-The local currency weakened by 13 paise to close at 83.04 against the U.S. Dollar.

- It closed at 82.91 a dollar on Monday.

Source: Bloomberg

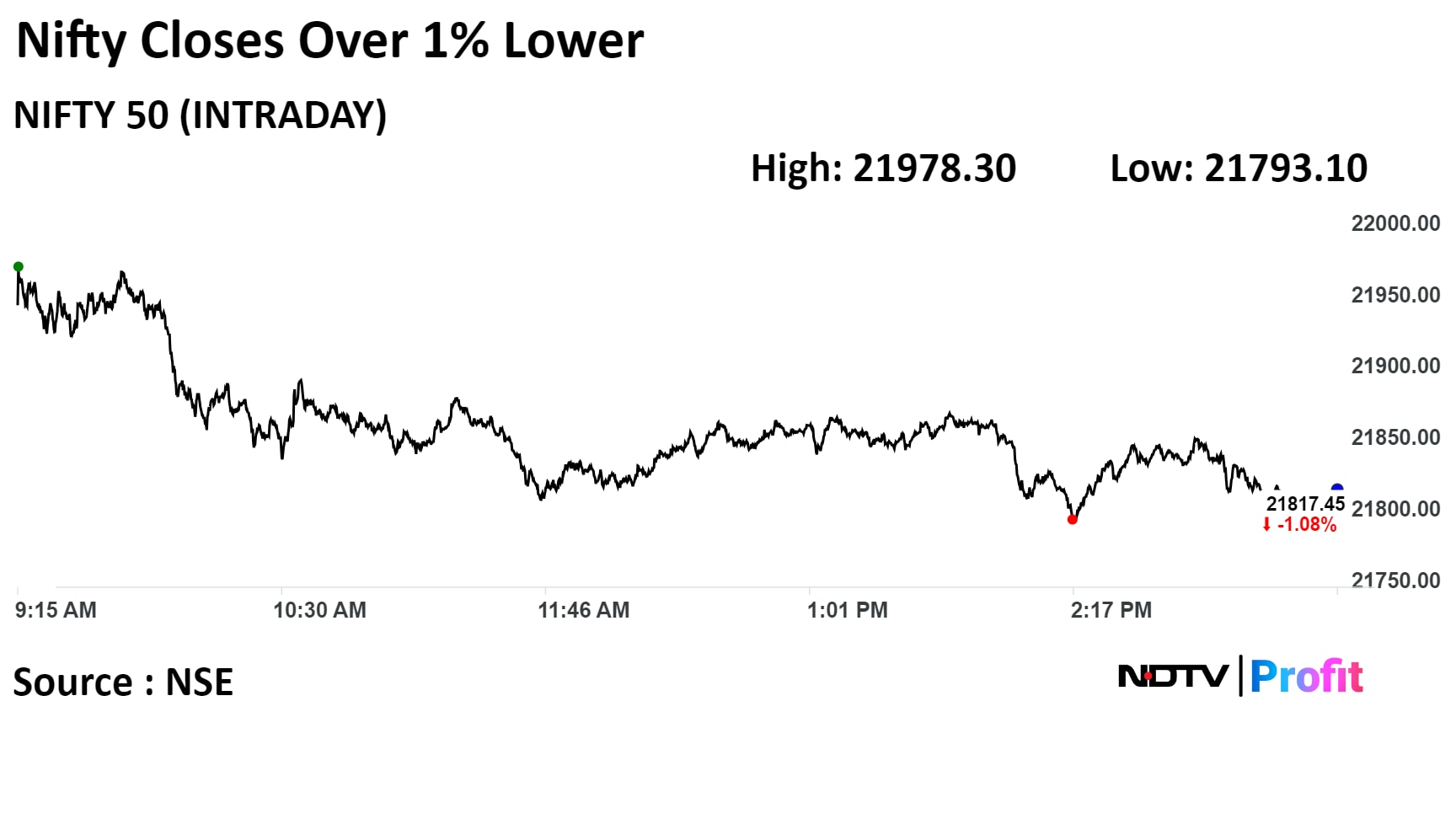

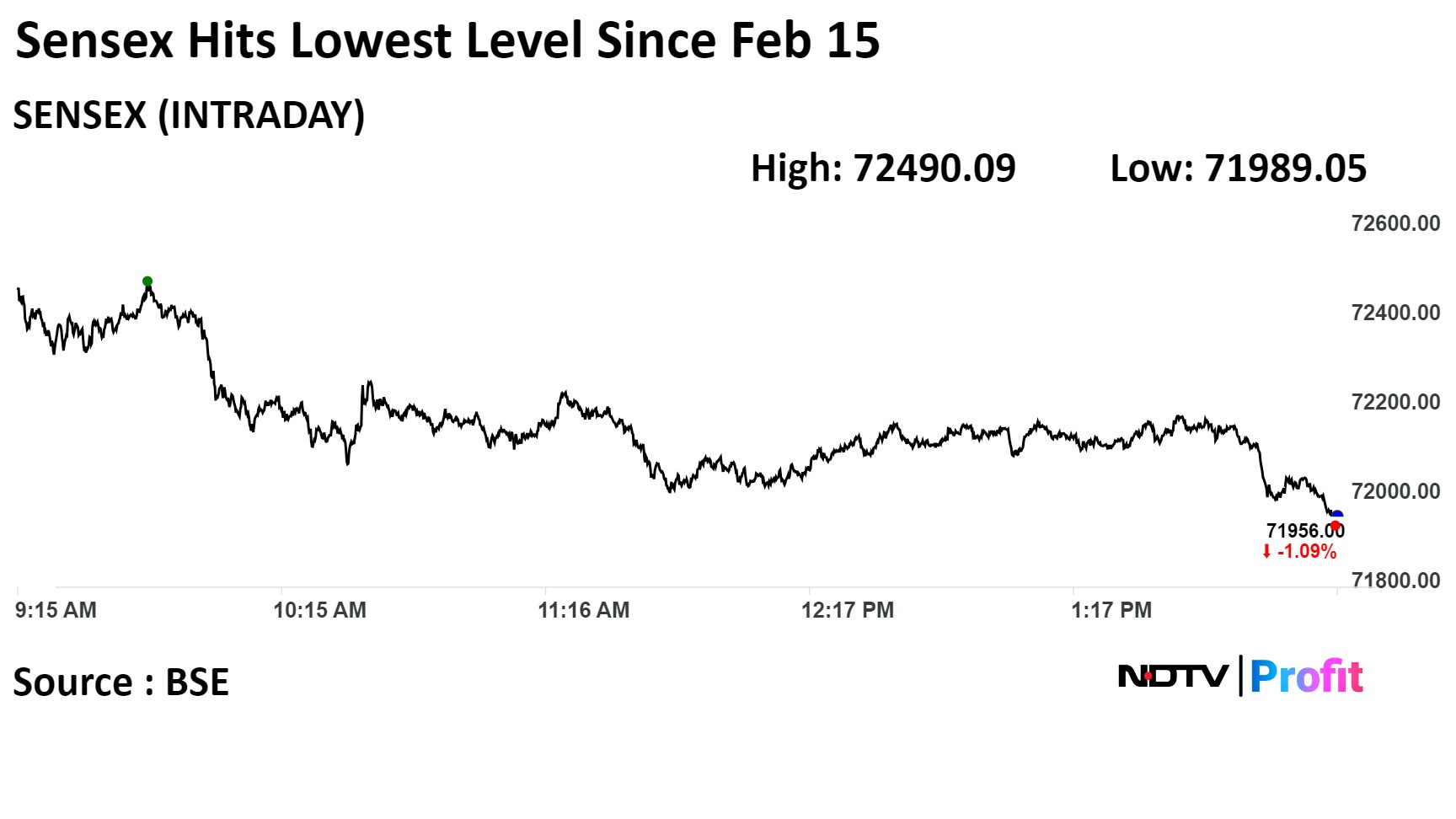

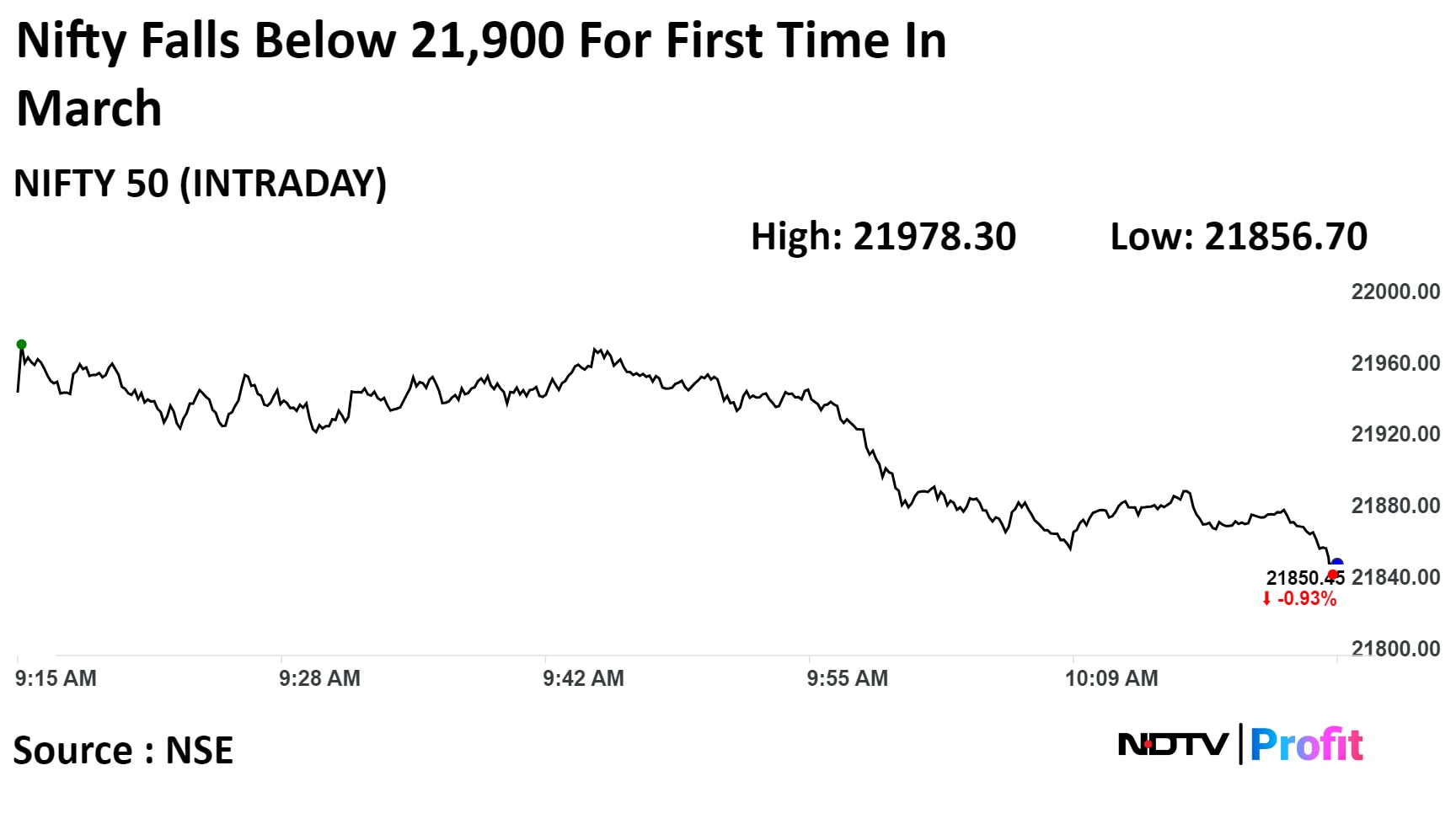

Benchmark indices fell to their lowest level in over a month in today's session as shares of IT companies dragged.

The Nifty closed 238.25 points or 1.08% lower at 21,817.45 points, its lowest level since February 13 while the Sensex closed at its lowest level since February 14 at 72,012.05, lower by 736.38 points or 1.01%.

After violating its immediate support of 21,900, the Index is about to form an advanced harmonic pattern known as Bullish Cypher at 21,740, said Aditya Gaggar Director of Progressive Shares. "Post the pattern reversal confirmation, one can expect the target of 22,000 followed by 22,200 respectively."

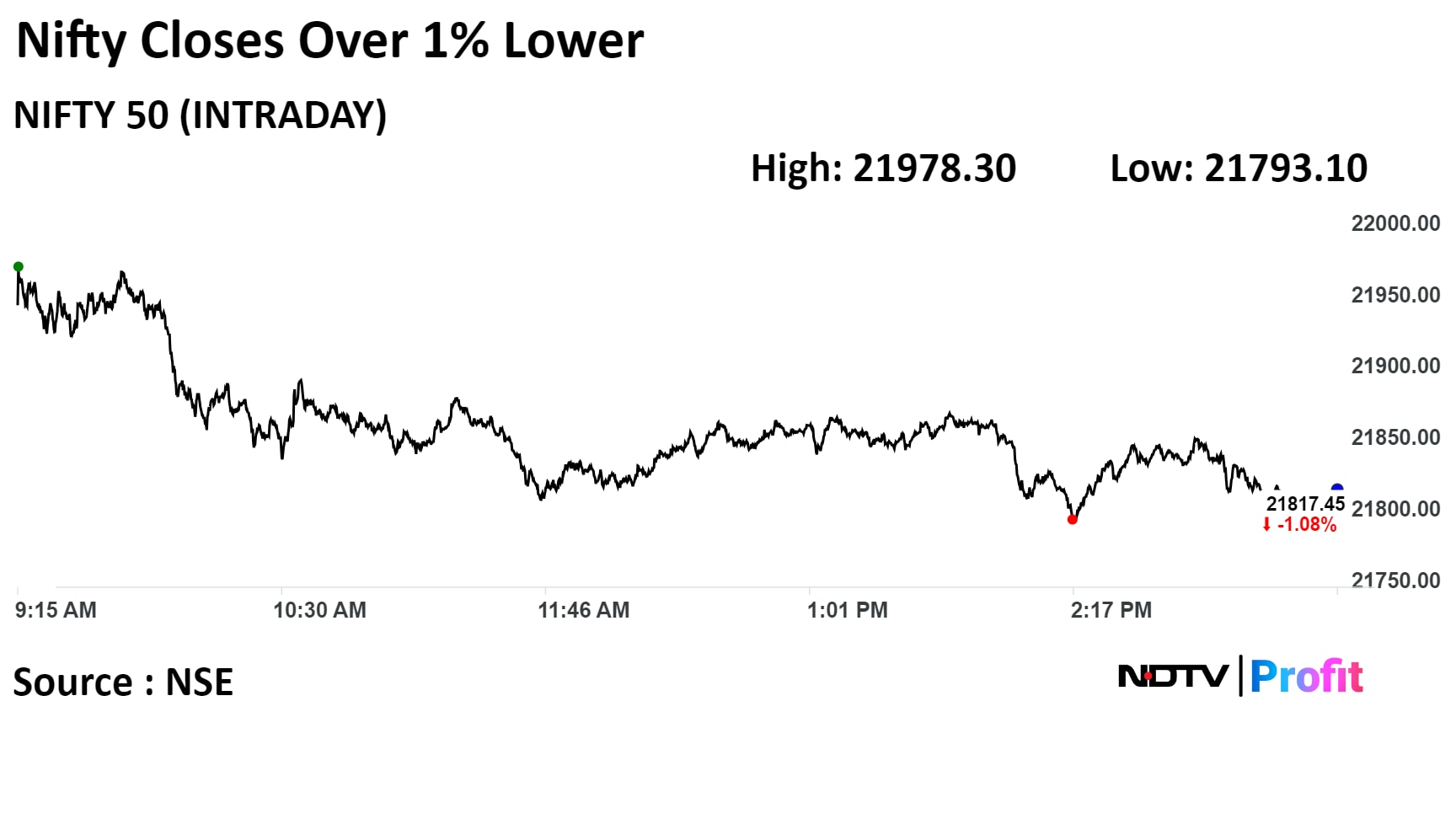

Benchmark indices fell to their lowest level in over a month in today's session as shares of IT companies dragged.

The Nifty closed 238.25 points or 1.08% lower at 21,817.45 points, its lowest level since February 13 while the Sensex closed at its lowest level since February 14 at 72,012.05, lower by 736.38 points or 1.01%.

After violating its immediate support of 21,900, the Index is about to form an advanced harmonic pattern known as Bullish Cypher at 21,740, said Aditya Gaggar Director of Progressive Shares. "Post the pattern reversal confirmation, one can expect the target of 22,000 followed by 22,200 respectively."

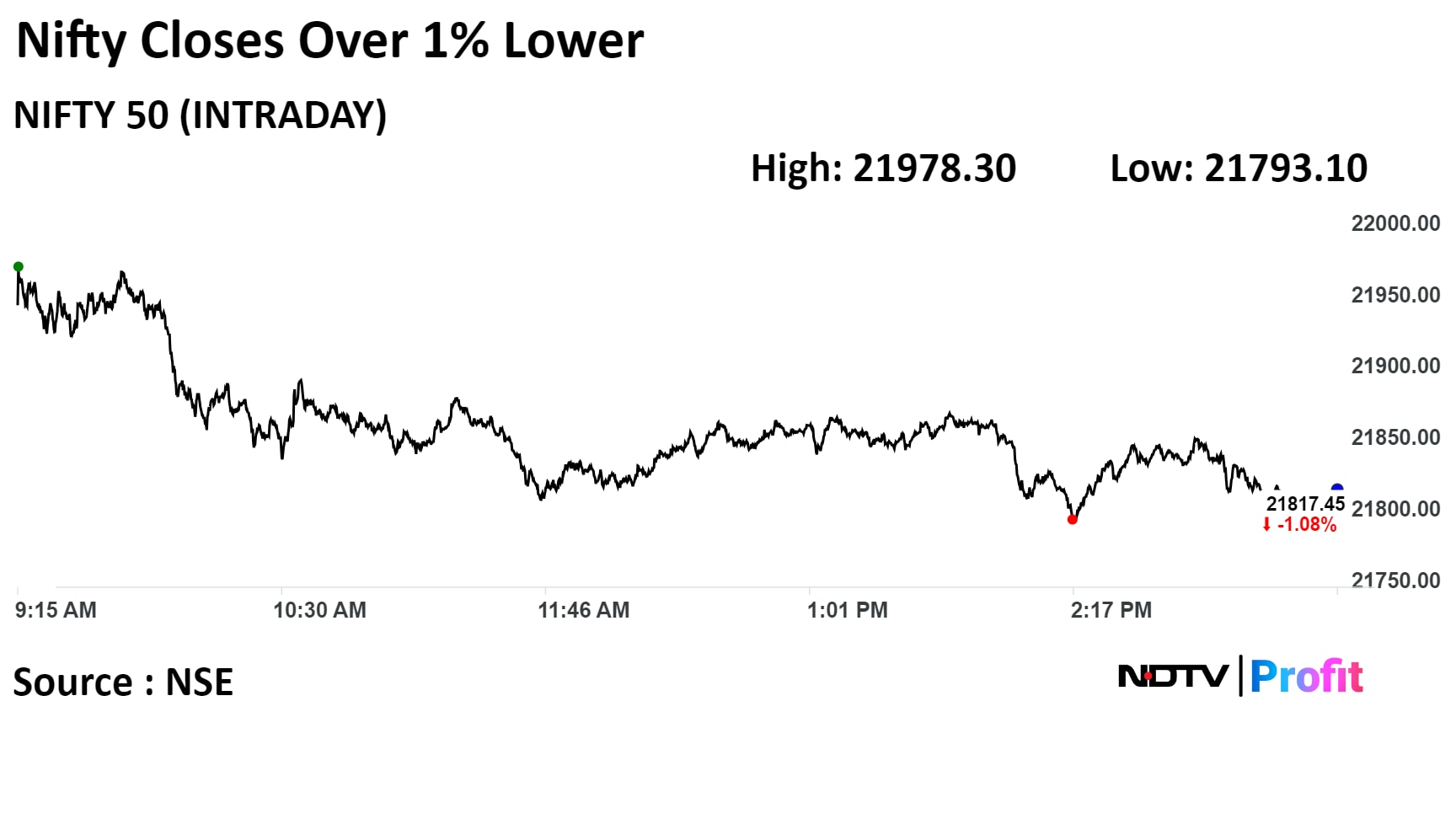

Benchmark indices fell to their lowest level in over a month in today's session as shares of IT companies dragged.

The Nifty closed 238.25 points or 1.08% lower at 21,817.45 points, its lowest level since February 13 while the Sensex closed at its lowest level since February 14 at 72,012.05, lower by 736.38 points or 1.01%.

After violating its immediate support of 21,900, the Index is about to form an advanced harmonic pattern known as Bullish Cypher at 21,740, said Aditya Gaggar Director of Progressive Shares. "Post the pattern reversal confirmation, one can expect the target of 22,000 followed by 22,200 respectively."

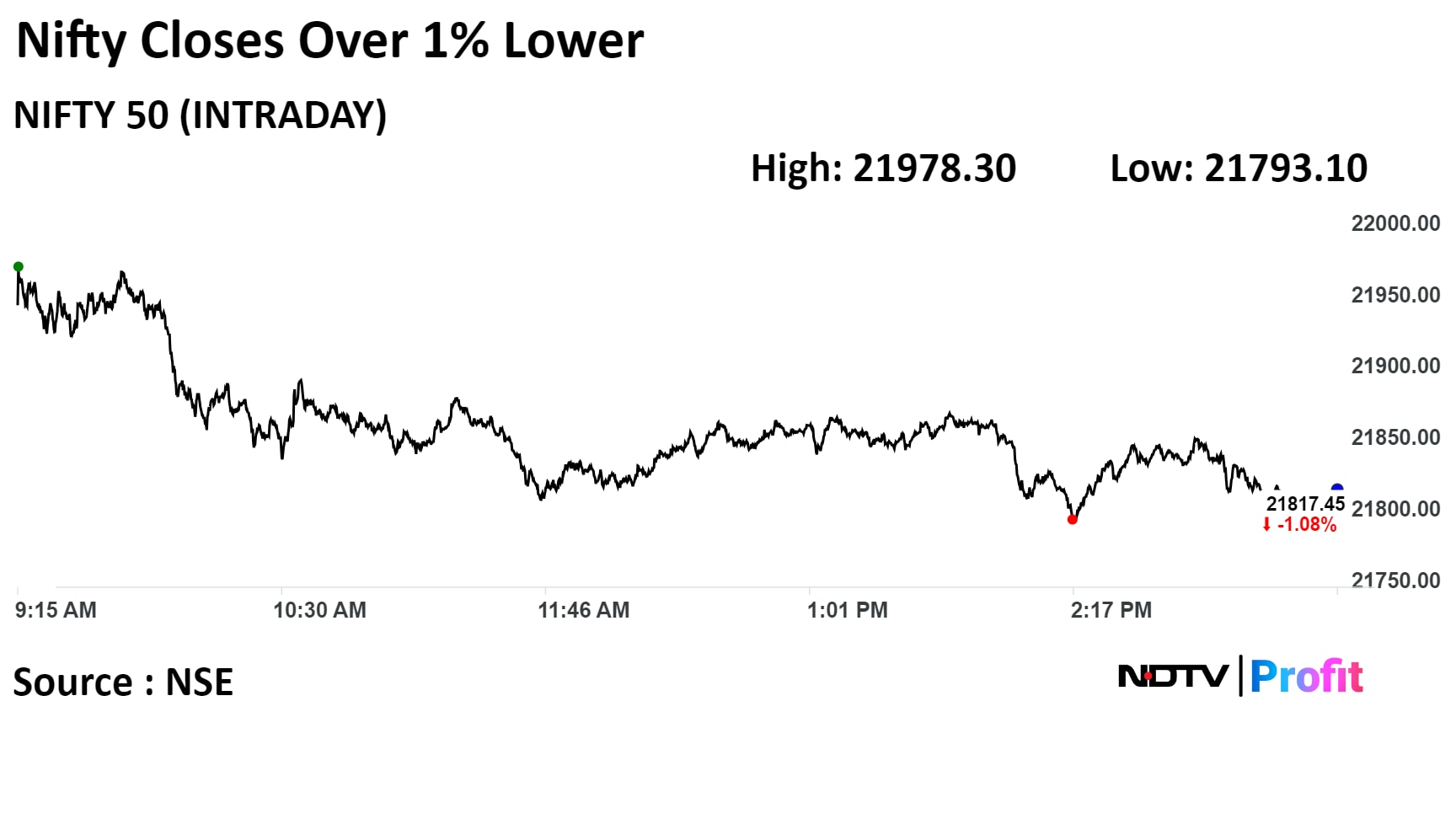

Benchmark indices fell to their lowest level in over a month in today's session as shares of IT companies dragged.

The Nifty closed 238.25 points or 1.08% lower at 21,817.45 points, its lowest level since February 13 while the Sensex closed at its lowest level since February 14 at 72,012.05, lower by 736.38 points or 1.01%.

After violating its immediate support of 21,900, the Index is about to form an advanced harmonic pattern known as Bullish Cypher at 21,740, said Aditya Gaggar Director of Progressive Shares. "Post the pattern reversal confirmation, one can expect the target of 22,000 followed by 22,200 respectively."

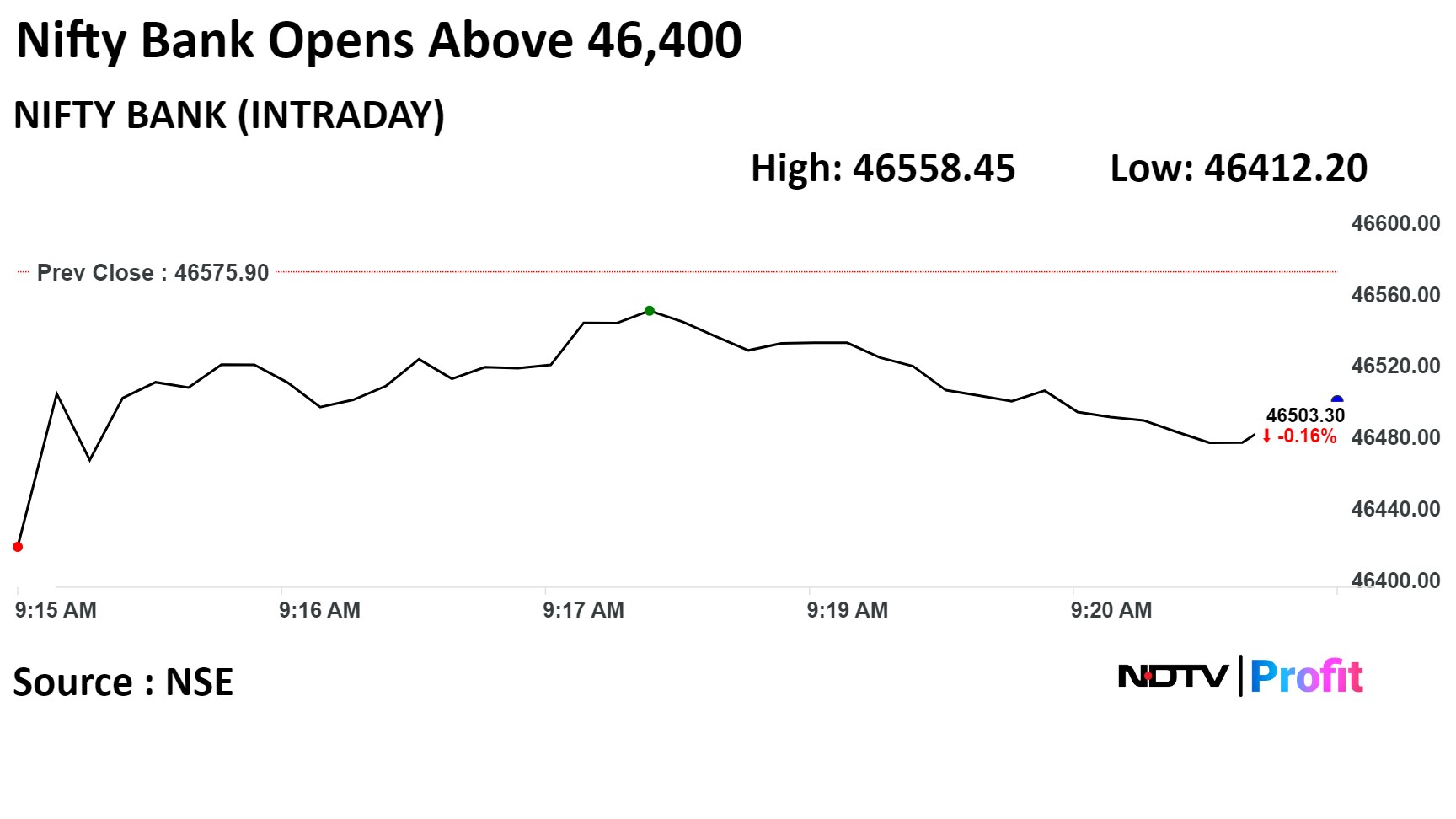

Nifty Bank fell for the eighth day in a row, recording its longest losing streak since Jan 21, 2022.

Benchmark indices fell to their lowest level in over a month in today's session as shares of IT companies dragged.

The Nifty closed 238.25 points or 1.08% lower at 21,817.45 points, its lowest level since February 13 while the Sensex closed at its lowest level since February 14 at 72,012.05, lower by 736.38 points or 1.01%.

After violating its immediate support of 21,900, the Index is about to form an advanced harmonic pattern known as Bullish Cypher at 21,740, said Aditya Gaggar Director of Progressive Shares. "Post the pattern reversal confirmation, one can expect the target of 22,000 followed by 22,200 respectively."

Benchmark indices fell to their lowest level in over a month in today's session as shares of IT companies dragged.

The Nifty closed 238.25 points or 1.08% lower at 21,817.45 points, its lowest level since February 13 while the Sensex closed at its lowest level since February 14 at 72,012.05, lower by 736.38 points or 1.01%.

After violating its immediate support of 21,900, the Index is about to form an advanced harmonic pattern known as Bullish Cypher at 21,740, said Aditya Gaggar Director of Progressive Shares. "Post the pattern reversal confirmation, one can expect the target of 22,000 followed by 22,200 respectively."

Benchmark indices fell to their lowest level in over a month in today's session as shares of IT companies dragged.

The Nifty closed 238.25 points or 1.08% lower at 21,817.45 points, its lowest level since February 13 while the Sensex closed at its lowest level since February 14 at 72,012.05, lower by 736.38 points or 1.01%.

After violating its immediate support of 21,900, the Index is about to form an advanced harmonic pattern known as Bullish Cypher at 21,740, said Aditya Gaggar Director of Progressive Shares. "Post the pattern reversal confirmation, one can expect the target of 22,000 followed by 22,200 respectively."

Benchmark indices fell to their lowest level in over a month in today's session as shares of IT companies dragged.

The Nifty closed 238.25 points or 1.08% lower at 21,817.45 points, its lowest level since February 13 while the Sensex closed at its lowest level since February 14 at 72,012.05, lower by 736.38 points or 1.01%.

After violating its immediate support of 21,900, the Index is about to form an advanced harmonic pattern known as Bullish Cypher at 21,740, said Aditya Gaggar Director of Progressive Shares. "Post the pattern reversal confirmation, one can expect the target of 22,000 followed by 22,200 respectively."

Nifty Bank fell for the eighth day in a row, recording its longest losing streak since Jan 21, 2022.

Shares of Tata Consultancy Services Ltd., Infosys Ltd., Reliance Industries Ltd., ITC Ltd., and Larsen & Toubro Ltd dragged the Nifty.

Meanwhile, those of Bajaj Finance Ltd., HDFC Bank Ltd., Kotak Mahindra Bank Ltd., ICICI Bank Ltd., and Bajaj Auto cushioned the fall.

All sectoral indices ended lower with Nifty IT losing nearly 3%.

Broader markets ended lower in line with the benchmark indices. The S&P BSE Midcap index fell 1.36%, and the S&P BSE Smallcap fell 1.04%.

On BSE, all 20 sectors ended in red with the S&P BSE IT index emerging as the top loser. The S&P BSE BANKEX index was the top performer among sectoral indices.

Market breadth was skewed in favour of sellers. Around 2,572 stocks declined, 1,244 stocks rose, and 112 stocks remained unchanged on BSE.

Gets order from Assam State Transport Corp for supply of 10 electric buses

Source: Exchange filing

Approves raising up to Rs 6,000 crore via multiple instruments in FY25

Source: Exchange filing

Board approves raising Rs 2,700 crore via NCDs

Source: Exchange Filing

Board declares third interim dividend of Rs 4.5/share

Source: Exchange Filing

In pact to roll out over 500 energy-efficient electric buses

Source: Exchange Filing

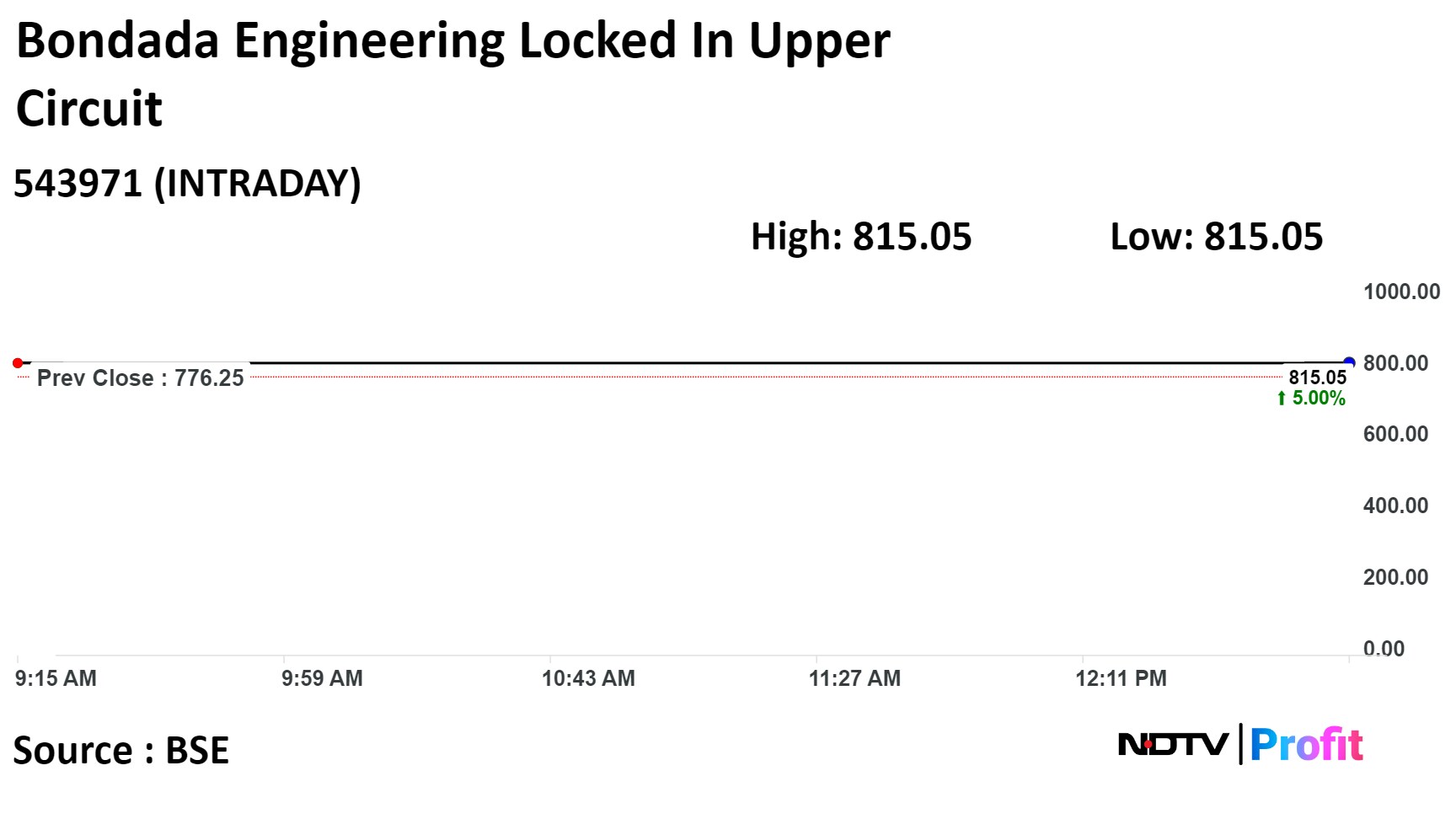

Gets LoI from The Singareni Collieries Co for Solar PV Power Plant

Source: Exchange Filing

Gets LoI from The Singareni Collieries Co for Solar PV Power Plant

Source: Exchange Filing

New facility located at Brigade International Finance Centre in GIFT City, Gujarat.

Source: Exchange Filing

The benchmark equity indices were trading sharply down through midday on Tuesday, tracking losses in shares of Reliance Industries Ltd., Tata Consultancy Services Ltd., and Larsen & Toubro Ltd.

As of 11:53 a.m. the NSE Nifty 50 was trading 219.15 points or 0.99% lower at 21,836.55, and the S&P BSE Sensex was trading 669.77 points or 0.92% down at 72,078.65.

Intraday, the Nifty slumped as much as 1.12% to 21,808.45, and the Sensex declined 1.02% to 72,007.35.

"We believe that the current market structure is directionless, perhaps traders are waiting for a breakout from either side," Shrikant Chouhan, head of equity research at Kotak Securities Ltd., said.

The double-bottom support was placed at 21,900/72,300, below which the index can slip to 21,800–21,600/72,000–71,400. For the day, it is advised to trade as per the given levels, Chouhan said.

The benchmark equity indices were trading sharply down through midday on Tuesday, tracking losses in shares of Reliance Industries Ltd., Tata Consultancy Services Ltd., and Larsen & Toubro Ltd.

As of 11:53 a.m. the NSE Nifty 50 was trading 219.15 points or 0.99% lower at 21,836.55, and the S&P BSE Sensex was trading 669.77 points or 0.92% down at 72,078.65.

Intraday, the Nifty slumped as much as 1.12% to 21,808.45, and the Sensex declined 1.02% to 72,007.35.

"We believe that the current market structure is directionless, perhaps traders are waiting for a breakout from either side," Shrikant Chouhan, head of equity research at Kotak Securities Ltd., said.

The double-bottom support was placed at 21,900/72,300, below which the index can slip to 21,800–21,600/72,000–71,400. For the day, it is advised to trade as per the given levels, Chouhan said.

The benchmark equity indices were trading sharply down through midday on Tuesday, tracking losses in shares of Reliance Industries Ltd., Tata Consultancy Services Ltd., and Larsen & Toubro Ltd.

As of 11:53 a.m. the NSE Nifty 50 was trading 219.15 points or 0.99% lower at 21,836.55, and the S&P BSE Sensex was trading 669.77 points or 0.92% down at 72,078.65.

Intraday, the Nifty slumped as much as 1.12% to 21,808.45, and the Sensex declined 1.02% to 72,007.35.

"We believe that the current market structure is directionless, perhaps traders are waiting for a breakout from either side," Shrikant Chouhan, head of equity research at Kotak Securities Ltd., said.

The double-bottom support was placed at 21,900/72,300, below which the index can slip to 21,800–21,600/72,000–71,400. For the day, it is advised to trade as per the given levels, Chouhan said.

The benchmark equity indices were trading sharply down through midday on Tuesday, tracking losses in shares of Reliance Industries Ltd., Tata Consultancy Services Ltd., and Larsen & Toubro Ltd.

As of 11:53 a.m. the NSE Nifty 50 was trading 219.15 points or 0.99% lower at 21,836.55, and the S&P BSE Sensex was trading 669.77 points or 0.92% down at 72,078.65.

Intraday, the Nifty slumped as much as 1.12% to 21,808.45, and the Sensex declined 1.02% to 72,007.35.

"We believe that the current market structure is directionless, perhaps traders are waiting for a breakout from either side," Shrikant Chouhan, head of equity research at Kotak Securities Ltd., said.

The double-bottom support was placed at 21,900/72,300, below which the index can slip to 21,800–21,600/72,000–71,400. For the day, it is advised to trade as per the given levels, Chouhan said.

The benchmark equity indices were trading sharply down through midday on Tuesday, tracking losses in shares of Reliance Industries Ltd., Tata Consultancy Services Ltd., and Larsen & Toubro Ltd.

As of 11:53 a.m. the NSE Nifty 50 was trading 219.15 points or 0.99% lower at 21,836.55, and the S&P BSE Sensex was trading 669.77 points or 0.92% down at 72,078.65.

Intraday, the Nifty slumped as much as 1.12% to 21,808.45, and the Sensex declined 1.02% to 72,007.35.

"We believe that the current market structure is directionless, perhaps traders are waiting for a breakout from either side," Shrikant Chouhan, head of equity research at Kotak Securities Ltd., said.

The double-bottom support was placed at 21,900/72,300, below which the index can slip to 21,800–21,600/72,000–71,400. For the day, it is advised to trade as per the given levels, Chouhan said.

The benchmark equity indices were trading sharply down through midday on Tuesday, tracking losses in shares of Reliance Industries Ltd., Tata Consultancy Services Ltd., and Larsen & Toubro Ltd.

As of 11:53 a.m. the NSE Nifty 50 was trading 219.15 points or 0.99% lower at 21,836.55, and the S&P BSE Sensex was trading 669.77 points or 0.92% down at 72,078.65.

Intraday, the Nifty slumped as much as 1.12% to 21,808.45, and the Sensex declined 1.02% to 72,007.35.

"We believe that the current market structure is directionless, perhaps traders are waiting for a breakout from either side," Shrikant Chouhan, head of equity research at Kotak Securities Ltd., said.

The double-bottom support was placed at 21,900/72,300, below which the index can slip to 21,800–21,600/72,000–71,400. For the day, it is advised to trade as per the given levels, Chouhan said.

The benchmark equity indices were trading sharply down through midday on Tuesday, tracking losses in shares of Reliance Industries Ltd., Tata Consultancy Services Ltd., and Larsen & Toubro Ltd.

As of 11:53 a.m. the NSE Nifty 50 was trading 219.15 points or 0.99% lower at 21,836.55, and the S&P BSE Sensex was trading 669.77 points or 0.92% down at 72,078.65.

Intraday, the Nifty slumped as much as 1.12% to 21,808.45, and the Sensex declined 1.02% to 72,007.35.

"We believe that the current market structure is directionless, perhaps traders are waiting for a breakout from either side," Shrikant Chouhan, head of equity research at Kotak Securities Ltd., said.

The double-bottom support was placed at 21,900/72,300, below which the index can slip to 21,800–21,600/72,000–71,400. For the day, it is advised to trade as per the given levels, Chouhan said.

The benchmark equity indices were trading sharply down through midday on Tuesday, tracking losses in shares of Reliance Industries Ltd., Tata Consultancy Services Ltd., and Larsen & Toubro Ltd.

As of 11:53 a.m. the NSE Nifty 50 was trading 219.15 points or 0.99% lower at 21,836.55, and the S&P BSE Sensex was trading 669.77 points or 0.92% down at 72,078.65.

Intraday, the Nifty slumped as much as 1.12% to 21,808.45, and the Sensex declined 1.02% to 72,007.35.

"We believe that the current market structure is directionless, perhaps traders are waiting for a breakout from either side," Shrikant Chouhan, head of equity research at Kotak Securities Ltd., said.

The double-bottom support was placed at 21,900/72,300, below which the index can slip to 21,800–21,600/72,000–71,400. For the day, it is advised to trade as per the given levels, Chouhan said.

Reliance Industries Ltd., Tata Consultancy Services Ltd., Larsen & Toubro Ltd., Infosys Ltd. and ITC Ltd. dragged the most on the Nifty.

Bajaj Finance Ltd., ICICI Bank Ltd., HDFC Bank Ltd., Bharti Airtel Ltd. and Kotak Mahindra Bank Ltd. limited the losses in the index.

Twelve sectors on the NSE were trading in the red, with the Nifty FMCG emerging as the top loser, dragged by losses in shares of ITC and Nestle India Ltd.

The broader markets were trading in line with the benchmark indices as the BSE MidCap fell 1.23% and the SmallCap declined 0.82%.

All the 20 sectors on the BSE declined, with the FMCG emerging as the top loser.

The market breadth was skewed in favour of the sellers as 2,307 stocks declined, 1,276 rose and 133 stocks remained unchanged on the BSE.

HCLTech will enhance design verification, emulation and rapid prototyping of its turnkey system-on-chip solutions by leveraging silicon-proven IP cores and controllers from CAST.

Source: Exchange Filing

Versavo is the first biosimilar product by the company to be launched in the UK

Source: Exchange Filing

Kamath resigns to pursue other opportunities outside the company

Source: Exchange Filing

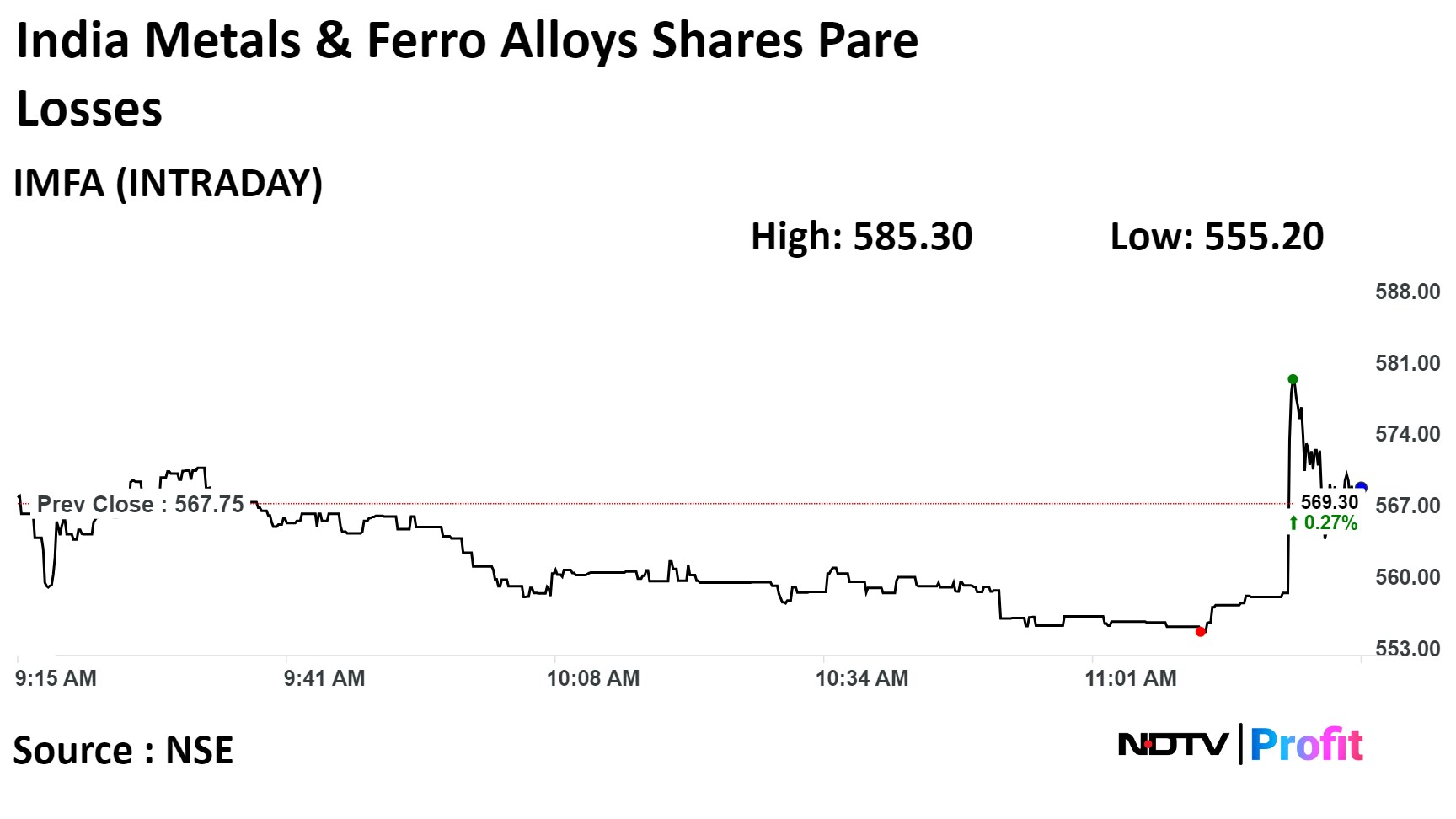

Unit gets Rs 132 crore from Ministry of Coal as partial compensation towards land for Utkal 'C' coal block

Source: Exchange Filing

Unit gets Rs 132 crore from Ministry of Coal as partial compensation towards land for Utkal 'C' coal block

Source: Exchange Filing

Baba Ramdev and Acharya Balkrishna to be present in the court on the next date of hearing.

Acharya Balkrishna has failed to reply to the court's contempt notice.

Next hearing after 2 weeks.

Source: Supreme Court Proceedings

Baba Ramdev and Acharya Balkrishna to be present in the court on the next date of hearing.

Acharya Balkrishna has failed to reply to the court's contempt notice.

Next hearing after 2 weeks.

Source: Supreme Court Proceedings

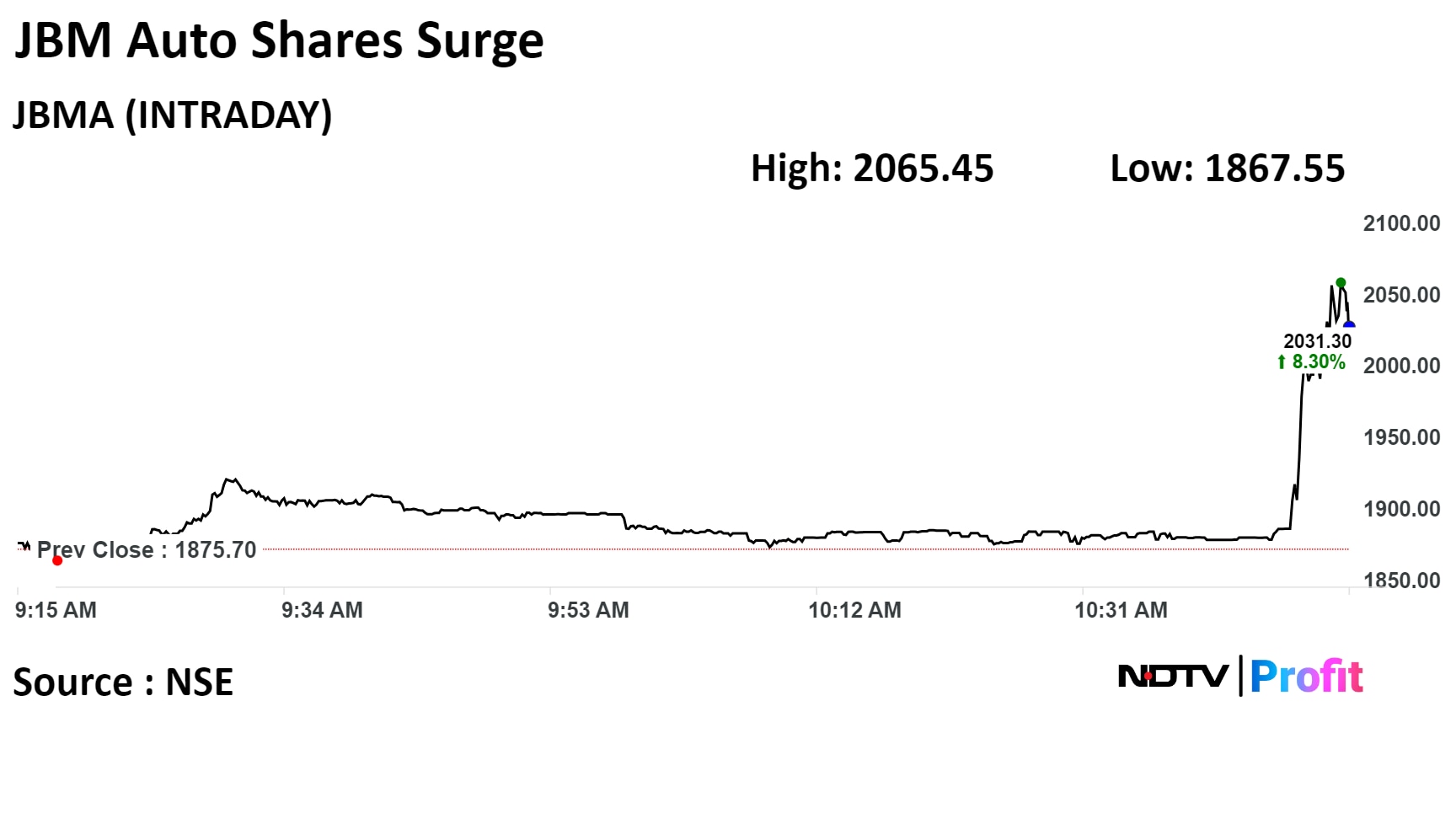

Shares of JBM Auto surged after it got a contract worth Rs 7,500 crore for procurement, supply, operation of 1,390 electric buses.

The order includes development of related electric and civil infrastructure under the PM-eBus Sewa Scheme.

Shares of JBM Auto surged after it got a contract worth Rs 7,500 crore for procurement, supply, operation of 1,390 electric buses.

The order includes development of related electric and civil infrastructure under the PM-eBus Sewa Scheme.

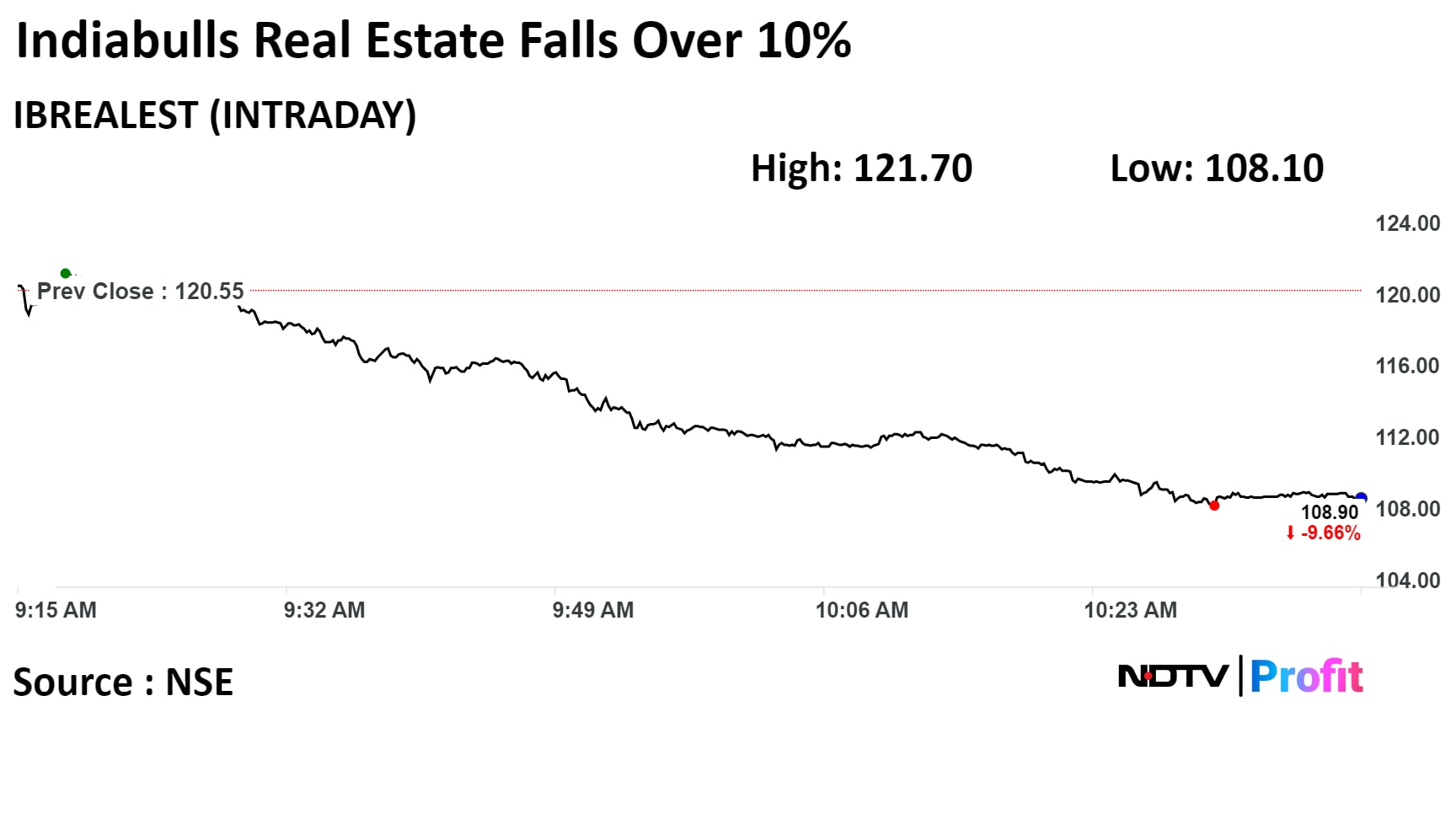

Shares of Indiabulls Real Estate snapped their three-day rally and fell over 10%.

Shares of Indiabulls Real Estate snapped their three-day rally and fell over 10%.

Minus Zero is an autonomous driving technology startup based in India

Tie-up to develop autonomous trucking solutions for ports, factory and corporate campuses

Future plans include autonomous long-haul trucking, subject to regulatory approvals

Source: Company statement

At 10:25 a.m., it traded at 21,855.00, down 200.70 points or 0.91%.

At 10:25 a.m., it traded at 21,855.00, down 200.70 points or 0.91%.

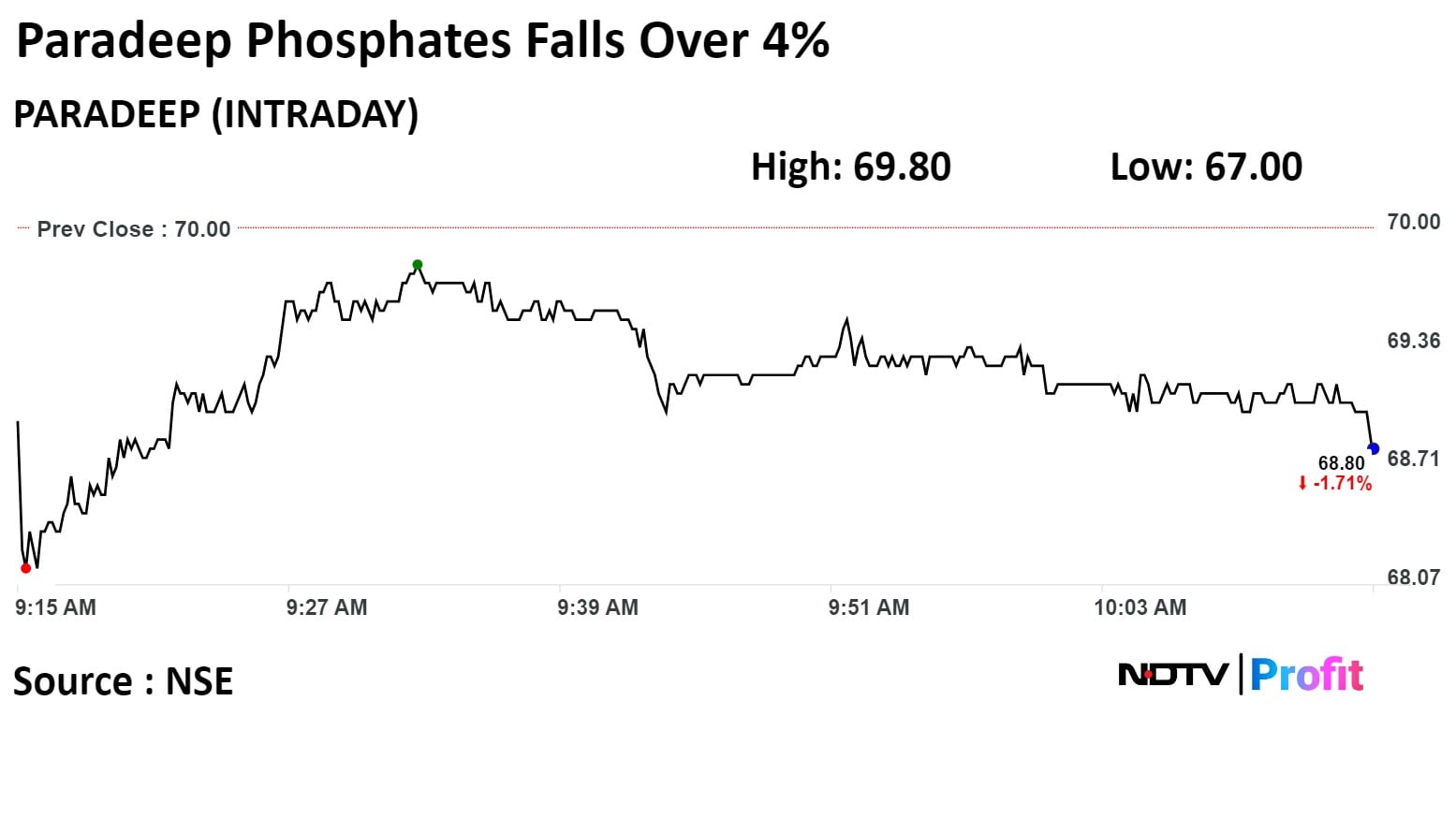

Shares of Paradeep Phosphates slumps to over two-month low on Tuesday as the company informed it has shut down two plants in Goa.

The company has shut down its ammonia and urea plants at Goa because of breakdown of Synthesis Gas Compressor.

Shares of Paradeep Phosphates slumps to over two-month low on Tuesday as the company informed it has shut down two plants in Goa.

The company has shut down its ammonia and urea plants at Goa because of breakdown of Synthesis Gas Compressor.

The scrip fell as much as 4.29% to Rs 67.00 apiece, the lowest level since Jan 1. It pared losses to trade 1.21% lower at Rs 69.15 apiece, as of 10:04 a.m. This compares to a 0.67% decline in the NSE Nifty 50 Index.

It has risen 37.20% in 12 months. The relative strength index was at 35.31.

Three analysts tracking the company, maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 47.2%.

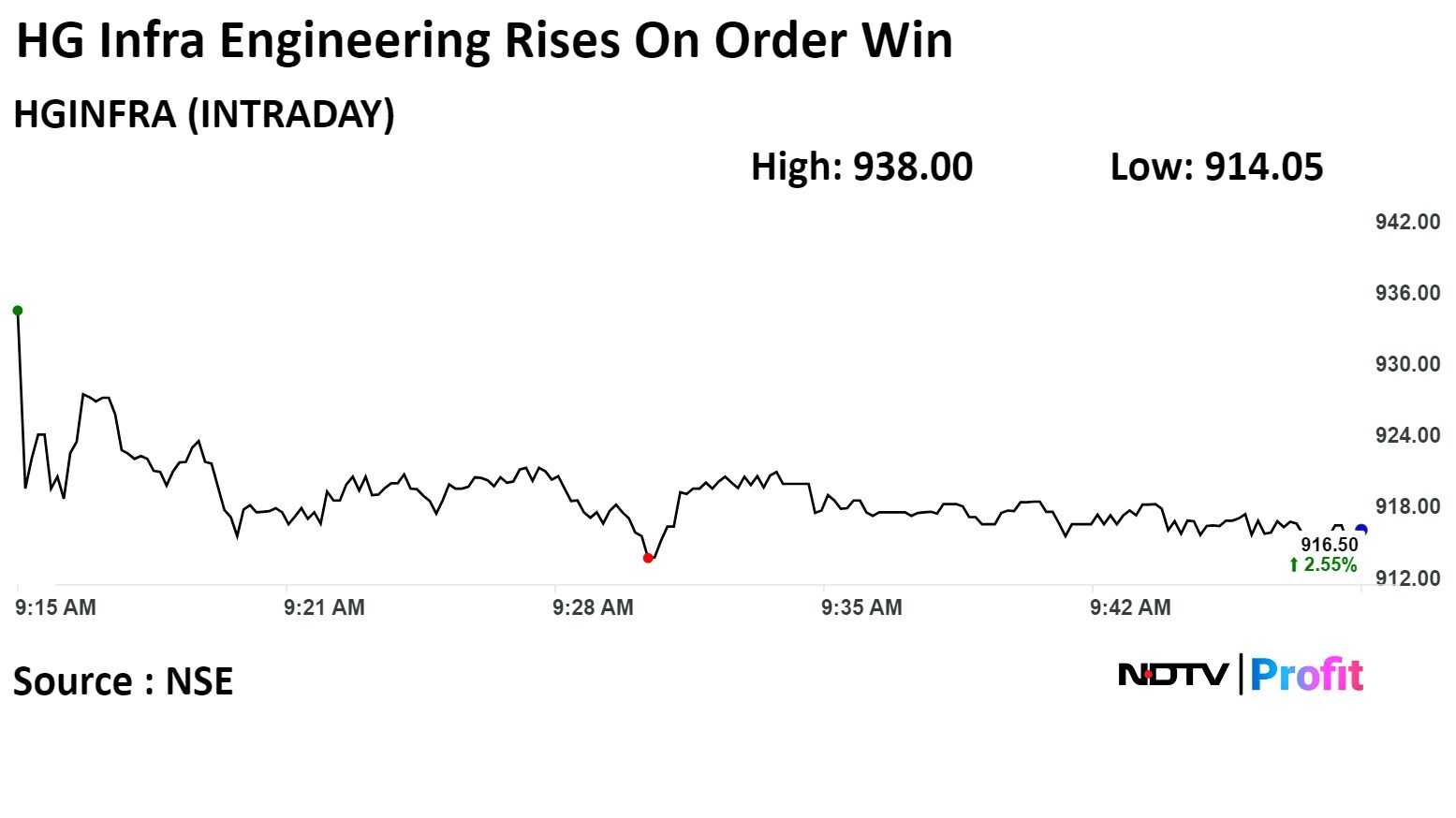

Shares of HG Infra Engineering Ltd. rose nearly 5% on Tuesday after it secured four orders worth total Rs 1,026 from Jodhpur Vidyut Vitran Nigam.

The company has won the orders in a joint venture with Stockwell Solar Services Ltd., according to an exchange filing.

Shares of HG Infra Engineering Ltd. rose nearly 5% on Tuesday after it secured four orders worth total Rs 1,026 from Jodhpur Vidyut Vitran Nigam.

The company has won the orders in a joint venture with Stockwell Solar Services Ltd., according to an exchange filing.

Shares of the company rose as much as 4.95% to Rs 938.00 apiece, the highest level since March 11. It was trading 2.67% higher at Rs 917.60 apiece as of 9:40 a.m. This compares to a 0.34% decline in the NSE Nifty 50 Index.

The stock has risen 17.4% in past 12 months. Total traded volume so far in the day stood at 14 times its 30-day average. The relative strength index was at 52.89.

Out of 14 analysts tracking the company, 13 maintain a 'buy' rating, one recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an upside of 14.22%.

The MRP of Birla Opus Paints is largely 5% cheaper than that of Asian Paints.

The discount is across categories like interiors, exteriors, enamel, water-proofing, etc., as well as across price-points.

In the interior-luxury segment, the products are priced at par with that of Asian Paints.

In addition to this, Birla Opus would be giving 10% quantity free as a part of an introductory offer.

Source: IIFL Securities

Lists at Rs 289.20 on NSE vs issue price of Rs 295

Lists at Rs 292 on BSE vs issue price of Rs 295

Lists at a discount of 1.02% to the issue price on BSE

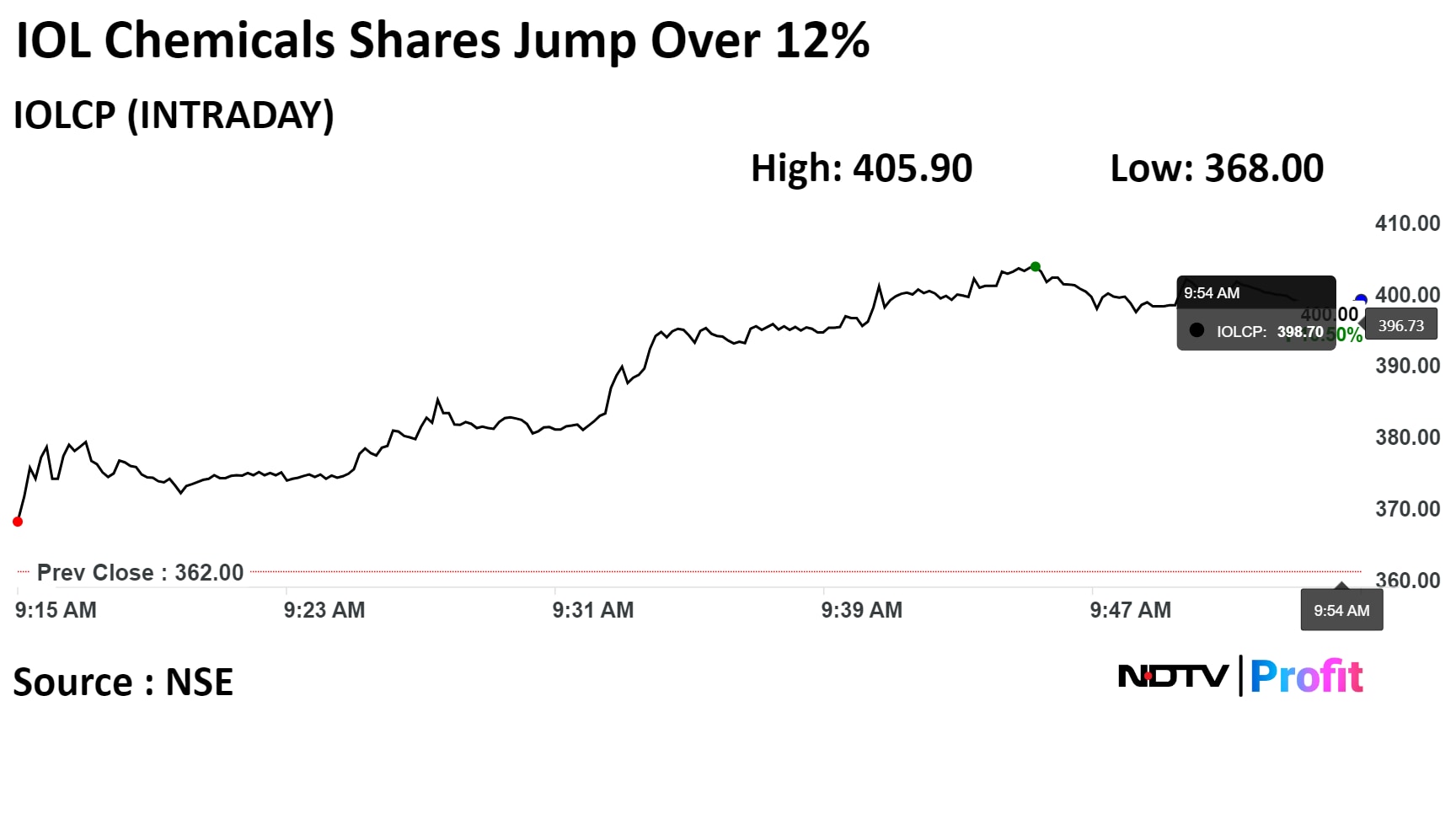

Shares of IOL Chemicals and Pharmaceuticals Ltd surged on completing the Brazilian Health Regulatory Agency GMP audit of all the 10 APIs manufacturing Units situated at Barnala, Punjab without any observations.

An exchange filing by the company said that the inspection was conducted from March 11-15, 2024.

Shares of IOL Chemicals and Pharmaceuticals Ltd surged on completing the Brazilian Health Regulatory Agency GMP audit of all the 10 APIs manufacturing Units situated at Barnala, Punjab without any observations.

An exchange filing by the company said that the inspection was conducted from March 11-15, 2024.

The scrip rose as much as 12.38% to Rs 406.80 piece, the highest level since March 6. It pared gains to trade 12.2% higher at Rs 406.50 apiece, as of 9:58 a.m. This compares to a 0.65% decline in the NSE Nifty 50 Index.

It has risen 43.89% in the last twelve months. Total traded volume so far in the day stood at 9.66 times its 30-day average. The relative strength index was at 53.69.

Two analysts tracking the company maintain a 'buy' rating according to Bloomberg data. The average 12-month consensus price target implies an upside of 28.3%.

To provide pre-booked and on-demand self-drive cars in India

Source: Exchange filing

MS overweight on AU Small; TP Rs 850

RoA challenges led by tight liquidity conditions, normalization of credit costs

Expects RoA of ~1.5-1.6% in F2025, similar to F2024 levels

Management guided to 23-25% balance sheet growth over next two to three years

Expects RoA to improve to 1.8% by F2027

Continue to prefer AU Bank among mid-sized banks in coverage

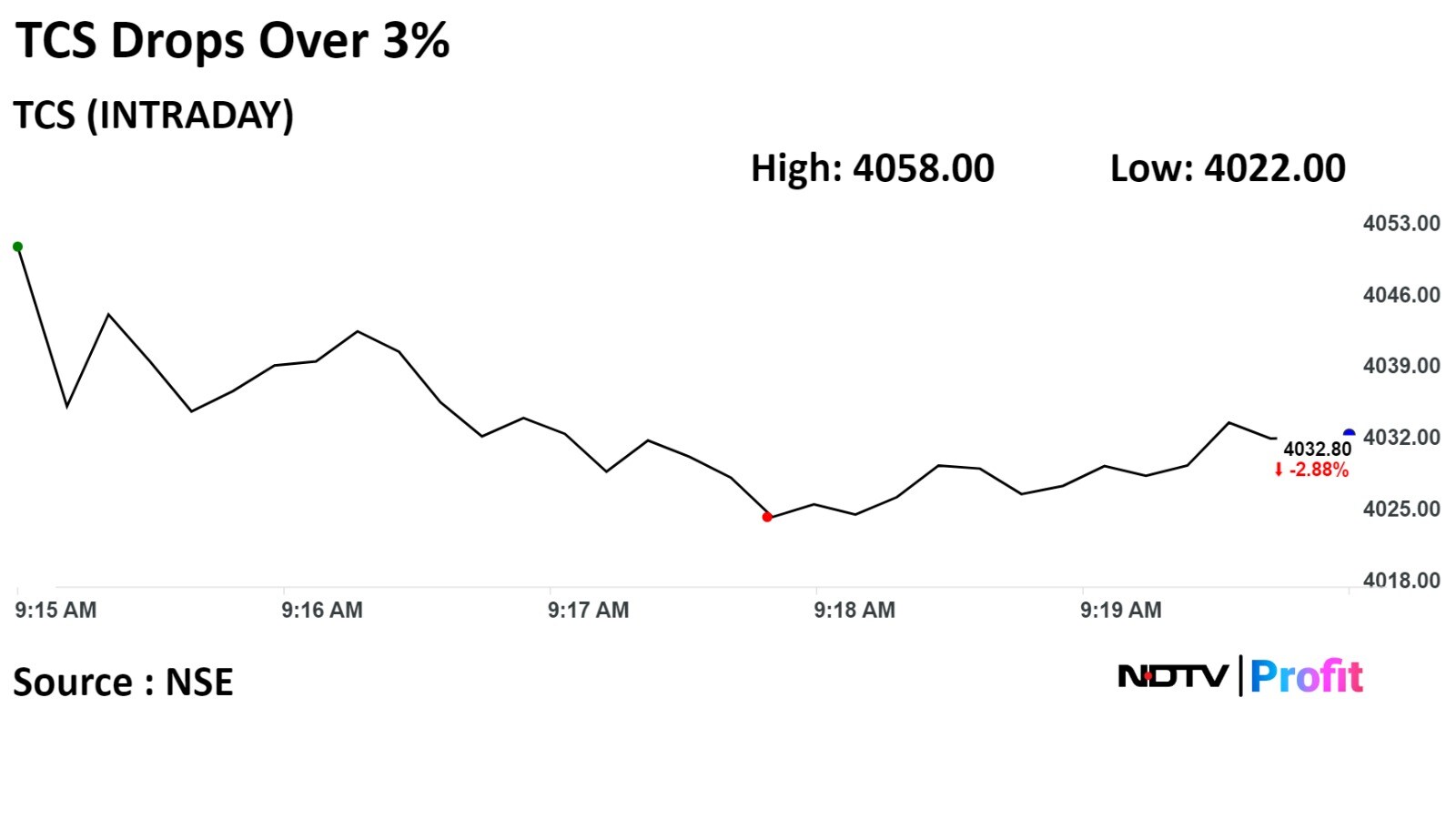

Tata Consultancy Services Ltd. fell over 3% to the lowest level since Feb 27 on NSE today after its 2.02 crore shares changed hands in 5 large trades

Buyers and sellers are not known immediately, Bloomberg reported.

Tata Sons Pvt. Ltd. is looking to divest 0.65% stake in the company, said people in the know to NDTV Profit.

Tata Sons Pvt. Ltd. is looking to sell 2.34 crore shares at a likely price of Rs 4,001. Through this offer for sale, Tata Sons will raise Rs 9,362 crores or $1.13 billion, which the company is expected to spend on reducing debt.

Tata Consultancy Services Ltd. fell over 3% to the lowest level since Feb 27 on NSE today after its 2.02 crore shares changed hands in 5 large trades

Buyers and sellers are not known immediately, Bloomberg reported.

Tata Sons Pvt. Ltd. is looking to divest 0.65% stake in the company, said people in the know to NDTV Profit.

Tata Sons Pvt. Ltd. is looking to sell 2.34 crore shares at a likely price of Rs 4,001. Through this offer for sale, Tata Sons will raise Rs 9,362 crores or $1.13 billion, which the company is expected to spend on reducing debt.

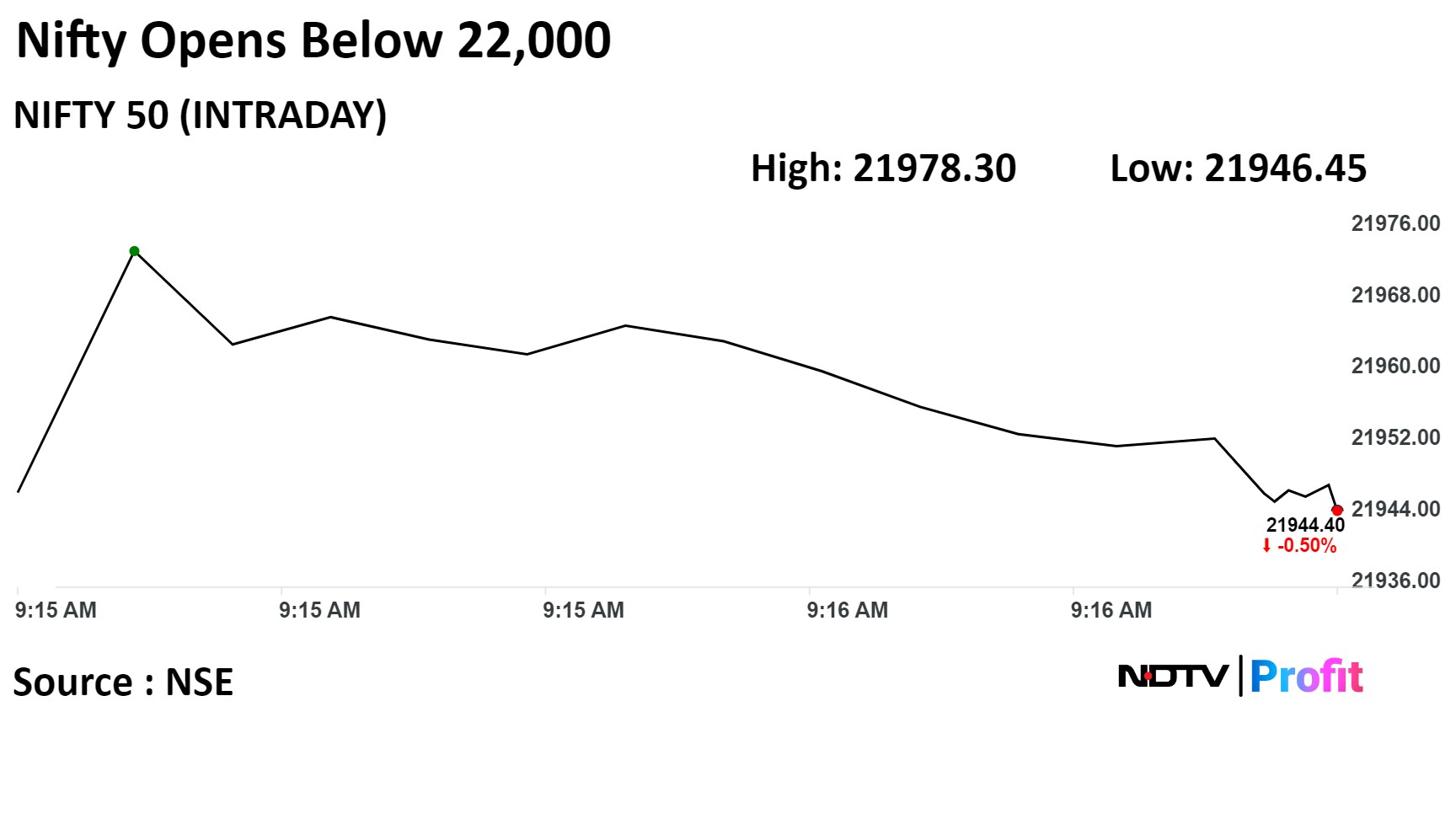

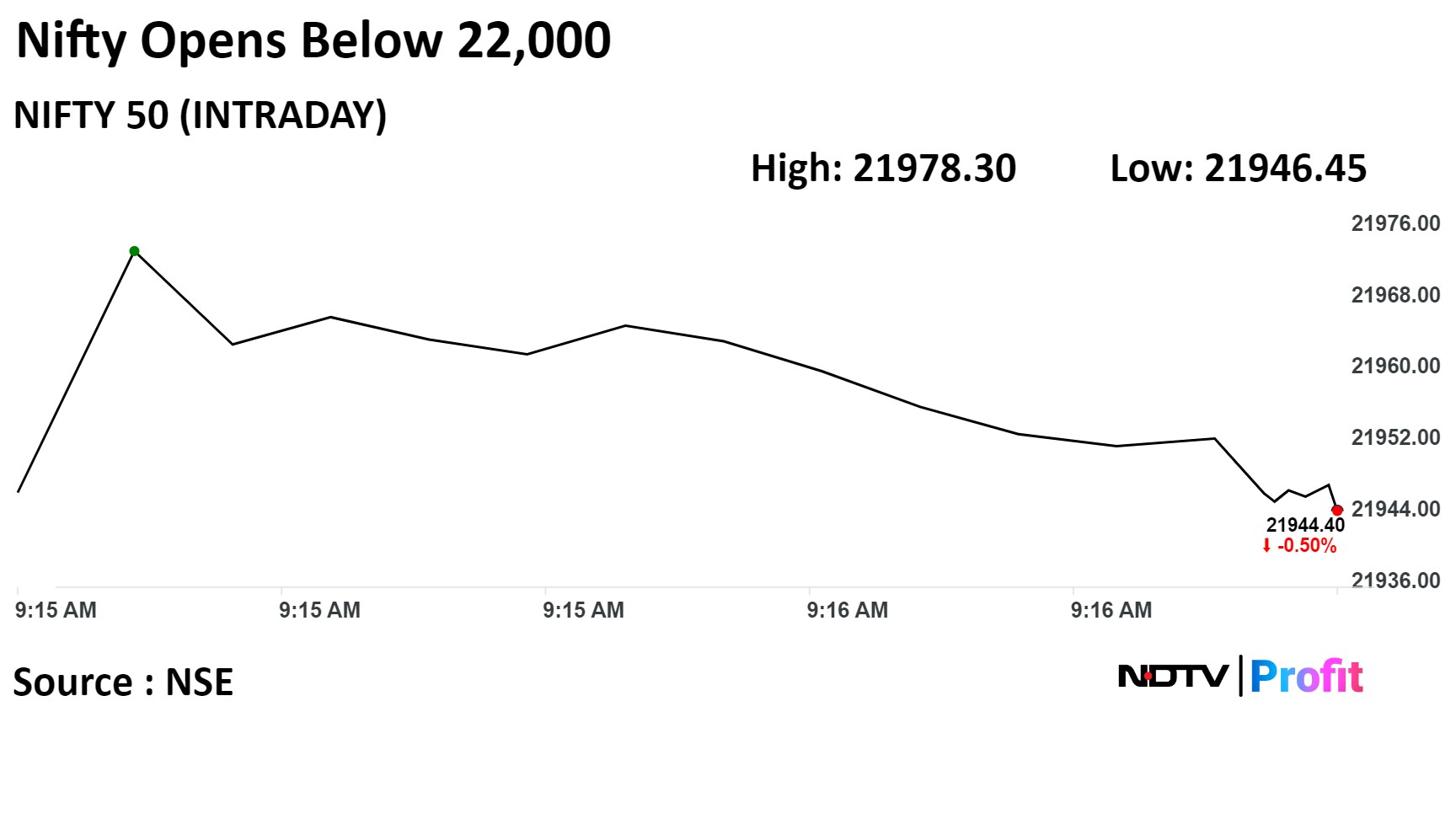

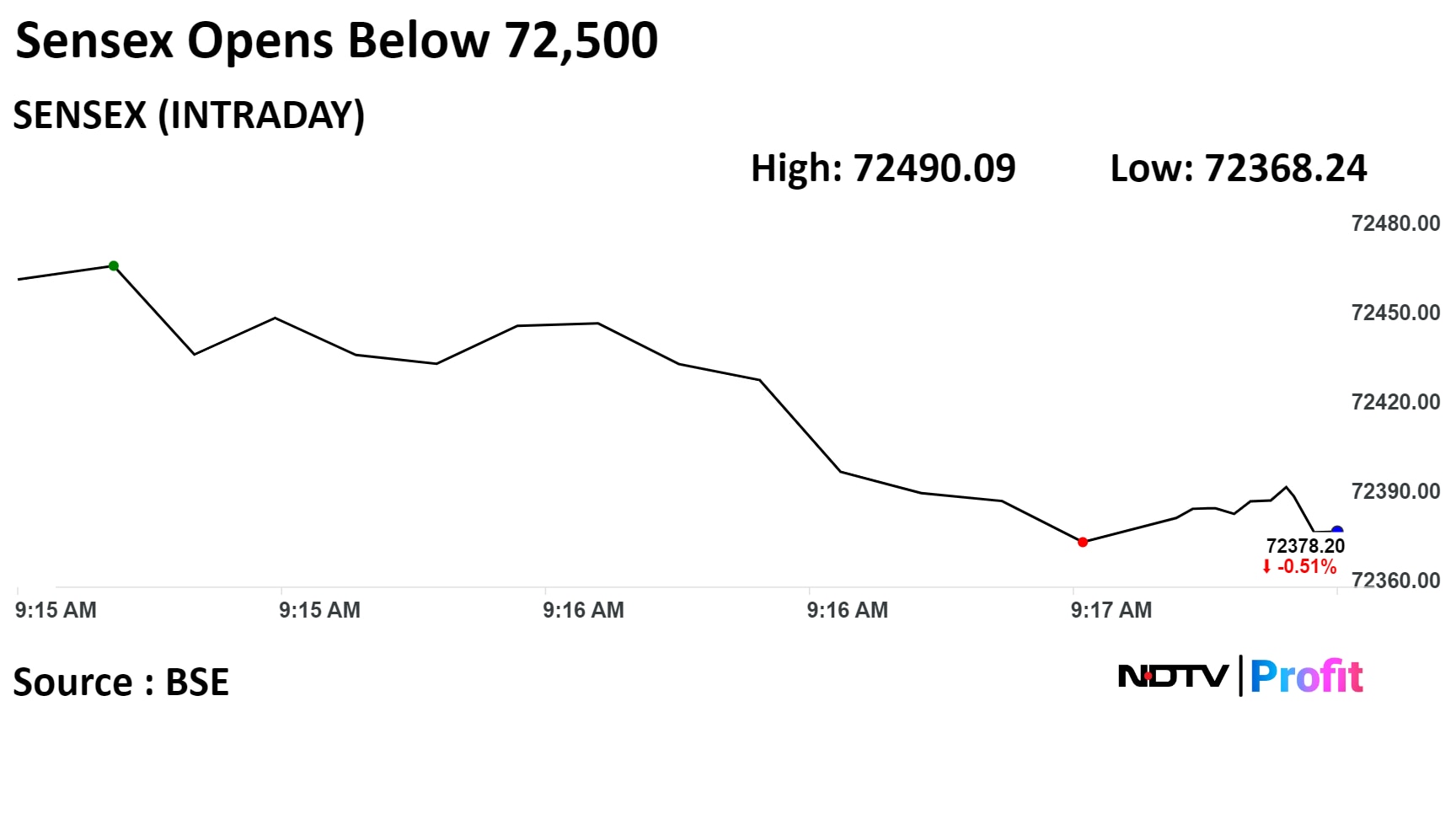

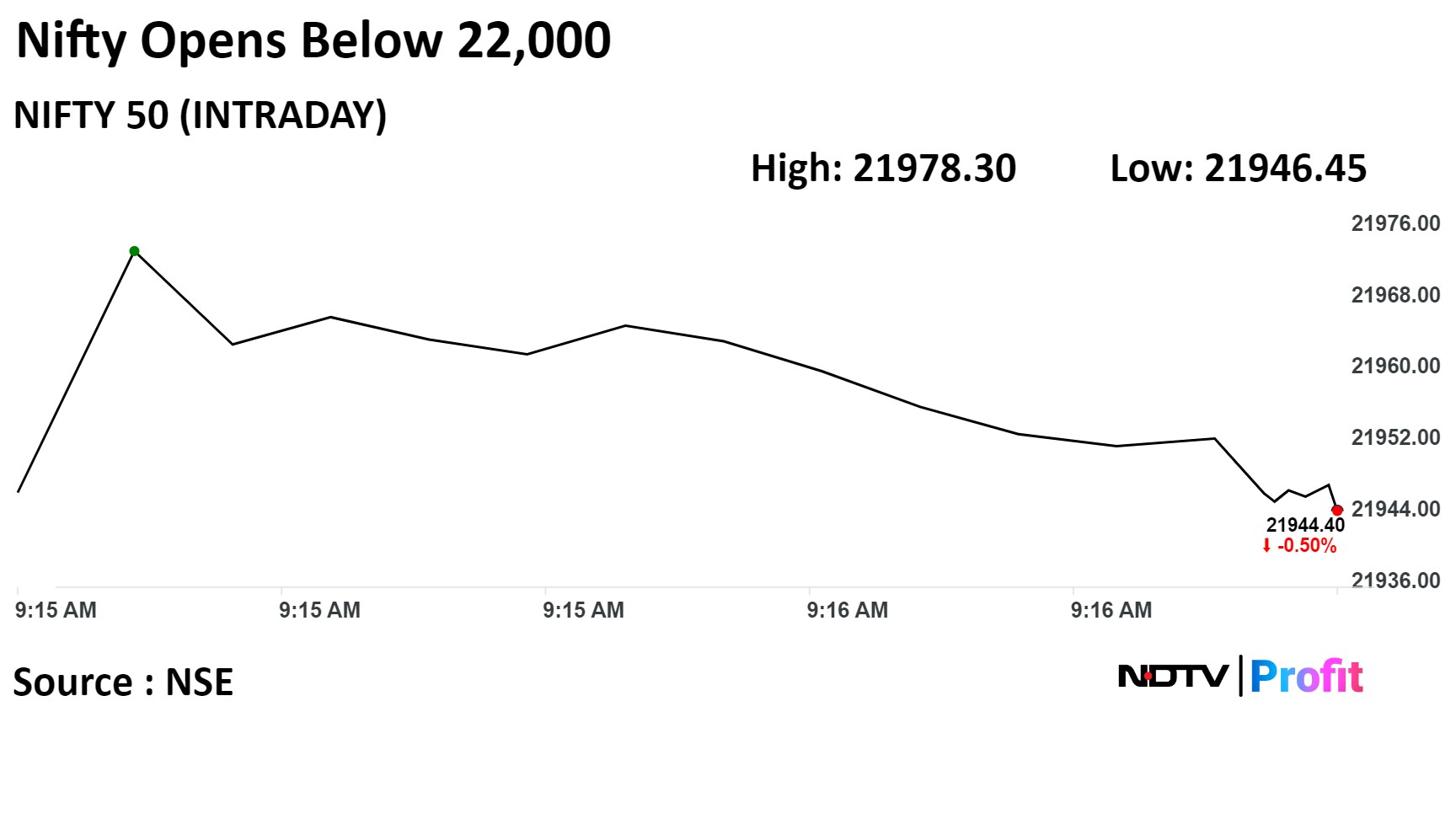

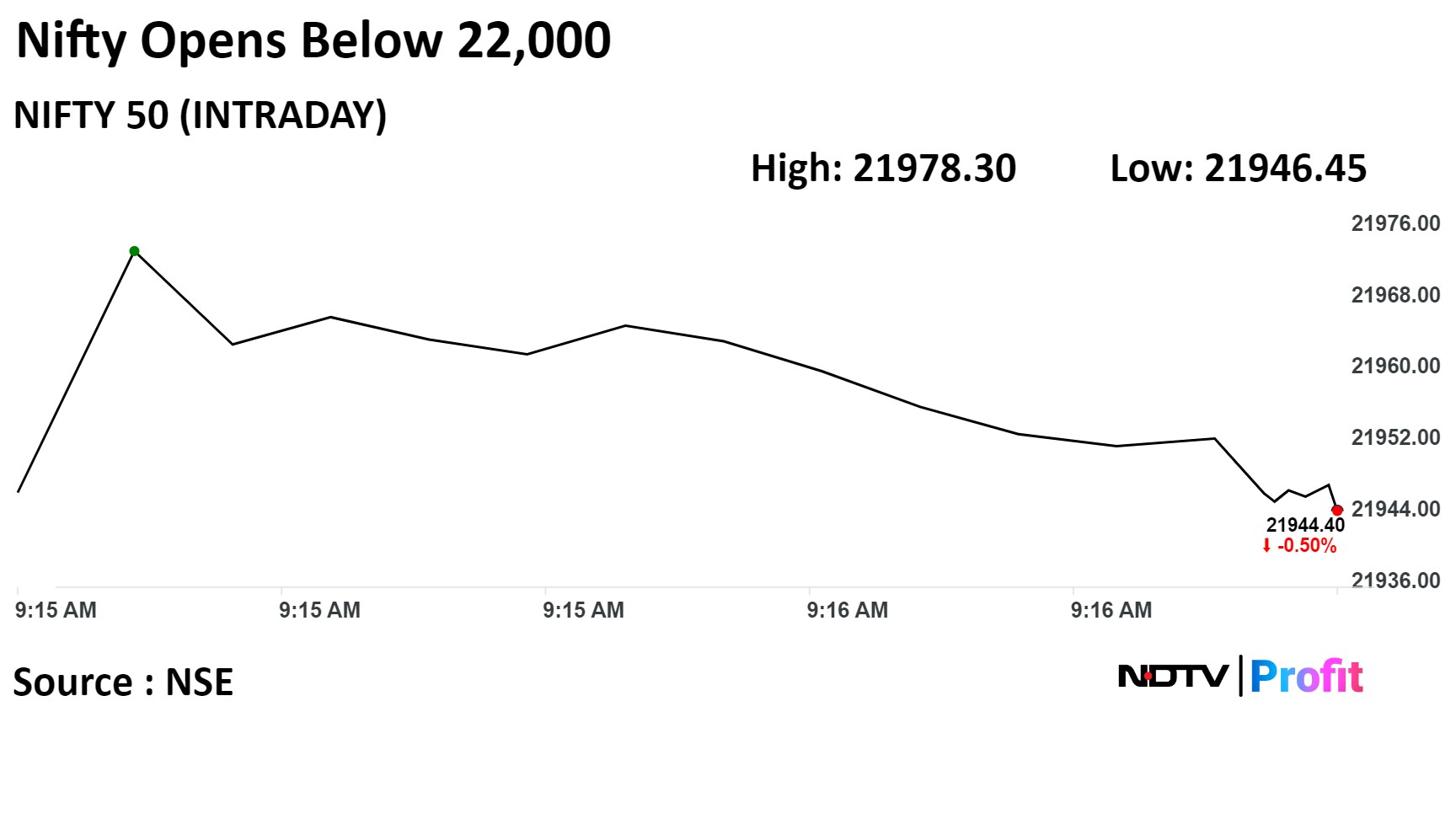

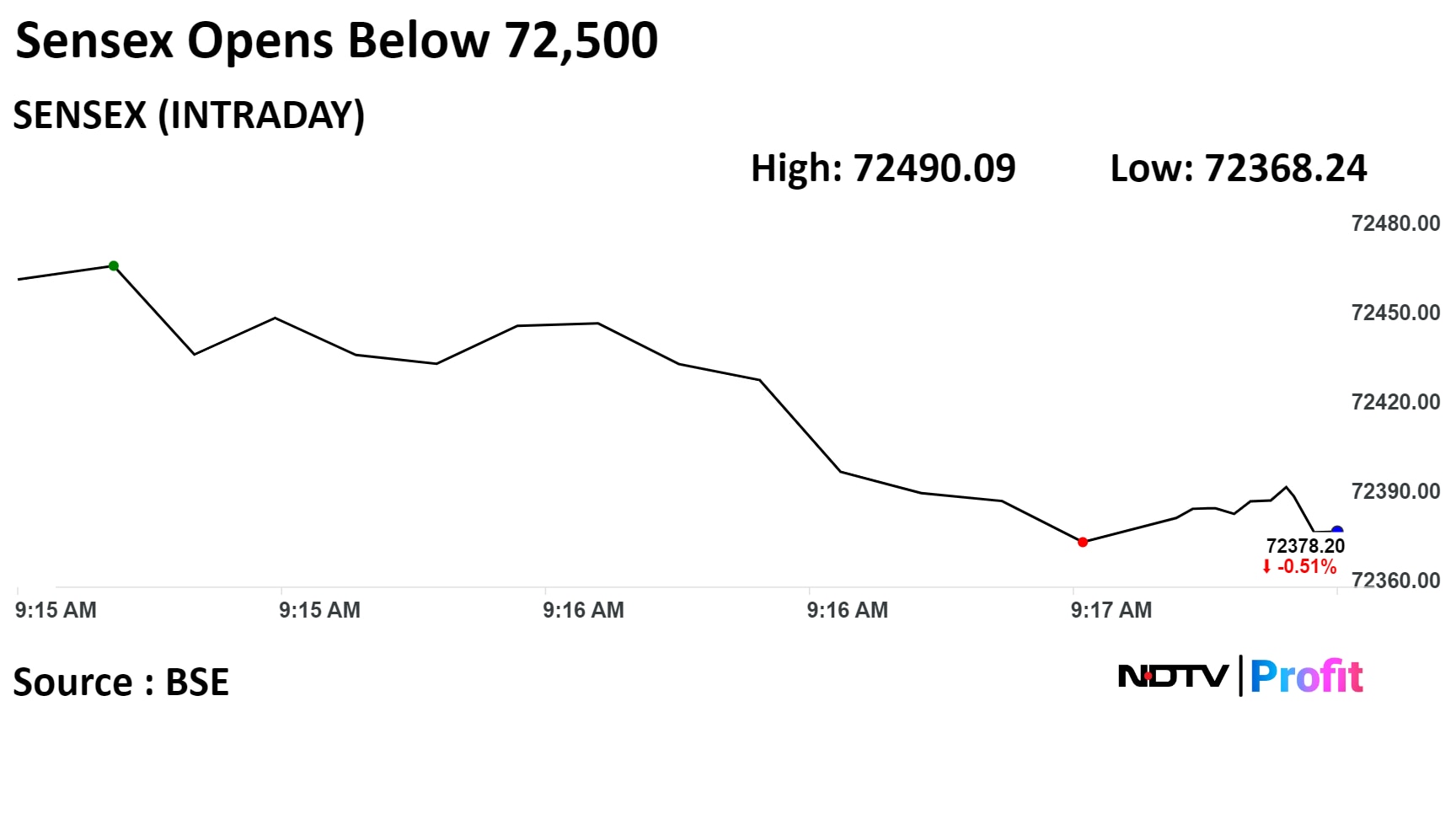

Benchmark equity indices opened lower today with TCS contributing the most to the fall after 2.02 crore shares change hands in five large trades.

At pre-open, the S&P BSE Sensex Index was at 72,462.94, down 285.48 points or 0.39% while the NSE Nifty 50 was at 21,946.45, down 109.25 points or 0.50%.

Benchmark equity indices opened lower today with TCS contributing the most to the fall after 2.02 crore shares change hands in five large trades.

At pre-open, the S&P BSE Sensex Index was at 72,462.94, down 285.48 points or 0.39% while the NSE Nifty 50 was at 21,946.45, down 109.25 points or 0.50%.

Benchmark equity indices opened lower today with TCS contributing the most to the fall after 2.02 crore shares change hands in five large trades.

At pre-open, the S&P BSE Sensex Index was at 72,462.94, down 285.48 points or 0.39% while the NSE Nifty 50 was at 21,946.45, down 109.25 points or 0.50%.

Benchmark equity indices opened lower today with TCS contributing the most to the fall after 2.02 crore shares change hands in five large trades.

At pre-open, the S&P BSE Sensex Index was at 72,462.94, down 285.48 points or 0.39% while the NSE Nifty 50 was at 21,946.45, down 109.25 points or 0.50%.

Benchmark equity indices opened lower today with TCS contributing the most to the fall after 2.02 crore shares change hands in five large trades.

At pre-open, the S&P BSE Sensex Index was at 72,462.94, down 285.48 points or 0.39% while the NSE Nifty 50 was at 21,946.45, down 109.25 points or 0.50%.

Benchmark equity indices opened lower today with TCS contributing the most to the fall after 2.02 crore shares change hands in five large trades.

At pre-open, the S&P BSE Sensex Index was at 72,462.94, down 285.48 points or 0.39% while the NSE Nifty 50 was at 21,946.45, down 109.25 points or 0.50%.

Benchmark equity indices opened lower today with TCS contributing the most to the fall after 2.02 crore shares change hands in five large trades.

At pre-open, the S&P BSE Sensex Index was at 72,462.94, down 285.48 points or 0.39% while the NSE Nifty 50 was at 21,946.45, down 109.25 points or 0.50%.

Benchmark equity indices opened lower today with TCS contributing the most to the fall after 2.02 crore shares change hands in five large trades.

At pre-open, the S&P BSE Sensex Index was at 72,462.94, down 285.48 points or 0.39% while the NSE Nifty 50 was at 21,946.45, down 109.25 points or 0.50%.

Shares of Tata Consultancy Services Ltd. contributed the most to the fall followed by Reliance Industries Ltd., Infosys Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd.

Meanwhile, those of ITC Ltd., Bajaj Finance Ltd., Sun Pharmaceutical Industries Ltd., Oil & Natural Gas Corp Ltd., and Adani Enterprises Ltd minimised the losses.

The fall was across sectors with Nifty IT losing the most. Nifty PSU Bank was the only sectoral index that rose.

Broader markets outperformed. The S&P BSE Midcap was 0.15% lower, and the S&P BSE Smallcap gained 0.20%.

On BSE, fourteen sectors declined, and six advanced. The S&P BSE Oil & Gas fell the most.

Market breadth was skewed in favour of buyers. Around 1,615 stocks advanced, 1,108 stocks fell, and 122 stocks remained unchanged on BSE.

Kotak institutional has a 'buy', hikes TP on Interglobe Aviation to Rs 4200 (3700 earlier)

Boeing to meaningfully limit capacity addition if peers over time

Real demand not served fully by supply and will grow at a healthy pace

Indigo to benefit from timely orders of past and healthy pricing ahead

We increase FV to Rs4,200 on higher 20X earnings multiple

Sets policy rate in the range between 0% to 0.1%

Scraps yield curve control, tweaks asset purchases

To continue JGB buys with broadly the same amount as before

Source: Bloomberg

At pre-open, the S&P BSE Sensex Index was at 72,462.94, down 285.48 points or 0.39% while the NSE Nifty 50 was at 21,946.45, down 109.25 points or 0.50%.

The local currency weakened by 3 paise to open at 82.94 against the U.S. Dollar.

It closed at 82.91 a dollar on Monday.

Source: Bloomberg

The yield on the 10-year bond opened flat at 7.09%.

Source: Bloomberg

Winlevi to be available in Australia from June 2024

Winlevi is approved for treatment of acne vulgaris in people 12 years and older

Source: Exchange filing

Loan growth to sustain at healthy around 25% CAGR after merger

Business mix to diversify; new product lines to open up growth avenues

Cost ratios to stay elevated; operating leverage to improve gradually

Elevated funding costs to remain a drag on near-term margins

Focus: merger integration with Fincare SFB

RoA to remain suppressed in near term, values it at 2.7 times PBV

Emkay reiterates reduce on Poonawalla with TP of Rs 440 per share

Announced the appointment of Mr. Arvind Kapil as the MD & CEO for 5 years

Expect Co to pivot to phygital approach: wider product offering, larger customer base

Right ingredients are in place to establish a successful retail lending franchise

Pivot in business model likely to drive growth, profitability moderation in near term

Value Poonawalla Fincorp at 3.1 times FY26E PBV

ICICI Bank

Expect tight liquidity, rate cut in / after Q4FY25

Deposit rates largely stable, margins expected to be stable

Loan growth in unsecured retail to moderate

Some improvement in pricing on Corporate

Kotak Bank

Deposit mobilisation a challenge, no challenge on loan growth

Gradual moderation in margins going forward, margins to normalise at pre-covid level

Expect cost ratios to moderate

Unsecured currently at 11.6% to rise to mid-teens

U.S. Dollar Index at 103.64

U.S. 10-year bond yield at 4.32%

Brent crude down 0.12% at $86.79 per barrel

Nymex crude down 0.15% at $82.60 per barrel

GIFT Nifty down 41.5 points or 0.19% at 22,055.50 as of 7:25 a.m.

Bitcoin was down 2.11% at $65,931.94

U.S. Dollar Index at 103.64

U.S. 10-year bond yield at 4.32%

Brent crude down 0.12% at $86.79 per barrel

Nymex crude down 0.15% at $82.60 per barrel

GIFT Nifty down 41.5 points or 0.19% at 22,055.50 as of 7:25 a.m.

Bitcoin was down 2.11% at $65,931.94

Met 40 investors at Financials roadshow

Investor mood has become cautious on India / financials

HDFC Bank has value but still not the time to go long

Investors still not confident of HDFC Bank delivering good numbers in near term

Shriram Finance consensus overweight among investors

Investors looking at PSUs more favourably

IndusInd Bank: valuations, risk reward comfortable, CEO renewal worrying investors

No interest in Paytm till dust settles

PB Fintech: valuations look stretched, expect some profit taking

HDFC Life: growth challenge, parent focused on selling deposits than insurance

SBI Life: preferred pick

SBI Cards: consensus sell

Trade: long PSU banks, sell private sector banks

Macquarie view: Growth to be biggest casualty

Received order for restoration of 33 wind turbine generators

Project worth Rs 39.5 crore to be completed within 8 months

Source: Exchange filing

HDFC’s Arvind Kapil to be Poonawalla Fincorp MD

Senior Management exit is negative

Smooth transitions will be key

Bank's strong talent base is comfort

Might be negative setiment for BAF, Poonawalla's peer

Watch for any attrition risk at Kotak

Target price of Rs 1,625

Mortgage business head, Arvind Kapil, to move out of bank

Post merger, he was responsible for managing home loan portfolio

Pre-merger, headed banks retail lending franchise

Bank has a significant depth in senior management

Do not expect any material impact on the business owing to this change

Churn at senior management level in medium term to be a key monitorable

Maintain 'sell' with target price at Rs 33,800 apiece.

Demand environment remains subdued

Volume decline higher in athleisurewear vs innerwear

Aspiration of Rs 8,000 crore revenue likely pushed to FY28E vs FY27E

Near-term Ebitda margin may get impacted due to investments

New customer acquisition in men’s innerwear remains subdued

Valuations at 53x 1-year forward consensus EPS

Price target of Rs 2,515

Management sees no change in demand environment

Positive client sentiment has not translated to higher deal TCV

Management expects 4Q growth beyond reversal of furloughs benefit

Expect FY24E margins to remain in guided range of 15.25-16.25%

Nifty March futures up by 0.01% to 22,135.45 at a premium of 79.75 points.

Nifty March futures open interest down by 1.07%.

Nifty Bank March futures up by 0.19% to 46,741.6 at a premium of 165.7 points.

Nifty Bank March futures open interest down by 1.9%.

Nifty Options March 21 Expiry: Maximum call open interest at 23,000 and maximum put open interest at 21,000.

Bank Nifty Options March Expiry: Maximum call open interest at 47,000 and maximum put open interest at 45,000.

Securities in ban period: Aditya Birla Fashion, Balrampur Chini Mills, Bharat Heavy Electricals, Biocon, Hindustan Copper, Manappuram Finance, National Aluminium, Piramal Enterprise, RBL Bank, Sail, Tata Chemical, Zee Entertainment Enterprise.

Ex/record Dividend: TVS Motor, KEI Industries, Sudarshan Chemical Industries.

Ex/record Bonus: Rama Steel Tubes.

Moved out of short-term ASM framework: Agro Tech Foods, Dynacons Systems and Solutions, IIFL Finance.

Mangalam Cement: Promoter Rambara Trading bought 40,500 shares on March 15.

Man Infraconstruction: Promoter Mansi P. Shah bought 2.31 lakh shares on March 15.

Satin Creditcare Network: Promoter Trishashna Holdings and Investments bought 96,533 shares on March 14.

Nuvoco Vistas Corporation: Promoter Niyogi Enterprise bought 1.1 lakh shares on March 15.

Repco Home Finance: S Gupta Family Investments bought 6 lakh shares (0.95%), SG Sports sold 5 lakh shares (0.79%) at Rs 395 apiece.

Krystal Integrated Services: The public issue was subscribed to 13.21 times on day 3. The bids were led by institutional investors (7.33 times), non-institutional investors (43.91 times), retail investors (3.32 times).

Popular Vehicles and Services: The company's shares will debut on the stock exchanges on Tuesday at an issue price of Rs 295 apiece. The Rs 601.55-crore IPO was subscribed 1.23 times on its third and final day. Bids were led by institutional investors (1.97 times), retail investors (1.05 times), non-institutional investors (0.66 times), and portion reserved for employees (7.59 times).

TCS: Tata Sons is looking to sell 2.34 crore shares of the company at Rs 4,001 per share. Through this sale, Tata Sons will raise approximately Rs 9,362 crore, or $1.13 billion.

L&T Finance: The board approved fund-raising through debentures. Funds are to be raised in a way that NCDs are issued and those outstanding do not exceed Rs 1.01 lakh crore.

Adani Group: The Adani Group has denied a Bloomberg report that said U.S. prosecutors have widened their probe on alleged bribery in India, calling it "false".

Aditya Birla Sun Life AMC: Two promoter entities of Aditya Birla Sun Life AMC Ltd. have offered to sell up to 11.47% of their stake through an offer for sale to achieve the minimum public shareholding norms. The floor price has been set at Rs 450 per share.

Poonawalla Fincorp: HDFC Bank veteran Arvind Kapil has been appointed as the company's new managing director and chief executive officer.

Tata Steel: Tata Steel UK has decided to cease operations of the coke ovens at the Port Talbot plant in Wales, following a deterioration of operational stability. The company will increase imports of coke to offset the impact of the coke oven closures.

HG Infra Engineering: The company received four orders worth Rs 1,026 crore with the Stockwell Solar Services JV consortium for solar business from Jodhpur Vidyut Vitran Nigam.

Paradeep Phosphates: The company shuts down ammonia and urea plants in Goa due to the breakdown of the synthesis gas compressor.

IRCTC: The company approved a Rs 187 crore project cost for the disaster recovery site at Secunderabad.

Sonata Software: The company signed a joint go-to-market agreement with Zones to simplify enterprise application delivery through end-to-end cloud-managed services.

IOL Chemicals and Pharmaceuticals: The company successfully completed the Brazilian Health Regulatory Agency GMP audit of all the 10 APIs manufacturing units situated in Punjab without any observation. The inspection was conducted from March 11 to 15.

Aegis Logistics: The company’s unit has approved the acquisition of the specialised storage terminals at Mangalore, resulting in capacity addition at its facilities at Mangalore. The project will entail an investment of up to Rs 75 crore for acquired capacity and up to Rs 50 crore for additional capacity under construction.

Signature Global: The company completed the acquisition of 100% stake in Gurugram Commercity. GCPL is now a wholly owned subsidiary of the company, effective today.

TVS Supply Chain Solutions: The company has deregistered their step-down subsidiary, Transtar China, as part of the of the rationalisation of the holding structure of foreign subsidiaries.

JSW Steel: The company clarified that it has not made a Rs 5 crore political contribution to JD(S) via electoral bonds.

Lemon Tree: The company signed a licence pact for an 80-room hotel in Tripura.

Nibe: The company received a purchase order worth Rs 21 crore from Larsen and Toubro for assemblies and sub-assemblies of heavy structures, including construction gabion walls.

Shares in the Asian-Pacific region were under pressure as investors awaited cues from various central bank decisions over the week, starting with the Bank of Japan. Hong Kong's Hang Seng fell over 1%, while Australia's S&P ASX 200 traded flat.

Overnight, U.S. stocks began the week by powering ahead with a rally in their tech stocks. The S&P 500 index and Nasdaq 100 rose 0.63% and 0.82%, respectively, as of Monday.

The yield on the 10-year U.S. bond was trading at 4.32%, and Bitcoin was below 66,000. Brent crude was trading 0.12% lower at $86.79. a barrel.

The March futures contract of the GIFT Nifty was at 22,055.50, down 41.5 points or 0.19% as of 7:25 a.m.

India's benchmark indices rebounded on Monday from a one-session fall to end the first session of the week higher, tracking gains in Tata Steel Ltd., Reliance Industries Ltd., and Mahindra & Mahindra Ltd.

The NSE Nifty 50 closed 32.35 points, or 0.15%, higher at 22,055.70, and the S&P BSE Sensex ended 104.99 points, or 0.14%, up at 72,748.42.

Overseas investors turned net sellers of Indian equities on Monday. Foreign portfolio investors offloaded stocks worth Rs 2,051.1 crore, while domestic institutional investors turned buyers and mopped up equities worth Rs 2,260.8 crore, the NSE data showed.

The Indian rupee weakened by 2 paise to close at Rs 82.91 against the U.S. dollar.

Shares in the Asian-Pacific region were under pressure as investors awaited cues from various central bank decisions over the week, starting with the Bank of Japan. Hong Kong's Hang Seng fell over 1%, while Australia's S&P ASX 200 traded flat.

Overnight, U.S. stocks began the week by powering ahead with a rally in their tech stocks. The S&P 500 index and Nasdaq 100 rose 0.63% and 0.82%, respectively, as of Monday.

The yield on the 10-year U.S. bond was trading at 4.32%, and Bitcoin was below 66,000. Brent crude was trading 0.12% lower at $86.79. a barrel.

The March futures contract of the GIFT Nifty was at 22,055.50, down 41.5 points or 0.19% as of 7:25 a.m.

India's benchmark indices rebounded on Monday from a one-session fall to end the first session of the week higher, tracking gains in Tata Steel Ltd., Reliance Industries Ltd., and Mahindra & Mahindra Ltd.

The NSE Nifty 50 closed 32.35 points, or 0.15%, higher at 22,055.70, and the S&P BSE Sensex ended 104.99 points, or 0.14%, up at 72,748.42.

Overseas investors turned net sellers of Indian equities on Monday. Foreign portfolio investors offloaded stocks worth Rs 2,051.1 crore, while domestic institutional investors turned buyers and mopped up equities worth Rs 2,260.8 crore, the NSE data showed.

The Indian rupee weakened by 2 paise to close at Rs 82.91 against the U.S. dollar.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.