Overseas investors stay net buyers for the third consecutive day of Indian equities on Tuesday.

Foreign portfolio investors mopped stocks worth Rs 76.86 crore, according to provisional data from the National Stock Exchange.

Domestic institutional investors turned net buyers and mopped up equities worth 1,923.32 crore, the NSE data showed.

Foreign institutions have been net buyers of Rs 136343 crore worth of Indian equities so far in 2023, according to data from the National Securities Depository Ltd., updated till the previous trading day.

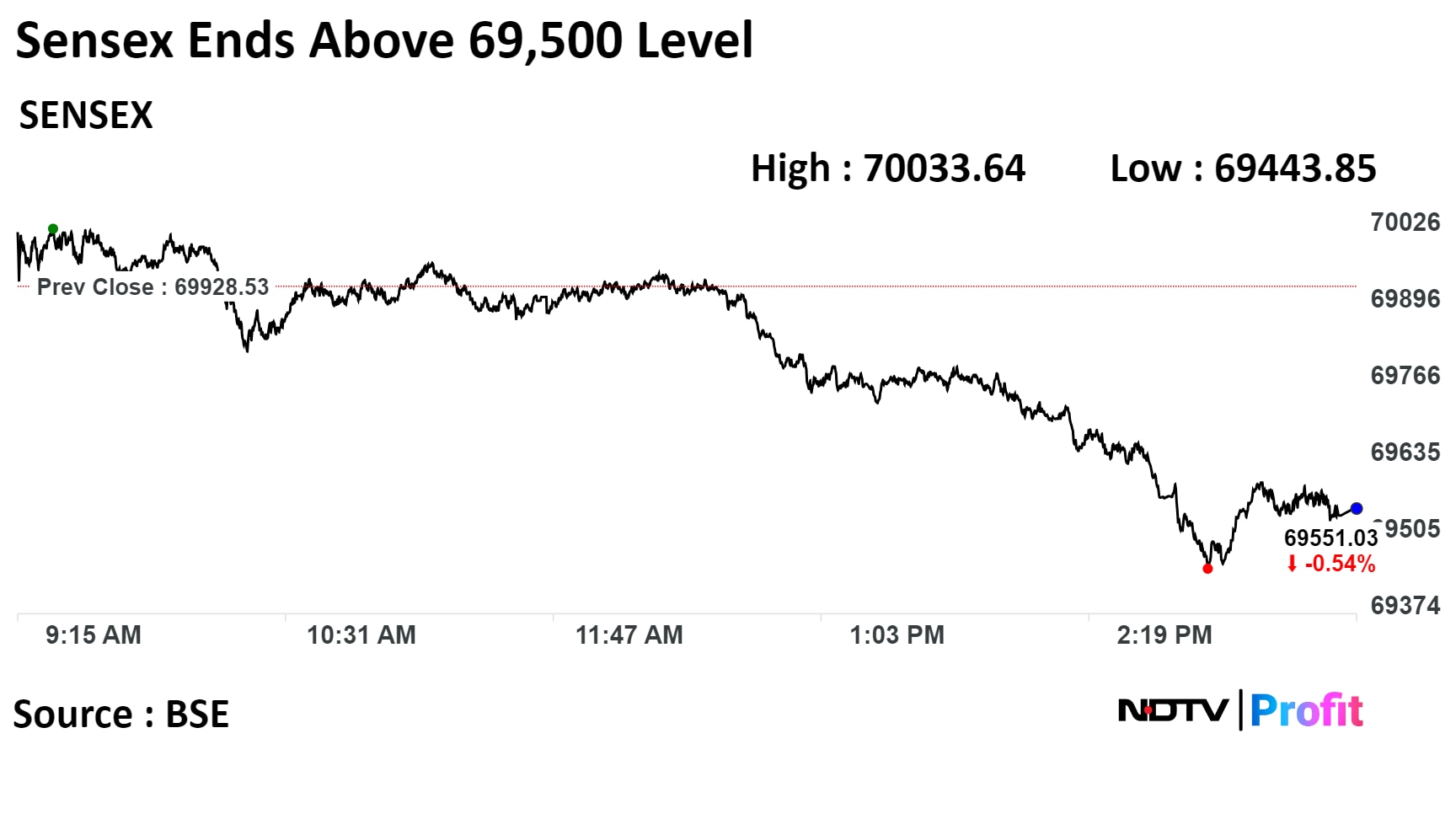

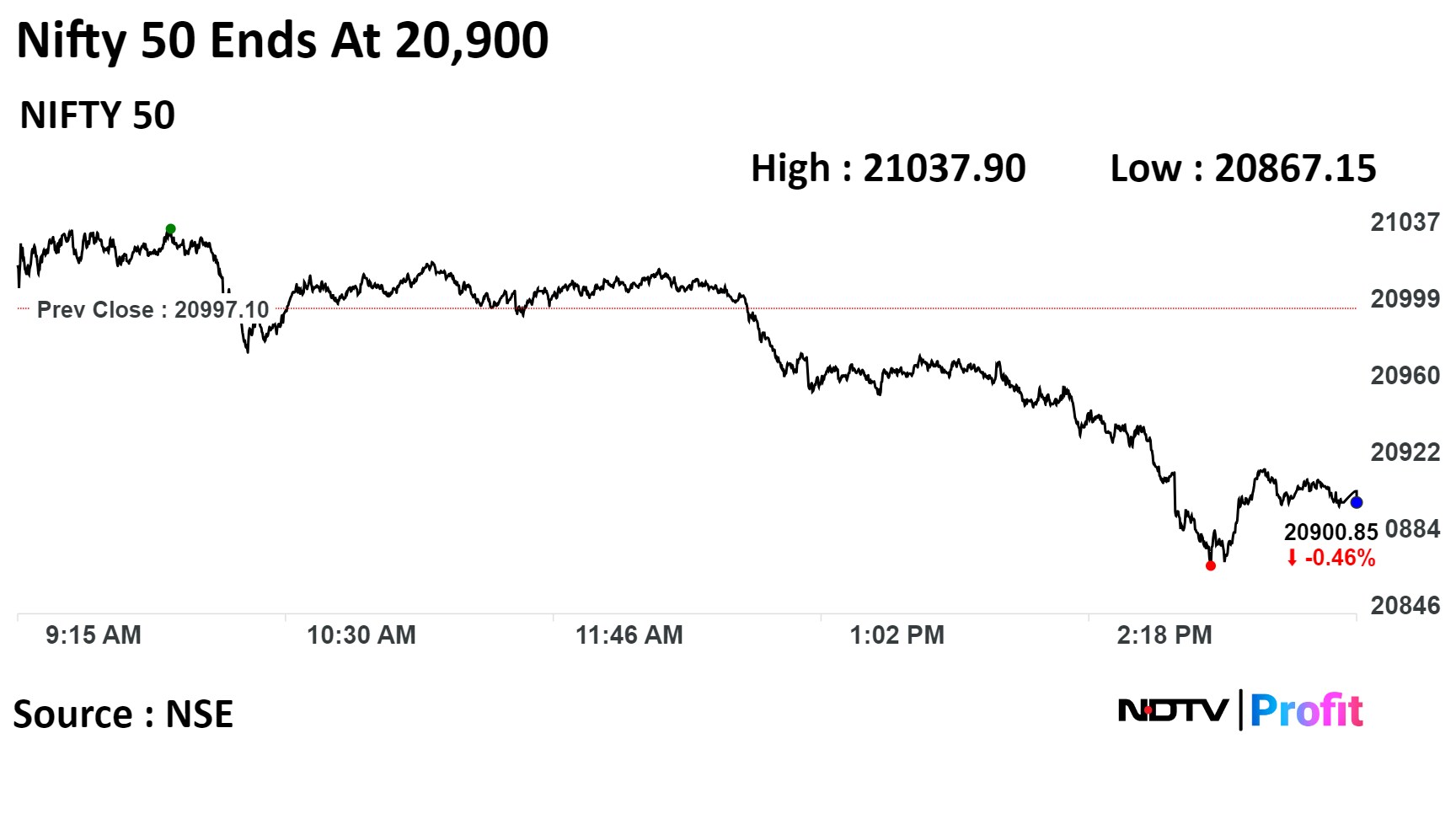

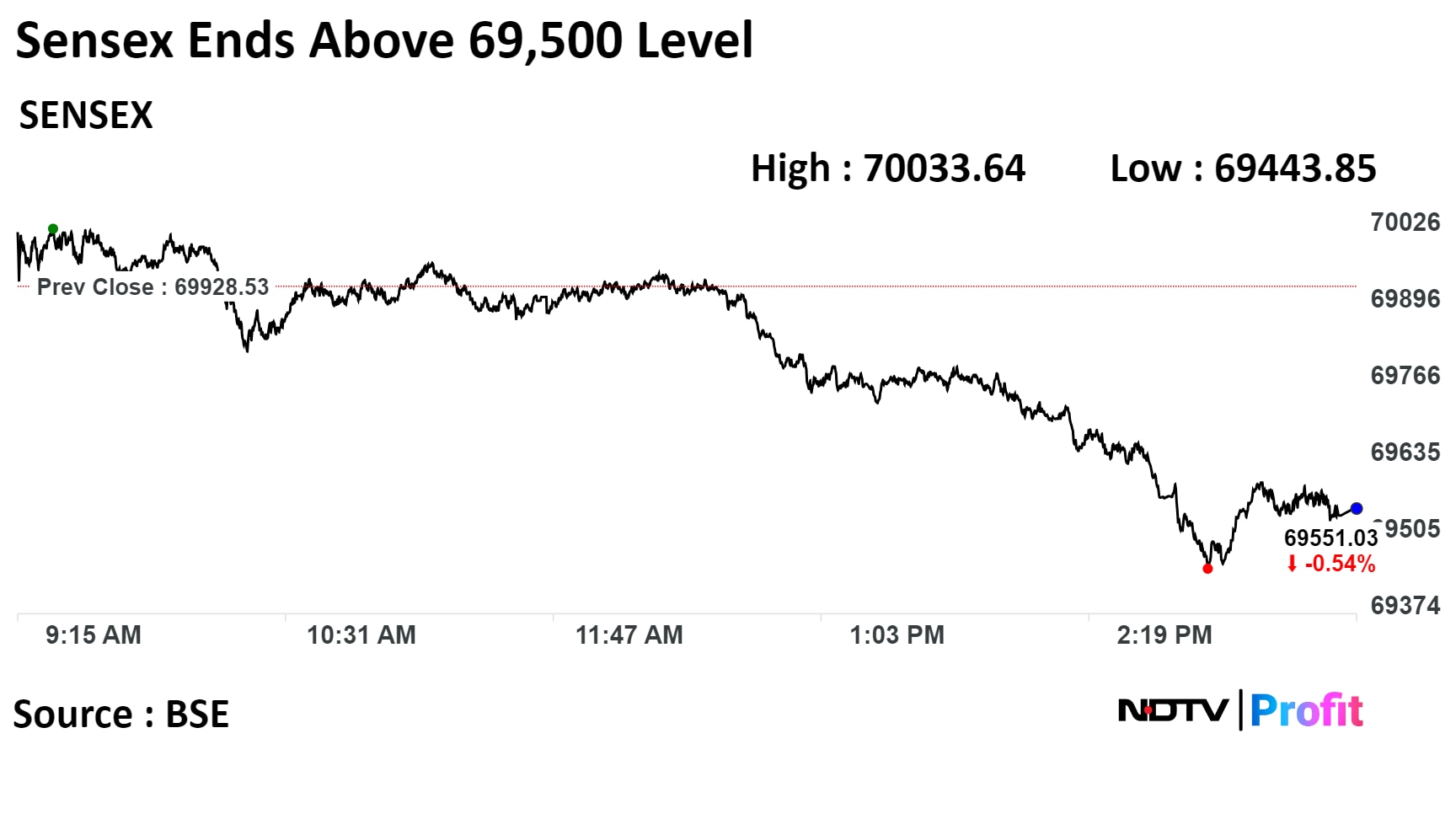

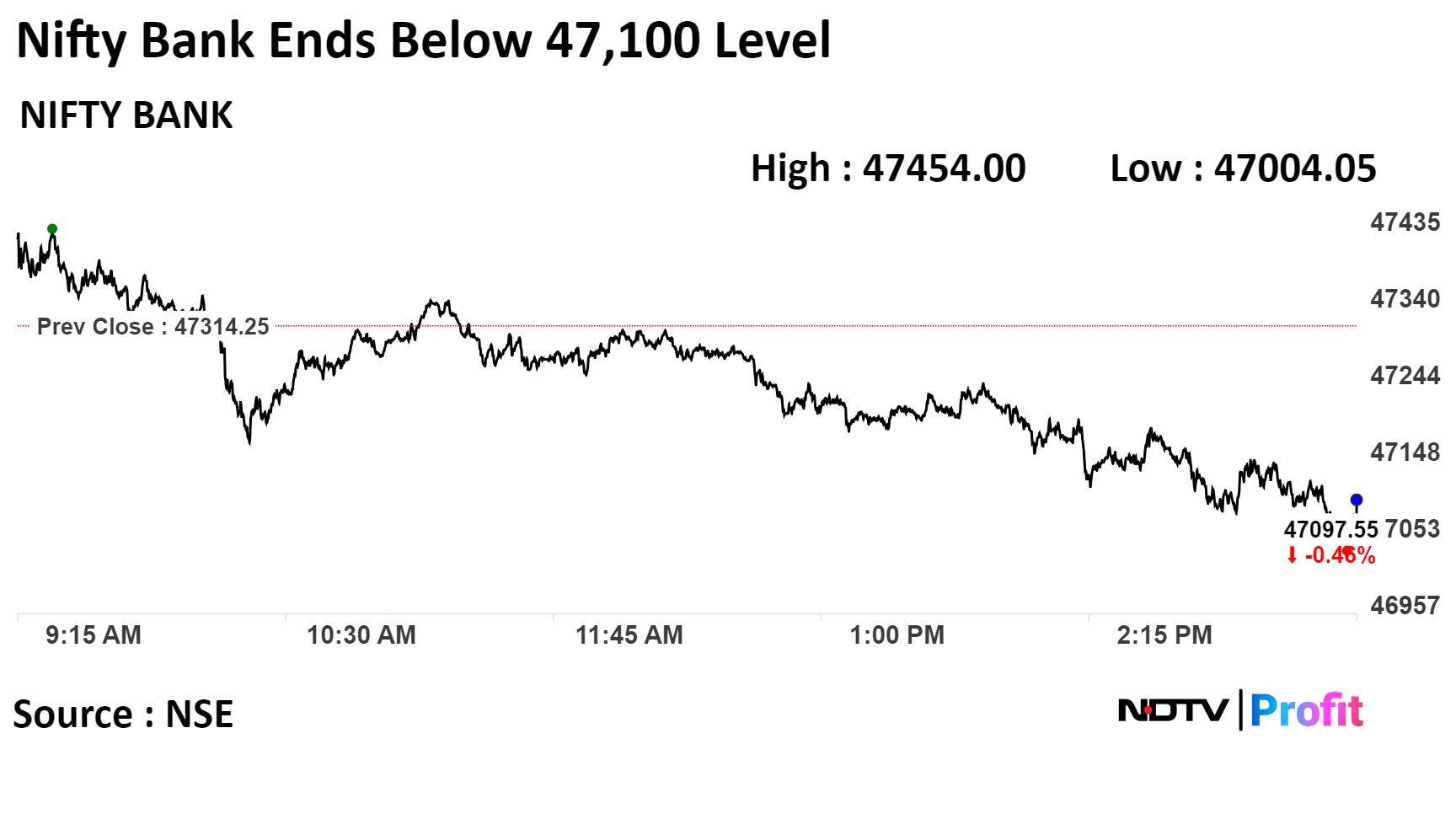

The NSE Nifty 50 closed 91 points or 0.43% lower at 20,906.40, while the S&P BSE Sensex was 378 points or 0.54% down at 69,551.03.

The yield on the 10-year bond closed flat at 7.27% on Tuesday.

Source: Bloomberg

The local currency closed flat at 83.39 against the U.S dollar on Tuesday.

Source: Bloomberg

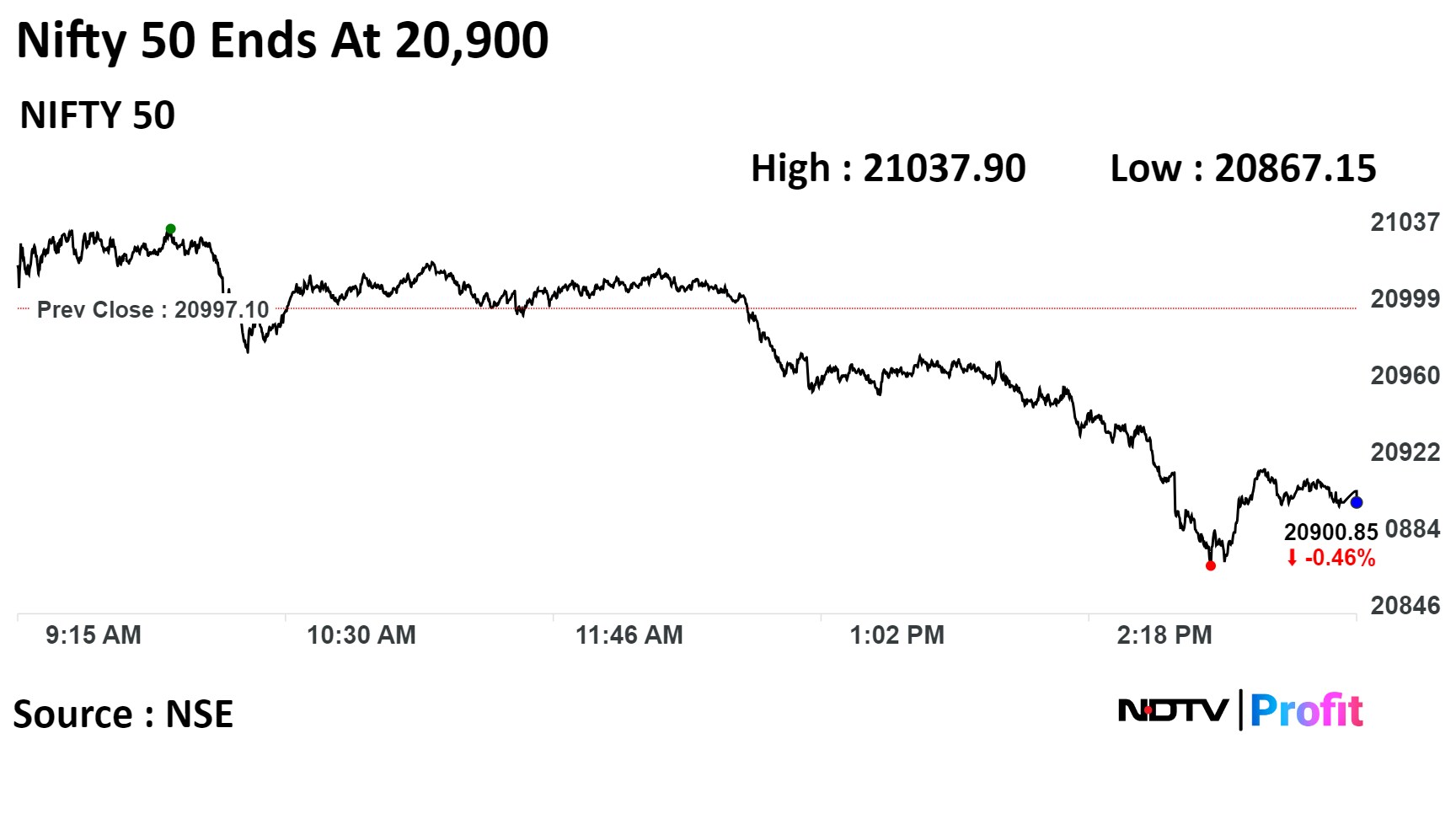

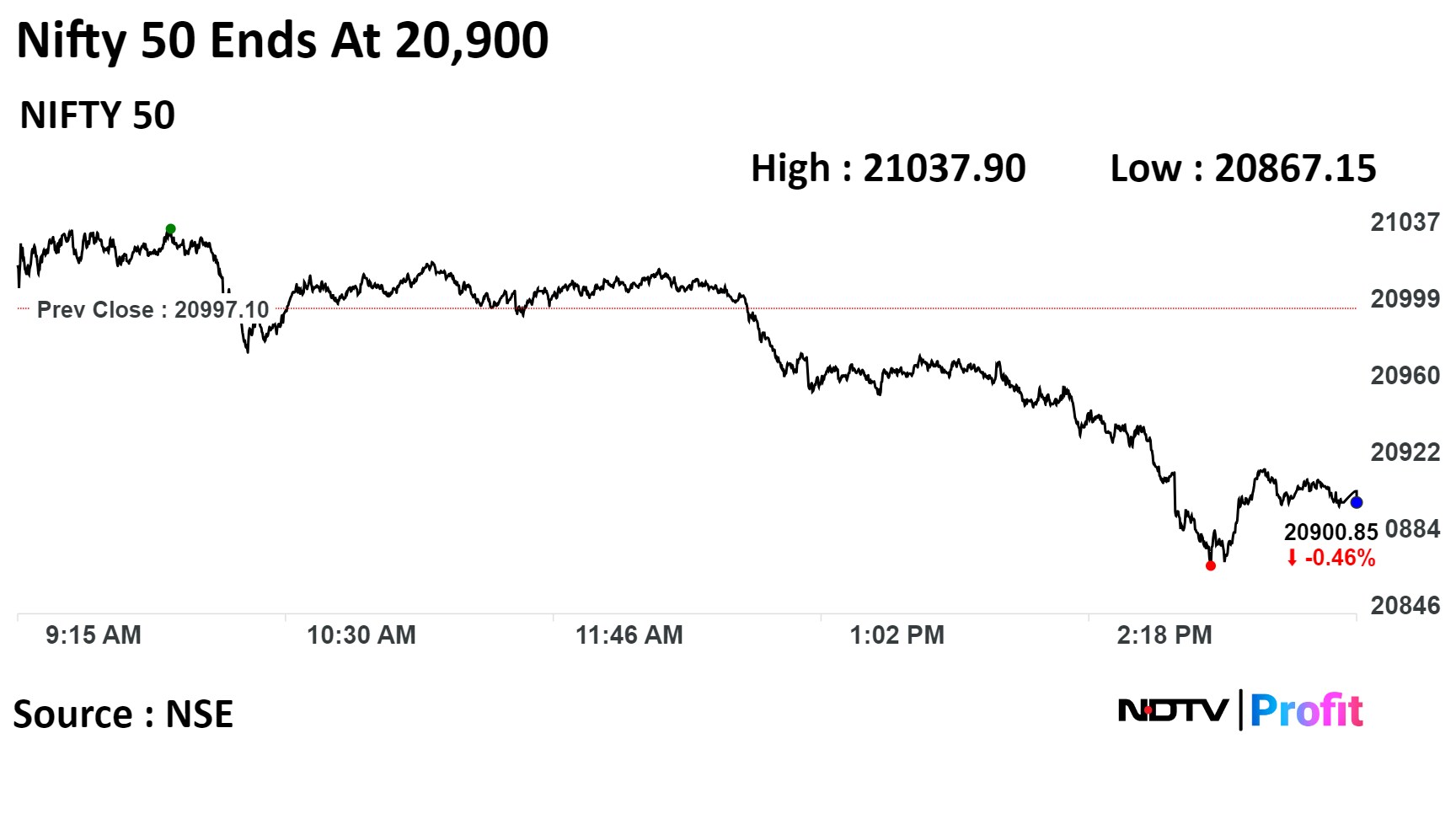

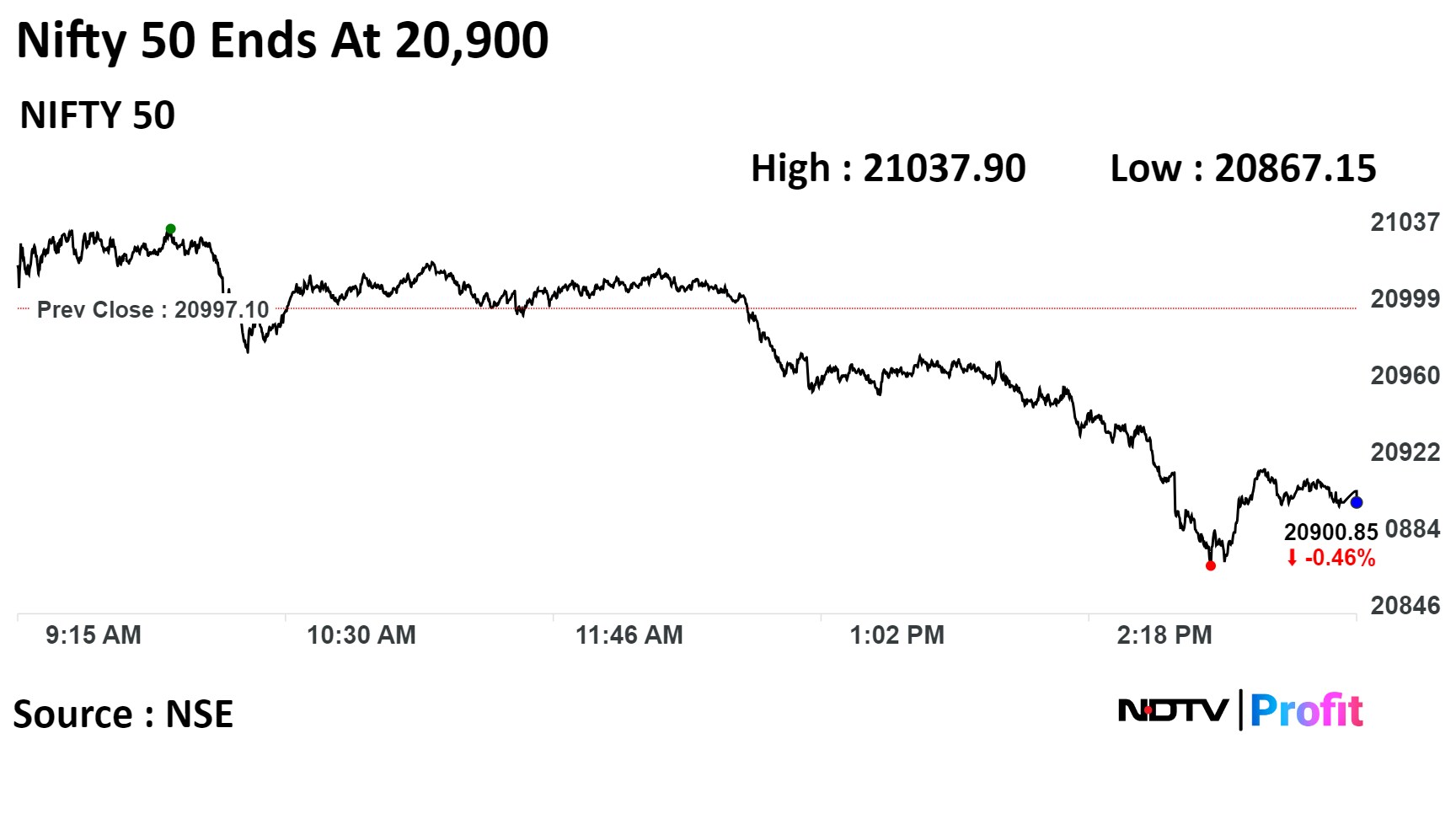

Benchmark indices snapped their two-day rally and closed lower due to losses in the shares of heavyweights Reliance Industries, HDFC Bank, and Infosys.

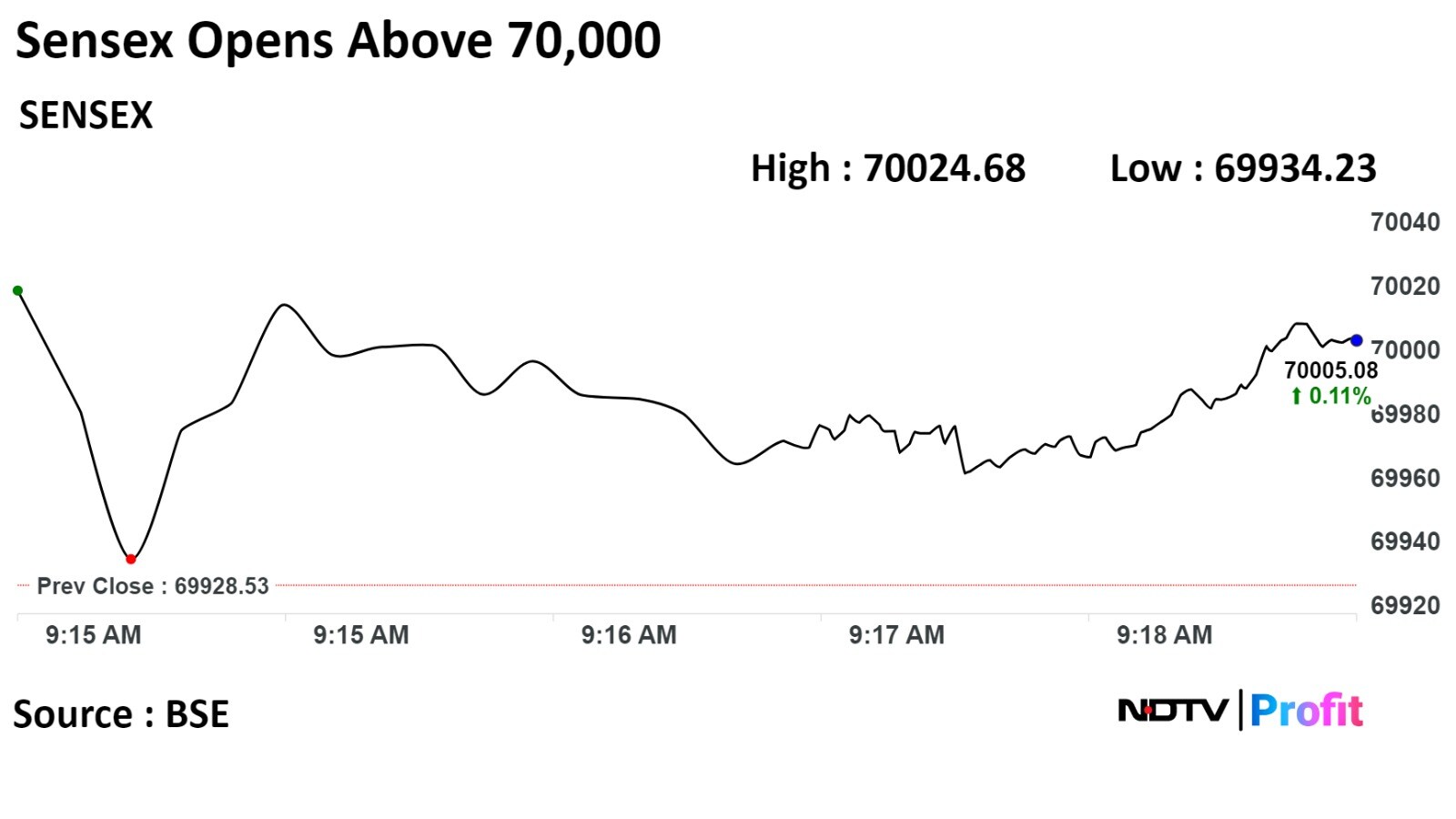

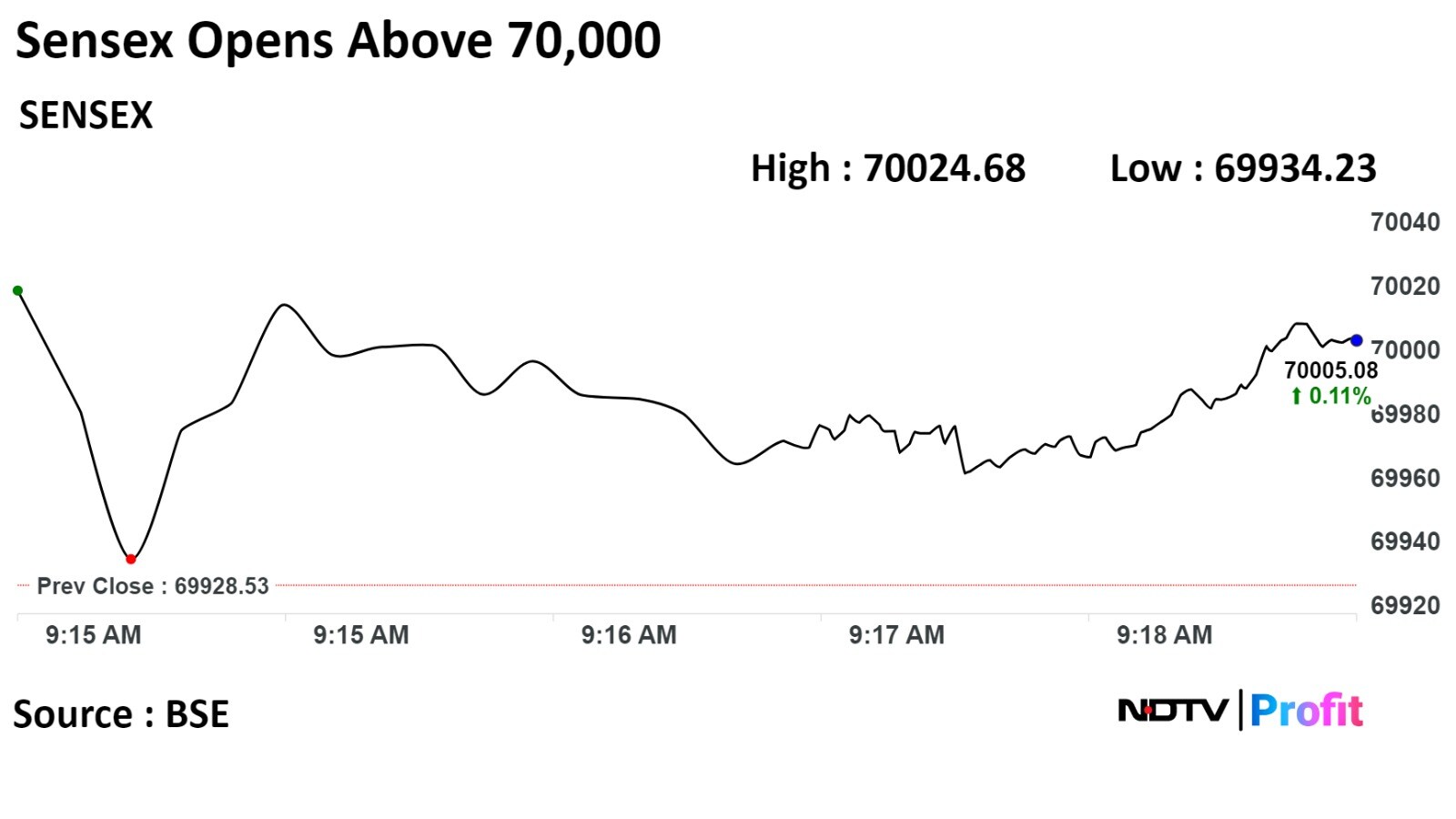

Intraday, the Nifty 50 index hit a fresh intraday high of 21,037.90 points and the Sensex crossed the crucial 70,000 level in the second consecutive session.

The Nifty ended lower by 96.40 points or 0.46% at 20,900.70 while the Sensex lost 365.02 points or 0.52% to close at 69,563.51.

"While the Sensex reaching 70,000 is a significant milestone, it's important to remember that investing is a long-term journey," said Nitin Rao, CEO of InCred Wealth in a note.

He added, "Resist chasing short-term gains and avoid investing based on emotions. Resist the urge to make impulsive decisions based on market noise. Stick to your investment plan and avoid making emotional trades. Don't be lured by stocks with attractive prices but lack underlying strength. Always prioritize companies with strong financials and long-term prospects."

Benchmark indices snapped their two-day rally and closed lower due to losses in the shares of heavyweights Reliance Industries, HDFC Bank, and Infosys.

Intraday, the Nifty 50 index hit a fresh intraday high of 21,037.90 points and the Sensex crossed the crucial 70,000 level in the second consecutive session.

The Nifty ended lower by 96.40 points or 0.46% at 20,900.70 while the Sensex lost 365.02 points or 0.52% to close at 69,563.51.

"While the Sensex reaching 70,000 is a significant milestone, it's important to remember that investing is a long-term journey," said Nitin Rao, CEO of InCred Wealth in a note.

He added, "Resist chasing short-term gains and avoid investing based on emotions. Resist the urge to make impulsive decisions based on market noise. Stick to your investment plan and avoid making emotional trades. Don't be lured by stocks with attractive prices but lack underlying strength. Always prioritize companies with strong financials and long-term prospects."

Benchmark indices snapped their two-day rally and closed lower due to losses in the shares of heavyweights Reliance Industries, HDFC Bank, and Infosys.

Intraday, the Nifty 50 index hit a fresh intraday high of 21,037.90 points and the Sensex crossed the crucial 70,000 level in the second consecutive session.

The Nifty ended lower by 96.40 points or 0.46% at 20,900.70 while the Sensex lost 365.02 points or 0.52% to close at 69,563.51.

"While the Sensex reaching 70,000 is a significant milestone, it's important to remember that investing is a long-term journey," said Nitin Rao, CEO of InCred Wealth in a note.

He added, "Resist chasing short-term gains and avoid investing based on emotions. Resist the urge to make impulsive decisions based on market noise. Stick to your investment plan and avoid making emotional trades. Don't be lured by stocks with attractive prices but lack underlying strength. Always prioritize companies with strong financials and long-term prospects."

Benchmark indices snapped their two-day rally and closed lower due to losses in the shares of heavyweights Reliance Industries, HDFC Bank, and Infosys.

Intraday, the Nifty 50 index hit a fresh intraday high of 21,037.90 points and the Sensex crossed the crucial 70,000 level in the second consecutive session.

The Nifty ended lower by 96.40 points or 0.46% at 20,900.70 while the Sensex lost 365.02 points or 0.52% to close at 69,563.51.

"While the Sensex reaching 70,000 is a significant milestone, it's important to remember that investing is a long-term journey," said Nitin Rao, CEO of InCred Wealth in a note.

He added, "Resist chasing short-term gains and avoid investing based on emotions. Resist the urge to make impulsive decisions based on market noise. Stick to your investment plan and avoid making emotional trades. Don't be lured by stocks with attractive prices but lack underlying strength. Always prioritize companies with strong financials and long-term prospects."

Benchmark indices snapped their two-day rally and closed lower due to losses in the shares of heavyweights Reliance Industries, HDFC Bank, and Infosys.

Intraday, the Nifty 50 index hit a fresh intraday high of 21,037.90 points and the Sensex crossed the crucial 70,000 level in the second consecutive session.

The Nifty ended lower by 96.40 points or 0.46% at 20,900.70 while the Sensex lost 365.02 points or 0.52% to close at 69,563.51.

"While the Sensex reaching 70,000 is a significant milestone, it's important to remember that investing is a long-term journey," said Nitin Rao, CEO of InCred Wealth in a note.

He added, "Resist chasing short-term gains and avoid investing based on emotions. Resist the urge to make impulsive decisions based on market noise. Stick to your investment plan and avoid making emotional trades. Don't be lured by stocks with attractive prices but lack underlying strength. Always prioritize companies with strong financials and long-term prospects."

Benchmark indices snapped their two-day rally and closed lower due to losses in the shares of heavyweights Reliance Industries, HDFC Bank, and Infosys.

Intraday, the Nifty 50 index hit a fresh intraday high of 21,037.90 points and the Sensex crossed the crucial 70,000 level in the second consecutive session.

The Nifty ended lower by 96.40 points or 0.46% at 20,900.70 while the Sensex lost 365.02 points or 0.52% to close at 69,563.51.

"While the Sensex reaching 70,000 is a significant milestone, it's important to remember that investing is a long-term journey," said Nitin Rao, CEO of InCred Wealth in a note.

He added, "Resist chasing short-term gains and avoid investing based on emotions. Resist the urge to make impulsive decisions based on market noise. Stick to your investment plan and avoid making emotional trades. Don't be lured by stocks with attractive prices but lack underlying strength. Always prioritize companies with strong financials and long-term prospects."

Benchmark indices snapped their two-day rally and closed lower due to losses in the shares of heavyweights Reliance Industries, HDFC Bank, and Infosys.

Intraday, the Nifty 50 index hit a fresh intraday high of 21,037.90 points and the Sensex crossed the crucial 70,000 level in the second consecutive session.

The Nifty ended lower by 96.40 points or 0.46% at 20,900.70 while the Sensex lost 365.02 points or 0.52% to close at 69,563.51.

"While the Sensex reaching 70,000 is a significant milestone, it's important to remember that investing is a long-term journey," said Nitin Rao, CEO of InCred Wealth in a note.

He added, "Resist chasing short-term gains and avoid investing based on emotions. Resist the urge to make impulsive decisions based on market noise. Stick to your investment plan and avoid making emotional trades. Don't be lured by stocks with attractive prices but lack underlying strength. Always prioritize companies with strong financials and long-term prospects."

Benchmark indices snapped their two-day rally and closed lower due to losses in the shares of heavyweights Reliance Industries, HDFC Bank, and Infosys.

Intraday, the Nifty 50 index hit a fresh intraday high of 21,037.90 points and the Sensex crossed the crucial 70,000 level in the second consecutive session.

The Nifty ended lower by 96.40 points or 0.46% at 20,900.70 while the Sensex lost 365.02 points or 0.52% to close at 69,563.51.

"While the Sensex reaching 70,000 is a significant milestone, it's important to remember that investing is a long-term journey," said Nitin Rao, CEO of InCred Wealth in a note.

He added, "Resist chasing short-term gains and avoid investing based on emotions. Resist the urge to make impulsive decisions based on market noise. Stick to your investment plan and avoid making emotional trades. Don't be lured by stocks with attractive prices but lack underlying strength. Always prioritize companies with strong financials and long-term prospects."

Global Cues

Globally, indices were higher ahead of the realease of U.S. inflation data inflation data due later in the day. Most European markets opened higher after year-on-year UK wage growth for the three months ending October was slower than expected.

Indices in Asia also closed higher led by Hong Kong's Hang Seng, as investors await decisions from a meeting of Chinese economic policymakers that may indicate how much stimulus to expect next year.

HDFC Bank Ltd., Reliance Industries Ltd., Larsen & Toubro Ltd., Infosys Ltd., and Kotak Mahindra Bank Ltd., dragged the index lower.

Meanwhile, Axis Bank Ltd., HDFC Life Insurance Co. Ltd., Tata Consultancy Services Ltd., UltraTech Cement Ltd., and Bajaj Auto Ltd., cushioned the fall.

All sectoral indices fell except Nifty Media and Nifty Metal. Nifty PSU Bank ended flat. Nifty Realty, Nifty Energy, and Nifty Oil & Gas ended over 1% lower.

The broader markets also fell with the BSE MidCap falling 0.4%, and the BSE SmallCap was 0.27% lower. Three out of the 20 sectors compiled by the BSE advanced, while 17 declined.

The market breadth was skewed in the favour of sellers. As many as 2,035 stocks declined, 1,753 advanced and 117 remained unchanged on the BSE.

Net loss of Rs 449.4 crore vs loss of Rs 833.2 crore YoY

Revenue down 26.9% at 1428.8 crore vs Rs 1954.5 crore YoY

Ebitda loss of Rs 443.4 crore vs loss of Rs 555.3 crore YoY

Approved issue and allotment of equity shares and warrants on preferential basis.

Spicejet Ltd.'s board approved up to 32.08 crore equity shares of Rs.10 each for issuance.

It further approved up to 13 crore warrants for issuance.

Warrants to be convertible into equivalent number of equity shares of Rs.10 each.

The issue price is Rs 50 per share, warrant.

Source: Exchange Filings

Adani Ports and Special Economic Zones Ltd's board has approved bonds and preference shares sale plan of up to Rs 5,250 crore.

It has also approved issuance of NCDs of up to Rs 5,000 crore.

The board has also Approves issuance of non-cumulative redeemable preference shares of up to Rs 250.19 crore.

Source: Exchange filing

After securing the new order, Mishra Dhatu Nigam Ltd.'s order book stands at Rs 1,100 crore in FY24 so far.

The open order position of the company is around Rs 1,750 crore as on date

Sources: Exchanges

Tejas Networks Ltd. received license of 5G tech from IIT Madras, IIT Kanpur, and Sameer for Rs 12 crore.

Sources: Exchange Filing

Coal India Ltd. aims to spend 80% of Rs 16,500 crore FY24 capex by Dec

Capex grows by Rs 741 crore to Rs 10,492 crore in Apr-Nov FY24

Sources: Exchange Filing

Top Gainers

MSTC up 11.44% at Rs 484.3

Equitas Small Finance up 9.05% at Rs 103.05

Safari Industries up 8.44% at Rs 2134.75

Sonata Software up 7.90% at Rs 760.95

Infibeam Avenues up 6.45% at Rs 23.10

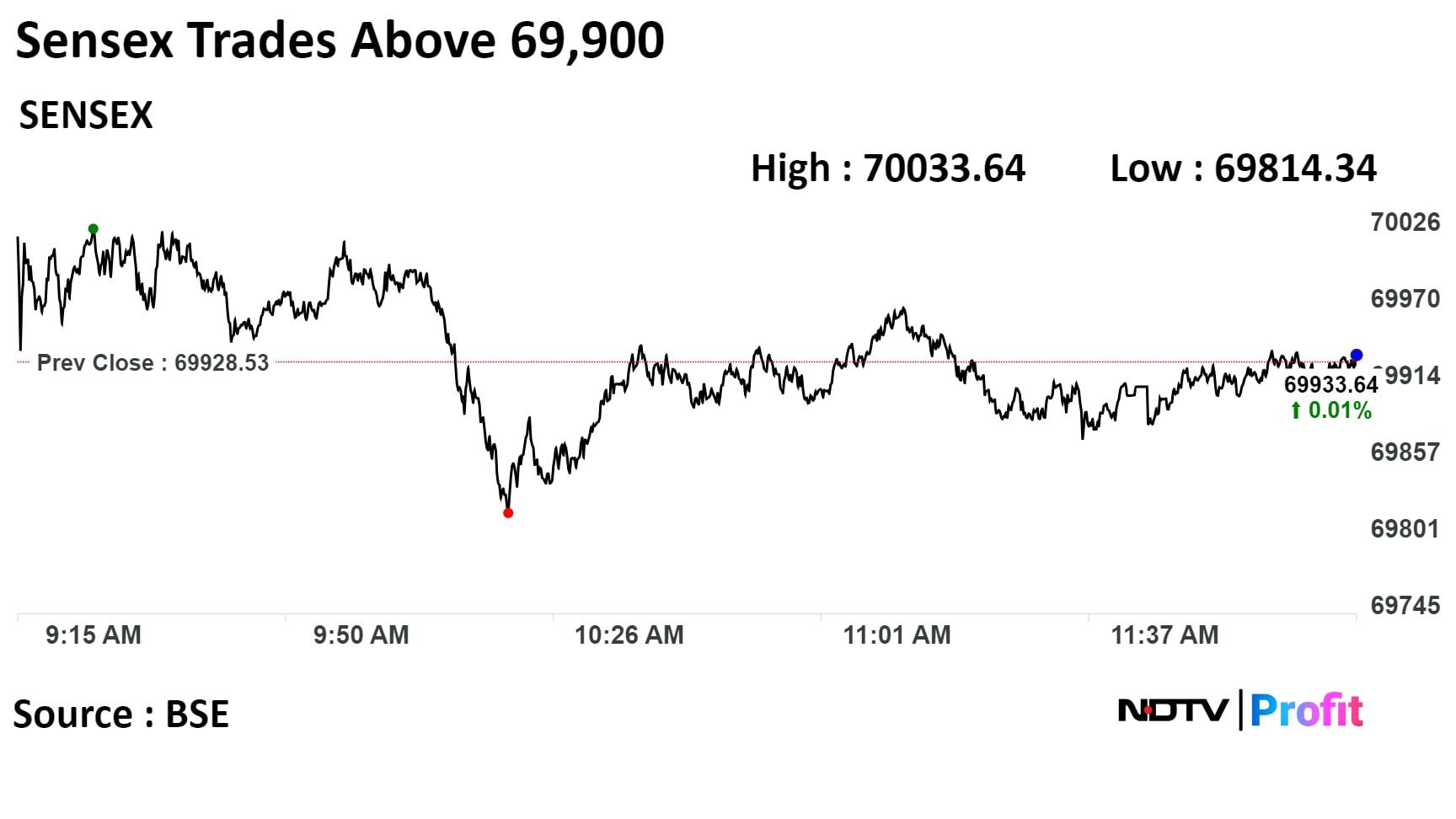

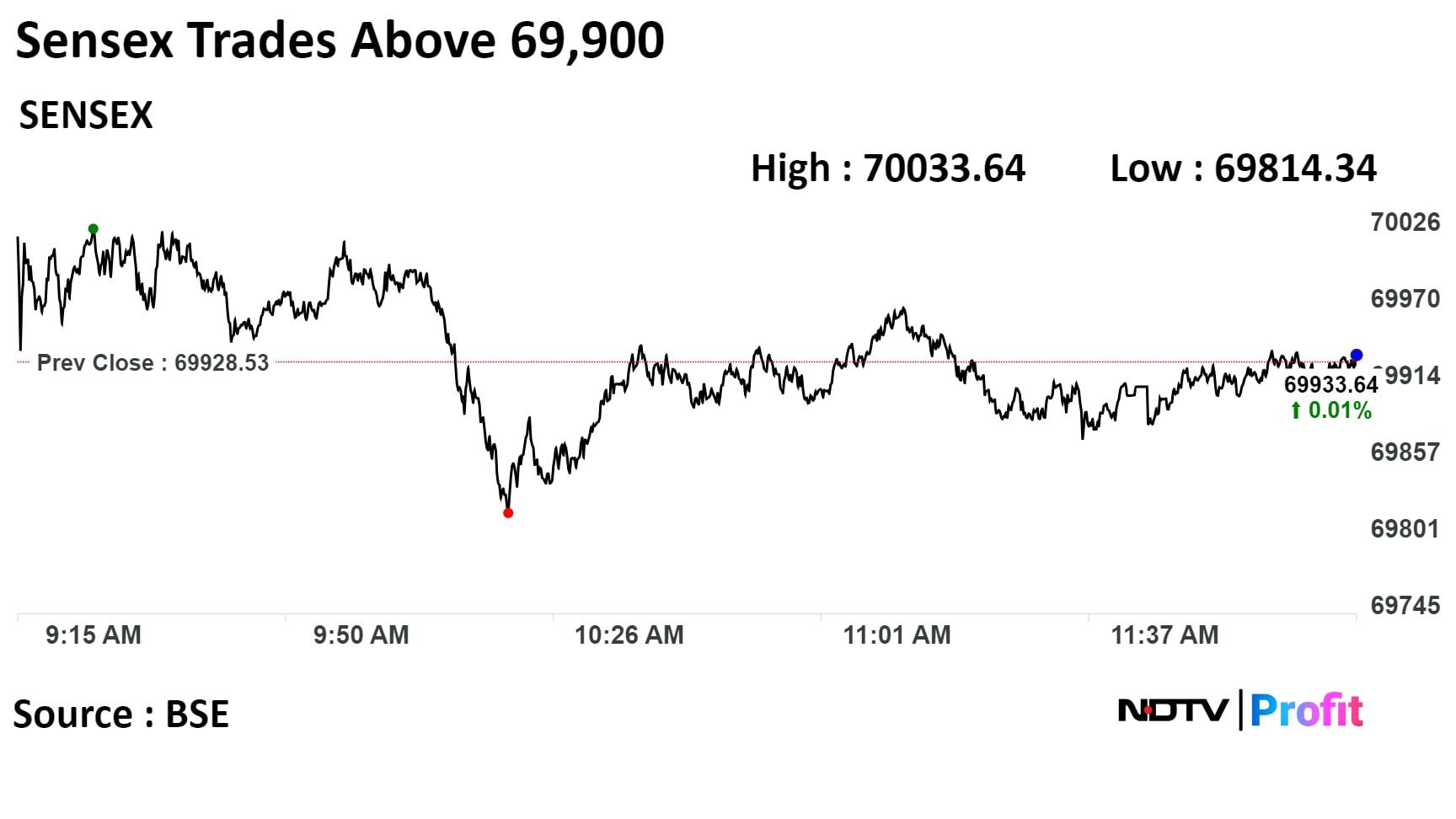

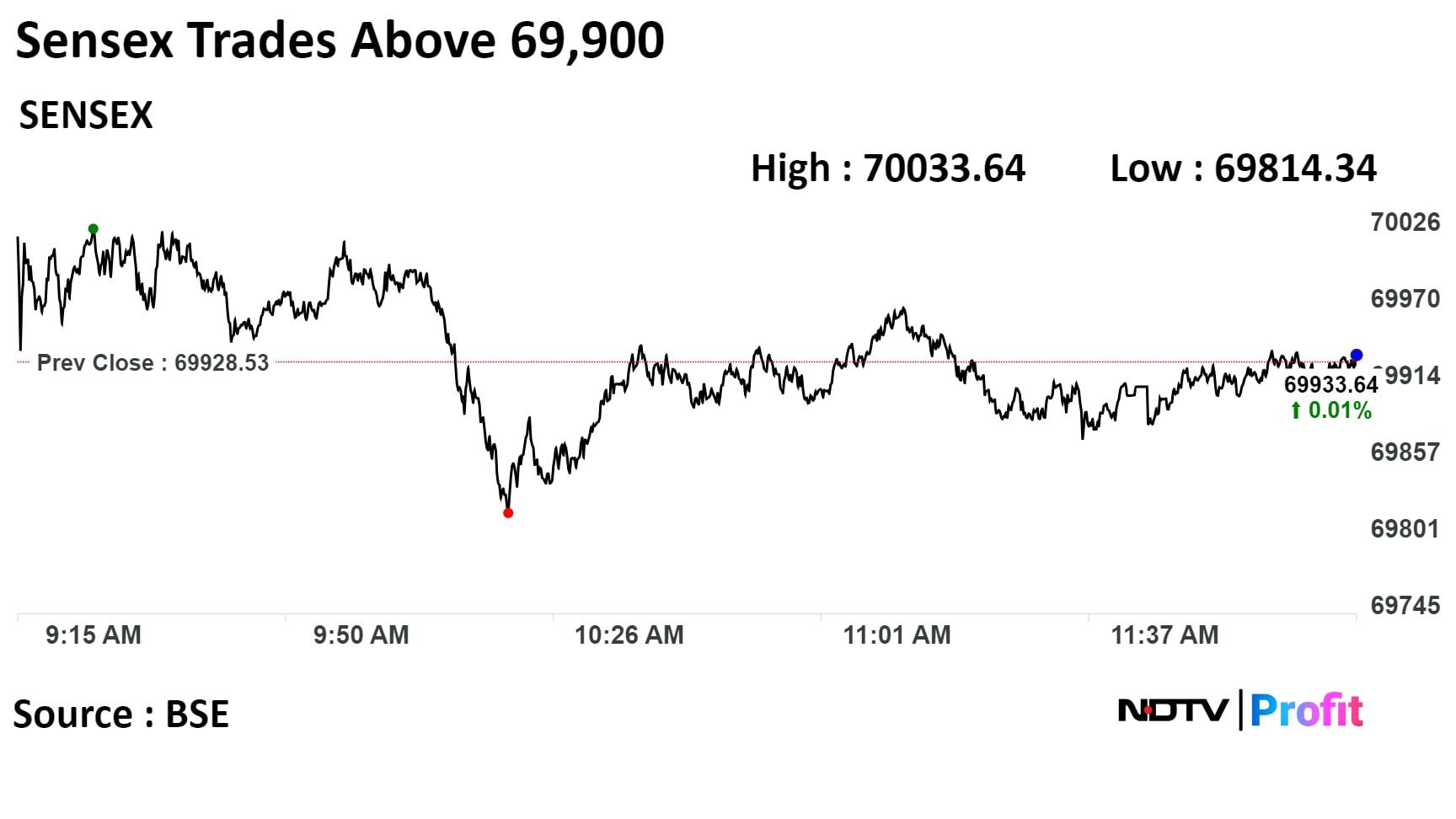

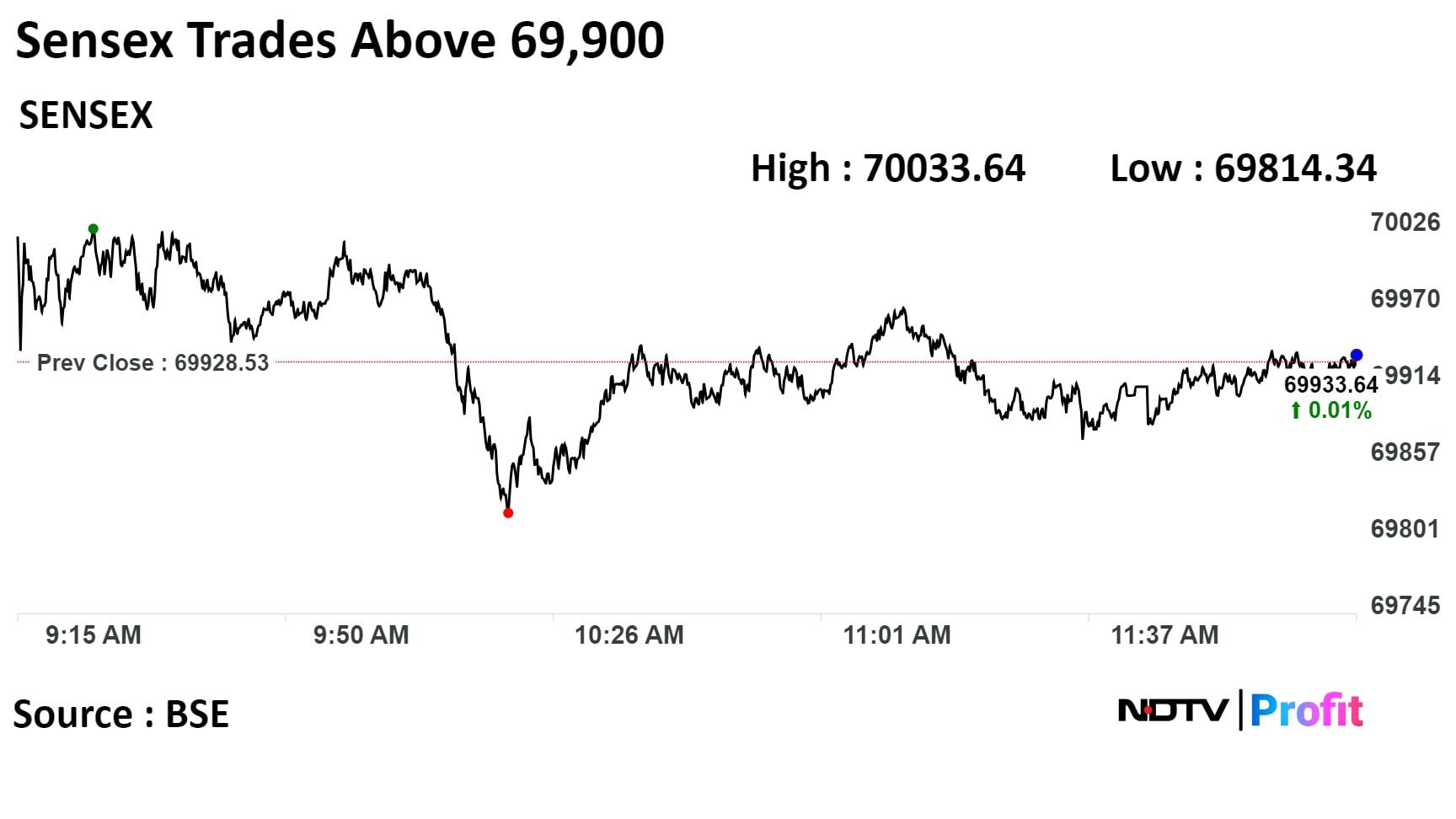

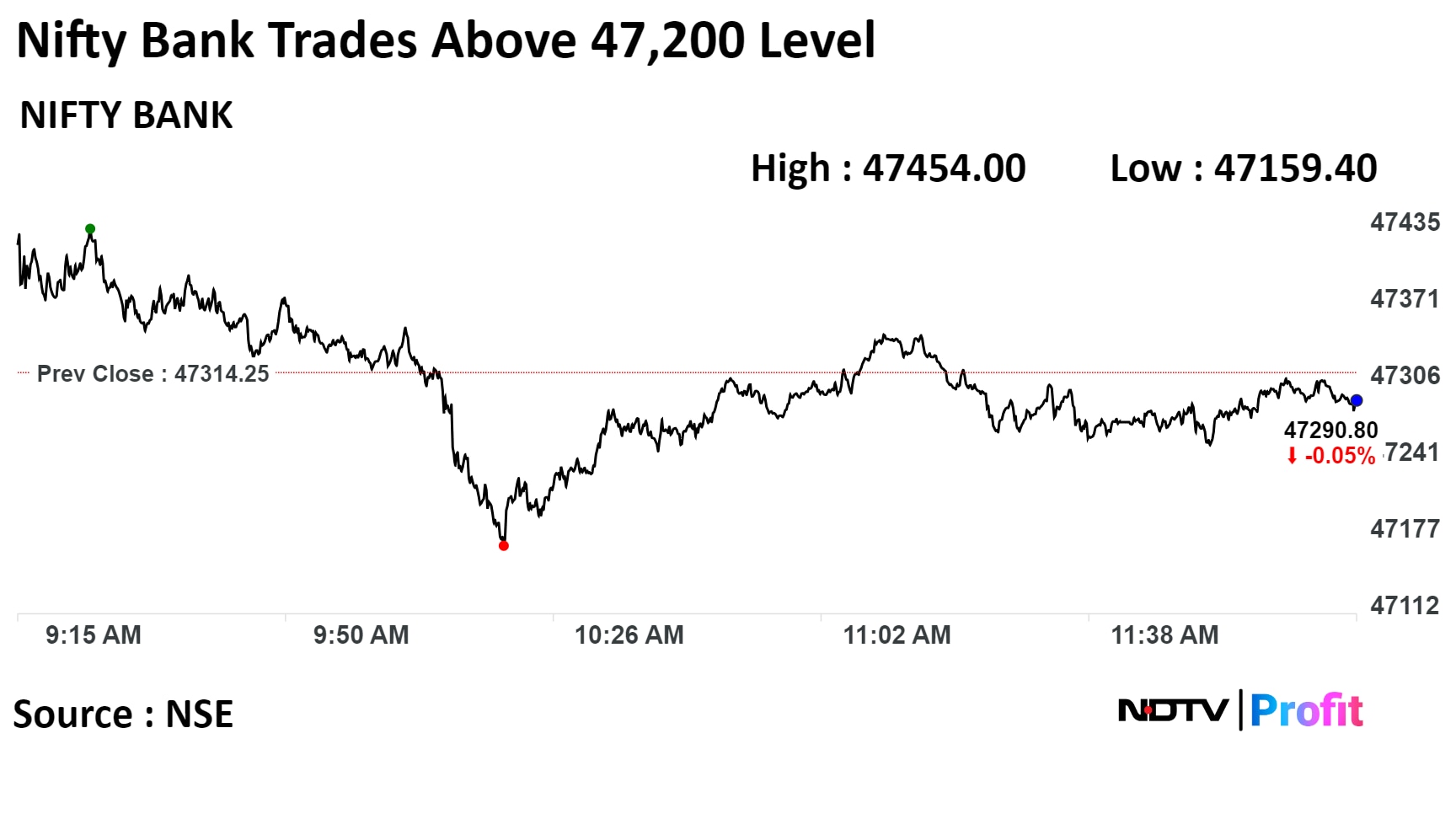

The benchmark indices were trading flat at midday after opening at record highs on Tuesday.

At 12:07 p.m., the NSE Nifty 50 was trading 10 points or 0.05% higher at 21,007.50, while the S&P BSE Sensex was 9.76 points or 0.01% up at 69,918.77.

The Nifty and the Sensex opened above the 21,000 and the 70,000 levels for the first time.

"The Nifty has been in consolidation mode for the fifth consecutive session, maintaining proximity to the 21,000 levels," Shrey Jain, chief executive officer of SAS Online, said. "We anticipate this consolidation to persist throughout the day."

The benchmark indices were trading flat at midday after opening at record highs on Tuesday.

At 12:07 p.m., the NSE Nifty 50 was trading 10 points or 0.05% higher at 21,007.50, while the S&P BSE Sensex was 9.76 points or 0.01% up at 69,918.77.

The Nifty and the Sensex opened above the 21,000 and the 70,000 levels for the first time.

"The Nifty has been in consolidation mode for the fifth consecutive session, maintaining proximity to the 21,000 levels," Shrey Jain, chief executive officer of SAS Online, said. "We anticipate this consolidation to persist throughout the day."

The benchmark indices were trading flat at midday after opening at record highs on Tuesday.

At 12:07 p.m., the NSE Nifty 50 was trading 10 points or 0.05% higher at 21,007.50, while the S&P BSE Sensex was 9.76 points or 0.01% up at 69,918.77.

The Nifty and the Sensex opened above the 21,000 and the 70,000 levels for the first time.

"The Nifty has been in consolidation mode for the fifth consecutive session, maintaining proximity to the 21,000 levels," Shrey Jain, chief executive officer of SAS Online, said. "We anticipate this consolidation to persist throughout the day."

The benchmark indices were trading flat at midday after opening at record highs on Tuesday.

At 12:07 p.m., the NSE Nifty 50 was trading 10 points or 0.05% higher at 21,007.50, while the S&P BSE Sensex was 9.76 points or 0.01% up at 69,918.77.

The Nifty and the Sensex opened above the 21,000 and the 70,000 levels for the first time.

"The Nifty has been in consolidation mode for the fifth consecutive session, maintaining proximity to the 21,000 levels," Shrey Jain, chief executive officer of SAS Online, said. "We anticipate this consolidation to persist throughout the day."

The benchmark indices were trading flat at midday after opening at record highs on Tuesday.

At 12:07 p.m., the NSE Nifty 50 was trading 10 points or 0.05% higher at 21,007.50, while the S&P BSE Sensex was 9.76 points or 0.01% up at 69,918.77.

The Nifty and the Sensex opened above the 21,000 and the 70,000 levels for the first time.

"The Nifty has been in consolidation mode for the fifth consecutive session, maintaining proximity to the 21,000 levels," Shrey Jain, chief executive officer of SAS Online, said. "We anticipate this consolidation to persist throughout the day."

The benchmark indices were trading flat at midday after opening at record highs on Tuesday.

At 12:07 p.m., the NSE Nifty 50 was trading 10 points or 0.05% higher at 21,007.50, while the S&P BSE Sensex was 9.76 points or 0.01% up at 69,918.77.

The Nifty and the Sensex opened above the 21,000 and the 70,000 levels for the first time.

"The Nifty has been in consolidation mode for the fifth consecutive session, maintaining proximity to the 21,000 levels," Shrey Jain, chief executive officer of SAS Online, said. "We anticipate this consolidation to persist throughout the day."

The benchmark indices were trading flat at midday after opening at record highs on Tuesday.

At 12:07 p.m., the NSE Nifty 50 was trading 10 points or 0.05% higher at 21,007.50, while the S&P BSE Sensex was 9.76 points or 0.01% up at 69,918.77.

The Nifty and the Sensex opened above the 21,000 and the 70,000 levels for the first time.

"The Nifty has been in consolidation mode for the fifth consecutive session, maintaining proximity to the 21,000 levels," Shrey Jain, chief executive officer of SAS Online, said. "We anticipate this consolidation to persist throughout the day."

The benchmark indices were trading flat at midday after opening at record highs on Tuesday.

At 12:07 p.m., the NSE Nifty 50 was trading 10 points or 0.05% higher at 21,007.50, while the S&P BSE Sensex was 9.76 points or 0.01% up at 69,918.77.

The Nifty and the Sensex opened above the 21,000 and the 70,000 levels for the first time.

"The Nifty has been in consolidation mode for the fifth consecutive session, maintaining proximity to the 21,000 levels," Shrey Jain, chief executive officer of SAS Online, said. "We anticipate this consolidation to persist throughout the day."

ICICI Bank Ltd., Infosys Ltd., Larsen & Toubro Ltd., Sun Pharmaceutical Industries Ltd. and Bharat Petroleum Corp. were weighing on the Nifty.

ITC Ltd., Tata Consultancy Services Ltd., UltraTech Cement Ltd., Hindalco Industries Ltd. and Axis Bank Ltd. were adding positively to the index.

Most sectoral indices were trading in red. Eight out of the 14 sectors on the NSE fell and six advanced. Realty and Oil & Gas declined the most, while Media rose the most.

The broader markets outperformed as the BSE MidCap was 0.20% higher and the SmallCap was up 0.41%. Eleven out of the 20 sectors compiled by the BSE advanced, while nine declined. Commodities and Metal rose the most.

The market breadth was skewed in favour of the buyers. As many as 2,048 stocks advanced, 1,560 rose and 149 remained unchanged on the BSE.

Shares of Safari Industries (India) Ltd. surged over 12% on Tuesday after a report by Nuvama Institutional Equities said that the company's next leg of growth will be driven by capacity expansion, along with the launch of its premium brand Urban Jungle.

Shares of Safari Industries rose as much as 12.7%, the most since Dec. 4, before paring gains to trade 8.7% higher at 11: 54 a.m. This compares to a 0.04% advance in the NSE Nifty 50.

The stock has risen 153.61% year-to-date. Total traded volume so far in the day stood at 13 times its 30-day average. The relative strength index was at 50.21.

Of the nine analysts tracking the company, seven maintain a 'buy' rating, and two recommend a 'hold', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 12.7%.

Shares of Hindalco Industries Ltd. gained on Tuesday after the company informed in an exchange filing it's going to set up a battery foil manufacturing plant in Odisha.

Hindalco plans to invest Rs 800 crore to set up the manufacturing facility in Odisha with an intent to expand its capacity of producing fine quality aluminum foil which are used in rechargeable batteries.

With this expansion, Hindalco is also trying to serve the EV and energy storage systems.

Shares of Hindalco Industries Ltd. gained on Tuesday after the company informed in an exchange filing it's going to set up a battery foil manufacturing plant in Odisha.

Hindalco plans to invest Rs 800 crore to set up the manufacturing facility in Odisha with an intent to expand its capacity of producing fine quality aluminum foil which are used in rechargeable batteries.

With this expansion, Hindalco is also trying to serve the EV and energy storage systems.

The scrips of Hindalco Industries Ltd. rose 3.08% to Rs 538 apiece. It was trading 2.60% higher at Rs 536.00 apiece, as of 11:20 a.m. This compares to a 0.05% advance in the NSE Nifty 50 Index as of 11:23 a.m.

It has risen 13.3% on a year-to-date basis. Total traded volume so far in the day stood at 2.0 times its 30-day average. The relative strength index was at 73.78.

Out of 25 analysts tracking the company, 24 maintain a 'buy' rating, one recommends to 'hold,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 5.0%.

Mankind Pharma at 110.35 times its 30 days average

Jtekt India at 9.42 times its 30 days average

Jammu and Kashmir Bank at 5.4 times its 30 days average

Equites Small Finance Bank at 5.1 times its 30 days average

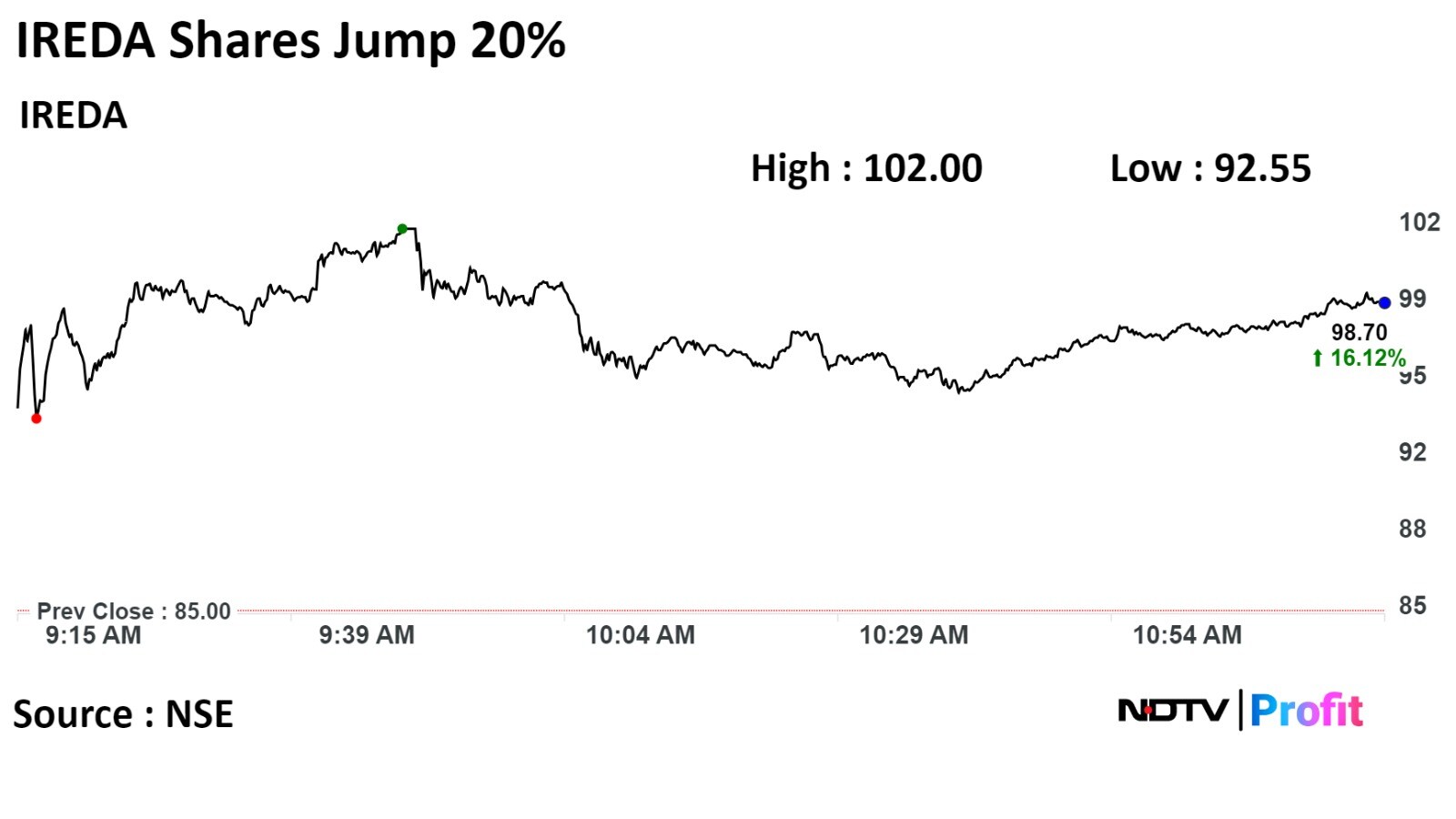

Shares Indian Renewable Energy Development Agency Ltd. jumped over 200% from it issue price.

The state-run company made its debut in the exchanges on Nov. 29 and marked a stellar closing of a premium of 87.5% over the issue price. The Rs 2,150 crore IPO was subscribed 38.80 times on its third and final day.

The government is considering granting Ireda the 'Navratna' status, according to Chairperson Pradip Kumar Das

Shares of the renewable energy company rose as much as 20%, at Rs 102.35. The stock is trading is trading 14.29 higher at Rs 97.15, compared to a 0.05% advance in the NSE Nifty 50 as of 11:04 a.m.

Shares Indian Renewable Energy Development Agency Ltd. jumped over 200% from it issue price.

The state-run company made its debut in the exchanges on Nov. 29 and marked a stellar closing of a premium of 87.5% over the issue price. The Rs 2,150 crore IPO was subscribed 38.80 times on its third and final day.

The government is considering granting Ireda the 'Navratna' status, according to Chairperson Pradip Kumar Das

Shares of the renewable energy company rose as much as 20%, at Rs 102.35. The stock is trading is trading 14.29 higher at Rs 97.15, compared to a 0.05% advance in the NSE Nifty 50 as of 11:04 a.m.

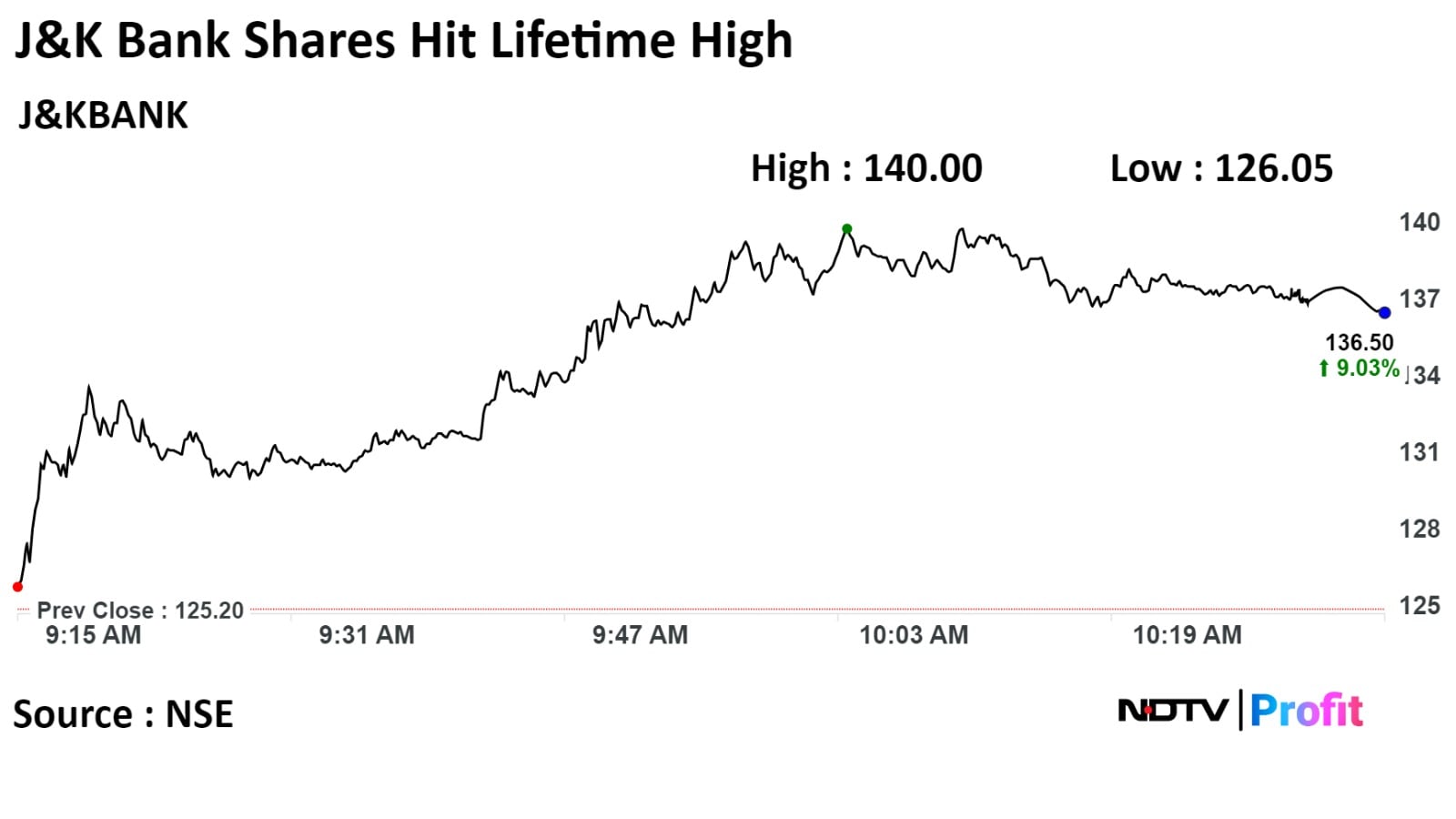

Shares of Jammu & Kashmir Bank Ltd jumped to hit its lifetime high today, after launching its QIP on Monday. For the same, the company has approved the floor price of Rs 112.66 per equity share for the QIP, according to an exchange filing.

Shares of Jammu & Kashmir Bank Ltd jumped to hit its lifetime high today, after launching its QIP on Monday. For the same, the company has approved the floor price of Rs 112.66 per equity share for the QIP, according to an exchange filing.

The scrip rose as much as 11.82% to Rs 140 apiece, its lifetime high. On Monday, it ended 9.73% higher at Rs 125.20.

It pared gains to trade 9% higher at Rs 136.45 apiece, as of 10:39 a.m. This compares to a 0.05% advance in the NSE Nifty 50 Index.

It has risen 139.86% on a year-to-date basis. Total traded volume so far in the day stood at 15 times its 30-day average. The relative strength index was at 81.46, indicating that the stock may be overbought.

One analyst tracking the company has a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an downside of 3.26%.

Hindalco Industries Ltd. will set up a battery foil manufacturing plant in Odisha.

Hindalco Plans Rs 800 crore capex for new battery foil plant . The 25,000 ton battery foil plant to start by July 2025.

Source: Exchange Filing

Honeywell Automation India Ltd. received a demand for duty worth Rs 6.56 crore with fines and penalty of Rs 22.5 lakh crore from Customs Department

Source: Exchange Filing

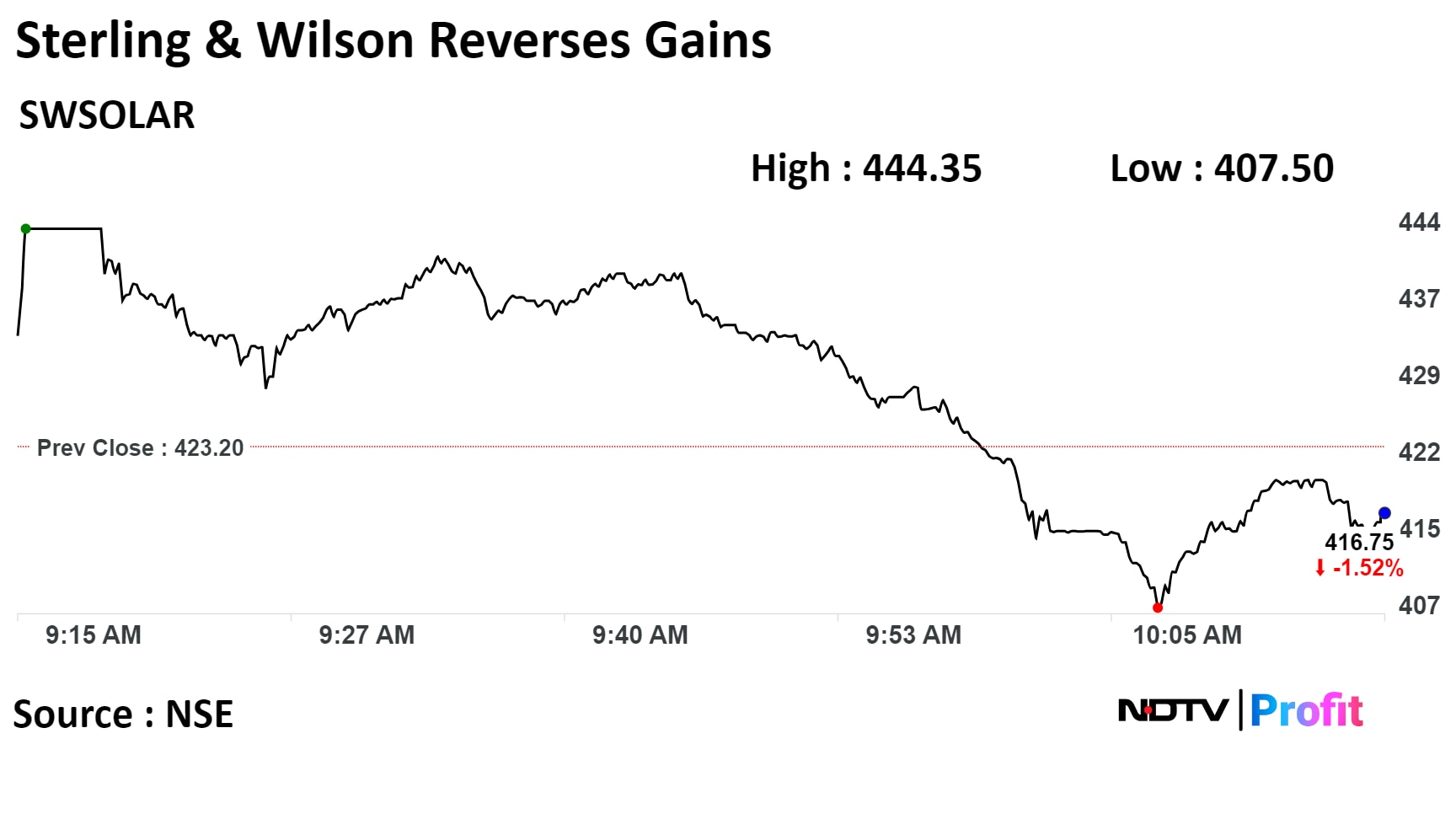

Shares of Sterling & Wilson Renewable Energy Ltd. erased all earlier gains after touching an over two-year high.

The renewable energy company has launched its qualified institutional placement to raise Rs 1,500 crore on Monday, it said in an exchange filing.

Shares of Sterling & Wilson Renewable Energy Ltd. erased all earlier gains after touching an over two-year high.

The renewable energy company has launched its qualified institutional placement to raise Rs 1,500 crore on Monday, it said in an exchange filing.

Shares of the Sterling & Wilson Ltd. rose to a high of 5.00% to Rs 444.35 apiece, the highest level since Nov 11, 2021. It reversed gains to trade 1.25% lower at Rs 417.90 apiece, as of 10:13 a.m. This compares to a 0.03% advance in the NSE Nifty 50 Index at 10:13 a.m.

It has risen 57.06% on a year-to-date basis. Total traded volume so far in the day stood at 7.8 times its 30-day average. The relative strength index was at 79.17, which implied the stock is overbought.

One analyst tracking the company maintains 'buy' rating according to Bloomberg data. The average 12-month consensus price target implies an upside of 7.3%

Got orders for establishment of five bio-CNG plants

Outlines plans to deploy 1 GW hybrid renewable energy solutions within next three years

Sets target to upscale coal gasification plants with capacities ranging from 100-500 TPD

Source: Exchange Filing

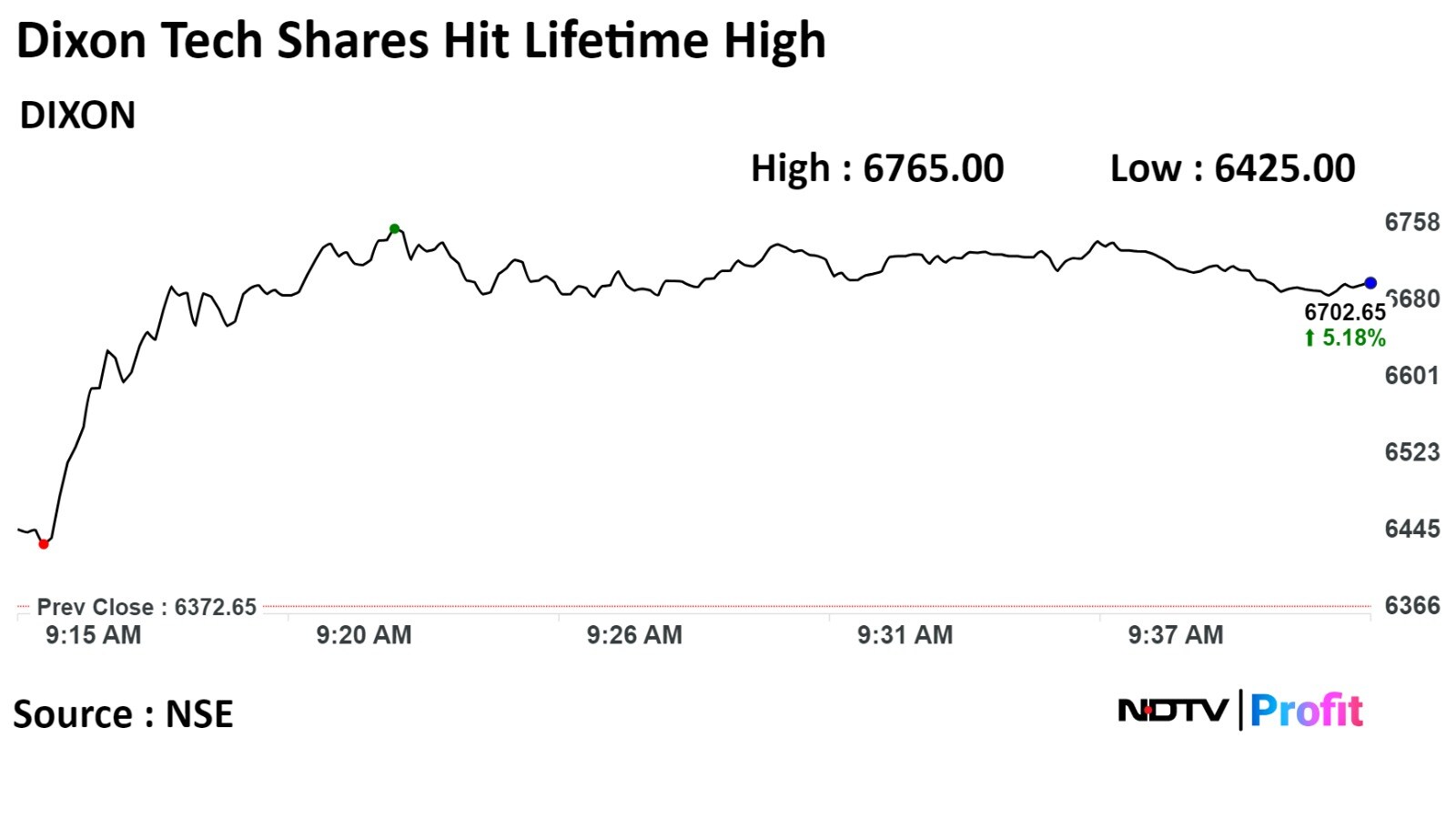

Shares of Dixon Technologies Ltd jumped to a lifetime high after the company said that its wholly owned subsidiary Padget Electronics Pvt. has received an order from Lenovo.

Shares of Dixon Technologies Ltd jumped to a lifetime high after the company said that its wholly owned subsidiary Padget Electronics Pvt. has received an order from Lenovo.

The scrip rose as much as 6.16% to Rs. 6,765 apiece, its lifetime high. It pared gains to trade 5.14% higher at Rs 6,700 apiece, as of 09:47 a.m. This compares to a 0.12% advance in the NSE Nifty 50 Index.

It has risen 71.46% on a year-to-date basis. Total traded volume so far in the day stood at 17 times its 30-day average. The relative strength index was at 85, indicating that the stock may be overbought.

Out of 27 analysts tracking the company, 15 maintain a 'buy' rating, 5 recommend a 'hold,' and 7 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 18.9%.

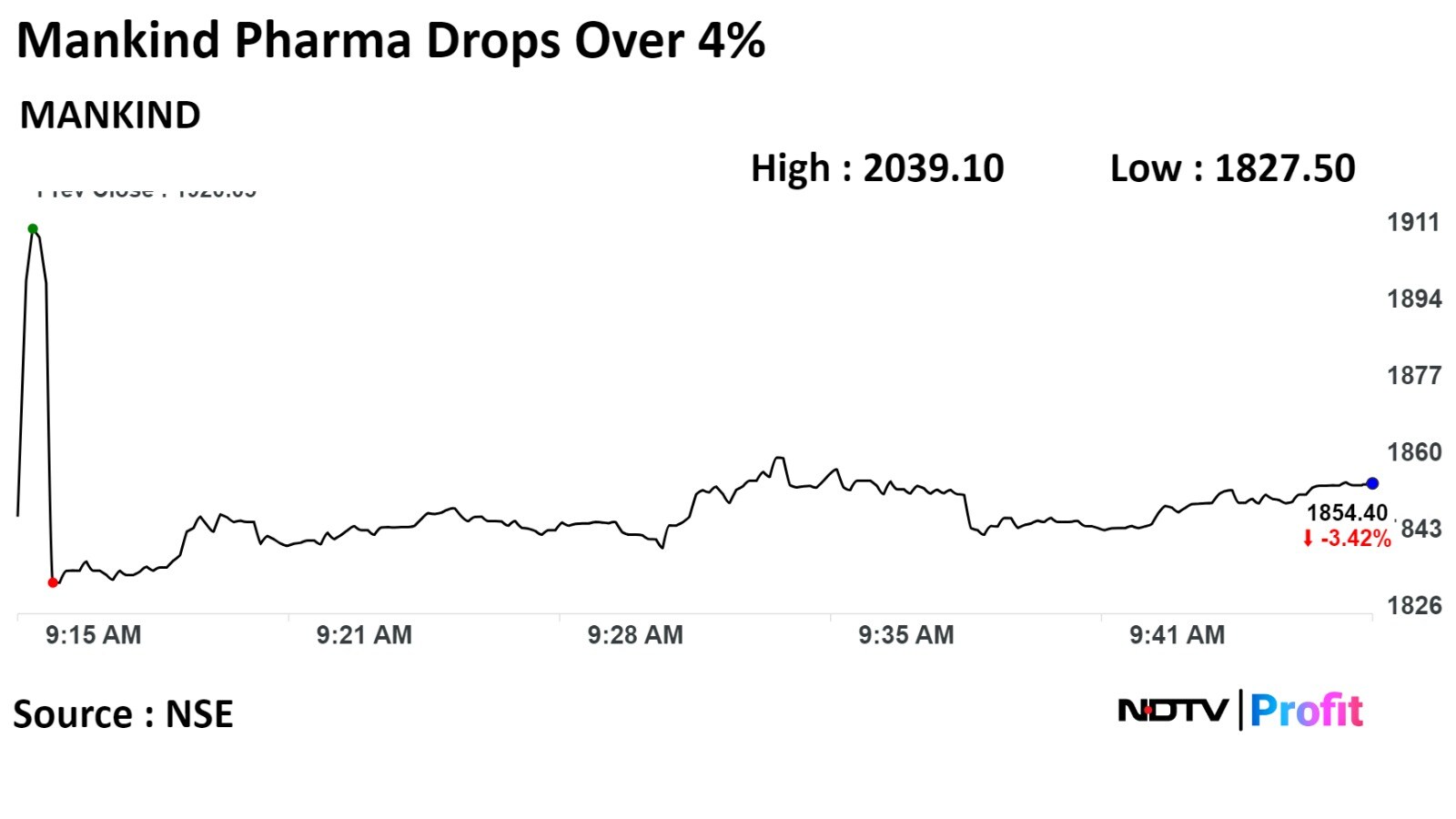

Shares of Mankind Pharma Ltd dropped over 4% after four large trades.

At least 3.05 core shares, or 7.6% changed hands in four large trades at price range of 1,832 to 1,841.50 a piece, according to Bloomberg data. The buyers and sellers not known immediately.

Shares of Mankind Pharma Ltd dropped over 4% after four large trades.

At least 3.05 core shares, or 7.6% changed hands in four large trades at price range of 1,832 to 1,841.50 a piece, according to Bloomberg data. The buyers and sellers not known immediately.

Shares of the company fell as much 4.83% to Rs 1,827.50 apiece, the most since Sept 1.

The stock is trading lower 3.75% at Rs 1,848, compared to a 0.11% advance in the benchmark NSE Nifty 50 at 9:45 a.m.

Total traded volume so far in the day stood at 2,070 times its 30-day average.

Of the 13 analysts tracking the company, seven maintain a 'buy', one recommends a 'hold,' and one suggests a 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 6.5%.

Mankind Pharma has 3.05 crore shares changed hands in 4 large trades

7.6% equity changed hands at price range of `1,832 to `1,841.50 a piece

Buyers and sellers not known immediately

Source: Bloomberg

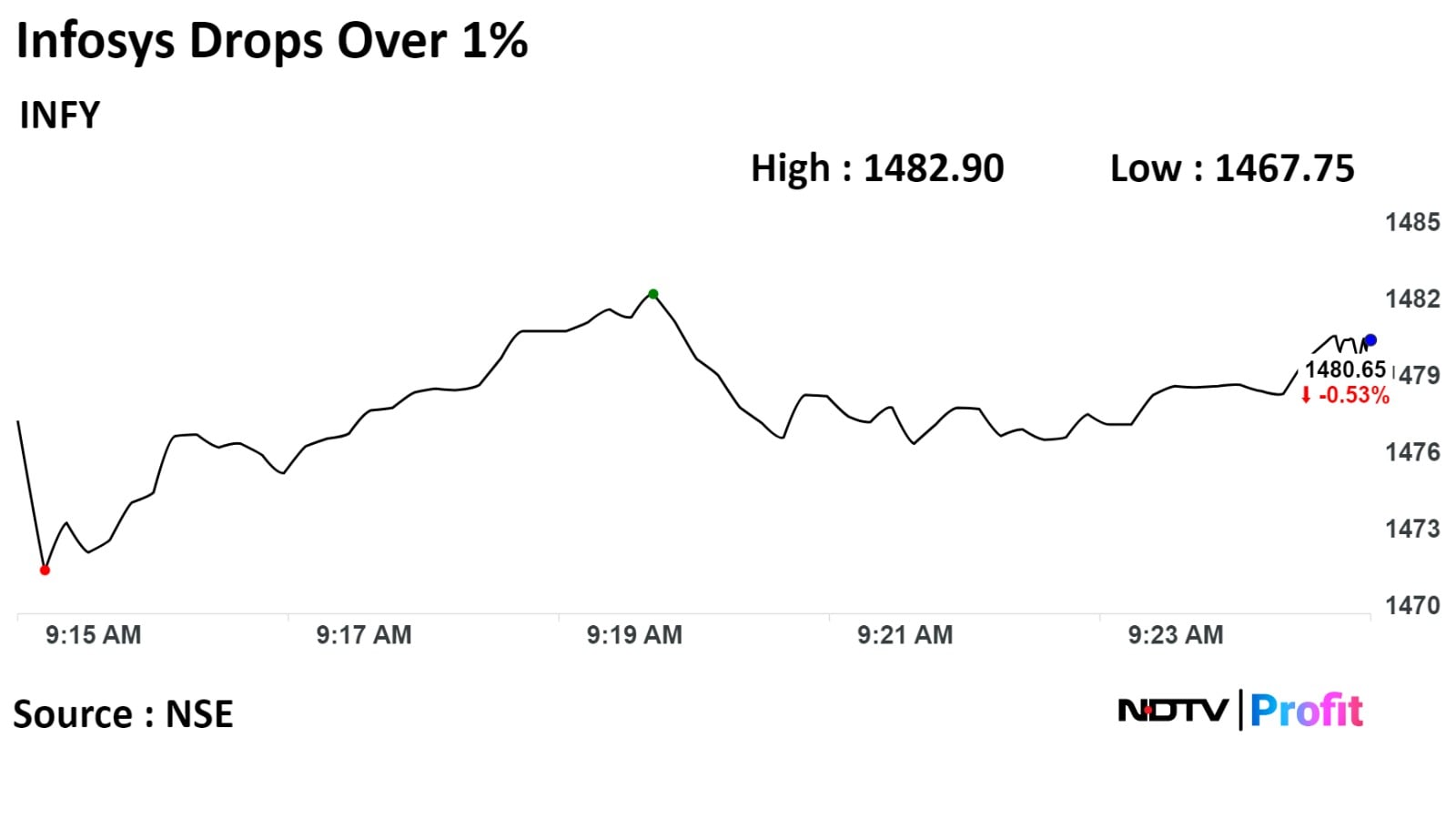

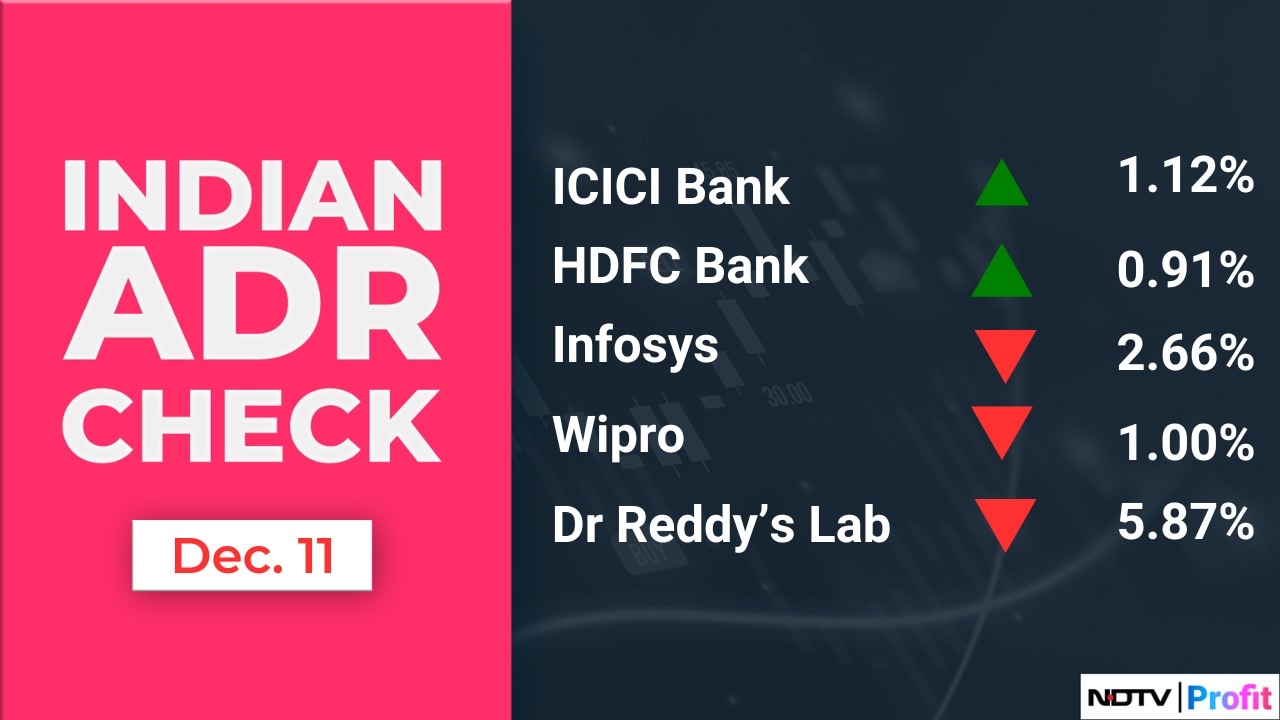

Shares of Infosys Ltd. tumbled over 1% on Tuesday after Nilanjan Roy resigned as the chief financial officer a day ago. Roy’s last working day is March 31. His deputy, Jayesh Sanghrajka, will be in charge the following day, according to an exchange filing on Monday.

Shares of Infosys Ltd. tumbled over 1% on Tuesday after Nilanjan Roy resigned as the chief financial officer a day ago. Roy’s last working day is March 31. His deputy, Jayesh Sanghrajka, will be in charge the following day, according to an exchange filing on Monday.

Infosys' stock fell as much as 1.39% to Rs 1,467 apiece on the NSE. The shares were trading 0.68% lower at Rs 1,478.40 compared to a 0.12% advance in the benchmark Nifty 50 at 9.22 a.m.

The stock has fallen 1.31% on a year-to-date basis.

Twenty-one out of the 45 analysts tracking Infosys have a 'buy' rating on the stock, 16 recommend a 'hold' and eight suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 2.4%.

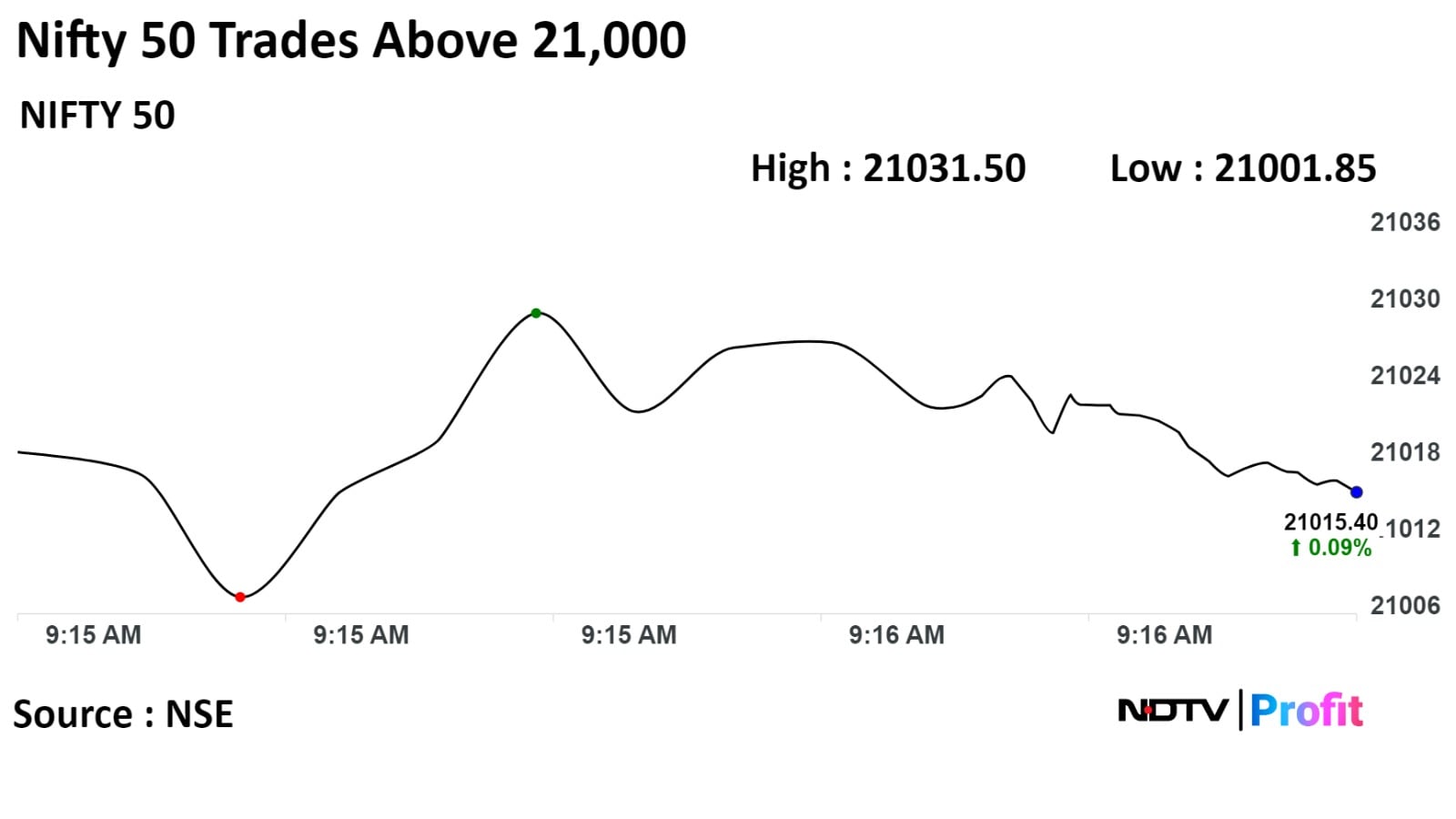

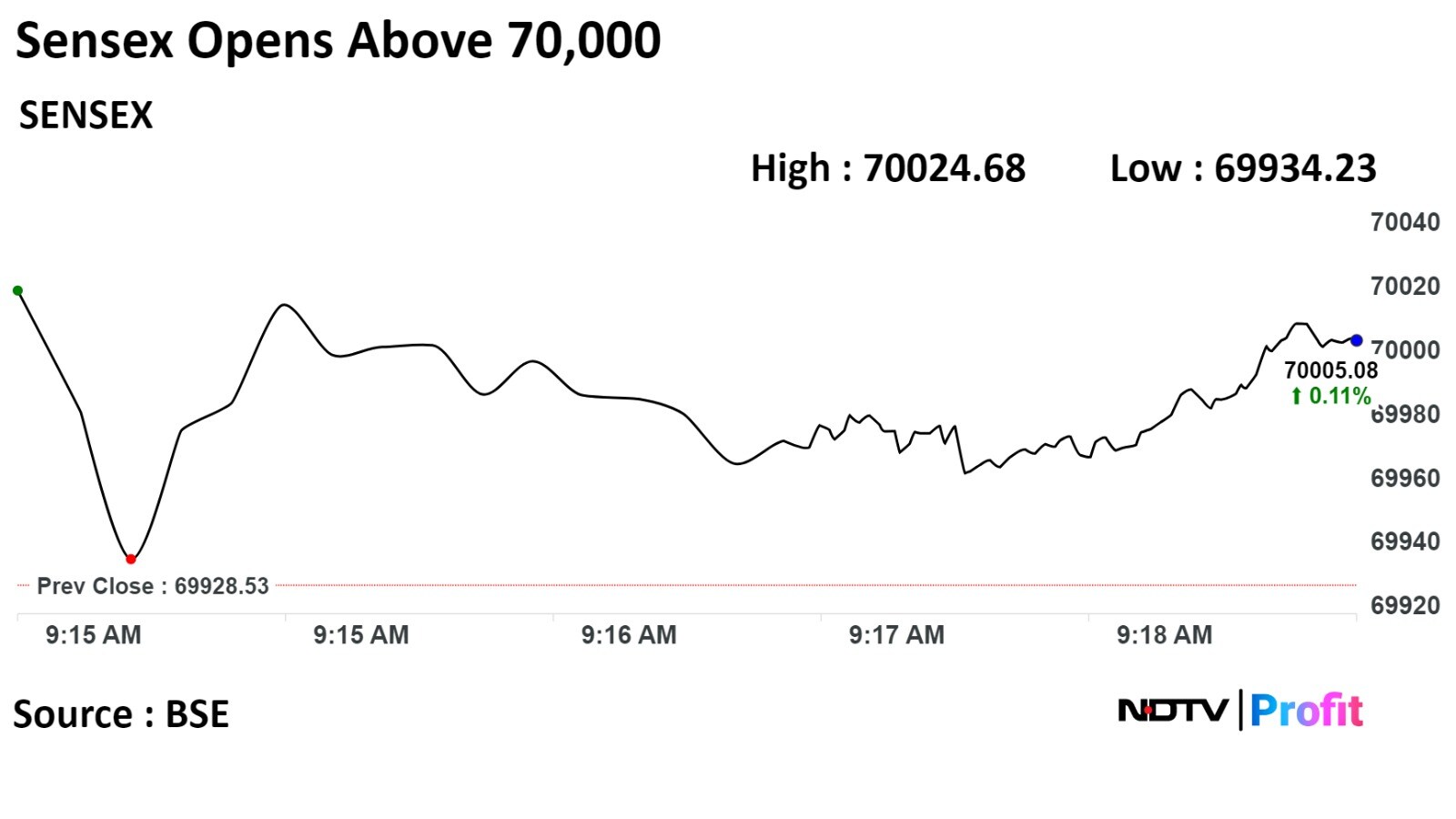

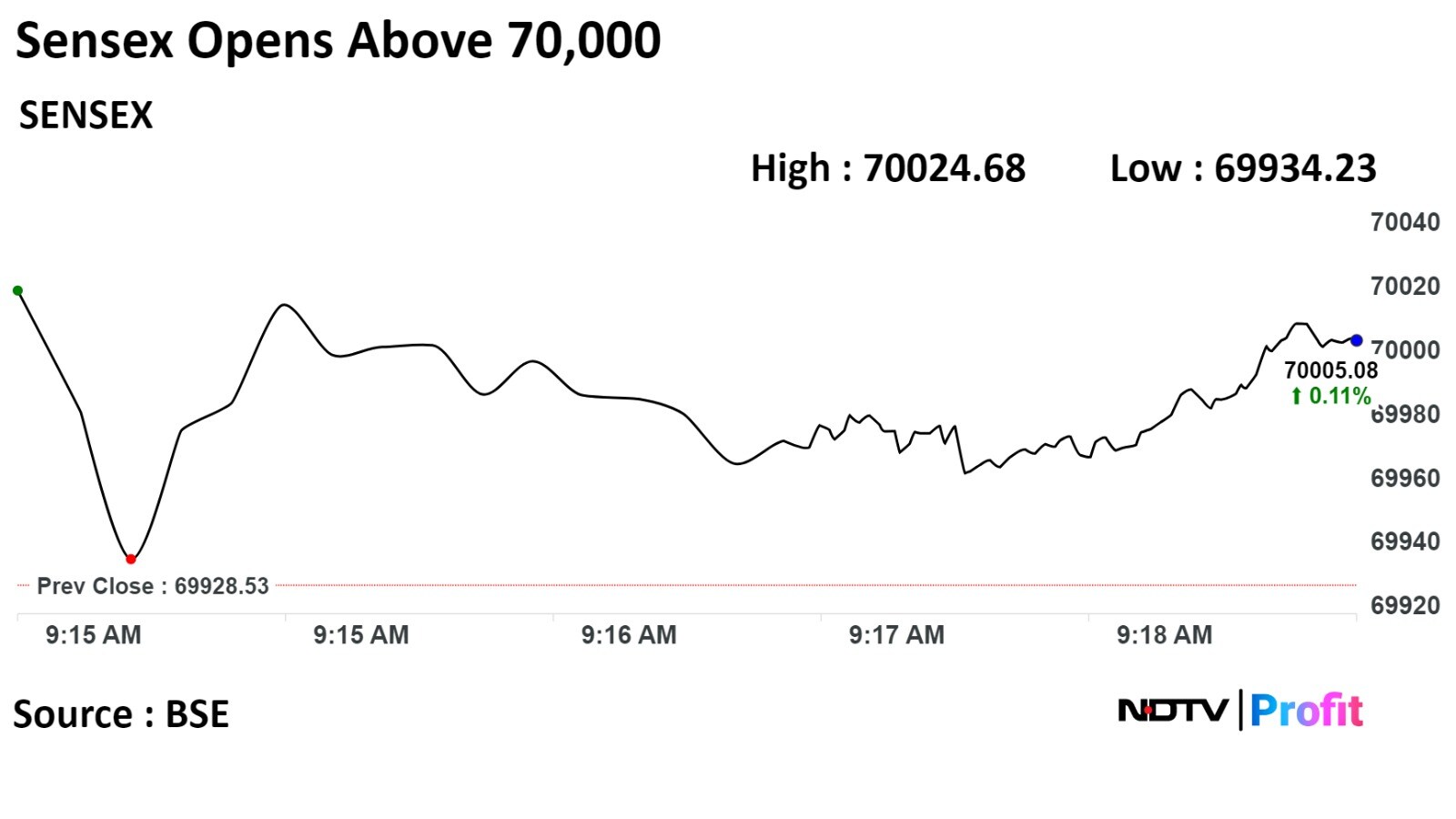

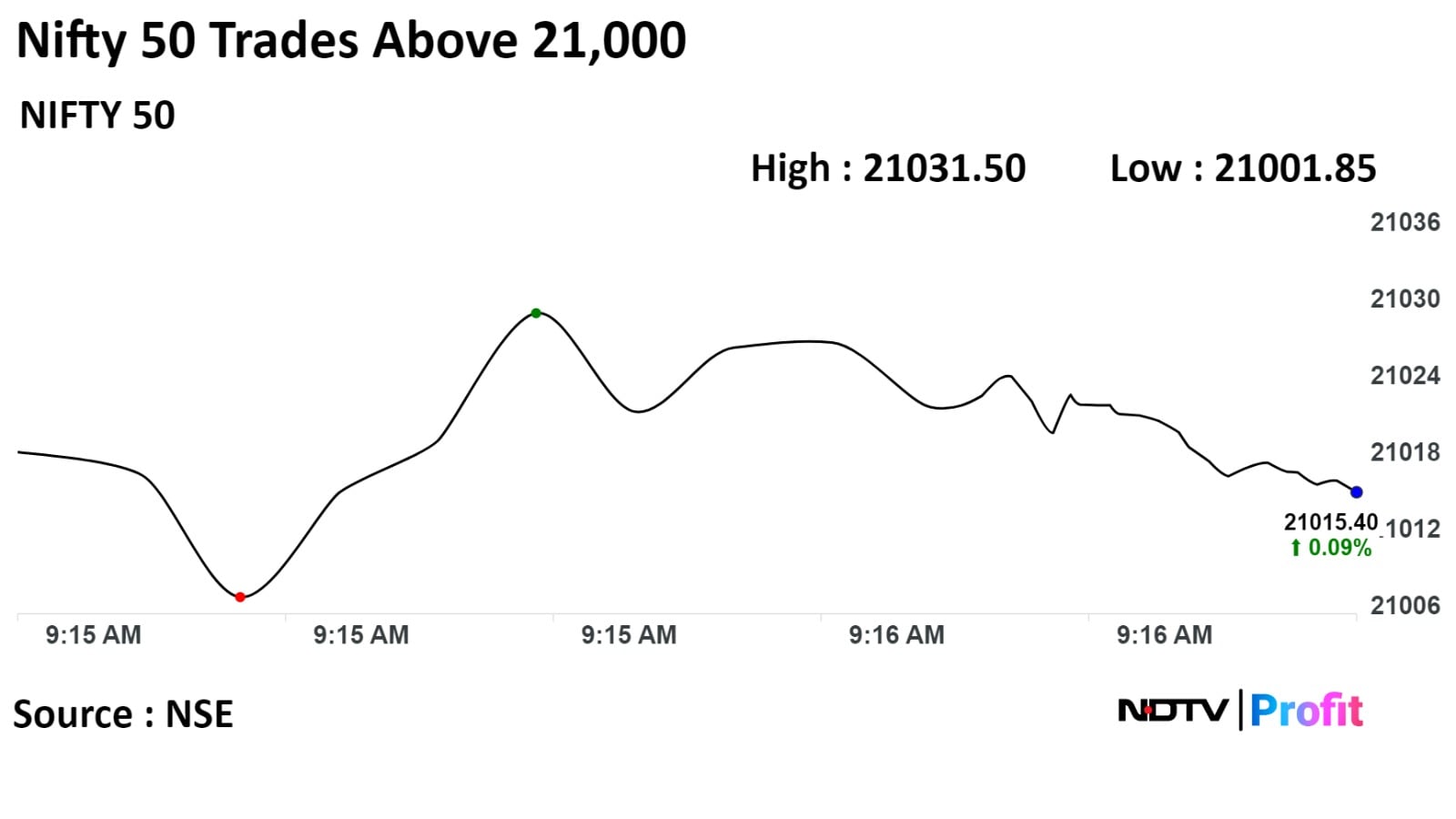

Indian benchmark indices opened at record high level as ITC Ltd., ICICI Bank Ltd., HDFC Life Insurance Company rose.

The benchmark NSE Nifty 50 index for the first time opened above 21,000 mark. On similar lines, the BSE Sensex opened above 70,000 mark.

The S&P BSE Sensex Index was up 43.40 points, or 0.06%, at 69,971.93 while the NSE Nifty 50 was 28.20 points or 0.13% higher at 21,025.30.

"The recent tentativeness around the market regarding the benchmarks achieving the milestones is due to concerns that the stocks are overbought after the recent run-up. But the undertone remains positive with FIIs continuing to pump up money into the domestic equities. The 50 index witnessed a lackluster trading day for 4th consecutive session as the price action briefly consolidated in a lateral range of 174 points. The index fell 3 points short of reclaiming the psychological mark of 21000, however, it managed to close in the upper quartile of the trading range," said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

"The market participants around the globe are awaiting the outcome of the U.S. central bank’s rate-setting meeting on Dec 13. Though the consensus estimates the Federal Reserve to maintain policy rates at 5.25%-5.50%, the course of direction of the interest rates would be significant for the markets,"

Indian benchmark indices opened at record high level as ITC Ltd., ICICI Bank Ltd., HDFC Life Insurance Company rose.

The benchmark NSE Nifty 50 index for the first time opened above 21,000 mark. On similar lines, the BSE Sensex opened above 70,000 mark.

The S&P BSE Sensex Index was up 43.40 points, or 0.06%, at 69,971.93 while the NSE Nifty 50 was 28.20 points or 0.13% higher at 21,025.30.

"The recent tentativeness around the market regarding the benchmarks achieving the milestones is due to concerns that the stocks are overbought after the recent run-up. But the undertone remains positive with FIIs continuing to pump up money into the domestic equities. The 50 index witnessed a lackluster trading day for 4th consecutive session as the price action briefly consolidated in a lateral range of 174 points. The index fell 3 points short of reclaiming the psychological mark of 21000, however, it managed to close in the upper quartile of the trading range," said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

"The market participants around the globe are awaiting the outcome of the U.S. central bank’s rate-setting meeting on Dec 13. Though the consensus estimates the Federal Reserve to maintain policy rates at 5.25%-5.50%, the course of direction of the interest rates would be significant for the markets,"

Indian benchmark indices opened at record high level as ITC Ltd., ICICI Bank Ltd., HDFC Life Insurance Company rose.

The benchmark NSE Nifty 50 index for the first time opened above 21,000 mark. On similar lines, the BSE Sensex opened above 70,000 mark.

The S&P BSE Sensex Index was up 43.40 points, or 0.06%, at 69,971.93 while the NSE Nifty 50 was 28.20 points or 0.13% higher at 21,025.30.

"The recent tentativeness around the market regarding the benchmarks achieving the milestones is due to concerns that the stocks are overbought after the recent run-up. But the undertone remains positive with FIIs continuing to pump up money into the domestic equities. The 50 index witnessed a lackluster trading day for 4th consecutive session as the price action briefly consolidated in a lateral range of 174 points. The index fell 3 points short of reclaiming the psychological mark of 21000, however, it managed to close in the upper quartile of the trading range," said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

"The market participants around the globe are awaiting the outcome of the U.S. central bank’s rate-setting meeting on Dec 13. Though the consensus estimates the Federal Reserve to maintain policy rates at 5.25%-5.50%, the course of direction of the interest rates would be significant for the markets,"

Indian benchmark indices opened at record high level as ITC Ltd., ICICI Bank Ltd., HDFC Life Insurance Company rose.

The benchmark NSE Nifty 50 index for the first time opened above 21,000 mark. On similar lines, the BSE Sensex opened above 70,000 mark.

The S&P BSE Sensex Index was up 43.40 points, or 0.06%, at 69,971.93 while the NSE Nifty 50 was 28.20 points or 0.13% higher at 21,025.30.

"The recent tentativeness around the market regarding the benchmarks achieving the milestones is due to concerns that the stocks are overbought after the recent run-up. But the undertone remains positive with FIIs continuing to pump up money into the domestic equities. The 50 index witnessed a lackluster trading day for 4th consecutive session as the price action briefly consolidated in a lateral range of 174 points. The index fell 3 points short of reclaiming the psychological mark of 21000, however, it managed to close in the upper quartile of the trading range," said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

"The market participants around the globe are awaiting the outcome of the U.S. central bank’s rate-setting meeting on Dec 13. Though the consensus estimates the Federal Reserve to maintain policy rates at 5.25%-5.50%, the course of direction of the interest rates would be significant for the markets,"

Indian benchmark indices opened at record high level as ITC Ltd., ICICI Bank Ltd., HDFC Life Insurance Company rose.

The benchmark NSE Nifty 50 index for the first time opened above 21,000 mark. On similar lines, the BSE Sensex opened above 70,000 mark.

The S&P BSE Sensex Index was up 43.40 points, or 0.06%, at 69,971.93 while the NSE Nifty 50 was 28.20 points or 0.13% higher at 21,025.30.

"The recent tentativeness around the market regarding the benchmarks achieving the milestones is due to concerns that the stocks are overbought after the recent run-up. But the undertone remains positive with FIIs continuing to pump up money into the domestic equities. The 50 index witnessed a lackluster trading day for 4th consecutive session as the price action briefly consolidated in a lateral range of 174 points. The index fell 3 points short of reclaiming the psychological mark of 21000, however, it managed to close in the upper quartile of the trading range," said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

"The market participants around the globe are awaiting the outcome of the U.S. central bank’s rate-setting meeting on Dec 13. Though the consensus estimates the Federal Reserve to maintain policy rates at 5.25%-5.50%, the course of direction of the interest rates would be significant for the markets,"

Indian benchmark indices opened at record high level as ITC Ltd., ICICI Bank Ltd., HDFC Life Insurance Company rose.

The benchmark NSE Nifty 50 index for the first time opened above 21,000 mark. On similar lines, the BSE Sensex opened above 70,000 mark.

The S&P BSE Sensex Index was up 43.40 points, or 0.06%, at 69,971.93 while the NSE Nifty 50 was 28.20 points or 0.13% higher at 21,025.30.

"The recent tentativeness around the market regarding the benchmarks achieving the milestones is due to concerns that the stocks are overbought after the recent run-up. But the undertone remains positive with FIIs continuing to pump up money into the domestic equities. The 50 index witnessed a lackluster trading day for 4th consecutive session as the price action briefly consolidated in a lateral range of 174 points. The index fell 3 points short of reclaiming the psychological mark of 21000, however, it managed to close in the upper quartile of the trading range," said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

"The market participants around the globe are awaiting the outcome of the U.S. central bank’s rate-setting meeting on Dec 13. Though the consensus estimates the Federal Reserve to maintain policy rates at 5.25%-5.50%, the course of direction of the interest rates would be significant for the markets,"

Indian benchmark indices opened at record high level as ITC Ltd., ICICI Bank Ltd., HDFC Life Insurance Company rose.

The benchmark NSE Nifty 50 index for the first time opened above 21,000 mark. On similar lines, the BSE Sensex opened above 70,000 mark.

The S&P BSE Sensex Index was up 43.40 points, or 0.06%, at 69,971.93 while the NSE Nifty 50 was 28.20 points or 0.13% higher at 21,025.30.

"The recent tentativeness around the market regarding the benchmarks achieving the milestones is due to concerns that the stocks are overbought after the recent run-up. But the undertone remains positive with FIIs continuing to pump up money into the domestic equities. The 50 index witnessed a lackluster trading day for 4th consecutive session as the price action briefly consolidated in a lateral range of 174 points. The index fell 3 points short of reclaiming the psychological mark of 21000, however, it managed to close in the upper quartile of the trading range," said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

"The market participants around the globe are awaiting the outcome of the U.S. central bank’s rate-setting meeting on Dec 13. Though the consensus estimates the Federal Reserve to maintain policy rates at 5.25%-5.50%, the course of direction of the interest rates would be significant for the markets,"

Indian benchmark indices opened at record high level as ITC Ltd., ICICI Bank Ltd., HDFC Life Insurance Company rose.

The benchmark NSE Nifty 50 index for the first time opened above 21,000 mark. On similar lines, the BSE Sensex opened above 70,000 mark.

The S&P BSE Sensex Index was up 43.40 points, or 0.06%, at 69,971.93 while the NSE Nifty 50 was 28.20 points or 0.13% higher at 21,025.30.

"The recent tentativeness around the market regarding the benchmarks achieving the milestones is due to concerns that the stocks are overbought after the recent run-up. But the undertone remains positive with FIIs continuing to pump up money into the domestic equities. The 50 index witnessed a lackluster trading day for 4th consecutive session as the price action briefly consolidated in a lateral range of 174 points. The index fell 3 points short of reclaiming the psychological mark of 21000, however, it managed to close in the upper quartile of the trading range," said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

"The market participants around the globe are awaiting the outcome of the U.S. central bank’s rate-setting meeting on Dec 13. Though the consensus estimates the Federal Reserve to maintain policy rates at 5.25%-5.50%, the course of direction of the interest rates would be significant for the markets,"

ITC Ltd., ICICI Bank Ltd., HDFC Life Insurance Company Ltd., Reliance Industries Ltd., and Hindustan Unilever Ltd. contributed positively to the Indices.

Coal India Ltd., Bharat Petroleum Corporation Ltd., Bharti Airtel Ltd., Infosys Ltd., and Larsen & Toubro Ltd. weighed on the indices.

Most sectoral indices advanced. Twelve out of 14 sectors on NSE gained with the Nifty Media emerging as the top gainer, and Nifty Energy as the top loser.

Broader markets outperformed benchmark indices. The S&P BSE Sensex MidCap rose 0.32% and S&P BSE Sensex SmallCap rising 0.58%.

Fourteen out of 20 sectors compiled by BSE advanced, while six declined. S&P BSE Oil and Gas, and Commodities rose the most.

The market breadth was skewed in the favour the buyers. Around 2095 stocks rose and 862 stocks declined, and 96 remained unchanged.

At pre-open, the S&P BSE Sensex Index was up 92.15 points, or 0.13%, at 70,020.68 while the NSE Nifty 50 was 21.45 points or 0.10% higher at 21,018.55.

The local currency strengthened 2 paise to open at 83.37 against the U.S dollar on Tuesday.

It closed at 83.39 on Monday.

Source: Bloomberg

The yield on the 10-year bond opened flat at 7.27% on Tuesday.

Source: Bloomberg

Sun Pharmaceuticals Industries Ltd. increases offer price to acquire remaining outstanding shares of Taro Pharmaceuticals.

Revised price stands at $43.00 per share compared to $38 per share. Revised price marks 13% rise in offer price.

Board submits non-binding indication of interest to acquire all outstanding ordinary shares in Taro.

Source - Exchanges

Aims for Rs 28,000 crore portfolio by FY28. The expansion is going to be led by Loan Against Property and Nano enterprises portfolio.

Spandana Sphoorty's AUM growth over next 4 fiscals implies a CAGR of 30%

Spandana Sphoorty is also going to shift book from monthly disbursements to weekly. The financial service provider also aim to enter shorter tenure loans.

To increase customer base to 62 lakh from 27 lakh currently. The ratio of borrowers per loan officer to increase to 450-475. To expand lending to existing customers.

Estimates potential inflow of $112 million equivalent to 4.8 million shares with 20 day volume impact

Nuvama said, post anticipated 7.9% block deal significant increase in free float is expected

Reports indicate existing PE investors plan to sell up to 7.9% stake on Dec 12. Current free float stands at 10%.

Morgan Stanley said unexpected CFO exit to weigh on infosys

Morgan Stanley rated Infosys Ltd. overweight with price target of Rs 1,600.

The brokerage expects a smooth transition as role has been filled by an internal candidate with long history at Infosys.

Over the last 15 months, there have been multiple exits from the senior level.

Morgan Stanley Overweight on Indigo with a target price of Rs 3,522

Morgan Stanley said Indigo remains a strong franchise in a consolidating industry.

Good directional trend indicated by airfare tracker for Indigo.

Overall traffic as of Dec 10 was 16% ahead of CY19 levels

Industry Load factors tracking well at 90+ plus for the month

Expect domestic aviation turbine fuel prices to decline further by 6%

HSBC said Indian IT Needs To Improve Onshore To Offshore Value Proposition

HSBC says in-house to outsourcing ratio is reaching equilbrium.

GCC gained market share from Indian IT companies, especially in BFSI

GCC value proposition improved compared to ISPs in terms of cost and services

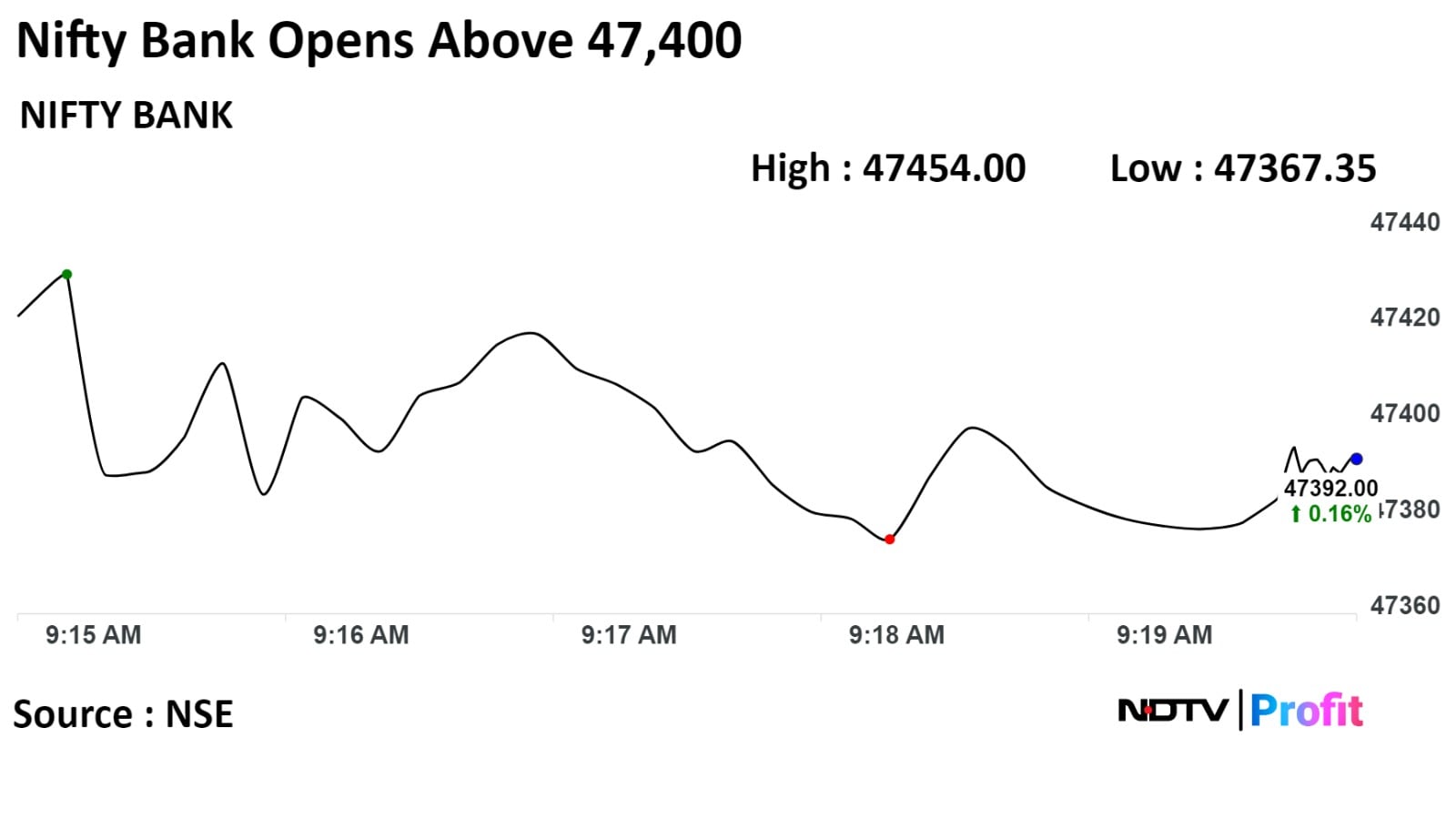

Nifty December futures are up 0.02% to 21,079.5 at a premium of 82.4 points.

Nifty December futures open interest up 2.7%.

Nifty Bank December futures are down 0.12% to 47,442.35 at a premium of 108.1 points.

Nifty Bank December futures open interest down 1.1%.

Nifty Options Dec 14 Expiry: Maximum call open interest at 21,000 and maximum put open interest at 20,900.

Bank Nifty Options Dec 13 Expiry: Maximum call open Interest at 49,000 and maximum put open interest at 47,000.

Securities in ban period: Balrampur Chini Mills, Delta Corp, Hindustan Copper, Indiabulls Housing Finance, National Aluminium, and Steel Authority of India.

Price band revised from 20% to 10%: Sandhur Manganese and Iron Ores.

Ex/record date Interim dividend: Bharat Petroleum Corp.

Ex/record date Bonus Issue: Safari Industries, Sonata Software.

Ex/record date Buyback: SIS.

Move into a short-term ASM framework: BCL Industries, Inox Wind.

Move out of short-term ASM framework: EMS, Sigachi Industries, Tilaknagar Industries, and Veranda Learning Solutions.

Kirloskar Industries: To meet investors and analysts on Dec. 14.

Navin Fluorine International: To meet investors and analysts on Dec. 18 and 19.

Khadim India: To meet investors and analysts on Dec. 14.

Pidilite Industries: To meet investors and analysts on Dec. 18 and 22.

Natco Pharma: To meet investors and analysts on Dec. 14.

Tilaknagar Industries: To meet investors and analysts on Dec. 14.

LTIMindtree: To meet investors and analysts on Dec. 14.

Cello World: To meet investors and analysts on Dec. 18.

MOIL: To meet investors and analysts on Dec. 14.

EMudhra: To meet investors and analysts on Dec. 18.

Inox Wind: To meet investors and analysts on Dec. 14 to 22.

Tega Industries: To meet investors and analysts on Dec. 14.

RPG Life Sciences: To meet investors and analysts on Dec. 15.

EIH: To meet investors and analysts on Dec. 14.

Can Fin Homes: To meet investors and analysts on Dec. 14.

Aditya Vision: Rinu Sinha sold 81,197 shares (0.67%) at Rs 3,442 apiece.

Swan Energy: 2I Capital PCC sold 14.43 lakh shares (0.54%) at Rs 465.85 apiece and 12.30 lakh shares (0.46%) at Rs 461.19 apiece. SBI Life Insurance bought 10 lakh shares (0.37%) at Rs 461 apiece.

Max Estates: Promoter Siva Enterprises bought 1.7 lakh shares on Dec. 6.

Ircon International: The Union government sold 7.5 crore shares between Dec. 7 and 8.

Goldiam International: Promoter Rashesh Manhar Bhansali sold 15 lakh shares on Dec. 8.

India Cements: Promoter group EWS Finance & Investments created a pledge of 65 lakh shares on Dec. 8.

Paisalo Digital: Promoter group Equilibrated Venture CFlow created a pledge of 18.75 lakh shares on Dec. 11.

Infosys: The IT major's chief financial officer and key managerial personnel, Nilanjan Roy, will resign from the position effective March 31, 2024. The company appointed Jayesh Sanghrajka as the CFO and key managerial personnel of the company effective April 1, 2024.

Canara Bank: The bank has raised Rs 1,403 crore through the issue of additional tier 1 bonds of face value Rs 1 crore each at a coupon of 8.40%.

Dixon Technologies: The company’s arm, Padget Electronics, received a manufacturing contract from Lenovo for manufacturing laptops and notebooks under the PLI 2.0 scheme.

Rail Vikas Nigam: The company with its JV URC (51:49) wins a bid of Rs 543 crore from the Madhya Pradesh metro project.

Sterling and Wilson Renewable Energy: The company launched its qualified institutional placement to raise Rs 1,500 crore. The floor price for the QIP is set at Rs 365.02 per share, which is a discount of 13.75% to the stock's previous close of Rs 423.20 on the NSE.

Jammu & Kashmir Bank: The company launched its qualified institutional placement to raise Rs 750 crore. The floor price for the QIP is set at Rs 112.66 per share, which is a discount of 10.02% to the stock's previous close of Rs 125.20 on the NSE.

Wipro: The IT major has supported Marelli electronic systems in the development of its cabin digital twin, which enables original equipment manufacturers to introduce connected vehicle services to the market quickly.

DLF: The company's CFO, Vivek Anand, tendered his resignation due to professional reasons. Managing Director Ashok Kumar Tyagi will now have oversight of the group's finances.

BLS International Services: The company has been awarded the contract for outsourcing consular, passport, and visa services by the High Commission of India in Canada. This contract encompasses operations at HCI in Ottawa and Consulate Generals of India in Toronto and Vancouver.

PNC Infratech: The company received Rs 116 crore from the National Highways Authority of India towards the 'Eligible Disputes' raised by PNC Raebareli Highways Pvt., a subsidiary of the company for 'one-time settlement' under the 'Vivad Se Vishwas II (Contractual Disputes)' scheme.

Relaxo Footwear: The company has been declared a successful bidder for the purchase of a land parcel of approximately 30 acres in Pathredi Industrial Area, Bhiwadi-II, Rajasthan. The cost of acquisition is Rs 135 crore.

Jtekt India: The company has received a new order worth Rs 182.7 crore from JTEKT Brasil for the supply of loose child (good) parts.

Puravankara: The company's unit launched a project named Deansgate in Bengaluru.

REC: The company enters into a €200-million loan agreement with German bank KfW.

Capri Global Capital: The company received a corporate agency licence from the Insurance Regulatory and Development Authority of India for setting up an insurance business.

Most share indices in the Asia-Pacific region rose on Tuesday, tracking overnight gains on Wall Street as investors shift their focus on key US inflation data and policy meetings of major central banks this week.

Share indices rose in Japan, South Korea and Australia. However, equity indices in Hong Kong declined on caution before an annual year-conference meeting of Chinese policy makers which will set down a new agenda for the upcoming year.

The US consumer price index is scheduled for release later on Tuesday and is expected to provide final cue before the Federal Reserve's policy outcome on Wednesday. According to a Bloomberg Survey, the CPI print is expected to come at 3.1% for November from 3.2% in the preceding month.

Moreover, market participants will also keep an eye on the European Central Bank and the Bank of England's policy meeting on Thursday.

The S&P 500 index and Nasdaq Composite rose 0.39% and 0.20%, respectively on Monday The Dow Jones Industrial Average gained 0.43%.

Brent crude was trading 0.25% higher at $76.03 a barrel. Gold was up 0.15% at $1,984.83 an ounce.

The GIFT Nifty was up 7.00 or 0.03% at 21,148.00 as of 7.14 a.m.

India's benchmark indices closed higher for the second consecutive session on Monday. Both the indices closed at record-high levels. The S&P BSE Sensex closed 102.93 points, or 0.15%, higher at 69,928.53, while the NSE Nifty 50 ended 27.70 points, or 0.13%, up at 20,997.10. Intra-day, the NSE Nifty 50 reclaimed the 21,000 level and the Sensex crossed the 70,000 mark for the first time.

Overseas investors remained net buyers of Indian equities for the second consecutive session on Monday. Foreign portfolio investors mopped up stocks worth Rs 1,261.1 crore, while domestic institutional investors remained net sellers and offloaded equities worth Rs 1,032.9 crore, the NSE data showed.

The Indian rupee closed flat at Rs 83.39 against the dollar on Monday.

Most share indices in the Asia-Pacific region rose on Tuesday, tracking overnight gains on Wall Street as investors shift their focus on key US inflation data and policy meetings of major central banks this week.

Share indices rose in Japan, South Korea and Australia. However, equity indices in Hong Kong declined on caution before an annual year-conference meeting of Chinese policy makers which will set down a new agenda for the upcoming year.

The US consumer price index is scheduled for release later on Tuesday and is expected to provide final cue before the Federal Reserve's policy outcome on Wednesday. According to a Bloomberg Survey, the CPI print is expected to come at 3.1% for November from 3.2% in the preceding month.

Moreover, market participants will also keep an eye on the European Central Bank and the Bank of England's policy meeting on Thursday.

The S&P 500 index and Nasdaq Composite rose 0.39% and 0.20%, respectively on Monday The Dow Jones Industrial Average gained 0.43%.

Brent crude was trading 0.25% higher at $76.03 a barrel. Gold was up 0.15% at $1,984.83 an ounce.

The GIFT Nifty was up 7.00 or 0.03% at 21,148.00 as of 7.14 a.m.

India's benchmark indices closed higher for the second consecutive session on Monday. Both the indices closed at record-high levels. The S&P BSE Sensex closed 102.93 points, or 0.15%, higher at 69,928.53, while the NSE Nifty 50 ended 27.70 points, or 0.13%, up at 20,997.10. Intra-day, the NSE Nifty 50 reclaimed the 21,000 level and the Sensex crossed the 70,000 mark for the first time.

Overseas investors remained net buyers of Indian equities for the second consecutive session on Monday. Foreign portfolio investors mopped up stocks worth Rs 1,261.1 crore, while domestic institutional investors remained net sellers and offloaded equities worth Rs 1,032.9 crore, the NSE data showed.

The Indian rupee closed flat at Rs 83.39 against the dollar on Monday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.