The yield on the 10-year bond closed 1 basis point lower at 6.98% on Thursday.

It closed at 6.99% on Wednesday.

Source: Bloomberg

The local currency appreciated by about 31 paise to close at Rs 82.41 against the U.S. dollar on Thursday.

The rupee closed at 82.73 on Wednesday.

Source: Bloomberg

Indian equity benchmarks swung between gains and losses through the day to end lower on Thursday. While private banks and non-banking financial companies declined realty and pharma were the top sectoral gainers. Kotak Bank, Airtel, ICICI Bank dragged the headlined indices, while TCS, HUL, HDFC Led.

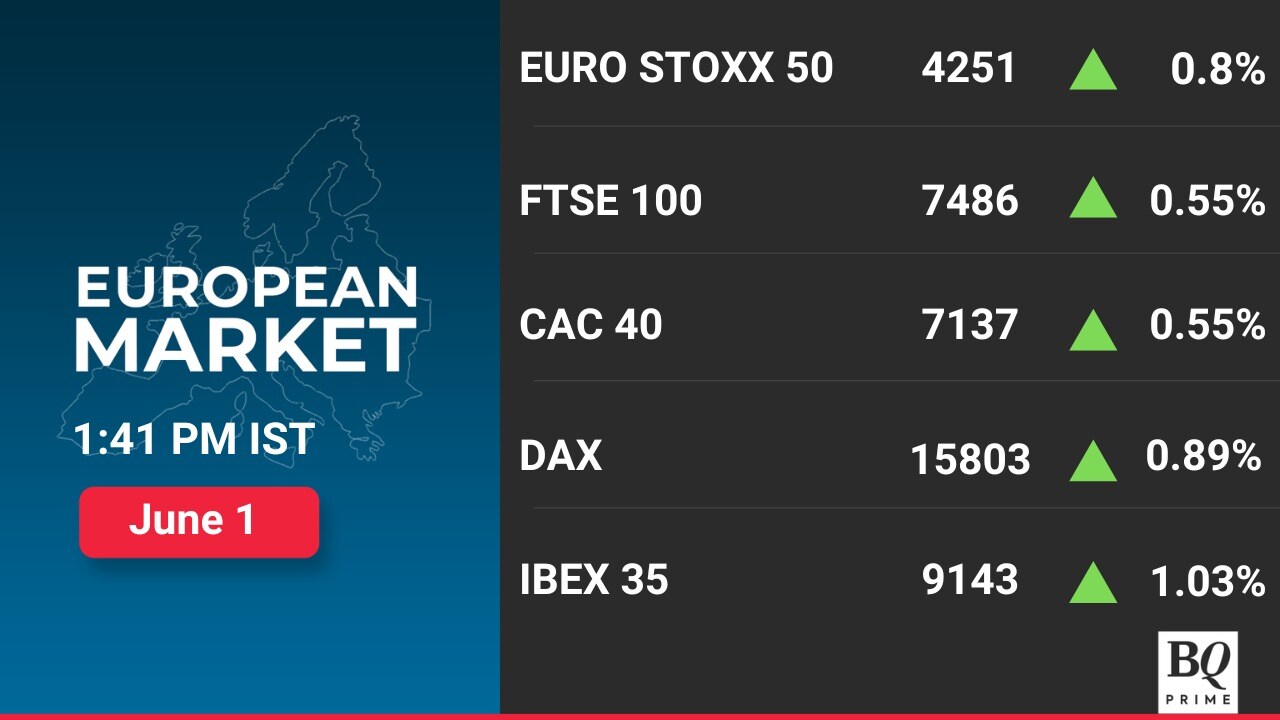

European stocks climbed after three days of declines, while US futures fluctuated after the House passed a deal to avert a US default and Federal Reserve officials hinted at a pause in interest-rate hikes.

Miners and media companies led gains in the Stoxx Europe 600 index. Remy Cointreau SA shares jumped after the French distiller’s operating income beat estimates. Adnoc Logistics & Services, the maritime logistics unit of Abu Dhabi’s main energy company, soared as much as 52% on its debut after a hugely oversubscribed initial public offering.

The advance in European stocks echoed a move higher in Asia, where markets got an initial boost from some encouraging economic data out of China.

Passage of the debt-ceiling deal struck by House Speaker Kevin McCarthy and President Joe Biden means the bill will be sent to the Senate days before the June 5 default deadline.

The S&P BSE Sensex Index closed down 194 points or 0.31% at 62,428.54 while the NSE Nifty 50 Index was lower 47 points or 0.25% at 18,487.75.

Kotak Mahindra Bank Ltd., ICICI Bank Ltd., Bharti Airtel Ltd., ITC Ltd., and Coal India Ltd. were negatively adding to the change in the Nifty 50 Index.

Whereas, TCS Ltd., Hindustan Unilever Ltd., Axis Bank Ltd., HDFC Ltd., and Apollo Hospitals Enterprise Ltd. were positively contributing to the change.

The broader markets were ended higher; the S&P BSE MidCap Index was up 0.11%, whereas S&P BSE SmallCap Index was higher by 0.61%.

Eleven out of the 20 sectors compiled by BSE advanced, while nine indices declined with S&P Bankex declining the most.

The market breadth was skewed in the favour of the buyers. About 2,080 stocks rose 1,454 declined, and 127 remained unchanged on the BSE.

Shares Atul Auto Ltd. fell the most in four weeks after its sales declined by 38.63% to 1,101 units in May.

The stock fell 5.43% to Rs 338.7 apiece, as of 3:07 p.m., in trade on Thursday compared to 0.20% decline in the benchmark, NSE Nifty 50 Index.

The scrip fell as much as 6.42% intraday, the most in over four weeks since May 2, 2023. Total traded volume stood at 1.5 times its 30-day average. The relative strength index was at 37.5.

Out of the three analysts tracking the company, 33 maintain a 'buy' rating, three recommend a 'hold' and two suggest to 'sell' the stock, as per the Bloomberg data.

The average calculated from the 12-month price target given by analysts implies a potential upside of 21.7%.

Source: Bloomberg, Exchange filing

Shares of Reliance Industries Ltd. were up in trade as S&P Global Ratings maintained a stable outlook with a 'BBB+' rating on the company.

Company's operating performance is likely to remain resilient over the next two years, as per S&P Global Ratings. Reliance's growing presence in the digital and retail segments will temper softer earnings in the energy business, it added.

The rating agency could lower its outlook if its capital expenditure, including acquisitions in digital or retail businesses, is higher than it expects. "We believe RIL's expansion plans for the period are manageable. Capex will remain elevated, but lower than the levels of fiscal 2023. We believe the company's leverage will remain at a level commensurate with the current rating," the report said.

S&P Global Ratings also affirmed the 'BBB+' rating on the company's senior unsecured debt. Despite elevated investments over the next 24 months, the stable rating outlook indicates that the company's cash flows will help preserve its financial profile

The agency plans on raising its outlook on the conglomerate if it demonstrates a track record of conservative financial policy, like debt-to-EBITDA below 2x. A higher rating could require the digital and retail segments' competitiveness to further strengthen.

Shares of Reliance Industries Ltd. gained 0.03% to Rs 2,470.65 apiece, as of 2:23 p.m., in trade on Thursday compared to 0.08% decline in the benchmark, NSE Nifty 50 Index.

The scrip gained 0.61% intraday. Total traded volume stood at 1.5 times its 30-day average. The relative strength index was at 55.

Out of the 38 analysts tracking the company, 33 maintain a 'buy' rating, three recommend a 'hold' and two suggest to 'sell' the stock, as per the Bloomberg data.

The average calculated from the 12-month price target given by analysts implies a potential upside of 13.7%.

Source: Bloomberg, Exchange filing

Total sales rise 11.6% to 6,289 units.

Domestic sales grow 15.8% to 5,826 units.

Exports fell 47% to 250 units.

Source: Exchange filing

Shares of NCC gained to day's high after it said it had received new orders worth Rs 2,088 crore in the month of May. 2023.

Of the aforementioned amount, company's building division has signed the agreements for the orders amounting Rs. 1,668 crore and water division secured order for Rs. 420 crore, it said in an exchange filing.

These orders are received from state government agencies and does not include any internal orders, it added.

The scrip was trading 3.14% higher at Rs 123 apiece. Total traded quantity stood at 1.2 times the 30-day average volume.

Of the 15 analysts tracking the stock, 14 maintained 'buy' while one recommended 'sell'. The consensus price target implies a potential upside of 15.5% over the next 12 months.

Source: Bloomberg, Exchange filing

Shares of Kotak Mahindra Bank Ltd. fell 3.77% to Rs 1,938.4 apiece, as of 11:02 a.m., in trade on Thursday compared to 0.19% advance in the benchmark, NSE Nifty 50 Index.

The scrip fell 4.07% in nearly a year since June 13, 2022. Total traded volume stood at 1.7 times its 30-day average. The relative strength index was at 52.2.

Out of the 42 analysts tracking the company, 24 maintain a 'buy' rating, 15 recommend a 'hold' and three suggest to 'sell' the stock, as per the Bloomberg data.

The average calculated from the 12-month price target given by analysts implies a potential upside of 10.4%.

Source: Bloomberg, Exchange filing

Passenger vehicle sales rise 22% to 32,886 units.

Three-wheeler sales jump 61% to 5,851 units.

Sales of medium duty light commercial vehicles decline 7% to 16,140 units.

Tractor dispatches fall 4% to 34,126 units.

Source: Exchange filing

Total sales rise 10% to 1.78 lakh units.

Domestic sales grow 13% to 1.52 lakh units.

Exports decline 2.6% to 26,477 units.

Source: Exchange filing

Indian equity benchmarks held on to slim gains after a dip in the early trade on Thursday. While, realty, pharma and PSU banks were the top sectoral gainers, private banks declined. Kotak Mahindra Bank and Bharti Airtel dragged the indices, while TCS, HUL and HDFC led.

European equity futures rose alongside Asian shares after the House passed a deal to avert a U.S. default, Federal Reserve officials hinted at a rate pause and China manufacturing expanded.

Contracts for the region-wide Euro Stoxx 50 rose around 0.7% and US equity futures edged higher in signs of positive sentiment that lifted most major markets in Asia on Thursday. Gains for benchmarks in Japan, Australia and China placed a gauge of Asian shares on course for its best day in four weeks.

The slight gain in S&P 500 futures came after a 0.6% loss for the benchmark on Wednesday that left the index clinging to a small gain for May, its third monthly advance. The Nasdaq 100 index fell 0.7%, weighed by a decline in Nvidia Corp. shares after a rapid rally that has nearly tripled the stock price this year.

As of 12:18 p.m., the S&P BSE Sensex Index was down 24 points or 0.04% at 62,597.84 while the NSE Nifty 50 Index was higher 10 points or 0.05% at 18,544.20.

Kotak Mahindra Bank Ltd., Bharti Airtel Ltd., ITC Ltd., Coal India Ltd., and Maruti Suzuki Ltd. were negatively adding to the change in the Nifty 50 Index.

Whereas, TCS Ltd., HDFC Ltd., Hindustan Unilever Ltd., Axis Bank Ltd., and Apollo Hospitals Enterprise Ltd. were positively contributing to the change.

The broader markets were trading higher; the S&P BSE MidCap Index was up 0.33%, whereas S&P BSE SmallCap Index was higher by 0.74%.

Thirteen out of the 19 sectors compiled by BSE advanced, while six indices declined with S&P Metals declining the most.

The market breadth was skewed in the favour of the buyers. About 2,205 stocks rose 1,143 declined, and 153 remained unchanged on the BSE.

Shares of Nucleus Software Exports Ltd. have jumped nearly 80% in the last two weeks after it reported a threefold rise in the net profit for the fourth quarter of FY23, last week.

Shares of Nucleus Software Exports Ltd. rose 10% to Rs 1,119.15 apiece, as of 11:02 a.m., in trade on Thursday compared to 0.19% advance in the benchmark, NSE Nifty 50 Index.

The stock hit 10% upper circuit intraday. The scrip has gained 79.92% in the last two weeks since May 22, 2023.

Total traded volume stood at 2.9 times its 30-day average. The relative strength index was at 90, implying that the stock maybe overbought.

Out analyst tracking the company maintains a 'buy' rating on the stock, as per the Bloomberg data. The average calculated from the 12-month price target given by analysts implies a potential downside of 40.1%.

Last week, the company's net profit rose nearly threefold to Rs 67.7 crore, beating the Bloomberg estimate of Rs 25.5 crore.

Nucleus Software Q4 FY23 (Consolidated, YoY)

Revenue up 34.7% at Rs 206.2 crore. (Bloomberg estimate: Rs 159.3 crore)

Ebitda is up 232.3% at Rs 82.7 crore.

Ebitda margin at 40.1% vs. 16.3%

Net profit is up 269.9% at Rs 67.7 crore. (Bloomberg estimate: Rs 25.5 crore.)

"While growth has been majorly led by revised AMC prices, the increase is a one-time phenomenon," Vishnu R Dusad, managing director at Nucleus Software, told BQ Prime's Niraj Shah.

"I'm confident that this rebalancing will be confident for all the stakeholders, and I see no reason why despite the increase in price, our customers would feel any interruption in value addition in future," he said.

Source: Bloomberg, Exchange filing

Shares of Mphasis Ltd. gained the most in eight weeks after it launched Mphasis.ai to utilise the potential of artificial intelligence and maximize business outcomes.

The scrip rose 3.48% to Rs 2,014.6 apiece, as of 10:48 a.m., in trade on Thursday compared to 0.15% advance in the benchmark, NSE Nifty 50 Index.

The stock gained as much as 3.71% intraday, the most in over eight weeks since March 31, 2023. Total traded volume stood at 2.2 times its 30-day average. The relative strength index was at 67.6.

Out of the 36 analysts tracking the company, 18 maintain a 'buy' rating, 11 recommend a 'hold' and seven suggest to 'sell' the stock, as per the Bloomberg data.

The average calculated from the 12-month price target given by analysts implies a potential downside of 1.1%.

Source: Bloomberg, Exchange filing

Manufacturing PMI rose to 58.7 in May compared to 57.2 in April.

Indicated the strongest improvement in the sector since October 2020.

Source: S&P Global

Shares of MOIL Ltd. rose the most in five weeks after it raised the price of manganese ore with effect from June 1.

The company increased the prices of manganese ore grades BGF452, CHF473, and GMF569 by 10%. While the price of electrolytic manganese dioxide, revised on May 1, remains unchanged.

Similarly, the prices for all grades of manganese ore—ferro grade, SMGR, fines (except BGF452, CHF473, and GMF569), and chemical grades—have been continued for the month of June, according to an exchange filing.

Shares of MOIL Ltd. advanced 2.42% to Rs 158.9 apiece as of 9.46 a.m. on Thursday, compared to a 0.21% rise in the benchmark Nifty 50. The stock advanced as much as 4.06% intraday, rising the most in over five weeks since April 26.

The total traded volume so far in the day stood at 14.9 times its 30-day average.

All four analysts tracking the company maintained a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 25%.

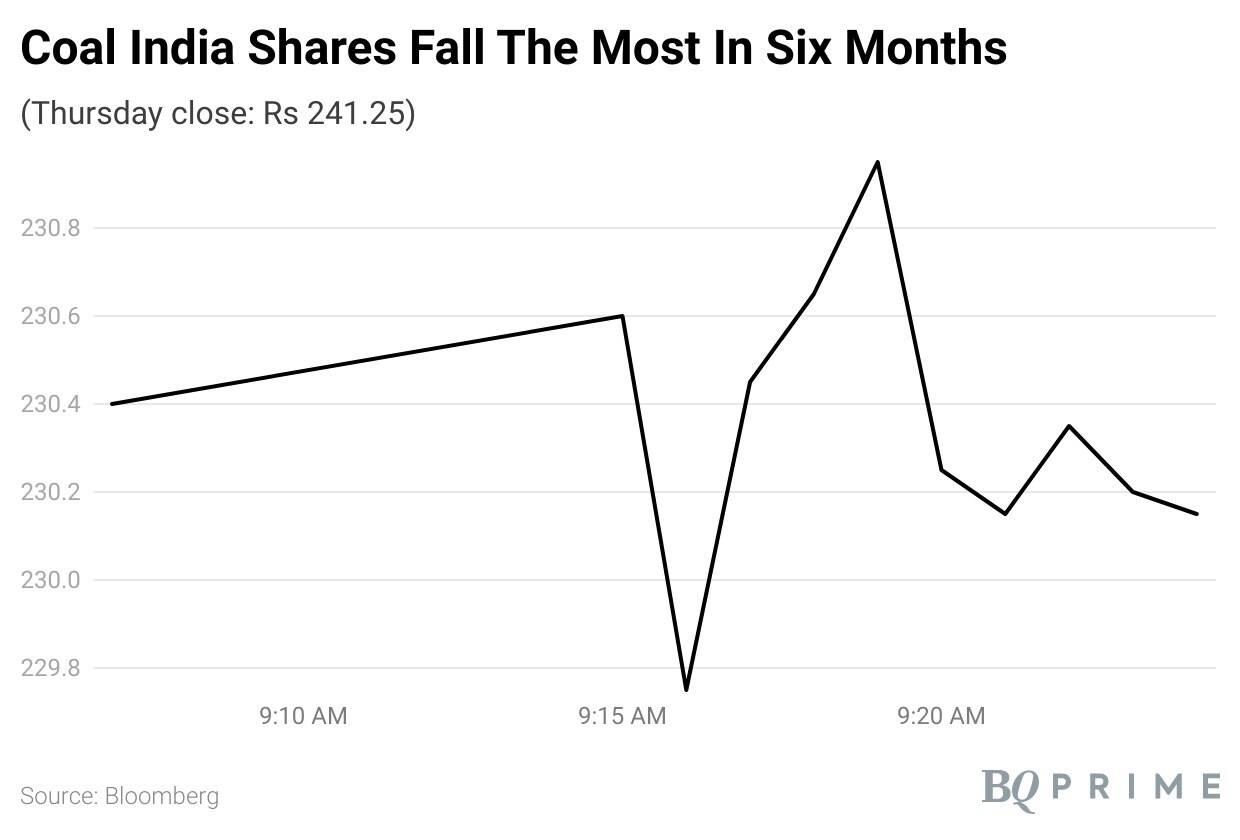

Shares of Coal India Ltd. fell the most in over six months on Thursday after the government said it would sell a 3% stake in the company this week.

The government will sell up to 18.48 crore shares, amounting to a 3% stake, in the company through an offer-for-sale on June 1 and 2. The floor price has been set at Rs 225 per share. The disinvestment will fetch at least Rs 4,158 crore for the government.

The government also retains the right to sell an additional equal amount of stock in the event of oversubscription.

The Coal India offer-for-sale opens for non-retail investors on June 1 and for retail investors on June 2. This is the first stake sale in a public sector undertaking by the government in the current financial year.

"The offer shall take place during trading hours on a separate window of the stock exchanges on June 1, commencing at 9.15 a.m. and shall close on the same date at 3.30 p.m," according to an exchange filing.

Shares of Coal India fell as much as 4.85%, the most since Nov. 15, 2022, and were trading 4.5% lower at 9.20 a.m. on Thursday, compared to a 0.10% decline in the benchmark Nifty 50.

The total traded volume so far in the day stood at 12.1 times its 30-day average.

Of the 23 analysts tracking the company, 14 maintain a 'buy' rating, three recommend a 'hold' and six suggest a 'sell' on the stock, according to Bloomberg data. The average of 12-month price targets implies an upside of 13.3%.

Shares of Coal India Ltd. fell the most in over six months on Thursday after the government said it would sell a 3% stake in the company this week.

The government will sell up to 18.48 crore shares, amounting to a 3% stake, in the company through an offer-for-sale on June 1 and 2. The floor price has been set at Rs 225 per share. The disinvestment will fetch at least Rs 4,158 crore for the government.

The government also retains the right to sell an additional equal amount of stock in the event of oversubscription.

The Coal India offer-for-sale opens for non-retail investors on June 1 and for retail investors on June 2. This is the first stake sale in a public sector undertaking by the government in the current financial year.

"The offer shall take place during trading hours on a separate window of the stock exchanges on June 1, commencing at 9.15 a.m. and shall close on the same date at 3.30 p.m," according to an exchange filing.

Shares of Coal India fell as much as 4.85%, the most since Nov. 15, 2022, and were trading 4.5% lower at 9.20 a.m. on Thursday, compared to a 0.10% decline in the benchmark Nifty 50.

The total traded volume so far in the day stood at 12.1 times its 30-day average.

Of the 23 analysts tracking the company, 14 maintain a 'buy' rating, three recommend a 'hold' and six suggest a 'sell' on the stock, according to Bloomberg data. The average of 12-month price targets implies an upside of 13.3%.

Shares of South Indian Bank rose most in a day in over three weeks after the board approved a panel of candidates for the position of managing director and chief executive officer, according to an exchange filing post market hours on May 31.

As per the norms set by the Reserve Bank of India, the bank will now submit its application to the RBI with the names of the candidates in order of preference seeking approval for the appointment of the positions.

Shares of South Indian Bank rose 5.8% to Rs 18.25 apiece, compared to a 0.21% gain in the NSE Nifty 50 as of 10:04 a.m. The stock rose 6.67% intraday, the most in over three weeks since May 12.

The average traded volume so far in the day stood at 3.6 times its monthly average.

Of the five analysts tracking the company, three maintain a 'buy' rating, and two suggest a 'hold', according to Bloomberg data. The average 12-month consensus price target implies a potential upside of 10.7%.

Shares of Laurus Labs Ltd. jumped the most in a week after it announced an acquisition of an additional 7.24% stake in Immunoadoptive Cell Therapy for Rs 80 crore.

After the completion of the deal, Laurus Labs Ltd.’s stake in ImmunoACT will increase by 33.86%. Additionally, some promoters and senior management of Laurus Labs would acquire 0.54% in ImmunoACT via secondary purchases for approximately Rs 4 crore.

Shares of Laurus Labs Ltd. rose 1.91% to Rs 337 apiece, as of 10:06 a.m., in trade on Thursday compared to 0.23% advance in the benchmark, NSE Nifty 50 Index.

The stock gained as much as 4.32% intraday, the most in a week since May 24, 2023. Total traded volume stood at 4.2 times its 30-day average. The relative strength index was at 63.

Out of the 15 analysts tracking the company, nine maintain a 'buy' rating, three recommend a 'hold' and three suggest to 'sell' the stock, as per the Bloomberg data.

The average calculated from the 12-month price target given by analysts implies a potential upside of 1%.

Source: Bloomberg, Exchange filing

Total sales rise 29% to 3.55 lakh units.

Two-wheeler sales grow 23% to 3.08 lakh units.

Commercial vehicle sales surge 80% to 47,452 units.

Source: Exchange filing

Total sales rise 8.9% to 9,167 units.

Domestic sales grow 13.5% to 8,704 units.

Exports fell 38.6% to 463 units.

Source: Exchange filing

The broader markets opened higher; the S&P BSE MidCap Index was up 0.32%, whereas S&P BSE SmallCap Index was higher by 0.61%.

Sixteen out of the 20 sectors compiled by BSE advanced, while S&P BSE Energy, S&P BSE Telecommunication, S&P BSE Bankex, and S&P BSE Metals declined.

The market breadth was split between the buyers and the sellers. About 1,959 stocks rose 747 declined, and 99 remained unchanged on the BSE.

Source: BSE

Kotak Mahindra Bank Ltd., Bharti Airtel Ltd., Coal India Ltd., Maruti Suzuki Ltd., and Power Grid Corp of India Ltd. were negatively adding to the change in the Nifty 50 Index.

Whereas, HDFC Ltd., TCS Ltd., Infosys Ltd., Hindustan Unilever Ltd. and HDFC Bank Ltd. were positively contributing to the change.

Indian equity benchmarks opened volatile on Thursday after snapping four days of gaining streak on Wednesday.

Stocks fluctuated in Asia on Thursday as the House passed the debt ceiling deal to avert default and investors weighed the prospect of a pause in rate hikes from the Federal Reserve this month.

Japanese and Australian shares rose, those in South Korea edged lower and US equity futures managed a small gain after news of the deal passing the House. Benchmarks in China opened lower, reflecting ongoing concerns over growth. Manufacturing data for China due later is forecast to show a further contraction in activity.

The picture for U.S. contracts followed declines on Wednesday and suggested that investors were taking more notice of Fed officials who backed the possibility of holding rates unchanged the next meeting.

The S&P 500 closed 0.6% lower on Wednesday, narrowly clinging to a small gain for May to mark three consecutive monthly advances. The Nasdaq 100 index fell 0.7%, weighed down by a decline for Nvidia Corp. shares after a rapid rally that has tripled the stock price this year.

Indian oil revised LPG prices of Indane in Delhi by Rs 83.5 from May, 2023. The prices were slashed to Rs 1,774 per 19 kg cylinder as of June 1, 2023.

Source: Indian Oil website

Yield on the 10-year bond opened flat at 7% on Thursday.

Source: Bloomberg

The local currency appreciated by 25 paise to open at Rs 82.48 against the U.S. dollar on Thursday.

The rupee closed at 82.73 on Wednesday.

Source: Exchange filing

Domestic jet fuel prices slashed by Rs 6,632.25 from May 1, 2023 to Rs 89,303.09 per kl in Delhi as of June 1, 2023.

Source: Indian Oil website

Debt limit deal wins passage in Republican-controlled house by 314-117 votes.

The deal now goes to Senate.

Source: U.S. Congress website

U.S. Dollar Index at 104.2

U.S. 10-year bond yield at 3.65%

Brent crude down 1.20% at $72.66 per barrel

Nymex crude up 0.06% at $68.13 per barrel

SGX Nifty down 0.28% at 18,611 as of 07:35 a.m.

Bitcoin down 0.13% at $27,081.20

Ex-Date Interim Dividend: Shree Cement, Trident, Aptech

Record-Date Interim Dividend: Shree Cement, Trident, Aptech

Move Into Short-Term ASM Framework: Centum Electronics

Move Out of Short-Term ASM Framework: Gland Pharma, Kaynes Technology India

Jubilant FoodWorks: Promoter Jubilant Consumer revoked a pledge of 28.5 lakh shares on May 30.

Max Healthcare Institute: Government of Singapore bought 66.6 lakh shares (0.69%) at Rs 549.53 apiece, UBS Principal Capital Asia sold 74.44 lakh shares (0.78%) at Rs 548.03 apiece.

Sona BLW Precision Forgings: Societe Generale bought 81.98 lakh shares (1.4%) at Rs 503 apiece, Government of Singapore bought 36.44 lakh shares (0.62%) at Rs 540.44 apiece, Aureus Investment sold 1.9 crore shares (3.23%) at Rs 503.73 apiece.

Welspun Enterprises: Welspun Enterprises Employees Welfare Trust bought 10 lakh shares (0.72%) at Rs 151 apiece.

Arman Financial Services: Stallion Asset bought 64.950 shares (0.76%) at Rs 1,.850.84 apiece.

Goodluck India: Nandanvan Investments bought 1.57 lakh shares (0.57%) at Rs 467.45 apiece.

HDFC Life Insurance Company: Abrdn (Mauritius Holdings) sold 3.57 crore shares (1.66%), Aditya Birla Sun Life Mutual Fund bought 25.75 lakh shares (0.12%), Amazon Market Neutral Fund bought 1.73 lakh shares (0.01%), Aptus Global Financials Fund bought 1.73 lakh shares (0.01%), BNP Paribas Arbitrage bought 13.99 lakh shares (0.07%), BofA Securities Europe SA bought 1.74 lakh shares (0.01%), FIAM Group Trust for Employee Benefit Plans bought 2.23 lakh shares (0.01%), Fidelity Investment Trust bought 11.44 lakh shares (0.05%), Ghisallo Master Fund LP bought 6.5 lakh shares (0.03%), ICICI Prudential Mutual Fund bought 25.75 lakh shares (0.12%), Morgan Stanley Asia Singapore Pte bought 6.5 lakh shares (0.03%), Nippon India Mutual Fund bought 11.5 lakh shares (0.05%), Norges Bank on account of Government Petroleum Fund bought 27.5 lakh shares (0.13%), SBI Mutual Fund bought 1.42 crore shares (0.66%), Societe Generale bought 33.25 lakh shares (0.15%), T Rowe Price Asia Opportunities Trust bought 18.5 lakh shares (0.09%), WF Asian Smaller Companies Fund bought 26 lakh shares (0.12%) at Rs 579.6 apiece.

Coal India: The government will sell up to 18.48 crore shares of the company, representing a 3% stake, via an offer for sale on June 1 and 2. The floor price of the offer has been pegged at Rs 225 per share.

MOIL: The company increased prices of manganese ore grades BGF452, CHF473 and GMF569 by 10%, effective from the June 1.

Tata Motors: The company is looking to buy back external commercial bonds worth $250 million from bond holders.

HFCL: The company will spend Rs 470 crore to expand current optical fibre capacity to 33.9 million fibre kilometer per annum from 10 million fibre kilometer per annum at its manufacturing facility in Telangana.

Bank of India: The bank hiked marginal cost of funds-based lending rates by five basis points across tenures, effective June 1.

Mahindra & Mahindra: Subsidiary Mahindra Holdings completed the sale of 30% stake of Mahindra Susten to 2452991 Ontario, a wholly owned subsidiary of Ontario Teachers' Pension Plan Board. Additional 9.99% stake of Mahindra Susten will be completed by March 31.

Laurus Labs: The company will acquire additional 7.24% stake in Immunoadoptive Cell Therapy for Rs 80 crore. Some promoters and senior management of the company will also acquire 0.54% stake in ImmunoACT for Rs 4 crore through secondary purchases. The company already holds 26.62% stake in ImmunoACT.

Vinati Organics: The company bought additional 65.97 lakh shares of subsidiary Veeral Organics for Rs 6.59 crore.

Lemon Tree Hotels: The company will acquire 9.67 lakh compulsorily convertible preference shares of Fleur Hotels from APG Strategic Real Estate Pool NV at Rs 505 apiece, resulting in a total outgo of Rs 48.84 crore.

Steel Authority of India: Amarendu Prakash has taken over as chairman of the company, effective May 31.

Rainbow Children’s Hospital: The company appointed Vikas Maheshwari as the chief financial officer, effective June 1, following resignation of R Gowrisankar from the position.

South Indian Bank: The board approved the panel of candidates for the position of managing director and chief executive officer. This will be sent to the Reserve Bank of India for approval. The bank also appointed General Manager Nandakumar G as the head of inspection and vigilance department and head of internal audit and chief of internal vigilance, effective June 1.

Gati: Pirojshaw Aspi Sarkari has stepped down as the chief executive officer of Gati to take charge as managing director and CEO of material subsidiary Gati-Kintetsu Express, effective immediately. Shashi Kiran Shetty, chairman and managing director of Gati, has been appointed as non-executive chairman of Gati-Kintetsu Express.

PNC Infratech: Bhupinder Kumar Sawhney has stepped down as chief financial officer of the company on health grounds, effective May 31.

Stocks fluctuated in Asia on Thursday as the House passed the debt ceiling deal to avert default and investors weighed the prospect of a pause in rate hikes from the Federal Reserve this month.

Japanese and Australian shares rose, those in South Korea edged lower and US equity futures managed a small gain after news of the deal passing the House. Benchmarks in China opened lower, reflecting ongoing concerns over growth. Manufacturing data for China due later is forecast to show a further contraction in activity.

The picture for U.S. contracts followed declines on Wednesday and suggested that investors were taking more notice of Fed officials who backed the possibility of holding rates unchanged the next meeting.

The S&P 500 closed 0.6% lower on Wednesday, narrowly clinging to a small gain for May to mark three consecutive monthly advances. The Nasdaq 100 index fell 0.7%, weighed down by a decline for Nvidia Corp. shares after a rapid rally that has tripled the stock price this year.

Meanwhile, the yield on 10-year treasuries in U.S. was trading at 3.65%. Crude declined nearly 1% below $73-mark, while Bitcoin was above 27,000-level.

At 07:35 a.m., the Singapore-traded SGX Nifty, an early indicator of the Nifty 50 Index’s performance in India, down 0.28% at 18,611.

Domestic benchmark indices ended lower as banks and financial stocks, including the HDFC twins, Axis Bank Ltd. and State Bank of India dragged. The Indian rupee closed flat against the U.S. dollar as domestic equities came under pressure and the greenback retained its strength.

Foreign investors were net buyers for the eighth straight day and bought equities worth Rs 3,405.9 crore. On the other hand, domestic institutional investors were net sellers for two days in a row and offloaded Rs 2,528.5 crore worth of equities.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.