The yield on the 10-year bond closed 2 bps higher at 7.06% on Friday.

Source: Bloomberg

-The local currency weakened by 6 paise to close at 82.89 against the U.S. Dollar.

-It closed at 82.83 a dollar on Thursday.

Source: Bloomberg

The benchmark 50-stock index snapped its four week rally and recorded their worst fall in over four months. Today, the indices were dragged by shares of M&M and Reliance Industries.

Smallcap and midcap indices recovered in the last part of today's trade but they ended with weekly losses.

The Nifty ended at 21,996.55, down 150.10 points or 0.68% and the Sensex closed at 72,643.43, 453.85 points or 0.62% lower.

On a weekly basis, the Nifty 50 fell 2.09% and the Sensex fell 1.99%.

"The Nifty has once again closed below the rising trendline, bringing market sentiment back into a state of weakness," said Rupak De, Senior Technical Analyst, LKP Securities. "The momentum indicator suggests bearish momentum in the near term"

Vinod Nair, head of research at Geojit Financial Services said, "Cautiousness towards mid & small caps continued to drag market sentiment, dampening the broader market."

He anticipates continued bargain opportunities in mid- and small-cap stocks, whose valuations are underpinned by strong fundamentals

The benchmark 50-stock index snapped its four week rally and recorded their worst fall in over four months. Today, the indices were dragged by shares of M&M and Reliance Industries.

Smallcap and midcap indices recovered in the last part of today's trade but they ended with weekly losses.

The Nifty ended at 21,996.55, down 150.10 points or 0.68% and the Sensex closed at 72,643.43, 453.85 points or 0.62% lower.

On a weekly basis, the Nifty 50 fell 2.09% and the Sensex fell 1.99%.

"The Nifty has once again closed below the rising trendline, bringing market sentiment back into a state of weakness," said Rupak De, Senior Technical Analyst, LKP Securities. "The momentum indicator suggests bearish momentum in the near term"

Vinod Nair, head of research at Geojit Financial Services said, "Cautiousness towards mid & small caps continued to drag market sentiment, dampening the broader market."

He anticipates continued bargain opportunities in mid- and small-cap stocks, whose valuations are underpinned by strong fundamentals

The benchmark 50-stock index snapped its four week rally and recorded their worst fall in over four months. Today, the indices were dragged by shares of M&M and Reliance Industries.

Smallcap and midcap indices recovered in the last part of today's trade but they ended with weekly losses.

The Nifty ended at 21,996.55, down 150.10 points or 0.68% and the Sensex closed at 72,643.43, 453.85 points or 0.62% lower.

On a weekly basis, the Nifty 50 fell 2.09% and the Sensex fell 1.99%.

"The Nifty has once again closed below the rising trendline, bringing market sentiment back into a state of weakness," said Rupak De, Senior Technical Analyst, LKP Securities. "The momentum indicator suggests bearish momentum in the near term"

Vinod Nair, head of research at Geojit Financial Services said, "Cautiousness towards mid & small caps continued to drag market sentiment, dampening the broader market."

He anticipates continued bargain opportunities in mid- and small-cap stocks, whose valuations are underpinned by strong fundamentals

The benchmark 50-stock index snapped its four week rally and recorded their worst fall in over four months. Today, the indices were dragged by shares of M&M and Reliance Industries.

Smallcap and midcap indices recovered in the last part of today's trade but they ended with weekly losses.

The Nifty ended at 21,996.55, down 150.10 points or 0.68% and the Sensex closed at 72,643.43, 453.85 points or 0.62% lower.

On a weekly basis, the Nifty 50 fell 2.09% and the Sensex fell 1.99%.

"The Nifty has once again closed below the rising trendline, bringing market sentiment back into a state of weakness," said Rupak De, Senior Technical Analyst, LKP Securities. "The momentum indicator suggests bearish momentum in the near term"

Vinod Nair, head of research at Geojit Financial Services said, "Cautiousness towards mid & small caps continued to drag market sentiment, dampening the broader market."

He anticipates continued bargain opportunities in mid- and small-cap stocks, whose valuations are underpinned by strong fundamentals

The benchmark 50-stock index snapped its four week rally and recorded their worst fall in over four months. Today, the indices were dragged by shares of M&M and Reliance Industries.

Smallcap and midcap indices recovered in the last part of today's trade but they ended with weekly losses.

The Nifty ended at 21,996.55, down 150.10 points or 0.68% and the Sensex closed at 72,643.43, 453.85 points or 0.62% lower.

On a weekly basis, the Nifty 50 fell 2.09% and the Sensex fell 1.99%.

"The Nifty has once again closed below the rising trendline, bringing market sentiment back into a state of weakness," said Rupak De, Senior Technical Analyst, LKP Securities. "The momentum indicator suggests bearish momentum in the near term"

Vinod Nair, head of research at Geojit Financial Services said, "Cautiousness towards mid & small caps continued to drag market sentiment, dampening the broader market."

He anticipates continued bargain opportunities in mid- and small-cap stocks, whose valuations are underpinned by strong fundamentals

The benchmark 50-stock index snapped its four week rally and recorded their worst fall in over four months. Today, the indices were dragged by shares of M&M and Reliance Industries.

Smallcap and midcap indices recovered in the last part of today's trade but they ended with weekly losses.

The Nifty ended at 21,996.55, down 150.10 points or 0.68% and the Sensex closed at 72,643.43, 453.85 points or 0.62% lower.

On a weekly basis, the Nifty 50 fell 2.09% and the Sensex fell 1.99%.

"The Nifty has once again closed below the rising trendline, bringing market sentiment back into a state of weakness," said Rupak De, Senior Technical Analyst, LKP Securities. "The momentum indicator suggests bearish momentum in the near term"

Vinod Nair, head of research at Geojit Financial Services said, "Cautiousness towards mid & small caps continued to drag market sentiment, dampening the broader market."

He anticipates continued bargain opportunities in mid- and small-cap stocks, whose valuations are underpinned by strong fundamentals

The benchmark 50-stock index snapped its four week rally and recorded their worst fall in over four months. Today, the indices were dragged by shares of M&M and Reliance Industries.

Smallcap and midcap indices recovered in the last part of today's trade but they ended with weekly losses.

The Nifty ended at 21,996.55, down 150.10 points or 0.68% and the Sensex closed at 72,643.43, 453.85 points or 0.62% lower.

On a weekly basis, the Nifty 50 fell 2.09% and the Sensex fell 1.99%.

"The Nifty has once again closed below the rising trendline, bringing market sentiment back into a state of weakness," said Rupak De, Senior Technical Analyst, LKP Securities. "The momentum indicator suggests bearish momentum in the near term"

Vinod Nair, head of research at Geojit Financial Services said, "Cautiousness towards mid & small caps continued to drag market sentiment, dampening the broader market."

He anticipates continued bargain opportunities in mid- and small-cap stocks, whose valuations are underpinned by strong fundamentals

The benchmark 50-stock index snapped its four week rally and recorded their worst fall in over four months. Today, the indices were dragged by shares of M&M and Reliance Industries.

Smallcap and midcap indices recovered in the last part of today's trade but they ended with weekly losses.

The Nifty ended at 21,996.55, down 150.10 points or 0.68% and the Sensex closed at 72,643.43, 453.85 points or 0.62% lower.

On a weekly basis, the Nifty 50 fell 2.09% and the Sensex fell 1.99%.

"The Nifty has once again closed below the rising trendline, bringing market sentiment back into a state of weakness," said Rupak De, Senior Technical Analyst, LKP Securities. "The momentum indicator suggests bearish momentum in the near term"

Vinod Nair, head of research at Geojit Financial Services said, "Cautiousness towards mid & small caps continued to drag market sentiment, dampening the broader market."

He anticipates continued bargain opportunities in mid- and small-cap stocks, whose valuations are underpinned by strong fundamentals

Shares of Reliance Industries Ltd., Larsen & Toubro Ltd., Infosys Ltd., Mahindra & Mahindra Ltd., and Tata Motors Ltd. dragged the Nifty.

While those of Bharti Airtel Ltd., Bajaj Finance Ltd., Hindalco Industries Ltd., Adani Enterprises Ltd., and HDFC Life Insurance Co Ltd. minimized the losses.

Broader markets ended on a mixed note on BSE. The S&P BSE Midcap ended 0.51% lower, and the S&P BSE Smallcap ended 0.25% higher.

On BSE, 16 sectors declined, and four advanced. The S&P BSE Oil and Gas fell the most among sectoral indices. The S&P BSE Telecommunication rose 1.04% to become the top performer among sectoral indices.

Market breadth was skewed in favour of sellers. Around 2, 010 stocks declined, 1,811 stocks rose, and 115 stocks remained unchanged on BSE.

Most sectoral indices ended lower this week.

Total aircraft movements at 63,785, up 8% YoY

Total passenger traffic at 1.02 crore, up 10% YoY

Source: Exchange Filing

ICICI holds eight hundred and eighty-six equity shares of the Company and is neither a related party nor part of the promoter group.

Source: Exchange Filing

India's benchmark stock indices were trading lower through midday on Friday, tracking similar movements in Asia and the US, as upbeat inflation dented hope of a Fed rate cut.

Losses in index heavyweights such as Reliance Industries Ltd., Infosys Ltd., and NTPC Ltd. weighed on the indices.

At 12:41 p.m., the NSE Nifty 50 was trading 191.45 points, or 0.86%, lower at 21,955.20, and the S&P BSE Sensex fell 540.70 points, or 0.74%, to trade at 72,556.58.

Intraday, Nifty fell 0.97% to 21,931.70, and Sensex fell 0.84% to 72,484.82.

"The immediate support (for Nifty) is placed at 21,900, while the higher side is capped at 22,260," said Aditya Gaggar, director, Progressive Share Brokers Pvt.

Selective buying can be seen in the energy segment, especially in the oil and gas space, Gaggar said. "A profit-booking correction can be expected in the railway stocks. Progressive Share continues to advocate booking profits in the realty stocks."

The metal sector reversed from its trendline support, but activity in today's trade will confirm a continuation or reversal of the trend, he said.

India's benchmark stock indices were trading lower through midday on Friday, tracking similar movements in Asia and the US, as upbeat inflation dented hope of a Fed rate cut.

Losses in index heavyweights such as Reliance Industries Ltd., Infosys Ltd., and NTPC Ltd. weighed on the indices.

At 12:41 p.m., the NSE Nifty 50 was trading 191.45 points, or 0.86%, lower at 21,955.20, and the S&P BSE Sensex fell 540.70 points, or 0.74%, to trade at 72,556.58.

Intraday, Nifty fell 0.97% to 21,931.70, and Sensex fell 0.84% to 72,484.82.

"The immediate support (for Nifty) is placed at 21,900, while the higher side is capped at 22,260," said Aditya Gaggar, director, Progressive Share Brokers Pvt.

Selective buying can be seen in the energy segment, especially in the oil and gas space, Gaggar said. "A profit-booking correction can be expected in the railway stocks. Progressive Share continues to advocate booking profits in the realty stocks."

The metal sector reversed from its trendline support, but activity in today's trade will confirm a continuation or reversal of the trend, he said.

India's benchmark stock indices were trading lower through midday on Friday, tracking similar movements in Asia and the US, as upbeat inflation dented hope of a Fed rate cut.

Losses in index heavyweights such as Reliance Industries Ltd., Infosys Ltd., and NTPC Ltd. weighed on the indices.

At 12:41 p.m., the NSE Nifty 50 was trading 191.45 points, or 0.86%, lower at 21,955.20, and the S&P BSE Sensex fell 540.70 points, or 0.74%, to trade at 72,556.58.

Intraday, Nifty fell 0.97% to 21,931.70, and Sensex fell 0.84% to 72,484.82.

"The immediate support (for Nifty) is placed at 21,900, while the higher side is capped at 22,260," said Aditya Gaggar, director, Progressive Share Brokers Pvt.

Selective buying can be seen in the energy segment, especially in the oil and gas space, Gaggar said. "A profit-booking correction can be expected in the railway stocks. Progressive Share continues to advocate booking profits in the realty stocks."

The metal sector reversed from its trendline support, but activity in today's trade will confirm a continuation or reversal of the trend, he said.

India's benchmark stock indices were trading lower through midday on Friday, tracking similar movements in Asia and the US, as upbeat inflation dented hope of a Fed rate cut.

Losses in index heavyweights such as Reliance Industries Ltd., Infosys Ltd., and NTPC Ltd. weighed on the indices.

At 12:41 p.m., the NSE Nifty 50 was trading 191.45 points, or 0.86%, lower at 21,955.20, and the S&P BSE Sensex fell 540.70 points, or 0.74%, to trade at 72,556.58.

Intraday, Nifty fell 0.97% to 21,931.70, and Sensex fell 0.84% to 72,484.82.

"The immediate support (for Nifty) is placed at 21,900, while the higher side is capped at 22,260," said Aditya Gaggar, director, Progressive Share Brokers Pvt.

Selective buying can be seen in the energy segment, especially in the oil and gas space, Gaggar said. "A profit-booking correction can be expected in the railway stocks. Progressive Share continues to advocate booking profits in the realty stocks."

The metal sector reversed from its trendline support, but activity in today's trade will confirm a continuation or reversal of the trend, he said.

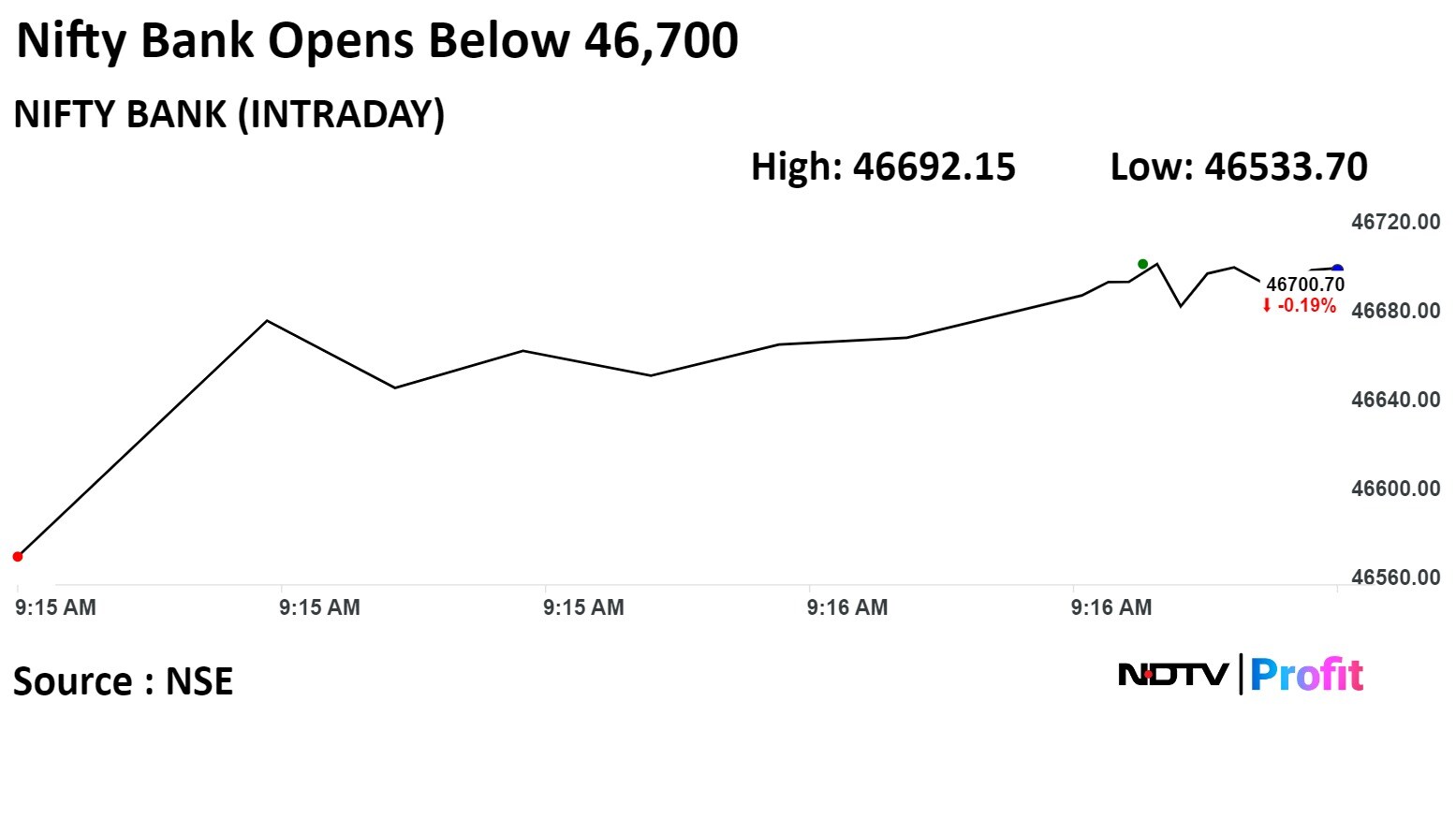

"The lower support average (for Nifty Bank) will be in the range of 46,200-46,400 levels, which is the band on the weekly charts," said Vikas Jain, senior research analyst at Reliance Securities Ltd.

RSI is trending below the average line, which indicates the negative momentum will continue for the next few days, Jain said.

India's benchmark stock indices were trading lower through midday on Friday, tracking similar movements in Asia and the US, as upbeat inflation dented hope of a Fed rate cut.

Losses in index heavyweights such as Reliance Industries Ltd., Infosys Ltd., and NTPC Ltd. weighed on the indices.

At 12:41 p.m., the NSE Nifty 50 was trading 191.45 points, or 0.86%, lower at 21,955.20, and the S&P BSE Sensex fell 540.70 points, or 0.74%, to trade at 72,556.58.

Intraday, Nifty fell 0.97% to 21,931.70, and Sensex fell 0.84% to 72,484.82.

"The immediate support (for Nifty) is placed at 21,900, while the higher side is capped at 22,260," said Aditya Gaggar, director, Progressive Share Brokers Pvt.

Selective buying can be seen in the energy segment, especially in the oil and gas space, Gaggar said. "A profit-booking correction can be expected in the railway stocks. Progressive Share continues to advocate booking profits in the realty stocks."

The metal sector reversed from its trendline support, but activity in today's trade will confirm a continuation or reversal of the trend, he said.

India's benchmark stock indices were trading lower through midday on Friday, tracking similar movements in Asia and the US, as upbeat inflation dented hope of a Fed rate cut.

Losses in index heavyweights such as Reliance Industries Ltd., Infosys Ltd., and NTPC Ltd. weighed on the indices.

At 12:41 p.m., the NSE Nifty 50 was trading 191.45 points, or 0.86%, lower at 21,955.20, and the S&P BSE Sensex fell 540.70 points, or 0.74%, to trade at 72,556.58.

Intraday, Nifty fell 0.97% to 21,931.70, and Sensex fell 0.84% to 72,484.82.

"The immediate support (for Nifty) is placed at 21,900, while the higher side is capped at 22,260," said Aditya Gaggar, director, Progressive Share Brokers Pvt.

Selective buying can be seen in the energy segment, especially in the oil and gas space, Gaggar said. "A profit-booking correction can be expected in the railway stocks. Progressive Share continues to advocate booking profits in the realty stocks."

The metal sector reversed from its trendline support, but activity in today's trade will confirm a continuation or reversal of the trend, he said.

India's benchmark stock indices were trading lower through midday on Friday, tracking similar movements in Asia and the US, as upbeat inflation dented hope of a Fed rate cut.

Losses in index heavyweights such as Reliance Industries Ltd., Infosys Ltd., and NTPC Ltd. weighed on the indices.

At 12:41 p.m., the NSE Nifty 50 was trading 191.45 points, or 0.86%, lower at 21,955.20, and the S&P BSE Sensex fell 540.70 points, or 0.74%, to trade at 72,556.58.

Intraday, Nifty fell 0.97% to 21,931.70, and Sensex fell 0.84% to 72,484.82.

"The immediate support (for Nifty) is placed at 21,900, while the higher side is capped at 22,260," said Aditya Gaggar, director, Progressive Share Brokers Pvt.

Selective buying can be seen in the energy segment, especially in the oil and gas space, Gaggar said. "A profit-booking correction can be expected in the railway stocks. Progressive Share continues to advocate booking profits in the realty stocks."

The metal sector reversed from its trendline support, but activity in today's trade will confirm a continuation or reversal of the trend, he said.

India's benchmark stock indices were trading lower through midday on Friday, tracking similar movements in Asia and the US, as upbeat inflation dented hope of a Fed rate cut.

Losses in index heavyweights such as Reliance Industries Ltd., Infosys Ltd., and NTPC Ltd. weighed on the indices.

At 12:41 p.m., the NSE Nifty 50 was trading 191.45 points, or 0.86%, lower at 21,955.20, and the S&P BSE Sensex fell 540.70 points, or 0.74%, to trade at 72,556.58.

Intraday, Nifty fell 0.97% to 21,931.70, and Sensex fell 0.84% to 72,484.82.

"The immediate support (for Nifty) is placed at 21,900, while the higher side is capped at 22,260," said Aditya Gaggar, director, Progressive Share Brokers Pvt.

Selective buying can be seen in the energy segment, especially in the oil and gas space, Gaggar said. "A profit-booking correction can be expected in the railway stocks. Progressive Share continues to advocate booking profits in the realty stocks."

The metal sector reversed from its trendline support, but activity in today's trade will confirm a continuation or reversal of the trend, he said.

"The lower support average (for Nifty Bank) will be in the range of 46,200-46,400 levels, which is the band on the weekly charts," said Vikas Jain, senior research analyst at Reliance Securities Ltd.

RSI is trending below the average line, which indicates the negative momentum will continue for the next few days, Jain said.

Shares of Bharti Airtel Ltd., Bajaj Finance Ltd., Britannia Industries Ltd., ITC Ltd., and UPL Ltd. were contributing to the Nifty.

While, HDFC Bank Ltd., Infosys Ltd., NTPC Ltd., Larsen & Toubro Ltd., and Reliance Industries Ltd. were weighing on the index.

All 12 sectors on NSE were trading in red, with Nifty Oil & Gas emerging as top loser. Nifty FMCG saw the least decline.

Broader markets underperformed benchmark indices, with the S&P BSE Midcap falling 1.71% and the S&P BSE Smallcap declining 1.18% through midday on Friday.

On BSE, all 20 sectors were trading in the negative. S&P BSE Oil and Gas was the top loser. S&P BSE TECK fell the least.

Market breadth was skewed in favour of the sellers. Around 2,512 stocks fell, 1,211 stocks rose, and 110 remained unchanged on BSE.

Jamnagar Utilities & Power acquires 7 crore shares of co from Reliance Industries.

Source: Exchange Filing

Got LoA from Haryana State Industrial & Infrastructure Development Corp for construction project worth Rs 103.5 crore

Source: Exchange Filing

Initiated arbitration over alleged non-compliance with alliance pact

Alliance pact was for setting out the basis on which Star would grant sub-license rights for the ICC men’s cricket events from 2024 to 2027

Star seeks specific performance of the alliance agreement and damages for non-compliance

Source: Exchange filing

Approves issue of bonds up to Rs 100 crore

Source: Exchange Filing

Air India's market share at 12.8% vs 12.2% in January

IndiGo's market share at 60.1% vs 60.2% in January

SpiceJet's market share at 5.2% vs 5.6% in January

Akasa Air's market share at 4.5%, flat in January

Source: DGCA release

Indranil Sen to be CFO effective March 18

Source: Exchange Filing

Introduced two aircrafts into fleet to elevate service, boost revenue

Source: Exchange Filing

11.6 lakh shares or 0.02% equity changed hands in a large trade

Buyers and sellers not known immediately

Source: Bloomberg

The authorized equity share capital of the proposed WOS shall be Rs. 50 crore. The initial paid up equity share capital shall be Rs. 9 crore to be subscribed by the Company for cash.

Source :Exchange Filing

Gets order from Assam govt to build open stadium

Source: Exchange Filing

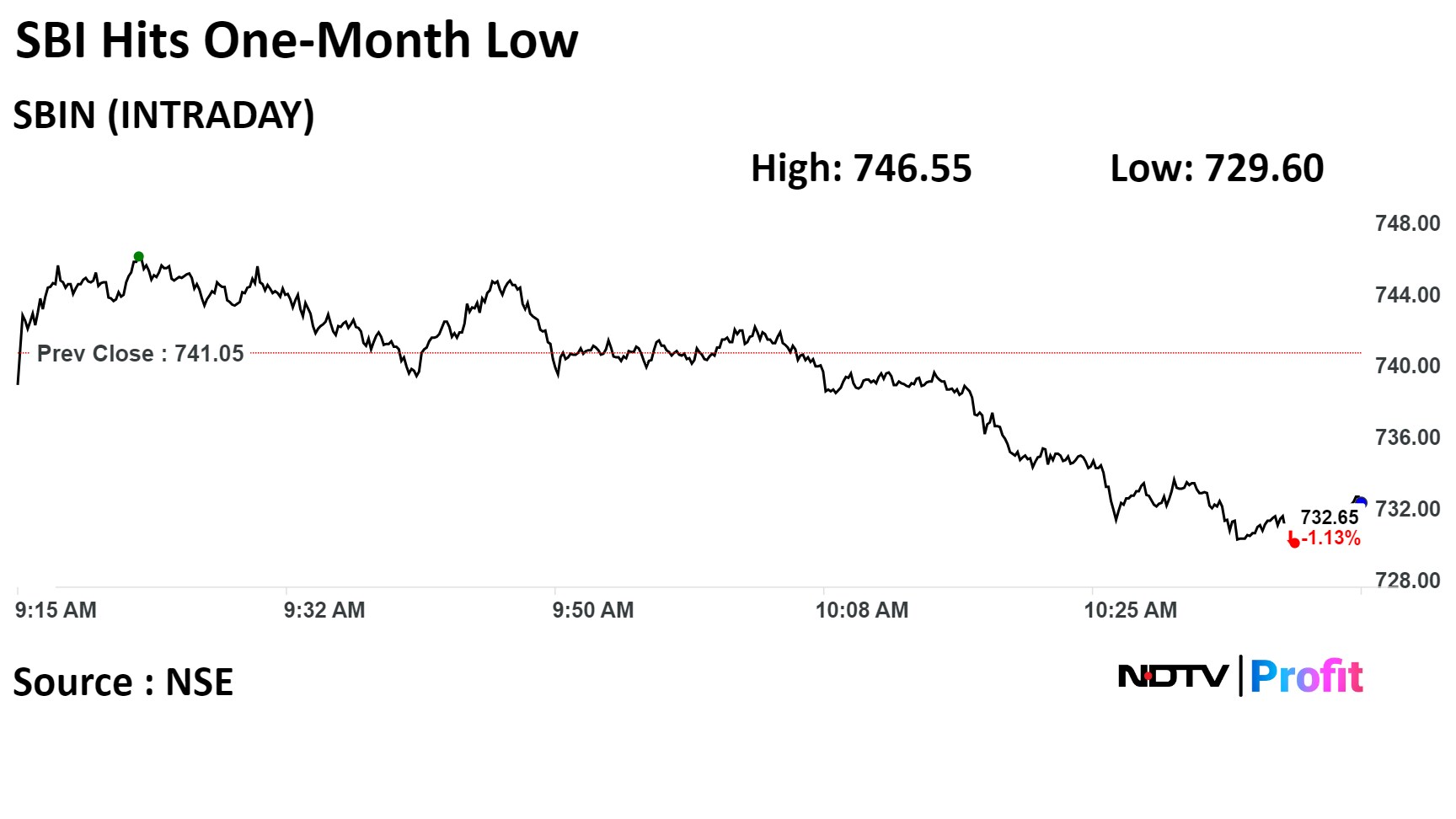

Meanwhile, Chief Justice of India DY Chandrachud observed in the electoral bonds case, State Bank of India has not disclosed bond numbers. He reiterated all details of electoral bonds has to be published, including bond numbers.

Meanwhile, Chief Justice of India DY Chandrachud observed in the electoral bonds case, State Bank of India has not disclosed bond numbers. He reiterated all details of electoral bonds has to be published, including bond numbers.

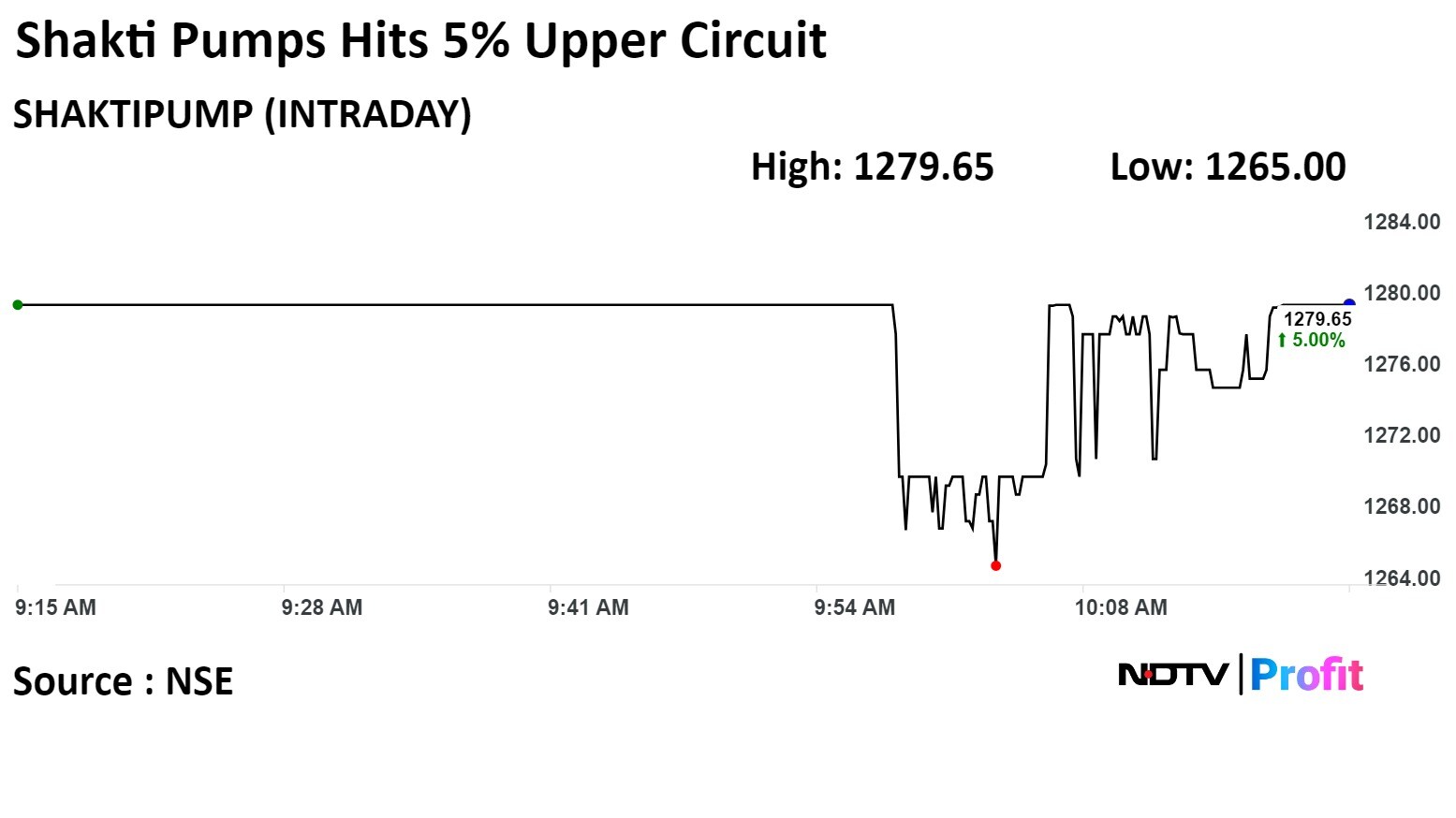

Shakti Pumps (India) Ltd.'s stock was locked in its 5% upper circuit on NSE as the company received an order worth Rs 93 crore in Maharashtra to supply solar photovoltaic water pumping systems.

Shakti Pumps has received the order from Maharashtra Energy Department to design, manufacture, install, and supply 3,500 solar photovoltaic water pumping systems, according to exchange filing.

Shakti Pumps (India) Ltd.'s stock was locked in its 5% upper circuit on NSE as the company received an order worth Rs 93 crore in Maharashtra to supply solar photovoltaic water pumping systems.

Shakti Pumps has received the order from Maharashtra Energy Department to design, manufacture, install, and supply 3,500 solar photovoltaic water pumping systems, according to exchange filing.

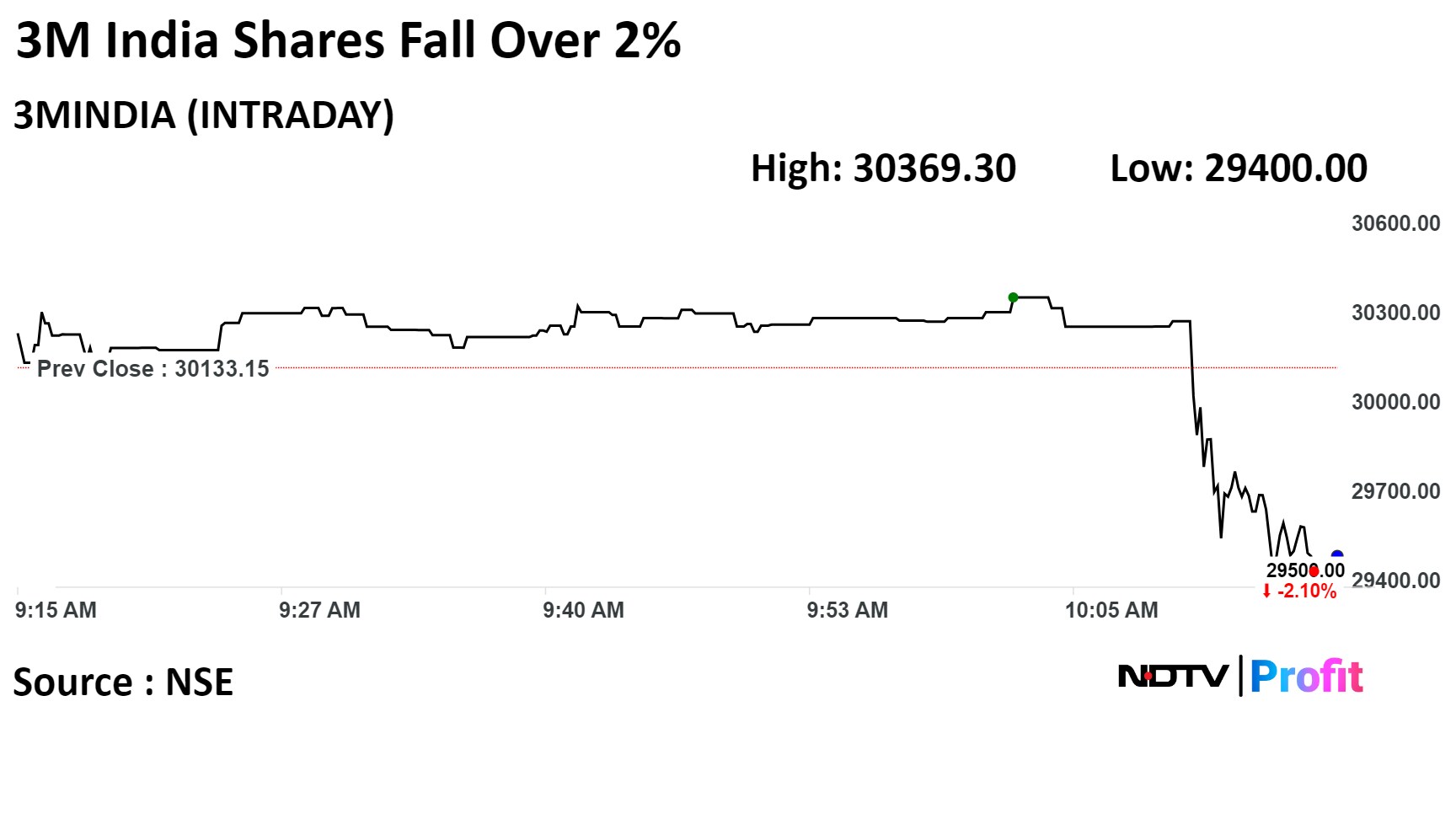

Share of 3M India fell sharply after the company informed the exchanges that ED has conducted searches at its Bangalore offices yesterday under FEMA.

The company said it has fully cooperated with officials, and will continue to provide further information.

Share of 3M India fell sharply after the company informed the exchanges that ED has conducted searches at its Bangalore offices yesterday under FEMA.

The company said it has fully cooperated with officials, and will continue to provide further information.

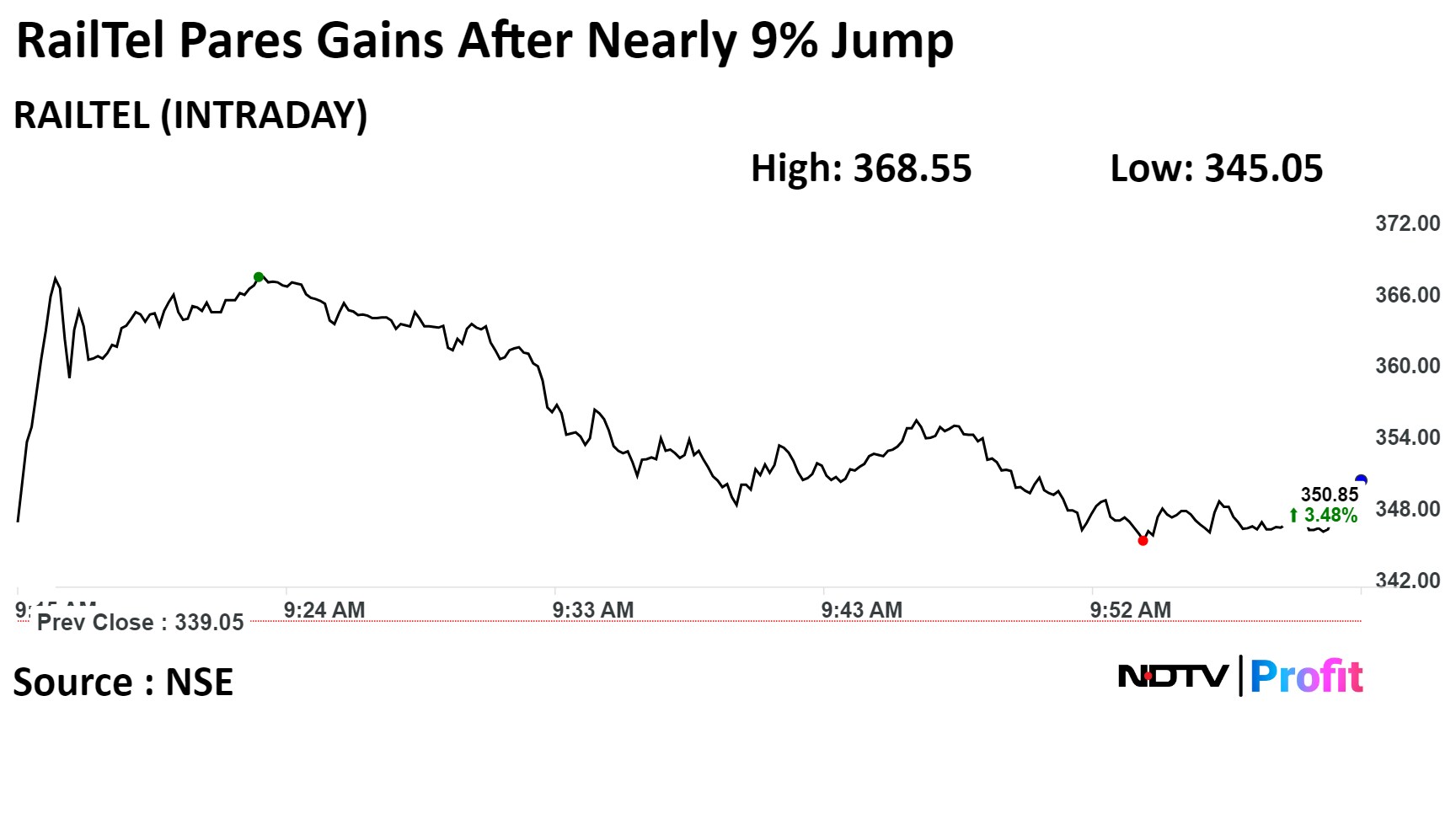

Shares of RailTel Corp. Of India Ltd surged after the company received order worth Rs. 113.46 Crore from Odisha Computer Application Centre.

The order is to establish IP-MPLS network connectivity in Odisha under OdishaNet Phase 1.0, an exchange filing by the company said. It is to be executed by September 13, 202

Shares of RailTel Corp. Of India Ltd surged after the company received order worth Rs. 113.46 Crore from Odisha Computer Application Centre.

The order is to establish IP-MPLS network connectivity in Odisha under OdishaNet Phase 1.0, an exchange filing by the company said. It is to be executed by September 13, 202

The scrip rose as much as 8.7% to Rs 345.05 piece, the highest level since March 13. It pared gains to trade 2.14% higher at Rs 346.30 apiece, as of 10:07 a.m. This compares to a 0.66% decline in the NSE Nifty 50 Index.

It has risen 242.83% in the last twelve months. Total traded volume so far in the day stood at 0.56 times its 30-day average. The relative strength index was at 39.49.

Out of three analysts tracking the company, one maintain a 'buy' rating and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 12.1%.

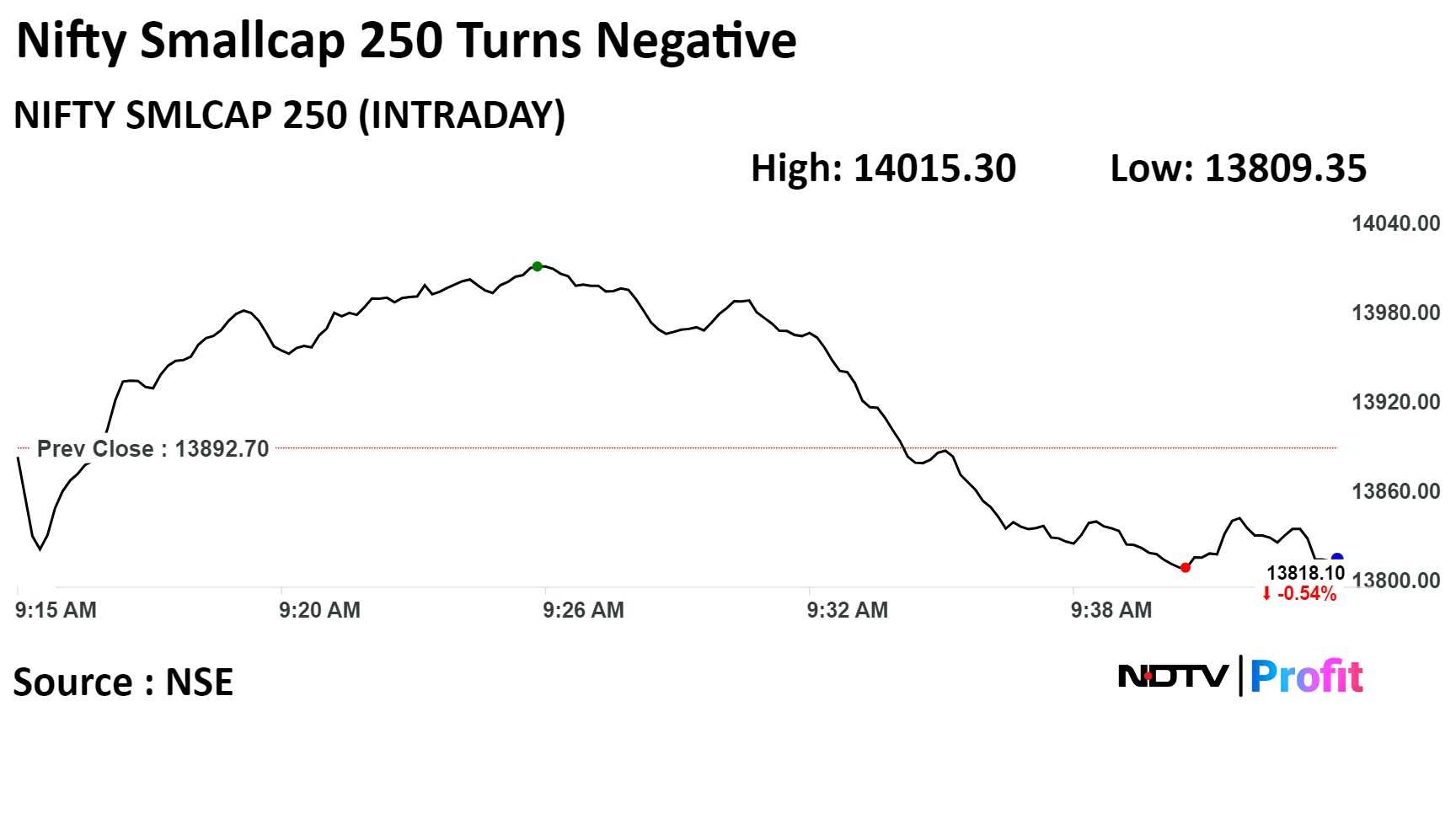

Nifty Smallcap 250 down over 130 basis points from day's high

Top Losers: Tata Investment, ITI, Olectra Greentech

Nifty Smallcap 250 down over 130 basis points from day's high

Top Losers: Tata Investment, ITI, Olectra Greentech

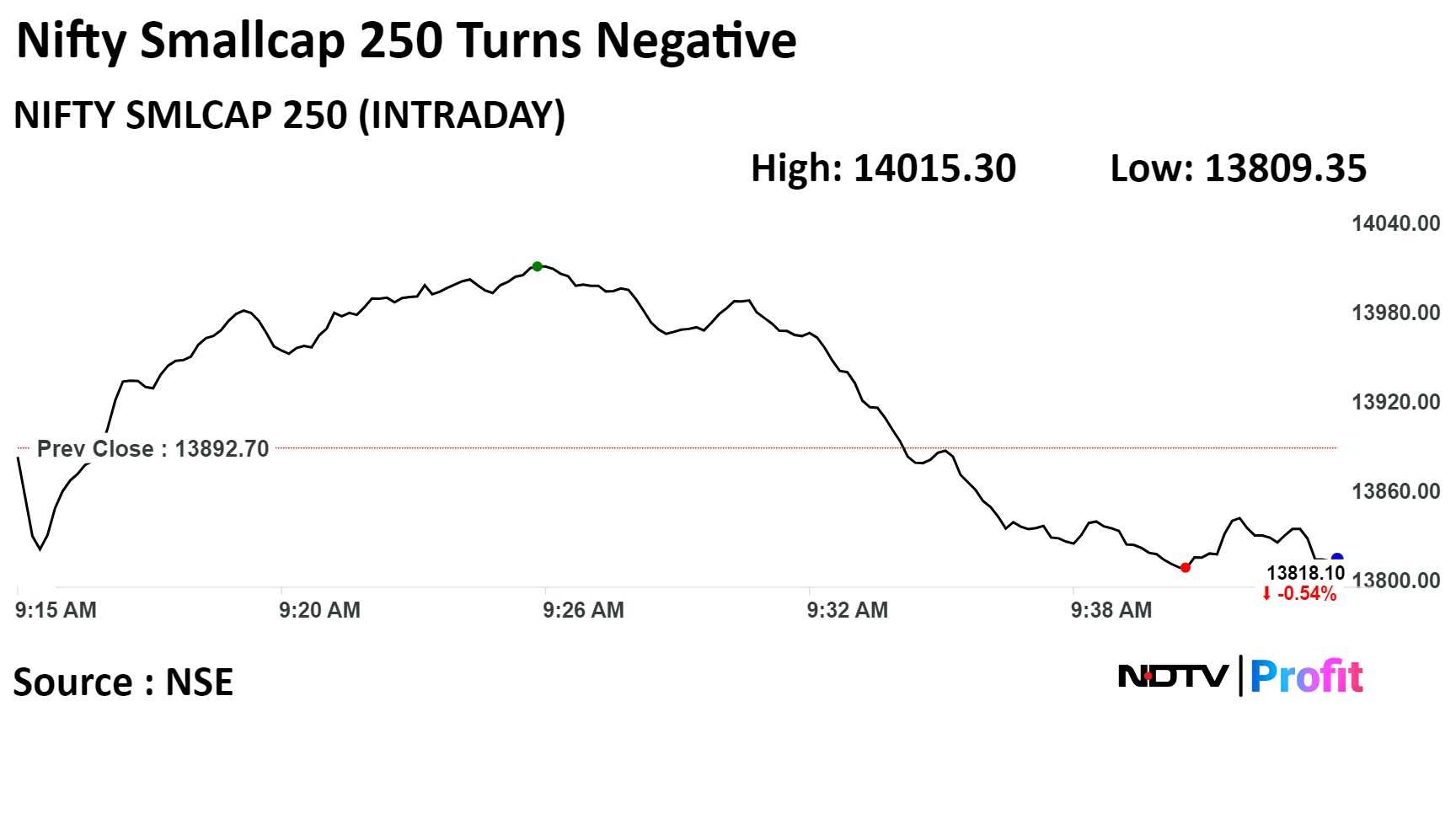

Nifty Midcap 150 down over 170 basis points from day's high

Top Losers: HPCL, Biocon, GIC

Nifty Smallcap 250 down over 130 basis points from day's high

Top Losers: Tata Investment, ITI, Olectra Greentech

Nifty Smallcap 250 down over 130 basis points from day's high

Top Losers: Tata Investment, ITI, Olectra Greentech

Nifty Midcap 150 down over 170 basis points from day's high

Top Losers: HPCL, Biocon, GIC

Shares of Indian Oil Corp Ltd., Hindustan Petroleum Corp. Ltd., and Bharat Petroleum Corp Ltd. fell following a price cut of petrol and diesel across the country. New prices would be effective from 15th March 2024, 06:00 AM.

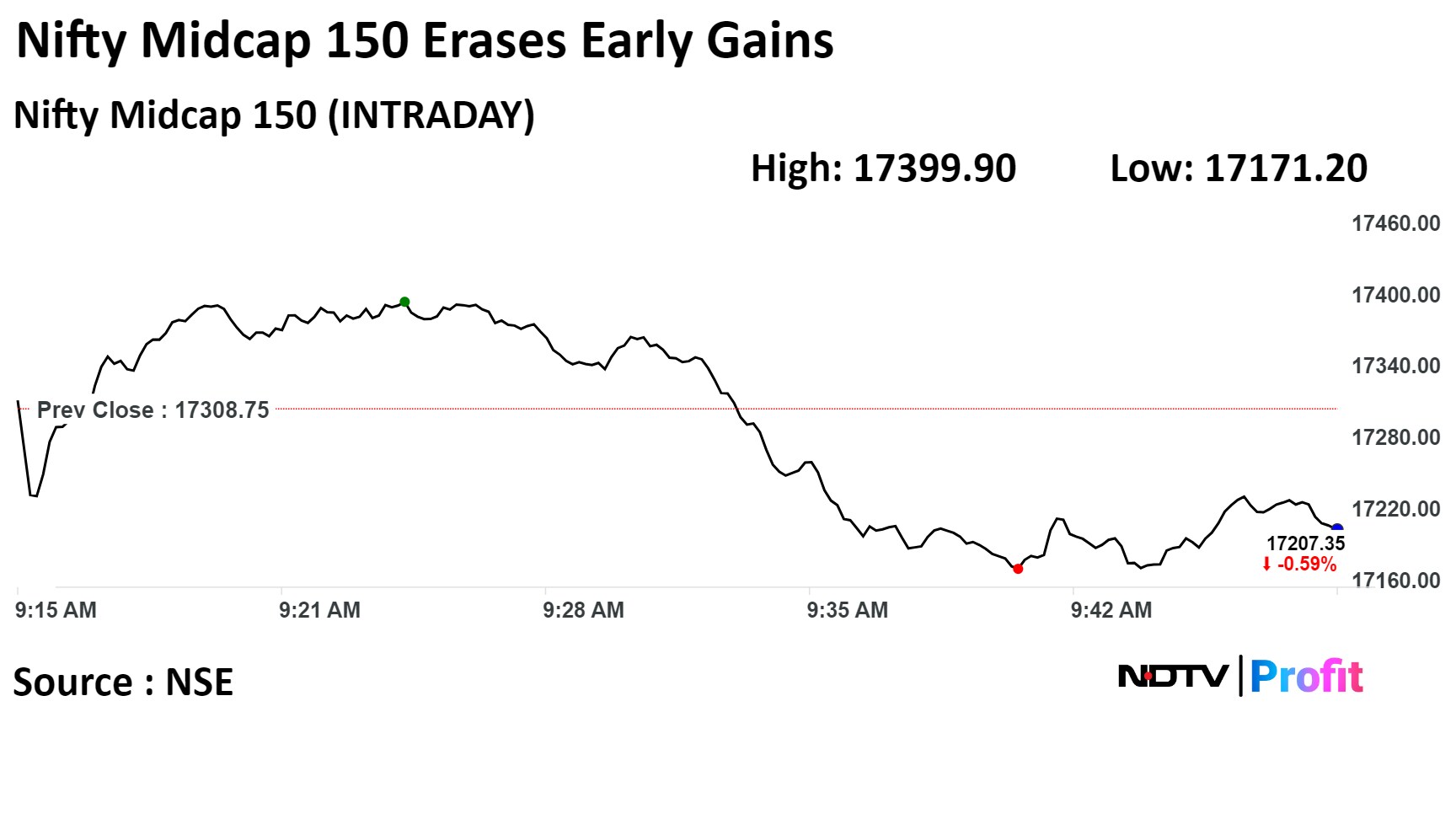

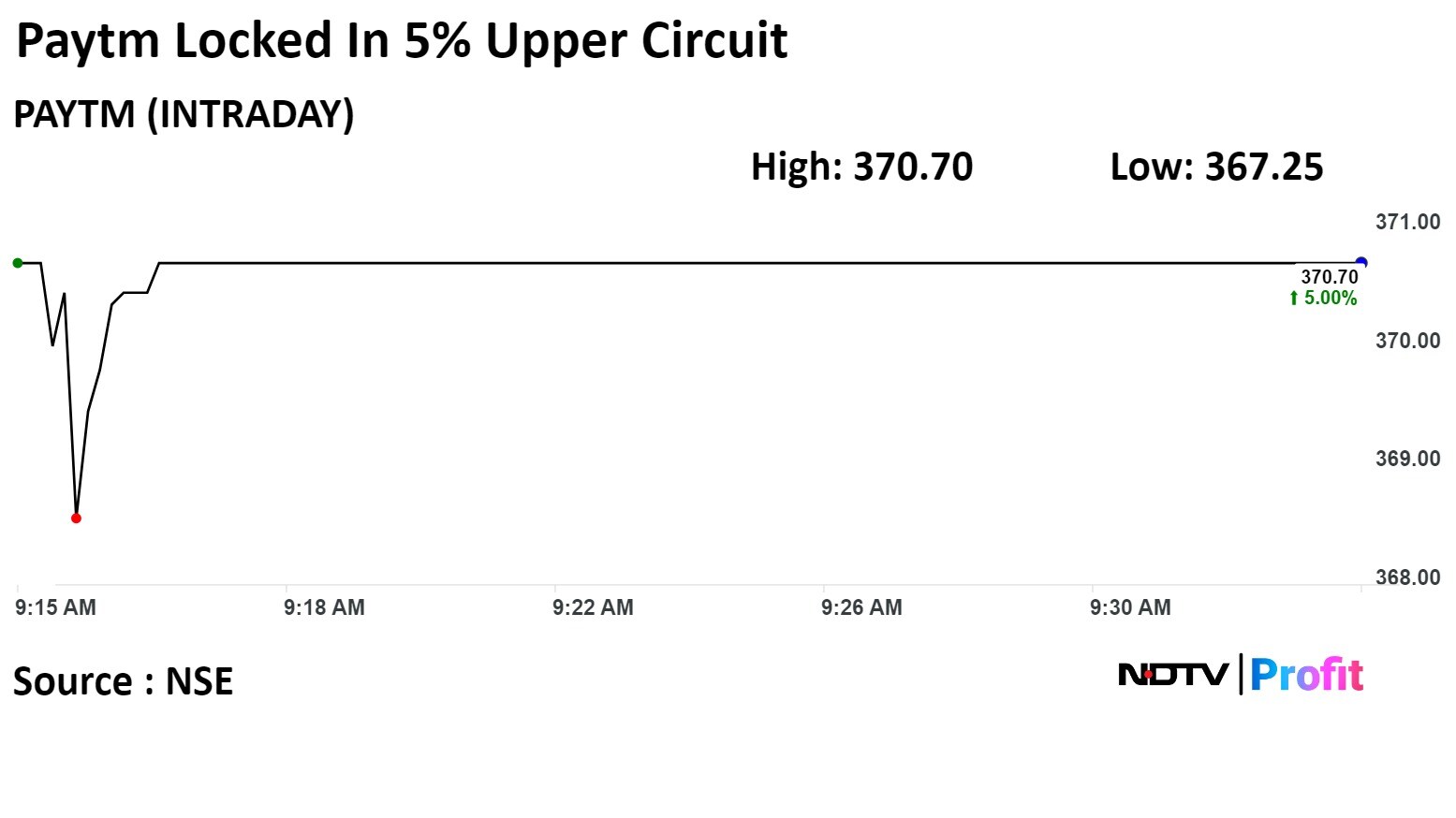

Shares of One97 Communications were locked in their upper circuit limit following National Payment Corporation of India's approval to participate in UPI as a third-party application provider under the multi-bank mode.

Shares of One97 Communications were locked in their upper circuit limit following National Payment Corporation of India's approval to participate in UPI as a third-party application provider under the multi-bank mode.

Scrip of One 97 Communications Ltd rose hit a 5.0% upper and rose to Rs 370.70 apiece, the highest level since March 11. It remained locked in the upper circuit, as of 09:36 a.m. This compares to a 0.47% decline in the NSE Nifty 50 Index.

It has declined 35.29% in 12 months. Total traded volume so far in the day stood at 1.67 times its 30-day average. The relative strength index was at 37.38.

Out of 14 analysts tracking the company, six maintain a 'buy' rating, three recommend a 'hold,' and five suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside 83.6%.

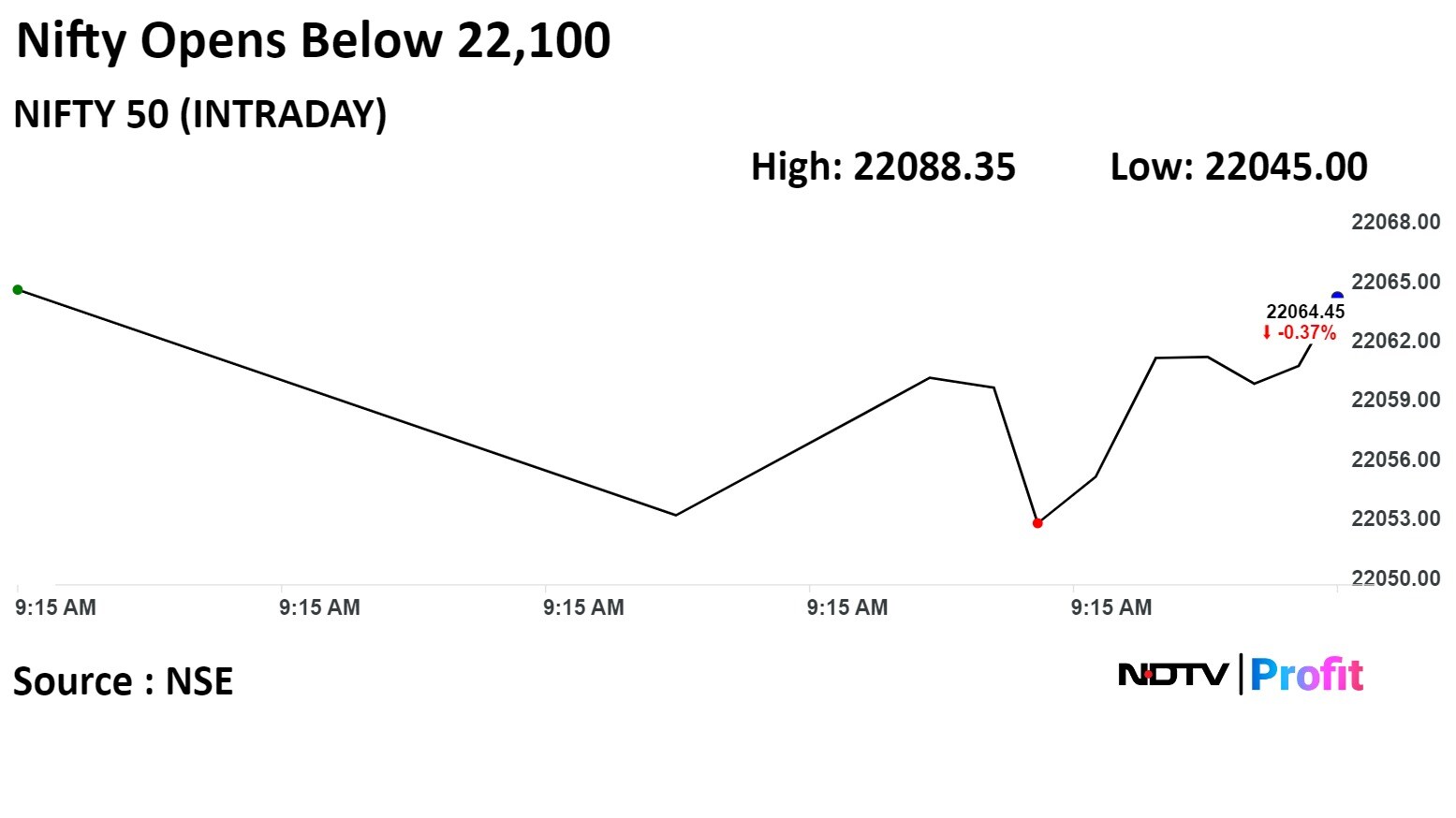

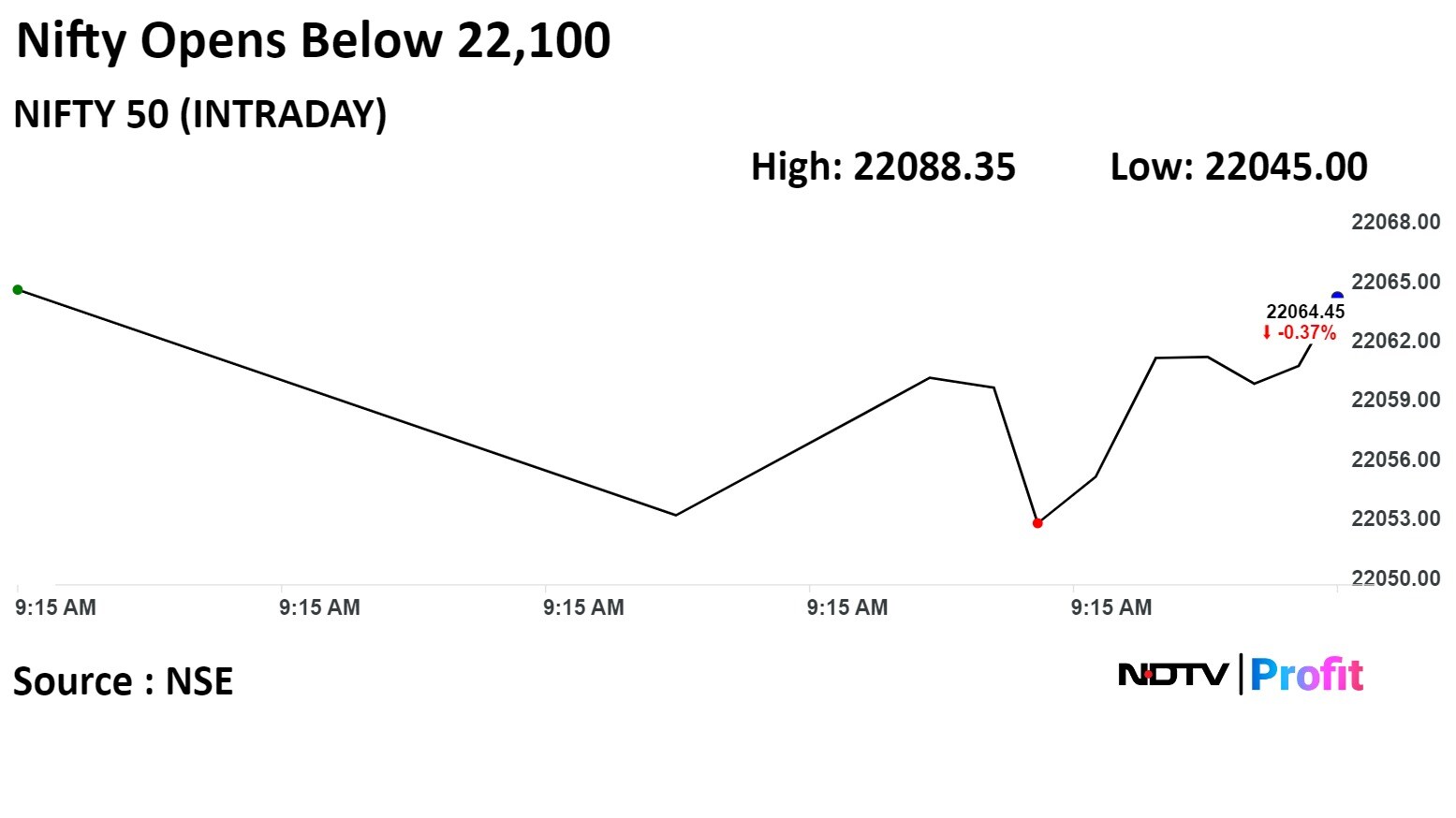

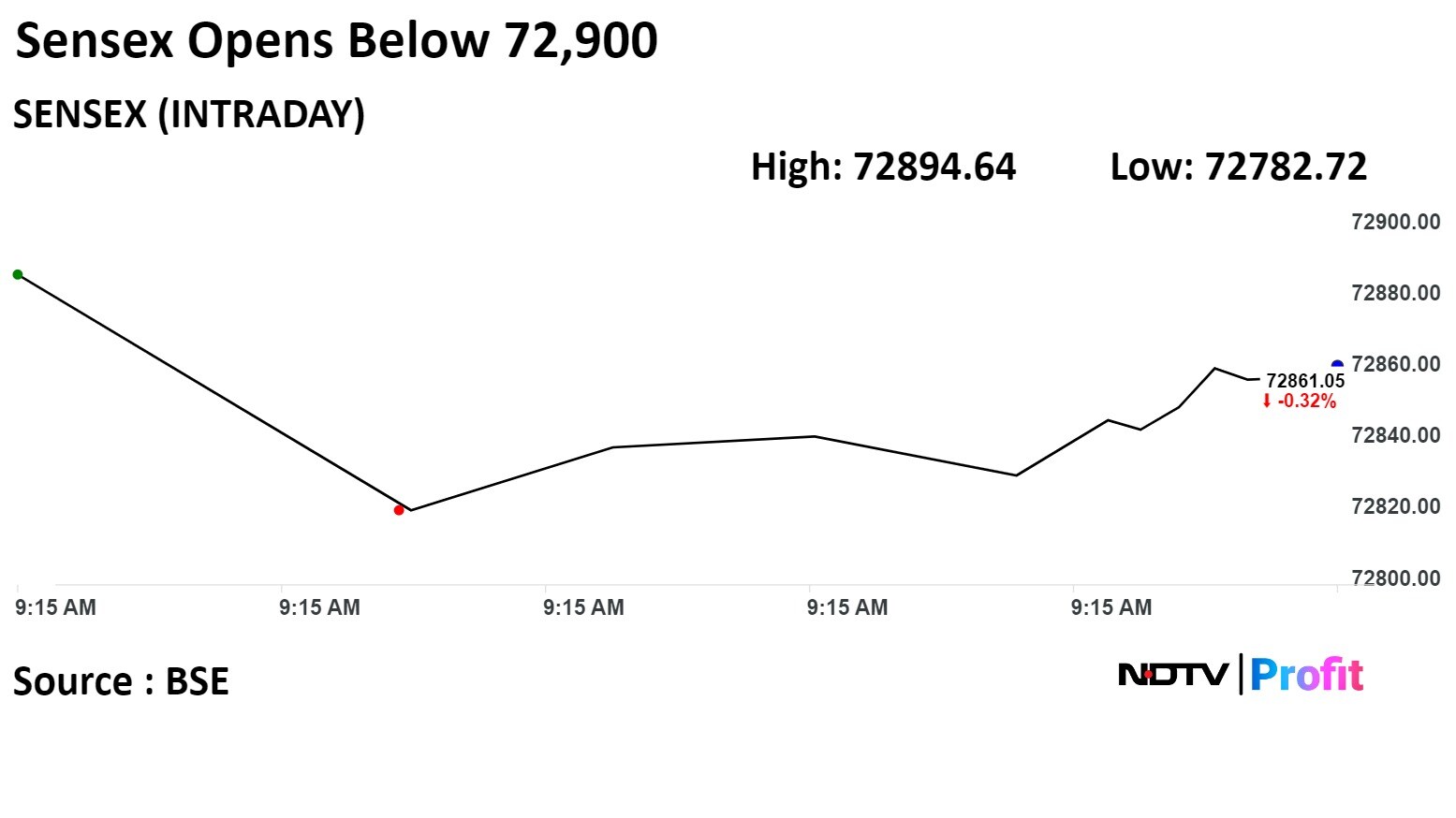

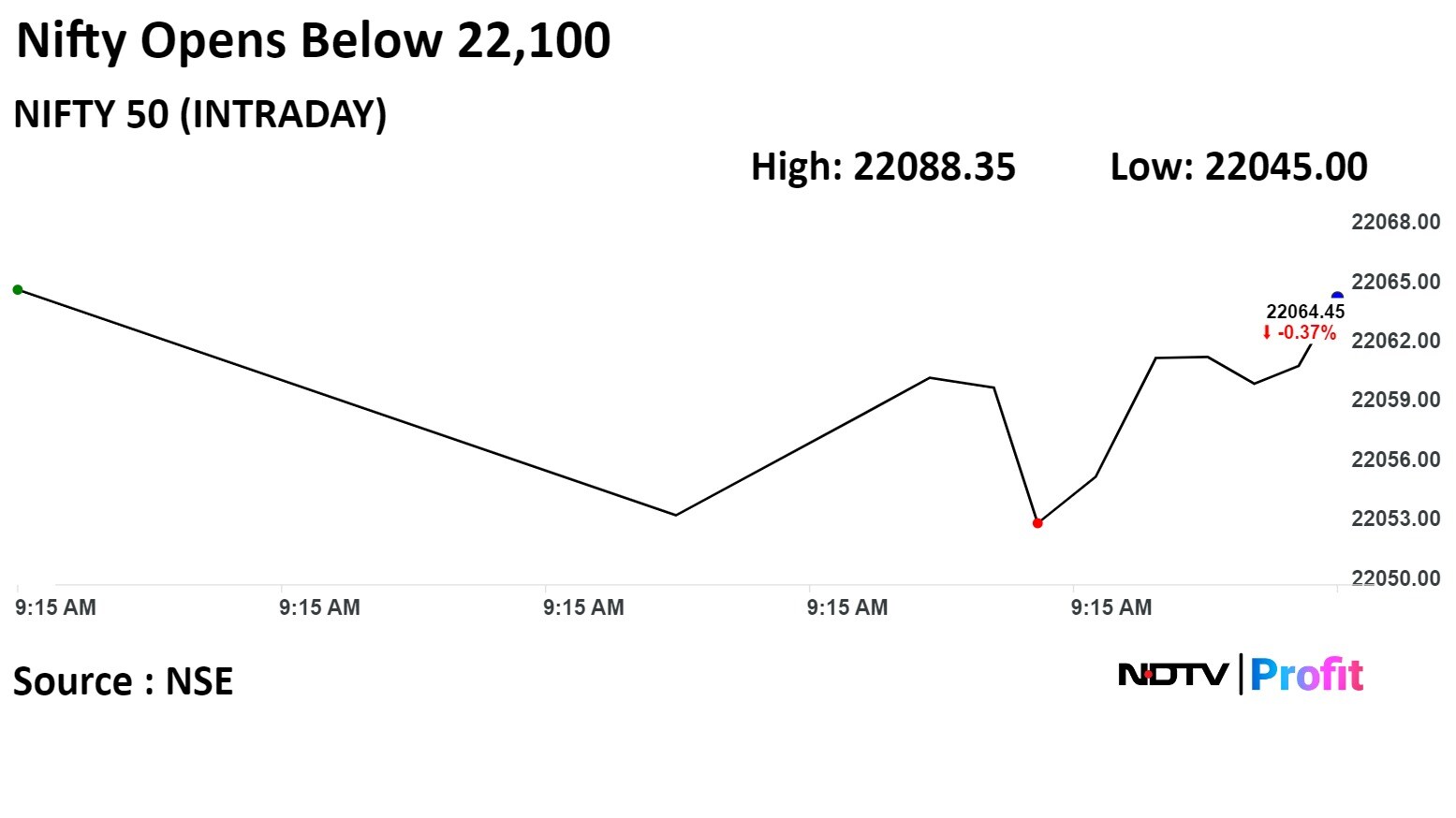

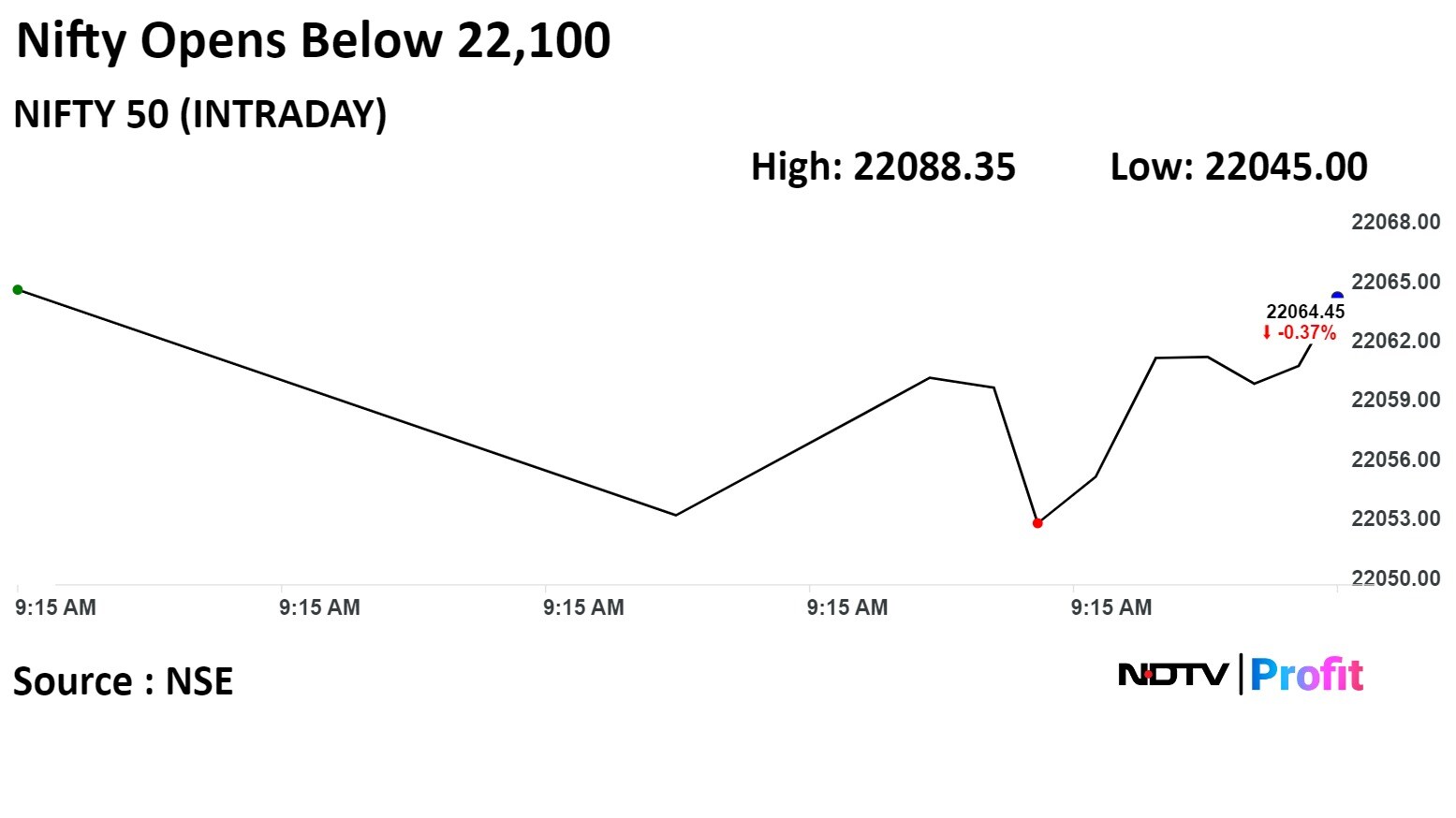

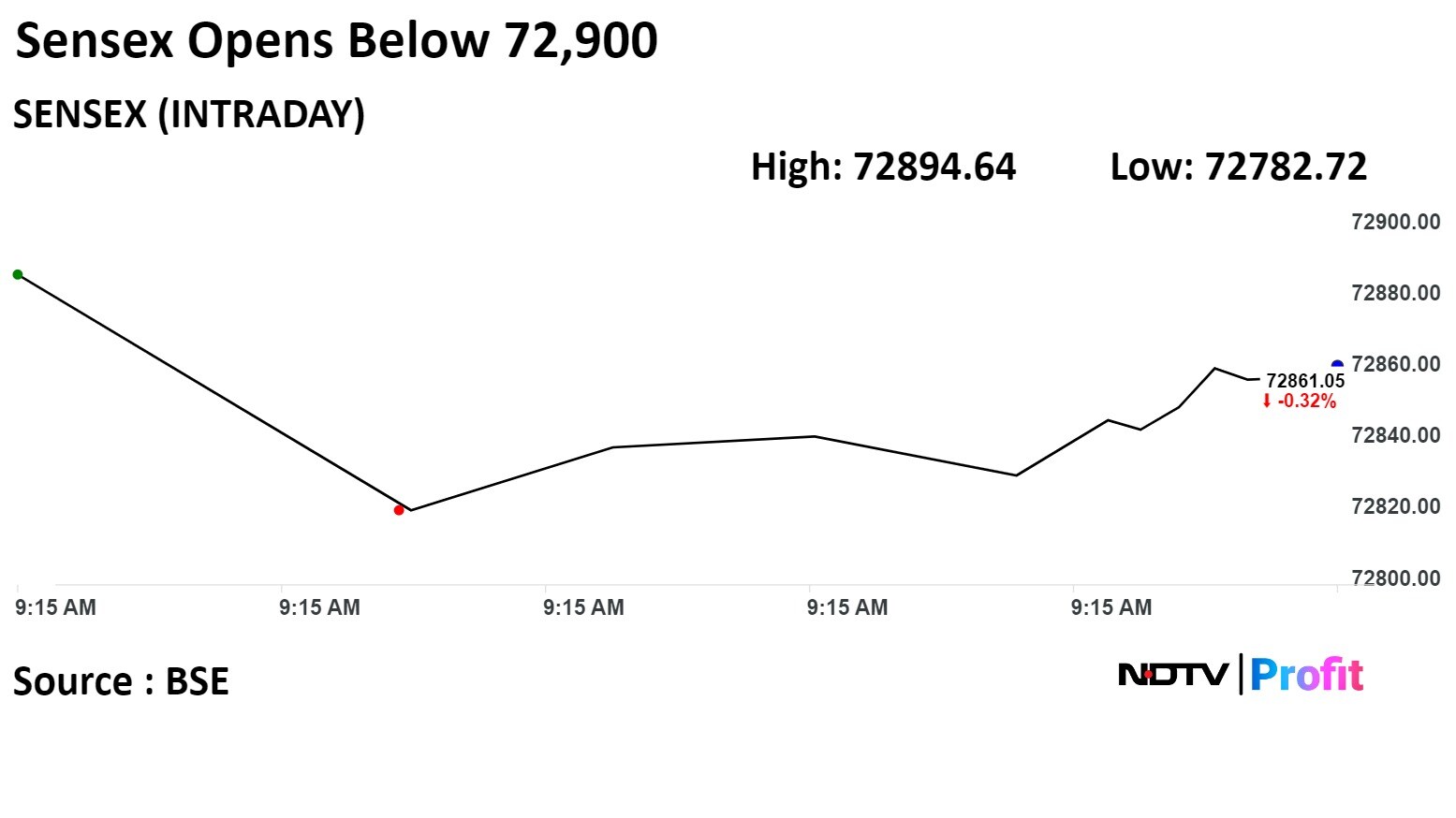

Benchmark equity indices opened lower today as shares of Infosys, ICICI Bank, and L&T dragged. However, broader indices rose.

At pre-open, the S&P BSE Sensex Index was down 210.51 points or 0.29% at 72,886.77 while the NSE Nifty 50 was at 22,064.85, lower by 81.80 points or 0.37%.

"Traders are advised to lighten their overnight positions as global markets are also becoming volatile," said Deven Mehata, Research Analyst at Choice Broking. "Investors can watch the lower levels for fresh investment for the long term."

Benchmark equity indices opened lower today as shares of Infosys, ICICI Bank, and L&T dragged. However, broader indices rose.

At pre-open, the S&P BSE Sensex Index was down 210.51 points or 0.29% at 72,886.77 while the NSE Nifty 50 was at 22,064.85, lower by 81.80 points or 0.37%.

"Traders are advised to lighten their overnight positions as global markets are also becoming volatile," said Deven Mehata, Research Analyst at Choice Broking. "Investors can watch the lower levels for fresh investment for the long term."

Benchmark equity indices opened lower today as shares of Infosys, ICICI Bank, and L&T dragged. However, broader indices rose.

At pre-open, the S&P BSE Sensex Index was down 210.51 points or 0.29% at 72,886.77 while the NSE Nifty 50 was at 22,064.85, lower by 81.80 points or 0.37%.

"Traders are advised to lighten their overnight positions as global markets are also becoming volatile," said Deven Mehata, Research Analyst at Choice Broking. "Investors can watch the lower levels for fresh investment for the long term."

Benchmark equity indices opened lower today as shares of Infosys, ICICI Bank, and L&T dragged. However, broader indices rose.

At pre-open, the S&P BSE Sensex Index was down 210.51 points or 0.29% at 72,886.77 while the NSE Nifty 50 was at 22,064.85, lower by 81.80 points or 0.37%.

"Traders are advised to lighten their overnight positions as global markets are also becoming volatile," said Deven Mehata, Research Analyst at Choice Broking. "Investors can watch the lower levels for fresh investment for the long term."

Benchmark equity indices opened lower today as shares of Infosys, ICICI Bank, and L&T dragged. However, broader indices rose.

At pre-open, the S&P BSE Sensex Index was down 210.51 points or 0.29% at 72,886.77 while the NSE Nifty 50 was at 22,064.85, lower by 81.80 points or 0.37%.

"Traders are advised to lighten their overnight positions as global markets are also becoming volatile," said Deven Mehata, Research Analyst at Choice Broking. "Investors can watch the lower levels for fresh investment for the long term."

Benchmark equity indices opened lower today as shares of Infosys, ICICI Bank, and L&T dragged. However, broader indices rose.

At pre-open, the S&P BSE Sensex Index was down 210.51 points or 0.29% at 72,886.77 while the NSE Nifty 50 was at 22,064.85, lower by 81.80 points or 0.37%.

"Traders are advised to lighten their overnight positions as global markets are also becoming volatile," said Deven Mehata, Research Analyst at Choice Broking. "Investors can watch the lower levels for fresh investment for the long term."

Benchmark equity indices opened lower today as shares of Infosys, ICICI Bank, and L&T dragged. However, broader indices rose.

At pre-open, the S&P BSE Sensex Index was down 210.51 points or 0.29% at 72,886.77 while the NSE Nifty 50 was at 22,064.85, lower by 81.80 points or 0.37%.

"Traders are advised to lighten their overnight positions as global markets are also becoming volatile," said Deven Mehata, Research Analyst at Choice Broking. "Investors can watch the lower levels for fresh investment for the long term."

Benchmark equity indices opened lower today as shares of Infosys, ICICI Bank, and L&T dragged. However, broader indices rose.

At pre-open, the S&P BSE Sensex Index was down 210.51 points or 0.29% at 72,886.77 while the NSE Nifty 50 was at 22,064.85, lower by 81.80 points or 0.37%.

"Traders are advised to lighten their overnight positions as global markets are also becoming volatile," said Deven Mehata, Research Analyst at Choice Broking. "Investors can watch the lower levels for fresh investment for the long term."

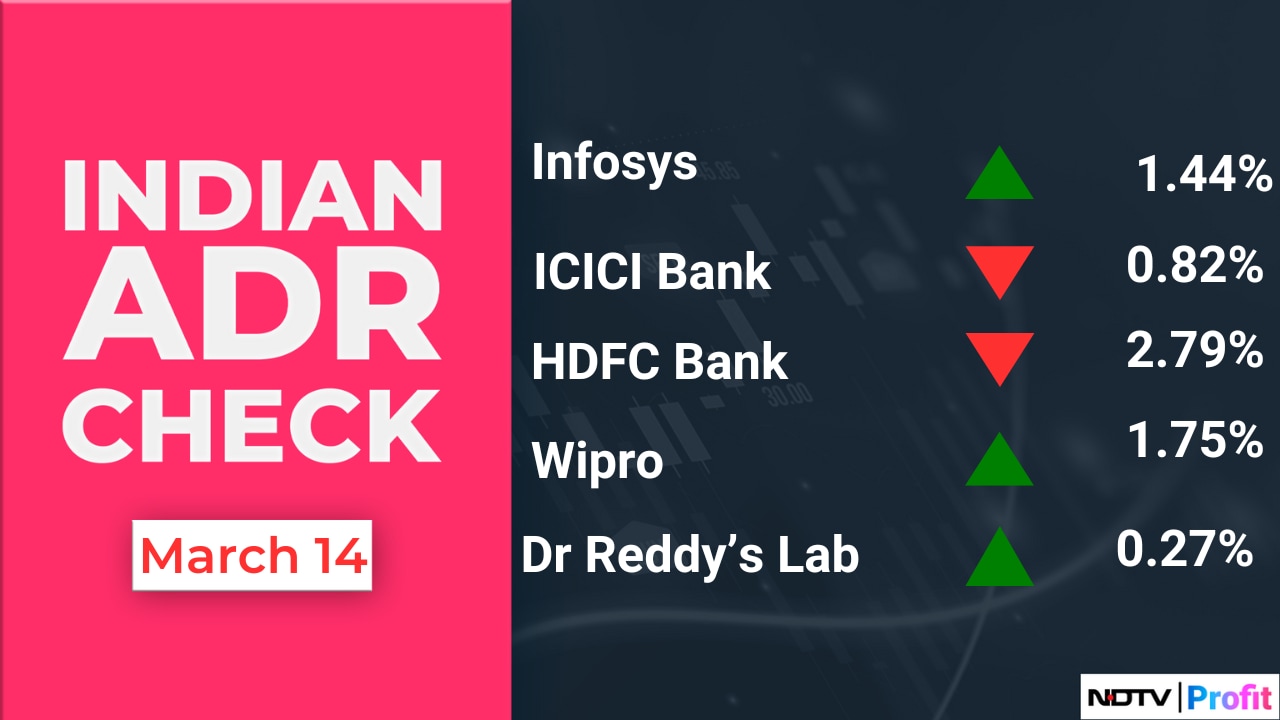

Shares of Infosys Ltd., ICICI Bank Ltd., Axis Bank Ltd., Larsen & Toubro Ltd., and Tata Consultancy Services Ltd. dragged Nifty 50 the most.

Meanwhile, those of Power Grid Corp of India Ltd., NTPC Ltd., State Bank of India Ltd., Bharti Airtel Ltd., and Oil and Natural Gas Corp Ltd., minimized the losses.

Most sectoral indices fell with Nifty IT losing the most. Meanwhile, Nifty Realty and Nifty Media gained over 1%.

Broader markets outperformed. S&P BSE Midcap was up 0.14% and S&P BSE Smallcap gained 0.77%.

Seven out of 20 sectoral indices fell on the BSE and 14 rose. S&P BSE Oil & Gas fell the most.

The market breadth was skewed in the favour of buyers. Around 2,013 stocks rose, 913 declined and 90 remain unchanged.

At pre-open, the S&P BSE Sensex Index was down 210.51 points or 0.29% at 72,886.77 while the NSE Nifty 50 was at 22,064.85, lower by 81.80 points or 0.37%.

The yield on the 10-year bond opened flat at 7.05%.

Source: Bloomberg

The local currency weakened by 13 paise to 82.96 against the U.S. Dollar.

It closed at 82.83 a dollar on Thursday.

Source: Bloomberg

Strong pre-sales growth of realty developers has led to the Nifty Realty Index surging

Expect buoyancy in housing sales to sustain; positive from a medium-term perspective

Lofty valuations are a concern, valuations in line with previous upcycle

Argues value exists: strong cash flows, low leverage and industry consolidation

Potential interest rate cut in 2024 can be stock catalyst

DLF, Prestige and Brigade are top picks

Price Target of Rs 930; 8% upside

Latest acquisitions to expand diabetes offerings, add oncology products

Deal at 12 times 1-yr forward EV/EBITDA,implies 25% YoY growth in EBITDA

ERIS proposed to buy 19% stake in Swiss Parenterals from ERIS promoters for Rs 2.4 billion.

Both deals to increase net debt to Rs 24 billion in FY24 from Rs 8.9 billion as of 3QFY24.

Scaling up acquired business and improving overall profitability to be vital for ERI

Nomura Maintains 'Buy' on Axis Bank at Rs 1250 target

Management expects tight liquidity environment to prevail longer

Deposit mobilisation to be sectoral challenge

Management believes sector loan growth outpacing deposit growth is not sustainable

Management expects cost of funds to gradually rise till Q1Fy25

Expect deposits/ loans growth CAGR of 15.5%/15% over FY24-26

Expect credit costs of 0.5-0.6% over FY25-26

To establish AI, ML-driven cybersecurity centre for Maharashtra government.

Source: Exchange filing

Time taken for 50% portfolio liquidation is 7 days for Nippon India Growth fund

Time taken for 50% portfolio liquidation is 27 days for Nippon Small Cap fund

Time taken for 25% portfolio liquidation is 4 days for Nippon India Growth fund

Time taken for 25% portfolio liquidation is 13 days for Nippon India Small Cap fund

Entire obligations with respect to borrowings of have been settled

Source: Exchange filing

BAT wants to have an influence in the ITC board and its future plans.

BAT is “very satisfied to be a very relevant shareholder” of ITC

When we wanted to trim some of the shareholding, we decided to keep it above 25% and use the proceeds for buyback of BAT shares

Source: UBS Global Consumer and Retail Conference

Continues expanding distribution reach for Mamaearth brand in offline channel

Honasa is shifting to a direct distributor model from the current distributor setup

Scale-up of The Derma Co into offline channel

Opportunity to expand across new sub-categories

Key focus area for management - new product launches

TP of Rs 923

Has successfully built a sustainable flywheel of growth

Flywheel: store expansion, product innovation, format extension and cost management

FY24E though has been a reset year due to demand slowdown & high base

Expect growth to resume in FY25E; forecast 17% revenue/43% PAT CAGR over FY24-26E

Value Westlife at 32x FY26E EV/EBITDA

Aditya Birla says

Time taken for 50% portfolio liquidation is 4 days for Aditya Birla Mid Cap fund

Time taken for 50% portfolio liquidation is 10 days for Aditya Birla Small Cap fund

Time taken for 25% portfolio liquidation is 2 days for Aditya Birla Mid Cap fund

Time taken for 25% portfolio liquidation is 5 days for Aditya Birla Small Cap fund

Lower EV subsidy under Electric Mobility Promotion Scheme 2024 is sentiment negative for TVS Motor and Bajaj Auto

Incentive reduced from Rs10,000/kWh of battery to Rs5,000/kWh

E2W incentives capped at Rs 10,000/unit from Rs 22,000 per unit

New scheme to have Rs 7-10,000/unit impact on E2W pricing

E3W incentives capped at Rs 50,000/unit

New scheme to have Rs 35-45,000/unit impact on E3W pricing

Note: The lower subsidy needs to be seen in context of the Auto PLI scheme effective FY25E and softening global EV cell prices, Macquarie says.

Source: Macquarie Flashnote

Jefferies retains Paytm rating "unrated"

NPCI approval removes last remaining regulatory challenge

Feb24 data indicates 8-15% hit to payments value / app usage

Business model moving to a pure payments company

Likely to dip into cash reserves ($1bn) for merchant / customer retention

Merchant attrition and lending business trajectory provides wide valn range

Remain watchful for clarity on attrition numbers

Morgan Stanley retains Equal Weight rating with a TP of 555

Partnered with four banks; "@paytm" handle will be redirected to YES Bank

Approval ensures seamless and uninterrupted UPI services to existing users and merchants

Move is a positive development and in-line with our expectations

Await clarity on impact on Paytm business and updated commercials

Systematix

Rs 2/ltr cut to lead to Ebitda degrowth of 21%/28/29% for IOC/BPCL/HPCL

Expect stocks to correct near term

Correction to make OMCs attractive for long term

Expect margins to remain at higher levls

Expect BPCL divestment process to restart post election

Prefer HPCL on reasonable valuations, followed by BPCL, IOC

Citi Research

Price cut unwarranted, but not entirely expected

Crude prices breached $85 around announcement

Price cut on diesel not warranted given breakeven margin levels

To watch out for export tax changes on the fuel

Expects healthy integrated margins after the cut

To impact FY25 EPS Estimates for BPCL/HPCL/IOCL by 10%/14%/12%

Emkay

OMCs margins to take a hit of Rs 1.6-1.7/ltr on price cut

Current petrol/diesel margins at Rs5/1.4 per liter

Expect cuts to be applicable till elections end

FY24/25 estimates stay intact

Material oil price spike is the only risk

U.S. Dollar Index at 102.92

U.S. 10-year bond yield at 4.15%

Brent crude down 0.18% at $85.27 per barrel

Nymex crude down 0.14% at $81.15 per barrel

GIFT Nifty was up 23.5 points or 0.11% at 22,146 as of 7:35 a.m.

Bitcoin was up 1.37% at $72,035.63

U.S. Dollar Index at 102.92

U.S. 10-year bond yield at 4.15%

Brent crude down 0.18% at $85.27 per barrel

Nymex crude down 0.14% at $81.15 per barrel

GIFT Nifty was up 23.5 points or 0.11% at 22,146 as of 7:35 a.m.

Bitcoin was up 1.37% at $72,035.63

Nifty March futures up by 0.69% to 22,264.55 at a premium of 117.9 points.

Nifty March futures open interest up by 6%.

Nifty Bank March futures down by 0.15% to 46,996.15 at a premium of 206.2 points.

Nifty Bank March futures open interest up by 2%.

Nifty Options March 14 Expiry: Maximum call open interest at 23,000 and maximum put open interest at 22,000.

Bank Nifty Options March Expiry: Maximum call open interest at 47,000 and maximum put open interest at 47,000.

Securities in ban period: Aditya Birla Fashion, Bharat Heavy Electricals, Manappuram Finance, National Aluminium, Piramal Enterprise, RBL Bank, Sail, Tata Chemical, Zee Entertainment Enterprise.

Nifty March futures up by 0.69% to 22,264.55 at a premium of 117.9 points.

Nifty March futures open interest up by 6%.

Nifty Bank March futures down by 0.15% to 46,996.15 at a premium of 206.2 points.

Nifty Bank March futures open interest up by 2%.

Nifty Options March 14 Expiry: Maximum call open interest at 23,000 and maximum put open interest at 22,000.

Bank Nifty Options March Expiry: Maximum call open interest at 47,000 and maximum put open interest at 47,000.

Securities in ban period: Aditya Birla Fashion, Bharat Heavy Electricals, Manappuram Finance, National Aluminium, Piramal Enterprise, RBL Bank, Sail, Tata Chemical, Zee Entertainment Enterprise.

Mold-Tek Packaging: Goldman Sachs India sold 2.36 lakh shares (0.71%) at Rs 804.98 apiece.

Popular Vehicles and Services: The public issue was subscribed to 1.23 times on day 3. The bids were led by institutional investors (1.97 times), non-institutional investors (0.66 times), retail investors (1.05 times) and a portion reserved for employees (7.54 times).

Krystal Integrated Services: The public issue was subscribed to 0.36 times on day 1. The bids were led by institutional investors (0.33 times), non-institutional investors (0.43 times), and retail investors (0.34 times).

FTSE and Sensex Rejig: Nuvama Institutional Equities expects that India will see an inflow of over $1.7 billion, mainly from the financial space. The FTSE rejig is set to happen on Friday.

Oil Marketing Companies: OMCs will cut petrol and diesel prices by Rs 2 per litre from Friday.

Wipro: The IT major has been selected by Desjardins to transform their credit solutions for members and clients.

One 97 Communication: The National Payments Corporation of India has granted approval to the company to participate in UPI as a third-party application provider under the multi-bank model.

NHPC: The company has received a letter of intent for a 200 MW solar power project at Khavda from Gujarat Urja Vikas Nigam.

TVS Motor: The company’s Singapore arm will invest $5.5 million in Ion Mobility.

Railtel Corp.: The company received a work order worth Rs 113.5 crore from the Odisha Computer Application Centre to establish IP-MPLS network connectivity in Odisha.

Tata Steel: The board is meeting on March 19 to approve fundraising.

Dr.Reddy’s Laboratories: The Mexican arm was fined Rs 28.8 crore in a tax litigation case.

JSW Energy: The company received a letter of intent for 300 MW of solar capacity from Gujarat Urja Vikas Nigam at Khavda RE Park.

KPI Green Energy: The company received an order for a 50MW wind-solar hybrid power project from Gujarat Urja Vikas Nigam.

Ashok Leyland: The company arm Hinduja Tech signed a definitive agreement with Creador to invest $50 million and acquire a 19.6% stake in the arm.

Tata Consumer Products: The company will consider a share-based long-term incentive plan for the grant of performance share units to eligible employees.

Navin Fluorine International: The company approved an additional investment of Rs 250 crore in the arm of Navin Fluorine Advanced Sciences.

Shakti Pumps: The company received a Rs 93 crore order from the Maharashtra Energy Department to design, manufacture, install, and supply 3,500 solar photovoltaic water pumping systems.

Sarveshwar Foods: The company will export white rice to Africa for $6 million.

Eris Lifesciences: The company entered into a pact to acquire 19% equity in Swiss Parenterals from the promoters of the company for Rs 238 crore.

Innova Captab: Gaurav Srivastava resigned from the position of chief financial officer effective March 29.

Gujarat Fluorochem: The company incorporated its arm, IGREL Mahidad, for power generation.

InterGlobe Aviation: The company introduced 11 new codeshare routes across Australia in a pact with Qantas Airways.

Infibeam Avenues: The company issued a guarantee worth Rs 140 crore on behalf of the arm in favour of IndusInd Bank.

Biocon: Indranil Sen has resigned from the position of chief financial officer, effective today.

Bombay Burmah: The Maharashtra state tax department initiated a search at the company’s office on March 13.

Network18 Media: Digital18 Media ceases to be an arm of the company consequent to the transfer of its stake in the arm to Viacom 18 Media.

Mukka Proteins: The company received purchase orders worth Rs 15.25 crore from Avanti Feeds for the supply of fish oil.

Shalby: The company secured a Rs 100 crore term loan agreement with Bajaj Finance for acquiring 100% equity shares of Healer’s Hospital, both for private and general corporate purposes.

NCC: The company’s unit has settled a dispute with TAQA India Power Ventures and Himachal Sorang regarding the Himachal Sorang power project. The company’s unit is to pay Rs. 175 crore in three instalments to TAQA, guaranteed by NCC.

Elpro International: The company acquired shares of Ami Organics for a cash consideration of Rs 6.31 crore.

Genesys International: The company secured an order worth Rs 155.8 crore from Brihanmumbai Municipal Corp. for developing, implementing, and maintaining a 3D city model using geospatial technology.

Asian indices were traded lower during early trade, taking cues from overnight losses on Wall Street.

The U.S. Producer Price Index rose more than expected in February, echoing the CPI report earlier in the week, which raised worries that the Federal Reserve will not be in any rush to ease monetary conditions, Bloomberg reported.

Following the hotter-than-expected inflation data, U.S. Treasury yields witnessed a sharp rise, and the dollar index strengthened, which pressured riskier assets like emerging market equities.

Brent crude was trading 0.18% lower at $85.27 a barrel. Gold was flat at $2,162.1 an ounce.

The GIFT Nifty was trading up 23.5 points, or 0.11%, at 22,146 as of 7:35 a.m.

India’s benchmark equity indices recovered from the worst selloff in over a month to end Thursday's trading session higher.

The NSE Nifty 50 closed 153.30 points or 0.7% higher at 22,151.00, and the S&P BSE Sensex ended 335.39 points or 0.46% up at 73,097.28.

Overseas investors remained net sellers of Indian equities on Thursday.

Foreign portfolio investors sold stocks worth Rs 1,356.3 crore; domestic institutional investors remained buyers and mopped up equities worth Rs 139.5 crore, the NSE data showed.

The Indian rupee strengthened by 3 paise to close at 82.83 against the U.S. dollar.

Edelweiss Mutual Fund said after stress and liquidity test results, it will take two days to liquidate 50% of its portfolio in mid-cap funds and one day to liquidate 25%. Further, Edelweiss will take three days to liquidate 50% of its small-cap fund.

Quant Mutual Fund said it will take 22 days to liquidate 22% of its portfolio in a small-cap fund and six days to liquidate 50% of its mid-cap fund.

Asian indices were traded lower during early trade, taking cues from overnight losses on Wall Street.

The U.S. Producer Price Index rose more than expected in February, echoing the CPI report earlier in the week, which raised worries that the Federal Reserve will not be in any rush to ease monetary conditions, Bloomberg reported.

Following the hotter-than-expected inflation data, U.S. Treasury yields witnessed a sharp rise, and the dollar index strengthened, which pressured riskier assets like emerging market equities.

Brent crude was trading 0.18% lower at $85.27 a barrel. Gold was flat at $2,162.1 an ounce.

The GIFT Nifty was trading up 23.5 points, or 0.11%, at 22,146 as of 7:35 a.m.

India’s benchmark equity indices recovered from the worst selloff in over a month to end Thursday's trading session higher.

The NSE Nifty 50 closed 153.30 points or 0.7% higher at 22,151.00, and the S&P BSE Sensex ended 335.39 points or 0.46% up at 73,097.28.

Overseas investors remained net sellers of Indian equities on Thursday.

Foreign portfolio investors sold stocks worth Rs 1,356.3 crore; domestic institutional investors remained buyers and mopped up equities worth Rs 139.5 crore, the NSE data showed.

The Indian rupee strengthened by 3 paise to close at 82.83 against the U.S. dollar.

Edelweiss Mutual Fund said after stress and liquidity test results, it will take two days to liquidate 50% of its portfolio in mid-cap funds and one day to liquidate 25%. Further, Edelweiss will take three days to liquidate 50% of its small-cap fund.

Quant Mutual Fund said it will take 22 days to liquidate 22% of its portfolio in a small-cap fund and six days to liquidate 50% of its mid-cap fund.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.