The yield on the 10-year bond closed 2 bps lower at 7.16% on Thursday.

Source: Bloomberg

The local currency closed at 83.03 against the U.S dollar on Thursday.

Source: Bloomberg

Indian stock market ended higher on Thursday after a range bound session ahead of the release of the crucial U.S. CPI data later today, which will provide fresh cues about Federal Reserve's monetary policy moving ahead.

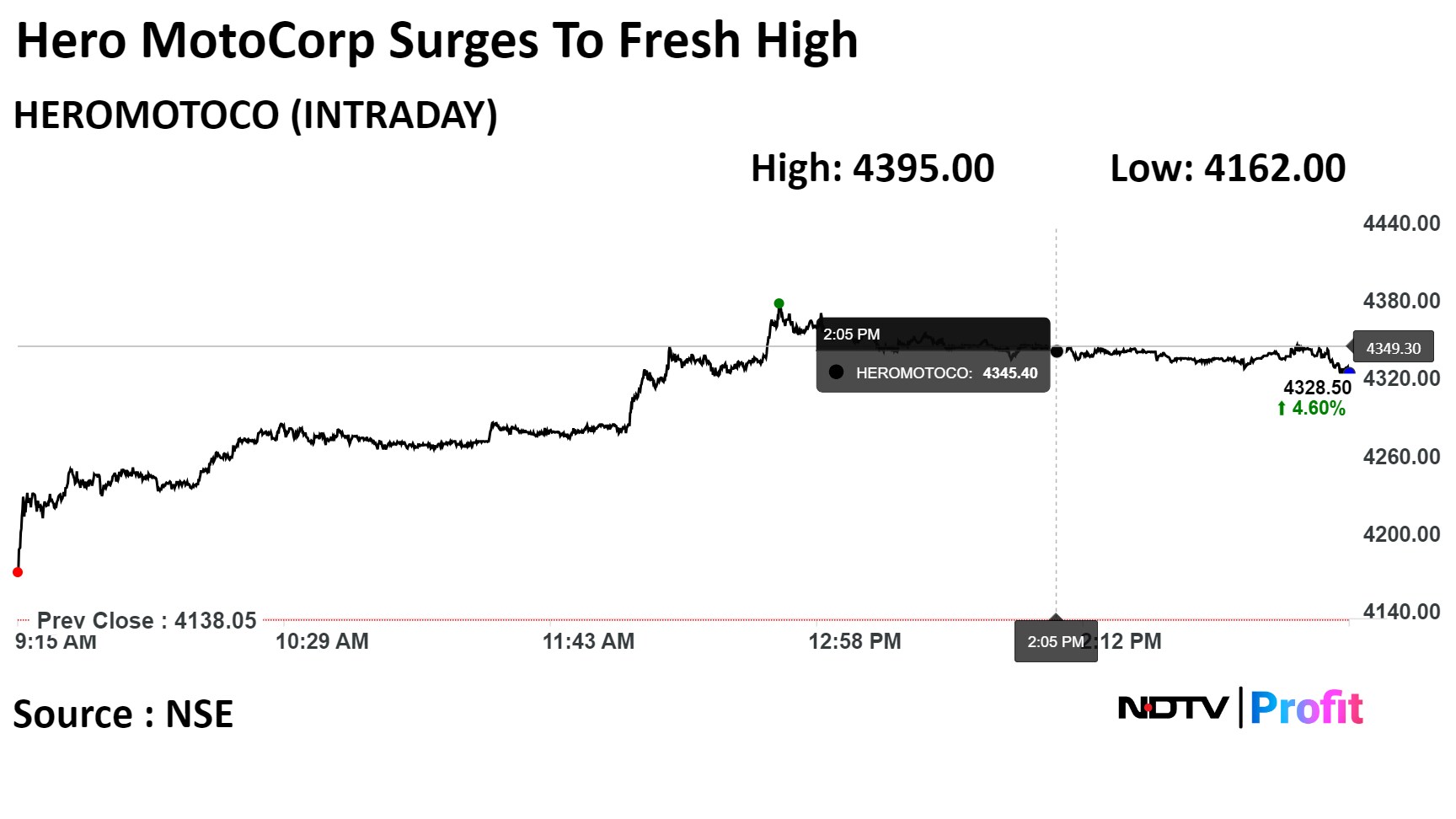

Reliance Industries Ltd, Axis Bank Ltd, Bajaj Auto Ltd, Hero MotoCorp Ltd led gains in benchmark indices.

The benchmark NSE Nifty 50 ended 0.13% or 28.50 points higher at 21,647.20, while the S&P BSE Sensex ended 0.089% or 63.47 points higher at 71,721.18.

"In anticipation of inflation data from the US, the Indian market exhibited range-bound trade. Though investors anticipate US inflation to ease, global markets, expecting a CY24 interest rate cut, have already priced in optimism. Profit booking occurred amid moderating Q3 corporate earnings and concerns about premium valuations. Selling pressure on IT stocks stemmed from weak earnings estimates," said Vinod Nair, head of research, Geojit Financial Services.

The U.S. CPI is expected to remain unchanged at 3.2% on year in December, according to a Bloomberg survey.

Indian stock market ended higher on Thursday after a range bound session ahead of the release of the crucial U.S. CPI data later today, which will provide fresh cues about Federal Reserve's monetary policy moving ahead.

Reliance Industries Ltd, Axis Bank Ltd, Bajaj Auto Ltd, Hero MotoCorp Ltd led gains in benchmark indices.

The benchmark NSE Nifty 50 ended 0.13% or 28.50 points higher at 21,647.20, while the S&P BSE Sensex ended 0.089% or 63.47 points higher at 71,721.18.

"In anticipation of inflation data from the US, the Indian market exhibited range-bound trade. Though investors anticipate US inflation to ease, global markets, expecting a CY24 interest rate cut, have already priced in optimism. Profit booking occurred amid moderating Q3 corporate earnings and concerns about premium valuations. Selling pressure on IT stocks stemmed from weak earnings estimates," said Vinod Nair, head of research, Geojit Financial Services.

The U.S. CPI is expected to remain unchanged at 3.2% on year in December, according to a Bloomberg survey.

Indian stock market ended higher on Thursday after a range bound session ahead of the release of the crucial U.S. CPI data later today, which will provide fresh cues about Federal Reserve's monetary policy moving ahead.

Reliance Industries Ltd, Axis Bank Ltd, Bajaj Auto Ltd, Hero MotoCorp Ltd led gains in benchmark indices.

The benchmark NSE Nifty 50 ended 0.13% or 28.50 points higher at 21,647.20, while the S&P BSE Sensex ended 0.089% or 63.47 points higher at 71,721.18.

"In anticipation of inflation data from the US, the Indian market exhibited range-bound trade. Though investors anticipate US inflation to ease, global markets, expecting a CY24 interest rate cut, have already priced in optimism. Profit booking occurred amid moderating Q3 corporate earnings and concerns about premium valuations. Selling pressure on IT stocks stemmed from weak earnings estimates," said Vinod Nair, head of research, Geojit Financial Services.

The U.S. CPI is expected to remain unchanged at 3.2% on year in December, according to a Bloomberg survey.

Indian stock market ended higher on Thursday after a range bound session ahead of the release of the crucial U.S. CPI data later today, which will provide fresh cues about Federal Reserve's monetary policy moving ahead.

Reliance Industries Ltd, Axis Bank Ltd, Bajaj Auto Ltd, Hero MotoCorp Ltd led gains in benchmark indices.

The benchmark NSE Nifty 50 ended 0.13% or 28.50 points higher at 21,647.20, while the S&P BSE Sensex ended 0.089% or 63.47 points higher at 71,721.18.

"In anticipation of inflation data from the US, the Indian market exhibited range-bound trade. Though investors anticipate US inflation to ease, global markets, expecting a CY24 interest rate cut, have already priced in optimism. Profit booking occurred amid moderating Q3 corporate earnings and concerns about premium valuations. Selling pressure on IT stocks stemmed from weak earnings estimates," said Vinod Nair, head of research, Geojit Financial Services.

The U.S. CPI is expected to remain unchanged at 3.2% on year in December, according to a Bloomberg survey.

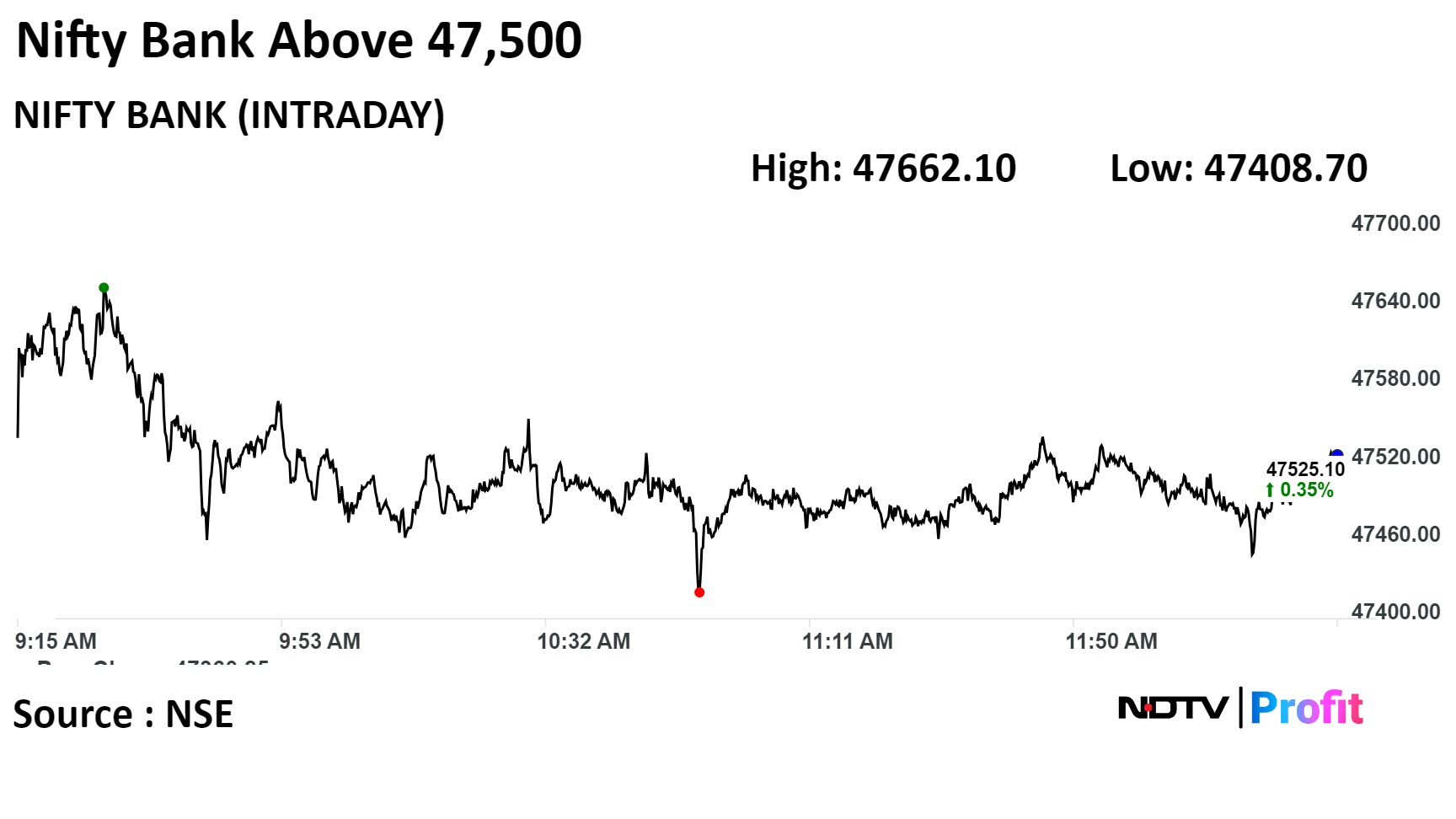

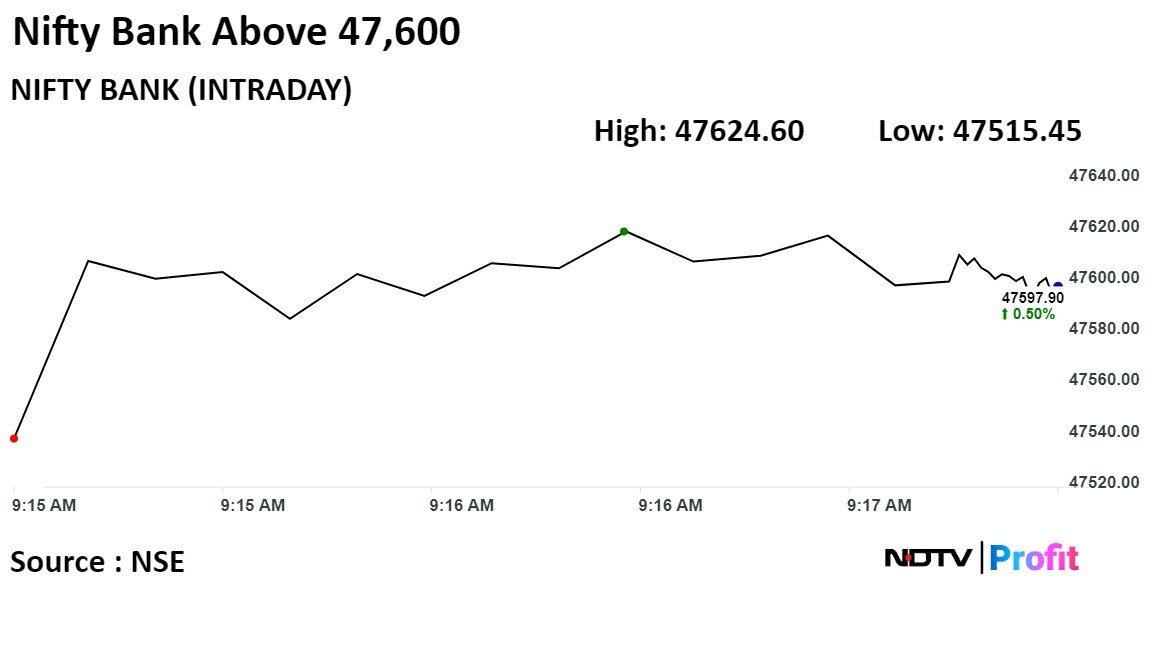

The Bank Nifty index witnessed ongoing struggles between bulls and bears, leading to a volatile trading session. A significant hurdle for the index is identified at 48000, marked by substantial call writing. A decisive breakthrough above this level is anticipated to trigger a sharp short-covering rally. On the downside, the lower-end support remains intact at 46900. A close below this support level may intensify selling pressure in the market," said Kunal Shah, senior technical and derivative analyst at LKP Securities.

Indian stock market ended higher on Thursday after a range bound session ahead of the release of the crucial U.S. CPI data later today, which will provide fresh cues about Federal Reserve's monetary policy moving ahead.

Reliance Industries Ltd, Axis Bank Ltd, Bajaj Auto Ltd, Hero MotoCorp Ltd led gains in benchmark indices.

The benchmark NSE Nifty 50 ended 0.13% or 28.50 points higher at 21,647.20, while the S&P BSE Sensex ended 0.089% or 63.47 points higher at 71,721.18.

"In anticipation of inflation data from the US, the Indian market exhibited range-bound trade. Though investors anticipate US inflation to ease, global markets, expecting a CY24 interest rate cut, have already priced in optimism. Profit booking occurred amid moderating Q3 corporate earnings and concerns about premium valuations. Selling pressure on IT stocks stemmed from weak earnings estimates," said Vinod Nair, head of research, Geojit Financial Services.

The U.S. CPI is expected to remain unchanged at 3.2% on year in December, according to a Bloomberg survey.

Indian stock market ended higher on Thursday after a range bound session ahead of the release of the crucial U.S. CPI data later today, which will provide fresh cues about Federal Reserve's monetary policy moving ahead.

Reliance Industries Ltd, Axis Bank Ltd, Bajaj Auto Ltd, Hero MotoCorp Ltd led gains in benchmark indices.

The benchmark NSE Nifty 50 ended 0.13% or 28.50 points higher at 21,647.20, while the S&P BSE Sensex ended 0.089% or 63.47 points higher at 71,721.18.

"In anticipation of inflation data from the US, the Indian market exhibited range-bound trade. Though investors anticipate US inflation to ease, global markets, expecting a CY24 interest rate cut, have already priced in optimism. Profit booking occurred amid moderating Q3 corporate earnings and concerns about premium valuations. Selling pressure on IT stocks stemmed from weak earnings estimates," said Vinod Nair, head of research, Geojit Financial Services.

The U.S. CPI is expected to remain unchanged at 3.2% on year in December, according to a Bloomberg survey.

Indian stock market ended higher on Thursday after a range bound session ahead of the release of the crucial U.S. CPI data later today, which will provide fresh cues about Federal Reserve's monetary policy moving ahead.

Reliance Industries Ltd, Axis Bank Ltd, Bajaj Auto Ltd, Hero MotoCorp Ltd led gains in benchmark indices.

The benchmark NSE Nifty 50 ended 0.13% or 28.50 points higher at 21,647.20, while the S&P BSE Sensex ended 0.089% or 63.47 points higher at 71,721.18.

"In anticipation of inflation data from the US, the Indian market exhibited range-bound trade. Though investors anticipate US inflation to ease, global markets, expecting a CY24 interest rate cut, have already priced in optimism. Profit booking occurred amid moderating Q3 corporate earnings and concerns about premium valuations. Selling pressure on IT stocks stemmed from weak earnings estimates," said Vinod Nair, head of research, Geojit Financial Services.

The U.S. CPI is expected to remain unchanged at 3.2% on year in December, according to a Bloomberg survey.

Indian stock market ended higher on Thursday after a range bound session ahead of the release of the crucial U.S. CPI data later today, which will provide fresh cues about Federal Reserve's monetary policy moving ahead.

Reliance Industries Ltd, Axis Bank Ltd, Bajaj Auto Ltd, Hero MotoCorp Ltd led gains in benchmark indices.

The benchmark NSE Nifty 50 ended 0.13% or 28.50 points higher at 21,647.20, while the S&P BSE Sensex ended 0.089% or 63.47 points higher at 71,721.18.

"In anticipation of inflation data from the US, the Indian market exhibited range-bound trade. Though investors anticipate US inflation to ease, global markets, expecting a CY24 interest rate cut, have already priced in optimism. Profit booking occurred amid moderating Q3 corporate earnings and concerns about premium valuations. Selling pressure on IT stocks stemmed from weak earnings estimates," said Vinod Nair, head of research, Geojit Financial Services.

The U.S. CPI is expected to remain unchanged at 3.2% on year in December, according to a Bloomberg survey.

The Bank Nifty index witnessed ongoing struggles between bulls and bears, leading to a volatile trading session. A significant hurdle for the index is identified at 48000, marked by substantial call writing. A decisive breakthrough above this level is anticipated to trigger a sharp short-covering rally. On the downside, the lower-end support remains intact at 46900. A close below this support level may intensify selling pressure in the market," said Kunal Shah, senior technical and derivative analyst at LKP Securities.

Reliance Industries Ltd, Axis Bank Ltd, Bajaj Auto Ltd, Hero MotoCorp Ltd, and Tata Consultancy Services Ltd. added positively to the indices.

Infosys Ltd, HDFC Bank Ltd, Larsen & Toubro Ltd, Hindustan Unilever Ltd, ICICI Bank Ltd weighed on indices.

On NSE, Six out of 12 sectors gained, and six declined. Nifty Oil & Gas sector rose 1.48% and was the top performer among sectoral indices, while Nifty Media fell 0.35% to become the top loser among sectoral indices.

The broader markets outperformed benchmark indices. The S&P BSE Midcap index rose 0.66% and BSE Smallcap rose 0.79%. Around 13 sectors out of 20 sectors, compiled by BSE advanced, while seven declined. S&P BSE Energy rose 1.57% to become the top gainer among sectoral indices, while S&P BSE Capital Goods fell 1.20% to become the top loser among sectoral indices.

Market breadth was skewed in favour of buyers. Around 2362 stocks rose, 1468 stocks declined, and 107 stocks remained unchanged on BSE.

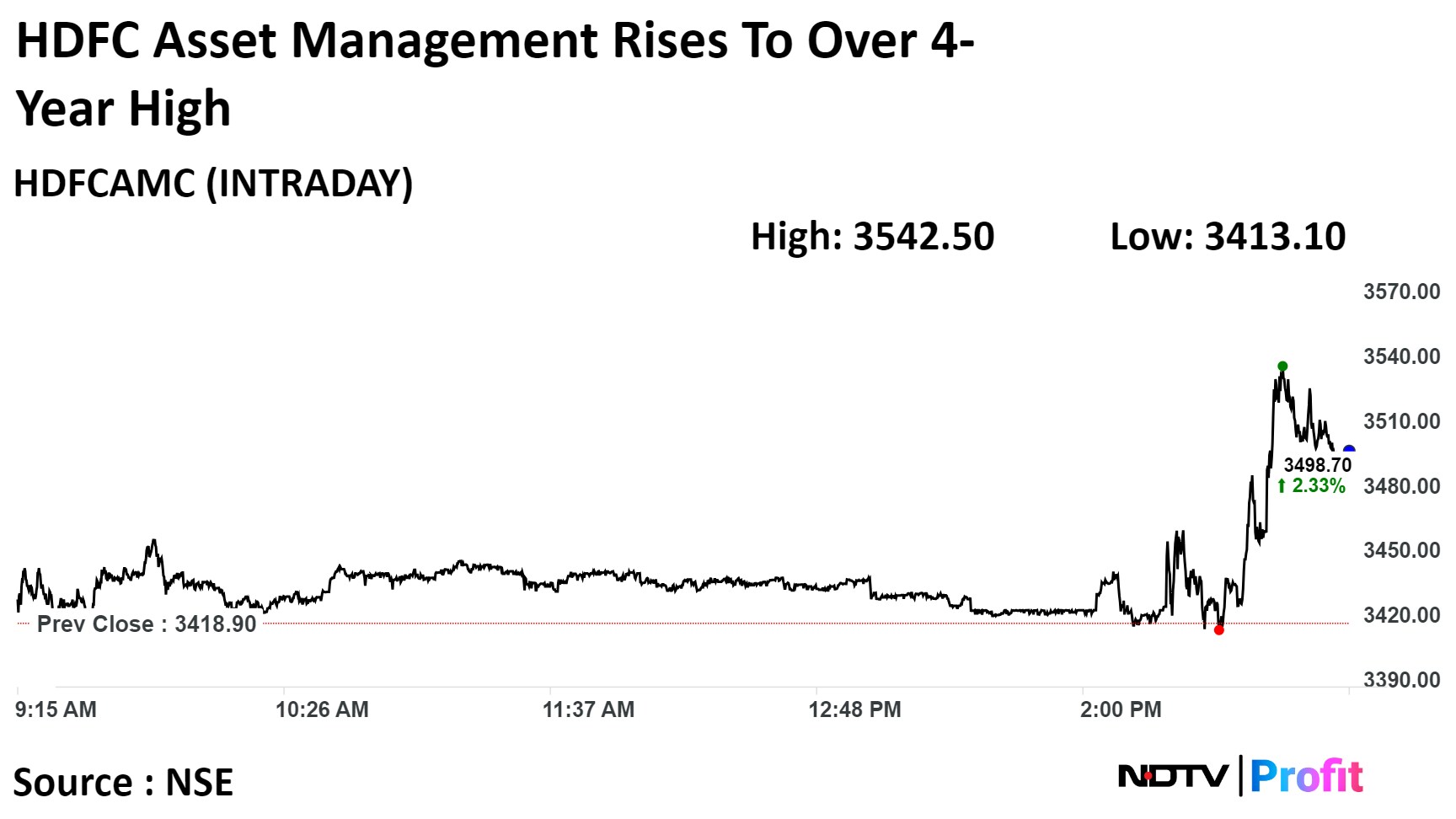

Standalone net profit at Rs 489.7 crore vs Bloomberg estimate of Rs 451.7 crore

Standalone total income at Rs 813.75 crore vs Rs 662.9 crore, up 22.75%

Standalone net profit at Rs 489.7 crore vs Rs 369.4 crore, up 32.56%

Standalone revenue at Rs 671.3 crore vs Rs 559.6 crore, up 19.96%

AUM as of Dec 31 at Rs 5.75 lakh crore up 28%

Equity AUM as of Dec 31 at Rs 3.47 lakh crore up 50%

Standalone net profit at Rs 489.7 crore vs Bloomberg estimate of Rs 451.7 crore

Standalone total income at Rs 813.75 crore vs Rs 662.9 crore, up 22.75%

Standalone net profit at Rs 489.7 crore vs Rs 369.4 crore, up 32.56%

Standalone revenue at Rs 671.3 crore vs Rs 559.6 crore, up 19.96%

AUM as of Dec 31 at Rs 5.75 lakh crore up 28%

Equity AUM as of Dec 31 at Rs 3.47 lakh crore up 50%

Scrips of HDFC Asset Management Company Ltd rose 3.62% to Rs 3,542.50, the highest level since Dec 27, 2019.

It has risen 17.77% in 12 months. Total traded volume so far in the day stood at 1.5 times its 30-day average. The relative strength index was at 83.49, which implied the stock is overbought.

Out of 23 analysts tracking the company, 10 maintain a 'buy' rating, 11 recommend a 'hold,' and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an downside of 11.6%.

Incorporates wholly owned subsidiary TVS Holdings Singapore

New unit incorporated for investment purposes

Source: Exchange Filing

Net profit at Rs 24.67 crore vs Rs 39.82 crore down 40%

Revenue at Rs 850.8 crore vs Rs 685.6 crore up 24%

Ebitda at Rs 120.6 crore vs Rs 112.1 crore, up 7.58%

Ebitda margin at 14.17% vs 16.35%, down217 bps

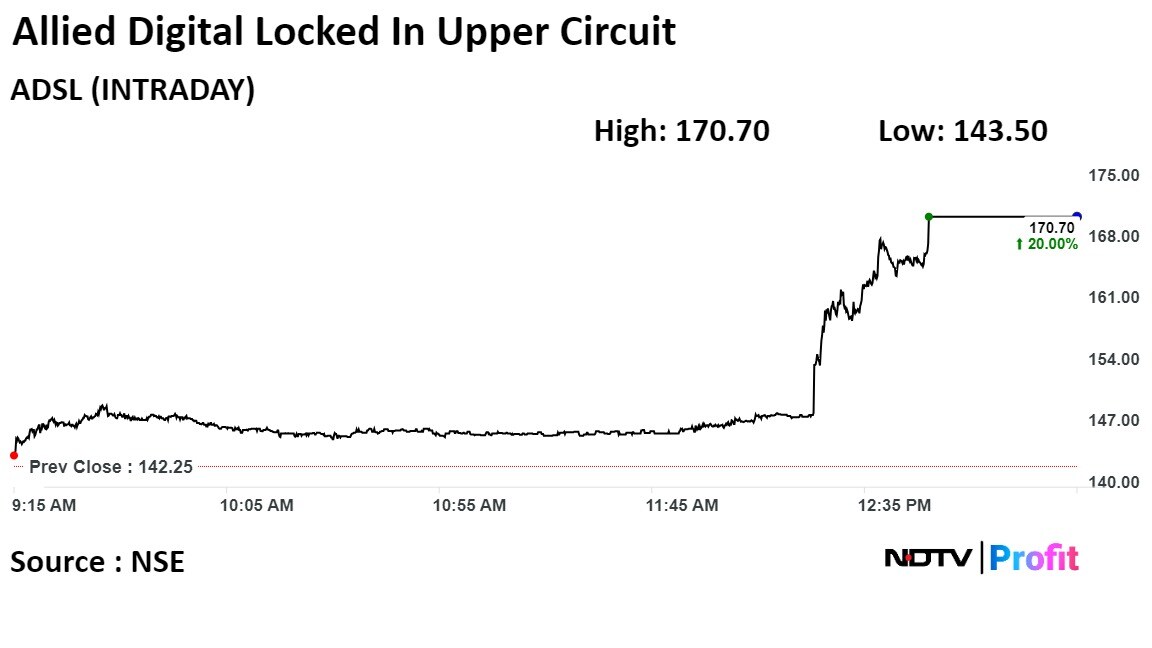

Shares of Allied Digital on Thursday rose over 20%, to be locked in upper circuit after the company was selected as a Master System Integrator for Ayodhya Smart City project. This is the highest in two years.

Shares of Allied Digital on Thursday rose over 20%, to be locked in upper circuit after the company was selected as a Master System Integrator for Ayodhya Smart City project. This is the highest in two years.

The scrip was locked in upper circuit with a jump of 20% to 170.70 apiece, the highest level since Jan. 10, 2022. This compares to a 0.20% advance in the NSE Nifty 50 Index at 1:23 p.m.

It has risen 86.66% in the last 12 months. Total traded volume so far in the day stood at 8.1 times its 30-day average. The relative strength index was at 71 indicating that it was overbought.

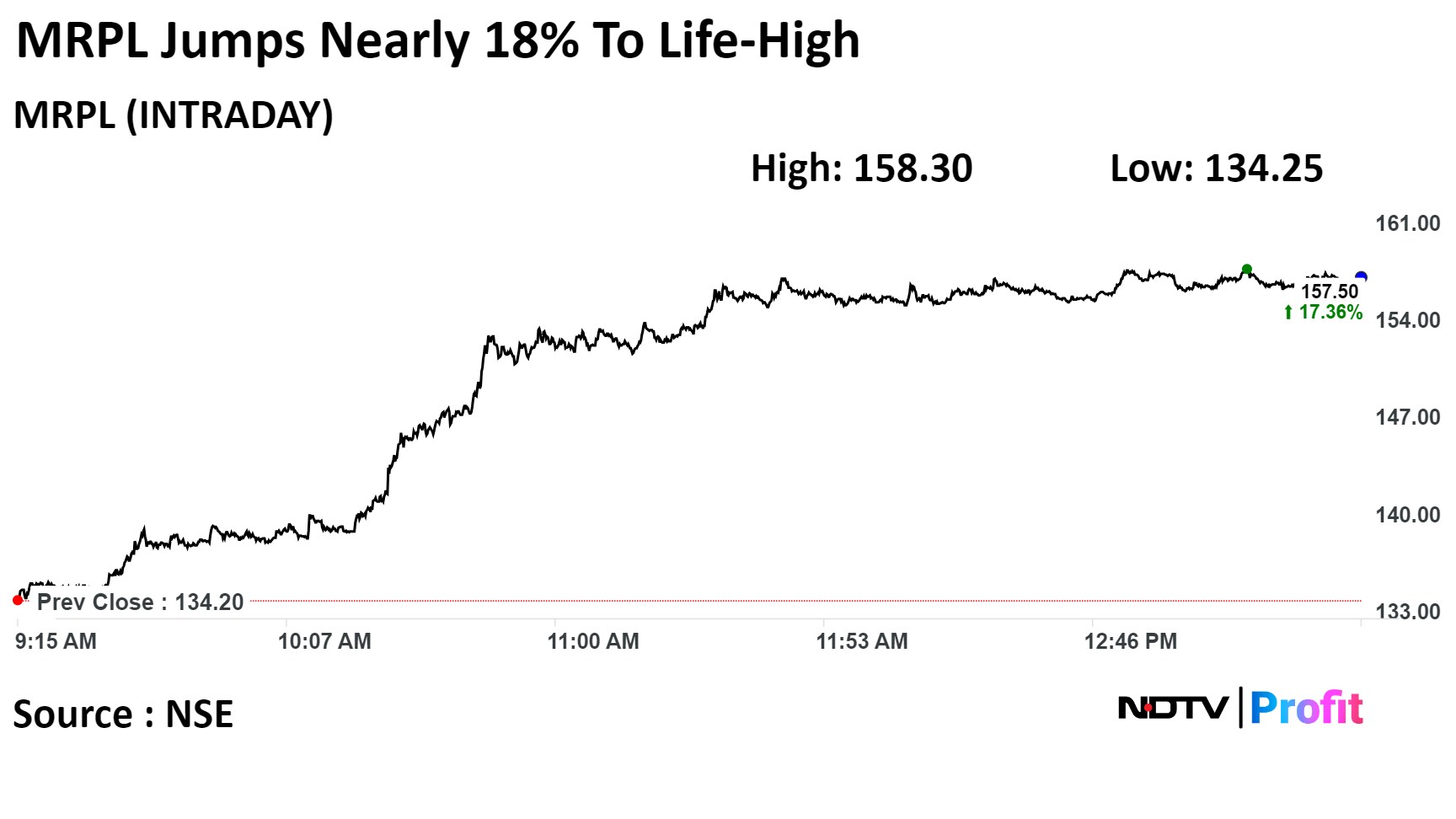

Shares of Mangalore Refinery and Petrochemicals Ltd jumped nearly 18% to record high on Thursday following large trades.

The refinery's total 25.26 lakh shares changed hands in 17 large trades with aggregate value of Rs 43.88 crore

Shares of Mangalore Refinery and Petrochemicals Ltd jumped nearly 18% to record high on Thursday following large trades.

The refinery's total 25.26 lakh shares changed hands in 17 large trades with aggregate value of Rs 43.88 crore

Scrips of MRPL rose as much as 17.96% to Rs 158.30, the highest level since it was listed on Aug 8, 1992. It was trading 17.25% higher at Rs 157.35 as of 1:44 p.m. This compares to 0.21% advance in NSE Nifty 50 index.

India's benchmark stock indices traded higher through midday on Thursday, led by gains in index heavyweight Reliance Industries Ltd., including oil & gas and automobile stocks.

As of 12:30 p.m., the S&P BSE Sensex rose 0.17%, or 122.72 points, to 71,780.42, while the NSE Nifty 50 gained 0.22%, or 47.35 points, to 21,667.80.

The indices moved in a narrow range ahead of the release of the U.S. CPI print for December at 7:00 p.m. IST, which would give further cues to the likely rate action by the Fed.

The U.S. CPI is expected to remain unchanged at 3.2% on year in December, according to a Bloomberg survey.

The Sensex hit an intraday high of 71,999.47 while the Nifty 50 touched 21,726.50 so far on Thursday.

"The Nifty is hovering around the 21,700 mark, with the Sensex gaining 150 points today, indicating a market stuck within a range. The inconsistent behaviour of foreign institutional investors and domestic institutional investors is evident this month, as they engage in alternating bouts of buying and selling, keeping the market confined. To break out or break down from this range, the market requires significant triggers," said Shrey Jain, founder and chief executive officer, SAS Online.

The Nifty is anticipated to trade within the 21,600–21,700 range on Thursday. The index is expected to find support in the range of 21,550–21,600, with a robust buy zone identified around 21,450–21,500 levels, according to Jain.

India's benchmark stock indices traded higher through midday on Thursday, led by gains in index heavyweight Reliance Industries Ltd., including oil & gas and automobile stocks.

As of 12:30 p.m., the S&P BSE Sensex rose 0.17%, or 122.72 points, to 71,780.42, while the NSE Nifty 50 gained 0.22%, or 47.35 points, to 21,667.80.

The indices moved in a narrow range ahead of the release of the U.S. CPI print for December at 7:00 p.m. IST, which would give further cues to the likely rate action by the Fed.

The U.S. CPI is expected to remain unchanged at 3.2% on year in December, according to a Bloomberg survey.

The Sensex hit an intraday high of 71,999.47 while the Nifty 50 touched 21,726.50 so far on Thursday.

"The Nifty is hovering around the 21,700 mark, with the Sensex gaining 150 points today, indicating a market stuck within a range. The inconsistent behaviour of foreign institutional investors and domestic institutional investors is evident this month, as they engage in alternating bouts of buying and selling, keeping the market confined. To break out or break down from this range, the market requires significant triggers," said Shrey Jain, founder and chief executive officer, SAS Online.

The Nifty is anticipated to trade within the 21,600–21,700 range on Thursday. The index is expected to find support in the range of 21,550–21,600, with a robust buy zone identified around 21,450–21,500 levels, according to Jain.

India's benchmark stock indices traded higher through midday on Thursday, led by gains in index heavyweight Reliance Industries Ltd., including oil & gas and automobile stocks.

As of 12:30 p.m., the S&P BSE Sensex rose 0.17%, or 122.72 points, to 71,780.42, while the NSE Nifty 50 gained 0.22%, or 47.35 points, to 21,667.80.

The indices moved in a narrow range ahead of the release of the U.S. CPI print for December at 7:00 p.m. IST, which would give further cues to the likely rate action by the Fed.

The U.S. CPI is expected to remain unchanged at 3.2% on year in December, according to a Bloomberg survey.

The Sensex hit an intraday high of 71,999.47 while the Nifty 50 touched 21,726.50 so far on Thursday.

"The Nifty is hovering around the 21,700 mark, with the Sensex gaining 150 points today, indicating a market stuck within a range. The inconsistent behaviour of foreign institutional investors and domestic institutional investors is evident this month, as they engage in alternating bouts of buying and selling, keeping the market confined. To break out or break down from this range, the market requires significant triggers," said Shrey Jain, founder and chief executive officer, SAS Online.

The Nifty is anticipated to trade within the 21,600–21,700 range on Thursday. The index is expected to find support in the range of 21,550–21,600, with a robust buy zone identified around 21,450–21,500 levels, according to Jain.

India's benchmark stock indices traded higher through midday on Thursday, led by gains in index heavyweight Reliance Industries Ltd., including oil & gas and automobile stocks.

As of 12:30 p.m., the S&P BSE Sensex rose 0.17%, or 122.72 points, to 71,780.42, while the NSE Nifty 50 gained 0.22%, or 47.35 points, to 21,667.80.

The indices moved in a narrow range ahead of the release of the U.S. CPI print for December at 7:00 p.m. IST, which would give further cues to the likely rate action by the Fed.

The U.S. CPI is expected to remain unchanged at 3.2% on year in December, according to a Bloomberg survey.

The Sensex hit an intraday high of 71,999.47 while the Nifty 50 touched 21,726.50 so far on Thursday.

"The Nifty is hovering around the 21,700 mark, with the Sensex gaining 150 points today, indicating a market stuck within a range. The inconsistent behaviour of foreign institutional investors and domestic institutional investors is evident this month, as they engage in alternating bouts of buying and selling, keeping the market confined. To break out or break down from this range, the market requires significant triggers," said Shrey Jain, founder and chief executive officer, SAS Online.

The Nifty is anticipated to trade within the 21,600–21,700 range on Thursday. The index is expected to find support in the range of 21,550–21,600, with a robust buy zone identified around 21,450–21,500 levels, according to Jain.

India's benchmark stock indices traded higher through midday on Thursday, led by gains in index heavyweight Reliance Industries Ltd., including oil & gas and automobile stocks.

As of 12:30 p.m., the S&P BSE Sensex rose 0.17%, or 122.72 points, to 71,780.42, while the NSE Nifty 50 gained 0.22%, or 47.35 points, to 21,667.80.

The indices moved in a narrow range ahead of the release of the U.S. CPI print for December at 7:00 p.m. IST, which would give further cues to the likely rate action by the Fed.

The U.S. CPI is expected to remain unchanged at 3.2% on year in December, according to a Bloomberg survey.

The Sensex hit an intraday high of 71,999.47 while the Nifty 50 touched 21,726.50 so far on Thursday.

"The Nifty is hovering around the 21,700 mark, with the Sensex gaining 150 points today, indicating a market stuck within a range. The inconsistent behaviour of foreign institutional investors and domestic institutional investors is evident this month, as they engage in alternating bouts of buying and selling, keeping the market confined. To break out or break down from this range, the market requires significant triggers," said Shrey Jain, founder and chief executive officer, SAS Online.

The Nifty is anticipated to trade within the 21,600–21,700 range on Thursday. The index is expected to find support in the range of 21,550–21,600, with a robust buy zone identified around 21,450–21,500 levels, according to Jain.

India's benchmark stock indices traded higher through midday on Thursday, led by gains in index heavyweight Reliance Industries Ltd., including oil & gas and automobile stocks.

As of 12:30 p.m., the S&P BSE Sensex rose 0.17%, or 122.72 points, to 71,780.42, while the NSE Nifty 50 gained 0.22%, or 47.35 points, to 21,667.80.

The indices moved in a narrow range ahead of the release of the U.S. CPI print for December at 7:00 p.m. IST, which would give further cues to the likely rate action by the Fed.

The U.S. CPI is expected to remain unchanged at 3.2% on year in December, according to a Bloomberg survey.

The Sensex hit an intraday high of 71,999.47 while the Nifty 50 touched 21,726.50 so far on Thursday.

"The Nifty is hovering around the 21,700 mark, with the Sensex gaining 150 points today, indicating a market stuck within a range. The inconsistent behaviour of foreign institutional investors and domestic institutional investors is evident this month, as they engage in alternating bouts of buying and selling, keeping the market confined. To break out or break down from this range, the market requires significant triggers," said Shrey Jain, founder and chief executive officer, SAS Online.

The Nifty is anticipated to trade within the 21,600–21,700 range on Thursday. The index is expected to find support in the range of 21,550–21,600, with a robust buy zone identified around 21,450–21,500 levels, according to Jain.

India's benchmark stock indices traded higher through midday on Thursday, led by gains in index heavyweight Reliance Industries Ltd., including oil & gas and automobile stocks.

As of 12:30 p.m., the S&P BSE Sensex rose 0.17%, or 122.72 points, to 71,780.42, while the NSE Nifty 50 gained 0.22%, or 47.35 points, to 21,667.80.

The indices moved in a narrow range ahead of the release of the U.S. CPI print for December at 7:00 p.m. IST, which would give further cues to the likely rate action by the Fed.

The U.S. CPI is expected to remain unchanged at 3.2% on year in December, according to a Bloomberg survey.

The Sensex hit an intraday high of 71,999.47 while the Nifty 50 touched 21,726.50 so far on Thursday.

"The Nifty is hovering around the 21,700 mark, with the Sensex gaining 150 points today, indicating a market stuck within a range. The inconsistent behaviour of foreign institutional investors and domestic institutional investors is evident this month, as they engage in alternating bouts of buying and selling, keeping the market confined. To break out or break down from this range, the market requires significant triggers," said Shrey Jain, founder and chief executive officer, SAS Online.

The Nifty is anticipated to trade within the 21,600–21,700 range on Thursday. The index is expected to find support in the range of 21,550–21,600, with a robust buy zone identified around 21,450–21,500 levels, according to Jain.

India's benchmark stock indices traded higher through midday on Thursday, led by gains in index heavyweight Reliance Industries Ltd., including oil & gas and automobile stocks.

As of 12:30 p.m., the S&P BSE Sensex rose 0.17%, or 122.72 points, to 71,780.42, while the NSE Nifty 50 gained 0.22%, or 47.35 points, to 21,667.80.

The indices moved in a narrow range ahead of the release of the U.S. CPI print for December at 7:00 p.m. IST, which would give further cues to the likely rate action by the Fed.

The U.S. CPI is expected to remain unchanged at 3.2% on year in December, according to a Bloomberg survey.

The Sensex hit an intraday high of 71,999.47 while the Nifty 50 touched 21,726.50 so far on Thursday.

"The Nifty is hovering around the 21,700 mark, with the Sensex gaining 150 points today, indicating a market stuck within a range. The inconsistent behaviour of foreign institutional investors and domestic institutional investors is evident this month, as they engage in alternating bouts of buying and selling, keeping the market confined. To break out or break down from this range, the market requires significant triggers," said Shrey Jain, founder and chief executive officer, SAS Online.

The Nifty is anticipated to trade within the 21,600–21,700 range on Thursday. The index is expected to find support in the range of 21,550–21,600, with a robust buy zone identified around 21,450–21,500 levels, according to Jain.

Axis Bank Ltd., Bajaj Auto Ltd., Kotak Mahindra Bank Ltd., Reliance Industries Ltd. and Tata Consultancy Services Ltd. positively contributed to the Nifty 50.

Dr. Reddy's Laboratories Ltd., ICICI Bank Ltd., Infosys Ltd., Larsen & Toubro Ltd. and Nestle India Ltd. weighed on the index.

All 12 sectoral indices on the NSE gained, with the Nifty Auto rising 1.37% to become the best performer. Nifty Media was the worst performer.

Broader markets outperformed benchmark indices, with the S&P BSE Midcap rising 0.73% and the S&P BSE Smallcap gaining 0.78% through midday on Thursda.

Of the 20 sectors complied by BSE, 16 advanced and four declined. S&P BSE Consumer Durable rose the most at 1.04%. S&P BSE Capital Goods fell the most at 0.83%.

Market breadth remained skewed in favour of buyers. Around 2,396 stocks rose, 1,319 stocks fell, and 121 remained unchanged on BSE.

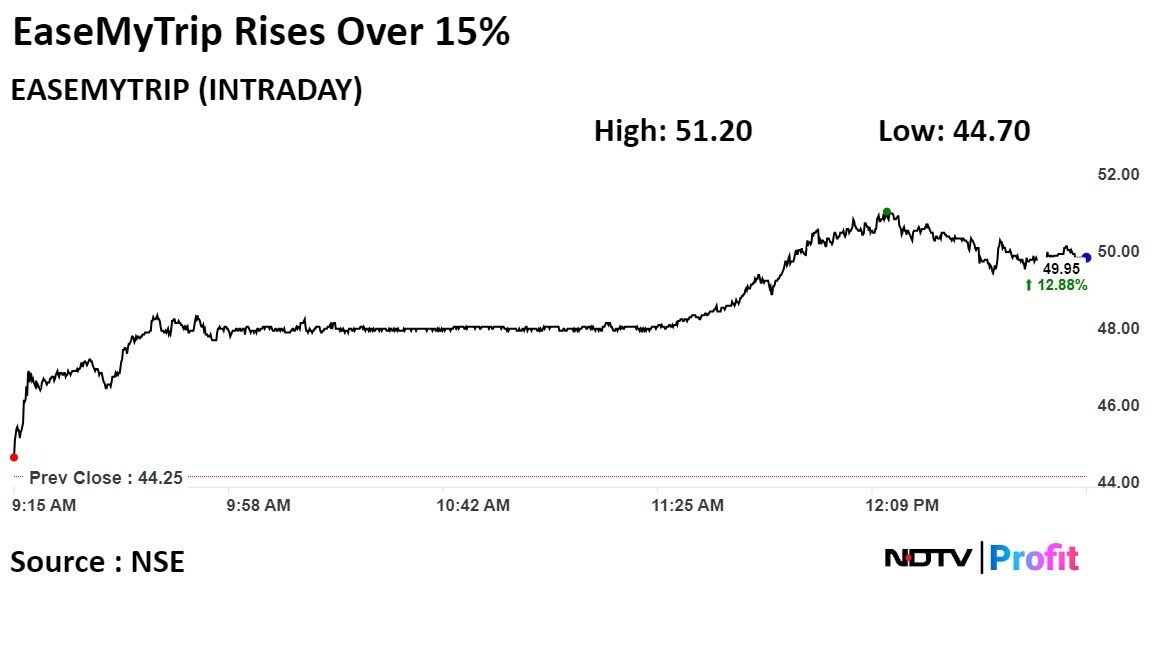

Shares of online travel booking platform EaseMyTrip jumped over 15% on Thursday after the company announced venturing into the insurance sector, with the launch of its subsidiary EaseMyTrip Insurance Broker Pvt.

This is a strategic move by the company to diversify its service portfolio and tap into the insurance market, by creating a specialised product to solve customer needs, an exchange filing said.

The new venture is expected to solidify EaseMyTrip's position in the industry and cater to a Rs 7.9 trillion market with the company's own 20 million userbase, it said.

The company's insurance foray comes days after it made headlines for suspending flight bookings to the Maldives, in the wake of diplomatic tensions between India and the island nation.

Shares of online travel booking platform EaseMyTrip jumped over 15% on Thursday after the company announced venturing into the insurance sector, with the launch of its subsidiary EaseMyTrip Insurance Broker Pvt.

This is a strategic move by the company to diversify its service portfolio and tap into the insurance market, by creating a specialised product to solve customer needs, an exchange filing said.

The new venture is expected to solidify EaseMyTrip's position in the industry and cater to a Rs 7.9 trillion market with the company's own 20 million userbase, it said.

The company's insurance foray comes days after it made headlines for suspending flight bookings to the Maldives, in the wake of diplomatic tensions between India and the island nation.

EaseMyTrip's stock rose as much as 15.71%, the highest since March 3, 2023, before paring gains to trade 12.54% higher at 12:48 p.m. This compares to a 0.22% advance in the NSE Nifty 50.

The stock has fallen 5.14% in the last 12 months. The total traded volume so far in the day stood at 15 times its 30-day average. The relative strength index was at 80, indicating that it was overbought.

Of the two analysts tracking the company, one recommends a 'hold,' and one suggests a 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 4.2%.

Cairn Oil & Gas submits first field development plan to commence gas production in Gujarat

Cairn signed commercial gas sales pact for Jaya Field

Cairn Oil plans to produce ~2,000 barrels initially

Source: Exchange Filing

Gets RBI registration for factoring business

This will help the company to cater to credit needs of more MSMEs

Source: Exchange Filing

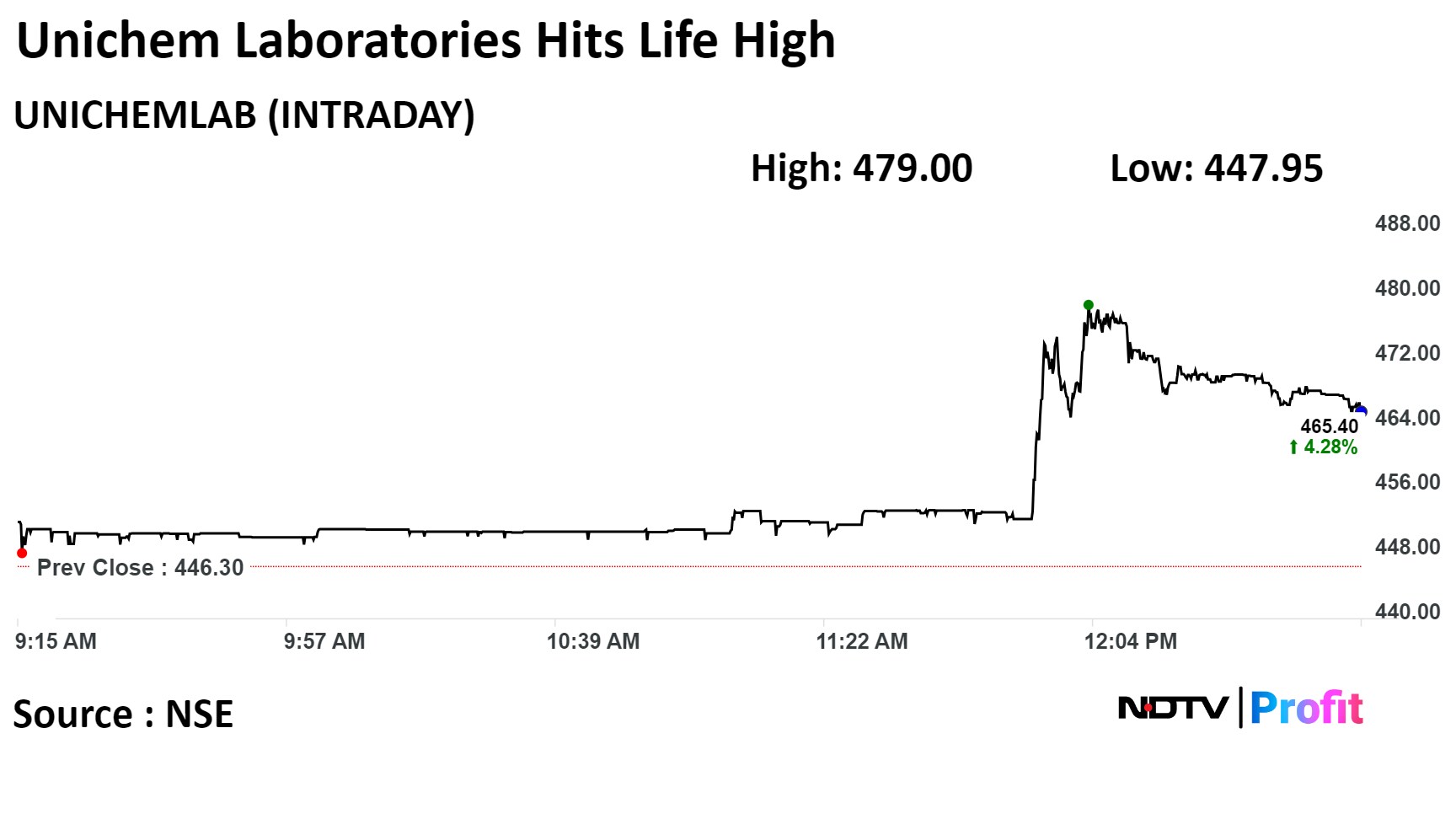

Scrips of Unichem Laboratories Ltd rose 7.33% and touched a fresh high on Thursday. The company received approval from U.S Food and Drug Administrations to produce, market generic hypertension and high blood pressure drug, Doxazosin in the U.S, according to an exchange filing.

Scrips of Unichem Laboratories Ltd rose 7.33% and touched a fresh high on Thursday. The company received approval from U.S Food and Drug Administrations to produce, market generic hypertension and high blood pressure drug, Doxazosin in the U.S, according to an exchange filing.

Shares of Unichem Laboratories Ltd rose as much as 7.33% to Rs 479.00, the highest level since its listing on Jun 11, 1963. It pared gains to trade 4.30% higher at Rs 465.50 as of 12:54p.m. This compares to 0.23% advance in NSE Nifty 50 index.

It has risen 54.64% in 12 months. Total traded volume so far in the day stood at 6.9 times its 30-day average. The relative strength index was at 68.36.

Unichem Laboratories received ANDA approval from US FDA for Doxazosin tablets

Alert: Doxazosin is a generic of Cardura

Source: Exchange Filing

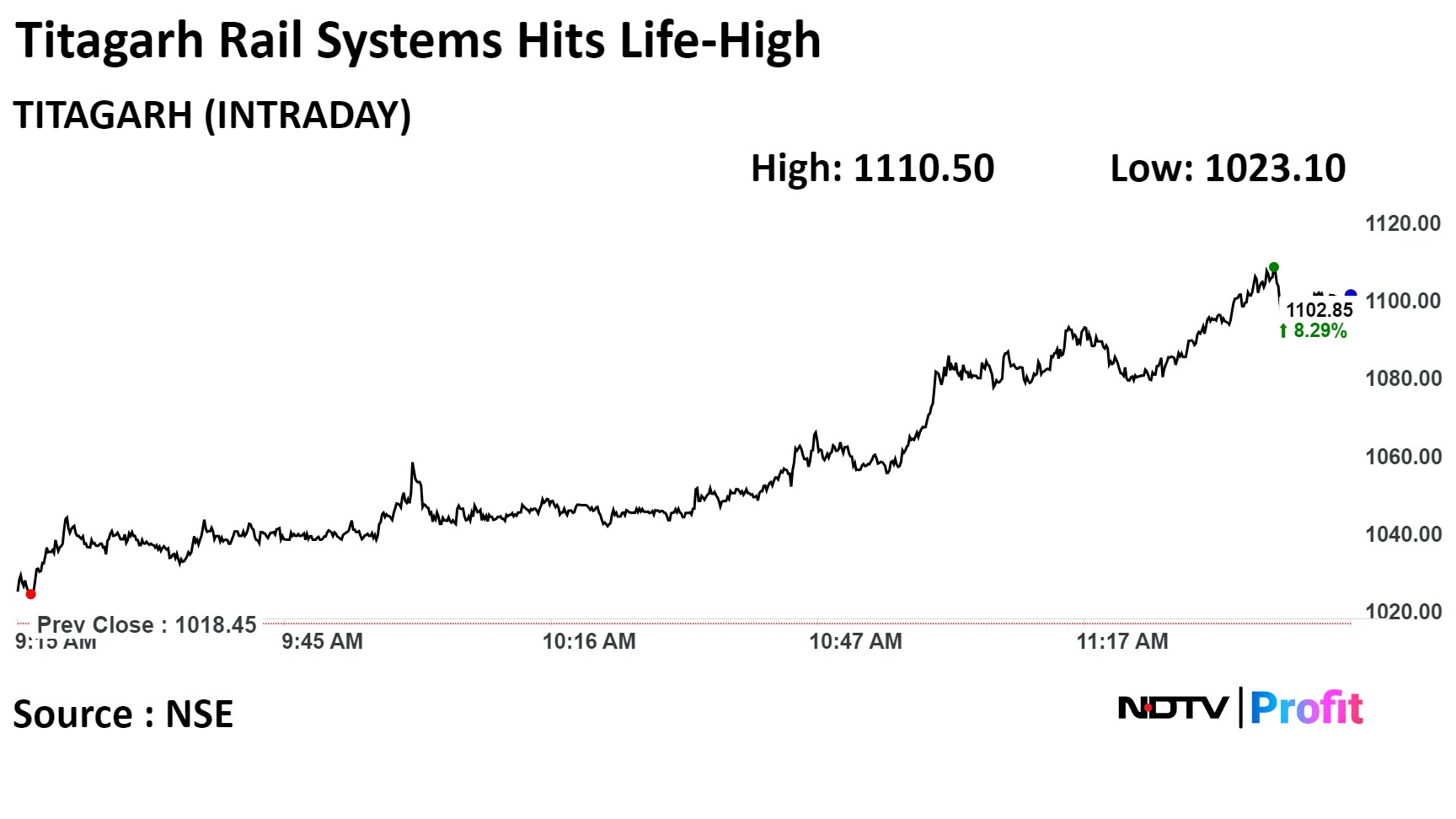

Scrips of Titagarh Rail Systems Ltd rose as much as 9.04% to Rs 1,110.50 apiece, the highest level since its listing on Apr 21,2008. It pared gains trade 8.42% higher at Rs 1,104.25 apiece, as of 11:45 a.m. This compares to a 0.22% advance in the NSE Nifty 50 Index.

It has risen 399.68% in 12 months. Total traded volume so far in the day stood at 3.5 times its 30-day average. The relative strength index was at 60.40.

Eight analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies a downside of 1.1%.

Scrips of Titagarh Rail Systems Ltd rose as much as 9.04% to Rs 1,110.50 apiece, the highest level since its listing on Apr 21,2008. It pared gains trade 8.42% higher at Rs 1,104.25 apiece, as of 11:45 a.m. This compares to a 0.22% advance in the NSE Nifty 50 Index.

It has risen 399.68% in 12 months. Total traded volume so far in the day stood at 3.5 times its 30-day average. The relative strength index was at 60.40.

Eight analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies a downside of 1.1%.

Maintains L&T as its top pick in industrials

Prefers Havells over Voltas in consumer durables

Expect 23% on year earnings growth for industrials on the back of higher execution

Expect margins to remain steady or face slight pressure

Sees mid-teen earning growth with margin expansion in consumer durables

Expect port, logistics to register low double-digit growth on volume uptick

There has been a gradual and consistent turnaround in Indian banking sector, despite multitude headwinds, says RBI Governor Shaktikanta Das

All SCBs have now shown improvement in last 4 years

Indian financial services sector has emerged out of crisis, is in a better shape now

Financial indicators of companies are in line with banking system

Source: Mint BFSI Summit & Awards 2024

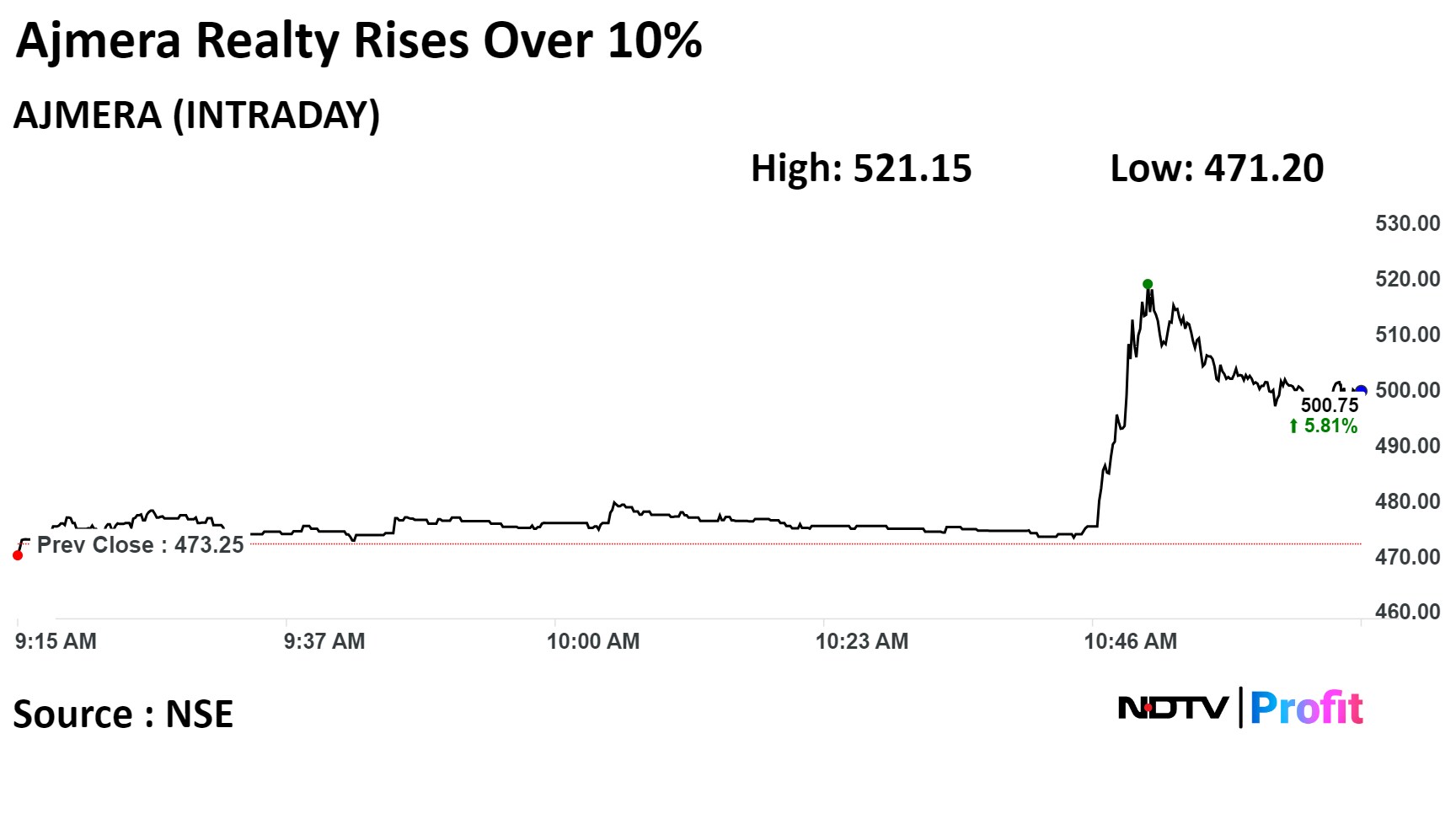

Shares of Ajmera Realty & Infra India Ltd. rose over 10% to the highest in over 15 years on Thursday after its sales area grew 63% to 1.04 lakh square feet in the third quarter.

Ajmera's sales value nearly doubled to Rs 253 crore in the December quarter compared to Rs 128 crore in the year-ago period on the back of sustained interest in its projects in Mumbai and Bengaluru. The collection jumped 30% to Rs 151 crore, according to an exchange filing.

Shares of Ajmera Realty & Infra India Ltd. rose over 10% to the highest in over 15 years on Thursday after its sales area grew 63% to 1.04 lakh square feet in the third quarter.

Ajmera's sales value nearly doubled to Rs 253 crore in the December quarter compared to Rs 128 crore in the year-ago period on the back of sustained interest in its projects in Mumbai and Bengaluru. The collection jumped 30% to Rs 151 crore, according to an exchange filing.

On the NSE, Ajmera's stock rose as much as 10.12% during the day to Rs 521.15 apiece, the highest since June 4, 2008. It was trading 6.71% higher at Rs 505 apiece, compared to a 0.18% advance in the benchmark Nifty 50 at 11:35 a.m.

The share price has risen 64.22% in the last 12 months. The total traded volume so far in the day stood at 7.5 times its 30-day average. The relative strength index was at 76, indicating that it maybe overbought.

Collections at Rs 151 crore, up 30%

Sales value at Rs 253 crore, up 98%

Sales area at 1.03 lakh sq ft, up 63%

Source: Exchange Filing

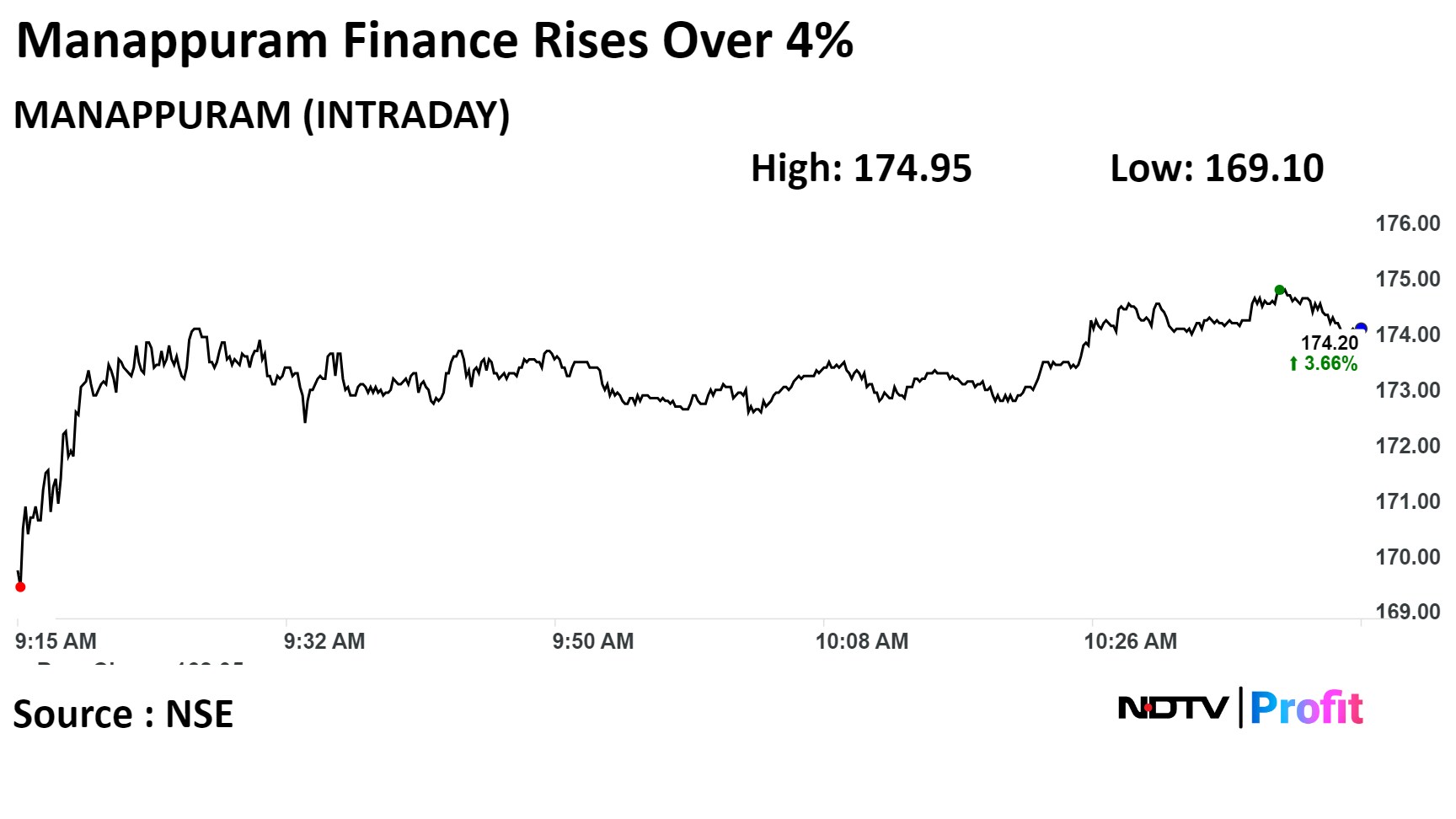

Morgan Stanley maintained 'Overweight' rating on Manappuram Finance Ltd and raised the price target of Rs 210 from Rs 176.55 earlier.

Stronger execution in non-gold loans business, higher-than-expected growth in gold loans, and better-than-expected recovery in gold margin are some of the risks to upside, the brokerage see,

As far as the downside risks are concerned, Morgan Stanley flagged adverse asset quality outcomes in the company's non-gold loans segment, higher-than-expected NIM compression in gold loans, and slow down in economic growth impacting overall loan growth.

Morgan Stanley maintained 'Overweight' rating on Manappuram Finance Ltd and raised the price target of Rs 210 from Rs 176.55 earlier.

Stronger execution in non-gold loans business, higher-than-expected growth in gold loans, and better-than-expected recovery in gold margin are some of the risks to upside, the brokerage see,

As far as the downside risks are concerned, Morgan Stanley flagged adverse asset quality outcomes in the company's non-gold loans segment, higher-than-expected NIM compression in gold loans, and slow down in economic growth impacting overall loan growth.

The scrip rose as much as 4.40% to Rs 175.45 apiece. It was trading 3.69% higher at Rs 174.25 apiece, as of 11:31 a.m. This compares to a 0.16% advance in the NSE Nifty 50 Index.

It has risen 42.95% in 12 months. Total traded volume so far in the day stood at 1.5 times its 30-day average. The relative strength index was at 55.54.

Out of 20 analysts tracking the company, 17 maintain a 'buy' rating, one recommends a 'hold,' and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 8.2%.

Maruti Suzuki to start EV exports to Europe, Japan this year

Rs 750 crore worth of EV battery packs in FY 2023-24:

Source: Bloomberg

Sundram Fastners Ltd to invest Rs 1,411 crore in Tamil Nadu factories

Source: Cogencis

Power Grid Corp has 51.1 lakh shares changed hands in a large trade

The company's 0.1% equity changed hands at Rs 240.9 apiece

Buyers and sellers not known immediately

Source: Bloomberg

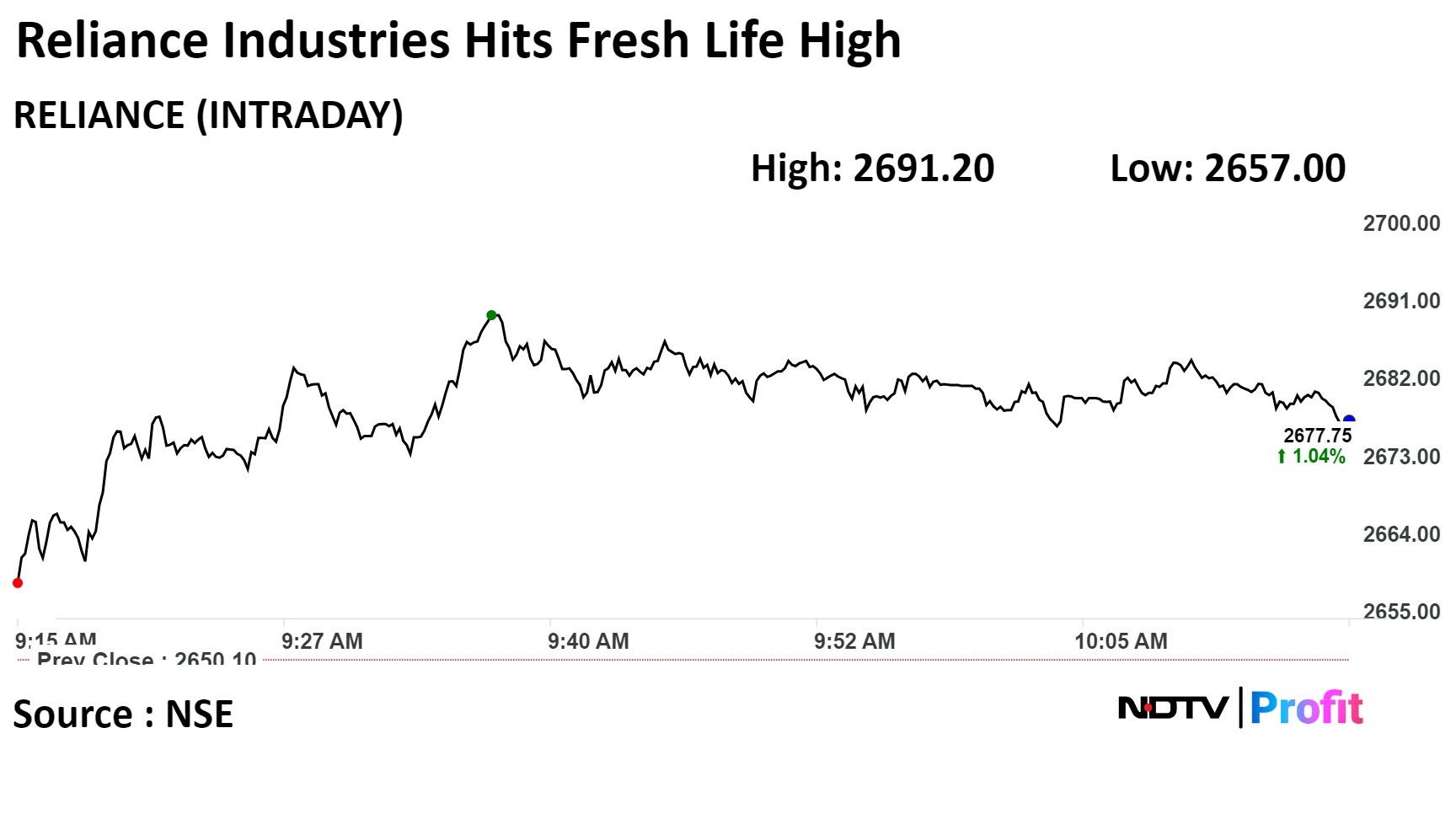

Shares of Reliance Industries Ltd rose as much as 1.55% to Rs. 2,691.20, highest level since it was listed on Jan 23, 1978. It was trading 1.02% up at Rs 2,677.05 as of 10:22 a.m. This compares to 0.19% advance on NSE Nifty 50 index.

The company's stock has gained 16.45% in 12 months. Total traded volume so far in the day stood at 1.7 times its 30-day average. The relative strength index was at 73.52, which implied the stock is overbought.

Out of 35 analysts tracking the company, 31 maintain a 'buy' rating, two recommend a 'hold,' and two recommend 'sell', baccording to Bloomberg data. The average 12-month consensus price target implies a upside of 4.6%.

Shares of Reliance Industries Ltd rose as much as 1.55% to Rs. 2,691.20, highest level since it was listed on Jan 23, 1978. It was trading 1.02% up at Rs 2,677.05 as of 10:22 a.m. This compares to 0.19% advance on NSE Nifty 50 index.

The company's stock has gained 16.45% in 12 months. Total traded volume so far in the day stood at 1.7 times its 30-day average. The relative strength index was at 73.52, which implied the stock is overbought.

Out of 35 analysts tracking the company, 31 maintain a 'buy' rating, two recommend a 'hold,' and two recommend 'sell', baccording to Bloomberg data. The average 12-month consensus price target implies a upside of 4.6%.

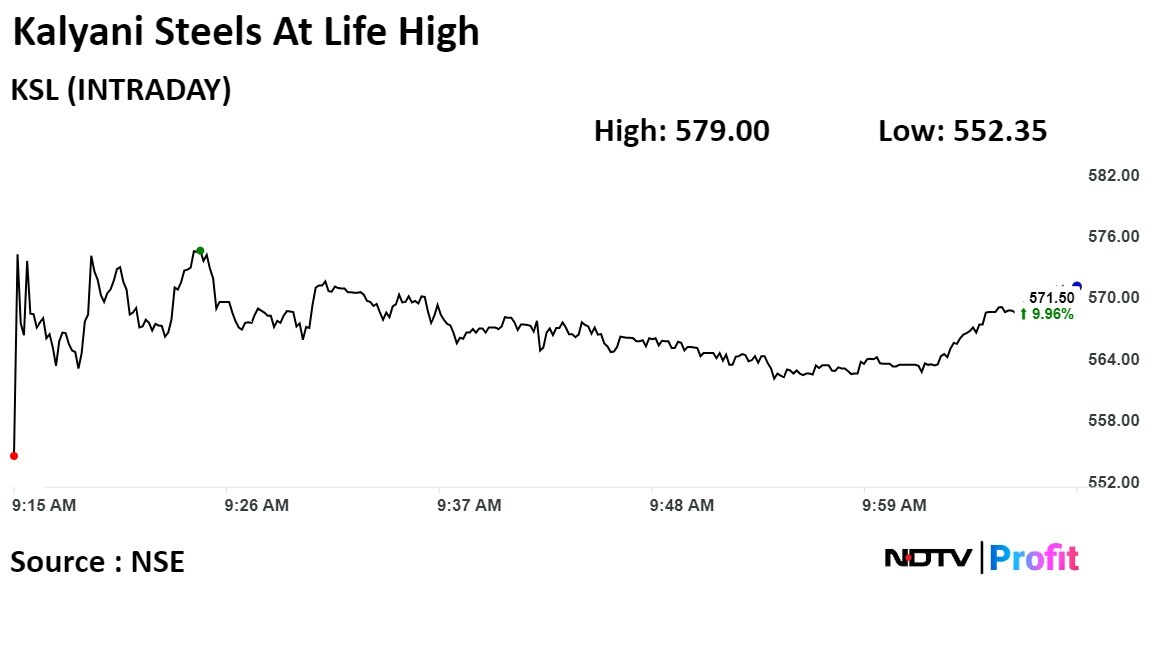

The shares of Kalyani Steels rose on Thursday after the company emerged as successful bidder to acquire assets of Kamineni Steel and Power India Private Ltd worth Rs 450 crore.

The assets that are a part of the sale include land and buildings, plant and machinery of Kamineni Steel and Power.

The scrip rose as much as 11.40% to 579 apiece to touch it's all time high. It pared gains to trade 9.48% higher at Rs 569 apiece, as of 10:06 a.m. This compares to a 0.23% advance in the NSE Nifty 50 Index.

It has risen 55.37% in the last 12 months. Total traded volume so far in the day stood at 16 times its 30-day average. The relative strength index was at 69.

The shares of Kalyani Steels rose on Thursday after the company emerged as successful bidder to acquire assets of Kamineni Steel and Power India Private Ltd worth Rs 450 crore.

The assets that are a part of the sale include land and buildings, plant and machinery of Kamineni Steel and Power.

The scrip rose as much as 11.40% to 579 apiece to touch it's all time high. It pared gains to trade 9.48% higher at Rs 569 apiece, as of 10:06 a.m. This compares to a 0.23% advance in the NSE Nifty 50 Index.

It has risen 55.37% in the last 12 months. Total traded volume so far in the day stood at 16 times its 30-day average. The relative strength index was at 69.

Expects demand trends to remain subdued adjusted for delayed festive/wedding season

Expects Kalyan Jewellers to report highest YoY revenue growth (+32%) and Page Industries to report lowest YoY revenue growth (-2%).

Building 27% YoY growth for Jewellery players vs 13% YoY growth for others

Management commentary on channel inventory, change in consumer sentiment and store expansion in FY25E will be the key monitorable.

Steel billets sales at 27,048 ton, down 22.6%

Sponge iron sales at 2.79 lakh ton, up 57.8%

Long steel sales at 3.38 lakh ton, up 14.1%

Steel sales at 6.45 lakh ton, up 26.8%

Source: Exchange Filing

Bandhan Bank Ltd had 10 lakh shares changed hands in a large trade

The lender's 0.1% equity changed hands at Rs 234.15 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Scrips of Axiscades Technologies rose as much as 9.88% to Rs 850.00 apiece, the highest level since its listing on Jan 1, 2001.It was trading 6.62% higher at Rs 824.75. This compares to a 0.21% advance in the NSE Nifty 50 Index.

It has risen 166.55% on a year-to-date basis. Total traded volume so far in the day stood at 5.9 times its 30-day average. The relative strength index was at 78.39, which implied the stock is overbought.

Scrips of Axiscades Technologies rose as much as 9.88% to Rs 850.00 apiece, the highest level since its listing on Jan 1, 2001.It was trading 6.62% higher at Rs 824.75. This compares to a 0.21% advance in the NSE Nifty 50 Index.

It has risen 166.55% on a year-to-date basis. Total traded volume so far in the day stood at 5.9 times its 30-day average. The relative strength index was at 78.39, which implied the stock is overbought.

The shares of Polycab India Ltd. were locked in a lower circuit on Thursday after the income tax department detected unaccounted cash sales of Rs 1,000 crore and Rs 400 crore cash payments made by a distributor on behalf of the flagship company. The stocks were locked in a lower circuit of 10% during the opening which was increased to 15%.

The comes after the IT department-initiated search and seizure operations against Polycab Group. A statement released by the finance ministry states that the company was indulged in unaccounted cash sales, cash payments for unaccounted purchases, non-genuine transport and sub-contracting expenses for suppression of its taxable income.

The scrip was locked in the lower circuit of 20% at Rs 3,929.50 apiece, the lowest level since Jul. 18, 2023. This compares to a 0.27% advance in the NSE Nifty 50 Index as of 9:57 a.m.

It has risen 47.11% in the last 12 months. Total traded volume so far in the day stood at 2.9 times its 30-day average. The relative strength index was at 18 indicating it was underbought.

Out of 31 analysts tracking the company, 19 maintain a 'buy' rating, 6 recommend a 'hold,' and 6 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 57.2%.

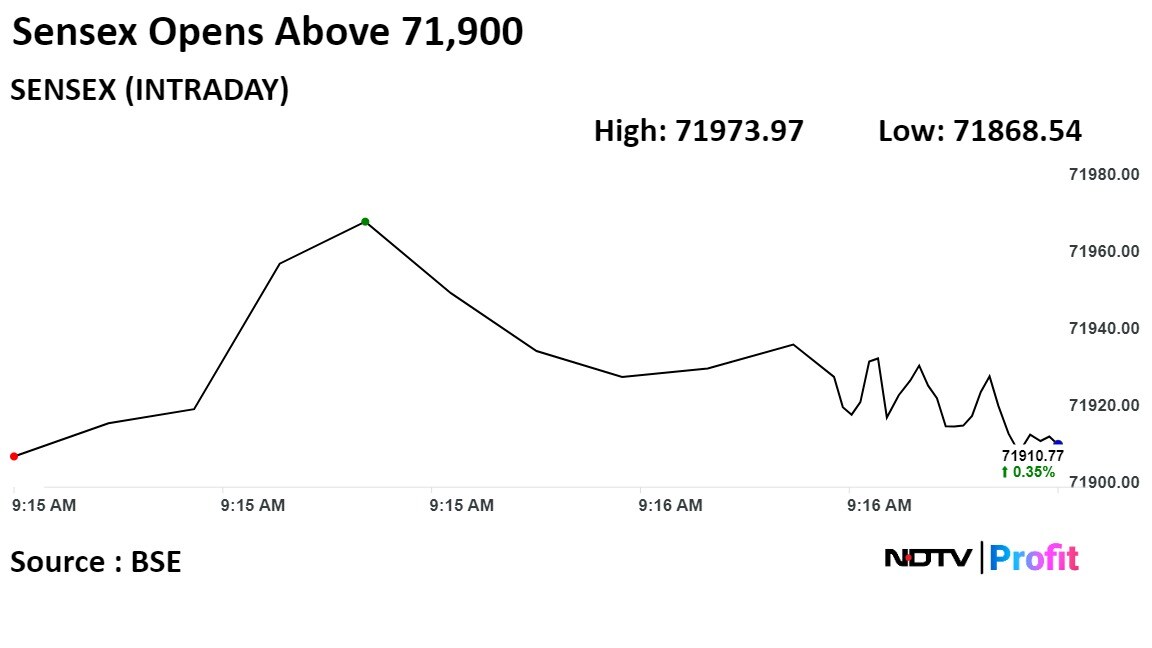

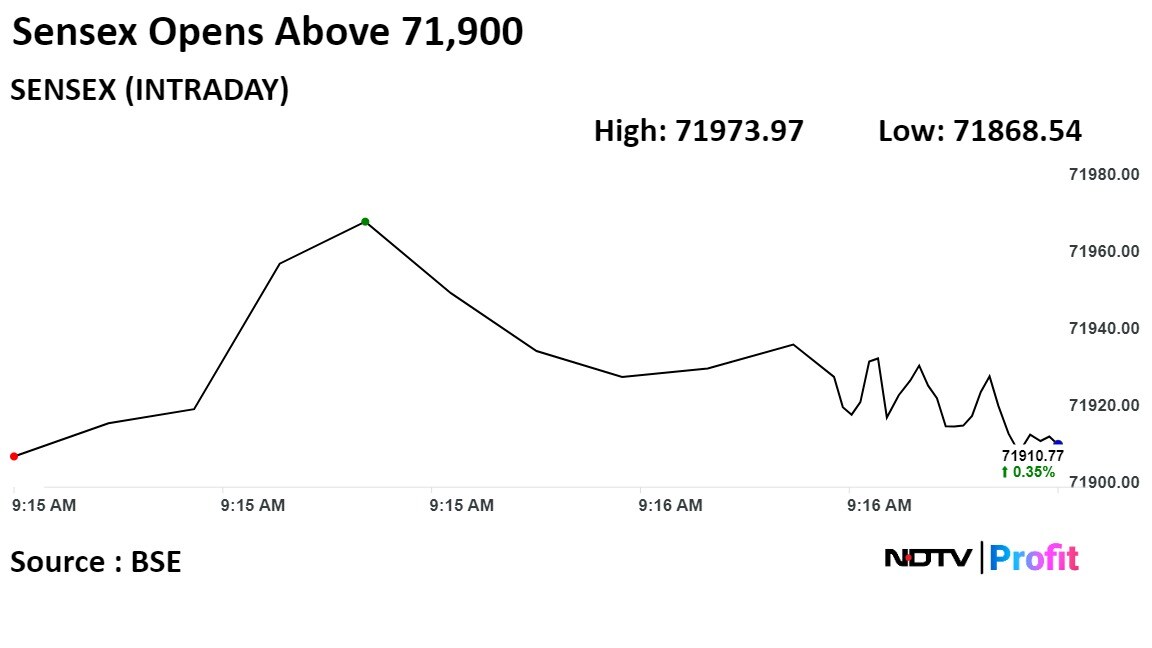

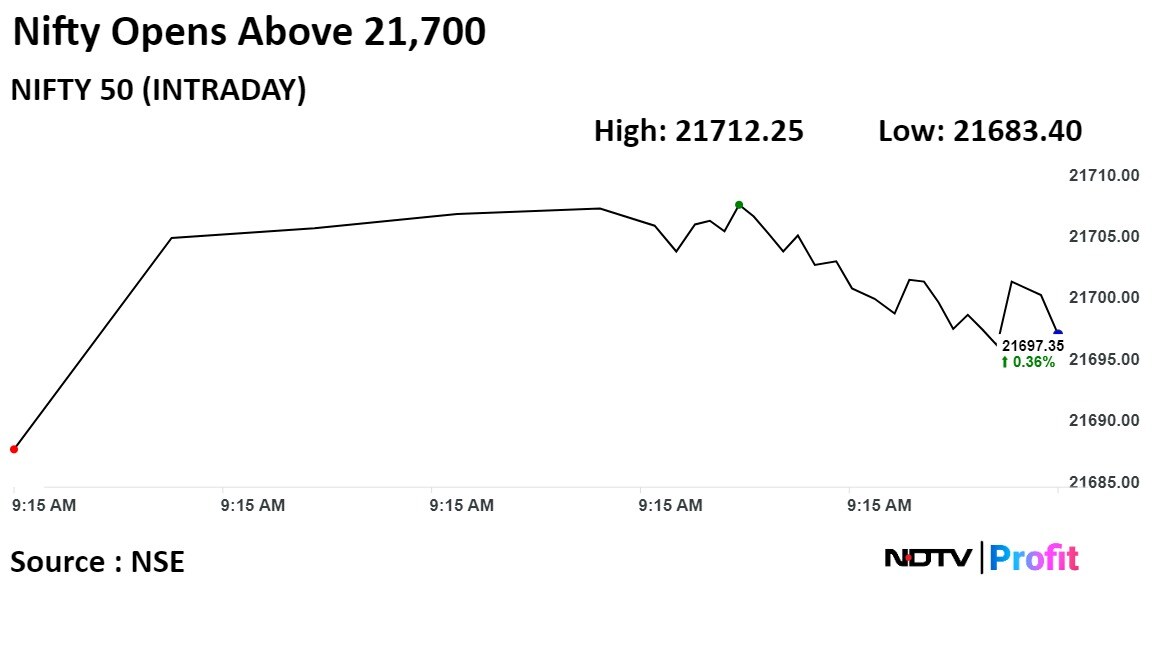

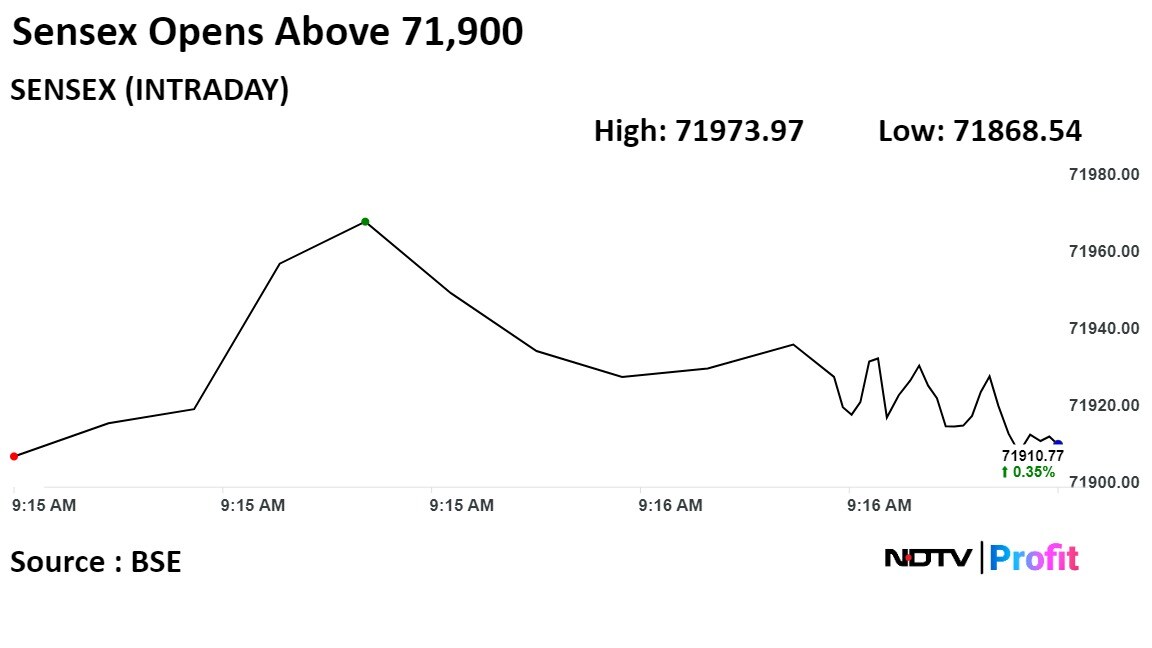

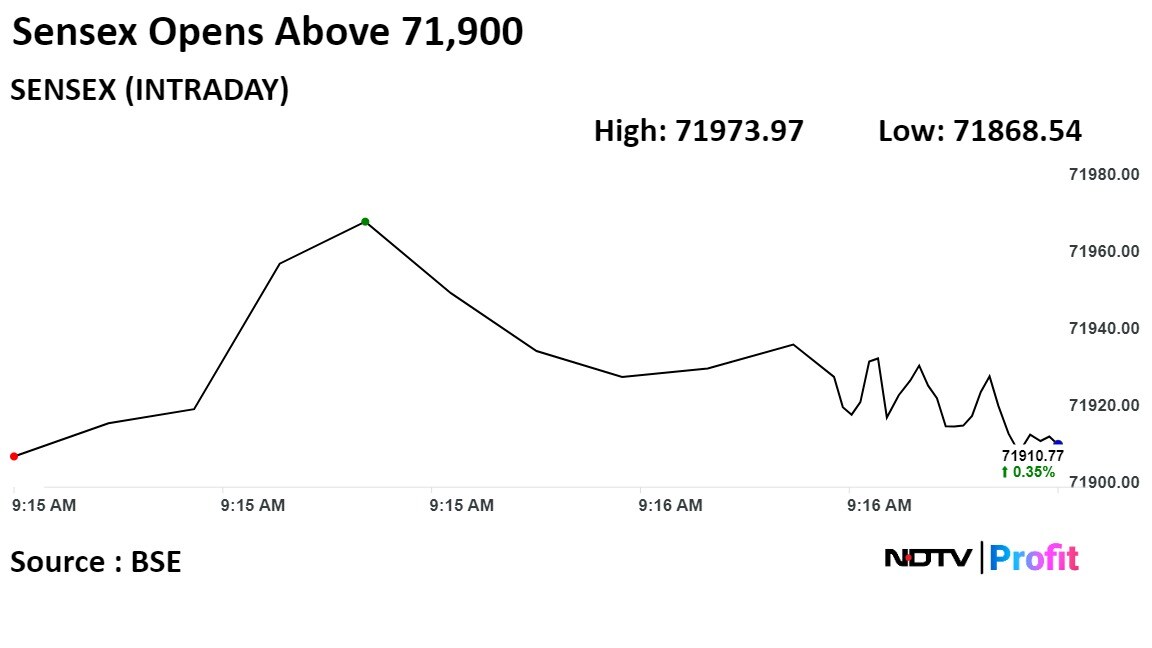

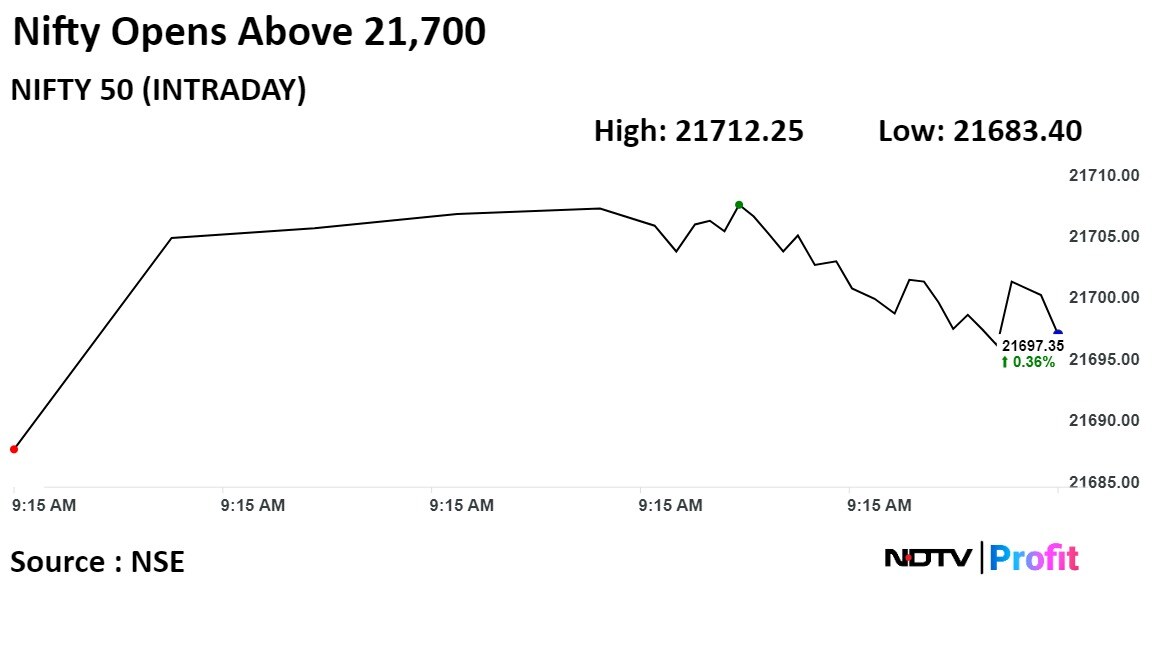

India's benchmark indices opened higher on Thursday as HDFC Bank, Reliance Industries Ltd, and ICICI Bank Ltd gained.

As of 09:18 a.m. the NSE Nifty 50 was trading 0.34% or 73.60 points higher at 21,692.30, while the BSE Sensex was 0.42% or 334 points higher at 71,992.12.

"Traders should consider the 20-day Simple Moving Average or 21500/71250 as a crucial support level. Above this, the pullback formation is likely to continue. The market has prospects of reaching 21680-21725/71900-72050. However, selling pressure is likely to increase below the 20-day SMA or 21500/71250. If the market slips below that, it may fall to 21400-21355/71000-70800," said Shrikant Chouhan, head, equity research, Kotak Securities.

"Traders should take profit on long positions or reduce weak long positions between 21680/21720 levels. For the bank nifty, 47000-46900 would be the ultimate support zone and if it falls below that, it could reach 46500 levels. On the higher side, 47550 is the biggest hurdle, so traders should consider reducing positions around the same level,"

India's benchmark indices opened higher on Thursday as HDFC Bank, Reliance Industries Ltd, and ICICI Bank Ltd gained.

As of 09:18 a.m. the NSE Nifty 50 was trading 0.34% or 73.60 points higher at 21,692.30, while the BSE Sensex was 0.42% or 334 points higher at 71,992.12.

"Traders should consider the 20-day Simple Moving Average or 21500/71250 as a crucial support level. Above this, the pullback formation is likely to continue. The market has prospects of reaching 21680-21725/71900-72050. However, selling pressure is likely to increase below the 20-day SMA or 21500/71250. If the market slips below that, it may fall to 21400-21355/71000-70800," said Shrikant Chouhan, head, equity research, Kotak Securities.

"Traders should take profit on long positions or reduce weak long positions between 21680/21720 levels. For the bank nifty, 47000-46900 would be the ultimate support zone and if it falls below that, it could reach 46500 levels. On the higher side, 47550 is the biggest hurdle, so traders should consider reducing positions around the same level,"

India's benchmark indices opened higher on Thursday as HDFC Bank, Reliance Industries Ltd, and ICICI Bank Ltd gained.

As of 09:18 a.m. the NSE Nifty 50 was trading 0.34% or 73.60 points higher at 21,692.30, while the BSE Sensex was 0.42% or 334 points higher at 71,992.12.

"Traders should consider the 20-day Simple Moving Average or 21500/71250 as a crucial support level. Above this, the pullback formation is likely to continue. The market has prospects of reaching 21680-21725/71900-72050. However, selling pressure is likely to increase below the 20-day SMA or 21500/71250. If the market slips below that, it may fall to 21400-21355/71000-70800," said Shrikant Chouhan, head, equity research, Kotak Securities.

"Traders should take profit on long positions or reduce weak long positions between 21680/21720 levels. For the bank nifty, 47000-46900 would be the ultimate support zone and if it falls below that, it could reach 46500 levels. On the higher side, 47550 is the biggest hurdle, so traders should consider reducing positions around the same level,"

India's benchmark indices opened higher on Thursday as HDFC Bank, Reliance Industries Ltd, and ICICI Bank Ltd gained.

As of 09:18 a.m. the NSE Nifty 50 was trading 0.34% or 73.60 points higher at 21,692.30, while the BSE Sensex was 0.42% or 334 points higher at 71,992.12.

"Traders should consider the 20-day Simple Moving Average or 21500/71250 as a crucial support level. Above this, the pullback formation is likely to continue. The market has prospects of reaching 21680-21725/71900-72050. However, selling pressure is likely to increase below the 20-day SMA or 21500/71250. If the market slips below that, it may fall to 21400-21355/71000-70800," said Shrikant Chouhan, head, equity research, Kotak Securities.

"Traders should take profit on long positions or reduce weak long positions between 21680/21720 levels. For the bank nifty, 47000-46900 would be the ultimate support zone and if it falls below that, it could reach 46500 levels. On the higher side, 47550 is the biggest hurdle, so traders should consider reducing positions around the same level,"

India's benchmark indices opened higher on Thursday as HDFC Bank, Reliance Industries Ltd, and ICICI Bank Ltd gained.

As of 09:18 a.m. the NSE Nifty 50 was trading 0.34% or 73.60 points higher at 21,692.30, while the BSE Sensex was 0.42% or 334 points higher at 71,992.12.

"Traders should consider the 20-day Simple Moving Average or 21500/71250 as a crucial support level. Above this, the pullback formation is likely to continue. The market has prospects of reaching 21680-21725/71900-72050. However, selling pressure is likely to increase below the 20-day SMA or 21500/71250. If the market slips below that, it may fall to 21400-21355/71000-70800," said Shrikant Chouhan, head, equity research, Kotak Securities.

"Traders should take profit on long positions or reduce weak long positions between 21680/21720 levels. For the bank nifty, 47000-46900 would be the ultimate support zone and if it falls below that, it could reach 46500 levels. On the higher side, 47550 is the biggest hurdle, so traders should consider reducing positions around the same level,"

India's benchmark indices opened higher on Thursday as HDFC Bank, Reliance Industries Ltd, and ICICI Bank Ltd gained.

As of 09:18 a.m. the NSE Nifty 50 was trading 0.34% or 73.60 points higher at 21,692.30, while the BSE Sensex was 0.42% or 334 points higher at 71,992.12.

"Traders should consider the 20-day Simple Moving Average or 21500/71250 as a crucial support level. Above this, the pullback formation is likely to continue. The market has prospects of reaching 21680-21725/71900-72050. However, selling pressure is likely to increase below the 20-day SMA or 21500/71250. If the market slips below that, it may fall to 21400-21355/71000-70800," said Shrikant Chouhan, head, equity research, Kotak Securities.

"Traders should take profit on long positions or reduce weak long positions between 21680/21720 levels. For the bank nifty, 47000-46900 would be the ultimate support zone and if it falls below that, it could reach 46500 levels. On the higher side, 47550 is the biggest hurdle, so traders should consider reducing positions around the same level,"

India's benchmark indices opened higher on Thursday as HDFC Bank, Reliance Industries Ltd, and ICICI Bank Ltd gained.

As of 09:18 a.m. the NSE Nifty 50 was trading 0.34% or 73.60 points higher at 21,692.30, while the BSE Sensex was 0.42% or 334 points higher at 71,992.12.

"Traders should consider the 20-day Simple Moving Average or 21500/71250 as a crucial support level. Above this, the pullback formation is likely to continue. The market has prospects of reaching 21680-21725/71900-72050. However, selling pressure is likely to increase below the 20-day SMA or 21500/71250. If the market slips below that, it may fall to 21400-21355/71000-70800," said Shrikant Chouhan, head, equity research, Kotak Securities.

"Traders should take profit on long positions or reduce weak long positions between 21680/21720 levels. For the bank nifty, 47000-46900 would be the ultimate support zone and if it falls below that, it could reach 46500 levels. On the higher side, 47550 is the biggest hurdle, so traders should consider reducing positions around the same level,"

India's benchmark indices opened higher on Thursday as HDFC Bank, Reliance Industries Ltd, and ICICI Bank Ltd gained.

As of 09:18 a.m. the NSE Nifty 50 was trading 0.34% or 73.60 points higher at 21,692.30, while the BSE Sensex was 0.42% or 334 points higher at 71,992.12.

"Traders should consider the 20-day Simple Moving Average or 21500/71250 as a crucial support level. Above this, the pullback formation is likely to continue. The market has prospects of reaching 21680-21725/71900-72050. However, selling pressure is likely to increase below the 20-day SMA or 21500/71250. If the market slips below that, it may fall to 21400-21355/71000-70800," said Shrikant Chouhan, head, equity research, Kotak Securities.

"Traders should take profit on long positions or reduce weak long positions between 21680/21720 levels. For the bank nifty, 47000-46900 would be the ultimate support zone and if it falls below that, it could reach 46500 levels. On the higher side, 47550 is the biggest hurdle, so traders should consider reducing positions around the same level,"

Reliance Industries Ltd, HDFC Bank Ltd, Axis Bank Ltd, Bharti Airtel Ltd, and Kotak Mahindra Bank Ltd contributed to the gains in benchmark indices.

Infosys Ltd, Dr Reddy's Laboratories Ltd, HCL Technologies Ltd, Sun Pharmaceutical Industries Ltd, and Wipro Ltd weighed on the indices.

On NSE, 11 sectors out of 12 gained, with the Nifty Energy rising 0.99% to become the top performer among sectoral indices. Nifty IT fell 0.25% and was the top loser among sectoral indices.

Broader markets outperformed benchmark indices. The S&P BSE Midcap rose 0.75%, and S&P BSE Smallcap gained 0.80%. Out of 20 sectors complied by BSE, 15 sectors advanced, while five declined. S&P BSE Auto rose the most among sectoral indices, and was up 1.37%. S&P BSE IT sector declined 0.26 % to become the worst performer among sectoral indices.

The market breadth was skewed in the favour of buyers. Around 2315 stocks gained, 687 fell, and 87 remained unchanged on BSE.

At pre-open, the benchmark NSE Nifty 50 was 0.32% or 69.30 points higher at 21,688.00, while the S&P BSE Sensex was 0.35% or 250.04 points up at 71,907.75.

The yield on the 10-year bond opened flat at 7.19% on Thursday.

Source: Bloomberg

The local currency opened flat at 83.05 against the U.S dollar on Thursday.

Source: Bloomberg

Downgrade to "Hold" from "Buy" with revised target at Rs 157

Stock price factors in improved pipeline regulatory environment

While turnaroud of marketing segment is great, earnings have likely peaked

Polyethylene (PE) plant remains challenged on high input costs and depressed commodity prices

PE plant to remain challenged in near term, 6-12 months for significant contribution

Earning contribution from acquired JBF plant and PDH-PP plant to come in from FY27

Cut FY26 Ebitda/PAT estimates by 8%/9%

Consumption recovery slower than expected

Cables, Air Conditioners see healthy traction

Discretionary consumption recovery remains slower in Q3FY24

See further revival in the mass segments in FY25

Low base, stable commodity, discounts push/financing schemes to drive recovery

Voltas remains preferred pick; raise target price to Rs 1,202

Remain positive on AC industry given low penetration, latent demand

Raise industry volume growth estimates to 12%-14% year-on-year in FY24/25 from 10%-12%

HSBC Global Research reiterates Buy rating raises TP to Rs.150 from Rs.140

Extremely strong 2023, expects relatively muted business and stock performance in 2024

Long-term view remains constructive and highly dependent on the continued progression of the QC business

Slowing QC growth is a key downside risk

Third quarter and fourth quarter are unlikely to drive major earnings upgrades

The brokerage maintains 'Buy' on Metro Brands at Rs 1530 target

Metro Brands is a top pick of Motilal Oswal for 2024

Metro posts industry leading growth despite weak discretionary demand trends

Expects 20% growth over 5 years on strong execution, footprint addition, new brand additions

Expect 21% revenue CAGR over FY24-26 led by 13% footprint CAGR

Expected OCF Rs 600 crore over FY24-25 to help fund store addition of 250 per annum

Fila, Foot Locker offers new growth engines

Fila, Foot Locker to make Rs 800-1000 crore revenue from EBOs, online and other channels

Neutral recommendation remains unchanged, raises TP to Rs. 3,900

Marginally increased their FY24E-26E revenue and EPS estimates by 2-3%

Adds an additional value for the company’s stake in CaratLane at 6x Sep-25E sales

Downside risks: deterioration in consumer sentiment, lower footfall, sharp movement in gold prices

Upside Risks: stronger traction to Titan’s new products, aggressive expansion strategy

Manufacturing cost of electric two wheeler vehicles still high at 2.5-3x of ICE

OLA targets EV penetration of 41-56% by FY28 seems high

To reach EV penetration of 41-56%, bill of material needs to halve, which is aggressive

OLA’s battery manufacturing initiatives, targets look creditable, but challenging

U.S. Dollar Index at 102.26

U.S. 10-year bond yield at 4.02%

Brent crude up 0.23% at $77.03 per barrel

Nymex crude 0.23% higher at $71.60 per barrel

GIFT Nifty was flat at 21,715 as of 07:35 a.m.

Bitcoin was up 1.34% at $46,561.56

ACC: Buy with price target of Rs 2,600

Ambuja Cements: Buy with price target of Rs 580

Birla Corp: Buy with price target of Rs 1,800

Dalmia Bharat: Add with price target of Rs 2,675

JK Cement: Add with price target of Rs 4,260

Sagar Cements: Add with price target of Rs 310

Shree Cement: Reduce with price target of Rs 29,650

Star Cement: Add with price target of Rs 185

The Ramco Cements: Reduce with price target of Rs 1,080

UltraTech Cement: Buy with price target of Rs 11,400

Emkay Research said, discretionary trends remain mixed, with muted growth in low-ticket categories like QSR/Apparel

The brokerage see strong growth in high-ticket categories like jewellery /durables/luxury

Within jewellery, Senco has delivered 24% top-line growth vs. their expectation of 15%

Titan's domestic jewellery segment growth to be at 21% is 4-5% above expectations

Expect durables retailer AVL to log the best topline growth at 35%

Go Fashion will continue outperforming, with 15% topline growth

Within QSRs, favours Westlife on better SSG confidence and Sapphire on potential re-rating

Have a reduce or sell on Titan, Aditya Birla Fashion and Retail Ltd, Page Industries, Jubilant Foodworks Devyani, Varun Beverages and ETHOS.

Moved into a short-term ASM framework: Kamdhenu.

Moved out of a short-term ASM framework: Kalyani Steels, Syncom Formulations.

Nifty January futures up by 0.49% to 21,709.10 at a premium of 90.4 points.

Nifty January futures open interest down by 1.9%.

Nifty Bank January futures up by 0.52% to 47,606.85 at a premium of 246 points.

Nifty Bank January futures open interest down by 3.4%.

Nifty Options Jan 11 Expiry: Maximum Call open interest at 21,800 and Maximum Put open interest at 21,500.

Bank Nifty Options Jan 17 Expiry: Maximum Call Open Interest at 47,500 and Maximum Put open interest at 45,000.

Securities in the ban period: Balrampur Chini Mills, Bandhan Bank, Chambal Fertilizer, Escorts Kubota, Hindustan Copper, Indian Energy Exchange, India Cements, Indus Tower, National Aluminium, Piramal Enterprise, PVR Inox, SAIL, Zee Entertainment.

Adani Enterprises: To meet analysts and investors on Jan. 15 to 18.

Adani Energy Solutions: To meet analysts and investors on Jan. 15 to 17.

Adani Green Energy: To meet analysts and investors on Jan. 15 to 17.

Onward Technologies: To meet analysts and investors on Jan. 19.

Rallis India: To meet analysts and investors on Jan. 24.

Tata Communication: To meet analysts and investors on Jan 18.

Dilip Buildcon: To meet analysts and investors on Jan. 12.

Jyothy Labs: To meet analysts and investors on Feb. 21.

Eris Lifesciences: To meet analysts and investors on Jan. 17.

Jyoti CNC Automation: The public issue was subscribed 3.92 times on day 2. The bids were led by retail investors (11.08 times), portion reserved for employees (5.08 times), non-institutional investors (6.49 times), and institutional investors (0.22 times).

NCC: Smallcap World Fund Inc bought 36.15 lakh shares (0.57%) at Rs 185.23 apiece.

Pennar Industries: Promoter Pennar Holdings created a pledge of Rs 15 lakh shares on Sept. 18.

Infosys, Tata Consultancy Services, HDFC Asset Management Co.

Polycab India: The I-T Department detected unaccounted cash sales of about Rs 1,000 crore after it initiated search and seizure operations against the company.

SpiceJet: The chairman and managing director unveiled the airline's ambitious plans for growth and network expansion through a fund infusion of Rs 2,250 crore. The company has the exclusive rights for Lakshadweep and will launch flights to Agatti Island soon.

Jindal Steel and Power: The insolvency appellate tribunal NCLAT dismissed the plea of Jindal Power to allow the company to participate in the ongoing resolution process of the debt-ridden Tuticorin Coal Terminal.

Kalyani Steels: The company has emerged as a successful bidder to acquire assets of Kamineni Steel and Power India, under liquidation. A cash consideration of Rs 450 crore is to be paid for the acquisition of assets on or before April 7, 2024.

Mahindra and Mahindra: The company’s stake in Sustainable Energy Infra Trust is diluted to 10.5% from 15.7% earlier and Mahindra Susten's stake in Sustainable Energy Infra Trust is diluted to 15% from 73.9% earlier.

Bank of India: The company reported total global business at Rs 12.75 lakh crore, up 9.9% YoY, and global deposits at Rs 7.1 lakh crore, up 8.7% YoY. The lender's domestic deposits stood at Rs 5.99 lakh crore, up 7.6% YoY, and global gross advances at Rs 5.66 lakh crore, up 11.5% YoY.

The Phoenix Mills: The company reported gross retail collections at Rs 700 crore up 30% YoY and total consumption at Rs 3,287 crore up 24% YoY.

Axiscades Technologies: The company launched its qualified institutional placement for raising up to Rs 500 crore. It sets the floor price at Rs 696.7 per share which indicates a discount of 9.9% to the stock's current market price.

CESC: The company’s unit Noida Power Company received an order from the Uttar Pradesh Electricity Regulatory Commission for procurement of power of 95 MW RTC Power per annum for 5 years.

Nuvama Wealth Management: The company formed a 50:50 Joint venture with U.S.-based real estate firm Cushman & Wakefield to provide investment opportunities to domestic investors in India's commercial real estate market. The Joint Venture aims to raise Rs 3,000 crore for investing in commercial offices across India.

ATUL: The company’s arm starts operations at 300 TPD caustic and 50 MW power plant.

Angel One: The company will consider fundraising via bonds on Jan. 15.

Satin Creditcare: The company will consider fundraising via public bond issues.

Indices in Asia-Pacific region gained during early trade on Thursday while investors braced themselves for U.S. CPI due later today.

In Japan, Nikkei extended its gains for four days, and crossed 35,000 mark briefly, marking the highest level since February, 1990. The rally in Japanese stocks is supported by overnight gains in tech shares on Wall Street, reported Nikkei Asia.

The Nikkei was trading 1.91% higher at 35,000 as of 7:40 a.m.

Stock indices in South Korea rose as the Bank of Korea kept its benchmark seven-day repurchase rate unchanged at 3.50%, and tweaked its hawkish tone on Thursday. The change led investors thinking the central bank may soon start a policy pivot this year. The benchmark KOSPI was trading 0.24% higher at 2,548.21 as of 7:41 a.m.

U.S. stocks, bonds and the dollar saw small moves, with investors awaiting Thursday’s inflation data for clues on the Federal Reserve outlook, reports Bloomberg.

The U.S. CPI is expected to remain unchanged at 3.2% on year in December, according to Bloomberg Survey.

The S&P 500 index and Nasdaq 100 settled 0.57% and 0.69% higher, respectively on Wednesday. The Dow Jones Industrial Average gained by 0.45%.

Brent crude was trading 1.02% lower at $76.80 a barrel. Gold was up by 0.14% at $2,027.30 an ounce.

GIFT Nifty was trading flat at 21,715 as of 7:35 a.m.

India's benchmark stock indices closed higher for the second straight day after a volatile session led by index heavyweight Reliance Industries Ltd. hitting a record high. The Nifty 50 closed 73.85 points, or 0.34%, higher at 21,618.70, while the Sensex gained 0.38%, or 271.50 points, to end at 71,657.71.

Overseas investors remained net sellers of Indian equities for the second consecutive session on Wednesday.

Foreign portfolio investors offloaded stocks worth Rs 1,721.3 crore, while domestic institutional investors remained net buyers and mopped up equities worth Rs 2,080 crore, the NSE data showed.

The Indian rupee strengthened 8 paise to close at Rs 83.04 against the U.S. dollar on Wednesday.

Indices in Asia-Pacific region gained during early trade on Thursday while investors braced themselves for U.S. CPI due later today.

In Japan, Nikkei extended its gains for four days, and crossed 35,000 mark briefly, marking the highest level since February, 1990. The rally in Japanese stocks is supported by overnight gains in tech shares on Wall Street, reported Nikkei Asia.

The Nikkei was trading 1.91% higher at 35,000 as of 7:40 a.m.

Stock indices in South Korea rose as the Bank of Korea kept its benchmark seven-day repurchase rate unchanged at 3.50%, and tweaked its hawkish tone on Thursday. The change led investors thinking the central bank may soon start a policy pivot this year. The benchmark KOSPI was trading 0.24% higher at 2,548.21 as of 7:41 a.m.

U.S. stocks, bonds and the dollar saw small moves, with investors awaiting Thursday’s inflation data for clues on the Federal Reserve outlook, reports Bloomberg.

The U.S. CPI is expected to remain unchanged at 3.2% on year in December, according to Bloomberg Survey.

The S&P 500 index and Nasdaq 100 settled 0.57% and 0.69% higher, respectively on Wednesday. The Dow Jones Industrial Average gained by 0.45%.

Brent crude was trading 1.02% lower at $76.80 a barrel. Gold was up by 0.14% at $2,027.30 an ounce.

GIFT Nifty was trading flat at 21,715 as of 7:35 a.m.

India's benchmark stock indices closed higher for the second straight day after a volatile session led by index heavyweight Reliance Industries Ltd. hitting a record high. The Nifty 50 closed 73.85 points, or 0.34%, higher at 21,618.70, while the Sensex gained 0.38%, or 271.50 points, to end at 71,657.71.

Overseas investors remained net sellers of Indian equities for the second consecutive session on Wednesday.

Foreign portfolio investors offloaded stocks worth Rs 1,721.3 crore, while domestic institutional investors remained net buyers and mopped up equities worth Rs 2,080 crore, the NSE data showed.

The Indian rupee strengthened 8 paise to close at Rs 83.04 against the U.S. dollar on Wednesday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.