Indian benchmark equity indices recovered from the day's low to trade little changed through midday on Friday after the Reserve Bank of India kept its policy rates unchanged at 6.5% for the ninth consecutive time, with the governor advocating patience and focusing on maintaining disinflationary policy.

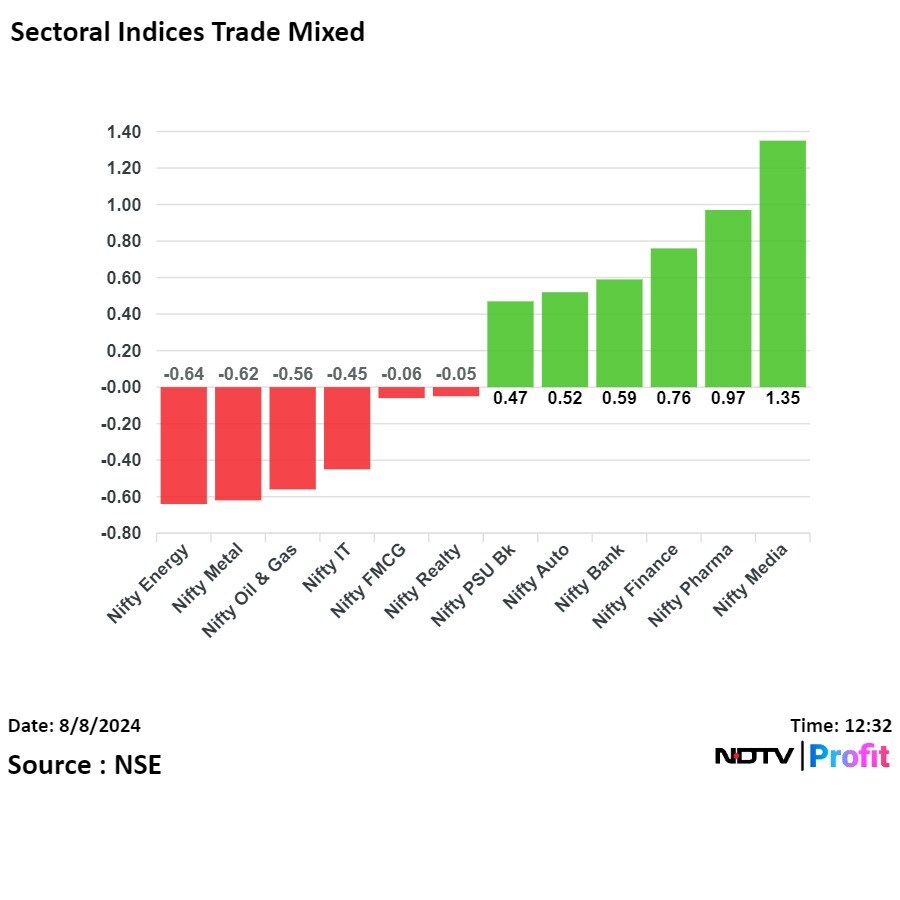

Sector-wise, IT and oil and gas weighed on the indices, while the RBI policy stance supported rate sensitive financial and auto sectors to gain.

At 12:41 p.m., the NSE Nifty 50 was trading 1.70 points, or 0.01%, lower at 24,295.80, and the BSE Sensex was trading 6.60 points, or 0.01%, higher at 79,474.61. Intraday, Nifty fell as much as 0.73%, and Sensex fell 0.72% during early trade.

"The heightened volatility in the market triggered by US recession fears and the unwinding of the yen carry trade is likely to persist for some time. Investors should wait for clarity on these two issues," said VK Vijayakumar, Chief Investment Strategist, Geojit Financial Services.

The Indian market has shown resilience, with FII selling and DII buying achieving Rs 19,278 crore in the last four days, reflecting rational decisions to deploy funds, he said.

.jpeg)

.jpeg)

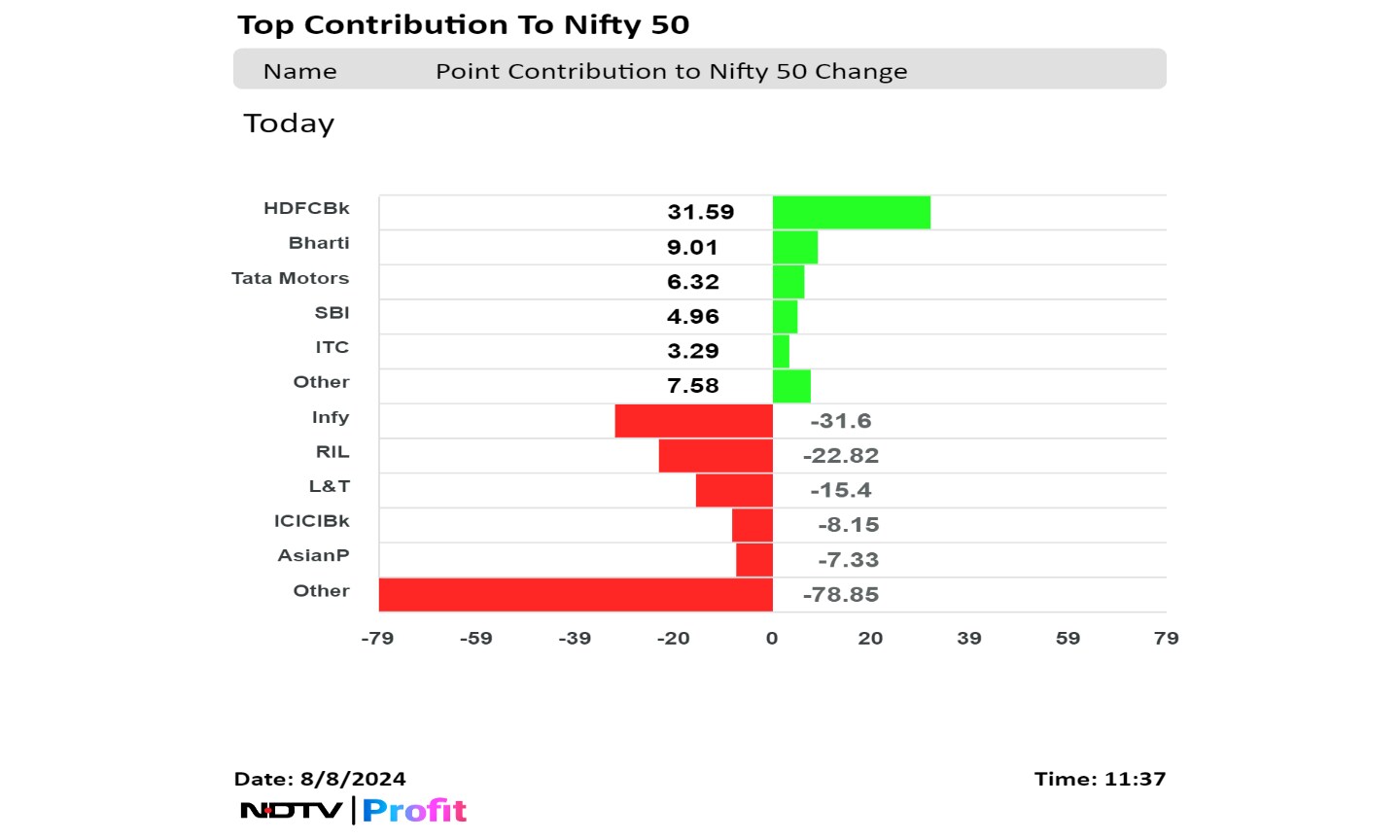

Shares of HDFC Bank Ltd., Bharti Airtel Ltd., Tata Motors Ltd., State Bank of India Ltd., and ITC Ltd. contributed to gains in the Nifty.

While those of Infosys Ltd., Reliance India Ltd., Larsen & Toubro Ltd., ICICI Bank Ltd. and Asian Paints Ltd. weighed on the index.

On NSE, six out of 12 sectors declined, other six advanced. Nifty Energy fell the most, while Nifty Media was the top performer.

Broader markets outperformed the benchmarks, with the BSE Smallcap and BSE Midcap rising 0.39% and 0.78%, respectively, as of 12:38 p.m.

On BSE, eight sectors declined and 12 advanced. BSE Oil and Gas was the worst performer with a decline of 0.70%. BSE Telecommunication was the top performer, rising 1.40%.

Market breadth was skewed in the favour of the buyers. Around 2,290 stocks advanced, 1,477 stocks declined, and 131 stocks remained unchanged on BSE.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.