Overseas investors remained net sellers of Indian equities for the sixth consecutive session on Tuesday.

Foreign portfolio investors offloaded stocks worth Rs 95.20 crore, according to provisional data from the National Stock Exchange.

Domestic institutional investors turned net buyers and mopped up stocks worth Rs 167.04 crore, the NSE data showed.

Foreign institutions have been net buyers of Rs 1,61,709 crore worth of Indian equities so far in 2023, according to data from the National Securities Depository Ltd., updated till the previous trading day.

The yield on the 10-year bond closed flat at 7.18% on Tuesday.

Source: Bloomberg

The local currency weakened 4 paise to close at 83.19 against the U.S dollar on Tuesday.

It closed at 83.15 on Friday.

Source: Bloomberg

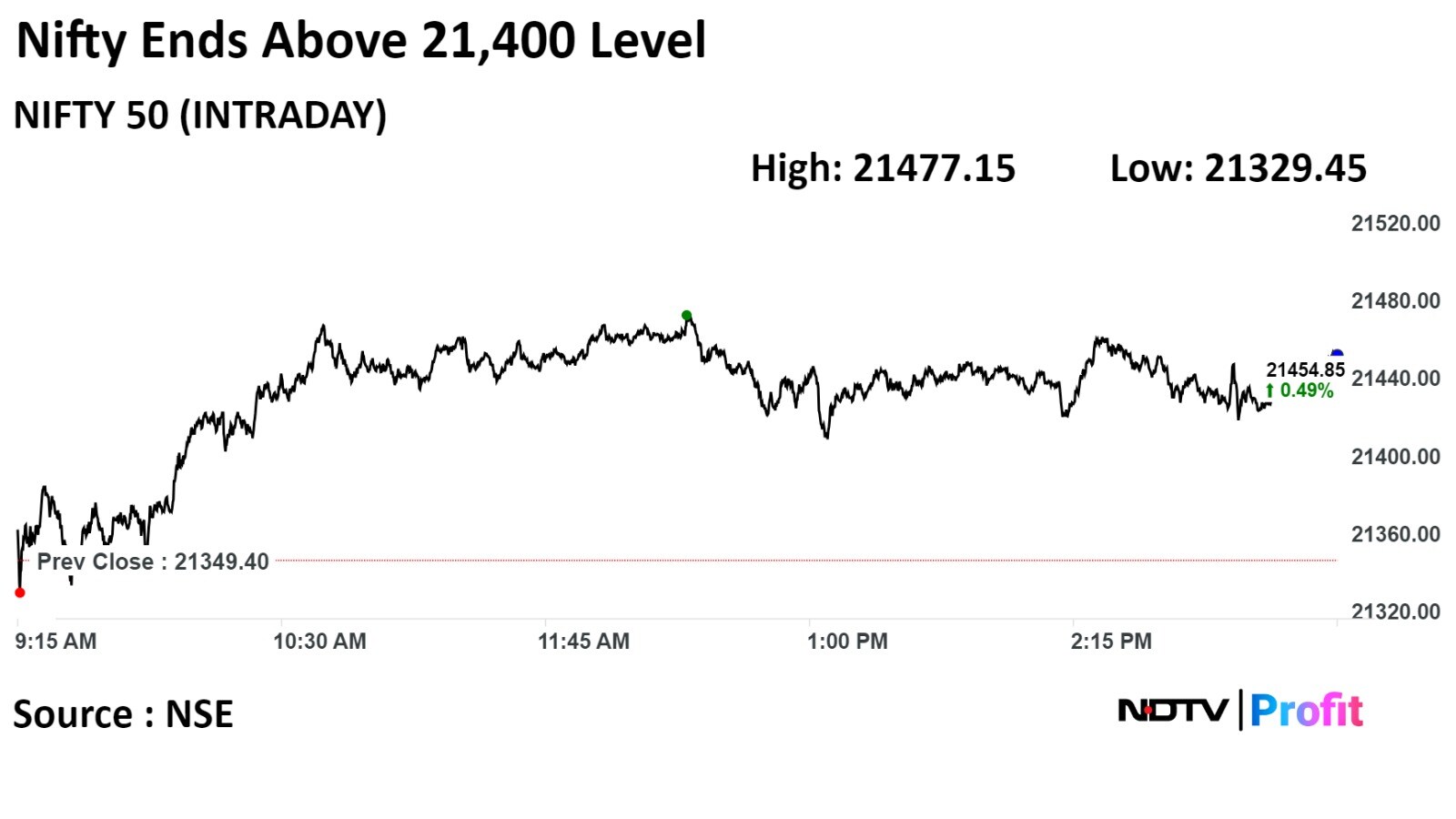

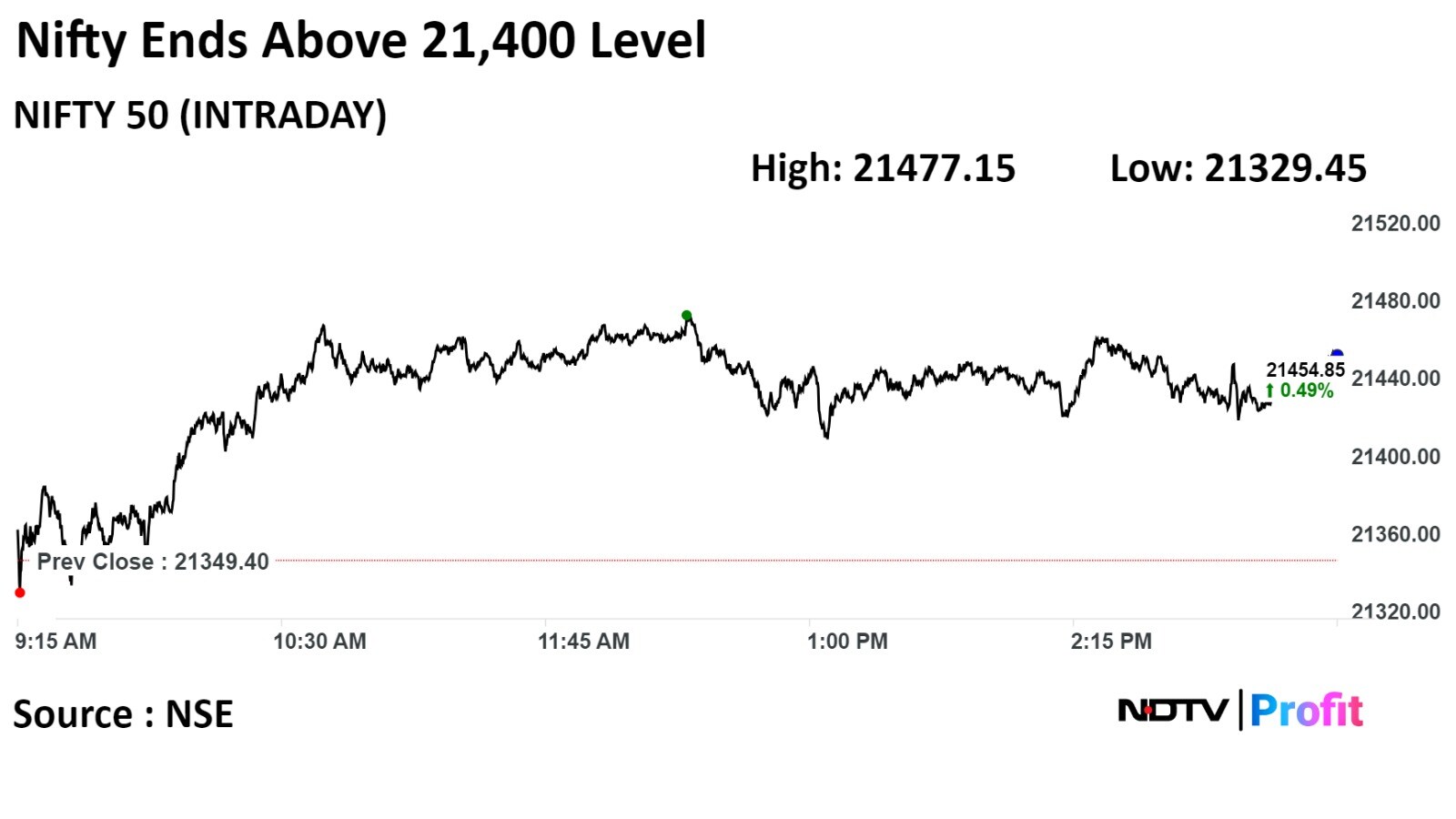

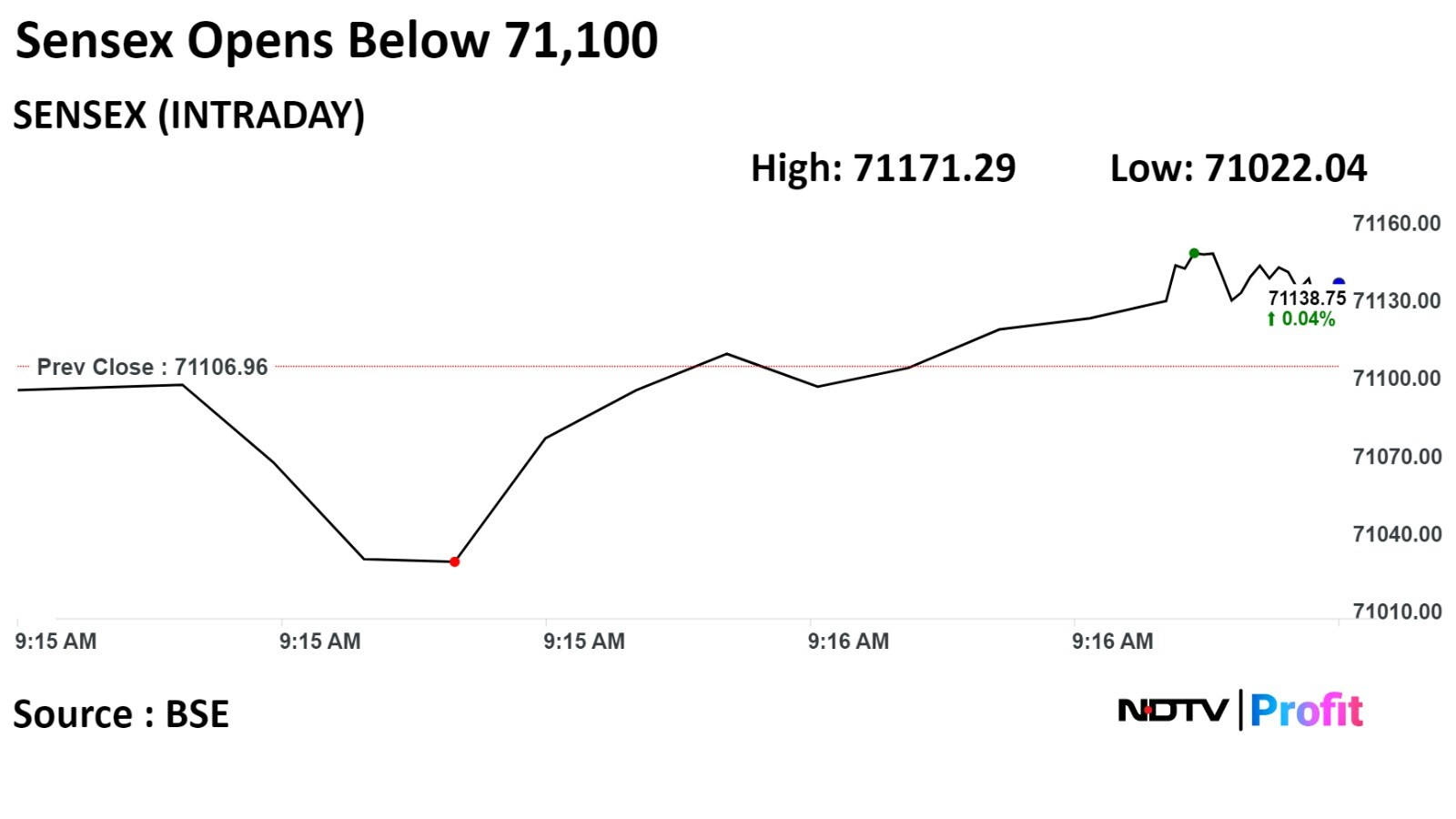

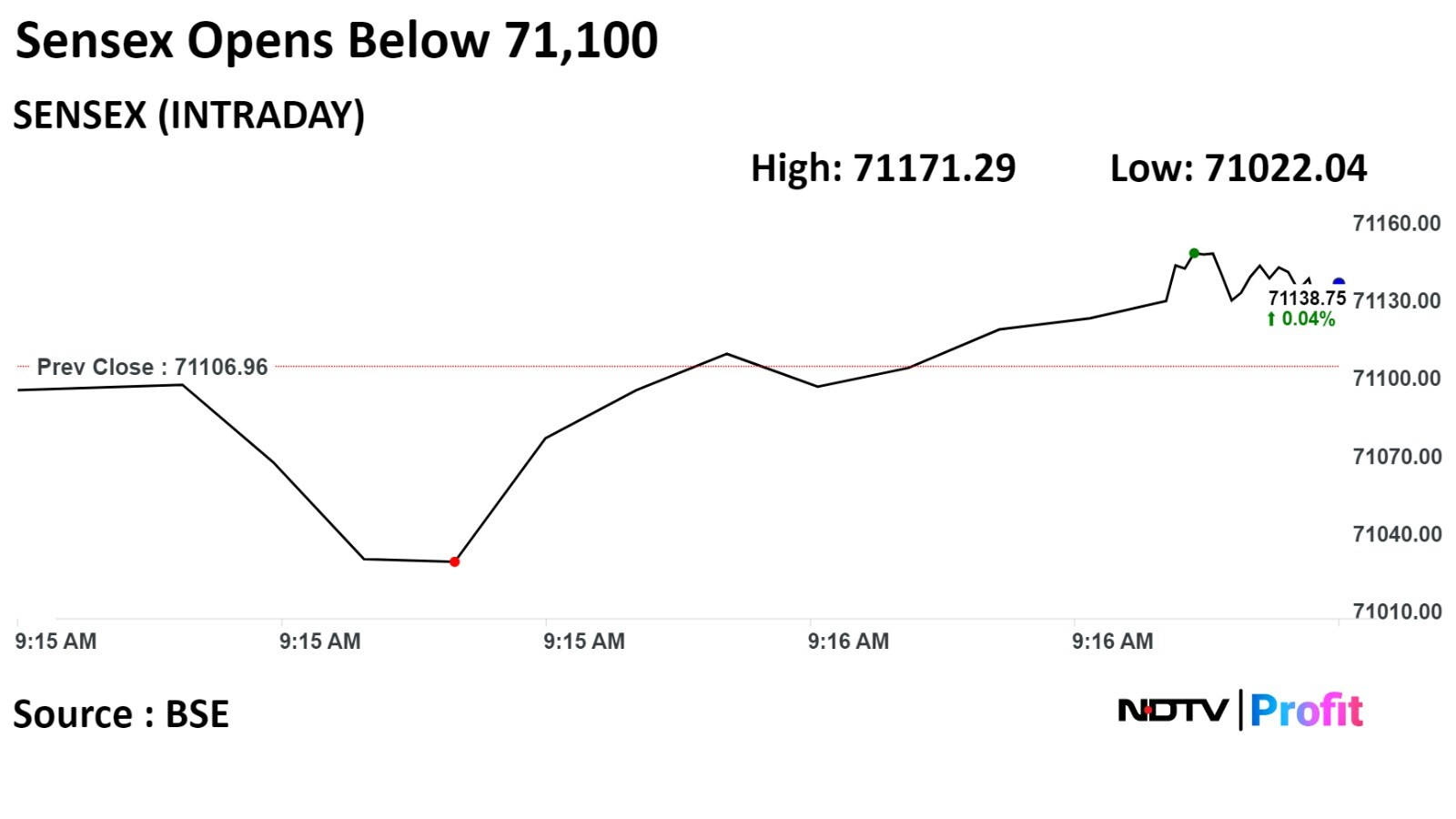

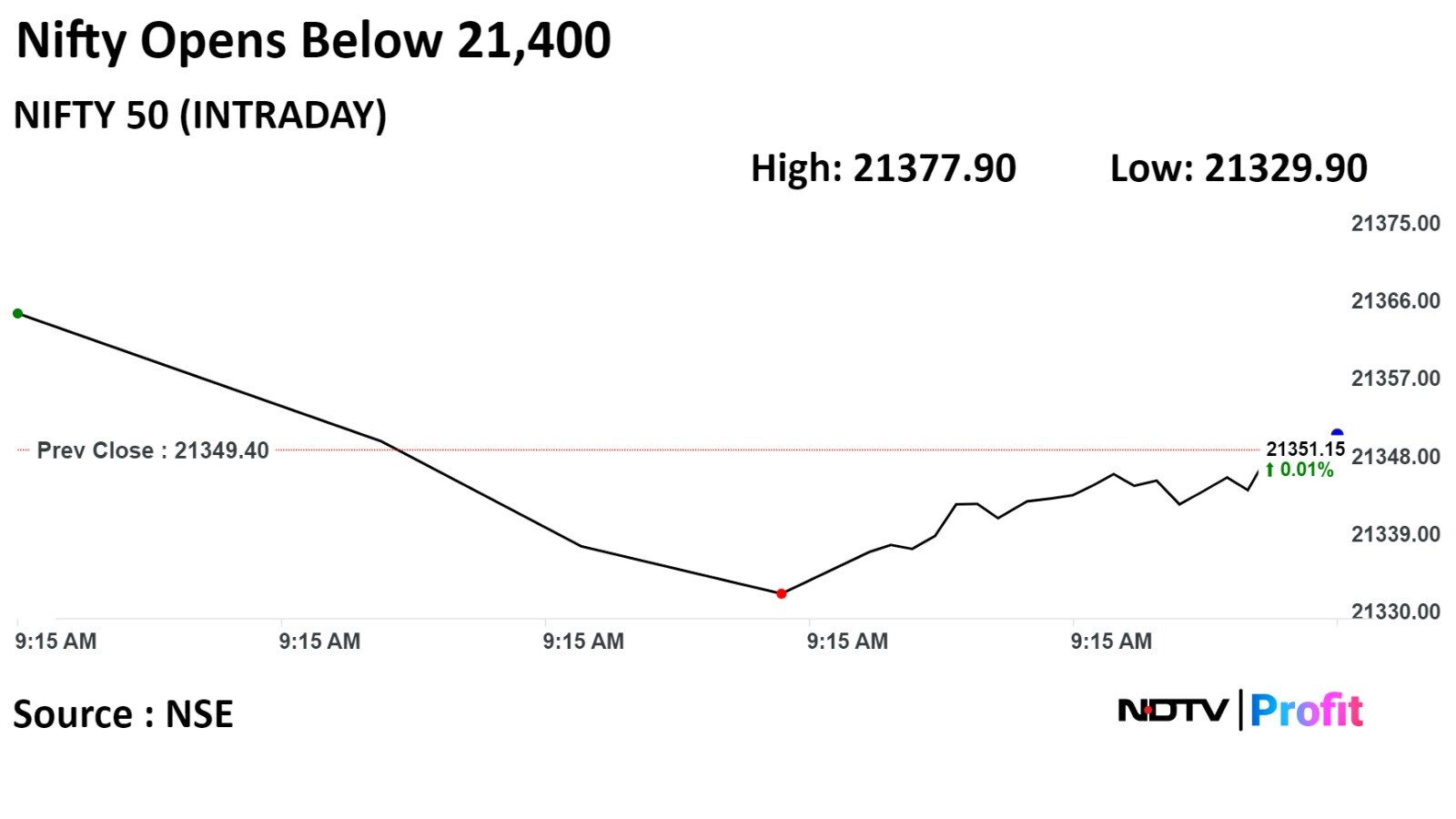

India's benchmark indices ended higher despite starting the day flat on Tuesday as HDFC Bank Ltd, Reliance Industries Ltd., Kotak Mahindra Bank Ltd gained.

The NSE Nifty 50 ended 0.43% or 91.95 points higher at 21,441.35, while the S&P BSE Sensex ended 0.32% or 229.84 points higher at 71,336.80.

"Technically, the short-term texture of the market is volatile hence; level-based trading would be the ideal strategy for the day traders. We are of the view that, as long as the index is trading above 21,400/71,300 the pullback formation is likely to continue. Above the same, the market could move up till 21,475-21,550/71,300-71,600. On the flip side, below 21,200/70,700 the sentiment could change. Below the same, the market could retest the level of 21,100-21,000/70,400-70,000. However, crossing 21,600/71,900 could lead to a rally towards 21,900-22,000/72,800-73,00 levels," said Shrikant Chouhan, head, equity research, Kotak Securities.

India's benchmark indices ended higher despite starting the day flat on Tuesday as HDFC Bank Ltd, Reliance Industries Ltd., Kotak Mahindra Bank Ltd gained.

The NSE Nifty 50 ended 0.43% or 91.95 points higher at 21,441.35, while the S&P BSE Sensex ended 0.32% or 229.84 points higher at 71,336.80.

"Technically, the short-term texture of the market is volatile hence; level-based trading would be the ideal strategy for the day traders. We are of the view that, as long as the index is trading above 21,400/71,300 the pullback formation is likely to continue. Above the same, the market could move up till 21,475-21,550/71,300-71,600. On the flip side, below 21,200/70,700 the sentiment could change. Below the same, the market could retest the level of 21,100-21,000/70,400-70,000. However, crossing 21,600/71,900 could lead to a rally towards 21,900-22,000/72,800-73,00 levels," said Shrikant Chouhan, head, equity research, Kotak Securities.

India's benchmark indices ended higher despite starting the day flat on Tuesday as HDFC Bank Ltd, Reliance Industries Ltd., Kotak Mahindra Bank Ltd gained.

The NSE Nifty 50 ended 0.43% or 91.95 points higher at 21,441.35, while the S&P BSE Sensex ended 0.32% or 229.84 points higher at 71,336.80.

"Technically, the short-term texture of the market is volatile hence; level-based trading would be the ideal strategy for the day traders. We are of the view that, as long as the index is trading above 21,400/71,300 the pullback formation is likely to continue. Above the same, the market could move up till 21,475-21,550/71,300-71,600. On the flip side, below 21,200/70,700 the sentiment could change. Below the same, the market could retest the level of 21,100-21,000/70,400-70,000. However, crossing 21,600/71,900 could lead to a rally towards 21,900-22,000/72,800-73,00 levels," said Shrikant Chouhan, head, equity research, Kotak Securities.

India's benchmark indices ended higher despite starting the day flat on Tuesday as HDFC Bank Ltd, Reliance Industries Ltd., Kotak Mahindra Bank Ltd gained.

The NSE Nifty 50 ended 0.43% or 91.95 points higher at 21,441.35, while the S&P BSE Sensex ended 0.32% or 229.84 points higher at 71,336.80.

"Technically, the short-term texture of the market is volatile hence; level-based trading would be the ideal strategy for the day traders. We are of the view that, as long as the index is trading above 21,400/71,300 the pullback formation is likely to continue. Above the same, the market could move up till 21,475-21,550/71,300-71,600. On the flip side, below 21,200/70,700 the sentiment could change. Below the same, the market could retest the level of 21,100-21,000/70,400-70,000. However, crossing 21,600/71,900 could lead to a rally towards 21,900-22,000/72,800-73,00 levels," said Shrikant Chouhan, head, equity research, Kotak Securities.

India's benchmark indices ended higher despite starting the day flat on Tuesday as HDFC Bank Ltd, Reliance Industries Ltd., Kotak Mahindra Bank Ltd gained.

The NSE Nifty 50 ended 0.43% or 91.95 points higher at 21,441.35, while the S&P BSE Sensex ended 0.32% or 229.84 points higher at 71,336.80.

"Technically, the short-term texture of the market is volatile hence; level-based trading would be the ideal strategy for the day traders. We are of the view that, as long as the index is trading above 21,400/71,300 the pullback formation is likely to continue. Above the same, the market could move up till 21,475-21,550/71,300-71,600. On the flip side, below 21,200/70,700 the sentiment could change. Below the same, the market could retest the level of 21,100-21,000/70,400-70,000. However, crossing 21,600/71,900 could lead to a rally towards 21,900-22,000/72,800-73,00 levels," said Shrikant Chouhan, head, equity research, Kotak Securities.

India's benchmark indices ended higher despite starting the day flat on Tuesday as HDFC Bank Ltd, Reliance Industries Ltd., Kotak Mahindra Bank Ltd gained.

The NSE Nifty 50 ended 0.43% or 91.95 points higher at 21,441.35, while the S&P BSE Sensex ended 0.32% or 229.84 points higher at 71,336.80.

"Technically, the short-term texture of the market is volatile hence; level-based trading would be the ideal strategy for the day traders. We are of the view that, as long as the index is trading above 21,400/71,300 the pullback formation is likely to continue. Above the same, the market could move up till 21,475-21,550/71,300-71,600. On the flip side, below 21,200/70,700 the sentiment could change. Below the same, the market could retest the level of 21,100-21,000/70,400-70,000. However, crossing 21,600/71,900 could lead to a rally towards 21,900-22,000/72,800-73,00 levels," said Shrikant Chouhan, head, equity research, Kotak Securities.

India's benchmark indices ended higher despite starting the day flat on Tuesday as HDFC Bank Ltd, Reliance Industries Ltd., Kotak Mahindra Bank Ltd gained.

The NSE Nifty 50 ended 0.43% or 91.95 points higher at 21,441.35, while the S&P BSE Sensex ended 0.32% or 229.84 points higher at 71,336.80.

"Technically, the short-term texture of the market is volatile hence; level-based trading would be the ideal strategy for the day traders. We are of the view that, as long as the index is trading above 21,400/71,300 the pullback formation is likely to continue. Above the same, the market could move up till 21,475-21,550/71,300-71,600. On the flip side, below 21,200/70,700 the sentiment could change. Below the same, the market could retest the level of 21,100-21,000/70,400-70,000. However, crossing 21,600/71,900 could lead to a rally towards 21,900-22,000/72,800-73,00 levels," said Shrikant Chouhan, head, equity research, Kotak Securities.

India's benchmark indices ended higher despite starting the day flat on Tuesday as HDFC Bank Ltd, Reliance Industries Ltd., Kotak Mahindra Bank Ltd gained.

The NSE Nifty 50 ended 0.43% or 91.95 points higher at 21,441.35, while the S&P BSE Sensex ended 0.32% or 229.84 points higher at 71,336.80.

"Technically, the short-term texture of the market is volatile hence; level-based trading would be the ideal strategy for the day traders. We are of the view that, as long as the index is trading above 21,400/71,300 the pullback formation is likely to continue. Above the same, the market could move up till 21,475-21,550/71,300-71,600. On the flip side, below 21,200/70,700 the sentiment could change. Below the same, the market could retest the level of 21,100-21,000/70,400-70,000. However, crossing 21,600/71,900 could lead to a rally towards 21,900-22,000/72,800-73,00 levels," said Shrikant Chouhan, head, equity research, Kotak Securities.

HDFC Bank Ltd, Reliance Industries Ltd, Kotak Mahindra Bank Ltd, NTPC Ltd, and Bharti Airtel Ltd were adding positively to the indices

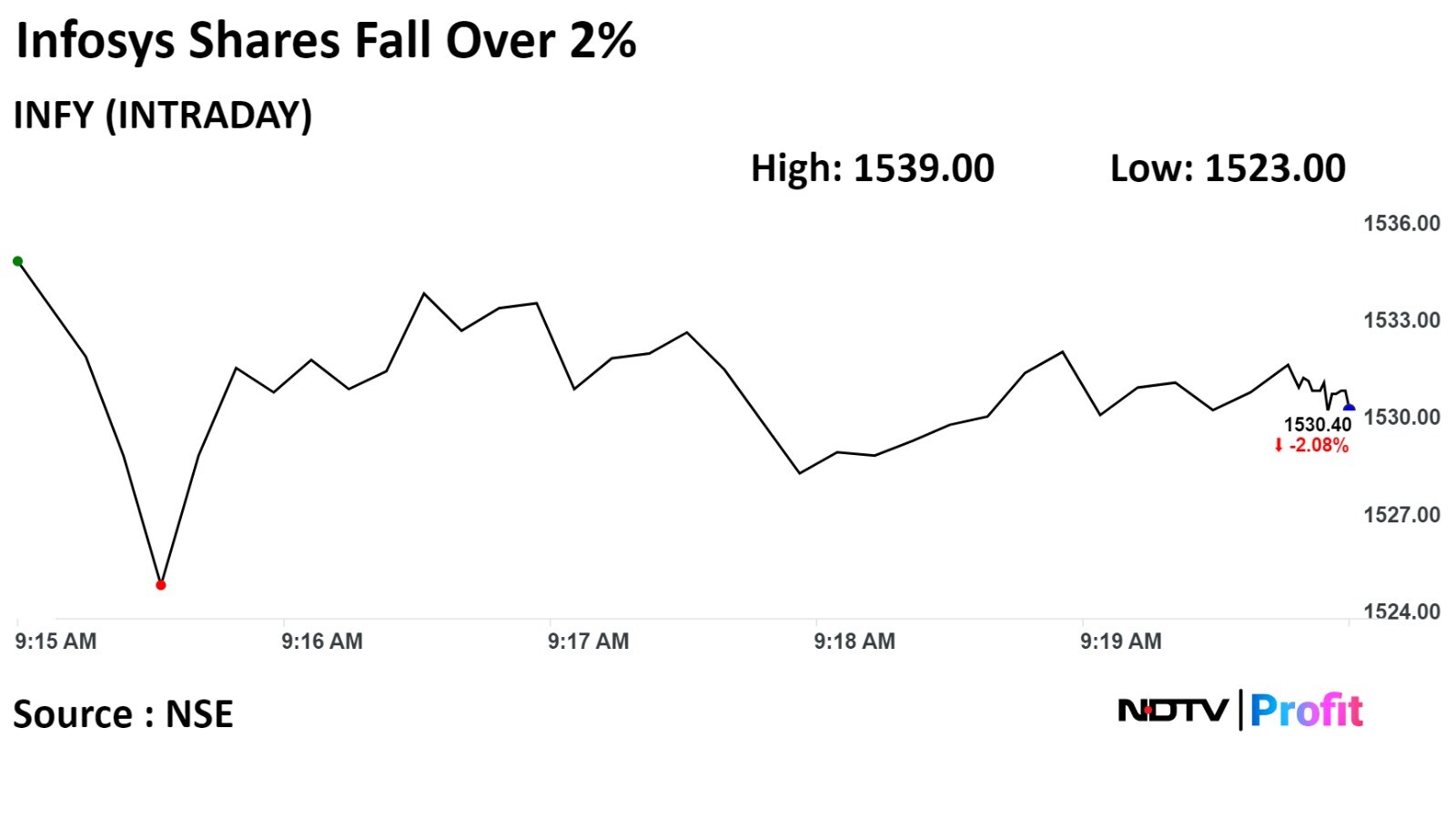

Infosys Ltd, Bajaj Finance Ltd., Tata Consultancy Services Ltd, Bajaj Financial Services Ltd, and Tata Motors Ltd weighed on the indices.

Around 11 sectors on NSE, out of 14 advanced with the Nifty PSE emerging as the top gainer among sectoral indices. Around three sectors declined with the Nifty Media declining the most

The broader markets outperformed the benchmark indices with S&P BSE MidCap Index gaining 0.72%, whereas S&P BSE SmallCap Index was 0.48% higher. 18 out of 20 sectors compiled by BSE advanced, while two declined. S&P BSE Oil and Gas rose the most.

The market breadth was skewed in the favour of buyers. Around 2330 stocks rose, 155 stocks declined, and 145 remained unchanged.

Polycab India said IT Department's search is still under process at some plants and premises

Alert: I-T Dept had commenced search operations at co's premises and plants on Dec 22

Source: Exchange filing

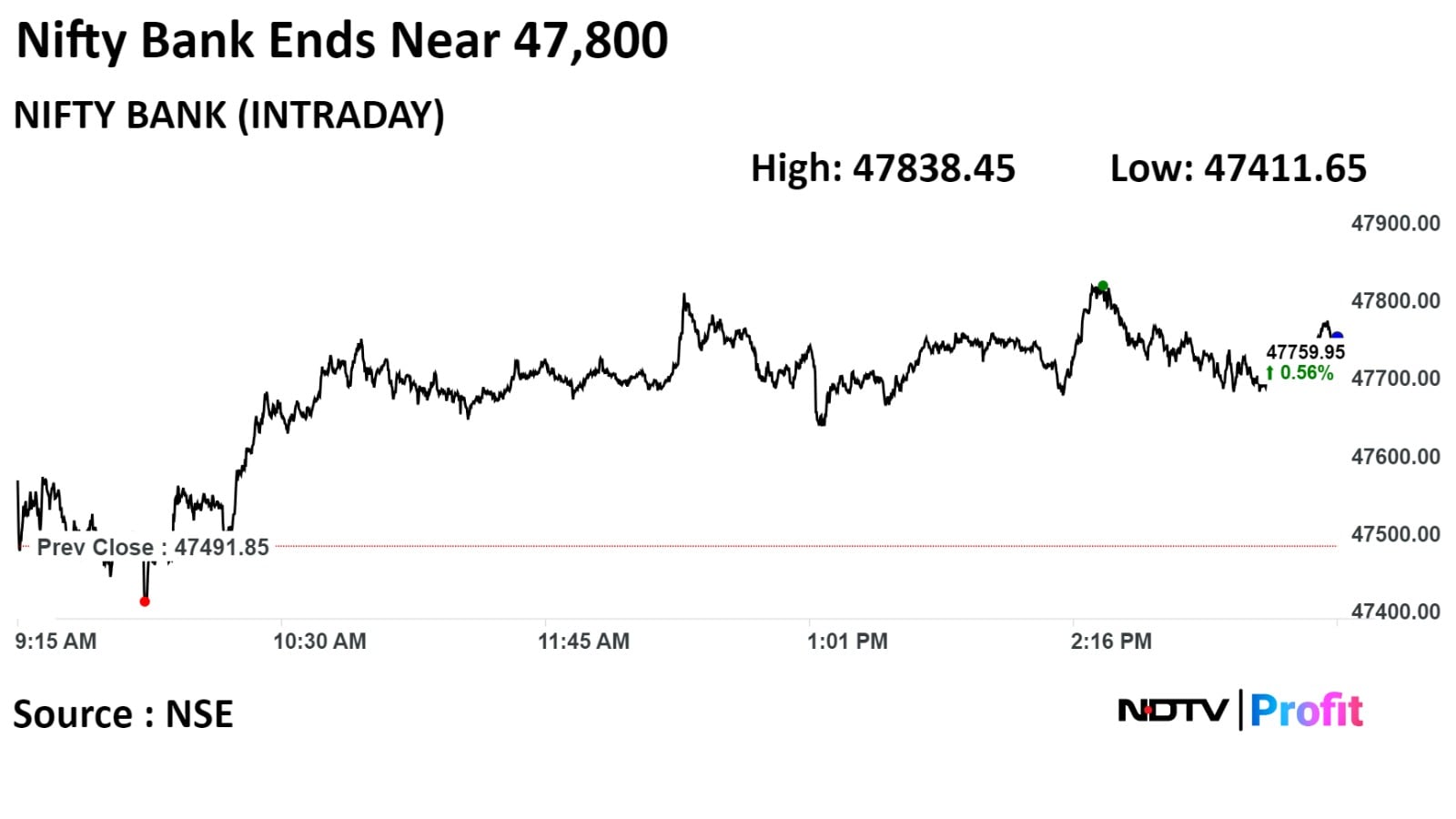

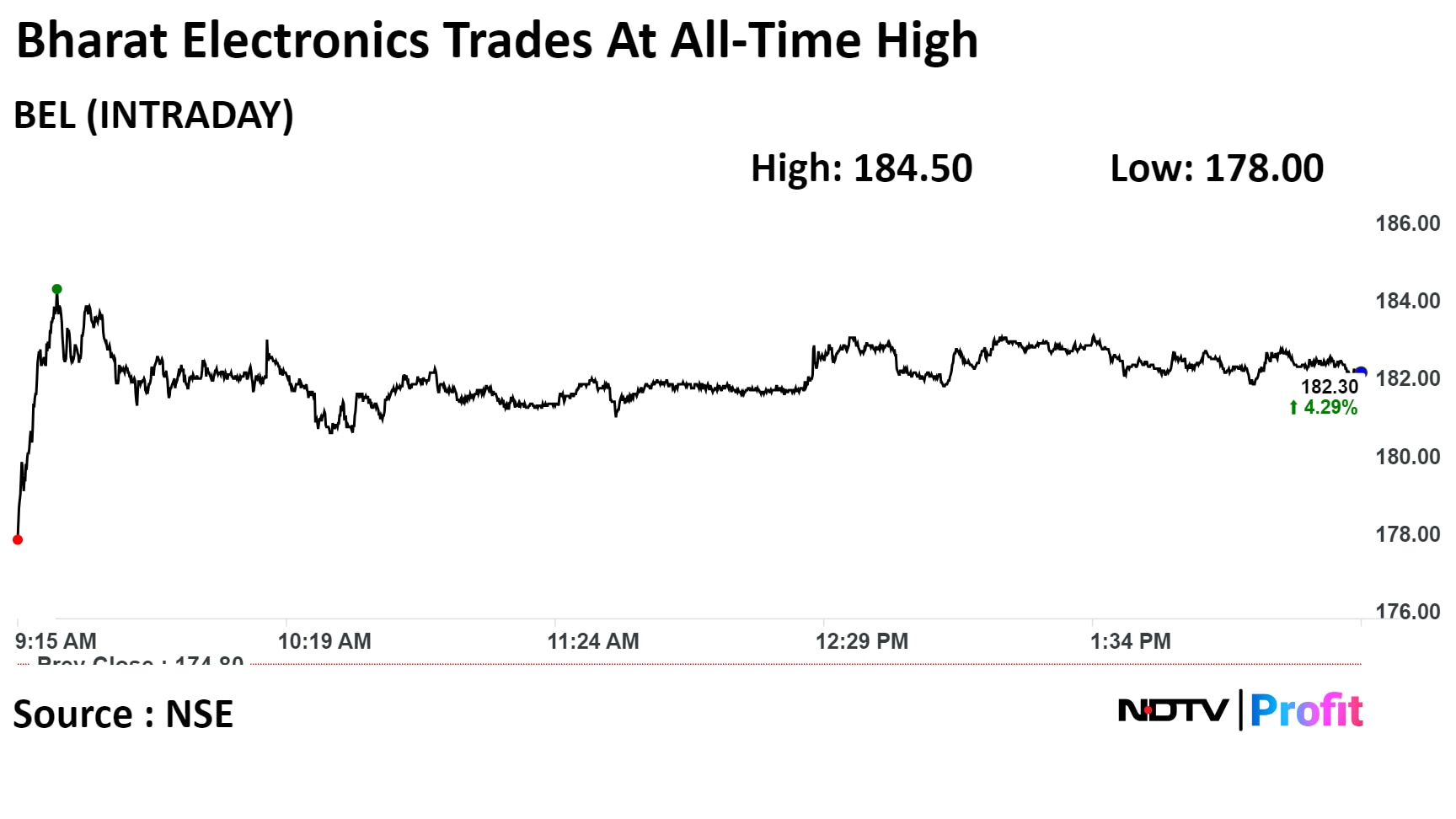

Bharat Electronics Ltd gained 5.55% on Tuesday to touch a life-time high after it informed the exchanged it has received an order worth Rs 678 crore from multiple clinets.

BEL has signed a contract worth Rs 445 crore with UP Government for next generation UP Dial 112 project. It has also received an additional orders worth Rs 233 crore for communication display units, thermal cameras and other equipment

Bharat Electronics Ltd gained 5.55% on Tuesday to touch a life-time high after it informed the exchanged it has received an order worth Rs 678 crore from multiple clinets.

BEL has signed a contract worth Rs 445 crore with UP Government for next generation UP Dial 112 project. It has also received an additional orders worth Rs 233 crore for communication display units, thermal cameras and other equipment

Scrips of Bharat Electronics Ltd rose as much as 5.55% to Rs 185.50 apiece, the highest level since it was listed on Feb 2, 1997. It was trading 4.46% higher at Rs 182.60 apiece, as of 2:26 p.m. This compares to a 0.48% advance in the NSE Nifty 50 Index.

It has risen 82.73% on a year-to-date basis. Total traded volume so far in the day stood at 3.0 times its 30-day average. The relative strength index was at 79.58, which implied the stock is overbought.

Out of 29 analysts tracking the company, 23 maintain a 'buy' rating, four recommend a 'hold,' and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 10.41%.

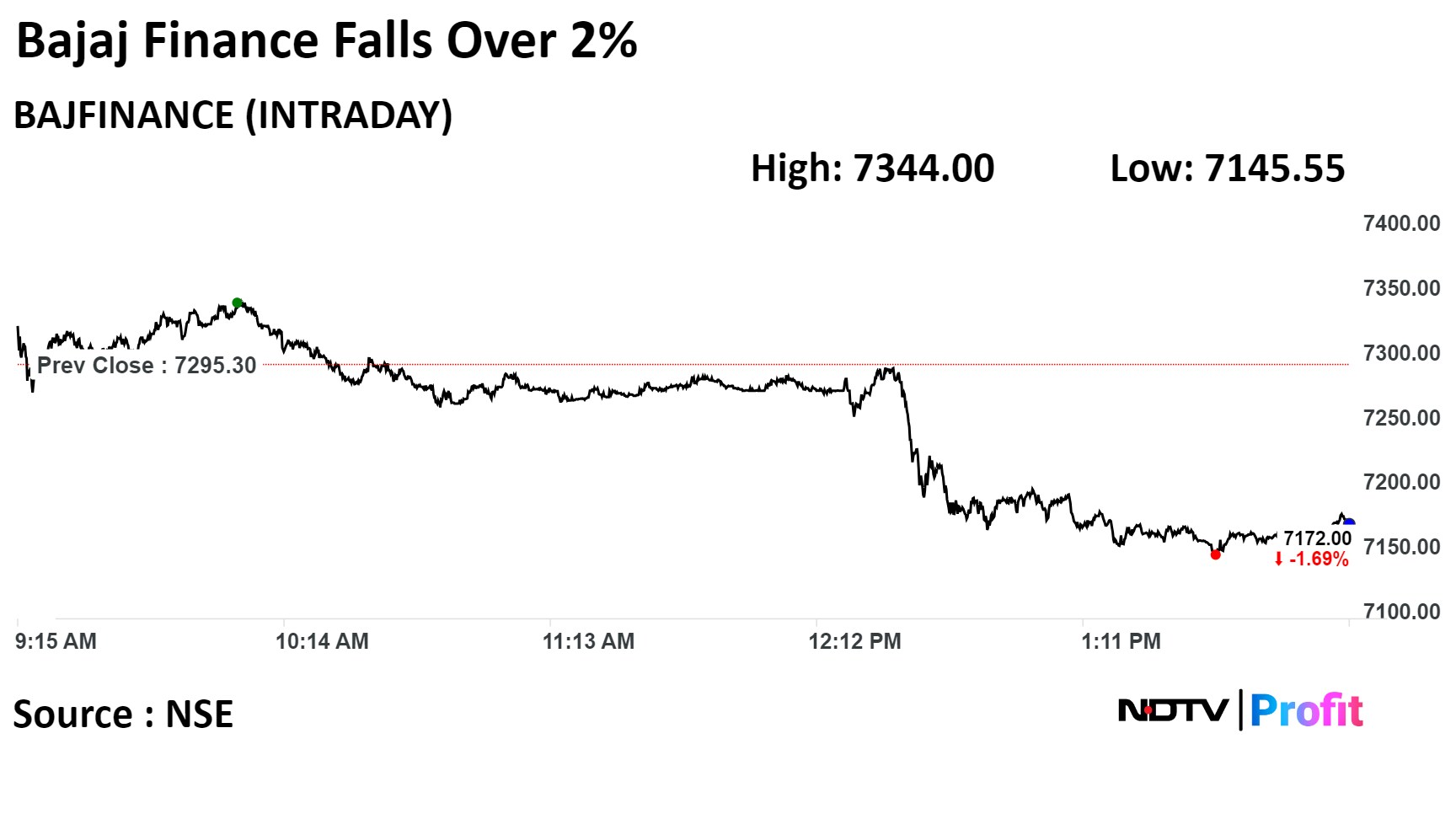

Shares of the Bajaj Finance Ltd declined over 2% on Tuesday as the Reserve Bank of India has found serious deficiencies in Bajaj Finance and RBL Bank Credit Card deal.

The central bank has given one-year extension to the Bajaj Finance and RBL Bank, against two years of extension was requested, citing serious deficiencies.

Shares of the Bajaj Finance Ltd declined over 2% on Tuesday as the Reserve Bank of India has found serious deficiencies in Bajaj Finance and RBL Bank Credit Card deal.

The central bank has given one-year extension to the Bajaj Finance and RBL Bank, against two years of extension was requested, citing serious deficiencies.

The scrip fell as much as 2.05% to Rs 7,145 apiece. It was trading 1.83% lower at Rs 7,162 apiece, as of 1:56 p.m. This compares to a 0.45% advance in the NSE Nifty 50 Index.

It has risen 8.89% on a year-to-date basis. The relative strength index was at 40.39.

Out of 35 analysts tracking the company, 27 maintain a 'buy' rating, four recommend a 'hold,' and four suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 24.5%.

Greenply approved transfer of 51% stake in arm Greenply Middle East, Dubai, to investor group

Unit to cease to be subsidiary of co after stake transfer

Source: Exchange Filing

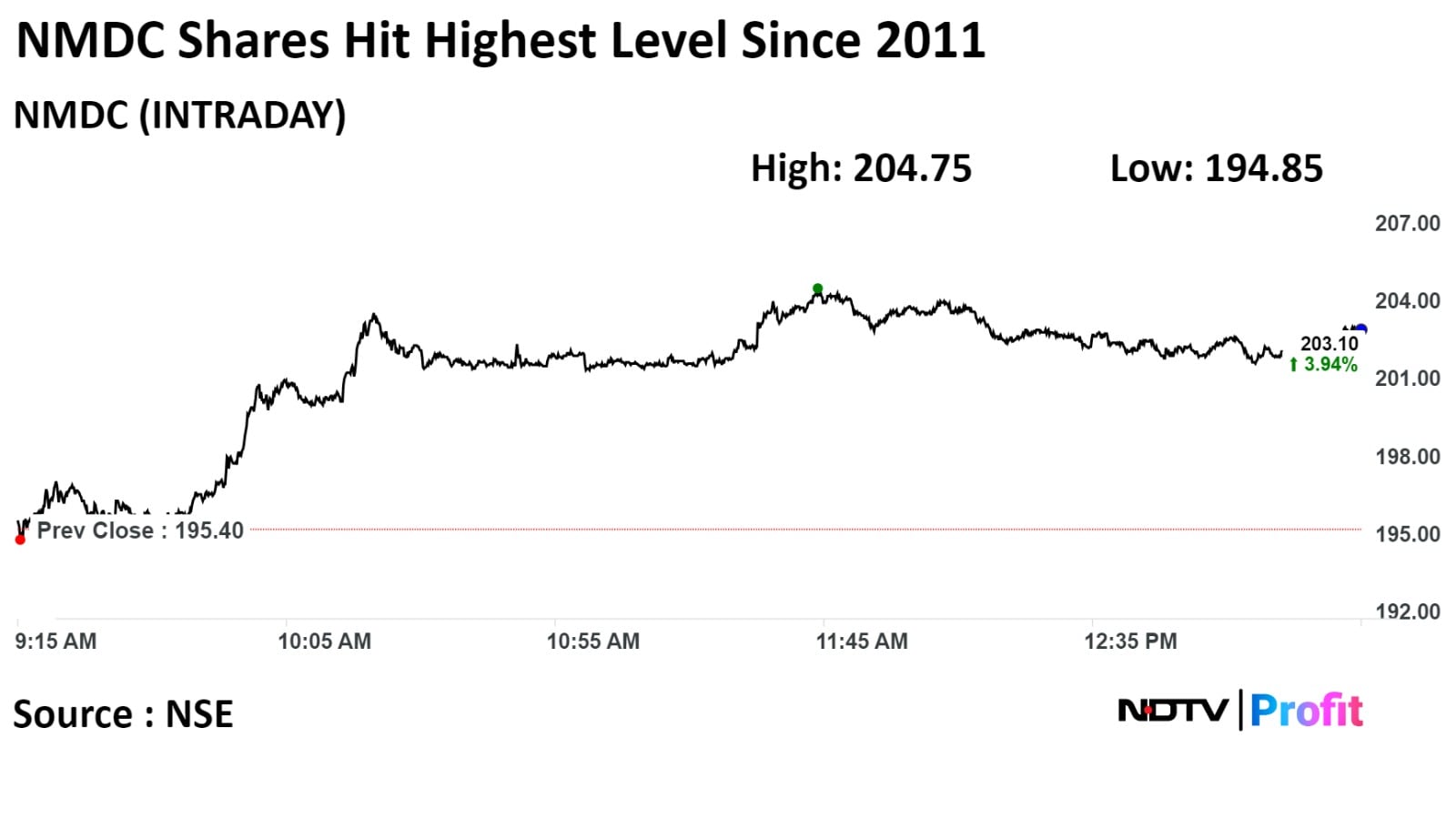

Shares of NMDC jumped over 4% on Tuesday as iron ore futures jumped to $140 a tonne, its highest level in 10 months.

The steel-making material traded close to the highest intraday level seen in late February, Bloomberg data showed. Iron ore futures have rallied almost 40% since early August as Chinese steel production looks poised for its first annual gain in three years.

Shares of NMDC jumped over 4% on Tuesday as iron ore futures jumped to $140 a tonne, its highest level in 10 months.

The steel-making material traded close to the highest intraday level seen in late February, Bloomberg data showed. Iron ore futures have rallied almost 40% since early August as Chinese steel production looks poised for its first annual gain in three years.

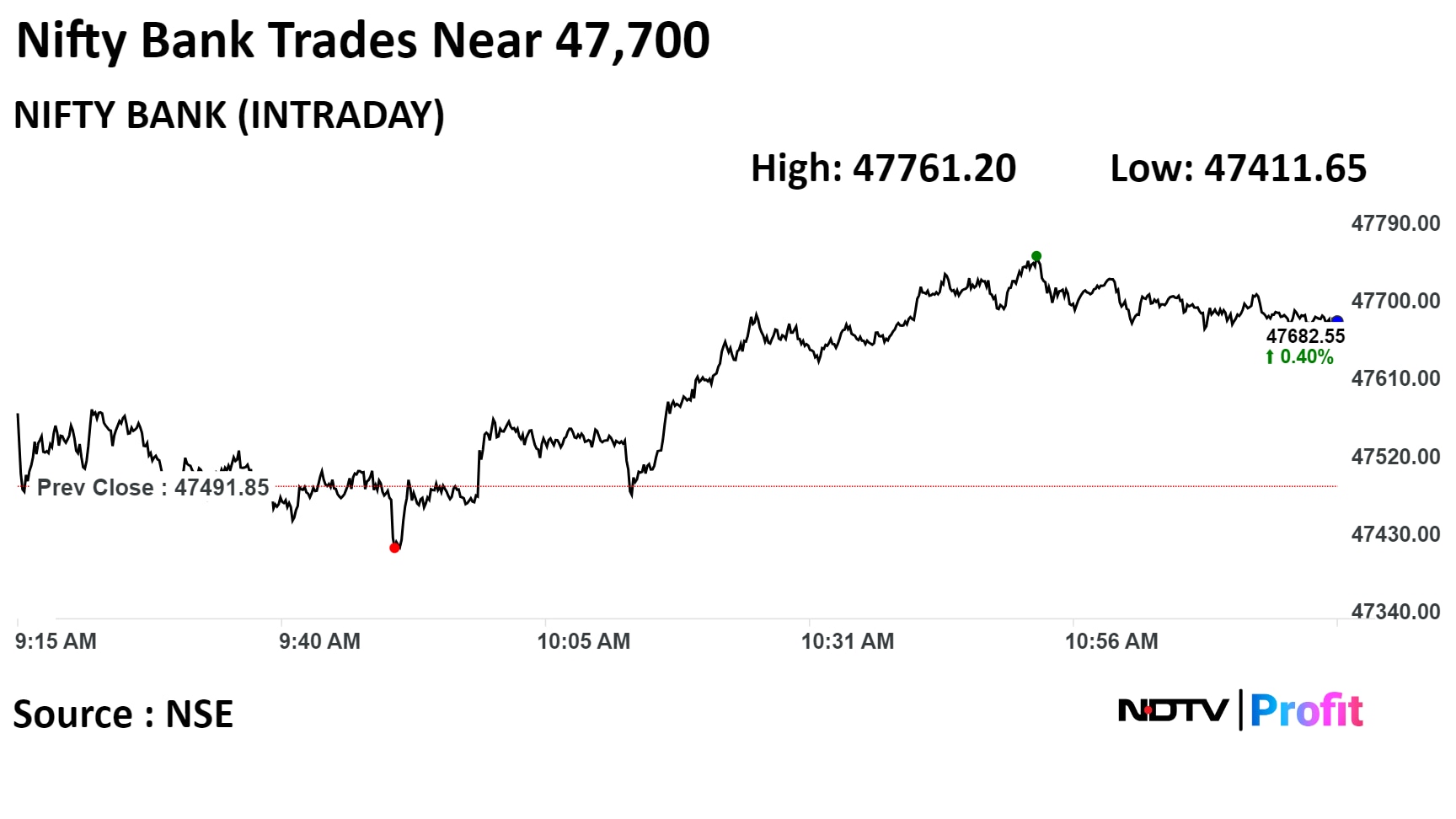

The benchmark indices were trading higher during midday on Monday after opening flat on the back of gains in Reliance Industries Ltd. and banking stocks.

At 11:48 a.m., the NSE Nifty 50 was 106 points or 0.49% higher at 21,455.05 and the S&P BSE Sensex was 275 points or 0.39% up at 71,382.37.

During the day, the Sensex rose as much as 0.51% to 71,097.78, while the Nifty gained 0.58% to reach 21,472.30 points.

"The Nifty is presently consolidating recent gains, anticipating a positive trend," Shrey Jain, chief executive officer of SAS Onlinesaid. "The recommended strategy in the current market context continues to be 'buy on dips'."

"The lower-end support for the index is firmly established at 21,250–21,300, offering an attractive buying opportunity should the index experience a dip within this range," Jain said. "Maintaining a position above 21,300 could potentially pave the way for additional upward momentum, with a target set at the 21,500 level."

The benchmark indices were trading higher during midday on Monday after opening flat on the back of gains in Reliance Industries Ltd. and banking stocks.

At 11:48 a.m., the NSE Nifty 50 was 106 points or 0.49% higher at 21,455.05 and the S&P BSE Sensex was 275 points or 0.39% up at 71,382.37.

During the day, the Sensex rose as much as 0.51% to 71,097.78, while the Nifty gained 0.58% to reach 21,472.30 points.

"The Nifty is presently consolidating recent gains, anticipating a positive trend," Shrey Jain, chief executive officer of SAS Onlinesaid. "The recommended strategy in the current market context continues to be 'buy on dips'."

"The lower-end support for the index is firmly established at 21,250–21,300, offering an attractive buying opportunity should the index experience a dip within this range," Jain said. "Maintaining a position above 21,300 could potentially pave the way for additional upward momentum, with a target set at the 21,500 level."

The benchmark indices were trading higher during midday on Monday after opening flat on the back of gains in Reliance Industries Ltd. and banking stocks.

At 11:48 a.m., the NSE Nifty 50 was 106 points or 0.49% higher at 21,455.05 and the S&P BSE Sensex was 275 points or 0.39% up at 71,382.37.

During the day, the Sensex rose as much as 0.51% to 71,097.78, while the Nifty gained 0.58% to reach 21,472.30 points.

"The Nifty is presently consolidating recent gains, anticipating a positive trend," Shrey Jain, chief executive officer of SAS Onlinesaid. "The recommended strategy in the current market context continues to be 'buy on dips'."

"The lower-end support for the index is firmly established at 21,250–21,300, offering an attractive buying opportunity should the index experience a dip within this range," Jain said. "Maintaining a position above 21,300 could potentially pave the way for additional upward momentum, with a target set at the 21,500 level."

The benchmark indices were trading higher during midday on Monday after opening flat on the back of gains in Reliance Industries Ltd. and banking stocks.

At 11:48 a.m., the NSE Nifty 50 was 106 points or 0.49% higher at 21,455.05 and the S&P BSE Sensex was 275 points or 0.39% up at 71,382.37.

During the day, the Sensex rose as much as 0.51% to 71,097.78, while the Nifty gained 0.58% to reach 21,472.30 points.

"The Nifty is presently consolidating recent gains, anticipating a positive trend," Shrey Jain, chief executive officer of SAS Onlinesaid. "The recommended strategy in the current market context continues to be 'buy on dips'."

"The lower-end support for the index is firmly established at 21,250–21,300, offering an attractive buying opportunity should the index experience a dip within this range," Jain said. "Maintaining a position above 21,300 could potentially pave the way for additional upward momentum, with a target set at the 21,500 level."

The benchmark indices were trading higher during midday on Monday after opening flat on the back of gains in Reliance Industries Ltd. and banking stocks.

At 11:48 a.m., the NSE Nifty 50 was 106 points or 0.49% higher at 21,455.05 and the S&P BSE Sensex was 275 points or 0.39% up at 71,382.37.

During the day, the Sensex rose as much as 0.51% to 71,097.78, while the Nifty gained 0.58% to reach 21,472.30 points.

"The Nifty is presently consolidating recent gains, anticipating a positive trend," Shrey Jain, chief executive officer of SAS Onlinesaid. "The recommended strategy in the current market context continues to be 'buy on dips'."

"The lower-end support for the index is firmly established at 21,250–21,300, offering an attractive buying opportunity should the index experience a dip within this range," Jain said. "Maintaining a position above 21,300 could potentially pave the way for additional upward momentum, with a target set at the 21,500 level."

The benchmark indices were trading higher during midday on Monday after opening flat on the back of gains in Reliance Industries Ltd. and banking stocks.

At 11:48 a.m., the NSE Nifty 50 was 106 points or 0.49% higher at 21,455.05 and the S&P BSE Sensex was 275 points or 0.39% up at 71,382.37.

During the day, the Sensex rose as much as 0.51% to 71,097.78, while the Nifty gained 0.58% to reach 21,472.30 points.

"The Nifty is presently consolidating recent gains, anticipating a positive trend," Shrey Jain, chief executive officer of SAS Onlinesaid. "The recommended strategy in the current market context continues to be 'buy on dips'."

"The lower-end support for the index is firmly established at 21,250–21,300, offering an attractive buying opportunity should the index experience a dip within this range," Jain said. "Maintaining a position above 21,300 could potentially pave the way for additional upward momentum, with a target set at the 21,500 level."

The benchmark indices were trading higher during midday on Monday after opening flat on the back of gains in Reliance Industries Ltd. and banking stocks.

At 11:48 a.m., the NSE Nifty 50 was 106 points or 0.49% higher at 21,455.05 and the S&P BSE Sensex was 275 points or 0.39% up at 71,382.37.

During the day, the Sensex rose as much as 0.51% to 71,097.78, while the Nifty gained 0.58% to reach 21,472.30 points.

"The Nifty is presently consolidating recent gains, anticipating a positive trend," Shrey Jain, chief executive officer of SAS Onlinesaid. "The recommended strategy in the current market context continues to be 'buy on dips'."

"The lower-end support for the index is firmly established at 21,250–21,300, offering an attractive buying opportunity should the index experience a dip within this range," Jain said. "Maintaining a position above 21,300 could potentially pave the way for additional upward momentum, with a target set at the 21,500 level."

The benchmark indices were trading higher during midday on Monday after opening flat on the back of gains in Reliance Industries Ltd. and banking stocks.

At 11:48 a.m., the NSE Nifty 50 was 106 points or 0.49% higher at 21,455.05 and the S&P BSE Sensex was 275 points or 0.39% up at 71,382.37.

During the day, the Sensex rose as much as 0.51% to 71,097.78, while the Nifty gained 0.58% to reach 21,472.30 points.

"The Nifty is presently consolidating recent gains, anticipating a positive trend," Shrey Jain, chief executive officer of SAS Onlinesaid. "The recommended strategy in the current market context continues to be 'buy on dips'."

"The lower-end support for the index is firmly established at 21,250–21,300, offering an attractive buying opportunity should the index experience a dip within this range," Jain said. "Maintaining a position above 21,300 could potentially pave the way for additional upward momentum, with a target set at the 21,500 level."

Shares of RIL, HDFC Bank Ltd., Bharati Airtel Ltd., ITC Ltd. and Axis Bank Ltd. contributed the most to the gains.

Infosys Ltd., Bajaj Finserv Ltd., Tata Consultancy Services Ltd., Bajaj Finance Ltd. and Tata Motors Ltd. weighed on the indices.

Except Nifty IT and Nifty Realty, all sectoral indices on the NSE gained, with PSE and Oil & Gas rising the most.

The broader markets rose, with the BSE MidCap rising 0.77% and SmallCap gaining 0.33%.

Seventeen out of the 20 sectors compiled by the BSE advanced, with Energy rising the most.

The market breadth was skewed in the favour of the buyers as 2,340 stocks rose, 1,401 declined and 169 remained unchanged on the BSE.

Step-down subsidiary incorporates wholly-owned arm RateGain Adara Japan GK

Incorporates new entity for data and software services

Source: Exchange Filing

Kaynes Technology India down 4.4% at Rs 2622.65

V - Mart Retail down 3.96% at Rs 2021.1

Maharashtra Seamless down 3.87% at Rs 894.5

Home First Finance Company India down 3.78% at Rs 957

Manappuram Finance down 3% at Rs 171.35

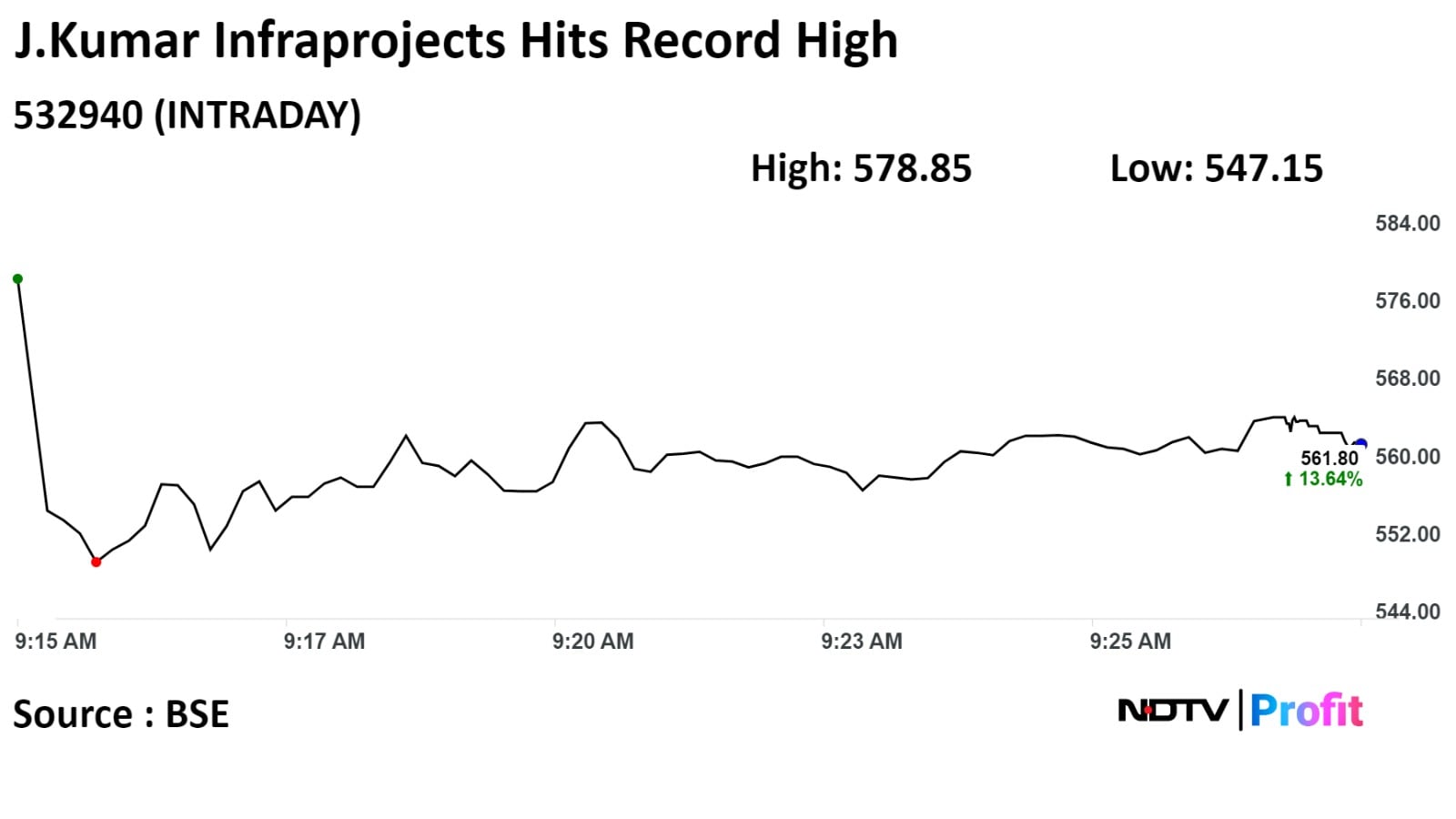

J.Kumar Infraprojects up 20% at Rs 593.5

MSTC up 11.37% at Rs 632.6

Heritage Foods up 10.11% at Rs 297.8

Tega Industries up 8.11% at Rs 1177

Mazagon Dock Shipbuilders up 8.09% at Rs 2293.05

Bharat Electronics Ltd received orders worth Rs 678 crore from multiple customers

Bharat Electronics Ltd signed contract worth Rs 445 crore with UP Govt for next generation UP Dial 112 project

Receives additional orders worth Rs 233 crore for communication display units, thermal cameras and other equipment

Source: Exchange filing

Lumax Auto Technologies Ltd approved proposed acquisition of Lumax Ancillary

Co to buy remaining 85.7% stake in Lumax Ancillary for Rs 49.5 crore

Lumax Ancillary to become a wholly-owned unit of co

Source: Exchange filing

IndusInd Bank Ltd launched 'eSvarna', India’s first corporate credit card on RuPay network.

Source: Exchange Filing

The S&P BSE Oil and Gas index rose 1.41% on Tuesday lead by gains in Hindustan Petroleum Corp, Indian Oil Corp.

Thermax Ltd received NCLT's approval for demerger of its wholly-owned units, Thermax Cooling Solutions and Thermax Instrumentation.

Source: Exchange Filing

Suraj Estate Developers Ltd list at Rs 340 on NSE vs issue price of Rs 360

Lists at a discount of 5.56% on NSE

Lists at Rs 343.8 on BSE vs issue price of Rs 360

Lists at a discount of 4.5% on BSE

Source: Exchanges

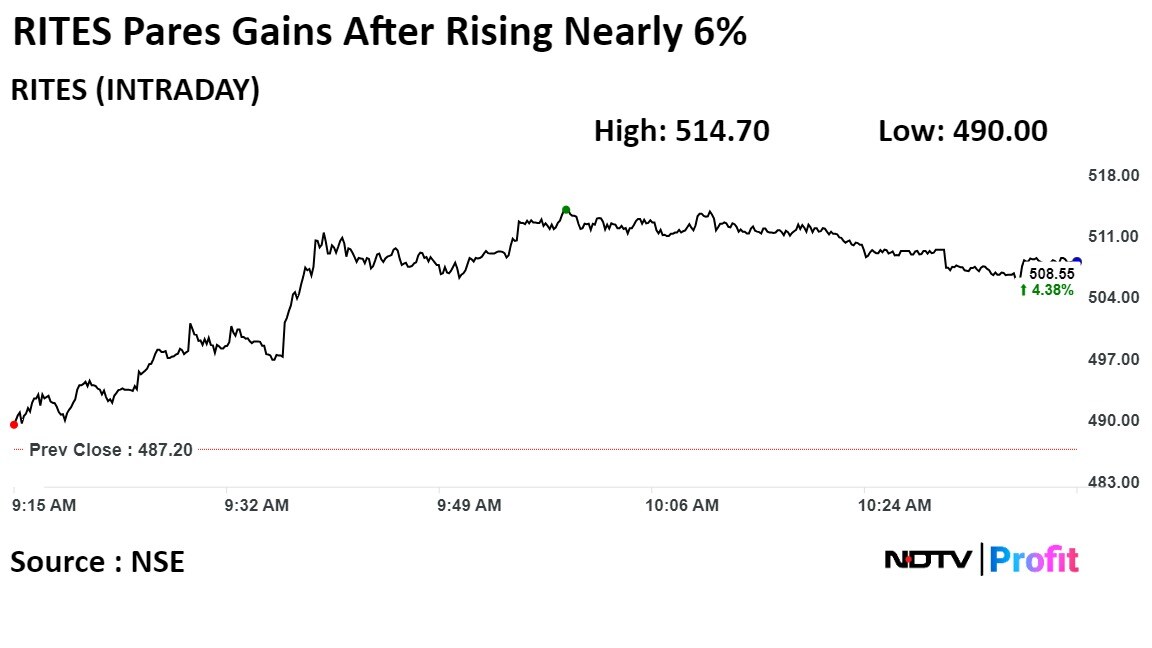

The shares of RITES Ltd rose on Tuesday after it signed a memorandum of understanding with North Eastern Electric Power Corporation Ltd on Friday.

The shares of RITES Ltd rose on Tuesday after it signed a memorandum of understanding with North Eastern Electric Power Corporation Ltd on Friday.

RITES shares rose as much as 5.64% to Rs 514 apiece. It last traded at these levels on Dec. 20, 2023. It pared gains to trade 4.14% higher at Rs 507.35 apiece, as of 10:52 a.m. This compares to a 0.45% advance in the NSE Nifty 50 Index.

It has risen 49.55% on a year-to-date basis. Total traded volume so far in the day stood at 4.7 times its 30-day average. The relative strength index was at 59.

Out of 8 analysts tracking the company, 3 maintain a 'buy' rating, 2 recommend a 'hold,' and 3 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 71.1%.

Star Health & Allied Insurance Company Ltd 14.3 lakh shares changed hands in a large trade

0.2% equity changed hands at Rs 526.90 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Swan Energy Ltd's unit pre-pays Rs 300 crore worth debt for FSRU Project

The unit has also created the required Debt Service Retention Account of Rs 95 crore

Alert: FSRU stands for Floating Storage and Regasification Unit

Source: Exchange Filing

Lists at Rs 275.3 on NSE vs issue price of Rs 291

Lists at a discount of 5.4% on NSE

Lists at Rs 278 on BSE vs issue price of Rs 291

Lists at a discount of 4.5% on BSE

Source: Exchanges

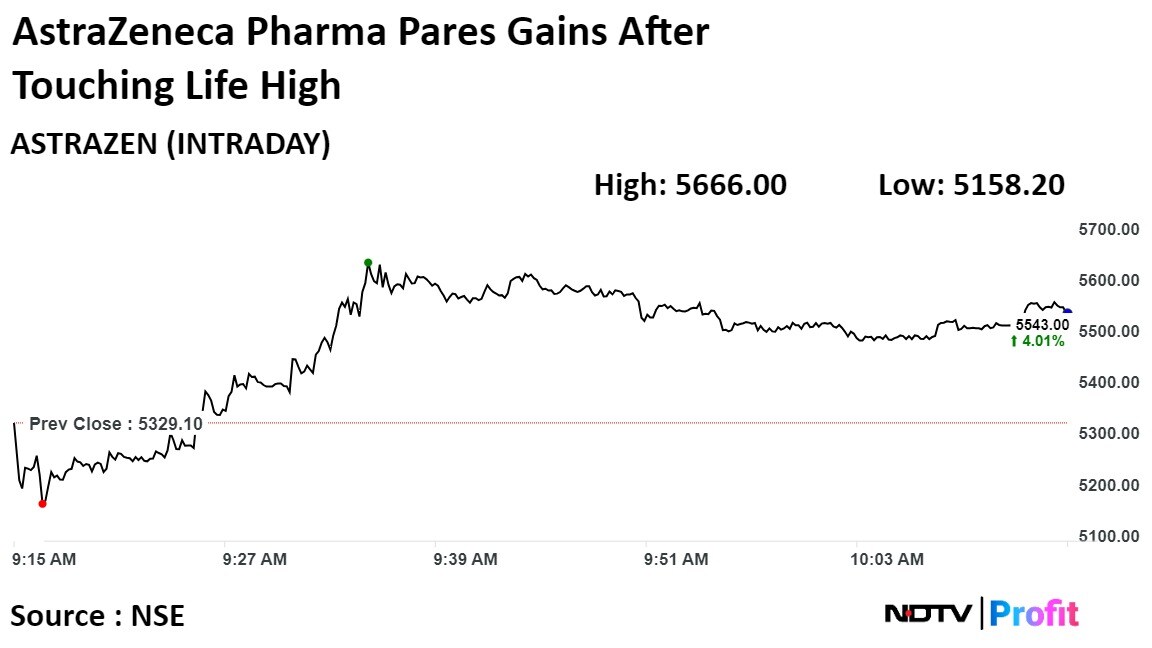

AstraZeneca Pharma shares rose as much as 6.32% to 5,666 apiece to reach its all time high. It pared gains to trade 3.52% higher at Rs 5,516.85 apiece, as of 9:58 a.m. This compares to a 0.29% advance in the NSE Nifty 50 Index.

It has risen 67.27% on a year-to-date basis. Total traded volume so far in the day stood at 38 times its 30-day average. The relative strength index was at 82.

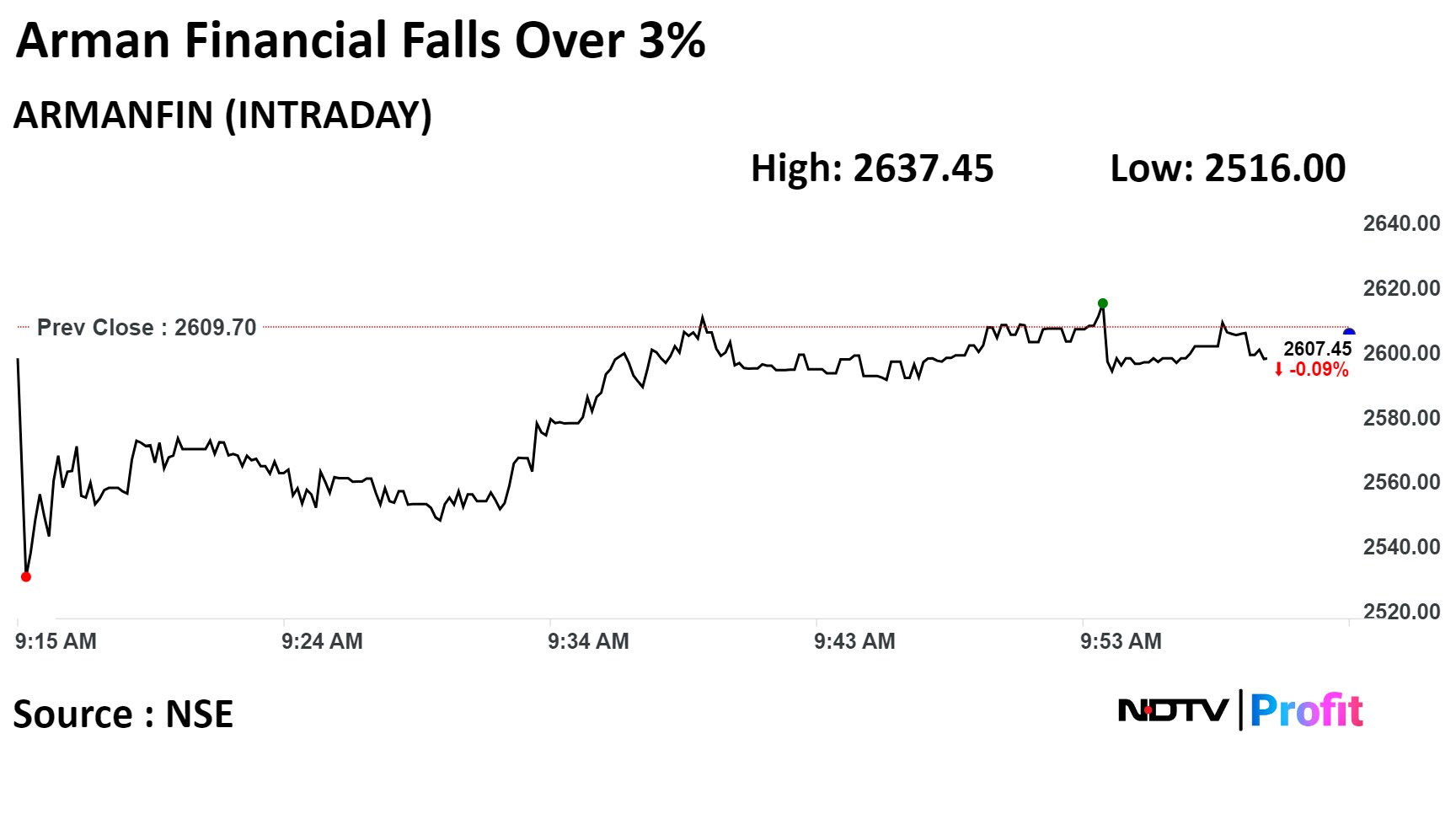

Shares of Arman Financial Services Ltd. declined over 3% on Tuesday after the company raised Rs 230 crore via qualified institutional placement at a discount to the prevailing market price.

The Gujarat-based non-banking finance company set the issue price at Rs 2,195 per share, according to its filing on Monday. That was a discount of nearly 16% to the Friday's closing price of Rs 2,609.70.

Shares of Arman Financial Services Ltd. declined over 3% on Tuesday after the company raised Rs 230 crore via qualified institutional placement at a discount to the prevailing market price.

The Gujarat-based non-banking finance company set the issue price at Rs 2,195 per share, according to its filing on Monday. That was a discount of nearly 16% to the Friday's closing price of Rs 2,609.70.

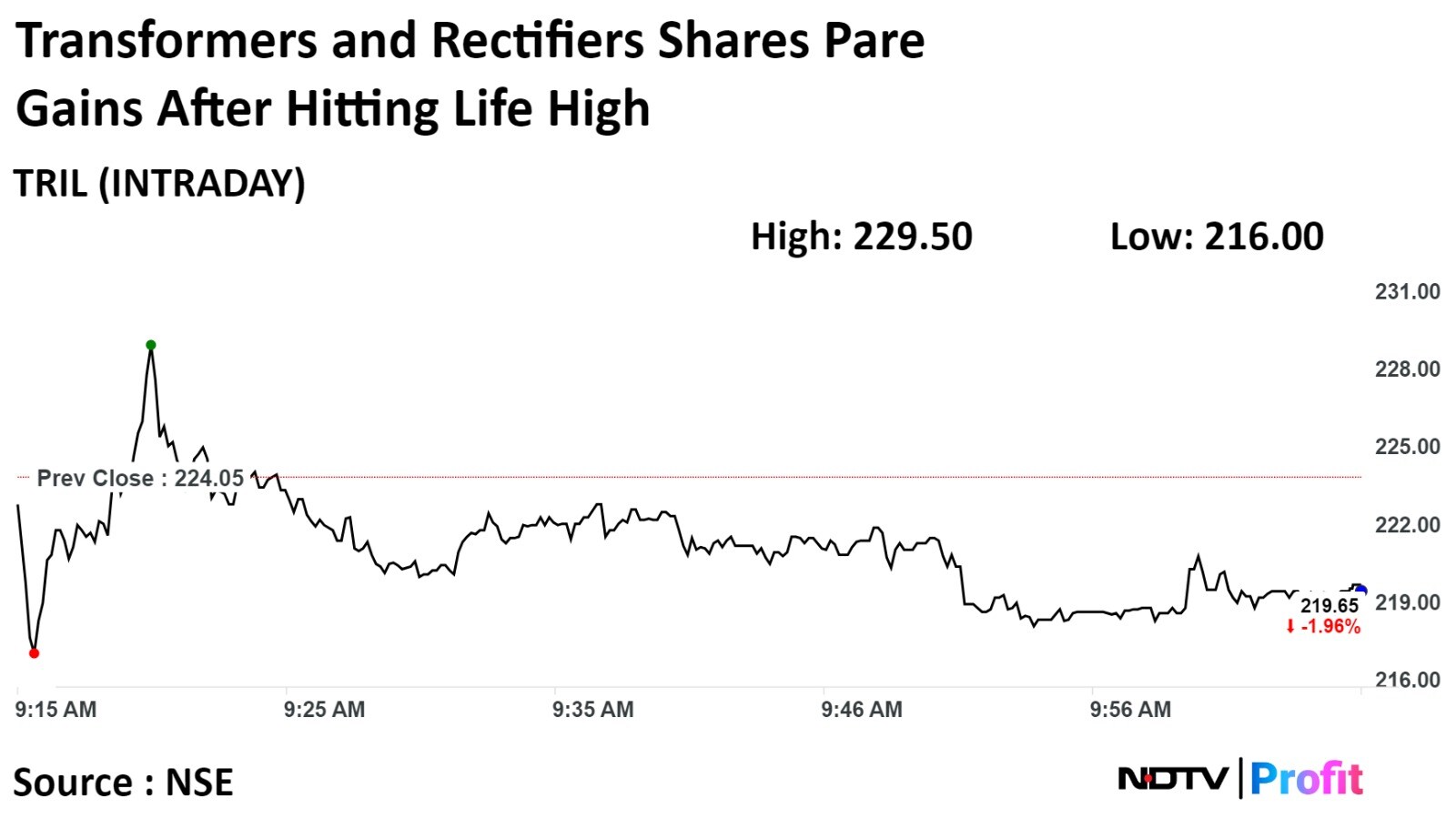

Shares of Transformers and Rectifiers (India) Ltd. hit their highest level today after the company announced Friday that it has has successfully completed the most stringent ‘Dynamic Short Circuit Test’ on 105 MVA single phase auto transformer, forming a bank of 315 MVA.

An exchange filing by the company said, "The successful short circuit testing on very large number of higher rating transformers demonstrates sound engineering, company’s adherence to stringent quality standards and the capability to manufacture and deliver high rating reliable power transformers to various specifications."

However, the shares pared gains and fell soon after hitting the lifetime high.

Shares of Transformers and Rectifiers (India) Ltd. hit their highest level today after the company announced Friday that it has has successfully completed the most stringent ‘Dynamic Short Circuit Test’ on 105 MVA single phase auto transformer, forming a bank of 315 MVA.

An exchange filing by the company said, "The successful short circuit testing on very large number of higher rating transformers demonstrates sound engineering, company’s adherence to stringent quality standards and the capability to manufacture and deliver high rating reliable power transformers to various specifications."

However, the shares pared gains and fell soon after hitting the lifetime high.

Lists at `109 on NSE vs issue price of `55

Lists at a premium of 98.18% on NSE

Lists `88.91 on BSE vs issue price of `55

Lists at a premium of 88.91% on BSE

Source: Exchanges

Indian Renewable Energy Development Agency Ltd had 44.5 lakh shares changed hands in multiple large trades.

0.2% equity changed hands at price range of Rs 103.25 to Rs 103.70 apiece

Buyers and sellers not known immediately

Source: Bloomberg

J.Kumar Infraprojects Ltd hit a record high after CLSA maintains the rating on the stock with 'buy', and raise target price from Rs 385 to Rs 720 with the rise in its new orders and 11% higher FY25CL earnings per shares estimate.

The reseach firm said company is raining with urbanisation orders, with Rs 88 billion orders won in FY24 year-to-date, as the government brings forward orders ahead of a likely election-led lull, according to CLSA.

"We also roll-forward our valuation and see a rerating as the government delivers on urban capital expenditure". The company it is set for large order wins as India builds new-age climate resistant infrastructure.

J.Kumar Infraprojects Ltd hit a record high after CLSA maintains the rating on the stock with 'buy', and raise target price from Rs 385 to Rs 720 with the rise in its new orders and 11% higher FY25CL earnings per shares estimate.

The reseach firm said company is raining with urbanisation orders, with Rs 88 billion orders won in FY24 year-to-date, as the government brings forward orders ahead of a likely election-led lull, according to CLSA.

"We also roll-forward our valuation and see a rerating as the government delivers on urban capital expenditure". The company it is set for large order wins as India builds new-age climate resistant infrastructure.

Shares of the company rose as much as 15% to hit record high at Rs 568. The stock was trading 13.02% higher at Rs 559 as of 9:26 a.m. compared to a 0.11% advance in the benchmark Nifty 50.

The stock has risen 104.7% year-to-date. The total traded volume so far in the day stood at 25 times its 30-day average. The RSI stands at 78, indicating that stock may be overbought.

Of the six analysts tracking the company, five maintain a 'buy' and one recommend a 'hold'. The average of 12-month analyst price targets implies a downside of 3.3%.

Shares of Infosys Ltd fell today after the company informed the exchanges that a global company has terminated the $1.5-Billion AI Contract signed in September.

Shares of Infosys Ltd fell today after the company informed the exchanges that a global company has terminated the $1.5-Billion AI Contract signed in September.

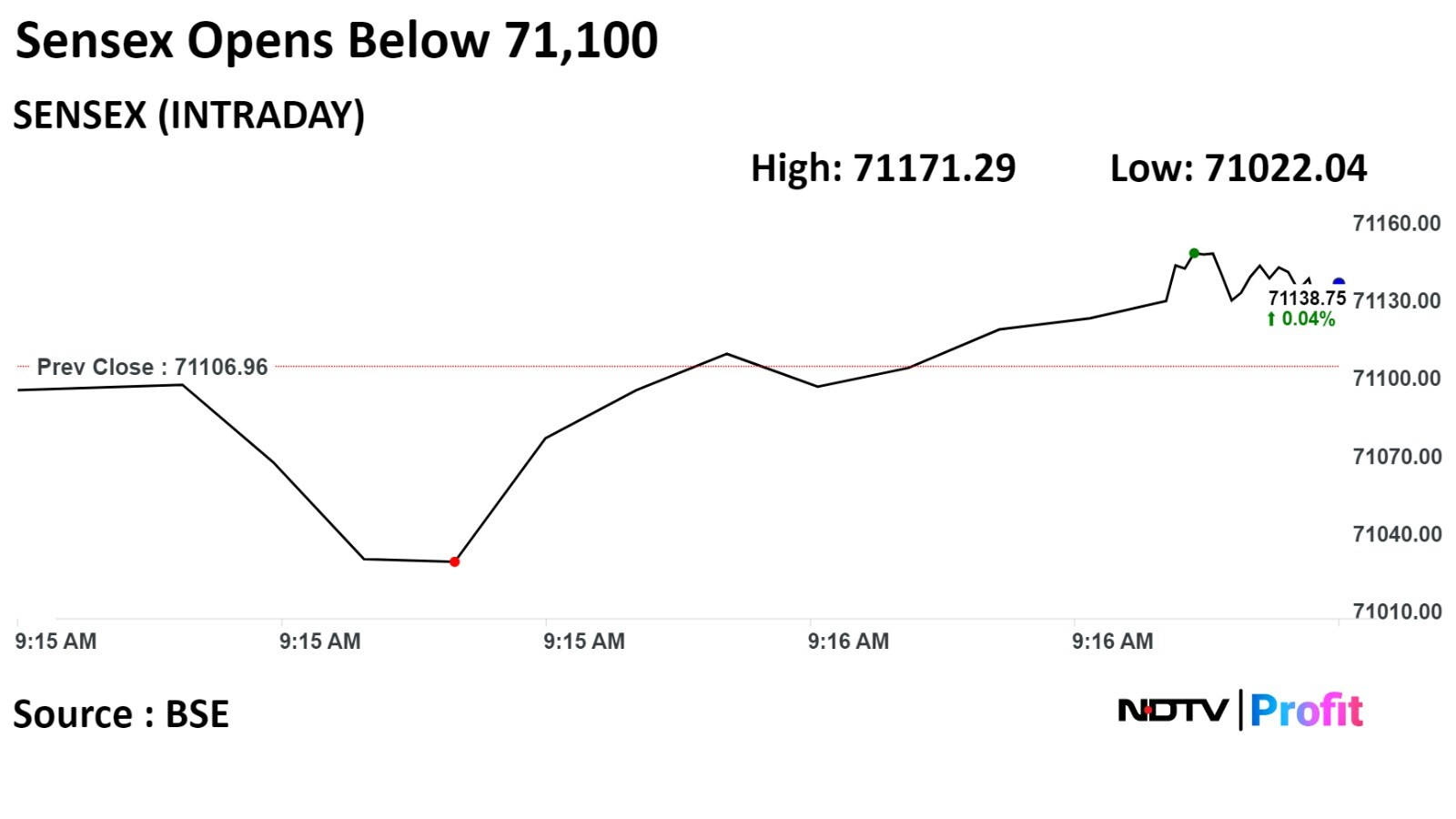

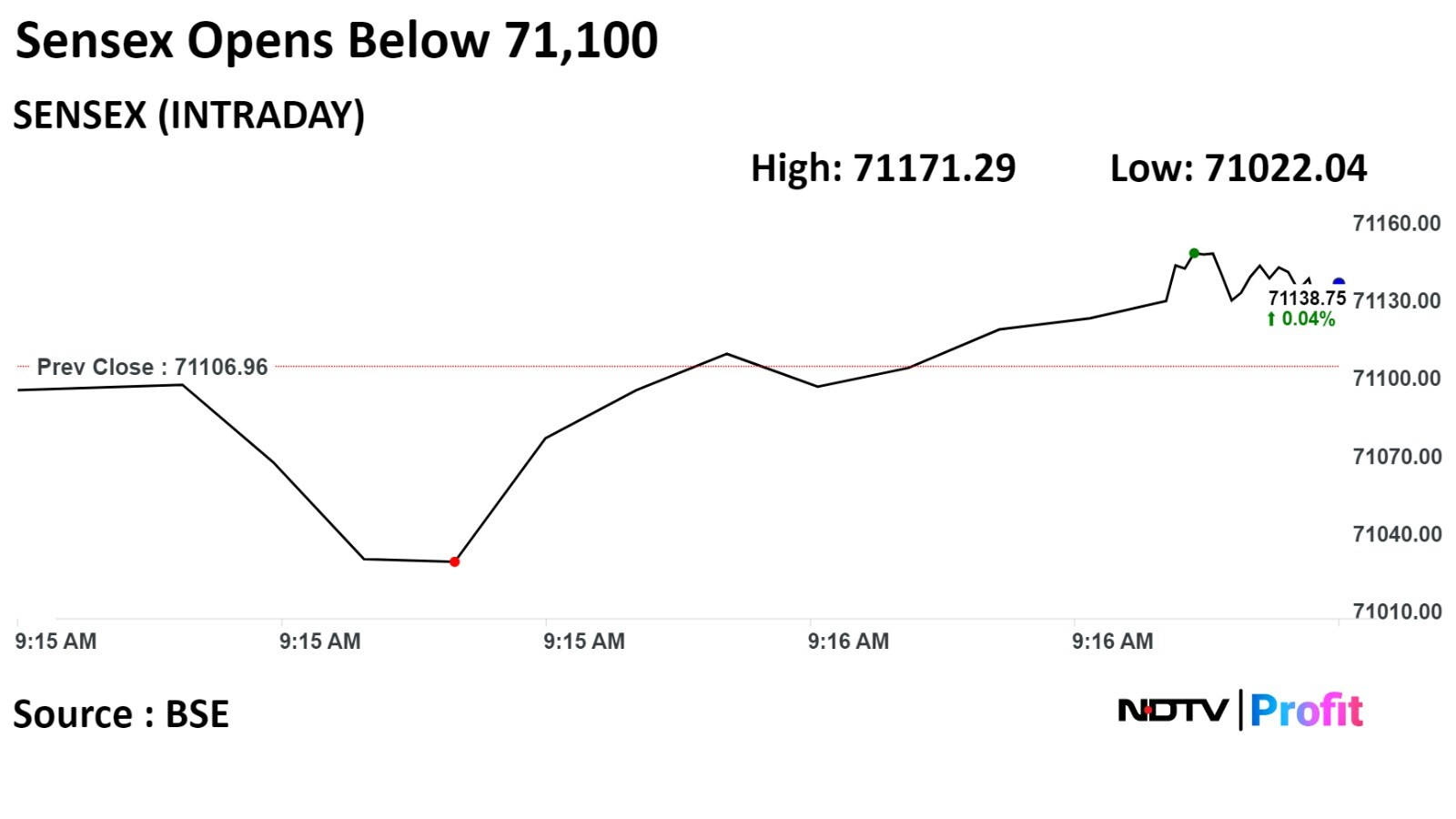

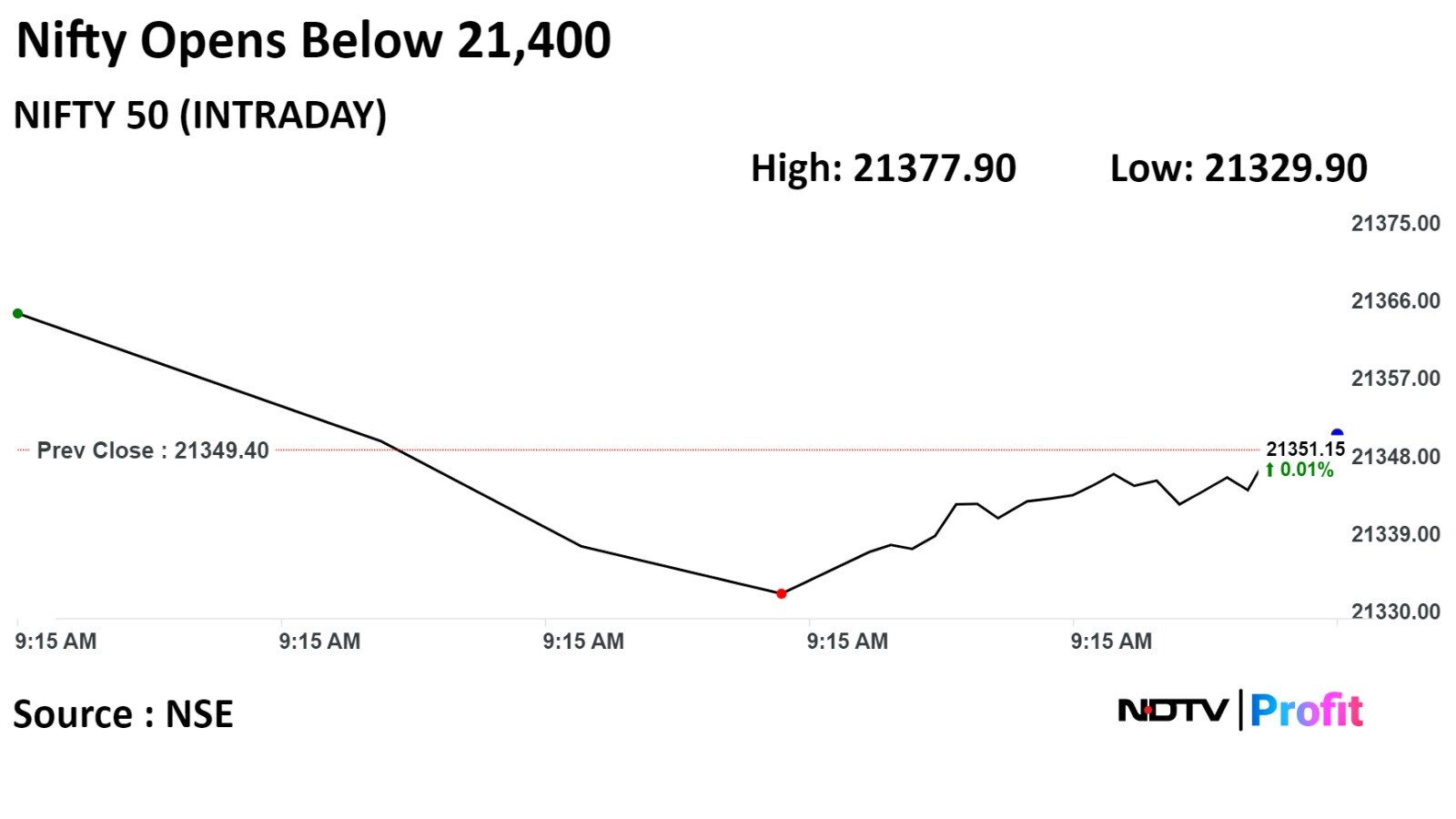

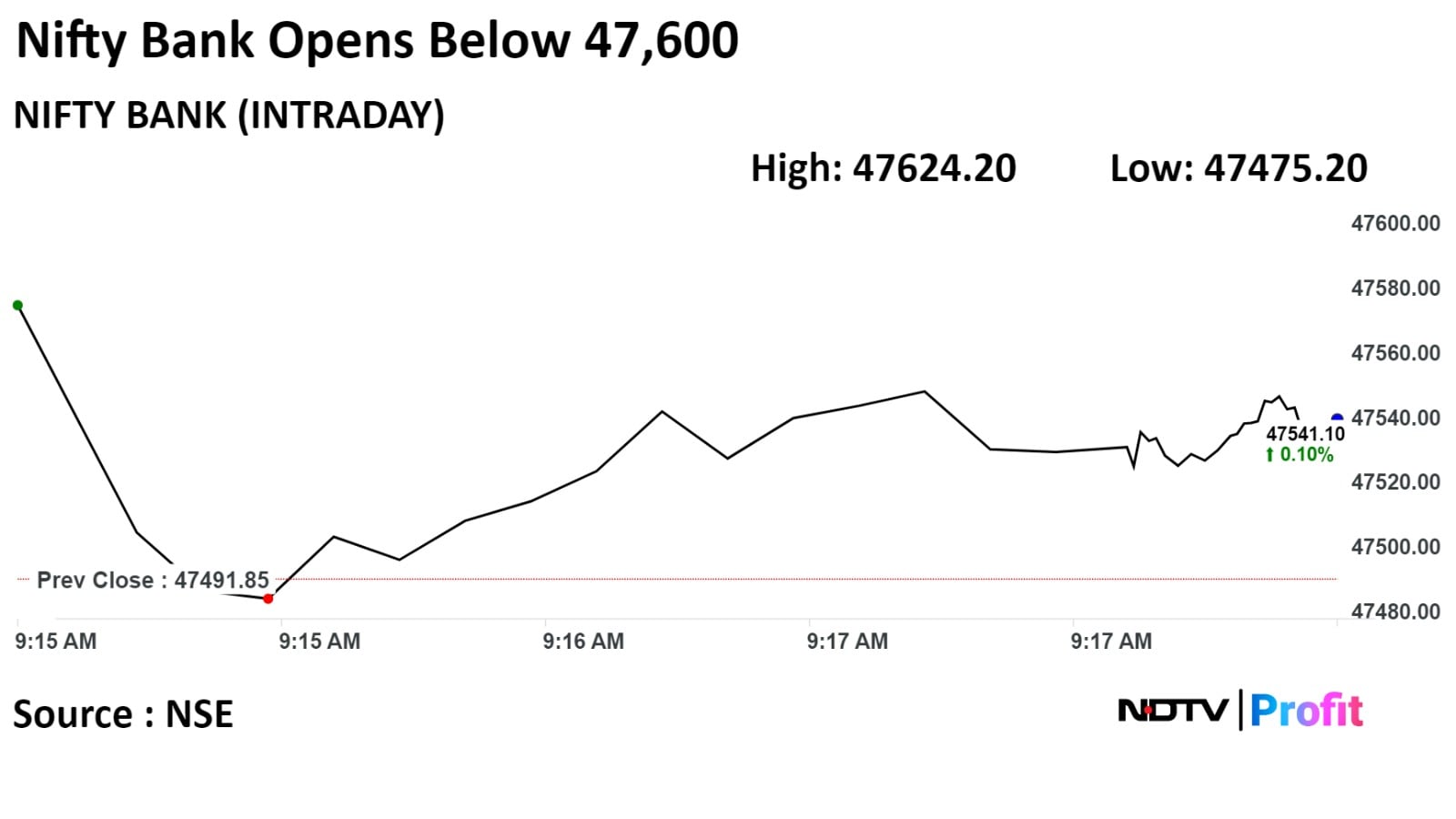

Indian benchmark indices opened flat on Tuesday as Reliance Industries Ltd, NTPC Ltd, Tata Steel Ltd led gains, while ICICI Bank Ltd, and Infosys Ltd weighed.

"The market is projected to stay range bound in the final week of the current calendar year, with the Nifty 50 encountering resistance in the 21,500-21,600 range and finding immediate support in the 21,300-21,200 range. A significant break of 21,600 can drive the index to 21,800 levels, while a break of the same support can drag it to 21,000 levels. Hence short term or intraday traders have the opportunity to trade on both the sides where Nifty can be purchased near to support levels and profits can be booked near to resistance levels," said Deven Mehata, equity research analyst at Choice Broking.

Indian benchmark indices opened flat on Tuesday as Reliance Industries Ltd, NTPC Ltd, Tata Steel Ltd led gains, while ICICI Bank Ltd, and Infosys Ltd weighed.

"The market is projected to stay range bound in the final week of the current calendar year, with the Nifty 50 encountering resistance in the 21,500-21,600 range and finding immediate support in the 21,300-21,200 range. A significant break of 21,600 can drive the index to 21,800 levels, while a break of the same support can drag it to 21,000 levels. Hence short term or intraday traders have the opportunity to trade on both the sides where Nifty can be purchased near to support levels and profits can be booked near to resistance levels," said Deven Mehata, equity research analyst at Choice Broking.

Indian benchmark indices opened flat on Tuesday as Reliance Industries Ltd, NTPC Ltd, Tata Steel Ltd led gains, while ICICI Bank Ltd, and Infosys Ltd weighed.

"The market is projected to stay range bound in the final week of the current calendar year, with the Nifty 50 encountering resistance in the 21,500-21,600 range and finding immediate support in the 21,300-21,200 range. A significant break of 21,600 can drive the index to 21,800 levels, while a break of the same support can drag it to 21,000 levels. Hence short term or intraday traders have the opportunity to trade on both the sides where Nifty can be purchased near to support levels and profits can be booked near to resistance levels," said Deven Mehata, equity research analyst at Choice Broking.

Indian benchmark indices opened flat on Tuesday as Reliance Industries Ltd, NTPC Ltd, Tata Steel Ltd led gains, while ICICI Bank Ltd, and Infosys Ltd weighed.

"The market is projected to stay range bound in the final week of the current calendar year, with the Nifty 50 encountering resistance in the 21,500-21,600 range and finding immediate support in the 21,300-21,200 range. A significant break of 21,600 can drive the index to 21,800 levels, while a break of the same support can drag it to 21,000 levels. Hence short term or intraday traders have the opportunity to trade on both the sides where Nifty can be purchased near to support levels and profits can be booked near to resistance levels," said Deven Mehata, equity research analyst at Choice Broking.

Indian benchmark indices opened flat on Tuesday as Reliance Industries Ltd, NTPC Ltd, Tata Steel Ltd led gains, while ICICI Bank Ltd, and Infosys Ltd weighed.

"The market is projected to stay range bound in the final week of the current calendar year, with the Nifty 50 encountering resistance in the 21,500-21,600 range and finding immediate support in the 21,300-21,200 range. A significant break of 21,600 can drive the index to 21,800 levels, while a break of the same support can drag it to 21,000 levels. Hence short term or intraday traders have the opportunity to trade on both the sides where Nifty can be purchased near to support levels and profits can be booked near to resistance levels," said Deven Mehata, equity research analyst at Choice Broking.

Indian benchmark indices opened flat on Tuesday as Reliance Industries Ltd, NTPC Ltd, Tata Steel Ltd led gains, while ICICI Bank Ltd, and Infosys Ltd weighed.

"The market is projected to stay range bound in the final week of the current calendar year, with the Nifty 50 encountering resistance in the 21,500-21,600 range and finding immediate support in the 21,300-21,200 range. A significant break of 21,600 can drive the index to 21,800 levels, while a break of the same support can drag it to 21,000 levels. Hence short term or intraday traders have the opportunity to trade on both the sides where Nifty can be purchased near to support levels and profits can be booked near to resistance levels," said Deven Mehata, equity research analyst at Choice Broking.

Indian benchmark indices opened flat on Tuesday as Reliance Industries Ltd, NTPC Ltd, Tata Steel Ltd led gains, while ICICI Bank Ltd, and Infosys Ltd weighed.

"The market is projected to stay range bound in the final week of the current calendar year, with the Nifty 50 encountering resistance in the 21,500-21,600 range and finding immediate support in the 21,300-21,200 range. A significant break of 21,600 can drive the index to 21,800 levels, while a break of the same support can drag it to 21,000 levels. Hence short term or intraday traders have the opportunity to trade on both the sides where Nifty can be purchased near to support levels and profits can be booked near to resistance levels," said Deven Mehata, equity research analyst at Choice Broking.

Indian benchmark indices opened flat on Tuesday as Reliance Industries Ltd, NTPC Ltd, Tata Steel Ltd led gains, while ICICI Bank Ltd, and Infosys Ltd weighed.

"The market is projected to stay range bound in the final week of the current calendar year, with the Nifty 50 encountering resistance in the 21,500-21,600 range and finding immediate support in the 21,300-21,200 range. A significant break of 21,600 can drive the index to 21,800 levels, while a break of the same support can drag it to 21,000 levels. Hence short term or intraday traders have the opportunity to trade on both the sides where Nifty can be purchased near to support levels and profits can be booked near to resistance levels," said Deven Mehata, equity research analyst at Choice Broking.

Out of 14 sectors on NSE, 13 advanced and Nifty PSE emerged as the top gainer among sectoral indices. Nifty IT declined and was 1.0% down

Broader markets outperformed benchmark indices. The BSE MidCap index was 0.40% up and the BSE Smallcap index was 0.26% higher. Out of 20 sectors compiled by the BSE, 18 advanced, and two declined. BSE Utilities and BSE Power rose the most.

The market breadth was skewed in the favour of the buyers. Around 2,115 stocks rose, 996 stocks declined, and 142 remained unchanged on BSE.

At pre-open, the NSE Nifty 50 0.07% or 15.80 points higher at 21,365, while the S&P BSE Sensex was 0.01% or 9.18 points down at 71,097.78.

The yield on the 10-year bond opened flat at 7.18% on Tuesday.

Source: Bloomberg

The local currency weakened 2 paise to open at 83.17 against the U.S dollar on Tuesday.

It closed at 83.15 on Friday.

Source: Bloomberg

JSW Energy Ltd commenced phase-wise commissioning of 810 MW ISTS-connected wind power project

Wind Power Project awarded under SECI tranche IX in Tamil Nadu for 25 years

Commissions first phase of 51 MW wind power capacity in Tamil Nadu

Source: Exchange Filing

Godrej Properties Ltd sold over 600 homes worth Rs 2,600 crore at launch of Gurugram project

Source: Exchange Filing

Downgrade to reduce with target price of Rs 3,005 compared to Rs 3,490 earlier

Increased competition to pause market share gains in 2024

Spicejet's equity infusion plans of Rs 2,250 crore to aid revival, pilot issues behind Akasa Air

Pricing power has declined from Oct-Dec, unable to offset rising aviation fuel cost

Higher competition risk has cut margins to Rs 0.69/set-km from Rs 0.8/seat-km

Lower FY25E EPS by 19% and FY26E EPS by 17%

Maintains 'Buy' rating and raises target price from Rs 385 to Rs 720

J Kumar Infraprojects Ltd is a play on urbanisation capex, and it is set for large order wins as India builds new-age climate resistant infrastructure

JKIL is well placed to benefit from the mega trend of urbanisation with its competencies in metro rail and complex urban projects

Lifts new order estimate for JKIL to 121% in FY24C

Expects JKIL’s EPS to see a 25% CAGR over FY24-26CL

Lifts FY25CL EPS estimate to 11%

Industry majors accelerating the development of large-scale Renewable Energy projects boosted by policy support, annual emission reduction targets and reducing dependence on China

Expects RE capacity to rise 2.5x over FY23-30E

Adani Green to develop 17GW of renewable power capacity (mix of solar and wind) over 3-4 years in Khavda with potential long-term plan of 30GW capacity

Adani Green targeting to add 2.8-3 GW of RE capacity in FY24 with significant development from Khavda and installing 45GW by 2030

Manpower at the site increased from 500 to 5000 people in the past 6-8 months

Reiterates 'buy' rating with a target price of Rs 1,210

Outlook remains robust; industry-leading volume growth.

Profitability outlook is also gradually improving in the overseas business.

Disruptive innovations, access packs, and higher but concentrated ad spending should result in consistently healthy growth.

Working capital enhancement progressing as planned.

Retains buy on ONGC with target price of Rs 250

Retains buy on Oil India with target price of Rs 445

Expects ONGC to report consolidated EPS of 38-40/share during FY24-26

On dividend yield ONGC and OIL well placed at 5-6% compared to PSU peers at 4%

Value of investments up for ONGC and OIL as downstream entities record strong earnings and stock run-up.

ONGC and Oil India being cheapest among heavy industry PSU pack.

ONGC guidance on first oil from KG-98/2 by end of December.

Steady production growth persists for OIL; NRL expansion on schedule.

Believes positive momentum in upstream sector led by shift to companies with undemanding valuation.

Moved out of short-term ASM framework: Ashapura Minechem, D B Realty.

Nifty December futures up by 0.16% to 21,385.05 at a premium of 35.65 points.

Nifty December futures open interest down by 1.4%.

Nifty Bank December futures down by 1.1% to 47,575.6 at a premium of 83.75 points.

Nifty Bank December futures open interest down by 8.05%.

Nifty Options Dec 28 Expiry: Maximum call open interest at 22,000 and Maximum put open interest at 21,000.

Bank Nifty Options Dec 28 Expiry: Maximum call open Interest at 50,000 and maximum put open interest at 45,000.

Securities in the ban period: Ashok Leyland, Balrampur Chini Mills, Delta Corp, Hindustan Copper, India Cements, Indus Tower, National Aluminium, and SAIL.

Kilburn Engineering: To meet investors and analysts on Dec. 26.

Mahindra Holidays and Resorts: To meet investors and analysts on Dec. 28.

Sky Gold: To meet investors and analysts on Jan. 4.

Aditya Vision: To meet investors and analysts on Dec. 28.

UltraTech Cement: To meet investors and analysts on Dec. 26

Ramkrishna Forgings: To meet investors and analysts on Dec. 28.

VIP Industries: Promoter group Kiddy Plast bought 2.9 lakh shares between Dec. 20 and 21.

Bengal and Assam Co.: Promoter group Accurate Finman Services bought 6,000 shares on Dec. 20, Promoter group Nav Bharat Vanijya bought 2,000 shares on Dec. 20, Promoter group JK Credit & Finance bought 10,000 shares on Dec. 20 and promoter Hari Shankar Singhania Holdings sold 18,000 shares on Dec. 20.

Shalimar Paints: Promoter group Kusum Mittal sold 50,000 shares on Dec.22.

Ultramarine and Pigments: Promoter S Narayanan sold 6,161 shares on Dec. 20.

Fusion Micro Finance: Promoter Devesh Sachdev bought 6,125 shares on Dec. 21.

Deccan Gold Mines: Promoter Rama Mines Mauritius sold 99,515 shares between Dec.18 and 19.

Sapphire Foods: Promoter Sagista Realty Advisors sold 1.16 lakh shares on Dec. 20.

Mangalore Chemicals and Fertilizers: Promoter Zuari Agro Chemicals created a pledge of five lakh shares on Dec. 22.

V-Guard Industries: Chittilappilly Thomas Kochuouseph sold 45 lakh shares (1.03%), while Aditya Birla Sun Life Mutual Fund bought 35 lakh shares (0.8%), and Motilal Oswal Mutual Fund bought 10 lakh shares (0.23%) at Rs 286 apiece.

IIFL Finance: FIH Mauritius Investments sold 2.16 crore shares (5.66%) at Rs 554.64 apiece. Nomura India Investment Fund Mother Fund bought 26.2 lakh shares (0.68%) at Rs 551.01 apiece, Mansi Share & Stock Advisors bought 21.44 lakh shares (0.56%) at Rs 555.42 apiece, and F3 Advisors bought 20.92 lakh shares (0.54%) at Rs 553.06 apiece.

Sansera Engineering: CVCIGP II Employee Ebene sold 12 lakh shares (2.25%) at Rs 966.1 apiece, while HDFC Standard Life Insurance bought 8.25 lakh shares (1.54%) at Rs 965 apiece.

Allcargo Gati: Equirus Wealth sold 19.68 lakh shares (1.51%) at Rs 129.04 apiece.

Antony Waste Handling Cell: The Miri Strategic Emerging Markets Fund LP bought 2.26 lakh shares (0.79%) at Rs 492.23 apiece.

Muthoot Microfinance: The company's shares will debut on the stock exchanges on Tuesday at an issue price of Rs 291 apiece. The Rs 960 crore IPO was subscribed 11.52 times on its third and final day. Bids were led by institutional investors (17.47 times), non-institutional investors (13.20 times), and retail investors (7.61 times), and a portion reserved for employees (2.87 times).

Suraj Developers: The company's shares will debut on the stock exchanges on Tuesday at an issue price of Rs 360 apiece. The Rs 400 crore IPO was subscribed 15.65 times on its third and final day. Bids were led by institutional investors (24.31 times), non-institutional investors (18.9 times), and retail investors (9.3 times).

Motisons Jewellers: The company's shares will debut on the stock exchanges on Tuesday at an issue price of Rs 55 apiece. The Rs 151.09 crore IPO was subscribed 159.61 times on its third and final day. Bids were led by institutional investors (157.40 times), non-institutional investors (233.91 times), and retail investors (122.28 times).

Azad Engineering: The public issue was subscribed 80.65 times on day 3. The bids were led by institutional investors (179.66 times), non-institutional investors (87.61 times), and retail investors (23.79 times).

Innova Captab: The public issue was subscribed 3.54 times on day 2. The bids were led by retail investors (5.02 times), non-institutional investors (3.28 times) and institutional investors (1.09 times).

Aurobindo Pharma: U.S FDA's pre-approval inspection—from Dec. 11-22—at the U.S.-based unit Eugia ended with 10 observations.

Adani Power: A consortium of Adani Power received a letter of intent from the resolution professional of Coastal Energen after lenders approved the resolution plan.

Adani Green Energy: Completed power purchase agreement with the Solar Energy Corp of India to supply 1,799 MW of solar power. Concludes power offtake tie-up for the entire 8,000 MW manufacturing-linked solar tender awarded by SECI.

Zydus Lifesciences: The FDA conducted an inspection at the API site situated in Ahmedabad between Dec. 14 and 22. The inspection was closed with six observations.

Bank of Baroda: The company raised its stake in Open Network for Digital Commerce to 8.51% from 5.56% for Rs 30 crore.

KPIT Technologies: The company approved the initial strategic acquisition of 13% shareholding in N-Dream AG, a cloud-based game aggregation platform for €2.7 million as a primary investment and €0.3 million as a secondary investment.

RBL Bank: The RBI-appointed director, named in 2021 when the bank was going through an unexpected leadership transition, retired on Dec 23.

Talbros Automotive Components: The company approved divesting and selling its entire 40% stake in Nippon Leakless Talbros to Nippon Leakless Corp. and Leakless Gasket for a consideration of Rs 81.80 crore.

Adani Wilmar: The company's promoters, Adani Commodities LLP and Lence Pte. Ltd., have proposed to sell their stakes to comply with the minimum public shareholding norms. The promoters sell up to a 1.24% stake between Dec. 26 and Jan. 31.

AstraZeneca Pharma: The company received a Rs 14.1 crore tax demand from the Income Tax Department for 2021–22.

Archean Chemical Industries: The company's unit was declared the successful bidder for acquiring Oren Hydrocarbons.

NHPC: The company will monetize future cash flow in respect of the Kishanganga power station or any other power station of the company for 8–10 years in a single tranche during 2023–24 or beyond.

Rites: The company signed an MoU with the Northeastern Electric Power Corp. for consultancy work.

Arman Financial Services: The company raised Rs 230 crore via QIP and set the issue price at Rs 2,195 per share, which indicates a discount of 4.96% to the floor price of Rs 2,309.51 per share.

Polycab India: The Income Tax Department has commenced search operations at the company’s premises.

Transformers and Rectifiers: The company has completed the ‘Dynamic Short Circuit Test’ on 105 MVA. The test was conducted at the national high-power test laboratory. With the successful completion of this test, the company has crossed a commendable milestone of a successful dynamic short circuit test on a record 150+ transformers in the last two decades.

Grindwell Norton: The company approved the investment of Rs 11 crore in VEH Wind Energy and an investment of Rs 15 crore in Advanced Synthetic Minerals.

TTK Prestige: The company appointed Venkatesh Vijayaraghavan as the Chief Executive Officer.

Crompton Greaves Consumer Electricals: The company launched a new product, Cavelo, in the category of 70W well glass trade to cater to the domestic market.

Power Finance Corp: The company's unit incorporated a wholly owned subsidiary, namely Khavda PSl, and three transmissions for the development of provision of dynamic reactive compensation at Khavda Pooling Station 1 and Khavda Pooling Station 3.

Carysil: Acrysil USA Inc, a wholly owned subsidiary of Carysil Ltd., acquired 100% membership interest of United Granite LLC.

PNC Infratech: PNC Infratech's PNC Unnao Highways received provisional completion certificate on Dec. 25 for NHAI project worth Rs 1,602 crore.

Markets in the Asia-Pacific region were trading on a mixed note on Tuesday on lack of significant cues.

Share indices in Japan and Australia were largely trading flat. Markets in Hong Kong declined.

Brent crude was trading 0.04% lower at $73.53 a barrel. Gold was up 0.35% at $2,053.08 an ounce.

The GIFT Nifty was trading 0.06% higher at 21,423 as of 07:16 a.m.

India’s benchmark indices closed higher for the second consecutive day on Friday but snapped a seven-week rally.

The NSE Nifty 50 closed 94 points, or 0.44%, higher at 21,349.40 and the Sensex ended 242 points, or 0.34%, up at 71,106.96. Intraday, the Nifty hit a high of 21,390.50 points and the Sensex hit a high of 71,259.55 points.

Overseas investors remained net sellers of Indian equities for the fifth consecutive session on Friday. Foreign portfolio investors offloaded stocks worth Rs 2,828.9 crore, while domestic institutional investors remained net buyers and mopped up stocks worth Rs 2,166.7 crore, the NSE data showed.

The Indian rupee strengthened 13 paise to close at Rs 83.15 against the U.S. dollar on Friday.

The S&P 500 index and Nasdaq 100 advanced 0.17% and 0.12% higher respectively as of Friday. The Dow Jones Industrial Average was trading 0.05% lower.

Markets in the Asia-Pacific region were trading on a mixed note on Tuesday on lack of significant cues.

Share indices in Japan and Australia were largely trading flat. Markets in Hong Kong declined.

Brent crude was trading 0.04% lower at $73.53 a barrel. Gold was up 0.35% at $2,053.08 an ounce.

The GIFT Nifty was trading 0.06% higher at 21,423 as of 07:16 a.m.

India’s benchmark indices closed higher for the second consecutive day on Friday but snapped a seven-week rally.

The NSE Nifty 50 closed 94 points, or 0.44%, higher at 21,349.40 and the Sensex ended 242 points, or 0.34%, up at 71,106.96. Intraday, the Nifty hit a high of 21,390.50 points and the Sensex hit a high of 71,259.55 points.

Overseas investors remained net sellers of Indian equities for the fifth consecutive session on Friday. Foreign portfolio investors offloaded stocks worth Rs 2,828.9 crore, while domestic institutional investors remained net buyers and mopped up stocks worth Rs 2,166.7 crore, the NSE data showed.

The Indian rupee strengthened 13 paise to close at Rs 83.15 against the U.S. dollar on Friday.

The S&P 500 index and Nasdaq 100 advanced 0.17% and 0.12% higher respectively as of Friday. The Dow Jones Industrial Average was trading 0.05% lower.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.