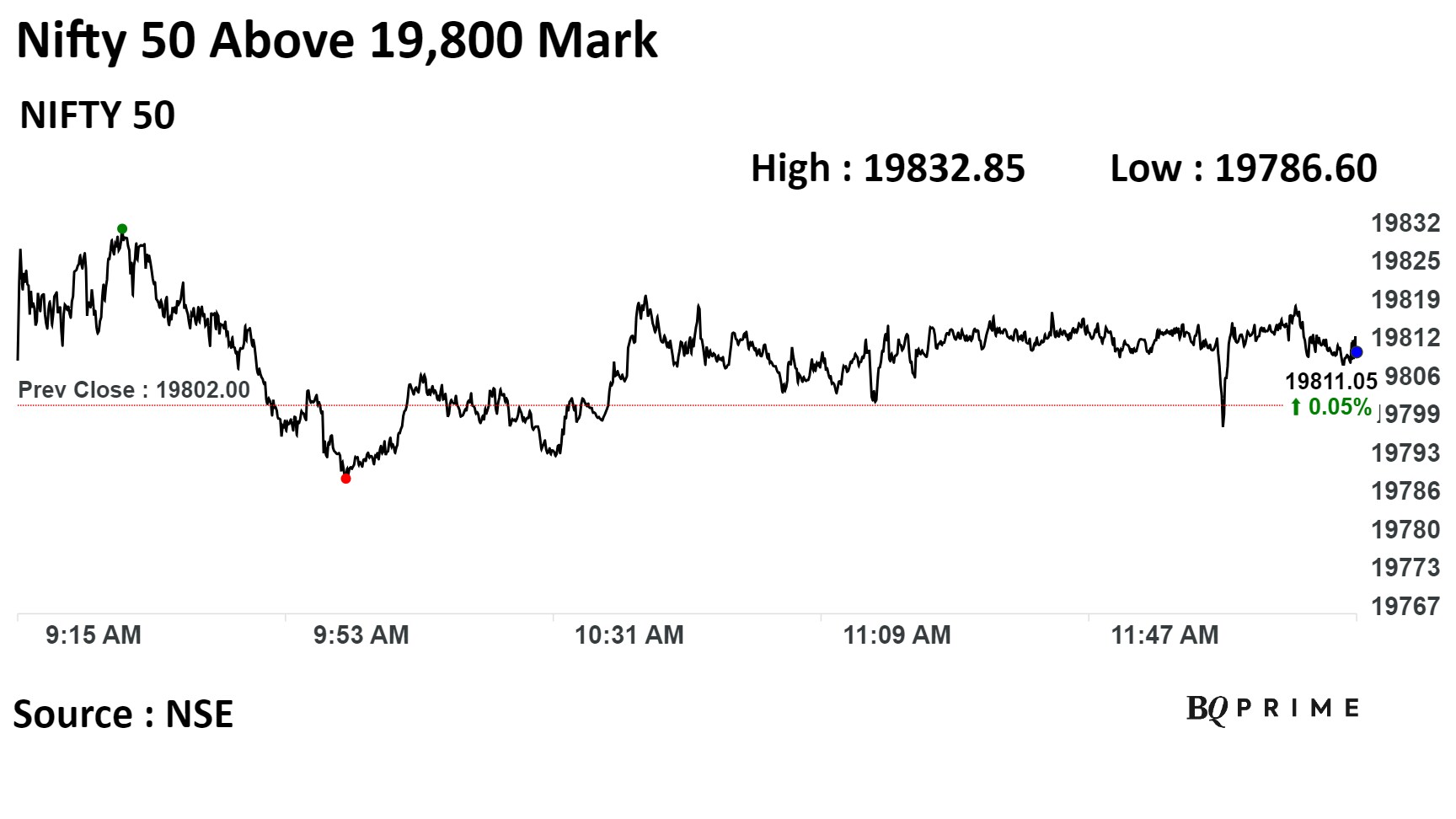

India's benchmark stock indices ended lower for the second day on Friday. Pharma and healthcare sectors advanced while IT sector was under pressure. The headline indices gained for the fourth week this Friday, the longest stretch of gains since July 21, 2023.

The S&P BSE Sensex Index closed down 48 points, or 0.07%, at 65,970.04 while the NSE Nifty 50 was 7 points or 0.04% lower at 19,794.70.

There could be some bout of volatility from current levels with respect to the monthly expiry next week, stated Vikas Jain, senior research analyst at Reliance Securities.

Sensex ended below 66,000 level whereas Nifty 50 was above just above 19,800 mark.

Examining the Nifty, it reached a peak of 19,875 last week, creating an immediate hurdle, as per Mandar Bhojane, equity research analyst at Choice Broking. "A crossover is deemed necessary for a fresh upward movement. On the hourly chart, the 19,600-19,550 range is identified as the immediate support zone. Traders are advised to maintain long positions with a stop loss at this level," he added.

European shares wavered after the latest economic data highlighted Germany’s struggle to recover from an energy-induced downturn last winter and the mounting impact of higher borrowing costs.

The Stoxx Europe 600 index was little changed at the open, holding onto a modest weekly gain. Hong Kong and mainland Chinese equities dropped, reversing Thursday’s rally inspired by Beijing’s widening property rescue campaign. Japanese stocks rose in catch-up play after a national holiday, while those in Australia also gained. U.S. equity futures were steady

The U.S. markets will open for half a day for Friday.

India's benchmark stock indices ended lower for the second day on Friday. Pharma and healthcare sectors advanced while IT sector was under pressure. The headline indices gained for the fourth week this Friday, the longest stretch of gains since July 21, 2023.

The S&P BSE Sensex Index closed down 48 points, or 0.07%, at 65,970.04 while the NSE Nifty 50 was 7 points or 0.04% lower at 19,794.70.

There could be some bout of volatility from current levels with respect to the monthly expiry next week, stated Vikas Jain, senior research analyst at Reliance Securities.

Sensex ended below 66,000 level whereas Nifty 50 was above just above 19,800 mark.

Examining the Nifty, it reached a peak of 19,875 last week, creating an immediate hurdle, as per Mandar Bhojane, equity research analyst at Choice Broking. "A crossover is deemed necessary for a fresh upward movement. On the hourly chart, the 19,600-19,550 range is identified as the immediate support zone. Traders are advised to maintain long positions with a stop loss at this level," he added.

European shares wavered after the latest economic data highlighted Germany’s struggle to recover from an energy-induced downturn last winter and the mounting impact of higher borrowing costs.

The Stoxx Europe 600 index was little changed at the open, holding onto a modest weekly gain. Hong Kong and mainland Chinese equities dropped, reversing Thursday’s rally inspired by Beijing’s widening property rescue campaign. Japanese stocks rose in catch-up play after a national holiday, while those in Australia also gained. U.S. equity futures were steady

The U.S. markets will open for half a day for Friday.

India's benchmark stock indices ended lower for the second day on Friday. Pharma and healthcare sectors advanced while IT sector was under pressure. The headline indices gained for the fourth week this Friday, the longest stretch of gains since July 21, 2023.

The S&P BSE Sensex Index closed down 48 points, or 0.07%, at 65,970.04 while the NSE Nifty 50 was 7 points or 0.04% lower at 19,794.70.

There could be some bout of volatility from current levels with respect to the monthly expiry next week, stated Vikas Jain, senior research analyst at Reliance Securities.

Sensex ended below 66,000 level whereas Nifty 50 was above just above 19,800 mark.

Examining the Nifty, it reached a peak of 19,875 last week, creating an immediate hurdle, as per Mandar Bhojane, equity research analyst at Choice Broking. "A crossover is deemed necessary for a fresh upward movement. On the hourly chart, the 19,600-19,550 range is identified as the immediate support zone. Traders are advised to maintain long positions with a stop loss at this level," he added.

European shares wavered after the latest economic data highlighted Germany’s struggle to recover from an energy-induced downturn last winter and the mounting impact of higher borrowing costs.

The Stoxx Europe 600 index was little changed at the open, holding onto a modest weekly gain. Hong Kong and mainland Chinese equities dropped, reversing Thursday’s rally inspired by Beijing’s widening property rescue campaign. Japanese stocks rose in catch-up play after a national holiday, while those in Australia also gained. U.S. equity futures were steady

The U.S. markets will open for half a day for Friday.

India's benchmark stock indices ended lower for the second day on Friday. Pharma and healthcare sectors advanced while IT sector was under pressure. The headline indices gained for the fourth week this Friday, the longest stretch of gains since July 21, 2023.

The S&P BSE Sensex Index closed down 48 points, or 0.07%, at 65,970.04 while the NSE Nifty 50 was 7 points or 0.04% lower at 19,794.70.

There could be some bout of volatility from current levels with respect to the monthly expiry next week, stated Vikas Jain, senior research analyst at Reliance Securities.

Sensex ended below 66,000 level whereas Nifty 50 was above just above 19,800 mark.

Examining the Nifty, it reached a peak of 19,875 last week, creating an immediate hurdle, as per Mandar Bhojane, equity research analyst at Choice Broking. "A crossover is deemed necessary for a fresh upward movement. On the hourly chart, the 19,600-19,550 range is identified as the immediate support zone. Traders are advised to maintain long positions with a stop loss at this level," he added.

European shares wavered after the latest economic data highlighted Germany’s struggle to recover from an energy-induced downturn last winter and the mounting impact of higher borrowing costs.

The Stoxx Europe 600 index was little changed at the open, holding onto a modest weekly gain. Hong Kong and mainland Chinese equities dropped, reversing Thursday’s rally inspired by Beijing’s widening property rescue campaign. Japanese stocks rose in catch-up play after a national holiday, while those in Australia also gained. U.S. equity futures were steady

The U.S. markets will open for half a day for Friday.

India's benchmark stock indices ended lower for the second day on Friday. Pharma and healthcare sectors advanced while IT sector was under pressure. The headline indices gained for the fourth week this Friday, the longest stretch of gains since July 21, 2023.

The S&P BSE Sensex Index closed down 48 points, or 0.07%, at 65,970.04 while the NSE Nifty 50 was 7 points or 0.04% lower at 19,794.70.

There could be some bout of volatility from current levels with respect to the monthly expiry next week, stated Vikas Jain, senior research analyst at Reliance Securities.

Sensex ended below 66,000 level whereas Nifty 50 was above just above 19,800 mark.

Examining the Nifty, it reached a peak of 19,875 last week, creating an immediate hurdle, as per Mandar Bhojane, equity research analyst at Choice Broking. "A crossover is deemed necessary for a fresh upward movement. On the hourly chart, the 19,600-19,550 range is identified as the immediate support zone. Traders are advised to maintain long positions with a stop loss at this level," he added.

European shares wavered after the latest economic data highlighted Germany’s struggle to recover from an energy-induced downturn last winter and the mounting impact of higher borrowing costs.

The Stoxx Europe 600 index was little changed at the open, holding onto a modest weekly gain. Hong Kong and mainland Chinese equities dropped, reversing Thursday’s rally inspired by Beijing’s widening property rescue campaign. Japanese stocks rose in catch-up play after a national holiday, while those in Australia also gained. U.S. equity futures were steady

The U.S. markets will open for half a day for Friday.

India's benchmark stock indices ended lower for the second day on Friday. Pharma and healthcare sectors advanced while IT sector was under pressure. The headline indices gained for the fourth week this Friday, the longest stretch of gains since July 21, 2023.

The S&P BSE Sensex Index closed down 48 points, or 0.07%, at 65,970.04 while the NSE Nifty 50 was 7 points or 0.04% lower at 19,794.70.

There could be some bout of volatility from current levels with respect to the monthly expiry next week, stated Vikas Jain, senior research analyst at Reliance Securities.

Sensex ended below 66,000 level whereas Nifty 50 was above just above 19,800 mark.

Examining the Nifty, it reached a peak of 19,875 last week, creating an immediate hurdle, as per Mandar Bhojane, equity research analyst at Choice Broking. "A crossover is deemed necessary for a fresh upward movement. On the hourly chart, the 19,600-19,550 range is identified as the immediate support zone. Traders are advised to maintain long positions with a stop loss at this level," he added.

European shares wavered after the latest economic data highlighted Germany’s struggle to recover from an energy-induced downturn last winter and the mounting impact of higher borrowing costs.

The Stoxx Europe 600 index was little changed at the open, holding onto a modest weekly gain. Hong Kong and mainland Chinese equities dropped, reversing Thursday’s rally inspired by Beijing’s widening property rescue campaign. Japanese stocks rose in catch-up play after a national holiday, while those in Australia also gained. U.S. equity futures were steady

The U.S. markets will open for half a day for Friday.

India's benchmark stock indices ended lower for the second day on Friday. Pharma and healthcare sectors advanced while IT sector was under pressure. The headline indices gained for the fourth week this Friday, the longest stretch of gains since July 21, 2023.

The S&P BSE Sensex Index closed down 48 points, or 0.07%, at 65,970.04 while the NSE Nifty 50 was 7 points or 0.04% lower at 19,794.70.

There could be some bout of volatility from current levels with respect to the monthly expiry next week, stated Vikas Jain, senior research analyst at Reliance Securities.

Sensex ended below 66,000 level whereas Nifty 50 was above just above 19,800 mark.

Examining the Nifty, it reached a peak of 19,875 last week, creating an immediate hurdle, as per Mandar Bhojane, equity research analyst at Choice Broking. "A crossover is deemed necessary for a fresh upward movement. On the hourly chart, the 19,600-19,550 range is identified as the immediate support zone. Traders are advised to maintain long positions with a stop loss at this level," he added.

European shares wavered after the latest economic data highlighted Germany’s struggle to recover from an energy-induced downturn last winter and the mounting impact of higher borrowing costs.

The Stoxx Europe 600 index was little changed at the open, holding onto a modest weekly gain. Hong Kong and mainland Chinese equities dropped, reversing Thursday’s rally inspired by Beijing’s widening property rescue campaign. Japanese stocks rose in catch-up play after a national holiday, while those in Australia also gained. U.S. equity futures were steady

The U.S. markets will open for half a day for Friday.

India's benchmark stock indices ended lower for the second day on Friday. Pharma and healthcare sectors advanced while IT sector was under pressure. The headline indices gained for the fourth week this Friday, the longest stretch of gains since July 21, 2023.

The S&P BSE Sensex Index closed down 48 points, or 0.07%, at 65,970.04 while the NSE Nifty 50 was 7 points or 0.04% lower at 19,794.70.

There could be some bout of volatility from current levels with respect to the monthly expiry next week, stated Vikas Jain, senior research analyst at Reliance Securities.

Sensex ended below 66,000 level whereas Nifty 50 was above just above 19,800 mark.

Examining the Nifty, it reached a peak of 19,875 last week, creating an immediate hurdle, as per Mandar Bhojane, equity research analyst at Choice Broking. "A crossover is deemed necessary for a fresh upward movement. On the hourly chart, the 19,600-19,550 range is identified as the immediate support zone. Traders are advised to maintain long positions with a stop loss at this level," he added.

European shares wavered after the latest economic data highlighted Germany’s struggle to recover from an energy-induced downturn last winter and the mounting impact of higher borrowing costs.

The Stoxx Europe 600 index was little changed at the open, holding onto a modest weekly gain. Hong Kong and mainland Chinese equities dropped, reversing Thursday’s rally inspired by Beijing’s widening property rescue campaign. Japanese stocks rose in catch-up play after a national holiday, while those in Australia also gained. U.S. equity futures were steady

The U.S. markets will open for half a day for Friday.

HDFC Bank Ltd., ICICI Bank Ltd. Axis Bank Ltd., Adani Enterprises Ltd., and Cipla Ltd. were positively adding to the change in the Nifty 50 Index.

Whereas, Tata Consultancy Services Ltd., Infosys Ltd., ITC Ltd., HCL Technologies Ltd., and Bajaj Finance were negatively contributing to the change.

The indices advanced for the fourth week this Friday, posting the longest stretch of gains since July 21, 2023. The S&P BSE Sensex rose 0.27% and NSE Nifty 50 was higher by 0.32% this week.

Last week, the headline indices advanced for the third time as the S&P BSE Sensex Index rose 1.56% and NSE Nifty 50 Index advanced by 1.72%.

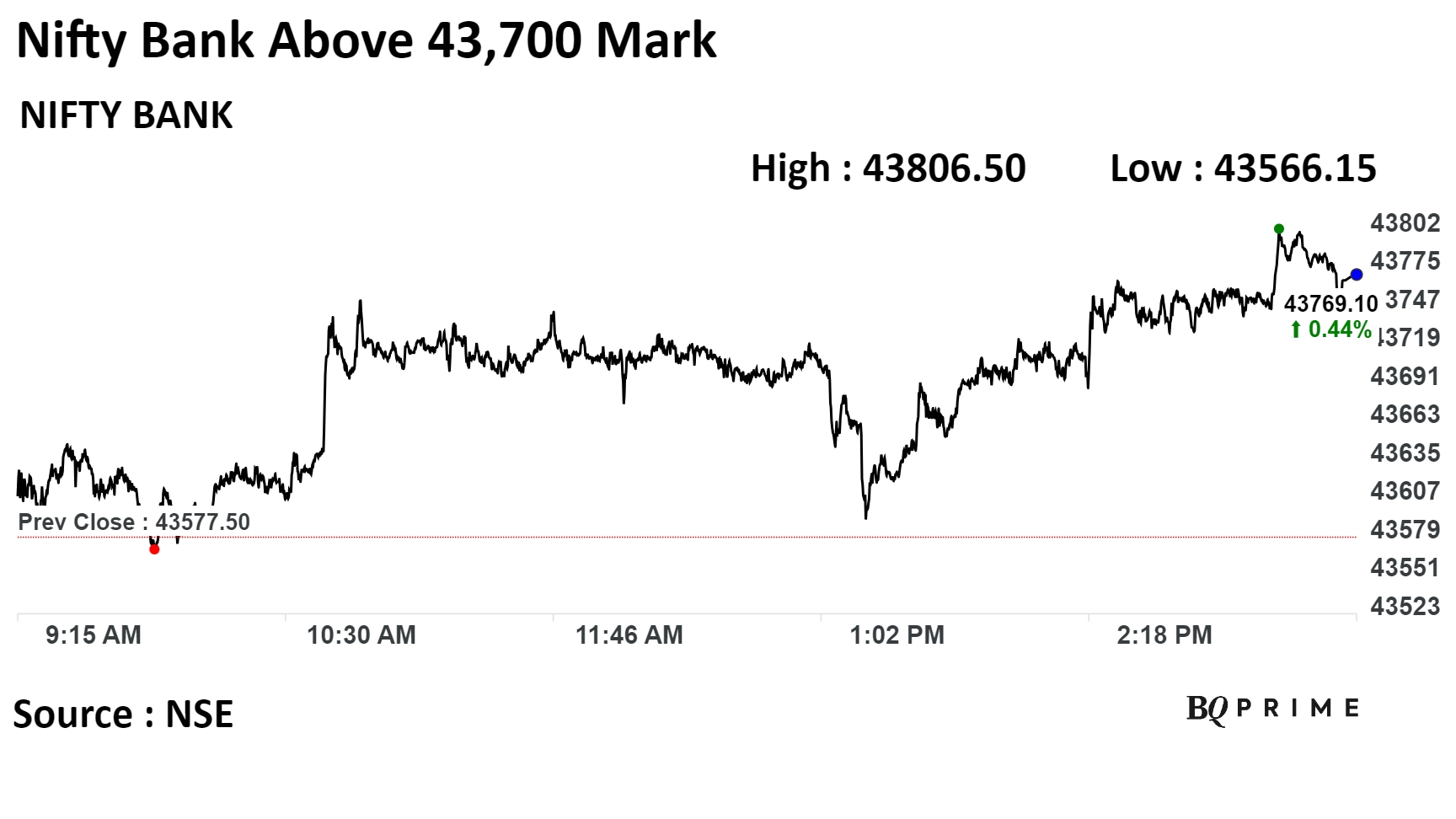

The dominant trend in the market this year is the huge outperformance of the mid and small caps, said Dr. V K Vijayakumar, chief investment strategist at Geojit Financial Services.

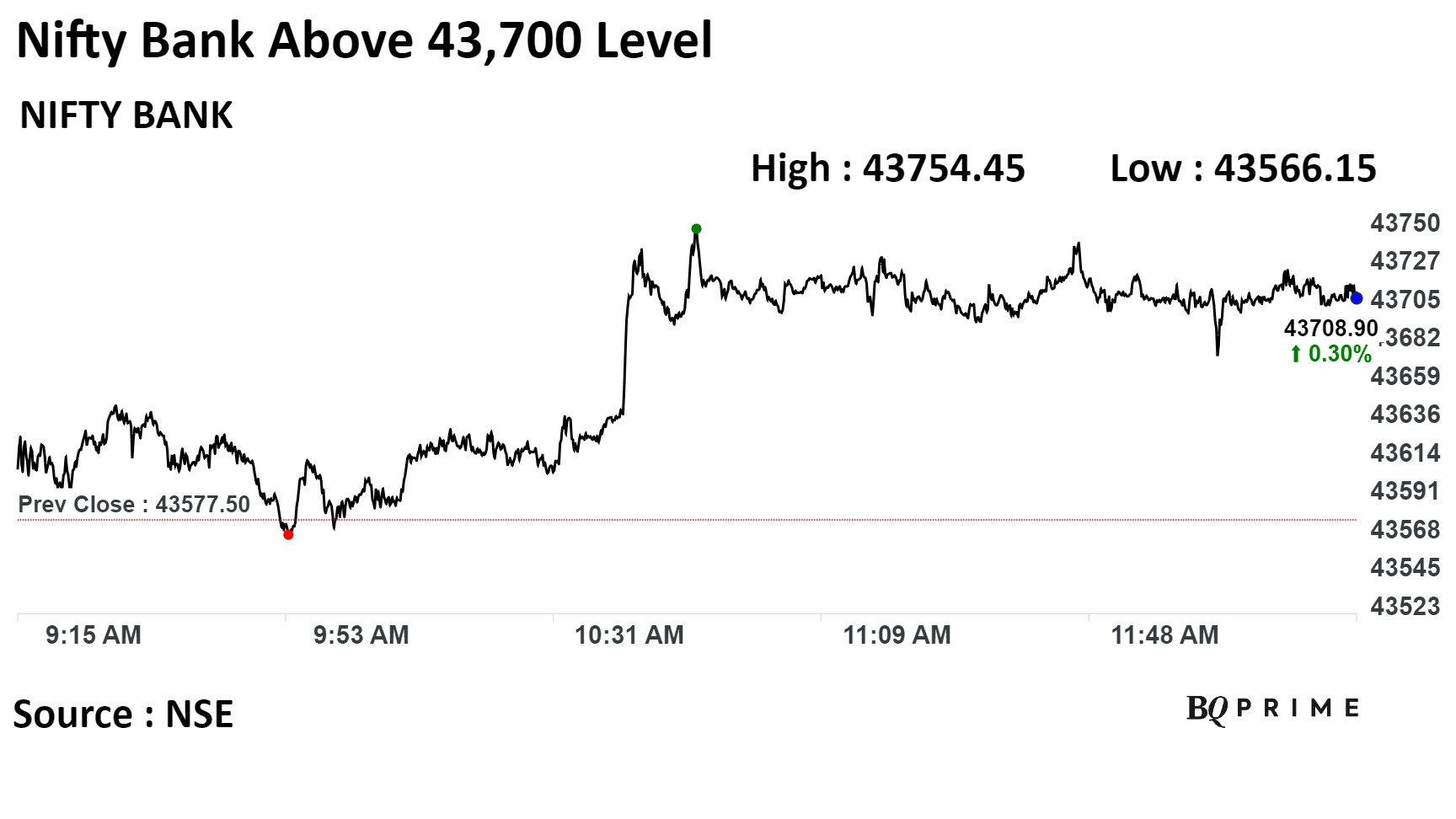

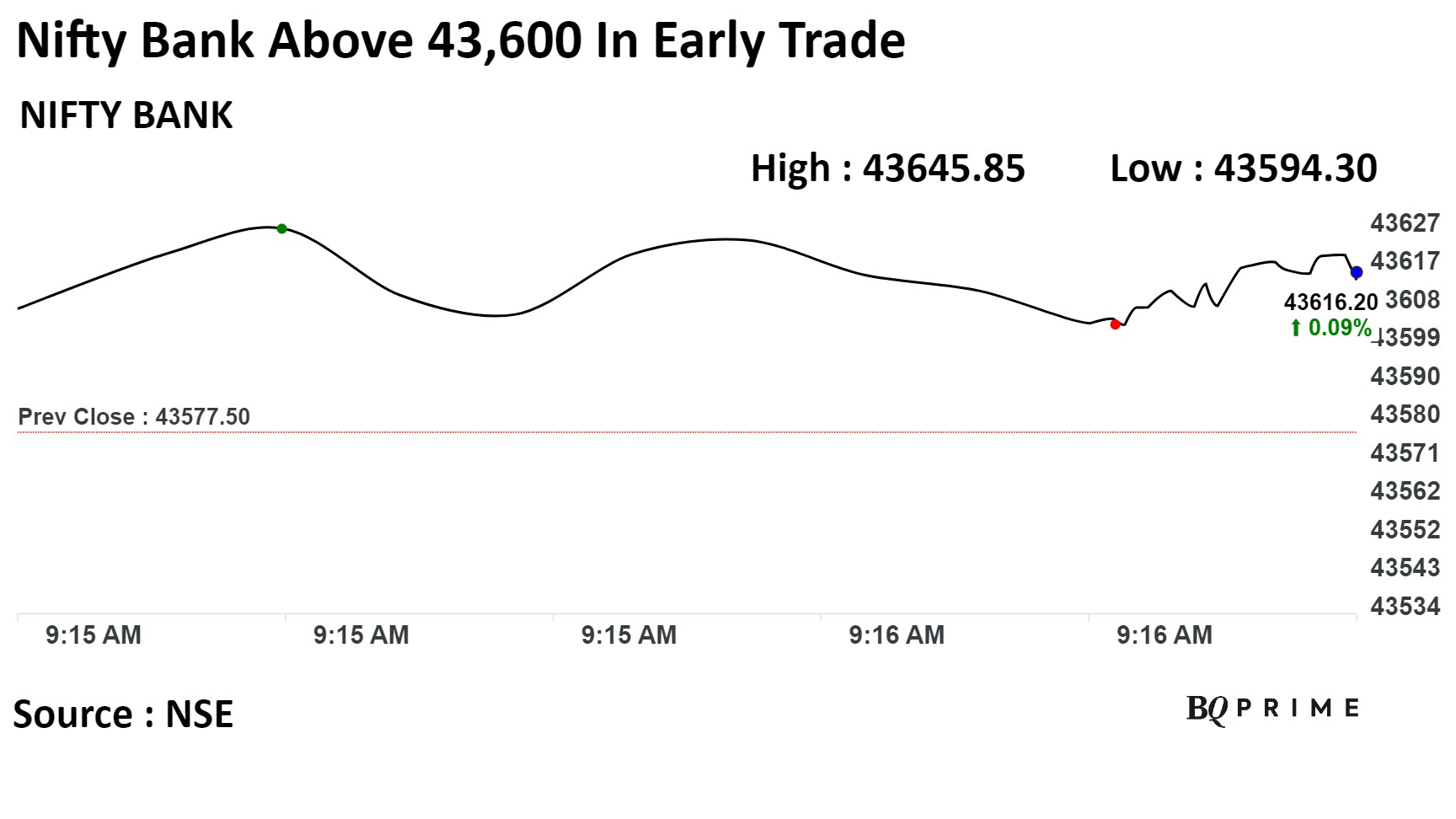

"While Nifty is up only 8.82% year-to-date, Nifty midcap index and Nifty Smallcap index are up 33.38% and 41.66% year-to-date. It is important to understand that Nifty is depressed by the poor performance of banks which have the largest weightage in Nifty. The Nifty Bank index is almost flat this year with measly growth of 0.87%," he added.

The broader markets outperformed larger peers; the S&P BSE MidCap Index was up 0.13%, whereas S&P BSE SmallCap Index was 0.14% higher.

Twelve out of 20 sectors compiled by BSE advanced, while eight sectors declined. S&P BSE IT fell the most, while S&P BSE Capital Goods rose the most.

The market breadth was split in between the buyers and sellers. About 1,805 stocks rose, 1,872 stocks declined, while 137 remained unchanged on the BSE.

Banks are underperforming despite very good results because they are over-owned and sustained FII selling is weighing on bank stocks. Mid and smallcaps are under-owned and retail exuberance is largely driving these stocks. There is no valuation comfort in the broader market but valuations are fair in large caps, Dr. V K Vijayakumar said further.

"Therefore, the next leg of the rally, driven by institutional money - both foreign and domestic- will be driven by large caps," he added.

Most sectors advanced this week with Nifty Realty Index gaining over 1%, followed by Nifty Metal. Nifty IT has fallen the most this week.

Ajay Gupta appointed as executive director of ICICI Bank for three years effective November 27.

Source: Exchange Filing

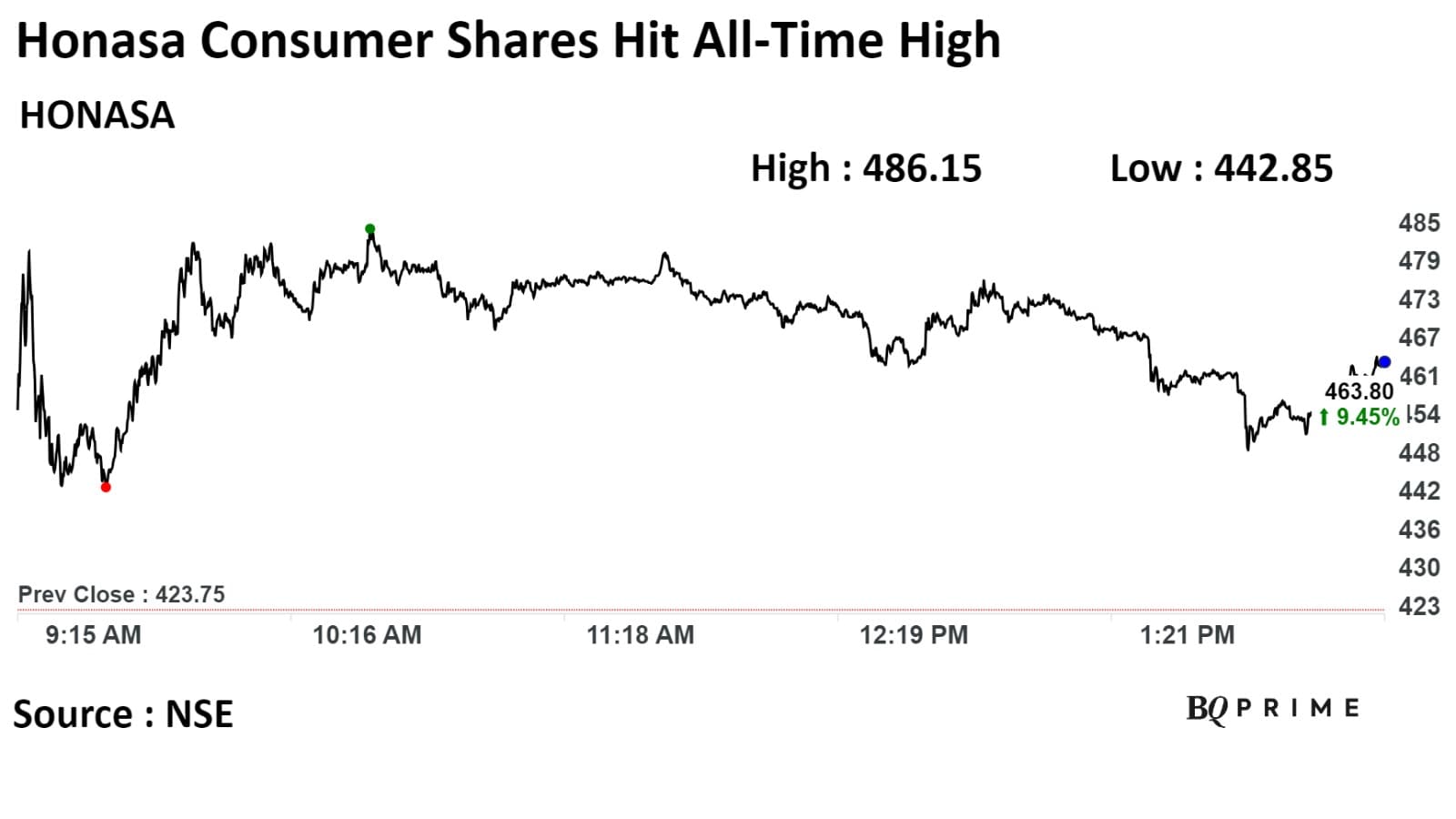

The scrip rose as much as 14% to Rs 486.15 apiece, the highest level since listing. It pared gains to trade 10% higher at Rs 466.10 apiece, as of 2:25 p.m. This compares to a 0.01% decline in the NSE Nifty 50 Index.

The relative strength index was at 77, indicating that the stock may be overbought

One analyst tracking the company maintain a 'buy' rating for the stock according to Bloomberg data. The average 12-month consensus price target implies an upside of 14%.

The scrip rose as much as 14% to Rs 486.15 apiece, the highest level since listing. It pared gains to trade 10% higher at Rs 466.10 apiece, as of 2:25 p.m. This compares to a 0.01% decline in the NSE Nifty 50 Index.

The relative strength index was at 77, indicating that the stock may be overbought

One analyst tracking the company maintain a 'buy' rating for the stock according to Bloomberg data. The average 12-month consensus price target implies an upside of 14%.

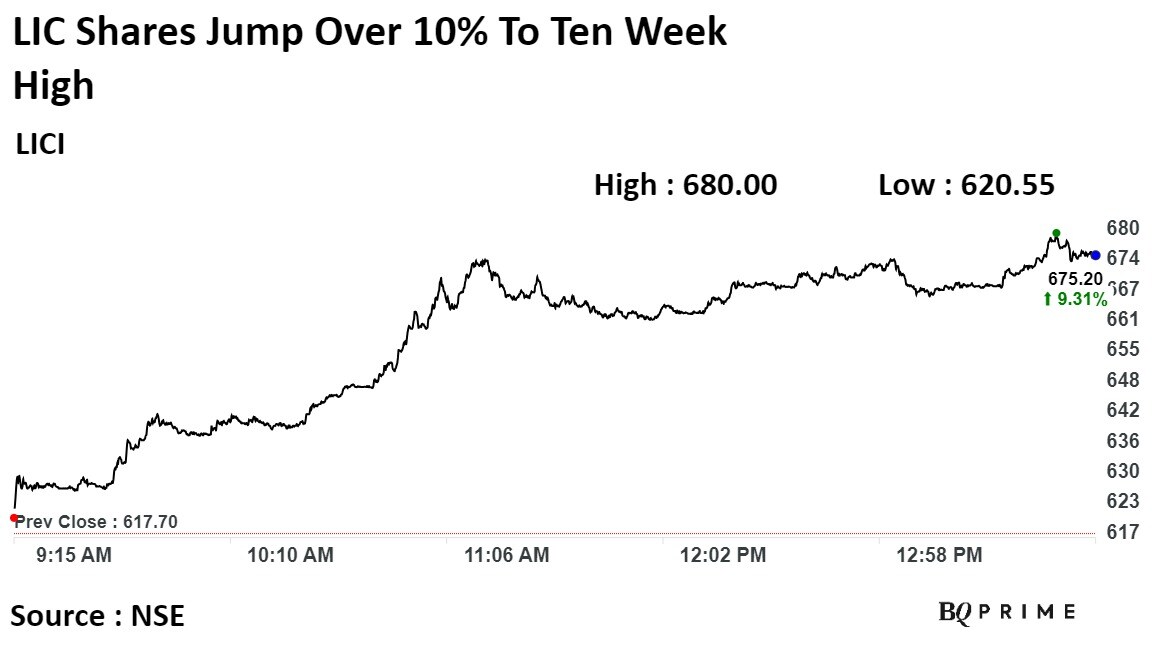

The scrip rose as much as 10.09% to Rs 6,80.00 apiece, the highest level since Sep 11. It was trading 9.32% higher at Rs 675.30 apiece, as of 1:54 p.m. This compares to 0.09% decline in the NSE Nifty 50 Index.

It has fallen 1.43% on a year-to-date basis.The relative strength index was at 77, implying that the stock maybe overbought.

Out of 19 analysts tracking the company, 15 maintain a 'buy' rating, 3 recommend a 'hold,' and 1 suggest 'sell,'according to Bloomberg data. The average 12-month consensus price target implies an upside of 18.2%.

The scrip rose as much as 10.09% to Rs 6,80.00 apiece, the highest level since Sep 11. It was trading 9.32% higher at Rs 675.30 apiece, as of 1:54 p.m. This compares to 0.09% decline in the NSE Nifty 50 Index.

It has fallen 1.43% on a year-to-date basis.The relative strength index was at 77, implying that the stock maybe overbought.

Out of 19 analysts tracking the company, 15 maintain a 'buy' rating, 3 recommend a 'hold,' and 1 suggest 'sell,'according to Bloomberg data. The average 12-month consensus price target implies an upside of 18.2%.

Ramkrishna Forging has signed a pact with Prozeal Green Energy to install 7.82 MWp Solar PV Project

Source: Exchange Filing

Board approves Rs 350 crore fund raise via QIP

Board approves Rs 150 crore warrants issue to founder

Source: Exchange Filing

In pact with Indraprastha Gas to enable digital rupee transactions in Delhi NCR

Source: Exchange Filing

The New India Assurance Company up 17.39% at Rs 204.5

General Insurance Corporation Of India up 13.1% at Rs 298.2

Edelweiss Financial Services up 13.92% at Rs 71.6

Fineotex Chemical up 11.39% at Rs 363.4

Elecon Engineering Co up 10.27% at Rs 973.85

Cartrade Tech up 7.73% at Rs 847.2

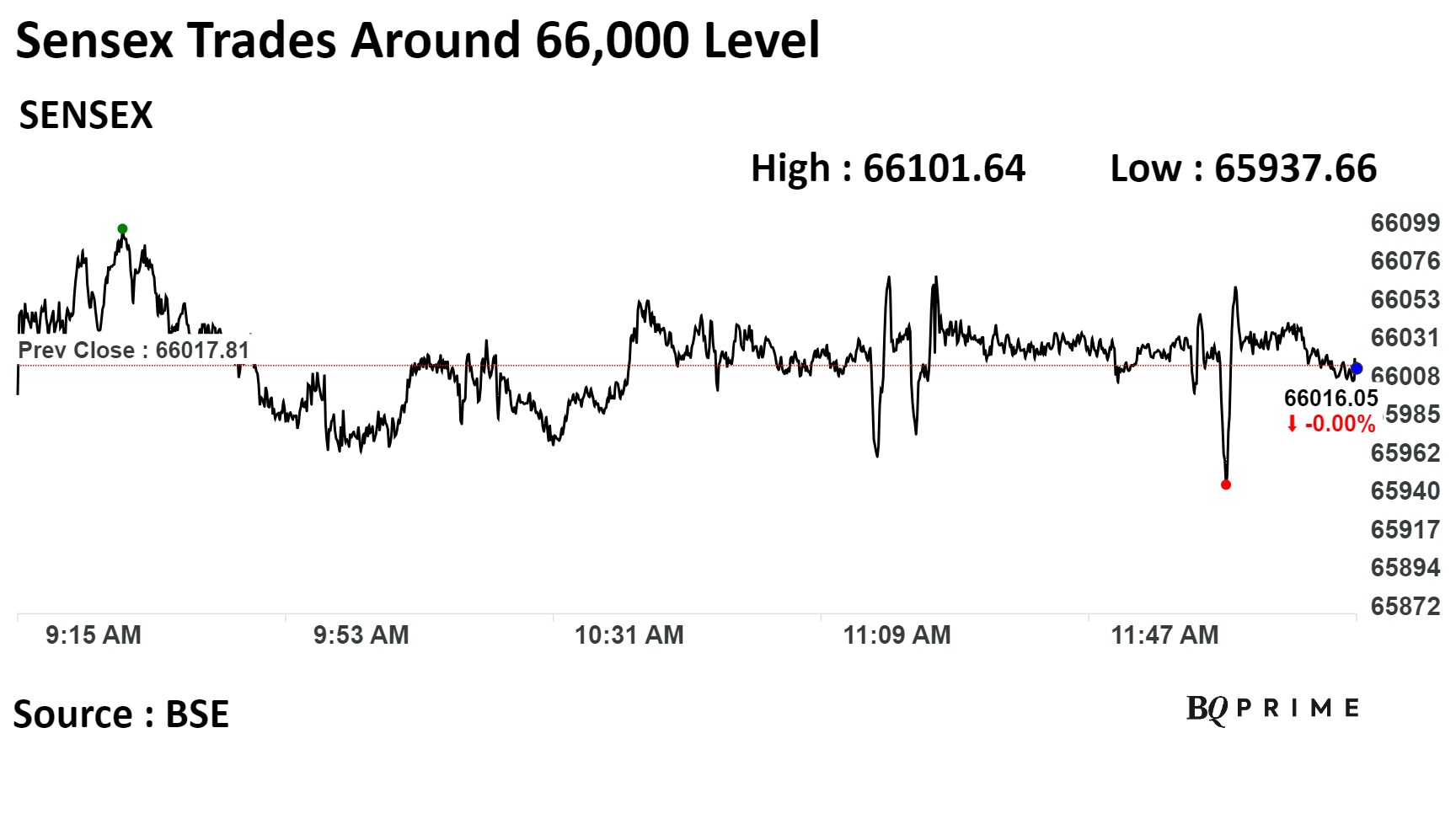

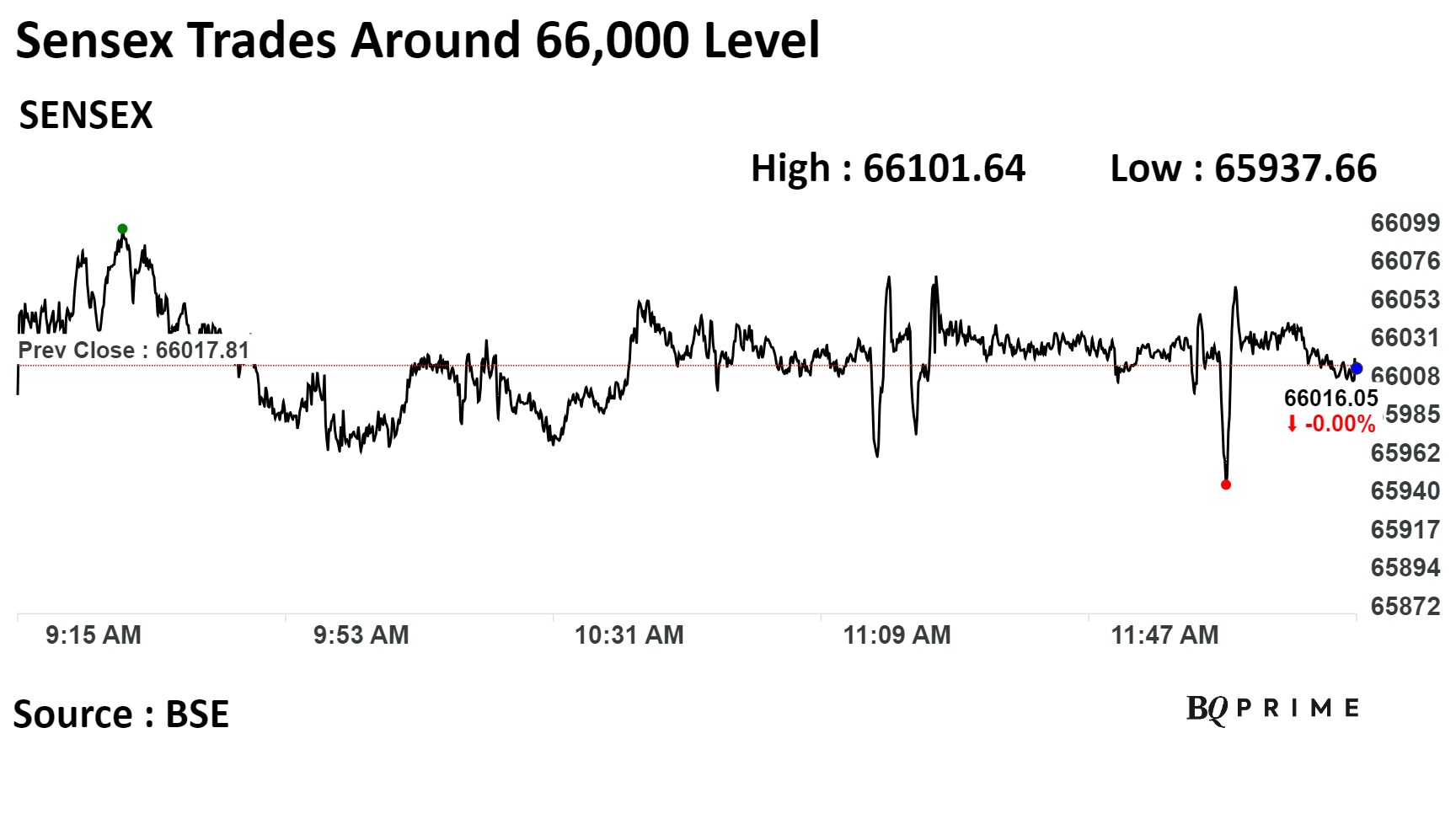

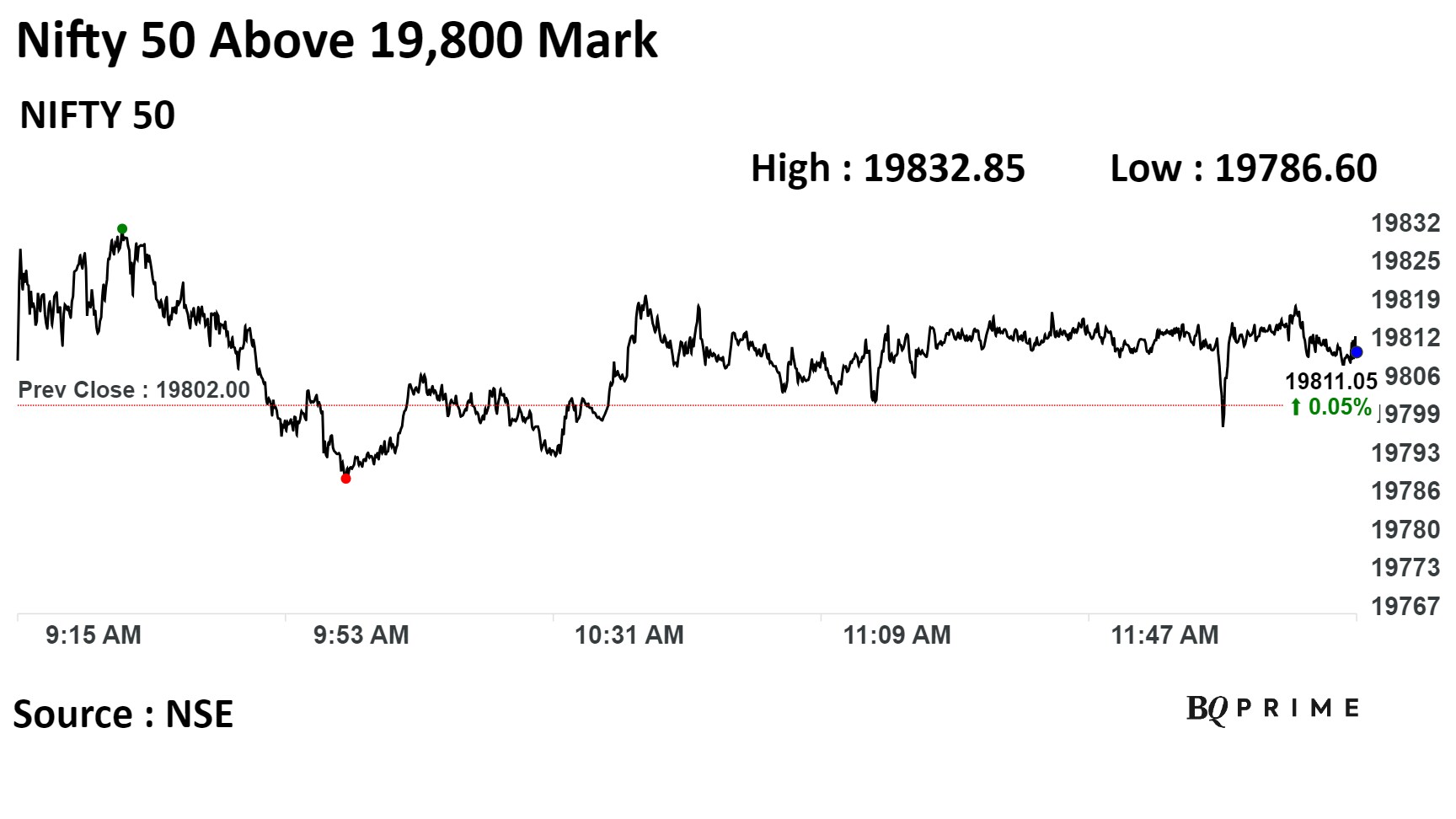

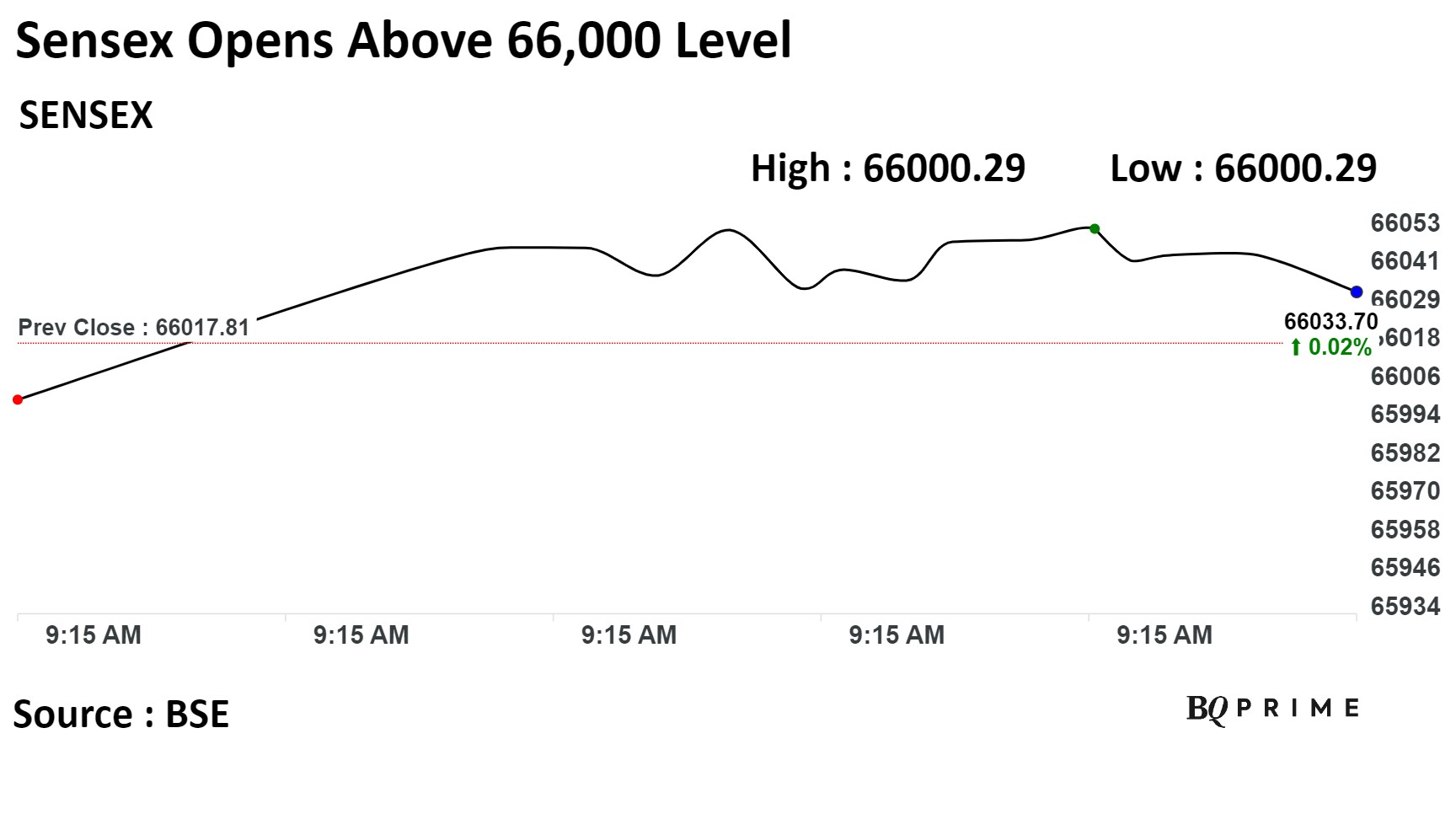

India's benchmark stock indices swung between gains and losses through midday on Friday. Pharma and healthcare sectors advanced while IT sector was under pressure.

As of 12:27 p.m., the S&P BSE Sensex Index was down 6 points, or 0.01%, at 66,0019.59 while the NSE Nifty 50 was 8 points or 0.04% higher at 19,809.45.

Sensex was trading around 66,000 level whereas Nifty 50 was above 19,800 mark.

The index has maintained the stability with 19,650 zone as the near-term support zone in the last few sessions and would need a decisive breach above 19,850 levels, said Vaishali Parekh, vice president - technical research, Prabhudas Lilladher Pvt.

"The support for the day is seen at 19,700 while the resistance is seen at 19,900," she added.

Asian markets were trading on a mixed note on Friday with no significant cues from its Wall Street peers as markets were closed on Thursday for Thanksgiving.

Hong Kong and mainland Chinese equities dropped, reversing Thursday’s rally inspired by Beijing’s widening property rescue campaign. Japanese stocks rose in catch-up play after a national holiday, while those in Australia also gained. U.S. futures contracts were steady.

The U.S. markets will open for half a day for Friday.

India's benchmark stock indices swung between gains and losses through midday on Friday. Pharma and healthcare sectors advanced while IT sector was under pressure.

As of 12:27 p.m., the S&P BSE Sensex Index was down 6 points, or 0.01%, at 66,0019.59 while the NSE Nifty 50 was 8 points or 0.04% higher at 19,809.45.

Sensex was trading around 66,000 level whereas Nifty 50 was above 19,800 mark.

The index has maintained the stability with 19,650 zone as the near-term support zone in the last few sessions and would need a decisive breach above 19,850 levels, said Vaishali Parekh, vice president - technical research, Prabhudas Lilladher Pvt.

"The support for the day is seen at 19,700 while the resistance is seen at 19,900," she added.

Asian markets were trading on a mixed note on Friday with no significant cues from its Wall Street peers as markets were closed on Thursday for Thanksgiving.

Hong Kong and mainland Chinese equities dropped, reversing Thursday’s rally inspired by Beijing’s widening property rescue campaign. Japanese stocks rose in catch-up play after a national holiday, while those in Australia also gained. U.S. futures contracts were steady.

The U.S. markets will open for half a day for Friday.

India's benchmark stock indices swung between gains and losses through midday on Friday. Pharma and healthcare sectors advanced while IT sector was under pressure.

As of 12:27 p.m., the S&P BSE Sensex Index was down 6 points, or 0.01%, at 66,0019.59 while the NSE Nifty 50 was 8 points or 0.04% higher at 19,809.45.

Sensex was trading around 66,000 level whereas Nifty 50 was above 19,800 mark.

The index has maintained the stability with 19,650 zone as the near-term support zone in the last few sessions and would need a decisive breach above 19,850 levels, said Vaishali Parekh, vice president - technical research, Prabhudas Lilladher Pvt.

"The support for the day is seen at 19,700 while the resistance is seen at 19,900," she added.

Asian markets were trading on a mixed note on Friday with no significant cues from its Wall Street peers as markets were closed on Thursday for Thanksgiving.

Hong Kong and mainland Chinese equities dropped, reversing Thursday’s rally inspired by Beijing’s widening property rescue campaign. Japanese stocks rose in catch-up play after a national holiday, while those in Australia also gained. U.S. futures contracts were steady.

The U.S. markets will open for half a day for Friday.

India's benchmark stock indices swung between gains and losses through midday on Friday. Pharma and healthcare sectors advanced while IT sector was under pressure.

As of 12:27 p.m., the S&P BSE Sensex Index was down 6 points, or 0.01%, at 66,0019.59 while the NSE Nifty 50 was 8 points or 0.04% higher at 19,809.45.

Sensex was trading around 66,000 level whereas Nifty 50 was above 19,800 mark.

The index has maintained the stability with 19,650 zone as the near-term support zone in the last few sessions and would need a decisive breach above 19,850 levels, said Vaishali Parekh, vice president - technical research, Prabhudas Lilladher Pvt.

"The support for the day is seen at 19,700 while the resistance is seen at 19,900," she added.

Asian markets were trading on a mixed note on Friday with no significant cues from its Wall Street peers as markets were closed on Thursday for Thanksgiving.

Hong Kong and mainland Chinese equities dropped, reversing Thursday’s rally inspired by Beijing’s widening property rescue campaign. Japanese stocks rose in catch-up play after a national holiday, while those in Australia also gained. U.S. futures contracts were steady.

The U.S. markets will open for half a day for Friday.

India's benchmark stock indices swung between gains and losses through midday on Friday. Pharma and healthcare sectors advanced while IT sector was under pressure.

As of 12:27 p.m., the S&P BSE Sensex Index was down 6 points, or 0.01%, at 66,0019.59 while the NSE Nifty 50 was 8 points or 0.04% higher at 19,809.45.

Sensex was trading around 66,000 level whereas Nifty 50 was above 19,800 mark.

The index has maintained the stability with 19,650 zone as the near-term support zone in the last few sessions and would need a decisive breach above 19,850 levels, said Vaishali Parekh, vice president - technical research, Prabhudas Lilladher Pvt.

"The support for the day is seen at 19,700 while the resistance is seen at 19,900," she added.

Asian markets were trading on a mixed note on Friday with no significant cues from its Wall Street peers as markets were closed on Thursday for Thanksgiving.

Hong Kong and mainland Chinese equities dropped, reversing Thursday’s rally inspired by Beijing’s widening property rescue campaign. Japanese stocks rose in catch-up play after a national holiday, while those in Australia also gained. U.S. futures contracts were steady.

The U.S. markets will open for half a day for Friday.

India's benchmark stock indices swung between gains and losses through midday on Friday. Pharma and healthcare sectors advanced while IT sector was under pressure.

As of 12:27 p.m., the S&P BSE Sensex Index was down 6 points, or 0.01%, at 66,0019.59 while the NSE Nifty 50 was 8 points or 0.04% higher at 19,809.45.

Sensex was trading around 66,000 level whereas Nifty 50 was above 19,800 mark.

The index has maintained the stability with 19,650 zone as the near-term support zone in the last few sessions and would need a decisive breach above 19,850 levels, said Vaishali Parekh, vice president - technical research, Prabhudas Lilladher Pvt.

"The support for the day is seen at 19,700 while the resistance is seen at 19,900," she added.

Asian markets were trading on a mixed note on Friday with no significant cues from its Wall Street peers as markets were closed on Thursday for Thanksgiving.

Hong Kong and mainland Chinese equities dropped, reversing Thursday’s rally inspired by Beijing’s widening property rescue campaign. Japanese stocks rose in catch-up play after a national holiday, while those in Australia also gained. U.S. futures contracts were steady.

The U.S. markets will open for half a day for Friday.

India's benchmark stock indices swung between gains and losses through midday on Friday. Pharma and healthcare sectors advanced while IT sector was under pressure.

As of 12:27 p.m., the S&P BSE Sensex Index was down 6 points, or 0.01%, at 66,0019.59 while the NSE Nifty 50 was 8 points or 0.04% higher at 19,809.45.

Sensex was trading around 66,000 level whereas Nifty 50 was above 19,800 mark.

The index has maintained the stability with 19,650 zone as the near-term support zone in the last few sessions and would need a decisive breach above 19,850 levels, said Vaishali Parekh, vice president - technical research, Prabhudas Lilladher Pvt.

"The support for the day is seen at 19,700 while the resistance is seen at 19,900," she added.

Asian markets were trading on a mixed note on Friday with no significant cues from its Wall Street peers as markets were closed on Thursday for Thanksgiving.

Hong Kong and mainland Chinese equities dropped, reversing Thursday’s rally inspired by Beijing’s widening property rescue campaign. Japanese stocks rose in catch-up play after a national holiday, while those in Australia also gained. U.S. futures contracts were steady.

The U.S. markets will open for half a day for Friday.

India's benchmark stock indices swung between gains and losses through midday on Friday. Pharma and healthcare sectors advanced while IT sector was under pressure.

As of 12:27 p.m., the S&P BSE Sensex Index was down 6 points, or 0.01%, at 66,0019.59 while the NSE Nifty 50 was 8 points or 0.04% higher at 19,809.45.

Sensex was trading around 66,000 level whereas Nifty 50 was above 19,800 mark.

The index has maintained the stability with 19,650 zone as the near-term support zone in the last few sessions and would need a decisive breach above 19,850 levels, said Vaishali Parekh, vice president - technical research, Prabhudas Lilladher Pvt.

"The support for the day is seen at 19,700 while the resistance is seen at 19,900," she added.

Asian markets were trading on a mixed note on Friday with no significant cues from its Wall Street peers as markets were closed on Thursday for Thanksgiving.

Hong Kong and mainland Chinese equities dropped, reversing Thursday’s rally inspired by Beijing’s widening property rescue campaign. Japanese stocks rose in catch-up play after a national holiday, while those in Australia also gained. U.S. futures contracts were steady.

The U.S. markets will open for half a day for Friday.

HDFC Bank Ltd., Axis Bank Ltd., Larsen & Toubro Ltd, and Cipla were positively adding to the change in the Nifty 50 Index.

Whereas, Tata Motors Ltd., ITC Ltd., HCL Technologies Ltd., Infosys, and Tata Consultancy Services Ltd. were negatively contributing to the change.

The broader markets outperformed larger peers; the S&P BSE MidCap Index was up 0.45%, whereas S&P BSE SmallCap Index was 0.42% higher.

Sixteen out of 20 sectors compiled by BSE advanced, while three sectors declined. S&P BSE Capital Goods rose the most.

The market breadth was skewed in the favour of the buyers. About 1,949 stocks rose, 1564 declined, while 170 remained unchanged on the BSE.

Aditya Birla Sunlife Mutual Fund sells 2.13% stake in RateGain Travel Technologies Ltd

Current share holding of Aditya Birla Mutual Fund stands at 3.06% vs 5.19% earlier

Source: Exchange filing

Nifty Midcap 150 rose 0.41% intraday to 15,705.85 points, its lifetime high level

Source: Bloomberg

Suprajit Engineering also bought buildings measuring 70,000 square feet in Bangalore

Source: Exchange filing

Intends to raise 10,000 crore via infrastructure bonds for a tenure of up to 7 years

Base size of bond issue at 2,000 crore, green shoe option of 8,000 crore

To issue 5,000 crore infra bonds in first tranche for a tenure between 7-10 years

First tranche of infra bonds issue to have base size of 1,000 crore green shoe option of `4,000 crore

Source: Exchange Filing

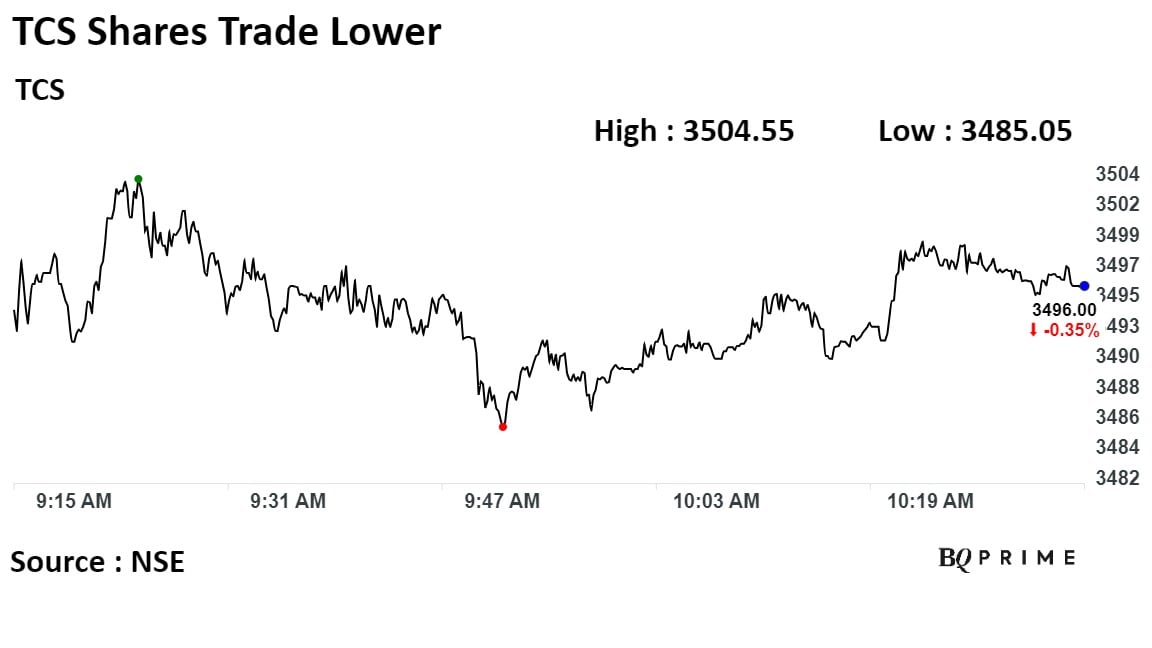

Shares of Tata Consultancy fell nearly 1% as it went ex-buyback today.

The tech company will buy back 4.09 crore shares representing 1.12% of the total paid-up equity share capital for Rs 17,000 crore on Saturday.

Tata Consultancy said the buyback price is set at Rs 4,150 apiece. The offer price represents a premium of 20.45% and 20.26% to the volume weighted average market price of the equity share on BSE and NSE respectively, during the three months preceding the date of intimation of the buyback, according to the shareholder report.

Shares of Tata Consultancy fell nearly 1% as it went ex-buyback today.

The tech company will buy back 4.09 crore shares representing 1.12% of the total paid-up equity share capital for Rs 17,000 crore on Saturday.

Tata Consultancy said the buyback price is set at Rs 4,150 apiece. The offer price represents a premium of 20.45% and 20.26% to the volume weighted average market price of the equity share on BSE and NSE respectively, during the three months preceding the date of intimation of the buyback, according to the shareholder report.

The scrip fell as much as 0.67% to Rs 3,484.84 apiece. It pared losses to trade 0.47% lower at Rs 3,491.65 apiece, as of 10:49 a.m. This compares to 0.05% advance in the NSE Nifty 50 Index.

It has risen 9.34% on a year-to-date basis.The relative strength index was at 55.24.

Out of 45 analysts tracking the company, 23 maintain a 'buy' rating, 13 recommend a 'hold,' and 7 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 6.0%.

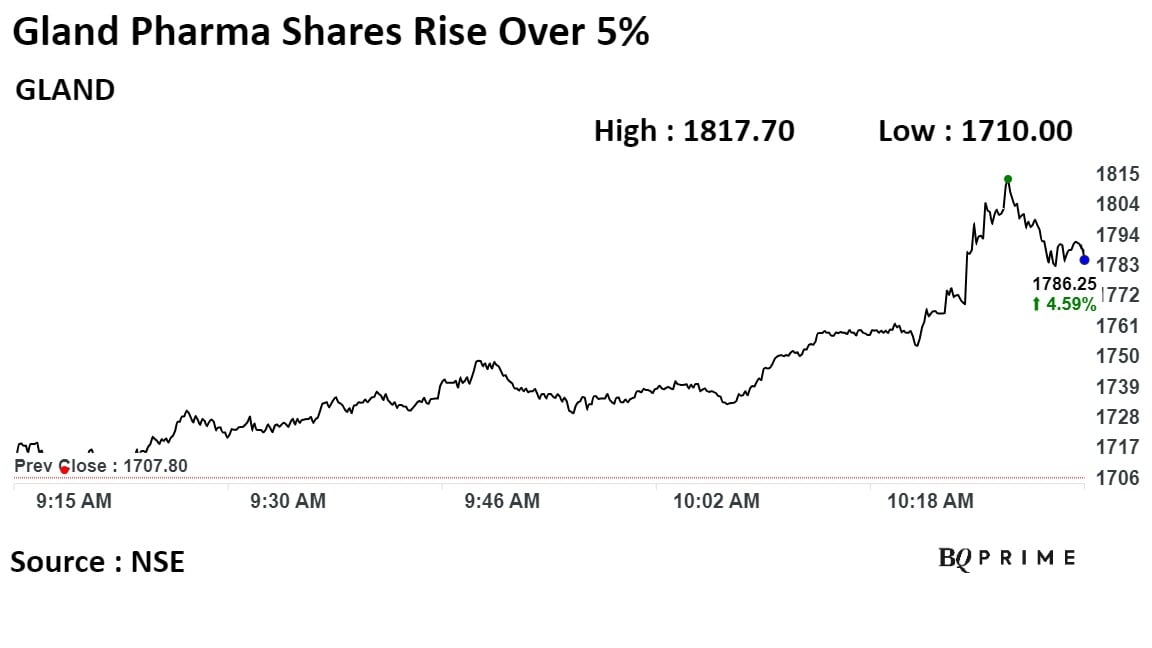

Gets Establishment Inspection Report from U.S. FDA for Pashamylaram facility

Received EIR from U.S. FDA on closure of inspection

Pashamylaram unit audit was conducted from Aug 23-26

Source: Exchange Filing

Gets Establishment Inspection Report from U.S. FDA for Pashamylaram facility

Received EIR from U.S. FDA on closure of inspection

Pashamylaram unit audit was conducted from Aug 23-26

Source: Exchange Filing

One97 communications at 7.23x of its 30day average

The New India Insurance at 5.7x of its 30 day average

DCM Sriram at 4.63x of its 30 day average

Sun Pharma Advanced Research at 4.12x of its 30 day average

Edelweiss Financial services at 3.66x of its 30 day average

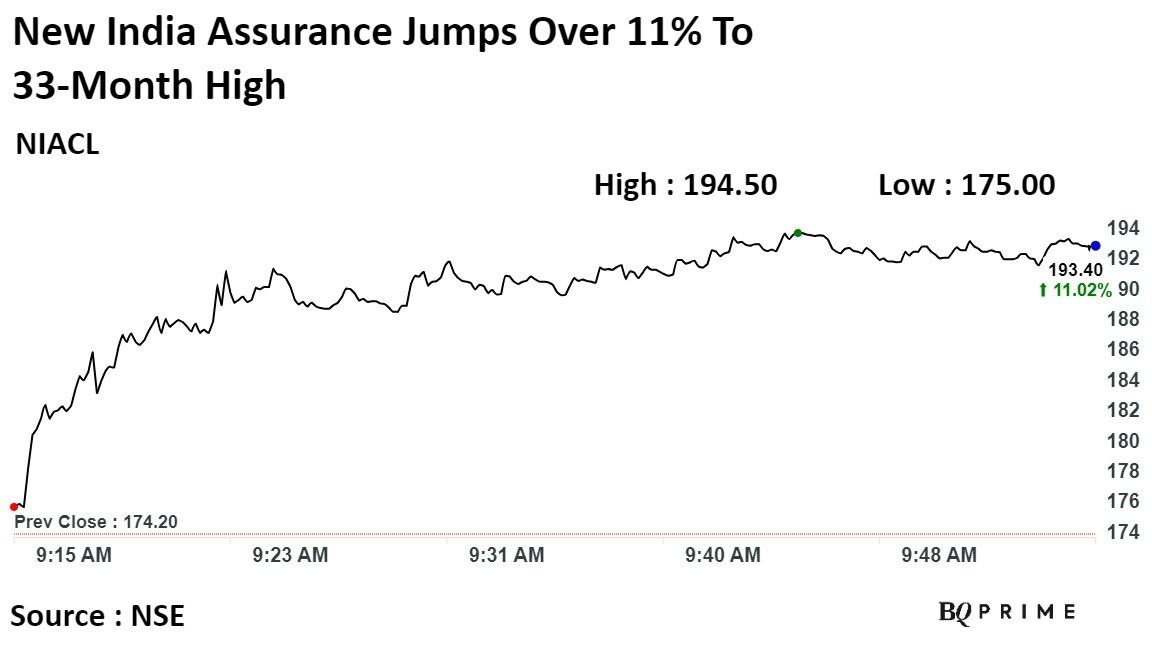

The scrip rose as much as 11.65% to Rs 194.50 apiece, the highest level since Feb 22, 2021. It was trade 10.59% higher at Rs 192.65 apiece, as of 0956vfd a.m. This compares no change in the NSE Nifty 50 Index.

It has risen 53.8% on a year-to-date basis. Total traded volume so far in the day stood at 21 times its 30-day average. The relative strength index was at 83.91DC.

Out of eight analysts tracking the company, 1 maintain a 'buy' rating, 1 recommend a 'hold,' and 4 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 32.7%.

The scrip rose as much as 11.65% to Rs 194.50 apiece, the highest level since Feb 22, 2021. It was trade 10.59% higher at Rs 192.65 apiece, as of 0956vfd a.m. This compares no change in the NSE Nifty 50 Index.

It has risen 53.8% on a year-to-date basis. Total traded volume so far in the day stood at 21 times its 30-day average. The relative strength index was at 83.91DC.

Out of eight analysts tracking the company, 1 maintain a 'buy' rating, 1 recommend a 'hold,' and 4 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 32.7%.

Nifty IT top loser, down 0.21%

Losses led by Coforge, Mphasis, HCL Tech

Mphases top loser, down 0.83%

3 out of 10 stock in the red

Persistent Systems, LTIMindtree, L&T Tech Services in the green

LTIMindtree up 0.29% on new Quantum Safe VPN link launch

The broader markets outperformed larger peers; the S&P BSE MidCap Index was up 0.33%, whereas S&P BSE SmallCap Index was 0.49% lower.

Sixteen out of 20 sectors compiled by BSE advanced, while four sectors declined. S&P BSE Healthcare rose the most.

The market breadth was skewed in the favour of the buyers. About 1,931 stocks rose, 786 declined, while 123 remained unchanged on the BSE.

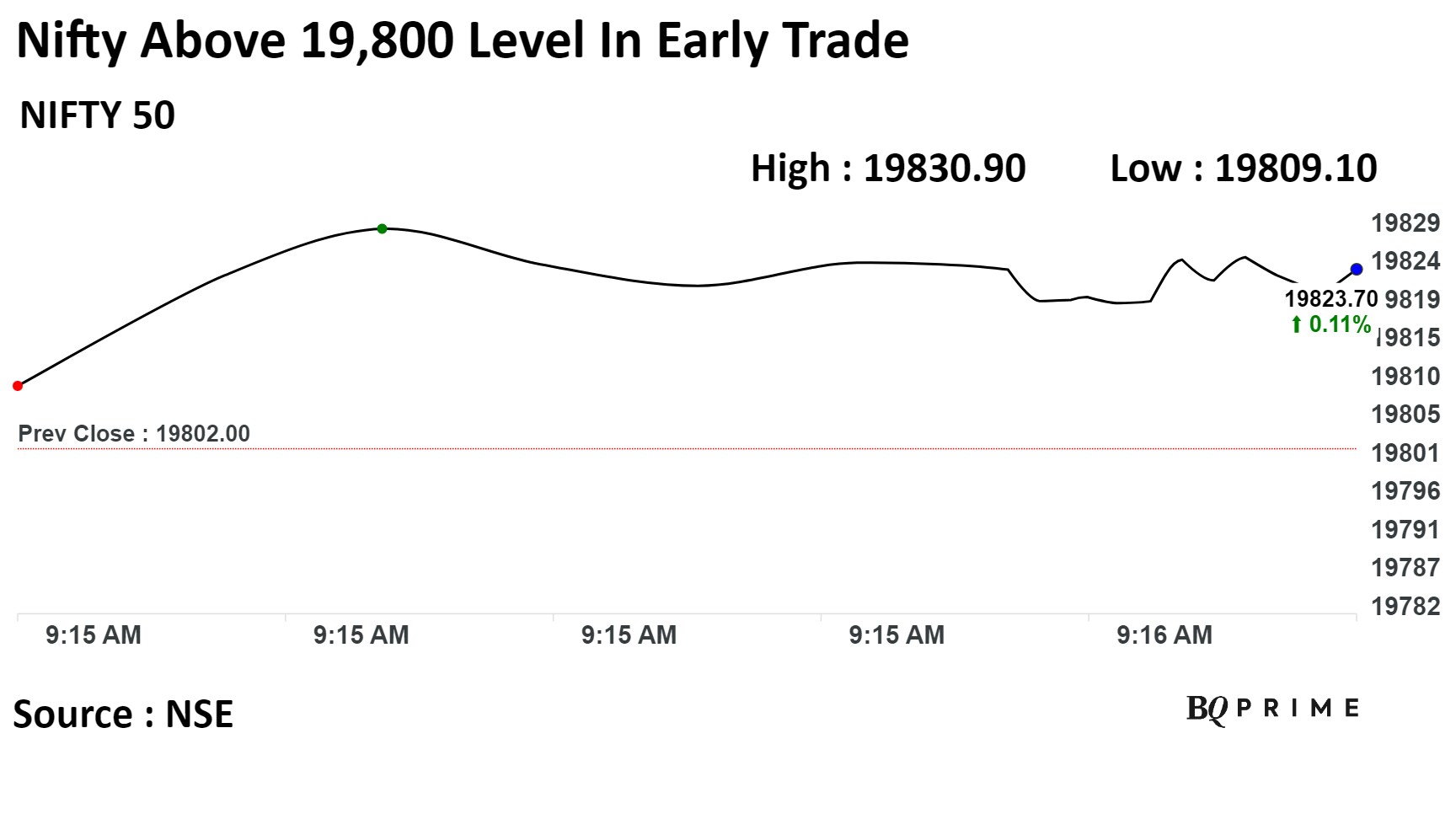

India's benchmark stock indices were trading higher in early trade on Friday.

Indices in Asia were trading on a mixed note on Friday with no significant cues from its Wall Street peers, and U.S. Treasury yields rose.

Financial markets in the U.S. were closed on Thursday for Thanksgiving.

Shares in Japan rose as Japan’s key inflation measure accelerated for the first time in four months, going against the Bank of Japan’s view that it would decelerate, likely strengthening expectations of policy normalization.

While the core inflation rate rose to 2.9% in October, as opposed to 2.8% in September, the headline inflation rate was at 3.3%, higher than the 3% seen in the month before.

Meanwhile, equity indices in China declined as the country may provide short-term unsecured loans to qualified developers for the first time to ease the property sector's woes.

India's benchmark stock indices were trading higher in early trade on Friday.

Indices in Asia were trading on a mixed note on Friday with no significant cues from its Wall Street peers, and U.S. Treasury yields rose.

Financial markets in the U.S. were closed on Thursday for Thanksgiving.

Shares in Japan rose as Japan’s key inflation measure accelerated for the first time in four months, going against the Bank of Japan’s view that it would decelerate, likely strengthening expectations of policy normalization.

While the core inflation rate rose to 2.9% in October, as opposed to 2.8% in September, the headline inflation rate was at 3.3%, higher than the 3% seen in the month before.

Meanwhile, equity indices in China declined as the country may provide short-term unsecured loans to qualified developers for the first time to ease the property sector's woes.

India's benchmark stock indices were trading higher in early trade on Friday.

Indices in Asia were trading on a mixed note on Friday with no significant cues from its Wall Street peers, and U.S. Treasury yields rose.

Financial markets in the U.S. were closed on Thursday for Thanksgiving.

Shares in Japan rose as Japan’s key inflation measure accelerated for the first time in four months, going against the Bank of Japan’s view that it would decelerate, likely strengthening expectations of policy normalization.

While the core inflation rate rose to 2.9% in October, as opposed to 2.8% in September, the headline inflation rate was at 3.3%, higher than the 3% seen in the month before.

Meanwhile, equity indices in China declined as the country may provide short-term unsecured loans to qualified developers for the first time to ease the property sector's woes.

India's benchmark stock indices were trading higher in early trade on Friday.

Indices in Asia were trading on a mixed note on Friday with no significant cues from its Wall Street peers, and U.S. Treasury yields rose.

Financial markets in the U.S. were closed on Thursday for Thanksgiving.

Shares in Japan rose as Japan’s key inflation measure accelerated for the first time in four months, going against the Bank of Japan’s view that it would decelerate, likely strengthening expectations of policy normalization.

While the core inflation rate rose to 2.9% in October, as opposed to 2.8% in September, the headline inflation rate was at 3.3%, higher than the 3% seen in the month before.

Meanwhile, equity indices in China declined as the country may provide short-term unsecured loans to qualified developers for the first time to ease the property sector's woes.

India's benchmark stock indices were trading higher in early trade on Friday.

Indices in Asia were trading on a mixed note on Friday with no significant cues from its Wall Street peers, and U.S. Treasury yields rose.

Financial markets in the U.S. were closed on Thursday for Thanksgiving.

Shares in Japan rose as Japan’s key inflation measure accelerated for the first time in four months, going against the Bank of Japan’s view that it would decelerate, likely strengthening expectations of policy normalization.

While the core inflation rate rose to 2.9% in October, as opposed to 2.8% in September, the headline inflation rate was at 3.3%, higher than the 3% seen in the month before.

Meanwhile, equity indices in China declined as the country may provide short-term unsecured loans to qualified developers for the first time to ease the property sector's woes.

India's benchmark stock indices were trading higher in early trade on Friday.

Indices in Asia were trading on a mixed note on Friday with no significant cues from its Wall Street peers, and U.S. Treasury yields rose.

Financial markets in the U.S. were closed on Thursday for Thanksgiving.

Shares in Japan rose as Japan’s key inflation measure accelerated for the first time in four months, going against the Bank of Japan’s view that it would decelerate, likely strengthening expectations of policy normalization.

While the core inflation rate rose to 2.9% in October, as opposed to 2.8% in September, the headline inflation rate was at 3.3%, higher than the 3% seen in the month before.

Meanwhile, equity indices in China declined as the country may provide short-term unsecured loans to qualified developers for the first time to ease the property sector's woes.

India's benchmark stock indices were trading higher in early trade on Friday.

Indices in Asia were trading on a mixed note on Friday with no significant cues from its Wall Street peers, and U.S. Treasury yields rose.

Financial markets in the U.S. were closed on Thursday for Thanksgiving.

Shares in Japan rose as Japan’s key inflation measure accelerated for the first time in four months, going against the Bank of Japan’s view that it would decelerate, likely strengthening expectations of policy normalization.

While the core inflation rate rose to 2.9% in October, as opposed to 2.8% in September, the headline inflation rate was at 3.3%, higher than the 3% seen in the month before.

Meanwhile, equity indices in China declined as the country may provide short-term unsecured loans to qualified developers for the first time to ease the property sector's woes.

India's benchmark stock indices were trading higher in early trade on Friday.

Indices in Asia were trading on a mixed note on Friday with no significant cues from its Wall Street peers, and U.S. Treasury yields rose.

Financial markets in the U.S. were closed on Thursday for Thanksgiving.

Shares in Japan rose as Japan’s key inflation measure accelerated for the first time in four months, going against the Bank of Japan’s view that it would decelerate, likely strengthening expectations of policy normalization.

While the core inflation rate rose to 2.9% in October, as opposed to 2.8% in September, the headline inflation rate was at 3.3%, higher than the 3% seen in the month before.

Meanwhile, equity indices in China declined as the country may provide short-term unsecured loans to qualified developers for the first time to ease the property sector's woes.

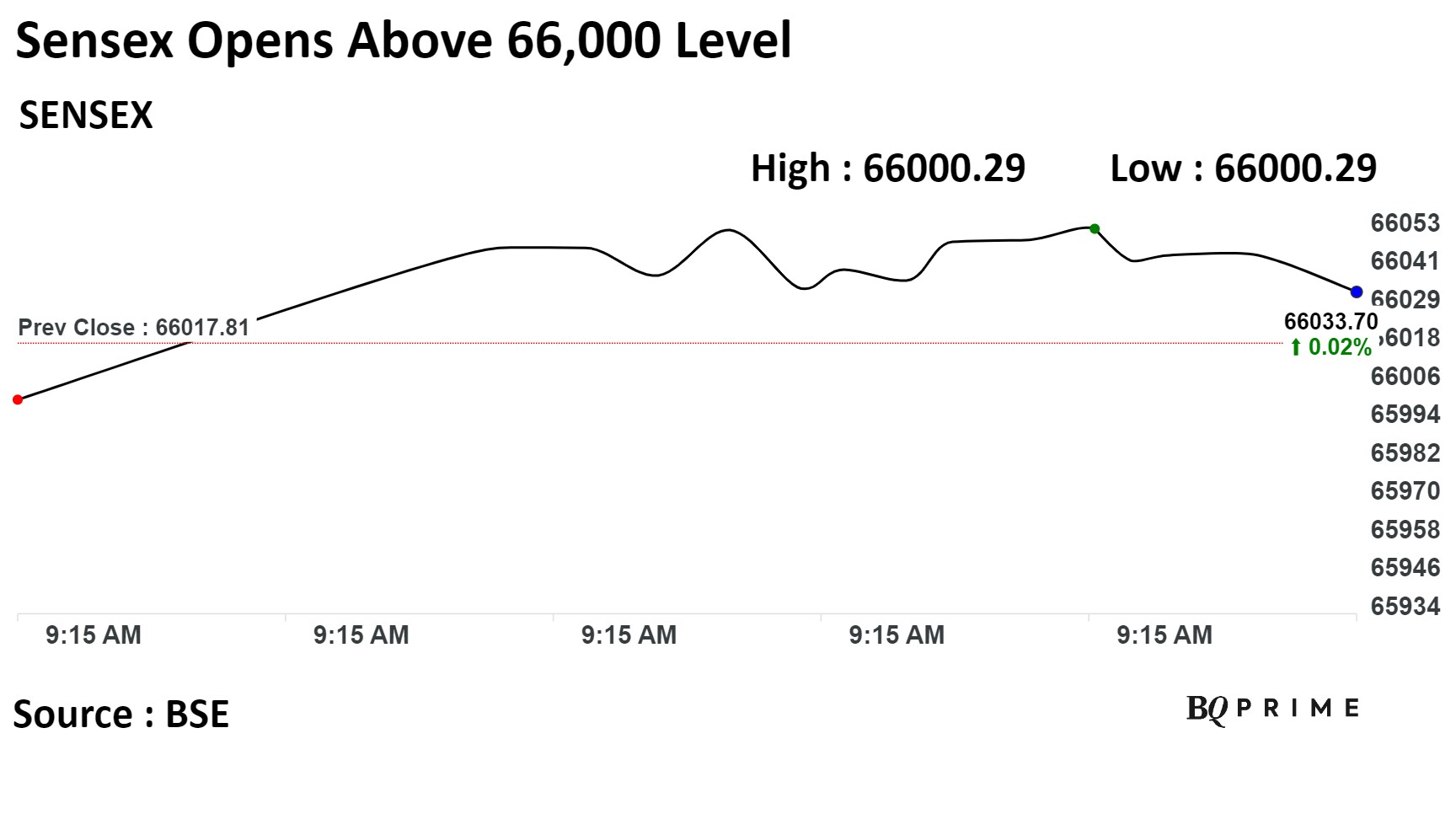

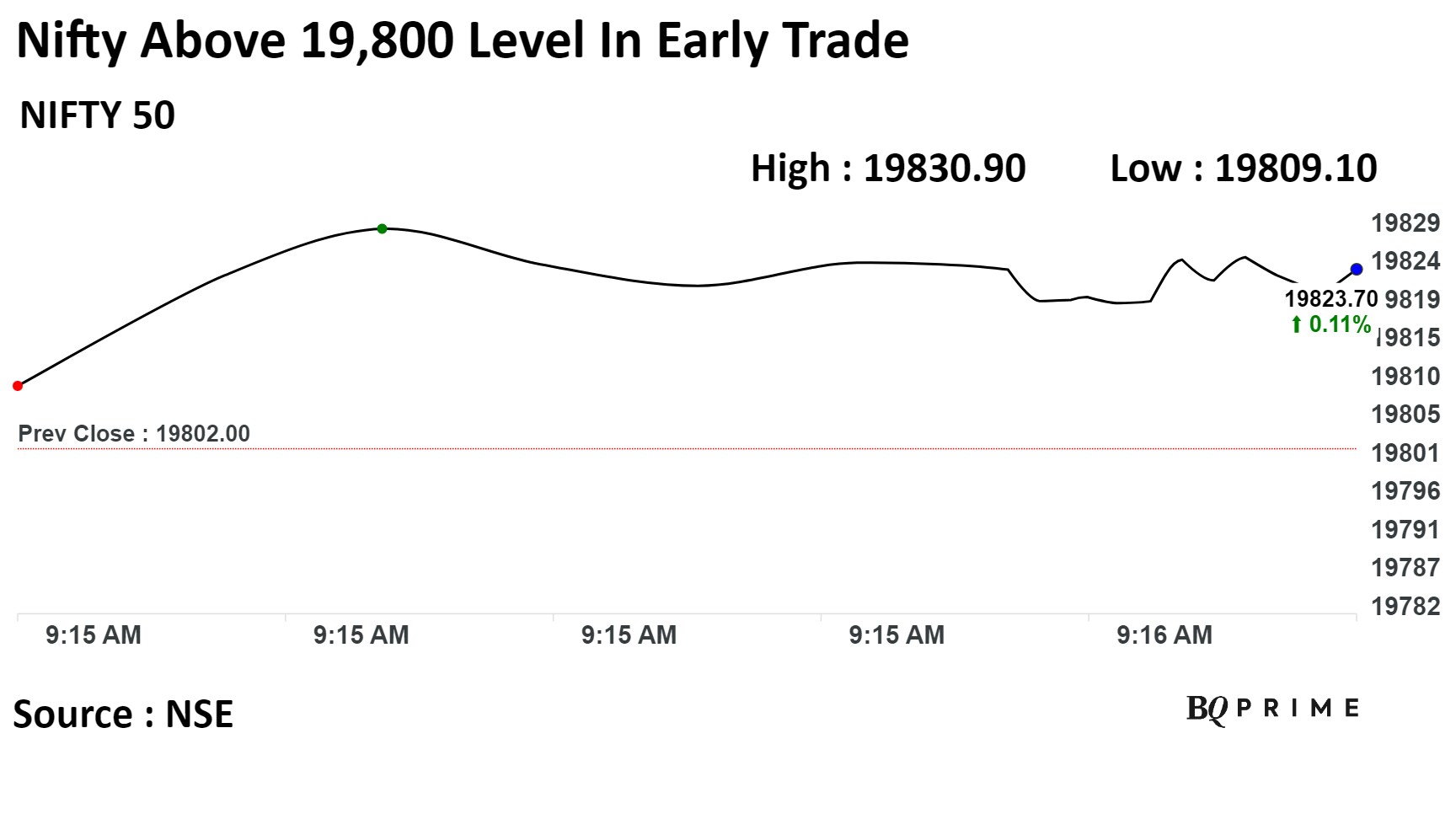

At pre-open, the S&P BSE Sensex Index was down 18 points, or 0.03%, at 66,000.29 while the NSE Nifty 50 was 8 points or 0.04% higher at 19,809.60.

Source: Bloomberg

The yield on the 10-year bond opened flat at 7.27% on Friday.

It closed at 7.26% on Thursday.

Source: Bloomberg

The local currency weakened 1 paise to open at 83.35 against the U.S dollar on Friday.

It closed at 83.34 on Thursday.

Source: Bloomberg

U.S. Dollar Index at 103.79

U.S. 10-year bond yield at 4.45% on Friday

Brent crude up 0.34% to $81.70 per barrel

Nymex crude at $76.69 per barrel

GIFT Nifty down 0.05% to 19,868.0 as of 8:15 a.m.

Bitcoin up 0.39% to $37,398.41

Ex/record date Interim dividend: BMW Industries, Ddev Plastiks Industries, ESAB India, Goldiam International, Manappuram Finance, Natco Pharma, Power Finance Corporation, Uniparts India.

Ex/record date Bonus issue: Avantel

Ex/record date Buyback: Gujarat Narmada Valley fetilizers & Chemicals, Tata Consultancy Services.

Move into a short-term ASM framework: Prataap Snacks.

Black Box: To meet analysts and investors on Dec. 1.

Premier Explosives: To meet analysts and investors on Nov. 28.

The New India Assurance Company: To meet analysts and investors on Nov. 29.

Five-Star Business Finance: To meet analysts and investors on Nov. 28 and Nov. 29.

JK Tyre & Industries: To meet analysts and investors on Nov. 28, 29 and 30.

The Phoenix Mills: To meet analysts and investors on Nov. 28 and 29.

Advanced Enzyme Technologies: To meet analysts and investors on Nov. 29 and 30.

Escorts Kubota: To meet analysts and investors on Dec. 5.

Indian Energy Exchange: To meet analysts and investors on Nov. 29.

V-Mart Retail: To meet analysts and investors on Nov. 30.

HEG: To meet analysts and investors on Nov. 29.

NHPC: To meet analysts and investors on Nov. 29.

Shriram Finance: To meet analysts and investors on Nov. 29.

Yatharth Hospital & Trauma Care Services: To meet analysts and investors on Nov. 28 and 30.

Titagarh Rail Systems: To meet analysts and investors on Nov. 25 to Dec. 1.

Care Ratings: To meet analysts and investors on Nov. 29 and 30.

Bajaj Finserv: To meet analysts and investors on Nov. 29 and 30.

Hindalco Industries: To meet analysts and investors on Nov. 29.

Tata Steel: To meet analysts and investors on Nov. 29.

Jindal Stainless: To meet analysts and investors on Dec. 12.

Oil and Natural Gas Corp: To meet analysts and investors on Nov. 30.

Rhi Magnesita India: To meet analysts and investors on Nov. 28.

Piramal Enterprise: To meet analysts and investors on Nov. 29.

Bharti Airtel: To meet analysts and investors on Nov. 29 and 30.

Grasim Industries: To meet analysts and investors on Nov. 29 and 30.

Usha Martin: Promoter group Nidhi Rajgarhia sold 8,000 equity shares on Nov. 21.

D B Realty: Promoter group Shravan Kumar Bali sold 81,060 equity shares between Nov. 20 and 21.

Promoter Vinod Goenka HUF sold 2.7 lakh equity shares on Nov. 21.

Ultramarine and Pigments: The promoter group sold 2,976 equity shares between Nov. 22 and 23.

Sterling and Wilson Renewable Energy: Promoter Khurshed Yazdi Daruvala created a pledge of 1.93 lakh equity shares on Nov. 20.

Home First Finance: Smallcap World Fund and Fidelity Global Investment Fund Asia Pacific Equity Fund bought over a 3.25% stake in Home First Finance Company India Ltd. for over 249 crore. True North Fund V LLP,Orange Clove Investments B.V., Aether Mauritius Ltd., True North Fund V LLP, Orange Clove Investments BV, and Aether Mauritius Ltd. sold over a 9.8% stake in Home First Finance Company India.

D B Realty: Authum Investment & Infrastructure bought 27 lakh shares (0.53%) at 198.90 apiece, while Neelkamal Tower Construction LLP sold 73 lakh shares (1.45%) at 199.05 apiece.

Lupin: The pharma major has received approval from the U.S. FDA for Bromfenac Ophthalmic Solution, 0.07%, and tentative approval from the U.S. FDA for Canagliflozin Tablets.

LTIMindtree: The global technology consulting and digital solutions company, launched the Quantum-Safe Virtual Private Network (VPN) link in London in collaboration with Quantum Xchange and Fortinet.

Indian Railway Catering and Tourism Corporation: The company’s e-ticket booking and cancellation were temporarily affected today from 11:15 a.m. to 1:52 p.m. due to technical reasons, and the same has been resolved.

Granules: The company received a communication from the GST authorities directing the payment of a tax liability of Rs 43.43 lakh for the tax period July 2017 to March 2021.

Radico Khaitan: The company announced the launch of Magic Moments Remix Pink Vodka to cater to the growing demand for the coloured and flavoured beverage alcohol category.

Bharat Electronics: NSE and BSE imposed a fine of Rs 1,82,900 each on the company for noncompliance with regulations with respect to the composition of the board of directors due to the insufficient number of independent directors.

Karnataka Bank: The bank tied up with Bajaj Allianz Life Insurance Company Limited to distribute life insurance products.

JSW Steel: The steel manufacturer completes the last tranche of its Rs 750 crore investment in JSW Paints, and the company now holds a 12.84% stake in JSW Paints.

Siemens: The company received a GST demand and penalty notice worth Rs 23.7 crore from Belapur's CGST and Central Excise Commissionerate.

NMDC: The company has set the iron ore price at 5,400 per tonne w.e.f Nov. 23 and the fines price at 4,660 per tonne w.e.f Nov. 23.

Indian Hotels: The company has made an investment of Rs 55 crore in Genness Hospitality Private Ltd. and 35 crore in Qurio Hospitality Private Ltd. by way of subscription to rights issues.

Prestige Estates: The company launched a residential project called “Prestige Glenbrook” in Bangalore, comprising 285 apartments across two high-rise towers with a developable area of 0.7 million sq ft and a revenue potential of Rs 550 crore.

Apar Industries: The company opens QIP for raising up to Rs 1000 crore at a floor price of Rs 5,540.33 per share.

Castrol India: The company entered into a tripartite agreement with KFin Technologies Ltd. and Link Intime India Pvt.

Samvardhana Motherson International: The National Company Law Tribunal gave the nod for the scheme of amalgamation between Motherson Consultancies Service Ltd., Motherson Invenzen Xlab Pvt., Samvardhana Motherson Polymers Ltd., and MS Global India Automotive Pvt. with Samvardhana Motherson International Ltd.

Bharat Heavy Electricals: NSE and BSE imposed a fine of Rs 5,42,800 each for non-compliance with the SEBI regulation.

Vishnu Chemicals: The company incorporated Vishnu International Trading FZE, a wholly owned subsidiary in Dubai, UAE.

Anup Engineering: The National Company Law Tribunal gave the nod for the scheme of amalgamation between Anup Heavy Engineering Ltd. and Anup Engineering Ltd.

Clean Science and Technology: The company made an investment of Rs 60 crore in Clean Fino-Chem Ltd., a wholly owned subsidiary of the company, by way of the right issue.

JM Financial: The company received a warning letter from SEBI for a merchant banker rule violation.

IREDA: The IPO was subscribed 38.80 times on day three. The bids were led by institutional investors (104.57 times), non-institutional investors (24.16 times), a portion reserved for employees (9.8 times), and retail investors (7.73 times).

Tata Technologies: The IPO was subscribed 14.86 times on day two. The bids were led by non-institutional investors (31.04 times), a reserved portion for shareholders (20.04 times), retail investors (11.20 times), institutional investors (8.55 times), and a reserve portion for employees (2.36 times).

Gandhar Oil Refinery: The IPO was subscribed 15.27 times on day two. The bids were led by non-institutional investors (26.24 times), retail investors (17.27 times), and institutional investors (3.14 times).

Fedbank Financial Services: The IPO was subscribed to 0.90 times on day two. The bids were led by retail investors (1.26 times), a portion reserved for employees (0.78 times), institutional investors (0.56 times), and non-institutional investors (0.52 times).

Flair Writing Industries: The IPO was subscribed to 6.12 times on day two. The bids were led by non-institutional investors (10.05 times), retail investors (7.16 times), and institutional investors (1.36 times).

Indices in Asia were trading on a mixed note on Friday with no significant cues from its Wall Street peers, and U.S. Treasury yields rose.

Financial markets in the U.S. were closed on Thursday for Thanksgiving.

Shares in Japan rose as Japan’s key inflation measure accelerated for the first time in four months, going against the Bank of Japan’s view that it would decelerate, likely strengthening expectations of policy normalization.

While the core inflation rate rose to 2.9% in October, as opposed to 2.8% in September, the headline inflation rate was at 3.3%, higher than the 3% seen in the month before.

Meanwhile, equity indices in China declined as the country may provide short-term unsecured loans to qualified developers for the first time to ease the property sector's woes.

India's benchmark stock indices snapped two days of gains to end marginally lower on Thursday, dragged by losses in Cipla Ltd., Infosys Ltd., and Tata Consultancy Services Ltd.

The yield on the 10-year U.S. bond was trading at 4.45%, and Bitcoin was above $37,000. Brent crude was above $81 a barrel, whereas WTI crude was above $76 a barrel.

The GIFT Nifty, an early indicator of the Nifty 50 Index’s performance in India, was 0.05% down at 19,868 as of 8:15 a.m.

The S&P BSE Sensex ended 5.43 points, or 0.01%, lower at 66,017.81, while the NSE Nifty 50 fell 9.85 points, or 0.05%, to close at 19,802.

Overseas investors turned net buyers on Thursday after being net sellers for four consecutive sessions. Foreign portfolio investors bought stocks worth Rs 255.5 crore, while domestic institutional investors continued to be buyers and purchased stocks worth Rs 457.4 crore, the NSE data showed.

The Indian rupee weakened 2 paise to close at 83.34 against the U.S. dollar on Thursday.

Indices in Asia were trading on a mixed note on Friday with no significant cues from its Wall Street peers, and U.S. Treasury yields rose.

Financial markets in the U.S. were closed on Thursday for Thanksgiving.

Shares in Japan rose as Japan’s key inflation measure accelerated for the first time in four months, going against the Bank of Japan’s view that it would decelerate, likely strengthening expectations of policy normalization.

While the core inflation rate rose to 2.9% in October, as opposed to 2.8% in September, the headline inflation rate was at 3.3%, higher than the 3% seen in the month before.

Meanwhile, equity indices in China declined as the country may provide short-term unsecured loans to qualified developers for the first time to ease the property sector's woes.

India's benchmark stock indices snapped two days of gains to end marginally lower on Thursday, dragged by losses in Cipla Ltd., Infosys Ltd., and Tata Consultancy Services Ltd.

The yield on the 10-year U.S. bond was trading at 4.45%, and Bitcoin was above $37,000. Brent crude was above $81 a barrel, whereas WTI crude was above $76 a barrel.

The GIFT Nifty, an early indicator of the Nifty 50 Index’s performance in India, was 0.05% down at 19,868 as of 8:15 a.m.

The S&P BSE Sensex ended 5.43 points, or 0.01%, lower at 66,017.81, while the NSE Nifty 50 fell 9.85 points, or 0.05%, to close at 19,802.

Overseas investors turned net buyers on Thursday after being net sellers for four consecutive sessions. Foreign portfolio investors bought stocks worth Rs 255.5 crore, while domestic institutional investors continued to be buyers and purchased stocks worth Rs 457.4 crore, the NSE data showed.

The Indian rupee weakened 2 paise to close at 83.34 against the U.S. dollar on Thursday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.