Overseas investors remained net sellers of Indian equities on Thursday.

Foreign portfolio investors offloaded stocks worth Rs 1,826.97 crore, according to provisional data from the National Stock Exchange.

Domestic institutional investors remained buyers and mopped up equities worth Rs 3,208.87 crore, the NSE data showed.

Foreign institutions have been net buyers of Rs 15220 crore worth of Indian equities so far in 2024, according to data from the National Securities Depository Ltd., updated till the previous trading day.

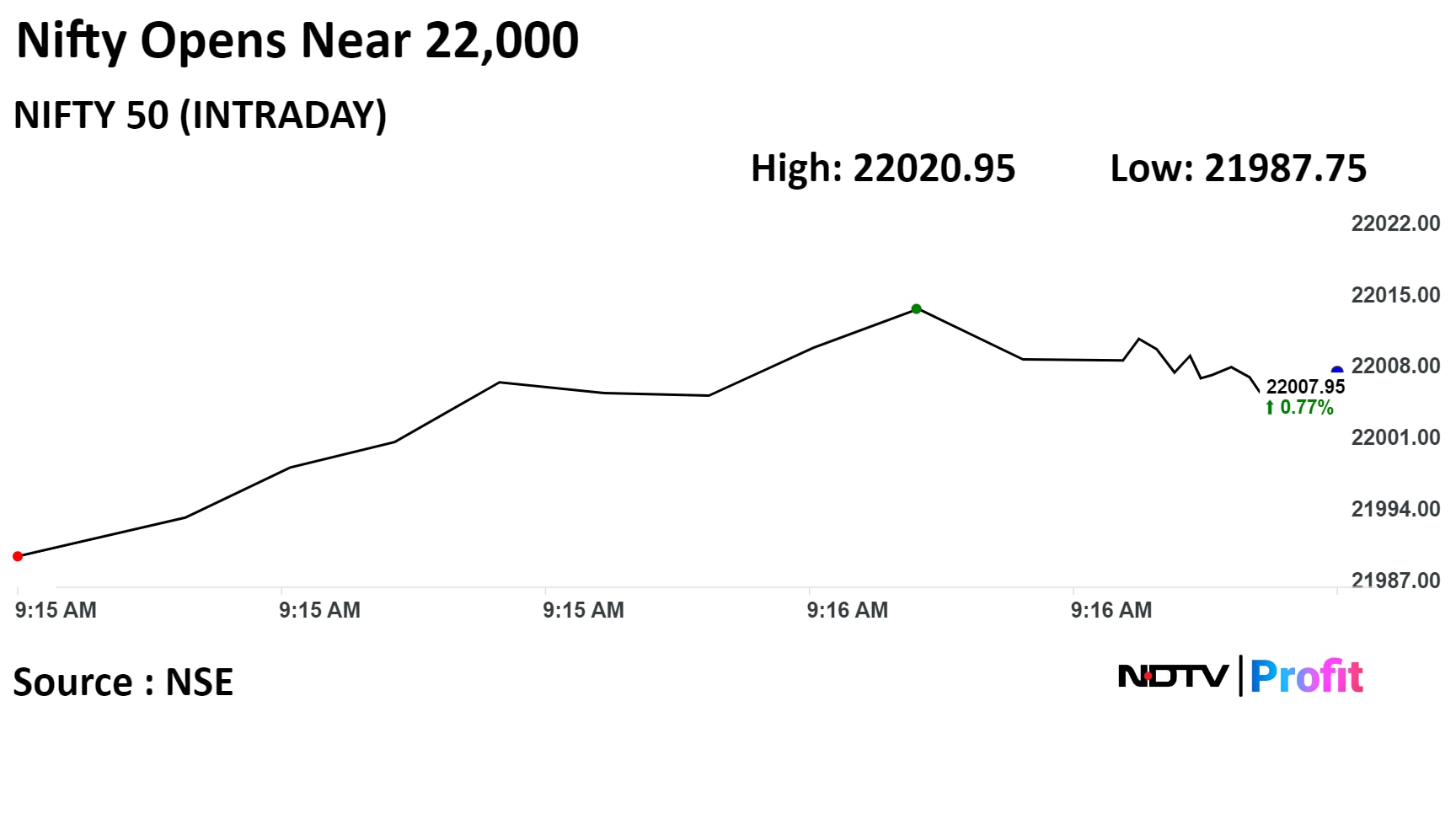

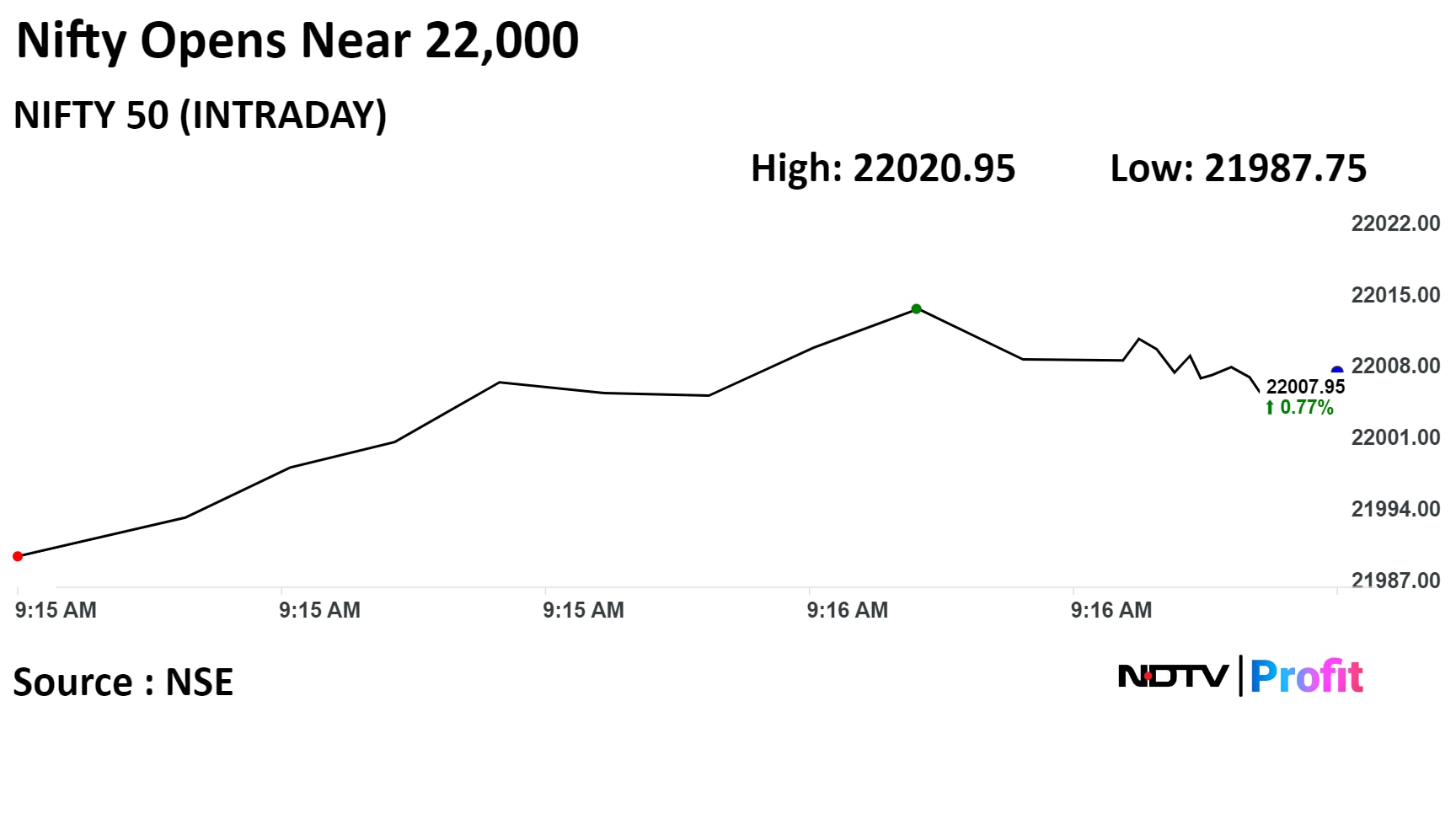

The NSE Nifty 50 ended 172.85 points, or 0.79%, higher at 22,011.95, while the S&P BSE Sensex was up 590.60 points, or 0.82%, at 72,692.29.

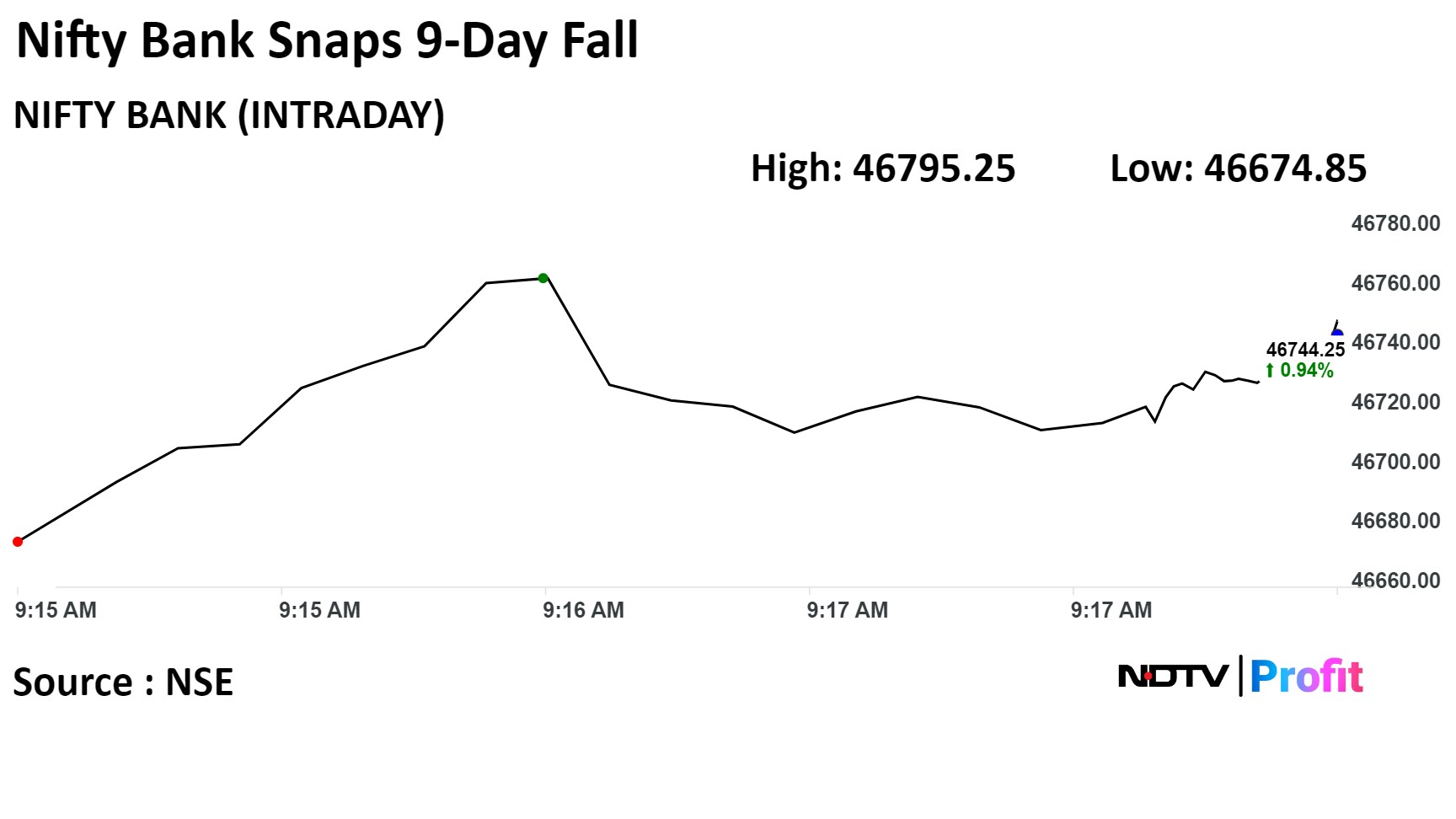

Benchmark equity indices gained for the second day consecutively with financial services stocks contributing the most to the gains following U.S. Federal Reserve's decision to keep interest rates unchanged.

The Nifty 50 ended at 22,011.95 points, up 172.85 points or 0.79% points while the Sensex gained 590.60 points or 0.82% to end at 72,692.29 points.

"Domestic market is taking cues from the global market infusing optimism as the Federal Reserve signalled to remain on track for three interest rate cuts this year despite inflation staying above long-term target," said Vinod Nair, head of research at Geojit Financial Services.

"Short-term traders are taking advantage of the oversold territory from the recent sell-off," he added.

Benchmark equity indices gained for the second day consecutively with financial services stocks contributing the most to the gains following U.S. Federal Reserve's decision to keep interest rates unchanged.

The Nifty 50 ended at 22,011.95 points, up 172.85 points or 0.79% points while the Sensex gained 590.60 points or 0.82% to end at 72,692.29 points.

"Domestic market is taking cues from the global market infusing optimism as the Federal Reserve signalled to remain on track for three interest rate cuts this year despite inflation staying above long-term target," said Vinod Nair, head of research at Geojit Financial Services.

"Short-term traders are taking advantage of the oversold territory from the recent sell-off," he added.

Benchmark equity indices gained for the second day consecutively with financial services stocks contributing the most to the gains following U.S. Federal Reserve's decision to keep interest rates unchanged.

The Nifty 50 ended at 22,011.95 points, up 172.85 points or 0.79% points while the Sensex gained 590.60 points or 0.82% to end at 72,692.29 points.

"Domestic market is taking cues from the global market infusing optimism as the Federal Reserve signalled to remain on track for three interest rate cuts this year despite inflation staying above long-term target," said Vinod Nair, head of research at Geojit Financial Services.

"Short-term traders are taking advantage of the oversold territory from the recent sell-off," he added.

Benchmark equity indices gained for the second day consecutively with financial services stocks contributing the most to the gains following U.S. Federal Reserve's decision to keep interest rates unchanged.

The Nifty 50 ended at 22,011.95 points, up 172.85 points or 0.79% points while the Sensex gained 590.60 points or 0.82% to end at 72,692.29 points.

"Domestic market is taking cues from the global market infusing optimism as the Federal Reserve signalled to remain on track for three interest rate cuts this year despite inflation staying above long-term target," said Vinod Nair, head of research at Geojit Financial Services.

"Short-term traders are taking advantage of the oversold territory from the recent sell-off," he added.

Benchmark equity indices gained for the second day consecutively with financial services stocks contributing the most to the gains following U.S. Federal Reserve's decision to keep interest rates unchanged.

The Nifty 50 ended at 22,011.95 points, up 172.85 points or 0.79% points while the Sensex gained 590.60 points or 0.82% to end at 72,692.29 points.

"Domestic market is taking cues from the global market infusing optimism as the Federal Reserve signalled to remain on track for three interest rate cuts this year despite inflation staying above long-term target," said Vinod Nair, head of research at Geojit Financial Services.

"Short-term traders are taking advantage of the oversold territory from the recent sell-off," he added.

Benchmark equity indices gained for the second day consecutively with financial services stocks contributing the most to the gains following U.S. Federal Reserve's decision to keep interest rates unchanged.

The Nifty 50 ended at 22,011.95 points, up 172.85 points or 0.79% points while the Sensex gained 590.60 points or 0.82% to end at 72,692.29 points.

"Domestic market is taking cues from the global market infusing optimism as the Federal Reserve signalled to remain on track for three interest rate cuts this year despite inflation staying above long-term target," said Vinod Nair, head of research at Geojit Financial Services.

"Short-term traders are taking advantage of the oversold territory from the recent sell-off," he added.

Benchmark equity indices gained for the second day consecutively with financial services stocks contributing the most to the gains following U.S. Federal Reserve's decision to keep interest rates unchanged.

The Nifty 50 ended at 22,011.95 points, up 172.85 points or 0.79% points while the Sensex gained 590.60 points or 0.82% to end at 72,692.29 points.

"Domestic market is taking cues from the global market infusing optimism as the Federal Reserve signalled to remain on track for three interest rate cuts this year despite inflation staying above long-term target," said Vinod Nair, head of research at Geojit Financial Services.

"Short-term traders are taking advantage of the oversold territory from the recent sell-off," he added.

Benchmark equity indices gained for the second day consecutively with financial services stocks contributing the most to the gains following U.S. Federal Reserve's decision to keep interest rates unchanged.

The Nifty 50 ended at 22,011.95 points, up 172.85 points or 0.79% points while the Sensex gained 590.60 points or 0.82% to end at 72,692.29 points.

"Domestic market is taking cues from the global market infusing optimism as the Federal Reserve signalled to remain on track for three interest rate cuts this year despite inflation staying above long-term target," said Vinod Nair, head of research at Geojit Financial Services.

"Short-term traders are taking advantage of the oversold territory from the recent sell-off," he added.

Shares of HDFC Bank Ltd., Larsen & Toubro Ltd., ITC Ltd., NTPC Ltd., and Reliance Industries Ltd. contributed the most to the gains.

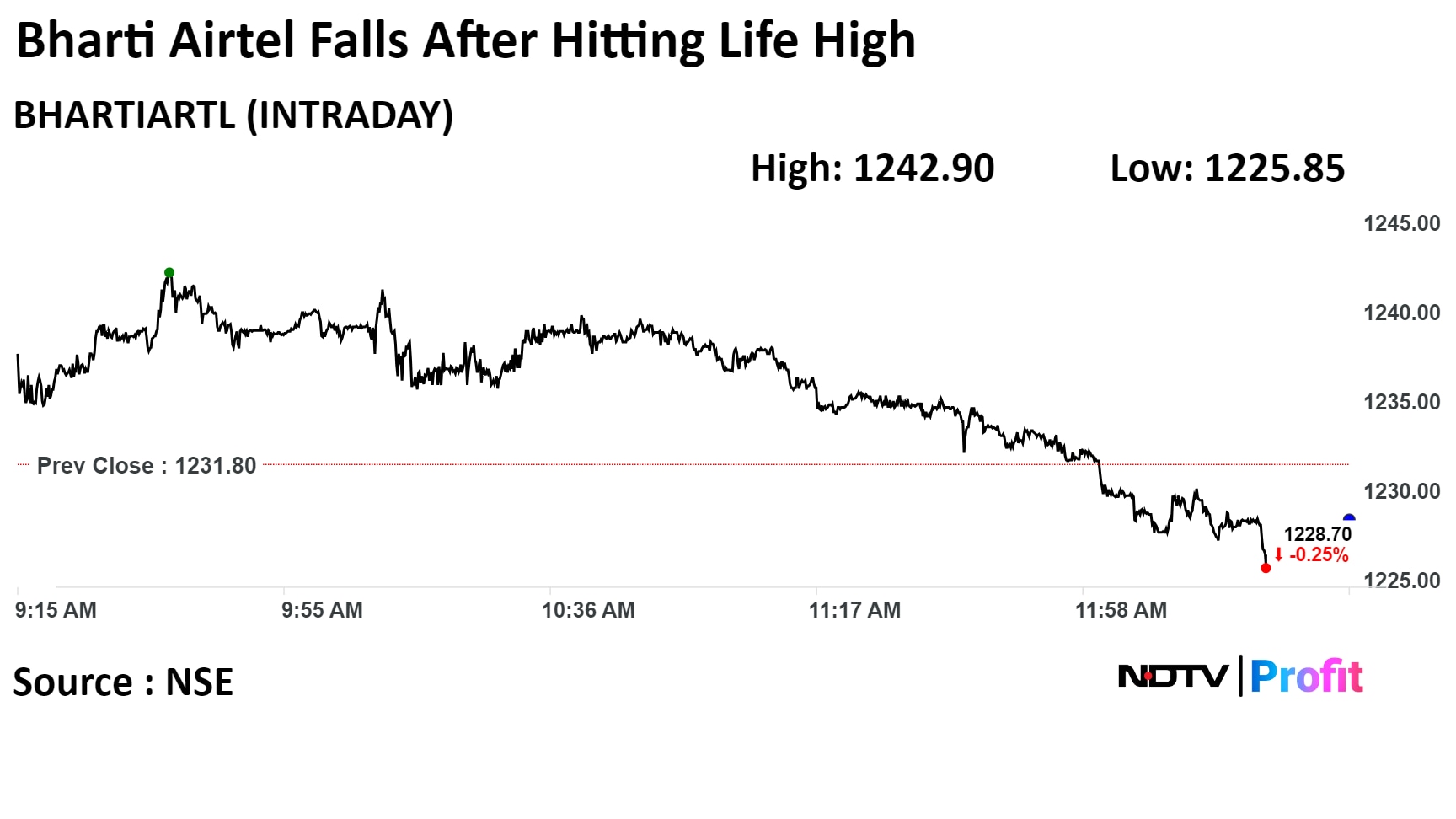

Meanwhile, those of Bharti Airtel Ltd., ICICI Bank Ltd., HDFC Life Insurance Co Ltd., Maruti Suzuki Ltd., and Oil and Natural Gas Corp Ltd. capped the upside.

All sectoral indices ended higher with most of them outperforming the benchmarks. Nifty Realty and Nifty Metal rose the most.

Broader markets outperformed benchmark indices. The S&P BSE Midcap ended 2.36%, and the S&P BSE Smallcap index settled 2.01% higher.

On BSE, all 20 sectors ended higher with the S&P BSE Power emerging as the top performer. The S&P BSE TECK index was the worst performing sector.

Market breadth was skewed in favour of buyers. Aroun 2,759 stocks rose, 1,063 stocks declined, and 104 stocks remained unchanged on BSE.

Signs 7-year contract for IT infra solutions

Will also deliver services to manage Ramboll’s operations

Source: Exchange Filing

Board approves raising up to Rs 650 crore via bonds

Source: Exchange Filing

In pact for expense management & employee benefits platform ' Zaggle Save'

Source: Exchange Filing

Praveen Achuthan Kutty MD, CEO for 3 years effective April 29

Source: Exchange filing

Deepak Chem Tech starts operations of its Benzo Triftuoride manufacturing plant in Bharuch

Deepak Chem Tech starts commercial production of speciality salts at its Sankarda plant

Source: Exchange filing

The stock has gained 18.7% in the seven-day rally.

The stock has gained 18.7% in the seven-day rally.

Resojet is a JV of co with LCGC Resolute Appliance

Source: Exchange Filing

The MoU between M&M and ATEL is aimed at creating an expansive EV charging network.

XUV 4OO customers to now have access to more than 1100 chargers on the Bluesense+ app.

Financial details of the partnership were not disclosed.

Source: Press statement

Car sales in Europe rose 10% year-on-year in February but EV sales remained flat as state-sponsored incentives go away.

New-vehicle registrations rose to 995,059 units last month, market share of electric vehicles flat

EV demand down in Germany and Sweden, among other countries

France, Germany and Italy are phasing out EV incentives

Sales of plug-in hybrid vehicles rose 12% outpacing gains for in EVs

A price war kicked off by Tesla hasn’t been enough to accelerate EV demand

Source: Bloomberg

Launches Unified Shipping API Software Platform for logistics requirements of MSMEs, large enterprises

Source: Exchange Filing

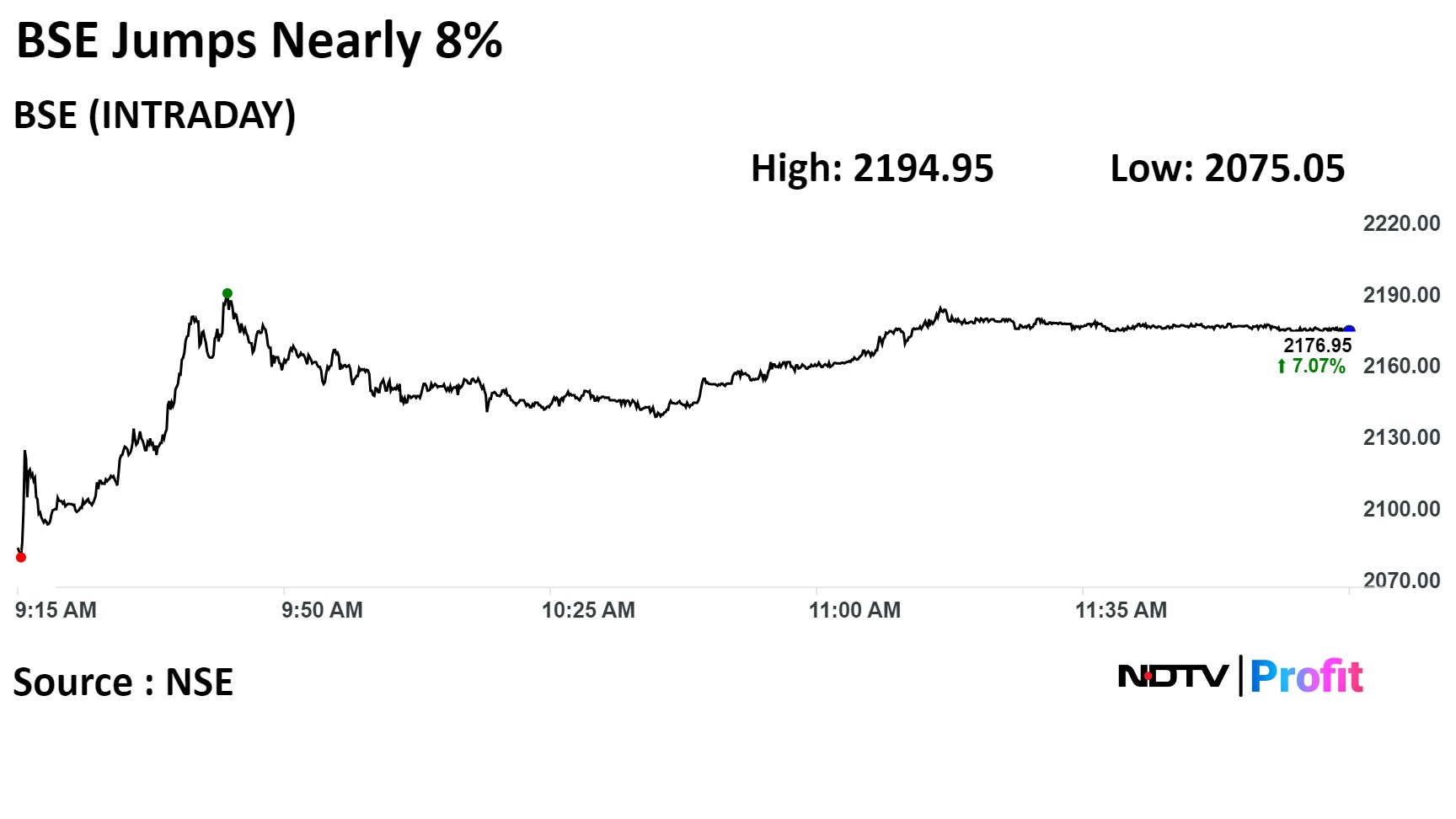

Investec upgraded the stock to 'buy', citing continuing growth in equity derivatives volumes. The oldest stock exchange in Asia saw its share in options market jump nearly threefold to over 15% in March 2024.

Investec upgraded the stock to 'buy', citing continuing growth in equity derivatives volumes. The oldest stock exchange in Asia saw its share in options market jump nearly threefold to over 15% in March 2024.

The scrip rose as much as 7.96% to Rs 2,194.95 apiece, the highest level since March 13. It pared gains to trade 7% higher at Rs 2,175 apiece, as of 12:12 p.m. This compares to a 0.7% advance in the NSE Nifty 50 Index.

It has risen 404.46% in the last twelve months. Total traded volume so far in the day stood at 1.32 times its 30-day average. The relative strength index was at 48.42.

MCX Gold hits new record high of Rs 66,943/10 gm

April futures currently up 1.7% at Rs 66,897/10 g

Cuts prices to Rs 5,800/ton from Rs 6,000/ton

Cuts fines prices to Rs 5060/ton from Rs 5,310/ton

Source: Exchange filing

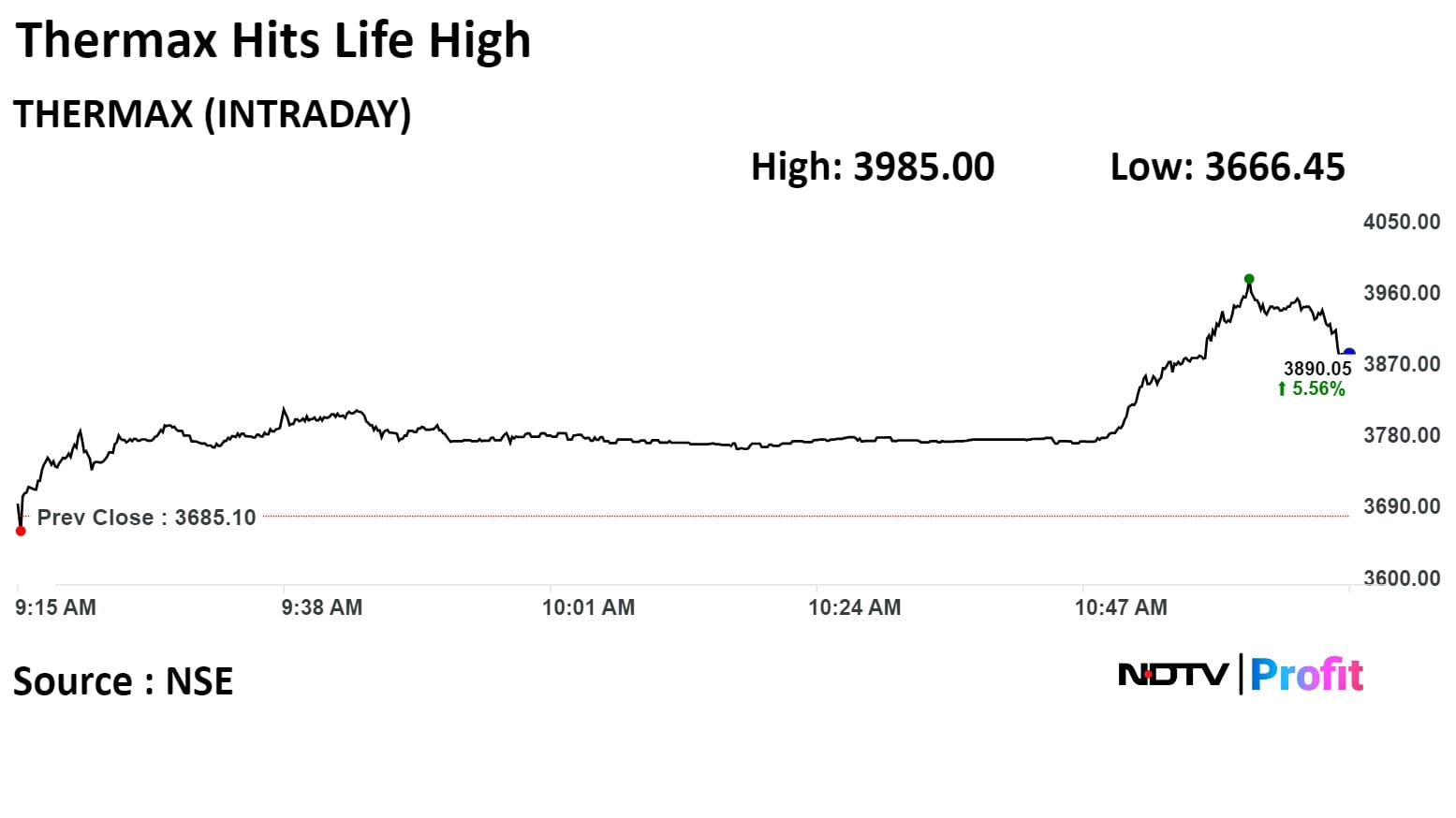

Thermax rose as much as 8.14% to Rs 3,985.00 apiece, the highest level since its listing on Aug 30, 1995. Paring gains, it was trading 5.96% higher at Rs 3,904.85 apiece, as of 11:16 a.m. This compares to a 1.08% advance in the NSE Nifty 50 Index.

It has risen 71.11% in 12 months. Total traded volume so far in the day stood at 1.8 times its 30-day average. The relative strength index was at 69.77.

Out of 25 analysts tracking the company, 10 maintain a 'buy' rating, eight recommend a 'hold,' and seven suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an downside of 16.19%.

Thermax rose as much as 8.14% to Rs 3,985.00 apiece, the highest level since its listing on Aug 30, 1995. Paring gains, it was trading 5.96% higher at Rs 3,904.85 apiece, as of 11:16 a.m. This compares to a 1.08% advance in the NSE Nifty 50 Index.

It has risen 71.11% in 12 months. Total traded volume so far in the day stood at 1.8 times its 30-day average. The relative strength index was at 69.77.

Out of 25 analysts tracking the company, 10 maintain a 'buy' rating, eight recommend a 'hold,' and seven suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an downside of 16.19%.

Gets Work Order for AI centre in Dubai

Source: Exchange Filing

Gets Work Order for AI centre in Dubai

Source: Exchange Filing

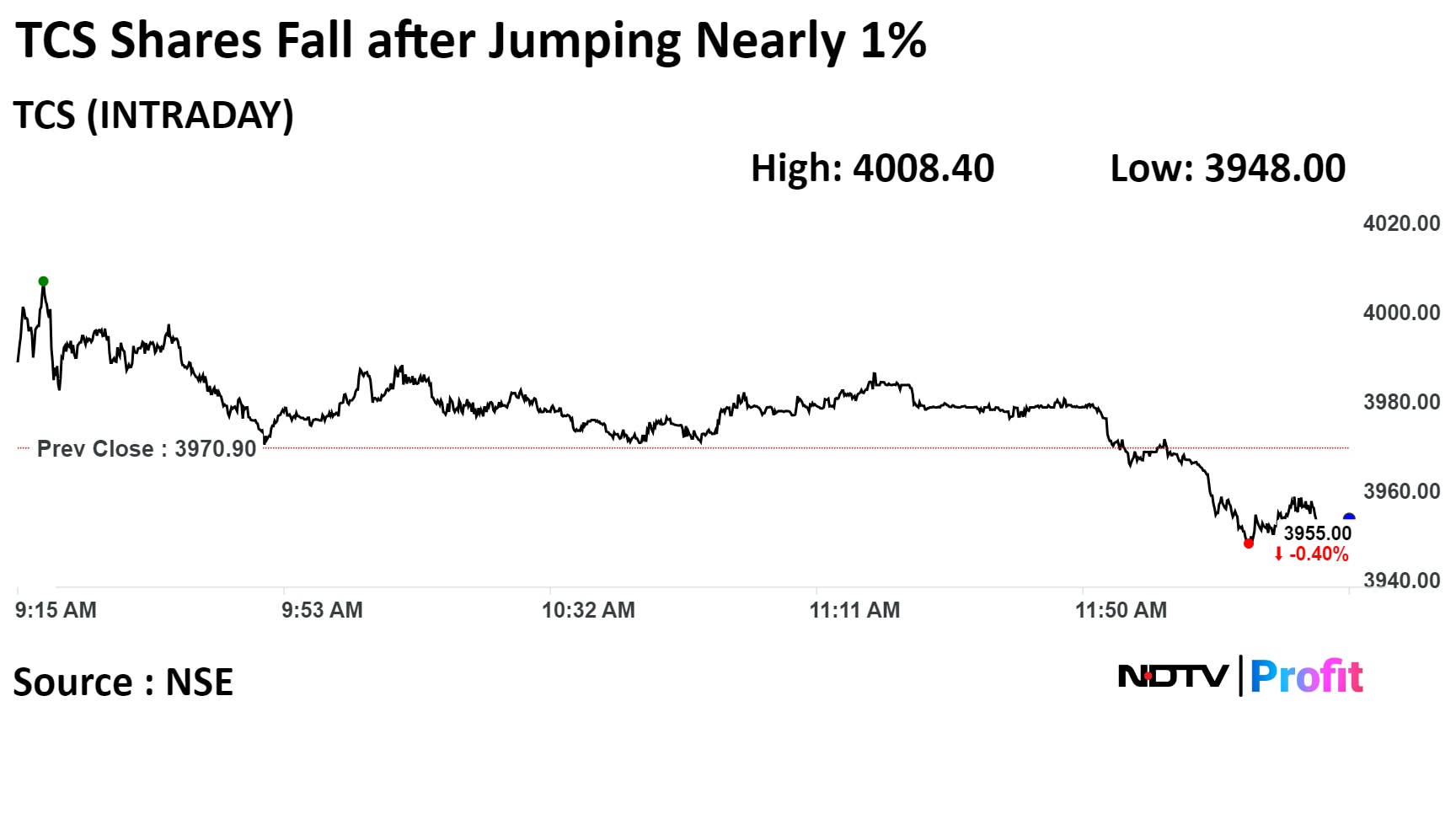

IT stocks advanced on Thursday on positive sentiment as the Federal Reserve kept its outlook for total 75 bps rate cut for this calendar year after holding rate steady at current range for fifth straight month.

Shares of IRB Infrastructure hit an intraday high of 9.8% after Kotak Institutional Equities upgraded IRB Infrastructure Developers Ltd. to 'add' from 'sell' rating, driven by adjustments to traffic estimate for the Private InvIT assets.

They were trading 8.7% higher at 10:02 a.m. at Rs 58.65 per share, compared to a 0.79% advance in the NSE Nifty 50.

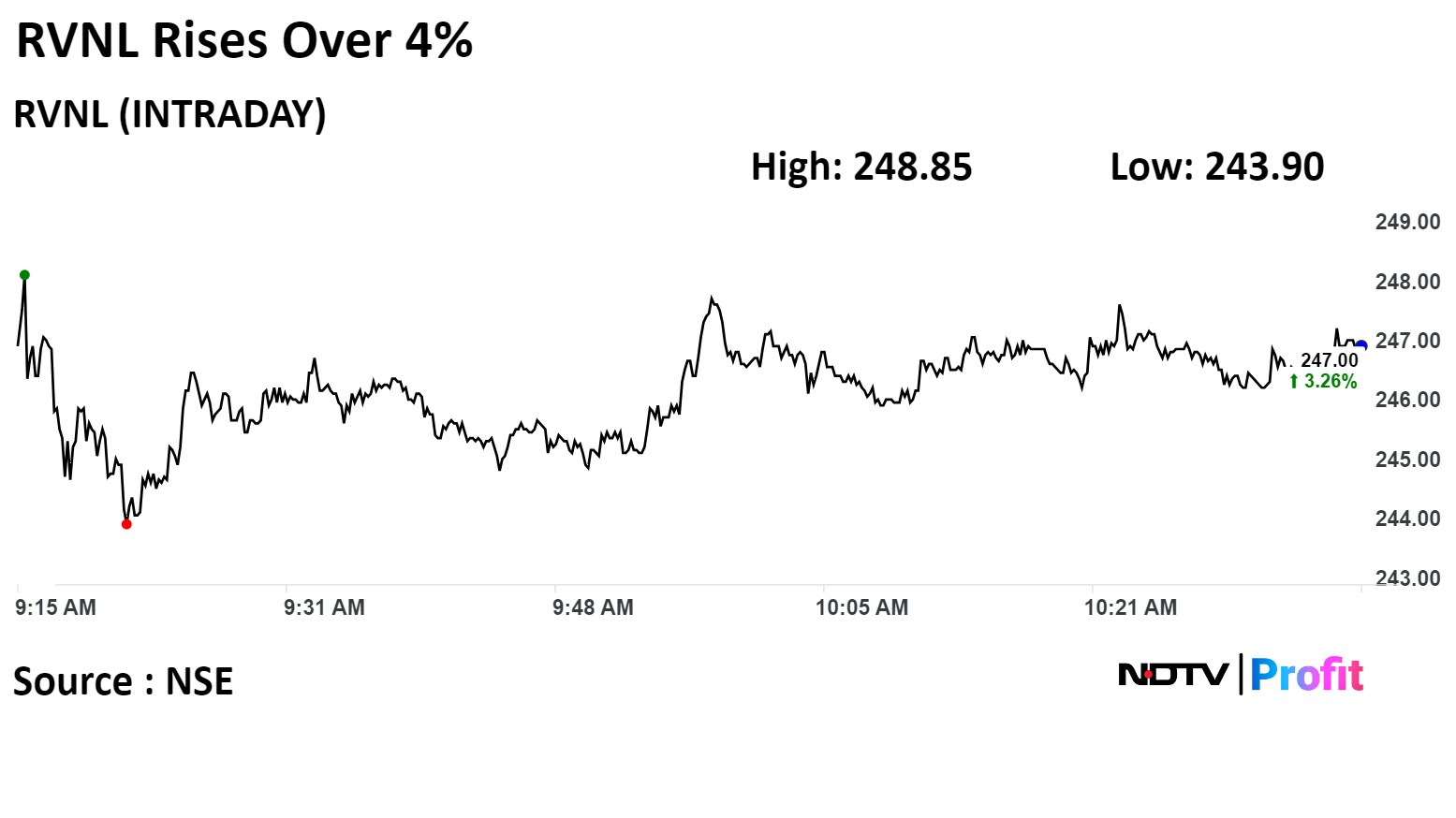

Rail Vikas Nigam Ltd. has secured a Letter of Acceptance from the Maharashtra Metro Rail Corp for designing and building elevated viaduct.

The order entails designing and budling elevated viaduct on North-South Corridor of Pune Metro Rail Project- Reach l -Extension., said the company in an exchange filing.

Rail Vikas Nigam Ltd. has secured a Letter of Acceptance from the Maharashtra Metro Rail Corp for designing and building elevated viaduct.

The order entails designing and budling elevated viaduct on North-South Corridor of Pune Metro Rail Project- Reach l -Extension., said the company in an exchange filing.

Rail Vikas Nigam Ltd. rose as much as 4.03% to Rs 248.85 apiece, the highest level since March 18. It was trading 3.05% higher at Rs 246.50 apiece, as of 10:31 a.m. This compares to a 0.98% advance in the NSE Nifty 50 Index.

It has risen 259.18% in 12 months. Total traded volume so far in the day stood at 0.39 times its 30-day average. The relative strength index was at 49.57.

Of the three analysts tracking the company, one maintains a 'buy' rating on the stock and two recommend 'hold.', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 3%

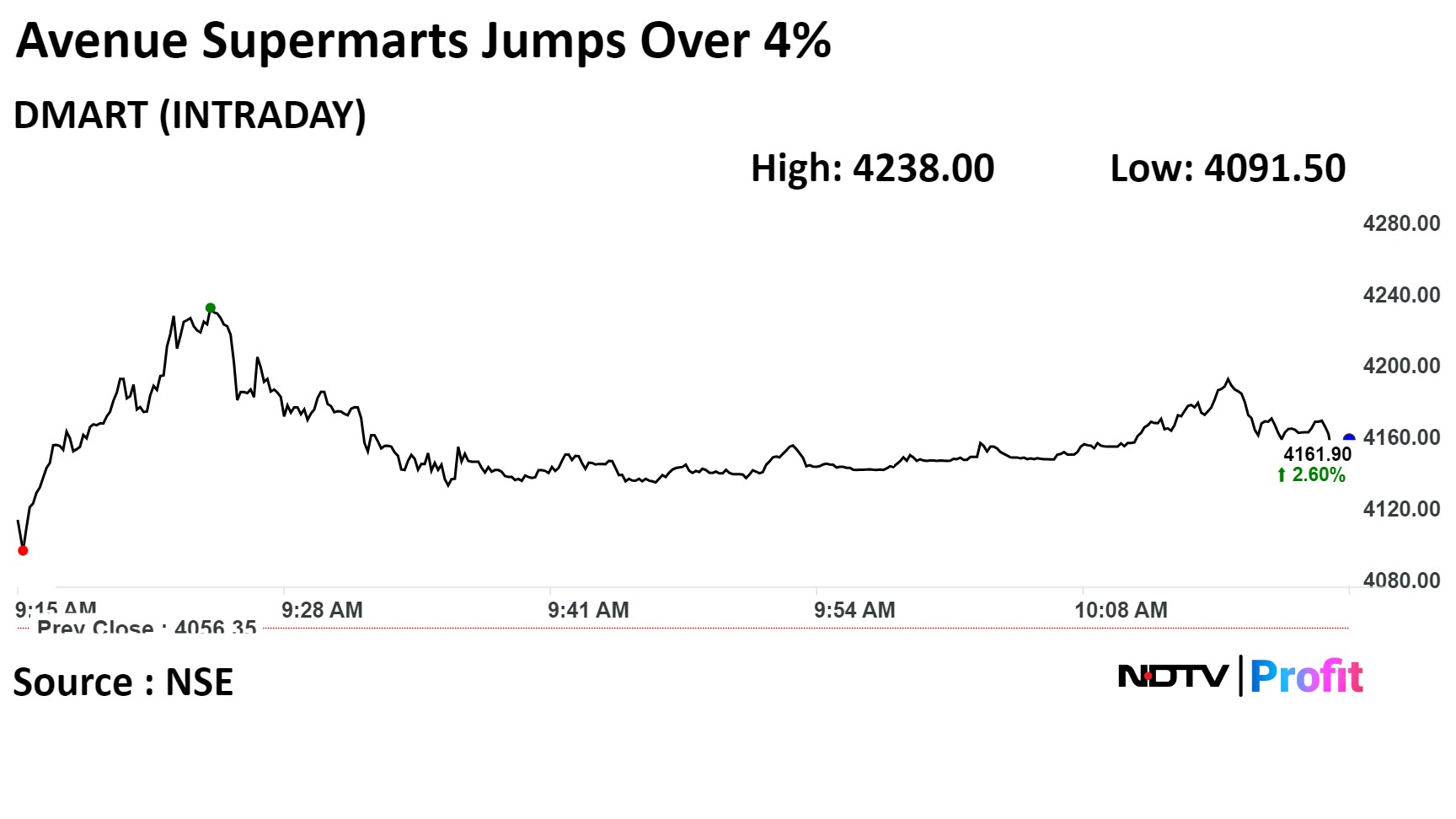

Shares of Avenue Supermart Ltd., which operates supermarket chain DMart, jumped over 4% on Thursday after CLSA India Pvt. initiated coverage on the stock with a 'buy' rating, citing an opportunity to enter in the untapped market.

Shares of Avenue Supermart Ltd., which operates supermarket chain DMart, jumped over 4% on Thursday after CLSA India Pvt. initiated coverage on the stock with a 'buy' rating, citing an opportunity to enter in the untapped market.

CLSA has the highest target price at Rs 5,107 apiece, implying a potential upside of 22.81%.

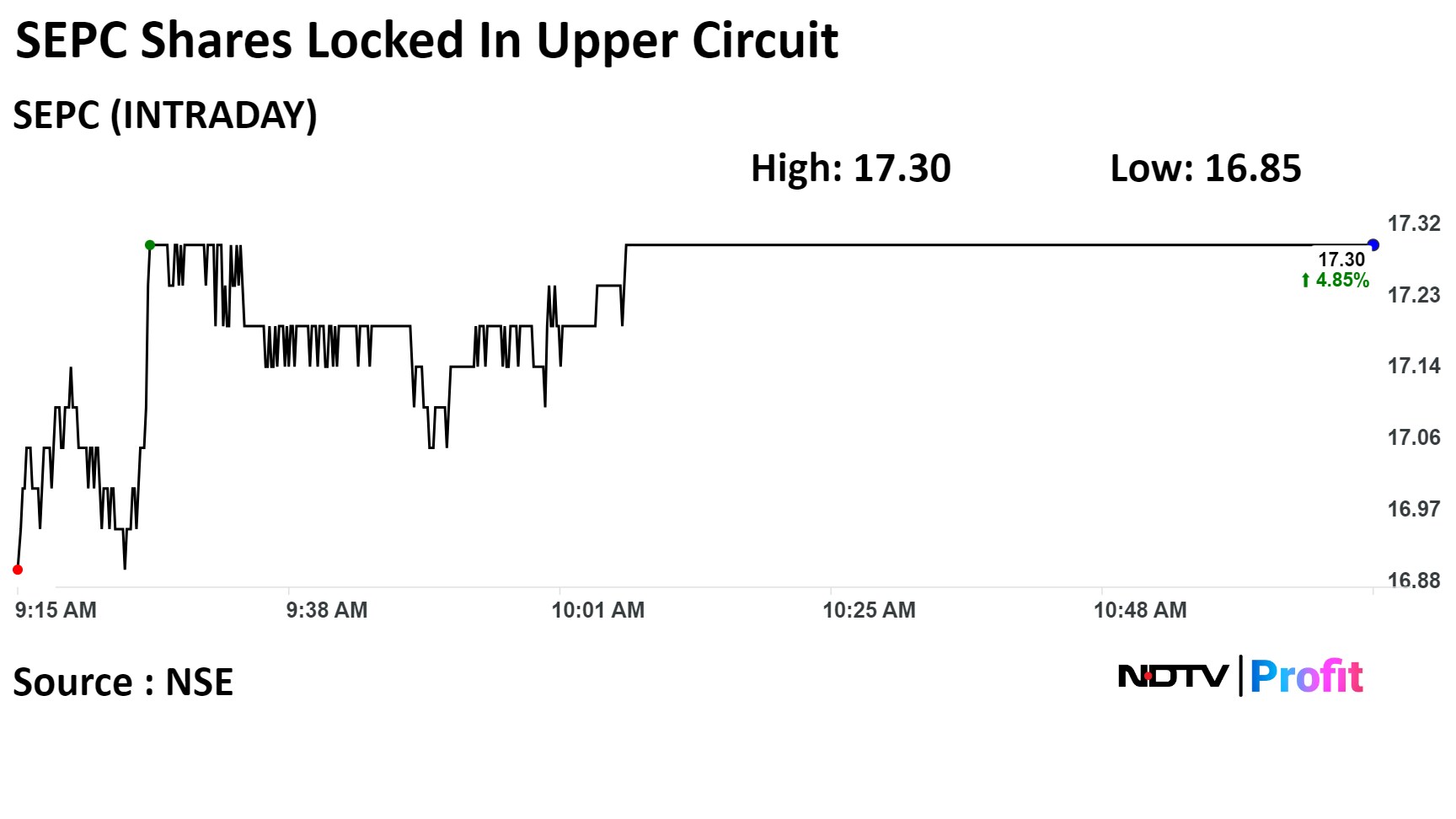

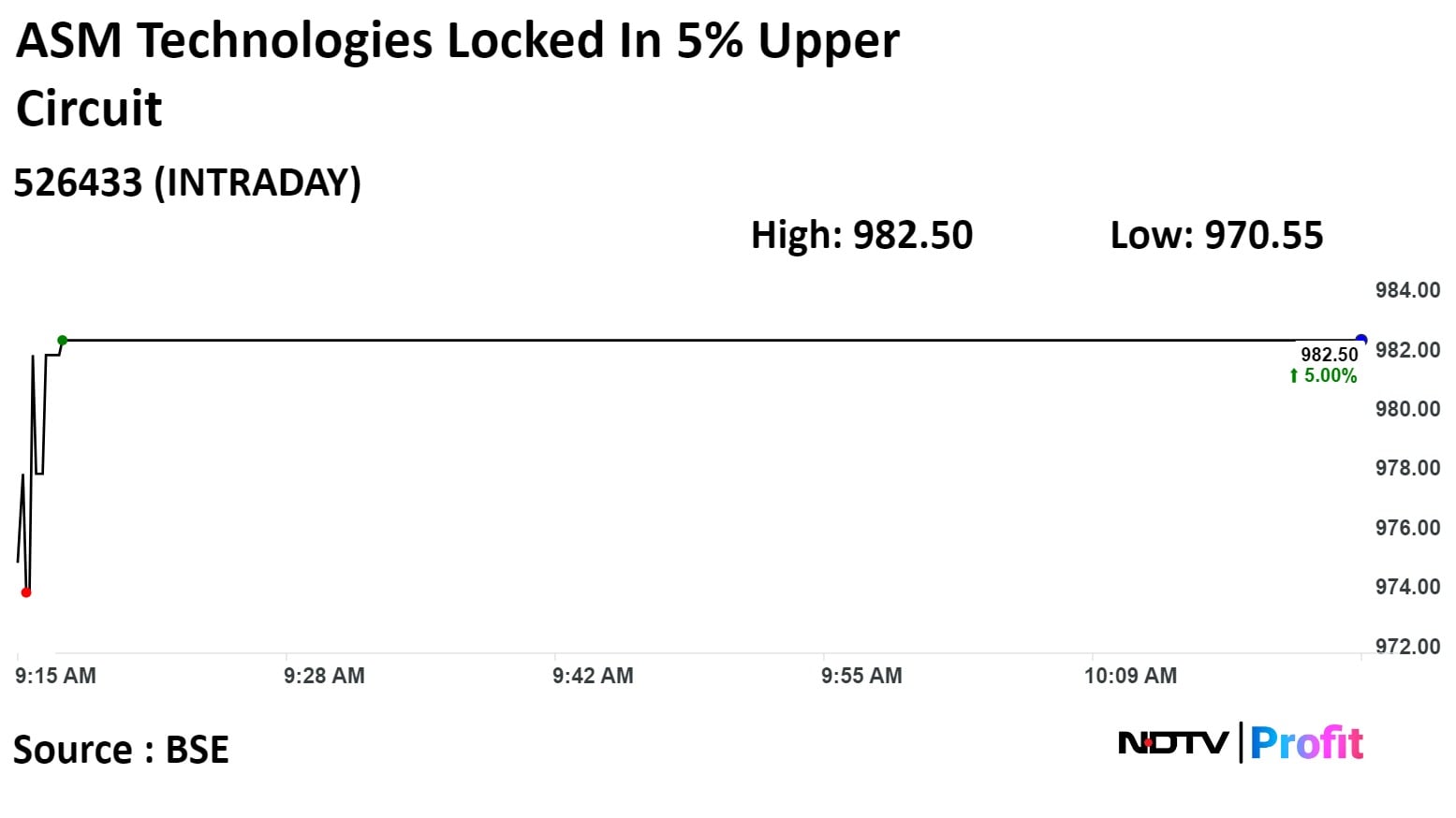

ASM Technologies Ltd. hit a 5% upper circuit on allotment of preferential shares and warrants worth Rs 170 crore. The company has already secured Rs 70 crore on Monday, and rest Rs 100 crore to be received in a period over 18 months.

The stock rose to Rs 982.50 apiece, the highest level since March 19. It remained locked in the 5% upper circuit as of 10:21 a.m. This compares to a 1.01% advance in the NSE Nifty 50 Index.

ASM Technologies Ltd. hit a 5% upper circuit on allotment of preferential shares and warrants worth Rs 170 crore. The company has already secured Rs 70 crore on Monday, and rest Rs 100 crore to be received in a period over 18 months.

The stock rose to Rs 982.50 apiece, the highest level since March 19. It remained locked in the 5% upper circuit as of 10:21 a.m. This compares to a 1.01% advance in the NSE Nifty 50 Index.

Commissions 10.6 MWp single rooftop solar In Madhya Pradesh

Source: Exchange Filing

Lists at Rs 785 on NSE vs issue price of Rs 715

Lists at Rs 795 on BSE vs issue price of Rs 715

Lists at a premium of 11.2% to the listing price on BSE

Sees TAM growing to US$2.3trn in 25 years and DMart's share rising to 5% from 1% at present

Sees DMart stores increasing over 3x by FY34 from 341 at present

Sees potential for over 7,000 Mart stores in urban India in the next 25 years

DMart's low prices have been a key competitive advantage along with consistent and efficient execution

Private labels should drive the next leg of share gains

Private labels can be a key differentiator when compared with ecommerce and quick commerce

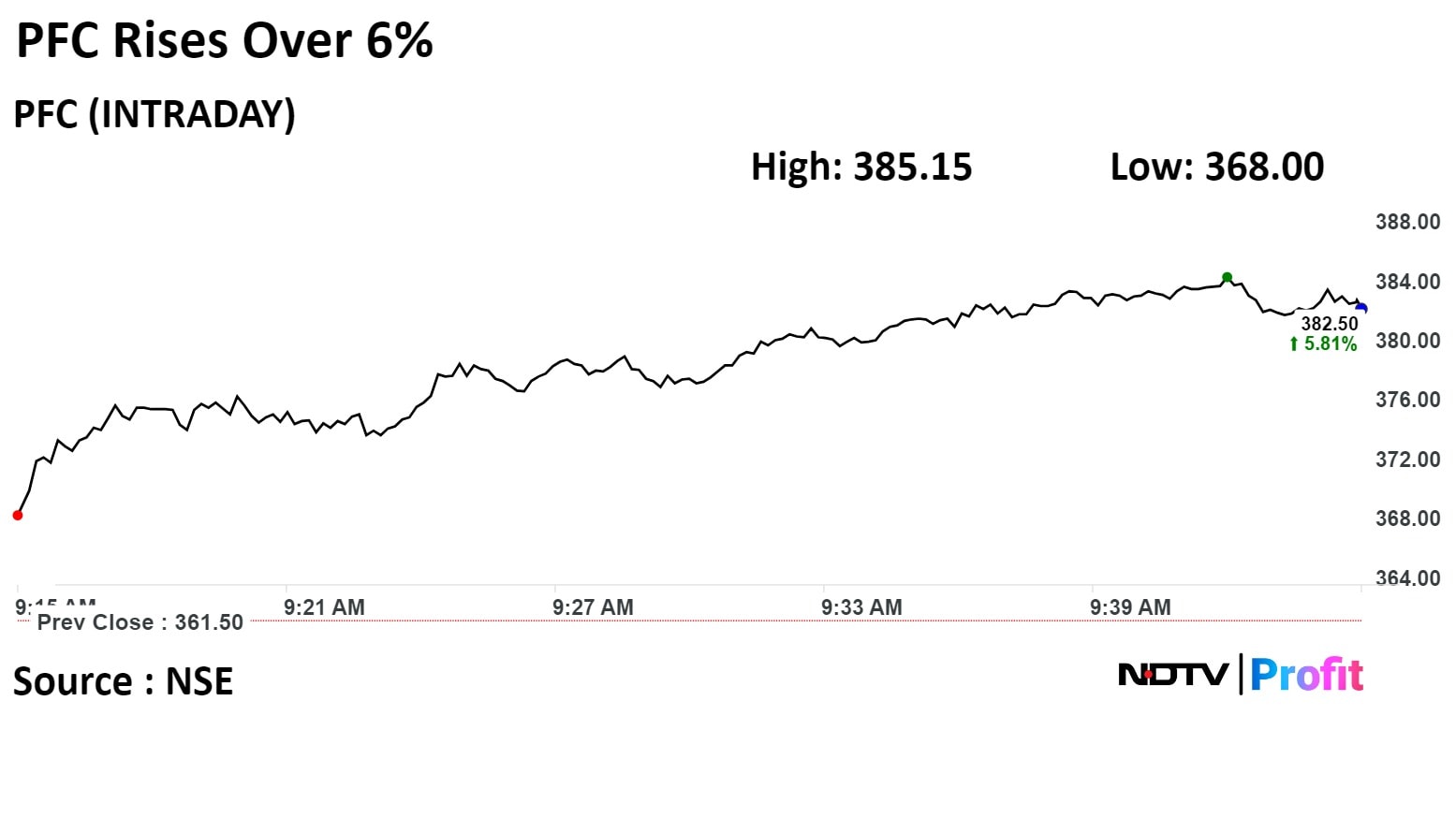

Power Finance Corp rises to the highest level in four days on NSE as it transferred Solarpur Transmission Ltd. to Torrent Power for Rs 6.54 crore.

The power finance company has concluded the sale of the special purpose vehicle on Wednesday, according to the exchange filing.

Power Finance Corp rises to the highest level in four days on NSE as it transferred Solarpur Transmission Ltd. to Torrent Power for Rs 6.54 crore.

The power finance company has concluded the sale of the special purpose vehicle on Wednesday, according to the exchange filing.

Power Finance Corp Ltd rose as much as 6.22% to Rs 384.00 apiece, the highest level since March 18. It was trading 6.09% higher at Rs 383.50 apiece, as of 09:42 a.m. This compares to a 0.76% advance in the NSE Nifty 50 Index.

It has risen 210.01% in 12 months. Total traded volume so far in the day stood at 1.7 times its 30-day average. The relative strength index was at 41.69.

Seven analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 40.8%.

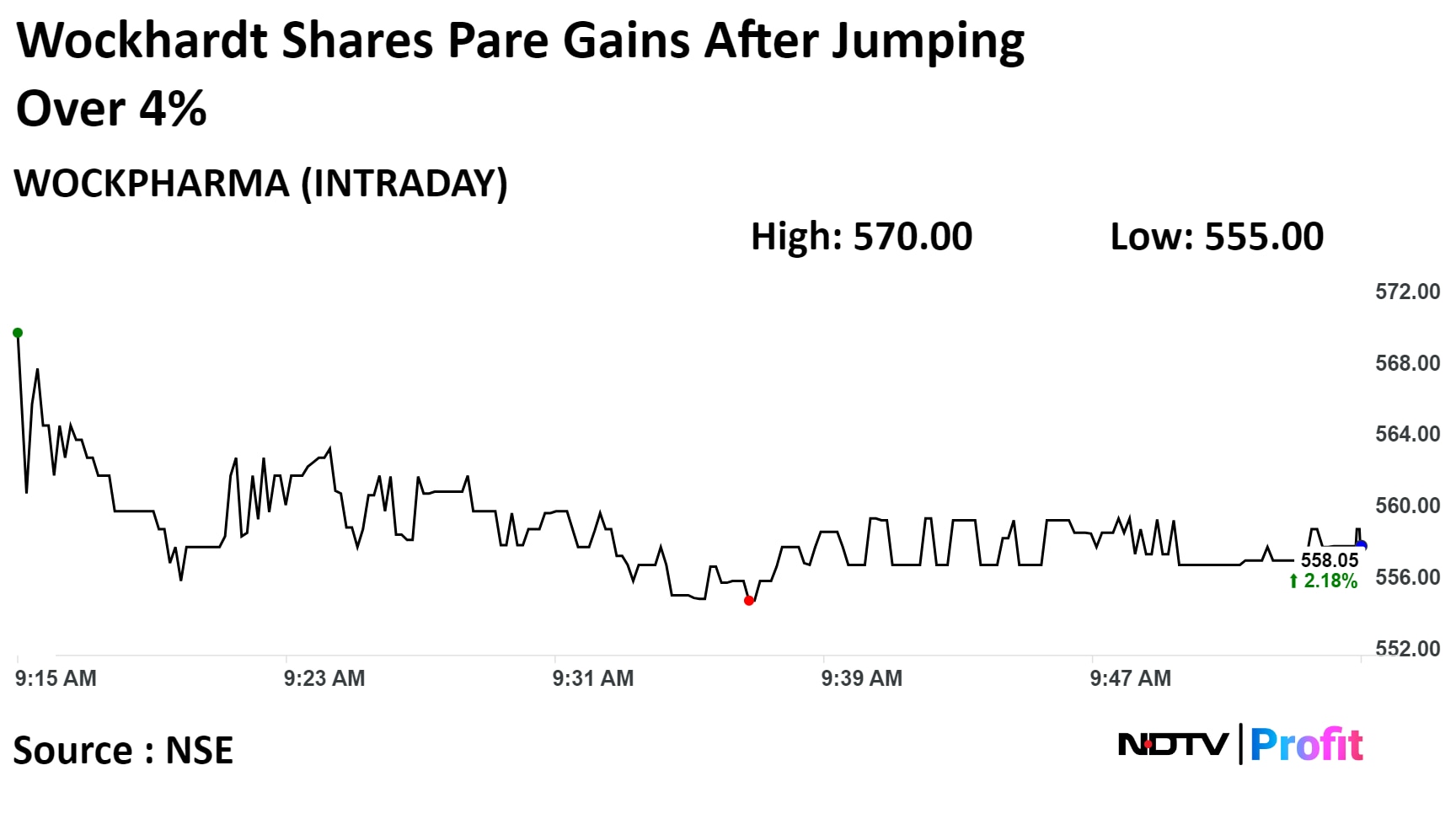

Shares of Wockhardt jumped over 4% as the company launched a QIP with a base issue of Rs 350 crore with a green shoe option of Rs 220 crore, according to the term sheet reviewed by NDTV Profit.

According to the term sheet, the issue price for the fundraise is set at Rs 517 apiece, representing a discount of 5.34% from Wednesday's closing price. The issue price also represents a discount of 4.97% from the floor price of Rs 544.02 apiece.

Another exchange filing by the company said that a meeting of the capital raising committee of the company shall be held on Tuesday consider and determine the issue price of Equity Shares to be issued pursuant to the issue, including any discount, not more than 5%, on the floor price or Rs 544.02 calculated in accordance with SEBI.

Shares of Wockhardt jumped over 4% as the company launched a QIP with a base issue of Rs 350 crore with a green shoe option of Rs 220 crore, according to the term sheet reviewed by NDTV Profit.

According to the term sheet, the issue price for the fundraise is set at Rs 517 apiece, representing a discount of 5.34% from Wednesday's closing price. The issue price also represents a discount of 4.97% from the floor price of Rs 544.02 apiece.

Another exchange filing by the company said that a meeting of the capital raising committee of the company shall be held on Tuesday consider and determine the issue price of Equity Shares to be issued pursuant to the issue, including any discount, not more than 5%, on the floor price or Rs 544.02 calculated in accordance with SEBI.

The scrip rose as much as 4.37% to Rs 570 apiece, the highest level since March 12. It pared gains to trade 2.18% higher at Rs 559 apiece, as of 9:57 a.m. This compares to a 0.75% advance in the NSE Nifty 50 Index.

It has risen 262.61% in the last twelve months. Total traded volume so far in the day stood at 0.09 times its 30-day average. The relative strength index was at 54.90.

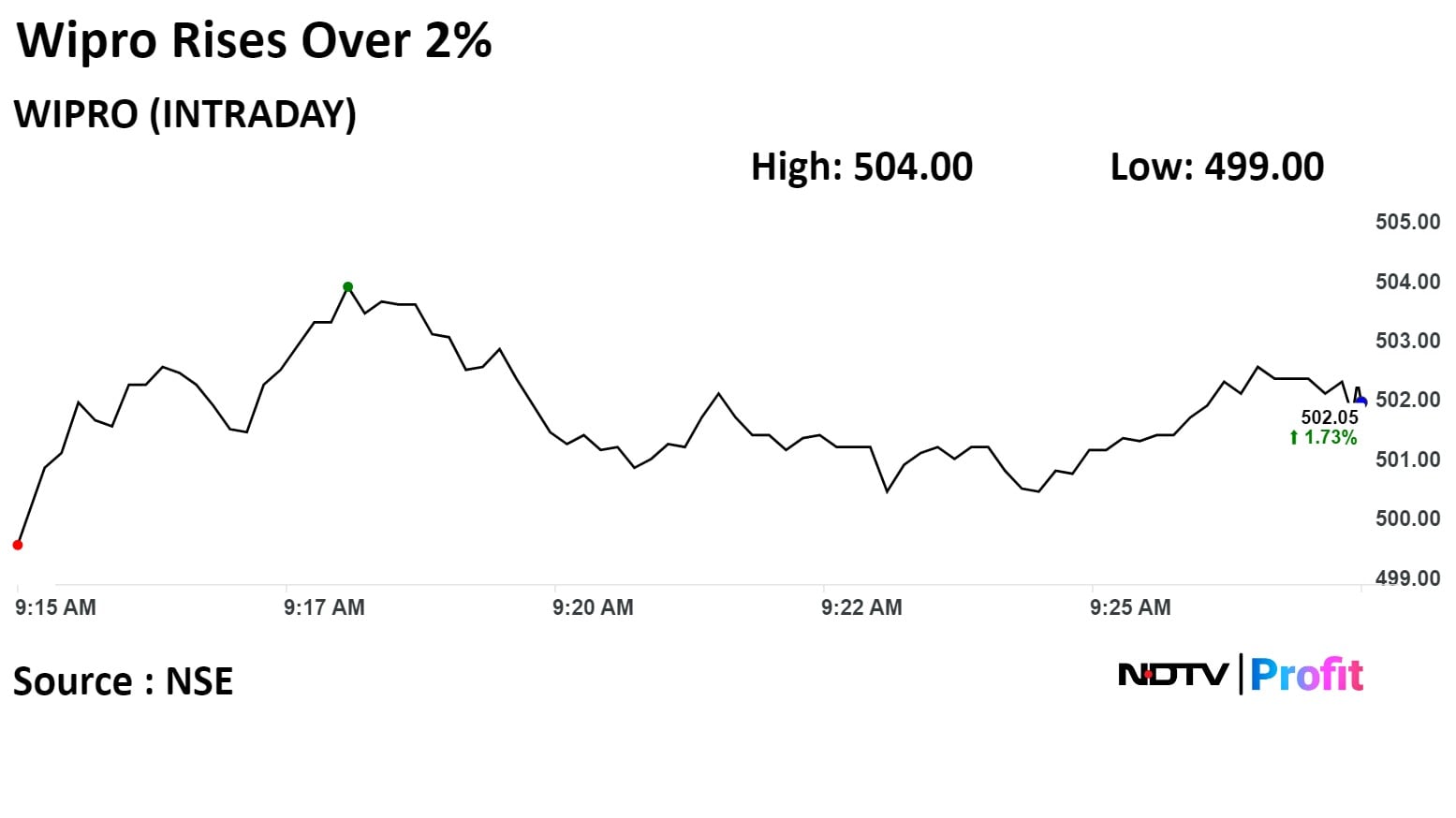

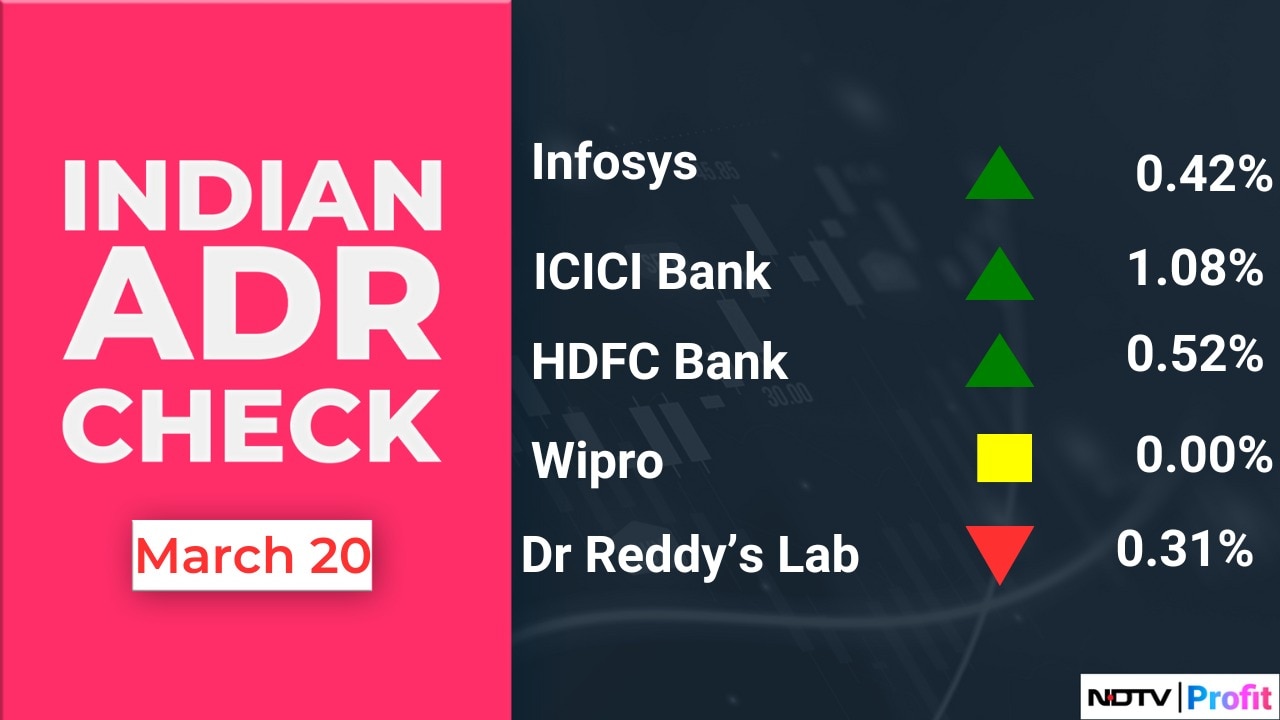

Wipro rose after it appointed Anne-Marie Rowland as the CEO of Capco with effect from April 1. She's currently serving as the managing partner to Capco, Wipro's consulting firm, in the U.K.

Wipro rose after it appointed Anne-Marie Rowland as the CEO of Capco with effect from April 1. She's currently serving as the managing partner to Capco, Wipro's consulting firm, in the U.K.

Wipro Ltd. rose as much as 2.13% to Rs 504.00 apiece, the highest level since March 19. It was trading 1.58% higher at Rs 501.30 apiece, as of 09:25 a.m. This compares to a 0.77% advance in the NSE Nifty 50 Index.

It has risen 36.82% in 12 months. Total traded volume so far in the day stood at 0.09 times its 30-day average. The relative strength index was at 46.08.

Out of 45 analysts tracking the company, nine maintain a 'buy' rating, 13 recommend a 'hold,' and 23 suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an downside of 6.6%.

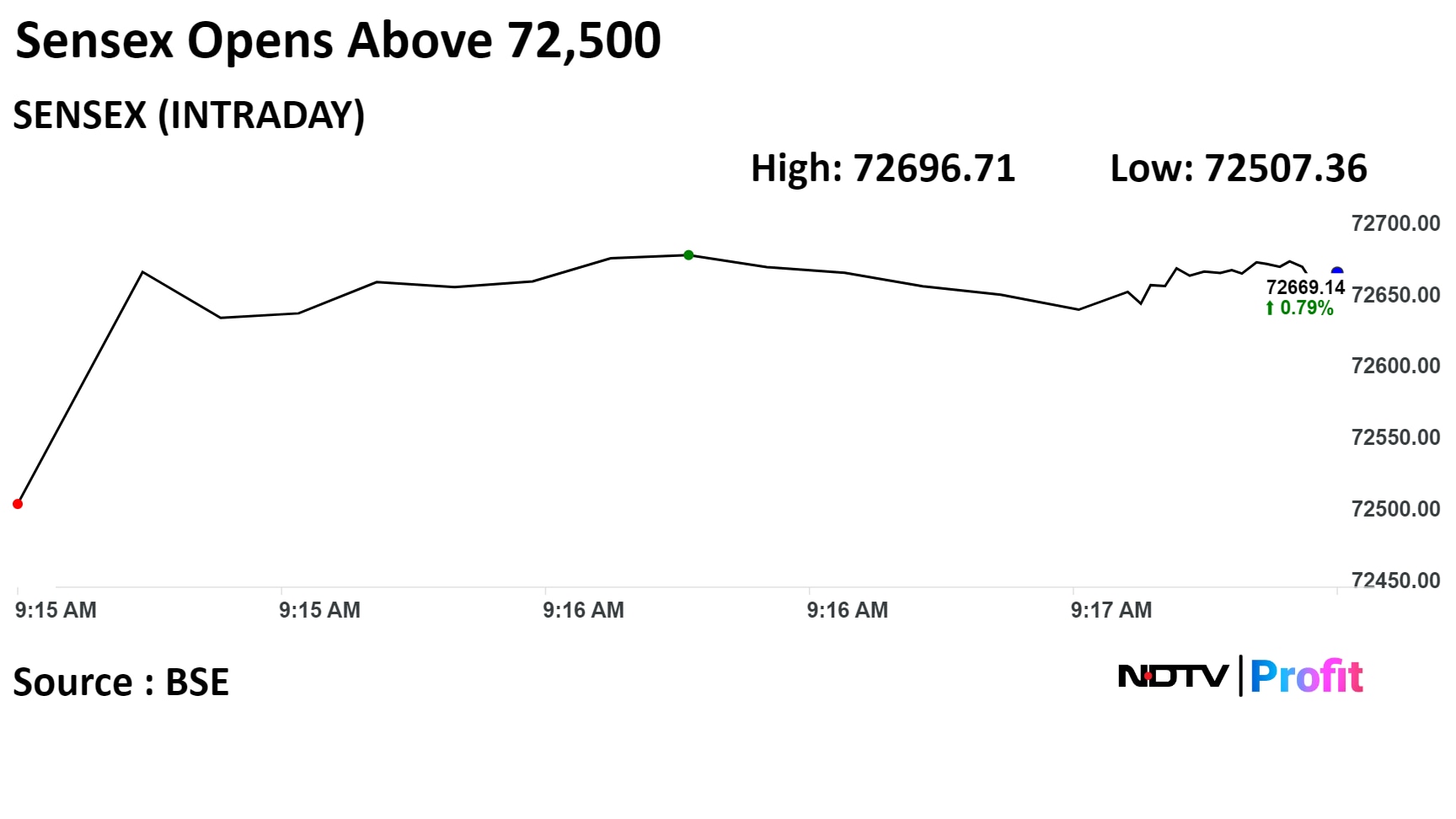

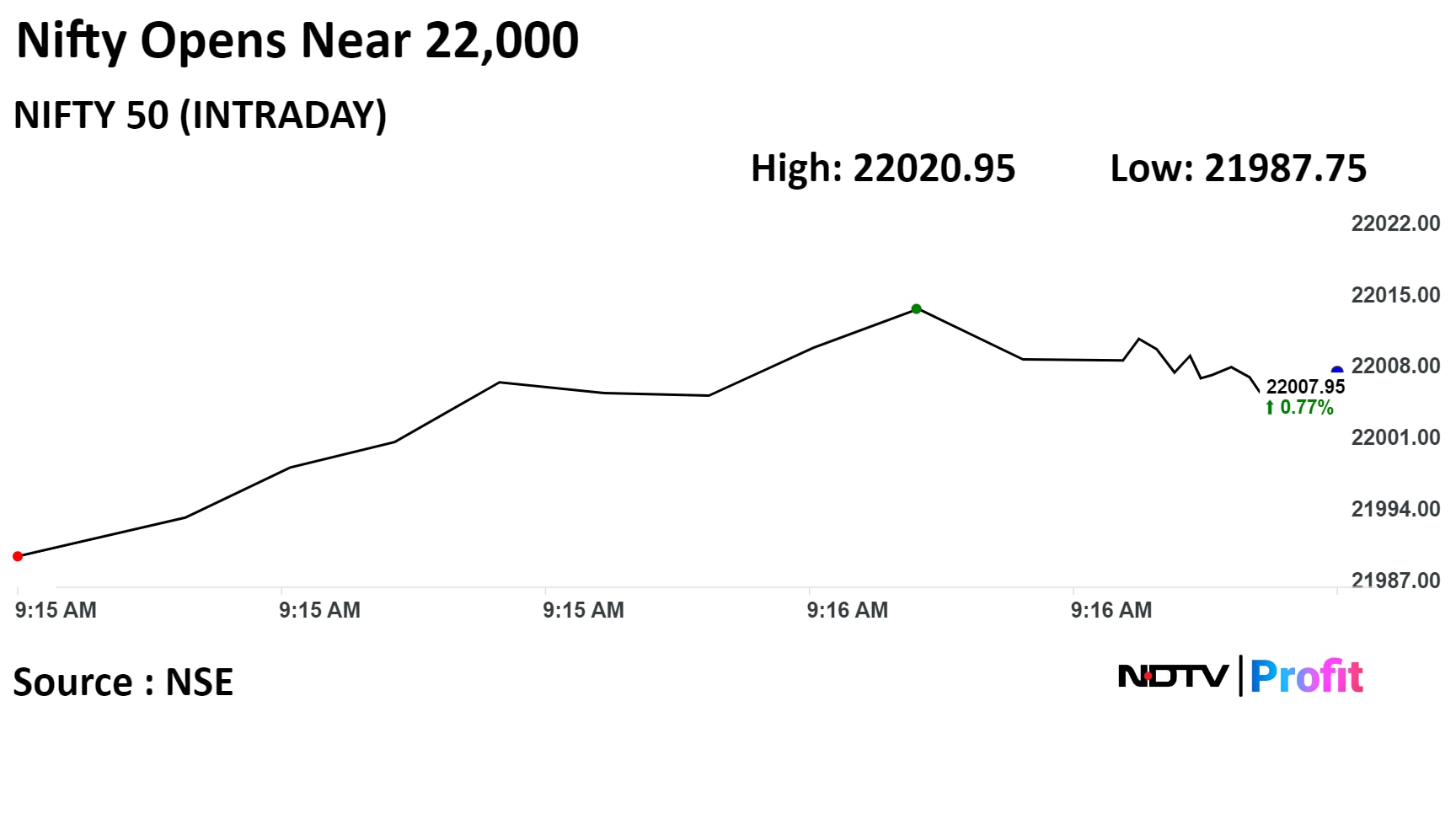

Benchmark equity indices opened higher today amid optimism in the global markets after the U.S. Fed kept interest rates unchanged in the fifth meeting.

At pre-open, the S&P BSE Sensex Index was up 393.18 points, or 0.55%, at 72,494.87 while the NSE Nifty 50 was at 21,989.90, up 150.80 points or 0.69%.

Vikas Jain, senior research analyst at Reliance Securities had expected market to open on a strong note on account of across the global market rally the Federal Reserve maintained its outlook for three quarter-point rate cuts this year 2024 despite uptick inflation.

"Moreover, the US Fed said it expects the economy to grow 2.1% in 2024, well above its prior 1.4% estimate," he said.

Shrikant Chouhan, head of equity research at Kotak Securities said, "We believe the market has started a pullback to the recent sell-off between 22525 and 21710, which could last a minimum of up to 22250."

He added that traders can hold or create long positions with a final stop loss at 21800 on a closing basis.

Benchmark equity indices opened higher today amid optimism in the global markets after the U.S. Fed kept interest rates unchanged in the fifth meeting.

At pre-open, the S&P BSE Sensex Index was up 393.18 points, or 0.55%, at 72,494.87 while the NSE Nifty 50 was at 21,989.90, up 150.80 points or 0.69%.

Vikas Jain, senior research analyst at Reliance Securities had expected market to open on a strong note on account of across the global market rally the Federal Reserve maintained its outlook for three quarter-point rate cuts this year 2024 despite uptick inflation.

"Moreover, the US Fed said it expects the economy to grow 2.1% in 2024, well above its prior 1.4% estimate," he said.

Shrikant Chouhan, head of equity research at Kotak Securities said, "We believe the market has started a pullback to the recent sell-off between 22525 and 21710, which could last a minimum of up to 22250."

He added that traders can hold or create long positions with a final stop loss at 21800 on a closing basis.

Benchmark equity indices opened higher today amid optimism in the global markets after the U.S. Fed kept interest rates unchanged in the fifth meeting.

At pre-open, the S&P BSE Sensex Index was up 393.18 points, or 0.55%, at 72,494.87 while the NSE Nifty 50 was at 21,989.90, up 150.80 points or 0.69%.

Vikas Jain, senior research analyst at Reliance Securities had expected market to open on a strong note on account of across the global market rally the Federal Reserve maintained its outlook for three quarter-point rate cuts this year 2024 despite uptick inflation.

"Moreover, the US Fed said it expects the economy to grow 2.1% in 2024, well above its prior 1.4% estimate," he said.

Shrikant Chouhan, head of equity research at Kotak Securities said, "We believe the market has started a pullback to the recent sell-off between 22525 and 21710, which could last a minimum of up to 22250."

He added that traders can hold or create long positions with a final stop loss at 21800 on a closing basis.

Benchmark equity indices opened higher today amid optimism in the global markets after the U.S. Fed kept interest rates unchanged in the fifth meeting.

At pre-open, the S&P BSE Sensex Index was up 393.18 points, or 0.55%, at 72,494.87 while the NSE Nifty 50 was at 21,989.90, up 150.80 points or 0.69%.

Vikas Jain, senior research analyst at Reliance Securities had expected market to open on a strong note on account of across the global market rally the Federal Reserve maintained its outlook for three quarter-point rate cuts this year 2024 despite uptick inflation.

"Moreover, the US Fed said it expects the economy to grow 2.1% in 2024, well above its prior 1.4% estimate," he said.

Shrikant Chouhan, head of equity research at Kotak Securities said, "We believe the market has started a pullback to the recent sell-off between 22525 and 21710, which could last a minimum of up to 22250."

He added that traders can hold or create long positions with a final stop loss at 21800 on a closing basis.

Benchmark equity indices opened higher today amid optimism in the global markets after the U.S. Fed kept interest rates unchanged in the fifth meeting.

At pre-open, the S&P BSE Sensex Index was up 393.18 points, or 0.55%, at 72,494.87 while the NSE Nifty 50 was at 21,989.90, up 150.80 points or 0.69%.

Vikas Jain, senior research analyst at Reliance Securities had expected market to open on a strong note on account of across the global market rally the Federal Reserve maintained its outlook for three quarter-point rate cuts this year 2024 despite uptick inflation.

"Moreover, the US Fed said it expects the economy to grow 2.1% in 2024, well above its prior 1.4% estimate," he said.

Shrikant Chouhan, head of equity research at Kotak Securities said, "We believe the market has started a pullback to the recent sell-off between 22525 and 21710, which could last a minimum of up to 22250."

He added that traders can hold or create long positions with a final stop loss at 21800 on a closing basis.

Benchmark equity indices opened higher today amid optimism in the global markets after the U.S. Fed kept interest rates unchanged in the fifth meeting.

At pre-open, the S&P BSE Sensex Index was up 393.18 points, or 0.55%, at 72,494.87 while the NSE Nifty 50 was at 21,989.90, up 150.80 points or 0.69%.

Vikas Jain, senior research analyst at Reliance Securities had expected market to open on a strong note on account of across the global market rally the Federal Reserve maintained its outlook for three quarter-point rate cuts this year 2024 despite uptick inflation.

"Moreover, the US Fed said it expects the economy to grow 2.1% in 2024, well above its prior 1.4% estimate," he said.

Shrikant Chouhan, head of equity research at Kotak Securities said, "We believe the market has started a pullback to the recent sell-off between 22525 and 21710, which could last a minimum of up to 22250."

He added that traders can hold or create long positions with a final stop loss at 21800 on a closing basis.

Benchmark equity indices opened higher today amid optimism in the global markets after the U.S. Fed kept interest rates unchanged in the fifth meeting.

At pre-open, the S&P BSE Sensex Index was up 393.18 points, or 0.55%, at 72,494.87 while the NSE Nifty 50 was at 21,989.90, up 150.80 points or 0.69%.

Vikas Jain, senior research analyst at Reliance Securities had expected market to open on a strong note on account of across the global market rally the Federal Reserve maintained its outlook for three quarter-point rate cuts this year 2024 despite uptick inflation.

"Moreover, the US Fed said it expects the economy to grow 2.1% in 2024, well above its prior 1.4% estimate," he said.

Shrikant Chouhan, head of equity research at Kotak Securities said, "We believe the market has started a pullback to the recent sell-off between 22525 and 21710, which could last a minimum of up to 22250."

He added that traders can hold or create long positions with a final stop loss at 21800 on a closing basis.

Benchmark equity indices opened higher today amid optimism in the global markets after the U.S. Fed kept interest rates unchanged in the fifth meeting.

At pre-open, the S&P BSE Sensex Index was up 393.18 points, or 0.55%, at 72,494.87 while the NSE Nifty 50 was at 21,989.90, up 150.80 points or 0.69%.

Vikas Jain, senior research analyst at Reliance Securities had expected market to open on a strong note on account of across the global market rally the Federal Reserve maintained its outlook for three quarter-point rate cuts this year 2024 despite uptick inflation.

"Moreover, the US Fed said it expects the economy to grow 2.1% in 2024, well above its prior 1.4% estimate," he said.

Shrikant Chouhan, head of equity research at Kotak Securities said, "We believe the market has started a pullback to the recent sell-off between 22525 and 21710, which could last a minimum of up to 22250."

He added that traders can hold or create long positions with a final stop loss at 21800 on a closing basis.

Shares of HDFC Bank Ltd., Infosys Ltd., ICICI Bank Ltd., Reliance Industries Ltd., and HCL Technologies Ltd. contributed the most to the gains.

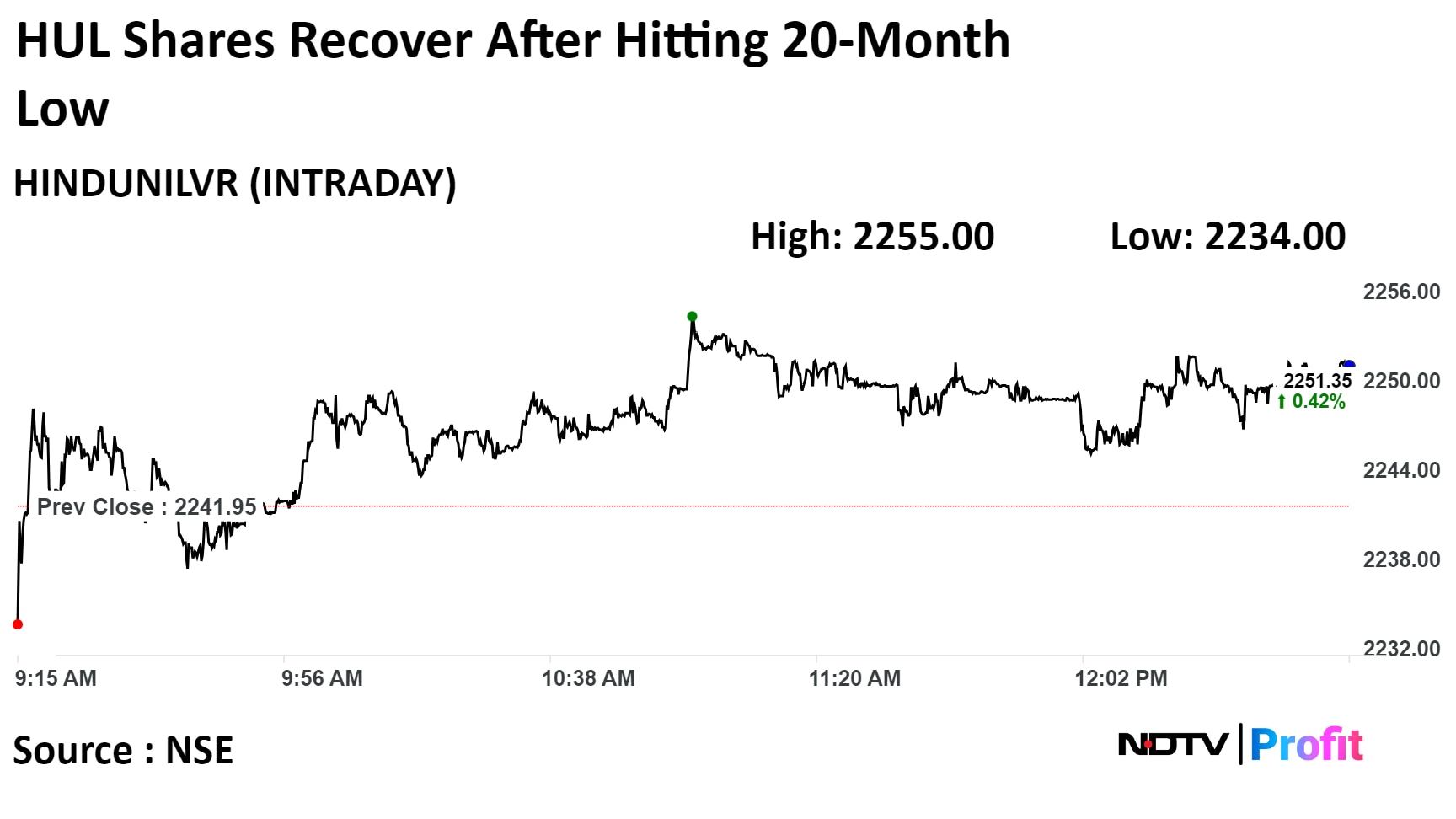

Meanwhile, shares of Britannia Industries Ltd., Hindustan Unilever Ltd., Dr Reddy's Laboratories Ltd., and Nestle India Ltd. weighed on them.

All sectoral indices gained with seven of them gaining over 1%.

Broader markets outperformed. The S&P BSE Midcap index was 1.44% higher, and the S&P BSE Smallcap was 1.53% higher. On BSE, all 20 sectoral indices rose.

Market breadth was skewed in favour of buyers. Around 2,409 stocks declined, 409 stocks rose, and 93 stocks remained unchanged on BSE

Shareholders have raised $7.1 billion selling their holdings in India so far this year, with the quarter on track to have raised the most from block trades since the January to March period in 2010, data compiled by Bloomberg show.

This week, Tata Sons Ltd. raised the equivalent of $1.1 billion through the sale of shares in the group’s software services unit Tata Consultancy Services Ltd.

British American Tobacco Plc last week raised almost 175 billion rupees from the sale of a 3.5% stake in its Indian partner ITC Ltd. for Asia’s largest block trade of 2024.

Click here to find out more.

At pre-open, the S&P BSE Sensex Index was up 393.18 points, or 0.55%, at 72,494.87 while the NSE Nifty 50 was at 21,989.90, up 150.80 points or 0.69%.

The yield on the 10-year bond opened 2 bps lower at 7.07%.

It closed at 7.09% on Wednesday.

Source: Bloomberg

The local currency strengthened by 9 paise to open at 83.08 against the U.S. Dollar.

It closed at 83.17 a dollar on Wednesday.

Source: Bloomberg

Price target of Rs 65 vs Rs 60

Upgrade driven through adjustments to traffic estimate for Private InvIT assets

Road sector awarding shifted to TOT and BOT projects to manage debt levels

Sees IRB benefiting from Rs 444 bn BOT pipeline by NHAI for FY2024

Sees IRB garnering healthy market share with its strong balance sheet

Estimates revised by 1% to 7% for FY2024-26

Brightline Trains to use co's AirGain product for rail & airline pricing intelligence in US rail market

Source: Exchange filing

Motilal Oswal Maintains BUY on Reliance Industries at Rs 3210 target

MNRE's hydrogen hubs initiative in line with RIL's Giga-scale electrolyzer manufacturing facility

RIL outlines green hydrogen production at less than $1/kg

Expects Q4FY24 O2C earnings to remain robust

Solar PV giga factory , battery pack production expected to start in Fy25

Expects energy costs for standalone entity to dip 30-40% inmedium term

Builds 5%/4% CAGR for subs/ARPU for telecome business over FY24-26

Expect 29% CAGR Ebitda over FY24-26 for retail

Continues to witness strong traction in equity derivatives volumes

Option market-share jumped 3 times QoQ from 4.2% to 15%+ in Mar’24

Expect clarity on margins and profitability, expect improved margin profile in Q4'24e

Recent correction a good time to Buy

Trades at ~24x FY26e P/E (ex SOTP) with potential for 40-45% EPS CAGR FY24-26E

Target price: 2000

Diversified franchise set to capitalize on a multi-decade wealth creation story

Consistent compounding track-record overlooked in the ‘cyclicality’ noise

Creditable track record of compounding despite distributions and without capital raise

Enough safety margin in valuation; initiate with a BUY recommendation

Expect FY23-26E operating PAT CAGR of 25%

Permanently revokes closure order of Sarigam plant

Source: Exchange filing

Target price: 9040

Largest NBFC with retail/MSME product, focussed on mass affluent

Uniquely successful cross-sell/upsell model

Long runway, no speed bumps in sight

Ingredients, not recipe, key to secret sauce

Valuations reflect a structural growth story

Multiple of 4.4 times FY25E PBV attractive given accelerated compounding

Raise target of Rs 1540 from Rs 1515 earlier; Maintains 'buy'

Margin impact from price cut cushioned by falling feedstock costs

HPHT gas prices expected to fall 10% from current levels

Expect FY25 margins to be at upper end of management guidance of Rs 10-12/scm

Expected subdued spot LNG market in near term to help protect margins

Acquisition of Unison Enviro to help volume growth

EV penetration risk low in MMR due to absent policy support

Risk reward has turned favourable with 20% correction

Japan & India are in strong secular bull markets which we expect to continue

China in secular bear market, Continue to hold Semiconductor stocks in Korea & Taiwan

India's decade: Multipolar world trends are supporting FDI and portfolio flows

Secular trend toward sustained superior USD EPS growth versus EM over the cycle

Valuations being at premium warranted due to superior EPS CAGR

Was targeted by ransomware attack on March 17

Incident has not impacted any core systems and operations

Source: Exchange filing

• Maintain Sell

• Iron ore price cut is imminent as current domestic prices are >25% (Rs1,000/t) premium to export parity

• There is limited support from domestic steel price trends

• Every Rs100/t change in fines prices impacts EBITDA by ~4% and fair value by Rs8/sh

• Iron ore is likely to be volatile and sees the selloff as having room to run further

• Expect 0-3m price at $120/t. Medium term

• Iron ore market could post a small surplus in 2024

• Large part of the supply and demand dynamics is dependent on China’s steel outlook

Maintains downside catalyst watch on stock

Rising competition from HPCL, GSPC, Gail to weigh in on stock

Asian spot LNG prices up 18% to $9.9/mmbtu in past month

Citi also maintains bullish gas price view

Rise in ONGC’s gas production in next few months to limit upside in LNG imports

Maintains neutral rating; reduces target price to Rs 622 (earlier Rs 790)

Management envisages AUM growth at CAGR of around 25%

Deposit (with focus on retail deposits) growth of 23-25% till FY27

Unsecured assets would constitute around 15-20% of the book

Asset quality is likely to remain rangebound, PCR at 65-70%

No additional branch expansion is planned for FY25

80-100 branches will be added over FY26-27

No major investments are envisaged till FY27

U.S. Dollar Index at 103.2

U.S. 10-year bond yield at 4.26%

Brent crude up 0.45% at $86.34 per barrel

Nymex crude down 2.14% at $81.68 per barrel

GIFT Nifty was up 34.5 points or 0.16% at 22,075.50 as of 7:21 a.m.

Bitcoin was up 1% at $67,749.63

U.S. Dollar Index at 103.2

U.S. 10-year bond yield at 4.26%

Brent crude up 0.45% at $86.34 per barrel

Nymex crude down 2.14% at $81.68 per barrel

GIFT Nifty was up 34.5 points or 0.16% at 22,075.50 as of 7:21 a.m.

Bitcoin was up 1% at $67,749.63

Sentiment dampened by cut in petrol, diesel price, upmove of crude, profit taking in PSUs

Price cut likely temporary, provides attractive entry point in medium term

Positive view on margins but watchful of downside risks from geopolitics

OMC order of preference: BPCL, IOCL, HPCL

MOSL reiterates 'buy' on Gland Pharma; TP: Rs 2,240 apiece

Encouraging revival in nine months of FY24 after weak FY23

New launches and revival in key markets to spur growth

Expanded CDMO offering in European markets through Cenexi acquisition

Expect Co to clock 20% earnings CAGR

Value Gland at 27 times 12 months forward earnings

Nifty March futures up by 0.15% to 21,910.05 at a premium of 70.95 points.

Nifty March futures open interest down by 1.8%.

Nifty Bank March futures up by 0.03% to 46,449.05 at a premium of 138.15 points.

Nifty Bank March futures open interest up by 0.5%.

Nifty Options March 21 Expiry: Maximum Call open interest at 22,000 and Maximum Put open interest at 21,500.

Bank Nifty Options March 27 Expiry: Maximum Call Open Interest at 46,500 and Maximum Put open interest at 44,000.

Securities in ban period: Balrampur Chini Mills, Biocon, Hindustan Copper, Indus Tower, Piramal Enterprise, RBL Bank, Tata Chemicals, and Zee Entertainment Enterprise.

Price band revised from 10% to 5%: Sindhu Trade Links.

Ex/record dividend: Castrol India.

Ex/record rights issue: Jyoti Structures.

Moved out into short-term ASM framework: Saurashtra Cement.

Moved out short-term ASM framework: JTL Industries, Saurashtra Cement.

Krystal Integrated Services: The company's shares will debut on the stock exchanges on Thursday at an issue price of Rs 715 apiece. The Rs 300.13 crore IPO was subscribed 13.21 times on its third and final day. Bids were led by institutional investors (7.33 times), retail investors (3.32 times), and non-institutional investors (43.91 times).

National Highways Infra Trust: Larsen & Toubro bought 1.20 crore units at Rs 124.71 per unit.

Wockhardt: The company launched a QIP with a floor price of Rs 544.02 per share.

Wipro: The company appointed Anne-Marie Rowland as CEO of Capco effective April 1.

Torrent Power: The company signed a share purchase agreement with Solapur Transmission for the acquisition of a 100% stake to establish a transmission system for the evacuation of power from renewable energy projects in Maharashtra.

TVS Motor: The company approved the issue of cumulative non-convertible redeemable preference shares up to Rs 1,900 crore via bonus. It appointed Vijay Sankar and Shailesh Haribhakt as independent directors, effective March 20 and April 1, respectively.

Power Finance Corp.: The company transferred unit Solapur Transmission to Torrent Power for Rs 7 crore.

Rail Vikas Nigam: The company emerged as the lowest bidder for a railway project worth Rs 167 crore for Southeastern Railway.

JSW Infrastructure: The company achieved a significant milestone as total cargo handled on a consolidated basis crossed 100 MMT.

Jupiter Wagons: The company acquired Bonatrans India for Rs 271 crore, becoming the first Indian rolling stock manufacturer with its own wheel plant.

Prince Pipes and Fittings: The company signed an agreement with Klaus Waren Fixtures and NM Shah for the purchase of the 'Aquel' brand and other assets worth Rs 55 crore to set up an in-house manufacturing facility, resulting in building greater value in the bathware segment.

Kansai Nerolac Paints: The company opened a sales depot in Kannur, Kerala.

Aeroflex Industries: The company has increased its installed capacity to 13.5 million metres p.a. in phase 1 expansion and will increase to 16.5 million metres in phase 2 expansion with an investment of Rs 39 crore.

Himadri Specialty Chemical: The company acquired a 40% stake in Invati Creations for Rs 45.16 crore.

GE Power: The company received a purchase order worth Rs 8.95 crore from Bharat Aluminium and an order worth Rs 7.47 crore from Nuclear Power Corp.

Cyient: The company's JV with HAL—Infotech HAL—filed an application initiating the corporate insolvency resolution process before NCLT, Bangalore Bench.

ASM Technologies: The company announced a preferential allotment of shares and warrants amounting to Rs 170 crore.

Crompton Greaves: The company received an order from HAREDA for a water pumping system.

Sapphire Foods: NCLT approved the scheme of merger by absorption of Gamma Pizzakraft and Gamma Pizzakraft with the company.

DOMS Industries: The company acquired a 51% stake in SKIDO Industries for Rs 51 lakh.

Stock markets in the Asia-Pacific region rose on Thursday as Wall Street reported fresh highs after the Federal Reserve kept its forecast for three quarter-basis-point rate cuts this year unchanged.

The Fed held its benchmark federal fund rates unchanged at the current 5.25–5.50% level for the fifth straight month, in line with market expectations, on Wednesday.

However, the Fed's outlook for rate cuts in 2025 has come down three times from the earlier four.

Chair Jerome Powell said though inflation has come down significantly, it still remains too high, and the central bank is committed to bringing it down to the target 2%.

The S&P 500 Index touched a historic high of 5,226.19 before settling 0.89% higher on Wednesday. The Nasdaq Composite and the Dow Jones Industrial Average ended 1.25% and 1.03% higher, respectively.

Brent crude was trading 0.45% higher at $86.34 a barrel. Gold was higher by 0.79% at $2,203.57 an ounce.

The GIFT Nifty was trading 24 points, or 0.11%, higher at 22,065.00 as of 6:34 a.m.

India's benchmark indices ended little changed with a positive bias amid volatility on Wednesday, led by gains in shares of Reliance Industries, ITC, and the State Bank of India.

The NSE Nifty 50 settled 21.65 points, or 0.10%, higher at 21,839.10, and the S&P BSE Sensex ended 89.64 points, or 0.12%, higher at 72,101.69.

Overseas investors became net sellers of Indian equities on Wednesday. Foreign portfolio investors offloaded stocks worth Rs 2,599.2 crore, and domestic institutional investors remained buyers and mopped up equities worth Rs 2,667.5 crore, the NSE data showed.

The Indian rupee weakened by 13 paise to close at 83.17 against the U.S. dollar.

The GIFT Nifty was trading 24 points, or 0.11%, higher at 22,065.00 as of 6:34 a.m.

India's benchmark indices ended little changed with a positive bias amid volatility on Wednesday, led by gains in shares of Reliance Industries, ITC, and the State Bank of India.

The NSE Nifty 50 settled 21.65 points, or 0.10%, higher at 21,839.10, and the S&P BSE Sensex ended 89.64 points, or 0.12%, higher at 72,101.69.

Overseas investors became net sellers of Indian equities on Wednesday. Foreign portfolio investors offloaded stocks worth Rs 2,599.2 crore, and domestic institutional investors remained buyers and mopped up equities worth Rs 2,667.5 crore, the NSE data showed.

The Indian rupee weakened by 13 paise to close at 83.17 against the U.S. dollar.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.